The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Workforce Report 2020 (a)

- Introduction

- Quick Read

- What to report

- Regulatory requirements

- Conclusion

- Regulatory and market context

- 1. Investor expectations and company views

- 2. Appendix A – questions and disclosures

- The importance of linkage

- 2. Appendix A – questions and disclosures

- 3. Appendix B – examples of developing practice

- Introduction to the examples

- Governance and management

- Barratt Developments plc

- Barratt Developments plc

- Directors' Remuneration Policy

- Rolls-Royce Holdings plc

- Business model and strategy

- SAP SE

- Fresnillo plc

- Carnival Corporation & PLC

- ConvaTec Group plc

- AstraZeneca plc

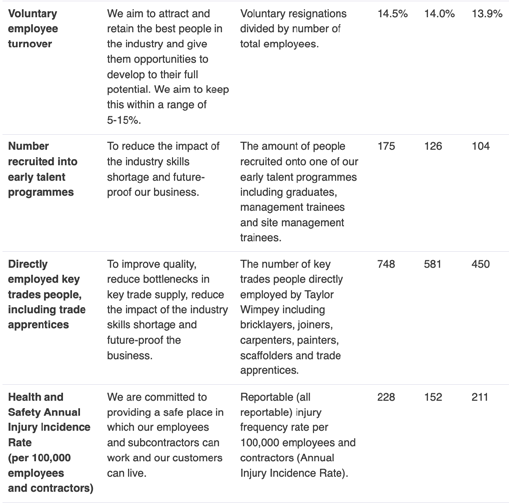

- Taylor Wimpey plc

- Rentokil Initial plc

- InterContinental Hotels Group plc

- Admiral Group plc

- SSE plc

- Marks and Spencer Group plc

- Risk management

- DILEMMA

- Case study: Risk assessment of strategic suppliers

- Fresnillo plc

- CERTIFICATIONS

- PERFORMANCE

- GENDER PAY GAPS OF NON-UNIONISED, NON-EXECUTIVE EMPLOYEES

- COMMUNITY PRIORITY ASSESSMENT

- Organisational

- How we serve and engage

- Strategy and change

- Metrics and targets

- Examples

- Go-Ahead Group plc

- InterContinental Hotels Group Plc

- Easyjet plc

- SSE plc

- Coca-Cola HBC AG

- SAP SE

- Stora Enso OYJ

- Rolls-Royce Holdings plc

- National Grid plc

- Section 4 Appendix C – participants and process

- Process

- Participants

- Section 5 Appendix D – regulatory and market initiatives

- Regulatory and market initiatives

- Market initiatives, frameworks and research

Introduction

This project sought to test whether the principles of good reporting in our previous reports on business models, risk and viability reporting and performance metrics could be applied in the context of reporting on the workforce. Each of these reports has proven relevant, as they highlighted the importance of companies articulating how the workforce contributes to the success of their business model, what the risks and opportunities are, and how they measure the success of their strategy through reliable, transparent metrics.

This project therefore builds on the Lab's previous messages and provides a view from companies and investors about how these areas of reporting can best reflect the contribution of the workforce.

What this report seeks to achieve

This project was undertaken alongside our work on climate change. In both of these projects there was a clear desire for reporting around four elements, namely governance and management, business model and strategy, risk management and metrics and targets. As such, the Lab's insights follow these four elements.

There are examples of developing reporting practice, but further improvements can be expected as regulatory changes and investor expectations develop. To assist, this report sets out how companies can make their reporting more effective and comprehensive by providing a set of questions that they should ask to help develop their reporting.

Examples used

Our report highlights examples of current practice that were identified by the Financial Reporting Lab (Lab) team and investors. Not all of the examples are relevant for all companies, and all circumstances, but each provides an example of a company that demonstrates an approach to useful disclosures. Highlighting aspects of reporting by a particular entity should not be considered an evaluation of that entity's annual report as a whole. Investors have contributed to this project at a conceptual level.

The examples used are selected to illustrate the principles that investors have highlighted and, in many cases, have been tested with investors. However, they are not necessarily examples chosen by investors, and should not be taken as confirmation of acceptance of the company's reporting more generally.

Responding to feedback

In 2019 the Lab ran a stakeholder survey. As part of this survey we asked users of the reports for feedback. We received feedback that the example disclosures were of particular value to users.

Responding to this feedback, we have included more examples within this report than in previous Lab reports. Whilst it makes the report longer, we hope it adds to the overall value of this report.

If you have any feedback, or would like to get in touch with the Lab, please email us at: [email protected]

Quick Read

Workforce matters have become an increasing area of focus over the last few years, whether in response to new regulations or wider societal expectations on areas such as executive pay, contractual employment arrangements, and the implications of automation.

While requirements to report on workforce-related matters have existed for a number of years, new regulations have resulted in a renewed focus.

There is an increasing appreciation of the value that the workforce brings to the success of a company and the importance of effective workforce engagement. Investors want to understand how the workforce creates value, how that value is maintained and what risks and opportunities may arise in the future.

There is also an increasing desire amongst a number of stakeholders for companies to report on workforce matters, such as culture, employee engagement and the workforce environment. A range of stakeholders have a legitimate interest in companies' approaches to workforce-related matters, not least the workforce themselves. Whilst this report focuses on investors' expectations of corporate reporting, alongside investors, many stakeholders are calling for companies to take the opportunity to improve their reporting on the contribution of the workforce.

What investors are trying to understand

Investor participants overwhelmingly support clearer disclosure of workforce matters. Disclosure is developing, and as investor expectations grow and new regulatory changes are implemented, further development will be necessary.

In trying to understand which companies are able to build and maintain a productive workforce over time, investors are interested in how a company intends to support the development of its workforce in a sustainable, long-term fashion.

While there are a number of metrics that might give an insight into a company, there is no single approach that captures how human capital considerations have an impact on company performance. Both companies and investors agree that the workforce can have a significant influence on company performance, but there is less agreement about what information should be reported to provide insight into this.

However, investor participants are seeking greater insight into:

- how boards consider and assess the topic of the workforce, including what information they see and what they consider the workforce to be;

- what the workforce is and how it contributes to the success of the business model, whether it is considered a strategic asset, how it is invested in, and what changes might need to be made to strategy in order to maximise workforce-related opportunities;

- the risks and opportunities related to the workforce and how the company is responding to these, including the prioritisation of risks and their likelihood and impact; and

- how the company measures the contribution of the workforce and how it has taken into account the workforce's views. Investors seek more data, including financially-relevant information and reliable, transparent metrics.

These reflect elements of a company's operating approach, and areas of assessment and consideration by investors. These areas of investor interest broadly cover the following: governance and management, business model and strategy, risk management, and metrics and targets. These are consistent with the areas of interest expressed by investors in relation to climate reporting. There is obvious overlap and linkage between these areas, and this structure can be helpful in thinking through workforce-related matters and the disclosures that could be made. As such, the Lab's report follows this structure.

This report focuses on workforce matters, but many of the reporting recommendations could equally apply to other sustainability-related topics, such as climate change, the subject of another recent Lab report.

What to report

It is important for companies to develop their reporting not only to respond to reporting requirements, but also to respond to investors' needs. In order to help companies to do so, the Lab has developed a set of questions for companies to ask themselves, supported by a set of examples that meet aspects of investor needs.

Investors are seeking to understand the composition of the workforce and whether the board views the workforce as a strategic asset, how value is maintained and risks mitigated. To aid investor understanding companies should therefore report:

- the oversight of workforce-related matters, including how the Board engages with the workforce and what impact the board's consideration of workforce matters has had on strategic decisions;

- who the company considers its workforce to be (including total headcount, demographics and employment composition such as direct employees, contractors and/or others in the supply chain);

- how each aspect of the workforce creates value for the organisation and what opportunities there are to grow that value, including how the workforce model links to the business model;

- the risks and opportunities related to the workforce, how the company is responding to these, how the risks were identified and where they are in the business, including health and safety metrics;

- how the desired culture is being driven from the top including how ‘buy in' has been achieved from the workforce and how culture and values help achieve the strategy, including:

- employee engagement

- retention and turnover (both planned and regrettable)

- values being applied in the working environment

- other measures of culture that the company monitors

- how the company is enhancing and incentivising its workforce to deliver value. This should include information about:

- remuneration and other benefits

- training and development

- progression

The metrics used should clearly show what parts of the workforce they apply to and should include relevant segmental information.

Regulatory requirements

While reporting that encourages or requires detail on a company's workforce has been in place for a few years, other relatively recent changes to regulation include:

- updates to the UK Corporate Governance Code 2018 ("the Code”), which includes specific provisions on the board's engagement with the workforce,

- reporting requirements on CEO and employee pay ratios, and

- a requirement to report on how directors have had regard to a range of factors, such as the interests of a company's employees, in carrying out their duty to act in a way that promotes the success of the company (their section 172 duty). Further detail on the regulatory requirements can be found on page 5 and in Section 5.

Investors themselves are also under pressure to report more fully on environmental, social and governance matters under new Financial Conduct Authority rules as a result of the Shareholder Rights Directive and the revised UK Stewardship Code. Mandates from asset owners are also increasingly referring to such matters, which is another reason for investor calls for more reporting in this area.

Conclusion

Despite regulatory focus over recent years and increasing company and investor interest, there is a lack of consistent disclosure on workforce matters. A gap remains between the reporting investors are looking for and what is being disclosed. Investors seek a more basic understanding of the composition of the workforce, but also an indication of whether the workforce is a strategic asset and how this relates to longer-term value creation. This report provides practical examples of how companies can close this gap.

Regulatory and market context

Whilst this report is not intended to be about regulatory changes and how to apply these, regulation has been a driver of recent changes in reporting practice. We highlight the main regulatory developments below as they provide valuable context for this report.

There have been requirements for companies to report on workforce-related matters for a number of years, but there are also a range of new regulatory requirements companies either have implemented, or will implement, in the next reporting cycle.

Companies Act 2006 ('Companies Act')

Under section 414C of the Companies Act, companies must, “to the extent necessary for an understanding of the development, performance or position of the company's business, include... (b)where appropriate, analysis using other key performance indicators, including information relating to environmental matters and employee matters".

Disclosures regarding principal risks and uncertainties may also be required under the Companies Act where workforce-related matters are material.

For periods beginning on or after 1 January 2019, company strategic reports must include a Section 172(1) statement describing how directors have had regard to the matters set out in section 172(1)(a) to (f) of the Companies Act when performing their duties under section 172, which in subsection (1)(b) relates to the interests of the company's employees.

Under The Companies (Miscellaneous Reporting) Regulations 2018, companies must disclose CEO pay ratios. This requires companies to disclose annually the ratio of their CEO's pay to the median, lower quartile and upper quartile pay of their UK employees. These regulations also brought into law the requirement for stakeholder engagement reporting, requiring disclosure of how the directors have engaged with employees, had regard to employee interests, and the effect of that regard, including on the company's principal decisions taken during the year.

The UK Corporate Governance Code 2018

The Code requires Boards to discuss how the matters set out in section 172, including the interests of the company's employees, are addressed. These requirements, which apply to accounting periods beginning on or after 1 January 2019, also include a number of new expectations for boards and their committees, including the following:

- The board should ensure that workforce policies and practices are consistent with the company's values and support its long-term sustainable success. The workforce should be able to raise any matters of concern;

- The annual report... should include an explanation of the company's approach to investing in and rewarding its workforce; and

- For engagement with the workforce, one or a combination of the following methods should be used: a director appointed from the workforce; a formal workforce advisory panel; or a designated non-executive director. If the board has not chosen one or more of these methods, it should explain what alternative arrangements are in place and why it considers that they are effective. The FRC recently issued its annual review of the Code which included consideration of how the FTSE 100 had reported early adoption of the 2018 Code. The FRC will carry out further analysis of Code reporting in

- In addition, the Guidance on Board Effectiveness provides useful guidance on the application of the Code, including questions for boards.

Other reporting requirements companies have had to respond to in recent years include:

- Gender Pay Gap reporting which requires the disclosure of mean and median gender pay gaps, mean and median gender bonus gaps, the proportion of men and women receiving bonuses and the proportion of men and women in each quartile of the organisation's pay structure.

- Modern Slavery Statements which must describe the main actions the organisation has taken during the financial year to deal with modern slavery risks in the supply chains and business.

Market activity such as the Workforce Disclosure Initiative, Social and Human Capital Coalition and ISO Standard on Human Capital have all recently raised the profile and importance of disclosures on workforce-related matters. The Investment Association also published Long-term reporting guidelines which included guidance on human capital and culture. This included suggested metrics to support human capital disclosures. These can be helpful frameworks to consider for those companies considering what kinds of disclosures to make. More information on regulatory requirements and other initiatives is provided in Appendix D.

1. Investor expectations and company views

Governance and management

Investor participants are seeking a better understanding of:

- how boards consider and assess workforce matters, including what information they see

Overview

Throughout this project, both companies and investors reinforced the importance of the board's role with investors seeking to understand how boards consider and assess workforce issues. This gives them comfort over the oversight procedures and the board's consideration of how the company's business model and strategy are affected by workforce matters. Investors want more information about how boards engage on a range of sustainability-related topics, including the workforce, relevant to the company's business model and strategy.

Investor view

The role of the board

Investors see the board's involvement as providing oversight and integration of workforce matters into strategic decisions. They want to understand whether, and how, the board considers the workforce to be a strategic asset. There are challenges in gathering, managing and understanding information about the workforce, but when done successfully it contains real insight. The inclusion of workforce matters in strategic plans aligns with the expectations in the Code. Investors are also seeking more practical information about board involvement, such as what information it has seen.

One approach is to explain what information the board sees and the effect of this engagement on board decisions (Barratt Developments plc, pages 29 and 30) or of the involvement of Committees in workforce-related matters (RBS plc, page 31)

Setting the strategy

Different business models will give rise to different challenges, but as the nature of work is likely to change dramatically (for example as a result of technology), it is increasingly important that strategic issues concerning the workforce are considered and reported.

Increasingly this topic touches on a wide range of areas subject to board oversight, from remuneration, to planning and strategy, to a consideration of company and management performance. It is important for the board to consider the interrelationship between workforce costs and benefits and treat workforce matters as a strategic issue.

The board has the capacity to bring together these connections and ensure that disclosure explains how they are thinking about this issue. Investors seek to understand what insights the board has gathered and, often most importantly, how the board factors these into strategic planning. This strategic view may include sensitive information, but it is for boards to move beyond a high-level narrative regarding the importance of the workforce to developing meaningful metrics.

One approach is to report how the board engages on workforce matters, and changes they have made as a result (Rolls Royce Holdings Plc, page 32)

"The challenge is really to stick your neck out and say why the workforce is important to you" - Company

Company view

The role of the board

The board's role is central to understanding and providing oversight into how workforce-specific risks are being managed and addressed. There is some question, however, about whether this should be overseen by the board, or whether some responsibility can be delegated to other internal functions or board committees. Not all workforce matters are subject to board oversight, with some metrics seen only by management, and a smaller subset by the board. However, board oversight is increasing as companies try to gather more information for external reporting purposes.

Many companies are aware of the importance of the workforce, but find topics like health and safety easiest to consider and measure. Topics such as culture, motivation and engagement are considered more difficult to address because of their strategic and interconnected nature. Therefore whilst investors are interested in the workforce as an enabler of future strategy, some companies are limiting disclosure on workforce to that which is about delivery of current performance; a missed opportunity perhaps.

Governance and management

In order to help investors understand how boards consider and assess workforce matters, including what information they see, companies should ask themselves...

- What arrangements does the board have in place for assessing and considering workforce-related matters?

- Who has responsibility for workforce-related matters and how often are workforce-related issues considered?

- What insight does the information on workforce matters give the company and how is it being integrated into strategic planning?

- What information and metrics do the board monitor in relation to the workforce?

- How does the board get comfort over the metrics being used to monitor and manage the relevant matters? Who prepares the information the board receives in relation to the workforce?

- What is it like to work in the company, and how does the board get sight of the workforce's views? How does the board interact with the workforce without management present?

- Which workforce-related matters does the board consider it might be helpful to change? Is this informed by workforce feedback?

- Does the board consider the workforce-related reporting to be fair, balanced and understandable?

Companies should then:

- Describe the board's oversight of workforce-related matters and how the board has engaged with the workforce

- Describe management's role in considering and managing workforce issues

- Describe what impact the board's consideration of workforce matters has had on strategic decisions

Business model and strategy

An approach is for a company to report what it considers to be its workforce, including by segment or site (SAP SE, ConvaTec Group PLC, Fresnillo Plc, Carnival Corporation & Plc, pages 34 and 35)

Investor participants are seeking a better understanding of:

- what the workforce is and how it contributes to the success of the business model, whether it is considered a strategic asset, how it is invested in, and what changes might need to be made to strategy in order to maximise the value of the workforce

Overview

In considering a company's business model and strategy the expectations of investors as outlined in the Lab's report and implementation study remain relevant. Investors are interested in the workforce as a strategic asset, and how the company is ensuring it maintains an effective workforce to support the sustainability of the business model.

Some investors are also interested in the workforce from the perspective of whether the company offers 'good work'. This concept is explained in Good Work: The Taylor Review of Modern Working Practices and covers areas such as wages, employment quality and working conditions, amongst other factors.

Investor view

What constitutes the workforce

The definition of the workforce is important. Investors and companies often have different concepts of what constitutes the workforce, with the investor viewpoint wider than that of some companies. This can be due to internal or legal restrictions on the provision of information, but can also be because companies have not considered the scope of their ‘workforce'. Companies should at least be clear about how they define their workforce, for example whether this includes contractors and others. This aligns to expectations in the Code and Guidance on Board Effectiveness, the latter of which states that companies should be able to explain who they have included in their definition of the workforce and why.

The importance of strategic linkage

A clear link between the workforce and the business model helps a company explain its competitive advantage. For many businesses their competitive advantage is driven in part by the workforce's knowledge, capabilities and the intellectual property that it generates. Therefore providing a clear link between the workforce and the articulation of the business model is crucial. This is an important factor in the board's responsibility to promote the long-term success of the company. The Code states: ‘The board should ensure that workforce policies and practices are consistent with the company's values and support its long-term sustainable success.'

Investors are clear that, whilst the workforce is clearly a cost it is also a vital asset, helping a company stay competitive or achieve its strategy. Understanding how the workforce is being treated and getting their insights into strategy is important. The key aspect is understanding how the workforce provides a competitive advantage and drives value.

Such an asset is important to the strategic drivers of the company and investors want companies to explain in more detail how the employment models align with the business model.

One approach is to present links between the workforce, and their view on strategy (AstraZeneca Plc, page 35)

An approach is to present links between key performance indicators and strategy in consistent ways across formats (Taylor Wimpey Plc, Rentokil Initial Plc, pages 36 and 37)

“I've only recently grasped the idea that the workforce IS the company. The workforce is your asset – intellectual property, skills and capabilities. If moving in and out over time, it's a really key indicator" - Investor

An approach is to explain the employment model in the context of the business model(s) (InterContinental Hotels Group plc, page 38) or outline workforce strategy and links to culture (Admiral Group plc, page 39)

One approach is to link investment in inclusion to performance and strategy (SSE plc, page 40)

Culture and strategic links

The FRC's 2016 Corporate Culture and the Role of Boards: Report of Observations highlighted the importance of culture to success and many of its findings were incorporated into the 2018 Code. The Code states that 'the board should assess and monitor culture'. The experience of employees offers an important insight into the culture of the company. Investors too are seeking insight into the culture of a company and how that culture drives value.

The board is also in the best position to take a long term view on the pipeline of talent and succession planning. These areas are strategic, and relate directly to the company's future. There are sensitivities, particularly around issues such as succession, which investors acknowledged, but they remain interested in what the board is trying to achieve and how board members are using the information they see.

Investors are also concerned that the information presented often presents only a positive picture. To many investors this feels superficial, and more information about where things may have gone wrong, and insight into what the company is going to do about it, would be welcomed.

“Culture is a hard thing to measure, but turnover and engagement are good indicators of it" - Investor

"Ask – What do you want the culture to be and how can it then be measured?" - Investor

“I'm interested in workforce reporting. I use it where it is disclosed well” Investor

"What is wrong is obvious. It's not always clear what is right" - Investor

<blockquoteblockquote markdown="1"> One approach is to discuss how some of the challenges the company faces are being addressed (Marks and Spencer Group plc, page 41)

One approach is to disclose how a company addresses employee feedback, and plans for the next year in the context of risk (Pearson plc, page 48)

Financial statement impact

Information about the payroll numbers in the financial statements, and the money being spent on the workforce can given them an insight, but is generally not considered to be detailed enough to allow a full understanding of the workforce picture (as it only includes direct employees). As such, a number of investors are calling for more granular information, including in which locations and divisions the workforce sits, or pay bands to which this cost is apportioned, to understand the company's drivers and associated costs even if that is not directly in the financial statements.

“I'm interested in how it flows through to financial statements, and obviously intangible value in acquisitions can be really relevant in terms of workforce value" - Investor

One approach is to link disclosures to definitions and personnel expenses (SAP SE, page 52)

Company view

What constitutes the workforce

Investors often expect companies to report on their workforce more widely than just direct employees. However, a number of companies only report certain information in relation to employees, with reporting regarding the workforce appearing less frequently, most often in relation to statistics around health and safety.

Companies explained that the workforce was not always well defined. The strict legal requirements relate to employees, but the Guidance on the Strategic Report and the Code refer to the workforce.

Sensitivity regarding strategy and the workforce

Information on the workforce can be sensitive and often, particularly for multi-jurisdictional companies, legally restricted. There may be sensitivities in relation to the metrics as lead indicators. In addition, different areas of the business may be more important in terms of key value drivers, or emphasized or de-emphasized business divisions, but whilst companies can acknowledge this privately it is more complicated to disclose this publicly.

Companies explained that reporting uses an investor perspective, but they are aware of its impact on current, or prospective, employees. Some felt that employees were their main audience for this information, as they had not received investor queries.

"This is sensitive internally... workforce is a leading indicator, so there can be a nervousness" - Company

“Employee turnover – is it a bad sign, or part of the business model?” Investor

“I want information beyond ‘the workforce is the most important asset'. I want more about how the company is 'using and investing' in the concept of human capital as a type of capital. It's about trade-offs and decisions and the effects of those. About what is really key to making their business run and how they are supporting and encouraging that" - Investor

Internal systems

Some companies have systems for ongoing board consideration and others report in alignment with external reporting deadlines. Some companies are using HR and data scientists to gather further insights on their workforce and help in their assessments of organizational development.

After ensuring that the right data is gathered and considered, there is a real challenge in interpreting what the information is saying about the company and what it means for the actions that should be taken.

Many reported the importance of board interest in this area in helping them to address information issues, improve systems, to consider this topic more strategically. There was, still, a question for some about where responsibility should sit, as human resources has a key role, but finance, strategy, risk and a health and safety may also be involved.

A study carried out by Alex Edmans, a professor of Finance at London Business School, sought to find out whether there was a link between employee satisfaction and long-term value. The study asked the following questions:

"Does employee satisfaction improve firm value? The answer to this question is not obvious. While it seems natural that satisfaction will facilitate worker recruitment, retention, and motivation, investing it is costly. Do the benefits outweigh the costs?"

"Firms with high employee satisfaction outperform their peers by 2.3% to 3.8% per year in long-run stock returns – 89% to 184% cumulative even after controlling for other factors that drive returns. Moreover, the results suggest that it's employee satisfaction that causes good performance, rather than good performance allowing a firm to invest in employee satisfaction."

The study was based on 28 years of data from the top 100 companies to work for in the U.S.A.

Business model and strategy

In order to help investors understand what the workforce is and how it contributes to the success of the business model, whether it is considered a strategic asset, how it is invested in, and what changes might need to be made to strategy in order to capitalise on workforce-related opportunities, companies should ask themselves...

- Is the workforce viewed as a strategic asset?

- What is the company's workforce, for example, does it include contractors, franchisee staff, supply chain, employees?

- How does the employment model enhance the business model?

- What workforce-related matters are relevant to the company's business model and strategy? What process has been followed in order to assess the impact of the workforce?

- How does the workforce help generate or preserve value in the company? How does the company invest in the workforce, and what expenditures are needed to ensure that the workforce continues to help the company generate and preserve value?

- How is the workforce enhanced and incentivised to deliver value?

- How do workforce matters affect key divisions, markets and/or revenue/profit drivers? Over short, medium or longer-term horizons?

- How does the information gathered, particularly the workforce's views, factor into strategic planning?

- What triggers would require a change of direction?

- How do workforce-related risks and opportunities impact the financial statements?

Companies should then:

- Describe who the company considers its workforce to be (including total headcount, demographics and employment composition such as direct employees, contractors and/or others in the supply chain)

- Describe whether, and how, the company invests in the workforce as a strategic asset

- Describe how the workforce creates value for the organisation and what opportunities there are to grow that value

- Describe how the workforce model supports the business model and strategy

- Describe how the workforce-related risks and opportunities the organisation has identified affect the company's business, strategy and financial planning

Risk management

Investor participants are seeking a better understanding of:

- the risks and opportunities presented by the workforce and how the company is responding to them

Overview

Participants agreed with the conclusions of the previous Lab report on risk and viability and the later implementation study, highlighting again the importance of company-specific information in the disclosure of risks and opportunities facing the company. Investors are also interested in which risks can be quantified and assessed, and in the assessment of changes in the risk during the year.

Risks are being assessed both over a short and long timeframe, metrics are also being monitored with an understanding of them as leading indicators.

Investor view

The importance of linkage

Most risk disclosures focus on either health and safety or the retention of talent. Where many companies state that their workforce is an important asset, not all link this to other parts of the report, such as risk. Some Lab insights on better linkage can be found on page

- There is some concern that company reporting does not go beyond a relatively generic 'attraction and retention' or health and safety risk. Investors are looking for more specific company insight, for example around specific health and safety issues relevant to the company and risks to its specific business model and ability to achieve value creation through the workforce.

An approach is to link risk to other parts of the business, with descriptions of how the impact of workforce risks is changing and who owns the risk (Fresnillo plc, Just Eat plc, Pearson plc, SSE plc, pages 43 to 48)

Segmentation of information

In relation to priority and impact, investors consider that workforce topics, some of which can be specific to an area or geography, may not be as relevant when aggregated. However, given the important role of the workforce, the returns of a division or segment can be affected by workforce-related risks. This is particularly important when it relates to an area of growth or a specific source of competitive advantage. Segmental workforce information is therefore most valued by investors.

Other reporting formats

Investors are positive about reporting, such as in sustainability reports, that provides them with more granular information, including more baseline information. This granularity can be very important in understanding where risks lie, and some examples of the presentation of more granular information are shown in the metrics and targets section of this report.

Some reported that gender pay gap and modern slavery statements are good sources of information, particularly in relation to risk and overall consistency of the company's messaging. One investor noted that good modern slavery statements, in particular, provide additional insights into the company and its business model. This provides a good opportunity for companies to better link these statements to the rest of their disclosures, e.g. annual reports.

Horizons

Investors expect some workforce risks, for example those related to contract formats and classifications of employees and the effect they might have on reputational issues or on the company's ability to operate its business model, potentially crystallising for companies. These possible shorter-term challenges can change their view of 'risk horizons.

They are also looking to the future and trying to understand the risks of automation and the future of work. Investors are trying to work out what risks the company faces from these challenges and what the company plans to do about them. Investors are therefore calling not only for more baseline information, but also a view to how the business model will adapt to the future.

“On workforce issues we have a much shorter-term horizon regarding risk. More portfolio managers are willing to act. The tolerance from an investment standpoint is different [in terms of horizon]" – Investor

Company view

Sensitivity of disclosure

Some companies we spoke to considered workforce matters to be a risk to their business. The most frequent risks related to health and safety and the retention of talent. Some also considered reporting on workforce issues to be a risk in itself, given questions of sensitivity and their concerns about attracting and retaining talented staff.

Examples cited included a loss of competitive advantage, or difficulties hiring from a diverse talent pool where reported diversity statistics showed a lack of diversity in the workforce. Because of the perceived sensitivity, some companies were hesitant to go beyond the reporting requirements.

This sensitivity also connected to the view of workforce issues as a leading indicator. Companies continue to refine the metrics they manage and monitor internally in relation to the workforce, as they view them as helpful in raising red flags for further consideration.

"Disclosure of gender pay information is a material risk to the acquisition of talent. Everyone wants [to recruit] more senior women, but if the statistics look bad, it makes it difficult to catch up" - Company

"With Glassdoor, it's harder to recruit if you have bad scores, so it's damaging to the overall value if you cut things now which have a staff impact and a rating impact" - Company

“Our disclosures reflect the reality of our value chain. That's why we're putting an emphasis on this area" - Company

"There is research showing diverse workforces are more efficient and creative, no wonder investors want that information" - Company

Understanding the risk

For some companies, the supply chain may be where much of the workforce risk lies. Questions of scope are considered more fully in the section on metrics, but many companies do not report information related to workforce matters beyond their employees. Some reported that they had included expectations, for example around wages, in contracts within their supply chains, but that they had been assessing whether or not such expectations were being fulfilled on a more strategic basis. The Lab's work on the Digital Future of Corporate reporting shows that the availability of data sources used by investors is growing significantly. Therefore choosing not to disclose information does not necessarily mean it isn't available to and being used by investors, through third-party and alternative data sources such as Glassdoor. Some companies are reacting by triangulating their own information to these outside sources.

One approach is to explain the supply chain, and some of the inherent risks (SSE plc, page 44)

Risk management

In order to help investors understand the risks and opportunities presented by the workforce and how the company is responding to them, companies should ask themselves...

- What systems and processes are in place for identifying and assessing workforce-related risks? How is a consideration of workforce-related risk integrated into this process?

- How are the risks related to the workforce being monitored, managed and mitigated?

- Which risks related to the workforce are most relevant to the business model and strategy? How are these identified and where are they in the business?

- What opportunities does the workforce provide to enhance the value of the company?

- Over what horizon have the risks been considered and risk assessments carried out? Why is this an appropriate horizon with reference to the business model?

- How is the assessment of the company's viability over the longer-term taking into account workforce-related issues?

Companies should then:

- Describe the organisation's processes for identifying, assessing and managing workforce-related risks and opportunities

- Describe which workforce-related risks and opportunities are most relevant to the company

- Describe where the risks and opportunities sit in the business and how they are managed

Metrics and targets

Investor participants are seeking a better understanding of:

- what is measured, monitored and managed in relation to the workforce, including more data and financially-relevant information

One approach is to explain how the company engages with employees and the feedback received (InterContinental Hotels Group plc, page 50)

Overview

Deciding which metrics to report has been the biggest area of discussion in relation to workforce issues. Companies and investors highlighted the same five elements of performance disclosure as being important in relation to workforce issues as those raised in our performance metrics report, namely alignment to strategy, transparency, information in context, reliability and consistency.

Investor view

The importance of data

Investors seek data that is reliable but many investors acknowledge that, whilst data is helpful, it can only tell part of the story of what is a complicated topic. There is also some concern about the maturity of the metrics being used, with most investors expressing more confidence in metrics such as health and safety. There is a balance to be found between data and narrative, with some areas, such as composition and turnover being reported numerically, but others such as employee views less so. Overall investors want quantitative disclosure, but interpretation of those metrics and why they are considered important necessarily requires qualitative description.

As highlighted in the section on business models and strategy an approach is to report what a company considers to be its workforce, including by segment or site (SAP SE, ConvaTec Group PLC, Fresnillo Plc, Carnival Corporation & Plc, pages 34 and 35)

"Sometimes with boundaries, if it's not clear we may need reluctantly to drop the number as we can't take anything from it, can't ‘trust' it" – Investor

“At a minimum a company should explain what the workforce is. We know too much about boards, not enough about the workforce” – Investor

Reflections on the five attributes of metrics investors seek – alignment to strategy, transparency, information in context, reliability, consistency

A number of investors do not think disclosures are well linked to the business model, or aligned to the strategy. The workforce can have a large impact on a company, whether in helping it achieve its strategy, or through payroll and investment costs. Where feedback is received, investors are interested in what insight that metric or feedback gives the company, and how it is going to address any problems identified.

Reliability of reporting is important. It is not clear how objective the measures used are, or what level of scrutiny they have been subject to. Many investors use third party data providers to triangulate a company's reporting, but these raise their own questions about timeliness and reliability.

As highlighted in the performance metrics report, investors would appreciate some indication of the oversight on which the information has been subject to. This may follow a spectrum, from third party assurance providers, through internal audit and to management metrics. They would also like to see more disclosure around the governance and oversight over the formulation of these metrics.

"How do I get the 'right' picture? For example, on regrettable turnover, the company can massage the numbers. This should be subject to internal audit” – Investor

“Comfort over the information and what the workforce is differs wildly... [but] the number of companies making an effort or expanding on their effort is obvious" – Investor

An approach is to refer to external providers of information or external data sources (Go-Ahead Group plc, EasyJet PLC, Rentokil Initial plc, pages 50 and 38)

Defining what good looks like in relation to workforce is complex. Therefore, comparisons are important. Many want to consider the company on a standalone basis where they can, especially around something as important as the workforce, but this assessment is better developed when comparisons can also be made. This allows investors to develop a view of the usefulness of the indicator in sectors and across time, including whether one company values its workforce and another does not.

One approach is to relate metrics to peer results (Coca-Cola HBC AG, page 51)

The key to getting an overview of the workforce is that the disclosures has been put in context. Investors felt that targets were often explained poorly. Investors want to understand what the target is, what the company considers to be good performance, and relative achievement levels, particularly where there is a link to remuneration.

"If there aren't enough details to form any conclusions it's a problem" – Investor

Many investors highlighted the importance of both consistency and comparability. Consistency includes the use of metrics across different reporting formats reflecting the same calculation and presentation across time. When questions of definition, boundary and scope are important, consistency becomes even more important to investors.

One approach is to present a range of interesting metrics, for example turnover, work patterns and promotion rate, by gender and location (National Grid plc, page 55)

An approach is to present granular information with trend data (SAP SE, SSE plc, Stora Enso OYJ, page 53) plus targets, with definitions for clarity (Rolls-Royce Holdings plc, page 54)

Company view

What is monitored and reported

Whilst many companies are monitoring topics such as health and safety, or carrying out employee engagement surveys to get insights into their organisation, there is a greater variety of approaches to workforce management and disclosure than there might be on other topics.

Companies are not always sure what to report. A number of organisations have been addressing workforce disclosures in recent years, and it is clear that metrics such as health and safety, staff numbers and composition and turnover are key for building an understanding of a company.

Reflections on the five attributes of metrics investors seek – alignment to strategy, transparency, information in context, reliability, consistency

Companies don't always define what they consider the workforce to be, what scopes their different metrics use, and whether these align. They are not always transparent about scope, calculation and boundaries when it comes to the disclosure of workforce information.

Often, the ability to disclose is closely tied to the business model. However, some companies also reported not necessarily interrogating the basis on which their metrics had been disclosed.

Company views on reliability were different from investors', as generally they had confidence in their internal data and processes. If companies did have questions around reliability they sometimes connected this to concern about the sensitive nature of the topic.

Companies generally noted that information was subject to management and board consideration, with some management teams seeing these metrics on a monthly basis. For most companies though, workforce disclosures are not subject to external assurance processes.

Many reported that it is difficult to show alignment to strategy in their workforce metrics, as it can imply singling out particular divisions or segments as the 'most important', or highlighting a competitive advantage.

One company also highlighted that not all workforce items are linked to the strategy, with some developed for a more specific purpose, such as a reporting requirement. Others outlined that they are addressing the regulatory need, but utilise that information more strategically as well.

"We can report on demographics, employee engagement, turnover etc, but I would ask so what? It's the impact of those figures that is interesting." – Company

The context of disclosures is important. Some report investment in systems and processes to gather information for both insight and reporting, and most were supportive of a range of metrics giving the best picture of their company. Many felt that until there was access to the information it was sometimes unclear what insight it could, or would, offer.

Companies were keen, however, also to have the capacity to tell their story. For example, whilst supportive of ethnic minority disclosures, one company asked what constituted an ethnic minority for their global company. In this type of instance companies feel that it is important to be able to provide the context around a metric to explain their own view.

In contrast to this, a lack of consistency can be difficult for some companies, as it results in a lack of comparability, and companies themselves are unable to assess effectiveness in addressing workforce issues. There is some support from companies for standardisation around the basis of preparation for the metrics that investors considered most important.

"Workforce disclosure is much more manageable as it relies on internal data. There is still some inconsistency obviously in the metrics, but it's more achievable" – Company

2. Appendix A – questions and disclosures

Metrics and targets

In order to help investors understand what is measured, monitored and managed in relation to the workforce, including more data and financially-relevant information, companies should ask themselves...

- What information is most relevant to an understanding of the workforce? How are these identified and how do they link to the strategy and business model?

- What metrics are monitored in relation to the company's culture?

- What do the metrics being monitored and managed indicate about the future direction of the company? How are they being integrated into day-to-day business management and reporting?

- What is the company doing to maximise workforce satisfaction and progression and how is this measured and monitored?

- What is the scope and boundary of the information presented? Is this the same across all information presented?

- To what level of oversight or assurance are the metrics subjected?

- What external data, or external expertise, is the company relying upon?

- Are the metrics disclosed calculated consistently? Is trend data provided?

- Which methodology is used for constructing the metrics? Is this comparable to other companies in the sector?

- What is the company trying to achieve in relation to its workforce and what targets has it set? Have the targets been achieved, and what comes next?

- How are metrics being integrated into the remuneration policy? Is this the most effective linkage possible?

Companies should then:

- Describe the metrics most relevant to an understanding of the workforce, including how they were identified

- Describe how the company is enhancing and incentivising its workforce to deliver value, including targets used to manage workforce-related challenges and performance

- Describe how the desired culture is being driven from the top including how 'buy in' has been achieved from the workforce

- Disclose employee engagement numbers, retention or turnover statistics (both planned and regrettable), values applied in the working environment or other measures used to monitor workforce culture

- Describe remuneration and other benefits and disclose training and development and progression statistics

The importance of linkage

Recent Lab projects on business models, risk and viability and performance metrics, have all raised the importance of linkage of company information. The conclusions from these previous reports have held true in the context of reporting on workforce matters.

Particular insights are in each of the sections of the report, but companies should generally consider the picture their reporting casts, and how they can fit elements of workforce reporting into their suite of disclosures most effectively to assist investors to understand their company. The infographic below describes some of the areas of reporting in which linkage is important, and how incorporating workforce elements into those sections of reporting can build a coherent picture about the company's workforce, and the company's attitude towards it.

The suite of disclosures that allow investors to understand a company:

This diagram illustrates how different aspects of a company's disclosure (Business model, Strategy and objectives, Business environment, Purpose, Principal risks and viability, Performance metrics) are linked by the central concept: "The disclosure of a company’s purpose, strategy, objectives and business model should together explain what the company does and how and why it does it. A description of a company’s values, desired behaviours and culture will help to explain and put its purpose in context."

Business model Explains how the company generates and preserves value over the longer-term

Strategy and objectives Provides insight into the company’s future development, performance, position and future prospects

Business environment Provides information about the main trends and factors, including both financial and wider matters

Purpose Explains how the company generate benefits for its members through economic success whilst contributing to inclusive and sustainable growth

Principal risks and viability Explains those material to the company, or where the impact of its activity poses a significant risk

Performance metrics Are used in assessing progress against objectives or strategy, monitoring principal risks, or generally the development, performance or position of the company

2. Appendix A – questions and disclosures

Governance and management

In order to help investors understand how boards consider and assess workforce matters, including what information they see, companies should ask themselves...

- What arrangements does the board have in place for assessing and considering workforce-related matters?

- Who has responsibility for workforce-related matters and how often are workforce-related issues considered?

- What insight does the information on workforce matters give the company and how is it being integrated into strategic planning?

- What information and metrics do the board monitor in relation to the workforce?

- How does the board get comfort over the metrics being used to monitor and manage the relevant matters? Who prepares the information the board receives in relation to the workforce?

- What is it like to work in the company, and how does the board get sight of the workforce's views? How does the board interact with the workforce without management present?

- Which workforce-related matters does the board consider it might be helpful to change? Is this informed by workforce feedback?

- Does the board consider the workforce-related reporting to be fair, balanced and understandable?

Companies should then:

- Describe the board's oversight of workforce-related matters and how the board has engaged with the workforce

- Describe management's role in considering and managing workforce issues

- Describe what impact the board's consideration of workforce matters has had on strategic decisions

Examples

| Company | Page | |

|---|---|---|

| One approach is to explain what information the board sees and the effect of this engagement on board decisions or of the involvement of Committees in workforce-related matters | Barratt Developments plc, RBS plc | 29, 30 and 31 |

| One approach is to report how the board engages on workforce matters, and changes they have made as a result | Rolls-Royce Holdings plc | 32 |

Business model and strategy

In order to help investors understand what the workforce is and how it contributes to the success of the business model, whether it is considered a strategic asset, how it is invested in, and what changes might need to be made to strategy in order to capitalise on workforce-related opportunities, companies should ask themselves...

- Is the workforce viewed as a strategic asset?

- What is the company's workforce, for example, does it include contractors, franchisee staff, supply chain, employees?

- How does the employment model enhance the business model?

- What workforce-related matters are relevant to the company's business model and strategy? What process has been followed in order to assess the impact of the workforce?

- How does the workforce help generate or preserve value in the company? How does the company invest in the workforce, and what expenditures are needed to ensure that the workforce continues to help the company generate and preserve value?

- How is the workforce enhanced and incentivised to deliver value?

- How do workforce matters affect key divisions, markets and/ or revenue/profit drivers? Over short, medium or longer-term horizons?

- How does the information gathered, particularly the workforce's views, factor into strategic planning?

- What triggers would require a change of direction?

- How do workforce-related risks and opportunities impact the financial statements?

Examples

| Company | Page | |

|---|---|---|

| An approach is for a company to report what it considers to be its workforce, including by segment or site | SAP SE, ConvaTec Group plc, Fresnillo plc, Carnival Corporation & plc | 34 and 35 |

| An approach is to present links between the workforce and their view on strategy | AstraZeneca plc | 35 |

| An approach is to present links between key performance indicators and strategy in consistent ways across formats | Taylor Wimpey plc, Rentokil Initial plc | 36 and 37 |

| An approach is to explain the employment model in the context of the business model(s) or outline workforce strategy and links to culture | InterContinental Hotels Group plc, Admiral Group plc | 38 and 39 |

| One approach is to link investment in inclusion to performance and strategy | SSE plc | 40 |

| One approach is to discuss how some of the challenges the company faces are being addressed | Marks and Spencer Group plc | 41 |

| One approach is to disclose how a company addresses employee feedback, and plans for the next year in the context of risk | Pearson plc | 48 |

| One approach is to link disclosures to definitions and personnel expenses | SAP SE | 52 |

Companies should then:

- Describe who the company considers its workforce to be (including total headcount, demographics and employment composition such as direct employees, contractors and/or others in the supply chain)

- Describe whether, and how, the company invests in the workforce as a strategic asset

- Describe how the workforce creates value for the organisation and what opportunities there are to grow that value

- Describe how the workforce model supports the business model and strategy

- Describe how the workforce-related risks and opportunities the organisation has identified affect the company's business, strategy and financial planning

Risk management

In order to help investors understand the risks and opportunities presented by the workforce and how the company is responding to them, companies should ask themselves...

- What systems and processes are in place for identifying and assessing workforce-related risks? How is a consideration of workforce-related risk integrated into this process?

- How are the risks related to the workforce being monitored, managed and mitigated?

- Which risks related to the workforce are most relevant to the business model and strategy? How are these identified and where are they in the business?

- What opportunities does the workforce provide to enhance the value of the company?

- Over what horizon have the risks been considered and risk assessments carried out? Why is this an appropriate horizon with reference to the business model?

- How is the assessment of the company's viability over the longer-term taking into account workforce-related issues?

Companies should then:

- Describe the organisation's processes for identifying, assessing and managing workforce-related risks and opportunities

- Describe which workforce-related risks and opportunities are most relevant to the company

- Describe where the risks and opportunities sit in the business and how they are managed

Examples

| Company | Page | |

|---|---|---|

| An approach is to link risk to other parts of the business, with descriptions of how the impact of workforce risks is changing and who owns the risk | Fresnillo plc, Just Eat plc, Pearson plc, SSE plc | 43 to 48 |

| One approach is to explain the supply chain, and some of the inherent risks | SSE plc | 44 |

Metrics and targets

In order to help investors understand what is measured, monitored and managed in relation to the workforce, including more data and financially-relevant information, companies should ask themselves...

- What information is most relevant to an understanding of the workforce? How are these identified and how do they link to the strategy and business model?

- What metrics are monitored in relation to the company's culture?

- What do the metrics being monitored and managed indicate about the future direction of the company? How are they being integrated into day-to-day business management and reporting?

- What is the company doing to maximise workforce satisfaction and progression and how is this measured and monitored?

- What is the scope and boundary of the information presented? Is this the same across all information presented?

- To what level of oversight or assurance are the metrics subjected?

- What external data, or external expertise, is the company relying upon?

- Are the metrics disclosed calculated consistently? Is trend data provided?

- Which methodology is used for constructing the metrics? Is this comparable to other companies in the sector?

- What is the company trying to achieve in relation to its workforce and what targets has it set? Have the targets been achieved, and what comes next?

- How are metrics being integrated into the remuneration policy? Is this the most effective linkage possible?

Examples

| Company | Page | |

|---|---|---|

| One approach is to explain how the company engages with employees and the feedback received | InterContinental Hotels Group PLC | 50 |

| An approach is to report what a company considers to be its workforce, including by segment or site | SAP SE, ConvaTec Group plc, Fresnillo plc, Carnival Corporation & plc | 34 and 35 |

| An approach is to refer to external providers of information or external data sources | EasyJet PLC, Go-Ahead Group plc, Rentokil Initial plc | 38 and 50 |

| An approach is to present granular information with trend data, plus targets with definitions for clarity | SAP SE, Stora Enso OYJ, SSE plc, Rolls-Royce Holdings plc | 51 to 54 |

| One approach is to relate metrics to peer results | Coca-Cola HBC AG | 51 |

| One approach is to present interesting metrics like turnover, work patterns and promotion rate, by gender and location | National Grid plc | 55 |

Companies should then:

- Describe the metrics most relevant to an understanding of the workforce, including how they were identified

- Describe how the company is enhancing and incentivising its workforce to deliver value, including targets used to manage workforce-related challenges and performance

- Describe how the desired culture is being driven from the top including how 'buy in' has been achieved from the workforce

- Disclose employee engagement numbers, retention or turnover statistics (both planned and regrettable), values applied in the working environment or other measures used to monitor workforce culture

- Describe remuneration and other benefits and disclose training and development and progression statistics

3. Appendix B – examples of developing practice

Introduction to the examples

Reporting on workforce issues is a developing area of practice. New regulatory requirements and investor expectations, are pushing companies towards more disclosure on this area. However, as this is a developing area the questions we have developed are designed to help make reporting more effective.

The following pages cover examples of developing practice. As this area is developing, it is likely that expectations will also continue to evolve.

Our report highlights some examples of current practice which resonated with investors. Not all of the examples are relevant for all companies and all circumstances, but each provides an example of where the company demonstrates how to enhance the value of their disclosures.

Highlighting aspects of good reporting by a particular entity should not be considered an evaluation of that entity's annual report as a whole.

Investors have contributed to this project at a conceptual level. The examples used are selected by the Lab to illustrate the principles that investors have highlighted and, in many cases, have been tested with investors, however, they are not necessarily examples chosen by investors and should also not be taken as confirmation of a holding or acceptance of the company's reporting more generally.

LIST OF EXAMPLES

| Area of reporting | Company | Page |

|---|---|---|

| Governance and Management | Barratt Developments plc | 29 and 30 |

| RBS plc | 31 | |

| Rolls-Royce Holdings plc | 32 | |

| Business model and strategy | SAP SE | 34 |

| Fresnillo plc | 34 | |

| Carnival Corporation & PLC | 34 | |

| ConvaTec Group plc | 35 | |

| AstraZeneca plc | 35 | |

| Taylor Wimpey plc | 36 | |

| Rentokil Initial plc | 37 | |

| InterContinental Hotels Group plc | 38 | |

| Admiral Group plc | 39 | |

| SSE plc | 40 | |

| Marks and Spencer Group plc | 41 | |

| Pearson plc | 48 | |

| SAP SE | 52 | |

| Risk Management | SSE plc | 43 and 44 |

| Fresnillo plc | 45 and 46 | |

| Just Eat plc | 47 | |

| Pearson plc | 48 | |

| Metrics and Targets | InterContinental Hotels Group plc | 50 |

| EasyJet PLC | 50 | |

| Go-Ahead Group plc | 50 | |

| Coca-Cola HBC AG | 51 | |

| Rentokil Initial plc | 38 | |

| SSE plc | 51 | |

| SAP SE | 52 | |

| Stora Enso OYJ | 53 | |

| Rolls-Royce Holdings plc | 54 | |

| National Grid plc | 55 |

Governance and management

In order to help investors understand how boards consider and assess workforce matters, including what information they see, companies should ask themselves...

- What arrangements does the board have in place for assessing and considering workforce-related matters?

- Who has responsibility for workforce-related matters and how often are workforce-related issues considered?

- What insight does the information on workforce matters give the company and how is it being integrated into strategic planning?

- What information and metrics do the board monitor in relation to the workforce?

- How does the board get comfort over the metrics being used to monitor and manage the relevant matters? Who prepares the information the board receives in relation to the workforce?

- What is it like to work in the company, and how does the board get sight of the workforce's views? How does the board interact with the workforce without management present?

- Which workforce-related matters does the board consider it might be helpful to change? Is this informed by workforce feedback?

- Does the board consider the workforce-related reporting to be fair, balanced and understandable?

Companies should then:

- Describe the board's oversight of workforce-related matters and how the board has engaged with the workforce

- Describe management's role in considering and managing workforce issues

- Describe what impact the board's consideration of workforce matters has had on strategic decisions

Examples

| Company | Page | |

|---|---|---|

| One approach is to explain what information the board sees and the effect of this engagement on board decisions or of the involvement of Committees in workforce-related matters | Barratt Developments plc, RBS plc | 29, 30 and 31 |

| One approach is to report how the board engages on workforce matters, and changes they have made as a result | Rolls-Royce Holdings plc | 32 |

Barratt Developments plc

Annual Report and Accounts 2019

Page 26

What is helpful?

Barratt Developments discloses employee-related metrics, the method of engaging with employees and the effect of engagement with employees on the decisions of the Board, including some additional data requested by the Board and plans for a future detailed review of culture.

Engagement

Employees continued

Engagement survey

- We annually undertake an employee engagement survey to gain insight into the issues that matter most to our employees. For the year under review, the survey results showed the overall level of engagement is above upper quartile and above the top decile score. More than 80% of our employees took part in the survey.

- Each divisional and functional head received a report setting out the results for their respective teams. These results have been shared with the teams and plans have been put in place to maintain or enhance employee engagement levels. We will be conducting pulse surveys during the course of the year to measure changes in any key areas.

- A number of changes were made to this year's survey to encourage employees to participate. These included:

- Introduction of the survey, by video from the Chief Executive;

- Fewer questions with more encouragement of open ended comments; and

- Drill down questions, where appropriate, to further investigate answers provided.

- Downloadable reports have been produced with actionable insights and guidance for line managers.

Outcome from engagement

- We have increased the emphasis on innovation around the Group within existing schemes such as the Customer First Recognition Scheme.

- New strategies to promote health and wellbeing have been put in place as detailed in the Health, safety and wellbeing section above.

- We have continued to streamline ways of working and build interdepartmental relationships.

- We have been more active in promoting our flexible working policy initiatives such as home working and job shares.

- We have put in place a number of initiatives to improve internal communications, both to and from employees.

- We actively promoted secondments and opportunities for involvement in projects across the business to help career and self development of our employees.

- To enable employees to see what changes are being made as a result of the survey we promote a 'You Said, We Did' on the Group's intranet.

Effect of engagement with employees on Board decisions

- The Board continues to encourage improvements in systems, processes and benefits which impact the health, safety and wellbeing of our employees.

- To increase its engagement with the workforce, the Board nominated Richard Akers, the Senior Independent Director, as the designated Non-Executive Director for workforce engagement. Richard will attend his first Workforce Forum meeting in October 2019 and report back to the Board thereafter. He will attend at least one meeting annually going forward and is also available to members of the Workforce Forum throughout the year.

- The Board discussed the benefits of a number of the suggestions made by Senior Management in respect of driving the Group's strategy and agreed to explore the opportunity to vertically integrate with our supply chain. Ultimately, this resulted in the acquisition of Oregon.

- The Board continues to encourage management to find ways of improving our diversity and inclusion position. It has requested diversity and inclusion data to be provided as part of the regional site visits that it undertakes on an annual basis. In addition, the Board monitors progress against, and the appropriateness of, the targets established to drive our diversity and inclusion initiative.

- The Board gained further insight into the importance of fire stopping and how it works.

- In order to ensure that the tone of our culture is driven from the top, the Board's involvement in the review process is critical. The Board is scheduled to undertake a detailed review of our culture and will agree with management as to what, if any, actions need to be taken to further improve, develop and embed the culture across the business.

Barratt Developments plc

Annual Report and Accounts 2019

Pages 42 and 46

The challenge

The housebuilding industry is facing a skills shortage and as the UK's largest housebuilder we are committed to playing our part to help address this shortage and to reduce the impact on our business.

Strategic priority

Our people are the heart of our business and we aim to attract and retain the best people by investing in their development and success. We have well-established apprenticeship schemes to attract the next generation to enter our industry. We seek to create a great place to work, founded on an open and honest culture that embraces diversity and inclusion.

KPIs

Upper quartile employee engagement

82% (2018: 79%)

Why we measure

- To gain an insight of, and provide a forum for, employee views.

- To retain and invest in the best people and focus on their development and success

Risks

The skills shortage in our industry means it is of utmost importance to recruit and retain best in class people.

Progress in FY19

Our people are the heart of our business and our continued success has been achieved through the hard work and dedication of our employees. Our future growth is underpinned by our aim to attract and retain the best people and our commitment to playing our part to help address the industry skills shortage.

We have 470 apprentices, graduates and trainees on programmes, around 7% of our workforce. A further 146 apprentices have been recruited in FY19 for our FY20 intake. During the year, average training days per employee increased to 4.7 days (2018: 4.0 days) and we have maintained our upper quartile performance in our engagement survey and reduced employee turnover.