The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

PricewaterhouseCoopers LLP Audit Quality Inspection and Supervision Report 2023

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it. © The Financial Reporting Council Limited 2023 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for UK statutory audit, responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are enhancing audit quality and are resilient. We adopt a forward-looking supervisory model and hold firms to account for changes needed to improve audit quality.

Auditors' opinions on financial statements play a vital role upholding trust and integrity in business. The FRC's objective is to achieve consistent high quality audits so that users have confidence in financial statements. To support this, we:

- Set ethical, auditing and assurance standards and guidance, as well as influence the development of global standards.

- Inspect the quality of audits performed by, and the systems of quality management of, firms that audit Public Interest Entities (PIEs1) and register auditors who carry out PIE audit work.

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification and the monitoring of non-PIE audits.

- Bring enforcement action against auditors for breaches of relevant requirements.

Since our July 2022 report we have delivered on a reform programme ahead of the Government response to restoring trust in audit and corporate governance, including:

- Taking responsibility for PIE auditor registration allowing us to impose conditions, suspensions and, in the most serious cases, remove registration of PIE auditors.

- Agreeing a memorandum of understanding with the Department for Levelling Up, Housing and Communities (DLUHC) setting out our responsibilities as shadow system leader for local audit.

- Updating Our Approach to Audit Supervision, outlining the work of our supervision teams.

- Publishing a Minimum Standard for Audit Committees and the External Audit and consulting on revisions to the UK Corporate Governance Code.

Our 2023/24 transformation programme will demonstrate our continued commitment to the public interest and restoring trust in the audit profession.

The seven Tier 1 firm2 reports provide an overview of key messages from our supervision and inspection work during the year ended 31 March 2023 (2022/23) and the firms' responses to our findings.

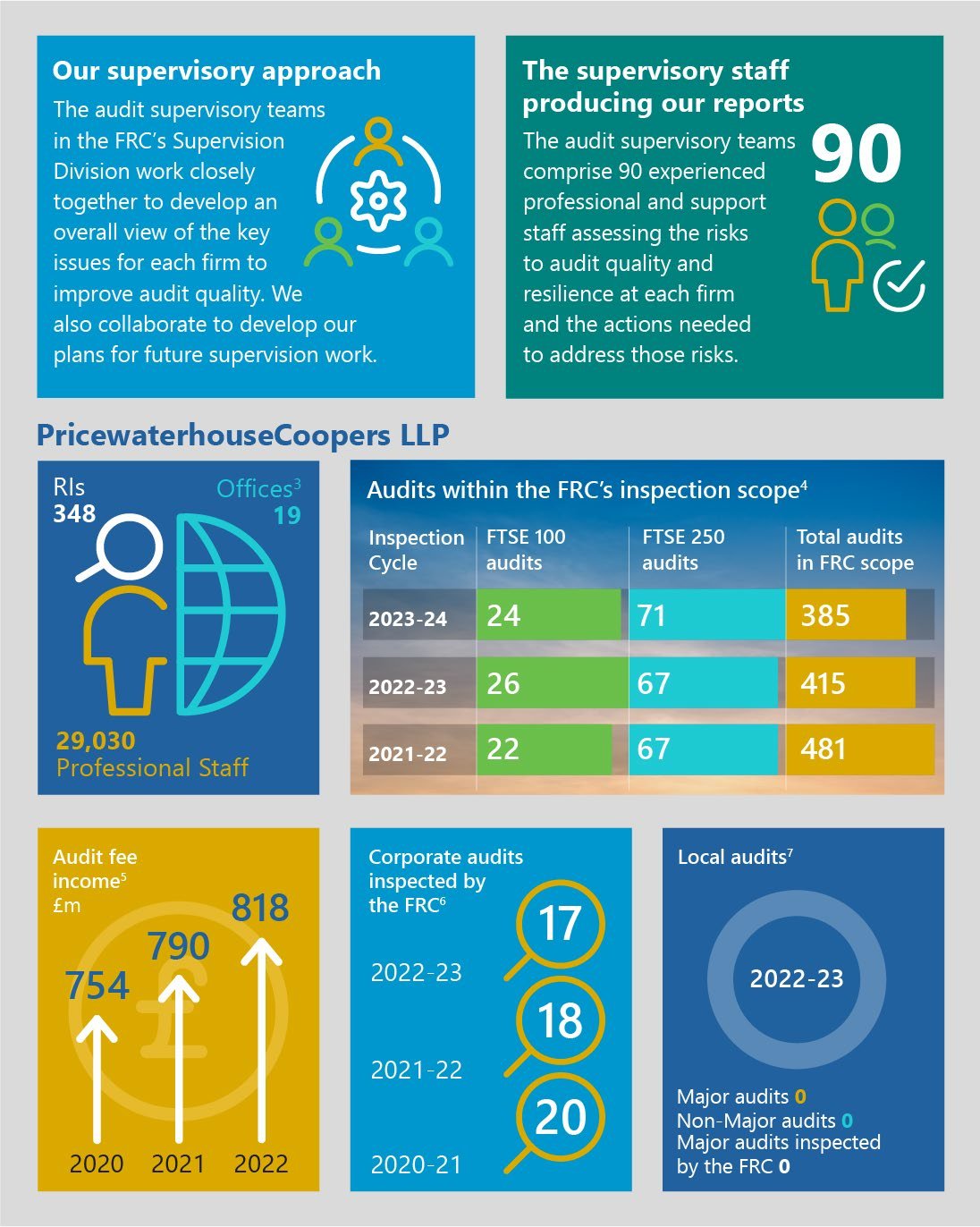

Our supervisory approach

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our plans for future supervision work.

The supervisory staff producing our reports

The audit supervisory teams comprise 90 experienced professional and support staff assessing the risks to audit quality and resilience at each firm and the actions needed to address those risks.

PricewaterhouseCoopers LLP

- RIs: 348

- Offices³: 19

- Professional Staff: 29,030

Audits within the FRC's inspection scope⁴

| Inspection Cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope |

|---|---|---|---|

| 2023-24 | 24 | 71 | 385 |

| 2022-23 | 26 | 67 | 415 |

| 2021-22 | 22 | 67 | 481 |

Audit fee income⁵ £m

- 2020: 754

- 2021: 790

- 2022: 818

Corporate audits inspected by the FRC⁶

- 2022-23: 17

- 2021-22: 18

- 2020-21: 20

Local audits⁷

- 2022-23:

- Major audits: 0

- Non-Major audits: 0

- Major audits inspected by the FRC: 0

³ Source - the ICAEW's 2023 QAD report on the firm. ⁴ Source - the FRC's analysis of the firm's PIE audits and other audits included within AQR scope as of 31 December 2022. ⁵ Source - the FRC's 2021, 2022 and 2023 editions of Key Facts and Trends in the Accountancy Profession. ⁶ Excludes the inspection of local audits. ⁷ The FRC's inspections of Major Local Audits are published in a separate annual report. The October 2022 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- 2. Review of individual audits

- Improve the audit of cash and cash flow statements, in particular in respect of classifications

- Continue to improve the testing of revenue and profit margin recognition

- Further improve aspects of the audit of impairment

- Good practice

- Monitoring review by the Quality Assurance Department of ICAEW

- Good practice

- 3. Review of firm-wide procedures

- Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019

- Partner and staff matters – recruitment, management of partner and senior staff engagement portfolios, appraisals, remuneration and promotion

- Acceptance, continuance, and resignation procedures

- Audit methodology (settlements and clearing processes for banks and building societies)

- Firm-wide key findings and good practice in prior inspections

- Implementation of ISQM (UK) 1

- 4. Forward-looking supervision

- The firm's Single Quality Plan, other quality improvement plans and audit quality initiatives

- Root cause analysis process

- PIE auditor registration

- Other activities focused on holding firms to account

- Culture and conduct

- Initiatives to ensure compliance with the FRC's Revised Ethical Standard 2019

- Operational separation of audit practices

- Appendix

1. Overview

Overall assessment

In our 2021/22 public report, we concluded that PwC had made improvements to audit quality through its transformation programme, and that the firm had demonstrated continuous improvement to audit quality and culture through the introduction of new initiatives in these areas.

The firm has continued to invest in improvements to audit quality. This has been done with a focus on culture and resourcing initiatives, specifically initiatives that lead to creating capacity and talent retention. We are pleased that the firm has maintained its focus on audit quality on individual audits, achieving consistent FRC inspection results. As reported last year, none of the audits we inspected were found to require significant improvements. In addition, 82% of all the audits inspected required no more than limited improvements; this compares with 83% last year and 78% on average over the past five years. In relation to the FTSE 350 audits inspected, as last year, only one required limited improvements.

The areas of the audit that contributed to the audits assessed as requiring improvements were cash and cash flow statements and revenue and profit margin recognition. There continues to be recurring themes related to the audit of revenue and impairment, which were also themes covering key findings last year. There has, however, been improvement identified in those areas, and a range of good practice in these and other areas. While actions have also been taken in the past to improve the audit of cash flow statements, these actions have not remained effective. Ensuring that planned actions aim to be effective in the long term, along with addressing inconsistency, are key to a continuing trend of consistent good quality results.

There has been a continued focus, through the root cause analysis (RCA) process, on the causes of inconsistency in audit quality and recurring findings. This has been done by comparing good practices and key findings across a range of audits which, when reviewed, had differing quality outcomes. Previous actions taken to address inconsistency and/or recurring findings need to be reconsidered in terms of their effectiveness and whether they were correctly prioritised. Adjustments should be made accordingly within the Single Quality Plan (SQP).

The results from other measures of audit quality, covering a broader population of audits, were similar, but a small number of audits across other internal and external inspections were assessed as needing significant improvements or equivalent. The results from the Quality Assurance Department (QAD) of the ICAEW set out on pages 21 and 22, which is weighted toward higher risk and complex non-PIE entities (within ICAEW scope), assessed 90% of the audits it inspected as good or generally acceptable (100% in the prior period) with one audit requiring significant improvement in relation to the audit work, following a refinancing, with a risk that the parent company balance sheet was materially misstated. The issue did not alter the group balance sheet. Over a similar period, the firm's internal quality monitoring process (covering both PIE and non-PIE audits) assessed 87% of audits as meeting its highest quality standard, an improvement on the prior period and similar to the FRC inspection results (see page 39). Findings identified by the firm, driving the poorer graded audits, were across a range of audit areas on smaller audit engagements. Some were in the areas of revenue and impairment as identified as key findings by the FRC but the firm's findings were not found to be thematic.

Our inspection results only provide a single point in time view on audit quality. The firm must continue to critically evaluate all its audit quality results, particularly any inconsistencies impacting the overall assessment of quality, across different populations of audits.

Last year we required PwC and all Tier 1 firms to develop a Single Quality Plan (SQP) that included all actions needed to improve audit quality and resilience. The firm has developed this plan and a tool that allows prioritisation, monitoring and reporting of actions in different ways. It has also begun to formally measure effectiveness (qualitatively and quantitatively) of some of the actions building on the considerations the firm previously carried out as part of RCA within its continuous improvement team. The firm must continue to develop its approach to evaluating the immediate and longer-term effectiveness of actions taken.

In response to this year's findings, we will take the following action:

- Maintain the reduced number of audits inspected at PwC in proportion to the number of audits in scope compared with other Tier 1 firms.

- Continue to review the SQP and use it to monitor the actions taken to improve audit quality, their effectiveness (over the short and long term) and its use in complying with International Standard on Quality Management (UK) 1 (ISQM (UK) 1).

- Continue to monitor and assess the firm's initiatives in relation to audit quality, in particular resourcing, culture and ethics.

Inspection results: arising from our review of individual audits

We reviewed 17 individual audits this year and assessed 14 (82%) as requiring no more than limited improvements. Of the 11 FTSE 350 audits we reviewed this year, we assessed 10 (91%) as achieving this standard.

Our assessment of the quality of audits reviewed: PricewaterhouseCoopers LLP

A bar chart showing the percentage of audits with different quality outcomes from 2018/19 to 2022/23.

- 2018/19: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (4%)

- 2019/20: Good or limited improvements required (60%), Improvements required (20%), Significant improvements required (1%)

- 2020/21: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

- 2021/22: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

- 2022/23: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

FTSE 350: PricewaterhouseCoopers LLP

A bar chart showing the percentage of FTSE 350 audits with different quality outcomes from 2018/19 to 2022/23.

- 2018/19: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (4%)

- 2019/20: Good or limited improvements required (60%), Improvements required (20%), Significant improvements required (1%)

- 2020/21: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

- 2021/22: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

- 2022/23: Good or limited improvements required (80%), Improvements required (15%), Significant improvements required (0%)

The audits inspected in the 2022/23 cycle included above had year ends ranging from July 2021 to April 2022.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings related to the audit of cash and cash flow statements, revenue and profit margin recognition and impairment.

We identified a range of good practice across all parts of the audit process but predominantly related to risk assessment and execution of the audit.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures.

This year, our firm-wide work focused primarily on evaluating the firm's: compliance with the FRC's Revised Ethical Standard; partner and staff matters; acceptance, continuance, and resignation procedures; and audit methodology relating to settlement and clearing processes.

Our key findings related to compliance with the Revised Ethical Standard, and partner and staff matters. We identified areas of good practice in respect of both these areas, and also in relation to acceptance, continuance, and resignation procedures.

Please refer to section 3 for further details.

Forward-looking supervision

The firm's audit quality plan, released last year, brings all quality initiatives together, mapping them to the pillars of the audit strategy which are then underpinned by culture and audit behaviours. The monitoring and reporting of the whole plan remains complex, but it is clear from our observations and assessment that matters key to audit quality such as resourcing, culture and technology are discussed, monitored and reported on regularly.

PwC has developed an SQP that links to its overall Audit Quality Plan (AQP). The SQP utilises an interactive tool allowing the data to be looked at in different ways and allows prioritisation, monitoring and reporting of actions. The firm has also begun to measure effectiveness (qualitatively and quantitatively) of some of the actions building on the considerations the firm previously carried out as part of RCA within its continuous improvement team. The firm must continue to develop how effectiveness is measured so that both immediate and long-term effectiveness is considered.

The firm has continued to make refinements to its root cause analysis, for example by considering secondary factors in lower impact areas, despite having a well-developed process. The design of actions in response to the RCA process needs to include consideration of expected effectiveness in the long term as well as the shorter term. This would reduce the risk of findings on individual audits, for example, recurring after apparently being resolved.

The firm developed actions in relation to all last year's findings, and the majority have been taken or appear in the SQP with an owner, timings and prioritisation. The firm takes a similar approach to constructive engagement cases, taking positive and prompt action to strengthen policies, procedures, and training. Further consideration is needed in relation to certain actions to ensure that when set they aim to be effective in the long term.

Firm's overall response and actions

Introduction

We are proud of our people and how they work together to deliver high quality audits, which has resulted in the overall outcome of the 2022/23 Audit Quality Review (AQR) inspection cycle. Achieving consistently high quality audits is a key objective of our audit culture programme and a focus of our audit teams. We are pleased we have maintained a consistent quality standard, and that 82% of our audits inspected by the AQR, and 90% inspected by the QAD, have been evaluated as requiring no more than limited improvements. We also recognise there are instances where the outcome of an inspection is disappointing, as parts of our audits do not meet the high standard expected by ourselves and other stakeholders. We continue to learn lessons from these instances through focused Root Cause Analysis (RCA). These instances, and matters identified on audits requiring no more than limited improvements, have contributed to the AQR key findings set out in section 2. The report also includes examples of good practice identified by the AQR and Audit Market Supervision (AMS) team, on audit inspections and ISQC1 review cycles respectively. It is pleasing that these have been identified by the AQR across audit planning, execution and completion phases, and in areas where the AQR have reported findings. We will continue to utilise these examples within our RCA and in demonstrating what high quality looks like with our people. We continue to find the proactive approach taken by the FRC Supervision teams to be constructive, and we are grateful for the insights provided from cross firm comparison and benchmarking in the work of the Audit Market Supervision team. We remain committed to working together with the FRC to deliver high quality across all our audits, to shape the future of audit for the profession, and deliver our public interest responsibilities.

Audit Quality Strategy and Plan

Our Audit Quality Plan (AQP) is aligned with our Audit Strategy, and includes five priority pillars to support the delivery of consistently high quality audits. The pillars bring together our actions and activities relating to: Quality; Technology and Transformation; Passionate People; Responsible Growth and Commercial, which are underpinned by our audit culture, including the Audit Behaviours. In August 2022, as a result of guidance from the FRC, we developed our Single Quality Plan (SQP), a prioritised plan including key audit quality actions, which follows the principles set out in guidance. The SQP is underpinned by a number of detailed action plans developed in response to quality processes, and overlaid with actions identified by the Audit Executive. The SQP is approved by the Audit Executive, and is discussed with, and challenged by, the Audit Oversight Body (AOB). The AOB has the responsibility to oversee the FRC's objective to improve audit quality by ensuring that people in the audit practice are focused above all on delivery of high quality audits in the public interest; to promote a culture supportive of the public interest; and to support (as appropriate) the firm's senior management in the execution of their responsibilities under the principles through robust oversight and constructive challenge. In December 2022 we updated our Audit Quality Measure (AQM) framework to report on three key measures considered to provide a comprehensive view of the quality of our audits. These are: Inspection results; Audit Committee Feedback; and our People's views. The AQM measures are reported to, and reviewed by, our relevant firm Governance bodies, and will be shared as part of our FY23 Transparency Report.

Audit culture and behaviours

Audit is a people centric business, which inherently brings the risk of human mistake or error into the audit process. Having an audit culture which supports the delivery of high quality audits has been a key priority over the past four years, and continues to underpin our AQP. Our Audit Behaviours, Take Pride, Challenge and be open to Challenge and Team First, are those expected of our teams to deliver high quality audits. These have remained unchanged over the last three years, and are embedded within our performance and progression processes. Our firmwide values – to act with integrity, work together, care, reimagine the possible and make a difference – also underpin our commitment to quality.

We are pleased that the Firm's Supervisor has identified that we have continued to advance our audit culture initiatives and assessment techniques, including having a focus on promoting psychological safety and obtaining further insights into how behaviour changes under pressure. Our culture programme continues to seek to understand the views of our people through an Annual Culture Survey, and we recognise the importance of the Audit Behaviours through the annual Audit Awards.

Audit Quality roles are a key contributor to audit culture of support and psychological safety. Our central Risk and Quality function (ARQ) provides audit guidance, consultation and support to our teams through all stages of delivering high quality audits and oversees our central quality assessment processes. Our Business Unit Risk Management teams help deliver our quality monitoring processes and provide on-hand localised guidance alongside the Chief Auditor Network which provides on the ground audit methodology support in each office location for our audit teams.

Continuous improvement, Root Cause Analysis and Action identification

- Continuous improvement activities: Our RCA process is well established and is performed on a continuous basis over internal reviews and external inspections across the quality spectrum. RCA is also undertaken on other activities, processes and controls, where there may be an impact on audit quality. In conducting RCA, the Continuous Improvement Team (CI Team) applies a consistent methodology that utilises quantitative and qualitative techniques, which enables analysis of patterns and trends of both causal factors and other quality indicators over time. The scope of RCA across all regulatory inspection cycles remains consistent with previous years. A focus of this year's RCA has been to ensure that both primary and secondary RCA factors are assessed and considered as part of our action planning process, including those factors which have not led to a lower internal review or external inspection outcome.

Consistent with the prior year, three key findings have been reported by the AQR. Two of the key findings are in recurring areas, and there is one new finding relating to the audit of cash and cash flow statements, and in particular in respect of classification.

We continue to take actions on a continuous basis and in Summer 2022, as part of our mandatory technical training for all qualified partners and staff, a session that focused on the audit of cash and cash flow statements, including common classification errors, was delivered as part of the training curriculum. This was supplemented by additional guidance from our Audit, Risk and Quality team (ARQ), from both accounting and audit methodology perspectives.

Linked to our ongoing effectiveness assessment, we will consider how we better assess actions taken in areas of recurring key findings (including in respect of the audit of revenue and impairment) for longevity. We continue to have good practice examples identified in areas consistent with the three findings, and whilst we are proud that aspects of our audits have been identified as good practice, we remain focused on addressing inconsistency across all our audits as we see this as fundamental to continuing to improve audit quality overall.

Root Cause Analysis and actions

This year, the primary factors identified from our RCA were:

- Responding to changes in underlying risk or audit issues and demonstrating professional scepticism: On occasions where an audit team is heavily focused on significant risk areas, or responding to a significant audit issue, there can be a consequential impact on the quality of coaching and/or review. Sometimes this can also result in an over-reliance placed on broader industry knowledge and/or prior year approaches when executing audit procedures. Specifically in relation to the cash flow statements key finding, the audit team did not demonstrate the appropriate professional scepticism and did not take a step back to assess the appropriate classification.

- There continues to be a significant focus on embedding our “challenge and be open to challenge” behaviour both internally within the audit team and externally with audited entity management. In Autumn 2022, our mandatory technical training for all qualified partners and staff, included a session that focused on the importance of professional judgement, incorporating the FRC's Professional Judgement Framework published in June 2022. The importance of coaching and supervision is also embedded in our "Be your Best” leadership programme for audit managers and senior managers, with the objective of driving increased accountability across all areas of the audit. The programme aims to provide senior managers and managers with a broader range of leadership skills in order to support them in their roles on leading both audit teams and relationships with entity management, so they feel empowered to make decisions and be leaders.

- Sub-optimal team composition: There continues to be a direct link between a high quality audit and having the right composition of skills and experience in an audit team. On occasion where this was not the case, there were examples, identified during RCA, of insufficient audit procedures performed. While our demand and supply activities continue to focus on maintaining a balance between the demand for audit services and the supply of auditors and other specialists available to deliver these audit services, we will also continue to consider resource allocation for audits in certain industries and to review the associated guidance, training and skills required for team members joining these audits.

- The quality and timeliness of audited entity deliverables and audit team challenge: RCA continues to highlight the need to strengthen and improve our 'Client Contracting' with the entities we audit. 'Client Contracting' includes: agreeing a clear plan with entity management; setting out the information needed to complete our audit procedures; and taking appropriate actions where deliverables are late or of poor quality. Our Breaking the Audit Cycle 'Client Contracting' initiative focuses on these areas. In situations where teams do not appropriately take action to challenge poor quality audit deliverables and proactively monitor timelines for delivery, our RCA indicates that this can lead to an overreliance on prior year or broader industry knowledge.

Our 'Client Contracting – A New Conversation' initiative will continue to be run during 2023. In addition, we continue to operate support mechanisms such as real time reviews and our buddy mentor programme which provides coaching and acts as an independent sounding board for certain engagement leaders.

In addition the results and learnings from RCA and how the factors arise across the quality spectrum, including good practice, will feed into a number of Audit LoS communications and the CI Team's annual internal publication "Insights from Root Cause Analysis” which will be shared with the audit practice.

To support our overall assessment of audit quality, we assess action effectiveness through our SQP. The framework for assessing the effectiveness is to monitor the package of actions as a whole, rather than the individual actions. Each action is mapped to a priority area in the SQP and this year's RCA demonstrates that our focus is in the right areas including continuing to strengthen and improve audit contracting with entities we audit, development programmes for staff, reinforcing our culture and behaviour workstreams and a continued focus on demand and supply.

We will continue to develop how action effectiveness is measured so that both immediate and long-term effectiveness is considered. We report our priority assessment and action effectiveness every six months to the Audit Oversight Body.

ISQC1 and ISQM1 implementation reviews

We welcome the findings from the AMS team's ISQC1, ES19 and ISQM1 implementation reviews of our activities, processes and controls which underpin the delivery of audits, and in particular the good practice examples identified during benchmarking performed across the larger audit firms.

We have made significant investment in our Quality Management Service Excellence (QMSE) programme over recent years which has formed the basis for our compliance with ISQM1 in the year of implementation. We are committed to continually enhancing our System of Quality Management (SoQM) as our processes evolve and when matters arise which affect our assessment of risk or potential impact. Our Continuous Improvement and QMSE teams work closely together to ensure effective integration between root cause analysis, action planning and SoQM assessment. We have appreciated the discussions with the AMS team on risk assessment and other aspects of ISQM1 that have been held as part of the work they are performing on the Firm's SoQM in the 2023/24 inspection cycle.

We take any findings or instances of Non-Compliance with the Revised Ethical Standard 2019 (ES19) seriously. The two specific instances of Non-Compliance identified during AMS review have been taken through our internal breaches process, and we have reported the instances to those charged with governance at the audited entities concerned. We have agreed a number of specific actions in response to the review, including a commitment to revisit our policy relating to accounting advice services and to clarify the supporting guidance. We welcome the inclusion of the good practice examples relating to the transparency of our communications with entities in respect of the impact of ES19.

We are pleased that there were no key findings to report by the AMS team as part of the audit Acceptance and Continuance review or from their review of specific banking methodology for settlements and clearing processes. We have considered, and taken action, in response to the broader observations and benchmarking provided as part of each review. Our Chief Auditor Network Banking & Capital Markets representatives continue to be focused on ensuring clear, practicable and effective guidance and tools are provided to our banking audit teams.

We recognise the inconsistency in how audit quality was assessed in some of the samples of performance assessment documentation during the Partner and Staff review. Our audit partners and staff obtain feedback each year and are encouraged to use standardised templates which ask for examples to be provided based on the Audit Behaviours. Annually, as part of the performance evaluation process, our audit partners and staff complete a performance self-assessment, and an Audit Risk & Quality (partners and directors), or Audit Quality evaluation (other staff), reflecting on their Audit Behaviour feedback. Following discussions with the AMS team, we have embedded two quality metrics within the PY23 Audit Quality evaluation. These are: personal compliance with independence requirements; and completion of required mandatory training.

Central to our audit culture are the concepts of psychological safety and learning from mistakes. In response to the finding relating to consideration of staff contribution to adverse or positive quality outcomes, we have also put in place a whole-team feedback mechanism following any internal or external review, to ensure audit quality learnings are shared directly and effectively with all team members.

Conclusion

We are proud of our audit teams and their hard work and commitment to high quality audits. We are committed to our role in driving confidence in audit, building public trust and serving the public interest. We are also committed to working with the FRC to ensure that the high value of audit is recognised, and the profession remains attractive in years to come. To do this, delivering high quality audits consistently is our priority, and this is embedded in our continuous improvement mindset, our audit behaviours and our audit culture.

We would like to reiterate our appreciation to the FRC inspection and supervision teams for the balanced and constructive manner in which they have undertaken their reviews.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements but are considered a key finding in this report due to the extent of occurrence across the audits we inspected.

Improve the audit of cash and cash flow statements, in particular in respect of classifications

The statement of cash flows is one of the primary financial statements. Auditors should perform sufficient procedures to ensure that items are correctly classified. In auditing cash and cash equivalents, auditors should ensure they obtain sufficient audit evidence over the classification of the balances in the financial statements.

Key findings

The audit of cash flow statements and also cash and cash equivalents was an area of focus for our inspections. We reviewed the audit of cash and cash equivalents on all the audits we reviewed, and the audit of cash flow statements on the majority of them. We raised findings on seven audits, including two assessed as requiring improvements.

- Cash flow statement misclassifications: On one of these audits, the audit team failed to identify certain material classification misstatements in the cash flow statement. On another audit, a misclassification error was not identified by the audit team until the review of the following year's interim financial statements.

- Netting of cash balances: On three audits, the audit team did not adequately assess the appropriateness of the accounting treatment for cash balances which had been netted off in the group financial statements.

- Bank confirmations and reconciliations: On one audit, the money market deposit had not been independently confirmed and there was no evidence of alternative audit procedures. On another audit, insufficient audit procedures were performed for reconciling items in the year end bank reconciliation for one of the bank accounts.

Continue to improve the testing of revenue and profit margin recognition

Revenue is a key driver of operating results and key performance indicators on which investors and other users of the financial statements focus. Audit teams should ensure that they design an approach which is responsive to the identified risks and undertake adequate audit procedures to address them.

Last year we stated that the firm should improve the consistency of the testing of revenue. The firm has since implemented a number of actions in this area and we have seen some examples of good practice. However, we are still seeing inconsistency in the audits we reviewed.

Key findings

We reviewed the audit of revenue on all of the audits inspected and raised findings on six of them, including one assessed as requiring improvements. We also identified areas of good practice, indicating some inconsistency between the audits we reviewed.

- Revenue and profit margin recognition on long term contracts: On one audit, the audit team performed insufficient audit procedures to assess the appropriateness of revenue and profit margin recognition on long term contracts, in particular in relation to contract accruals. On another audit, the audit team did not adequately evidence their consideration or challenge regarding performance obligations or the stage of completion for certain contracts.

- Other revenue testing: On one audit there was insufficient evidence of the audit team verifying the physical collection of on-line sales to support the extent of revenue recognised. There was also insufficient evidence of testing of revenue on three further audits, one relating to estimated insurance premiums; another to management's comparison of data sources; and the third over the integrity of system generated reports.

Further improve aspects of the audit of impairment

The audit of management's impairment assessment often involves significant judgement. Changes to key assumptions could result in a material impairment. Auditors are expected to obtain sufficient and appropriate evidence when evaluating the reasonableness of the assumptions made by management, the disclosures and whether the assessment takes account of all relevant information of which they are aware from the audit.

Key findings

Last year we stated that the firm should improve aspects of the audit of impairment. The firm continues to implement a number of actions in this area and we have seen improvements, with several examples of good practice. This year's findings are less significant than last year. However, this is still a recurring theme for the firm where we are seeing inconsistency in the audits we reviewed.

We reviewed the audit of impairment on the majority of audits inspected and raised findings on six of them.

- Goodwill impairment – cash flow forecast assessments: On one of these audits, the audit team did not sufficiently evidence its challenge or corroboration of the forecasted revenue and margin growth rates, the use of terminal values and discount rates for certain Cash Generating Units (CGUs). On another audit, for one of the CGUs, the audit team did not sufficiently evaluate short-term growth rate assumptions or consider the need for additional sensitivity analysis to identify the impact of the level of headroom.

- Goodwill impairment – other matters: On one audit, the audit team did not sufficiently evidence their evaluation of management's conclusion that no impairment assessment was required for a material tangible fixed asset. On another audit, the audit team obtained insufficient evidence and explanation of the financial data used to support management's assessment of the recoverability of goodwill.

- Investments in subsidiaries in the parent company: On one audit, the audit team did not sufficiently evidence its challenge of the achievability of the revenue growth in the forecast period or justify why growth was significantly in excess of the growth rate reflected in a third-party industry report. On another audit, the audit team did not evidence its rationale for concluding that management's use of the net asset position as the recoverable amount was appropriate.

Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach responding to those risks.

- Effective risk assessment procedures, including climate risk: This included a comprehensive risk assessment of the entity's revenue streams and data relied on by the actuarial specialists. In another audit, there was extensive sensitivity analysis for the climate risks, which included analysing the impact if technology needed replacing or whether additional cash outflows were required to decarbonise.

- Comprehensive group audit planning: For one audit, the group audit team had a comprehensive planned approach for revenue, identifying the revenue streams and approach by division/units.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Effective challenge of management: On one audit, the audit team challenged management to prepare an additional worst-case going concern scenario which included a severe IT cyber-attack. On another audit, the firm's technical panel robustly challenged the audit team's going concern assessment resulting in the performance of additional procedures by the audit team. Another two examples related to the audit team's challenge resulting in the appointment by management of an independent valuer and an in-depth granular analysis of key valuation assumptions and effective use of valuation experts, which resulted in a good level of challenge of management for the valuations.

- Robust challenge of management's impairment assessments: On two audits, the audit teams robustly challenged management's key assumptions which resulted in updates to management's models and further sensitivity analysis being performed.

- Effective group oversight: On a complex group audit, the group oversight procedures for significant risk areas were extensive and included the group audit team reperforming aspects of the component auditors' work. On another group audit, the audit team reperformed a significant proportion of the entity's consolidation using an internally developed model.

- Effective revenue testing: On one audit, the audit team demonstrated a good understanding of the entity's revenue transaction process in a complex trading business, enabling it to perform a detailed and focused data analytic procedure. On another audit, extensive procedures were performed over on-line revenue, including reconciling third party payment provider reports to management's records.

- Other areas: Other areas of good practice related to the use of data analytics for auditing leases (IFRS 16), the audit of cash and cash equivalents, the audit of supplier rebates and the use of experts and specialists.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Effective Audit Committee reporting: On one audit, the reports to the Audit Committee were of a high standard and aided effective communication. This included effective use of infographics to explain the audit team's assessment of the control environment, the level of audit effort required, and assumptions used.

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by ICAEW. ICAEW undertakes its reviews under delegation from the FRC as the Competent Authority. ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC, except for review of continuing professional development (CPD) records for a sample of the firm's staff involved in audit work within ICAEW remit.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher risk and potentially complex audits within the scope of ICAEW review.

ICAEW has completed its 2022 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2023.

Summary

Overall, the audit work reviewed was of a good standard, with nine out of ten engagements being either good or generally acceptable, including the AIM-listed and both public profile audits.

QAD identified one engagement as requiring significant improvement. For comparison at the 2021 visit all ten engagements were either good or generally acceptable.

The audit needing significant improvement was an entity significantly impacted by the coronavirus pandemic and lockdowns. The audit team had dealt with various challenges due to restructuring of the business and issued a modified audit report. QAD identified a very specific error in transactions within the group following a refinancing, with a risk that the parent company balance sheet was materially misstated. The issue did not alter the group balance sheet position.

Results

Results of ICAEW's reviews for the last three years are set out below.

ICAEW Audit Quality Review Results (2020-2022)

A bar chart illustrating the outcomes of ICAEW audit reviews over three years.

- 2020: 90% Good / generally acceptable, 9% Improvement required, 1% Significant improvement required.

- 2021: 90% Good / generally acceptable, 10% Improvement required, 0% Significant improvement required.

- 2022: 90% Good / generally acceptable, 9% Improvement required, 1% Significant improvement required.

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

ICAEW identified good practice in several files reviewed. Broad themes were:

- Demonstrable professional scepticism and challenge of management in engagement team approaches to accrued income, going concern and impairment reviews.

- Comprehensive audit documentation, including consideration of risks relating to accounting estimates and IT systems, and closing down matters raised by the firm's specialist teams.

3. Review of firm-wide procedures

We reviewed firm-wide procedures, based on those areas set out in ISQC (UK) 1, on an annual basis in certain areas, and on a three-year rotational basis in others.

In this section, we set out the key findings and good practice we identified in our review of the four areas of the firm's quality control procedures, which we reviewed this year under our three-year rotational testing. We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2022.

Matters arising from our review of the quality control procedures assessed on an annual basis are included, where applicable, in section 4.

The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2022/23 | Prior year 2021/22 | Two years ago 2020/21 |

|---|---|---|---|

| • Audit quality focus and tone of the firm's senior management. • RCA process. • Audit quality initiatives, including plans to improve audit quality. • Complaints and allegations processes. |

• Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019 • Partner and staff matters, including recruitment, appraisals, remuneration, and promotion • Acceptance, continuance and resignation procedures • Audit methodology (settlements and clearing processes for banks and building societies) |

• Implementation of the FRC's Revised Ethical Standard 2019. • Engagement Quality Control Reviewers (EQCRs), consultations and audit documentation. • Audit methodology (fair value of financial instruments with a focus on banks). • Internal quality monitoring. |

• Audit methodology (recent changes to auditing and accounting standards). • Training for auditors. |

We also set out a summary of our prior year findings (in the two previous years) later in this section.

Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019

In the current year, we evaluated the firm's compliance with the FRC's Revised Ethical Standard 2019. The work considered the breadth of the Ethical Standard, focusing on areas where there were more significant changes to the requirements in the 2019 revisions. This testing involved checking for:

- Prohibited non-audit services.

- Timely approvals of non-audit services.

- Identification and assessment of threats and safeguards for non-audit services.

- Compliance with fee ratios for non-audit services.

- Robust evidencing of consultations.

- Timely rotation of individuals off audit teams.

- Financial independence of individuals.

We also held biannual meetings with the Ethics Partners to inform our understanding of their current challenges and priorities.

Key findings

We identified the following key findings where the firm needs to:

- Strengthen their assessments of proposed accounting advice to ensure impermissible accounting services, involving the firm undertaking the role of management or anything other than of a routine or mechanical nature, are not provided (our testing identified an accounting service which the firm incorrectly considered to be accounting advice).

- Ensure that the appropriate approvals are obtained before work starts on any non-audit service.

- Enhance the existing monitoring of UK audited entities with overseas activities to ensure measures to prevent network firms from commencing non-audit services before obtaining any necessary approvals are effective. In addition, seek and assess the results of the global compliance testing to determine if it provides additional assurance that network firms are obtaining all relevant approvals from the UK firm on a timely basis.

- Ensure relevant individuals' pension investments are all logged to facilitate prompt identification of any conflicts.

Good practice

We identified the following areas of good practice:

- We identified an engagement letter that clearly highlighted the implications on the non-audit service if the firm was later to be appointed as auditor, identifying at the outset that the service might require to be terminated.

- The firm does not allow the provision of gifts and hospitality to/from audited entities (other than if de-minimis), and we identified an example of a clear and educational communication to a non-audit service team working on an audited entity explaining why they could not accept a gift.

- We identified examples of strong analysis of conflict checks. For example, the analysis for an acquisition by an audited entity, incorporated not just non-audit services provided to the acquired entity, but also considered if there were business relationships, employment relationships, contingent fee arrangements, and personal investments with this entity.

Partner and staff matters – recruitment, management of partner and senior staff engagement portfolios, appraisals, remuneration and promotion

Recognition and reward of partners and staff, particularly those involved in the delivery of external audits, is a key element of a firm's overall system of quality control and is integral to support and appropriately incentivise audit quality. Robust recruitment processes are also essential in creating a culture and environment that supports audit quality. We reviewed the firm's policies and procedures in these areas and tested their application for a sample of partners and staff for the firm's 2021 appraisal year processes.

Appropriate allocation and management of partner and senior staff portfolios enables a firm to ensure its audits are being led and staffed by auditors with appropriate skills, experience and time. We reviewed the firm's policies and procedures around the accreditation of auditors (Responsible Individuals or RIs) to sign audit reports, the allocation of RIs to audits, and the review of responsibilities and workloads for audit staff and partners. We tested the application of these policies for a sample of RI accreditations.

Key findings

We identified the following key finding:

- For the appraisal year ending in 2021, we identified inconsistencies in how the consideration of quality was evidenced in staff appraisals. For some of the appraisals reviewed, no comments had been recorded by the appraiser, or the comments recorded did not refer to audit quality. The firm also does not have a process in place to ensure that the results of internal or external inspections are appropriately considered and, where appropriate, reflected in appraisals for senior staff below RI level, where staff are deemed to have significantly contributed to adverse or positive quality outcomes. This is a recurring area of concern from our last review of this area in 2019/20.

Good practice

We identified the following area of good practice:

- The firm requires all audit RI promotion candidates to pass two internal file reviews to evidence their attainment of audit quality.

Acceptance, continuance, and resignation procedures

A firm is required to establish policies and procedures for the acceptance and continuance of audits to ensure that it only undertakes audits: that it is competent to and has the resources to perform, where it can comply with the ethical requirements, and where it has considered the integrity of management, those charged with governance and, where relevant, the owners of the entity. This assessment needs to be made prior to the acceptance or continuance decision for each engagement.

We have reviewed these policies and procedures, including the firm's wider risk assessment of entities and audits as part of acceptance and continuance decisions. In addition, we have considered the firm's policies relating to withdrawal or dismissal from audits and the required communication on ceasing to hold office.

Key findings

We had no key findings to report. The firm had improved its policies and processes, particularly by improving the extent of evidence captured in the acceptance and continuance system and introducing a new tender approval process, since our last review of this area.

Good practice

We identified the following area of good practice:

- The firm requires all tenders to be reviewed by a bid review panel, regardless of the size or risk level of the prospective audit. The papers prepared for this panel require an assessment of resourcing needs.

Audit methodology (settlements and clearing processes for banks and building societies)

In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to the audit of the cash and payments process cycle for the audit of banks, building societies, other credit institutions and payment services providers. Our evaluation focused on assessing the firm's guidance and templates provided in relation to:

- Understanding the relevant financial statement line items and their linkage to internal and external applications.

- Performing appropriate risk assessment procedures.

- IT specific guidance including the assessment of matching and other configuration rules and system generated report logic.

- Testing bank reconciliations (both controls and substantive testing).

- Guidance over external confirmations.

Key findings

- We had no key findings to report.

Good practice

We identified no specific examples of good practice in our review.

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:

- Implementation of the FRC's Revised Ethical Standard (2021/22): The firm needed to improve its guidance on how to consider the perspective of an Objective, Reasonable and Informed Third Party when taking decisions relating to ethics and independence. The firm also needed to enhance its controls to ensure a network firm cannot commence a non-audit service before approval is provided by the UK audit partner.

- Internal quality monitoring (2021/22): The firm needed to ensure that reviewer's professional judgements were sufficiently recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised.

Further information on the firm's actions against these areas can be found in the 2021/22 and 2020/21 reports.

Good practice

Good practice was identified in four areas:

- On EQCR, consultations and audit documentation, the firm's audit software required each audit working paper to be re-reviewed following each modification, including in the archiving period. The firm also specifically assessed the completeness of mandatory consultations for all engagements selected for review in the internal quality monitoring process.

- On audit methodology for fair value of financial instruments, the firm's guidance was identified as being of a high quality, particularly in respect of risk assessment, control and substantive testing procedures, and model risk management.

- On internal quality monitoring the firm required all audit partners who received an adverse result to be re-selected for review in the following year, and required all grading decisions, including where no findings were raised, to go through a moderation panel.

- On audit methodology and training we identified a strong monitoring process of completion of mandatory training with clear consequences for individuals that did not attend, good frequency and quality of ongoing communications to partners and staff on methodology updates and detailed guidance to audit teams on controls that are common at banking entities.

Implementation of ISQM (UK) 1

In the current inspection cycle, 2022/23, prior to the implementation of ISQM (UK) 1, we have held discussions with the firm to understand its plans and progress for implementation, focusing on how the firm has:

- Ensured adequate oversight of and accountability for its system of quality management.

- Identified quality objectives, risks and responses and assessed the significance of its quality risks and the design and implementation of its responses.

- Identified the service providers and network resources that it relies upon in its system of quality management and how it will assess the reliability of these on an ongoing basis.

- Planned to undertake monitoring activities over its system of quality management on an ongoing basis.

Since the implementation of ISQM (UK) 1 we have begun our statutory monitoring under this standard.

In the 2022/23 inspection cycle, prior to the implementation of ISQM (UK) 1, (2023/24), we are focusing on the firm's identification of objectives, risk assessment processes and the completeness of the risks identified. In addition, we are reviewing certain components of the system of quality management, including governance and leadership, acceptance and continuance, network resources and service providers. In these areas we are looking at the design and implementation of responses. We will also review the firm's plans for ongoing monitoring and remediation of the system of quality management and the annual evaluation process.

Observations

On an ongoing basis, our inspection will be undertaken on a risk focused and cyclical basis, supported by targeted thematic work where we will perform in-depth reviews of particular aspects of the firm's systems of quality management. Our thematic reviews in the current inspection cycle will also cover the following areas:

- Audit sampling methodology, within the engagement performance and intellectual resources components.

- Hot reviews (internal reviews that take place during the audit, prior to the audit report being signed), within the engagement performance component.

- Identification and assessment of network resources and service providers, within the resources component.

- Root cause analysis, within the monitoring and remediation component.

We will also annually review elements of the ethics component as this continues to be a priority area for the FRC, where our work will again focus on ensuring firms adhere to the FRC's Revised Ethical Standard through: compliance testing, review of breaches reported and regular interaction with the firm's ethics functions.

Other annual areas of review will include elements of monitoring and remediation, including root cause analysis and audit quality plans, and leadership and governance, including tone at the top.

4. Forward-looking supervision

This section of the report focuses on our forward-looking supervisory approach - identifying and prioritising what firms must do to improve audit quality and enhance resilience. We balance an assertive approach, holding audit firms accountable, with acting as an improvement regulator, identifying and sharing good audit practice to drive further improvements across the sector.

We employ, to differing extents, all four faces of supervision in our work. A fuller explanation of our forward looking supervision approach is set out in Our Approach to Audit Firm Supervision 2023.

Diagram: The Four Faces of Supervision

This diagram illustrates the four aspects of FRC's supervision approach:

- System Partner: Educating, collaborating, and supporting continuous improvement

- Facilitator: Encouraging good practice through structured engagement

- Supervisor: Supervision and monitoring of requirements, culture and behaviours

- Enforcer: Investigating conduct and applying proportionate sanctions and directions

We hold the firms to account through assessment, challenge, setting actions and monitoring progress. We do this through: assessing and challenging the effectiveness of the firm's RCA processes; evaluating the developments of firms' audit quality plans (AQPs); reviewing firms' action plans - now including their Single Quality Plan (SQP) - and monitoring the effectiveness of firms' responses to our prior year findings; assessing the spirit and effectiveness of the firm's response to non-financial sanctions; and through PIE auditor registration.

We also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2022/23 we held a roundtable, attended by the Tier 1 firms, sharing good practices and success stories on in-flight or hot reviews. We also carried out thematic work including on tone at the top and aspects of IFRS 9.

Our observations from the work we have conducted this year, and updates from previously reported findings, are set out under the following areas:

- The firm's Single Quality Plan, other quality improvement plans and audit quality initiatives.

- Root cause analysis.

- PIE auditor registration.

The firm's Single Quality Plan, other quality improvement plans and audit quality initiatives

Background

The SQP was introduced, as we required, by the Tier 1 firms during the year and is maintained by each firm as a mechanism to further facilitate our holding firms to account. Each firm should develop an SQP that drives measurable improvements in audit quality and resilience. The firm should also have an overarching plan and strategy for audit (Audit Quality Plan or AQP). The AQP should include initiatives that respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality. Where a firm has poorer results, these audit plans should either be transformational in themselves or be supplemented with a plan that prioritises those initiatives that will quickly bring about the transformation needed to improve audit quality. These overarching plans should then be used in the development of the firm's SQP in terms of purpose and prioritisation of individual actions or in the development of core pillars or similar. The SQP allows the firm and us to monitor whether changes are being prioritised and made in a timely and effective way. Where they are not achieving the objectives, we will hold the firm to account against their plan and consider whether further actions are necessary.

Last year we reported that the firm's transformational plan (PEAQ) was coming to an end with all the initiatives moving to business as usual and that a new AQP grounded in the audit strategy had been introduced.

When we reviewed the plan last year, it had only just been introduced but the core audit activities and initiatives were mapped to the five pillars of the audit strategy which were then underpinned by the firm's audit behaviours. We identified good practice in relation to the mapping which also included mapping the plan to quality standards (ISQC (UK) 1 and ISQM (UK) 1) and the FRC's What Makes a Good Audit. However, we found that the monitoring and reporting of the new plan was complex with different reports covering different initiatives being presented to different committees/Boards at different times.

Observations

We assessed the following:

- SQP – Development: PwC has developed an SQP that links with its AQP. The processes of maintaining and monitoring the plan as well as analysing the data within the plan were enabled from the inception of the plan using a simple, but interactive tool that works with the firm's method of recording actions. The processes are integrated reducing the risk of an action not being tracked once it has been recorded.

- Principles of SQPs: PwC's SQP encompasses all the principles outlined by the FRC as we worked with firms to develop these plans. These principles include prioritisation, having a forward-looking focus, an ability to measure the effectiveness of the actions and the overall SQP, and regular reporting.

- Measuring the effectiveness of individual actions and the overall SQP: The firm has begun to measure effectiveness (qualitatively and quantitatively) of some of the actions building on the considerations the firm previously carried out as part of RCA within its continuous improvement team. The firm must continue to develop how effectiveness is measured for both individual actions and the overall SQP, so that both immediate and long-term effectiveness are considered.

- SQP and AQP – Monitoring and reporting: The monitoring and reporting to the Audit Executive and Audit Oversight Body, of the whole plan (AQP) remain complex, but it is clear from our observations and assessment that matters key to audit quality such as resourcing, culture and technology are discussed, monitored, and reported on regularly. The SQP allows regular reporting providing RAG ratings on action progress and more recently on effectiveness of actions depending on the progress to embed the action.

- Recurring findings and inconsistent audit quality: There continues to be recurring themes, arising from individual audit inspections, related to the audit of revenue and impairment, which were also themes covering key findings last year. In addition, with good practices and findings in similar areas across audits inspected, inconsistent audit quality remains. A continued focus on recurring findings and inconsistency within the RCA process has been maintained and it is needed to further improve audit quality.

We will use the SQP alongside the AQP to monitor the progress of actions and how the firm measures their effectiveness. We will continue to assess the actions and/or initiatives the firm adds to the SQP to facilitate continuous improvement.

Root cause analysis process

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM (UK) 1, introduced a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we assessed that the firm's overall approach to RCA was well developed; an established process that has been embedded in its processes to remediate and continually improve. We identified good practice in relation to the focus on the drivers on an audit that lead to positive outcomes and the use of quantitative and qualitative analysis to assess the effectiveness of actions. The firm has continued to make refinements to its RCA approach.

Observations

We assessed the following:

- Continuous Improvement – Primary and Secondary Factors: The firm uses a taxonomy of risk factors, assessing the relative impact of each before identifying primary and secondary factors for each engagement. The factors from each assessment are then combined and analysed across all engagements. Based on discussions with external providers in the field, findings across our public reports and discussions with peers, the firm is piloting the additional consideration of secondary factors in lower impact areas and an improved cause-effect pattern between primary and secondary factors.

- RCA covering themes relating to the audit of the cash flow statement: During Summer 2022 the firm carried out a deep dive into the audit of cash flows. This resulted in a more structured seven step guidance being launched for UK audit teams and autumn 2022 training which focused on common mistakes in cash flow statement classification. The training and changes to guidance occurred after the audits reviewed and reported on in Section 2.

- Monitoring prior year adjustments: The firm monitors prior year adjustments on its audits on a quarterly basis and looks for patterns. RCA is carried out on a sample basis. This process would be improved if wider monitoring is carried out, for example monitoring prior year adjustments on audits that have moved from PwC to a new audit firm.

- Long-term effectiveness actions: When actions are set and agreed, consideration is needed to ensure that they are designed to be effective in the long-term as well as in the shorter term. This would reduce the risk of findings on individual audits, for example, recurring after apparently being resolved.

We will continue to assess the firm's RCA process as a crucial part of the feedback loop within ISQM (UK) 1 as well as part of our holding the firm to account. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result through the SQP.

PIE auditor registration

Background

The FRC is now responsible for the registration of all firms which carry out statutory audit work on public interest entities (PIEs). This registration is in addition to the ongoing requirement for firms and Responsible Individuals (RIs)3 to register with their Recognised Supervisory Body (RSB). The FRC's PIE auditor registration remit covers all firms and relevant Rls which audit one or more PIEs which includes: UK-incorporated entities listed on the London Stock Exchange (or another UK-regulated market); a UK registered bank, building society or other credit institution (but not credit unions or friendly societies); or are a UK insurance entity which is required to comply with the Solvency II regulations.

All firms and RIs carrying out statutory audit work on PIEs were required to register with the FRC by 5 December 2022 under a set of transitional provisions. Thereafter, any firm that plans to take on a PIE audit, or remain auditor to an entity that is to become a PIE, (for example, if it obtains a listing on the London Stock Exchange), together with relevant RIs, must register with the FRC before undertaking any PIE audit work.

Where appropriate, firms and/or Rls can be held to account through conditions, undertakings and suspension or involuntary removal of registration, adding to our activities focused on holding firms to account. Measures used through the PIE auditor registration process are not always published.

Observation

On 5 December 2022 PwC's transitional application for registration as a PIE auditor was granted and as at 31 March 2023 139 RIs at the firm had been approved. The following diagram shows the number of PIE and non-PIE RIs as a percentage of the total RIs at PwC:

PwC LLP: Percentage of PIE and Non-PIE RIs

A pie chart illustrating the proportion of Responsible Individuals (RIs) at PwC who are classified as PIE and non-PIE RIs.

- PIE and non PIE: 60%

- non PIE: 40%

Other activities focused on holding firms to account

Background

Our forward-looking supervisory approach includes a number of other activities designed to hold firms to account. We have carried out certain procedures during the year to consider tone at the top, the contents of the firm's Transparency Report and the firm's responsiveness to feedback and where relevant to constructive engagement and non-financial sanctions. This firm was not subject to increased supervisory activities during the year.

Observations

We assessed the following:

- Constructive engagement: Where we have engaged on constructive engagement cases throughout the period, the firm has taken prompt action to strengthen policies, procedures and training aimed at preventing future recurrence of findings. In certain cases, training appears to have made an initial but not lasting impact as findings are beginning to reoccur. The firm must understand the root causes of this, as part of continuing assessment of the effectiveness of actions.

- Non-financial sanctions: In respect of non-financial sanctions, three have been imposed and agreed since the end of the last inspection cycle with reporting and monitoring having already commenced on two cases.

Culture and conduct

Background

The firm's culture has a significant impact on audit quality and the speed at which audit quality is improved. Firms that have more advanced cultural programmes, where desired audit specific behaviours are promoted through their wider policies and procedures (in particular training and coaching, performance management and reward and recognition), typically have better or improving audit quality.

Reported instances of integrity issues or misconduct matters have a significant impact on trust and confidence in the profession. Ethical conduct must therefore be an intrinsic part of all firms' cultural programmes and the profession must strive to maintain a culture of integrity in which the highest standards of ethical values and professional behaviour are upheld.

Observations

We assessed the following:

- Audit culture: PwC continue to develop more advanced audit culture initiatives and assessment techniques to remain a leader in this field, including a focus on psychological safety and how behaviour changes under pressure. It is important that the firm pays attention to individual behaviour that is not consistent with the firm's desired values and behaviours.

- Ethical conduct: We have seen examples of misconduct including exam cheating and breaches of integrity at certain firms that impact the reputation of the profession as a whole. All firms need to ensure that their culture promotes individuals to operate to the highest ethical standards in order to maintain public confidence and trust.

Initiatives to ensure compliance with the FRC's Revised Ethical Standard 2019

Background

During 2022, we held biannual meetings with the Ethics Partner, undertook compliance testing and reviewed the firm's biannual reporting of identified breaches. The specific findings from this work are detailed in section 3. However, we have the following, observations on the steps being taken to comply with the FRC's Revised Ethical Standard going forward.

Observations

We assessed the following:

- Ensuring networks firms obtain all necessary UK approvals for non-audit services: The firm is currently working towards a new global client and finance system which may enhance and standardise controls to prevent non audit services commencing without all relevant approvals. In the interim, the firm is seeking assurance that overseas network firms are obtaining all the relevant approvals via additional monitoring and review of the global compliance testing for network firms.

- Individuals' pension investments: New arrangements are being implemented for staff and partners to record pension investments, which includes an automated data feed from the firm's pension providers. Once embedded, such automated processes should enable any conflicts to be identified and rectified more quickly.

Operational separation of audit practices