The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 2 'Share-based Payment'

- 1. Executive Summary

- 2. Scope and how to use this publication

- 3. Classification of share-based payments

- 4. Measurement and recognition of share-based payments

- 5. Share-based payment transactions among group entities

- 6. Tax associated with share-based payments

- 7. Completeness and conciseness of IFRS 2 disclosures

- 8. Other IFRS 2 associated disclosures

- 9. Other matters

- 10. Considerations for private companies

- 11. Key expectations

- Contact Information

1. Executive Summary

Introduction

Companies apply IFRS 2, 'Share-based Payment', to account for transactions in which they receive goods or services in exchange for their equity instruments. It also applies to transactions settled in cash based on the value of those instruments.

It can be a complex standard to apply as companies need to use models to value share-based payment arrangements, and these require judgements and assumptions to be made. Different accounting treatments are required depending on whether transactions are settled in cash or equity. The accounting treatment applied to the tax effects of share-based payments can also be complicated and there are additional considerations in group situations.

Share-based payments are most often used as part of employee compensation packages. This can lead to overlapping disclosure requirements, particularly with the Directors' remuneration report, and challenges in making sure key messages are not obscured by the volume of disclosures.

This thematic review looks at some of the key recognition, measurement, classification, and disclosure requirements of IFRS 2 and highlights examples of good practice. It also sets out areas for potential improvement and some of the common pitfalls when applying the standard.

Key observations

- Classification of share-based payment (section 3) The most helpful disclosures explained how awards were classified and, where settlement alternatives existed, explained who had the choice of settlement and how the company intended to settle the awards. However, we identified companies who stated their awards were equity-settled but had unexplained cash outflows in the cash flow statement.

- Measurement and recognition of share-based payment (section 4) All companies in our sample used share-based payments to reward directors and employees, with the expense measured by reference to the fair value of the equity instruments.

- Share-based payment transactions among group entities (section 5) All companies explained how transactions were accounted for in the consolidated financial statements, but information about how they impacted the parent company financial statements was often missing.

- Tax associated with share-based payment (section 6) In some cases, it was unclear whether excess tax deductions arising from share-based payments were correctly identified and recorded in equity.

- Completeness and conciseness of disclosures (section 7) We identified and have shared some good examples of companies using aggregation or cross-references to be more concise.

2. Scope and how to use this publication

Why are we reviewing share-based payment?

IFRS 2 was issued by the IASB in 2004 and, whilst the accounting principles underlying it have remained largely unchanged, there are numerous challenges for companies when applying it.

We have not undertaken a thematic review of share-based payments before, and this review has allowed us to identify better practices and highlight common pitfalls.

Share-based payments are a common form of remuneration for directors, senior management, and employees and can give rise to significant expenses.

While such payments can also be made to suppliers of goods and services, these instances are less frequent. None of the companies within our sample made share-based payments to non-employees for goods or services. Therefore, this thematic concentrates on employee related share-based payments, but the good practices identified are equally applicable across all types of share-based payments.

This report is not intended to cover all aspects of the reporting requirements and should not be relied upon as a detailed guide, but it highlights examples that we thought were particularly informative and helpful to users as well as signposting areas where we believe reporting could be improved.

Using this publication

Instances of good practice and opportunities for improvement are identified in the report as follows:

A characteristic of good quality application of reporting requirements.

An opportunity for improvement by companies to move them towards good quality application of reporting requirements.

An omission of required disclosure or other issue companies should avoid in their annual reports and accounts.

Example disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

The word 'should' is used in this report to describe legal and accounting applications and disclosures that are required if material and relevant.

Scope and selection

We performed a desktop review of 20 listed companies with significant share-based payment expenses. Our selection covered annual reports and accounts with year-ends falling between September 2024 and February 2025. We chose companies from a variety of sectors and of various sizes, as shown in the charts opposite.

Our review did not include private companies, but this report could be applied to them where relevant. Section 10 explains some of the issues that private companies should consider when applying IFRS 2.

Selection by equity market

Pie chart showing the selection of companies by equity market: * FTSE 100: 20% * FTSE 250: 40% * AIM: 25% * Other Listed Equity: 15%

Our proportionate approach to principles-based corporate reporting in the UK

The UK's financial reporting framework is principles-based, requiring preparers to exercise judgement to ensure that the financial statements provide a true and fair view.

The FRC adopts a proportionate approach to its corporate reporting review work, raising substantive questions where there appears to be a material breach of the relevant requirements. This approach reflects the FRC's commitment to maintaining high standards in corporate reporting while supporting UK economic growth and competitiveness, which is explained further on page 7 of the FRC's 2024/25 Annual Review of Corporate Reporting.

Industries sampled (number of reports)

Pie chart showing industries sampled and number of reports: * A - Technology (4) * B - Banks (2) * C - Construction and Materials (2) * D - Media (3) * E - Travel and Leisure (3) * F - Industrial Goods and Services (2) * G - Energy (1) * H - Health Care (2) * I - Real Estate Investment (1)

3. Classification of share-based payments

Equity or cash-settled awards

IFRS 2 requires a share-based payment transaction to be classified as either equity-settled or cash-settled. The different recognition and measurement requirements for equity and cash-settled awards are discussed further in Section 4.

If the entity has an obligation to deliver only its own equity instruments, then the transaction is equity-settled. If the entity has an obligation to deliver cash or other assets, then the transaction is cash-settled.

60% of the companies in our sample stated in their accounting policies that they have only equity-settled share-based payment awards, while 20% disclosed having both equity and cash-settled awards.

Four companies stated that they have only equity-settled awards, but other associated disclosures suggest that some of their schemes may be cash-settled. Users may have found clarification of the apparent inconsistencies useful.

Two companies disclosed that they have only equity-settled share awards, but there were unexplained cash outflows in the cashflow statement, indicating an element of cash-settlement. We may challenge companies to explain their judgements on classification when we see this.

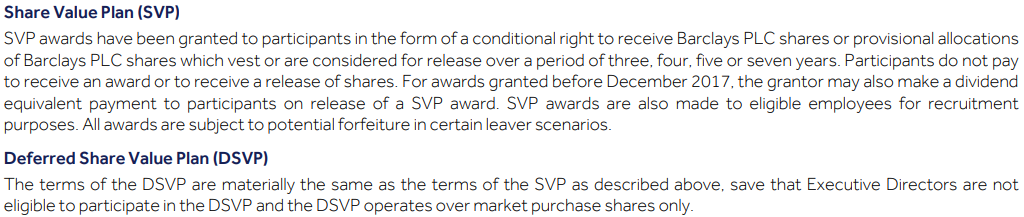

Awards with a settlement choice

When a share-based payment transaction includes a settlement choice, the accounting treatment depends on whether it is the entity or counterparty who holds the choice.

When the entity has the choice of settlement:

The entity must assess whether it has a present obligation to settle in cash. If such an obligation exists, the transaction is accounted for as cash-settled.1

When the counterparty has the choice of settlement:

The arrangement is treated as a compound financial instrument. For transactions with parties other than employees, the entity measures the liability component first and assigns the residual value to equity. For transactions with employees, the entity must measure the fair value of both the liability and equity components separately.2

Where settlement flexibility exists whether for the company or the counterparty, we expect companies to disclose the terms of such arrangements, identify the party with the choice of settlement, and explain how the arrangements have been accounted for.3

If companies settle equity awards in cash, they should consider carefully whether they have established a practice of cash-settlement resulting in an obligation that would require the awards to be classified as cash-settled in their entirety.

Two companies in our sample disclosed that their share-based payment arrangements included a settlement alternative and provided details on the accounting treatment. One of those companies classified its share options as cash-settled, while the other company treated them as equity-settled.

The most helpful disclosures explained how companies had classified their share-based payment transactions. For example, by explaining:

- whether each share award is classified as equity or cash-settled;

- that a settlement alternative exists and stating who has the choice of settlement;

- how the company intends to settle the awards; and

- how the equity or cash-settled award has been recognised and measured in the financial statements.

4. Measurement and recognition of share-based payments

Measurement of share-based payments

IFRS 2 requires share-based payments to be measured at the fair value of the goods or services received. If the fair value cannot be reliably measured, then the fair value of the payment should be measured by reference to the fair value of the equity instruments granted. For transactions with employees, IFRS 2 states that it is not possible to measure the services received.4

As expected, all companies in our sample measured the grant date fair value of their share-based payments to employees by reference to their instruments granted, with 19 companies explaining the models used.

Vesting conditions

There are often conditions attached to share-based payments and there may be more than one condition that needs to be met for the award to vest. Each will affect how the share-based payment is measured and how the charge is recognised. These conditions can be categorised as:

- Service conditions: require the counterparty to complete a specified period of service.

- Performance conditions: require the achievement of specified performance targets (other than market conditions).

- Market conditions: performance targets related to the market price of the entity's equity instruments.

11 companies in our selection had awards with performance conditions, while 13 companies had both performance and market conditions. 18 companies had service conditions attached to the awards.

Impact of vesting conditions on measurement

For equity-settled transactions, non-market performance and service conditions are not included in the grant date fair value of the equity instruments. Instead, they affect the estimate of the number of awards expected to vest, which is revised over time. Market conditions are included in the grant date fair value and are not adjusted for subsequently.

For cash-settled transactions, a similar treatment applies in that non-market conditions affect the vesting estimate. However, current market conditions are considered when remeasuring the fair value at the end of each reporting period and on settlement such that the cumulative expense recognised is equal to the cash paid.

Companies in our selection used the Black-Scholes model to estimate grant date fair value when there were no market conditions, and a Monte-Carlo (or stochastic) model when the award had market conditions. These are well-established valuation methodologies for share-based payments and incorporate assumptions such as share price and historical volatility. IFRS 2 does not mandate a particular model so companies should assess which is most appropriate for their awards. We observed that 10 companies disclosed using two models, when they had more than one type of share-based payment, while nine companies reported using a single model to value their share-based payments.

Recognition Over Time

IFRS 2 requires share-based payment expense to be recognised over the award's vesting period, based on the best estimate of the number of instruments expected to vest. For equity-settled awards adjustments are made to the charge to reflect changes in expectations for non-market conditions, and if awards do not vest due to failure to meet non-market conditions, the expense is reversed. Charges are not reversed if a market condition is not met as the likelihood will have been included in the fair value of the award.

Unlike equity-settled awards, the fair value of the liability for cash-settled awards is remeasured at each reporting date and at settlement. If the market condition becomes unlikely or impossible to meet, the fair value of the liability may decrease, reducing future expense.

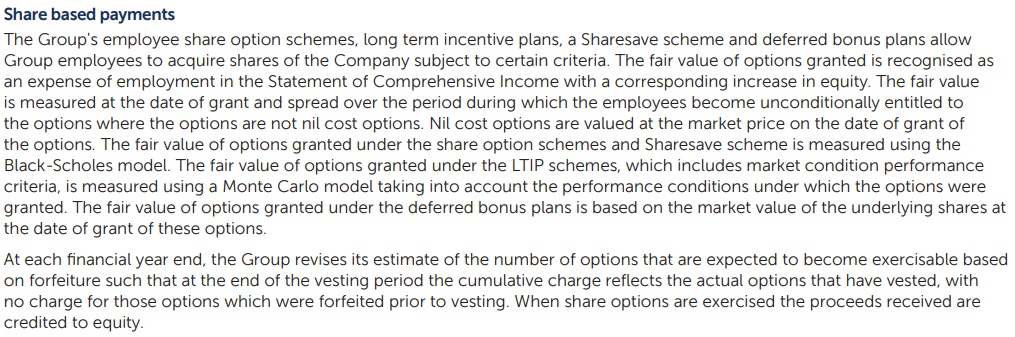

The below example illustrates how a company recognises and measures its equity-settled share-based payments:

Clearly explains how the company recognises and measures its various IFRS 2 arrangements, including the valuation methodology used.

The following accounting policy explains how the company recognise and measure its cash-settled share-based payments:

Provides details of how the company recognises and measures its cash-settled schemes.

5. Share-based payment transactions among group entities

Parent company accounting policy

Whilst our review focused on the accounting in the consolidated accounts, IFRS 2 also applies to the parent company, and subsidiaries where employees may be the beneficiaries of awards.

The accounting in each will differ, and companies will need to assess their particular arrangements to ensure that the accounting is appropriate. Paragraphs 43A to 43D of IFRS 2 provide guidance on how to account for share-based payment transactions among group entities.

Where directors of the parent company are providing services to the parent company, it should recognise a share-based payment charge (where services are being provided to more than one group company, the charge may be allocated across companies on an appropriate basis).

From our review, whilst it was implied that eighteen companies had a group share-based payment scheme (i.e. employees of subsidiaries received share-based payments) it was not always clear what role the parent company had in the award.

Thirteen companies in our selection had an accounting policy for how the parent company accounted for share-based payments, but, of those, only nine explained the parent's role in group arrangements.

Where the parent is party to transactions in one form or another, we would expect the accounting policy to give enough detail for users to be able to understand how such awards are accounted for.

For UK companies, the accounting in the parent company financial statements is important as it is the parent's distributable reserves which need to be considered when determining whether a dividend can be paid to shareholders.

Section 7 of TECH 02/17BL5 provides guidance on how share-based payments impact distributable profits. Following on from the example where the parent company grants an equity-settled share-based payment to employees of a subsidiary, one common issue that arises is the resulting credit to equity is an unrealised profit as the transaction does not involve qualifying consideration.

Accounting in the parent company

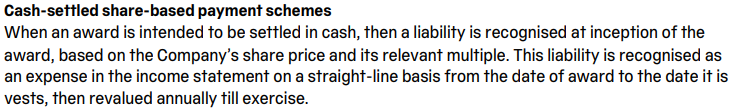

A parent company may grant awards of its own shares to employees of subsidiaries, and it may have the obligation to settle awards made to employees of the subsidiaries. In this scenario, the parent company typically recognises the cost of the share-based payment as an increase in its investment in the subsidiary to reflect its contribution to the subsidiary in exchange for employee services received by the subsidiary.

Sometimes, the parent company may recharge the cost of the award to the subsidiary, although the basis for the recharge can vary. The substance of the recharge arrangement should be understood and accounted for appropriately. We saw one company who adjusted the cost of investment in subsidiaries due to the existence of a recharge arrangement (see example overleaf).

Explains how the parent has accounted for awards it has made to employees of subsidiaries.

Employee benefit trusts

90% of companies in our selection utilised employee benefit trusts (EBT) to settle equity-settled share-based payments. These companies consolidated the trust and presented the shares held by the EBT as a deduction from equity in the consolidated accounts. In addition, 56% of them explained how the EBT was accounted for in the parent company's financial statements.

The EBT is treated as an extension of the group and the company.

During the year, the EBT purchased 1,312,000 shares and transferred 1,235,976 (2023: 1,339,634 shares acquired and 1,054,620 transferred) in order to settle share awards in relation to the directors' share bonus award and Long-Term Incentive Plan.

Where the EBT purchases the company's equity share capital the consideration paid, including any directly attributable incremental costs, is deducted from equity attributable to the company's equity holders until the shares are cancelled or reissued. As at 31 December 2024, 388,184 shares (2023: 312,160) were held by the EBT in relation to the directors' share bonus award and Long-Term Incentive Plan. The EBT share reserve represents the consideration paid when the EBT purchases the company's equity share capital, until the shares are reissued.

Describes how the EBT is accounted for and details the transactions the EBT has entered into, and what the reserve balance represents.

Accounting for share-based payments in the subsidiary whose employees have received a share-based payment granted by a parent

When a parent grants share-based payments to a subsidiary's employees, the subsidiary's accounting depends on who settles the award:

- If the parent settles (e.g. by issuing its own shares), the subsidiary recognises an expense and a corresponding capital contribution (in equity) from the parent. This is treated as equity-settled.

- If the subsidiary settles (e.g. in cash or using its parent's shares), it recognises a liability and treats the arrangement as cash-settled, even if the award is based on the parent's equity.

6. Tax associated with share-based payments

Deferred and current tax in respect of share-based payments

In some tax jurisdictions (such as the UK), entities receive a tax deduction for share-based payments but the timing and amount of the deduction may differ from the related accounting expense. For example, an entity may recognise an expense over the vesting period but not receive a tax deduction until the share options are exercised, with the measurement of the tax deduction based on the entity's share price at the date of exercise.6

An entity shall estimate the future tax deduction based on the share price at the end of the reporting period, if the tax deduction is based on the share's value at exercise date.7

The estimated tax deduction may differ from the cumulative remuneration expense recognised in the financial statements. This indicates that the tax deduction relates not only to remuneration expense but also to an equity item. In this situation, the excess of the associated current or deferred tax should be recognised directly in equity.8

Twelve companies in our selection recorded 'excess' tax deductions related to IFRS 2 directly in equity, and one of them further disclosed a breakdown between the current and deferred tax components. This indicates that the estimated tax deduction may differ from the cumulative remuneration expense recognised in profit or loss. Only one company explained the nature of this adjustment, for example, in their accounting policy.

IAS 12 also requires companies to disclose the amount of the deferred tax asset recognised, the basis for determining the expected tax deduction, and any uncertainties regarding its amount or timing.

Three companies included an IFRS 2 expense adjustment in their total tax charge reconciliation with no tax deduction recognised in equity. This may suggest that an element of excess tax deduction has been incorrectly included in profit.

Companies should carefully consider the requirements of paragraph 68C of IAS 12. Where the tax deduction exceeds the cumulative share-based payment expense recognised, the excess tax benefit should be recognised directly in equity. Companies should consider the extent to which further explanation of the nature of the adjustment is required.

Where a temporary difference arises between the tax base of employee share options and their carrying value, a deferred tax asset should arise. To the extent that the future tax deduction exceeds the related cumulative IFRS 2 ‘Share-Based Payment’ (‘IFRS 2’) expense, the excess of the associated deferred tax balance is recognised directly in equity. To the extent that the future tax deduction matches the cumulative IFRS 2 expense, the associated deferred tax balance is recognised in the Consolidated Income Statement.

The company's policy explains how the excess tax benefit is recognised and measured.

Employment tax obligation

Where companies have obligations to pay employer or employee tax obligations, we would expect liabilities to be recognised. Only eight companies in our sample referred to employer and employee tax obligations in their annual reports; we recognise that the amounts involved may not have been material for the other companies.

The only exception to recognising liabilities would be the IFRS 2 net-settlement exception, although we did not observe examples of this.

Tax regulations may require entities to withhold some of an employee's share-based payment to cover their tax liabilities which are then typically remitted in cash. In such a circumstance the terms of the share-based payment may allow the entity to withhold equity equal to the tax due. This is called a 'net settlement feature'.9 In this scenario the share-based payment shall be classified in its entirety as equity-settled if it would have been so classified in the absence of the net settlement feature.10

When no obligation to net settle exists, an entity shall account for the tax liability or cash outflow as cash-settled. This also applies when excess shares are withheld.11

IFRS 2 requires entities to disclose an estimate of the amount that it expects to transfer to tax authorities to settle employee's tax obligations, when this is necessary to inform users about the future cash flow effects associated with the transaction.12

Where companies consider information on employment tax obligations to be material, the following example provides useful disclosures that could be made:

National Insurance contributions are payable by the Company in respect of some of the share-based payment transactions. These contributions are payable on the date of exercise based on the intrinsic value of the share-based payments and are, therefore, treated as cash-settled awards. The Group had an accrual for National Insurance at 28 February 2025 of £0.5m (2024: £0.5m), of which none related to vested options. The weighted average share price at the date of exercise for share options exercised during the period was 697 pence.

Describes the nature of the NI contribution, when it becomes payable and how it is calculated.

Clearly states that the employer tax obligation is classified as cash-settled.

Provides the exercise date share price details.

7. Completeness and conciseness of IFRS 2 disclosures

Required disclosures

If companies have several schemes, IFRS 2 disclosures have the potential to span multiple pages. Companies should consider how to provide informative disclosures in a complete but clear and concise manner.

IFRS 2 sets out the minimum information to be disclosed for each share-based payment arrangement, but it does permit information to be aggregated for 'substantially similar' schemes unless separate disclosure is required to 'enable users to understand the nature and extent of share-based payments arrangements that existed during the period.'

We explain in more detail how companies can communicate effectively whilst complying with the disclosure requirements of accounting standards, laws and regulations in our publication 'What Makes a Good Annual Report and Accounts'.

We observed that many companies chose to include all disclosures for all of their schemes, regardless of their relative significance. There are opportunities to cut clutter from the annual report and accounts whilst still providing the information necessary for users to understand the effect of share-based payments on the financial statements.

Where companies did provide disclosures for all their schemes, the better examples brought together the common disclosures for each scheme and considered how to avoid duplication.

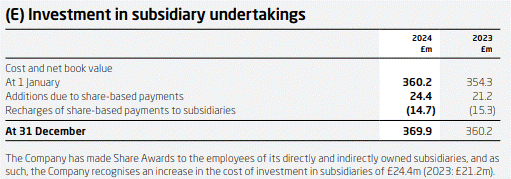

In summary, IFRS 213 requires companies to disclose:

- a description of each type of arrangement that existed during the period, including the vesting requirements, the maximum term of the options granted and the method of settlement;

- the number and weighted average exercise prices of share options, showing options: outstanding at the beginning of the period, granted, forfeited, exercised, expired, outstanding and exercisable at the end of the period;

- the weighted average share price at the date of exercise (or an average during the period if options were exercised on a regular basis); and

- for options outstanding at the end of the period, the range of exercise prices and the weighted average contractual life.

Provides aggregated disclosures for similar schemes.

During the year ended 31 December 2024, the Group had two share-based payment arrangements for employees, subsidiary and Group Directors (Approved ESOT and LTIP) and two share-based payment arrangements for the Group Directors (Bonus Scheme and Deferred Bonus Scheme). Under each of the arrangements the options are granted with a fixed exercise price, are exercisable three years after the date of grant and expire ten years after the date of grant. Employees are not entitled to dividends until the share options are exercised. Employees are required to remain in employment with the Group, or have left in accordance with the 'good leaver' provisions until exercise, otherwise the awards lapse. On exercise of the options by the employees the Company issues shares held in trust by the Billington Holdings ESOT.

In addition, the LTIP provides additional remuneration for those employees who are key to the operations of the Company. Vesting of the options for this scheme is also conditional on meeting agreed growth targets (non-market performance conditions).

This company also aggregated information for similar schemes and provided a separate disclosure where appropriate.

Examples of lack of conciseness identified included:

- Repetition of the same information in a number of places in the annual report and accounts (for example in the Directors' Remuneration Report, the share-based payment note, the related parties note, staff costs note etc).

- The inclusion of non-specific and irrelevant policies, such as a policy for accounting for cash-settled awards when all awards are equity-settled.

For some UK companies, there are overlaps between what is required to be disclosed to comply with IFRS 2 and what is required to comply with other regulations such as the Directors' Remuneration Report, which can lead to duplication of information about arrangements. Companies should consider the extent to which they can use cross referencing and signposting.

The better annual reports and accounts focused on the most material schemes and sought to cross reference disclosures where appropriate to avoid duplication.

Refer to the Directors' remuneration report on pages 52 for a breakdown of the vesting conditions related to each award.

Makes a cross reference from the share-based payments note in the accounts to the Directors' remuneration report, to avoid duplication of information.

Companies should also ensure that the disclosures within the annual report and accounts are consistent. As we note in section 3, we saw some companies state that all of their schemes were equity-settled but the detailed descriptions of some schemes suggested cash-settlement.

8. Other IFRS 2 associated disclosures

Significant judgements and estimates

All companies in our selection disclosed that IFRS 2 required estimates. These included: the fair value of awards granted, the cumulative IFRS 2 expense, the expected number of awards that would eventually vest, and the expected life of the awards. IAS 1, ‘Presentation of Financial Statements', requires disclosure of certain judgements and estimates.

Significant estimates are those with a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year.14

An entity shall disclose the judgements that have the most significant effect on the amounts recognised in the financial statements.15

Three companies in our sample identified share-based payment as an area of accounting judgement or estimate with one company clearly stating that it does not meet the definition of significant judgements and estimates required to be disclosed under IAS 1.

We were pleased that we did not find irrelevant or boilerplate narrative; companies had generally made an effort to tailor their disclosures to their circumstances.

Please see section 3 of our thematic review on Judgements & estimates published in July 2022 for further detail on our expectations and examples of better practice.

We would not expect generic IAS 1 disclosures in relation to IFRS 2, as charges for equity-settled share-based payment awards are not adjusted after initial recognition, other than for estimates around vesting and performance, and do not relate to assets or liabilities.

Judgements on the scope of IFRS 2

Financial instruments such as share warrants, swaps and options may fall under IFRS 2, or could be accounted for under IAS 32, 'Financial Instruments: Presentation', and IFRS 9, 'Financial Instruments', depending on their nature and purpose.16

We have previously challenged companies in our routine reviews where it was unclear why financial instruments were considered to be in the scope of IFRS 2.

Companies should disclose significant judgements made in concluding whether transactions are in the scope of IFRS 2.

The following example illustrates how one company provided disclosures on how it judges whether put options are in the scope of IFRS 2 or 9.

Clearly explains the rationale for recognising the company's option arrangement as either IFRS 9 liability or IFRS 2 scheme, and how these are accounted for.

Business combinations

Appendix B17 of IFRS 3, 'Business Combinations', provides application guidance in respect of an acquirer's IFRS 2 awards exchanged for awards held by the acquiree's employees.

Our 2022 thematic review on Business Combinations explains our expectations in relation to share awards issued in a business combination arrangement.

None of the companies reviewed had a replacement award issued due to business combination. We observe that one company settled acquiree's share options post completion, but there was no explicit statement on whether this is voluntary or obliged as part of the acquisition.

It is helpful when companies explain if material share awards are replaced or not, and the resulting accounting applied.

Alternative performance measures (APMs)

Financial measures that are not derived directly from accounting standards are referred to as APMs or non-GAAP measures. Common examples include measures such as EBITDA or adjusted profit.

Some companies adjust for share-based payments when calculating their APMs. Nine companies in our sample disclosed IFRS 2 charges as an adjusting item in their APMs, and five of these companies explained the rationale for excluding IFRS 2 charges.

In line with findings from our routine monitoring work, some companies in our sample did not provide clear explanations for excluding IFRS 2 charges from their APMs, despite these charges appearing to be an established part of their employee compensation.

Where companies exclude IFRS 2 charges from their APMs, we expect clear and useful explanations to be provided. Please see section 12 of our 2021 thematic review on Alternative Performance Measures for further detail on our expectations.

The following extracts illustrate how two companies provided specific explanations for how share-based payments impacted their reported results.

The Group has issued share awards to employees and Directors: at the time of IPO; for the acquisition of LiveAuctioneers; and operates several employee share schemes. The share-based payment expense is a significant non-cash charge driven by a valuation model which references the Group's share price. As the Group is still early in its lifecycle as a newly listed business the expense is distortive in the short term and is not representative of the cash performance of the business. In addition, as the share-based payment expense includes significant charges related to the IPO and LiveAuctioneers acquisition, it is not representative of the Group's steady state operational performance.

Clearly explains why the share-based payment charge is excluded from profit before tax when reporting adjusted EBITDA.

In previous results announcements we have also focused on adjusted operating profit (AOP), which removes the effects of share-based payment (SBP) charges and amortisation of acquired intangibles – notably because of the growth of these SBP charges over the time since IPO, from a near-zero starting position in 2020/21 of £0.3 million to £5.1 million this year. Given that we have now moved out of that growth cycle, as older schemes vest and new schemes are introduced, the current charges are now viewed to be normalised as business-as-usual recurring expenses. Similarly, our amortisation charges are stable at £0.9 million for the current and prior year. So, AOP is no longer considered to add value to understanding our results. We will now focus on operating profit, which brings us in line with other similar businesses in our market segment.

Highlights why, given where the company is in its development, the previously adjusted IFRS 2 charge is no longer considered an adjusting item.

9. Other matters

Presentation of share-based payment in equity

IFRS 2 requires the credit entry for the share-based payment expense to be recognised in equity;18 however, the standard does not specify in which reserve this should be recognised. We saw companies adopt a variety of approaches. Some recorded the entry in retained earnings whilst others recorded the entry in a separate share-based payment reserve. For those that did record the amount in a separate reserve, 71% of the companies provided an explanation of what the reserve represented (as required by paragraph 79 of IAS 1) and 29% went on to explain what entries were made in the reserve when options vested.

The share-based payments reserve represents the Group's obligation to settle share-based awards issued to its employees. When employees exercise their awards, the portion of the share-based payments reserve which represents the share-based payment charge for those awards is transferred to retained earnings and the Group discharges its obligation.

Explains what the reserve is used for and when amounts are transferred from equity.

Modification of IFRS 2 arrangements

Sometimes, the terms of a share-based payment may be changed before the award has vested. Modifications could change the manner in which the transaction is settled (e.g. from equity-settled to cash-settled, or vice versa) or could increase or decrease the fair value of the award. For equity-settled awards, if the modification results in an increase in the fair value of the award (i.e. the IFRS 2 charge will increase), the incremental fair value is recognised as an additional expense over the remaining vesting period.

If the fair value decreases, then companies should continue to account for the award as if the modification had not occurred. No reversal of the previously recognised expense is allowed.

If the classification as equity or cash-settled changes, then any amount recognised in equity should be reclassified as a liability, and vice versa. If the resulting award is cash-settled, then the resulting liability should be remeasured at each reporting date.

It is helpful when companies explain if material share awards are replaced or not, and the resulting accounting applied.

Accounting for clawback/malus clauses

Some awards, predominantly those issued to directors, may have adjustment mechanisms (a malus clause) which may reduce or withhold amounts to be awarded.

How any such clauses impact the measurement of the share-based payment depends on the terms of the clause. If they are non-vesting conditions (i.e. because they do not require service or performance to be completed), then they are included in the determination of the fair value of the award and any expenses related to amounts forfeited are not reversed.

Three companies disclosed the inclusion of malus/clawback clauses in their directors' share schemes. Two of these companies explicitly stated that the clauses had not been exercised, although one provided a useful explanation of the specific share schemes containing the clauses. The third company disclosed that it applied the malus provisions in the current year following a retrospective adjustment to its prior year financial results.

Share-based payment transactions with non-employees

For equity-settled transactions, the entity should measure the fair value of the goods or services received, unless that value cannot be estimated reliably. In such cases, the fair value of the equity instruments granted is used instead.19

For cash-settled transactions, these transactions are measured at the fair value of the liability incurred, which is re-measured at each reporting date and at the date of settlement, with any changes in fair value recognised in profit or loss for the period.20

10. Considerations for private companies

Although private companies were not selected for this thematic, the overall findings and observations are relevant.

Some considerations that are particularly relevant for private companies are:

Classification

Shares in private companies lack the liquidity of publicly-traded instruments and may have restrictions on whom they can be sold to. They may be subject to buy-back arrangements or companies may otherwise repurchase them when employees leave. Such a feature may indicate that the awards are, in substance, cash-settled. Private companies should give careful consideration to the terms of their arrangements to ensure that they are appropriately classified.

Valuation

IFRS 2 requires awards to be measured at fair value at the grant date. For private companies, determining the fair value can be complex due to the lack of observable market information. Valuation techniques such as option pricing models (for instance, Black-Scholes or binomial models) may be used, but these may require further adjustment to reflect the lack of public information.

Disclosures

IFRS 2 requires companies to disclose sufficient information to understand the nature and extent of share-based payment arrangements. For private companies, information about the circumstances in which awards vest (for example, on a company's IPO) and how employees can dispose of shares may be particularly relevant.

11. Key expectations

We expect companies to consider the examples provided of better disclosure and opportunities for improvement and to incorporate them in their future IFRS 2 reporting, where relevant and material.

Companies should also:

- Clearly explain the valuation technique(s) used, and the assumptions made, in determining the fair value of instruments granted.

- Disclose judgements made and accounting policies applied where there is a choice of how a share-based payment is settled. Careful consideration should be given to the implications of any cash-settlement on the classification of the awards as a whole.

- Focus on providing material disclosures that are clear and concise, and internally consistent. Where appropriate, seek to cross reference or aggregate information to avoid duplication.

- Assess whether there are excess tax deductions in respect of share-based payments and consider whether any such excess has been excluded from profit or loss and recognised directly in equity.

- Consider the effect of group arrangements on individual companies and distributable reserves.

Contact Information

Financial Reporting Council

London office: 13th Floor, 1 Harbour Exchange Square, London E14 9GE

Birmingham office: 5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300 www.frc.org.uk

Follow us on Linked in.

Disclaimers and Copyright

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, Exchange Tower, 1 Harbour Exchange Square, London E14 9GE

Footnotes

-

IFRS 2, paragraphs 41 to 43 ↩

-

IFRS 2, paragraphs 35 to 40 ↩

-

IFRS 2, paragraphs 34 and 52 ↩

-

IFRS 2, paragraph 11 (an employee may receive a remuneration package that includes a base salary, bonus, other benefits etc., making it difficult to attribute service to a particular component.) ↩

-

ICAEW and ICAS Guidance on realised and distributable profits under the Companies Act 2006 ↩

-

IAS 12, paragraph 68A ↩

-

IAS 12, paragraph 68B ↩

-

IAS 12, paragraph 68C ↩

-

IFRS 2, paragraph 33E ↩

-

IFRS 2, paragraph 33F ↩

-

IFRS 2, paragraph 33H ↩

-

IFRS 2, paragraph 52 ↩

-

IFRS 2, paragraph 45 ↩

-

IAS 1, paragraph 125 ↩

-

IAS 1, paragraph 122 ↩

-

IFRS 2, paragraph 6 ↩

-

IFRS 3, paragraphs B56-B62B ↩

-

IFRS 2, paragraph 10 ↩

-

IFRS 2, paragraph 13 ↩

-

IFRS 2, paragraph 30 ↩