The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting June 2025 Paper 3: IFRS S2 Proposed Amendments Comment Letter

AGENDA PAPER 3

Executive summary

| Date | 10 June 2025 |

|---|---|

| Paper reference | 2025-TAC-036 |

| Project | Proposed amendments to IFRS S2 Climate-related Disclosures |

| Topic | Greenhouse gas emissions measurement and disclosure |

Objective of the paper

This paper provides an update to the TAC following the May 2025 discussion paper 2025-TAC-035, regarding the International Sustainability Standards Board (ISSB)'s Exposure Draft Amendments to Greenhouse Gas Emissions Disclosures (Proposed amendments to IFRS S2)).

It includes a draft comment letter for the TAC's review and approval prior to submission to the ISSB.

The paper is intended solely for discussion purposes and does not constitute the final and official position of the TAC on the proposed amendments.

Decisions for the TAC

The TAC is asked to:

- Discuss and evaluate the draft comment letter in Appendix 1.

- Provide any comments, observations and any alternative viewpoints.

- Approve the draft comment letter, subject to any suggested amendments.

Appendices

- Appendix 1(a) – Draft comment letter to the ISSB

- Appendix 1(b) – Detailed responses to the exposure draft questions

- Appendix 2 – Summary of stakeholders' feedback

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including 'IAS®', ‘IASB®', ISSB™, 'IFRIC®', 'IFRS®', the IFRS® logo, 'IFRS for SMEs®', IFRS for SMEs® logo, ISSB™, the 'Hexagon Device', 'International Accounting Standards®”, ‘International Financial Reporting Standards®', and 'SIC®'. Further details of the Foundation's Trade Marks are available from the Licensor on request.

Context

1At its May 2025 meeting, the TAC reviewed a discussion paper outlining preliminary considerations on the ISSB's Exposure Draft Amendments to Greenhouse Gas Emissions Disclosures (Proposed amendments to IFRS S2). The Exposure Draft aims to address practical implementation challenges related to the measurement and disclosure of greenhouse gas emissions, focusing particularly on:

- certain Scope 3 Category 15 greenhouse gas emissions,

- the use of the Global Industry Classification Standard (GICS) for the disaggregation of counterparties' greenhouse gas emissions,

- clarity on the existing jurisdictional relief regarding the application of the GHG Protocol Corporate Standard, and

- the lack of jurisdictional relief regarding the application of global warming potential (GWP) values.

2Following that meeting, the Secretariat integrated the TAC's comments, along with stakeholder feedback gathered through targeted outreach meetings, to develop a draft comment letter appended to this paper for the TAC's review and approval.

3The table below summarises the Secretariat's recommended response for each proposed amendment for the TAC's consideration. Further details on each draft response and the underlying considerations are outlined in the sections that follow.

| Item No. | Proposed amendments | Summary of the Secretariat's recommended position for the TAC's consideration |

|---|---|---|

| (a) | Relief in paragraph 29A(a) to limit disclosure of Scope 3 Category 15 greenhouse gas emissions to 'financed emissions' as defined in IFRS S2. | Support the relief, subject to future review as methodologies, data and technology improve. Additionally, recommend that the ISSB considers enhancements outlined in (b) and (c) below. |

| (b) | New requirement in paragraph 29(b)(i) to disclose the 'amount' of derivatives excluded from the emissions disclosure, alongside an explanation of what has been treated as a derivative. | Do not support the amendment. Instead, recommend qualitative disclosure of emissions exposure through derivatives. |

| (c) | New requirement in paragraph 29(b)(ii) to disclose 'amount' of other financial activities excluded from the emissions disclosure. | Support the amendment, subject to clarification of the concept of an 'amount'. In addition, recommend that the ISSB considers enhancing the paragraph to require disclosure of qualitative information that explain emissions exposure. |

| (d) | Amendment to require mandatory use of GICS in certain circumstances – decision tree approach. | Strongly disagree with the amendment. Instead, recommend that the ISSB considers allowing use of classification systems that are aligned with the entities' financial and regulatory reporting, and business models. |

| (e) | Clarification on the relief that permits use of non-GHG Protocol measurement methods where such methods are mandated by a jurisdictional authority or an exchange on which the entity is listed. | Support the amendment. |

| (f) | Allowing jurisdictional relief for use of global warming potential (GWP) values mandated by a jurisdictional authority or an exchange on which an entity is listed. | Support the amendment. |

| (g) | Proposal to establish effective date for the proposed amendments to apply as soon as possible, with option for early application. | Support the proposal. |

Scope 3 Category 15 greenhouse gas emissions

Facilitated, insurance-associated and derivatives-related emissions

4Scope 3 Category 15 greenhouse gas emissions arise from an entity's financial investments and financial-related activities, including financed, facilitated, insurance-associated, derivatives-related and other emissions. The proposed relief primarily focuses on facilitated, insurance-associated and derivatives-related emissions, as these are significant components for entities carrying out banking, insurance and asset management activities.

5The relief is broadly framed to apply to all Scope 3 Category 15 greenhouse gas emissions other than financed emissions which are defined as those arising from loans and investments made by an entity to an investee or counterparty. Rather than explicitly listing all exclusions, the amendment refers to them collectively as Scope 3 Category 15 greenhouse gas emissions outside of financed emissions.

6IFRS S2 Climate-related Disclosures does not define 'facilitated emissions'. However, for context, these emissions generally arise from capital markets activities where financial institutions enable entities to raise capital, typically through underwriting or arranging debt or equity issuance. Although these activities do not involve balance sheet exposure, they indirectly contribute to emissions by financing emissions-generating entities or projects.

7Similarly, insurance-associated emissions refer to emissions linked to underwriting activities by insurers and reinsurers. These are the emissions associated with insured assets or liabilities such as vehicles, properties or industrial facilities, not emissions related to the insurer's investment portfolio (which are captured as financed emissions).

8While methodologies for financed emissions had been developed when IFRS S2 was issued in 2023, those for facilitated, insurance-associated and derivatives-related emissions were not yet developed at the time. Since then, the Partnership for Carbon Accounting Financials (PCAF) released methodologies in late 2022 and 2023 for some of these categories, with currently ongoing refinements of the standards. There remains, however, no established methodology for derivatives-related emissions.

9During its deliberations to finalise IFRS S2, the ISSB clarified in the Basis for Conclusions (paragraphs 127 and 129) that it would not require the reporting of derivatives-related, facilitated or insurance-associated emissions (each part of Scope 3 Category 15 greenhouse gas emissions). However, this position was not reflected in the final text of IFRS S2. As a result, paragraph 29(a)(i)(3), when read alongside the application guidance in paragraph B34, effectively mandates disclosure of these emissions.

10To resolve this inconsistency between the Basis for Conclusions and paragraphs 29(a)(i)(3) and B34, and to align more closely with paragraph 29(a)(vi)(2), which requires additional information about financed emissions (explicitly referencing asset management, commercial banking and insurance activities), the ISSB has issued this Exposure Draft. It proposes a new paragraph, paragraph 29A(a), which would permit entities to limit their disclosure of Scope 3 Category 15 greenhouse gas emissions to 'financed emissions' as defined in IFRS S2. Since facilitated, insurance-associated and derivatives-related emissions fall outside of this definition, the amendment effectively provides optional relief from disclosing these emissions while allowing entities currently reporting them to continue doing so. It also offers the option for others to report these emissions if they choose. This aims to minimise disruption to the ongoing implementation of IFRS S2.

11However, the rationale for this relief reflects conditions in 2023 and does not fully take into account the development and uptake of new methodologies since then, leading to mixed stakeholder views about this relief.

12While there was broad support for the relief in relation to reporting derivatives-related emissions, stakeholders' views were mixed on whether the relief should extend to facilitated and insurance-associated emissions. Investors and other users of sustainability disclosure reports disagreed with this relief, stressing the importance of disclosing such emissions to support systemic and climate risk management, understanding of carbon exposure in capital markets, benchmarking climate-related performance and evaluation of progress towards net zero targets. Investors also recommended that if entities do not report their facilitated and insurance-associated emissions based on the relief, they should explain why and disclose if any steps are being taken to report them in the future.

13Some organisations involved in developing methodologies for Scope 3 Category 15 greenhouse gas emissions noted that standards for facilitated and insurance-associated emissions have been adopted by major UK financial institutions since IFRS S2's issuance. Although these methodologies continue to evolve, particularly for life and health insurance, they highlighted that data challenges exist across all Scope 3 greenhouse gas emissions and should not hinder the momentum in making progress with emissions disclosures.

14Conversely, preparers particularly in the banking and insurance sectors supported the relief, considering it flexible, proportionate and aligned with the evolving nature of market practices. Without such relief, preparers raised concerns about the less established nature of methodologies, and data quality and availability challenges, particularly from small and medium enterprises (SMEs) in their value chain. This leads to significant judgments and estimates being made using sector averages, which may pose reporting and assurance challenges and may not provide the most reliable and decision useful disclosures to investors. There is also a view from preparers that motor vehicle, for instance, is legally required in the UK and juxtaposing it with decarbonisation requirements conflicts with the entities' societal responsibilities to provide such products.

15In light of these implementation challenges and considering the optional nature of the proposed relief and the possibility for the ISSB to revisit it in future, the Secretariat recommends that the TAC support the relief, subject to future review when data, methodologies and technology improve. For instance, the revision of the GHG Protocol Corporate Standard provides an opportunity to review this relief in the near future. In addition, the ongoing work of PCAF may also help address some of the current challenges.

16The Secretariat has also considered suggestions from some investors for the ISSB to enhance the relief by requiring entities that apply it to explain the basis for using relief and disclose whether any steps are being taken to report these emissions in the future. Regarding this suggestion, the Secretariat proposes two options for the TAC's consideration:

- Given that the ISSB has already included conditions requiring entities using the relief to disclose the activities and derivative amounts for which they have taken the relief, adding another condition to explain why the relief was used, although useful, may impose potentially disproportionate conditions to the relief. Therefore, the TAC may consider not making a recommendation of this enhancement to the ISSB.

- Alternatively, the TAC could recommend that the ISSB considers strengthening the relief by requiring an entity to explain its basis for using the relief. This would not, however, remove the requirement to disclose the other relevant activities and derivative amounts excluded from the disclosures.

17In the current draft comment letter, the Secretariat have supported the relief, given that it is optional in nature. Further, this support is subject to the following recommendations:

- that the ISSB considers enhancing the disclosure requirements for derivatives and other financial activities 'amounts' excluded from emissions disclosures (paragraphs 29A(b)(i) and 29A(b)(ii)) respectively, with a requirement to disclose qualitative information explaining emissions exposure through these activities and derivatives; and

- that the ISSB considers revisiting the relief in the future as data, methodologies and technology improve.

18Considered together, the Secretariat believes that overtime, this approach strikes a fair balance between the needs of preparers and investors. However, the Secretariat would welcome the TAC's views on the options in paragraph 16.

Relief for derivatives-related emissions and disclosure of derivative amounts

19The amendment introducing paragraph 29A(a) provides relief from disclosing Scope 3 Category 15 greenhouse gas emissions outside of 'financed emissions'. Due to the complexity of derivatives and lack of definition thereof for sustainability reporting, the ISSB decided to explicitly include them in the relief set out in paragraph 29A(a), to avoid any confusion. However, as a condition for using this relief, the proposed paragraph 29A(b)(i) would require disclosure of the 'amount' of derivatives that would have been excluded from Scope 3 Category 15 greenhouse gas emissions disclosure.

20At the May meeting, the TAC questioned why derivatives were the only asset class specifically identified for this relief. Other assets such as goodwill, intangible assets or tax assets for which Scope 3 Category 15 greenhouse gas emissions are not calculated, are not mentioned. It was noted that the assets within Scope 3 Category 15 greenhouse gas emissions are primarily financial investments and those arising from financial activities. Non-financial assets like intangible assets, goodwill and tax assets are not relevant for these disclosures. Other financial assets, such as credit cards, invoice finance, or short-term lending fall under the requirements of the new paragraph 29A(b)(ii), which would require disclosure of other financial activities excluded from the emissions disclosure, thereby leaving derivatives as the main asset class covered by this specific relief.

21During stakeholder meetings, the majority of stakeholders supported the proposed relief, citing the complexity of derivatives and the lack of established methodologies for measuring their related emissions.

22The Secretariat also considered the TAC's discussion at the May meeting, which raised concerns over the usefulness of disclosing derivative amounts as in some cases disclosure of a material derivative amount may not necessarily correlate with material emissions exposure and could lead to potential misinterpretation. Moreover, derivatives can alternate between assets and liabilities classifications from year to year, diminishing the informational value of trends from an emissions perspective. It is also unclear from the ISSB's proposal whether the 'amount' to be disclosed for derivatives should include assets only or liabilities as well, and whether the amount is fair value or nominal value. In addition, the proposed requirement to explain what has been treated as a derivative for the purpose of Scope 3 Category 15 greenhouse gas emissions could clutter the disclosure with information of limited relevance.

23In light of the above, the draft comment letter supports the relief from disclosing derivatives-related emissions. However, it does not support the proposed paragraph 29A(b)(i) that would require disclosure of the 'amount' of derivatives excluded from the emissions disclosure, alongside an explanation of what is treated as a derivative for the purpose of the disclosure. Instead, the draft comment letter recommends that the ISSB considers revising the amendment to require qualitative information explaining an entity's emissions exposure through derivatives. For instance, an entity trading derivatives linked to high-emitting commodities could describe its exposure to those markets.

Disclosure of other financial activities excluded from Scope 3 Category 15 greenhouse gas emissions and their related amounts

24As discussed above, the amendment introducing paragraph 29A(a) provides relief from disclosing all Scope 3 Category 15 greenhouse gas emissions except financed emissions, primarily encompassing facilitated, insurance-associated, and derivatives-related emissions. As a condition of using this relief, entities are required to disclose the 'amount' of other financial activities giving rise to Scope 3 Category 15 greenhouse gas emissions that are excluded from the disclosure.

25This means that if an entity is unable to determine financed emissions for some of its activities such as credit cards, invoice finance or others within the broad scope of Scope 3 Category 15 greenhouse gas emissions it is required to disclose the amount of such activities under the requirements of the proposed paragraph 29A(b)(ii). The scope of activities and amounts covered by paragraph 29(b)(ii) is therefore broad and complex. Some items, like credit cards (which are part of financed emissions), would be reported in the financial statements and are potentially easy to cross-reference. However, others such as facilitation in banking or insurance underwriting, may involve amounts like revenues which are in the financial statement and other amounts like notional deal values or assets/liabilities underwritten that are not captured in the financial statements, therefore not easily cross-referenced.

26One investment banking stakeholder explained that the term 'amount' could be interpreted either as facilitation fees (which are included in financial statements) or the notional deal amount (which is not). These two figures differ significantly. Similarly, insurers noted that the 'amount' could be interpreted as underwriting revenue or as the value of underwritten assets and liabilities, again, figures that are not comparable if different entities report them inconsistently. As a result, stakeholders suggested that for the disclosure to be meaningful and comparable, the ISSB could consider to clarify the concept of 'amount'.

27Some stakeholders also explained that the 'amount' may not help in understanding emissions exposure. Therefore, for this disclosure to be meaningful, qualitative information explaining emissions exposure from activities not covered in the emissions disclosure is more decision useful.

28Considering the above points, the draft comment letter supports the amendment introducing paragraph 29A(b)(i), subject to the ISSB enhancing it with clarification of the concept of 'amount' and requiring disclosure of qualitative information explaining emissions exposure through these activities. This is because 'amount' alone does not always provide decision useful information about emissions exposure.

Global Industry Classification Standard

29The Secretariat has incorporated the TAC's strong disagreement with the proposed decision-tree approach for applying the Global Industry Classification Standard (GICS), together with stakeholder feedback, in informing the position in the draft comment letter. While some investor stakeholders supported broader GICS use for comparability, some preparers disagreed with both the current GICS requirement and the proposed decision tree approach, particularly when triggered by use in a small business unit.

30The points for the ISSB's consideration are presented in the draft comment letter in order of significance, beginning with how the ISSB's proposal could undermine key principles of sustainability and financial reporting, ending with concerns about comparability benefits.

Jurisdictional reliefs and effective date

31At the May meeting, a majority of TAC members supported the ISSB's clarification regarding the existing jurisdictional relief, allowing the use of alternative greenhouse gas measurement methods, for 'part or all of an entity' when mandated by a jurisdictional authority or an exchange on which it is listed, and the introduction of a similar jurisdictional relief for using GWP values mandated by a jurisdictional authority or exchange on which the entity is listed.

32A minority of investor stakeholders disagreed with these jurisdictional reliefs, citing a preference for global consistency grounded in the GHG Protocol Corporate Standard and the latest Intergovernmental Panel on Climate Change (IPCC) science-based GWP values.

33No major concerns were raised regarding the proposal to make the amendments effective as soon as practicable, with early adoption permitted.

34Given the broad support for these amendments, which are seen as resolving interpretation uncertainty and reducing reporting duplication, the draft comment letter supports them.

Next steps

35If the TAC approves the draft comment letter subject to any final comments and authorises the Chair to resolve any edits arising from those comments, the letter will then undergo final proofreading and formatting. Once completed, it will be submitted to the ISSB by the deadline, 27 June 2025.

Questions for the TAC

- Does the TAC have any comments on the draft comment letter and related appendix?

- Specifically, does the TAC have any comments on the suggestion in paragraph 16 for an entity that is not reporting all of its Scope 3 Category 15 greenhouse gas emissions to provide an explanation and outline any steps it is taking to report such emissions in the future?

- Does the TAC approve the draft comment letter and related appendix?

Appendix 1(a) – Draft comment letter to the ISSB

The Chair Mr Emmanuel Faber International Sustainability Standards Board Columbus Building 7 Westferry Circus London E14 4HD

xx June 2025

36Exposure Draft ISSB/ED/2025/1

37Dear Emmanuel,

38The UK Sustainability Technical Advisory Committee (TAC) welcomes the opportunity to provide feedback on the ISSB's Exposure Draft Amendments to Greenhouse Gas Emissions Disclosures (Proposed amendments to IFRS S2).

39The TAC is an independent expert advisory body established by the UK Government to provide technical input to support the government with the development and endorsement of the IFRS Sustainability Disclosure Standards for use in the UK. Accordingly, this letter is solely intended to inform and constructively contribute to the ISSB's standard setting outcomes and does not reflect an endorsement or formal technical advice under the TAC's statutory remit concerning the UK Sustainability Reporting Standards. Instead, it reflects our independent assessment of the proposals set out in the Exposure Draft based on our assessment criteria, supported by views from targeted stakeholder outreach.

40The TAC commends the ISSB for its proactive approach to reduce implementation complexity, address interpretation uncertainties and promote proportionality to ensure successful implementation of the IFRS Sustainability Disclosure Standards.

41This letter sets out our key points for consideration and is accompanied by an appendix containing our detailed responses to each specific question posed in the Exposure Draft.

Scope 3 Category 15 greenhouse gas emissions

42The TAC supports the proposed amendment in paragraph 29A(a), which would permit entities to limit disclosure of Scope 3 Category 15 greenhouse gas emissions to 'financed emissions' as defined in IFRS S2, thereby excluding facilitated, insurance-associated and derivatives-related emissions. We support this relief, subject to it being reviewed in the future as methodologies, data and technology improve. For instance, the revision of the GHG Protocol Corporate Standard provides an opportunity to review this relief in the near future.

43This relief reduces reporting and assurance-related challenges for preparers as methodologies for these emissions, and data availability and quality are still evolving. We have considered the concerns of investors and others who do not support this relief, stressing the need to disclose these emissions for effective systemic and climate risk management and assessment of progress towards net zero targets. We believe that offering this relief subject to review in the future as data and methodologies improve, together with our recommended enhancements to paragraphs 29A(b)(i) and 29A(b)(ii) as described below, strikes a fair balance for all stakeholders.

44While we support the relief from disclosing derivatives-related emissions in paragraph 29A(a), we do not support the proposed requirement under paragraph 29A(b)(i) to disclose the 'amount' of derivatives excluded from Scope 3 Category 15 greenhouse gas emissions disclosures and to explain what is treated as a derivative for this purpose.

45We are concerned that such disclosure may mislead users. For instance, a material derivative amount may not necessarily correlate with significant emissions exposure. In addition, the possible year-to-year variability in the classification of derivatives as assets or liabilities further reduces the informational value for trend analysis from an emissions perspective. There is also ambiguity regarding whether amounts should reflect fair or nominal value, or include assets, liabilities, or both.

46Instead, we recommend replacing the quantitative disclosure requirement with a qualitative one requiring explanation of an entity's emissions exposure through derivatives. For example, an entity could describe its sectoral emissions exposure via derivatives, such as involvement in commodities markets with high emissions.

47We support the requirement in paragraph 29A(b)(ii) for entities applying the relief to disclose other financial activities excluded from Scope 3 Category 15 greenhouse gas emissions disclosure. However, we recommend that the ISSB considers enhancing this amendment by:

- providing clarification or guidance on the concept of an 'amount' (whether it represents a notional value, revenue or another metric); and

- requiring disclosure of qualitative information explaining emissions exposure through these other financial activities, as the 'amount' alone may not convey useful information about emissions.

48There are varied interpretations of 'amount'. Therefore, without further clarification in the standard, the disclosure risks inconsistency and limited comparability across entities.

Use of Global Industry Classification Standard

49We strongly disagree with the proposed decision tree structure mandating the use of the Global Industry Classification Standard (GICS) in specific circumstances. This proposal misaligns with core sustainability and financial reporting principles, imposes potentially significant operational challenges and introduces inconsistencies with other jurisdictional mandate considerations the ISSB has taken. Further, the proprietary nature of GICS presents cost challenges for UK financial institutions, and the purported benefits for global comparability are not compelling at this stage given data limitations and evolving methodologies.

50We recommend that the ISSB considers allowing entities to use classification systems that align with their business models and are consistent with their regulatory and financial reporting, as this provides users with more useful information about the entity.

Jurisdictional reliefs - use of GHG Protocol Corporate Standard and applicability of GWP values

51We support the clarification on the existing jurisdictional relief for the use of alternative greenhouse gas emissions measurement methods and the new relief for using alternative global warming potential (GWP) values for an entity, in whole or in part, when mandated by a jurisdictional authority or exchange on which it is listed. This resolves interpretation uncertainties, thereby mitigating the potential for diverse reporting practices and reducing duplicative reporting.

Effective date

52We agree with the ISSB's proposal to set the effective date as soon as practicable, with the option for early adoption.

53Our detailed responses to each question in the Exposure Draft are provided in the appendix to this letter.

54We welcome the opportunity to continue to work with the Board and Staff in the implementation of IFRS Sustainability Disclosure Standards and future standard setting initiatives.

55Should you require any clarification or wish to discuss our feedback in greater detail, we would be pleased to engage further.

56Yours sincerely

Sally Duckworth Chair of the UK Sustainability Disclosure TAC Email: [email protected]

Appendix 1(b) – Detailed responses to the Exposure Draft questions

Question 1: Measurement and disclosure of Scope 3 Category 15 greenhouse gas emissions

a) Do you agree with the proposal to explicitly allow entities, by adding a new paragraph 29A(a) that would expressly allow entities to limit disclosure of Scope 3 Category 15 greenhouse gas emissions to financed emissions (excluding derivatives-related, banking-facilitated, and insurance-associated emissions), while permitting voluntary disclosure of the excluded categories? Why or why not?

57The TAC supports, the proposed relief in paragraph 29A(a), which would allow entities to limit the disclosure of Scope 3 Category 15 greenhouse gas emissions to 'financed emissions' as defined in IFRS S2 Climate-related Disclosures. This support is subject to the relief being reviewed in future as data and methodologies improve. For instance, the revision of the GHG Protocol Corporate Standard provides an opportunity to review this relief in the near future.

58This amendment aligns IFRS S2 with the Basis for Conclusions (BC127 and BC129), which already acknowledges the challenges of reliably measuring facilitated, insurance-associated and derivatives-related emissions. Our targeted outreach with preparers identified key reporting challenges, including evolving but still less established measurement methodologies and issues with data availability and quality, particularly from small and medium enterprises in the financial institutions' value chain. These challenges result in reliance on significant judgements and estimates using sector averages which pose difficulties for both reporting and assurance processes. Ultimately, this limits the decision-usefulness of the information for users. As such, preparers view this relief as offering flexibility and proportionality, with its optional nature allowing market practices to evolve.

59However, we noted concerns from investors and other users of sustainability-related financial information, who did not support the relief. They emphasised the importance of disclosing these emissions to enable effective assessment of systemic and climate-related risks, as well as progress toward net zero targets. With the exception of derivatives, investors also pointed to the existence of the Partnership for Carbon Accounting Financials (PCAF) standards, which entities can use to report facilitated and insurance-associated emissions.

60Furthermore, stakeholders noted that measurement methodologies have evolved since the ISSB issued IFRS S2, with major UK financial institutions already adopting the PCAF standard for facilitated and insurance-associated emissions. They expressed concern that the ISSB has not revisited its original technical analysis in light of these developments and that basing amendments on outdated conclusions does not reflect current market practices. They also highlighted that data challenges are not unique to Scope 3 Category 15 greenhouse gas emissions and should not hinder the ongoing progress in reporting such emissions.

61Taking these mixed views into account, the TAC supports the relief subject to it being reviewed in the future. At that time, disclosures could be required as data availability and quality, methodologies and technology improve. The ongoing work of PCAF may address some of the current methodology limitations, although we note its methodology for insurance-associated emissions does not yet cover all products, such as life and health insurance lines, nor does it fully address derivatives.

62On balance, the TAC believes this approach would support the needs of both preparers and investors over time.

b) Do you agree with the requirement for entities applying the above limitation to disclose the ‘amount' of excluded derivatives alongside an explanation of what they treat as derivatives for the purpose of limiting disclosure of Scope 3 Category 15 greenhouse gas emissions and also the amount of other financial activities excluded? Why or why not?

63The TAC does not support the proposed introduction of paragraph 29A(b)(i), which would require entities applying the relief under paragraph 29A(a) to disclose the 'amount' of derivatives excluded from emissions reporting, along with an explanation of what it treats as a derivative. The TAC questions the usefulness of this disclosure, as a material derivative amount may not necessarily correlate with significant emissions exposure and may therefore be misleading. Additionally, because derivatives can alternate between asset and liability classifications from year to year, the informational value of such disclosure, particularly for identifying emissions trends, may be limited.

64The TAC also notes ambiguity in the proposal regarding whether the disclosed derivative 'amount' should include both assets and liabilities, and whether it should be reported at fair value or nominal value. Moreover, the requirement to explain what has been treated as a derivative for this purpose may result in disclosures that are cluttered with information of limited relevance.

65In light of these concerns, the TAC recommends that the ISSB considers replacing the quantitative disclosure requirement for derivatives with a qualitative one. For example, an entity could provide a narrative explanation of its sectoral emissions exposure through derivatives. This could include disclosing its involvement, via derivatives, in commodity markets associated with high emissions, thereby offering users more decision-useful information.

66Subject to further improvement discussed below, the TAC supports the proposed introduction of paragraph 29A(b)(ii), which would require disclosure of financial activities excluded from Scope 3 Category 15 greenhouse gas emissions. This information is considered decision-useful, as it enhances transparency regarding the extent to which an entity's financial activities are included in or excluded from Scope 3 Category 15 greenhouse gas emissions disclosures.

67However, the TAC recommends that the ISSB considers providing clarification on the concept of 'amount', along with a requirement to include qualitative information explaining an entity's emissions exposure through these other financial activities. This is because the 'amount' may not always correlate with emissions exposure.

68For facilitated and insurance-associated emissions in particular, it would be helpful to establish common metrics for measuring facilitation or underwriting activities such as whether to use revenue from these activities or notional values. Without a common and consistent metric, the use of diverse benchmarks may result in inconsistent and non-comparable disclosures across similar entities. In addition, clarification of the basis of measurement, whether to report at fair value or nominal value would help promote consistency in reporting practices.

Question 2: Use of the Global Industry Classification Standards in applying specific requirements related to financed emissions

a) Do you agree with the proposal to permit the use of alternative industry classification systems to GICS, in specified circumstances, when disaggregating financed emissions? Why or why not?

69We strongly disagree with the proposed amendment that introduces a decision tree approach mandating the use of the Global Industry Classification Standard (GICS) in certain circumstances. Instead, we recommend that the ISSB considers allowing entities to use classification systems that align with their business models and are consistent with their regulatory and financial reporting purposes, as this provides users with more useful information about the entity. Below, we outline in order of significance, the specific details of our key concerns regarding the proposed amendment.

Conflict with existing core sustainability and financial reporting principles

70Paragraph 1 of IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information requires an entity to disclose information about its sustainability-related risks and opportunities that is useful to primary users of general-purpose financial reports. However, in the ISSB's proposed decision tree or hierarchy for sector classification, this objective is ranked only fourth in priority, thereby undermining this fundamental principle in IFRS S1.

71IFRS S1 paragraph B38 stipulates that, in a group context, the 'reporting entity' for sustainability-related information is the entity that prepares the consolidated financial statements under IFRS Accounting Standards. A well-established principle of financial reporting is that consistent policies must be applied across the group. Accordingly, any differences in subsidiary accounts must be adjusted to align with the parent's policies during consolidation. In this context, if a subsidiary, regardless of its materiality, uses the GICS classification while the parent and other subsidiaries use a different system, applying GICS to the consolidated sustainability-related information solely due to that subsidiary's practice would create an inconsistent reporting approach where a subsidiary's policy overrides the group's established sustainability reporting policy.

72Moreover, requiring GICS-based classification across the group could conflict with classification systems used for other financial reporting purposes, such as those that underpin expected credit losses (ECL) calculations. For example, if ECLs (including those driven by climate factors) are based on a non-GICS classification, applying GICS to sustainability disclosures could impair connectivity and consistency of financial information reported.

Costs

73GICS is a proprietary system and requires licensing fees, which may vary depending on the entity size and use case causing additional costs to large UK financial institutions with operations in multiple jurisdictions.

Operational challenges and internal inconsistency

74The requirement to use GICS throughout the group, simply because one part of the entity applies it, would result in parallel classification systems. This imposes duplicative reporting, significant reconciliation demands on large, multinational groups, and may fragment internal systems.

Inconsistency with other ISSB's considerations

75Jurisdictional mandates often require specific classification systems. While the ISSB has applied jurisdictional reliefs in other contexts (e.g., GHG Protocol Corporate Standard, global warming potential values), this principle is not consistently applied in the case of GICS as an entity would still be mandated to use GICS if a small part of it uses it despite the jurisdictional rules elsewhere requiring an alternative classification system.

76The ISSB cites the widespread use of GICS in global capital markets, yet asset managers are not required to use it. This undermines the strength of the global use argument.

Questionable comparability benefit

77Given that financed emissions methodologies are still evolving and with current data quality and availability challenges, it is questionable whether mandating GICS to a large group on the basis that an insignificant part of such a group uses GICS (even if used for non-core purposes) would yield meaningful global comparability.

78We understand that the ISSB considers that use of GICS would not result in significant interoperability issues with the European Sustainability Reporting Standard on Climate Change (ESRS E1) as the statistical classification of economic activities in the EU (NACE) can be mapped into GICS easily. However, this raises questions about the necessity of mandating GICS if it can yield comparable outcomes with other classification systems.

b) Do you agree that entities not using GICS should be required to disclose the industry-classification system used to disaggregate its financed emissions information and explain the basis for its industry-classification system selection? Why or why not?

79We support the requirement for entities not using GICS to disclose the industry system used and explain the basis for its industry-classification system selection. This enhances transparency and provides users with the necessary context for understanding reported emissions.

Question 3: Jurisdictional relief from using the GHG Protocol Corporate Standard

Do you agree with the proposed clarification that the existing jurisdictional relief from using the GHG Protocol: Corporate Standard (2004) is permitted to an entity in part or in whole if a jurisdictional authority or an exchange on which it is listed mandates an alternative method? Why or why not?

80We support the clarification to the existing jurisdictional relief as it resolves interpretation uncertainty and mitigates the potential for inconsistent reporting practices that could affect comparability. It also reduces duplicative reporting if local regulations mandate alternative measurement methods.

Question 4: Applicability of jurisdictional relief for global warming potential values

Do you agree with the proposal to extend a jurisdictional relief that would allow an entity in whole or in part to use global warming potential (GWP) values that are mandated a jurisdictional authority or exchange on which it is listed? Why or why not?

81We support the proposal to allow an entity in whole or in part to use GWP values mandated by a jurisdictional authority or exchange on which it is listed. This approach aligns with the relief provided under the GHG Protocol Corporate Standard and prevents duplicative calculations, particularly in multi-jurisdictional contexts.

Question 5: Effective date

Do you agree with the proposed approach for setting the effective date of the amendments and permitting early application? Why or why not?

82We support the proposed approach for establishing an effective date that applies as soon as possible, with the option for early application. This would align with the ongoing implementation of IFRS S2 and streamline the process.

Question 6: Other comments

Do you have any other comments on the proposals set out in the Exposure Draft?

83We have no further comments on the proposals set out in the Exposure Draft.

Summary of stakeholders' feedback

Appendix 2(a) - Analysis of stakeholders engaged

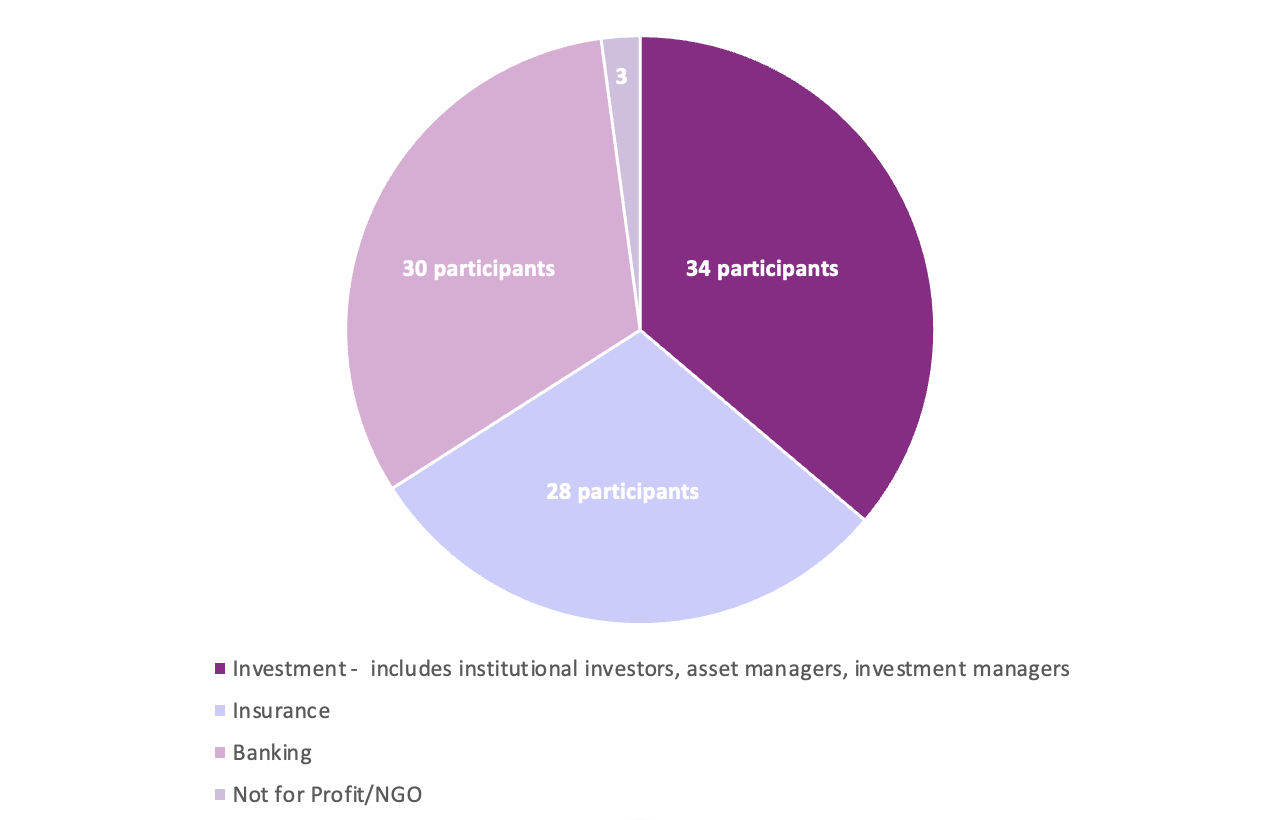

84As part of its work to draft the TAC's response to the ISSB's 'Proposed amendments to IFRS S2 Climate-related Disclosures', the Secretariat conducted a series of targeted stakeholder outreach activities. These engagements were intended to gather stakeholders' views on how the proposed amendments might affect users and preparers of sustainability-related financial information in the UK.

85The outreach included roundtable discussions and one-on-one interviews with a broad range of stakeholder groups, including institutional investors, asset managers, investment managers, insurers, banks and non-governmental organisations (NGOs).

86The analysis below provides a breakdown of stakeholders involved in this outreach, categorised by participant numbers and sectors.

- Investment includes institutional investors, asset managers, investment managers

- Insurance

- Banking

- Not for Profit/NGO

Appendix 2(b) – Overview of stakeholder findings

| Amendment proposal | Extent of stakeholder support | Summary of views |

|---|---|---|

| Relief from disclosing facilitated and insurance associated-emissions | Mixed views | * Participants from the investment sector and NGO sector who expressed views opposed this relief. The following were mentioned by stakeholders as reasons for opposing this relief: data was important for understanding and managing climate risks more generally (including systemic climate risk, reputational risks e.g., arising from greenwashing, litigation risks, market, investment, and other business risks) as well for assessing opportunities. This was especially the case for emissions from banks and insurers. It was also highlighted that accounting and reporting methodologies by PCAF were in place for insurance-related and facilitated emissions and that many of the largest UK firms, in particular from the banking sector, were already disclosing this information. * Banks and insurers expressing views generally supported these reliefs. Some insurers highlighted challenges in disclosing this emissions data and questioned the value of such emissions metrics. Some banks and insurers referenced their use of PCAF's measurement and disclosure methodologies, with some insurers noting challenges in operationalising these methodologies, as well as challenges in obtaining the data to do so. One insurer asserted that reliefs risked delaying market maturity and another participant from the insurance sector, agreed that there are current challenges with disclosing emissions, and asserted that the ISSB should revisit this issue in the future. |

| Relief from disclosure of derivatives-related emissions | Widely supported | * Those banks and insurers commenting on the derivatives relief generally supported it and mentioned the following: the absence of any disclosure methodology, e.g. from PCAF; the complexity of this area; limited market disclosures in this area; and real questions about how derivatives link to the real economy. This was also a view shared by some participants from the investment sector, along with other Not for profit organisations, who considered the relief to be reasonable (currently) or were neutral in relation to its use. * Some stakeholders from the investment sector however felt that derivatives data is useful for assessing/managing climate exposures and did not support this relief. |

| Use of GICS for disaggregation of counterparties emissions. | Mixed views | * A number of participants who commented on this from the investment sector supported GICS, due to the scope for greater comparability, while banks, some insurers, and participants from the investment sector highlighted implementation burdens and a preference for flexibility. Not for profit organisations were neutral in their views, whilst also commenting that standardisation/harmonisation is valuable. |

| Other financial activities excluded from emissions disclosures | Support for improvement/modification | * Stakeholders expressed a range of views on how these provisions could be improved, including through disclosure of qualitative information. |

| Disclosure of derivatives 'amount' | Support for a modified approach | * Some banks were particularly concerned about the term 'amount'. One bank flagged that using notional amounts would result in burdensome reviews of all transactions at the legal entity level and another mentioned that complex booking models could make this disclosure challenging. Related audit concerns were also flagged. A couple of banks suggested that guidance/educational material on this would be helpful. |

| Clarification of jurisdictional relief for GHG Protocol Corporate Standard | Inconclusive | * Most stakeholders did not comment on this, but some participants from the investment sector were keen to limit divergence given that GHG Protocol Corporate Standard is widespread and well proven. Others noted that what matters was transparency and disclosure of methodologies. |

| Introduction of jurisdictional relief on global warming potential (GWP) values | Inconclusive | * Stakeholders for the most part did not comment on this, however some participants from the investment sector opposed deviation from the latest GWP values (from the latest IPCC report) on grounds that this represents the latest science. Others noted that what matters is transparency, and methodology disclosure. |

Appendix 2(c) – Detailed stakeholder feedback

| Subject | Detailed findings |

|---|---|

| Usefulness of facilitated and insurance-related emissions data and views on linked reliefs | * Participants from the investment sector and other Not for profit organisations expressing views opposed these reliefs emphasising that facilitated and insurance-associated emissions are important for the following: evaluating and managing exposure to climate risks (e.g. reputational/greenwashing risks, litigation risks, market, business, investment, and systemic risks), assessing climate-related opportunities, understanding firms' climate strategies, understanding firms' progress/alignment with their stated net zero goals, peer benchmarking and understanding the relative amounts of capital markets activities between high and low carbon intensities. * Some participants from the investment sector also highlighted their use of this emissions data to additionally: deliver on fiduciary duties for sustainability impact funds; undertake stewardship; and for the purposes of their own climate commitments. One participant noted that they had found emissions data difficult to obtain from banks for the purposes of assessing the banks' climate commitments and had stopped trading with banks who refused to disclose this information. * Stakeholders opposing this relief also often highlighted the existence of market standards for measuring and disclosing these emissions, notably PCAF's Insurance-Associated and Facilitated Emissions Standards. It was noted by two stakeholders that there was also widespread participation by UK financial institutions in initiatives to disclose emissions in line with PCAF's standards. * A few stakeholders noted that the largest UK banks were typically disclosing facilitated emissions, and one noted that it is typically large banks that engage in these activities. One participant flagged sound take-up by UK insurers of the PCAF standard for insurers. References were made to a public database that track PCAF signatories' progress/position in relation to emissions disclosure standards issued by PCAF. * A few stakeholders expressed concern that the amendments could be used strategically by financial institutions to entrench non-disclosure, especially in a context where banks had begun to revise or soften emissions-related targets. * A Not for profit organisation highlighted the disconnect in the ISSB's approach to opportunities (which typically allow firms to include 'green' capital markets activities) and risks, which permit their exclusion. * A few other stakeholders mentioned that this emissions data is also useful for preparers, who were using this data for transition planning, and redesigning products. * A few banks mentioned using this data for their targets, whilst a few banks and insurers mentioned dealing with investor questions, with one bank mentioning it was not used for internal purposes. * Those insurers expressing views had mixed views, but more expressing views supported the reliefs. Several insurers mentioned methodological challenges in making emissions disclosures. Challenges raised by insurers included challenges relating to data collection in particular from SMEs, the absence of granular data, which resulted in using sector averages for commercial lines of business, complexity, challenges in operationalising PCAF's standards across business lines, limitations in coverage of market standards, and challenges with modelling. The value of such data was also questioned by some insurers, noting concerns around accuracy due to the use of estimation. The limited scope for insurers to impact customer behaviour in certain lines of business, such as with (compulsory) motor insurance was also flagged, and the need to give time for the best methodologies and practices to emerge/mature, before requiring disclosure, was also highlighted. One insurer flagged that reliefs may stifle market momentum and impair internal firm backing/efforts in this area. Another stakeholder from the insurance sector acknowledged widespread participation of UK insurers in PCAF's initiatives, noted existing and current challenges, and suggested that it would be good for the ISSB to provide an indication that it will revisit this topic in the future as firms refine/develop their approaches. |

| Usefulness and complexity of derivatives-related emissions disclosures and views on linked reliefs | * There were mixed views on the extent of investors requests for this data from insurers with some mentioning requests in a group context and others saying that they had not seen requests for this. * Stakeholder views were varied on this topic. * A majority banks and insurers who expressed views, supported the proposed relief for derivatives due to the complexity of this area and the absence of any measurement and reporting standard from PCAF. * A UK life insurer stated that reporting emissions from derivatives was theoretically possible but lacked meaning due to limited links with the real economy. * Other insurers expressed concern about inconsistent methodologies, highlighting the absence of guidance, and flagged that notional amounts are difficult to report. * A global investment bank flagged that they record fees, not notional values, and raised concerns about the operational effort required to derive these values across legal entities. Another bank added that complex booking models would compound this challenge. * Participants from the investment sector and other non-preparer stakeholders had mixed views, with some accepting that the relief is presently necessary given the absence of measurement and reporting methodologies, the complexity of this area and absence of links to the real economy. Others were neutral but noted the disconnect with the ISSB's approach to opportunities (which can include derivatives) or opposed the relief on the grounds that such data is useful, noting that without both derivatives and facilitated emissions data, the quality of climate exposure assessments would suffer. |

| Drafting of the reliefs | * There was a relatively common view amongst the investment sector participants and NGOs that indefinite reliefs are undesirable, and a number of participants thought that clearer drafting of these provisions would be useful. * An asset manager recommended a review provision in a few years. * A few stakeholders suggested specified phase-in periods for emissions covered by the reliefs. * Conversely, a UK diversified insurer stated that indefinite relief would provide space to improve methodologies rather than rushing into disclosure. * A UK diversified insurer proposed that qualitative disclosures on what is excluded, including rationale and challenges, should be mandatory. * A firm from the investment sector suggested requiring explanations for non-disclosure from entities that rely on reliefs to foster accountability. These explanations should explain the rationale for non-disclosure and when the reporter anticipated being in a position to report. * Banks expressing views were particularly concerned about the term 'amount'. One bank flagged that using notional amounts would result in burdensome reviews of all transactions at the legal entity level. This was echoed by another bank who indicated that this would be exacerbated by complex booking models. Others noted inconsistencies with how data is typically recorded and disclosed. Assurance implications were also raised. A bank and an insurer noted that vague relief provisions would create challenges in obtaining assurance over disclosures. Several stakeholders suggested that interpretation guidance and educational material from the ISSB would be welcome in relation to the application of 'amounts'. * Investors and others requested that any relief used should be accompanied by qualitative disclosures explaining scope, methodology limitations, and rationale. * Another Not for profit stakeholder noted that there should be data in this section about industries and projects financed for it to be meaningful, together with clarity on where this is reported. |

| Industry Classification Systems and GICS | * Participants from the investment sector expressing views often supported the GICS proposal, emphasising the importance of consistency and comparability. It was explained by a stakeholder that most systems, including Bloomberg terminals, rely on GICS. Some noted a mapping between NACE and GICS would be helpful for aligning with other standards. * However, those insurers and banks expressing views were more cautious. A UK life insurer stated that GICS is not used in their reporting systems, though their asset management business unit uses it for internal purposes. * Some banks highlighted intra-group inconsistencies in GICS application and queried whether applying it to only a portion of a group was appropriate. * A UK bank suggested a proportionality threshold (e.g. apply GICS where it used by more than half of the group). * Another UK bank flagged that GICS classifications do not always reflect internal decision-making or risk management structures. * One insurer proposed that the ISSB allow a list of acceptable classification systems beyond GICS to increase flexibility. |

| Clarification of jurisdictional relief for GHG Protocol | * This wasn't frequently commented upon by stakeholders, but comments received, noted below. * A UK insurer expressed concern about legal obligations to apply other methodologies in specific jurisdictions. * The preference amongst stakeholders from the investment management sector was to limit divergence from the GHG Protocol. * Stakeholders from all categories agreed that the GHG Protocol is well-established and facilitates consistency across markets. |

| Jurisdictional relief for global warming potential (GWP) values | * Some from the investment management sector commented that there was no reason to not support using the latest science based GWP values. * Others from the investment management sector noted that the most important thing is transparency, i.e. knowing what data they are dealing with, and how it has been measured. As long as this information is available, they supported the relief. |

| Effective date of amendments | * Most stakeholders expressing views on implementation supported early implementation for amendments relating to the GHG Protocol, GWP values and GICS. |