The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

UKSEF 2025 Tagging Guide v2.1

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2025

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Introduction

This guide sets out the main principles involved in using the UKSEF method of filing for developers (sections 3 and 4) and preparers (sections 5 and 6).

Readers should be aware that there is no UKSEF taxonomy per se. Instead, UKSEF uses a standard feature of Inline XBRL – multiple target documents – to make it possible to use the ESEF taxonomy and UK Taxonomy Suite together. This approach was first adopted for UKSEF 2023 and allows preparers to meet both FCA (ESEF) and Companies House (UK-specific) reporting requirements by tagging one report.

Prior to adopting multiple target documents, UKSEF taxonomies were created in 2022 and 2021. These are documented separately on the FRC Taxonomies website.

Conventions used in this guide

When stating rules, this guide uses the following conventions to indicate requirement levels, based on RFC2119 published by the IETF organisation. (These conventions are not the same as those used by the FRC in publications on accounting standards.)

- MUST: This word, or the terms "REQUIRED" or "SHALL", means that the definition is an absolute requirement.

- MUST NOT: This phrase, or the phrase "SHALL NOT", means that the definition is an absolute prohibition.

- SHOULD: This word, or the adjective "RECOMMENDED", means that there may be valid reasons in certain circumstances to ignore a particular item, but the full implications must be understood and carefully weighed before choosing such a course.

- SHOULD NOT: This phrase, or the phrase "NOT RECOMMENDED", means that there may be valid reasons in certain circumstances when the particular behaviour is acceptable, but the full implications should be understood and carefully weighed before adopting it.

- MAY: This word, or the adjective "OPTIONAL", means that an item is truly optional.

Alignment with XBRL technical specifications

Unless otherwise indicated or, where no specific guidance is provided in this document, the applicable XBRL specifications MUST be followed in the creation of Inline XBRL reports and issuers' XBRL extension taxonomies. This includes XBRL 2.1, XBRL Dimensions 1.0, Inline XBRL 1.1, Formula 1.0, Taxonomy/Report Packages 1.0, Enumerations 1.0 and 2.0 and the Unit Types Registry.

The FRC taxonomies and other supporting information are published on the FRC website at https://xbrl.frc.org.uk.

2. Overview

The UKSEF Taxonomy was first introduced for the 2021 reporting period and a re-architected version was included with the suite of FRC Taxonomies for 2022. Support for Multiple XBRL Target Documents1, which is also supported by ESEF to accommodate local jurisdiction reporting requirements2, was introduced in 2023; this eliminated the need for an explicit UKSEF Taxonomy extension completely.

At a minimum, the purpose of the UKSEF approach is that the tagged consolidated financial statements that comprise an ESEF report are augmented by UK-specific tagging of information legally required by Companies House for the individual parent entity.

The sections below provide guidance on the use of the UKSEF approach (updated for 2025) and the method of tagging UK-specific information. The guidance assumes familiarity with the general structure of an ESEF report as well as the guidance provided by the ESEF Reporting Manual.

3. Multiple Target Documents

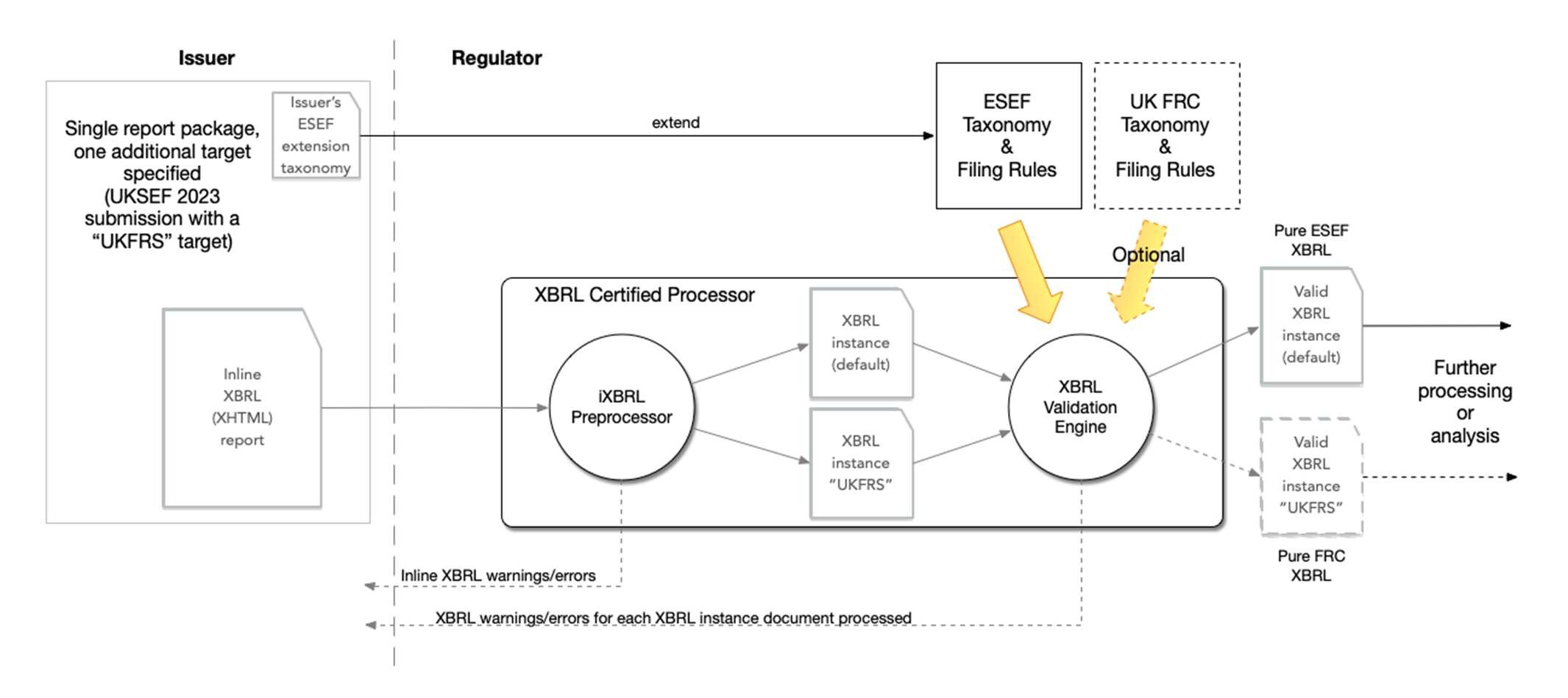

"Multiple XBRL target documents” is a standard feature of Inline XBRL. It eliminates the need for an actual UKSEF taxonomy – instead of incorporating a UKSEF taxonomy and references to the FRC Taxonomy in the issuer's extension, the report itself includes a direct reference to the relevant FRC Taxonomy entry-point. This reference, and all FRC-tagged data in the report, carries a target attribute with the value "UKFRS”3.

When processed by a conforming Inline XBRL processor, two XBRL target documents are produced: one, the default ("unnamed”) target, contains all the XBRL data that has no explicit target attribute in the Inline XBRL (i.e. the ESEF data) and the other, named “UKFRS", contains all the XBRL data that carries the “UKFRS" target attribute value in the Inline XBRL. Each resulting XBRL document is completely standalone and self-contained and can be independently validated against the relevant taxonomy.

This means that the default target document will contain the same data that would have resulted from a pure ESEF submission, and the “UKFRS" target document will contain the same data that would have resulted from a pure FRC-based submission. If a consuming system (e.g. an EU regulator) is not interested in the UK-specific information, then the “UKFRS” target document can be ignored and discarded. In this case, the consumer will validate the report solely against the ESEF taxonomy and filing rules. On the other hand, the “UKFRS” target contains accounts data that, if valid, is acceptable to Companies House, like any other FRC-based Inline XBRL accounts submission.

The practical implication of this method is that a “UKSEF” report (i.e. one that contains both ESEF and FRC-based tagging, correctly targeted) can serve as an ESEF report in non-UK jurisdictions with no change from a technical perspective. However, companies should seek advice on this from the relevant National Competent Authorities (NCAs) for those jurisdictions.

4. UKSEF 2025 developer information

Developers are encouraged to use the UKSEF Conformance Suite (v2.0) to ensure software conforms with the rules listed below and should refer to section 4.4, below, for more information.

4.1 UKSEF-specific rules

4.1.1 Taxonomy References in report

To support an FRC-tagged “UKFRS” target, two UKSEF-specific entry-points are available in the FRC Taxonomy. At present these entry-points are equivalent to the corresponding FRS102 and IFRS entry-points, but preparers MUST use the UKSEF variants to ensure that any future UKSEF-specific variations or additions to the FRC Taxonomy are in scope of the report.

4.1.1.1 Guidance UKFRC1 – FRC taxonomy reference in report

UKSEF 2025 reports MUST have a reference (a schemaRef in a “UKFRS” targeted ix:references element) to one of the three possible FRC taxonomy entry-points for either FRS102 or IFRS. Companies House allow use of the current and last two annual versions of the FRC's Taxonomy Suite. The 2025, 2024 or 2023 Taxonomy Suites all contain the relevant UKSEF entry-points:

2025 Taxonomy Suite

- <https: 2025-01-01="" frs-102="" frs-102-2025-01-01.xsd;="" uksef="" xbrl.frc.org.uk=""> or

- <https: 2025-01-01="" ifrs="" ifrs-2025-01-01.xsd="" uksef="" xbrl.frc.org.uk="">

2024 Taxonomy Suite

- <https: 2024-01-01="" frs-102="" frs-102-2024-01-01.xsd;="" uksef="" xbrl.frc.org.uk=""> or

- <https: 2024-01-01="" ifrs="" ifrs-2024-01-01.xsd="" uksef="" xbrl.frc.org.uk="">

2023 Taxonomy Suite

- <https: 2023-01-01="" frs-102="" frs-102-2023-01-01.xsd;="" uksef="" xbrl.frc.org.uk=""> or

- <https: 2023-01-01="" ifrs="" ifrs-2023-01-01.xsd="" uksef="" xbrl.frc.org.uk="">

The reference must be in the report, NOT in the extension taxonomy.

4.1.1.2 Guidance UKFRC2 – ESEF Taxonomy reference in the issuer's extension taxonomy

Since the issuer's extension taxonomy is now reserved exclusively for use with ESEF, it is not possible to use it to extend or modify the FRC Taxonomy, which should be used as is. Tagging UK-specific information DOES NOT require issuer extensions, and so the mechanisms provided by ESEF to facilitate the definition of issuer-specific concepts and anchoring them are not applicable – they MUST NOT be used with FRC-defined concepts.

UKSEF 2025 reports MUST only be used in conjunction with ESEF 2022 or later.

4.2 Implementation

This section covers key aspects of the implementation changes required to align existing preparation applications with the specific requirements of UKSEF 2025.

4.2.1 Specifying A Target

The key to multiple XBRL target documents is the 'target' attribute. If this attribute exists on certain key Inline XBRL elements their content is diverted to a target XBRL document with a name derived from the attribute value, which for the UK MUST be “UKFRS” (all caps).

4.2.1.1 Guidance UKFRC3 – Target document name attribute value must be "UKFRS"

If the target attribute exists on certain key Inline XBRL elements their content is diverted to a target XBRL document with a name derived from the attribute value, which for the UK MUST be "UKFRS" (all caps).

Any Inline XBRL elements that do not carry a target attribute will continue to be output to the (un-named) default target document. It is intended that ESEF tagging will fall into this category and MUST continue to end up in the default target document (as happens by default now).

4.2.1.2 Guidance UKFRC4 – ESEF tagged information must be in the default target document

In accordance with the ESEF Reporting Manual, Rule 2.5.3, “All [ESEF] tagged data MUST be in the "default" target XBRL document".

ESEF tagged data MUST NOT carry a target attribute.

The target attribute MAY be applied to the 'ix:references' container element and to all data mark-up elements in the 'ix' namespace (ix:nonFraction, ix:nonNumeric, ix:footnote). It MUST NOT be applied to the 'ix:resources' container element a conforming Inline XBRL processor MUST include all required context and unit declarations in the target document(s) automatically. It MUST NOT be applied to 'ix:continuation' or 'ix:exclude' elements.

A typical 'ix:references' container for UKSEF might look like this:

<ix:references target="UKFRS">

<link:schemaref xlink:href="https://xbrl.frc.org.uk/IFRS/2025-01-01/UKSEF/IFRS-2025-

01-01.xsd" xlink:type="simple"></link:schemaref>

</ix:references>

In a UKSEF report this would be one of two 'ix:references' containers – the other would contain the schemaRef for the issuer's private extension as per ESEF requirements and MUST omit the target attribute.

A typical UKSEF data item for UK-specific information might look like this:

<ix:nonnumeric contextref="c1" name="bus:UKCompaniesHouseRegisteredNumber" target="UKFRS">01234567</ix:nonnumeric>

In this case, the context with the ID "c1" would be copied into the “UKFRS" target, but it may also be copied to the default target if referenced by non-targeted ESEF data items (but, see Dimensional Qualifiers, below).

4.2.1.3 Guidance UKFRC5 – ix:references and schemaRefs

In a UKSEF report, there should be two ix:references containers – one should contain the schemaRef for the issuer's private extension as per ESEF requirements and MUST omit the target. The other MUST contain a UKSEF schemaRef with the "UKFRS" target attribute.

4.2.2 Entity identifiers

In accordance with the ESEF Reporting Manual, Rule 2.1.1 and Annex IV of the RTS on ESEF, "issuers shall identify themselves in the Inline XBRL document using ISO 17442 legal entity identifiers. This shall be implemented in such way that an xbrli:identifier element has a valid Legal Entity Identifier (LEI) as its content.".

4.2.2.1 Guidance UKFRC6 – Default target document must use LEI entity scheme

The "default" target document must use the LEI entity scheme (http://standards.iso.org/iso/17442). The same LEI MUST be used throughout the document.

Companies House requires a Company Registration Number (CRN) to identify the individual (parent) entity.

4.2.2.2 Guidance UKFRC7 – UKFRS target document must use CRN entity scheme

The "UKFRS" target document must use the CRN entity scheme (http://www.companieshouse.gov.uk/). The same CRN MUST be used throughout the document.

4.2.3 Namespaces

All namespaces used in the Inline XBRL report MUST be declared as usual, whether they originate from use of the ESEF taxonomy or of the FRC taxonomy.

Attributes which declare namespace bindings (“xmlns” and “xmlns:prefix” for any prefix) have semantic significance for their element and its descendants as defined in XML Names. This implies that a processor should not 'blindly' copy such attributes across from the input document set to target document(s) as part of mapping 'other attributes', but rather attempt to preserve the namespace context of elements when mapping them. However, an Inline XBRL processor may make no distinction when creating the target XBRL documents, so all target documents would contain declarations for all namespaces. This is not an issue, but it does result in a sub-set of un-used namespace declarations in each target document (and a residual clue as to the origin of the XBRL document).

4.2.4 Dimensional Qualifiers

The ESEF and FRC taxonomies have differing requirements when it comes to which context container to use for dimensional qualifications. The ESEF taxonomy requires the 'scenario' container to be used; the FRC taxonomy requires the 'segment' container to be used. Both are legitimate XBRL design choices.

As noted above, contexts that are shared between ESEF and FRC data items will be copied to both target documents. However, this would be inappropriate for dimensionally-qualified contexts – it would result in the wrong container being used in one of the two target documents4.

There are no namespaces or dimensions that are common to both taxonomies, so there will never be dimensionally qualified contexts shared between ESEF- and FRC-tagged data items. Consequently, contexts that belong with FRC-tagged data will end up in the UKFRS target document, and contexts that belong with ESEF-tagged data will end up in the default target document.

This means that the use of 'segment' and 'scenario' containers can be mixed in the Inline XBRL report as required. Existing ESEF/UKSEF preparation software simply needs to ensure that when emitting contexts into the generated Inline XBRL report, the 'scenario' container is used for ESEF-tagged data, and the 'segment' container is used for FRC-tagged data.

ESEF Filing Rules prohibiting use of the 'segment' container should apply to the default target document only and not other explicitly named target documents. The 'segment' container is also prohibited in the issuer's extension taxonomy, but as that is exclusively used in connection with ESEF tagging, this is not a problem. Readers are also referred to the note at the top of Appendix A.

4.2.4 Guidance UKFRC8 – Scenario and segment elements

xbrli:segment elements MUST be used in the contexts of UKFRS target FRC-tagged data. xbrli:scenario elements MUST be used in the contexts of default target ESEF-tagged data.

4.2.5 Unit Declarations

Unit declarations can be shared by ESEF- and FRC-tagged data items.

4.3 General Technical Requirements

4.3.1 Report package

4.3.1.1 Guidance UKFRC9 – Permitted report package file extension

UKSEF report package MUST be submitted as a zipped report package (*.zip or *.xbri extensions only).

4.3.1.2 Guidance UKFRC10 – Permitted report package content

The report package MUST only include one report in the “reports” directory.

4.3.1.3 Guidance UKFRC11 - Subdirectories

Subdirectories MUST NOT be used in the “reports” directory.

4.3.1.4 Guidance UKFRC12 – Permitted report file extension

The report MUST be XHTML tagged using the iXBRL format with a .html or .xhtml file extension only.

4.3.1.5 Guidance UKFRC13 – Scripts not permitted in report package

Script-based iXBRL viewers MUST NOT be included either as part of iXBRL documents or as a separate resource.

4.3.1.6 Guidance UKFRC14 – Including images in the report

For tagged files, images can be provided either in the XHTML document as a base64 encoded string or be referenced as separate files in the package. The use of these two methods MUST NOT be combined.

4.3.1.7 Guidance UKFRC15 – Image format

If images are contained in separate files in the package, they MUST be in PNG, GIF, SVG or JPG/JPEG format. All the external referenced images MUST be placed in the same location within the zip package.

4.3.1.8 Guidance UKFRC16 – Including CSS in the report

CSS MUST be embedded in the XHTML document.

Software developers will most likely be aware of changes arising from the most recent ESEF Reporting Manual. However, for the purpose of clarity, please remember that referencing the ESEF 2024 taxonomy necessitates updating the entry-point of the data types registry in your extension taxonomy (cf. “Guidance 3.2.2 Data types to be used on extension concepts" pp42-43 in the most recent ESEF Reporting Manual).

4.3.1.9 Guidance UKFRC17 – Report package naming convention

For a report package, issuers are required to adopt a naming convention which matches {base}-{date}.zip or {base}-{date}.xbri, whereby:

- The {base} component of the filename shall indicate the LEI of the issuer

- The {date} component of the filename should indicate the accounting reference date. The {date} component should follow the YYYY-MM-DD format.

E.g. 213800YWQOYL4VQODV50-2022-12-31.zip.

4.3.1.10 Guidance UKFRC18 – Tagged report naming convention

For a tagged xHTML file within a report package, issuers are required to adopt a naming convention which matches {base}-{date}.html or .xhtml whereby:

- The {base} component of the filename shall indicate the LEI of the issuer

- The {date} component of the filename should indicate the accounting reference date. The {date} component should follow the YYYY-MM-DD format.

E.g. 213800YWQOYL4VQODV50-2022-12-31.html

The filename MAY also end with "-T01"

4.3.1.11 Guidance UKFRC19 – Other files naming convention

Any other file present in a report package MUST NOT include spaces in the filename.

4.3.2 Character encoding

The XML and XBRL specifications place no restrictions on the character encodings that may be used in instance documents. In order to avoid using a character encoding that is not supported by a receiving processor, all instances should use the UTF-8 character encoding.

4.3.2 Guidance UKFRC20 – Instance Document Encoding

UKSEF instance documents MUST use UTF-8 character encoding.

4.3.3 Publisher country

4.3.3 Guidance UKFRC21 – Publisher country setting

UKSEF report package "publisherCountry” metadata element MUST be "GB".

4.4 The UKSEF Conformance Suite

The UKSEF Conformance Suite (v2.0) is the physical embodiment of the UKSEF filing requirements adopted and published by one or more regulators, in this case the FCA and Companies House. It is the "single source of the truth” in relation to the meaning and intention of UKSEF filing rules and should ensure universal consistency in the UKSEF filing regime, no matter the preparation application or the regulator. It is key to the smooth adoption and working of the regime.

The UKSEF Conformance Suite provides a set of tests that enables the behaviour of a consuming system, such as that operated by a regulator, to be verified for conformance with the published filing requirements, or “filing rules". Each requirement/rule, is addressed by a small set of test cases that each have a predictable outcome, either 'pass' or 'fail'.

At least one test case in each requirement set demonstrates the requirement and is intended to pass validation. In addition, one, or more, test cases in each requirement set violates the requirement in a unique way and is intended to fail validation. Conformance is verified when all the test cases that comprise the Suite pass or fail as expected. Unexpected test results indicate deviation from the published requirements.

The Suite is supplied as a (zipped) set of uniquely identified filing rules, abstracted from the filing guidelines or technical interface specifications of individual regulators. Each “rule” directory comprises one or more valid ("pass") cases and one or more invalid (“fail”) cases, along with an XML file ("index.xml") that describes the rule requirement and the expected outcomes for each test case. These XML files, and some other XML infrastructure, provide the means for automating the entire Suite. This is identical to the XML infrastructure for other conformance suites, such as the ESEF Conformance Suite provided by ESMA, and is intended to make use of the same automation tools.

A summary spreadsheet accompanies the Conformance Suite:

- The first sheet defines the ESEF and Companies House Filing Rules that this version of the Conformance Suite is compliant with, and the taxonomies required for validation. It also includes a changelog, specifying the differences between the most recent version of the Conformance Suite and the previous version.

- The second sheet describes each rule requirement, referencing the source document, and describes each test case; valid cases are highlighted in green, invalid cases in yellow, following the convention adopted by the ESEF Conformance Suite.

- The third sheet in this spreadsheet workbook identifies the variations in the outcome of specific individual ESEF Conformance Suite tests that are expected when submitting UKSEF-conformant test cases to an ESEF-conformant system. For a consuming system that is applying both ESEF and UKSEF filing rules, this will provide explanations for deviations from conformant ESEF filing behaviour when submitting the UKSEF Conformance Suite test cases. Developers of preparation applications should also note and make allowance for these variations when testing their own applications against regulator's services.

5. UKSEF 2025 tagging guidance for filers

5.1 Companies House Requirements

Companies House requires the following disclosures for group audited accounts (whether filed on paper or electronically):

- A balance sheet date for both individual entity AND consolidated entity accounts5

- The UK Companies House registered number of the individual entity

- The legal or registered name of the individual entity

- A directors' report for the group

- An auditor's report for the group

- A P&L/income statement for the individual entity, if not claiming exemption under Section 408 of the Companies Act 2006

- A balance sheet/statement of financial position for the individual entity

The extent to which an issuer tags these disclosure requirements in a UKSEF report is discretionary, except to say that there is a minimum mandatory set defined by Companies House and full tagging is encouraged.

5.1.1 Companies House Mandatory Items

The full set of mandatory FRC tags (identified below by their labels, element names and membership of the disclosure requirement sections described above where applicable) required by Companies House for group audited accounts is:

- UK Companies House registered number[bus:UKCompaniesHouseRegisteredNumber]

- Balance Sheet Date for individual AND group entity [bus:BalanceSheetDate] (Balance Sheet)

- Start date for period covered by report [bus:StartDateForPeriodCoveredByReport]

- End date for period covered by report [bus:EndDateForPeriodCoveredByReport]

- Entity current legal or registered name [bus:EntityCurrentLegalOrRegisteredName]

- Date Authorisation Financial Statements For Issue [core:DateAuthorisationFinancialStatementsForIssue] (Balance Sheet)

- Director Signing Financial Statements [core:DirectorSigningFinancialStatements] (Balance Sheet)

- Entity Dormant True/False [bus:EntityDormantTruefalse]

- Entity Trading Status [bus:EntityTradingStatus]

- Accounting Standards Applied [bus:AccountingStandardsApplied]

- Accounts Status Audited or Unaudited [bus:AccountsStatusAuditedOrUnaudited]

- Accounts Type [bus:AccountsType]

- Average number of employees during the period [core:AverageNumberEmployeesDuringPeriod]

- ProfitLoss [core:ProfitLoss] (Profit & Loss statement)

- Date auditor's report [aurep:DateAuditorsReport] (Auditor's Report)

- Opinion of auditors on entity [aurep:OpinionAuditorsOnEntity] (Auditor's Report)

- Name of individual auditor [aurep:NameIndividualAuditor] OR Name of senior statutory auditor [aurep:NameSeniorStatutoryAuditor] AND Name of entity auditors [bus:NameEntityAuditors] (Auditor's Report)

- Date signing Directors' report [direp:DateSigningDirectorsReport] (Directors' Report)

- Director signing Directors' report [direp:DirectorSigningDirectorsReport] (Directors' Report)

These items are mandatory for group audited accounts ordinarily filed electronically to Companies House using the FRC Taxonomy. The items are also mandatory for UKSEF filings. The first 14 represent items that are mandatory for all account types; the remainder are mandatory items only for group audited accounts6.

| Item | Tag name | Company | Group |

|---|---|---|---|

| 1 | bus:UKCompaniesHouseRegisteredNumber | X | |

| 2 | bus:BalanceSheetDate | X | X |

| 3 | bus:StartDateForPeriodCoveredByReport | X | |

| 4 | bus:EndDateForPeriodCoveredByReport | X | |

| 5 | bus:EntityCurrentLegalOrRegisteredName | X | |

| 6 | core:DateAuthorisationFinancialStatementsForIssue | X | |

| 7 | core:DirectorSigningFinancialStatements | X | |

| 8 | bus:EntityDormantTruefalse | X | |

| 9 | bus:EntityTradingStatus | X | |

| 10 | bus:AccountingStandardsApplies | X | |

| 11 | bus:AccountsStatusAuditedOrUnaudited | X | |

| 12 | bus:AccountsType | X | |

| 13 | core:AverageNumberEmployeesDuringPeriod | X | |

| 14 | core:ProfitLoss | X | X |

| 15 | aurep:DateAuditorsReport | X | |

| 16 | aurep:OpinionAuditorsonEntity and bus:NameEntityAuditors; or aurep:NamedIndividualAuditor and bus:NameEntityAuditors | X | |

| 17 | aurep:NameSeniorStautoryAuditor | X | |

| 18 | direp:DateSigningDirectorsReport | X | |

| 19 | direp:DirectorSigningDirectorsReport | X |

All mandatory items are required by Companies House to be tagged. Most relate to the legal entity that is responsible for preparing the consolidated financial statements, not directly to the group whose financial statements they represent. However, the directors' and auditor's report items, and the consolidated balance sheet date, must relate to the group.

The UK Companies House Registered Number (item 1) and Balance Sheet Date (item 2) are fundamental identifiers for the legally-registered entity. The Balance Sheet Date (accounting period) of the group entity is also required by Companies House. The group may have its own legally-recognised name and identifier (an LEI in the case of issuers subject to the ESMA mandate) but the UK Companies House Registered Number is required to associate the group's consolidated financial statements with a legally-registered entity in the UK. This is used for the purposes of publishing those consolidated financial statements on the public record. The individual entity's legal or registered name (item 5) serves as an additional identity cross-check.

A Directors' Report, signed by a company secretary or director (represented at a minimum by items 18 and 19) must be provided. Similarly, an Auditor's Report, containing the name of the auditor, the date of "signing” and the opinion of the auditors on the entity (represented at a minimum by items 15, 16 and 17) must be provided unless the company/group is exempt from audit (which is unlikely for an issuer subject to the ESMA mandate).

A Profit and Loss (P&L) account (also known as an Income Statement) is required (represented at a minimum by item 14) for the individual legal entity in addition to the P&L/Income Statement provided for the group in the consolidated financial statements, but not if the individual legal entity has claimed the exemption identified in Section 408 of the Companies Act 2006.

Finally, a Balance Sheet (also known as a Statement of Financial Position) is required (represented at a minimum by items 2, 6 and 7) for the individual legal entity in addition to the ESEF-tagged Balance Sheet/Statement of Financial Position provided for the group in the consolidated financial statements. A Balance Sheet Date for the consolidated Balance Sheet is also required (item 2).

The remainder of the items in the list enumerate basic information about the reporting period, the report or the individual entity itself.

It is important that items relating to the individual entity MUST use the default 'Company' member of the FRC Taxonomy's 'Group and company data' dimension to clearly distinguish them from ESEF consolidated data reported using the 'Consolidated' member of the similarly intentioned 'Consolidated and separate financial statements' dimension of the ESEF Taxonomy. In the case of the Directors' and Auditor's Reports, and the consolidated Balance Sheet Date, items comprising these MUST use the 'Consolidated' member of the FRC Taxonomy's 'Group and company data' dimension since they relate to the group.

5.2 Financial Conduct Authority (FCA) Requirements

ESEF Taxonomy concepts MUST NOT be used to tag the financial statements, reports or notes of the company that is the individual legal entity (or the UK-specific reports relating to the group – i.e. the directors' and auditors reports). To satisfy Companies House's voluntary online filing requirements and/or HMRC's mandatory online filing requirements individual company financial statements and reports MUST be tagged using FRC Taxonomy concepts.

The FCA Handbook defines the UK disclosure requirements for issuer's Annual Financial Reports in section DTR 4.1: https://www.handbook.fca.org.uk/handbook/DTR/4/1.html.

5.2.1 FCA Mandatory Items

FCA specific requirements can be found on the FCA website: https://www.fca.org.uk/markets/filing-structured-annual-financial-reports.

5.2.2 ESEF Reporting Manual exceptions for UKSEF 2025, 2024 and 2023

The list of ESEF Reporting Manual exceptions affecting the UKSEF 2025, 2024 and 2023 taxonomies, can be found in Appendix A of this document.

6. Reporting with historical UKSEF taxonomies

Prior to 2023, when the multiple target documents approach was adopted, UKSEF taxonomies were produced for 2022 and 2021.

Please see https://www.fca.org.uk/markets/filing-structured-annual-financial-reports for details on which taxonomies the FCA currently accepts. It is recommended that filers use the UKSEF 2025, 2024 or 2023 multiple target documents approach except where there is a specific need to report using UKSEF 2022 or UKSEF 2021.

Documentation for UKSEF 2022 and 2021 can be found on the FRC Taxonomies website. The list of ESEF Reporting Manual exceptions affecting the UKSEF 2022 and UKSEF 2021 taxonomies, found in Appendix B of this document.

Appendices

A: ESEF Reporting Manual Exceptions (UKSEF 2025, 2024 and 2023)

The following ESEF Reporting Manual guidance items are not applicable to UKSEF 2025, 2024 or 2023 reports or are varied as indicated below. These exceptions are required because the guidance items explicitly relate to the “Inline XBRL” document (i.e. the combined report containing both ESEF and UK tagging). If, instead, these guidance items referred to "the ESEF default target document”, there would not be a need for these exceptions as the requirements would be met (i.e. this is the purpose and benefit of the multiple target documents approach).

All other ESEF guidance items remain applicable to UKSEF 2025, 2024 and 2023 reports.

2.1.3 Use of segment and scenario containers in the context elements of Inline XBRL documents

This ESEF guidance item is designed to ensure that the issuer's extension taxonomy uses the 'scenario' context container when defining dimensional items, in line with the ESEF taxonomy itself. The UK FRC taxonomy uses the 'segment' container by convention. The use of 'scenario' and 'segment' are both legitimate XBRL design choices. Mixing ESEF and UK FRC tagging in a single iXBRL report violates this restriction and therefore this Guidance is not applicable to UKSEF reports.

2.1.4 The Inline XBRL document shall only contain data of the issuer

The intent of this ESEF guidance item is to ensure that the Inline XBRL document contains data from only a single issuer. However, FRC-tagged data relates, as far as Companies House is concerned, not to the issuer (the group) but to the individual entity (usually the group's parent entity), which would be identified by a UK Company Registration Number in the context entity identifier, associated with the Companies House entity identifier scheme ("http://www.companieshouse.gov.uk/").

2.5.3 Use of more than one target XBRL document for an Inline XBRL report package

Multiple target XBRL documents are not currently permitted. All tagged data must be in the "default" target XBRL document.

B: ESEF Reporting Manual Exceptions (UKSEF 2022 and UKSEF 2021)

This Appendix MUST be read in conjunction with the 2022 UKSEF 1.2 (2023) Tagging Guide available on the FRC Taxonomies website. The following ESEF Reporting Manual guidance items are not applicable to UKSEF 2022 or UKSEF 2021 reports or are varied as indicated below. All other ESEF guidance items remain applicable to UKSEF 2022 and UKSEF 2021 reports.

Please note that the UKSEF Conformance Suite does not apply to UKSEF 2022 or UKSEF 2021.

2.1.3 Use of segment and scenario containers in the context elements of Inline XBRL documents

This ESEF guidance item is designed to ensure that the issuer's extension taxonomy uses the 'scenario' context container when defining dimensional items, in line with the ESEF taxonomy itself. The UK FRC taxonomy uses the 'segment' container by convention. The use of 'scenario' and 'segment' are both legitimate XBRL design choices. Mixing ESEF and UK FRC tagging in a single report with a single XBRL target document violates this restriction and therefore this Guidance is not applicable to UKSEF reports.

2.1.4 The Inline XBRL document shall only contain data of the issuer

The intent of this ESEF guidance item is to ensure that the Inline XBRL document contains data from only a single issuer. However, FRC-tagged data relates, as far as Companies House is concerned, not to the issuer (the group) but to the individual entity (usually the group's parent entity), which would be identified by a UK Company Registration Number in the context entity identifier, associated with the Companies House entity identifier scheme ("http://www.companieshouse.gov.uk/").

2.5.3 Use of more than one target XBRL document for an Inline XBRL report package

Multiple target XBRL documents are not currently permitted. All tagged data must be in the "default" target XBRL document.

3.1.2 Taxonomy files published by ESMA

The intent of this ESEF guidance item is to ensure that an issuer's extension taxonomy must import the entry-point of the taxonomy files prepared by ESMA. However, as Guidance UKFRC22.1 indicates for UKSEF 2022, and UKFRC21.1 indicates for UKSEF 2021, a reference to the UKSEF core entry-point is required. This in turn imports the ESEF core entry-point so it has the desired effect.

3.4.2 Defining the dimensional validity of line items in the definition linkbase

The FRC taxonomy does not follow the ESEF guidance in this regard. The application of Guidance UKFRC22.4 for UKSEF 2022, and UKFRC21.6 for UKSEF 2021, will ensure that this ESEF guidance is not applicable to the FRC taxonomy.

3.4.6 Restrictions on taxonomy relationships

The intent of this ESEF guidance item is that all usable concepts in extension taxonomy relationships should be used by tagged facts. With an “extension” taxonomy as large and complex as the FRC taxonomy this is impracticable. The application of Guidance UKFRC22.4 for UKSEF 2022, and UKFRC21.6 for UKSEF 2021, will ensure that this ESEF guidance item is not applicable to the FRC taxonomy.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

Footnotes

-

XBRL currently has a review draft of guidance on how to use a single Inline XBRL document for multiple reports: https://www.xbrl.org/guidance/single-ixbrl-document-for-multiple-reports/ ↩

-

Most notably in practice by Denmark. ↩

-

This will be added automatically by preparation software when tagging against the FRC taxonomy. ↩

-

Be aware that where explicit dimensions with a default member are being used, the use of the wrong container might result in an assumption of a defaulted dimension rather than a dimensional invalidity – XBRL processors are not required to examine the unused container for content. Only the use of explicit dimensions without a default or the use of typed dimensions is sure to produce a dimensional error under these circumstances. ↩

-

The ESEF taxonomy does not provide a concept for 'balance sheet date' so the FRC taxonomy concept 'Balance Sheet Date' must be used for both individual and consolidated balance sheets, using appropriate members of the FRC 'Group and company data' dimension. ↩

-

See the Technical Interface Specification (TIS) published by Companies House (obtained via: https://www.gov.uk/company-filing-software). ↩

-

With electronic filing it is sufficient to provide the tagged name of the relevant individual.</https:></https:></https:></https:></https:></https:> ↩