The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Public Report on the 2010/12 inspection of Crowe Clark Whitehill LLP

This report is issued by the FRC's Audit Inspection Unit. It has been approved for publication on behalf of the Professional Oversight Board.

1. Background information and key messages

1.1 Introduction

This report sets out the principal findings arising from the inspection of Crowe Clark Whitehill LLP (“Crowe Clark Whitehill" or "the firm") carried out by the Audit Inspection Unit (“the AIU”) of the Financial Reporting Council (“the FRC”), in respect of the period to 31 March 2012 (“the 2010/12 inspection"). Our inspection was conducted in the periods from March 2011 to April 2011 and from October 2011 to December 2011 (referred to as "the time of our inspection"). The objectives of our work are set out in Appendix A.

Our inspection comprised reviews of individual audit engagements and a review of the firm's policies and procedures supporting audit quality.

We reviewed five audit engagements undertaken by the firm in our 2010/12 inspection. These related to major public interest entities, including pension schemes and charities, with financial year ends between 31 March 2010 and 31 March 2011. Our reviews were selected on a risk basis, utilising a risk model; each review covered only selected aspects of the relevant audit.

Each year we select a number of areas of particular focus. For the period of our review, these were: group audit considerations; the valuation of assets held at fair value; the impairment of assets (including goodwill and other intangibles); the assessment of going concern; revenue recognition; related parties and the quality of reporting to Audit Committees.

In addition, we undertook one follow-up review to assess the extent to which our prior year findings on those audits had been addressed in the following year's audit.

Our review of the firm's policies and procedures supporting audit quality covered the following areas:

- Tone at the top and internal communications

- Transparency report

- Independence and ethics

- Performance evaluation and other human resource matters

- Audit methodology, training and guidance

- Client risk assessment and acceptance/continuance

- Consultation and review

- Audit quality monitoring

- Other firm-wide matters

The AIU exercises judgment in determining those findings which it is appropriate to include in its public report on each inspection, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to areas of particular focus in the AIU's overall inspection programme for the relevant period. In relation to reviews of individual audits, we have generally reported our findings by reference to important matters arising. Where appropriate, we have commented on themes arising or issues of a similar nature identified across a number of audits.

Further information on the scope of our work and the basis on which we report is set out in Appendix A.

All findings requiring action set out in this report, together with the firm's proposed action plan, have been discussed with the firm. Appropriate action may have already been taken by the date of this report. The adequacy of the actions taken and planned will be reviewed during our next inspection.

The firm was invited to provide a response to this report for publication. The firm's response is set out in Appendix B.

The AIU acknowledges the co-operation and assistance received from the partners and staff of Crowe Clark Whitehill LLP in the conduct of the 2010/12 inspection.

1.2 Background information on the firm

The firm is a UK limited liability partnership. In October 2010 the firm changed its name from Horwath Clark Whitehill LLP to Crowe Clark Whitehill LLP. Crowe Clark Whitehill is the UK member firm and part of Crowe Horwath International, described as a 'network of independent firms'. On 1 November 2010, the firm acquired a practice, Freeman & Partners Limited, now Crowe Clark Whitehill (London) Ltd, which maintains its own audit registration and has no audits within the AIU's scope; accordingly, we have not reviewed this firm as part of our inspection.

The firm is organised into regional offices and business units including Audit, Business and Tax (ABT) within the London office. All statutory audit work is performed within the ABT business unit and regional offices.

For the year ended 31 March 2011, the firm's turnover was £47.8 million, of which £23.6 million related to regulated audit work. There was a total of 75 partners, of whom 46 were authorised to sign audit reports, and one employee who was authorised to sign audit reports.1

The AIU estimates that the firm audited 21 entities within the scope of independent inspection by the AIU, under UK company law, as at the 2011/12 reference date of 28 February 2011.

Audits of entities incorporated in Jersey, Guernsey or the Isle of Man whose securities are traded on a regulated market in the European Economic Area are subject to inspection by the AIU under separate arrangements agreed with the relevant regulatory bodies. The firm currently has one such audit within our scope.

1.3 Overview

We focus in this report on matters where we believe improvements are required to safeguard and enhance audit quality. We set out our key messages to the firm in this regard in section 1.4. While this report is not intended to provide a balanced scorecard, we highlight certain matters which we believe contribute to audit quality, including the actions taken by the firm to address findings arising from our prior inspection.

The firm maintains an overall system of quality control which is in many areas appropriate for its size and the nature of its client base. However, we are concerned that, in some areas, actions taken by the firm in response to our prior findings have not adequately addressed the issues previously identified. We have also identified certain other areas where improvements are required to the firm's procedures, which we set out in this report.

Our file review findings, as set out in section 2, largely relate to the application of the firm's procedures by audit personnel, whose work and judgments ultimately determine the quality of individual audits.

1.4 Key messages

The firm should pay particular attention to the following areas in order to enhance audit quality and safeguard auditor independence:

- Give increased focus and attention to ethical matters, including the monitoring of business relationships and timelier updating of the firm's ethical policies and procedures.

- Ensure appropriate focus on audit quality in the partner appraisal and remuneration processes, including giving appropriate weight to audit quality indicators in assessing partner performance.

- Enforce appropriate attendance by all audit partners and staff at training courses deemed to be mandatory, and ensure appropriate follow-up action is taken in the event of non-attendance.

- Ensure that appropriate action is always taken on a timely basis to address issues identified by external inspections and monitor the effectiveness of these actions through the firm's own quality review processes.

- Improve the audit of cash and investment balances, including providing guidance on the need to obtain third party confirmations where possible.

- Take action to improve the audit of disclosures, including obtaining sufficient evidence and recording key judgments.

2. Principal findings

The comments below are based on our reviews of individual audits and the firm's policies and procedures supporting audit quality.

2.1 Review of audit engagements

Follow-up of audits reviewed in the prior inspection

We undertook one follow-up review of an audit we had reviewed in the prior inspection. Most of the issues arising from our previous review had been sufficiently addressed, which resulted in improvements to audit quality, however further improvements are required.

Audits reviewed in the current period

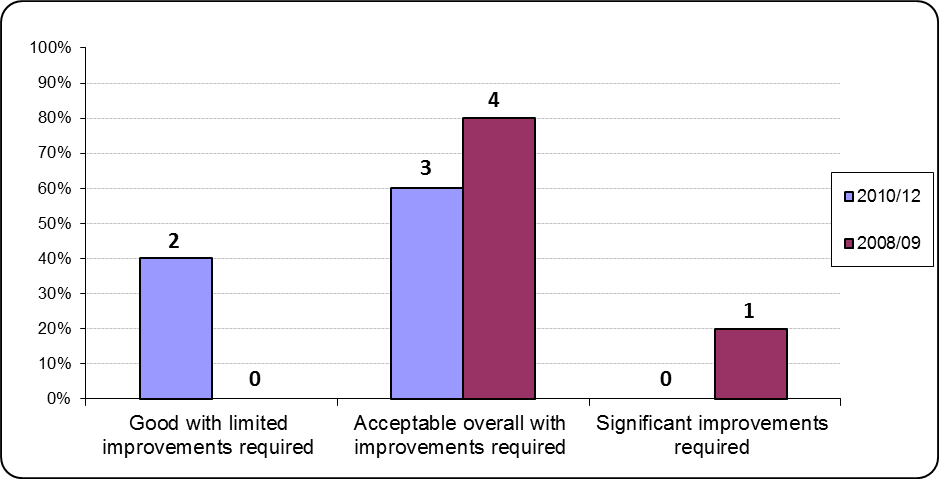

We reviewed selected aspects of five audits and assessed the quality of those aspects of the audit. Two of the audits we reviewed were performed to a good standard with limited improvements required and three audits were performed to an acceptable overall standard with improvements required.

The bar chart below shows the number and percentage of the audits we reviewed in 2010/12 by AIU grade with comparatives for 2008/9.

An audit is assessed as requiring significant improvement if the AIU had significant concerns in relation to the sufficiency or quality of audit evidence or the appropriateness of audit judgments in one or more key audit areas, or the implications of concerns relating to other areas are considered to be individually or collectively significant. This assessment does not necessarily imply that an inappropriate audit opinion was issued.

Changes to the proportion of file reviews falling within each grade from period to period reflect a wide range of factors, which may include the size, complexity and risk of individual audits selected for review, changes to the AIU's areas of particular focus and the scope of the individual reviews. For this reason, and because of the small size of the samples involved, changes in gradings from one period to the next are not necessarily indicative of any overall change in audit quality at the firm.

Findings in relation to audit evidence and judgments

The focus of our reviews has been on the audit evidence and related judgments for material areas of the financial statements and areas of significant risk.

We draw attention to the following findings which the firm should ensure are adequately addressed in future audits:

- Audit of cash and investments On three audits, independent third party confirmations were not obtained for material cash or investment balances. Auditing Standards state that audit evidence is more reliable when it is obtained from outside the entity. The firm currently has no guidance on the need to obtain third party confirmations for cash and investments.

- Audit of disclosures On five audits we identified weaknesses in the audit of certain disclosures. These included, on three audits, insufficient consideration of whether amounts held should be disclosed as cash or short-term investments.

Recurring findings from one period to the next

While we have seen some improvement in relation to the following matters, the matters noted below continue to require improvement:

- Substantive analytical procedures We previously reported that we had identified weaknesses in the performance of substantive analytical procedures. While action was taken by the firm, including providing additional guidance and training on this area, on four audits reviewed in this inspection we considered the substantive analytical procedures performed on the income statement to be inadequate.

- Significant risks We identified a number of issues relating to the evaluation of controls over significant risks in our previous report. While the firm has updated its audit processes and provided further guidance on this area, on five audits reviewed in this inspection insufficient procedures were carried out to assess the design and implementation of controls over significant risks.

Other findings in the current period

Communicating with Audit Committees

Subject to our comments below, reporting to Audit Committees or their equivalent was generally performed to a satisfactory standard and communications were made on a timely basis.

On two audits significant risks of material misstatement and threats to independence and safeguards adopted for non-audit services were not adequately reported to the Audit Committee.

2.2 Review of the firm's policies and procedures

The firm has taken a number of recent initiatives to promote audit quality including introducing a single staff management system for the audit stream and a focus on quality and integrity in training and internal communications. These and other changes since our previous inspection demonstrate the firm's willingness to respond to recommendations.

We identified certain areas for improvement, as outlined below, which need to be addressed.

Progress on dealing with prior period findings

The firm has made progress in acting on our findings from previous inspections and improvements have been made to its procedures as a result. However, prior inspection findings in a number of areas have not yet been adequately addressed.

We expect the firm to take effective action on a timely basis to address the outstanding matters set out below.

- Attendance at mandatory training courses Nearly 25% of the firm's qualified staff and partners, including many of the senior partners, failed to attend one of the two mandatory audit courses in 2010. While the firm implemented a process to record attendance at training courses in 2010, the follow-up procedures for non-attendance at mandatory core training courses were found to be inadequate during our first visit. No specialist licences were revoked by the firm as a result of non-attendance at relevant training courses. The firm has since changed the partner in charge of monitoring attendance at training and we noted an improvement in the attendance levels. We expect the firm to ensure that this improvement is maintained.

- Consideration of audit quality in partner appraisal and remuneration Since our previous inspection, the firm introduced a new partner remuneration process that includes rewarding partners based on performance in the year. The firm still does not give appropriate weight to audit quality indicators in assessing partner performance and determining partner remuneration. The adverse AIU findings on an audit reviewed in the prior AIU inspection, although discussed, had no impact on the overall appraisal or remuneration of the relevant partner.

- Monitoring of business relationships We previously reported that the firm had no processes to identify and monitor business relationships with audit clients. No such processes were put in place by the time of our first visit. At the time of our second visit, the firm's offices had reported business relationships, but a review of these by the Ethics Partner was not complete. Once reported, not all these relationships received appropriate attention to ensure that threats to independence were assessed and resolved in accordance with Ethical Standards in a timely manner.

- Updating ethical guidance The firm's mapping of the December 2010 revisions to the Ethical Standards to its ethical guidance was not up to date and a number of revisions to Ethical Standard requirements were not adequately addressed by the firm's guidance.

- Internal Quality Assurance Review While the firm changed its Quality Assurance Review policies to make the gradings more robust, issues arose regarding the consistency and support for the grades awarded in certain cases.

Other findings in the current period

Rotation monitoring

There were significant omissions and inaccuracies in the records maintained to monitor rotation of partners and managers on public interest entity audits. A new Audit Compliance Principal appointed in July 2011 instigated a review of processes to ensure that rotation monitoring records are kept up to date and accurately reflect the positions held by partners and staff on the relevant audits. We were informed that this review was completed in January 2012.

Accounting services provided to a listed audited entity

For one listed audited entity, accounting services were provided, in what was deemed to be an emergency situation, without consulting the Ethics Partner. Based on the description provided, it was not clear to us that this was an emergency situation and therefore permissible under the Ethical Standards.

Acceptance and continuance procedures

We identified a number of issues with the firm's acceptance and continuance procedures. There is no guidance on acceptance procedures for groups of related entities and no requirement to obtain additional approval for the continuance of an audit appointment when the audit risk has increased significantly since initial acceptance. We also identified one case where the necessary approvals had not been obtained on acceptance of the audit of an AIM listed entity.

Timely completion of staff appraisals

Staff appraisals and the setting of objectives were often not completed on a timely basis. The majority of the staff appraisals we reviewed were completed more than a month after the appraisal deadline. We were assured that in most, if not all, cases the appraisal meetings had taken place within the planned timetable. The firm needs to put a process in place to ensure that appraisals and objectives are agreed and recorded on a timely basis.

Guidance on the use of internal specialists and experts

The firm has no guidance to ensure that audit teams are appropriately identifying non-audit partners and staff involved in an audit as either internal specialists, who form part of the audit team and whose length of service should be monitored, or as internal experts whose work will require evaluation in accordance with Auditing Standards.

Andrew Jones Director of Audit Quality Audit Inspection Unit FRC Conduct Division 10 May 2012

Appendix A – Objectives, scope and basis of reporting

Scope and objectives

The overall objective of our work is to monitor and promote improvements in the quality of auditing. As part of our work, we monitor compliance with the regulatory framework for auditing, including the Auditing Standards, Ethical Standards and Quality Control Standards for auditors issued by the FRC's Auditing Practices Board and other requirements under the Audit Regulations issued by the relevant professional bodies. The standards referred to in this report are those effective at the time of our inspection or, in relation to our reviews of individual audits, those effective at the time the relevant audit was undertaken.

Our reviews of individual audit engagements and the firm's policies and procedures cover, but are not restricted to, the firm's compliance with the requirements of relevant standards and other aspects of the regulatory framework. Our reviews of individual audit engagements place emphasis on the appropriateness of key audit judgments made in reaching the audit opinion together with the sufficiency and appropriateness of the audit evidence obtained.

We seek to identify areas where improvements are, in our view, needed in order to safeguard audit quality and/or comply with regulatory requirements and to agree an action plan with the firm designed to achieve these improvements. Accordingly, our reports place greater emphasis on weaknesses identified, which require action by the firm than areas of strength and are not intended to be a balanced scorecard or rating tool. We also assess the extent to which the firm has addressed the findings arising from its previous AIU inspection.

Our inspection is not designed to identify all weaknesses which may exist in the design and/or implementation of the firm's policies and procedures supporting audit quality or in relation to the performance of the individual audit engagements selected by us for review and cannot be relied upon for this purpose.

The monitoring units of the professional accountancy bodies in the UK which register firms to conduct audit work are responsible for monitoring the quality of audit engagements falling outside the scope of independent inspection but within the scope of audit regulation in the UK. Their work, which is overseen by the FRC, covers audits of UK incorporated companies and certain other entities which do not have any securities listed on the main market of the London Stock Exchange and whose financial condition is not otherwise considered to be of major public interest. All matters raised in this report are based solely on work carried out by the AIU.

Basis of reporting

This report is based on the AIU's more detailed private report on its inspection of the firm to the Audit Registration Committee (“the ARC") of the Institute of Chartered Accountants in England and Wales (“the ICAEW”) with which the firm is registered for audit purposes. The AIU currently inspects the largest audit firms including Crowe Clark Whitehill over a two year cycle. The ARC considers whether audit registration should be continued for the firm following each inspection undertaken. The AIU's report to the ARC, which was finalised in March 2012, recommended that the firm's registration to conduct audit work should be continued.

The AIU exercises judgment in determining those findings which it is appropriate to include in its public report on each inspection, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to areas of particular focus in the AIU's overall inspection programme for the relevant period. In relation to reviews of individual audits, we have generally reported our findings by reference to important matters arising on one or more audits. Where appropriate, we have commented on themes arising or issues of a similar nature identified across a number of audits.

While the AIU's public reports seek to provide useful information for interested parties, they do not provide a comprehensive basis for assessing the comparative merits of individual firms. The findings reported for each firm in any one period reflect a wide range of factors, including the number, size and complexity of the individual audits selected for review by the AIU which, in turn, reflects the firm's client base. An issue reported in relation to a particular firm may therefore apply equally to other firms without having arisen in the course of the AIU's inspection fieldwork at those other firms in the relevant period. Also, only a small sample of audits are selected for review at each firm and the findings may therefore not be representative of the overall quality of each firm's audit work.

The fieldwork at each firm is completed at different times during the period and comprehensive quality control procedures are applied before the AIU's private and public reports are finalised. As a result, there may be a significant period of elapsed time between completion of the AIU's inspection fieldwork at a firm and the publication of a report on the inspection findings.

The AIU also issues confidential reports on individual audits reviewed during an inspection which are addressed to the relevant audit engagement partner or director. Firms are expected to provide copies of these reports to the directors or equivalent of the relevant audited entities.

Purpose of this report

This report has been prepared for general information only. The information in this report does not constitute professional advice and should not be acted upon without obtaining specific professional advice.

To the full extent permitted by law, the FRC and its employees and agents accept no liability and disclaim all responsibility for the consequences of anyone acting or refraining from acting in reliance on the information contained in this report or for any decision based on it.

Appendix B – Firm's response

Crowe Clark Whitehill.. Crowe Clark Whitehill LLP Chartered Accountants Member of Crowe Horwath International St Bride's House 10 Salisbury Square London EC4Y 8EH, UK +44 (0)20 7842 7100 +44 (0)20 7583 1720 DX: 0014 London Chancery Lane www.croweclarkwhitehill.co.uk

1 May 2012

Audit Inspection Unit Aldwych House 71-91 Aldwych London W2B 4HN

Dear Sirs

Response to AIU Public Report on Crowe Clark Whitehill LLP for 2010/2012

We appreciate the opportunity to comment on the AIU's findings arising from its 2011/2012 inspection of the firm.

The results of the AIU's file reviews in section 2.1 of the report show a marked improvement compared to the results from the 2008/2009 inspection. We believe this improvement demonstrates not only a desire to improve audit quality but also our willingness to engage with and respond positively to recommendations made by the AIU.

We are disappointed that the AIU has found that we have not made sufficient progress on some findings from the previous review and we have undertaken to ensure that these matters are progressed as a matter of priority.

Audit quality is important to us and we take it very seriously, as we do in all areas of our business. Quality is one of the values we seek to embed across the firm, along with others such as trust, integrity and honesty, the achievement of excellence, professionalism and independence, and the continuous development of our people.

We would like to thank the AIU for the constructive manner in which they conducted the inspection.

Yours faithfully

Crowe Clark Whitehill LLP

Crowe Clark Whitehill LLP is a limited liability Partnership registered in England and Wales with registered number OC307043. The registered office is at St Bride's House, 10 Salisbury Square, London EC4A 8EH. Registered by the Institute of Chartered Accountants in England and Wales to carry out company audit work in the UK. Authorised and regulated by the Financial Services Authority. Crowe Clark Whitehill LLP is an independent member of Crowe Horwath International, with offices and associated firms throughout the UK and Worldwide. A list of members' names is available at the above address.

FINANCIAL REPORTING COUNCIL 5TH FLOOR ALDWYCH HOUSE 71-91 ALDWYCH LONDON WC2B 4HN TEL: +44 (0)20 7492 2300 FAX: +44 (0)20 7492 2301 WEBSITE: www.frc.org.uk

The Financial Reporting Council Limited 2012

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN.

-

As disclosed in the annual return to the ICAEW as at March 2011. ↩