The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Technical Actuarial Guidance: Confirmation under sections 101 and 105 of the Pension Schemes Act 2026

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2026

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

- 1. Introduction

- 2. Application of technical actuarial standards

- 3. Clarification of key terms

- 4. A proportionate approach to the technical actuarial work

- Data availability

- Understanding the rule alteration

- Cases where no further information is needed

- Cases where further information is needed

- Contradiction approach

- Individual member data needed to form an opinion

- Inability to provide retrospective confirmation

- Retrospective confirmation outside the scope of section 101

- Multiple rule alterations

- 5. Illustrative approach to the technical actuarial work and examples

- 6. Professional and ethical considerations

1. Introduction

Purpose

1.1.The FRC issues guidance for a number of specific purposes, for example to support good practice, to address concerns raised by stakeholders or at the request of government or other regulators. The guidance is not prescriptive and is not mandatory.

1.2.The overall purpose of the FRC's technical actuarial guidance is to improve the quality of technical actuarial work. The purpose of this guidance is to assist scheme actuaries in considering whether to provide a confirmation under section 101 or section 105 of the Pension Schemes Act 2026 (referred to in this guidance as a retrospective confirmation) in a proportionate manner and to promote consistency across the industry. Section 6 of this guidance relates to ethical matters and has been provided by, and included at the request of, the Institute and Faculty of Actuaries.

1.3.As the Pension Schemes Bill has not yet received Royal Assent and remains in draft, this guidance is subject to change as the Bill progresses through Parliament. The FRC will update this guidance to reflect legislative changes, where necessary.

Context

1.4.Section 37(1) of the Pension Schemes Act 1993, together with regulation 42 of the Occupational Pension Schemes (Contracting-out) Regulations 1996 (regulation 42), required that, for an alteration to the rules of a contracted-out salary-related pension scheme to be valid, the scheme actuary had to be satisfied, and to have confirmed so in writing to the trustees or managers, that the pension scheme would have continued to satisfy the statutory standard relevant to contracting-out. The statutory standard from 6 April 1997 was that pensions for members, and for their widows or widowers, were broadly equivalent to, or better than, the pensions which would be provided under a reference scheme (the reference scheme test).

1.5.A High Court ruling in 2023, subsequently supported by the Court of Appeal in 2024, in Virgin Media Ltd v NTL Pension Trustees II Ltd, determined that certain amendments to the Virgin Media pension scheme were void because no evidence could be produced to show that the necessary actuarial confirmation had been obtained. This created uncertainty across the pensions industry because many pension schemes may be unable to evidence actuarial confirmation in relation to historic rule alterations, and so may potentially have significantly higher liabilities than expected. The government decided to resolve this uncertainty through legislation.

1.6.Under section 101 or section 105 of the Pension Schemes Act 2026, the trustees or managers may request the current scheme actuary in writing to consider whether or not, on the assumption that it was validly made, an alteration purportedly made, and which meets the conditions for a potentially remediable alteration as defined in section 100 and section 104 of the Pension Schemes Act 2026, would have prevented the pension scheme from continuing to satisfy the statutory standard.

1.7.Sections 100 and 101 apply to pension schemes in Great Britain and sections 104 and 105 apply to pension schemes in Northern Ireland. References in this guidance to section 100 or 101 are to be taken as references to section 104 or 105 respectively where appropriate.

1.8.If a scheme actuary who has received a request in accordance with section 101 confirms to the trustees or managers in writing that, in the scheme actuary's opinion, it is reasonable to conclude that, on the assumption that it was validly made, the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard, then the alteration is to be treated as having been validly made insofar as the requirements of regulation 42 are concerned.

Intended audience

1.9.This guidance is aimed at practitioners who have received a written request from the trustees or managers of a pension scheme, of which they are the scheme actuary, in accordance with section 101.

2. Application of technical actuarial standards

Application of technical actuarial standards

2.1.The work carried out by a scheme actuary in considering whether to provide a retrospective confirmation is technical actuarial work and is in scope of TAS 100.

2.2.If the rule alteration affected only future service benefits then the work is not in scope of TAS 300 but, if it also affected accrued benefits, then it is a "scheme modification", as defined in TAS 300, and the work is in scope of TAS 300, but the only provisions which may be relevant are P1.1 and P1.3. These are pensions sector-specific provisions in relation to compliance with TAS 100 Principle 3 'Data' and TAS 100 Principle 4 'Assumptions' respectively.

2.3.Other provisions of TAS 300 are not relevant to the technical actuarial work in relation to a retrospective confirmation. In particular, P4.1 to P4.3 of TAS 300 are not relevant because the work does not involve providing advice on the rule alteration itself.

2.4.The definitions used in TAS 100 and TAS 300 apply to this guidance.

Data

2.5.Data is defined in TAS 100 and TAS 300 as:

Facts or information usually collected from records or from experience or from observation. Examples include membership or policyholder data, claims data, asset and investment data, operating data (such as administrative or running costs), benefit definitions, and policy terms and conditions.

2.6.Therefore, for work in relation to section 101, in addition to any individual pension scheme member data which the current scheme actuary may use, data includes any relevant facts or information available to the current scheme actuary in relation to the rule alteration being considered or the pension scheme on or after the effective date of the rule alteration. References to data in TAS 100 and TAS 300 and in this guidance are to be read accordingly.

Assumptions

2.7.Section 101 refers to "making assumptions or relying on presumptions”. A scheme actuary who is making assumptions or relying on presumptions will be making considerations based on facts or information available to them and treating a matter as true without complete evidence or proof. Both assumptions and presumptions should be treated as assumptions when applying the TASs.

Documentation and communications

2.8.The scheme actuary will exercise judgement over applying TAS 100 Principle 6 'Documentation' and TAS 100 Principle 7 'Communications'. Documentation is physical or digital material in relation to the scheme actuary's technical actuarial work which provides evidence that serves as a record of facts, opinions, explanations of judgements, or other matters. It is not necessarily provided to an intended user. This differs from communications, which are provided to the intended user.

2.9.The scheme actuary may choose to limit communications to provision of the retrospective confirmation or the indication of a decision not to provide it, if giving any further information is unlikely to affect the actions of the intended user. However, a scheme actuary who judges that they cannot provide a retrospective confirmation will need to consider whether, to comply with TAS 100 Principle 7 'Communications', it is necessary to set out the reason for this.

3. Clarification of key terms

Reasonable to conclude

3.1.A scheme actuary who is considering whether to provide a retrospective confirmation has to form an opinion about whether it is reasonable to conclude that, on the assumption that the rule alteration was validly made, the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard, that is from continuing to meet the reference scheme test.

3.2.There is no definition of the phrase "reasonable to conclude” as it is used in section 101. The phrase takes its ordinary meaning, and the scheme actuary is expected to exercise judgement if there is uncertainty about whether the reference scheme test would continue to have been met after the rule alteration.

3.3.The test does not require the scheme actuary to have certainty about whether the rule alteration would not have prevented the pension scheme from continuing to meet the reference scheme test. Instead, the test requires the scheme actuary to reach a reasoned and justifiable conclusion taking into account all the relevant facts and circumstances identified after taking a proportionate approach to the gathering of data.

Continuing to satisfy

3.4.Section 101 refers to whether "the alteration would have prevented the scheme from continuing to satisfy the statutory standard". Therefore, for the purpose of providing confirmation under section 101 (and only for this purpose), the scheme actuary is required to adopt the premise that the reference scheme test was satisfied immediately before the purported rule alteration and to consider only whether the rule alteration itself, and not any changes (such as to pay structures) over time, would have affected meeting of the reference scheme test.

3.5.If information discovered subsequently suggests that the scheme did not meet the reference scheme test prior to the rule alteration, it is a matter for the trustees whether that earlier breach has any current consequences for the scheme, but consideration of this does not fall within the scheme actuary's assessment under section 101.

4. A proportionate approach to the technical actuarial work

4.1.The scheme actuary is encouraged to take a proportionate approach to carrying out technical actuarial work and to applying the TASs. The rest of this guidance sets out how proportionality can be applied when carrying out work in relation to a retrospective confirmation. Further guidance on proportionality in technical actuarial work can be found in Technical Actuarial Guidance: Proportionality.

4.2.The scheme actuary is reminded that, in order to form an opinion on whether to provide a retrospective confirmation, it is not necessary to:

- put themselves in the position of the scheme actuary at the time of the purported rule alteration, carry out calculations which that scheme actuary might have carried out to provide a confirmation in accordance with regulation 42, or consider whether that scheme actuary would have been able to provide such a confirmation;

- have the full data which would have been available at the time of the purported rule alteration;

- meet the requirements of Guidance Note 28 (for purported rule alterations with an effective date up to 30 September 2011) or those parts of the Occupational Pension Schemes (Contracting-out) Regulations 1996 which superseded it (for purported rule alterations with an effective date from 1 October 2011), as they applied at the time of the purported rule alteration;

- determine with certainty whether the reference scheme test was met after the purported rule alteration;

- determine with certainty whether the purported rule alteration would not have prevented the pension scheme continuing to meet the reference scheme test; or

- have regard to TAS 300 P4.1 to P4.3.

Data availability

4.3.Section 101 sets out that the scheme actuary "may act on the basis of the information available to the actuary, as long as the actuary considers it sufficient for the purpose of forming an opinion on the subject matter of the request”. Therefore, the scheme actuary is expected to exercise judgement over what information is sufficient for the purpose of forming an opinion. In doing so, the scheme actuary is encouraged to use information which is readily available, that is information which can be obtained without incurring a disproportionate amount of time and effort.

4.4.Section 101 gives flexibility over the approach to be taken by setting out that the scheme actuary "may take any professional approach (including making assumptions or relying on presumptions) that is open to the actuary in all the circumstances of the case”. Hence the scheme actuary may make appropriate assumptions about the pension scheme and/or about information which is not available.

4.5.In the majority of cases, the scheme actuary will not need full individual membership data to be able to form an opinion on whether it is reasonable to conclude that the rule alteration would not have prevented the pension scheme from continuing to meet the reference scheme test.

Understanding the rule alteration

4.6.To comply with TAS 100 Principle 3 'Data', the scheme actuary will need to have a full understanding of the rule alteration insofar as it could have an impact on the reference scheme test. If there is any uncertainty, whether on a legal matter or otherwise, about which rule alteration is the subject of the section 101 request, or about the effect of the rule alteration, the scheme actuary is encouraged to ask the trustees, or their legal advisors, for clarification.

Cases where no further information is needed

4.7.The scheme actuary may wish to consider first whether an understanding of the rule alteration alone is sufficient to determine whether the alteration would not have prevented the pension scheme from continuing to meet the reference scheme test.

4.8.Examples where no further information beyond details of the rule alteration itself is needed may include rule alterations (non-exhaustively):

- which do not decrease any benefits;

- which affect only benefits which are not connected to the meeting of the reference scheme test, such as lump sum benefits on death in service, children's pensions and ill-health pensions;

- where benefits from the pension scheme are subject to a reference scheme underpin;

- to indexation and revaluation caps, or changes from RPI to CPI for indexation or revaluation, which reflect corresponding changes in legislation; and

- where a simple assessment is sufficient to reach a conclusion, such as spouses' pensions being cut below 50% of members' pensions but remaining at least 50% of reference scheme members' pensions because the accrual rate for members' pensions sufficiently exceeds the reference scheme accrual rate.

4.9.Section 5 of this guidance provides illustrative examples (examples 1 to 3) to aid understanding.

Cases where further information is needed

4.10.In cases where further information is needed to consider whether or not the rule alteration would have prevented the pension scheme from continuing to meet the reference scheme test, the scheme actuary is encouraged to inform the trustees or managers of the pension scheme, and the employer where appropriate, what further information would be helpful in forming an opinion.

4.11.As it is unlikely that individual member data from the relevant period in question would be readily available, the scheme actuary is encouraged to target their efforts on information which provides indirect evidence which could support the exercise of their judgement in forming an opinion, noting that certainty is not required.

4.12.The scheme actuary may choose to request the provision of any such information which is readily available. It is for the trustees or managers, or the employer where appropriate, to decide how much time and effort to spend on obtaining data. However, it is a matter for the scheme actuary's judgement whether the information made available is sufficient to form an opinion about whether to provide the retrospective confirmation.

4.13.Forms of data which provide indirect evidence may include the following (non-exhaustively):

- legal advice, trustees' meeting minutes, member communications or other documents relating to the rule alteration;

- triennial and other reference scheme test certificates, and contracting-out certificates, produced subsequent to the effective date of the rule alteration;

- pension scheme valuation reports produced after the effective date of the rule alteration, to the extent that these include information about the rule alteration or about the ongoing meeting of the reference scheme test;

- papers which contain evidence that work was carried out at the time of the rule alteration in relation to considering the reference scheme test, such as requests for relevant data, relevant calculations, meeting notes and correspondence with the trustees or the employer about the reference scheme test; and

- papers relating to a bulk transfer into the pension scheme which include references to earlier rule alterations, or the ongoing meeting of the reference scheme test, in the transferring pension scheme.

4.14.The scheme actuary may be able to obtain such information from the trustees, but it is possible that some of this information can be obtained from a third party such as the scheme actuary or pension scheme administrator at the time of the purported rule alteration, advisors to the employer or any legal advisors involved.

4.15.A particular cause of complexity in carrying out the reference scheme test for some pension schemes was differences between the earnings definitions used by the pension scheme and the reference scheme. Forms of data which provide indirect evidence may include information relevant to the earnings of pension scheme members, such as (non-exhaustively):

- information about general or average salary levels, pay bands and variable pay across the pension scheme membership;

- information about salary structures or employment structures, including proportions of workers in different roles who may have had different proportions of non-pensionable pay;

- earnings information stored for the purpose of GMP calculations (which, while relating to dates earlier than 6 April 1997, may allow the scheme actuary to draw inferences about earnings patterns at later dates); and

- information from the scheme actuary's experience about earnings of employees in the same industry.

4.16.In seeking to obtain data about earnings levels and structures, the scheme actuary may:

- consider obtaining confirmation from the employer that no significant changes in remuneration patterns occurred over specific periods of time;

- obtain current salary information and backdate this, either by establishing that the remuneration structure is similar to that at the time of the rule alteration or by taking account of relevant changes where these are known;

- take into account the levels of variable pay, such as overtime and shift pay, that are typical in particular industry sectors to make an assessment about the proportion of members of the pension scheme who received a particular level of non-pensionable pay relative to pensionable pay; and/or

- choose to draft a descriptive statement, for signature by the employer, on past earnings, which would allow the scheme actuary to make reasonable assumptions to support the judgement to which they come.

4.17.A scheme actuary may use information from a later date to make inferences about whether the reference scheme test continued to be met after the effective date of the rule alteration. However, it would not be appropriate to use information which could not have been known by the scheme actuary at the effective date of the rule alteration, for example later actual rates of inflation.

4.18.Section 5 of this guidance provides illustrative examples (examples 4 to 6) to aid understanding.

Contradiction approach

4.19.The scheme actuary may be able to form a view on the pay structures which would have had to be in place at the time of the rule alteration for the reference scheme test not to have continued to have been met. For instance, the scheme actuary may conclude that this would have required a certain proportion of pension scheme members to have had non-pensionable earnings of more than a certain percentage of their pensionable earnings.

4.20.The scheme actuary may judge that such circumstances were unlikely to have existed and so be able to provide the retrospective confirmation without seeking further pay data. Alternatively, they may choose to request a statement from the employer, or from the trustees, that such circumstances did not exist, or were unlikely to have existed.

4.21.Section 5 of this guidance provides illustrative examples (examples 7 and 8) to aid understanding.

Individual member data needed to form an opinion

4.22.In a minority of cases, the scheme actuary may judge that individual member data is needed in order to form an opinion about whether the rule alteration would not have prevented the pension scheme from continuing to meet the reference scheme test.

4.23.Section 5 of this guidance provides an illustrative example (example 9) to aid understanding.

Inability to provide retrospective confirmation

4.24.In following TAS 100 Principle 7 'Communications', the scheme actuary is expected to communicate to the requesting trustees or managers that they are unable to provide the retrospective confirmation if, in their opinion, it is not reasonable to conclude that the rule alteration would not have prevented the pension scheme from continuing to meet the reference scheme test.

4.25.Where a scheme actuary is unable to provide a retrospective confirmation, they may choose to set out details of the investigation and analysis undertaken and the reason why the confirmation cannot be given. They may also choose to communicate their view of what additional information, if it were available, might enable them to provide a retrospective confirmation.

4.26.Section 5 of this guidance provides illustrative examples (examples 10 and 11) to aid understanding.

Retrospective confirmation outside the scope of section 101

4.27.The trustees or managers of a pension scheme may make a request to the scheme actuary in accordance with the process set out in section 101 in connection with a case where the scheme actuary considers it unnecessary. This may be where there is some evidence of a written confirmation having been given at the time of the rule alteration or where the scheme actuary considers that the rule alteration does not meet the conditions for a potentially remediable alteration as defined in section 100, but the trustees or managers have chosen to follow the section 101 process to provide greater certainty (noting that there may be particular types of rule alteration over which there is legal uncertainty about whether they were in scope of regulation 42, and therefore are now in scope of section 101).

4.28.In such a case, the scheme actuary may suggest to the trustees or managers that the rule alteration may be out of scope of section 101 and that they seek legal advice on whether it is appropriate to make a request in accordance with section 101.

4.29.The scheme actuary may nevertheless be able to form an opinion that it would be reasonable to conclude that the rule alteration would not have prevented the pension scheme from continuing to meet the reference scheme test. In this event, the scheme actuary may wish to consider confirming this to the requesting trustees or managers.

4.30.Section 5 of this guidance provides an illustrative example (example 12) to aid understanding.

Multiple rule alterations

4.31.Where multiple rule alterations to a pension scheme, with the same effective date, are to be considered under the section 101 process, it is likely that the scheme actuary will consider whether the combined effect of the alterations would be that the scheme continued to meet the reference scheme test.

4.32.Where multiple rule alterations to a pension scheme, with different effective dates, are to be considered sequentially under the section 101 process, the considerations for each alteration may differ, for example because of the nature of the rule alterations or the quality of data available from each occasion. However, as the information which the scheme actuary uses may be available from the same sources, and as information relevant to one alteration may be relevant to another alteration, the scheme actuary may wish to consider asking for information about the multiple alterations together.

5. Illustrative approach to the technical actuarial work and examples

Illustrative approach

5.1.A scheme actuary who is considering a request under section 101 and is deciding whether to provide a retrospective confirmation “may take any professional approach (including making assumptions or relying on presumptions) that is open to the actuary in all the circumstances of the case".

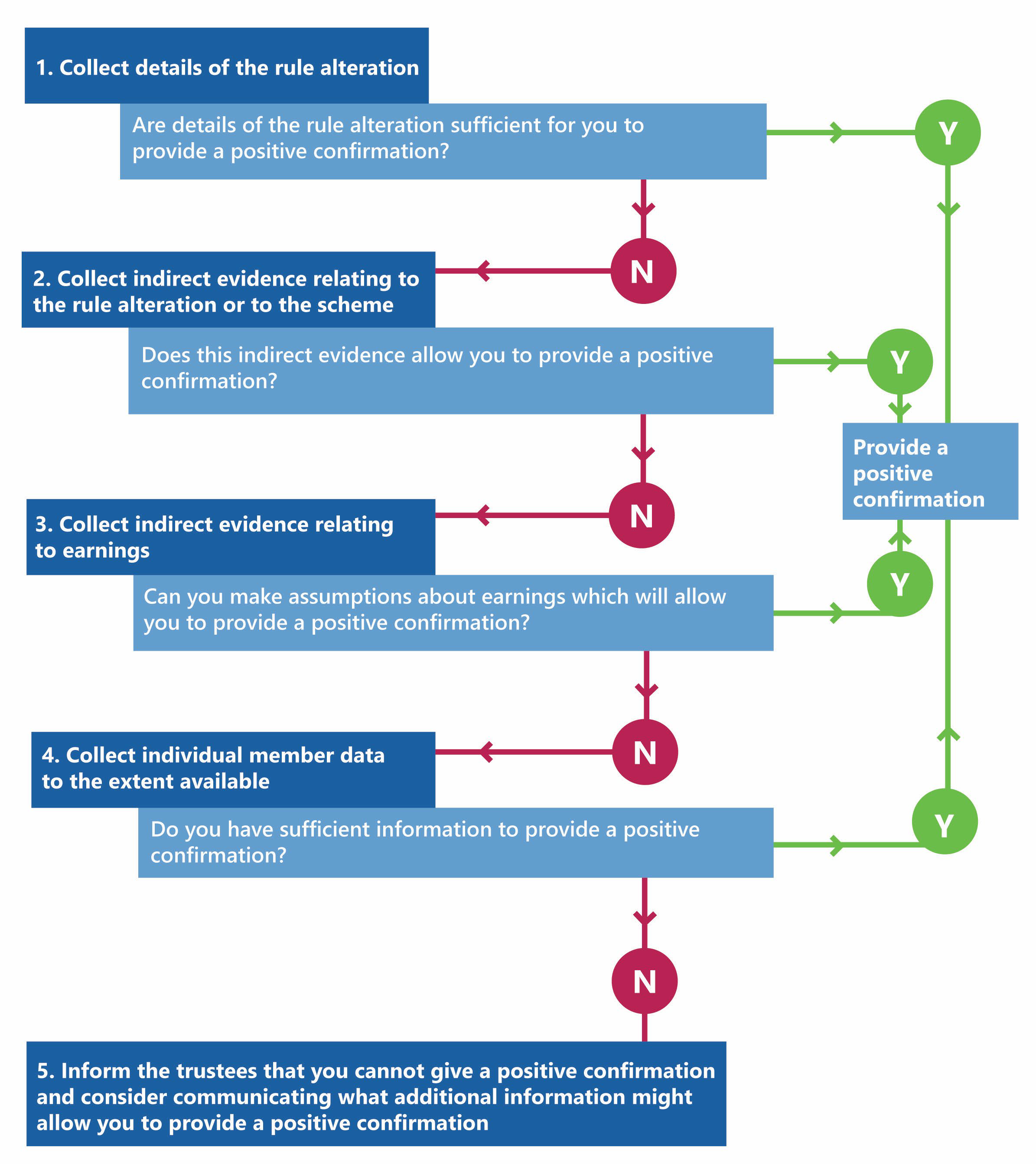

5.2.The flow chart below represents one possible approach which the scheme actuary may adopt and which is expected, in most cases, to be a proportionate approach which minimises the time and effort required to form an opinion about whether to provide the retrospective confirmation. However, other approaches may be adopted, according to the circumstances.

5.3.Where the scheme actuary has been unable to provide a retrospective confirmation because there was insufficient information to form the necessary opinion, the scheme actuary may be able to start anew if more information subsequently comes to light.

Examples

Cases where no further information is needed beyond rule alteration

Example 1 - independent of benefits before alteration

The accrual rate was reduced from 1/60 to 1/80 for future service but, at the same time, an underpin was introduced for future service benefits such that they became subject to a minimum of those payable under reference scheme.

The scheme actuary notes that the rule alterations have the same effective date and decides to consider their combined effect. The reference scheme test is met so the scheme actuary provides the retrospective confirmation.

Example 2 - dependent on benefits before alteration

Pension increases for future service benefits were changed to be based on CPI rather than RPI. The change and the date of the rule alteration match the change in statutory minimum increases.

Since section 101 requires adoption of the premise that the scheme met the reference scheme test immediately before the rule alteration, it will meet the reference scheme test after the alteration, so the scheme actuary provides the retrospective confirmation.

Example 3 - simple assessment

In a scheme with an accrual rate of 1/50 in which all earnings were pensionable, spouses' pensions for future service were reduced from one half to one third of the member's pension.

Although the spouse's pension fraction is lower than in the reference scheme, the spouse's pension accrual rate of 1/150 still exceeds the reference scheme spouse's pension accrual rate of 1/160. The reference scheme test is met so the scheme actuary provides the retrospective confirmation.

Cases where further information is needed beyond rule alteration

Example 4 - data in form of trustees' meeting minutes and inference about earnings levels

The accrual rate was reduced from 1/60 to 1/80 for future service. Pensionable salary was basic salary. The industry sector and the eligibility criteria for scheme membership suggest that it is likely that most members would have had salaries above the upper earnings limit, and so above the maximum earnings taken into account in the reference scheme test.

The scheme actuary asks the trustees whether there is any contemporaneous record of discussions about the rule alteration. The trustees provide a copy of the minutes of a trustees' meeting where the alteration was considered. These refer to the scheme actuary at the time explaining that the alteration could be made without affecting the scheme's contracting-out status.

Based on the likelihood that most members' salaries were above the maximum level which is taken into account in the reference scheme test and the contents of the trustees' meeting minutes, the scheme actuary forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard and provides the retrospective confirmation.

Example 5 - data in form of earnings patterns and subsequent reference scheme test certificate

The accrual rate was reduced from 1/60 to 1/80 for future service benefits. Pensionable salary was basic salary. The industry sector suggests that it is likely that a significant proportion of members had salaries below the upper earnings limit. As a result, there would potentially have been members whose benefits would be lower than reference scheme benefits.

The scheme actuary considers that it is likely that, if the scheme actuary at the time of the rule alteration had assessed whether the reference scheme test would have been met after the alteration, this assessment would have been carried out using individual members' earnings data.

There is no evidence relating to such an assessment having been carried out, but there is a reference scheme test certificate provided in conjunction with the next actuarial valuation following the alteration, and it is known that no further alterations were made before the valuation date.

The scheme actuary asks the employer whether there was any change in earnings patterns for the relevant employees between the date of the rule alteration and the effective date of the valuation. The employer confirms that there was no such change.

Based on the indirect evidence of the reference scheme test certificate and the employer's confirmation about earnings patterns, the scheme actuary forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard and provides the retrospective confirmation.

Example 6 - data in form of subsequent reference scheme test information

The rule alteration and earnings levels are the same as in example 5, but no subsequent reference scheme certificate has been found. However, the trustees obtain from the firm of the original scheme actuary evidence of the scheme meeting the reference scheme test, with supporting calculations, at the next actuarial valuation after the alteration

Unlike in example 5, the employer is no longer in business and the scheme actuary is not able to obtain information on whether there was any change in earnings patterns for the relevant employees between the date of the rule alteration and the effective date of the valuation.

The period between the date of the rule alteration and the effective date of the next actuarial valuation was short and there is nothing to suggest that earnings patterns had changed in a way which would make the reference scheme less likely to have been met after the rule alteration. The scheme actuary forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard and provides the retrospective confirmation.

Contradiction approach

Example 7 - use of contradiction approach to support judgement

The accrual rate was reduced from 1/60 to 1/70 for future service benefits. Pensionable salary was basic salary.

An actuarial valuation was carried out with an effective date the same as that of the rule alteration. The report on the valuation does not refer to the reference scheme test but shows the average pensionable salary of scheme members.

The scheme actuary estimates that, for the reference scheme test to have failed for an individual, non-pensionable earnings within the upper earnings limit would typically have had to have been of the order of 100% or more of pensionable earnings.

The scheme actuary has significant experience over a long period of advising on schemes of employers in the same sector and considers that it would be rare for non-pensionable earnings to exceed 20% of basic salary for such employees.

The scheme actuary considers that it is likely that fewer than 10% of members would have failed the reference scheme test and forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to meet the reference scheme test and that there is no need to ask the employer for further information about earnings. The scheme actuary provides the retrospective confirmation.

Example 8 - use of contradiction approach to support judgement

The circumstances are similar to example 7, except that the actuary estimates that, for the reference scheme test to have failed for an individual, non-pensionable earnings within the upper earnings limit would typically have had to have been of the order of 50% or more of pensionable earnings.

The scheme actuary asks the employer about typical levels of earnings relative to basic salary for employees in the scheme at the time of the rule alteration. The employer indicates that it would have been common for non-pensionable earnings to exceed 20% of basic salary for such employees.

Based on this information from the employer, the scheme actuary considers that it is likely that fewer than 10% of members would have failed the reference scheme test. The scheme actuary forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to meet the reference scheme test and provides the retrospective confirmation.

Individual member data needed to form an opinion

Example 9 - need for individual member data

The accrual rate was reduced from 1/60 to 1/80 for future service benefits. Pensionable salary was basic salary so there would potentially have been some members whose benefits would be lower than reference scheme benefits, and it is possible that such members amounted to more than 10% of the total membership. No information can be found relating to the reference scheme test on or after the effective date of the rule alteration.

The scheme actuary explains to the trustees and the employer that, in the absence of alternative indirect evidence, data about individual members' earnings would be needed to form an opinion about whether or not the alteration would have prevented the scheme from continuing to meet the reference scheme test.

Earnings data from the time of the rule alteration is extracted from the pensions administration system. The scheme actuary is unable to verify the data but, after inspection and carrying out some tests for reasonableness, has no reason to doubt its accuracy.

The scheme actuary considers the information available, and judges that it is sufficient to make appropriate assumptions which can be used to estimate the proportion of the membership whose benefits would be lower than reference scheme benefits. Based on this estimate, the scheme actuary forms the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to meet the reference scheme test and provides the retrospective confirmation.

Inability to provide retrospective confirmation

Example 10 - insufficient evidence to form an opinion

The circumstances are similar to example 9, except that no individual earnings data, or information on earnings structures in place at the time, can be found.

The scheme actuary is aware that the regime in force in relation to contracting-out on a salary-related basis from 1997 relied on periodic actuarial checks that the reference scheme test continued to be met, and that trustees were to inform the scheme actuary appointed at the time if they became aware of changes in circumstances which might lead to the reference scheme test ceasing to be met.

The scheme actuary considers that the fact that the scheme continued to be used for contracting-out is therefore supportive of a conclusion that the reference scheme test was met. However, the scheme actuary makes the judgement that, in their opinion, this is insufficient on its own for it to be reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to meet the reference scheme test.

The scheme actuary considers it possible that there may be further information which, if provided, and when taken together with the inference from the scheme continuing to be used for contracting-out, might be sufficient to form an opinion which would allow provision of the retrospective confirmation. The scheme actuary asks the trustees and the employer whether they can provide any additional information to support a conclusion that the reference scheme test was met at a point after the rule alteration. The scheme actuary provides the trustees and the employer with a list of types of information which might help, and offers to discuss what information may be readily available to the trustees, employer or third parties. The trustees and the employer do not provide anything further.

The scheme actuary explains to the trustees and the employer that, without some positive evidence that the contracting-out regime was followed, they would need data about individual members' earnings at the time of the rule alteration to form an opinion about whether the alteration would not have prevented the scheme from continuing to meet the reference scheme test.

In the absence of any such data, the scheme actuary's opinion is that it is not reasonable to conclude that the alteration would not have prevented the scheme from meeting the reference scheme test.

The scheme actuary therefore does not provide the retrospective confirmation, explaining the reason for this to the trustees and noting that, if further information becomes available in future, they may wish to revisit the position.

Example 11 - evidence suggests reference scheme test not met

The circumstances are similar to example 7, where there is information on the average pensionable salary of scheme members but no information about the reference scheme test having been carried out. In this case, the scheme actuary estimates that, for the reference scheme test to have failed for an individual, non-pensionable earnings within the upper earnings limit would typically have had to have been of the order of 10% or more of pensionable earnings.

The scheme actuary asks the employer about typical levels of earnings relative to basic salary for employees in the scheme at the time of the rule alteration. The employer states that it would have been common for non-pensionable earnings to exceed 10% of basic salary for such employees.

As a result, the scheme actuary forms the opinion that it is likely that the rule alteration would have prevented the scheme from continuing to meet the reference scheme test.

The scheme actuary therefore does not provide the retrospective confirmation. However, since it is not certain that the pension scheme would not have continued to meet reference scheme test, the scheme actuary explains the reason for this to the trustees and notes that, if further information becomes available in future, they may wish to revisit the position.

Retrospective confirmation outside the scope of section 101

Example 12 – circumstances fall outside section 101

The scheme rules were amended solely to increase members' contributions from 5% to 6% of pensionable salary.

Since the rule alteration did not affect rights accruing to scheme members and their spouses, the scheme actuary expects that it would not have been in scope of regulation 42 at the time. The scheme actuary therefore considers that the case is unlikely to be in scope of section 101 and suggests to the the trustees that that they seek legal advice on whether it is appropriate to make a request in accordance with section 101.

The trustees do not withdraw their request and the scheme actuary acknowledges that whether to ask for a retrospective confirmation is a matter for the trustees. However, the scheme actuary recognises that the rule alteration would not have affected whether the scheme met the reference scheme test and that no further work will be necessary to form the opinion that it is reasonable to conclude that the alteration would not have prevented the pension scheme from continuing to satisfy the statutory standard.

The scheme actuary confirms this opinion to the trustees.

6. Professional and ethical considerations

Introduction

6.1.Scheme actuaries and other members of the Institute and Faculty of Actuaries (IFoA) may face professional and ethical questions when undertaking work or providing evidence in relation to section 101 of the Pension Schemes Act 2026 and may find it helpful to consider how the principles within the Actuaries' Code (the Code) could apply.

6.2.This section has been provided by the IFoA Regulatory Board to assist scheme actuaries and other IFoA members with professional and ethical considerations. It is intended to complement the guidance provided by the FRC in the remainder of this document. The content of this section will be kept under review and for that reason the IFoA would be pleased to receive any comments readers may wish to offer. Please direct any comments on this section to [email protected].

Background knowledge

6.3.To be able to fulfil their obligations under the 'Competence and care' and 'Compliance' principles of the Code, the scheme actuary will wish to consider their awareness and understanding of the relevant laws and guidance which apply to the work they are undertaking, and keeping abreast of any changes.

6.4.When undertaking work under section 101, this may include having an understanding of:

- the requirements for pension schemes to be contracted-out on a reference scheme test basis;

- the regulation 42 confirmation process;

- the requirements of actuarial guidance note GN281 and (from 1 October 2011) the regulations2 that replaced it;

- the High Court ruling and Court of Appeal decision on Virgin Media Ltd v NTL Pension Trustees II Ltd;

- sections 100 to 107 of the Pension Schemes Act 2026; and

- this Technical Actuarial Guidance and any other guidance produced by regulators.

6.5.As the contracting-out rules varied over the period from 1997 to 2016, the scheme actuary may wish to focus on the requirements applying around the time the rule alteration under consideration was purportedly made.

6.6.Other IFoA members who are being asked to review evidence in relation to past rule alterations may also wish to familiarise themselves with the above.

Initial considerations

6.7.Under section 101, it is the role of the trustees of the pension scheme, where they wish to do so, to ask the current scheme actuary in writing to provide a 'reasonable to conclude' opinion in relation to a relevant alteration.

6.8.In some pension schemes, in the aftermath of the Virgin Media judgements, the trustees and their legal and actuarial advisers will have carried out some work to locate regulation 42 confirmations to establish the validity of past rule alterations. This may have included research on the past rule alterations that the trustees may now consider to be 'potentially remediable alterations'. The files being examined for this regulation 42 process may therefore be useful in applying the section 101 process. It is a matter for the trustees rather than the current scheme actuary to decide how much research will be undertaken in relation to locating regulation 42 confirmations before the section 101 process is used.

Legal advice

6.9.If the trustees have not already taken legal advice on this matter, the scheme actuary may consider it appropriate to draw to the attention of the trustees the need to seek legal advice.

6.10.In some cases, the scheme actuary may be asked to provide a view on the validity of past rule alterations relative to the Virgin Media judgements or what is a potentially remediable alteration without the trustees having obtained appropriate legal advice. There may also be uncertainty over the benefits that were actually amended by a particular alteration. The scheme actuary will wish to consider the 'Competence and care' principle of the Code as there is a risk that the advice the scheme actuary is being asked to give may not relate wholly to their actuarial skills and expertise and/or might include advice that should be provided by the trustees' legal advisers.

6.11.It is ultimately the decision of the trustees whether they should take legal advice, but if they choose not to, the scheme actuary is reminded of the risks of being drawn into providing advice on legal matters and the trustees not understanding the limitations on the actuary's ability to advise on these issues.

Integrity and impartiality

6.12.The scheme actuary will wish to consider how the Code principles of 'Integrity' and 'Impartiality' affect how this type of work is approached.

6.13.This may include considering what is reasonable, and conversely what would not be reasonable. Acting with integrity also suggests acting honestly and fairly and only providing the section 101 opinion if it is believed appropriate to do so.

6.14.The scheme actuary will be exercising professional judgement to determine whether to provide a section 101 opinion. In all considerations regarding the alteration in question, including when considering past alterations and liaising with trustees and/or sponsors or their advisers, the scheme actuary will wish to comply with the 'Impartiality' principle of the Code. This means they will need to act in a way which is free from bias (actual or perceived) and ensure that their decision regarding whether to provide a section 101 opinion is independent of any personal interests or feelings or any pressure placed on them by their employer, their client or any other party. Their opinion will need to be based on sound analysis and on any evidence that they have gathered and/or that is made available to them.

Speaking up

6.15.There may be situations where the scheme actuary or other IFoA members become aware that the original scheme actuary had expressed concerns at the time about their ability to provide the regulation 42 confirmation in relation to the relevant alteration. (This should be separated from cases where the alteration that was actually implemented differed from an earlier draft alteration that had attracted the concerns of the original scheme actuary, as those concerns had been addressed.)

6.16.This scenario may be uncommon as the relevant alteration should not have come into effect if the original scheme actuary had not provided a confirmation, having expressed concerns. In these circumstances, the (current) scheme actuary is likely to find it difficult to provide confirmation under section 101, unless there is a particular reason for the relevant alteration being effected without the actuarial confirmation being given. In this scenario the current scheme actuary will wish to consider, having regard to the 'Speaking up' principle of the Code, whether they ought to take any other action arising from their investigations, noting that speaking up can take a number of forms.

Sharing information

6.17.In some cases, the organisation or individual who may be holding evidence may not have a contractual relationship with the trustees or the sponsor of the scheme. This may arise for various reasons, including where the trustees or sponsor have changed advisers. IFoA members involved in dealing with requests for evidence or their employers may wish to consider putting in place contractual arrangements before providing evidence, which may also include the agreement of fees. The comments in the next three paragraphs assume that these arrangements have been put in place.

6.18.In some cases, the IFoA member may now be an adviser to the employer, or otherwise have a role that presents a potential conflict of interest. Under the 'Impartiality' principle of the Code, the IFoA member will wish to consider the implications of sharing information or testimony and whether this may present a potential conflict. This may also include reviewing any conflicts management plan (prepared in accordance with APS P1) or information sharing arrangements for the scheme before sharing such information or testimony.

6.19.IFoA members involved in responding to requests for information from trustees may wish to consider the 'Integrity' principle of the Code in conducting searches. It may also be appropriate for such members to discuss with the trustees and/or the current scheme actuary the evidence that might be available to help determine whether it is relevant.

6.20.IFoA members may also be asked about their recollection of events. Such members may again wish to consider the ‘Integrity' principle of the Code in being open about what they can and cannot recall, and being prepared to review past records (if they continue to have access to such records) and share evidence.

Records retention policies

6.21.There is a risk that evidence relating to a past alteration that still exists at organisations is destroyed as part of scheduled records destruction policies. The scheme actuary or other IFoA member may have influence over their organisation's records retention and destruction policies. Where they become aware that the trustees may be making a request under section 101 in relation to a specific past alteration, the scheme actuary or other IFoA member might want to check that evidence that currently still exists in a larger collection of files is not destroyed as part of ongoing document destruction programmes until it has been appropriately reviewed.

IFoA guidance and resources

6.22.The scheme actuary or other IFoA member may find it helpful to consult other non-mandatory guidance when undertaking work in relation to section 101, including:

- Guidance to support the Actuaries' Code

- Conflicts of interest: a guide for members

- Speaking up: a guide for members

6.23.The IFoA also provides the Professional and Regulatory Support Helpdesk, a free and confidential support service for its members. The helpdesk provides expert guidance on the interpretation and application of professional and technical standards, as well as guidance on ethical challenges that may arise in actuarial practice. Members who submit a query receive a tailored response informed by the expertise and perspectives of our experienced panel members (although the Helpdesk does not represent the views of the FRC).

Financial Reporting Council

London office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office: 5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in

-

Actuarial Guidance Note GN28: "Retirement Benefit Schemes – Adequacy of Benefits for Contracting-out on or after 6 April 1997". Version 2.1 is available to download from the FRC website. All previous versions are available to download from the IFoA website. ↩

-

Schedule 3 ("Further requirements for meeting the statutory standard") of the Occupational Pension Schemes (Contracting-out) Regulations 1996 (SI 1996/1172) (as amended), applying from 1 October 2011 to 5 April 2016. ↩