The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Climate-related Financial Disclosures by AIM and Large Private Companies

- 1. Executive summary

- 2. How to use this publication

- 3. Scope and selection

- 4. CFD and TCFD interaction

- 5. Location of disclosures

- 6. Parent and subsidiary company disclosures

- 7. Governance arrangements

- 8. Risk management

- 9. Principal climate-related risks and opportunities

- 10. Business model and strategy

- 11. Resilience and scenario analysis

- 12. Targets and key performance indicators

- 13. Clear and concise CFD reporting

- 14. Key expectations

1. Executive summary

Introduction

For accounting periods starting on or after 6 April 2022, mandatory Climate-related Financial Disclosures (CFD) are required under s414C, s414CA and s414CB of the Companies Act 2006 (the Act). They apply to entities with more than 500 employees that are:

- traded, 1 banking, insurance or AIM companies

- private companies, and Limited Liability Partnerships (LLPs), with turnover of over £500 million

In-scope entities are required to prepare a Non-Financial and Sustainability Information Statement (NFSIS), which discusses the risks and opportunities the entity is exposed to because of climate change, and the way in which those risks and opportunities are governed, measured and managed. To support entities in preparing CFD, the government has issued non-binding guidance (the Guidance). We do not necessarily expect entities to provide all the information it suggests; however, it is a useful tool that can aid entities in preparing disclosures that are compliant with the Act.

The FRC's Corporate Reporting Review team carried out a review of the newly applicable CFD requirement for in-scope AIM and large private companies. As a new requirement, the FRC has taken a proportionate approach recognising that preparers will continue to develop reporting approaches over time. The review sets out good practice examples for preparers that will assist companies in meeting the requirements and developing their CFD as they progress along their climate journey.

Reporting against the Taskforce on Climate-related Financial Disclosures (TCFD) framework is outside the scope of this review. This has been covered extensively in previous thematic reviews.2,3

The importance of CFD

AIM companies and large private entities within the scope of the CFD requirements often provide employment for large numbers of people, sustain extensive supply chains, utilise substantial debt financing and are drivers of economic growth. Therefore, it is critical that these economically significant entities consider the risks and opportunities that climate change could have on their strategy, operations and people. Further, investors and other stakeholders want to understand the potential effects of climate change on these entities to enable them to make fully informed business decisions.

CFD are designed to help entities meet these challenges and, as a result, have an important role to play in supporting economic growth through the UK's transition to a low-carbon economy.

We set out our CFD expectations against this backdrop.

Key findings

As expected, it was evident from our review that this was the first time most companies in our selection had prepared CFD for an external audience. In many cases, companies have endeavoured to meet the requirements of the Act. However, the quality of CFD reporting varied across our selection. Areas for improvement were identified for most companies:

- An analysis of the resilience of the company's business model and strategy considering different climate-related scenarios (scenario analysis) is required by the Act. We acknowledge that this disclosure is challenging to produce and will likely develop over time. However, several companies failed to provide any analysis, with others providing disclosures that were not sufficiently company specific.

- Disclosures in relation to climate-related targets, and the assessment of progress against these targets using key performance indicators (KPIs), require improvement. Only half of the companies presented all of this information. For some companies it was unclear whether targets were in place but not disclosed, or if there were no targets to disclose.

- Disclosures explaining the company's governance arrangements in respect of climate-related risks and opportunities were provided by almost all companies, but they were sometimes unstructured and spread throughout the annual report and accounts without specific cross-references.

- Information explaining the climate-related risk assessment and management process, and its integration with the overall risk management process, was generally sufficient to meet the requirements of the Act. However, some companies failed to explain the way in which climate-related risks and opportunities were identified.

- Most companies disclosed climate-related risks. However, opportunities were not always identified. Further, the timeframes over which the risks and opportunities were assessed were not always described.

- Some companies voluntarily based their disclosures on the TCFD framework. However, a number of these companies failed to present one or more of the disclosures required by the Act.

- Some companies referred to climate-related information presented outside of the annual report and accounts. Presenting CFD outside the annual report and accounts does not comply with the requirements of the Act.

We remind preparers that good CFD disclosures do not have to be long or complex. Better disclosures were generally more concise and often conveyed information using tables or diagrams.

We expect the quality of companies' CFD to improve following this first year of application and will take that into account in our future correspondence with companies.

2. How to use this publication

Using this publication

This review is part of the FRC's ongoing programme of work on climate change. It considers how a selection of preparers have complied with the new CFD requirements, highlights where we saw examples of emerging good practice, and sets out our expectations for reporting in future periods.

We have not considered the consistency of CFD reporting with information presented elsewhere in the financial statements in preparing this report, as this has been a focus of previous climate-related thematic reviews. However, we encourage preparers of CFD to consider the messages on consistency and connectivity 4,5 contained in those publications, as they remain relevant.

The requirements of the Act, in respect of CFD, are high-level in nature. However, they require disclosures that describe or analyse certain matters. Judgement is required in determining the level of detail to include in CFD to meet the requirements of the Act. In providing examples of good disclosures, we have considered the information that may be important in meeting the requirements of the Act and which may contribute to CFD information being fair, balanced and comprehensive.

Example disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

Instances of good practice and opportunities for improvement are identified in the report as follows:

A characteristic of good quality application of reporting requirements.

An opportunity for improvement by companies to move them towards good quality application of reporting requirements.

An omission of required disclosure or other issue companies should avoid in their annual reports and accounts.

The word 'should' is used in this report to describe legal and accounting applications and disclosures that are required if material and relevant.

The word 'must' is used only when it features in an extract of the Act that has been replicated within this report.

The relevant requirements – how much is enough?

The financial reporting framework in the UK is principles-based and requires the application of judgement. Preparers must consider the following overarching requirements, where applicable, in determining which climate-related financial information requires disclosure:

- the annual report and accounts, taken as a whole, should be fair, balanced and understandable [UK Corporate Governance Code, Provision 27, where adopted]

- the strategic report must be fair, balanced and comprehensive [s414C Companies Act 2006]

- the purpose of the strategic report is to inform members of the company and help them assess how the directors have performed their duty to promote the success of the company [s414C (1) Companies Act 2006]

- the directors may omit all or part of the disclosures required by subsection 2A (e), (f), (g) or (h) of s414CB if it is not necessary for an understanding of the business, provided a clear and reasoned explanation is given [s414CB (4A) Companies Act 2006]

We do not expect companies to go beyond these requirements or to provide information that is not material or relevant to users.

Our proportionate approach to corporate reporting review

Our formal powers relating to corporate reporting review are derived from the Companies Act 2006 and other relevant law.

We engage with companies principally on a voluntary basis. We rarely resort to use of our formal powers. Further information about our approach, powers and remit is set out in our Operating Procedures for Corporate Reporting Review.

We carefully consider proportionality, and the materiality of the reporting matters concerned, at every stage of our review work. We are mindful of the need to balance high standards in corporate reporting, and our responsibility to protect stakeholders in the public interest, with supporting UK economic growth. We ask companies a substantive question only when it appears that there is, or may be, a material breach of the relevant reporting requirements.

3. Scope and selection

Scope

Our review looked at the annual reports and accounts of 20 UK companies. All the companies had more than 500 employees and were either AIM companies or private companies with turnover of more than £500 million.

Our selection covered year-ends falling between August and December 2023.

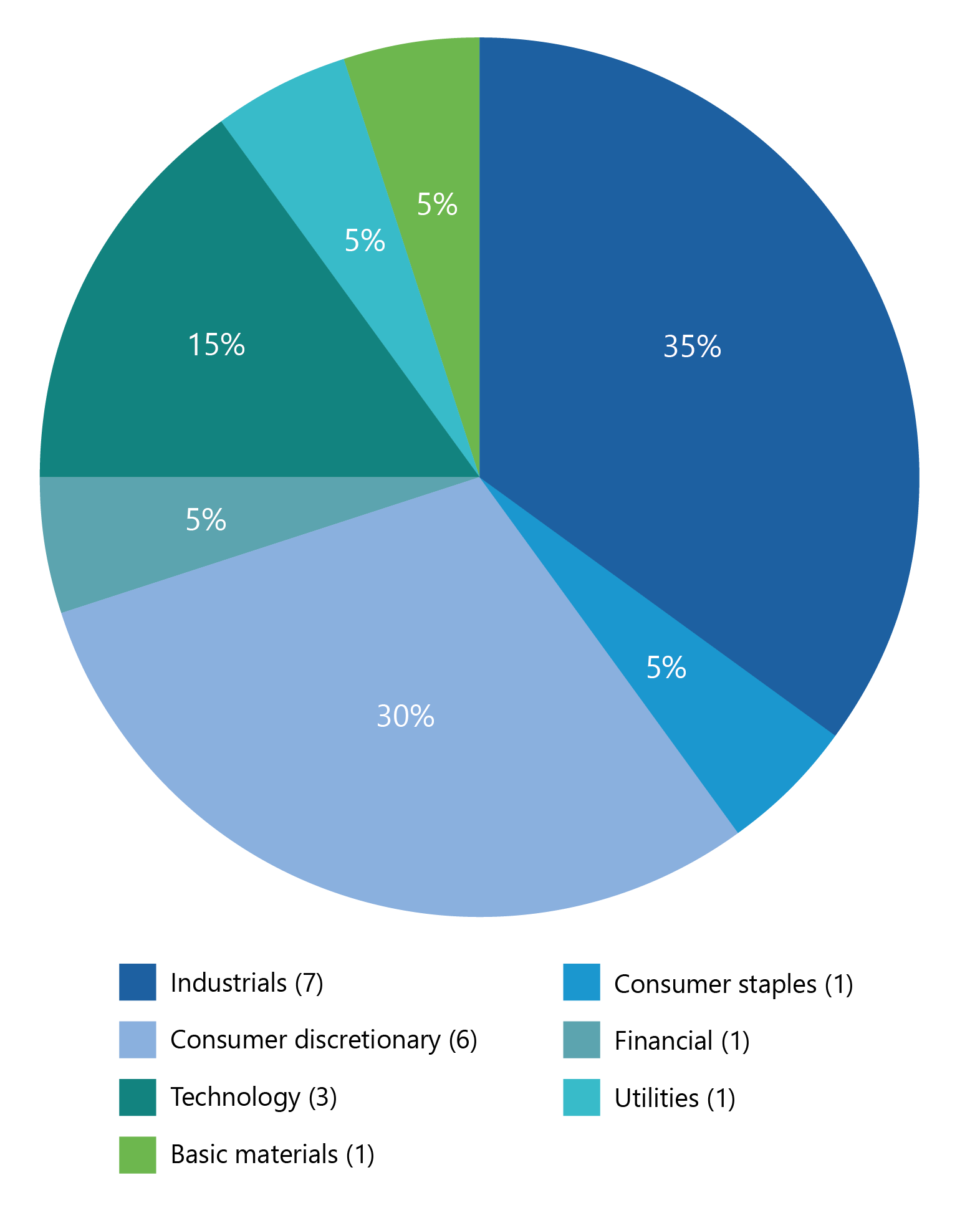

Companies were chosen from a variety of industries, which will be affected by climate change in different ways and extents, as set out in the chart opposite.

The companies can be split into three categories:

- Parent companies of privately owned groups. These companies all prepared consolidated accounts.

- Subsidiaries of overseas companies. Most of these companies prepared intermediate level consolidated accounts, and the remainder presented company-only accounts.

- AIM companies, all of which prepared consolidated accounts.

Industries selected (percentage of reports)

- Industrials (7)

- Consumer discretionary (6)

- Technology (3)

- Basic materials (1)

- Consumer staples (1)

- Financial (1)

- Utilities (1)

4. CFD and TCFD interaction

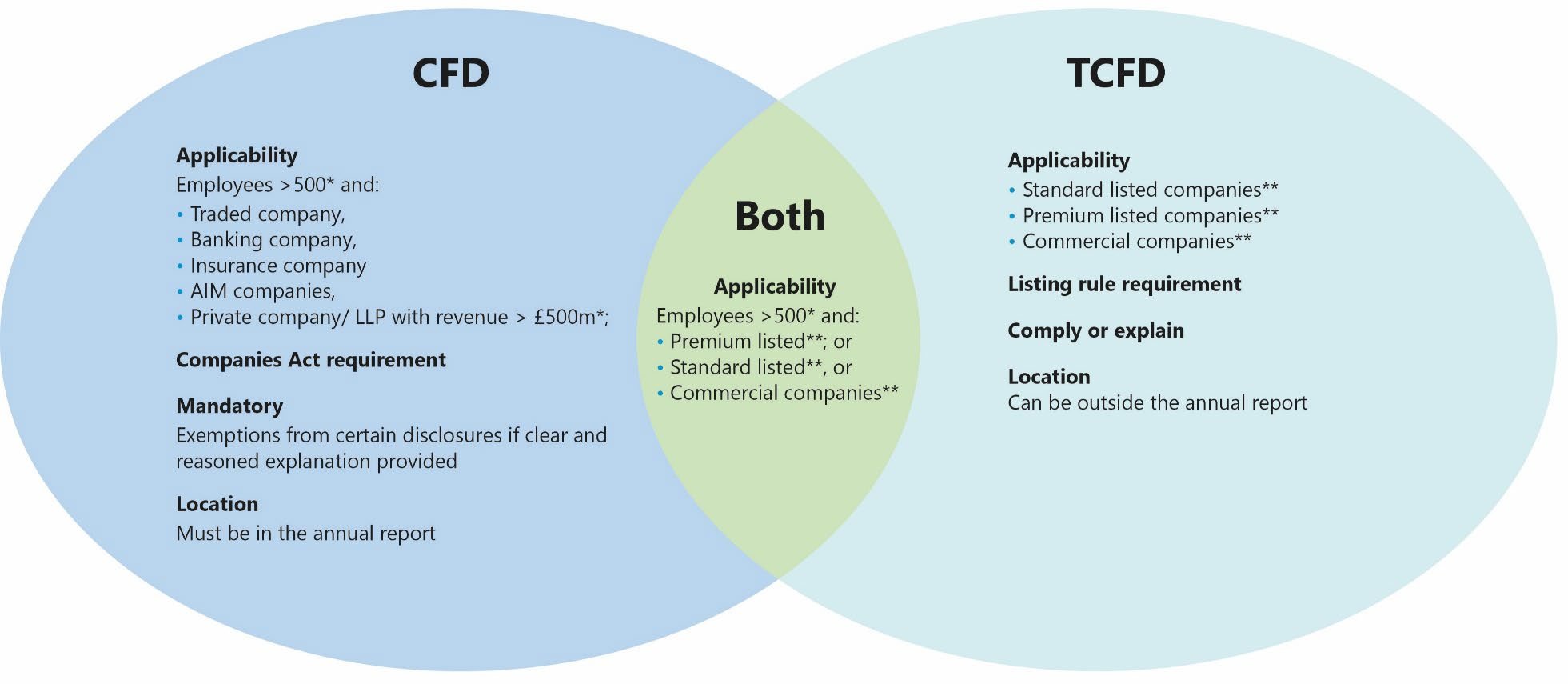

The requirement to present CFD is separate from the requirement to present disclosures consistent with the TCFD framework, which was introduced into the Listing Rules by the Financial Conduct Authority (FCA) and applies to Commercial companies **.

The CFD requirements are not identical to the TCFD framework. Although there is significant overlap, the disclosures required by the TCFD framework are more detailed, are provided on a comply or explain basis, and can be presented outside the annual report and accounts. In the case of CFD, all the disclosures required by the Act should be provided unless one of the available exemptions applies. All CFD should be presented in the annual report and accounts.

* where a parent, the criteria should be applied to the aggregated turnover/employee figures of the group it heads. ** from 29 July 2024, premium listed and standard listed categories have been replaced with a single 'commercial companies' category for future listings. Companies that were standard listed or premium listed before 29 July 2024, and commercial companies listed after 29 July 2024, are required to present disclosures consistent with the TCFD framework.

Where the directors of a company reasonably believe that, having regard to the nature of the company's business, and the manner in which it is carried on, the whole or a part of a climate-related financial disclosure required by subsection (2A) (e), (f), (g) or (h) is not necessary for an understanding of the company's business, the directors may omit the whole or (as the case requires) the relevant part of that climate-related financial disclosure.

[s414CB (4A)]

Where the directors omit the whole or part of a climate-related financial disclosure in reliance on subsection (4A) the non-financial and sustainability information statement must provide a clear and reasoned explanation of the directors' reasonable belief mentioned in that subsection.

[s414CB (4B)]

None of the companies in our selection took the exemptions from disclosure offered by s414CB (4A)-(4B).

Many companies used the TCFD framework to prepare disclosures required by the Act; however, none were required to do so. Some explained that disclosures consistent with the TCFD framework had been presented to comply with the Act, with others making no reference to the Act.

The TCFD framework may be used in preparing CFD. However, companies should ensure that all the requirements of the Act are met when presenting disclosures using alternative disclosure frameworks.

Several companies using the TCFD framework failed to provide one or more of the disclosures required by the Act but did not provide a clear and reasoned explanation.

Good examples that were based on TCFD mentioned that the disclosures were presented to meet the CFD requirements and provided cross-references to disclosures relevant for compliance with the Act.

5. Location of disclosures

A strategic report of a company to which this subsection applies must include a non-financial and sustainability information statement which must contain the climate-related financial disclosures of the company.

[s414CB (A1)]

A company is exempt from preparing CFD information in its own annual report and accounts if it and any subsidiaries' results are included in the consolidated report of a UK parent presenting CFD compliant information for the same or an earlier year-end date.

[s414CA (7),(8)]

The majority of companies in our selection presented CFD within the strategic report. However, only a minority presented them within a separately identified non-financial and sustainability information statement.

Six companies referred to a separate Environmental, Social and Governance (ESG) report (or similar document) that was outside of the annual report and accounts.

Five of these companies did not include sufficient disclosures in the annual report and accounts to meet all the requirements of the Act. For two companies, at least one further requirement would have been met had some of the information presented in the separate ESG report been included in the annual report and accounts.

The CFD presented within the annual report should be sufficient to meet the requirements of the Act.

Inclusion of CFD information within the annual report and accounts of a subsidiary does not provide an exemption from presenting CFD information in the parent company annual report and accounts when the parent company is in-scope of the Act.

One parent company did not provide all the CFD information required by the Act in its annual report and accounts. However, the disclosure cross-referred to supplementary information included in a subsidiary's TCFD statement. This approach is insufficient. To comply with the Act, a company should include all CFD information in its own annual report and accounts.

6. Parent and subsidiary company disclosures

For a parent company, the scope criteria should be applied to the aggregated turnover and employee figures of the group headed by that parent, irrespective of whether it prepares consolidated accounts.

[s414CA (2A)(b)]

For parent companies preparing consolidated accounts, the NFSIS should include information relating to the company and its subsidiary undertakings.

[s414CA (2)]

In total, 85% of the companies in our selection prepared consolidated accounts. The extent to which the CFD covered the whole group was not always clear.

Good practice examples identified the parts of the group on which the disclosures focused.

Some companies explained that they had focused their disclosures on parts of the group more significantly affected by climate or that represented a substantial proportion of the group's operations. This allowed the companies to focus on the material and relevant climate-related effects in a concise way.

One company's climate-related disclosures were taken from those provided by its overseas parent with limited tailoring for its own circumstances. For example, the KPIs disclosed were those of the overseas parent.

Good disclosures were provided from the perspective of the group headed by an intermediate UK parent. These disclosures explained concisely how the UK group's climate-related governance and risk management arrangements interacted with those of the wider group.

UK Mandatory Climate Disclosure

The UK Mandatory Climate Disclosures required under 'The Companies (Strategic report) (climate financial disclosures) Regulation 2022' consist of eight disclosure requirements that fall under four thematic pillars: Governance, Risk Management, Strategy, and Metrics & Targets.

This disclosure sets out the UK Mandatory Climate Disclosures (MCD) for Celsa (UK) Holdings Limited (''Celsa UK'') and encompasses all of its subsidiary undertakings (the ''Company'').

Celsa (UK) Holdings Limited, Annual report and financial statements for the year ended 31 December 2023, p4

Explains clearly the companies the disclosure covers.

Parent company presenting company-only accounts

The Guidance, on page eight, recommends that CFD in parent company-only accounts should relate to the individual company, including how climate-related risks and opportunities may affect the value of its investment in subsidiaries.

One company in our selection failed to present a strategic report and omitted all the CFD information required by the Act. It was an intermediate parent company that took the exemption from presenting consolidated accounts available under s401 of the Act.

Section 414A of the Act requires all companies that are not small to prepare a strategic report. For a parent company, the group it heads also needs to be small for the exemption to apply, irrespective of whether it prepares consolidated accounts.

Another intermediate parent that presented company-only accounts included CFD about its operations but did not explain the effect on the value of its investments in subsidiaries.

7. Governance arrangements

Climate-related financial disclosures include a description of the governance arrangements of the entity in relation to assessing and managing climate-related risks and opportunities.

[s414CB (2A)(a)]

Almost all companies in the selection provided disclosures explaining their governance arrangements in respect of climate change. However, disclosures were sometimes unstructured and spread throughout the annual report and accounts without specific cross-references. Other disclosures appeared unduly lengthy or complex.

Some companies had specific governance arrangements in respect of climate-related risks and opportunities. However, the extent of the integration of the climate governance process with the company's overall governance process was often unclear. This was exacerbated in cases where a separate climate committee was established but its specific role and interaction with other committees and the board was not explained.

We acknowledge that the complexity of governance arrangements and, therefore, the level of detail presented in climate-related governance disclosures, is likely to vary between companies.

Irrespective of the complexity of a company's governance arrangements, good governance disclosures:

- are company specific and well-structured

- are clear and concise with specific cross-references to further relevant information contained within the annual report and accounts

- may include supporting diagrams illustrating the interactions between climate and general governance committees, where established, and the board

- describe the roles of different committees and their interactions

- state whether the governance arrangements for climate are integrated with the general governance arrangements

Considering the effective communication principles outlined in 'What Makes a Good Annual Report and Accounts' may help in preparing good quality climate-related and general governance disclosures. See also section 13, 'Clear and concise CFD reporting'.

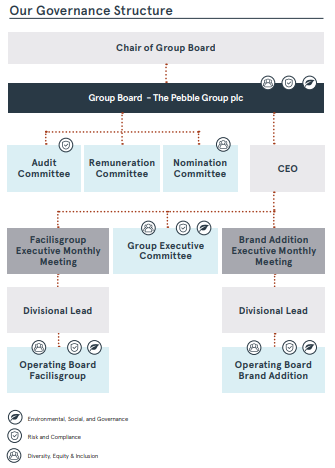

Our Governance Structure

Chair of Group Board

The Operating Boards typically meet prior to the Group Executive Committee meetings, which is before the Group Board meetings. This enables the Executive Directors to provide the most up to date information possible to the Group Board.

ESG governance

The Group Board sets and approves Group ESG strategy and policy on an annual basis and reviews and approves each ESG Report prior to publication, following consultation with the Group Senior ESG Officer and Group General Counsel and Company Secretary. The Group Board reviews progress against ESG strategy every six months. The Group Executive Committee includes an ESG update as a standing agenda item at each meeting and ensures regular communication and discussion of ESG strategy and progress with the Divisional Leads and other members of the Committee. Each Operating Board, led by their Divisional Leads, is responsible for the implementation of the ESG strategy. Each business has flexibility to develop its own ESG focus, policies and initiatives, defining their own objectives. The Senior ESG Officer holds meetings with each business at least every two months to discuss progress against agreed non-financial objectives related to energy usage, carbon emissions and roll-out, training and adherence to policies. Through this governance structure, the Group Board perpetuates an open, honest environment and its view of the right ethical culture, to drive effective risk management, governance practices and processes and effective decision making at all levels of the Group.

The Pebble Group plc, Annual Report 2023, p64

The supporting diagram shows the interactions between different boards and committees. The diagram illustrates how climate governance is integrated with the overall governance process.

Company specific narrative explains the governance process logically and concisely. The narrative explains who is responsible for implementing the strategy and when progress against strategy is reviewed.

8. Risk management

Climate-related financial disclosures include a description of how the entity identifies, assesses, and manages climate-related risks and opportunities.

[s414CB (2A)(b)]

Climate-related financial disclosures include a description of how processes for identifying, assessing, and managing climate-related risks are integrated into the entity's overall risk management process.

[s414CB (2A)(c)]

The majority of companies presented disclosures that adequately described the way in which climate-related risks and opportunities are assessed and managed. Most companies also described the level of integration between climate risk management and overall risk management processes.

Some companies did not explain how climate-related risks and opportunities are identified.

Good disclosures:

- explain who is involved in risk and opportunity identification

- describe the process used to identify risks and opportunities

- clarify the method used to determine whether the risk or opportunity is significant ('principal') to the business

- provide details of the way in which these principal risks and opportunities are monitored

- state whether climate risk management is integrated into the overall risk management process

We employed the following risk and opportunity management approach:

Identify: A workshop to consider the potential risks and opportunities associated with climate change was held for senior representatives across the business, including the ESG Committee and EMC representation from our Group COO and from CPP India.

Assess: The likelihood and potential impact were discussed considering our own business and its value chain operations, as well as the potential impacts to revenue and reputation.

Manage: All risks are now integrated into the Group's Risk Management Framework. All opportunities are being maintained by the ESG Committee, which will continue to engage with the relevant business leads to monitor realisation plans.

We will continue to monitor the risks and opportunities and repeat the scenario analysis following the completion of the CMP in 2026.

CPPGroup Plc, Annual Report and Accounts 2023, p21

Explains the process followed to identify risks.

Explains what was considered in assessing the significance of the risks and opportunities to the company.

Details the process followed in respect of the ongoing monitoring of risks and opportunities.

9. Principal climate-related risks and opportunities

Climate-related financial disclosures include a description of:

- the principal climate-related risks and opportunities arising in connection with the entity's operations

- the time periods by reference to which those risks and opportunities are assessed

[s414CB (2A)(d)]

Almost all companies identified climate-related risks associated with their operations. However, opportunities were not always disclosed. This may be because climate-related opportunities are fewer in number or harder to identify, especially for companies that are early in their climate journey.

Companies that adopted a tabular format to present this information, together with the associated time periods and effects, were often able to express this information more clearly and concisely.

Good disclosure was company specific and focused on a limited number of the most significant ('principal') climate-related risks and opportunities.

Some companies disclosed several, seemingly more minor, climate-related risks and/or opportunities, without clarifying why they were considered 'principal'. Highlighting only the matters with the potential to significantly affect the business model and/or strategy may allow for more concise disclosures.

The timeframes used to assess the risks and opportunities were not always described.

One company provided information about its transition plan to a lower carbon economy, which included using unproven technology. However, it did not disclose the potential challenges associated with bringing that technology into practical use.

Interaction with company-level principal risks and uncertainties

All strategic reports are required, under s414C (2)(b) of the Act, to include a description of the principal risks and uncertainties (PRUs) facing the company. As explained on page 32 to 33 of the FRC's Guidance on the Strategic Report (June 2022), the PRUS disclosed should be limited to those considered to be material to the development, performance, position or future prospects of the company.

It follows that principal climate-related risks may not always be so significant to the business as a whole, individually or in combination, that they would be disclosed as a PRU under s414C (2)(b) of the Act.

Some companies that were significantly affected by climate and disclosed climate-related PRUs, used clear cross-referencing to avoid duplication between their PRUs and CFD reporting.

One company that disclosed climate-related PRUs did not provide sufficient company specific detail in its CFD reporting to explain the climate-related risks and their potential effect on its operations. In another company, it was unclear why climate change was regarded as a PRU based on the limited effects that were disclosed in the CFD reporting.

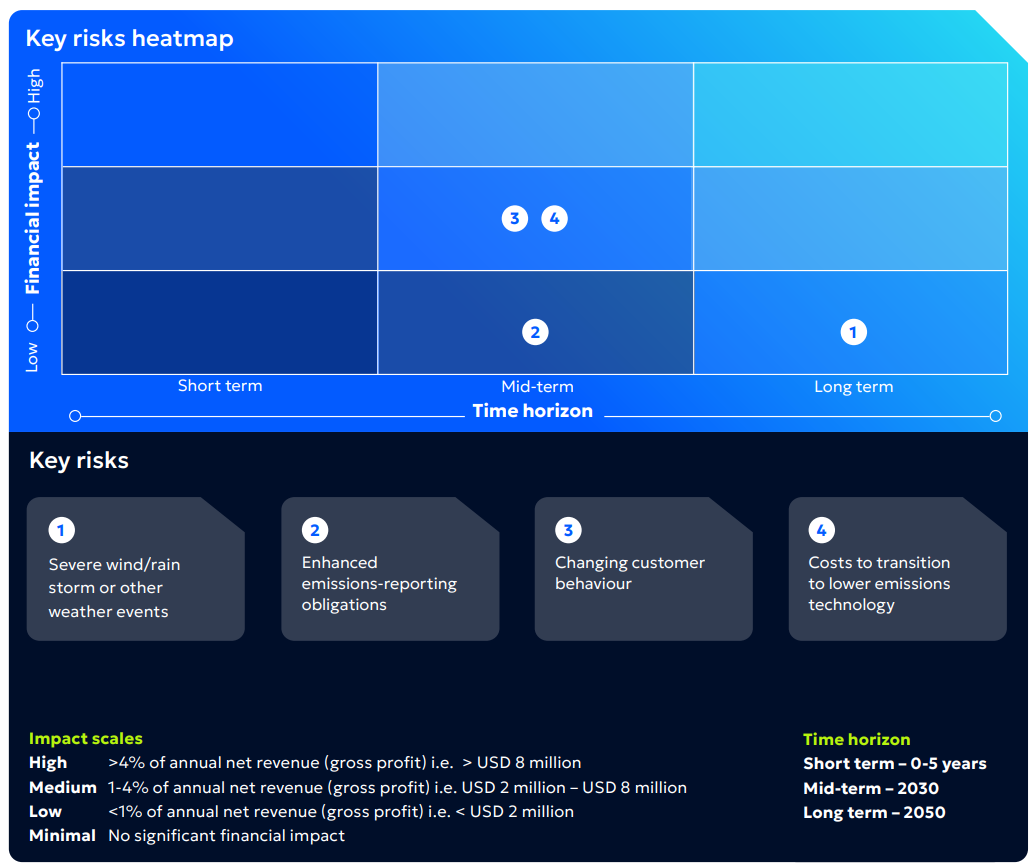

Key risks heatmap

Key risks

- Severe wind/rain storm or other weather events

- Enhanced emissions-reporting obligations

- Changing customer behaviour

- Costs to transition to lower emissions technology

Impact scales

- High >4% of annual net revenue (gross profit) i.e. > USD 8 million

- Medium 1-4% of annual net revenue (gross profit) i.e. USD 2 million – USD 8 million

- Low <1% of annual net revenue (gross profit) i.e. < USD 2 million

- Minimal No significant financial impact

Time horizon

- Short term – 0-5 years

- Mid-term - 2030

- Long term - 2050

Team Internet Group Plc, Annual report 2023, p36

Example identifies a small number of principal climate-related risks, which are described in more detail elsewhere in the annual accounts.

Disclosure of the financial effect and timeframe over which the identified risks are expected to crystallise has been presented.

Financial effects and time horizons used are defined.

10. Business model and strategy

Climate-related financial disclosures include a description of the actual and potential impacts of the principal climate-related risks and opportunities on the entity's business model and strategy.

[s414CB (2A)(e)]

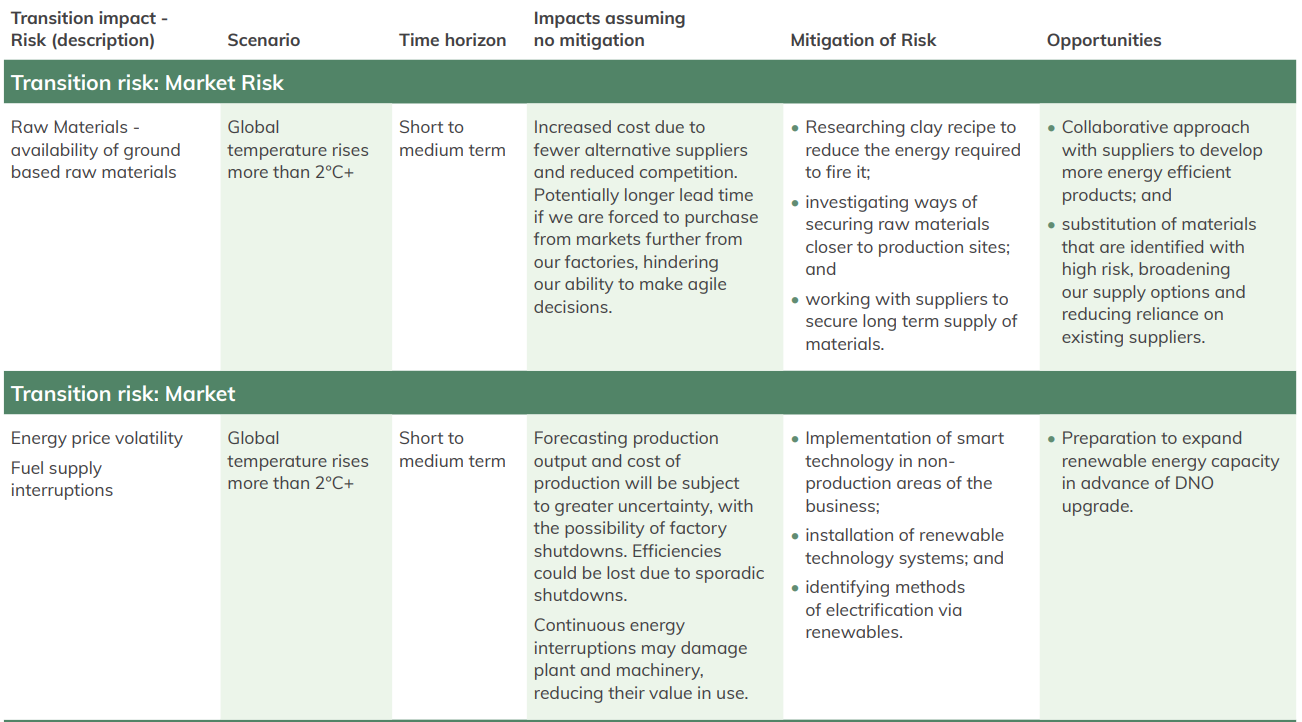

The actual and potential impacts of climate-related risks and opportunities on the company's business model and strategy were well described by most companies.

Good disclosures listed, often in tabular format, the company's climate-related risks and opportunities, and clearly and concisely documented the specific effects of these risks and opportunities on the business model.

Some companies with operations in multiple geographical locations did not disclose whether the specified effect of the identified risks and opportunities varied for each significant geographic area.

One company failed to describe the impact that each of the principal climate-related risks and opportunities it identified has on the business model and strategy.

The full effect of identified climate-related risks and opportunities on the business model and strategy was unclear in the accounts of three companies, as the description lacked sufficient detail.

The statement must, where appropriate, include references to, and additional explanations of, amounts included in the company's annual accounts.

[s414CB (5)]

One company explained that energy inefficient assets would be retired to mitigate climate-related risks and realise climate-related opportunities.

Another company indicated that it had secured a specific amount of carbon allowances for use in future periods.

However, it was unclear whether or to what extent these plans and actions affected the financial statements.

As set out in the 'CRR thematic review of climate-related metrics and targets', we expect narrative disclosures to be consistent with disclosures presented in the financial statements.

The potential effect on the business model and strategy is clearly and concisely described for each climate-related risk identified.

[...] Portmeirion Group Plc, Report and Accounts for the year ended 31 December 2023, p29

11. Resilience and scenario analysis

Climate-related financial disclosures include an analysis of the resilience of the company's business model and strategy, taking into consideration different climate-related scenarios.

[s414CB (2A)(f)]

We recognise that, for many companies, this is the first time that scenario analysis of any type has been performed and, as such, we expect that practice will develop and evolve significantly over time. However, the quality of analysis provided varied widely across our selection, with areas for improvement identified for most companies.

As explained on page 16 of the Guidance, it is not necessary for a company to produce a quantitative scenario analysis to meet the requirements in the Act. However, disclosure of 'an analysis' is required – a simple statement that one has been undertaken is not sufficient.

Almost all companies that provided the required analysis specified that it was prepared on a qualitative basis.

Several companies failed to provide an analysis. Where an analysis was provided, it often lacked company or scenario specific details for users to understand the resilience of the company's business model and strategy.

One company explained that they had not disclosed an analysis using different climate-related scenarios as external scenario information was not readily available. However, suitable information will generally be accessible and has been used by TCFD reporters in the preparation of their disclosures.

Good disclosures:

- provide details about the climate-related scenarios used

- explain how the analysis was undertaken and key assumptions used

- specify the effect on the business model and strategy from operating within each scenario considered, together with the relevant time horizons

- use diagrams to convey the effect and likelihood of events occurring within each scenario

Risk and opportunity assessment

The identified risks and opportunities were scored and ranked using three assessment criteria: vulnerability (combination of exposure, adaptive capacity, and sensitivity), magnitude, and likelihood across climate scenarios and time horizons.

Each risk and opportunity were assessed over different time horizons:

- Short-term: 0 to 1 years (2024 to 2025), aligns with business risk and finance strategy in dealing with the most immediate events that might impact the business.

- Medium-term: 2 to 5 years (2026 to 2030), aligns with business transformation and strategic positioning of the business in the medium-term

- Long-term: 5+ (2031 to 2050), aligns with UK net zero targets to decarbonise the UK economy by 2050, anticipating any long-term effects of climate change.

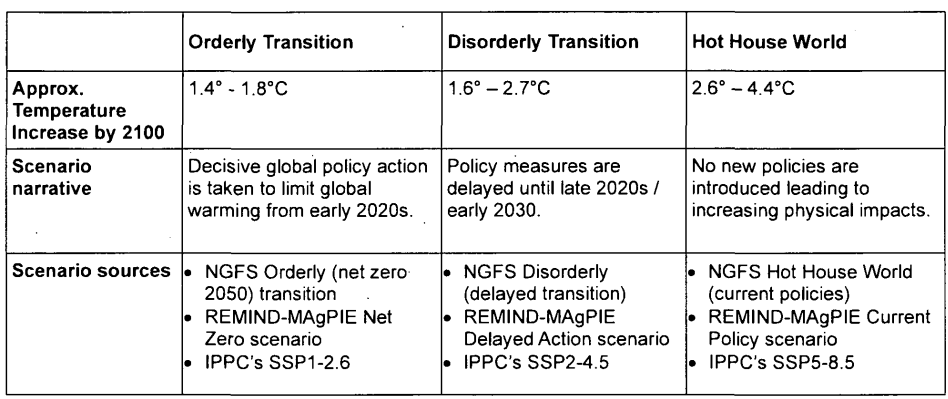

A range of scenarios were selected to understand the potential impact of climate change under uncertain future outcomes. We have used three different scenarios including an orderly, disorderly and hot house, to ensure understanding of all different outcomes of climate change are considered.

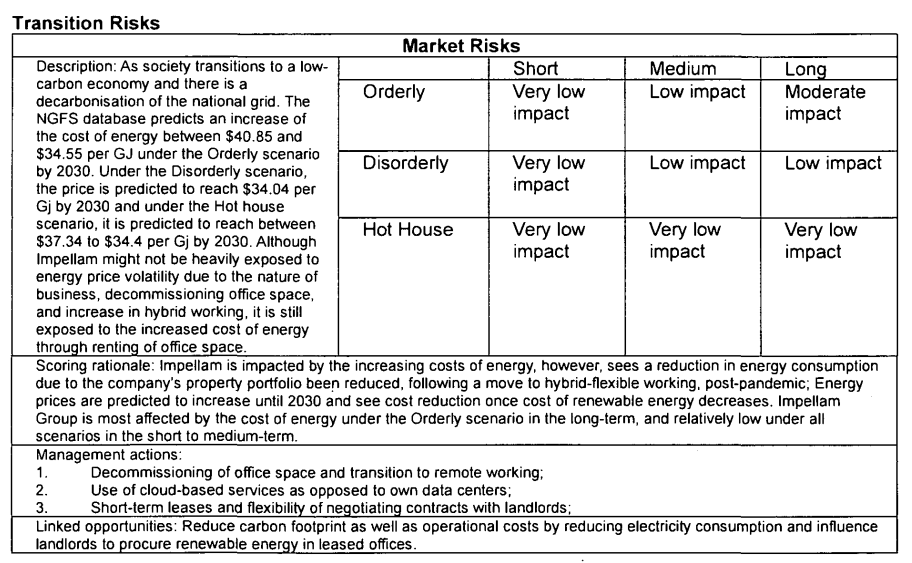

For transition risks, Impellam Group has utilised climate scenarios published by the Network for Greening the Financial System (NGFS), an open-source platform containing a variety of climate indicators including projections on energy prices. Looking at physical risks, Impellam Group utilised climate projections from the IPCC WGI Interactive Atlas. The database outlines regional information on climate variations including precipitation, snowfall, wind, and temperature. The most recent climate model CMIP6 has the latest climate change projections available, allowing for an assessment over several shared socioeconomic pathways (SSP1-2.6, SSP2-4.5 and SSP5-8.5).

Impact assessment of risks and opportunities

A qualitative assessment was conducted, where risks were prioritised on their overall risk score across all three scenarios and time horizons; the assessment was validated by the Group Financial Controller. In the table below, are the risks and opportunities identified as most material to Impellam and corresponding opportunities and mitigation actions.

Overall, Impellam Group is not exposed to any material climate change risks in the short to medium-term in the defined climate scenarios. Looking further into the longer-term time horizon, there is a degree of uncertainty in terms of how climate change scenarios might develop. Hence, the forward-looking analysis took into consideration Impellam Group's current actions to mitigate impacts of climate change, knowing that by setting forth a net zero strategy, the longer-term impact of climate change risks can be mitigated.

As society transitions to a low-carbon economy, clients will require candidates to be equipped with skills and knowledge to facilitate their own decarbonisation efforts. Impellam Group is well-positioned to respond to an increased demand for such professionals and will look into developing appropriate workforce recruitment and upskilling strategies, whilst simultaneously engaging with clients to understand their recruitment needs.

Transition Risks

The company provided details about the three scenarios selected for its qualitative scenario analysis.

The company has summarised the potential effect on the business of each risk under each of the three scenarios selected.

[...] Impellam Group Limited (formerly Impellam Group Plc), Annual Report for the 53 weeks ended 5 January 2024, pp14-15

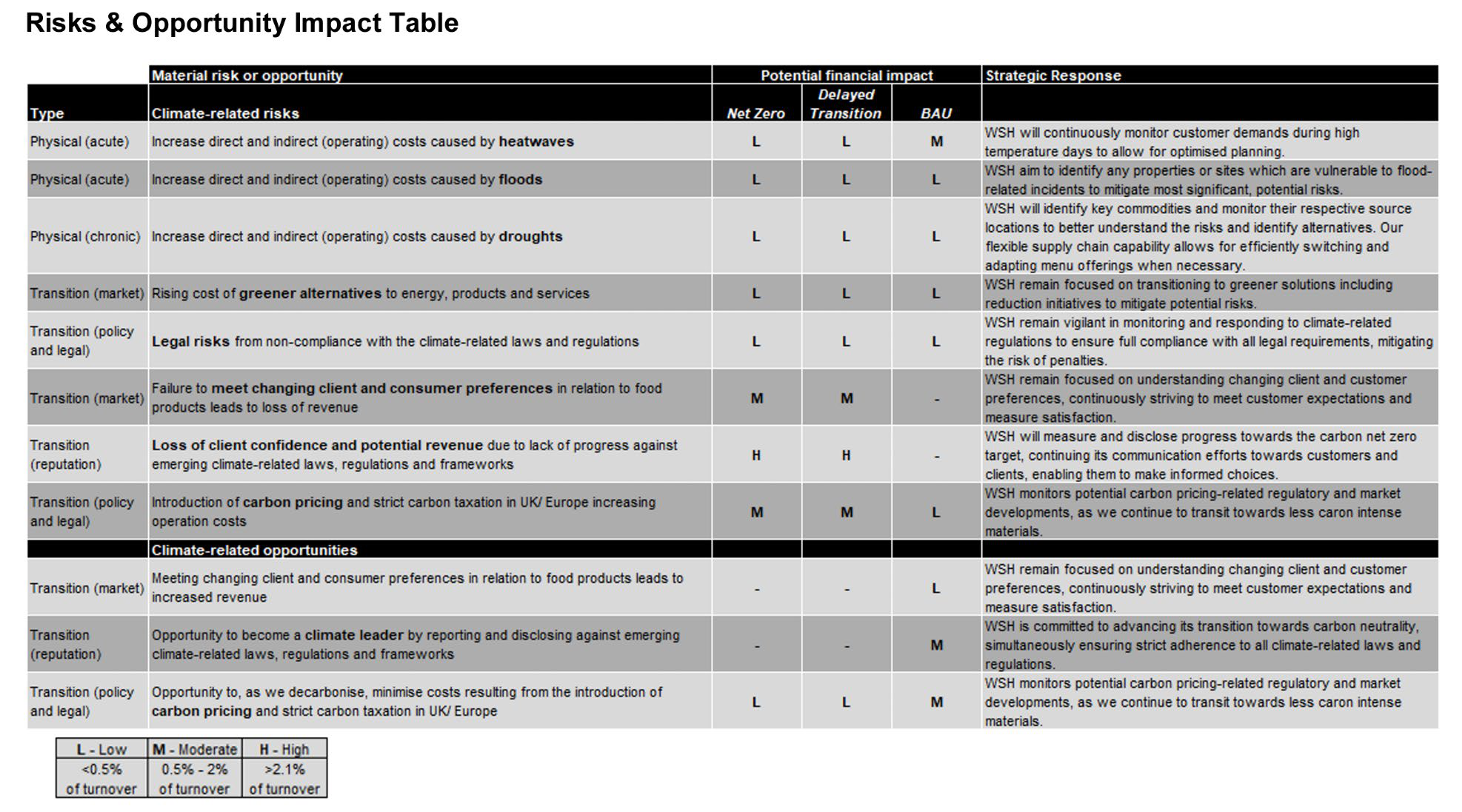

Risks & Opportunity Impact Table

CD&R and WSH JVCO (UK) Limited, Annual report and financial statements for the period ended 27 December 2023, p14

The company used a table to summarise the findings from its scenario analysis, which sets out the potential financial effect. The company provided further detail about each of the scenarios used elsewhere in its annual accounts.

12. Targets and key performance indicators

Climate-related financial disclosures include a description of the:

- targets used by the entity to manage climate-related risks and to realise climate-related opportunities and of performance against those targets

- key performance indicators used to assess progress against targets used to manage climate-related risks and realise climate-related opportunities and of the calculations on which those key performance indicators are based

[s414CB (2A)(g),(h)]

We appreciate that companies may still be developing their approach to the use of targets and KPIs to manage their climate-related risks and opportunities.

Some companies explained that they were still in the process of setting targets and explained the timescale for doing so. Others disclosed short-term targets and explained that they were determining longer-term targets.

A number of companies did not mention any climate-related targets. In these cases, it was unclear whether targets were in place but not disclosed, or if there were no targets to disclose.

Where targets were disclosed, they primarily related to reducing greenhouse gas (GHG) emissions.

Good practice examples of GHG emission reduction targets specified the base year, the scope and boundary of GHG emissions and the timescale for their achievement.

Several companies disclosed that they intended to reduce GHG emissions, and disclosed related KPIs but did not specify a target.

Information about performance against targets and the basis for the calculation of climate-related KPIs was not always disclosed.

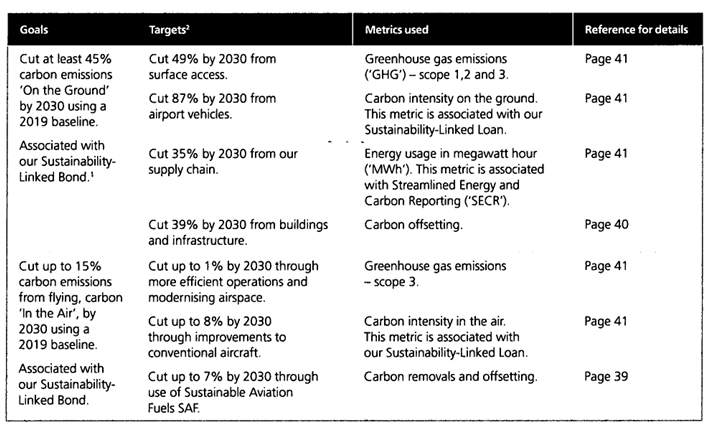

The table sets out the target and the way in which progress is measured. A cross-reference is provided to information in the annual report and accounts disclosing performance against targets and the baseline used in these calculations.

FGP Topco Limited, Annual Report 2023, p87

Interaction between Streamlined Energy and Carbon Reporting (SECR) and GHG emission reduction targets and KPIs

Our selection includes only unquoted companies, which are not required to disclose GHG emissions from outside the UK and offshore area in their SECR reporting. Disclosure of Scope 3 emissions data is encouraged, but not required, under the SECR requirements. For further information see 'Thematic Review: Streamlined Energy and Carbon Reporting'.

As explained in section 6, 'Parent and subsidiary company disclosures', parent companies preparing consolidated accounts are required to provide CFD information that covers the group headed by that company, including its overseas operations. Consequently, where a company's targets and related KPIs include global GHG emissions and/or Scope 3 emissions, a cross-reference to the company's SECR reporting may not be sufficient to meet the requirements of the Act.

Groups with exclusively UK operations and targets based on reducing Scope 1 and Scope 2 emissions were able to cross-refer to the information included in their SECR disclosures to describe the calculation of the related KPIs.

Several of the companies with overseas operations did not explain whether their GHG emission reduction targets and associated KPIs included GHG emissions from their non-UK operations and subsidiaries.

Good practice examples specified whether GHG emission reduction targets included global emissions, presented those for the group and split out those related to the UK based operations to meet the SECR requirements.

One company with UK-only operations included a GHG emission target to reduce Scope 1 and Scope 2 emissions. However, there was an inconsistency between the GHG emissions disclosed in its CFD reporting and those included in its SECR disclosures.

Two companies disclosed that they had carbon intensity ratio reduction targets in place. However, neither defined the denominator used, and one did not explain whether it included GHG emissions from its overseas operations.

One company stated that its GHG emission data had been verified by an external party. However, it did not provide details about the level of assurance obtained. As explained in the 'CRR thematic review of climate-related metrics and targets', we expect companies to be clear about the extent and scope of any external assurance obtained.

13. Clear and concise CFD reporting

Our publication, 'What Makes a Good Annual Report and Accounts', sets out the 4Cs of effective communication (Company specific, Clear, concise and understandable, Clutter free and relevant, and Comparable) which, when followed, support the preparation of a good annual report and accounts.

In the accounts of the companies we reviewed, on average approximately 25% of the strategic report was devoted to CFD. The inclusion of CFD will increase the length of the strategic report. However, companies could improve their climate-related financial reporting by considering the 4Cs of effective communication.

Often narrative disclosures were lengthy, unstructured and, as a result, difficult to understand. We encourage the use of straightforward language and short sentences in the preparation of CFD.

Lengthy prose can often be conveyed more clearly and concisely using tables and diagrams.

Some companies included climate-related information in respect of their parent. We encourage preparers to consider whether such information is relevant.

A minority of companies replicated the climate-related financial information presented by their parent without making it specific to the company's circumstances. It is important that CFD are company specific.

14. Key expectations

We expect companies and LLPs to consider the areas of good practice and opportunities for improvement set out in this report and to incorporate them in their future reporting, where relevant and material. Companies and LLPs should:

provide, in the annual report and accounts, all the disclosures required by the Act. Cross-referring to information presented outside the annual report and accounts does not comply with the requirements of the Act

present an entity-specific analysis of the resilience of the business model and strategy, taking into consideration different climate-related scenarios. This can be prepared on either a qualitative or quantitative basis

describe the targets used to manage climate-related risks, and to realise climate-related opportunities, and the KPIs used to measure progress against these targets

explain, where material and relevant, the financial statement effect of strategies introduced to manage climate-related risks and opportunities

ensure disclosures are clear, concise and entity-specific

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk

Follow us on LinkedIn or X @FRCnews

-

As defined in s474(1) of the Act. ↩

-

https://www.frc.org.uk/documents/3561/Thematic_review_of_climate-related_metrics_and_targets_2023.pdf ↩

-

https://www.frc.org.uk/documents/4204/TCFD_disclosures_and_climate_in_the_financial_statements.pdf ↩

-

https://www.frc.org.uk/documents/3561/Thematic_review_of_climate-related_metrics_and_targets_2023.pdf ↩

-

https://www.frc.org.uk/documents/4204/TCFD_disclosures_and_climate_in_the_financial_statements.pdf ↩