The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Guidance on the Going Concern Basis of Accounting and Related Reporting (including Solvency and Liquidity Risks)

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

This document contains copyright material of the IFRS® Foundation (Foundation) in respect of which all rights are reserved.

No rights are granted to third parties other than as permitted by the Terms of Use (http://www.frc.org.uk/FRStermsofuse) without the prior written permission of the FRC and the Foundation.

Material issued in respect of the application of Financial Reporting Standards in the UK and the Republic of Ireland has not been prepared or endorsed by the International Accounting Standards Board.

© The Financial Reporting Council Limited 2025

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number

- Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- 1. Introduction

- 2. Overview and scope

- 3. Going concern basis of accounting and material uncertainties

- 4. Solvency and liquidity risks

- 5. The assessment process

- Forecasts and the timing of cash flows

- Factors to consider

- Products, services and markets

- Inflation

- Geopolitical and economic events

- Financial and operational risk management

- Borrowing facilities

- Alternative sources of finance

- Contingent liabilities

- Acquisitions, disposals and restructuring

- Techniques

- Acquisitions, disposals and restructuring

- Techniques

- 6. Materiality and placement of disclosures

- 7. Group considerations

- 8. Auditor's responsibilities

- Appendix A: Application to other reports

- Appendix B: Code companies

- Basis for Conclusions

- General approach to the Guidance (issued February 2025)

- Scope of the Guidance (issued February 2025)

- Content of the Guidance (issued February 2025)

1. Introduction

Background

1.1.The Financial Reporting Council's (FRC's) purpose is to serve the public interest and support UK economic growth by upholding high standards of corporate governance, corporate reporting, audit and actuarial work.

1.2.Ensuring that a business is able to continue over the longer term involves an assessment of the solvency and liquidity risks that a company faces. Directors must also assess whether the going concern basis of accounting is appropriate. The process should inform reporting that allows investors to understand a company's exposure to and plans to navigate these risks. The Guidance on the Going Concern Basis of Accounting and Related Reporting (including Solvency and Liquidity Risks) (the Guidance) is intended to help companies in performing these assessments and in preparing high-quality and company-specific disclosures about the conclusions and how they were reached.

1.3.The Guidance replaces the FRC's Guidance on the Going Concern Basis of Accounting and Reporting on Solvency and Liquidity Risks, issued in 2016, and this edition provides guidance on the going concern basis of accounting for both companies that apply The UK Corporate Governance Code (the Code, Code companies) and non-Code companies along with guidance on the reporting of solvency and liquidity risks. The previous guidance issued in 2016 is now withdrawn.1

1.4.In recent years, companies have faced a challenging business and corporate reporting environment due to the significant economic and operational uncertainties caused by developments such as the Covid-19 pandemic, geopolitical conflicts and sustainability-related risks. In the UK, there have also been several high-profile corporate collapses. As a result, reporting on the going concern basis of accounting and solvency and liquidity risks has been under focus and reporting practice has evolved. There have also been changes to related accounting standards and auditing standards. This edition of the Guidance incorporates changes to reflect these developments.

Purpose

1.5.The Guidance is non-mandatory and intended to serve as a proportionate and practical guide for directors of all companies2 within its scope to assist them with the application of the applicable legal and regulatory requirements to:

- assess and make disclosures related to the going concern basis of accounting and any material uncertainties in their financial statements; and

1.6.disclose principal risks and uncertainties, which may include risks that might impact solvency and liquidity, within their strategic report.

The Guidance brings together the requirements or provisions of company law, accounting standards, auditing standards, listing rules, the Code and other regulation relating to reporting on the going concern basis of accounting and solvency and liquidity risks. It incorporates recent developments in the corporate reporting framework and auditing standards, evolving reporting practice, and the FRC's continued focus on encouraging high-quality reporting within the annual report.

1.7.In addition, the Guidance:

- encourages directors to take a broader view, over a longer term, of the risks and uncertainties that goes beyond the specific requirements in accounting standards;

- acknowledges that companies have risk management and control processes in place that underpin the assessment and that the degree of formality of these processes and the level of analysis applied depends on the size, complexity, and the particular circumstances of the company;

- acknowledges that the amount of information disclosed should be proportionate to the uncertainties to which the company is exposed and to its financial and liquidity position;

- and

- uses the term 'going concern' only in the context of referring to the going concern basis of accounting for the preparation of financial statements.

Key changes in this edition

1.8.This edition of the Guidance updates the Guidance on the Going Concern Basis of Accounting and Reporting on Solvency and Liquidity Risks, issued in 2016:

- to include companies applying the Code within the scope of the Guidance;

- to reflect changes in accounting standards and auditing standards;

- to provide additional guidance on overarching disclosure requirements, especially in situations when significant judgement was involved in the assessment of the appropriateness of the going concern basis of accounting or the conclusion that there are no material uncertainties; and

- to provide additional guidance on techniques that could support the assessment process.

How to use the Guidance

1.9.The Guidance is structured to include good practice guidance and other suggestions explaining how the requirements might be applied. It also includes highlighted text as follows:

Summary of requirements

This information is intended to summarise important aspects of law, accounting standards, the Code or other regulation that underpin the guidance. It is not intended to be a comprehensive analysis of those requirements.

Example

Practical examples are included. These examples are intended to be illustrative only and may not be appropriate for all companies and circumstances.

1.10.The Guidance uses the following terms to distinguish between mandatory requirements (in law, regulation or standards), and good practice guidance, suggestions or examples:

Terminology

- 'Must' or 'required to' are used to refer to mandatory requirements or provisions derived from law, accounting standards, listing rules, the Code or other regulatory requirements for entities within their scope (as set out in the table in Section 2). Such requirements might be mandatory as a result of the combined effect of different sources of requirements, or only when resulting disclosures would be material.

- 'Should' is used throughout this document to refer to good practice guidance and recommended ways of applying the requirements in law, accounting standards or other regulatory requirements.

- 'Could' or 'may' is generally used when preparers may wish to consider alternative ways to perform assessments and present information, or when providing examples of issues, techniques or disclosures which may be applicable depending on the company's specific circumstances.

1.11.Provisions of the Code apply on a 'comply or explain' basis, but in some cases the UK Listing Rules specify that companies within their scope must comply with certain Provisions. For example, the UK Listing Rules3 require certain listed UK companies to include statements in the annual report containing the information set out in Provisions 30 and 31 of the Code in relation to the going concern basis of accounting and the assessment of prospects.

2. Overview and scope

Overview

2.1.The Guidance considers the related requirements or provisions in:

- accounting standards and the Code which require disclosure in the financial statements on the going concern basis of accounting and any material uncertainties; and

- company law which require disclosure in the strategic report of principal risks and uncertainties, and may include risks that might impact solvency and liquidity.

2.2.A company faces many risks. The principal risks and uncertainties are required to be disclosed in the strategic report. Of these, some may have the potential to threaten the company's ability to continue in operation because of their impact on solvency and liquidity.

2.3.Some solvency and liquidity risks may be so significant that they highlight material uncertainties that may cast significant doubt on a company's ability to continue to adopt the going concern basis of accounting. These material uncertainties must be disclosed in accordance with the requirements or provisions of accounting standards and the Code. In extreme circumstances, such risks may crystallise thus making liquidation of the company inevitable and the going concern basis of accounting inappropriate.

Determining the relevant disclosures

2.4.The process for determining which disclosures are necessary includes:

- identifying risks and uncertainties, including those relating to solvency and liquidity and other potential threats to the company's ability to continue in operation;

- determining which of the identified risks and uncertainties are 'principal' and thereby require disclosure in the strategic report;

- considering whether it is appropriate to adopt the going concern basis of accounting and provide disclosures about the basis adopted in the financial statements;

- considering whether there are material uncertainties that require disclosure in the financial statements; and

- considering whether disclosures additional to those explicitly required by law, regulation or accounting standards are necessary for the financial statements to comply with overarching disclosure requirements (including disclosures about significant judgements made) and to provide a true and fair view.

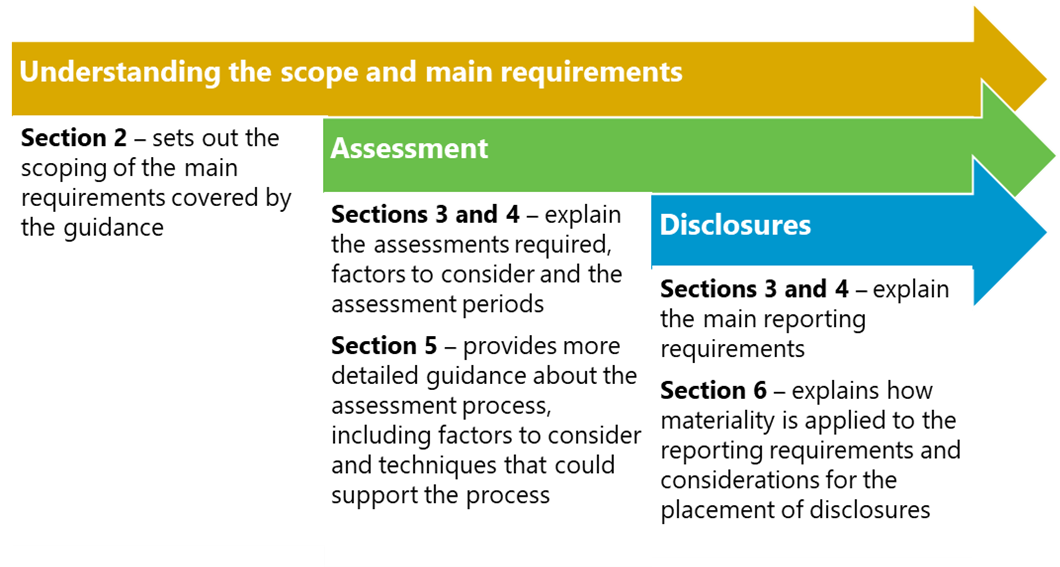

2.5.The Guidance supports this process by setting out and explaining:

- factors to consider and the assessment periods when determining the appropriateness of the going concern basis of accounting (Section 3) and when assessing solvency and liquidity risks (Section 4);

- summaries of the related reporting requirements (Section 3 and Section 4); and

- guidance on the assessment process (Section 5).

Scope

2.6.The Guidance is intended for all UK companies except small companies and micro-entities. Small companies and micro-entities must assess whether the going concern basis of accounting is appropriate in preparing their financial statements and small companies must also consider certain disclosure requirements in their financial statements. However, they are excluded from the scope of the Guidance as, overall, it has not been written with these companies in mind and some aspects do not apply to them (for example, strategic report requirements and auditing standards, unless they have chosen to obtain an audit).

2.7.The Guidance is relevant to UK companies that are required to or choose voluntarily to apply the Code and those that do not. Code companies are subject to additional Provisions in areas that are related to the going concern basis of accounting and solvency and liquidity risks – for example, requirements for risk management, internal controls and the assessment of prospects (the viability statement). Appendix B provides an overview of some of these areas and includes related references to the Code guidance. This Guidance does not address the application of those Provisions and Code companies should also refer to separate Code guidance.4

2.8.The following table sets out the requirements for each type of company, highlighting the sections of the Guidance that may assist directors in meeting those requirements. For completeness it includes small companies and micro-entities. Directors of small companies and micro-entities may find the specific guidance paragraphs referenced in this table helpful in identifying and applying the requirements applicable to them.

2.9.The Guidance is also likely to be helpful for other types of entities (for example, LLPs). Such entities may have other sources of requirements not listed in this table depending on their legal form and some aspects of the Guidance might not be relevant to them (for example, strategic report requirements).

| Main requirements | Source of requirements | Micro-entity5 | Small company | Large or medium-sized company | Code company | Guidance paragraph reference |

|---|---|---|---|---|---|---|

| Financial statements | ||||||

| Assessment of the appropriateness of the going concern basis of accounting | FRS 1056, 3.3 FRS 1027, 3.8 IAS 18, 25 |

✓ | ✓ | ✓ | ✓ | 3.1 to 3.19 |

| Statement when the financial statements are prepared on a going concern basis | FRS 102, 3.8A9 FRS 102, 1AC.2C The Code, Provision 30 UK Listing Rules, UKLR 6.6.6R(3)(a) |

X | ✓ | ✓ | ✓ | 3.21, 3.23, 3.24 to 3.27 |

| Disclosure of material uncertainties or when the financial statements are not prepared on a going concern basis | FRS 102, 3.9 FRS 102, 1AC.2C IAS 1, 25 The Code, Provision 30 |

X | ✓ | ✓ | ✓ | 3.20, 3.23, 3.28 to 3.30 |

| Disclosure of significant judgements related to the going concern basis of accounting and any material uncertainties | FRS 102, 3.8A and 8.6 FRS 102, 1AC.2C IAS 1, 122 |

X | ✓ | ✓ | ✓ | 3.22, 3.23, 3.31 to 3.35 |

| Main requirements | Source of requirements | Micro-entity5 | Small company | Large or medium-sized company | Code company | Guidance paragraph reference |

|---|---|---|---|---|---|---|

| Financial statements | ||||||

| Additional disclosures may be required to give a true and fair view | Companies Act 2006, s.393 | X5 | ✓10 | ✓ | ✓ | 3.22, 3.36 to 3.40 |

| Other relevant financial statement disclosures | FRS 10211 IFRS 7 IFRS 9 IAS 1 IAS 7 IAS 37 |

X | X | ✓ | ✓ | 4.17 |

| Strategic report | ||||||

| Description of the principal risks and uncertainties facing the company | Companies Act 2006, s.414C(2)(b) The Code, Provision 28 DTR 4.1.8R(2) |

X12 | X12 | ✓ | ✓ | 4.1 to 4.16 |

| Assessment of prospects (viability statement) | The Code, Provision 31 UK Listing Rules, UKLR 6.6.6R(3)(b) |

X | X | X | Not applicable |

3. Going concern basis of accounting and material uncertainties

Assessment

Adoption of the going concern basis of accounting

Summary of requirements

3.1.All companies must assess the appropriateness of the going concern basis of accounting when preparing their financial statements.

3.2.Companies are required to adopt the going concern basis of accounting, except in circumstances when the directors determine at the date of approval of the financial statements either that they intend to liquidate the company or to cease trading or have no realistic alternative to liquidation or cessation of operations.13

3.3.The threshold for departing from the going concern basis of accounting is very high, as there are often realistic alternatives to liquidation or cessation of operations. Such realistic alternatives can exist even if they depend on uncertain future events.

3.4.The assessment process carried out by the directors (see Section 5 for more information) should be proportionate to the size, complexity and the particular circumstances of the company.

3.5.The assessment must take into account all relevant facts and circumstances at the date of approval of the financial statements.14 It is not appropriate to prepare the financial statements using the going concern basis of accounting if the directors determine after the reporting period that they intend to liquidate the company or to cease trading or have no realistic alternative but to do so.15

3.6.When making the assessment, directors might apply significant judgement in:

- the determination of the assumptions used in forecasts or other techniques (see Section 5); and

- the determination of whether the going concern basis of accounting is appropriate and whether there are material uncertainties (see below).

3.7.The assessment should be sufficiently robust and documented in sufficient detail to explain the basis of the directors' conclusion with respect to the going concern basis of accounting at the date of approval of the financial statements. The documentation should include any significant judgements made and assumptions used, which should usually be consistent with those used in other forward-looking parts of the financial statements (such as impairment reviews) unless another accounting standard permits or requires otherwise in specific circumstances.

Material uncertainties

Summary of requirements

3.8.Accounting standards16 require directors to assess the company's ability to continue as a going concern. As part of their assessment, the directors must determine if there are any material uncertainties relating to events or conditions that may cast significant doubt upon the company's ability to continue as a going concern.

3.9.In performing this assessment, the directors must consider all available information about the future.

3.10.Events or conditions could result in the going concern basis of accounting being inappropriate in future reporting periods. In assessing material uncertainties, directors should also consider the realistically possible outcomes of events and changes in conditions, and the realistically possible mitigating actions to such events and conditions that would be available to the directors. Section 5 sets out factors to consider when identifying events or conditions, and techniques that may be used in the assessment, while paragraphs 3.14 to 3.19 cover the assessment period.

3.11.Uncertainties relating to such events or conditions are considered material if their disclosure could reasonably be expected to affect the economic decisions of shareholders and other users of the financial statements. This is a matter of judgement. In making this judgement, the directors should consider the uncertainties arising from their assessment, both individually and in combination with others.

3.12.In determining whether there are material uncertainties, the directors should consider:

- the magnitude of the potential impacts of the uncertain future events or changes in conditions on the company and the likelihood of their occurrence;

- the realistic availability and likely effectiveness of any mitigating actions that the directors could take to avoid, or reduce the impact or likelihood of, the uncertain future events or changes in conditions; and

- whether the uncertain future events or changes in conditions are unusual, rather than occurring with sufficient regularity for the directors to make predictions about them with a high degree of confidence.

3.13.Uncertainties should not usually be considered material if the likelihood that the company will not be able to continue to use the going concern basis of accounting is assessed to be remote, however significant the assessed potential impact is.

The assessment period

Summary of requirements

3.14.Accounting standards and the Code provide for a minimum period that must be reviewed by directors as part of their assessment of the going concern basis of accounting and any material uncertainties:

- FRS 102 requires companies to consider a period of at least 12 months from the date the financial statements are authorised for issue.17

- IFRS Accounting Standards (IFRS) require companies to consider a period of at least 12 months from the end of the reporting period.18

- The Code19 requires companies to consider a period of at least 12 months from the date of approval of the financial statements.

3.15.Additionally, auditing standards20 require auditors in the UK to consider a period of at least 12 months from the date that the financial statements are authorised for issue.

3.16.Consequently, in the UK the minimum period for the going concern assessment is 12 months from the date the financial statements are authorised for issue.

3.17.The minimum period for the going concern assessment does not mean that the outlook should be limited to 12 months. A longer assessment period could be more appropriate, especially if significant events or conditions (such as large debt repayments, debt covenant tests, significant capital commitments or expiry dates for key contracts or licences) are identified beyond that minimum period that may cast significant doubt upon the continuing use of the going concern basis of accounting.

3.18.Determining the appropriate assessment period is a matter of judgement for the directors. Directors must consider all available information about the future when determining the assessment period, which includes the company's principal risks (see Section 4), the company's specific circumstances and factors relevant to the assessment (see Section 5).

3.19.Particularly when a longer assessment period has been selected or when the determination of the assessment period involves significant judgement, companies should clearly identify the period covered by the assessment and the reason for selecting that duration in their going

Footnotes

3.13Uncertainties should not usually be considered material if the likelihood that the company will not be able to continue to use the going concern basis of accounting is assessed to be remote, however significant the assessed potential impact is.

The assessment period

Summary of requirements

3.14Accounting standards and the Code provide for a minimum period that must be reviewed by directors as part of their assessment of the going concern basis of accounting and any material uncertainties:

- FRS 102 requires companies to consider a period of at least 12 months from the date the financial statements are authorised for issue. 17

- IFRS Accounting Standards (IFRS) require companies to consider a period of at least 12 months from the end of the reporting period. 18

- The Code 19 requires companies to consider a period of at least 12 months from the date of approval of the financial statements.

3.15Additionally, auditing standards 20 require auditors in the UK to consider a period of at least 12 months from the date that the financial statements are authorised for issue.

3.16Consequently, in the UK the minimum period for the going concern assessment is 12 months from the date the financial statements are authorised for issue.

3.17The minimum period for the going concern assessment does not mean that the outlook should be limited to 12 months. A longer assessment period could be more appropriate, especially if significant events or conditions (such as large debt repayments, debt covenant tests, significant capital commitments or expiry dates for key contracts or licences) are identified beyond that minimum period that may cast significant doubt upon the continuing use of the going concern basis of accounting.

3.18Determining the appropriate assessment period is a matter of judgement for the directors. Directors must consider all available information about the future when determining the assessment period, which includes the company's principal risks (see Section 4), the company's specific circumstances and factors relevant to the assessment (see Section 5).

3.19Particularly when a longer assessment period has been selected or when the determination of the assessment period involves significant judgement, companies should clearly identify the period covered by the assessment and the reason for selecting that duration in their going concern disclosures. This information provides useful insight into the liquidity factors and risks faced by the company.

Reporting requirements

Summary of requirements

3.20Accounting standards and the Code 21 require disclosure when a company does not prepare financial statements on a going concern basis or when there are material uncertainties related to events or conditions that may cast significant doubt upon the company's ability to continue to adopt the going concern basis of accounting.

3.21FRS 102, 22 the UK Listing Rules 23 and the Code 24 require an explicit statement about the adoption of the going concern basis of accounting.

3.22Additional disclosures may be required to comply with the overarching requirements in accounting standards to disclose significant judgements, assumptions and other sources of estimation uncertainty, or for the financial statements to give a true and fair view.

3.23In the financial statements, four reporting scenarios follow from the directors' assessment of whether the going concern basis of accounting is appropriate and whether there are material uncertainties. These scenarios are summarised in the table below and the disclosure requirements are discussed in further detail in the paragraphs that follow.

| Scenario | Basis of accounting | Disclosure requirements |

|---|---|---|

| Going concern basis of accounting is appropriate and there are no material uncertainties | Going concern basis of accounting | Disclose basis of preparation FRS 102, the UK Listing Rules and the Code require an explicit statement about the adoption of the going concern basis of accounting Consider overarching disclosure requirements and information necessary for a true and fair view |

| Going concern basis of accounting is appropriate and there are no material uncertainties but reaching that conclusion involved significant judgement | Going concern basis of accounting | Disclose basis of preparation FRS 102, the UK Listing Rules and the Code require an explicit statement about the adoption of the going concern basis of accounting Overarching disclosure requirements apply including disclosures about significant judgements, and any assumptions or information necessary for a true and fair view |

| The going concern basis of accounting is appropriate but there are material uncertainties. Reaching that conclusion may or may not involve significant judgement. | Going concern basis of accounting | Disclose basis of preparation FRS 102, the UK Listing Rules and the Code require an explicit statement about the adoption of the going concern basis of accounting Disclose material uncertainties Overarching disclosure requirements apply including disclosures about any significant judgements, assumptions and information necessary for a true and fair view |

| The going concern basis of accounting is not appropriate | Basis other than the going concern basis of accounting | Disclose the fact that the financial statements are not prepared on a going concern basis of accounting and the reasons why Disclose basis of preparation, including the basis of accounting adopted |

Basis of preparation

3.24All financial statements must describe the basis of preparation, 25 including material accounting policy information. This includes the adoption of the going concern basis of accounting or any alternative basis adopted if the going concern basis of accounting is not appropriate.

3.25FRS 102, the UK Listing Rules and the Code explicitly require a statement about the adoption of the going concern basis of accounting and the assessment of material uncertainties. There is no such requirement under IFRS Accounting Standards or FRS 101.

3.26Companies could include a summary of how the directors reached their conclusions, for example, with reference to their profitability, cash flows, liquidity position, available borrowing facilities or other sources of financing including the techniques applied in the analysis. This may be particularly relevant for users at times of greater economic uncertainty. Increased levels of uncertainty or judgement may mean that more comprehensive and prominent disclosures to explain the going concern basis of accounting are considered material information (see Section 6).

3.27The amount of information provided should be proportionate to the uncertainties to which the company is exposed and to its financial and liquidity position. A company facing greater uncertainty and with less financial headroom should provide more detail than one without such challenges, including details about any material uncertainties, significant judgements, assumptions and other sources of estimation uncertainty, as discussed in the following paragraphs. More detailed qualitative and quantitative information about the factors considered and significant assumptions and inputs applied could also be appropriate in such circumstances to help users understand the uncertainties and how they might affect the company's financial and liquidity position.

Material uncertainties

3.28When there are material uncertainties that may cast significant doubt upon the company's ability to continue to adopt the going concern basis of accounting, the financial statements must disclose them. The financial statements should clearly disclose the existence and nature of the material uncertainty, including:

- a description of the principal events or conditions that may cast significant doubt; and

- the directors' plans to deal with these events or conditions.

3.29Disclosures about material uncertainties should be company-specific. For example, companies could identify the specific issue that is considered a material uncertainty and explain when the uncertainty might crystallise, how it could affect the company's financial position and liquidity, and set out the specific mitigating actions available to the company should the material uncertainty crystallise.

3.30Directors may also wish to understand the auditor's responsibility to assess whether material uncertainties are clearly disclosed 26 (see Section 8).

Significant judgements, assumptions and other sources of estimation uncertainty

Summary of requirements

3.31Accounting standards require disclosure of judgements made in applying the company's accounting policies that have the most significant effect on amounts recognised in the financial statements (significant judgements). 27 This applies to situations when significant judgement has been applied in determining whether:

- the going concern basis of accounting is appropriate; or

- a material uncertainty in respect of going concern exists. 28

3.32Disclosures about significant judgements related to going concern assessments should be company-specific and should clearly identify the judgement made. For example, companies could explain the company-specific factors considered (see Section 5) and how they affected the assessment, such as the events or conditions that are subject to significant judgement, or the feasibility and effectiveness of the directors' plans or mitigating actions in response to those events or conditions.

3.33Examples of situations that could involve significant judgement in determining whether the going concern basis of accounting is appropriate or whether a material uncertainty exists (if they have a significant effect on the overall assessment either individually or when considered together with other factors) may include:

- when a significant borrowing facility may need to be restructured or renewed;

- when a waiver of a covenant by a lender of a significant borrowing facility may be needed; or

- if other types of significant business restructuring, asset disposals or cost reductions are planned during the assessment period and these have been assumed in the assessment based on the directors' expectations of achieving them.

Summary of requirements

3.34Accounting standards require disclosure of information about the assumptions made about the future and other sources of estimation uncertainty at the reporting date that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. 29 This applies to assumptions made as part of the going concern assessment when relevant.

3.35Disclosures about assumptions should be company-specific and provide sufficient information about the directors' basis for their assessment. This allows users to understand how the company might be affected by changes in factors and to assess whether the assumptions are consistent with those applied in other areas of the financial statements (such as impairment reviews) unless another accounting standard permits or requires otherwise in specific circumstances. For example, companies could provide qualitative and quantitative details about the significant inputs to scenarios considered in the going concern assessment, including how they were determined. If there are material differences between the assumptions used in other related disclosures, then this should be disclosed.

True and fair view

Summary of requirements

3.36The directors are responsible for ensuring that the financial statements give a true and fair view. 30

3.37Directors must consider whether additional disclosures relating to the going concern basis of accounting and any material uncertainties are necessary for the financial statements to present a true and fair view.

3.38This involves considering whether additional company-specific information is necessary to understand the particular circumstances.

3.39In some circumstances there are grounds for disclosure beyond the explicit reporting requirements in accounting standards.

Example

3.40A subsidiary company may be heavily loss-making or have substantial net liabilities. The financial statements of a subsidiary company might therefore give the impression that the company is experiencing significant financial difficulties. However, the existence of ongoing support from its parent may, in some circumstances, mean that no material uncertainty exists. Disclosure of this ongoing support as a key assumption made in the assessment may be necessary to give a true and fair view.

4. Solvency and liquidity risks

Assessment

Summary of requirements

4.1The Companies Act 2006 requires all companies that are not small companies or micro-entities to prepare a strategic report. The strategic report must contain a fair review of the company's business, and a description of the principal risks and uncertainties that it faces. 31

4.2The strategic report, by its nature, has a forward-looking orientation and the directors are encouraged to think broadly about all relevant matters that may pose risks to the company. When making their risk assessment, the directors should identify as principal risks and uncertainties those matters that could significantly affect the development, performance, position and future prospects of the company. The principal risks and uncertainties identified are generally matters that the directors regularly monitor and discuss because of their likelihood, the magnitude of their potential effect on the company, or a combination of the two.

4.3Solvency risk is the risk that a company will be unable to meet its liabilities in full. A company must generate sufficient value that its assets exceed its liabilities. A failure to do so could render it insolvent. The assessment of solvency risk over the longer term involves considering the sustainability of the business model and the maintenance of capital.

4.4Liquidity risk is the risk that a company will be unable to meet its liabilities as they fall due. A company must generate and retain sufficient cash to allow it to meet its liabilities at the time contractual payments are due. The liquidity of an otherwise profitable company can be threatened if it is incapable of converting assets into cash when it is necessary to make such payments. The assessment of liquidity risk may need to take account of potential short-term fluctuations in the company's working capital requirements.

4.5Directors should consider threats to solvency and liquidity as part of their assessment of the principal risks and uncertainties faced by the company. When the directors have concluded that there is no material uncertainty regarding the appropriateness of the going concern basis of accounting, the assessment of principal risks and uncertainties may still identify risks that impact solvency and liquidity.

4.6When making the assessment of principal risks and uncertainties, directors should consider both those business risks that are financial in nature and those that are non-financial. Principal risks and uncertainties that arise from, for example, operational, competitive, market, regulatory, or sustainability-related factors, may affect a company's business model and prospects, and ultimately, the solvency and liquidity position. It is not necessary to label risks as solvency and liquidity risks if other descriptions can more easily set out their nature and potential effects including how they might affect the company's solvency and liquidity position.

Example

4.7The directors of a company that is heavily reliant on a single customer may identify this as a principal risk to the business that could have an impact on its solvency or liquidity. If this customer ceases to purchase the company's products or services, or becomes unable to pay its debts to the company, the company might be unable to meet its liabilities as they fall due. In an extreme case, the loss of the customer might have the potential to render the company insolvent.

4.8In assessing the risks and uncertainties that may affect solvency and liquidity, directors should consider the likelihood and possible effects of those risks materialising.

4.9The extent of the process for assessing the risks and uncertainties and considering their implications should be appropriate to the size, complexity and particular circumstances of the company and is a matter of judgement for the directors. See Section 5 for more information about the assessment process.

The assessment period

4.10The period of the assessment for solvency and liquidity risks in the context of the requirement to disclose principal risks and uncertainties in the strategic report is a matter of judgement for the directors and depends on the facts and circumstances of the company.

4.11The period of assessment for solvency and liquidity risks will usually be longer than 12 months from the date of authorisation for issue of the financial statements, and will often be longer than the going concern assessment period (see Section 3). The length of the period should be determined taking into account a number of factors, including the nature of the business, its stage of development, debt maturities, investment and planning time horizons.

4.12Given the forward-looking nature of this assessment, the level of detail and accuracy of the information available relating to the future will vary. 32

Reporting requirements

Disclosure of principal risks and uncertainties

4.13The strategic report should provide users with information about the development, performance, position and future prospects of the company, proportionate to the size, complexity and the particular circumstances of the company. Principal risks and uncertainties should be described in a clear, concise and understandable way and should include a description of how the principal risks and uncertainties are managed or mitigated.

4.14When the directors identify solvency or liquidity risks as principal risks, they should explain the particular economic or operational conditions that give rise to those principal risks and uncertainties, and the potential impact on specific aspects of the business. Issues that may require disclosure depend on individual facts and circumstances but may include:

- uncertainties about current financing arrangements (whether committed or uncommitted);

- potential changes in financing arrangements such as critical covenants and any need to increase borrowing levels;

- counterparty risks arising from current credit arrangements (including the availability of insurance when relevant) with either customers or suppliers;

- a dependency on key suppliers and/or customers; and

- uncertainties posed by the potential impact of the economic outlook on business activities.

4.15When relevant, the description of the principal risks and uncertainties facing the entity should highlight any linkage with disclosures in the financial statements relating to the going concern basis of accounting, material uncertainties and risks, and any other related disclosures in the annual report (such as impairment reviews or, for Code companies, the viability statement).

Example

4.16A company that is growing rapidly may need to ensure that it is able to access long-term financing to support its future development. The inability of the company to access this financing could result in liquidity risk and in extreme circumstances lead to insolvency. Directors may have actions planned for mitigating this, for example, obtaining a bank loan or raising funds through the issue of shares. The directors should consider disclosing the risk of not raising sufficient financing and the planned actions to mitigate that risk as a principal risk and mitigation in the strategic report. Directors should also consider whether the risk represents a material uncertainty relating to the going concern basis of accounting, or whether significant judgement was involved in the assessment, also requiring disclosure in the financial statements.

Other disclosures

4.17Accounting standards require other disclosures in the financial statements that may be relevant to an understanding of solvency risk and liquidity risk. An overview of the main requirements is set out in the table that follows.

| Disclosure | FRS 102 paragraph number | IFRS 33 paragraph number |

|---|---|---|

| Risks arising from financial instruments | 11.42, 11.48A(f), 34.23 to 34.30 34 | IFRS 7, 31 to 42 |

| Undrawn borrowing facilities and any restrictions on the use of those facilities such as covenant requirements | n/a | IAS 7, 50(a) 35 |

| Defaults and covenant breaches | 11.47 | IFRS 7, 18 to 19 |

| Non-current liabilities with covenants | n/a | IAS 1, 76ZA |

| Changes in net debt / liabilities arising from financing activities | 7.22 | IAS 7, 44A to 44E |

| Supplier finance arrangements | 7.20B to 7.20C 36 | IAS 7, 44F to 44H |

| Significant judgements relating to the application of accounting policies | 8.6 | IAS 1, 122 to 124 |

| Assumptions and other sources of estimation uncertainty about the carrying amounts of assets and liabilities | 8.7 | IAS 1, 125 to 133 |

| Contingent liabilities | 21.15 | IAS 37, 86 to 88 |

5. The assessment process

5.1This section sets out factors to consider and techniques that may be applied in assessing:

- whether the going concern basis of accounting is appropriate or whether there are any material uncertainties that may cast significant doubt that it will continue to be so; and

- in identifying principal risks and uncertainties to disclose in the strategic report, including risks that might impact solvency and liquidity.

5.2For companies that apply the Code, these factors and techniques may also be relevant for the assessment of prospects (viability statement) under the Code and the UK Listing Rules.

5.3As set out in Section 3 and Section 4, the directors must consider all available information about the future in performing these assessments. Examples of internal and external factors to consider are set out in the table after paragraph 5.14.

5.4Directors should assess which factors are likely to be relevant to their company. These factors will vary according to the company's particular circumstances including its business model, sources of finance, industry, and how it is affected by the general economic and wider external environment. Some of these factors will be more relevant to the strategic report assessment of risk whereas others will be more relevant to the assessment of the going concern basis of accounting and financial statement disclosures.

5.5The extent of the directors' assessment process will depend on the size, complexity and particular circumstances of the company. The process is likely to be simpler and less extensive for companies that depend on fewer providers of finance and are readily able to access finance, have more straightforward business activities with a history of profitable and cash-generating operations, and are less affected by the economic and wider external environment. However, it is still important that the assessment is carried out and addresses, to the extent necessary, the directors' plans to manage the company's borrowing requirements, the timing of cash flows and the company's exposure to contingent liabilities.

5.6In contrast, directors of companies with more complex circumstances may need to consider a wide range of factors including those related to current and expected profits and cash flows, debt covenants and maturities, potential alternative sources of finance, potential changes to the business model and various market and other external conditions that could affect the business and its financial and liquidity position.

5.7The level of detail applied in the analysis of these factors will depend on the scale and nature of the risks and uncertainties a company faces and the time horizon over which the analysis is applied. Longer-term assessments, such as those that will inform the disclosures in the strategic report (or the assessment of prospects for Code companies), are likely to be performed at a higher, more aggregated level, reflecting the difficulties in making detailed long-term predictions.

5.8The assessments of solvency and liquidity risks and the going concern basis of accounting (and for Code companies, the assessment of prospects) are an integral process in managing the business. The assessments should be robust and appropriately documented. Appropriate processes should be in place with sufficient time available for the directors to review and approve the assessments and any analysis performed by the management of the company.

5.9The going concern assessment must reflect the effect of events and conditions occurring after the end of the reporting period up to the date that the financial statements are authorised for issue. Directors must review and update preliminary assessments of the appropriateness of using the going concern basis of accounting, the extent of analysis performed and decisions about which disclosures are necessary until the financial statements are authorised for issue. A similar approach should be applied to the assessment of solvency and liquidity risks disclosed in the strategic report, which should reflect the circumstances at the date of approval of the annual report.

Forecasts and the timing of cash flows

5.10Forecasting and budgeting are long-established techniques in business management. For the purposes of assessing whether the going concern basis of accounting is appropriate and in assessing solvency and liquidity risks, directors could prepare a budget, trading estimate, cash flow forecast or other equivalent analysis covering the appropriate assessment periods (as described in Section 3 and Section 4). The directors could also review previous forecasts or other analysis against actual results and make appropriate adjustments to the analysis for the current assessment.

5.11Cash flow forecasts and other financial plans can indicate whether there is an adequate matching (of both the timing and the amount) of projected cash inflows with projected cash outflows, including those for the settlement of liabilities, loan repayments, payment of tax and pension liabilities and other commitments, which is particularly relevant to assessing liquidity risk and the appropriateness of the going concern basis of accounting.

5.12Other types of forecasts and analysis could also be performed to assess expected financial performance and position, which may be relevant to compliance with covenant ratios and the availability of borrowing facilities.

5.13Preparing forecasts often involves significant judgement and various assumptions, which must be reasonable and supportable, reflect conditions at the date of authorisation of the financial statements and should usually be consistent with other forward-looking parts of the annual report such as any impairment reviews, unless another accounting standard permits or requires otherwise in specific circumstances. Both internal and external factors and sources of information are relevant when making these judgements and assumptions. Directors should be aware of their own potential bias when making judgements and assumptions in forecasts, for example, overestimation of positive outcomes and underestimation of negative effects. As discussed in Section 3, significant judgements and some assumptions are required to be disclosed in the financial statements.

Factors to consider

5.14Directors should consider both internal and external factors in the assessment. When evaluating which factors to consider, directors should think broadly of the uncertain future events or conditions most relevant to them. Examples of factors to consider in the assessment include but are not limited to:

| Factors | |

|---|---|

| Expected sales volumes and prices | Working capital risks |

| Raw material, energy, labour, transportation and other costs | Availability of borrowings |

| Inflation rates | Compliance with borrowing covenants |

| Exchange rates | Interest rates |

| Acquisitions, disposals, restructuring or other planned changes to the business model | Alternative sources of finance |

| Technological, sustainability-related or other external developments affecting products and services | Support from government bodies |

| Geopolitical and economic events | Capital commitments |

| A customer or supplier failing (counterparty and supply chain risks) | Penalties or damages from claims or legal judgements (contingent liabilities) |

| Business disruption or systems failure including from digital or cybersecurity threats | Changes in legislation, government policy or public finance |

| Availability of cash balances | Changes in taxation rates |

Products, services and markets

5.15Directors could obtain information about the major aspects of the economic environment within which the company operates, considering the size of the market, competitive landscape, its strength, and their market share, and assess whether there are any economic, political or other factors which may cause the market to change. It may be necessary to do this for each of the main product or service markets when developing assumptions for estimated sales volumes and prices and related costs, including raw material, energy, labour, transportation and other costs.

5.16Directors could assess whether their products or services are compatible with their market projections in terms of market position, quality and expected life. This could involve considering technological, sustainability-related and other external developments that could affect demand for their products and services.

5.17Market conditions impact companies differently. It cannot be assumed that difficult market conditions, affecting many companies, mean that a material uncertainty exists about a specific company's ability to continue as a going concern. Equally, material uncertainties may exist about a company's ability to continue as a going concern in times of relatively benign economic circumstances.

Inflation

5.18Inflation can pose a risk and appropriate inflation rates should be factored into the company's forecasts when relevant to estimating revenues and costs, including raw materials, energy, labour and transportation costs. With higher inflation, the assumptions made in forecasts could be significant sources of estimation uncertainty. Directors could obtain and apply projected inflation rates from reliable external sources in developing their forecasts. Low inflation can also threaten the business performance and liquidity of some businesses.

Geopolitical and economic events

5.19Geopolitical and economic events, such as a war or a pandemic, can cause economic uncertainties and significant disruption to business operations, including restrictions to normal operations and supply chain risks. Directors should identify the specific effects on the company's business and identified risks, and reflect those in their assessments and disclosures, as necessary. It may be appropriate for companies to update their risk assessments and forecasts more frequently in times of heightened uncertainty and volatility.

Financial and operational risk management

5.20There are many types of financial and operational risks facing a company and directors should identify which risks are most significant and have the potential to threaten the going concern basis of accounting, or the solvency or liquidity of the company. In developing forecasts, directors make assumptions about the company-specific effects of such risks and how they will be managed or mitigated.

5.21Counterparty risks may arise from reliance on key suppliers (including service providers) or customers who may themselves be facing financial difficulty or operational challenges.

5.22Significant business disruption or system failures may arise from events beyond the company's control causing restricted access to key infrastructure or disruption in the supply chain; or a digital, cyber or data incident (whether internally or externally caused).

Borrowing facilities

5.23The onus is on the directors to be satisfied that there are likely to be adequate financing arrangements in place. The directors could compare the facilities available to the company (drawn and undrawn) with the entity's expected cash requirements from such facilities, as indicated by cash flow forecasts, budgets or trading estimates. The available headroom in facilities can be an important measure of liquidity risk for directors when considering how much analysis to perform, what techniques to apply and the nature and extent of disclosures about going concern, solvency and liquidity risk assessments.

5.24The availability of borrowing facilities often depends on the company's compliance with specific terms and conditions (covenants). A review of borrowing documentation should be undertaken to ensure that all critical terms and conditions are identified so that the risks to continued compliance can be assessed. Assessing compliance with more subjective conditions, such as material adverse change clauses, may involve more judgement compared to covenants that involve the calculation of financial ratios.

5.25Processes for regular monitoring of expected compliance with covenants could be integrated with the assessments of going concern, solvency and liquidity risks as any expected breach of covenants or other triggers within the assessment period could result in material uncertainties related to going concern, and increased solvency and liquidity risks. Forecasts may need to include other information relevant to covenant tests, such as asset values.

5.26The availability of borrowing facilities is also likely to depend on the lender's assessment of the risks to the solvency and liquidity of the company, amongst other factors. The directors may need to consider the likely outcome of the lender's assessment and how it might impact the continuation or renewal of existing facilities beyond contractual periods.

Alternative sources of finance

5.27When companies rely on alternative sources of financing, such as factoring or reverse factoring (also called supplier finance arrangements), key assumptions may include any restrictions to the continuing availability of the arrangement and the timing of the cash inflows or outflows of the arrangements.

5.28When companies rely on government support schemes, key assumptions may include the continuing availability of such schemes, compliance with any attached conditions, the expected timing of the receipt of funds from the government and whether these may need to be repaid in the future.

Contingent liabilities 37

5.29Directors should consider the company's exposure to contingent liabilities and the likely impact on cash flows. These may include sources of potential cash outflows during the review period relating to legal proceedings, guarantees, margin or other credit support provisions under derivative contracts, environmental costs and product liabilities.

Acquisitions, disposals and restructuring

5.30Forecasts should reflect the impact of acquisitions, disposals and restructuring activities on the business. Key assumptions may include the amount, probability and timing of cash flows for acquisition consideration, disposal proceeds, restructuring costs and any expected synergies. Such transactions will also affect the ongoing cash-generating capacity and the levels of uncertainty of the business, which should be reflected in operating cash flows in forecasts and any other analysis. The nature and extent of analysis performed depends on the size, complexity, probability and levels of uncertainty of the transaction.

Techniques

5.31Directors should consider the company's circumstances when tailoring appropriate analysis to support the assessment. The directors could perform further analysis to test the principal risks and most significant assumptions in forecasts in different scenarios.

5.32For example, directors could develop a severe but plausible downside scenario (in contrast to the base case scenario reflected in the forecasts) with changes to key assumptions, such as expected revenues, and then perform sensitivity analysis or stress testing to identify any potential shortfalls in facilities or breaches of covenants.

5.33Techniques that may assist companies in preparing their assessments include the following:

| Techniques | |

|---|---|

| Sensitivity analysis | * Involves measuring the impact on forecasts of changing individual assumptions * Provides an understanding of the critical assumptions that underlie forecasts |

5.29Directors should consider the company's exposure to contingent liabilities and the likely impact on cash flows. These may include sources of potential cash outflows during the review period relating to legal proceedings, guarantees, margin or other credit support provisions under derivative contracts, environmental costs and product liabilities.

Acquisitions, disposals and restructuring

5.30Forecasts should reflect the impact of acquisitions, disposals and restructuring activities on the business. Key assumptions may include the amount, probability and timing of cash flows for acquisition consideration, disposal proceeds, restructuring costs and any expected synergies. Such transactions will also affect the ongoing cash-generating capacity and the levels of uncertainty of the business, which should be reflected in operating cash flows in forecasts and any other analysis. The nature and extent of analysis performed depends on the size, complexity, probability and levels of uncertainty of the transaction.

Techniques

5.31Directors should consider the company's circumstances when tailoring appropriate analysis to support the assessment. The directors could perform further analysis to test the principal risks and most significant assumptions in forecasts in different scenarios.

5.32For example, directors could develop a severe but plausible downside scenario (in contrast to the base case scenario reflected in the forecasts) with changes to key assumptions, such as expected revenues, and then perform sensitivity analysis or stress testing to identify any potential shortfalls in facilities or breaches of covenants.

5.33Techniques that may assist companies in preparing their assessments include the following:

| Techniques | |

|---|---|

| Sensitivity analysis | • Involves measuring the impact on forecasts of changing individual assumptions |

| • Provides an understanding of the critical assumptions that underlie forecasts | |

| Stress test | • Involves identifying adverse scenarios and understanding their effects on the company |

| • May incorporate sensitivity analysis to consider the effect of a change to a single factor or event in the scenario | |

| • Shows how a company would be affected by certain adverse situations or economic events and allows mitigating actions and plans to be developed | |

| Scenario analysis | • Involves identifying multiple and potentially more complex scenarios involving many assumptions and understanding the outcome if multiple factors in the scenario change at the same time |

| • Allows a company to evaluate the effect of more complex hypothetical future events or scenarios | |

| Reverse stress test | • A type of stress test that typically starts from a situation that causes a business to fail or for a business plan to become unviable (alternatively, the directors could define a different adverse outcome, such as one that results in a material uncertainty related to going concern) |

| • Involves identifying one or more adverse scenarios in which this could occur and assessing the likelihood of these scenarios | |

| • Allows mitigating actions and plans to be developed |

5.34In deciding which key assumptions to sensitise or test, directors could consider the principal risks the company is facing, and provide disclosures that explain the linkage between the principal risks identified and the sensitivity or other analysis performed.

5.35A company facing greater uncertainty or longer-term time horizons could consider the more complex techniques such as scenario analysis and reverse stress testing. Different techniques could be applied in a way that is proportionate to the circumstances. For example, scenario analysis could range from a more simple exercise that considers a limited number of scenarios and assumptions to more complex modelling addressing multiple scenarios, assumptions, time horizons and combinations of changes in circumstances.

5.36Reverse stress testing may be a regulatory requirement for some companies, especially some financial institutions, in which case specific requirements set by regulators apply. However, reverse stress testing may also be a useful technique for other companies to identify adverse scenarios, such as situations in which the company is unable to settle loan repayments or breaches borrowing covenants resulting in a demand for repayment of the borrowings. It can help companies consider scenarios not identified by other forms of stress testing and sensitivity analysis.

6. Materiality and placement of disclosures

Materiality

6.1The assessment of materiality depends on the context of its application.

Summary of requirements

6.2In the context of the financial statements, accounting standards38 39 state that information is material if omitting, misstating or obscuring it could reasonably be expected to influence decisions that the users 40 make on the basis of the financial statements.

6.3Materiality depends on the nature or magnitude of information, or both. An entity assesses whether information, either individually or in combination with other information, is material in the context of its financial statements taken as a whole.

6.4In the context of the strategic report, information is material if its omission or misrepresentation could reasonably be expected to influence the economic decisions shareholders take on the basis of the annual report as a whole. Only information that is material in the context of the strategic report should be included within it.

6.5Conversely, the inclusion of immaterial information can obscure key messages and impair the understandability of information provided in the strategic report. Immaterial information should be excluded from the strategic report.41

6.6For financial statements disclosures related to going concern assessments, solvency and liquidity risk, the amount of information provided should be proportionate to the uncertainties to which the company is exposed and to its financial and liquidity position. For example, a company with a material uncertainty or significant judgement relating to its borrowing facilities, might disclose more detailed information about its levels of drawn and undrawn facilities, repayment terms, covenants, headroom, and whether the company expects any breaches of covenants or waivers of covenants during the going concern assessment period. The greater the uncertainty the company faces, the more likely such information is to be material and relevant to users in understanding how such matters might affect the company's financial and liquidity position.

6.7The principal risks disclosed in the strategic report should be those that are considered, by the directors to be material to a user's understanding of the development, performance, position or future prospects of the business.42

6.8The inclusion of too many risks that are not material to an understanding of the business detracts from the usefulness of the principal risks and uncertainties disclosure; disclosures relating to solvency or liquidity risks should be assessed for their materiality as other risk disclosures are.

Placement of going concern disclosure

6.9Directors should consider the placement of disclosures with a view to facilitating the effective communication of that information.43

6.10In some instances, it may be helpful to group together similar or related disclosure requirements arising from different legal or regulatory requirements that apply to different components of the annual report. This reduces duplication and enables linkages to be highlighted and explained clearly in one place.

6.11Company law and accounting standards set the requirements for disclosures relating to principal risks and uncertainties and the going concern basis of accounting, respectively. This may result in the inclusion of these disclosures in different components of the annual report (for example, the strategic report and the financial statements). The Code and the UK Listing Rules also set the requirement for a viability statement which may be presented within the corporate governance statement or alternatively it may be included in the strategic report.

6.12Cross-referencing is a means by which an item of information, which has been disclosed in one component of an annual report, can be included as an integral part of another component of the annual report. A cross-reference should specifically identify the nature and location of the information to which it relates in order for the disclosure requirements of a component to be met through the information located elsewhere. For example, disclosures in the strategic report that refer to a material uncertainty could briefly indicate the nature of the material uncertainty in addition to the location of more detailed financial statements disclosures. A component is not complete without the information to which it is cross-referenced. Cross-referenced information must be included within the annual report.

6.13The effective use of cross-referencing and signposting can reduce duplication of information across disclosures relating to principal risks and uncertainties and the going concern basis of accounting, and other related disclosures (such as impairment reviews). It can also help to demonstrate the consistency of assumptions and judgements in related assessments or highlight any material differences in specific circumstances when another accounting standard permits or requires a different approach.

6.14When law or regulation specifies the location for a disclosure (for example, the financial statements) and the information is presented outside that specified component of the annual report, cross-referencing must be used in order for the disclosure requirement to be met.

6.15In other cases, it may be helpful to direct users to related information included in different parts of the annual report or outside the annual report. Signposting can be used for this purpose.

6.16Signposting is a means by which a user's attention can be drawn to complementary information that is related to a matter disclosed in a component of the annual report. A component must meet its legal and regulatory requirements without reference to signposted information.

7. Group considerations

Assessment

7.1Directors of subsidiary companies must make their own assessment to support disclosure of the principal risks and uncertainties facing the company in the strategic report and of the subsidiary's ability to continue to adopt the going concern basis of accounting. Directors should take into account the specific facts and circumstances of the subsidiary company, in particular:

- the need for support from the parent company or fellow subsidiaries;

- the ability and intention of the parent company or fellow subsidiaries to provide adequate support over the period covered by the going concern assessment; and

- the risks to the company arising from support that it has undertaken to provide to other members of the group, for example through cross-guarantees or from being part of a group cash pooling arrangement.

7.2The directors could consider the degree of autonomy exercised by the subsidiary company, how the subsidiary's business fits into the group's activities and future plans, and the particular business risks the group faces.

7.3Subsidiary companies that are part of arrangements involving cash pooling or cross-guarantees can be exposed to greater liquidity risk and default risk if another fellow subsidiary is unable to repay its borrowings. As such arrangements can be complex, it is important for directors of subsidiaries to understand the terms of the arrangement and to assess the implications for the going concern assessment and solvency and liquidity risks of the subsidiary company.

7.4The adequacy of the evidence of any parent company or fellow subsidiary support is a matter of judgement for the directors of the subsidiary company. Their judgement usually incorporates their experience of dealing with the parent company or fellow subsidiary company over time, in the context of recent events and current circumstances, and the adequacy of related documentation in place to confirm the parent company or fellow subsidiary company support. This includes considering the development, performance, position and future prospects of the group, and the group's ability and intention to support the subsidiary, taking into account other guarantees made by the parent company and fellow subsidiaries, and the availability of group borrowing facilities.

Disclosures

7.5The reporting requirements and guidance in Section 3 and Section 4 apply to disclosures relating to solvency and liquidity risks and the going concern basis of accounting in group situations.

7.6In particular, the directors of subsidiary companies should provide company-specific disclosures about any significant judgement and key assumptions made in assessing the adequacy of support or guarantees provided by the parent company or fellow subsidiaries. This could include the name of the parent company or fellow subsidiary, the period covered by the support or guarantees, and the basis for assessing the ability and intention of the parent company or fellow subsidiary to provide the support or guarantees.

8. Auditor's responsibilities

8.1The purpose of this section is to help directors understand the responsibilities that the auditor has in connection with the directors' assessment of the company's ability to continue to adopt the going concern basis of accounting and related disclosures in the financial statements or annual report.

The auditor's responsibilities

Summary of requirements

8.2Auditors are required by auditing standards44 to obtain sufficient appropriate audit evidence and conclude on whether it is appropriate for the directors to use the going concern basis of accounting to prepare the financial statements, and whether a material uncertainty related to going concern exists and is appropriately disclosed.

8.3In addition, the auditor has responsibilities for considering, based on the audit work performed, whether the other information included in the annual report is materially misstated or materially inconsistent with the financial statements, and for reporting in relation to such matters. This other information includes the description of the principal risks and uncertainties including those related to solvency and liquidity risks, disclosed in the strategic report.45 Some additional requirements apply to auditors in respect of Code companies.

8.4There are implications for the auditor's report which depend on the auditor's conclusions.

Evaluating the directors' assessment

8.5As part of the auditor's risk assessment procedures, the auditor is required to obtain an understanding of the company and its environment, the applicable financial reporting framework and the company's system of internal control as it relates to going concern. This understanding helps the auditor to identify any events or conditions that, individually or collectively, may cast significant doubt on the company's ability to continue as a going concern and whether or not a material uncertainty related to going concern exists.

8.6The auditor is required to evaluate the directors' going concern assessment and if the assessment has not yet been performed, the auditor must request the directors to make their assessment. In evaluating the directors' going concern assessment, the auditor considers whether the assessment includes all relevant information, including all available information about the future, of which the auditor is aware as a result of the audit.

8.7The auditor covers the same period as the directors used to make their assessment. If the period of the directors' assessment is less than 12 months from the date of approval of the financial statements, the auditor requests the directors to extend their assessment. If the directors do not make or extend their assessment, or do not provide sufficient information about the company's ability to continue as a going concern, there may be implications for the auditor's report.

8.8The auditor is required to challenge and test the directors' going concern assessment. This includes evaluating the appropriateness of the method, the relevance and reliability of the underlying data, the appropriateness and consistency of the assumptions used, the feasibility of plans for future actions and the risk of management bias. The auditor must then stand back and take into account all evidence obtained, whether corroborative or contradictory, before concluding on the appropriateness of the going concern basis of accounting and whether a material uncertainty related to going concern exists.

8.9The auditor also must inquire about events or conditions beyond the period of the directors' assessment that may cast significant doubt on the company's ability to continue as a going concern. When such events or conditions are identified, the auditor requests the directors to evaluate their potential significance on the going concern assessment.

8.10For Code companies, the auditor must also consider whether there is a material inconsistency between the auditor's knowledge obtained through their evaluation of the directors' going concern assessment and other related reporting under the Code, including reporting against Provision 31 of the Code on the prospects of the company (the viability statement).

Disclosures

8.11As part of the audit, the auditor considers any disclosures relating to solvency and liquidity risk, and the going concern basis of accounting made in the annual report. For Code companies, the auditor also considers the related reporting under the Code, including the viability statement.

8.12If the going concern basis of accounting is appropriate but a material uncertainty related to going concern exists, the auditor must determine whether the financial statements appropriately disclose:

- the principal events or conditions that may cast significant doubt on the company's ability to continue to adopt the going concern basis of accounting;

- the directors' plans to deal with those events or conditions; and