The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Forvis Mazars LLP Audit Quality Inspection and Supervision Report 2025

Using this publication

The Financial Reporting Council (FRC) is responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are consistently delivering high-quality audits and are resilient.

This report sets out the FRC's findings on key matters relevant to audit quality at Forvis Mazars LLP (Forvis Mazars or the firm). It should be used alongside the FRC's Annual Review of Audit Quality, which contains combined results and themes for all firms1 that were inspected this year.

Given our risk-based approach to selecting audits for inspection, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm. Given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance.

Individual audit and System of Quality Management (SoQM) inspection findings are not the only metrics to assess audit quality. This report also considers other wider measures, such as the results from the firm's own internal quality reviews. The firm's response to the findings and the actions it plans to take as a result, are included on page five and Appendix B. The Institute of Chartered Accountants in England and Wales (ICAEW) did not inspect a sample of the firm's non-PIE audits this year, in accordance with its planned rotational inspection programme.

This report is for general use by interested parties. However, we expect the following:

- Forvis Mazars to use this report and its peers' reports to facilitate continuous improvement through actions in its Single Quality Plan (SQP).

- Other audit firms of all sizes to use this report for examples of good practice.

- Audit Committees to use this report to help them assess the quality of their audit/auditor and when appropriate as part of the process of appointing a new auditor.

- Investors to use this report in making assessments about the quality of audit, transparency and accountability in the relevant markets.

Throughout this report, the following symbols are used:

- **Action required icon**

- Represents a finding where the firm must take action to improve audit quality.

- **Good practice icon**

- Represent an example of good practice we identified in our supervision, and we encourage other firms to consider applying these if appropriate to their circumstances.

- **Observation icon**

- Represents an observation relating to the firm's initiatives to improve audit quality.

Our Supervisory Approach2

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our future supervision work.

Further details on our approach to audit supervision can be found on our website. We also separately publish the findings of our major local audit inspections each year, the latest publication was in July 2025 and can be found on our website.

- Using this publication

- Our Supervisory Approach

- 1. Overview – overall assessment

- 1. Overview – Firm and FRC actions

- Forvis Mazars LLP – at a glance

- 2. Inspection of individual audits

- 2. Inspection of individual audits

- 2. Inspection of individual audits

- 3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

- 3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

- 3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

- 4. Forward-looking supervision

- 4. Forward-looking supervision

- 4. Forward-looking supervision

- Appendix A – Firm's internal quality monitoring

- Appendix B – Forvis Mazars' responses and actions

- Appendix B – Forvis Mazars' responses and actions

- Appendix B – Forvis Mazars' responses and actions

- Appendix C – ISQM (UK) 1 Glossary

- Appendix C – ISQM (UK) 1 Glossary

- Financial Reporting Council

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, Exchange Tower, 1 Harbour Exchange Square, London, E14 9GE

1. Overview – overall assessment

Forvis Mazars has continued to invest in audit quality and made good progress through its Audit Quality Transformation Plan (AQTP). The audit quality inspection results for the firm are a significant improvement on last year. It is too soon to identify this improvement as a trend; however, it is an encouraging indication that the AQTP is having an impact. Continued effort is needed to ensure lasting improvement. The firm's key challenges now are to complete the AQTP, ensuring the longer-term effectiveness of actions taken to improve consistency in audit execution. The firm must also continue to invest in and develop its SoQM to provide a solid foundation for high-quality audits. The firm's strategy and specific actions planned or already taken demonstrate that the firm remains committed to this continuous improvement and this is embedded within the firm's culture.

Firm's system of quality management (SoQM)

Forvis Mazars has demonstrated significant commitment to, and is investing in, improving and strengthening its SoQM, in line with the requirements of ISQM (UK) 1. The firm has significantly improved the evidencing, assessment, and monitoring of its SoQM. However, the firm still needs to strengthen its responses to quality risks, the assessment of the design of responses, and the monitoring of the operation of responses. The firm also needs to strengthen the performance and evidencing of aspects of its annual evaluation, to ensure the conclusion is appropriately supportable.

FRC audit quality inspections

The percentage of audits inspected by the FRC requiring no more than limited improvements was 90%. However, one of the ten audits we inspected (10%) was found to require significant improvements. The main findings from our inspections were in the areas of revenue (aspects of which were recurring), archiving and file assembly, and group oversight.

SoQM inspection approach

We assessed the following aspects of the scoped in areas of the firm's SoQM, with each one building upon the next.

- Do the quality risks appear complete and appropriate?

- Have appropriate responses been identified and described to demonstrate how quality risks can be mitigated?

- Was there adequate monitoring of these responses and other relevant information?

- Have deficiencies been identified and individually assessed?

- Was the aggregate impact of deficiencies assessed?

See good practice points and findings in section 3.

FRC audit quality review inspection results at Forvis Mazars

% of audits inspected by the FRC requiring no more than limited improvements (Section 2)

A bar chart showing the percentage of audits inspected by the FRC requiring no more than limited improvements for five fiscal years.

- 2024/25: 90% (1 audit required significant improvements)

- 2023/24: 44%

- 2022/23: 56%

- 2021/22: 50%

- 2020/21: 57%

An annotation points to the 2024/25 bar, stating "1 audit inspected by the FRC in 2024/25 required significant improvements".

Other audit quality inspection results at Forvis Mazars

The firm's own internal quality monitoring (Appendix A) also shows an improvement in the results from last year, with revenue also identified as a recurring finding. Root cause analysis is crucial to understanding inconsistencies in audit quality and recurring findings.

1. Overview – Firm and FRC actions

Forvis Mazars' response

We are pleased with the overall results of this year's AQR inspections, where 90% of files inspected requiring no more than limited improvements. We are proud of our people for their hard work and commitment to audit quality. We recognise that further efforts are necessary to ensure that we deliver high-quality audits consistently and sustainably.

We agree with the FRC that AQR results on their own cannot be relied upon to provide a complete picture of a firm's audit quality. We equally note that AQR findings may be isolated to specific sectors and not systemic, and therefore an increase or decrease in the overall scores may not necessarily indicate a positive or negative trend in audit quality. We will continue to focus our efforts on our firm's system of quality management (SoQM), and work with the FRC as part of its future of audit supervision strategy.

We are disappointed that one audit was found as requiring significant improvements. We undertook a root cause analysis for all inspection results; we note that the key findings were not systemic. We welcome the observations and insights raised by the FRC and are encouraged by the good practice points identified. We have invested considerable time and resources in developing our SoQM, and in monitoring responses. We recognise that whilst significant improvements have been made in the last year, we continue to enhance and develop our approach and documentation.

Our vision is for audit quality to be fully integrated within our SoQM and to be maintained as it becomes the 'Forvis Mazars' way. We will continue in delivering our AQTP, ensuring that the actions are fully embedded in our SoQM as part of 'business as usual' (BAU) and within the firm's culture.

Forvis Mazars' actions

Our commitment and key strategic priority is to ensure the delivery of high-quality audits and to play our part in safeguarding the public interest. We have taken, or are undertaking, the following actions (refer to Appendix B for further details of our response):

- Robust actions to address the findings and root causes and apply the positive learnings, including strengthening the firm's policy on file archiving, reinforcing the guidance on group audits and deploying our ISA (UK) 600R templates, and further improving our portfolio reviews and project management.

- Enhancing and developing our approach and documentation to more effectively evaluate and assess the effectiveness of the SoQM responses; and

- Focusing on the effectiveness of existing actions in our AQTP and continuing with our inflight review programme.

FRC's actions

In response to this year's findings, we will take the following actions:

- Continue with our standard programme of work under ISQM (UK) 1 and maintain the number of audits to be inspected at 10.

- Maintain our review of the AQTP and SQP, using them to monitor the actions taken to improve audit quality and their effectiveness, including their impact on the firm's SoQM.

- Maintain a level of intensive supervision in relation to the continuing changes to ethics, culture and specific AQTP actions. This will include actions related to the new strategy and sustaining audit quality.

Forvis Mazars LLP – at a glance

Audits within the FRC's inspection scope3

| Inspection cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope | Public Interest Entity (PIE) audits4 | Number of PIE Responsible Individuals4 |

|---|---|---|---|---|---|

| 2025/26 | 0 | 5 | 101 | 98 | 30 |

| 2024/25 | 0 | 4 | 87 | 81 | 27 |

| 2023/24 | 0 | 3 | 98 | 81 | 23 |

Audit fee income5 £m

A bar chart showing Audit fee income and PIE Audit Fee Income from 2022 to 2024.

- 2022: Total Audit Fee Income: 110, PIE Audit Fee Income: 26

- 2023: Total Audit Fee Income: 133, PIE Audit Fee Income: 31

- 2024: Total Audit Fee Income: 150, PIE Audit Fee Income: 37

The chart shows an increasing trend in both Total Audit Fee Income and PIE Audit Fee Income over the three years.

Total Audits6

3,147

Responsible Individuals6

81

Audits inspected by the FRC7

A visual representation of the number of audits inspected by the FRC over three years.

- 2022-23: 9 audits

- 2023-24: 9 audits

- 2024-25: 10 audits

The numbers are shown in circles, indicating a slight increase in inspections for 2024-25.

Professional Staff6

3,062

Offices6

15

Local audits8

A pie chart illustrating the breakdown of local audits for 2024-25.

- Non-major audits: 52

- Major audits: 53

A small segment within 'Major audits' indicates that 1 major audit was inspected.

2. Inspection of individual audits

Our assessment of the quality of audits inspected:

We inspected ten individual audits this year and assessed nine (90%) as requiring no more than limited improvements. The overall results are an improvement on those in prior years.

A stacked bar chart showing the breakdown of audit quality assessments for audits inspected by the FRC from 2020/21 to 2024/25.

- 2020/21: Good or limited improvements required: 4 audits (40%), Improvements required: 2 audits (20%), Significant improvements required: 4 audits (40%)

- 2021/22: Good or limited improvements required: 4 audits (40%), Improvements required: 1 audit (10%), Significant improvements required: 5 audits (50%)

- 2022/23: Good or limited improvements required: 5 audits (50%), Improvements required: 3 audits (30%), Significant improvements required: 2 audits (20%)

- 2023/24: Good or limited improvements required: 4 audits (40%), Improvements required: 4 audits (40%), Significant improvements required: 1 audit (10%)

- 2024/25: Good or limited improvements required: 9 audits (90%), Improvements required: 0 audits (0%), Significant improvements required: 1 audit (10%)

The legend indicates three categories: "Good or limited improvements required", "Improvements required", and "Significant improvements required". The 2024/25 year shows a significant increase in audits requiring good or limited improvements compared to previous years.

The audits inspected in the 2024/25 cycle had year-ends ranging from September 2023 to May 2024. Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Given our risk-based approach, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm.

Information on how the FRC assesses audit quality and classifies findings between key findings and other findings on individual inspections is available on our website.

We set out below the findings in areas where, based on our inspections, we believe improvements in audit quality are required. These findings related to key findings on our individual inspections, which impacted our assessment of quality in those audits (as set out on the previous page), as well as other findings in the same area that occurred frequently.

| Findings | Why it is important |

|---|---|

| Improve the audit of revenue | Auditors should obtain sufficient and appropriate audit evidence to assess whether revenue is recognised correctly as it is a key driver of an entity's results. |

| Strengthen audit completion procedures relating to audit file assembly and archiving | Timely completion and assembly of audit files and archiving is important to ensure the integrity of the record of the audit work performed and audit evidence obtained. |

Analysis of areas with findings by significance

A stacked bar chart showing the number of inspections for each area with findings categorized by significance.

- Revenue: 10 inspections in total. 8 inspections had 'Key findings', 1 had 'Other findings', and 1 had 'No findings'.

- File assembly and archiving: 10 inspections in total. 7 inspections had 'Key findings', 2 had 'Other findings', and 1 had 'No findings'.

The chart indicates that 'Revenue' and 'File assembly and archiving' were both areas with a high number of 'Key findings'.

Further details of the above findings, as well as good practice points, are set out on the following pages.

2. Inspection of individual audits

Improve the audit of revenue

We inspected the audit of revenue on nine audits and raised related key findings on one audit assessed as requiring significant improvements.

- Contract accounting: The audit team performed insufficient audit procedures to validate that contract revenue was recognised in accordance with underlying performance obligations and that the fair value of performance obligations was appropriate. There were also weaknesses in the testing of the stage of completion and costs to complete for contracts not completed at year-end, and the allocation of contract costs.

- Cash to revenue reconciliation: There was insufficient precision in the cash-to-revenue substantive analytical procedure performed by the audit team for non-contract revenue, and no audit procedures were performed to validate the reliability of key listings supporting this analysis.

Strengthen audit completion procedures relating to audit file assembly and archiving

We raised findings relating to file assembly and archiving of audit working papers on three audits.

- Audit file archiving: On one audit, a component audit file was not archived on a timely basis alongside the group audit file and the associated file assembly process was not completed within the 60-day period required by auditing standards.

- Audit file assembly: On two audits, insufficient evidence was retained of the changes made to certain working papers after the date of signing the auditor's report.

2. Inspection of individual audits

Other findings leading to significant improvements being required

On one audit, there were additional key findings that contributed to the overall assessment of significant improvements being required that are not included in the findings above.

- Group audit approach and oversight: The audit strategy and approach to a significant component of the group contained several weaknesses and the group auditor was not sufficiently involved in the work of the component auditor.

- Component audit work: Shortcomings were identified in the underlying audit work performed across multiple areas for the same significant component.

We also identified good practice in the audits we inspected, including:

Execution

- Revenue: On one audit, the audit team performed a comprehensive cash to revenue reconciliation which resulted in an efficient and effective audit of revenue.

- Insurance technical provisions: On two audits, the audit team, supported by actuarial specialists, performed extensive procedures to evaluate and challenge management's methodology and assumptions relating to the calculation of technical provisions.

- Group audit oversight: On one audit, the group audit team's oversight of, and involvement with, component auditors was of a high standard. This included extensive evidence of interactions and discussions throughout the audit and a detailed review of component audit working papers.

- Investment fair value disclosures: On one audit, the audit team performed a thorough assessment of the frequency of trading of investments throughout the year to support the audit of fair value hierarchy disclosures.

3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

In this section, we set out the findings and good practice identified in our inspection of the firm's SoQM. 2024/25 is the first inspection cycle that we have solely inspected firms under ISQM (UK) 1, as 2023/24 was a transitional cycle from ISQC (UK) 1. In the interests of proportionality, we adopt a rotational approach to inspection, ensuring all components of the SoQM are inspected across a three-year cycle. Details of our ISQM (UK) rotational testing can be found on our website. A glossary of some key ISQM (UK) 1 terms can be found in Appendix C.

Inspection approach in 2024/25 cycle

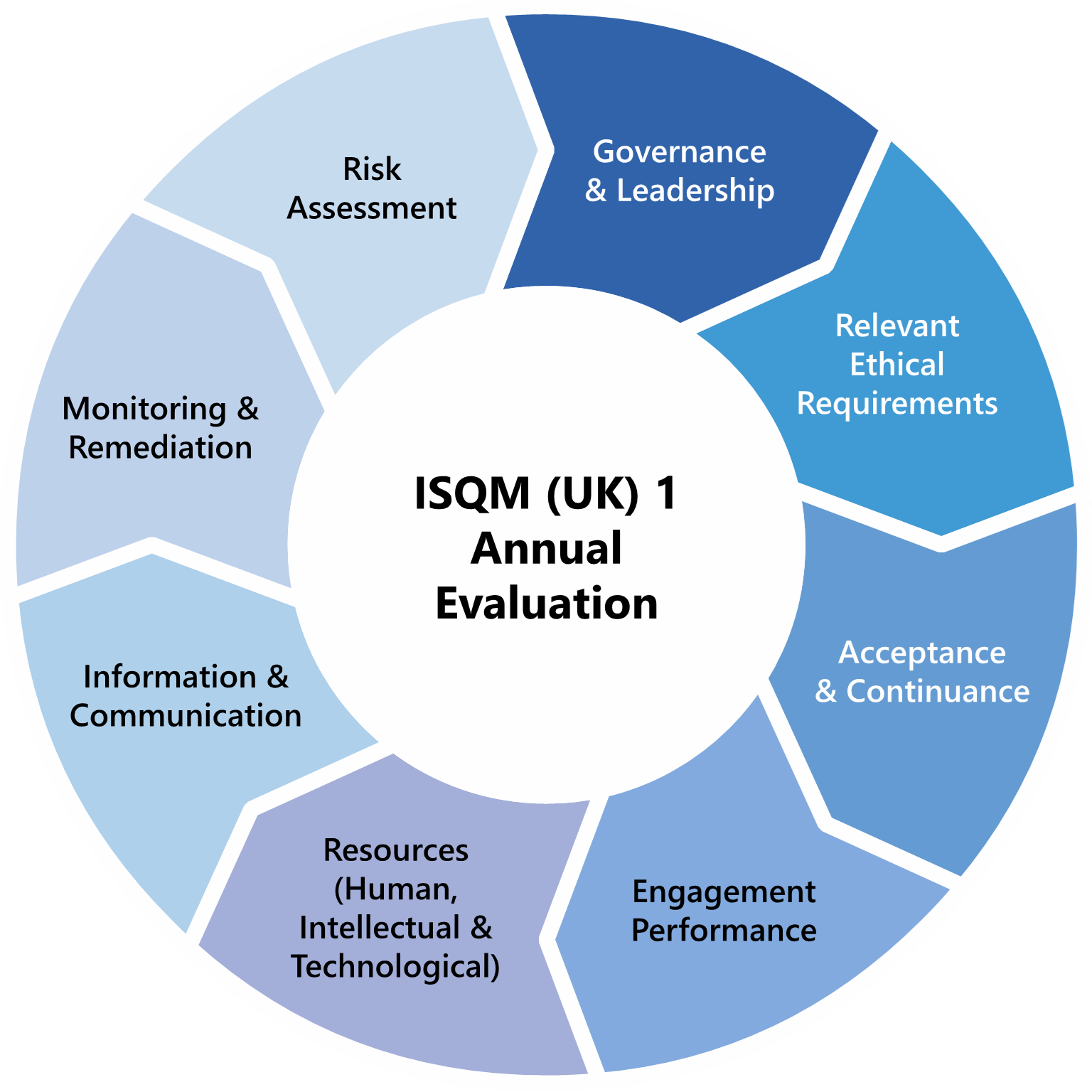

In this inspection cycle, we inspected the firm's SoQM risk assessment and the design and implementation of responses in the Governance and Leadership (G&L), Information and Communication (I&C), Human Resources (HR), and Relevant Ethical Requirements (RER) components of the firm's SoQM.

For each component we also inspected a small sample of the monitoring procedures performed by the firm to assess the operating effectiveness of responses. This sample focused on responses with significant elements of judgement, including management review controls and processes.

We also inspected the process, evidence, and outcome for the firm's annual evaluation of its SoQM as at 31 August 2024. This included how other sources of information on audit quality and the firm's SoQM were considered, and how the aggregated significance of findings and deficiencies were assessed. We did not independently perform, or reperform, this annual evaluation. As ISQM (UK) 1 is focused on how firms achieve continuous improvement, we assessed how the firm has developed its SoQM, including in response to the findings we shared during the inspection period.

We scoped our inspection of each component based on consideration of risk, including the results of previous monitoring and root cause analysis. We focused on high-risk areas in respect of:

| Component | Focus areas |

|---|---|

| G&L (annual review) | Reporting to leadership on the SoQM and the culture of quality |

| I&C (rotational review) | Promoting and driving two-way communication with and between audit personnel |

| HR (rotational review) | Resource management and allocations for audit engagements and SoQM activities |

| RER (annual review) | Approval of non-audit services (NAS), and the length of involvement, on audit engagements, by key audit partners and the firm |

3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

Forvis Mazars has demonstrated significant commitment to, and is investing in, improving and strengthening its SoQM, in line with the requirements of ISQM (UK) 1. The firm has significantly improved the evidencing, assessment, and monitoring of its SoQM. However, the firm still needs to strengthen its responses to quality risks, the assessment of the design of responses, and the monitoring of the operation of responses. The firm also needs to strengthen the performance and evidencing of aspects of its annual evaluation, to ensure the conclusion is appropriately supportable.

In this section, we are solely reporting on the specific matters where we have identified that further improvement is needed and areas where we have observed particularly good practice.

Design and implementation of responses to quality risks

- Design assessments of responses: In the samples reviewed in the Human Resources component, the firm's design assessments did not consistently assess how all responses were effectively designed to mitigate the relevant quality risks. For responses relating to reviews, the firm did not always identify the expected review steps, the expected thresholds and inputs used, or where follow-up action should be taken.

- RI portfolio reviews: The firm's existing framework for ensuring RI portfolios are appropriate (with regards to size, complexity and risk), was not effectively designed or applied consistently to effectively identify where changes may be needed to individual RI's portfolios to ensure sufficient capacity. The firm also did not adequately monitor the portfolio review process to assess if it operated consistently with its design.

- Workload monitoring: The firm did not identify SoQM responses over its processes for monitoring workload, at an individual level to ensure sufficient capacity. Therefore, it was not clear how the firm was satisfied its processes and thresholds were effectively designed, implemented and operated. The firm also did not have a formal monitoring process to track the remedial actions for individuals whose workloads may be too high. Therefore, it was not clear how the firm consistently ensured individuals had sufficient capacity.

Monitoring procedures

- Monitoring procedures over responses: From the sample reviewed, the monitoring procedures did not consistently assess if all responses operated robustly with consideration of all relevant response steps, particularly the reasonableness of assumptions and inputs used in reviews, how reviews were undertaken to identify concerns, and how concerns were followed up.

- Monitoring of services provided by non-network component auditors: The firm has not undertaken monitoring over non audit services (NAS) provided by non-network component auditors, to ensure such services do not create a condition that compromises the firm's independence.

3. Inspection of the firm's system of quality management ISQM (UK) 1 and 2

- Mitigating actions for the deficiency with the global conflict check system: The firm recognised a deficiency regarding its global conflict check system so could not take reliance on this system. The firm did not sufficiently assess the adequacy of the remaining responses or implement compensating controls, to mitigate the risk of NAS being commenced by other network firms without relevant UK approvals. This included whether robust engagement level reconciliations, between UK NAS approvals and management's records, are performed.

Annual evaluation processes

- Assessment of the completeness of SoQM findings to identify deficiencies. The firm did not sufficiently evidence the basis for concluding on the completeness of SoQM findings and deficiencies. Specifically, the firm did not evidence:

- Sufficient assessment of the effectiveness of remediating or mitigating actions, with consideration of the firm's recent effectiveness review of remedial actions.

- Aggregate assessment of findings to identify deficiencies.

- Sufficient consideration of all root cause analysis (RCA) themes identified from engagement findings and ethics breaches.

- Consideration of and conclusions on, other sources of information, including internal audit reports, progress of AQTP actions, trends in prior period adjustments, and results of staff survey and focus groups.

Good Practice

- The firm identified a wide range of other sources of information for consideration in their monitoring, and was proactive in identifying some deficiencies based on specific overarching themes identified in the design, implementation, and operation in their SoQM. Furthermore, for several instances of the identified deficiencies, the firm undertook robust analysis of the scope, and root causes, clearly identifying commonalities between, and aggregation of, the underlying findings.

4. Forward-looking supervision

We adopt a risk-focused, outcome-based, and proportionate approach to supervising firms, which complements our inspection programme. We balance holding firms accountable for promptly addressing quality findings with encouraging proactive improvement behaviours and sharing best practices to facilitate improvements across the firm and audit market. Each firm has a dedicated Supervisor who gathers evidence and risk indicators, identifies and prioritises actions firms must take to serve the public interest by enhancing audit quality and resilience. This includes anticipating future challenges and potential issues. Our observations from this year's work, along with updates on what the firm must do regarding previous observations, are set out below. When we identify findings, we require the firm to include actions in their SQP.

Audit Quality Transformation Plan, Single Quality Plan and other key quality initiatives

We require the largest PIE audit firms to maintain an SQP to drive measurable improvements in audit quality and resilience, and to demonstrate the effectiveness of actions taken. The SQP ensures action is prioritised in the most critical areas and enables firms to be held to account by us and their non-executives.

Observations

- Audit Quality Transformation Plan (AQTP): The firm launched its AQTP in October 2023. This was in addition to its SQP, to separately strengthen, focus and prioritise audit quality. The AQTP continues to focus on the firm's key outcomes, as per its latest Transparency Report.

- Consistent and sustainable high-quality audits: The firm has invested significantly in audit quality, supporting audit teams and strengthening the front-line delivery teams through its AQTP initiatives. It now needs to focus on achieving consistent audit quality from one year to the next and across all audit teams. The firm must understand the most successful actions and replicate them across the audit practice, for example by embedding methodologies / audit approach and audit behaviours aligned to achieving consistent high-quality audit.

- New initiatives within the AQTP: The firm continues to consider new areas of focus and resulting initiatives for the AQTP. For example, recent findings on budgeting and planning have resulted in a new initiative to improve the accuracy of budgets, which in turn will improve acceptance and continuance, risk assessment, planning, portfolio reviews and allocations.

- SQP: While it is important for the firm to maintain focus on high priority actions, it must also continue to address medium and lower-priority actions, as these may become high priorities over time. The firm must proceed on a timely basis with its plan to reintegrate the AQTP and SQP.

Effectiveness testing and RCA:

Linking the RCA on this year's positive outcomes with other effectiveness testing of delivered AQTP actions is crucial for understanding where further initiatives or cultural change are needed, and how to replicate this year's success.

4. Forward-looking supervision

Upholding high standards and continuous improvement

We expect firms to take prompt action to address quality findings and to set a tone at the top that prioritises continuous improvement.

Observations

- Tone at the top: The firm's communications during the period remain clear and consistent around the importance of audit quality. The new four-year strategy and new senior management of the firm continue to reinforce this message.

- Constructive engagement: One case, which was opened in a previous period, has been closed since the last report. The firm engaged positively and took some short-term immediate measures whilst incorporating full changes into new methodology already being prepared. No further cases have been opened in the period.

- Non-financial sanctions (NFS): We have engaged on one NFS in the period since the last report, which is ongoing. The firm is continuing to engage positively to ensure that actions taken have been effective.

- RCA: The firm has embedded what has become a robust RCA process into its SoQM. Improvements have been made annually since its introduction and the process is a key driver of continuous improvement in audit quality. In response to previous feedback the firm reports on themes across all internal and external reviews.

- Banking: As one of the firm's largest specialist sectors, the firm must continue to evolve its specific banking strategy to align the specialist resources with the firm's growth aspirations in this sector. It must also continue to develop its banking specific methodology.

- Culture: The firm's progress on culture initiatives has been positively influenced by the AQTP. The firm must continue to align these initiatives with the firm's cultural ambitions and the public interest purpose of audit. Additionally, the measurement and reporting of culture and ethical health need to be advanced.

- Ethics function: We acknowledge ongoing recruitment in line with the Ethics function's Target Operating Model (TOM). We continue, however, to monitor and challenge the resourcing levels and therefore the viability of the TOM, due to delays in monitoring, incomplete work or other indicators, some of which have been referred to in Section 3.

Continuous improvement:

The firm has used the findings and good practice from audit inspections and the review of its SoQM to develop initiatives to improve audit quality and related systems. Whilst there remains more to do, including embedding these changes and ensuring their long-term effectiveness, the firm has been open and receptive to our challenges and the need for continuous improvement.

4. Forward-looking supervision

Emerging risks and trends

Our forward-looking supervision aims to aid firms by anticipating challenges and risks from emerging trends before quality issues occur.

Industry trends:

All firms are impacted by emerging risks and trends in the industry related to:

- The use of technology and AI in the audit; and

- Changes to workforce and staff / partner development needs as a result of the above and other drivers.

These are addressed further in the 2025 Annual Review of Audit Quality. We are working with firms to understand how they are responding to these trends whilst safeguarding audit quality.

Observations

- Offshore delivery centres (ODCs): As the firm is continuing to develop its use of ODCs it will need to re-evaluate the sufficiency and effectiveness of the quality control processes to mitigate certain risks. Current changes include increasing volume and risk-level (sector based and/or audit risk) of work.

- Technological change: Rapid technological development will provide opportunities and threats for the profession and the firm. This year, use of the latest audit software led to certain archiving issues (Sections 2) and more generally, use of technology can enable conduct issues such as exam cheating, a profession wide concern. However, to date, we have seen minimal use of technological tools such as data analytics on the firm's audits inspected by the FRC. How the firm develops and uses technology on audits compared to faster adopters in the market will be an ongoing area of focus for the firm and the FRC.

- Resourcing: The use of ODCs and increased technology will impact the onshore resourcing model. Early thinking about these changes and associated risks/opportunities is needed by the firm.

- Growth: Controlled growth (audit and non-audit) is an essential part of the firm's new four-year strategy. The firm must ensure that its central systems and controls grow in line with this strategic growth. As the firm's audited entity base changes / grows it is essential that the firm's audit methodology (general and sector specific) and culture also develop to keep up with the pace of change, whilst maintaining focus on the public interest.

Appendix A – Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements (Internal Quality Monitoring, or IQM). We have not verified the accuracy or appropriateness of these results. The appendix should be read together with the firm's Transparency Report for 2024 which provides further detail of the firm's internal quality monitoring approach, results, root cause analysis, remediation, and wider system of quality management. Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring are not directly comparable to those of other firms or external regulatory inspections.

Results of internal quality monitoring9

The results of the firm's IQM for 2024 and two previous years are set out below. The 2024 IQM comprised inspections of 46 individual audits (2023: 33), with periods ending from 31 December 2021 to 31 March 2024.

A stacked bar chart illustrating the results of internal quality monitoring from 2022 to 2024. The bars show the percentage of audits falling into different quality categories: "A and B - Good or limited improvements required", "C - Improvements required", and "D - Significant improvements required".

- 2022:

- A and B: 63%

- C: 21%

- D: 16%

- 2023:

- A and B: 61%

- C: 33%

- D: 6%

- 2024:

- A and B: 74%

- C: 20%

- D: 6%

The chart indicates an improvement in "Good or limited improvements required" from 2023 to 2024, and a consistent low percentage for "Significant improvements required" in the last two years.

Themes arising from internal quality monitoring

The quality findings from the firm's 2024 IQM programme had the following themes, the first six of which were also identified in the prior year:

- Procedures or evidence obtained to support fraud risk assessment including consideration of account balances and assertions with fraud risk indicators;

- Procedures performed or evidence obtained over revenue, in particular verifying that performance obligations had been satisfied for revenue recognition;

- Procedures performed or evidence obtained over asset valuations, including impairment indicators;

- Evidence obtained as part of journal entry testing including sufficient testing on journals selected per risk criteria;

- Challenge of management over judgements applied on estimated credit loss models;

- Procedures or evidence obtained over transfer pricing arrangements;

- Procedures performed over defined benefit pension assets, including understanding of the composition of scheme assets and the audit approach thereof; and

- Evidence supporting timely assembly of audit documentation to comply with the firm's policies and ISA (UK) requirements.

Appendix B – Forvis Mazars' responses and actions

Our commitment to audit quality

The FRC recognises the strategic importance of Forvis Mazars in the market. As a Tier 1 firm in the UK PIE market, we strive to operate to the highest standards. In February 2025, we launched our firm's new four-year strategy where we reconfirmed our commitment to audit quality and to the public interest. We aligned our AQTP outcomes to our firm's new strategy. The AQTP is well embedded and on track to deliver our desired outcomes.

Our audit quality improvement journey

In our response to the FRC's July 2024 public report, we expressed our disappointment with the results of the AQR inspections. We took those findings seriously and continued to deliver the priority actions in our AQTP. Our FY24 Transparency Report published in December 2024 provided an overview of positive progress, towards delivering on our quality goals.

We are highly encouraged by the overall results of this year's AQR inspections, with 90% of the files inspected having been assessed as requiring no more than limited improvements. This is a significant improvement compared to last year's results. Moreover, the combined results of AQR inspections together with the firm's internal file inspections of AQR-scope audits this cycle show 86% (2023/24: 64%) as either good or limited improvements required. These results demonstrate that we are on the right track and indicate that our audit quality plan and actions appear to be making an impact and delivering the desired outcomes.

Our audit quality initiatives are collectively underpinned by our Audit Quality Transformation Plan (AQTP) and Single Quality Plan (SQP), and our quality risk responses and controls that form our firm's system of quality management (SoQM). We have aligned our AQTP, which was launched in October 2023, with our SoQM, and we will continue to build the foundations of sustainable audit quality through an iterative risk assessment process, monitoring, remediation, and assessment of effectiveness.

We acknowledge that we need to address the points raised by the FRC. Whilst an annual quality snapshot is important, our plans are iterative and longer term. We acknowledge the importance of ensuring actions in our AQTP are effectively implemented to achieve consistent and sustainable high-quality audits and are fully embedded in our SoQM as part of business as usual (BAU) and within the firm's culture.

Results of external and internal audit quality inspections

As highlighted by the FRC, we are aware that AQR results on their own cannot be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm. We agree with this, and we will continue to focus our efforts on our SoQM

We are encouraged that nine (90%) of the audits inspected by the FRC were assessed as either good or limited improvements required. However, we are disappointed that one audit was found as requiring significant improvements. We performed a root cause analysis of the findings; we note that the key findings were not systemic. We have taken robust actions to address the findings identified.

As outlined on page 10, the AQR team identified a few examples of good practice, including on revenue and group audits. The AQR team has also identified good practice in the audit of technical insurance provisions including the involvement of actuarial specialists. These are good indications of the effectiveness of several of our quality actions.

Appendix B – Forvis Mazars' responses and actions

which are now better embedded into our SoQM. We are sharing these good practice examples with our teams to encourage similar practices and help drive consistency.

As noted in Appendix A, the results of our internal Quality Monitoring (iQM) file inspections this year also shows a significant improvement compared to last year, with 74% found to be either good or requiring limited improvements compared to 61% in the prior year. This reflects the progress we are making in audit quality.

Insights from our root cause analysis

Root cause analysis (RCA) is integral to our continuous improvement efforts in audit quality. The RCA process is crucial for identifying factors leading to adverse quality audits and developing remedial actions to address these issues. Additionally, RCA is conducted on audits with positive results to identify good practices and behaviours that lead to high audit quality, which are then shared across the board to encourage similar practices on all engagements.

We have undertaken RCAs for all files inspected either internally by our iQM or externally by the AQR. We identified root causes relating to the one audit which was assessed by the AQR as requiring significant improvements; these included ineffective portfolio review, the responsible individual's (RI) engagement style, insufficient oversight by the RI and audit team, and inappropriate planning the group audit and approach and project management.

Positive learning themes identified from the other audits inspected by AQR included effective RI management, robust project management, effective challenge from inflight reviews and team ethos.

We have sought to be clear and comprehensive on what actions we took that led to positive findings arising from internal or external that were not up to standard and whether the root causes were specific to the audit engagements or indicative of a systemic issue. We are taking actions to ensure consistency in the delivery of high-quality audits and ensuring that those are fully embedded within the firm's culture. We outline on the next page some of the key actions that we have taken and/or are undertaking to address the findings and root causes.

Our system of quality management, ethics and other areas

We have invested considerable time and resources in developing our SoQM, and in monitoring responses. We recognise that whilst significant improvements have been made in the last year, we continue to enhance and develop our approach and documentation.

We have taken on board all recommendations from the FRC from the previous inspection cycle. We are in the process of addressing the findings raised this cycle – strengthening our responses to quality risks, the assessment of the design of responses, and the monitoring of the operation of responses.

We recognise the FRC's observation on the target operating model (TOM) for our Ethics function. We are committed to strengthening our Ethics function to ensure that it continues to protect our independence and manage risk effectively.

We will continue to focus on methodology and training. We also continue to further enhance our banking specific methodology, following constructive feedback from the FRC.

Appendix B – Forvis Mazars' responses and actions

Delivering and maintaining audit quality

We assessed and will continue to assess the effectiveness of our AQTP actions, and we will refresh and enhance our AQTP and SQP and/or add new actions as required. Some of the key actions we have taken and that we will continue to develop include, but are not limited to:

- Setting the right tone at the top with clear communication of audit quality messages, at Partner/Director meetings, team webinars, business unit meetings and audit newsletters;

- Holding our annual Audit Quality Convention (AQC) reinforcing key quality and culture messages;

- Release of our construction and retail methodology framework;

- Further development and enhancement of our banking specific methodology and guidance, and supporting 'frontline' teams on targeted engagements;

- Reinforcing the coaching and consultation culture as well as the 'one-team' approach across audit teams, specialists and experts and audit quality support team;

- Continuing to focus on risk panels and applying a professional sceptical mindset in areas of judgement;

- Timely communication of emerging themes, and implementing learnings from regulatory findings and insights;

- Continued investment in the development of our people through our training including our 5-year Audit Fundamentals initiative;

- Strengthening our recognition and reward framework in respect of audit quality; and

- Relaunching and communicating effectively the updated inflight review process focusing on high-risk audits. This process has been designed to provide timely support and challenge and safeguarding audit quality.

We continue to perform post implementation reviews which is an integral part of our continuous quality improvement process. We aim to improve and further integrate our annual portfolio review with resource planning and allocation including consideration of involvement of experts and specialists.

We acknowledge the importance of innovation, technology and AI at a whole of firm and audit service line level. We continue to embed and ensure the robust appropriateness of relevant tools within our SoQM. We also continue to invest on our people, their continuous development through training, coaching and refreshing our performance management.

Looking ahead and our ongoing commitment to audit quality

We welcome the acknowledgment by the FRC that the firm has invested, and continues to invest, significantly in our commitment to improving audit quality. We are also encouraged by the FRC's observation that the firm's communications remain clear and consistent around the importance of audit quality, and the firm's new four-year strategy and the firm's new senior management continue to reinforce this message.

Audit quality remains a strategic priority for our firm and our people. We will sustain our efforts in ensuring that our quality plan and actions are fully embedded in our firm's SoQM and more importantly within the firm's culture. We have a responsibility to act in the public interest and believe that investors and other stakeholders should be able to rely with confidence on high-quality audits. We will continue our focus on audit quality and play our part in restoring trust in audit and corporate governance.

Appendix C – ISQM (UK) 1 Glossary

The following definitions were extracted from ISQM (UK) 110.

| System of quality management (SoQM) | Quality objectives | The desired outcomes in relation to the components of the system of quality management to be achieved by the firm. |

|---|---|---|

| A system designed, implemented and operated by a firm to provide the firm with reasonable assurance that: | Quality risk | A risk that has a reasonable possibility of: |

| i. The firm and its personnel fulfil their responsibilities in accordance with professional standards and applicable legal and regulatory requirements, and conduct engagements in accordance with such standards and requirements; and | i. Occurring; and | |

| ii. Engagement reports issued by the firm or engagement partners are appropriate in the circumstances. | ii. Individually, or in combination with other risks, adversely affecting the achievement of one or more quality objectives. | |

| A system of quality management under ISQM (UK) 1 addresses the following eight components: | Response | Policies or procedures designed and implemented by the firm to address one or more quality risk(s) in relation to its system of quality management: |

| - The firm's risk assessment process; | i. Policies are statements of what should, or should not, be done to address a quality risk(s). Such statements may be documented, explicitly stated in communications or implied through actions and decisions. | |

| - Governance and leadership; | ii. Procedures are actions to implement policies. | |

| - Relevant ethical requirements; | Findings | |

| - Acceptance and continuance of client relationships and specific engagements; | Information about the design, implementation and operation of the system of quality management that has been accumulated from the performance of monitoring activities, external inspections and other relevant sources, which indicates that one or more deficiencies may exist. | |

| - Engagement performance; | ||

| - Resources; | ||

| - Information and communication; and | ||

| - The monitoring and remediation process. | ||

| Firms were required to perform their first annual evaluation of the SoQM by 15 December 2023. |

Appendix C – ISQM (UK) 1 Glossary

| Deficiency | Ultimate responsibility | Individual(s) assigned ultimate responsibility and accountability for the firm's SoQM should evaluate the SoQM, on behalf of the firm, and shall conclude, on behalf of the firm, whether or not the SoQM provides the firm with reasonable assurance that the objectives of the SoQM are being achieved, required under ISQM (UK) 1 paragraph 54. |

|---|---|---|

| A deficiency in a firm's system of quality management exists when: | ||

| i. A quality objective required to achieve the objective of the system of quality management is not established; | ||

| ii. A quality risk, or combination of quality risks, is not identified or properly assessed; | ||

| iii. A response, or combination of responses, does not reduce to an acceptably low level the likelihood of a related quality risk occurring because the response(s) is not properly designed, implemented or operating effectively; or | ||

| iv. An other aspect of the system of quality management is absent, or not properly designed, implemented or operating effectively, such that a requirement of this ISQM (UK) 1 has not been addressed. |

Financial Reporting Council

London office:

13th Floor, 1 Harbour Exchange Square, London, E14 9GE

Birmingham office:

5th Floor, 3 Arena Central, Bridge Street, Birmingham, B1 2AX

+44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in.

Footnotes

-

The six annually inspected firms in 2024/25 were: BDO LLP, Deloitte LLP, Ernst & Young LLP, KPMG LLP, Forvis Mazars LLP, and PricewaterhouseCoopers LLP. We have published a separate report for each of these firms along with a cross-firm Annual Review of Audit Quality, which also includes results of firms not inspected annually. ↩

-

We are currently reviewing our future approach to audit supervision. Further detail can be found in the Annual Review of Audit Quality. ↩

-

Source - FRC analysis of the firm's PIE audits and other audits included within the Audit Quality Review scope as at 31 December 2024. ↩

-

Source - FRC's PIE Auditor Registration data as at 31 December 2024. There may be timing differences between the collation of this data and the FRC inspection scope data. ↩↩

-

Source - FRC's 2023, 2024 and 2025 editions of Key Facts and Trends in the Accountancy Profession. Audit fee income may be prepared to different reference dates by different firms. ↩

-

Source - the firm's Annual Return to the ICAEW dated, 30 April 2025. Data has been prepared by different firms using different reference dates and methodologies. The FRC has not validated the methodologies used. ↩↩↩↩

-

Excludes the inspection of local audits. ↩

-

Source - FRC analysis of Major Local Audits (MLA) as at 31 March 2024. The FRC's inspections of MLAs are published in a separate annual report which can be found on our website. ↩

-

The grading categories used by the firm are aligned as closely as possible to those that would result from the FRC's regulatory inspection process. ↩

-

https://www.frc.org.uk/documents/4691/ISQM_UK_1_Issued_July_2021_Updated_March_2023_7S8WvVE.pdf ↩