The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Accounts Taxonomies Design 2026

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, 1 Harbour Exchange Square, London E14 9GE

- 1. Introduction

- 2. UK Taxonomy Suite

- 3. Taxonomy Objectives

- 4. Taxonomy Presentation view of Concepts and Dimensions

- 5. Comprehensive tagging

- 6. Groupings

- 7. Tagging of text

- 8. Labels and Element Names general principles

- 9. Handling of guidance within the taxonomy

- 10. Accounting references

- 11. Summation and checking of tagging

- 12. Other issues

- Appendices

1. Introduction

This document sets out important aspects of the design of the FRC Taxonomy Suite, the Irish Taxonomy, and the Charities Taxonomy developed by the Financial Reporting Council (FRC). It explains the main goals and assumptions which underlie the design and content of the taxonomies. The design principles of those taxonomies are set out in the Developers Guide available from the FRC Taxonomies website.

The document is intended to help prospective users assess the 2026 version of the Taxonomies. The Taxonomy release is also accompanied by detailed guides for developers and for those preparing accounts in iXBRL format. Those guides will incorporate the content of this design document.

2. UK Taxonomy Suite

2.1 Scope

In addition to the descriptions below, the taxonomies also contain components to reflect other developments in the annual report and accounts, including those in Auditor report, Directors'/Strategic report, Accountant's report. The statements on design in this document apply to all components and Taxonomies, unless otherwise stated.

The set of taxonomies released by the FRC are:

FRC Taxonomy Suite

The FRC Taxonomy Suite provides the following entry points for preparing a report:

FRS-102

This entry point defines elements for FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland and is useful for companies filing financial statements prepared in accordance with FRS 102 and FRS 105.

IFRS

This entry point defines elements for IFRS Accounting Standards that have been endorsed by the UK Endorsement Board and is useful for companies filing financial statements prepared in accordance with IFRS Accounting Standards

FRS-101

This entry point is useful for companies filing financial statements prepared in accordance with FRS 101 Reduced Disclosure Framework, which enables subsidiaries and ultimate parent companies to take advantage of disclosure exemptions in comparison to the requirements in IFRS Accounting Standards.

IFRS-UKSEF

This entry point is useful for companies filing their annual consolidated report using the multiple target documents approach (UKSEF approach) to use elements (e.g. Streamlined Energy and Carbon Reporting (SECR) concepts) from the FRC Taxonomy Suite for the "UKFRS” target document and to tag parent company data for the purpose of annual statutory accounts reporting to Companies House. This entry-point is equivalent to the corresponding IFRS entry-point, but preparers must use the UKSEF variants to ensure that any future UKSEF-specific variations or additions to the FRC Taxonomy Suite are in scope of the report.

FRS-102-UKSEF

This entry point is useful for companies filing their annual consolidated report using the multiple target documents approach (UKSEF approach) to use elements (e.g. Streamlined Energy and Carbon Reporting (SECR) concepts) from the FRC Taxonomy Suite for the “UKFRS” target document and to tag parent company data for the purpose of annual statutory accounts reporting to Companies House. This entry-point is equivalent to the corresponding FRS-102 entry-point, but preparers must use the UKSEF variants to ensure that any future UKSEF-specific variations or additions to the FRC Taxonomy Suite are in scope of the report.

DPL

The Detailed Profit & Loss taxonomy has, for a number of years, been a separate taxonomy owned and managed by HMRC, for use in combination with either the FRC Taxonomy Suite or HMRC's own Tax Computation Taxonomy. In versions from 2022 onwards, the elements of the standalone DPL Taxonomy have been included in the FRC Taxonomy Suite and are available in this separate entry point as well as in the other applicable entry points.

CIC-34

This entry point defines elements for requirements stipulated in section 34 of the Companies (Audit, Investigations and Community Enterprise) Act 2004 and contain the information required by Part 7 of the Community Interest Company Regulations 2005 (SI 2005/1788). This entry point is useful for community interest companies (CICs) for filing their CIC-34 report. The CIC-34 report serves as a comprehensive reflection of a CIC's activities and the benefits it has contributed to the community over the past year. The annual accounts of CICs need to be filed using a different appropriate entry point from the FRC Taxonomy Suite.

DSEP-AA06

This entry point defines elements for the statement of guarantee from the parent company – form AA06 – which is part of the Dormant Subsidiary Exempt Package, used for both filing-exempt and audit-exempt subsidiaries.

DSEP-Agreement

This entry point defines elements for the written notice of agreement by the subsidiary's members which is part of the Dormant Subsidiary Exempt Package, used for both filing-exempt and audit-exempt subsidiaries.

Charities Taxonomy

The Charities Taxonomy extends the FRC Taxonomy Suite and provides one entry point for preparing a report:

Charities

This entry point extends FRS-102 from the FRC Taxonomy Suite and defines additional elements for the Statement of Recommended Practice (SORP) applicable to charities preparing their accounts in accordance with FRS 102.

Irish Taxonomy

The Irish Taxonomy extends the FRC Taxonomy Suite and provides the following entry points for preparing a report:

FRS-101

This entry extends FRS-101 from the FRC Taxonomy Suite and is useful for companies filing financial statements prepared in accordance with FRS 101 Reduced Disclosure Framework to the Revenue Commissioners of Ireland. It enables subsidiaries and ultimate parent companies to take advantage of disclosure exemptions in comparison to the requirements in IFRS Accounting Standards.

FRS-102

This entry point extends FRS-102 from the FRC Taxonomy Suite and is useful for companies filing financial statements prepared in accordance with FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland to the Revenue Commissioners of Ireland.

EU IFRS

This entry point extends IFRS from the FRC Taxonomy Suite and is useful for companies filing financial statements prepared in accordance with IFRS Accounting Standards to the Revenue Commissioners of Ireland.

UKSEF approach

In 2023, the UKSEF Taxonomy was re-architected to support multiple target documents approach (UKSEF approach), eliminating the need for an explicit UKSEF Taxonomy. At a minimum, the purpose of the UKSEF approach is that the tagged consolidated financial statements that comprise an ESEF report are augmented by UK-specific tagging of information legally required by Companies House for the individual parent entity. Readers are referred to the UKSEF Guidance documentation on the FRC Taxonomies website for full information.

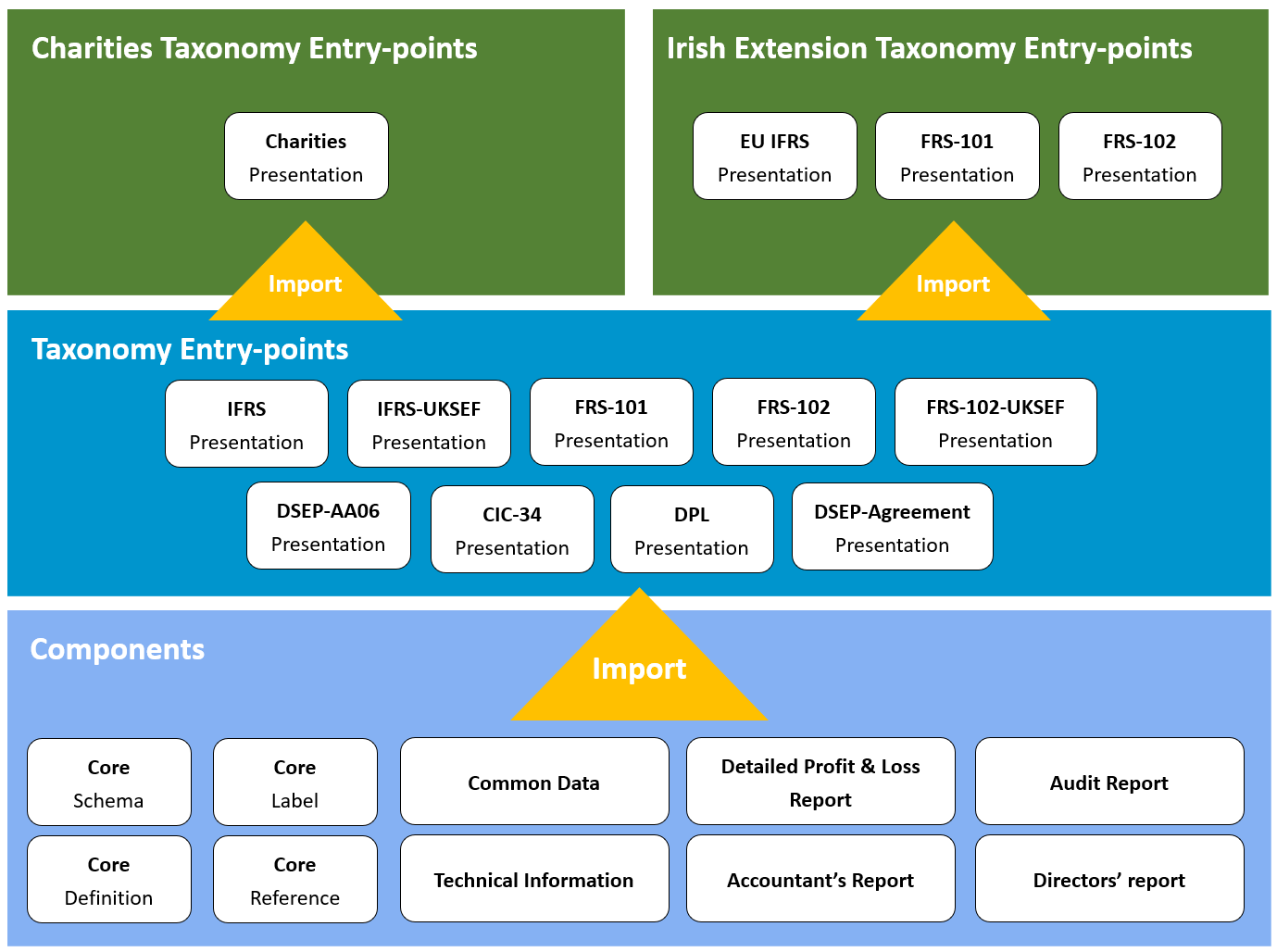

2.2 Structure

The diagram below shows the main components of the taxonomies. It is illustrative and does not show all technical components, files and links.

3. Taxonomy Objectives

3.1 General Objectives

The over-arching objective is to provide taxonomies which enable the efficient preparation of legally compliant corporate reports in XBRL. The content of the taxonomies is derived from current UK regulations, and they are designed to be used by companies and other entities to meet the relevant legal reporting requirements.

Separately to tags provided to meet legal requirements, the taxonomies should include tags to digitally disclose additional types of information that filers have in their paper reports. Filers may elect to tag these at their own discretion as there is no legal obligation to do so.

The objectives are all relevant and the order of them does not denote a ranking or relative importance. In devising the objectives, the needs of users and regulators are given equal weighting. It should be noted that UK regulators may have differing priorities regarding objectives for the taxonomies, however the following objectives are high level and apply to all UK regulators, agencies, and government departments signed up to the FRC's Taxonomies project.

This means taxonomies which:

- Generate quality structured data.

- Clearly and accurately define the XBRL tags needed to identify specific information.

- Cover financial, non-financial and narrative elements within annual and other corporate reports which are useful for analysis, comparison, or review by existing and potential consumers of XBRL reports.

- Are easy and efficient to use.

- Provide clear and consistent tagged information which can be used effectively by consumers of XBRL information.

The taxonomies should, as far as is practical:

- Be in line with technology available in the marketplace and with relevant regulatory scope and remit.

- Enable tagging of financial statements and other key monetary and numeric data in the main body of financial statements, to ensure compliance with regulations.

- Facilitate tagging, for the purposes of identification, of all textual information which is important to the interpretation and meaning of an annual report and accounts. This means high-level tagging to indicate the presence and scope of particular textual statements, but not necessarily granular tagging of the detailed components of such statements.

- Play a role in encouraging the creation of further taxonomies and the embedding of a digital focus for FRC core policy areas through a combination of innovation, outreach, promotion, and education activities.

It is not practical to define tags to cover every eventuality or item which may be reported in annual reports. However, appropriate techniques, such as the use of analysis tags, enable comprehensive tagging of most financial schedules in accounts without requiring a particularly large number of tags in the taxonomies.

Despite the general aims, particular areas of reporting may not be in scope for detailed tagging where these are:

- Very varied in content and form across companies.

- Highly specialised – either in general or for the sector concerned.

- Not expected to be a high priority for analysis by likely users of accounts.

Areas of reporting have been excluded from detailed tagging if they meet at least two of these criteria.

4. Taxonomy Presentation view of Concepts and Dimensions

4.1 Concepts

A concept is the representation of a line item that needs to be reported in a set of accounts—such as "Operating profit (loss)" or " Fixed assets ". The Taxonomies organise concepts for line items that reflect their appearance in typical accounts. This is achieved primarily through a hierarchical Presentation View. This view is a crucial aspect of the taxonomy, as it dictates how preparers navigate and interact with the available concepts. Concepts for line items are arranged and ordered in sections (e.g., Directors'/Strategic Report, Balance Sheet, Income statement) to reflect their natural appearance in typical financial accounts. The organisation and ordering within these sections are designed to be intuitive, mirroring the familiar layout of financial statements.

The identification of concepts within the taxonomy relies heavily on a combination of their human-readable labels and their specific positioning within this presentation view. For instance, a parent heading like "Net cash flows from (used in) operating activities" clarifies the meaning and appropriate use of the concepts grouped underneath it. This method of identification through structural placement is designed to minimise ambiguity and ensure that the correct accounting meaning is consistently applied by all users, promoting high-quality and consistent digital reporting.

While the labels and positioning in the presentation view are generally sufficient for identification, this information is supplemented by further, guidance tags within the taxonomies wherever necessary and via references to specific accounting standards.

Labels, coupled with positioning in the presentation view, should be sufficient to identify the meaning and use of most elements. However, this information is supplemented by further guidance within the taxonomies and accounting references, as explained in sections 9 and 10 respectively.

4.2 Dimensions

Dimensions allow a single concept to be broken down by a particular characteristic or attribute. Dimensions are used to add contextual detail to reported data, for example, breaking down revenue by region or listing individual subsidiaries. This mechanism ensures that preparers provide the granular data required by accounting standards and regulators.

There are two primary types of dimensions: Explicit Dimensions and Typed Dimensions.

Explicit Dimensions explicitly define a finite, discrete set of elements (domain members) within the taxonomy using domain-member relationships. The taxonomy author defines the exact members allowed (e.g., " Product and service 1", " Product and service 2"). The complete list of explicit dimensions and their domain members are organised in a separate presentation section to enable easier review of available dimensions.

The link between a concept and its required dimensions is formally established within the definition linkbase of the taxonomy. This linkbase defines the relationships and rules that govern how data can be reported. The hypercube acts as a central point in this linkbase, a hypercube is the mechanism that links a specific concept to the dimensions that are required to segment it. It is essentially a container for a set of dimensions that must be used together with concepts when reporting a fact.

Typed Dimensions do not contain a closed set of specific, predefined domain members in the taxonomy. Instead, they allow preparers to define custom values that conform to a specified XML data type as their domain members directly within the iXBRL instance document. The domain is defined by an XML Schema data type (like a string, integer, or a complex XML structure). Typed dimensions are governed by the same general rules as explicit dimensions, but they cannot have a default domain member, since they do not have an explicit domain member defined in the Taxonomy which could serve as a default. The number of domain members they contain is not limited. The purpose of typed dimensions is to enable multiple occurrences of the line-item concept to which they are attached.

The 'groupings' of elements are handled using dimensions rather than 'tuples', this change is explained in section 6 on groupings.

5. Comprehensive tagging

5.1 Comprehensive tagging approaches

The sections below explain the methods used to support complete tagging of schedules or sections of accounts.

These methods are used selectively in particular parts of the taxonomies. The Taxonomies do not use 'Detailed analysis dimension' with all line items. This is because of the size, complexity and nature of company accounts. An important aim has been to limit the risk of misuse and tagging error arising with the more complex Taxonomies.

5.2 Analysis items

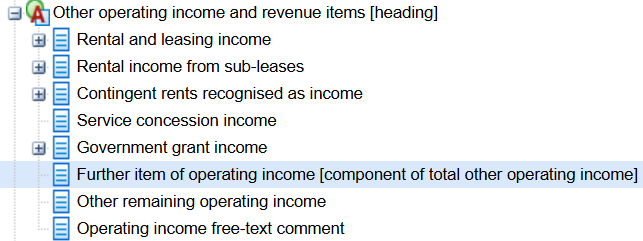

Tags known as 'analysis items' are included in particular sections of accounts to enable preparers to tag line items for which no specific tag exists. These tags are attached to a typed dimension, enabling each tag to be used multiple times, if necessary. They should enable complete tagging of the section in which they appear and, where appropriate, the summation of the data concerned to be checked.

The label of the tag makes clear the use of the tag and the total within which it is included. The label takes the form "Further xyz item [component of abcd]”.

The following shows an example of an analysis item included under ‘Other operating income':

The 'Further item of operating income...' item is the analysis item concerned. Its label and positioning emphasise that it should only be used for line items which are direct components of 'Other operating income'. It may be used as often as required in combination with a different member of the typed analysis dimension to which it is attached.

Since the typed analysis dimension domain is defined as a positive integer, the typed dimension tags will not carry meaning. No name or description tag will be associated with the dimension. Taxonomy users will need to look at the content of the Inline XBRL document if they wish to see a human-readable description of the item concerned.

The issue of summation of tagged data is discussed in section 11. An important point to note is the taxonomy cannot guarantee that summation of sections will operate correctly in all cases even with the use of analysis items and the application of correct tagging. The variability of items which may be included in some financial aggregations may mean the summation implied in a taxonomy will not match that used in some specific accounts. For example, companies may apply varying definitions to what is contained within operating income, non-operating income and revenue. However, the use of analysis items will:

- enable more complete tagging;

- allow summation to be confirmed in many cases; and

- encourage checks on the correctness of tagging where summation fails.

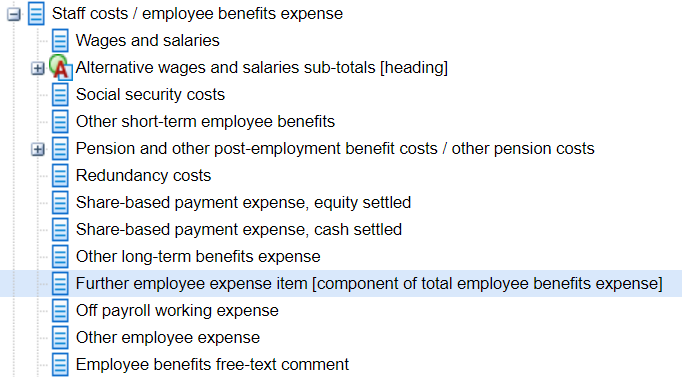

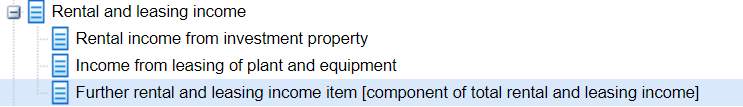

Other examples of the use of analysis items are shown below:

Note that 'Rental and leasing income' is included within 'Other operating income', showing how sub-components can also be tagged comprehensively where needed.

Analysis items are only included where they are likely to be required – they are not included as routine within all sections of the taxonomy. The latter approach would lead to redundant tags and might encourage incorrect or loose tagging.

5.3 Additional dimension tags to handle non-standard breakdowns

While the content of many classes of data covered by dimensions, such as classes of Property Plant Equipment or Intangibles, is largely predictable, some additional, untypical classes may be used by some companies. These undermine the completeness of tagging since they lead to whole columns or rows in financial tables being untagged.

Financial statements which raise this issue will usually follow most of the classes represented in a taxonomy but introduce one or two additional classes which reflect the particular circumstances of a company.

To deal with this, the taxonomies include a small number of 'non-standard' dimension tags in some of the main dimensions representing such classes of data. This should be sufficient to handle the vast majority of such variations.

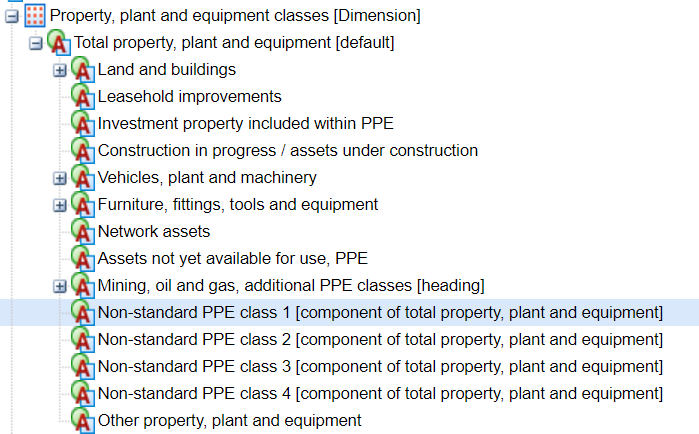

In the case of PPE, for example, four tags of the form 'Non-standard PPE class 1' have been added to the dimension alongside the explicit tags for PPE classes. These could, for example, be used to represent aggregations of classes which are not represented by specific tags.

These tags are only intended to be used for classes which are direct components of the main total – not narrow subdivisions of classes which are already tagged. They thus allow checking of the completeness of tagging of the main classes and summation across those classes to the total. This is made clear by their labels, which, like analysis items, include the wording [component of abcd].

The following example show the 'non standard' dimension tags for PPE:

Such cases only involve a small number of 'non-standard' tags in order to encourage use of the explicit tags as far as possible, avoid redundancy and limit any risk of mis-tagging.

6. Groupings

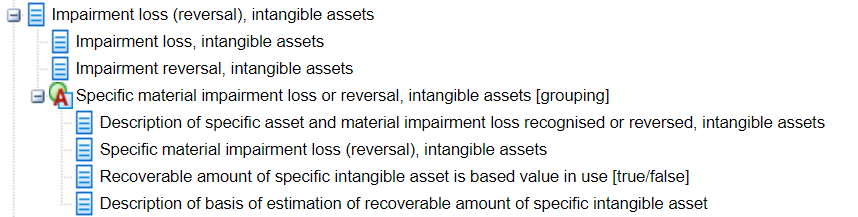

'Groupings' of concepts are underpinned by typed dimensions. All concepts within a grouping are attached to a typed dimension which effectively binds the items together. Each occurrence of the set of concepts within the grouping should be attached to a single typed dimension tag. The same domain member of a typed dimension should be used for the occurrence across different periods, enabling easy comparison across periods, unlike the case with tuples.

An example of a grouping is shown below:

A different typed dimension has been defined for each grouping. Since the domain members in each typed dimension will be identical, this difference may be largely invisible to preparers, but it will be a convenience in clarifying the data for consumers.

7. Tagging of text

7.1 General approach to tagging of text

For the purposes of this section, the phrase 'text tags' refers to line item concepts of 'stringItem Type' which are used for tagging sections of text in financial reports. (Other tags based on this item type may be used for other purposes, such as abstract headers or as domain members of a dimension, but they are not the subject of the section.)

7.2 Use of text tags

The main purposes of text tagging are:

- Identification of important data, such as the name of the entity concerned;

- Confirmation that certain information is present in a report; and

- Identification of significant textual information which can then be easily located, viewed, compared, collated or stored for further examination. Analysis of textual content may be by human readers or text analysis software.

The following types of text tags are generally used:

- Names;

- Basic descriptions (e.g. Description of material intangible asset);

- Standard statements (e.g. Directors acknowledge responsibilities under the Companies Act);

- Statements of information (e.g. Statement on reasons for any qualification of audit opinion);

- Free-text comment tags.

Text tags are used for specific textual financial information which may be reported in accounts. The text tags cover a full item of textual information rather than detailed parts. Very granular text tags are not used in the Taxonomies. This reduces the number of required concepts and simplifies tagging, while continuing to provide all the information likely to be required for the location, analysis, comparison or storage of tagged information.

Points to note are:

- Monetary or numeric concepts which applies to the data concerned are necessary to tag important monetary or numeric data which is nested within a block of text; and

- The Taxonomies are expected to be used with the latest version of Inline XBRL which allows a single text tag to be applied across different fragments of text. This complements the less granular definition of text tags.

8. Labels and Element Names general principles

Labels are the natural language expressions (e.g., "Operating profit (loss)") that make the taxonomy understandable to people, such as preparers and data consumers.

From the 2022 version onwards, the FRC Taxonomy Suite and the Charities Taxonomy includes a complete set of Welsh labels in addition to English, enabling Welsh accounts preparers and taxonomy browsers to see and understand the contents of the taxonomies in their native tongue (if enabled by their taxonomy-aware software).

Element names are unique technical identifiers (e.g., OperatingProfitLoss) designed to be read by machine. The name of element are derived from their human-readable standard labels. This design decision serves a practical purpose: it enables technical users, such as data analysts, software developers, to easily read and understand the underlying data in the XBRL files. By deriving names from the standard label, the data remains intelligible even without the need for specialised taxonomy viewing software, which promotes transparency and efficient debugging.

9. Handling of guidance within the taxonomy

9.1 Use of the documentation label

The 'documentation label' has been used to provide additional guidance on the use of individual tags, where required. This guidance centres on how tags should or should not be used.

The use of documentation labels has been restricted to line item tags. Documentation labels have not been applied to domain members of a dimension since this would be likely to over-complicate user interface displays.

Software providers are encouraged to make documentation labels easily available to users and to indicate clearly to users when the label is available for a concept.

9.2 General guidance and cross-reference information

General guidance and cross-reference tags have been expanded to help users find tags and apply them correctly.

Cross-reference tags have been connected to the data at which they point by the use of custom arcs. This will enable software developers to implement a form of hyperlinking within the taxonomies if they wish.

10. Accounting references

References to financial reporting standards are an important way of confirming the meaning of a taxonomy element and the authority for its use. Software providers are encouraged to make accounting references available for users to view easily and efficiently in any software which supports manual tagging choices.

References in the taxonomies adhere to the following practices:

- All accounting line-item tags will carry one or more references to accounting standards.

- IFRS and FRS 101 accounting content has references from the IFRS Accounting Standards.

- FRS 102 accounting content has references from FRS 102.

- Charities SORP content has references from Charities SORP and FRS 102.

- Taxonomies also include references to the Companies Act, Charities Act, Auditing Standards and other authoritative sources, where appropriate.

- All references are contained in common reference linkbases available to all taxonomies.

- This full reference information should benefit users by providing complete information on the authority for a tag.

- All references are to specific sections of official standards. We have avoided the use of generalised terms within references such as 'derived practice' or 'common practice'.

- Dimension tags do not in general carry references since their broad use means that specific references to individual paragraphs in standards are not appropriate. However, country, currency and language dimension tags carry International Standards Organisation (ISO) references to confirm identification of tags concerned.

- References to textual standards use 'Paragraph' as the most granular 'reference part'. They do not use reference parts representing sub-divisions of paragraph such as clause or sub-clause. Such sub-divisions are represented by components within the paragraph reference, with each component separated by a stop (.). An example is "para: 3.c.ii”. Brackets are not used to separate components. This approach provides simplicity of presentation. It also avoids difficulties in determining consistently what is a sub-para, clause, sub-clause and the like, since standards do not explicitly define such distinctions. Reference parts which reflect official, higher-level sub-divisions in UK Acts, such as 'Schedule', are used. This is consistent with practice in the original taxonomies.

- Where a reference relates to a range of paragraphs or sub-divisions of paragraphs, the range is shown within a single reference field. For example, a reference relating to paragraphs 31, 32 and 33, is shown as 31-33 in the paragraph field. This is not shown as three separate individual references to para 31, para 32 and para 33. This applies even if the sections are not contiguous. For example, a reference to para 32, clauses (a) and (c) is shown as 'para: 32.a,c', not as separate references to 'para: 32.a' and 'para: 32.c'.

As shown in these examples, references to a range use a dash (-) as separator and references to closely tied, non-contiguous items use a comma as separator. This approach is intended to simplify the presentation and viewing of references by users.

Clearly, if two or more references are genuinely separate and relate to entirely different sections of a standard or to different standards, then separate references are used.

11. Summation and checking of tagging

The design of the taxonomies, and particularly the introduction of analysis items, implies some sections of accounts may be tagged comprehensively and that the tagged data within them may be successfully summed. The summing of tagged data and checking against tagged totals provides a means of testing the accuracy of tagging (and potentially a check on the correctness of totals in the accounts).

The FRC has published a set of consistency checks covering expected summations and other relations involving tagged data which can be found on the FRC website.

Such consistency checks are purely intended as a helpful support to improve the quality of tagging. They are intended to provide information to taxonomy users. They are not intended to be an infallible guide on which acceptance or rejection of accounts might be based. The variability in the content of accounts across companies and industry sectors means that it is difficult to set rules and formulae which will all hold true in all circumstances for all entities.

The taxonomies do not include XBRL calculation linkbases. Calculation linkbase functionality, which is centred on simple summation, is very weak. It is unable to represent aggregation across dimensions and contexts. It is also unable to cope effectively with alternative summation pathways which may exist in different sets of accounts. Proper formulae are the only effective means of representing a broad range of calculations in accounts.

12. Other issues

12.1 Datatypes

Datatypes used in the Taxonomies reflect international types where an international type is available. This is to achieve consistency and compatibility with software which is used internationally. It is also consistent with HMRC's approach to its taxonomies.

The most-used datatypes, such as Monetary, String, Decimal and the like, are international types and will not change. UK datatypes have been revised, particularly through the introduction of specific datatypes introduced for heading, grouping, guidance and cross-reference items, so that software can easily identify these items and apply special processing to them, if required. Since the characteristics of the international and UK types normally match exactly, they should generally not pose problems for implementers.

12.2 Boolean tags

Boolean tags are used in the Taxonomies to indicate whether or not a particular condition applies. They are often the most efficient way to represent a particular declaration of circumstance in an XBRL report. It is accepted that such boolean tags may have to be included in the 'hidden' sections of iXBRL reports.

Labels of boolean tags include the words '...[true/false]' at the end of the label to indicate a boolean item.

In some cases, a boolean tag need only be used if the condition 'true' applies but may be omitted if it does not apply. This should simplify tagging. These cases are identified by documentation labels.

12.3 Pre-defined or 'enumerated' values

Taxonomies standardise on the 'fixed item type' mechanism for handling cases in which a concept can only take a fixed set of pre-defined values. These concepts have the datatype fixed ItemType and cannot directly contain a value. The information they represent is shown by the domain members in the dimension to which they are attached. The concept 'country of formation' is attached to the 'countries' dimension, while 'director signing report' is attached to the 'entity officer' dimension, which uniquely identifies each director.

These concepts must be entered in the hidden section since they have an empty value and thus cannot be tied to specific text in the readable part of accounts.

12.4 Balance attribute for cash flow data

The Taxonomies apply 'debit' and 'credit' balance attributes to cash flow and similar data using the convention that 'credit' represents an outflow of cash while 'debit' represents an inflow. (This is consistent with increase in cash being a debit.)

We have supplemented this approach with appropriate links in the definition linkbase to distinguish cash inflow and outflow items.

It is important to note that the rules on setting the correct sign of items will continue to rely on the label of tags. The balance attribute remains a supplementary aid; the label will always take priority in determining sign.

12.5 Range dimension

A number of important values are often reported as a range, with a top and bottom value, rather than a single amount. An example is ‘Useful life of property, plant and equipment', which is often reported as, say, 10 to 15 years.

The original taxonomies only allow tagging of such items as a single value or treat them as text strings, which is of limited benefit for automated analysis.

A 'range' dimension is therefore used in the Taxonomies to handle such cases. This takes the form:

![Screenshot of a financial taxonomy tree-view showing "Range [Dimension]" with "Single value" default, and "Top" and "Bottom" of range values.](https://media.frc.org.uk/images/page_25_img_0_qUd1gJL.original.png)

This dimension should be sufficient to handle general types of reporting of ranges. It will be applied to a small number of numeric tags where this is justified by requirements.

Appendices

A: Glossary

| Charities SORP | Statements of Recommended Practice (SORPs). SORPs are sector-driven recommendations on financial reporting, auditing practices and actuarial practices for specialised industries, sectors or areas of work, or which supplement FRC standards and other legal and regulatory requirements in the light of special factors prevailing or transactions undertaken in that particular industry, sector or area of work that are not addressed in FRC standards. The Charities SORP provides guidance to preparers of charity accounts. The SORP provides recommendations and requirements setting out how to prepare 'true and fair' accounts in accordance with UK accounting standards. |

| Datatypes | Taxonomy tags are assigned a 'data type' to identify their meaning and role and to assist in processing XBRL data. |

| Dimensions and dimension tags | Taxonomy dimensions represent the different forms in which financial data may be reported. A dimension tag is used to represent each individual form of reporting. |

| FRS 101, FRS 102 and FRS 105 | Accounting standards for the UK and Republic of Ireland published by the Financial Reporting Council. |

| IFRS Accounting Standards | IFRS® Accounting Standards and interpretations issued by the International Accounting Standards Board (IASB). They comprise: (a) International Financial Reporting Standards; (b) IAS® Standards; (c) IFRIC® Interpretations developed by the IFRS Interpretations Committee; and (d) SIC® Interpretations developed by the former Standing Interpretations Committee. |

| Inline XBRL or iXBRL | The Inline XBRL format provides a human-readable version of the report based on XHTML, with XBRL tags normally hidden from view in the underlying file. Also known as iXBRL. |

| Labels | Labels are the human-readable description on XBRL tags, which provide their main definition. As far as possible, they uniquely identify the tag concerned. |

| Manual tagging | The process of manually applying XBRL tags to items in financial statements with the aid of software. This involves the mapping of tags in a XBRL taxonomy to items contained in the financial statements. |

| SECR | Streamlined Energy and Carbon Reporting |

| Tag | An XBRL tag is the computer-readable identifier attached to an item of business data. |

| Taxonomy | Taxonomies are the dictionaries of the XBRL language, containing the computer-readable tags used to identify specific financial and business data items and the conventions which determine how they may be used. |

| Tuples | Tuples are used to group tags in a taxonomy which: (a) may be used repetitively in an XBRL report; and (b) can only be properly understood when used in conjunction with one another. |

| UKSEF | UK Single Electronic Format, based on ESEF (the European Single Electronic Format) |

Financial Reporting Council

London office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office: 5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in