The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

KPMG LLP Audit Quality Inspection and Supervision Report 2025

Using this publication

The Financial Reporting Council (FRC) is responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are consistently delivering high-quality audits and are resilient.

This report sets out the FRC's findings on key matters relevant to audit quality at KPMG LLP (KPMG or the firm). It should be used alongside the FRC's Annual Review of Audit Quality, which contains combined results and themes for all firms1 that were inspected this year.

Given our risk-based approach to selecting audits for inspection, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm. Given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance.

Individual audit and System of Quality Management (SoQM) inspection findings are not the only metrics to assess audit quality. This report also considers other wider measures, such as the results of audit inspections completed by the Institute of Chartered Accountants in England and Wales (ICAEW) and results from the firm's own internal quality reviews. The firm's response to the findings and the actions it plans to take as a result, are included on page five and Appendix B.

This report is for general use by interested parties. However, we expect the following:

- KPMG to use this report and its peers' reports to facilitate continuous improvement through actions in its Single Quality Plan (SQP).

- Other audit firms of all sizes to use this report for examples of good practice.

- Audit Committees to use this report to help them assess the quality of their audit/auditor and when appropriate as part of the process of appointing a new auditor.

- Investors to use this report in making assessments about the quality of audit, transparency and accountability in the relevant markets.

Throughout this report, the following symbols are used:

- Represents a finding where the firm must take action to improve audit quality.

- Represents an example of good practice we identified in our supervision, and we encourage other firms to consider applying these if appropriate to their circumstances.

- Represents an observation relating to the firm's initiatives to improve audit quality.

Our Supervisory Approach2

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our future supervision work.

Further details on our approach to audit supervision can be found on our website. We also separately publish the findings of our major local audit inspections each year, the latest publication was in July 2025 and can be found on our website.

- Using this publication

- 1. Overview – overall assessment

- KPMG – at a glance

- 2. Inspection of individual audits

- Our assessment of the quality of audits inspected: All

- FTSE 350

- Improve the quality and consistency of the audit of estimates in the valuation of investments and provisions

- Improve the quality of the audit of consolidation and other journals

- Improve the quality and consistency of the audit of estimates in the valuation of investments and provisions

- Improve the quality of the audit of consolidation and other journals

- Monitoring review results by the Quality Assurance Department of ICAEW

- 3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

- 4. Forward-looking supervision

- Appendix A – Firm's internal quality monitoring

- Appendix B – KPMG's responses and actions

- Appendix C - ISQM (UK) 1 Glossary

- Financial Reporting Council

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, Exchange Tower, 1 Harbour Exchange Square, London, E14 9GE

1. Overview – overall assessment

KPMG has continued to demonstrate a strong commitment to audit quality, leading to further improvements over the past year. Clear communication from leadership on the importance of quality and continual improvement sets a strong tone from the top. The firm remains focused on its key audit priorities, such as effective remediation and simplification, and continues to invest in its people, technology, and quality framework to ensure consistent and sustained audit quality.

Firm's system of quality management

KPMG has an established SoQM structure, with a robust process to identify and assess risks and the responses to these risks. The firm has strengthened its monitoring and its annual evaluation process. However, the firm still needs to improve how it monitors the operation of some responses and elements of its annual evaluation, particularly its assessment of the reliance that can be placed on remediating and mitigating actions taken.

FRC audit quality inspections

The percentage of audits inspected by the FRC requiring no more than limited improvements was 90%, with only two audits graded improvements required (one FTSE 350), showing sustained high quality. The findings that contributed most to this year's inspection results related to the audit of estimates in the valuation of investments and audit of consolidation and other journals. Both areas have arisen on previous cycles and the issue on journals was mirrored in the firm's internal quality monitoring process. To respond to these findings the firm must continue to assess the effectiveness of remediation actions.

SoQM inspection approach

We assessed the following aspects of the scoped in areas of the firm's SoQM, with each one building upon the next.

- Do the quality risks appear complete and appropriate?

- Have appropriate responses been identified and described to demonstrate how quality risks can be mitigated?

- Was there adequate monitoring of these responses and other relevant information?

- Have deficiencies been identified and individually assessed?

- Was the aggregate impact of deficiencies assessed?

See good practice points and findings in section 3.

FRC audit quality review inspection results at KPMG

Bar chart showing percentage of audits inspected by the FRC requiring no more than limited improvements (Section 2) over five years.

- 2024/25: 90%

- 2023/24: 89%

- 2022/23: 74%

- 2021/22: 84%

- 2020/21: 59%

This chart also highlights that in 2024/25, 0 audits inspected by the FRC required significant improvements.

Other audit quality inspection results at KPMG

The overall results profile for inspections by the ICAEW was 100% classified as good or generally acceptable (page 11). The overall results profile for the firm's internal quality monitoring also indicated improvement over prior years (Appendix A).

Firm and FRC actions

KPMG's response

This year's strong results are evidence that our continued drive and investment is delivering sustainable audit quality, underpinning the pivotal role audit plays in serving the public interest.

FRC inspection results of 90% and ICAEW QAD outcomes of 100%, reflect our ongoing commitment to developing robust processes that support quality, and the approach we take to foster continuous improvement within a complex audit and economic environment. We are proud of how our people deliver high quality audits, particularly in embracing and deploying innovative new technologies in a manner recognised as good practice.

We value the engagement with the FRC and welcome the observations raised. We have performed root cause analysis (RCA) for all findings, including areas of good practice, which identified the following factors as key drivers of outcomes:

- Critical thinking mindset and challenging assumed knowledge

- Appropriately targeted supervision and timely review

- Quality of project and resource management

The FRC acknowledged our robust processes to identify, assess and respond to risks through our SoQM framework, and we will address their findings to support our continuous improvement.

Further details of root causes are included in Appendix B.

KPMG's actions

Many responsive actions have already been initiated through our SQP and system of quality management (SoQM) remediation programmes.

Our key programmes include a continued focus on phasing work across the audit lifecycle and simplifying our audit processes to develop a more streamlined experience for our people, creating capacity to focus on further enhancing audit quality. Achieving behavioural change is supported through investment in our training and culture programmes which reinforce the behaviours we expect.

FRC's actions

In response to this year's findings, we will take the following actions:

- Continue our inspection of completed audits and the firm's SoQM, including how the firm is responding to our findings.

- Maintain our supervision of the firm's SQP and use it to monitor the actions taken to improve audit quality and their effectiveness. This will include simplification, resourcing-related initiatives and foundational programmes on culture, technology and training.

- Continue our review of the root cause and remediation process to ensure that it minimises the risks of recurrence and supports the delivery of consistent improvements in audit quality.

KPMG – at a glance

| Inspection cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope3 |

|---|---|---|---|

| 2025/26 | 20 | 28 | 178 |

| 2024/25 | 19 | 34 | 187 |

| 2023/24 | 20 | 41 | 240 |

Chart showing Audit fee income5 £m over 2022-2024.

- 2022: Total Audit Fee Income £709m, PIE Audit Fee Income £221m

- 2023: Total Audit Fee Income £840m, PIE Audit Fee Income £260m

- 2024: Total Audit Fee Income £878m, PIE Audit Fee Income £318m

Diagram showing Audits inspected by the FRC7 over 2022-2025.

- 2022-23: 19 audits inspected

- 2023-24: 19 audits inspected

- 2024-25: 20 audits inspected

Pie chart showing Local audits8 in 2024-25.

- Non-major audits: 49

- Major audits: 40

- Major audits inspected: 1

2. Inspection of individual audits

Our assessment of the quality of audits inspected: All

We inspected 20 individual audits this year and assessed 18 (90%) as requiring no more than limited improvements. These results are an improvement on prior years.

Bar chart showing the quality of all audits inspected.

- 2020/21: 13 Good or limited improvements required, 8 Improvements required, 0 Significant improvements required

- 2021/22: 16 Good or limited improvements required, 3 Improvements required, 1 Significant improvements required

- 2022/23: 14 Good or limited improvements required, 4 Improvements required, 1 Significant improvements required

- 2023/24: 17 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required

- 2024/25: 18 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required

FTSE 350

Of the 11 FTSE 350 audits we inspected this year, we assessed 10 (91%) as requiring no more than limited improvements. These results are an improvement on prior years.

Bar chart showing the quality of FTSE 350 audits inspected.

- 2020/21: 9 Good or limited improvements required, 3 Improvements required, 0 Significant improvements required

- 2021/22: 10 Good or limited improvements required, 1 Improvements required, 0 Significant improvements required

- 2022/23: 7 Good or limited improvements required, 2 Improvements required, 0 Significant improvements required

- 2023/24: 7 Good or limited improvements required, 2 Improvements required, 1 Significant improvements required

- 2024/25: 10 Good or limited improvements required, 1 Improvements required, 0 Significant improvements required

The audits inspected in the 2024/25 cycle had year-ends ranging from August 2023 to March 2024. Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm. Given our risk-based approach, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm.

Information on how the FRC assesses audit quality and classifies findings between key findings and other findings, on individual inspections is available on our website.

We set out below the findings in areas where, based on our inspections, we believe improvements in audit quality are required. These findings related to key findings on our individual inspections, which impacted our assessment of quality in those audits (as set out on the preceding page), as well as other findings in the same areas that occurred frequently.

Improve the quality and consistency of the audit of estimates in the valuation of investments and provisions

Why it is important

The valuation of investments and provisions is inherently subjective and may be susceptible to management bias or error. Auditors should challenge and corroborate the key judgements in management's assumptions and valuation models.

Improve the quality of the audit of consolidation and other journals

Why it is important

An appropriate audit approach to the testing of consolidation and other journals reduces the risk of material misstatement arising from the consolidation process or the risk of management override of controls arising through the posting of journal entries.

Bar chart: Analysis of areas with findings by significance.

This chart shows the number of inspections for each area: Estimates in the valuation of investments and provisions, and Consolidation and other journals.

Estimates in the valuation of investments and provisions: - Key findings: 1 inspection - Other findings: 4 inspections - No findings: 4 inspections (Total 9 inspections)

Consolidation and other journals: - Key findings: 1 inspection - Other findings: 2 inspections - No findings: 11 inspections (Total 14 inspections)

Further details of the above findings, as well as good practice points, are set out on the following pages.

Improve the quality and consistency of the audit of estimates in the valuation of investments and provisions

We reviewed estimates in the valuation of investments and provisions on nine of the audits that we inspected and had findings on five audits.

- Valuation of investments: On one audit, the audit team performed insufficient evaluation, corroboration and challenge of certain assumptions used in the valuation models for unquoted investments. In addition, there was inadequate sensitivity analysis performed to determine whether reasonably possible changes to key valuation assumptions would be unlikely to materially change the valuation.

- Dilapidation provision: One audit team did not adequately support its risk assessment and audit testing of the completeness and accuracy of the dilapidation provision. There was a lack of challenge over management's methodology for setting the provision and certain assumptions.

- Restoration and decommissioning provisions: An audit team performed insufficient testing of the information provided by management to verify that a certain movement in capital provisions was correctly charged to the income statement.

- Inventory provision: Two audit teams did not sufficiently evidence their risk assessment for, and therefore audit approach to, the inventory provision.

Improve the quality of the audit of consolidation and other journals

We reviewed the audit of consolidation and other journals on 14 of the audits that we inspected. We identified findings on three audits.

- Consolidation journals: An audit team did not perform sufficient, appropriate audit procedures, over material consolidation journals. These journals related to the unrealised profit on inventory elimination, cumulative translation reserve movement and the acquired intangible assets amortisation charge.

- Journal risk criteria: On one audit, the team did not sufficiently justify how one of its risk criteria for selecting journals to test, adequately addressed the risks associated with data transferred from one system to another.

- Data used in testing journals: On one of the audits noted above, the reliability of data transferred to the audited entity's general ledger financial system from another system was not sufficiently tested. On another audit, insufficient procedures were performed by the audit team over data, linked to certain users, used to perform the team's risk assessment and identify journals for testing.

We also identified good practice in the audits we inspected, including:

Risk assessment and planning

- Robust and detailed risk assessment: We identified examples of a comprehensive risk assessment of the risks related to bribery and corruption, climate related risks, closure provisions, and restoration and decommissioning provisions on four audits. This enabled robust challenge of management's assumptions.

Execution

- Closure provisions: On one audit, there were extensive audit procedures over closure provisions including challenge of management's assumptions and the work of its experts.

- Restoration and decommissioning provisions: One audit team in particular, robustly challenged and tested management's assumptions and integrity of the models used.

- Impairment assessment for non-current assets: There was clearly evidenced and robust challenge of the key inputs and assumptions used in management's impairment model on four audits.

- Inventory: We identified an example where the audit approach to testing the existence of inventory was particularly robust. A significant number of sites were attended and a larger sample size was used for inventory counts.

- Valuation of insurance contract liabilities: We observed an example of comprehensive evidence of challenge of the valuation of the entity's insurance contract liabilities.

- Effective response: There were examples of an effective audit approach over revenue recognition, inventory cost, climate related risks, valuation of private investments, and the implementation of IFRS 17 insurance contracts.

- Use of specialists: We identified examples of particularly effective involvement of audit team specialists on three audits, which supported enhanced audit procedures over bribery and corruption, climate related risks, impairment assessments for non-current assets and insurance provisioning.

- Group audit oversight: On three audits, the group team's involvement with, and oversight of, the work performed by component auditors was of a high standard and clearly evidenced.

Completion and reporting

- Stand-back assessment: One audit team demonstrated a particularly extensive stand-back review of the assessed audit risks. This also demonstrated the depth of the engagement partner's understanding of the entity and its environment.

Monitoring review results by the Quality Assurance Department of ICAEW

ICAEW undertakes independent monitoring of the firm's non-PIE audits, under delegation from the FRC as the Competent Authority. ICAEW's work covers private companies, smaller AIM listed companies, charities and pension schemes. The FRC is responsible for monitoring the firm's firm-wide controls and ICAEW additionally reviews training records for a sample of the firm's staff involved in the audit work within ICAEW remit.

Of the ten standard file reviews, all were either good or generally acceptable. On the files that the ICAEW concluded were generally acceptable, the ICAEW have specifically highlighted a thematic finding across several files related to understanding the entity and risk assessment.

A detailed report summarising the audit file review findings and any follow-up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2025.

Bar chart showing Monitoring review results by the Quality Assurance Department of ICAEW over 2022-2024.

- 2022: 1 Good/generally acceptable, 10 Improvement required, 1 Significant improvement required

- 2023: 7 Good/generally acceptable, 10 Improvement required, 2 Significant improvement required

- 2024: 10 Good/generally acceptable, 10 Improvement required, 1 Significant improvement required

Good practice

ICAEW identified good practice across almost all the files reviewed. Examples included:

- Some good internal risk assessment challenge by the audit teams.

- Clear review for contradictory evidence and challenge of management where accounting estimation uncertainty was identified.

- Good use and application of testing of the operating effectiveness of key controls and of substantive analytical review procedures.

ICAEW assesses audit quality as 'good', 'generally acceptable', 'improvement required', or 'significant improvement required'. File selection is focused towards higher risk and more complex audits. Given the sample size, changes from one year to the next cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

In this section, we set out the findings and good practice identified in our inspection of the firm's SoQM. 2024/25 is the first inspection cycle that we have solely inspected firms under ISQM (UK) 1, as 2023/24 was a transitional cycle from ISQC (UK) 1. In the interests of proportionality, we adopt a rotational approach to inspection, ensuring all components of the SoQM are inspected across a three-year cycle. Details of our ISQM (UK) rotational testing can be found on our website. A glossary of some key ISQM (UK) terms can be found in Appendix C.

Inspection approach in 2024/25 cycle

In this inspection cycle, we inspected the firm's SoQM risk assessment and the design and implementation of responses in the Governance and Leadership (G&L), Information and Communication (I&C), Human Resources (HR), and Relevant Ethical Requirements (RER) components of the firm's SoQM.

For each component we also inspected a small sample of the monitoring procedures performed by the firm to assess the operating effectiveness of responses. This sample focused on responses with significant elements of judgement, including management review controls and processes.

We also inspected the process, evidence, and outcome for the firm's annual evaluation of its SoQM as at 30 September 2024. This included how other sources of information on audit quality and the firm's SoQM were considered, and how the aggregated significance of findings and deficiencies were assessed. We did not independently perform, or reperform, this annual evaluation. As ISQM (UK) 1 is focused on how firms achieve continuous improvement, we assessed how the firm has developed its SoQM, including in response to the findings we shared during the inspection period.

We scoped our inspection of each component based on consideration of risk, including the results of previous monitoring and root cause analysis. We focused on high-risk areas in respect of:

| Component | Focus areas |

|---|---|

| G&L (annual review) | Reporting to leadership on the SoQM and the culture of quality |

| I&C (rotational review) | Promoting and driving two-way communication with and between audit personnel |

| HR (rotational review) | Resource management and allocations for audit engagements and SoQM activities |

| RER (annual review) | Approval of non-audit services (NAS), and the length of involvement, on audit engagements, by key audit partners and the firm |

KPMG has an established SoQM structure, with a robust process to identify and assess risks and the responses to these risks. The firm has strengthened its monitoring and its annual evaluation process. However, the firm still needs to improve how it monitors the operation of some responses and elements of its annual evaluation, particularly its assessment of the reliance that can be placed on remediating and mitigating actions taken.

In this section, we are solely reporting on the specific matters where we have identified that further improvement is needed and areas where we have observed particularly good practice.

Design and implementation of responses to quality risks

- Workload monitoring: The firm did not sufficiently assess the appropriateness of its monitoring thresholds to identify individuals whose workloads may be too high or demonstrate mechanisms for consistent identification of individuals with prolonged periods of high workloads just below this threshold. Therefore, it was not clear how this enabled the firm to identify all individuals where follow-up might be required.

Monitoring procedures

- Monitoring procedures over responses: Within the sample reviewed, the monitoring procedures completed over the operation of certain elements in the responses did not consistently evidence that all elements had operated robustly and, in particular, how individuals performed reviews to identify and conclude on any concerns. In a few instances, the monitoring did not evidence an assessment of whether the individuals performing the responses fully undertook these as designed.

Annual evaluation processes

- Assessment of the effectiveness of remediating and mitigating actions: When evaluating SoQM findings and potential deficiencies, the firm identified where remediating actions had been started or completed and where mitigating actions were in place. However, this evaluation did not evidence assessment of the effectiveness of specific actions as-at the annual evaluation date, consideration of the firm's recent assessment of the historic effectiveness of different types of actions, or clear consideration as to whether surveys, root cause analysis, reviews of in-progress audits, or emerging audit inspection findings, might indicate that actions were not fully effective.

- Assessment of recent audit inspection findings, root causes, and prior year adjustments: The firm did not sufficiently evidence how it fully assessed key findings and trends from the internal and external inspections completed up to the conclusion of the annual evaluation, themes in root causes for findings across different audit areas, or the number and nature of prior year adjustments identified in this period, to support the completeness of SoQM findings.

Good Practice

- Identification of deficiencies: To support the identification of SoQM deficiencies, the firm identified, and performed additional assessment of, findings deemed more significant. It specifically assessed where there was a close call as to whether, individually or in aggregate, findings gave rise to a deficiency. This strengthened the firm's assessment of the completeness of deficiencies identified.

- Component auditors' compliance with the ethical standard: Group audit teams are required to hold mandatory discussions with component auditors to understand their systems and processes that enable them to confirm compliance with the ethical standard. Group audit teams are also required to document these discussions and the conclusions reached. This reduces the risk of unidentified ethical breaches arising in respect of these component auditors.

4. Forward-looking supervision

We adopt a risk-focused, outcome-based, and proportionate approach to supervising firms, which complements our inspection programme. We balance holding firms accountable for promptly addressing quality findings with encouraging proactive improvement behaviours and sharing best practices to facilitate improvements across the firm and audit market. Each firm has a dedicated Supervisor who gathers evidence and risk indicators, identifies and prioritises actions firms must take to serve the public interest by enhancing audit quality and resilience. This includes anticipating future challenges and potential issues. Our observations from this year's work, along with updates on what the firm must do regarding previous observations, are set out below. When we identify findings, we require the firm to include actions in their SQP.

Single Quality Plan and other key quality initiatives

We require the largest PIE audit firms to maintain an SQP to drive measurable improvements in audit quality and resilience, and to demonstrate the effectiveness of actions taken. The SQP ensures action is prioritised in the most critical areas and enables firms to be held to account by us and their non-executives.

Observations

- Sustaining high-quality audit: The firm has invested significantly in priority areas over the last few years, resulting in enhancements to methodology and audit approach in multiple areas. The firm must ensure that these improvements are embedded consistently across the firm. A robust risk assessment process will be crucial to achieving this and we acknowledge the progress the firm has made as reflected in the good practice on page 10.

- Simplification: The firm has launched a simplification programme to assess where improvements can be made to audit approach and methodology. The firm must ensure that any resulting changes from this programme prioritise maintaining consistently high-quality audits.

- SQP: KPMG's SQP continues to evolve and is at the forefront of the firm's regulatory strategy. It is designed to work dynamically by responding to areas of quality risk throughout the year. It works in parallel with existing quality processes and provides a mechanism to escalate topics so that its priorities are targeted to the areas of pervasive concern.

Ethics Programme

KPMG has successfully rolled out further initiatives within their Ethics Programme. The assessment of individual partner conduct comprises a comprehensive set of metrics, integrated into a new partner balanced scorecard and the importance of ethical conduct is reinforced at all levels of the firm.

Upholding high standards and continuous improvement

We expect firms to take prompt action to address quality findings and to set a tone at the top that prioritises continuous improvement.

Observations

- Tone at the top: There is clear and consistent communication from leadership on the importance of quality and continual improvement, setting a strong tone from the top.

- Constructive engagement: One case, which was opened in a previous period, has been closed since the last report. The firm responded positively and no further cases have been opened in the period.

- Non-financial sanctions (NFS): We have engaged on four NFS in the period since the last report, two of which are ongoing. The firm has actively engaged with the purpose of the NFS, identifying improvements in the firm's processes to prevent the recurrence of any breaches identified.

- RCA: Resourcing related matters continue to be a recurring root cause of audit quality findings. The firm must continue to invest in project management and talent initiatives to ensure that sufficient and appropriate high-quality resources are available at the right time to deliver quality audits.

- Remediation: This is a key part of the RCA process. The firm has continued to improve its remediation efforts and must keep investing in this process, ensuring that the remediation actions effectively address the underlying root causes.

Emerging risks and trends

Our forward-looking supervision aims to aid firms by anticipating challenges and risks from emerging trends before quality issues occur.

Industry trends

All firms are impacted by emerging risks and trends in the industry related to:

- The use of technology and AI in the audit; and

- Changes to workforce and staff / partner development needs as a result of the above and other drivers.

These are addressed further in the 2025 Annual Review of Audit Quality. We are working with firms to understand how they are responding to these trends whilst safeguarding audit quality.

Observations

- Use of advanced technology: The firm is expanding its use of innovative technologies including AI in its audits. By leveraging AI, the firm aims to enhance its audit processes and improve efficiency and risk assessment in audits. While these technologies can enhance efficiency and audit quality, they also introduce new risks and implementation challenges. The firm must navigate these risks carefully to leverage technology effectively while safeguarding against potential threats.

Technology

The firm has developed a clear strategy to effectively integrate new technology solutions. The firm has been proactive in engaging with us on this and we welcome the in-depth and early engagement.

Appendix A – Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements (Quality Performance Review, or QPR). We have not verified the accuracy or appropriateness of these results. The appendix should be read together with the firm's Transparency Report for 2024 which provides further detail of the firm's internal quality monitoring approach, results, root cause analysis, remediation, and wider system of quality management. Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring are not directly comparable to those of other firms or external regulatory inspections.

Results of internal quality monitoring9

The results of the firm's QPR for 2024 and two previous years are set out below. The firm's 2024 QPR comprised inspections of 103 audit engagements (2023: 120), covering periods ending between 30 June 2022 and 31 March 2024.

Bar chart showing Results of internal quality monitoring (2022-2024).

- 2022:

- Compliant: 64%

- Compliant - Improvements Needed (CIN): 23%

- Not Compliant: 13%

- 2023:

- Compliant: 59%

- Compliant - Improvements Needed (CIN): 26%

- Not Compliant: 15%

- 2024:

- Compliant: 68%

- Compliant - Improvements Needed (CIN): 22%

- Not Compliant: 10%

Themes arising from internal quality monitoring

Improvements were seen in 2024 with 90% of audits reviewed having no or only minor findings (2023: 85%). Findings related to the audit of journals; evidencing risk assessment decisions; testing and evaluation of statistical samples; and testing related party transactions. Three of the four areas with frequent findings remained consistent with the previous year with related party transactions having been identified as a new issue in 2024.

Areas that contributed most significantly to 'Not Compliant' ratings were:

- the failure to design appropriate procedures to address identified risks of material misstatement;

- insufficient clarity or evidence to allow an independent reviewer to understand the basis for individual conclusions; and

- insufficient procedures or weaknesses in the performance or documentation of certain procedures including aspects of journals testing, evaluation of errors in substantive tests and testing of transactions with related parties.

Appendix B – KPMG's responses and actions

Delivering sustainable audit quality is at the heart of our strategy to be the most trusted audit firm by our regulators, the businesses we audit, investors, the public and our people. It is evident that our investments in audit quality are driving consistency in outcomes with our results of 90% and 100% in FRC and ICAEW inspections, respectively. Additionally, half of the audits inspected by the FRC this year received no findings, achieving the highest possible outcome, further demonstrating the relentless approach we take in championing an environment where continuous improvement is expected.

We are proud that the investment and continued focus and commitment from our people to work together to deliver high-quality audits is making a difference. We recognise that the open and transparent relationship we have with the FRC through its inspection and supervision process is an enabler of progress, and value the constructive input and challenge received. We continue to work closely with the FRC to understand its identified areas of good practice and where we need to focus to ensure that we continue to build trust and confidence in our profession.

Our SQP is a critical component of how we respond to feedback, identifying root causes and emerging issues. It is designed to be agile to ensure that, over the course of the year, we have a clear but dynamic approach to prioritisation.

Through our SQP, we have continued to focus on phasing our work across the audit lifecycle and accelerating work where possible to create additional time and space for enhancing quality. We have supplemented this with a complementary key programme this year; simplifying elements of our end-to-end audit process. As well as contributing to positive quality outcomes, an audit product that is simplified is one that can be more effectively systematised and delivered sustainably while also being more agile. We are confident that this approach, combined with our strategy for embracing innovative people-led audit technology solutions, positions us strongly for the future.

Sustaining audit quality is only possible with the strong foundations of an effective SoQM. Our KPMG UK 2024 Transparency Report sets out how our framework supports us in doing this. This is an area we continue to invest in to ensure our SoQM evolves to respond to findings, including those raised by the FRC, changes in processes and identification of new risks. We are taking action to address these findings, particularly in the consistency of how we monitor responses to quality risks and the extent of evidence documented for our annual evaluation process.

Our approach and attitude to continuous improvement, and our results of both internal and external inspections, demonstrate we have robust processes in place to support us on this journey.

Root cause of findings and good practice

RCA remains a critical component of our SoQM and underpins our ability to drive continuous improvements. This year, we completed more root cause reviews (98) in the 2024/25 cycle (89 in the 2023/24 cycle). This includes an increase in the number of firmwide RCA projects performed in the 2024/25 cycle to enable the realisation of wider benefits from our enhanced root cause process. The insights that this analysis generates enable us to be increasingly targeted in our remediation response.

From a remediation perspective, this year we have prioritised understanding the effectiveness of different types of actions and applying this knowledge to ensure the right selection is taken to increase the likelihood of success. We have identified several focus areas, including enhancing the breadth of data sources used in our monitoring activities for the coming year which will drive further improvement.

We have performed RCA for all findings, including areas of good practice. We welcome the breadth and depth of good practice points raised by the FRC, particularly in respect of comprehensive risk assessment, effective involvement of specialists and strong group audit oversight. Our analysis identified the primary root causes for quality findings this year were:

Critical thinking mindset and challenge of assumed knowledge

Our RCA demonstrates a clear link between the consistent application of a critical thinking mindset and higher quality outcomes. Instances where audit teams relied on assumed knowledge from previous years on the audited entity or industry know-how, led to weaknesses in documentation supporting key decisions and, ultimately, detracted from the overall quality of the work performed. This root cause was prevalent in findings relating to valuations and provisions. We observed good practices where audit teams applied a critical thinking mindset to challenge management robustly and clearly evidenced the outcomes of this process on the audit file. We have a number of ongoing actions to continue to drive behavioural change in this area through enhanced training and support from our culture programme. This includes focusing on being alert and responding to pressures, such as tight timetables that influence behaviours, and using our external speakers and Culture Ambassador network to reinforce messaging around behavioural expectations at a local level.

Appropriately targeted supervision and timely review

Senior team member involvement at the right times of the audit and focused on the right areas is a critical driver of high-quality outcomes. Insufficient stand-back review performed over key areas, and instances where focus was targeted at other parts of the audit contributed to weaknesses in overall quality and depth of the review. Our simplification programme aims to further streamline our audit approach to ensure time is being spent where it matters most and provide our senior team members with increased capacity to more effectively supervise the audit.

Quality of project and resource management

Where we do not effectively manage our resources, the engagement process or appropriately challenge the quality of information received from management in a timely manner, there are clear links to lower quality outcomes, particularly in relation to journals testing. Conversely, we have seen strong results achieved when teams effectively plan the audit and resources, establishing clear roles and responsibilities, and phase their work across the audit lifecycle. We have a number of actions initiated or planned to address these findings, including one of our key programmes to accelerate work and reduce audit peaks of activity. We are encouraged by the results of this multi-year programme to date and the positive benefits it drives, including on the wellbeing of our people.

Looking ahead

The emerging risks and trends highlighted in section 4 of this report align with our areas of focus through both priority programmes and targeted actions within our SQP.

Our approach to adopting new technologies and automated tools including AI in our audits was recognised as good practice, and we have shared our current and future technology roadmap with both the FRC and ICAEW. We have made significant investment in innovative audit techniques using AI, and a number of the audits inspected in this cycle used these methods to provide substantive evidence. We recognise that emerging technologies like generative AI are significantly influencing audit techniques, are supporting the productivity of our people and are driving high audit quality.

We are continuing to invest in and embrace these new technologies, upskilling our people to best utilise these capabilities.

It is important to have the right mix of skills and experience across engagements and be agile to move people when needed. Our flexible resource pool is one tool we have established to enable us to be responsive to resourcing needs over the audit lifecycle, and we are exploring how we can continue optimising this process moving ahead. Our KPMG Clara workflow tool provides us with deeper data mining capabilities which in turn facilitate strong oversight and challenge of audit timetables, facilitating the movement of resource where needed.

Learning for a lifetime is a key offering for our people. We are focused on developing our technical learning programme by deconstructing level-based curriculums into smaller segments that cover specific technical competencies or skills, and which are delivered at point of need rather than a centrally established point in time. As part of this, we are challenging our approach to assessing knowledge retention and evolving this to incorporate a more continuous evaluation of skills and delivery of individual learning programmes.

We are confident that our audit strategy and actions put us in a robust position as we look to the future. Our strong inspection results demonstrate our commitment to delivering sustainable audit quality, which we know is a journey of continuous investment, learning and improvement. We are proud of the enhancements we have made and sustained and believe that we are well placed to succeed in the ever-evolving future of audit.

Appendix C - ISQM (UK) 1 Glossary

The following definitions were extracted from ISQM (UK) 110.

| System of quality management (SoQM) | A system designed, implemented and operated by a firm to provide the firm with reasonable assurance that: i. The firm and its personnel fulfil their responsibilities in accordance with professional standards and applicable legal and regulatory requirements, and conduct engagements in accordance with such standards and requirements; and ii. Engagement reports issued by the firm or engagement partners are appropriate in the circumstances. |

|---|---|

| Quality objectives | The desired outcomes in relation to the components of the system of quality management to be achieved by the firm. |

| Quality risk | A risk that has a reasonable possibility of: i. Occurring; and ii. Individually, or in combination with other risks, adversely affecting the achievement of one or more quality objectives. |

| Response | Policies or procedures designed and implemented by the firm to address one or more quality risk(s) in relation to its system of quality management: i. Policies are statements of what should, or should not, be done to address a quality risk(s). Such statements may be documented, explicitly stated in communications or implied through actions and decisions. ii. Procedures are actions to implement policies. |

| Findings | Information about the design, implementation and operation of the system of quality management that has been accumulated from the performance of monitoring activities, external inspections and other relevant sources, which indicates that one or more deficiencies may exist. |

| Deficiency | A deficiency in a firm's system of quality management exists when: i. A quality objective required to achieve the objective of the system of quality management is not established; ii. A quality risk, or combination of quality risks, is not identified or properly assessed; iii. A response, or combination of responses, does not reduce to an acceptably low level the likelihood of a related quality risk occurring because the response(s) is not properly designed, implemented or operating effectively; or iv. An other aspect of the system of quality management is absent, or not properly designed, implemented or operating effectively, such that a requirement of this ISQM (UK) 1 has not been addressed. |

| Ultimate responsibility | Individual(s) assigned ultimate responsibility and accountability for the firm's SoQM should evaluate the SoQM, on behalf of the firm, and shall conclude, on behalf of the firm, whether or not the SoQM provides the firm with reasonable assurance that the objectives of the SoQM are being achieved, required under ISQM (UK) 1 paragraph 54. |

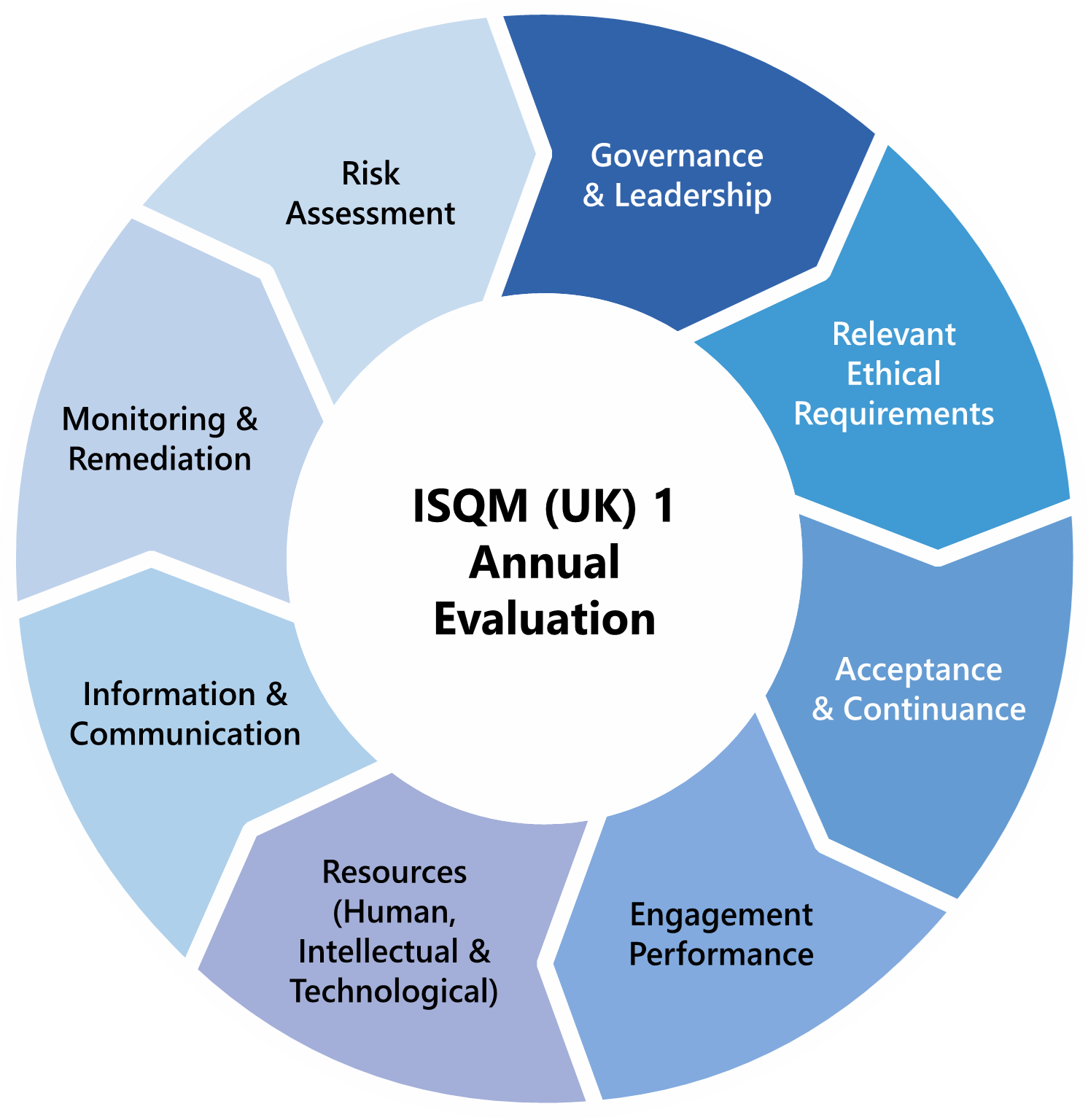

A system of quality management under ISQM (UK) 1 addresses the following eight components:

- The firm's risk assessment process;

- Governance and leadership;

- Relevant ethical requirements;

- Acceptance and continuance of client relationships and specific engagements;

- Engagement performance;

- Resources;

- Information and communication; and

- The monitoring and remediation process.

Firms are required to perform their first annual evaluation of the SoQM by 15 December 2023.

Financial Reporting Council

London office:

13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office:

5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in.

-

The six annually inspected firms in 2024/25 were: BDO LLP, Deloitte LLP, Ernst & Young LLP, KPMG LLP, Forvis Mazars LLP, and PricewaterhouseCoopers LLP. We have published a separate report for each of these firms along with a cross-firm Annual Review of Audit Quality, which also includes results of firms not inspected annually. ↩

-

We are currently reviewing our future approach to audit supervision. Further detail can be found in the Annual Review of Audit Quality. ↩

-

Source - FRC analysis of the firm's PIE audits and other audits included within the Audit Quality Review scope as at 31 December 2024. ↩

-

Source - FRC's PIE Auditor Registration data as at 31 December 2024. There may be timing differences between the collation of this data and the FRC inspection scope data. ↩↩

-

Source - FRC's 2023, 2024 and 2025 editions of Key Facts and Trends in the Accountancy Profession. Audit fee income may be prepared to different reference dates by different firms. ↩

-

Source - ICAEW's 2025 Quality Assurance Department (QAD) Report on the firm. Data has been prepared by different firms using different reference dates and methodologies. The FRC has not validated the methodologies used. ↩↩↩↩

-

Excludes the inspection of local audits. ↩

-

Source - FRC analysis of Major Local Audits (MLA) as at 31 March 2024. The FRC's inspections of MLAs are published in a separate annual report which can be found on our website. ↩

-

The grading categories used by the firm are: Compliant – audits that comply with relevant standards in all significant respects; Compliant – Improvements Needed - audits that have an audit report supported by evidence but required additional information in the view of the reviewer, documentation of evidence obtained, or did not follow the firm's methodology in a specific area; and Not Compliant – audits that were not performed in line with relevant standards in a more significant area or had a deficiency in the financial statements. ↩

-

https://www.frc.org.uk/documents/4691/ISQM_UK_1_Issued_July_2021_Updated_March_2023_7S8WvVE.pdf ↩