The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Annual Review of Corporate Reporting 2024/2025

How to use this report

This report provides information that is relevant to preparers and auditors of financial statements, investors and other users of corporate reports and accounts, and wider FRC stakeholders. It has been structured to help readers focus on the content best suited to their needs.

The Highlights section provides an overview of our activities and findings in 2024/25, our expectations for 2025/26 reports, and reporting developments, which we consider to be relevant to all stakeholders. This section outlines current key corporate reporting issues with links to more detailed material elsewhere in the report.

Our findings in greater depth contains further detail illustrating and explaining the reporting issues. We consider this content to be most relevant to those directly involved in the preparation, audit or analysis of annual reports and accounts.

The Appendices include detailed data providing transparency on our monitoring activities and outcomes, detailed findings from some of our thematic reviews, a summary of the upcoming changes to reporting requirements, and an overview of the scope of our reviews.

Example disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

The FRC does not accept any liability to any party for any loss, damage or costs, howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

- How to use this report

- Highlights

- 1. Executive summary

- 2. Our monitoring activities and outcomes: At a glance

- 3. Our findings: At a glance

- 4. Our key expectations for annual reports and accounts

- Our findings in greater depth

- 5. Top ten issues

- 5.1 Impairment of assets

- 5.2 Cash flow statements

- 5.3 Financial instruments

- 5.4 Presentation of financial statements and related disclosures

- 5.5 Revenue

- 5.6 Strategic report and other Companies Act 2006 matters

- 5.7 Judgements and estimates

- 5.8 Income taxes

- 5.9 Consolidated financial statements

- 5.10 TCFD, CFD and climate-related narrative reporting

- 6. Thematic and other reviews

- Thematic reviews

- Other reviews

- Digital reporting

- 6.1 Thematic review: Reporting by the UK's smaller listed companies

- 6.2 Thematic review: Share-based payments

- 6.3 Thematic review: Investment trusts, venture capital trusts and similar closed-ended entities

- 6.4 Thematic reviews: Other

- 6.5 Digital reporting

- Appendices

- Appendix 1: CRR monitoring activities: Review activities for the year

- Appendix 1: CRR monitoring activities: Publication of CRR interaction

- Appendix 1: CRR monitoring activities: Post-review survey

- Did you consider the matters raised to be clear and understandable?

- Were the matters raised in our review relevant to your company?

- Were the outcomes of our review proportionate?

- Has the quality of your corporate reporting improved as a result of our review?

- Did our review take place early enough in your reporting cycle to factor any issues raised into your subsequent annual report?

- Appendix 1: CRR monitoring activities: Engagement

- Appendix 2: Supplier finance arrangement disclosures

- Appendix 3: Review of disclosures of a pension accounting surplus

- Appendix 4: Developments in corporate reporting

- Appendix 5: Scope of CRR's work and interacting with our team

Highlights

1. Executive summary

- Quality of reporting by the FTSE 350 maintained

- Key areas for improvement are impairment, cash flow statements and explanations of key assumptions

- A lower proportion of our reviews resulted in substantive enquiry letters and restatements

- Lack of internal consistency within the annual report and accounts continues to be a significant driver of queries The Financial Reporting Council (FRC) applies a proportionate approach when considering whether company annual reports and accounts comply with the relevant reporting requirements, as described on page

- The Corporate Reporting Review (CRR) team upholds high standards of corporate reporting, which are important for maintaining investors' confidence and underpinning UK companies' access to the capital they need to scale and grow. Through our publications, including focused thematic reviews on complex and emerging reporting areas, we seek to support companies and drive up the quality of reporting. This report sets out the findings from our review work in our 2024/25 monitoring cycle and our expectations for the coming reporting season.

The quality of corporate reporting across the FTSE 350 companies reviewed in 2024/25 has been maintained. We are pleased to note that a lower proportion of our reviews this year resulted in substantive queries compared to previous years, with some reduction being evidenced for both companies within and outside the FTSE 350.

Overall, the number of restatements prompted by our reviews has fallen this year compared to the previous three years. There has also been a reduction in the number of these restatements that affect profit.

There remains a quality gap between companies in the FTSE 350 and other companies. We note that the majority of restatements continue to arise in companies outside the FTSE 350. We are undertaking a thematic review to look further into reporting by UK smaller listed companies, see section 6.1 for further detail.

Our most frequently raised issues remain consistent with recent years. Impairment tops the list for the third successive year, although we were pleased that we identified no matters requiring a restatement this year. However, we are disappointed by the continuing number of cash flow restatements resulting from our reviews. These were mainly classification errors by companies outside the FTSE 350, and this has been selected as an area of focus in the thematic review noted above.

Inconsistency of information and explanations between the financial statements and other sections of the report and accounts remains a key theme that resulted in our writing to companies.

As we have highlighted previously, in many cases our most common areas of challenge could have been identified by a sufficiently robust pre-issuance review. This remains one of our key expectations, which we ask those with oversight of the reporting process to consider.

The explanation of significant judgements and estimates, including disclosure of the key inputs and assumptions, remains an area for improvement in relation to several of the topics in our top ten including impairment testing, financial instruments and revenue.

There remain global political and economic risks, such as those relating to trade tariffs and ongoing international conflicts, that can contribute to increased uncertainty in these estimates and assumptions used by companies in preparing their annual report and accounts.

Developments in corporate reporting

Changes to IFRS accounting standards for the coming reporting season are relatively minor. With more extensive changes expected in future, such as the implementation of IFRS 18, 1 companies may wish to start considering the effects these will have on their reporting. Further information on developments in corporate reporting is set out in Appendix 4.

There are also new standards and guidance issued by the FRC applicable for the current reporting period including:

- The 2024 UK Corporate Governance Code (the Code) is applicable for periods beginning on or after 1 January 2025, with targeted revisions made compared to the previous Code. Provision 29, which asks boards to make a declaration in relation to the effectiveness of their material internal controls, applies to periods beginning on or after 1 January 2026.

- Additional disclosures required under FRS 102 2 for 'Supplier Finance Arrangements'.

Wider revisions, which align the accounting for revenue and leases under FRS 102 with IFRS principles, will apply for periods beginning on or after 1 January 2026.

The UK Government recently consulted on making UK Sustainability Reporting Standards (UK SRS), available for voluntary use in the UK, see Appendix 4. Subject to feedback, the Financial Conduct Authority (FCA) and the Government will then consult separately on introducing any mandatory disclosure requirements against these standards.

2025/26 reporting focus

With a stable set of reporting requirements and similar recurring themes in the matters raised with companies, our expectations for the coming reporting season remain consistent with those highlighted in recent years. We encourage companies to consider the matters set out in section 4 when preparing their next annual report and accounts.

The relevant reporting requirements – how much is enough?

The financial reporting framework in the UK is principles-based and requires the application of judgement. Preparers must consider the following overarching requirements in determining which information requires disclosure in their annual report and accounts:

- the financial statements must present a true and fair view [s393 Companies Act 2006; IAS 1.15 3]

- the annual report and accounts, taken as a whole, should be fair, balanced and understandable [UK Corporate Governance Code Principle N, where applicable]

- the strategic report must be fair, balanced and comprehensive [s414C Companies Act 2006]

- specific disclosures required by accounting standards need not be provided if the information resulting from that disclosure is not material [IAS 1.31]

- companies are required to consider whether to provide additional disclosures if the specific requirements of IFRS accounting standards are insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity's financial position, financial performance and cash flows [IAS 1.17(c), 31 and 112(c)]

We do not expect companies to go beyond what is necessary to comply with these requirements and note that good quality reporting does not necessarily require a greater volume of disclosure.

Our proportionate approach to corporate reporting review

Our formal powers relating to corporate reporting review are derived from the Companies Act 2006 and other relevant legislation.

This report sets out the areas where we most frequently challenge companies on their reporting by asking the directors for further information or explanations about their annual reports and accounts. We only ask companies a substantive question when it appears that there is, or may be, a material breach of the relevant reporting requirements.

We principally engage with companies on a voluntary basis. We rarely resort to the use of our formal powers and have not done so in the year under review. Further information about our approach, powers and remit is set out in our Operating Procedures for Corporate Reporting Review. Further details are also included in Appendix 5.

Proportionality and materiality are carefully considered at every stage of our review work. We are mindful of our duties to support UK economic growth and protect stakeholders in the public interest, by promoting high standards in corporate reporting while avoiding disproportionate impact on those we regulate.

This year we have continued to challenge ourselves on the application of proportionality. We have assessed the effectiveness of raising observations in the appendices to our letters in driving improvements in companies’ reporting. This approach can reduce the burden of responding to a substantive enquiry. See Appendix 1 for further information.

2. Our monitoring activities and outcomes: At a glance

Reviews performed * 2024/25: 222 * 2023/24: 243 * 2022/23: 263

We performed fewer reviews this year, partly impacted by longer recruitment timescales for specialist reviewers with the required technical expertise, although these roles have now been successfully filled. In addition, a higher proportion of our reviews this year were full scope reviews, which are more resource-intensive than thematic reviews. In such circumstances we postpone lower risk reviews. We expect this to increase back to the 240-260 range in 2025/26.

FTSE 350 (% of reviews) * 2024/25: 38% * 2023/24: 40% * 2022/23: 59%

Reviews of FTSE 350 companies, which are selected over a five-year cycle, made up less than 50% of our reviews again this year. The nature of the thematic reviews completed during the last two years meant that the selections for these included a higher proportion of AIM and large private companies.

Substantive letter write-rate - % of reviews * 2024/25: 37% * 2023/24: 47% * 2022/23: 43% * Of which: FTSE 350 * 2024/25: 26% * 2023/24: 28% * 2022/23: 36% * Other companies * 2024/25: 44% * 2023/24: 61% * 2022/23: 52%

We write 'substantive letters' to companies when we need additional information or further explanations to help us understand their reporting more fully. We are pleased that the 'substantive letter write-rate', as a percentage of reviews performed, has decreased this year for both companies within and outside the FTSE 350. This reduction is in part attributable to an improvement in the quality of reporting of the companies reviewed, with other factors affecting this discussed further in Appendix 1.

Although less pronounced than the prior year, we note there remains a gap between the FTSE 350 and other companies. There are a number of factors other than quality that affect this statistic and these are set out in Appendix 1. We are undertaking a thematic review to look further into reporting by UK smaller listed companies, see section 6.1 for further detail.

To provide transparency over our findings, we continue to publish case summaries for reviews that resulted in substantive enquiries. This process is explained further in Appendix 1, together with more detailed information about our activities and outcomes, required references, and how we collaborate with other public bodies as well as across the FRC.

Required references to the FRC's review * 2024/25: 18 * 2023/24: 26 * 2022/23: 25

We ask companies to refer to our review in their next annual report and accounts when more significant changes are made as a result of our enquiries, typically when the company restates comparative information in primary financial statements.

We were pleased to see a reduction in the number of required references. The majority relate to cash flow reclassifications and other presentational matters, with only one (2023/24: five) affecting profit.

3. Our findings: At a glance

The top ten areas where we asked companies substantive questions in 2024/25 are summarised below.

| Ranking 24/25 | Ranking 23/24 | Topic | Percentage of reviews where issue identified 24/25 | Percentage of reviews where issue identified 23/24 |

|---|---|---|---|---|

| 1 | 1 | Impairment of assets | 10% | 12% |

| 2 | 2 | Cash flow statements | 9% ! | 11% |

| 3 | 3 | Financial instruments | 9% ! | 10% |

| 4 | 5 | Presentation of financial statements | 5% ! | 6% |

| 5 | 4 | Revenue | 5% | 9% |

| 6 | 6 | Strategic report and Companies Act 2006 | 4% | 5% |

| 7 | 7= | Judgements and estimates | 3% | 5% |

| 8= | 7= | Income taxes | 2% ! | 5% |

| 8= | - | Consolidated financial statements | 2% | 1% |

| 10 | 9= | TCFD4, CFD5 and climate-related narrative reporting | 2% | 4% |

Our headline expectations for the coming reporting season, and how to avoid these most common areas of challenge, are summarised in section 4.

A full description of the nature of the top ten issues we identified, including our detailed expectations for future reporting periods, is included in the section Our findings in greater depth.

! Restatements of a company's financial statements and a reference to our review were required in these topic areas. Appendix 1 includes a complete list of such references.

Thematic and sector-focused reviews

Performing focused thematic work allows us to assess the quality of reporting on emerging or complex areas, set out clear expectations, and provide companies with guidance and good practice examples. Reports reviewed as part of a thematic review represented a lower proportion (16%) of our casework this year. The findings of substantive enquiries arising from thematic reviews are incorporated in our top ten issues in the year the review is performed.

Supplier finance arrangement disclosures

IFRS accounting standards have been amended to include specific disclosure requirements for supplier finance arrangements. We conducted a limited scope review of the reporting for a selection of companies that provided these disclosures. Appendix 2

Share-based payments

The thematic review will focus on listed companies with significant share-based payment arrangements, and will clarify expectations on recognition, measurement and classification of such arrangements. Section 6.2

Good practice disclosures, as referred to in our thematic review reports, are those that represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts.

Structured digital reporting

During the year the FRC launched its CODEx tools including the free, publicly available, UK iXBRL viewer designed to make structured financial data more accessible and usable. The FRC also published its 2024/25 insights on structured digital reporting in April

- See section 6.5.

Reporting by the UK's smaller listed companies

We will look more closely at the quality gap between FTSE 350 companies and other companies that has been highlighted in this and previous annual reviews. Following on from our thematic review on reporting by the UK's largest private companies, this thematic review will focus on the reporting by listed companies ranked outside of the FTSE 350 and those listed on AIM. Section 6.1

Investment trusts, venture capital trusts and similar closed-ended entities

Investment companies typically hold a portfolio of investments, providing investors with a broad range of exposure through a single investment. They make up a meaningful proportion of the FTSE 350. The thematic review focuses on a number of reporting topics, including fair value measurement disclosures, which have been identified from recent casework and reviews of a selection of such companies. Section 6.3

Review of disclosures of a pension accounting surplus

In recent years we have observed that many companies have reported a pensions accounting surplus. We reviewed the disclosures made by a selection of companies that have recognised such an asset in their most recent financial statements. Appendix 3

4. Our key expectations for annual reports and accounts

The FRC seeks to support companies in complying with the relevant reporting requirements, and providing high-quality information, in their annual reports and accounts. Our headline expectations for the coming reporting season, and how to avoid the most common areas of challenge, are set out below. In all cases, we expect directors to apply careful judgement in the preparation of the annual report and accounts. We only ask companies a substantive question when it appears that there is, or may be, a material breach of the relevant reporting requirements.

Pre-issuance checks

Ensure the company has a sufficiently robust review process in place to identify common technical compliance issues.

Many questions, corrections and restatements could be avoided by reviewing against the top ten issues we challenge, including ensuring that clear, company-specific accounting policies are included for key matters such as revenue recognition.

Judgements, risks and uncertainties

Ensure clear and consistent disclosures about judgements, uncertainty and risk are provided that are sufficient for users to understand the positions taken in the financial statements.

We frequently ask companies to enhance their disclosures when they fail to comply with requirements in these areas.

Narrative reporting

Ensure the strategic report includes a fair, balanced and comprehensive review of the company's development, position, performance and future prospects.

Take care to comply with the applicable climate-related reporting requirements,6 ensuring disclosures are concise and that material information is not obscured.

These are the areas the FRC identified as common challenges: * 1. Impairment * 2. Cash flow statements * 3. Financial instruments * 4. Presentation of financial statements * 5. Revenue * 6. Strategic report and Companies Act 2006 * 7. Judgements and estimates * 8= Income taxes * 8= Consolidated financial statements * 10. TCFD, CFD and climate-related narrative reporting

Take a step back and consider whether the annual report and accounts as a whole

- tells a consistent and coherent story throughout the narrative reporting and financial statements

- is clear, concise and understandable

- includes all material and relevant information, including information not specifically required by standards, where it is necessary for users' understanding 7

- includes only material and relevant information 7 – good quality reporting does not necessarily require a greater volume of disclosure

Our findings in greater depth

5. Top ten issues

This section explores the most common topics on which we raised substantive questions with companies in our 2024/25 monitoring cycle. It covers case reviews opened between 1 April 2024 and 31 March 2025, generally companies with year-ends between December 2023 and November

- The topics are ranked in order of the number of companies involved and for each, we outline the more significant or common issues that arose as a result of our reviews.

The issues we highlight in these summaries are not a complete list of possible errors for each accounting topic, but they do provide insights into common areas for improvement. We encourage preparers to read the summaries and related thematic review reports and consider whether the matters raised are relevant to their own reports and accounts.

Additional information about specific cases is available in case summaries, which detail our findings in relation to closed cases that involved substantive queries. This is explained further in Appendix 1.

| Rank | % of cases | Topic |

|---|---|---|

| 1 | 10% | Impairment of assets |

| 2 | 9% | Cash flow statements ! |

| 3 | 9% | Financial instruments ! |

| 4 | 5% | Presentation of financial statements ! |

| 5 | 5% | Revenue |

| 6 | 4% | Strategic report and Companies Act 2006 |

| 7 | 3% | Judgements and estimates |

| 8= | 2% | Income taxes ! |

| 8= | 2% | Consolidated financial statements |

| 10 | 2% | TCFD, CFD and climate-related narrative reporting |

Represents key points to consider when preparing annual reports and accounts. The word 'should' is used in this report to describe accounting applications or disclosures that are required if material and relevant.

! Restatements of a company's financial statements and a reference to our review were required in these topic areas. A complete list of such references can be found in Appendix 1.

5.1 Impairment of assets

For the third consecutive year, impairment of assets is the issue that resulted in the most substantive enquiries (10% of companies reviewed, 2023/24: 12%). However, this year our enquiries did not result in any restatements (2023/24: four companies restated their parent company financial statements to recognise an impairment of their investments in subsidiaries).

The issues involved in our questions remained largely unchanged from last year. Many of our queries could have been avoided by clearer, more comprehensive impairment disclosures, or better connectivity between these disclosures and other areas of the financial statements.

Key inputs and assumptions

We asked companies for further information when:

- assumptions appeared to be inconsistent with those used elsewhere in annual reports, such as viability statements

- it was not clear how key assumptions, such as growth rates, were calculated and whether they reflected past experience and external information

- it appeared that cash flows used to estimate value in use (VIU) included those arising from the enhancement of assets

- disclosure of sensitivities, or the amount by which a key assumption must change in order to reduce headroom to nil, appeared to be required by IAS 36, 'Impairment of Assets', or IAS 1 but had not been given

- it was unclear whether the effect of tax was consistently reflected in the discount rates and projected cash flows

- a single discount rate was used for all cash-generating units (CGUs), despite their different risk profiles

Impairment method

We questioned companies when:

- it was unclear how CGUs had been determined, or goodwill had been allocated to CGUS

- goodwill appeared to have been allocated to a CGU larger than an operating segment

- it was not clear how cashflows relating to online sales revenue had been allocated to CGUs

- liabilities had been deducted from the carrying amount of CGUs

Recoverability of investments in subsidiaries

We sought clarification when:

- the net assets of the parent company significantly exceeded its market capitalisation but there was no evidence that this had been considered as an indicator of impairment

- it was unclear whether the parent company's impairment testing had considered the subsidiaries' liabilities, including amounts owed to the parent company

Companies should ensure that ...

- they provide adequate disclosures about the key inputs and assumptions used in their impairment testing, including justifying the use of financial budgets/forecasts for periods longer than five years [IAS 36.134; IAS 1.125]

- the effect of tax is consistently reflected in the discount rates and projected cash flows used in VIU calculations [IAS 36.51], discount rates used are consistent with how the market would assess the specific risks associated with the asset's estimated cash flows [IAS 36.56], and the forecasts used for VIU calculations reflect the asset in its current condition [IAS 36.44]

- for impairment testing, goodwill acquired in a business combination is not allocated to a CGU or group of CGUs that is larger than an operating segment as defined by IFRS 8, 'Operating Segments', before aggregation [IAS 36.80(b)]

- impairment reviews and related disclosures appropriately reflect information elsewhere in the report and accounts about events or circumstances that are indicators of potential impairment, as well as information about the company's business operations and principal risks. We challenge companies when we identify potentially material inconsistencies about the fact pattern or management's assumptions

- they explain the sensitivity of recoverable amounts to reasonably possible changes in assumptions, or the amount by which a key assumption must change in order to reduce headroom to nil, where required [IAS 36.134(f); IAS 1.129]

Further guidance is available in our previous thematic reviews on impairment of non-financial assets and discount rates.

Companies should ensure that ...

- they provide adequate disclosures about the key inputs and assumptions used in their impairment testing, including justifying the use of financial budgets/forecasts for periods longer than five years [IAS 36.134; IAS 1.125]

- the effect of tax is consistently reflected in the discount rates and projected cash flows used in VIU calculations [IAS 36.51], discount rates used are consistent with how the market would assess the specific risks associated with the asset's estimated cash flows [IAS 36.56], and the forecasts used for VIU calculations reflect the asset in its current condition [IAS 36.44]

- for impairment testing, goodwill acquired in a business combination is not allocated to a CGU or group of CGUs that is larger than an operating segment as defined by IFRS 8, 'Operating Segments', before aggregation [IAS 36.80(b)]

- impairment reviews and related disclosures appropriately reflect information elsewhere in the report and accounts about events or circumstances that are indicators of potential impairment, as well as information about the company's business operations and principal risks. We challenge companies when we identify potentially material inconsistencies about the fact pattern or management's assumptions

- they explain the sensitivity of recoverable amounts to reasonably possible changes in assumptions, or the amount by which a key assumption must change in order to reduce headroom to nil, where required [IAS 36.134(f); IAS 1.129]

Further guidance is available in our previous thematic reviews on impairment of non-financial assets and discount rates.

5.2 Cash flow statements

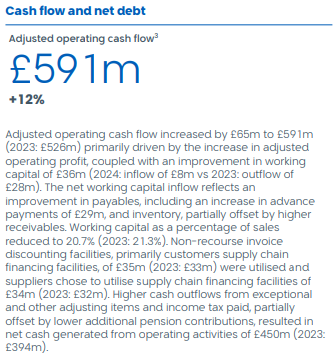

Similar to last year, cash flow statements resulted in the second highest number of substantive queries (9% of companies reviewed, 2023/24: 11%). It also continues to be one of the most common reasons for companies making a prior year restatement as a result of our enquiries, although the number of companies restating their cash flow statement fell to 12 compared to 16 last year. The main issues identified related to classification of cash flows by companies outside the FTSE 350, an area that is being considered as part of our 2024/25 Reporting by the UK's smaller listed companies thematic review. In other cases, we found inconsistencies between amounts or descriptions in the cash flow statement and other information in the report and accounts. In many cases, our questions could have been avoided by clearer explanations of transactions and the rationale for the treatment of the related cash flows. The International Accounting Standards Board (IASB) is currently undertaking a research project on the cash flow statement as this was rated as a high priority by the users they consulted.

Classification of cash flows

We sought clarification of the classification of several material cash flows, including: !

- the purchase or sale of non-controlling interests classified as investing, rather than financing, activities

- the settlement of borrowings of an acquiree on or shortly after acquisition classified as an investing cash flow

- the payment of deferred consideration for prior year acquisitions of subsidiaries presented as an operating, rather than investing, cash flow

- the repayment of loans to group undertakings classified as operating or financing, rather than investing, cash flows

- payments to acquire assets held for rental to others and subsequently held for sale classified as investing, rather than operating activities

- reclassification of interest on wholesale borrowings from financing activities to operating activities during the year

We also challenged a company when deferred consideration paid in relation to an acquisition of a subsidiary was classified inconsistently in the consolidated and parent company statements of cash flows.

Reported cash flows

We questioned companies when: !

- there appeared to be material inconsistencies between amounts or descriptions in the cash flow statement and other information in the report and accounts, for example when cash flows in relation to purchases of property, plant and equipment were significantly different from the additions amount reported in the notes to the accounts

- it was not clear how working capital adjustments included within operating cash flows related to movements in the corresponding statement of financial position line items

- it appeared that non-cash transactions were included in the cash flow statement, for example when dividends payable were settled through netting arrangements but presented as cash outflows from financing activities or operating cash flows were not adjusted for a non-cash tax expense

- cash flows appeared to have been inappropriately aggregated, for example on purchases of intangible assets and property, plant and equipment

Cash and cash equivalents

We requested more information when:

- the cash and cash equivalents amount presented in the statement of cash flows was materially inconsistent with the corresponding amount presented in the statement of financial position

- a term deposit with a maturity of more than three months from the date of acquisition was included within cash and cash equivalents !

Disclosures

We queried a company that did not present a reconciliation of changes in liabilities from financing activities.

We asked a company for further information about the consideration received for the issue of share capital and settled intercompany loans. The consideration appeared to be non-cash, but no disclosure of non-cash transactions had been provided. !

Companies should ensure that ...

- the classification of cash flows, as well as cash and cash equivalents, complies with relevant definitions and criteria in the standard [IAS 7, 'Statement of Cash Flows', paragraph 6]

- amounts and descriptions of cash flows are consistent with those reported elsewhere in the report and accounts

- cash flows are not inappropriately netted in both the group and (where applicable) parent company cash flow statement [IAS 7.21]

- non-cash investing and financing transactions are excluded from the statement and disclosed elsewhere if material [IAS 7.43]

- materially dissimilar classes of cash flows are presented separately [IAS 1.29; IAS 7.21]

Further guidance is available in our previous thematic review of cash flow and liquidity disclosures, which includes a list of the consistency checks our reviewers perform, and our 2024 thematic review of offsetting in the financial statements.

5.3 Financial instruments

The number of substantive questions raised in relation to financial instruments was similar to last year (9% of companies reviewed, 2023/24: 10%), and the subject remains at third place in our top ten issues. In 2024/25, three companies restated their primary statements as a result of these enquiries (2023/24: nil). All restatements related to inappropriate application of the offsetting requirements for financial instruments. The type of questions we raised is similar to previous years, although a number of our queries in 2024/25 related to relatively unusual or more complex transactions. Our questions could often have been avoided by companies including more complete and specific disclosure of relevant accounting policies and financial risks.

Scope, recognition, derecognition and measurement

We asked companies for further information when:

- obligations to repurchase the company's own shares were disclosed, but not recognised, and it was unclear whether such commitments could be avoided

- warrants issued as consideration in a business combination were classified as equity instruments but there appeared to be variability in the number of shares to be issued

- the accounting policies did not make clear how significant items, such as royalty arrangements, had been determined to be within the scope of IFRS 9, ‘Financial Instruments', or how contracts to buy or sell a non-financial item, which the company typically settled net in cash, qualified for the own-use exemption

- the accounting treatment applied to embedded derivatives in the financial statements did not appear to be consistent with the related accounting policy or was not clear

- financial instruments were measured initially at face value, which did not appear to represent fair value

- it was not clear whether the repeated extension of a related party loan receivable constituted a modification

Offsetting

We requested more information when companies had offset cash and overdraft balances but it was unclear whether the qualifying criteria for offset had been met. !

Expected credit loss (ECL) provisions and credit risk

We asked companies to explain:

- how the ECL requirements of IFRS 9 had been applied to material amounts owed by group companies in parent company financial statements

- the omission of credit risk disclosures when other disclosures implied a material risk existed or when ECLs were disclosed as a key source of estimation uncertainty

- apparent inconsistencies between the narrative around forward-looking conditions and a reduction in the ECL rate

Other disclosures

We questioned companies that had significant investments in unquoted companies but had not provided quantitative disclosures about their exposure to market risk, for example information about the valuation techniques and assumptions used by the company.

Companies should ensure that

- sufficient information is given to explain all material financial instruments, including company-specific accounting policies [IAS 1.117]

- the nature and extent of material risks arising from financial instruments and related risk management are adequately disclosed, particularly in relation to material exposure to credit risk [IFRS 7, ‘Financial Instruments: Disclosures', paragraphs 31-42]

- the approach and significant assumptions applied in the measurement of ECLs are appropriate, and concentrations of risks, when material, have been considered, including in the parent company financial statements where relevant [IFRS 9.5.5.17]

- the financial risk assumptions and disclosures reflect the risks and circumstances disclosed elsewhere in the financial statements

- cash and overdraft balances have been offset only when the qualifying criteria have been met. Balances that are part of a cash-pooling arrangement that includes a legal right of offset may only be offset in the balance sheet when there is also an intention either to settle on a net basis, or to realise the asset and settle the liability simultaneously [IAS 32, 'Financial Instruments: Presentation', paragraph 42]. Our 2024 thematic review of offsetting in the financial statements sets out more information in this area.

5.4 Presentation of financial statements and related disclosures

We raised fewer substantive questions in this area as a proportion of companies reviewed in 2024/25 (5% of companies reviewed, 2023/24: 6%). However, nine (2023/24: ten) companies restated their primary statements, either as a direct result of these enquiries or as a result of enquiries in other areas that resulted in presentational restatements.

Presentation of primary statements

We challenged companies when:

- the classification of amounts due from subsidiaries as current or non-current appeared to be inconsistent with other information

- material impairment losses in relation to financial assets (including trade receivables) were not presented separately on the face of the income statement !

- an adjusted measure of revenue was presented on the face of the income statement, and the statutory measure was omitted !

- the notes appeared to include immaterial information that reduced the understandability of the financial statements by obscuring material information

Disclosures and other matters

We wrote to companies when:

- the accounting policy for a material transaction or amount was either not included, or not explained in sufficient detail for readers to understand its substance

- material balances were not separately disclosed in the notes to the financial statements or on the face of a primary statement !

- there appeared to be discrepancies between the reported amounts of material balances disclosed in different notes

- insufficient information was disclosed in relation to the nature of an unusual or complex transaction

Company responses to some of our substantive queries in other areas also resulted in changes to the disclosure of material accounting policies.

Companies should ensure that ...

- company-specific material accounting policy information is clearly disclosed [IAS 1.117]

- sufficient information is disclosed in the notes to allow users to understand unusual or complex transactions and how these are reflected in the accounts and information is reported consistently across the financial statements [IAS 1.17; 112]

- the financial statements are reviewed carefully to avoid common areas of non-compliance with IAS 1, including the classification of receivables as current or non-current [IAS 1.66] and the presentation of material impairment losses in relation to financial assets on the face of the income statement [IAS 1.82(ba)]

5.5 Revenue

We raised comparatively fewer substantive queries on revenue recognition and related disclosures in 2024/25 (5% of companies reviewed, 2023/24: 9%). This is partly due to revenue being an area considered as part of our 2023/24 Reporting by the UK's largest private companies thematic review, which led to an increased number of queries last year. Our queries often related to the clarity of related accounting policy and significant judgement disclosures. Companies were generally able to address our enquiries by providing more explanation and agreeing to enhance their future disclosures.

IFRS 15 accounting policies

We questioned accounting policies that:

- were unclear about the rationale for recognising revenue over time and the methods for measuring progress towards satisfaction

- implied that fees charged by external finance houses, for companies offering interest-free credit, had been offset against revenue, rather than classified as an expense

- were unclear about how the transaction price had been determined, including how the effect of variable consideration had been considered

- did not explain whether the company was acting as principal or agent, the basis for determining this, and whether this involved significant judgement

- did not explain the nature of, and accounting policies applied to, a significant revenue stream

We also challenged companies when:

- it appeared that revenue was recognised prior to the performance obligation being satisfied

- revenue was recognised on a contract under IFRS 15, ‘Revenue from Contracts from Customers', even though one of the criteria in paragraph 9 of IFRS 15 – namely, that collection of consideration from the customer is probable – did not appear to be met

- contract liabilities appeared to have been inappropriately netted with other amounts

Other issues

We requested more information when companies had not provided disclosures on:

- the transaction price allocated to the remaining performance obligations when the exemption in paragraph 121 of IFRS 15 did not appear to apply

- contract balances, as required by paragraph 116 of IFRS 15

- turnover by class of business (for UK GAAP preparers) and it was not clear why it was considered seriously prejudicial to the interests of the company

Companies should ensure that ...

- sufficient information is provided for all significant revenue streams, including [IAS 1.117-117E; IFRS 15.110]:

- specific accounting policies

- the timing of revenue recognition

- the basis for recognising any revenue over time

- the methodology applied

- significant judgements made in relation to revenue recognition are disclosed [IFRS 15.123]

More guidance on this topic is available in our 2019 thematic review of IFRS 15 Disclosures and our 2020 follow up report, as well as our 2023/24 thematic review of Reporting by the UK's largest private companies.

5.6 Strategic report and other Companies Act 2006 matters

We raised fewer substantive questions in this area than in the prior year (4% of companies reviewed, 2023/24: 5%). The most common Companies Act 2006 matter we raised with companies continues to be compliance with distributable profits requirements when paying dividends. We also continue to challenge companies where it is unclear whether the strategic report meets the requirement to be fair, balanced and comprehensive.

Distributable profits and other Companies Act 2006 issues

We queried the lawfulness of dividends that were not supported by the company's last audited accounts, and the interim accounts had not been filed at Companies House, as required by section 838(6) of the Companies Act 2006 for public companies.

We also asked questions in relation to:

- significant differences between the share premium balance disclosed in the consolidated and parent company financial statements

- unrealised profits in respect of intercompany transactions included in the profit and loss account for companies preparing accounts under UK GAAP

- the timing of the recognition of a distribution

Fair, balanced and comprehensive

We asked companies for more information when the description of the business model and strategy in the strategic report disclosure was unclear.

We also challenged a parent company that headed a large group taking advantage of the small companies' exemption from presenting a strategic report.

Companies should ensure that ...

- the strategic report provides a fair, balanced and comprehensive review of the company's development, position, performance and future prospects. Further guidance is available in the FRC's Guidance on the Strategic Report (June 2022). This guidance explains that the review should include an unbiased discussion of positive and negative aspects of performance and, where appropriate, include references to, and additional explanations of, amounts included in the financial statements [s414C(2)(a), (3) and (12) Companies Act 2006].

- in the case of a quoted company, the strategic report should include a clear description of the company's strategy and business model [s414C(8)(a) and (b)]

- all statutory requirements for the payment of dividends have been met [Part 23 Companies Act 2006]

5.7 Judgements and estimates

The frequency of substantive queries on significant judgements and estimates decreased from last year (3% of companies reviewed, 2023/24: 5%). Providing high quality disclosures in this area continues to be important. In the current climate, where ongoing conflicts and trade disputes increase economic and geopolitical uncertainty, such disclosures are vital to enable users to appreciate the effects of these uncertainties on the financial statements.

Key sources of estimation uncertainty

We challenged companies when:

- disclosures of estimation uncertainty did not include sufficient information about key assumptions, or the sensitivities to changes in those assumptions or ranges of potential outcomes

- significant estimates were disclosed but did not appear to have a significant risk of resulting in a material adjustment to the carrying amount of assets and liabilities within the next financial year

Significant accounting judgements

We questioned companies when:

- the information provided did not cover all aspects of the factors that the directors would have been reasonably expected to consider in making a judgement

- other disclosures suggested that a significant judgement had been made but no disclosures required by IAS 1 had been given

In some cases, responses to other queries on particular accounting treatments indicated that significant judgements had been made that had not been disclosed.

Companies should ensure that ...

- all significant judgements have been described in appropriate detail, including explanations of the uncertainties involved [IAS 1.122]

- disclosures of key sources of estimation uncertainty are clearly distinguished from other estimates, and contain sufficient company-specific information. A list of uncertainties is not sufficient [IAS 1.125]

- sufficient information is provided in order for users to understand significant estimates, for example disclosure of sensitivities and the range of possible outcomes [IAS 1.129]

Our 2022 thematic review of judgements and estimates provides further guidance on this topic.

5.8 Income taxes

Fewer substantive questions were raised in this area this year (2% of companies reviewed, 2023/24: 5%), although one company restated its primary statements as a result of our enquiries (2023/24: two) and the topic remains firmly in our top ten. Details of this restatement are included in Appendix 1. Clarification of the calculation and presentation of deferred tax, linkages with the effective tax rate reconciliation and support for the recoverability of deferred tax assets were the most common aspects we queried.

Recoverability of deferred tax assets (DTAs)

We challenged the recoverability of DTAs when:

- companies with a recent history of losses had not disclosed details of the evidence supporting their recognition, as required by IAS 12, 'Income Taxes'

- a company recognised significant deferred tax assets in relation to share-based payment deductions, but it was not clear how the timing of exercise of options, as well as the forecast taxable profits, had been considered in the assessment of when these deductions would be utilised

Recognition of deferred tax assets and liabilities

We raised a query with a company in relation to the measurement basis of the deferred tax liability associated with a retirement benefit surplus.

Other issues

We asked companies to explain:

- apparent inconsistencies between information in the tax reconciliation and information elsewhere in the financial statements

- the rationale for recognising movements in deferred tax balances in other comprehensive income or directly in equity !

Companies should ensure that

- the evidence supporting recognition of deferred tax assets and related uncertainties is disclosed in sufficient detail to provide useful information to users [IAS 12.82; IAS 1.122, 125]

- transparent and informative tax disclosures are provided [IAS 12.79-85]

- the disclosures relating to Pillar Two income taxes are given when applicable [IAS 12.4A; IAS 12.88A-D]

- disclosures and assumptions are consistent with those disclosed elsewhere in the annual report and accounts

Further guidance can be found in our previous thematic review reports on deferred tax assets and more general tax matters.

5.9 Consolidated financial statements

This is the first time in recent years that consolidated financial statements has appeared in our top ten. Substantive queries were raised in 2% (2023/24: 1%) of reviews. Many of our queries arose because of inconsistencies between the significant judgements disclosures on control and disclosures in other areas of the financial statements. In other cases, our queries related to unusual or complex transactions where companies had not explained clearly enough how they had applied the requirements of IFRS 10, ‘Consolidated Financial Statements'.

Control

We challenged a company's conclusion that it did not control, and so did not consolidate, an investee.

We asked for more information from companies that:

- did not appear to consider the presence of significant financing provided by the company in determining that it exercised joint, rather than sole, control over an investee

- treated a 49% equity holding in an investee as an investment in a subsidiary but had not disclosed any judgements or assumptions made in reaching this conclusion and did not include any amounts for non-controlling interests

Loss of control

We questioned companies when:

- the accounting treatment applied to transactions that changed a parent company's ownership interest in a subsidiary, but did not result in loss of control, was not clear

- it was not clear how a gain on partial disposal of an investment in a mining asset had been calculated

Companies should ensure that ...

- significant judgements made in assessing whether an investor controls an investee disclose the factors considered in making this assessment and address each of the requirements of paragraph 7 of IFRS 10, and the relevant supporting paragraphs [IFRS 10.7, IAS 1.122]

- disclosures on the investors' relationship with the investee that affect the control assessment are reported consistently throughout the annual report and accounts

5.10 TCFD, CFD and climate-related narrative reporting

We continue to work closely with the FCA in relation to TCFD reporting in line with the supervisory strategy explained in Primary Market Bulletin 36. This year, we have reviewed the extent of compliance with the new Companies Act 2006 CFD requirements for the first time. In addition, we continue to review the extent to which material information about the effects of climate change is incorporated into the financial statements, and the consistency with the degree of emphasis placed on climate-related risks and uncertainties identified in companies' narrative reporting.

We have had fewer substantive queries in respect of TCFD, CFD and climate-related narrative reporting in 2024/25 (2% of reviews, 2023/24: 4%). This is the third year of reporting against the TCFD framework for most listed companies and the frequency of substantive queries on TCFD is lower than it has been in preceding years. This is consistent with companies becoming more familiar with reporting in accordance with this framework. This year, our questions were almost all in respect of CFD and these arose mainly as a result of our 2025 thematic review of Climate-related Financial Disclosures by AIM and Large Private Companies.

Climate-related Financial Disclosures (CFD)

We questioned companies that did not provide a qualitative or a quantitative analysis of the resilience of the company's business model and strategy considering different climate-related scenarios.

We also challenged a parent company that headed a large group that incorrectly applied the small companies' exemption from presenting a strategic report (including the CFD disclosures).

Taskforce for Climate-related Financial Disclosures (TCFD)

We asked a company to explain an apparent inconsistency between the reporting boundary used for its principal greenhouse gas (GHG) emissions target disclosed under the TCFD framework, and that for GHG data reported elsewhere in the annual report and accounts, and to confirm the basis of calculation of this target.

Companies in scope of the relevant requirements should ensure that ...

- disclosures are clear, concise and entity-specific

- it is clear how any material financial impact of climate change has been reflected in the financial statements

- all CFD disclosure requirements are provided in the annual report and accounts. Unlike the FCA listing rule for TCFD, cross-referring to information presented outside the annual report and accounts does not comply with the requirements of the Companies Act 2006. CFD disclosures are also mandatory and are not given on a comply-or-explain basis.

Further information about our findings on TCFD and CFD reporting is available in our 2022, 2023 and 2025 thematic review reports.

6. Thematic and other reviews

This section summarises the key findings of our thematic reviews undertaken since the publication of our Annual Review of Corporate Reporting 2023/24 in September 2024.

Thematic reviews

| Reporting by the UK's smaller listed companies (due in autumn 2025) | Investment trusts, venture capital trusts and similar closed-ended entities (due in autumn 2025) |

|---|---|

| Share-based payments (due in autumn 2025) | Review of disclosures of a pension accounting surplus |

| Supplier finance arrangement disclosures |

During the year we held several outreach meetings with investors to help inform the scope and focus of our thematic reviews of investment trusts, venture capital trusts and similar closed-ended entities as well as reporting by the UK's smaller listed companies.

Other reviews

We have embedded our monitoring of Directors' Remuneration Report (DRR) and UK Corporate Governance Code (the Code) reporting into our routine reviews.

In 2024/25 we reviewed the DRR disclosures of 10 (2023/24: 10) companies against the requirements of Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008.

We also reviewed the corporate governance disclosures of 25 (2023/24: 25) companies focusing on the quality of disclosures around the application of the principles and the adequacy of explanations for departures from the Code.

A key feature of the Code's flexibility is its 'comply or explain' approach. This means companies can depart from a provision when circumstances warrant it, provided they offer a high-quality explanation of why their chosen approach constitutes good governance.

No substantive queries were raised from these reviews (2023/2024: one in relation to DRR) although we did raise a small number of points in the appendix of our letters to draw companies' attention to matters where there was scope to improve their reporting against the Code or DRR requirements.

Digital reporting

Working with the FCA, the FRC published its 2024/25 insights on structured digital reporting in April

- This included a review of 25 annual reports in a structured digital format (iXBRL) filed in 2024. Further information is provided in section 6.5 along with details of how CRR will be incorporating this into a selection of our reviews going forward.

6.1 Thematic review: Reporting by the UK's smaller listed companies

As noted earlier in this report, and in previous years, companies outside the FTSE 350 are significantly more likely to receive a substantive letter as a result of our reviews, and our enquiries are more likely to result in a restatement of a primary financial statement. Although the number of restatements affecting consolidated profit remain relatively low, there appear to be areas of presentation and disclosure where smaller listed companies' reporting is of lower quality than their larger counterparts. Companies in this market segment are often engines of growth in the economy. Their annual reports are particularly valued by investors given the reduced analyst coverage and other reliable publicly available data. Good quality corporate reporting may lead to improved access to, and lower cost of, capital.

The thematic review will provide further information to smaller listed companies on the areas where we have identified non-compliance and provide expanded guidance on our expectations in relation to these areas.

Focus of review

The thematic review will focus on the areas where we have most frequently asked substantive questions of smaller listed companies as part of our routine monitoring work in recent years, which are also areas to which investors pay particular attention:

- impairment of non-financial assets

- revenue recognition

- financial instruments

- cash flow statement and related notes

We also intend to explain our approach to proportionality and provide insights into how we review companies' accounts and identify potential issues we might query with the companies.

Companies to be reviewed

- We will perform a desktop review of around 20 companies that are either listed outside of the FTSE 350 or on AIM. Our selection will be based upon the annual reports and accounts of companies that have year ends between September 2024 and April 2025. Our selection will cover companies from a variety of sectors.

- We will also draw on the findings of our routine reviews of companies within this market segment.

Publication

- Our review is currently ongoing and we expect to publish our final report before the end of 2025.

6.2 Thematic review: Share-based payments

We expect to publish a thematic review on IFRS 2, ‘Share-based Payments', shortly. Its focus will be on listed companies with significant share-based payment (SBP) arrangements, and will seek to clarify expectations on recognition, measurement and classification of such arrangements. Our reporting on this subject will identify good examples of proportionate disclosures and highlight the more common pitfalls to avoid, to drive continuous improvement in the quality of corporate reporting.

Our report will be of particular use to those companies with material share-based payment arrangements.

Key focus areas

Some of the areas we will be commenting on and providing guidance on include:

- Completeness and conciseness of IFRS 2 disclosures – if a company has several arrangements this can lead to many pages of disclosure. We will highlight how companies have provided clear and informative disclosures in a concise manner.

- Accounting for SBP arrangements where there is a choice of settlement – the recognition and measurement requirements of an award vary depending on how they are settled, and whether there is a choice by the company or employee. We will consider how companies have addressed these requirements.

- Accounting for arrangements with net settlement features linked to employee taxes – a common feature of UK awards is that companies facilitate the payment of employee income taxes. We understand there may be some diversity in the accounting for these arrangements, and we will review the treatments identified.

- How parent companies have accounted for group-wide SBP arrangements – awards will often involve employees of the parent's subsidiaries. There are different arrangements in place, and we will review how parent companies account for these.

- Accounting for employee benefit trusts and treasury shares – companies often settle awards through delivering their own shares and there are various mechanisms for doing this. We will examine how companies explain how they do this.

6.3 Thematic review: Investment trusts, venture capital trusts and similar closed-ended entities

Investment trusts make up a meaningful proportion of the FTSE 350 and, while the accounts for these companies are generally relatively straightforward, a number of common issues in these annual reports have been identified over time.

Our thematic review collates the findings of a review of the accounts of a selection of companies in this industry, coupled with the results of CRR's regular casework over the last five years. It focuses on the requirements under both IFRS and FRS 102 for areas where we find more frequent application issues, with a particular focus on the disclosures about fair value measurement of Level 3 financial investments.8 Our report will highlight examples of good practice reporting in the areas examined, and aspects where we believe reporting could better meet the disclosure requirements of the applicable standards.

Our key observations include:

Fair value measurement

- The significant unobservable inputs, or significant assumptions, used in determining Level 3 fair value measurements should be clearly disclosed. It is helpful to include weighted averages when input ranges are wide.

- Where reasonably possible changes in unobservable inputs would significantly affect the valuation of financial instruments, IFRS reporters should disclose the impact. Sensitivity analysis may also be required to satisfy the disclosure requirements for estimation uncertainty under FRS 102.

- Valuation techniques should be clearly disclosed.

Significant judgements

- The basis for determining whether the IFRS 10 investment entity definition is met (which results in subsidiaries being measured at fair value rather than consolidated) should be clearly explained, when this involves significant judgement.

Strategic report and alternative performance measures (APMs)

- Strategic reports should provide a fair, balanced and comprehensive analysis, including key movements in Net Asset Value during the year.

- APMs should be clearly defined, labelled, and reconciled to the closest GAAP equivalent to support transparency and comparability. The basis for calculating ratios, such as ongoing charges, should also be clearly disclosed. In addition, APMs should not be given undue prominence over GAAP measures.

6.4 Thematic reviews: Other

Supplier finance arrangement disclosures

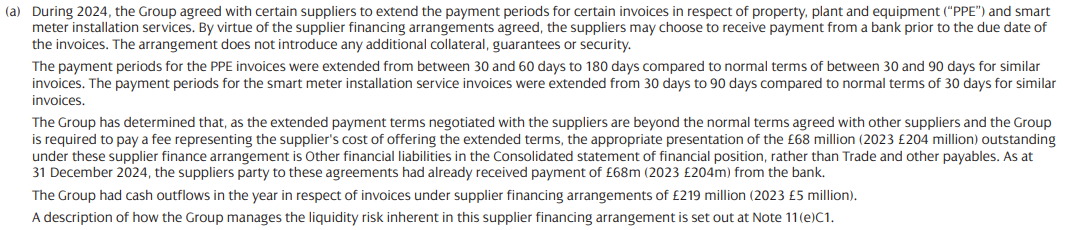

Disclosure of supply chain finance (SCF) arrangements has been an area of focus for the FRC for some time, with investors previously calling for transparent disclosure of the use of such arrangements to allow a better understanding of the risks faced by companies. We conducted a limited scope review of the supplier finance arrangement disclosures of ten UK companies, following the new IAS 7 disclosure requirements.

We were pleased to find that the companies in our selection provided information about the use of supplier finance arrangements to meet the new disclosure objectives in IAS 7. We were also pleased to note that almost all companies reviewed provided disclosure of the use of supplier finance arrangements in the prior year, showing there was already a good standard of transparency and disclosure in this area, supporting user needs and confidence in UK companies.

The findings of this review are set out in Appendix 2.

Key recommendations

When drafting their upcoming annual reports, we encourage companies to consider our key recommendations:

- Continue to provide high quality disclosures of the use of SCF arrangements, proportionate to the risks faced;

- Explain how SCF impacts the liabilities and cash flows of the company, including disclosing any accounting judgements, if relevant; and

- Describe the impact of SCF arrangements on liquidity risk and explain how this is managed.

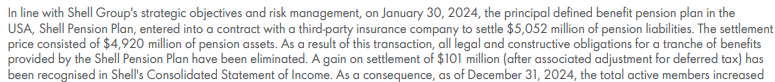

Review of disclosures of a pension accounting surplus

Over the last few years CRR has observed that many companies have recognised a pensions accounting surplus in their balance sheets. This year, CRR has conducted limited-scope reviews of a selection of annual reports and accounts of companies that have recognised an asset in their balance sheet for a pension surplus. The findings from these reviews are set out in Appendix 3.

Our observations included:

- Where pension scheme trustees have rights to enhance benefits or wind up a scheme without the consent of the company, different approaches to considering whether these rights restrict the recognition of a surplus exist.

- Better disclosure examples explained the company's assessment of its ability to control how the pension surplus is used in future.

- We saw some good examples of disclosures of the surplus or deficit shown by the most recent triennial funding valuation and why the assumptions used for the funding valuation differed from the accounting valuation.

- More informative disclosures about the purchase of bulk annuity policies or insurance transactions entered into by pension schemes described the nature and scale of the transactions and the accounting treatment applied.

Pension surplus disclosures for UK schemes may be of heightened interest to users in the future should it become easier for employers to access a pension surplus following the Government's proposed changes to UK regulations.

6.5 Digital reporting

Objectives and approach

Since 2021 most listed companies have been required to produce their annual financial report in a structured digital format (called iXBRL) under FCA rules, enabling that information to be machine-readable. The Digital Annual Report is therefore now a critical component of the reporting environment that enables investors and other users to access data more quickly and efficiently. This supports investing and lending decisions in the UK and improves market effectiveness. During the year, the FRC's Digital Reporting and Taxonomies (DR&T) team supported by the FCA's Primary Market Oversight and Listing Transactions Departments carried out a review of the quality of digital reporting based on annual reports filed in

- The review focused on a selection of 25 companies from the FTSE 350, selected using a risk-based approach. Companies were chosen based on specific criteria related to tagging, entities operating within FRC priority sectors and a broader selection. Alongside the focused review we also used the FRC's Company and Organisational Data Explorer (CODEX) XBRL toolkit to identify wider market trends across reports. The FRC's CODEx tools (UK Viewer and Toolkit) aim to make structured financial data more accessible and usable for investors, businesses, and regulators. This project enhances transparency and supports data-driven decision-making, ultimately fostering innovation and economic growth in the UK.

The FRC review highlighted six areas for improvement set out below.

- Use of custom extensions – custom tags/extensions are often being created when not necessary.

- Anchoring of extension taxonomy – where extensions are used it is common for them to not be anchored correctly.

- Accounting meaning – there are cases where the accounting meaning of the tags does not correspond to the facts reported or does not reflect the correct standard.

- Incorrect sign or scale – there are cases where amounts are reported with the incorrect sign or scale.

- Missing tags and granularity – there are many cases where some 'mandatory' tags such as 'Principal place of business' or 'Domicile of entity' are not included or where the relevant level of granularity has not been applied.

- Design and usability – design issues can still be a challenge for some filers. Many companies are also failing to put the file on their website or limit its value by delaying publication or not providing the tags in a viewable format.

A more detailed description of the issues and how to tackle them can be found within the full review and in the factsheet.

For 2025/26 CRR will be working with DR&T to coordinate a selection of our routine reviews with their review of structured digital reporting. We will write to companies where we identify opportunities to improve the quality of their structured digital reporting.

Conclusion

While overall, we were pleased to see that a number of basic errors and issues with the digital report that had previously been observed had been resolved, there remain a number of quality issues in more complex areas or where focus by specific companies and management teams would be valuable.

Appendices

Appendix 1: CRR monitoring activities: Review activities for the year

Number of reviews

We performed 222 reviews in 2024/25, which represents a 9% decrease against the number performed in the prior year. We performed fewer reviews this year, partly impacted by longer recruitment timescales for specialist reviewers with the required technical expertise, although these roles have now been successfully filled. In addition, a higher proportion of our reviews this year were full scope reviews, which are more resource-intensive than thematic reviews. In such circumstances we postpone lower risk reviews. We expect this to increase back to the 240-260 range in 2025/26. Routine reviews below include full scope reviews and companies to which we wrote in relation to complaints.

| 2024/25 | 2023/24 | 2022/23 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FTSE 100 | FTSE 250 | Other | Total | FTSE 100 | FTSE 250 | Other | Total | FTSE 100 | FTSE 250 | Other | Total | |

| Routine reviews | 29 | 48 | 109 | 186 | 21 | 59 | 114 | 194 | 22 | 66 | 75 | 163 |

| Thematic reviews | 6 | 1 | 29 | 36 | 12 | 6 | 31 | 49 | 31 | 36 | 33 | 100 |

| Total | 35 | 49 | 138 | 222 | 33 | 65 | 145 | 243 | 53 | 102 | 108 | 263 |

Reviews by market

We aim to undertake at least one full-scope review of a FTSE 350 company's annual report and accounts, and at least one limited-scope review, every five years.

| 2024/25 | 2023/24 | 2022/23 | |

|---|---|---|---|

| FTSE 350, as percentage of total reviews | 38% | 40% | 59% |

FTSE 350 companies again accounted for a smaller proportion of our reviews this year than they have historically. Our cyclical review expectation for these companies drives a similar number of reviews each year, and so the main factor for this was our 2024/25 thematic reviews principally involving companies outside the FTSE 350.

Queries raised with companies

We wrote to 83 companies requesting a response to substantive queries. The overall 'write-rate' (substantive letters as a percentage of cases opened in the year) of 37% has decreased compared with prior years and we are pleased to see a reduction in write-rate for both companies within and outside the FTSE 350. We consider each case on its own merits, having careful regard to proportionality, and do not have a target rate for writing to companies. The reduction in write-rate is consistent with an improvement in the quality of reporting of the companies reviewed. There are also other factors that have fed into this including the nature of the thematic reviews undertaken. During 2024/25, we also had a conscious focus to further challenge whether a substantive letter is the most appropriate option (see below).

| | 2024/25 | | | | | 2023/24 | | | | | 2022/23 | | | | | |:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------|:----------| | | FTSE 350 | | Other | | Total | FTSE 350 | | Other | | Total | FTSE 350 | | Other | | Total | | | No. | % | No. | % | No. | % | No. | % | No. | % | No. | % | No. | % | No. | % | | Substantive | 22 | 26% | 61 | 44% | 83 | 37% | 27 | 28% | 88 | 61% | 115 | 47% | 56 | 36% | 56 | 52% | 112 | 43% | | Appendix | 36 | 43% | 67 | 49% | 103 | 47% | 51 | 52% | 46 | 31% | 97 | 40% | 75 | 48% | 39 | 36% | 114 | 43% | | No issues | 26 | 31% | 10 | 7% | 36 | 16% | 20 | 20% | 11 | 8% | 31 | 13% | 24 | 16% | 13 | 12% | 37 | 14% | | Total | 84 | | 138 | | 222 | | 98 | | 145 | | 243 | | 155 | | 108 | | 263 | |

Although less pronounced than the prior year, we note there remains a gap between the FTSE 350 and other companies. The overall write-rate for companies outside the FTSE 350 has decreased, indicating an improvement in the quality of reporting. However, we note that other factors such as the mix of case types and the nature of thematic reviews also affect the write-rate. Analysis of routine reviews over the past few years indicates that there is consistently a quality gap, and we are still roughly twice as likely to write to these companies compared to those in the FTSE 350. As detailed in section 6.1, we are undertaking a thematic review to look further at the reporting by this population.

Focus on proportionality

This year we have continued to challenge ourselves on the application of proportionality. We completed an exercise showing that, in the majority of cases, companies amend subsequent reports for issues we raise as observations in the appendices to our letters. These can be an effective tool for driving improvements in corporate reporting, while placing a lower burden on companies than requiring a response to a substantive question.

Queries raised with companies (continued)

Appendix points convey less significant matters where the company may not have complied with the relevant legal, accounting or reporting requirements. We bring these points to the company's attention so that changes can be made to the reporting if the matters are material and relevant.

Complaints

When the FRC receives a complaint about a company's report and accounts that falls within CRR's remit, the matter is reviewed by members of our team. We always welcome well-informed complaints, which are carefully considered. When we identify that there is, or may be, a question of whether the report complies with relevant accounting or reporting requirements, we write to the company seeking further information and explanations. Matters not within our remit are shared with other FRC units or other regulators as appropriate.

| 2024/25 | 2023/24 | 2022/23 | |

|---|---|---|---|

| Total number of complaints received | 30 | 32 | 17 |

| Approach made to company or being analysed as at 31 March | 11 | 17 | 9 |

Response times and case closures