The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Assurance of Sustainability Reporting Market Study Final Report

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from an omission from it.

The Financial Reporting Council Limited 2025

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Executive summary

This report sets out findings from the FRC's sustainability assurance market study and proposes remedies to support the functioning of the market. The report draws on evidence and information gathered from extensive engagement with a broad range of stakeholders, including FTSE 350 companies, private companies, audit and non-audit firm providers of sustainability assurance, investors, professional and trade bodies, academics and other institutions with an interest in sustainability.

Market study findings

> Finding I: At present, there is a wide variety and choice of sustainability assurance providers in the UK but there are concerns over the consistency in the quality of the assurance provided.

Summary of evidence:

- In 2023, 59 firms supplied assurance to FTSE 350 companies over their sustainability reporting. Sustainability is a broad term that is interpreted widely by companies, and sustainability assurance varies (both in the subject matter being assured and the level and nature of assurance being provided).

- Large companies reported a choice of three to four providers of sustainability assurance, but smaller companies reported less choice and fewer options.

- Many companies reported difficulties in determining the suitability of sustainability assurance providers and assessing their likely quality, especially when appointing a new provider.

> Finding II: There is a growing preference amongst the largest companies to use the Big Four audit firms (Deloitte, EY, KPMG, and PwC) to carry out sustainability assurance in the UK market, which could have implications for future choice.

Summary of evidence:

- The proportion of FTSE 100 companies using their auditors to provide sustainability assurance grew from 25% in 2019 to 37% in 2023.

- The Big Four are the largest four providers of assurance to FTSE 350 companies and have increased their collective market share to 40% (up from 33% in 2019, and 35% in 2022).

- The preference for using auditors to supply sustainability assurance appears driven by various factors including companies seeking efficiencies and possibly international changes affecting some UK companies, for example those in scope of the EU's Corporate Sustainability Reporting Directive (CSRD) requirements.

> Finding III: There are concerns about the immaturity of the UK sustainability assurance market and that a lack of clarity on the UK's regulatory position could hinder investment, planning and capacity development. According to many stakeholders, there is a need for education and communication to bridge gaps in knowledge and understanding within the market.

Summary of evidence:

- Although we do not have fundamental concerns about how the sustainability assurance market functions at present, the market is still developing and is relatively immature. Stakeholders collectively agreed that there was a clear need for transparency and clarity on likely future regulatory requirements, or at least the direction of travel, including a clear timeline for law and regulation to come into effect and any implementation period to enable adequate planning, investment and future compliance.

- Many stakeholders would like any UK regulatory requirements to be fully interoperable with other international regulations.

- Many stakeholders also emphasised the importance of education and training across a broad range of stakeholders involved in preparing, assuring and using sustainability information and reports.

> Finding IV: There could be a risk that without an established regulatory framework, including appropriate monitoring and oversight, the UK sustainability assurance market may not produce consistent, high-quality sustainability information for decision-making.

Summary of evidence:

- Given the market is still immature, many stakeholders suggested that a regulatory framework could play an important role in helping to ensure high-quality sustainability information.

- Some stakeholders had concerns that the lack of an established framework for the quality of assurance created inconsistencies in the market.

Remedies

In light of our findings summarised above, we consider the following remedies could help ensure a well-functioning sustainability assurance market in the UK.

> Remedy I: The market would benefit from the timely development of a policy framework for sustainability assurance in the UK that creates certainty for providers over the medium term, supporting necessary investment, and providing clarity on any alignment with international frameworks, where appropriate.

> Remedy II: The market would benefit from the creation of a holistic regulatory regime that brings together all the relevant elements for sustainability assurance such as standard setting, oversight, enforcement and monitoring of the market in one place to maximise certainty for companies, providers and investors.

> Remedy III: The market would benefit from better information on the quality of sustainability assurance to support how it functions. This gap in information could be addressed through the creation of a holistic regulatory regime.

Introduction

1This document presents our final findings and proposed remedies from our market study on the assurance of sustainability reporting by UK companies, which we launched in March 2024.

2We want to ensure the UK's market for sustainability assurance is working effectively, with a wide range of providers producing high-quality assurance that meets the needs of companies and investors.

3The market study has focused on how well the UK sustainability assurance market is functioning; whether it is delivering desirable results, including high-quality assurance, without creating undue burdens and costs for business; and how it could develop in the future.

4The market study had three broad themes:

i) Choice of sustainability assurance providers and competition.

ii) Market capacity, opportunities and barriers to entry/expansion.

iii) The regulatory framework, including how changing international requirements could affect the UK market.

5We published our emerging findings in October 2024 inviting stakeholders to comment. The publication was informed by evidence and data from several sources. A third-party provider Minerva Analytics Ltd collected publicly available data on the assurance of sustainability information reported by FTSE 350 companies since 2019. We also engaged with over 100 stakeholders through 32 one-to-one meetings and 10 roundtables.

6This report builds on the emerging findings and the additional information and evidence we have gathered since October 2024, as detailed below.

i) The latest publicly available 2023 data on the assurance of sustainability information reported by the FTSE 350 companies.

ii) Through a further eight roundtables, we engaged with over 40 stakeholders to discuss our emerging findings and collect new evidence. These included FTSE 350 companies, private UK companies, audit and non-audit firm providers of sustainability assurance, sustainability consultancies, investors, professional and industry trade bodies and other institutions with an interest in sustainability.

iii) We received 15 written submissions to our emerging findings publication. All stakeholders broadly agreed with our emerging findings. Most of these written submissions have been published at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/

7We would like to take this opportunity to thank all stakeholders who have engaged with us and contributed throughout the market study.

1. Market trends

8In this section, we provide the latest available information for the key trends relating to the market for sustainability assurance for FTSE 350 companies. All figures in this section originally appeared in our emerging findings publication in October 2024, but have been updated with the latest available data from 2023. 1

Summary

9Some of the main developments in the FTSE 350 sustainability assurance market are summarised below.

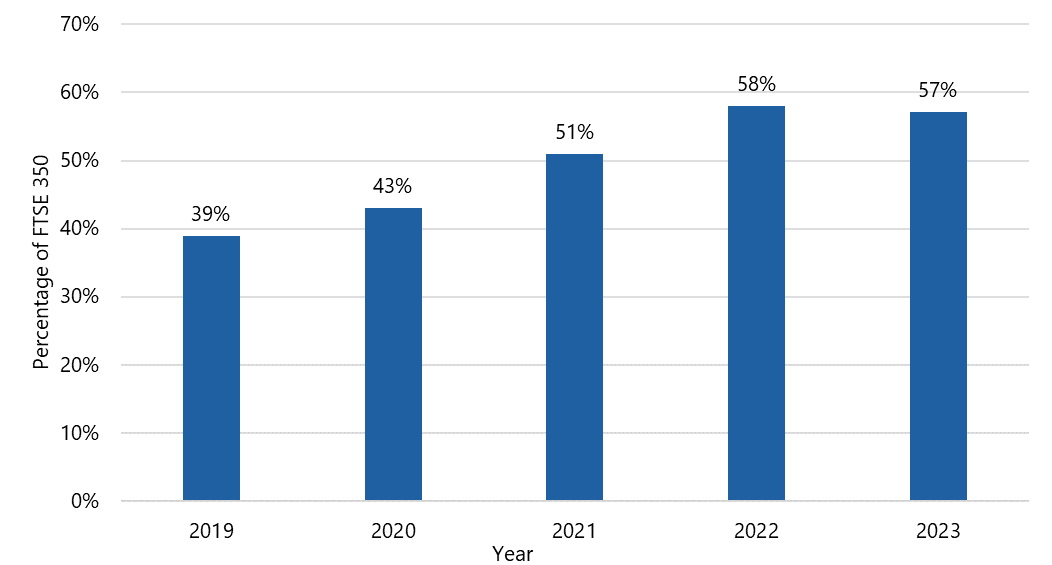

- Demand for sustainability assurance amongst FTSE 350 companies has grown by 18 percentage points since 2019 (see Figure 1). All stakeholders told us that they believed demand for sustainability assurance will continue to grow and, with the exception of the stagnation in growth between 2022 and 2023, it is poised to grow significantly in the coming years as UK multinationals seek to meet incoming assurance requirements in other jurisdictions, e.g. the EU.

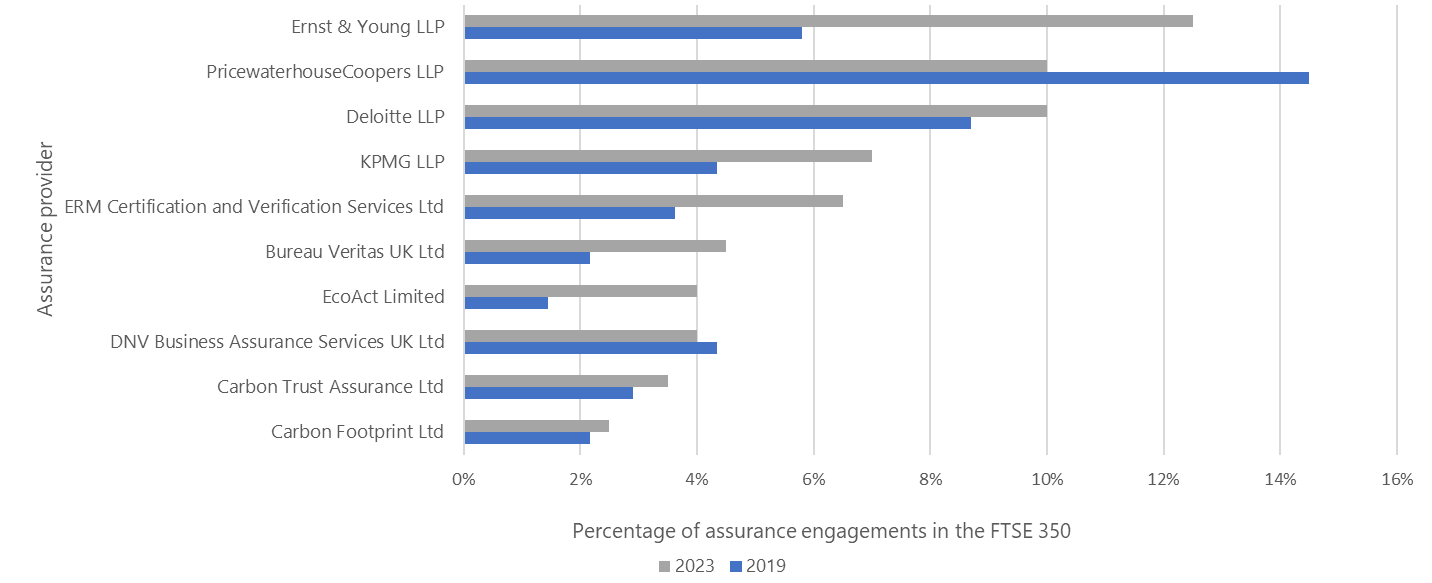

- There is an increasing tendency amongst FTSE 350 companies to appoint an audit firm, particularly the Big Four, for the provision of sustainability assurance. The Big Four are the largest four providers of assurance in the FTSE 350 and have increased their collective market share to 40% (up from 33% in 2019, and 35% in 2022) (see Figure 3).

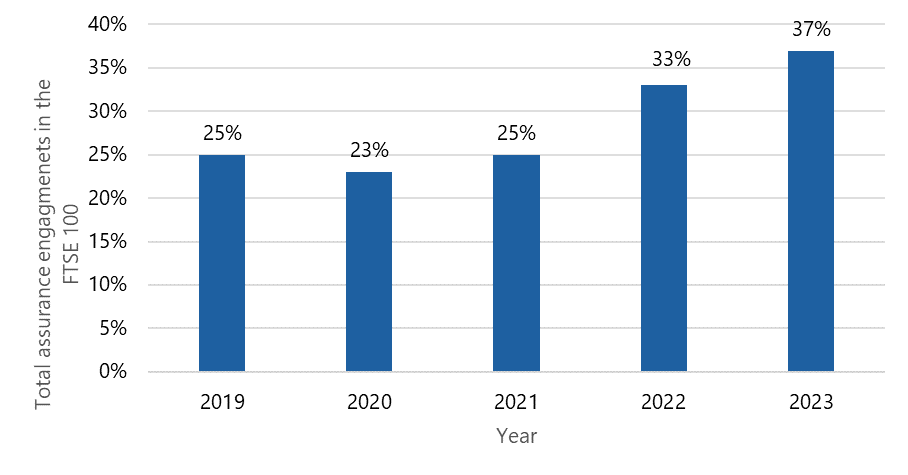

- Companies are increasingly appointing one provider, often one of the Big Four, to provide both statutory audit and sustainability assurance services. Notably, 37% of FTSE 100 companies used their statutory auditor for sustainability assurance in 2023, an increase of 12 percentage points since 2019 (see Figure 7).

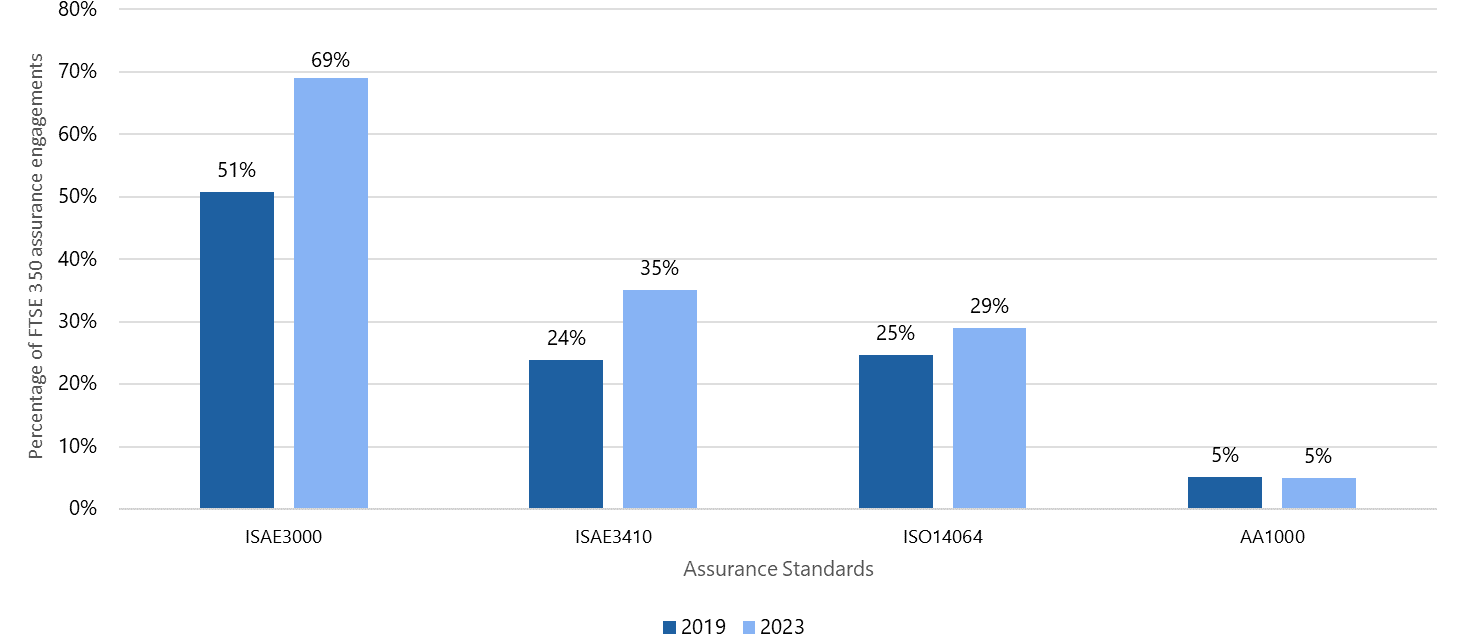

- In 2023, ISAE 3000 was the most common assurance standard used in sustainability assurance engagements for FTSE 350 companies, with 69% of engagements referring to the ISAE 3000 standard (see Figure 9).

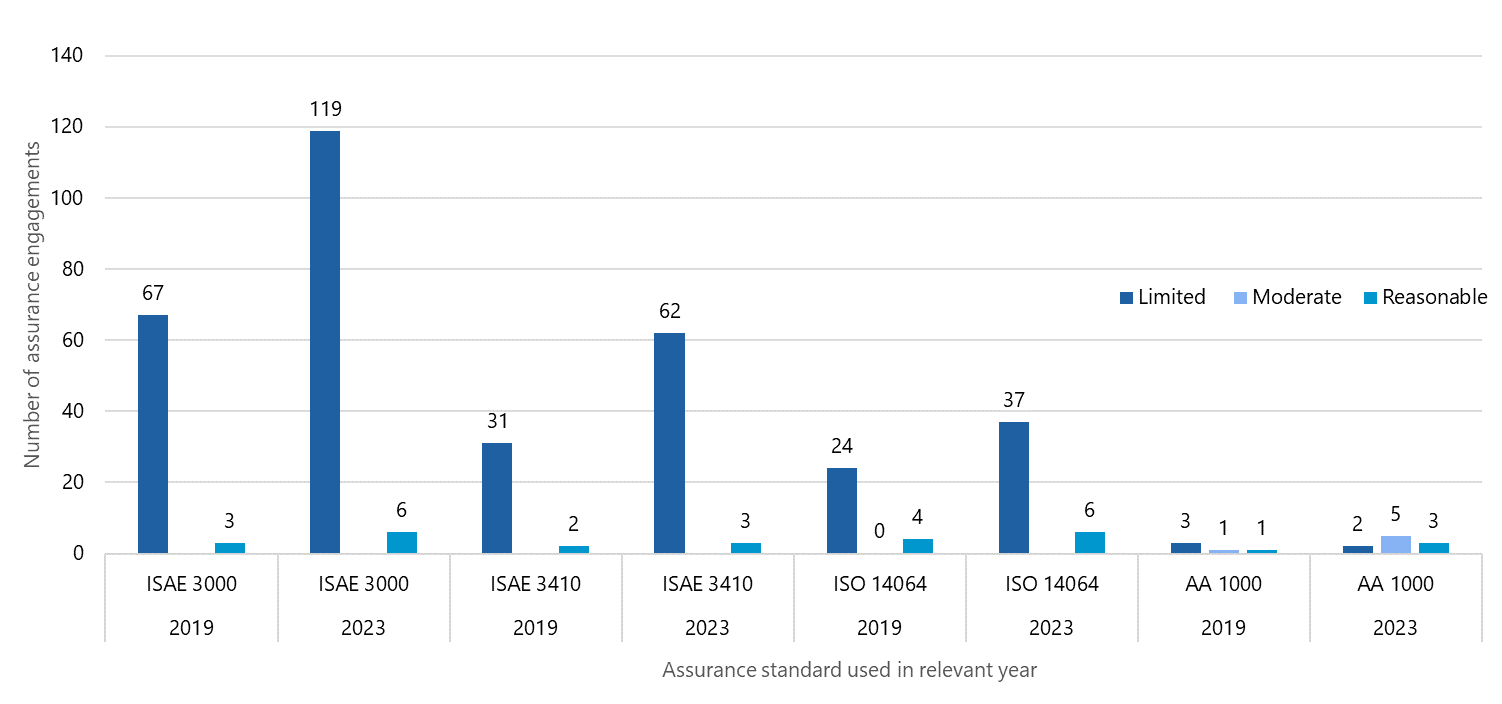

- Limited assurance remains the predominant level of assurance in the FTSE 350 across all assurance standards, with 83% of assurance engagements for FTSE 350 companies in 2023 involving limited assurance over some, or all, of the metrics being assured.

Demand for sustainability assurance

10All stakeholders reported a growing demand for sustainability assurance, with an increasing number of companies seeking to provide confidence to stakeholders on a variety of different sustainability metrics they are reporting.

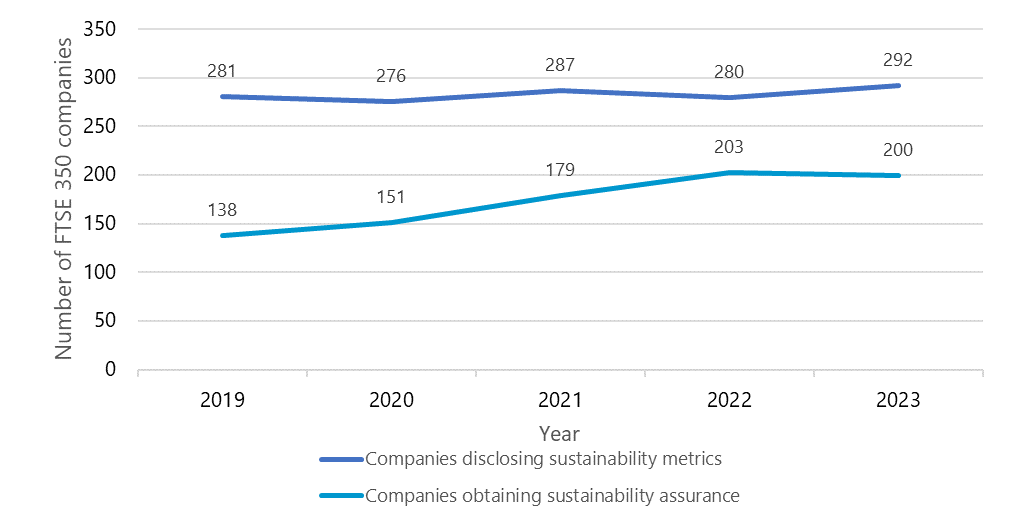

11Figure 1 shows that between 2019 and 2023, there was an 18-percentage point increase in the number of FTSE 350 companies obtaining sustainability assurance. This equates to 62 additional companies obtaining assurance between 2019 and 2023, as show in Figure 2. 2

Figure 1. Proportion of FTSE 350 companies obtaining sustainability assurance

Source: Minerva Analytics Ltd

Figure 2. Number of FTSE 350 companies disclosing sustainability metrics and obtaining assurance

Source: Minerva Analytics Ltd

Market composition

12In 2023, there were 59 providers of sustainability assurance in the FTSE 350 market, however, 40 of these providers carried out only one or two engagements in that year. 3 16 providers carried out assurance only relating to greenhouse gas emissions. 4

13Figure 3 shows that the Big Four audit firms were the largest four providers of sustainability assurance in the FTSE 350 market in 2023, with a combined market share of 40%, up from 33% in 2019, and 35% in 2022. In contrast, the non-Big Four audit firms accounted for 4% of assurance obtained by FTSE 350 companies in 2023, up from 1% in 2019. 5

Figure 3. Market share by number of engagements of top 10 assurance providers in the FTSE 350

Source: Minerva Analytics Ltd

Audit vs non-audit firm sustainability assurance providers

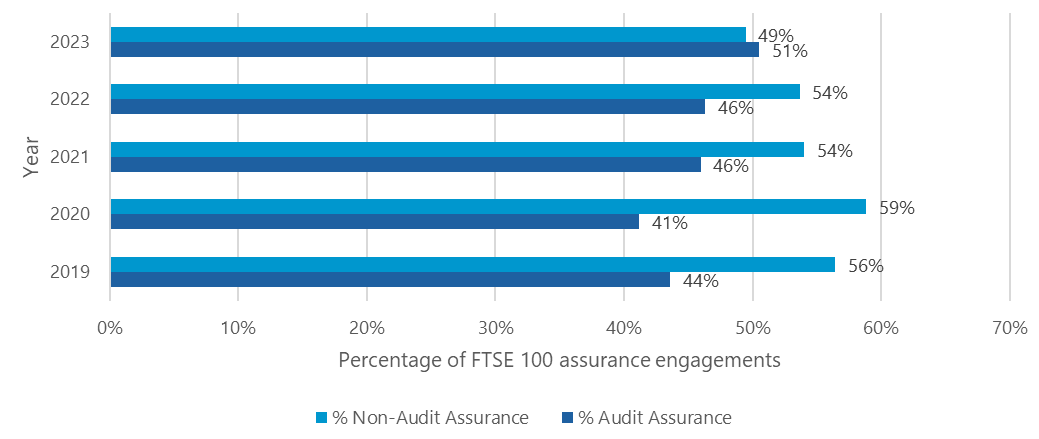

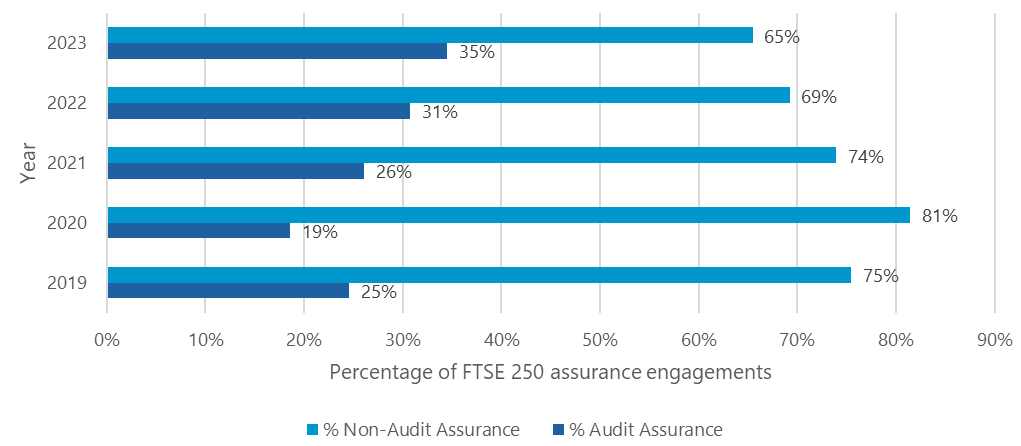

14Figures 4 and 5 show an increasing trend towards the use of audit firms for the provision of sustainability assurance by FTSE 100 and FTSE 250 companies respectively. As of 2023, audit firms supplied a higher percentage of assurance engagements to the FTSE 100. Between 2019 and 2023, audit firms increased their share of assurance engagements in the FTSE 250 by 10 percentage points.

Figure 4. Proportion of FTSE 100 companies using an audit firm vs a non-audit firm for assurance

Source: Minerva Analytics Ltd

Figure 5. Proportion of FTSE 250 companies using an audit firm vs a non-audit firm for assurance

Source: Minerva Analytics Ltd

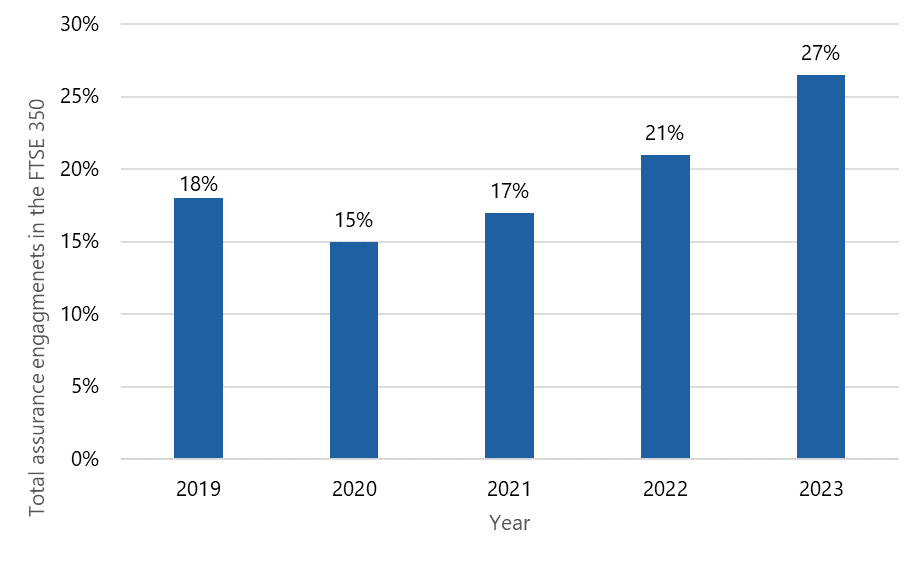

15Figure 6 shows that 27% of FTSE 350 companies who obtained assurance in 2023 used their statutory auditor, an increase of 9 percentage points since 2019. In the FTSE 100, 37% of companies who obtained assurance in 2023 used their auditor, as shown in Figure 7.

Figure 6. Proportion of FTSE 350 companies using their auditor for sustainability assurance

Source: Minerva Analytics Ltd

Figure 7. Proportion of FTSE 100 companies using their auditor for sustainability assurance

Source: Minerva Analytics Ltd

Switching of assurance providers among FTSE 350 companies

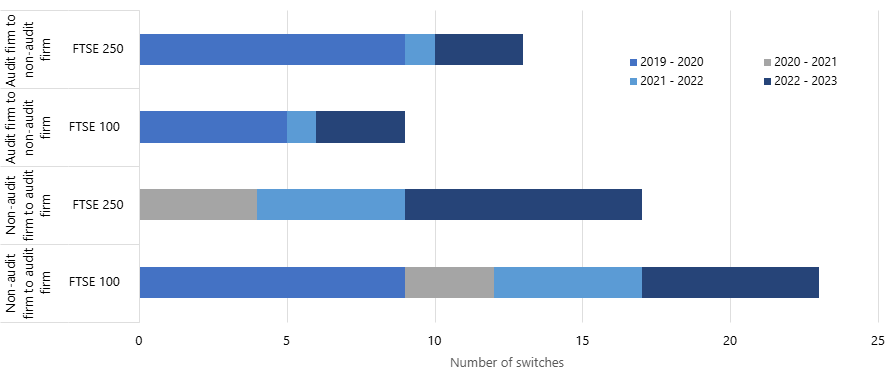

16Figure 8 shows that the majority of FTSE 350 companies switching assurance providers between 2019 and 2023 switched from non-audit firm providers to audit firm providers. Between 2022 and 2023, a total of 14 companies switched providers from non-audit firms to audit firms. In contrast, 6 companies switched from an audit firm provider to a non-audit firm provider.

Figure 8. Number of switches of sustainability assurance providers by FTSE 100 and FTSE 250 companies between 2019 and 2023

Source: Minerva Analytics Ltd

Use of sustainability assurance standards

17Figure 9 shows that 69% of assurance provided to FTSE 350 companies in 2023 was provided with reference to ISAE 3000, up from 51% in 2019 and 56% in 2022. By contrast, the provision of assurance with reference to ISO 14064 and AA 1000 remained relatively consistent.

Figure 9. Assurance standards used by FTSE 350 companies in 2019 and 2023 6

Source: Minerva Analytics Ltd

1883% of assurance engagements for FTSE 350 companies in 2023 involved limited assurance over some, or all, of the metrics being assured. Figure 10 shows that, with the exception of the AA 1000 standard, the vast majority of assurance provided under each assurance standard was 'limited'.

Figure 10. Level of FTSE 350 assurance engagements broken down by assurance standard 7

Source: Minerva Analytics Ltd

2. Market study themes: findings and evidence

19In this section, we set out our key findings by each of the three themes for the market study. The findings are broadly consistent with our emerging findings, which we published in October 2024. However, in light of the additional feedback from stakeholders, we have revised Finding III to capture the importance of more education and communication about sustainability assurance to help bridge gaps in knowledge and understanding within the market.

Theme 1: choice and competition

> Finding I: At present, there is a wide variety and choice of sustainability assurance providers in the UK but there are concerns over the consistency in the quality of the assurance provided.

20In 2023, there were 59 providers of assurance to FTSE 350 companies, which demonstrates a degree of choice and variety of providers in the market.

21The majority of stakeholders reported sufficient choice in the market with no difficulties in appointing a suitable sustainability assurance provider, particularly amongst larger FTSE-listed companies. However, some smaller companies reported difficulties finding a suitably qualified provider within their price range, which was often lower than that of larger companies.

22Whilst most companies noted that they had adequate choice, many expressed concerns over their ability to identify suitably qualified providers and assess the quality of the assurance delivered by prospective providers. Some stakeholders felt that buyers of assurance, such as companies, and wider stakeholders, including investors, were not always clear on how various assurance services differed.

- The Association of Chartered Certified Accountants (ACCA) said that in its own outreach "the majority of respondents did not feel capable of choosing a sustainability provider. This highlights the need for improved awareness of what sustainability assurance is, including how limited assurance differs to reasonable assurance. [...] [t]he majority of respondents did not sufficiently understand the work that a sustainability assurance provider undertakes". 8

Quality of assurance

23Most companies told us that, when considering assurance providers, the primary factor they considered was the quality of the assurance, which included considerations such as the level of expertise and experience of the provider, their size and global presence, and their reputation.

24However, many stakeholders had concerns over the quality of the assurance being delivered, including some buyers of assurance who noted significant variability in the quality and credibility of assurance providers. Some companies felt there was a lack of sufficient technical expertise in the market which limited their choice, due to concerns over quality.

25Some stakeholders pointed to the lack of a regulatory framework and mandatory standards as a cause of the inconsistency of quality in the market.

Use of standards and frameworks

26Some stakeholders noted concerns over the lack of mandatory assurance standards and frameworks in the market. Many felt that there was inconsistency in the assurance provided in the market, even where the same assurance standards are used.

- The Investment Association, a trade body for investment managers, told us that "[o]ne of the key challenges for sustainability assurance is the lack of a global and consistent framework that can guide the assurance practitioners and provide confidence to the users of the assurance statements. The current landscape is characterised by varying sustainability reporting standards and approaches, consequently leading to discrepancies in the scope, quality and level of assurance, potentially eroding the credibility and comparability of sustainability information. This fragmentation can result in confusion and uncertainty among investors and other stakeholders." 9

27In addition to assurance standards, some quality management standards exist in the market, such as ISQM 1 which apply to audit firms in the market, and ISO 90001 which are required for providers accredited by the UK Accreditation Service (UKAS). These standards provide a framework to ensure a consistent system of quality management in the provision of the services.

28The difficulty for buyers of sustainability assurance is that there are no mandatory quality management standards applicable for all providers of assurance in the market. As a result, stakeholders have difficulties in relying on, or comparing, information assured by different providers, or different types of providers. 10

- MHA Baker Tilly told us that, as the auditor of a company, it has difficulties relying on the work of assurance providers unable to demonstrate compliance with a quality management standard: “[The] quality of the assurance reports differ significantly and in some cases they are unable to rely on the work provided by an assurance provider, resulting in additional costs to the provider and the client. [A common issue we experience relates to] the inability of the assurance provider to demonstrate systems of quality management that are 'at least as demanding' as ISQM 1.” 11

> Finding II: There is a growing preference amongst the largest companies to use the Big Four audit firms to carry out sustainability assurance in the UK market, which could limit future choice.

29We have not found that the Big Four are currently dominating the market (as detailed in section 2 above). However, stakeholders expressed concerns that the Big Four could eventually dominate the market due to various factors.

Established relationships and reputation

30Many stakeholders told us that the Big Four had pre-existing relationships, and enjoyed positive reputations, with FTSE 350 companies, largely due to their roles as statutory auditors. These existing relationships provided them with an advantage over smaller non-audit firm providers.

- The GC100, an association of general counsel and company secretaries of FTSE 100 companies, told us that "[t]here is an inherent advantage in the market for 'traditional' assurance providers who currently audit financial statements as they have pre-existing relationships with a large number of clients.” 12

- The Audit Committee Chairs' Independent Forum (ACCIF), a forum representing FTSE 350 audit committees, told us that "[o]utside of the larger audit firms, the providers available are not recognised names and unfamiliar to many audit committees, boards and stakeholders [...] Investors are likely to want recognised names signing off". 13

31Additionally, in some cases, we heard that companies seeking assurance did not know how to identify suitably qualified non-audit firms to invite to tender for a sustainability assurance engagement.

Perceived quality and capability

32Some stakeholders said that the Big Four were better able to deliver larger assurance engagements due to their size and capacity. They had more resources, expertise and capacity to handle large, complex assurance engagements whilst smaller providers, often non-audit providers, had fewer resources and talent, and might therefore be unable to deliver.

33Audit firms were perceived to have a more credible and robust assurance process, methodology and standards, which often made them a preferred choice for many companies.

Efficiencies of using one provider for both statutory audit and sustainability assurance

34Many stakeholders noted the synergies involved in using one provider for both statutory audit and sustainability assurance. This was particularly the case for large, complex companies. Using one provider for both assurance and audit could allow a company to streamline the process and reduce resource burdens. Some Big Four firms also noted that companies were increasingly tendering both audit and assurance together. 14

35Some audit firms, outside of the Big Four, expressed concern that if companies begin using one firm for both the provision of assurance and statutory audit, it would risk entrenching Big Four dominance in the FTSE 350 due to the market being primarily audited by the Big Four.

Changing regulatory requirements

36Mandatory assurance requirements being imposed in other jurisdictions, e.g. CSRD in the EU, may drive companies to choose Big Four providers, due to the wider range of sustainability metrics falling under these requirements. Some audit firms questioned whether many non-audit firm providers would be able to compete for broader scope assurance engagements, due to their more limited resources. 15

37Some stakeholders expressed the view that incoming sustainability reporting standards developed by the International Sustainability Standards Board (ISSB) more closely link sustainability reporting to financial reporting, which would only further increase the synergies in having a company's statutory auditor also provide the assurance. However, other stakeholders disagreed with this view, particularly non-audit firm providers, who said they were equally qualified to provide assurance over ISSB reporting.

Limitations in the use of audit firms

38Some stakeholders expressed a view that, in many instances, an audit firm may not be best placed to provide sustainability assurance.

- Due to the wide variety of metrics covered under 'sustainability assurance', some stakeholders felt that there would inevitably be a need for specialist providers with expertise in specific, often niche sectors.

- A significant number of stakeholders noted that price was a key factor companies considered when selecting a provider. Many stakeholders, including audit firms, told us that audit firms tended to be the most expensive providers on the market, costing – at times - significantly more than non-audit firms. Some stakeholders expressed the view that non-audit firms would inevitably have a significant share of the wider UK market for assurance amongst companies who are price sensitive and unwilling and/or unable to pay the higher fees demanded by their audit counterparts.

- Some stakeholders also noted the current non-audit service fee cap could prevent them from selecting their auditor, even where this is their preferred provider. 16

Impact of growing demand for sustainability assurance on the statutory audit market

39Some stakeholders raised concerns that the growing use of auditors in the provision of sustainability assurance, together with the growth in demand for assurance services, could exacerbate capacity issues in the statutory audit market.

Theme 2: market capacity, opportunities and barriers

> Finding III: There are concerns about the immaturity of the UK sustainability assurance market and that a lack of clarity on the UK's regulatory position could hinder investment, planning and capacity development. According to many stakeholders, there is a need for education and communication to bridge gaps in knowledge and understanding within the market.

Opportunities for growth

40All stakeholders anticipated that the demand for sustainability assurance would grow and therefore, many expected growth opportunities for providers of sustainability assurance to expand their services, as well as opportunities for the market to develop sustainability assurance services and related products. Some stakeholders also told us that the UK could become a leader in the market for sustainability assurance providing existing barriers to market entry and expansion were addressed. For example. Deloitte told us: “the UK has the opportunity to demonstrate global leadership by developing a cohesive and integrated ecosystem for sustainability reporting and assurance.” 17

41Stakeholders suggested a considerable proportion of this greater demand would be driven by international regulatory changes that will mandate assurance over a variety of sustainability metrics. This includes the EU's CSRD which will create mandatory requirements for UK companies carrying out activities in the EU (above a designated threshold).

42Demand might also increase amongst smaller companies not subject to international regulatory changes, particularly those within the supply chain of a larger company caught by the regulation.

43As a result of this, stakeholders suggested there were likely to be numerous developments within the market related to the process and delivery of assurance, including:

- Improving the robustness of companies' sustainability data and working with data solutions and companies to improve data collection, quality and outcomes.

- Enhancing and developing methodologies so sustainability data and relevant standards can be used for financial decisions with a greater degree of confidence.

- Developing skills and training on sustainability data and sharing the capacity to upskill industries to move towards a greener economy supported by data.

Barriers to market entry and expansion

44However, stakeholders reported barriers that could prevent market participants taking advantage of these market opportunities and could hinder the development of a well-functioning market.

45All stakeholders collectively agreed that the key barrier in the UK market for sustainability assurance was a lack of clarity on likely future regulatory requirements hindering adequate planning, investment and future compliance. For example:

- EY told us that "It is important that UK companies have clarity and certainty on future UK regulatory requirements [...]. Most companies are likely to need to make investments in resources (including people and technology) to not only meet new reporting requirements but more importantly to ensure data quality and consistency.” 18

- Forvis Mazars also told us that "[t]here are significant barriers to entry/expansion for challenger firms in the sustainability assurance market. Investment in a new service is, to a degree, a gamble and firms need a degree of certainty in order to encourage them to invest in any given market. [...] it is difficult for firms to judge when to make the required investment". 19

46Many stakeholders, including providers, preparers and companies, called for any UK regulatory requirements to be fully interoperable with other international regulations.

Education and training

47Many stakeholders commented that difficulties in attracting skilled staff created barriers for some audit and non-audit firm providers, especially given the perception that there was a shortage of technical experts in the market. Some stakeholders emphasised a need for a globally recognised sustainability assurance qualification. For example, PwC told us: “[i]n support of the public interest, sustainability assurance should be provided by those with appropriate training and assurance qualifications, which are also recognised across different jurisdictions, to allow firms to provide assurance to companies with international reporting requirements.”

48Many stakeholders emphasised the importance of education and training for those involved in preparing, assuring and using sustainability information and reports. For example:

- The Institute of Chartered Accountants in England and Wales (ICAEW) said that: "[t]o support further development of the market, there is a need for high quality education and clear communication to bridge gaps in knowledge and understanding across a broad range of stakeholders involved in the sustainability reporting and assurance eco-system." 20

- BDO told us that "[e]ducation and training are at the heart of immediate action required.” Further explaining the need for wider market education and training "to build increased competency and scale in the market.” 21

- The Investment Association told us that: “there are significant gaps and challenges in the current level of skills and knowledge among various stakeholders involved in the preparation, validation and usage of sustainability reporting. Therefore, there is a need for upskilling across the board.” 22

Capacity

49Whilst many providers of assurance noted that they are able to meet current demand for assurance services, many stakeholders raised concerns over the ability of the market to meet the growing demand for sustainability assurance in the future. As discussed above, this concern over future capacity is exacerbated by the lack of clarity on future regulatory requirements, and therefore future demand, and the need for recognised education and/or qualifications for practitioners to enable firms to develop skilled staff.

Theme 3: regulatory framework

> Finding IV: There could be a risk that without an established regulatory framework, including appropriate monitoring and oversight, the UK sustainability assurance market may not produce consistent, high-quality sustainability information for decision-making.

50Currently there is no established regulatory framework governing sustainability assurance in the UK. Many stakeholders told us this lack of framework presented difficulties for those active in the market. 23

51Stakeholders broadly expressed a desire for the establishment of a regulatory framework which would cover a wide range of activities including standards setting, registration of assurance providers, and the monitoring of assurance quality in the UK.

Assurance requirements

52Many stakeholders expressed support for mandatory assurance requirements in the UK.

53Many of these stakeholders noted that any requirements should be proportionate, both in respect of the scope of the assurance required, but also the scope of the companies caught by these requirements. Some smaller companies caught by future requirements may not have the necessary resources to develop their reporting environments to enable assurance.

54Some stakeholders said that a clear regulatory framework would help ensure consistency in this market. In addition to enabling higher quality assurance, it would also allow investors and wider stakeholders to better compare company performance by ensuring all companies are reporting and assuring the same information.

55However, some stakeholders expressed reservations, noting mandatory requirements would create additional burden on companies who have limited resources. Other stakeholders felt that the market was too immature for mandatory assurance, and it would need time to develop best practices to avoid regular restatements.

56Some stakeholders suggested that an alternative to mandatory assurance requirements could be the implementation of an Audit and Assurance Policy statement, which would enable greater transparency to stakeholders on the reasoning behind directors' decisions to assure, or not assure, particular elements of their sustainability reporting.

Standards and frameworks

57Many stakeholders expressed the view that there should be greater clarity on the standards assurance providers would be expected to use as part of an assurance engagement, inclusive of assurance standards and quality management frameworks.

58The majority of those who expressed a preference on standards supported the use of ISSA 5000, although it was noted that there are additional, industry-specific standards, such as in banking and extraction, which might also have a place in a future framework.

59Audit firms were particularly in favour of a uniform quality management framework for all providers. Audit firms are subject to the mandatory application of ISQM 1, 24 and some non-audit providers of assurance accredited by UKAS are subject to ISO 9001, 25 both quality management systems developed within their relevant sectors. However, many non-audit firms are not subject to any quality management frameworks whatsoever. Audit firms told us that this created uneven competition where some firms are caught by more stringent standards than others, leading to higher costs incurred in the provision of assurance.

Supervisory regime

60In conjunction with standardisation of assurance standards and frameworks, many stakeholders in the market would like the development of a supervisory regime. Many called for an appointed regulator with a statutory role to oversee and monitor the market. The regulator's role could include accreditation of assurance providers offering services in the UK and quality oversight, similar to the FRC's Audit Quality Review mechanism. Some providers of assurance also said any regulator should have an enforcement mechanism.

-

Deloitte told us that “in order to reduce diversity in practice, both in terms of the application of standards and the quality of service provided, and to ensure more consistent, high-quality outcomes, regulators and the UK government must adopt a systematic and holistic approach to any plans for the UK market for sustainability assurance. This should start with the development of an overarching supervisory framework for sustainability assurance, comprised of: i) a regulatory framework which provides oversight and monitoring, and ii) a professional framework and ethical code for sustainability assurance providers that covers, for example, requirements for competence and accreditation, independence, a system of quality management and professional liability mechanisms". 26

-

Forvis Mazars told us that "all providers should be subject to the same standards for providing assurance [...] as well as being subject to the same rigorous quality inspection and enforcement regime". 27

61In addition to improving the consistency of high-quality assurance, stakeholders suggested that an accreditation regime could improve trust in the quality of assurance in the market. Through accreditation and quality assessments, buyers of assurance could be more confident in the quality of services being offered by various providers in the market. Stakeholders also suggested such a regime would enable wider stakeholders, such as investors, to place greater reliance on the information being assured.

62A further benefit to the creation of an accreditation regime in the UK is that it may enable UK parent companies with EU subsidiaries to report under CSRD at the group level and take exemptions for its subsidiaries. This exemption is available if the assurance opinion on the consolidated sustainability reporting is provided by a person or firm authorised to provide such an opinion under UK law. Currently, no such authorisation regime exists in the UK. However, if an accreditation regime was established in the UK, accredited firms may be deemed as authorised.

Implementation

63Stakeholders in favour of a regulatory regime suggested some factors that should be considered if such a regime was implemented.

- Interoperability: A key concern for many stakeholders was the impact of developments overseas and the extent to which UK requirements would converge with those elsewhere. CSRD was mentioned most frequently but also other requirements elsewhere in the world. Stakeholders said it was important to have interoperability between different jurisdictions and they hoped that the adoption of ISSB standards would assist in this regard.

For example, the UKAS noted there “[t]here [are] a great number of sustainability reporting initiatives and evolving legislation around the globe with many of these recognising the role of [non-audit firms]. It is worth emphasising that many UK companies will have to comply with one or more of these initiatives and requirements in managing their global operations, complex supply chains and cross-border trade. Aligning the UK approach with the approach that many other jurisdictions have taken will level the playing field and help lower barriers to trade and entry into new markets or for the UK plc." 28

- 'Phasing-in' requirements: Many stakeholders wanted any future requirements phased-in appropriately. The market for sustainability reporting and assurance is immature and companies are still developing their capabilities and systems. Requiring too much too quickly might not only impact the ability of companies to meet these requirements, but also impact the capacity of assurance providers to deliver the work required. Many stakeholders specifically recommended that the introduction of reporting and assurance requirements should be staggered to ensure companies develop their reporting capabilities before being required to obtain assurance.

3. Remedies

64In this section, we set out some remedies that respond to our findings.

65Overall, at present, the market for assurance of sustainability reporting seems to function relatively well. However, the market is still developing and remains relatively immature, and we have found some issues, as set out in the previous section, that we could address to help ensure the market develops well. It is also important to ensure there is sufficient capacity in this market to meet any further growth in demand, which could be rapid.

66We believe the three remedies below could help ensure a well-functioning sustainability assurance market in UK. A well-functioning market would produce good quality assurance to support the production of useful, reliable reporting for investors, without creating undue burdens and costs on business.

> Remedy I: The market would benefit from the timely development of a policy framework for sustainability assurance in the UK that creates certainty for providers over the medium term, supporting necessary investment, and providing clarity on any alignment with international frameworks, where appropriate.

67The evidence shows that currently there is a variety and choice of sustainability assurance providers in the UK but there are concerns over consistency and quality of the assurance (Finding I). In addition, there are significant concerns that a lack of clarity on UK's regulatory position could hinder investment, planning and capacity development (Finding II).

68Development of a clear, proportionate, sector and provider agnostic policy framework could help address these issues and provide clarity to the market.

69Given the sustainability assurance market is global and international developments impact on the UK market, consideration should be given to the interoperability of any UK policy framework with international standards, policies and other requirements.

70Further considerations should also be given to the timings and phasing-in of any policy framework or regulations to minimise unintended consequences, potential cost burdens on businesses and ensure market readiness.

> Remedy II: The market would benefit from the creation of a holistic regulatory regime that brings together all the relevant elements for sustainability assurance such as standard setting, oversight, enforcement and monitoring of the market in one place to maximise certainty for companies, providers and investors.

71Our findings demonstrate a potential risk that without an established regulatory framework, the UK sustainability assurance market may not produce consistent, high-quality sustainability information for decision-making (Finding IV).

72A body responsible for sustainability assurance in the UK could help ensure consistency and quality of sustainability assurance. Consideration should be given to the remit and scope of this body to achieve the desired outcome while promoting competition and ensuring quality in the market.

73The evidence shows that there has been a growing preference for companies to use their audit providers for sustainability assurance, and there are concerns that the market could become dominated by the Big Four. The UK market is subject to significant change due to regulatory developments internationally and in the UK (Finding II).

74Monitoring of the market and emerging trends will be crucial to understand how the market evolves and responds to the challenges and opportunities, and can also help ensure evidence-based policy development in the future.

> Remedy III: The market would benefit from better information on the quality of sustainability assurance to support how it functions. This gap in information could be addressed through the creation of a holistic regulatory regime.

75Our findings demonstrate that there are concerns about the immaturity of the market. Many stakeholders said there was limited understanding of sustainability assurance including of its benefits (Finding III).

76The development of better information on the quality of sustainability assurance could support companies when they are selecting and tendering for providers. For a well-functioning market, buyers need to be able to access, assess, and act on information that enables them to select the goods or services that offer the best value.

77Companies could benefit from more advice/guidance that covers the different levels of assurance and relevant standards. This advice/guidance could also benefit investors and wider stakeholders, who are less familiar with assurance, enabling them to better understand the differences between the assurance obtained by different companies.

78Finally, given the market's immaturity and limited understanding of sustainability issues amongst some stakeholders, there might be benefits in providing information on the importance and value of sustainability assurance more generally.

Financial Reporting Council

February 2025

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300 www.frc.org.uk

Follow us on Linked in or X @FRCnews

Footnotes

-

The data used in Figures 4 and 5 of this report relating to assurance engagements carried out between 2019 and 2022, by audit and non-audit assurance providers, has been revised since the publication of the FRC's emerging findings in October 2024. ↩

-

Whilst demand between 2022 and 2023 appears to be relatively stagnant, this could be the result of some FTSE 350 companies preparing for mandatory assurance requirements from 2025, as a result of the EU's CSRD. Notably, all stakeholders who engaged with the FRC predicted that demand for sustainability assurance will continue to grow, particularly as a result of CSRD. ↩

-

This is down from 64 providers in 2022, 44 of which only carried out one or two engagements in that year. The market between 2022 and 2023 appears to have been dynamic, with six new entrants in the FTSE 350 market and ten firms exiting due to switching. One provider, Avieco Ltd, exited the market due to an acquisition in 2022 and is now part of Accenture. ↩

-

FRC analysis of data provided by Minerva Analytics Ltd. ↩

-

FRC analysis of data provided by Minerva Analytics Ltd. ↩

-

Note: Figure 10 captures each instance an assurance standard is referenced by the reporting company when disclosing the assured information. In many cases, assurance opinions may make reference to more than one assurance standard, so the total will exceed 100% in any year. ↩

-

Note: Many assurance engagements in the FTSE 350 are carried out at different levels often using different assurance standards. For example, a company may decide to obtain assurance over their greenhouse gas emissions at a reasonable level under ISAE 3410 but obtain limited assurance over certain other sustainability metrics under ISAE 3000. Figure 10 would capture this assurance engagement twice. ↩

-

The ACCA's submission to the FRC dated 13 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

The Investment Association's submission to the FRC dated 14 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

We note that firms applying the incoming ISSA 5000 assurance standard developed by the International Sustainability Standards Board will require firms applying this standard either be subject to ISQM 1, or a quality management system "at least as demanding as ISQM 1". See para. 6 of ISSA 5000 General Requirements for Sustainability Assurance Engagements: Final Pronouncement; November 2024. ↩

-

MHA Bakertilly's submission to the FRC dated 18 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

GC100's submission to the FRC dated 24 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

ACCIF's submission to the FRC dated 13 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

We have not seen any evidence to suggest audit firms were engaging in anticompetitive behaviour by tying or bundling audit and assurance services. ↩

-

Notably, CSRD in some EU member states is being implemented in a way to exclusively allow audit firms to provide assurance; whereas only three member states have so far allowed non-audit firms to provide assurance in the market, namely Spain, France and Italy. ↩

-

The Non-Audit Service Fee Cap prohibits audit firms offering statutory audit clients who are Public Interest Entities non-audit services totalling more than 70% of their average audit fees paid in the last three consecutive financial years. In some cases, audit firms are prevented from offering assurance services (i.e. where this will bring their total non-audit fee over this limit). See paragraphs 4.13 and 4.14 of the FRC's Revised Ethical Standard 2024, available at: https://www.frc.org.uk/library/standards-codes-policy/audit-assurance-and-ethics/ethical-standard-for-auditors/ ↩

-

Deloitte submission to the FRC dated 28 November 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

EY submission to the FRC dated 5 December 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

Forvis Mazars submission to the FRC dated 7 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

ICAEW submission to the FRC dated 29 November 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

BDO submission to the FRC dated 29 November 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

Investment Association submission to the FRC dated 14 June 2024, available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

We note that the Government has signalled its support for the creation of a regulatory framework for sustainability reporting via the creation of an endorsement mechanism for ISSB standards (for more information, please see: https://www.gov.uk/guidance/uk-sustainability-reporting-standards). However, agreeing a similar framework for assurance against those reporting standards has yet to progress. ↩

-

ISQM 1 refers to the International Standard on Quality Management 1 published by the International Auditing and Assurance Standards Board. ↩

-

ISO 9001 is an internationally recognised quality management standard developed by the International Standards Organisation. ↩

-

See Deloitte submission to the FRC dated 28 November 2024; available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

See Forvis Mazars submission to the FRC dated 7 June 2024; available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩

-

See UKAS submission to the FRC dated 13 June 2024; available at: https://www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/ ↩