The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Investment trusts, venture capital trusts and similar closed-ended entities

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, Exchange Tower, 1 Harbour Exchange Square, London E14 9GE

1. Executive summary

Introduction

Investment trusts, venture capital trusts and similar closed-ended entities (investment companies or companies) generally offer investors access to a diversified portfolio through a single investment and make up a meaningful proportion of the FTSE 350. Unlike open-ended funds which issue and redeem shares on demand, they have a fixed number of shares that are traded on an exchange. While the accounts prepared by these companies are generally relatively straightforward, the Corporate Reporting Review (CRR) team has identified some common issues in the reports they have reviewed. The most significant of these is the sufficiency of disclosures about Level 3 (L3) fair value measurements (measurements involving significant unobservable inputs1). Clear disclosures about the techniques and assumptions underlying fair value measurements and related sensitivities, are key.

Other areas where we have found application issues include alternative performance measures (APMs), whether the strategic report is fair, balanced and comprehensive, and significant judgements relating to the investment entity definition.

This publication reflects CRR's experience reviewing the disclosures within the annual reports of investment companies and focuses on areas of disclosure where significant improvements can be made. It is particularly aimed at companies with material L3 assets, such as infrastructure, private equity and property.

In 2023, we published Thematic Review: IFRS 13 ‘Fair Value Measurement’, which readers may find helpful to refer to alongside this report.

Key observations

Fair value measurement (see section 3)

- Significant unobservable inputs, or significant assumptions, used to determine L3 fair value measurements should be clearly disclosed. It is helpful to include weighted averages when input ranges are wide.

- Where reasonably possible changes in unobservable inputs would significantly affect the valuation of financial instruments, IFRS reporters should disclose the impact. A sensitivity analysis may also be required to satisfy the disclosure requirements relating to estimation uncertainty under FRS 102.

- The valuation techniques used should be clearly disclosed.

Strategic report and APMs (see sections 4 and 5)

- The strategic report should provide a fair, balanced and comprehensive analysis, including key movements in Net Asset Value (NAV) during the year.

- APMs should be clearly defined, labelled, and reconciled to the closest IFRS or UK GAAP equivalent (GAAP measure) to support transparency and comparability. The basis for calculating ratios, such as ongoing charges, should also be clearly disclosed.

Significant accounting judgements (see section 6)

- The basis for determining whether the IFRS 10 investment entity definition is met should be clearly explained, when this involves significant judgement.

2. Scope and how to use this publication

Scope

This thematic review considers the quality and adequacy of several key disclosures relevant to investment companies. We selected a sample of companies to review and considered the results of CRR's routine reviews over the past five years, to identify key areas for improvement. Our sample included a mix of investment companies reporting under IFRS, and FRS 102, investing in infrastructure, private equity, venture capital and property. We also conducted some outreach activities with investors and other stakeholder groups to help inform our findings.

Our report focuses on areas where we found common issues in the financial reporting of investment companies, such as quantitative disclosures about L3 fair value measurements ('L3 measurements') and APM disclosures.

Our proportionate approach to principles-based corporate reporting in the UK

The UK's financial reporting framework is principles-based, requiring preparers to exercise judgement to ensure the financial statements provide a true and fair view. The FRC adopts a proportionate approach to its corporate reporting review work, raising substantive questions only where it appears there is a material breach of the relevant requirements. This approach reflects the FRC's commitment to maintaining high standards in corporate reporting while supporting UK economic growth and competitiveness, which is explained further on page 7 of the FRC's 2024/25 Annual Review of Corporate Reporting.

Using this publication

Instances of good practice and opportunities for improvement are identified in the report as follows:

A characteristic of good quality application of reporting requirements.

An opportunity for improvement by companies to move them towards good quality application of reporting requirements.

An omission of required disclosure or other issue companies should avoid in their annual reports and accounts.

Example disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

The word 'should' is used in this report to describe legal and accounting applications and disclosures that are required if material and relevant.

3. Fair value measurement

Quantification of inputs

IFRS 13 requires quantification of the significant unobservable inputs used in determining L3 measurements.2

Similarly, FRS 102 requires disclosure of the assumptions applied,3 and paragraph 11.43 refers to examples such as information about the assumptions relating to prepayment rates, rates of estimated credit losses, and interest rates or discount rates.

Quantitative information about significant unobservable inputs helps users to understand the measurement uncertainty inherent in fair value measurements.4 Most companies disclosed some quantitative information; however, these disclosures were sometimes incomplete or absent.

Companies should ensure that quantitative information about significant unobservable inputs or assumptions used is appropriately disaggregated by class of the relevant asset.5

Better quantitative disclosures include disaggregating inputs, for example by region, sector or investment type, or quantifying the assumptions relating to the valuation of specific investment(s) that are significant to the overall portfolio. Weighted averages of significant unobservable inputs are also helpful where the range used for a particular assumption is wide.

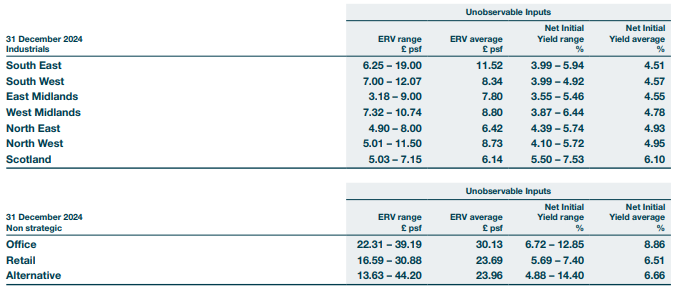

Tritax Big Box REIT plc, Annual Report 2024, p139

The company disaggregates the unobservable inputs underpinning the valuation of its property portfolio by type and location, quantifies the ranges of corresponding inputs, and provides their weighted averages.

The company also disaggregates the fair value of its portfolio into the same locations on page 24 of the Annual Report which has not been reproduced here.

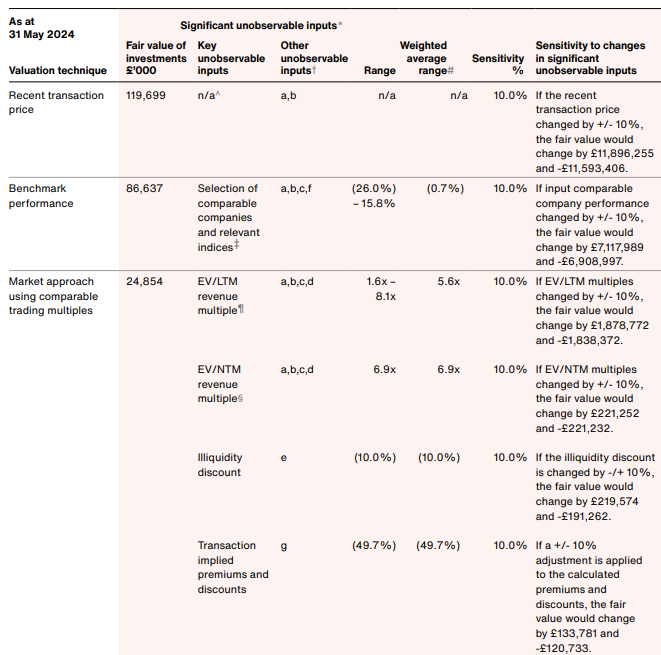

Baillie Gifford US Growth Trust plc, Annual Report and Financial Statements 2024, p107

The company disaggregates its portfolio by valuation technique, and quantifies the unobservable inputs relevant to each technique, including weighted averages where relevant.

Explanatory notes were also provided to help users to understand the table on page 109 of the Annual Report and Financial Statements which have not been reproduced here.

The company, reporting under FRS 102, has provided sensitivity disclosures to aid users' understanding of the associated estimation uncertainty.

For valuations based on NAV statements received from third parties, it was generally unclear from the disclosures whether any adjustments had been made to this externally-received information as part of the company's internal fair valuation processes (discussed on page 11). In this context, we note that, while IFRS 13 states that companies are not required to create quantitative information, they cannot ignore quantitative unobservable inputs that are significant to the fair value measurement and are reasonably available.6

We remind companies that, if an adjustment, such as a discount, has been applied to third-party pricing information, which is significant to the fair value measurement, that adjustment would be considered an unobservable input and should be disclosed.7

IFRS reporters should ensure they quantify the significant unobservable assumptions underpinning L3 measurements, and that the quantification provided is sufficiently detailed to assist users to understand how these fair values were derived.

The requirements under FRS 102 are not as detailed, but generally we would expect similar disclosures.

We noted that some disclosures about significant unobservable inputs excluded material proportions of the portfolio on the basis that there was no associated major estimation uncertainty. This indicates that there is some confusion about the interaction between the requirements about quantification of inputs or assumptions and disclosures about estimation uncertainty in IAS 1 or FRS 102.8

Quantification of significant unobservable inputs under IFRS 13, and of assumptions under FRS 102 where relevant, should be provided irrespective of whether L3 measurements represent major sources of estimation uncertainty.

Sensitivity disclosures

In addition to qualitative information, IFRS 13 requires quantitative disclosure of the effect of reasonably possible changes in assumptions, if the effect on the L3 measurement of a financial instrument would be significant.9

Good sensitivity disclosures under IFRS 13 enable users to understand the potential variability of fair value measurements at the assumption level and reflect reasonably possible alternative assumptions.

We have seen some good examples in our reviews of sensitivity analysis, shown in tabular format for ease of reading, with accompanying explanatory footnotes.

Interaction with disclosures about key sources of estimation uncertainty

L3 measurements may also represent key sources of estimation uncertainty under IAS 1.10 Given the level of granularity of analysis required by IFRS 13 for L3 financial instruments, these disclosures are likely to satisfy the estimation uncertainty requirements under IAS 1.11

However, an analysis designed to simply meet the estimation uncertainty requirements of IAS 1 for a L3 financial instrument may not satisfy the more detailed IFRS 13 sensitivity disclosure requirements.

FRS 102 does not include the estimation uncertainty disclosure examples in paragraph 129 of IAS 1.12 As such, companies applying this framework will need to use judgement to determine what information may be necessary to understand the estimation uncertainty, such as a sensitivity analysis. It may not be sufficient to disclose just the nature and carrying amount of the affected balance.

We encourage FRS 102 reporters to consider disclosing quantitative information about the sensitivity of changes in assumptions where significant estimation uncertainty is involved.

We may challenge companies reporting under IFRS that sensitise their entire portfolio without linking those sensitivities to specific unobservable inputs. This approach does not meet the sensitivity disclosure requirements of L3 measurements under IFRS 13.

Companies reporting under IFRS should consider whether past changes in valuations indicate that sensitivity ranges disclosed under IFRS 13 should be revised. Changes in macroeconomic, regulatory or company-specific factors may also prompt an update to these ranges.

Valuation techniques

Companies used a variety of valuation techniques to determine the fair value of their investments, including various market approaches and the discounted cash flow method. Both IFRS 13 and FRS 102 require companies to disclose the valuation technique(s) used to determine fair value.13

When more than one valuation technique is used by a company, better disclosures provide an analysis of the investment balance by valuation technique.

We may challenge insufficient or unclear explanation of the valuation techniques used for L3 measurements.

Paragraph 93(d) of IFRS 13 also requires any change in the valuation technique to be disclosed along with the reason(s) for making it.

When a change in valuation technique occurs, better disclosures identify the affected investment balance, specify the valuation techniques applied before and after the change, and clearly explain the rationale for the change.

| Valuation methodology | 31 December 2024 £'000 | 31 December 2023 £'000 |

|---|---|---|

| Cost and price of recent investment (calibrated and reviewed for impairment) | 114,347 | 54,544 |

| Revenue multiple | 56,788 | 21,772 |

| Discounted cash flow (supported by third party valuation) | 18,005 | 9,086 |

| Earnings multiple (supported by third party valuation) | 7,724 | 8,562 |

| Earnings multiple | 5,536 | 3,044 |

| Net assets | 2,280 | 2,209 |

| Bid Price | 82 | 143 |

| Discounted offer price | - | 50 |

| 204,762 | 99,410 |

Albion Technology & General VCT PLC, Annual report and Financial Statements 2024, p88

The company, reporting under FRS 102, discloses the valuation techniques used and the related investment balances.

Valuation processes

Many companies disclosed that their L3 measurements were performed by the investment manager and reviewed by their boards and auditors. However, the level of detail about the valuation processes used varied, including how the company decided its valuation policy and procedures, and how it analysed changes in the fair value of its investments.

When valuations were based on NAVs received from third parties, it was not always clear what internal processes were used to ensure that NAVs received were in line with IFRS 13 and how any adjustments had been determined.

Information about valuation processes helps users assess the relative subjectivity of companies' L3 measurements.14 Please refer to page 23 of the FRC's 2023 Thematic Review: Fair Value Measurement for further information, including an example of better disclosure.

Companies reporting under IFRS should clearly explain the valuation processes used to measure L3 measurements.15,16 Although not a requirement under FRS 102, we encourage FRS 102 reporters to consider similar disclosure.

Earlier this year the FCA published a multi-firm review of private market valuation processes. Although primarily directed at private markets managers, the findings are also likely to be relevant to investment companies, particularly those with exposure to unlisted investments.

4. Strategic report

Fair, balanced and comprehensive

The strategic report should provide a fair, balanced and comprehensive analysis of the company's business. This should include a review of the company's development and performance over the financial year, as well as its position at the year-end.17

Better disclosures we observed included NAV bridges (or similar roll forwards) that illustrated the impact on NAV per share of key movements during the year, for example, fair value changes, dividends and share buybacks.

Most companies discussed the value of their investments and NAV as at the reporting date. Although companies generally, and helpfully, included an analysis of their performance relative to a benchmark where relevant, the depth of further commentary on financial performance varied significantly.

We would expect a balanced and comprehensive analysis of the company's performance to include an analysis of any significant gains or losses, income or expenses recognised during the year.

Several companies trading at a discount to NAV explained how this was managed, for example, providing details of marketing initiatives and share buybacks. Feedback from several investors indicated that they valued this information.

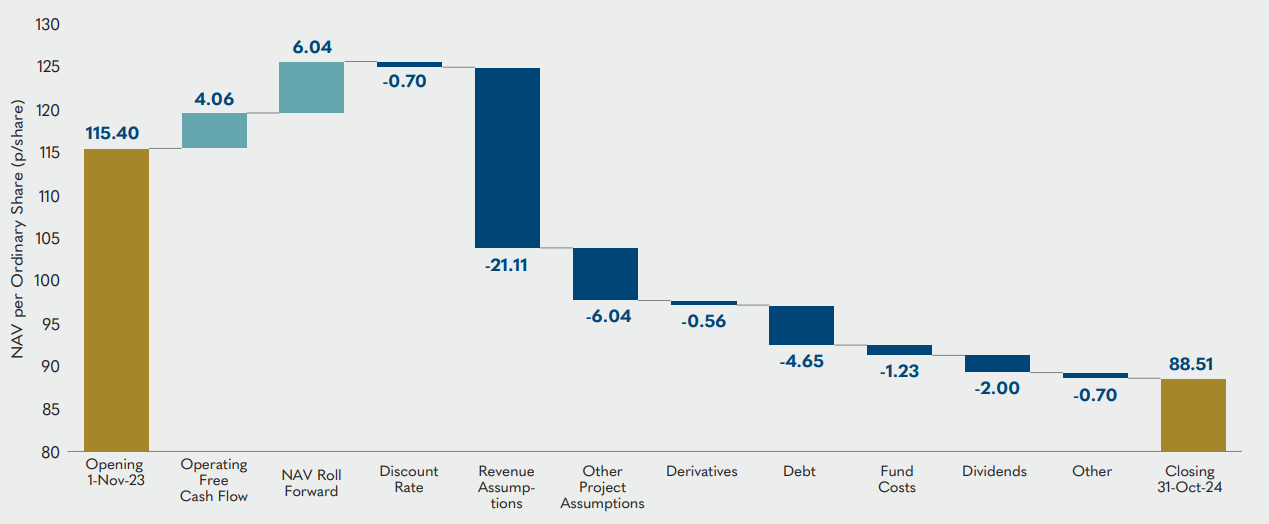

Harmony Energy Income Trust Plc, Annual Report and Accounts 2024, p16

The company presents the opening NAV per share balance and quantifies several factors that influenced the NAV per share over the period to reconcile to the closing NAV per share balance.

5. Alternative performance measures

Reconciliations

Companies used various industry metrics/APMs to supplement their financial reporting. Several presented APMs, such as portfolio value or metrics prepared on a 'look-through' basis, but did not reconcile them to the closest GAAP measure. Other APMs that could not be reconciled directly to the financial statements, such as total return ratio or ongoing charges ratio, were not always accompanied by calculations or explanations.

Companies should provide reconciliations of APMs to the closest GAAP measures.18 When APMs are not directly reconcilable to the financial statements, companies should provide calculations (and/or explanations) of how the APMs were determined (see page 16 of the FRC's 2021 APM thematic review).

Ongoing charges ratio

Investors have told us that disclosure of an ongoing charges ratio (or equivalent) provides useful information about the costs incurred by a company to manage its investments. Most companies disclosed this ratio, but the basis of calculation was not always clear.

When ongoing charges ratios were disclosed, better disclosures reconciled the numerator of the ongoing charges ratio to the closest GAAP measure, included an analysis of reconciling items where necessary, and provided the basis for calculating the denominator.

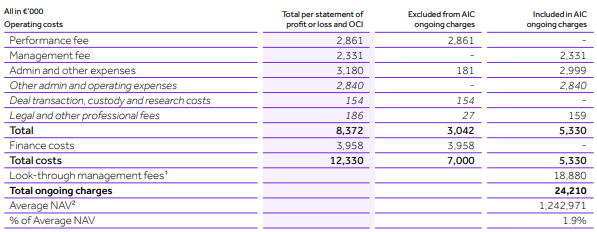

Apax Global Alpha Limited, Annual Report and Accounts 2024, p116

The company discloses a detailed analysis of the adjustments made to operating costs presented in the statement of profit or loss and OCI in determining the ongoing charges figure.

The company explains on the same page how average NAV is calculated and that 'look-through management fees' represent the management fees of the funds managed, advised and/or operated by Apax Partners LLP. It also explains that the calculation of the ratio is in line with the Association of Investment Companies' (AIC) recommended methodology. These disclosures have not been reproduced here.

Prominence and consistency

Some companies described certain APMs as offering a more understandable or meaningful view of their performance. Describing APMs in this way implied the APMs were superior to GAAP measures.

Companies should avoid comments that indicate APMs have more authority than GAAP measures.19

A company may amend its APMs over time, for example, because of a change to its investment strategy. This may involve refining or discontinuing an existing APM, or disclosing a new one.

Where an APM was no longer disclosed, the rationale for its removal was not always explained. This was particularly concerning when the omitted APM would have highlighted a negative trend had it been disclosed.

Companies should clearly explain the reason for changing or no longer disclosing an APM and consider the effect of its omission when producing a strategic report that is fair, balanced and comprehensive.20

Labelling and definitions

Some companies used labels for APMs that could be considered misleading to users, such as using 'total assets' when certain liabilities had been deducted, or 'NAV' and 'NAV per share' for amounts that were based on adjusted NAV.

In some cases, different labels were used for the same metric in different parts of the annual report, which could lead to confusion and impact comparability.

Definitions of APMs and the basis of their calculation were sometimes missing or unclear. For example, it was not always clear whether total return had been calculated gross or net of fees.

Companies should use labels that appropriately describe their content and the basis of calculation and should apply them consistently throughout their annual reports.21 Definitions of APMs and the basis of their calculation should also be clear and understandable.22

Better disclosures also signpost APMs, for example, using a distinguishing symbol.

Other matters

Some companies provided APMs on a 'look-through' basis using consolidated or partially consolidated information (rather than the fair value information typically required for investment entities, see Section 6). While several investors noted that such information provided helpful additional insights, companies should ensure that clear explanations accompany these measures to avoid potential confusion or misinterpretation.

Please refer to pages 10, 11, 19 and 20 of the FRC's 2021 АРМ thematic review for further information relating to the above areas.

6. Significant accounting judgements

Investment entity definition

Paragraph 27 of IFRS 10, 'Consolidated Financial Statements', defines an investment entity as an entity that:

- obtains funds from one or more investors for the purpose of providing those investor(s) with investment management services;

- commits to its investor(s) that its business purpose is to invest funds solely for returns from capital appreciation, investment income, or both; and

- measures and evaluates the performance of substantially all of its investments on a fair value basis.

Companies that satisfy the above definition are required to measure their subsidiaries at fair value rather than consolidate them.23 As a result, the financial statements present the fair value of these subsidiaries and the movement thereof rather than the underlying assets and liabilities, income and expenses of the subsidiaries themselves.24

Related application guidance and illustrative examples in IFRS 10 provide further information about the facts and circumstances that should be considered in determining whether the above criteria are met. For example, whether there is an exit strategy documenting how the entity plans to realise capital appreciation from certain investments.25

Several companies identified the presence of an exit strategy when explaining the judgement involved in assessing whether they met the definition of an investment entity. Feedback from some investors, who preferred consolidated information in certain cases, highlighted that additional factors may also be relevant to this assessment. For example, for infrastructure investment companies, the extent of active management of its investees to generate benefits other than capital appreciation and investment income,26 and whether fair value is the main basis for performance evaluation. These considerations, along with the absence of an exit strategy, are among the reasons why some real estate investment trusts do not meet the definition of an investment entity. They may be similarly relevant for infrastructure investment companies when making this assessment.

While most companies disclosed a significant judgement in assessing the investment entity definition, in several cases only boilerplate information was disclosed in support of the judgement.

When significant judgement is applied in assessing the investment entity definition, companies should clearly explain the basis for this assessment, supported by relevant company-specific information.27

FRS 102 includes a similar requirement to measure certain investments in subsidiaries at fair value rather than to consolidate them. However, this consolidation exception depends on whether the subsidiaries are held as part of an investment portfolio.28 While the requirement differs from the criteria under IFRS, judgement may still be needed in determining whether it is met.

The Company's exit of its investments in project companies may be at the time the existing turbines or other generation assets get to the end of their economic lives or planning or leasehold land interests expire, at which point the project companies may be considering redevelopment (referred to as a 'repowering') of the site. The Company may remain invested in the event there is the opportunity to repower and undertake the repowering, subject to its investment limits on construction activity being met and depending on economic considerations at the time. The Company may also exit investments earlier for reasons of portfolio balance or profit as there is an active secondary market for renewables projects in the countries in which we operate.

The Renewable Infrastructure Group Limited, Annual Report 2024, p122

The rationale for an exit strategy is provided, and supported by relevant company-specific information.

The Company and its subsidiaries hold their investments primarily for income generation purposes and do not have plans to realise capital appreciation from substantially all of the investments in Partner-firms and non-financial assets in the normal course of operations. The Company and its subsidiaries do not have an exit strategy as defined by IFRS 10 and therefore do not meet one of the essential criteria to be treated as an investment entity.

Accordingly, the Company has not applied the provisions of Para 31 of IFRS 10 that requires an investment company to measure its investment in subsidiaries at fair value through profit or loss. Instead, the Company consolidates the subsidiaries that it controls as discussed in the next section.

Petershill Partners plc, Annual Report 2024, p93

The company explains that it does not have an exit strategy and, as a result, concludes that it does not meet the IFRS 10 criteria for the investment entity exception to consolidation.

7. Other matters

Statement of Recommended Practice (SORP)

The SORP for Investment Trust Companies and Venture Capital Trusts, issued by the Association of Investment Companies (AIC), represents non-mandatory best practice for FRS 102 reporters on the form and content of financial statements of investment companies.

Although application of the SORP is not mandatory, investment companies reporting under FRS 102 are required to include a statement setting out whether they have applied the SORP and to explain any departures.29

Our reviews indicated that some companies may not have fully complied with the SORP requirements, for example, by not disclosing financial information about certain unquoted investments or about individually material disposals or write-ups/downs, and not acknowledging these departures.

When information required by a SORP has not been provided, companies should clearly identify this as a departure from the SORP. Disclosures should also include brief details of the information not provided and the reason(s) for its omission.

Investment manager agreement

Companies should provide a summary of the key terms of their agreements with investment managers, including a clear explanation of the basis of their remuneration and termination provisions, including any exit payments.30

Better disclosures include the specific amount to which the investment manager fee percentage is applied, particularly when this figure is not directly identifiable from the annual report and accounts.

In addition to explaining how performance fees are calculated, better disclosures clearly set out the expected timing of any settlement and the method of settlement, such as in cash or company shares.

Investment commitments

Companies should disclose details of their commitments to make further investments in investees, including the total amount, when these commitments are not recognised in the balance sheet.31

Better disclosures include the total amount of investment commitments, the amount used, the undrawn balance and when those commitments will expire.

8. Key expectations

We expect investment companies to consider the examples of better disclosure provided and opportunities for improvement and to incorporate them in their future reporting, where relevant and material. In particular, investment companies should:

Provide sufficient and meaningful quantification of the significant unobservable inputs/assumptions used in determining the fair value of relevant L3 measurements, for example, by disaggregating the amounts or including weighted averages when a wide range of inputs is disclosed. This disclosure should extend to adjustments applied to third-party valuation information, such as NAV statements.

Disclose sensitivity analyses for L3 measurements that are sufficient to satisfy the relevant requirements under IFRS, and FRS 102 where applicable.

Clearly explain which valuation technique(s) have been used in determining L3 measurements at the reporting date.

Provide reconciliations of APMs to their closest GAAP measures, or calculations/explanations when APMs cannot be reconciled directly to the financial statements.

Define and label APMs clearly and avoid comments that could indicate APMs have more authority than GAAP measures. Any refinements to APMs or changes in their use should be clearly explained.

Clearly explain the basis for determining whether the IFRS 10 investment entity definition is met, supported by relevant company-specific information, when this involves significant judgement.

Financial Reporting Council

London office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office: 5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300

Visit our website at www.frc.org.uk

Follow us on Linked in.

-

IFRS 13, 'Fair Value Measurement', paragraphs 72, 73, 86 and 87; FRS 102, 'The Financial Reporting Standard applicable in the UK and Republic of Ireland', paragraph 34.22 ↩

-

IFRS 13, paragraph 93(d) ↩

-

FRS 102, paragraphs 11.43 and 16.10(a) ↩

-

IFRS 13, 'Basis for Conclusions', BC190 ↩

-

IFRS 13, paragraph 94; FRS 102, paragraph 11.43 ↩

-

IFRS 13, paragraph 93(d) ↩

-

IFRS 13, 'Basis for Conclusions', paragraph BC195 ↩

-

IAS 1, 'Presentation of Financial Statements', paragraph 125; FRS 102, paragraph 8.7 ↩

-

IFRS 13, paragraph 93(h)(ii) and accompanying 'Basis for Conclusions', paragraph BC208 ↩

-

For periods commencing on or after 1 January 2027, subject to UK endorsement, IAS 1 will be replaced by IFRS 18 'Presentation and Disclosure in Financial Statements', while the requirements relating to estimation uncertainty will move to IAS 8, 'Basis of Preparation of Financial Statements' ↩

-

IAS 1, paragraph 133 ↩

-

FRS 102, paragraph 8.7 ↩

-

IFRS 13, paragraph 93(d); FRS 102, paragraphs 11.43 and 16.10(a) ↩

-

IFRS 13, 'Basis for Conclusions', paragraph BC200 ↩

-

IFRS 13, paragraph 93(g) ↩

-

See IFRS 13, 'Illustrative Examples', paragraph IE65 for examples of disclosures that may comply with paragraph 93(g) of IFRS 13 ↩

-

Companies Act 2006, section 414C ↩

-

ESMA Guidelines on Alternative Performance Measures, paragraph 26 ↩

-

ESMA Guidelines, paragraph 35 ↩

-

ESMA Guidelines, paragraphs 41 and 42 ↩

-

ESMA Guidelines, paragraph 22 ↩

-

ESMA Guidelines, paragraphs 20 and 21 ↩

-

IFRS 10, 'Consolidated Financial Statements', paragraph 31 ↩

-

Certain subsidiaries are still consolidated regardless of whether the investment entity definition is satisfied as outlined in paragraph 32 of IFRS 10 ↩

-

IFRS 10, paragraphs B85F to B85H and 'Illustrative Examples', paragraphs IE8, IE11(b) and IE14 ↩

-

IFRS 10, 'Basis for Conclusions', paragraph BC241 and 'Illustrative Examples', paragraph IE11(a) ↩

-

IAS 1, paragraph 122; IFRS 12, 'Disclosure of Interests in Other Entities', paragraph 9A ↩

-

FRS 102, paragraphs 9.9(b) and 9.9C ↩

-

FRS 102, paragraph 1.7A; FRS 100, 'Application of Financial Reporting Requirements', paragraph 6 ↩

-

UK Listing Rule 11.7.2R(3) ↩

-

The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, SI 2008/410, Schedule 1, paragraph 63(2) ↩