The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

NHS Audit Market Study Final Report

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2025 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 13th Floor, 1 Harbour Exchange Square, London, E14 9GE

1. Executive summary

1.1This report sets out our findings on the NHS audit market and proposes remedies to improve the functioning of the market. The findings and remedies are based on views and information obtained from NHS bodies, audit firms, NHS procurement framework providers, professional bodies and other stakeholders between July 2024 and April 2025. The report takes account of relevant developments during this period including the Government's local audit reform consultation (December 2024) and subsequent consultation response (April 2025).

1.2The FRC is interested in the effectiveness of the whole audit market and we have explored the NHS audit market, where we know there are particular challenges, to help improve our understanding. The final report will help inform our future work on the audit market and is also a contribution to the Government's ongoing work on local audit reform. In particular, as stated in the Government's consultation, the market study could help inform policy regarding future audit procurement arrangements for NHS bodies. 1

Our findings

1.3We found that the NHS audit market in England is functioning but issues in the market may risk future resilience. Some NHS bodies have a limited choice of auditor as a result. Only three of the nine audit firms active in the market have NHS audit clients across all of England's regions. A total of 87% of NHS bodies responding to our survey told us they had concerns about the limited choice of auditor for their next audit.

1.4We also found that the NHS audit market is working more effectively than the market for local authority audits. This is in part due to comparative efficiencies in the NHS financial reporting system, characterised by a simpler financial reporting framework, the capability of NHS finance teams and direct central structural support given to NHS bodies.

1.5While our focus has been the NHS audit market, we have found some issues that apply across the whole audit market. For example, concerns about the recruitment and retention of audit staff, and how audit firms view revised audit standards and regulatory scrutiny.

1.6We identified three key issues in the NHS audit market.

1) Constraints on market capacity

1.7Audit firms active in the market have capacity to supply audits to their current NHS audit clients but face barriers to expanding their capacity. The barriers include: audit timetable pressures; conflicts of interest arising from firms' provision of non-audit services; geographic limitations and segmentation; hiring appropriately qualified staff; and local authority audit backlogs. Some NHS bodies' finance teams' capacity to produce high-quality financial information to support the delivery of high-quality audits may be limited.

2) Concerns about the procurement processes for NHS audits

1.8Audit firms reported problems with the timing and complexity of audit tender processes, and a lack of pre-bidding engagement between NHS bodies and audit firms. These problems are adding to the barriers to expansion mentioned above and creating barriers to entry for potential new suppliers.

3) Conflicting views about the value of NHS audits

1.9Stakeholders have different views on the value and purpose of NHS audits. There are good relationships between auditors and NHS bodies but potential differences in their priorities. NHS bodies often prioritise meeting audit deadlines and achieving financial targets over ensuring good quality accounts and audits. Some NHS bodies have questioned the purpose of Value for Money (VfM) reporting that forms part of their audits, while other stakeholders told us VfM is an important element of NHS audits.

Our proposed remedies

1.10Having engaged with stakeholders on potential solutions to the issues in the market, we have identified a number of remedies that relevant organisations, including the Department for Health and Social Care (DHSC) and the Ministry of Housing, Communities and Local Government (MHCLG), may wish to implement to help improve the functioning of the NHS audit market. The Government's local audit reform strategy includes establishing the Local Audit Office (LAO) to provide oversight of the local audit system. We suggest relevant proposed remedies could be taken forward by MHCLG prior to the potential establishment of the LAO.

1.11Some of the remedies are relatively easy to implement in the short-term and others may be for the medium to longer-term. The key remedies are summarised below.

1.12Given our interest in the functioning of the whole audit market, we intend to continue to monitor developments as part of our wider audit market monitoring work.

Potential short-term remedies

- Create a single national procurement framework tailored specifically for NHS external audit, for NHS bodies to use to independently appoint auditors.

- Increase transparency of NHS audit engagement information and implement more monitoring of market health by NHS England (NHSE), DHSC or MHCLG.

- Encourage NHS bodies to engage more with audit firms during the audit procurement process, including pre-bidding engagement.

- Encourage better coordination of the procurement of audit and non-audit services within Integrated Care Systems (ICSs) to avoid audit firm conflicts of interest.

Potential medium to long-term remedies

- If the Government considers national block procurement for NHS audits they could engage with the market first, to gather views.

- Consider reviewing public provision of NHS audits at the same time as any market engagement concerning national block procurement for NHS audits.

- Consider the provision of nationally coordinated training to auditors specifically for NHS audits.

- Establish better alignment between the timetable for NHS financial statements closedown and audit with the following year's financial planning processes and in-year funding allocations.

- Review NHS Annual Report requirements with a view to streamlining and considering which elements should be subject to audit.

- Consider the provision of additional training workshops to NHS bodies' Finance Directors and finance teams about the purpose and value of audit.

- Consider NHS financial reporting reviews as a proportionate mechanism to drive up reporting quality.

- Consider how the different powers and duties, accreditation requirements, and inspection regimes across various NHS bodies may be affecting the market.

2. Introduction

2.1The FRC's priorities in recent years have included developing a greater understanding of the whole audit market and working with local audit system partners to improve the capacity and capability of the local audit market. 2 When working with local audit system partners we heard concerns from some stakeholders about the NHS external audit market.

2.2Our market study, launched in July 2024, focused on how the audit market for NHS providers (NHS Trusts and Foundation Trusts) and Integrated Care Boards (ICBs) in England was functioning, how it should function in the future, and whether there were any lessons on good practice for the wider local audit market.

2.3The market study had three broad themes – the supply of auditors, the demand for NHS audits, and the regulatory framework. We gathered views and information on these themes from a range of sources before publishing our emerging findings in December 2024.

2.4Following publication of our emerging findings, we gathered further views and information including updated NHS audit engagement data for the financial year 2023-24, collated by NHSE. We received 12 written submissions to our emerging findings publication, conducted a survey of audit firms, and held 23 bilateral meetings with stakeholders to discuss our emerging findings and potential solutions to address issues in the market. Further details of the written submissions received during the market study are available.

2.5We would like to take this opportunity to thank all stakeholders who engaged with us and contributed throughout the market study.

3. Market background

3.1The scope of the market study was limited to external audit of NHS Trusts and Foundation Trusts (collectively known as NHS providers) and ICBs (also referred to as NHS commissioners). These different types of organisations are collectively referred to as NHS bodies in this document. The scope of the study did not include other types of NHS organisations.

3.2For the financial year 2023-24 there were 211 NHS providers and 42 ICBs. The 42 ICBs were established in 2022, replacing 106 Clinical Commissioning Groups (CCGs). 3 NHS bodies sit within ICSs. Each ICS contains one ICB and several NHS providers, determined by geographic location. 4

3.3Since the introduction of the Local Audit and Accountability Act 2014 (the Act), NHS Trusts and ICBs (previously CCGs) have been required to procure and appoint their own auditors, with the process overseen by an auditor panel. 5 NHS Trusts and commissioners have procured their own auditors since 2017-18. Public Sector Audit Appointments Limited (PSAA) managed the ongoing contracts during 2015-16 and 2016-17. Collectively, NHS Trust, ICB and local authority audits are known as local audits.

3.4Foundation Trusts are responsible for appointing their auditors under the NHS Act 2006. 6 Appointments are made by Foundation Trusts' council of governors, with audit committees supporting the council of governors, including monitoring auditors' performance. 7 Foundation Trust audits are not classified as local audits.

3.5Audits of NHS bodies are conducted in accordance with the Code of Audit Practice issued by the National Audit Office (NAO). The FRC's Audit Quality Review (AQR) team is responsible for monitoring the quality of Major Local Audits (MLAs). An MLA is an audit of an NHS Trust, ICB or local authority body with income or expenditure of at least £500 million, or which maintains a local authority pension scheme of certain characteristics. 8 The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales (ICAEW) is responsible for monitoring the quality of non-MLAs.

3.6NHSE is responsible for monitoring the quality of Foundation Trust audits. 9 However, in recent years NHSE has contracted with FRC and ICAEW to perform quality inspections on its behalf, using the same income and expenditure thresholds as local audits to determine whether FRC or ICAEW performs the quality inspection. 10

3.7In accordance with the Act and delegated legislation, in order to audit NHS Trusts and ICBs, audit firms must be a registered local audit firm, 11 with key audit partners (KAPs) to sign-off audits. While Foundation Trust audits are not subject to the same requirements, in practice it is local audit firms who conduct these audits. 12

3.8There are currently 104 registered KAPs, 90 KAPs have signed off NHS audits in the past year. Two Responsible Individuals (RIs), who are not also KAPs, have also signed off Foundation Trust audits in the past year.

4. NHS audit market characteristics and trends

4.1This section summarises the NHS audit market's characteristics and trends. 13 Much of the content in this section was reported in our emerging findings but there is some additional data and analysis relating to the drivers of audit fees, the increase in MLAs and regional analysis.

NHS audit fees and drivers of fee increases

4.2The amount of NHS expenditure subject to audit has increased in recent years. Between 2015-16 and 2023-24, NHS spending in England grew from £128.4bn to £153.8bn. 14 Our emerging findings report highlighted the notable increase in audit fees for NHS providers, particularly between 2020-21 and 2022-23. This trend has continued for audits in 2023-24 when NHS providers paid an average of £185k for their audits. Average NHS audit fees have increased by 163% from 2018-19 to 2023-24.

4.3The trend in yearly average audit fees and the percentage increase in total audit fees is shown in Figure 1.

Figure 1. NHS providers' average audit fees and percentage increase in total audit fees, 2018-19 to 2023-24

Bar and line chart showing average audit fee in £'000s and total audit fee percentage increase from 2018-19 to 2023-24. Average audit fees show a steady increase, rising from £70K in 2018-19 to £185K in 2023-24. The total audit fee percentage increase also shows an upward trend, with significant jumps such as 29% in 2020-21 and 23% in 2022-23.

Source: Data from NHS providers' published consolidated accounts, collated by NHSE

4.4As mentioned in the emerging findings, we surveyed NHS bodies concerning the drivers influencing audit fee increases. The most common factors cited for the rise in audit fees were additional requirements resulting from audit standards and regulations (62%) and the general increase in audit costs (52%).

4.5Since the emerging findings, we have explored the drivers for NHS audit fee increases, outside the increase in NHS bodies' spend subject to audit. Eight of the nine audit firms active in NHS audits responded to a survey on the drivers of these fee increases. The audit firms' responses were consistent with what we heard from NHS bodies.

4.6The primary factor cited by audit firms for the increase in audit fees was additional audit requirements due to changes in audit standards or financial reporting requirements. The main auditing standards mentioned by firms were ISA (UK) 315 (Revised July 2020) 15 and ISA (UK) 600 (Revised September 2022). 16 Respectively, these standards aim to enhance auditors' ability to identify and respond to risks of material misstatement, and to improve the quality and efficiency of group audits. These standards are therefore equally relevant to corporate audits as they are to NHS audits.

4.7Increased investment in technology, inflation, wage increases, and additional audit work required due to increased scrutiny of MLAs were selected as the next most significant drivers of NHS audit fee increases. The results of the survey of firms on the drivers of fee increases for NHS audits is summarised in Figure 2.

Figure 2. Drivers of audit fee increases that are most often mentioned in the Top 5 by audit firms

Horizontal bar chart showing the number of times various factors were ranked in the top 5 drivers of audit fee increases by audit firms, based on responses from 8 of the 9 active NHS audit firms. 'Additional audit requirements due to changes in audit standards or additional financial reporting requirements, generally' was mentioned 6 times. 'Increased investment in technology (Software, systems and emerging technologies, AI Tools)' was mentioned 5 times. 'Inflation – a general increase in prices', 'Staff wage Increases', and 'Additional audit work due to increased regulatory scrutiny of Major Local Audits' were each mentioned 4 times. 'Historical underpriced audits post Audit Commission' was mentioned 3 times. 'Recruitment challenges for audit staff', 'Increased VfM reporting requirement', and 'Greater risk/complexity of NHS audits' were each mentioned 2 times. Other factors like 'Additional audit requirements specific to the NHS', 'Restrictions on price flexibility', 'The tight timeframe to produce an NHS audit', and 'Other' were mentioned once. Factors like 'Impact of COVID', 'Delays to previous year's audit', 'Ineffective engagement during procurement', and 'Impact of local authority audit backlog' were not mentioned in the top 5.

Source: FRC survey of audit firms. This is based on responses from 8 of the 9 active NHS audit firms. Full wording of Figure 2 Audit Fee drivers with "..." listed below:

- Additional audit requirements due to changes in audit standards or additional financial reporting requirements, generally.

- Increased investment in technology (Software, systems and emerging technologies, AI Tools).

- Additional audit work due to increased regulatory scrutiny of Major Local Audits.

- Additional audit requirements due to changes in audit standards or additional financial reporting requirements, specific to the NHS.

- Ineffective engagement during procurement processes, resulting in less informed priced audits.

4.8The responses from audit firms to the survey indicate that the main drivers of fee increases for NHS audits are generally not NHS or local audit specific, rather they are the same drivers of fee increases across audit markets.

4.9However, while not as significant as general drivers, NHS specific factors have played some role in fee increases. As shown in Figure 2, as well as the increase in number of MLAs, drivers such as historically low-priced NHS audits, increased VfM reporting requirements, greater risk/complexity of NHS audits, restrictions on price flexibility within contracts and the tight timetable to produce audits, featured in firms' responses.

NHS audit timeliness

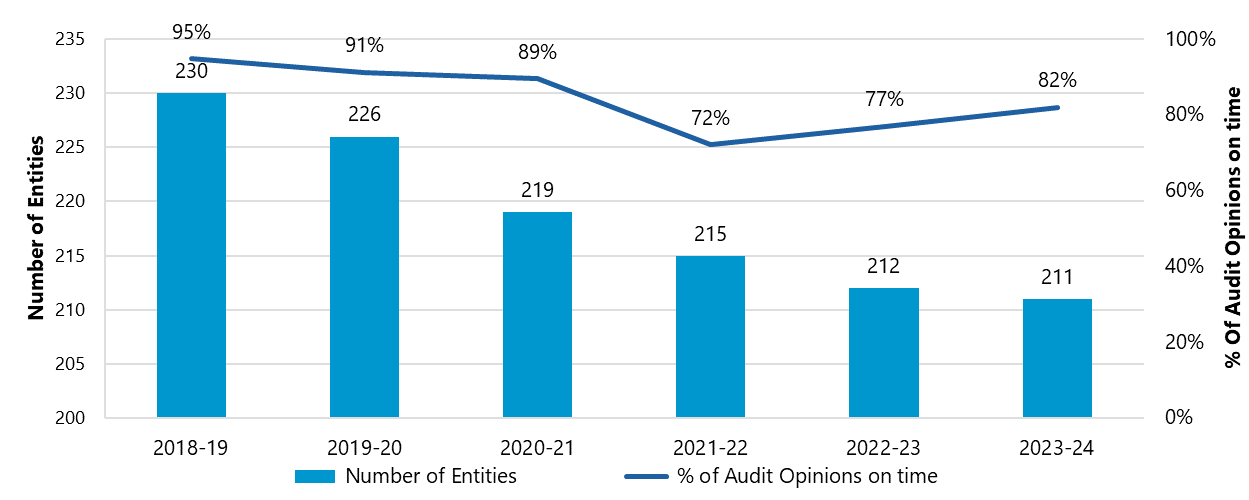

4.10As stated in the emerging findings, in the past two years, there has been an improvement in the percentage of "on time” audit opinions for NHS providers following a decline between 2020-21 and 2021-22. 17 The proportion of “on time” audit opinions rose from 72% in 2021-22 to 82% in 2023-24 as seen in Figure 3.

Figure 3. NHS providers percentage of opinions on time and total number of entities, 2018-19 to 2023-24

Source: Data from NHS providers' published consolidated accounts, collated by NHSE

Audit firm market shares

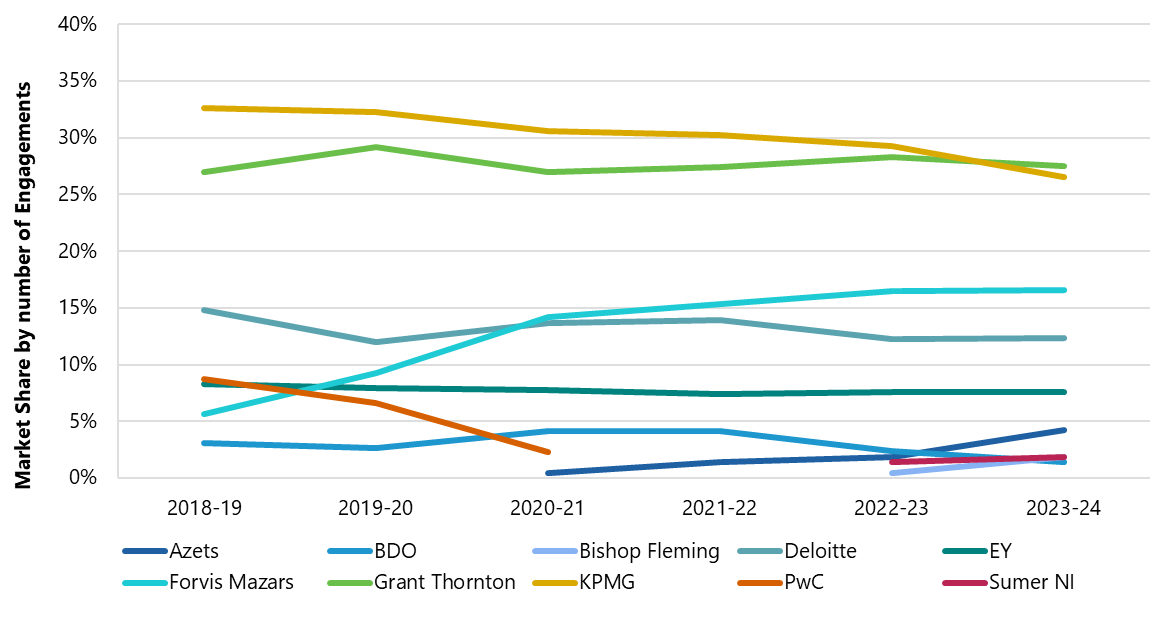

4.11Nine audit firms are currently active in the NHS audit market. These firms are Azets, BDO, Bishop Fleming, Deloitte, EY, Forvis Mazars, Grant Thornton, KPMG and Sumer NI.

4.12As highlighted in our emerging findings, Grant Thornton and KPMG hold the largest shares of audit engagements for NHS providers. Forvis Mazars has experienced the largest increase in its market share of NHS provider audit engagements in recent years. The three recent new entrants – Azets, Bishop Fleming and Sumer NI – have a relatively low combined market share. Figure 4 shows the market shares of audit firms by engagement for NHS providers.

Figure 4. Market share of audit firm engagements of NHS providers, 2018-19 to 2023-24

Source: NHSE collated data

Number of MLAs

4.13In 2018-19, 22% of NHS providers audited were MLAs; in 2023-24 MLAs represented 49% of NHS provider audits. In 2023-24, there were 104 NHS provider audits which were MLAs, which is more than double the number of NHS provider audits which were MLAs in 2018-19. This highlights the increase in NHS providers' income and expenditure in recent years, and the likelihood of the number of MLAs further increasing under the current MLA threshold. Given their size, all 42 ICBs are MLAs. Figure 5 illustrates the changes in the number of NHS providers that qualify as MLAs since 2018-19.

Figure 5. Number of MLAs per year for NHS providers, 2018-19 to 2023-24

Clustered bar chart showing the number of MLAs and Non-MLAs among NHS providers from 2018-19 to 2023-24. The number of Non-MLAs decreased from 180 in 2018-19 to 107 in 2023-24, while the number of MLAs increased from 50 to 104 over the same period, indicating a notable shift towards more entities qualifying as MLAs.

Source: NHSE collated data

4.14The average audit fee for NHS provider MLAs has consistently been higher than for non-MLAs. The higher fees reflect audit firms' risk appetite in the amount of additional work they choose to do for MLAs. Both MLAs and non-MLAs have seen increases in their average audit fees. The average audit fee for MLAs has risen by 130% between 2018-19 and 2023-24, which is less than non-MLAs where the increase was 141%.

4.15However, NHS providers that have recently exceeded the MLA threshold might see their audit fees rise once their contracts are retendered. Consequently, there may be a delay in NHS providers becoming MLAs and any increase in audit fees due to this change. Figure 6 illustrates average audit fees for MLAs and non-MLAs since 2018-19.

Figure 6. Average Audit fee for MLAs/Non-MLAs NHS for NHS Providers, 2018-19 to 2023-24

Clustered bar chart illustrating the average audit fee in £'000s for MLAs and Non-MLAs among NHS providers from 2018-19 to 2023-24. Both categories show increasing fees over the period. For MLAs, fees increased from approximately £110k in 2018-19 to over £200k in 2023-24. For Non-MLAs, fees increased from around £90k to approximately £150k in the same period, with MLA audit fees consistently higher than Non-MLA fees.

Source: NHSE collated data

4.16Figure 7 displays MLA market shares for NHS providers, by audit engagement. As the number of MLAs has increased, most audit firms have increased their number of MLA clients. Forvis Mazars has gained the highest number of NHS provider audits which are MLAs, with an increase of 16 since 2018-19. BDO are the only active NHS audit firm who have had a reduction in MLAs. Azets and Bishop Fleming do not currently bid for MLAs, though two of Azets' clients exceeded the MLA threshold during their audit engagements.

Figure 7. Number of NHS provider MLAs per audit firm, 2018-19 to 2023-24

Clustered column chart showing the number of NHS provider MLAs per audit firm for years 2018-19 to 2023-24. Grant Thornton and KPMG consistently have the highest numbers of MLAs, with Grant Thornton peaking at 27 in 2020-21 and KPMG at 26 in 2021-22. Deloitte and Forvis Mazars also show significant shares, while Azets, BDO, Bishop Fleming, PwC, EY, and Sumer NI have fewer MLAs. The chart indicates fluctuations in MLA numbers for most firms over the period.

Source: NHSE collated data

Switching

4.17As highlighted in our emerging findings and Figure 8, the switching of audit firms by NHS providers has increased from 2019-20 to 2023-24. As we do not have data on the number of tenders per year, we do not know what percentage of tenders resulted in switches. Some of the switches may be due to mergers between some NHS bodies. 18

Figure 8. Number of audit firm switches per year for NHS providers, 2019-20 to 2023-24

Bar and line chart showing the number of audit firm switches per year and the percentage of NHS provider audits switched from 2019-20 to 2023-24. The number of switches increased from 18 in 2019-20 to 39 in 2022-23, then slightly decreased to 35 in 2023-24. The percentage of audit opinions switched per year shows a similar trend, peaking at 18% in 2022-23.

Source: NHSE collated data 18

Regional analysis

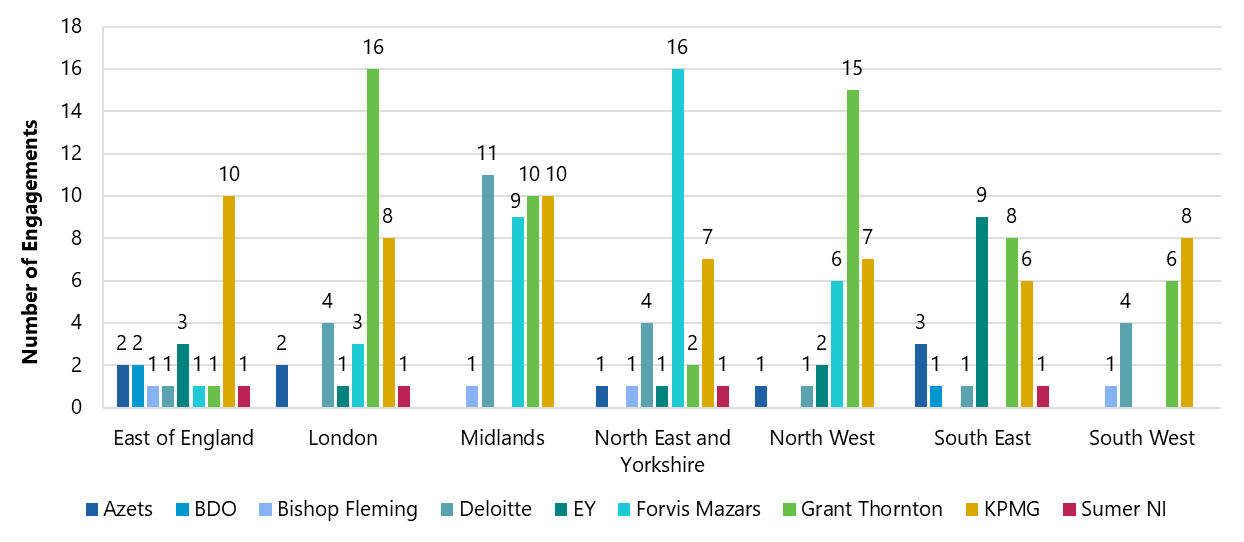

4.18As presented in the emerging findings, the regional breakdown of audit engagements for NHS providers shows that North-East and Yorkshire (8) and the East of England (9) have the highest number of audits firms with NHS clients, though both regions have a single clear market leader.

4.19Grant Thornton and KPMG have the largest number of engagements in most regions. The only region which has a substantial market leader, in terms of engagements, which is not Grant Thornton or KPMG is the North-East and Yorkshire, where Forvis Mazars are the market leader. The geographical spread of audit firms in these regions may be partly due to legacy contract allocation, pricing strategies and conflict of interest between audit and non-audit work. Figure 9 provides a breakdown of audit firms' NHS provider engagements by region.

Figure 9. Audit firm engagements by region for NHS providers, 2023-24

Source: NHSE collated data

4.20The data suggests regional segmentation in the NHS audit market, which may impact the choice of audit firms available to some NHS bodies. Apart from KPMG, audit firms appear to be more active in some geographic regions than others.

4.21Since the emerging findings, we have analysed audit fees for NHS providers by region. The increase in average audit fees has been a trend across all regions. London has the highest average audit fee for 2023-24 with £215k, and the East of England has the second highest average audit fee with £191k. The Midlands experienced slower growth in its average audit fee from 2020-21 to 2022-23. There is no clear market leader in the Midlands and, unlike other regions, it has four leading firms with roughly equal market share. Figure 10 shows the average audit fees by region between 2018-19 to 2023-24.

Figure 10. NHS providers average audit fee by region, 2018-19 to 2023-24

Clustered column chart showing NHS providers' average audit fee by region for the years 2018-19 to 2023-24. All regions show an increasing trend in average audit fees over the period. London consistently has the highest average fees, peaking at over £200k in 2023-24. Other regions also show significant fee increases, with East of England and North East and Yorkshire seeing substantial growth.

Source: NHSE collated data

4.22East of England has seen the largest increase in average audit fees, with a 218% increase from 2018-19 to 2023-24. All regions have seen an increase in average audit fees of over 100% over the past five years. Although London has the largest average audit fees, its percentage increase has been the lowest at 141%. Figure 11 illustrates the average audit fee percentage increase by region since 2018-19.

Figure 11. Average Audit Fee Increase per Region for NHS Providers, 2018-19 to 2023-24

Column chart showing the percentage increase in average audit fees per region for NHS providers from 2018-19 to 2023-24. East of England shows the highest increase at 218%, followed by North West at 180% and North East and Yorkshire at 170%. London has the lowest increase at 141%, while Midlands, South East, and South West show increases ranging from 142% to 165%.

Source: NHSE collated data

5. Our findings - issues in the NHS audit market

5.1In this section, we set out our findings on the NHS audit market including issues we have found. Our emerging findings publication set out our initial views on the market and stakeholders overwhelmingly concurred with our emerging findings. They told us we had presented an accurate picture of the market and identified the key issues. Following our emerging findings, we explored the use of procurement frameworks and the effectiveness of NHS Audit Committees (ACs) and Audit Committee Chairs (ACCs) in more detail. Our findings on these topics are set out in this section.

Overall functioning of the market

5.2Overall, we have found that the NHS audit market is functioning but there are issues affecting the market and its future resilience. Stakeholders reported the market had functioned more effectively in the past and there is a downward trajectory in its effectiveness, particularly in terms of capacity and choice of audit firm for NHS bodies.

5.3We have also found that the NHS audit market is working more effectively than the market for local authority audits. There is consensus from audit firms that the NHS financial reporting framework is simpler than the local authority financial reporting framework and accounts. Features of local authority reporting such as pension liabilities and statutory overrides contribute to more complex audits. While the NHS financial reporting framework contributes to better mitigated risk in the NHS audit market, compared to the local authority audit market, most firms highlight more significant factors.

5.4Better capacity and capability at NHS finance teams and direct central structural support (via NHSE) to NHS bodies were mentioned as the most significant factors to mitigating risk. Another feature that enables the NHS audit market to function better than the local authority audit market is the effectiveness and professionalism of ACs and ACCs in the NHS.

Key issues

5.5In commenting on the downward trajectory in the NHS audit market's effectiveness, stakeholders mentioned similar concerns about the market and many of these have also been raised about the local authority audit market. There are concerns about the supply of audit, choice of firm and competition, and audit quality and timeliness. We have explored these concerns during the market study and identified the following as key issues in the NHS audit market:

- Constraints on NHS audit market capacity.

- Concerns about the procurement processes for NHS audits.

- Conflicting views about the value of NHS audits.

1. Constraints on NHS audit market capacity

5.6Audit firms active in the market have sufficient capacity to deliver their current NHS audits. However, there are barriers to expansion. There are specific barriers or constraints to firms increasing their capacity, which are discussed in paragraphs 5.8-5.39. The barriers and constraints we have identified are:

- Reporting and audit timetable pressures.

- Audit firm conflicts of interest.

- Audit firm geographic limitations.

- Recruitment of audit staff and access to talent pool.

- NHS finance teams' capacity and capability.

- The increase in MLAs.

5.7We also spoke to six audit firms that could potentially enter the NHS audit market. Four reported that they would consider entering the market, with two particularly interested and willing to audit MLAs, but all six audit firms reported barriers to entry:

- All six firms highlighted regulatory requirements as a major barrier, namely the experience requirement to be an accredited local audit firm with KAPs. Some firms see the concept of KAPs as an unnecessary barrier for NHS Trust and ICB audits. This barrier relates to the recruitment of audit staff and access to talent pool barrier mentioned by firms active in the market.

- All six firms expressed concerns about having the staff and resources to deliver high-quality audits for a new market. Firms would need to hire staff from current local audit firms, given the regulatory experience requirements. This barrier also relates to the recruitment of audit staff and access to talent pool barrier mentioned by firms active in the market.

- All six firms mentioned the need for attractive NHS audit fees and commercial returns. There is a perception that fees are still relatively low in comparison to other markets.

- Five firms highlighted the complexity of public sector procurement frameworks. This barrier relates to the concerns about the procurement processes for NHS audits mentioned by firms active in the market.

Timetable pressures

5.8NHS bodies' accounts are initially consolidated into either the Consolidated NHS Provider Accounts (for NHS providers) or the NHSE Group Accounts (for ICBs), which are audited by the NAO. These are then consolidated into the DHSC group accounts, which are then consolidated into the Whole of Government Accounts.

5.9Following the financial year-end of 31 March, NHS bodies must submit their draft annual accounts by late April and submit their audited accounts by late June. Prior to Covid-19 the deadline to submit their audited accounts was late May. The tight reporting timetable and short audit timeframe are causing resource strain and acting as barriers to growth by limiting the number of tenders firms can bid for. From a risk perspective, firms would prefer to focus on delivering a lower volume of audits to a high quality, within the designated timeframe, than risk compromising quality by taking on more work.

5.10While well-organised NHS bodies can meet deadlines, the capacity and capability of NHS bodies is variable, and the current deadlines can lead to capacity strain, which can compromise reporting and audit quality. Capacity can be further constrained due to overlapping schedules for other essential activities, such as financial planning returns, which often coincide with the accounts and audit period, leading to coordination issues.

5.11Audit firms would like to see the alignment of financial statements closedown and audit with two key activities – financial planning and final in-year funding allocations. There is consensus from audit firms that the uncertainties surrounding these activities can have a profound impact on the capacity of NHS bodies and audit quality.

5.12The key benefit of financial planning processes being completed before the start of audits is that NHS finance teams can prioritise audits during the audit period. Two firms told us another benefit to the process being completed before the start of audits, would be the scope for them to finish their VfM work on financial sustainability at an earlier stage, improving audit efficiency.

5.13In response to our emerging findings, we were told the current NHS financial framework presents significant pressures for NHS finance teams, in particular the timescales for financial planning which in recent years have overlapped with year-end processes. Two audit firms gave examples of the delays in financial planning, with one firm stating it has worsened significantly since Covid-19 and another firm stating that the capacity of one NHS finance team was particularly constrained last year because of this.

5.14The key benefit of timely final in-year funding allocations to NHS bodies is that it allows incorporation into the first draft of financial statements. This prevents uncertainty and complications in NHS audits due to late changes in accounts, which compromises audit quality and strains capacity. We heard that some NHS bodies are receiving final funding confirmation two months after the year end.

5.15Two firms gave examples of issues with the timing of final in-year funding allocations. We were told late funding allocations posed one of the biggest issues with NHS audits, as it is currently difficult to address the associated risks in a timely way. We were also told, from a VfM perspective, firms are being asked to form a conclusion of their work while the 'picture is still moving'.

5.16Audit firms and NHS bodies were not in favour of potentially staggering timeframes for the preparation of financial statements and delivery of audits for different categories of NHS body, in order to create capacity. Should audits be staggered or deadlines moved back, it could negatively impact other non-NHS audit work and impact DHSC's consolidated accounts.

5.17The expectation of Parliament and HM Treasury is that government departments publish their audited accounts by the beginning of the summer Parliamentary recess. DHSC has not met this expectation since 2019, instead publishing its accounts in January each year, six months after the deadline. In September 2024, DHSC set a target to return to a pre-summer recess sign-off by the 2026-27 year-end. 19 The Comptroller and Auditor General (C&AG) has recommended that "To meet this commitment, the Department’s timetable for completion of the NHS provider and ICB audits will need to be significantly advanced. This is dependent on earlier completion of audits at these bodies”. 20

5.18Earlier audit completion, as recommended by the C&AG, will help the Government meet its sign-off target. Most audit firms told us they welcome the focussed time period to produce NHS audits. While audit firms are not necessarily seeking to extend the period to sign-off audits, they unanimously feel a return to the pre-Covid-19 deadline of late May is no longer practical and would severely test capacity and impact audit quality. Aligning financial statements with planning and funding, and simplifying annual report and property valuation requirements (discussed in paragraphs 5.93-5.100), could free capacity for NHS finance teams and auditors, supporting earlier audit completion.

Conflicts of interest

5.19Five firms view conflicts of interest considerations regarding the provision of non-audit services to NHS audit clients as a barrier to bidding for NHS audits. Some audit firms divide geographic regions based on where they offer audit and non-audit services, which constrains their ability to increase their NHS audit clients in certain areas.

5.20The transition from CCGs to ICBs might have reduced audit opportunities for some firms. Since ICBs cover larger areas, firms offering non-audit services to ICBs could be restricted from auditing more NHS providers within the same ICS than before due to conflicts of interest. There are inconsistencies in the way firms interpret what constitutes conflicts in this scenario. A system stakeholder told us this inconsistency may be attributable to individual audit firms' risk appetite rather than ambiguity in guidance.

5.21Those firms who provide audit services and non-audit services are currently adopting different interpretations of the NAO's Auditor Guidance Note 1 (AGN/01). Even one well established NHS audit firm told us they are adopting a binary approach but are not sure whether this is correct. Audit firms have told us that confusion over conflicts of interest is impacting their ability to bid for audit work.

5.22We have been told that National bodies and systems/provider groupings are increasingly procuring services that impact multiple entities, which can be challenging to evaluate from an audit independence perspective. We have also been told that clarifying the treatment of nationally procured programmes and revisiting AGN/01 could help address potential conflicts and improve the attractiveness of the NHS audit market.

5.23Most firms have suggested there should be clear conflict of interest policies and guidelines for the sector. This would allow audit firms to manage and mitigate conflicts, particularly given the structure of the healthcare sector. Most audit firms sought further clarification on AGN/01 so that conflicts of interest are black and white, and are not open to interpretation or individual risk appetite. Only one firm told us that there should be relaxation of the requirements of AGN/01. They stated ICBs do not operate in the same way as NHS providers do, so they do not see why there should be prohibited services on ethical grounds, if the same firm audited a provider body in the ICB area.

5.24The NAO have told us that it is not their role to try to centrally assess permissible services against the FRC's Ethical Standard or calculate the 70% fee cap on behalf of audit firms, and that firms should be able to assess the appropriateness against the FRC's Objective Reasonable and Informed Third Party (ORITP) test. It is our view that the NHS sector is not necessarily more nuanced, due to structure, than the corporate sector in the context of non-audit services, therefore there is no unique challenge here for NHS auditors. However, better coordination of audit and non-audit services at an ICS level may help mitigate conflicts of interest issues.

Geographic limitations

5.25Most audit firms focus on specific regions to manage their capacity. Geographic location influences client selection and can impact market dynamics, particularly when it comes to auditor choice and price expectations.

5.26Some audit firms' geographic limitations are influenced by both physical presence in regions and strategic decisions regarding non-audit services. While hybrid audits have become more common, our roundtables with NHS bodies revealed a strong preference for auditors to be mainly on-site, which may limit audit firms' ability to take on clients in certain regions.

Recruitment of staff and access to talent pool

5.27Recruitment and retention of good quality, experienced staff is a challenge for audit firms. Challenges in recruiting and retaining staff may be related to audit firms using the same resources for local authority audits. All six audit firms which supply audits to local authority bodies for the four-year period commencing 2023-24 are active in the NHS audit market. The local authority audit backlog has impacted the resourcing of NHS audits and may continue to do so.

5.28Some audit firms feel the regulatory environment, including the need for sector-specific knowledge and accreditation for NHS and local audits in general, adds a particular challenge for the recruitment of staff to undertake NHS audits.

5.29We heard mixed views about whether auditors with experience in auditing other sectors could deliver good quality NHS audits if there was no requirement for KAP accreditation, and whether audit firms should have more discretion on the staff responsible for NHS audits. Four audit firms, ICAEW, Healthcare Finance Management Association (HFMA) and three NHS bodies who responded to our emerging findings are in favour of reconsideration of KAP requirements for NHS audits. Two firms and one NHS body are against amendments to KAP criteria. Three firms and one NHS body are neutral on the matter, seeing the arguments for and against.

5.30Those in favour of reconsidering KAP requirements argue that NHS audits are more akin to corporate audits, there are no KAP requirement for the auditing of Foundation Trusts, and incumbent firms are well placed to judge internally if partners are suitable to sign-off NHS bodies' audits. Therefore, a specific regulatory barrier, which restricts firms' entry and expansion should not exist. Those in favour of maintaining KAP requirements argue that it is important to maintain this specialism to ensure audit quality and prestige of the profession. Audit firms' views on this subject appear to be somewhat predicated by their market position.

5.31The Government has proposed removing KAP eligibility criteria in primary legislation and empowering the LAO to consider appropriate eligibility requirements. The LAO will have the statutory responsibility to consider the appropriate eligibility requirements and produce guidance for auditors and the market. The Government will work with stakeholders to determine what changes to current KAP eligibility requirements could usefully be made ahead of the LAO's establishment. 21

5.32The Government may wish to consider the differences between the complexities of local authority and NHS financial reporting frameworks and audits, when considering eligibility requirements. The Government may also wish to consider the view that NHS audits are less "specialist" than local authority audits and the value of experience gained in other types of healthcare audits, when considering eligibility requirements.

NHS finance teams' and audit firms' capacity and capability

5.33Potential capacity issues for NHS bodies' finance teams may be adversely affecting NHS financial reporting. NHS finance teams face numerous challenges including increasing workloads, the need for better national planning and for more continuous training and development to ensure high-quality financial reporting.

5.34However, there are mixed views on the actual capacity and capability of NHS finance teams. While only 19% of NHS bodies responding to our survey said their capacity to deliver high quality audits on time was very good, 51% reported that they had very good capability. Audit firms told us that NHS bodies' finance teams face capacity challenges, with two audit firms highlighting this as a significant issue.

5.35We heard mixed views on the need for nationally coordinated training for NHS auditors. There is agreement for more support around training and creating a pipeline of new auditors, though the larger audit firms feel as if they have the capability to provide this in-house. The provision of nationally coordinated training would be helpful for new entrants and RIs new to NHS audits, particularly with relation to VfM work. It was noted that the CIPFA local audit diploma was far more geared towards the auditing of local authority bodies rather than the NHS.

MLAs

5.36The number of MLAs have been increasing in recent years, reflecting the increase in NHS bodies' expenditure and income (see paragraph 4.2). Given two of the audit firms active in the NHS audit market have made strategic decisions to not bid for MLA audits, there are currently seven firms actively bidding for MLA audits, making it a more capacity constrained market. Although the audit requirements are no different for MLAs, regulatory scrutiny of auditing MLAs have been mentioned by firms as one of the drivers for fee increases. The increased fees reflect firms' risk appetite in the amount of additional work they choose to do for MLAs.

5.37There is overwhelming consensus from audit firms, HFMA and NHS bodies that the current MLA threshold is out-of-date and needs to be increased in line with inflation as a minimum. We welcome the Government's proposal to introduce secondary legislation to amend the MLA threshold 22 to support the timely completion of audits while maintaining oversight and accountability. 23

5.38We heard mixed views about whether ICBs should be exempt from being MLAs. Five audit firms and HFMA are of the view that ICBs should be exempt, arguing that while ICBs are large, they are not complex enough to be considered MLAs, are simple audits and are far less risky than NHS provider audits. Only one audit firm told us ICBs should remain MLAs given they handle significant amounts of money, are reasonably complex, do more than just pass money to NHS hospitals and material errors in accruals have been seen at ICBs. ICAEW believe NHS bodies should not be exempt from being MLAs. Two firms were neutral on the matter.

5.39We note the Government proposes to introduce legislation to move away from audit regimes based solely on thresholds and give the LAO the power to decide the appropriate regime for bodies to ensure a risk based and proportionate approach which could include general exemptions for types of bodies. 24 The Government may wish to adopt a risk-based approach to judging MLA status for ICBs 25 and take time to consider whether a blanket exemption is appropriate.

Public sector provision of audits

5.40The Government has been considering barriers and constraints in the wider local audit market and committed to establish public provision of local audit services to support the private market. 26 There is a question whether public provision should include the audits of NHS bodies. In response to this question, there were mixed responses from audit firms. Two firms are in favour of public provision of NHS audits, two firms are fairly neutral, and five firms are against it. HFMA and two NHS bodies who responded to our emerging findings are in favour of public provision for NHS audits.

5.41The main reason given for being in favour of public provision for NHS audits is that it provides the safety of a public auditor, if NHS bodies have difficulties finding an auditor. In response to our emerging findings, one NHS body said they were in favour of a full-scale return of public provision, believing it would save money in the long run.

5.42The main argument given by audit firms against a level of public provision is that it would not increase capacity. Rather capacity would just be shifted from firms to the public provider, which would destabilise the market. Two firms highlighted that shifting of capacity to a public provider would have a detrimental impact on the capacity of other services, given staff at audit firms are involved in other non-local audit work. Another firm drew a clear distinction between the NHS and local authority audit market, telling us the NHS had a strong top-down system headed by NHSE, which meant public provision would not be necessary.

5.43We note the Government's commitment to public provision of local audit will be introduced through a phased approach to gradually scale up over time, with collaboration with the NAO, other public audit bodies and private firms to build capacity and recruit new auditors into the sector. 27

2. Concerns about the procurement processes for NHS audits

5.44We think concerns surrounding choice of audit firm for NHS bodies result from issues with the NHS audit procurement processes. The majority of NHS bodies we engaged with told us that they have struggled to find auditors, had limited choice and had concerns about their next audit tender. Our survey results highlight the lack of choice some NHS bodies faced in their last audit tender exercise:

- A total of 47% of respondents only received one bid, with 7% receiving no bids at all.

- A total of 59% of respondents appointed their incumbent auditor, with 9 appointments made without any formal bid.

- A total of 70% of respondents had concerns about their next audit tender, with a further 17% having serious concerns.

5.45Most audit firms active in NHS audits reported substantial issues with the competitive process for winning NHS audit contracts. We heard problems with the procurement process for NHS audits include:

- Long and complicated tender processes, including numerous procurement frameworks with terms and conditions which are not suited for external audit engagements.

- Poorly planned or late tendering by NHS bodies for audits.

- Tender exercises being procurement driven rather than led by NHS finance teams.

- A lack of engagement from NHS bodies before bids, which could lead to higher price points due to firms struggling to tailor their bids without any existing relationships or knowledge of the NHS bodies.

Procurement frameworks

5.46The use of NHS accredited procurement frameworks is the preferred method for procuring audits by NHS bodies. Only 3% of respondents to our survey of NHS bodies told us they did not use a procurement framework to appoint their auditor.

5.47Procurement frameworks aim to streamline the buying process while saving time, resources, and costs. They assist NHS bodies in purchasing goods and services from a list of pre-approved suppliers who have agreed to consistent terms and conditions and legal protections. For suppliers, frameworks aim to simplify contract processes and make bidding for contracts easier.

5.48Respondents to our survey of NHS bodies mentioned nine procurement frameworks used for their last external auditor procurement exercise. We understand that four of those frameworks have consolidated for the purpose of external audits, meaning there are currently six active frameworks available for the procurement of NHS external audits. These six frameworks include several lots, each offering different services; one lot on each framework is dedicated to external audit services. Audit firms will go through a tender process and bid to be included on framework lots. Figure 12 provides details of the six procurement frameworks, as reported to us by audit firms and NHS bodies.

| Category | NHS Procurement in Partnership 2024-2026 | NHS Shared Business Services 2020-2025 | Crown Commercial Service 2021-2025 | HealthTrust Europe 2024-2027 | Countess of Chester Hospital NHS Foundation Trust 2021-2029 | Eastern Shires Purchasing Organisation 2021-2025 |

|---|---|---|---|---|---|---|

| Number of lots in the same framework as external audit lot | 7 | 5 | 4 | 5 | 4 | 9 |

| Active local audit firms in external audit lot | Azets BDO Bishop Fleming Deloitte EY Forvis Mazars Grant Thornton KPMG |

BDO Deloitte EY Forvis Mazars Grant Thornton KPMG |

BDO Deloitte EY Forvis Mazars Grant Thorton KPMG Sumer NI |

Grant Thornton KPMG |

Azets Sumer NI |

BDO Grant Thornton KPMG |

Source: NHS procurement framework websites

5.49None of the external audit lots in the six frameworks include all nine registered local audit firms active in NHS audits. The consolidation of four frameworks to form NHS Procurement in Partnership has created a framework with the largest coverage of registered local auditors, with eight firms. According to our survey of NHS bodies, NHS Shared Business Services and Crown Commercial Service are overwhelmingly the most used frameworks by NHS bodies to procure external auditors; they feature six and seven firms active in NHS audits respectively, though both will launch new frameworks in 2025.

5.50From our engagement with audit firms, NHS bodies and procurement framework providers, it is our view that procurement frameworks are not working as intended for NHS audits. Seven audit firms told us that the market would benefit from greater standardisation of procurement processes. Two audit firms not active in NHS audits have mentioned the complexity of public sector procurement processes as a barrier to entry. In response to our emerging findings, two NHS bodies and HFMA also told us that the number of procurement frameworks added unnecessary complexity.

5.51The desired benefits of procurement frameworks such as reducing procurement timelines, and creating effective competition and choice are not being realised. On the contrary, the majority of NHS bodies who responded to our survey told us they used frameworks to directly appoint auditors, rather than through a competitive process facilitated by a framework. Some NHS bodies have told us they have been unable to procure an auditor via a framework, so find an auditor independently and then use a framework the auditor is part of to formalise the appointment.

5.52We have concluded that the current procurement process is inefficient and there are too many frameworks for the limited number of suppliers. This has resulted in the following issues which are limiting choice:

- NHS bodies do not have sight of all active NHS audit firms on individual frameworks. During conversations with NHS bodies, it is clear that many are not aware of the full range of potential audit suppliers. The existence of multiple frameworks plays a significant role in this information asymmetry.

- Some procurement frameworks can be difficult for new entrants to get on if they do not have dynamic purchasing mechanisms. One new entrant also told us that they have found it impossible to get on one prominent framework due to failures of the framework provider to respond to the firm.

- Varying procurement processes and rules across existing frameworks has created inconsistency. Different frameworks appear to have different rules with regards to pre-bidding engagement between NHS bodies and audit firms, and pricing-flexibility during audit engagements, which can deter audit firms.

- The need for NHS bodies to potentially join multiple frameworks to get a full view of the market can be both time-consuming and expensive, so they do not do it.

5.53Following discussions with stakeholders, it is our view that external audit is a unique service which should not be bundled into other services in procurement frameworks. Unlike other services for the NHS, external audit is a statutory requirement, has specific requirements which do not fit well with standard NHS terms and conditions, and it is a fairly standardised service. Local audit is also heavily regulated meaning it is inefficient for the limited number of firms permitted to perform NHS audits to go through additional “vetting" to get on to frameworks.

Procurement planning

5.54All the audit firms active in NHS audits agreed that there was need for better planning in the logistics for the audit procurement process by NHS bodies, so firms could incorporate tender opportunities into their workforce planning. NHSE's procurement guidance was widely appreciated by audit firms, however there appeared to be inconsistencies in its use.

5.55Ideally tender processes should start in spring, though we have heard of processes starting as late as December. We have been told, given the three-to-five-year cycle of audit contracts, there should be no excuse for late procurement planning. We have also been told NHS bodies should be thinking about their next tender two years in advance, though the unusually high frequency (i.e. every three to five years) of public sector audit tenders can make this difficult.

5.56Six of the audit firms told us that they saw benefits in requiring NHS bodies to disclose tendering plans to NHSE/ DHSC for publication on their website, to enable firms to evaluate the market for upcoming tenders. One of those firms told us that due to the nature of NHS audit contracts with potential extensions, tenders can often come as a surprise, so a central database would be of great benefit. The prevalence of these extensions, however, could pose challenges to the practicalities of obtaining accurate information to publish.

5.57While enforcement of the NHSE guidance and mandating procurement processes be concluded within appropriate timeframes would be welcomed, they would be difficult to compel without some sort of penalty. Stakeholders are sympathetic to the strain on NHS bodies' capacity and their competing tasks, however better procurement planning should elicit more auditor choice.

Procurement engagement

5.58Seven of the audit firms feel there needs to be more engagement between NHS bodies and prospective auditors during the tendering process. A lack of engagement means firms cannot tailor bids appropriately including the price. One of those firms highlighted the contrast with corporate auditing, where there is far more engagement, meaning firms are able take the specific circumstances of a company into account when preparing a proposal, creating a better understanding and a better quality relationship.

5.59The lack of engagement also gives a clear advantage to the incumbent auditor, as it places too much importance on existing personal relationships. Audit firms told us that without requisite information about NHS bodies they may decide not to bid as it would essentially be "blind bidding".

5.60One audit firm told us, however, that were opportunities to engage with NHS bodies, but this was dependent on the individuals within the bodies and the procurement framework being used. As discussed in paragraph 5.52, different frameworks appear to have different rules with regards to pre-bidding engagement between NHS bodies and audit firms. This was highlighted by one NHS body's response to the emerging findings, which stated they were advised by procurement colleagues that they were prohibited from one-to-one engagement. HFMA also stated that its members had received conflicting advice surrounding this issue.

5.61To note, The Procurement Act 2023 which came into effect in February 2025, offers more engagement flexibility, allowing for pre-procurement meetings and other forms of engagement, provided they are conducted transparently and fairly. However, the procurement frameworks under previous regulations, such as the Public Contracts Regulations (2015), will continue to apply to procurement procedures which commenced before 24 February 2025. Under the 2015 Regulations, engagement between buyers and suppliers is more restricted and the rules are open to interpretation.

5.62In HFMA's response to the emerging findings, they told us, while it brings advantages, pre-bidding engagement does create an extra time-consuming step in an already complex process. However, evidence obtained through the market study suggests, by reducing complexity by creating a single framework, NHS ACCs may be well placed to lead in more market engagement. The ACCs we spoke to acknowledged the benefit in introducing a tailored procurement framework process to support the appointment of external auditors.

National or block procurement

5.63The proposed creation of the LAO will see the transfer of PSAA's role of appointing auditors for eligible local government bodies. There is a question on whether the appointment of auditors for NHS bodies should also be part of the LAO's remit.

5.64Two audit firms and ICAEW are in favour of the LAO having responsibility for nationally procuring audits for NHS bodies, with another firm not against the idea. The main advantages of national block procurement given were that it provides clarity to audit firms and NHS bodies, reduces bidding costs for firms, ensures economies of scale of clients for firms, and ensures all NHS bodies have an auditor. HFMA reported that some of its members are in favour of national block procurement due to the lack of competition in the market and the costly and timely process of procurement.

5.65Six firms are strongly opposed to national block procurement, citing the issues seen in the local authority audit market, including:

- The detrimental impact on auditor-client relationships, where the auditor has not been procured by the client and does not have the power to resign from audits.

- Firms do not know which bodies they are bidding for, so are essentially blind bidding.

- The inability for firms who were not awarded a contract during the previous tender process to enter the market during appointment periods.

- Block appointments being a barrier to entry for new entrants who don't have the required capacity to take numerous clients. It is worth noting that Azets and Bishop Fleming both entered the NHS audit market with a small amount of NHS clients, prior to entering the local authority audit market.

- Capacity issues for firms if all appointments are made at the same time.

- Issues with separating MLAs and non-MLAs from blocks, for firms who do not audit MLAs.

- Issues with block appointment may be particularly difficult to coordinate from a conflicts of interest perspective in the NHS given the frequency of audit firms offering non-audit services.

5.66Some firms have told us they would consider exiting the market, or reduce their capacity, if national procurement arrangements were enforced. HFMA also told us that for many NHS bodies, the ability to engage with the procurement process and appoint their own external auditors ensures an appropriate fit for them and this would be lost if the procurement process moved to a centralised system.

5.67We spoke to four NHS bodies who carried out group procurement with other NHS bodies. The rationale for the NHS bodies was to save procurement costs and create economies of scale. DHSC procurement guidance says the following “The group may also wish to consider whether a joint procurement with one or more other NHS bodies is appropriate and could offer some economies of scale, for example sharing the procurement cost”. 35

5.68Our engagement revealed that no savings or economies of scale were realised by NHS bodies through group procurement, as each audit is an individual engagement. In fact, the NHS bodies told us that the procurement exercise was more costly and cumbersome, i.e. trying to align all contract end dates to start the procurement process and getting agreement from multiple ACCs on matters. The group procurements did not attract many bids, with only the largest firms having the required capacity to bid for them. NHSE/DHSC may want to reflect on our findings on group procurement in any updates to their procurement guidance.

3. Conflicting views about the value of NHS audits

5.69Generally, the relationships between audit firms and NHS bodies are good but there can be differences in their priorities, which result in different perceptions of the quality and value of NHS audits.

Engagement levels during audits

5.70While there can be variability, there is good engagement from NHS financial teams, ACs and other senior staff during audits.

5.71Some audit firms told us that some local authority bodies could learn from their NHS counterparts, particularly in relation to having better resourced finance teams, stronger ACS, more professionalism, better quality of accounts and better levels of collaboration and engagement.

5.72In the emerging findings we stated that, generally, NHS ACs and ACCs were perceived to be more effective than their local authority counterparts. Demand-side professionalism in the NHS was amongst the reasons why the NHS audit market functions more effectively than the local authority audit market. Following further discussions with audit firms and ACCs, this view has been reinforced.

5.73The main reason for this is that NHS AC members are non-executive directors appointed for their finance experience, whereas in contrast local authority ACs usually have elected members, with no guarantee of a finance or other relevant background. The NHS ACCs we spoke to are qualified accountants and were aware of many other ACCs from similar backgrounds. In their view this experience enables ACCs to work effectively and add value to the wider governance operations of their organisation.

5.74AC effectiveness is driven by the calibre of the ACC as they set the agenda and direction for the AC, facilitating accountability of the executive with a positive and constructive relationship with their Director of Finance, external auditors and internal auditor. Positive examples of engagement include dialogue with external and internal auditors to understand emerging issues and challenges so that the AC are not presented with unexpected circumstances in their AC meetings.

5.75ACCs we spoke to acknowledged that if you have a positive relationship with your external auditor, there is an incentive to retain them, in a market where choice is limited. It was highlighted that this motivation to retain your external auditor could see some engagements demonstrate a familiarity risk.

5.76The ACCs we spoke to also provided insight on tendering for external auditors. They shared the limited effectiveness of procurement frameworks, with frameworks not necessarily identifying all the audit firms in the market. ACCs told us they were frustrated by the limited suppliers in the market which means they cannot conduct a meaningful tender process. Also, sometimes geographic location or the risk profile of an organisation can limit auditor choice.

Quality versus deadlines

5.77Eight audit firms told us that NHS bodies prioritised audit deadlines over audit quality, which can compromise quality. Most audit firms sympathised with NHS bodies, noting they had tight timetables, budget constraints and wider healthcare system pressure. These include the overlap of financial planning returns with the accounts and audit period, and the pressure to achieve financial targets while the funding picture remained uncertain.

5.78In our survey, 73% of NHS bodies reported the deadline to produce draft accounts was about right and 59% felt the time to complete the audit was about right.

5.79We have been told a high-quality, financial reporting process, with appropriate controls and management consideration and support of key accounting judgements and estimates, makes audits more attractive to firms by reducing the time required for the audit, improving timeliness of the process, and reducing the risk associated with individual audits.

5.80The FRC's Corporate Reporting Review (CRR) team, reviews the annual report and accounts of public and large private companies, and certain other entities, for compliance with the law and other relevant reporting requirements. This relates to the FRC's statutory responsibility to monitor and improve the quality of corporate reporting. It was suggested to us that a similar mechanism should exist for the NHS, in order to monitor and improve financial reporting.

5.81Four audit firms agreed that an equivalent to CRR should exist for the NHS. Three firms were neutral about it, while two firms were against the idea. While some firms thought it could help raise the quality of financial reporting, there doesn't appear to be a significant issue with the standard of financial reporting in the NHS, and an equivalent to CRR may be disproportionate.

5.82Stakeholders told us they understand the capacity pressures some NHS finance teams are under, however a number of them advocated additional coordinated training for NHS bodies to improve capability.

5.83In their response to the emerging findings, ICAEW stated that there are differing views across the sector in terms of the overall value of an audit. ICAEW would recommend that further support and training is provided to finance teams and audit committee/board members regarding its purpose and value. One audit firm explicitly told us that training and support should be offered to NHS finance teams to enhance their capacity for high-quality financial reporting, emphasising the importance of accurate accounts and audits through workshops, case studies, and best practices. Additionally, there should be provision of resources and training on VfM reporting to demonstrate its impact on performance and service delivery.

Value and purpose of financial reporting and audit

5.84In the emerging findings it was noted that there is a split in how NHS bodies value audits when assessed against the audit fee. A total of 46% of respondents to our survey said audits provided good value, while 38% said they did not.

5.85While the NHS financial reporting framework is relatively lean, there are requirements which stakeholders believe could be amended or streamlined to improve capacity and provide more value to the readers of NHS accounts.

5.86Since the emerging findings we have tested with stakeholders whether there is scope for some of the reporting and audit requirements to be amended to reinforce the value and purpose of financial reporting and audits, while potentially creating capacity for both audit firms and NHS bodies.

VfM reporting

5.87In the emerging findings we reported that many NHS bodies had expressed views that the VfM reporting aspect of audits were unnecessary because they provided no new information to NHS bodies, did not actually measure value for money, duplicated work carried out by other regulators such as Care Quality Commission (CQC) and was resource intensive. Four out of the five NHS bodies who responded to our emerging findings reiterated this view, with one suggesting VfM assurance could be provided by internal auditors.

5.88Most audit firms and system stakeholders believe that VfM reporting is an integral part of NHS audits. As reported in the emerging findings, one system stakeholder observed VfM reporting may not provide new information to some NHS bodies, but it may provide additional beneficial information for other users of NHS audits, such as members of the public. For example, for the financial year 2023-24, 65 NHS providers were found to have significant weaknesses in their VfM arrangements by their auditors. 36 The majority of audit firms agree that VfM reporting is important; only one audit firm felt VfM audits do not provide great benefits and this differentiation from corporate audits makes it harder to attract people to these audits.

5.89There appears to be a difference of opinion about the purpose of VfM reporting between NHS bodies and audit firms. However, three audit firms and HFMA believe that VfM reporting requirements should be reviewed. It has now been five years since the 2020 Local Audit Code of Practice was introduced, which led to the changes in VfM reporting.

5.90We welcome the Government's commitment to undertake a post-implementation review to assess whether changes to VfM requirements in the 2020 and 2024 Code of Practice have led to more effective consideration of financial resilience and VfM, and to conduct this review by the end of 2027. This review will consider whether auditors should assess VfM achievement. 37 As part of the review, the Government could consider how better coordination and dialogue between NAO, CQC and audit firms can be achieved to prevent unnecessary duplication of work and to improve quality.

Mental Health Investment Standard compliance

5.91We heard mixed views about whether the requirement for external assurance over ICBs compliance with the Mental Health Investment Standard should be removed, with the potential to replace this with self-certification. Two audit firms and HFMA have argued that external assurance does not add much value and can impact auditor capacity. However, one firm told us they have found a number of issues in the way information is compiled, which suggests there is value in independent assurance. Most firms are neutral on this proposal, however.

5.92We are aware that DHSC has proposed including the Mental Health Investment Standard disclosure within the audited financial statements. 38 Our information gathering in this area has not provided any conclusive market views. For example, one audit firm welcomed the inclusion saying this will reduce the overall level of work required if this removes separate certification, while one firm said it would increase the work required.

Annual Report requirements for NHS bodies

5.93Six audit firms, HFMA and one NHS body in response to our emerging findings believe that the market would benefit from rationalisation of annual report disclosure requirements, where they add limited value to the user, and reconsideration to which elements are required to be subject to audit. HFMA stated there should be full-scale review of reporting beyond annual report requirements. One firm did not believe rationalisation to annual reports is required, while two firms are neutral to the idea.

5.94Most stakeholders believe that annual reports have become too long, which is disproportionate to all other sectors, and related work comes quite late in the audit. Some firms told us NHSE are the only audience for annual reports, and they will already be aware of the information included in them. Firms told us the time and money spent on producing such a huge document is disproportionate to the benefit. One of these firms told us annual reports took five to six days to review, so rationalisation could provide significant benefits with regards to auditor capacity.

5.95We have been told that simplifying the annual report and accounts to make it more accessible and similar to a normal corporate entity would be welcome. We have also been told that stakeholders' interest in this information is questionable, and there might be a different mechanism for them to get this information without it going through the auditor.

5.96With regards to reconsideration of which elements of annual reports are required to be subject to audit, some audit firms believe the auditing of remuneration disclosures should be reconsidered. One of these firms told us it takes up a disproportionate amount of time for the content that's in there and the rules around it are "quite grey”. However, one firm told us remuneration requirements are clear, and another firm told us remuneration disclosures are of great interest to the public.

Simplifying financial reporting requirements relating to valuation of property

5.97Seven firms and HFMA told us that the market would benefit from simplifying financial reporting requirements relating to valuation of property. There is belief from these stakeholders that the time and resources spent on valuations is significant and do not add much value. As well as a strain on capacity, two firms mentioned large fees they pay to expert valuers, to provide insights on things which are not important in the grand scheme of things. However, one firm told us NHS assets are crucial to business and future planning, which is contrast to local government.

5.98The Financial Reporting Advisory Board has been involved in reviewing and updating the financial reporting requirements for non-investment assets, including property, for NHS bodies and other bodies in the public sector. This includes changes to the Financial Reporting Manual (FReM) that aim to strike a balance between high quality financial reporting, the costs of the valuation regime, and the benefits to users. 39

5.99The results of the thematic review by HM Treasury, which included input from Financial Reporting Advisory Board, proposed significant changes to how property assets are valued, including simplifying the revaluation cycle with a focus on five-yearly revaluations with indexation in the intervening years. Other changes to the valuation methodology are also being considered, including relating to the valuation of land when a modern equivalent asset approach is applied. The approach to reflecting these proposals in the Group Accounting Manual (GAM) has recently been consulted on by the DHSC. 40

5.100We found consensus in the market about the need for simplification of property valuation. This includes a potential creation of NHS indexation to standardise ways to adjust property values.

6. Our proposed remedies

6.1In this section, we set out potential remedies to address the issues we found in the NHS audit market. Having engaged with stakeholders about potential solutions to the issues, we have identified a longlist of possible proposals that could be progressed by relevant bodies including DHSC, NHSE, NAO, and MHCLG in the short-term and over the medium to longer-term.

6.2Since the commencement of our market study in July 2024, the Government has announced potential changes in the local audit system that may help improve the functioning of the NHS audit market. We welcome the Government's commitments to:

- Remove KAP eligibility criteria in primary legislation and empower the proposed LAO to consider appropriate eligibility requirements.

- Introduce secondary legislation to amend the MLA threshold to support the timely completion of audits while maintaining oversight and accountability.

6.3Given the FRC's interest in the functioning of the whole audit market, we intend to continue to monitor developments as part of our wider market monitoring work.

Potential short-term remedies

1: Create a single national procurement framework tailored specifically for NHS external audit, including appropriate terms and conditions.