The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

The Financial Reporting Council’s report on its supervision of the professional bodies during 2024/25

Financial Reporting Council Limited

The Financial Reporting Council's report on its supervision of the professional bodies during 2024/25

Presented to the Parliament pursuant to section 1252(10) of, and paragraph 10(3) of Schedule 13 to, the Companies Act 2006.

To be printed on 05 November 2025.

OGL

Financial Reporting Council copyright 2025

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3.

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at www.gov.uk/official-documents.

Any enquiries regarding this publication should be sent to us at: The Financial Reporting Council Limited 13th Floor 1 Harbour Exchange Square London E14 9GE

This document is also available on the FRC website at www.frc.org.uk

Registered number: 02486368

ISBN 978-1-5286-5998-7

E03455945 11/25

Printed on paper containing 40% recycled fibre content minimum

Printed in the UK by HH Associates Ltd. on behalf of the Controller of His Majesty's Stationery Office

- 1. Foreword by Executive Director of Supervision

- 2. Introduction and conclusions

- 3. Key themes impacting professional bodies

- 4. Our supervision of the professional bodies

- 5. Supervision of RSBs and RQBs

- 6. Supervision of actuarial regulation

- 7. Supervision of accountancy

- Appendix 1: Our responsibilities

- Appendix 2: Open requirements

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, 1 Harbour Exchange, London E14 9GE

1. Foreword by Executive Director of Supervision

I am proud to take up the role of Executive Director of Supervision at the Financial Reporting Council (FRC), following the departure of Sarah Rapson, who has taken up the position of Chief Executive Officer at the Solicitors Regulation Authority.

Anthony Barrett Executive Director of Supervision

I am committed to building on the strong foundations laid during Sarah's tenure, ensuring that our supervision remains rigorous, proportionate, and focused on the public interest. The work of the professional bodies is central to the integrity of the UK's audit and actuarial professions, and I look forward to continuing our collaborative efforts to uphold high standards, drive growth and innovation, and support the resilience of the sector.

Statutory audit and actuarial work are essential to the health of the UK's financial system. They underpin trust in financial reporting, support investor confidence, and help manage risk across sectors critical to economic stability. The FRC plays a central role in ensuring that the professional bodies responsible for these functions uphold high standards of regulation, education, and ethics.

The FRC supervises seven professional accountancy bodies and the UK's only chartered actuarial body 1. Together, these organisations register and regulate over 4,000 audit firms, 9,500 Responsible Individuals (RIs) and 18,000 actuaries. Our work ensures that their regulatory frameworks remain effective, proportionate, and aligned with the public interest.

Our supervision found that all professional bodies are committed to improving audit and actuarial quality. We were pleased to see progress on previous requirements, including ensuring that all statutory audit firms receive a monitoring visit at least once every six years. We also worked closely with the Institute and Faculty of Actuaries (IFoA) to ensure that invigilation was re-introduced to their examinations, having been taken out in 2020 due to the Covid-19 pandemic. This is key to ensuring academic integrity and protecting the value of the actuarial qualification.

In addition, we identified areas for improvement, particularly in the level of challenge applied during inspections and the documentation of audit monitoring work across all the professional bodies responsible for audit regulation (Association of Chartered Certified Accountants (ACCA), Institute of Chartered Accountants in England and Wales (ICAEW), Institute of Chartered Accountants in Ireland (ICAI) and Institute of Chartered Accountants of Scotland (ICAS)). We obtained action plans from the bodies to remedy the issues we identified and are regularly engaging with them on progress throughout the year. The ACCA failed to comply with some of its Delegation Agreement requirements on publishing disciplinary decisions. Following our intervention, it has implemented improvements to ensure this does not reoccur.

2. Introduction and conclusions

This is the FRC's 2025 report to the Secretary of State for Business and Trade on how it has discharged the powers and responsibilities delegated to it under the Companies Act 2006 (the Act). The Act requires the FRC to report annually to the Secretary of State on the discharge of these delegated powers and responsibilities 2.

This report sets out the FRC's findings on matters relevant to the performance of the professional audit, accounting and actuarial bodies 3 and highlights the key themes impacting them. The complete list of our statutory and non-statutory responsibilities under this legislation is set out in Appendix 1.

Many of our responsibilities in respect of UK statutory auditors and audit firms in the non-Public Interest Entity (PIE) market are delegated to the four RSBs. Their responsibilities and requirements are set out in Delegation Agreements agreed with the FRC.

The education and training of future auditors rests with the bodies the FRC has recognised as recognised qualifying bodies (RQBs). The FRC also supervises how the IFoA regulates its members and the public interest regulatory element of its examinations and admissions framework.

Our supervision of these bodies enables us to judge whether they are operating in a manner that enhances audit quality, supports the resilience of the audit market, and effectively performs the regulatory activities for which, as competent authority, the FRC is ultimately responsible. Through our supervision of the IFoA, we assess its integrity, competence, and transparency, in addition to its supervision of the quality of actuarial work.

Based on our statutory and non-statutory supervision in 2024/25, our principal conclusions were:

- All RSBs and RQBs continue to meet the recognition criteria in Schedules 10 and 11 of the Act.

- All RSBs are complying with all significant aspects of the terms and conditions of the Delegation Agreements.

- We are satisfied that the IFoA's regulatory framework is operating effectively and is being actively reviewed to ensure it remains fit for purpose.

- None of the complaints about the professional bodies that we reviewed raised issues of substantive mishandling by any of the professional bodies.

While we are satisfied that the recognitions of the bodies should continue, we have nevertheless made requirements and recommendations for each body where we consider that improvements are needed. Requirements should be implemented within 12-months and recommendations within three years unless we have agreed a different timescale. The suitability and effectiveness of the implementation is assessed in subsequent years' supervision work. Requirements are only made of RSBs that are not fully meeting the terms of their Delegation Agreement.

A list of the open requirements for each body can be found in Appendix 2.

Professional bodies that we supervise:

RSBs and RQBs

- Association of Chartered Certified Accountants (ACCA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Institute of Chartered Accountants in Ireland (ICAI)

- Institute of Chartered Accountants of Scotland (ICAS)

RQB only

- Association of International Accountants (AIA)

- Chartered Institute of Public Finance and Accountancy (CIPFA)

Management Accountants

- Chartered Institute of Management Accountants (CIMA)

Actuaries

- Institute and Faculty of Actuaries (IFoA)

3. Key themes impacting professional bodies

Future of the audit profession

High-quality statutory audit is vital to the UK economy. It builds investor confidence, supports capital investment, and helps maintain the UK's global reputation for business integrity. Audits also promote financial discipline and early risk detection, reducing the likelihood of corporate failures and systemic crises.

To maintain public trust, auditors must demonstrate professional scepticism, sound judgement, and ethical conduct. The FRC's DQAET project, launched in 2025, made recommendations to RQBs to strengthen these behaviours across qualification, performance development, and continuing professional development (CPD). Implementation plans are underway, with full findings to be reported later this year.

The audit profession is facing several challenges, including a continued decline in the number of audit firms and RIs, and a plateau in the growth of audit trainees. These issues are compounded by the upcoming withdrawal of funding for the Level 7 apprenticeship 4 January 2026, which places additional pressure on professional bodies and firms to actively promote audit as a rewarding and viable career path.

Professional bodies are adapting by modernising syllabi and offering more flexible, technology enabled learning pathways. These efforts aim to attract a new generation of auditors seeking meaningful careers with strong development opportunities and better work-life balance.

The FRC has also initiated the Audit Qualification 2030 project which will work closely with the RQBs to ensure that qualifications remain relevant, engaging, and aligned with technological advancements and global developments.

The FRC continues to expand the UK's global audit reach. MRA with Australia, New Zealand, and Switzerland now allow qualified auditors to operate across jurisdictions. Further agreements are in development, supporting the UK's growth and trade ambitions. The FRC remains committed to expanding these arrangements.

MRAs allow qualified auditors to work across jurisdictions, which enhances the international career prospects of members. This makes membership of the professional bodies more attractive to both domestic and international professionals. It also means that the audit qualification, training, and ethical standards must maintain the highest standards to ensure eligibility with the MRAs is met.

Control and ownership

There has been a growing trend for capital restructuring within the UK audit market, allowing firms to raise additional finance through private capital investment or initial public offering. This marks a shift away from the traditional partnership model that has historically defined the sector.

We have appreciated the early and transparent engagement from PIE firms exploring private investment, which has allowed us to provide confidential guidance on the regulatory framework and our expectations.

Other non-public interest entity (non-PIE) firms have also secured private investment. We continue to work closely with professional bodies to ensure that such firms meet the necessary Eligibility Criteria.

In September 2024, we outlined our position on capital restructuring, stressing the importance of maintaining professional control and independence within audit firms. Any structural changes must support audit quality, uphold ethical standards, and serve the public interest. While increased investment and innovation are welcome, they must be balanced against the need to preserve trust and independence in the profession.

The move toward more diverse ownership models reflects a broader transformation in the UK audit sector. While private investment can drive growth and modernisation, it also introduces risks that must be carefully managed to safeguard audit independence and quality.

The FRC has dedicated expert resources to this area and encourages PIE firms considering restructuring to engage early. Non-PIE firms should consult their RSB to ensure alignment with regulatory expectations.

Technological advancement

Advanced technologies continue to reshape the audit and actuarial professions, driving innovation and transforming practices. Many firms are actively integrating emerging tools such as generative artificial intelligence (AI), machine learning, and advanced analytics to enhance the efficiency, accuracy, and depth of data analysis.

To support this evolution, the FRC has strengthened its Technology and Digital Working Group, which engages with professional bodies and regulated firms to ensure that technological adoption is aligned with ethical standards, regulatory expectations, and public interest outcomes.

While most of the early use of generative AI in audit has been to obtain audit evidence to support the team with productivity tasks, there is evidence that the deployment of AI in automated tools and techniques to obtain audit evidence is expanding into areas such as risk assessment, anomaly detection, and automated evidence gathering.

As set out in our 2025-2028 strategy, the FRC is committed to understanding the impact of AI, technology and digital reporting on the markets and firms we oversee, as well as on our own operations. In June 2025, we published landmark guidance providing clarity to the audit profession on the uses of AI.

The FRC recognises that unequal access to advanced technologies may widen capability gaps across the market. To mitigate this, we encourage collaboration between firms, vendors, and regulators to ensure that innovation is inclusive and does not compromise audit independence or quality.

Professional bodies are actively considering how best to integrate advanced technologies into audit and actuarial practice while maintaining professional standards. Over the past year, they have demonstrated strong engagement by publishing articles, hosting webinars, and updating syllabi to reflect emerging technologies and core areas such as cybersecurity, ensuring that the next generation of auditors and actuaries are equipped to use these tools effectively.

As AI adoption accelerates, the need for robust governance frameworks becomes increasingly critical. Professional bodies and regulated firms must ensure that AI tools are deployed responsibly, with clear accountability, transparency, and ethical safeguards. This includes establishing policies for model validation, data integrity, bias mitigation, and human oversight. The FRC encourages all bodies to adopt proportionate AI governance structures that align with international best practices and regulatory expectations, ensuring that innovation enhances, rather than compromises, audit quality and public trust.

We will continue to be proactive in collaborating with peer regulators, the professional bodies, firms and industry experts to understand how technology is being used in audit and actuarial work to ensure that the regulatory approach remains proportionate, balanced and effective.

4. Our supervision of the professional bodies

Our risk-based supervision continues to hold the professional bodies to the highest standards, with a strong emphasis on the public interest.

The accounting, audit, and actuarial professions are vital to the UK economy. They provide assurance that UK companies and financial institutions are credible and trustworthy, supporting economic confidence, effective risk management, and sound financial decision-making, particularly during periods of economic uncertainty.

The FRC is the Competent Authority for audit and the independent regulator for corporate reporting and governance in the UK. It also conducts a non-statutory role in ensuring the regulation of actuaries and accountants remains proportionate and effective.

Our approach, as outlined in our 3-Year Strategy, goes beyond setting standards and monitoring compliance. We aim to foster a culture of continuous improvement, where those we regulate take proactive responsibility for high performance in the public interest. This is emphasised by our four faces of regulation model:

The "Four Faces" of regulation model describes the FRC's approach:

- System Partner: Educating, collaborating, and supporting continuous improvement.

- Supervisor: Supervision and monitoring of requirements, culture and behaviours.

- Facilitator: Encouraging good practice through structured engagement.

- Enforcer: Investigating conduct and applying proportionate sanctions and directions.

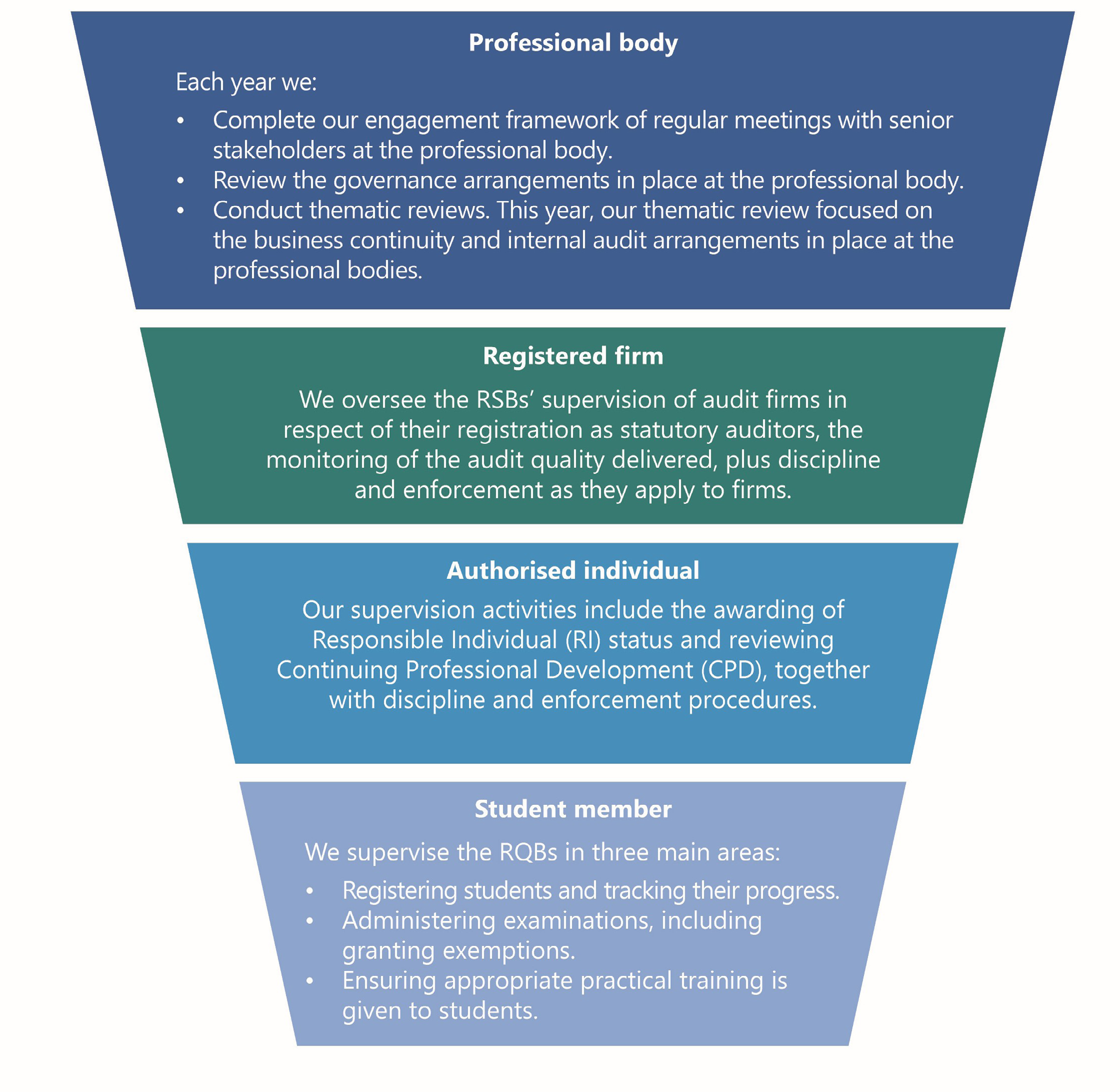

Our supervisory model is built around four key areas:

- Student members

- Authorised individuals

- Registered firms

- The professional body

We challenge the professional bodies to demonstrate how they meet their regulatory and educational obligations, and support students, members and their regulated community.

Our supervision activities take a risk-based, holistic view of each professional body. We consider the membership journey from student through to conclusion of full membership, and each RSB's approach to the supervision of firms and governance of its audit regulatory functions.

5. Supervision of RSBs and RQBs

Statutory responsibility

Over the following pages we will work through the four elements of the Supervision model to explain our approach for each and the key findings from our work in 2024/25:

- Student members.

- Authorised individuals.

- Registered firms.

- The professional body.

The list of open requirements for each body and deadline for implementation is contained in Appendix 2.

5.1 Student member

Our approach

We reviewed how RQBs assess and manage exemptions from examinations, focusing on compliance with Schedule 11 of the Companies Act 2006.

Key findings

Exemptions

The RQBs offer exemptions to students who have studied relevant accountancy qualifications which recognise the prior learning they have already achieved. This means that each RQB must assess qualifications offered by Higher Education Institutions (HEIs) to ensure it is confident that the prior learning and outcomes are equivalent to the relevant exam required by the RQB. To ensure the ongoing quality and integrity of the UK statutory audit qualification, it is imperative that all exemptions granted are appropriate.

Our review focused on four areas:

- Initial accreditation.

- Ongoing management.

- Process of award to students.

- Governance of the end-to-end exemptions process.

Overall, we found that the RQBs' processes in relation to exemptions comply with the Companies Act 2006 Schedule 11 requirements for the award of a UK statutory audit qualification and that those processes are suitably robust.

Through our review it was evident that the RQBs have developed positive, professional relationships with HEIs and maintain regular engagement. Policies around awarding exemptions were clearly set out and the RQBs carry out thorough and detailed reviews of syllabi and assessments.

We noted some areas of improvement for each RQB and made recommendations to ensure that their exemptions processes remain forward looking and fit for purpose and provide additional assurance. The primary theme from our findings was that several RQBs should look to make improvements to their terms and conditions with HEIs.

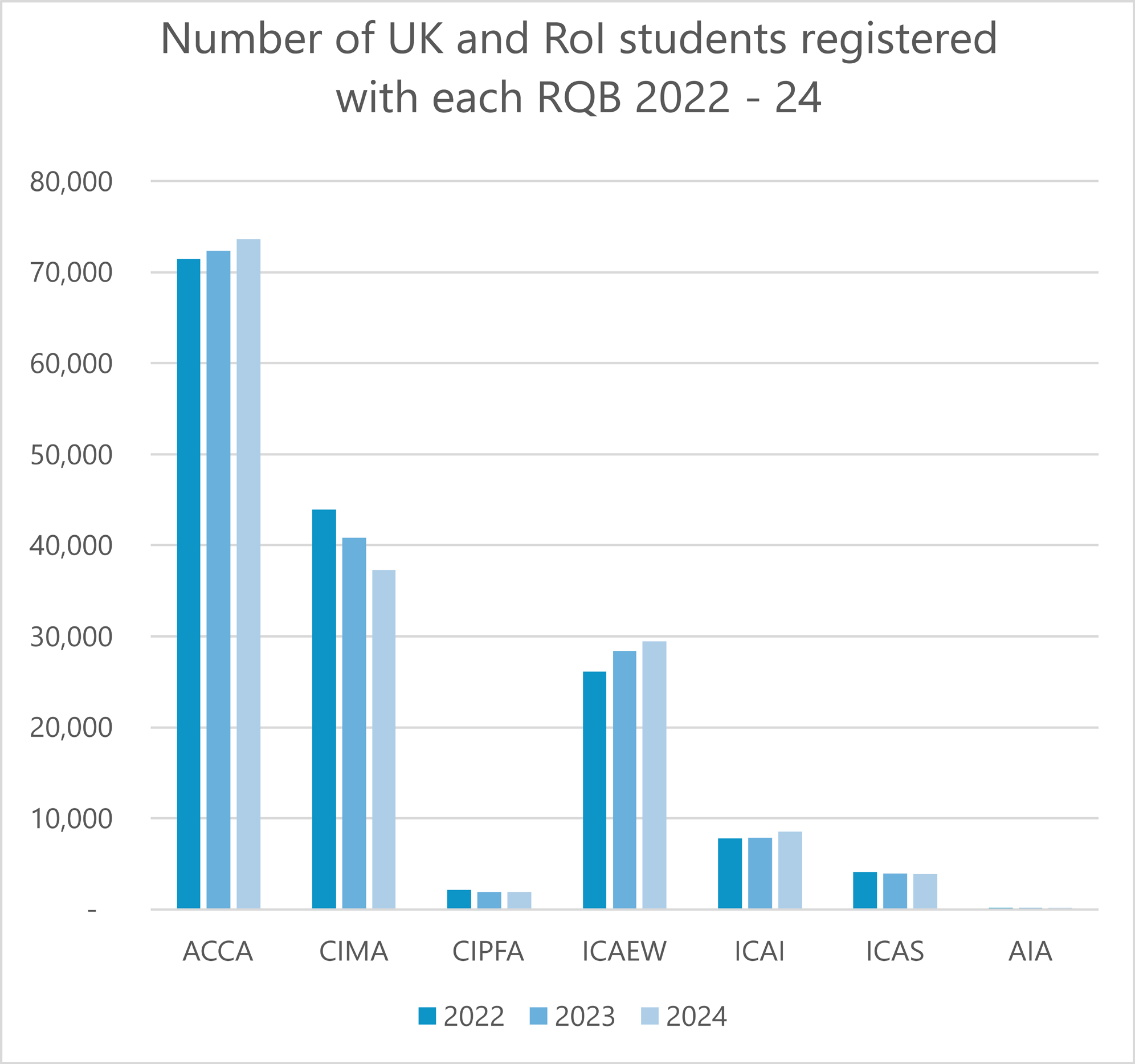

The graph above shows the number of registered UK and Republic of Ireland students registered at RQBs has remained consistent over the last three years. Encouraging these students to consider the Audit Qualification is a key focus of the FRC and RQBs.

5.2 Authorised individual

Our approach

We shadowed RSB monitoring teams, reviewed CPD regimes, and assessed enforcement processes through a sample of investigations closed in 2023.

Key findings

Evidencing CPD review

Regular CPD ensures that auditors keep their skills and knowledge up-to-date, reducing the risk of errors or outdated practices and stay current with evolving standards and practices, critical for maintaining quality service and public confidence.

To ensure registered individuals are completing necessary CPD the RSBs must have robust processes in place to ensure compliance and hold individuals accountable for their ongoing development, reinforcing the integrity and credibility of the profession.

Our review of ACCA found insufficient evidence that it consistently applied sufficient challenge to CPD information submitted by members, which could limit the effectiveness of CPD compliance monitoring, and the accuracy of feedback provided.

We required ACCA to update its work programmes to ensure that reviewers adequately document any challenges made to information provided by members.

Publication of disciplinary decisions

We identified that disciplinary decisions relating to audit were mistakenly removed from ACCA's website before the required five-year publication period had elapsed. Fourteen such instances occurred in 2022/23 and 2023/24, with a further two this year.

This constitutes a breach of Appendix 4, paragraph 6 of the Delegation Agreement, which requires ACCA to maintain the publication of disciplinary sanctions related to audit on its website for a minimum of five years from the date of the sanction. To remedy this issue ACCA has:

- Updated how it categorises its published decisions to better distinguish between audit cases (published for five years) and non-audit cases (which until recently were only published for two years) to improve clarity.

- Appointed a legally qualified Case Presenter to approve all requests to remove publicity from the website for the time being.

- Carried out a reconciliation exercise checking that all audit-related decisions made in the last five years are still published.

We will assess the success of these measures in 2025/26.

5.3 Registered firm

Our approach

We met each RSB on a quarterly basis to discuss performance of the delegated tasks. We also shadowed each RSB's key regulatory decision-making forums at least once.

Our shadowing of each RSB's audit quality monitoring visits focused on International Standard on Quality Management (ISQM) 1, Environmental, Social and Governance and climate related considerations.

We conducted file reviews on closed enforcement cases at each RSB and held an Enforcement roundtable with RSB representatives on the theme of 'Public Protection'.

Chart: Number of registered audit firms at each RSB 2022 - 2024

| RSB | 2022/23 | 2023/24 | 2024/25 |

|---|---|---|---|

| ACCA | 1303 | 1239 | 1150 |

| ICAEW | 2298 | 2137 | 1996 |

| ICAI | 581 | 545 | 515 |

| ICAS | 128 | 117 | 99 |

Key findings:

Compliance with the statutory monitoring visit cycle

Appendix 3 of the Delegation Agreements between the FRC and RSBs requires the RSBs to inspect their registered auditors at least every six years for non-PIE audits. This is to ensure that the RSBs are regularly checking that the quality of audit work carried out by the firms they register continues to meet the required standards.

In 2024, all RSBs met their statutory monitoring visit requirements, except for the ACCA. ACCA has implemented a plan to address this which includes earlier and increased contact with firms to reduce the risk of the inspection being delayed.

We have reminded all bodies of the importance of meeting the statutory cycle and of having robust processes in place to achieve this. We have also reiterated the importance of informing us promptly if a body thinks it may be unable to meet this requirement.

ISQM(UK) 1 monitoring

ICAEW has made notable progress in developing and piloting its methodology to assess ISQM(UK)1 implementation. While we observed areas for improvement, including documentation of quality objectives and risk responses, the overall approach reflects a constructive commitment to enhancing audit quality. We will continue to monitor how this methodology evolves, and the approach taken by the other RSBs.

Improving challenge of auditors

During our supervisory work we observed that, in general, the bodies demonstrated a good level of challenge to auditors when reviewing their files. This is an area we have worked closely with the bodies on over recent years. Effective challenge by RSB inspectors of the appropriateness and quality of auditors' testing and evaluation procedures in relation to audit evidence obtained, is the most important aspect of the overall audit file assessment. We continued to observe areas where each RSB could improve its challenge to the firms it reviews on specific aspects of the file. Failing to adequately challenge the auditor presents a risk that specific quality issues remain unaddressed, which could impact the overall conclusions on the quality of the auditor's work.

At ICAS we identified instances of insufficient challenge of the audit firm on revenue testing deficiencies on one outsourced review and at ICAI we identified instances of a lack of challenge of auditors in relation to revenue cut-off.

During our sampling, we found ICAEW had not sufficiently challenged work as we would have expected. In several files, the firm's audit documentation did not clearly evidence how, in some instances, sufficient audit procedures were performed, and differences or contradictory evidence investigated.

On all ACCA files we reviewed, we expected more robust challenge from the Senior Compliance Officers on specific aspects of the audits. This included areas such as planning, cash, direct expenses, and investment property.

We made requirements for each RSB to address these issues to improve on the overall quality of their inspection work. Each requirement is detailed in Appendix 2.

Grading

While carrying out a review at ACCA we identified one audit file that was graded 'C' 5 despite evidence suggesting a 'D' was more appropriate. The issue stemmed from insufficient explanation rather than misapplication of grading criteria. We reminded all RSBs to apply grading guidance consistently and document rationale clearly.

Improving review documentation

We identified examples where documentation for scoping decisions and findings within ICAI's working papers were insufficient to understand whether scoping decisions were appropriate and how conclusions were reached. Examples were seen in relation to several audit areas including going concern, group testing, climate and materiality.

While ICAI have made some updates to their checklists and Audit Manual to support inspectors in making improvements, further updates are needed to enable inspectors to document all areas of a review to the detailed retail.

Joint Audit Register

ICAEW now manages the joint audit register for all RSBs. In 2024, we discussed ways to improve its content and presentation, and some changes have already been made.

Separately, the FRC maintains the PIE audit register. Both organisations agree that merging the two would better serve the public interest. We are continuing to explore the feasibility and cost of creating a single, unified register.

Local audit

To address the significant backlog in local audits, the Government tabled legislation in July 2024 which introduced backstop dates for local bodies and their auditors to publish audited accounts. In response, the FRC paused routine local government audit inspections up to and including the 2023/24 financial year, unless public interest required otherwise. ICAEW also paused reviews for audits up to 2022/23, and we did not shadow any local audit visits during this period.

The ICAEW is the only RSB for local audit. We welcome its engagement with new firms entering the local audit market to ensure they are prepared for the specific demands of these audits.

On 12 February 2025, local audit system leadership responsibilities transferred from the FRC back to the Ministry of Housing, Communities and Local Government (MHCLG) ahead of the planned establishment of the Local Audit Office which is included in the English Devolution and Community Empowerment Bill. The FRC will continue to support MHCLG to achieve the successful delivery of measures to restore the timeliness of local body financial reporting and audit in our regulatory role. We remain committed to collaborating with the National Audit Office to support auditors through this period leveraging the model used to develop the Local Audit Reset and Recovery Implementation Guidance.

Based on our supervision this year, we are satisfied that the ICAEW continues to meet the criteria for recognition as a Recognised Supervisory Body (RSB) for local audit, and that CIPFA continues to meet the criteria for recognition as a Recognised Qualifying Body (RQB) for local audit.

5.4 Professional body

Our approach:

We reviewed each body's internal audit policies, business continuity planning, and governance arrangements. We observed committees and boards, focusing on policy, decision-making, nominations, and transparency. We also assessed changes to the bodies' rules and regulations to ensure clarity, consistency, and benefits for audit regulation.

Key findings:

Relationship with the professional bodies

Over the last year we have had positive engagement from all professional bodies. The ability to have open conversations and exchange views constructively has allowed our supervision work to be undertaken effectively.

Internal audit

Internal audit ensures effective governance, risk management, and control processes, aiding an organisation in achieving strategic, operational, financial, and compliance goals.

Our thematic review evaluated the effectiveness of internal audit functions, highlighting good practices and areas for improvement. We ensured risks to the professional body had proper oversight and that controls were appropriately designed and effective.

As part of the exercise, we benchmarked each organisation, offering tailored feedback and sharing examples of good practice. This included recommendations for developing a risk-based internal audit plan by ensuring that all critical areas are identified and prioritised. Strengthening the audit plan is essential for maintaining a robust internal control environment. Additionally, conducting regular External Quality Assessments helps ensure that internal audit functions remain aligned with international standards and best practices.

We are content with the internal audit processes implemented by the professional bodies.

Business continuity planning

A business continuity plan (BCP) is crucial for ensuring an organisation's resilience during unexpected disruptions. For the professional bodies that are RSBs, it is a Delegation Agreement requirement that they implement and maintain appropriate continuity arrangements and provide the FRC with such information as it reasonably requires from time to time concerning such continuity arrangements.

Our thematic review in these areas assessed the effectiveness of each body's continuity arrangements in the following key areas:

- Business impact analysis.

- Cyber security.

- Examination delivery.

Overall, we found the arrangements in place at the bodies to be comprehensive and supported by detailed documentation. Each body demonstrated a commitment to maintaining and developing its business continuity processes.

Areas that we noted could be improved upon were:

- Ensuring procedures are established for all premises, not just main offices, with comprehensive internal information on backup facilities accessible to staff at all levels in case of a disaster.

- Considering where and how critical risks are assessed that could lead to failure of the business functions described in Business Impact Analysis documentation.

- Putting in place processes to ensure that documentation is kept under sufficiently frequent and detailed review to ensure that it is reflective of significant changes.

Governance

Our Governance work focused on three areas:

- Policy and Decision making relevant to regulations.

- Nominations processes and procedures.

- Transparency.

When reviewing these areas, we referred to the UK Corporate Governance Code which, while the professional bodies are not required to adhere to it, sets a useful benchmark for comparison. For CIPFA specifically we also considered the Charity Governance Code.

We continued our meetings with key stakeholders under our Engagement Framework. In 2024/25 we met with the President, Chief Executive Officer (CEO), Chief Financial Officer, Heads of the Regulatory and Qualification Board and the Executive Directors of Regulation and Education at each professional body.

In addition, we held either pre or post appointment meetings with ACCA, CIPFA, ICAEW and ICAI for new appointments to key positions in these bodies including CEO and Board Chairs.

Regular and positive engagement with key figures at the professional bodies strengthens our supervision and promotes transparency and collaboration. These meetings provide valuable insights into understanding issues the bodies are facing, help identify emerging risks, and support continuous improvement across the profession.

Rules and regulations of the professional bodies

We reviewed changes proposed by the professional bodies to their rules and regulations. Our role is to approve them or to advise the Privy Council Office that the changes may be approved. We are satisfied that this year's changes will be beneficial and enhance the governance of these bodies.

We review and comment on amendments, requesting changes if needed. For changes requiring Privy Council approval under a body's Royal Charter, we submit our comments as advice to the Privy Council Office. Otherwise, we communicate directly with the body.

Most changes update regulations for new legislative requirements or standards. Other changes improve and update a body's processes and procedures where it has encountered difficulties or inconsistencies in how they work in practice. Significant changes this year include ACCA's Rulebook, separating processes for awarding Audit Qualifications and granting statutory auditor rights, and ICAI's bye-laws and regulations to implement its merger with Certified Public Accountants in Ireland (CPA Ireland).

We review all rule amendments, including non-audit ones, to assess their impact on our regulatory work. We ensure the amended rules are clear and address identified problems. Our assessment considers the relevance to members, firms, and affiliates, and incorporates findings from our governance oversight.

6. Supervision of actuarial regulation

Non-statutory responsibility

Our supervision approach:

The IFoA regulates over 32,000 members globally, overseeing actuarial education, qualification, and professional development. The FRC supervises the IFoA under a non-statutory Memorandum of Understanding (MoU), with a focus on protecting the public interest.

Our approach mirrors that used for audit supervision and includes reviews of governance, regulatory functions, and the regulatory aspects of examinations and admissions. We assess whether the IFoA's framework is effective, proportionate, and aligned with the MoU.

We focus on three areas:

- The pre-qualified member.

- The qualified member.

- The professional body.

Through our supervision activities, we found that the IFoA's regulatory framework was effectively implemented during 2024.

The pre-qualified member

This group includes all individuals participating in IFoA examinations, regardless of membership status.

Key areas reviewed:

- Curriculum design and standard-setting.

- Examination administration and exemption policies.

- Practical training requirements.

Key findings:

Exam invigilation

The IFoA ceased invigilating its exams in 2020 following the outbreak of Covid-19. Exam invigilation is essential for upholding the integrity and fairness of the assessment process and prevent cheating and/or the use of prohibited materials.

Without proper invigilation, the risks to the credibility of the examination system aresignificant. Cheating may go undetected, leading to unfair advantages and undermining the value of qualifications. This can damage the reputation of educational institutions and erode trust among students, employers, and the wider public.

We stressed the importance to the IFoA of resuming invigilation and were pleased to note that the IFoA reinstated for all exams in April 2025. Following this, IFoA noted that the number of incidents of suspected cheating had reduced significantly.

The qualified member

This includes Associates, Affiliates 6, Fellows and Certified Actuarial Analysts. Our review focused on:

- The awarding of Practising Certificates.

- The CPD frameworks.

- Assessment of the Quality Assurance Scheme.

- Monitoring through the Actuarial Monitoring Scheme.

- Enforcement under the Disciplinary Scheme.

Key findings:

Overall, we were satisfied that the IFoA's processes were adequate and proportionate.

The professional body

We assessed the IFoA's governance arrangements, focusing on:

- Policy and regulatory decision-making.

- Nominations processes.

- Transparency.

Key findings:

Governance reform

The IFoA has implemented significant governance reforms, including the establishment of a new Board and Management Board. We met with key leadership figures, including the new Chair, President, Interim CEO, and Regulatory Board Chair. We also engaged with the incoming CEO prior to appointment as part of our voluntary pre-appointment process.

While the reforms are still embedding, they are viewed positively. The IFoA has considered the UK Corporate Governance Code in its approach, although it has chosen not to reference it in its annual report.

7. Supervision of accountancy

Non-statutory responsibility

Our supervision approach

The Chartered Institute of Management Accountants (CIMA) is a professional accountancy body focused on developing management accountants. The FRC's supervision of CIMA is non-statutory and governed by an exchange of letters dating back to 2003. Although CIMA left the Consultative Committee of Accountancy Bodies (CCAB) 7 in 2011, both parties agreed that the FRC would continue its oversight on the same basis. CIMA's participation in our supervision activities remains voluntary.

Our assessment of CIMA is based on:

- Thematic reviews.

- Our engagement framework of regular meetings with key individuals at CIMA.

- Review of proposed amendments to rules and regulations.

Key findings

We conducted thematic reviews of CIMA's internal audit and business continuity planning processes, in line with our approach for other professional bodies.

Internal Audit:

CIMA's internal audit framework is proportionate and well-documented. It includes a comprehensive plan for engagement, performance monitoring, and reporting. The framework is broadly comparable to peer bodies.

Business Continuity Planning:

CIMA has a robust business continuity policy with clear objectives. We found its arrangements to be effective and appropriate for its size and complexity. We provided suggestions for further strengthening assurance, including enhancements to documentation and review cycles.

Complaints about the accountancy bodies

The FRC has a voluntary, non-statutory role in supervising how professional accountancy bodies handle complaints, including those not related to statutory audit.

This role is governed by an exchange of letters with the CCAB, covering five of the six chartered accountancy bodies. CIMA is supervised under a separate arrangement.

Chart: Number of complaint received for all professional bodies

| Year | Number of complaints |

|---|---|

| 2022/23 | 40 |

| 2023/24 | 38 |

| 2024/25 | 40 |

Complaints about the professional bodies come to us from a variety of stakeholders including students, members of the profession and public.

Most complaints relate to the qualifications process for students (i.e. examinations), the registration process for new firms and RIs or enforcement action.

We are generally content with the bodies' approach to managing and resolving complaints and did not make any new recommendations in 2024/25.

Appendix 1: Our responsibilities

Statutory responsibilities

Statutory audit supervision

The FRC is the competent authority for statutory audit in the UK. Our responsibilities are set out in regulation 3 of the Statutory Auditors and Third Country Auditors Regulations 2016.

The FRC's statutory responsibilities for the supervision of the regulation of statutory auditors are discharged by:

- Supervising the regulation of statutory auditors by RSBs and the award of the statutory audit qualification by RQBs and assessing annually whether the recognised bodies continue to meet the requirements for recognition.

- Assessing that each RSB carries out the Regulatory Tasks delegated to it by the FRC in accordance with the requirements of the Delegation Agreements between the FRC and the RSB. The tasks include the registration of audit firms and individuals, audit firm monitoring, CPD and enforcement.

The FRC has a graduated range of enforcement powers which it may use in cases where an RSB or RQB fails to meet its statutory responsibilities.

Non-statutory responsibilities

The following arrangements are undertaken on a voluntary basis:

Actuarial oversight

The FRC conducts supervision of the IFoA by voluntary agreement. Our oversight is facilitated by a MoU between the FRC and the IFoA, supplemented by a Communications Protocol.

We have aligned our supervision approach to the IFoA with that of the audit professional bodies to ensure consistency and so that we continue to hold it to the same high standards.

Accountancy oversight

By agreement with the six chartered accountancy bodies, the FRC has a voluntary, non-statutory role for supervision of the professional accountancy bodies' regulation of their members beyond those that are statutory auditors.

Appendix 2: Open requirements

| Body | Year made | Type | Detail | Status |

|---|---|---|---|---|

| The authorised individual | ||||

| ACCA | 2024 | Requirement | Disciplinary decisions relating to audit have been removed in error from ACCA's website before the requisite five-year publication period had expired. | On track |

| 2024 | Requirement | By 1 July 2025, ACCA must demonstrate it has effective processes and controls in place, meaning there are no further instances of decisions being removed from its website in error. | On track | |

| 2024 | Requirement | ACCA must update its work programmes to ensure that there is adequate documentation of appropriate challenge by reviewers to CPD information supplied to them by members. Any conclusion following the challenge should also be documented. | On track | |

| 2024 | Requirement | We require the ACCA to demonstrate to us how internal notifications will be managed. | On track | |

| The registered firm | ||||

| ACCA | 2024 | Requirement | The ACCA grading guidance should be applied in full when grading every audit file inspection. We expect robust challenge of the grade to be documented. | On track |

| 2024 | Requirement | Where consultations occur regarding file or visit grades, we expect evidence of these consultations to be included in ACCA's visit documentation. | On track | |

| 2024 | Requirement | ACCA must make the necessary updates to its work programmes (for example, including prompts), and provide technical training to its Senior Compliance Officers. | On track | |

| ICAEW | 2024 | Requirement | ICAEW must make the necessary updates to its work programmes and provide technical training to its inspectors. | On track |

| 2024 | Requirement | ICAI must put in processes to support inspectors to address findings on revenue, defined benefit pension schemes, cash flow statements and ISA 600. | On track | |

| ICAI | 2024 | Requirement | ICAI must put in place processes to support inspectors to address the adequacy of scoping decisions and the documentation of these. | On track |

| 2024 | Requirement | ICAI must put in processes to support inspectors to address the standard of documentation on monitoring checklists. | On track | |

| ICAS | 2024 | Requirement | ICAS must ensure that audit deficiencies in revenue sampling and cut-off testing are robustly challenged and result in adequate corrective actions undertaken by audit firms. | On track |

Financial Reporting Council

London office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office: 5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300 www.frc.org.uk

Follow us on LinkedIn

Footnotes

-

The list of professional bodies supervised by the FRC can be found under 'Professional bodies that we supervise' on page 9. ↩

-

The relevant functions the FRC is required to report on are the delegated functions of the Secretary of State under Part 42 of the Act, which were delegated to the FRC under Article 7 of the Statutory Auditors (Amendment of Companies Act 2006 and Delegated Functions etc) Order 2012. ↩

-

While this report focuses on the supervision of the professional audit, accounting and actuarial bodies, in 2023/24 the FRC satisfactorily discharged all powers and responsibilities delegated to it by the Secretary of State under Part 42 of the Act. ↩

-

A Level 7 apprenticeship is equivalent to a master's degree. They are designed for those who want to gain advanced qualifications while working. They involve a combination of on-the-job training and academic study. Over 4,000 apprentices a year complete the Level 7 end point assessment for accountancy and tax. ↩

-

Grading definitions: C: Significant, but not pervasive, deficiencies identified. D: Serious non-compliance with applicable standards. ↩

-

This refers to those who became Affiliate members prior to January 2021. ↩

-

The CCAB has five members – ICAEW, ACCA, CIPFA, ICAS and ICAI. ↩