The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Tier 2 and Tier 3 Audit Firms - Audit Quality Inspection and Supervision 2023/24

Foreword from the Executive Director of Supervision

Audits provide stakeholders — including investors, employees, and the public — with confidence and assurance in the transparency and accountability of financial statements. Trust and confidence in corporate disclosures is underpinned by the delivery of audit quality that enables businesses across the UK to attract capital and grow. Public Interest Entity (PIE) audits, while representing a variable portion of a firm's portfolio, are of systemic importance and subject to additional requirements.

Upholding high standards of audit quality and ethics are critical to serving the public interest. Our inspections at Tier 2 and Tier 3 firms focus on their higher-risk and more complex PIE audits. Although the portfolios of these firms evolve annually, making year-on-year comparisons difficult, we continue to find that the majority of Tier 2 and Tier 3 firms are falling short in delivering consistent levels of audit quality. The disparity in inspection results is disappointing. Among Tier 2 firms, some firms have 100% of their inspected audits assessed as good or limited improvements required, while some others have 0% over the same three-year period.

Our inspections, the findings from reviews by the Recognised Supervisory Bodies and firm's own internal quality monitoring systems show that all audit firms can deliver good levels of quality outcomes in non-PIE audits. Improving quality takes time and Tier 2 and Tier 3 firms are committed to improving their system of quality management, but the overall pace of improvement remains disappointing.

We are enhancing our supervisory efforts to drive measurable improvements. For Tier 2 firms, this includes enhanced oversight of audit quality planning and root cause analysis, and a rolling three-year inspection cycle under the International Standard on Quality Management (UK) 1. For Tier 3 firms, we are focused on minimising unnecessary burdens while ensuring our regulatory approach supports tangible improvements being made. However, the onus remains with the firms themselves to embed systems of quality management that meet the public and market's expectations.

We must constantly evolve our approach to enhancing the resilience of the UK audit market by understanding the impact of our regulatory requirements and embedding the needs of the market and the public interest. As such, this will be the final report on Tier 2 and Tier 3 firms in this format. We will continue to convene, influence and engage with the audit ecosystem to understand the impact of our regulatory actions. We remain committed to maintaining the transparency that underpins confidence for investors, businesses and the public, and robust inspection and reporting on a firm's audit quality. We will also leverage existing regulatory tools to encourage firms to take greater ownership and accountability of their continuous improvement journey, including strengthening their own systems of quality management and assurance.

Sarah Rapson Executive Director of Supervision

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

- Foreword from the Executive Director of Supervision

- 1. Introduction

- Tier 2 and Tier 3 – at a glance

- Tier 2 and Tier 3 – auditor switching data

- Tier 2 and Tier 3 - audit file inspection information

- 2. Tier 2 and Tier 3 Inspection results: individual audits

- 2. Tier 2 and Tier 3 Inspection results: individual audits (continued)

- 2. Tier 2 and Tier 3 Inspection results: individual audits (continued)

- 3. Tier 2 and Tier 3 Inspection results: firms' SoQM

- 3. Tier 2 and Tier 3 Inspection results: firms' SoQM (continued)

- 3. Tier 2 and Tier 3 Inspection results: firms' SoQM (continued)

- 4. Forward looking supervision

- 4. Forward looking supervision (continued)

- 4. Forward looking supervision (continued)

- 5. PIE Auditor Registration

- 6. Audit Firm Scalebox

- Appendix A – Definitions

- Appendix B – Monitoring reviews by the Recognised Supervisory Bodies (RSBs)

- Appendix C - Firms in Tier 2 and Tier 3 for 2023/24

1. Introduction

This annual report, sets out the key findings and observations from our inspection and supervision work across Tier 2 and Tier 3 firms during 2023/24.

We categorise firms that audit PIEs into three tiers, based primarily on their current impact on the UK audit market according to the size and nature of their audit portfolios (see Appendix A for more information on our approach to tiering). Tier 2 or Tier 3 status does not imply that we have concerns about audit quality at a firm or that it is unable to undertake a more complex audit.

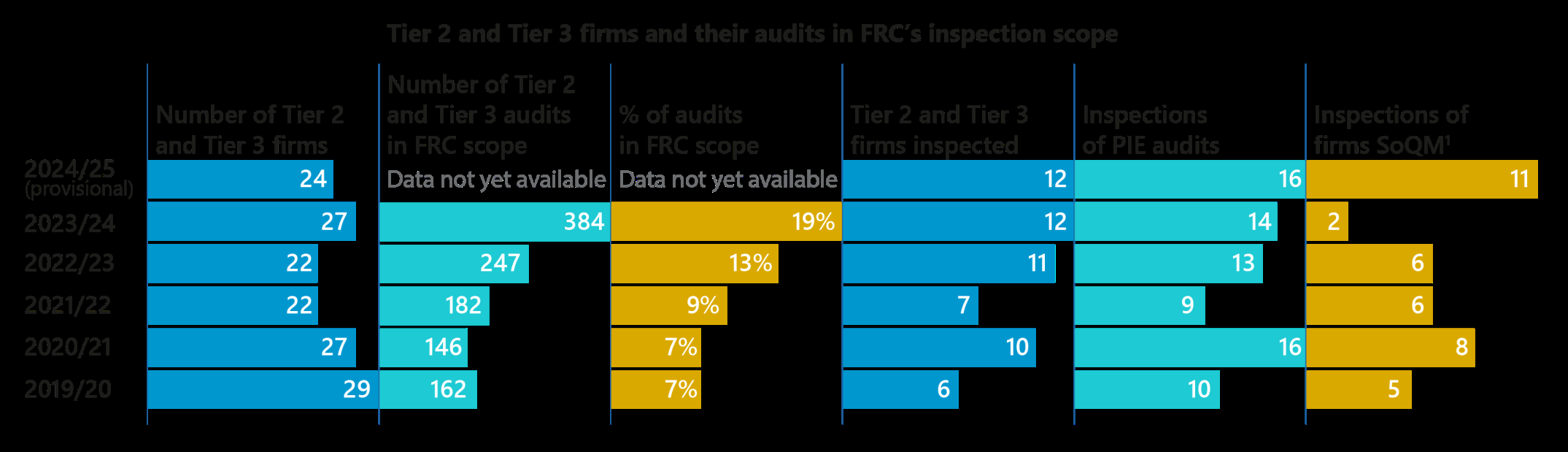

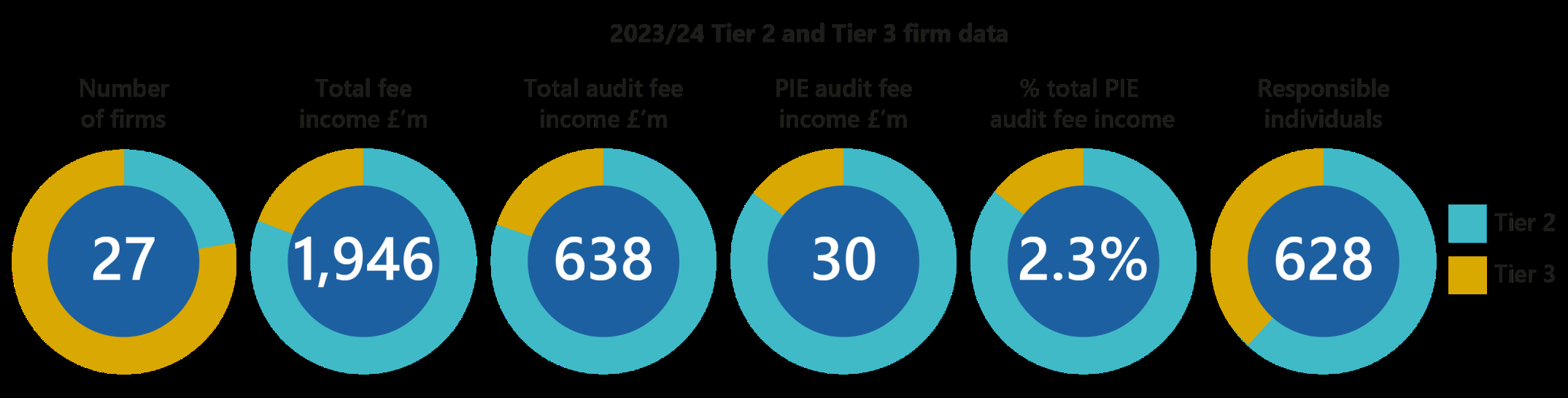

Tier 2 and Tier 3 firms together account for 19% of audits falling within the FRC's inspection scope but only 2% of PIE audit fees. However, an increasing proportion of changes in auditor are from Tier 1 to Tier 2 and Tier 3 firms.

This report firstly sets out findings from our 2023/24 inspections of a small sample of PIE audits at Tier 2 and Tier 3 firms, focusing on their higher risk audits and, for the first time since the implementation of International Standard on Quality Management (UK) 1 (ISQM (UK) 1), our inspections of the System of Quality Management (SoQM) at a sample of firms.

The report then outlines our observations in six areas, which are key to improving audit quality. This is followed by a snapshot of our PIE Auditor Registration regime, one of our important regulatory tools in promoting audit quality. The report then concludes with an outline of the work conducted by one of our recent improvement initiatives, the Audit Firm Scalebox.

Using this publication

This report may be used by:

- Audit firms to identify areas where they need to improve.

- Audit Committees to identify areas where they may wish to examine the quality of the audit that they are getting from their current audit firm or firms involved in any tender process.

- Investors and users of financial statements to make assessments about the quality of audit, transparency and accountability in relevant markets.

It is important to note that:

- Our findings are aggregated and anonymised and do not apply to all firms in Tier 2 and Tier 3. Further information on audit quality at individual Tier 2 and Tier 3 firms, including actions firms are taking to improve their SoQM, may be found in their Transparency Reports.

- Given our risk-based approach to selecting audits for inspection, our inspection findings should not be extrapolated across firms' entire audit portfolios.

- Given the small sample of audits inspected and changes in the population of Tier 2 and Tier 3 firms, the aggregated inspection information set out in this report should not be taken as an indicator of changes in audit quality from year to year.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

Tier 2 and Tier 3 – at a glance

[^1] From 2023/24 inspections are conducted against the requirements of ISQM (UK) 1. Prior to this they were conducted against the requirements of International Standard on Quality Control (UK) 1, which preceded ISQM (UK) 1. From 2024/25 we will be inspecting elements of all Tier 2 firms' SoQM annually, together with a sample of Tier 3 firms.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

Tier 2 and Tier 3 – auditor switching data

Auditor changes

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

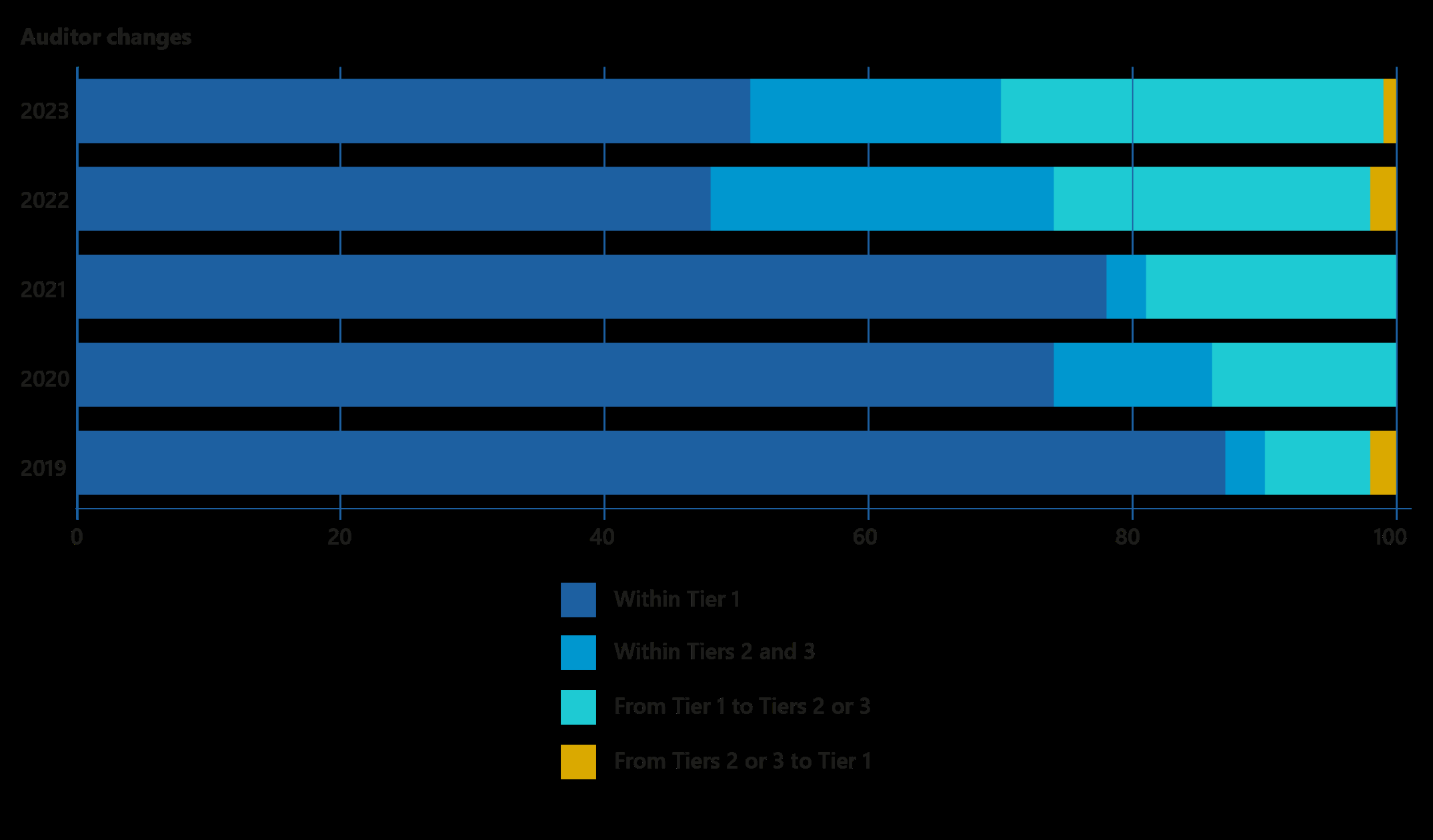

Tier 2 and Tier 3 - audit file inspection information

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

2. Tier 2 and Tier 3 Inspection results: individual audits

Our inspection results this year indicate that many Tier 2 and Tier 3 firms are falling short in delivering consistent levels of audit quality.

During 2023/24, we completed the inspection of 14 audits conducted by 12 Tier 2 and Tier 3 firms. Of these 14 audits:

- Three (21%) were assessed as requiring no more than limited improvements, compared to the average of 31% in this category over the previous four years, 2019/20 to 2022/23.

- A further eight (57%) were assessed as requiring significant improvements, compared to the average of 33% in this category over the previous four years, 2019/20 to 2022/23. It is concerning that such a high proportion of audits were assessed in the poorest quality category.

There is a widened gap this year between the inspection results for Tier 2 and Tier 3. Over the last three years, only 17% of Tier 3 inspections have been assessed as requiring no more than limited improvements, compared to 39% for Tier 2 (three years to 2022/23: 24% and 36% respectively). The underlying inspection results for individual firms continue to vary significantly. This is most marked in Tier 2, where some firms have had 100% of their audits assessed as good or limited improvements required within the last three years of inspections and some others have had 0% assessed in this category over the same timeframe.

The audit quality monitoring activities conducted on Tier 2 and Tier 3 firms' non-PIE audits by the Recognised Supervisory Bodies (RSBs) continue to show an improving trend with 85% of audits reviewed in 2023/24 being assessed as good or generally acceptable, compared to the average of 74% in this category over the previous four years, 2019/20 to 2022/23 (see Appendix B). The difference between RSB's and the FRC's outcomes may reflect the lower complexity of firms' non-PIE audits or differences in the scope of the review.

Inspection scope

We take a risk-based approach to determine the areas that we review on individual audits. These areas are those which would have a significant impact on an entity's financial statements should they not be fairly stated and on which investors and users of financial reports may rely.

Most frequent audit execution areas reviewed[^2]

Bar chart showing the most frequent audit execution areas reviewed and the percentage of audits with findings in those areas: Journals testing (93%), Revenue (86%), Fair value of financial instruments / investment property (50%), Impairment (43%), Provisions (including ECL, insurance provisions) (43%), and Going concern (36%).

As shown in the graph above, and consistent with our approach to Tier 1 inspections, we paid particular attention to key areas of estimates and judgement (including impairment, valuation, going concern and provisions) as well as the audit of revenue and journals in our inspections. In addition to these areas, we also reviewed risk assessment (including fraud and climate risk), audit planning, and the communications to Audit Committees on all inspections.

[^2] The published areas of focus for the 2023/24 inspection cycle are available on our website.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

2. Tier 2 and Tier 3 Inspection results: individual audits (continued)

Inspection findings

The areas covered by our inspection findings this year are largely consistent with those in previous years. Four of the five most common findings (estimates and judgements, journal entry testing, going concern and revenue) are recurring issues from previous years. We have also seen an increased number of findings in relation to risk assessment this year.

Common inspection findings

Stacked bar chart illustrating common inspection findings across different areas: Estimates and judgements, Journal entry testing, Revenue, Risk assessment, and Going concern. Each bar is segmented into "Key finding" and "Other finding", with numerical values. For example, Estimates and judgements had 11 key findings and 2 other findings for a total of 13.

Weaknesses in firms' quality control procedures, such as shortcomings in the review of audit work by the Engagement Partner and Engagement Quality Reviewer, continue to be a contributory factor to many of the key findings (see Appendix A) that we identify in our inspections.

The repetition of findings over multiple inspection cycles indicates that, for many firms in this sector, the past actions committed to have not been sufficiently effective and urgent action is needed to improve the quality and consistency of audit work in these areas. Further details of each of these findings are set out below.

Estimates and judgements

We had findings in this area on 93% of the audits we inspected (2022/23: 77%), the majority of which were assessed as key findings. Our findings covered areas including expected credit loss (ECL) provisions, insurance technical provisions, investment valuation and impairment.

As in previous inspection cycles, many of our key findings were linked to audit teams not displaying adequate professional scepticism. An appropriately sceptical mindset is essential to audit these areas, which are often complex, judgemental and may potentially be subject to management bias.

Estimates and judgements – examples of key findings

- ECL provisions: Weaknesses in the audit procedures performed to test the methodology, assumptions and data inputs used in ECL calculations, including procedures over significant increases in credit risk criteria, macro-economic scenarios and post model adjustments. In several cases, our findings were compounded by shortcomings in audit teams' oversight of the work of third-party specialists / experts.

- Provisions for insurance liabilities: Weaknesses in the testing of data used in the provision calculation and insufficient evaluation of the work performed by the auditor's expert over the valuation of the provision.

- Impairment: Weaknesses in the audit procedures performed to corroborate and challenge cash flow forecasts used in management's impairment assessments of property, plant and equipment, goodwill and other intangible assets.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

2. Tier 2 and Tier 3 Inspection results: individual audits (continued)

Journal entry testing

We review journal entry testing on most audits inspected at Tier 2 and 3 audit firms, given its importance in addressing the fraud risk around management override of controls and the frequency of past inspection findings.

We had findings in this area on 86% of the audits inspected (2022/23: 69%), just under half of which were assessed as key findings. Our findings, similar to prior periods, mainly related to shortcomings in the planned audit approach, in particular the fraud risk criteria used to identify journals for testing, and the specific testing of individual journal entries.

Journal entry testing – examples of key findings

- No testing performed over journal entries or any evidence of the audit team's response to the risk of management override of controls.

- Inadequate or no corroboration performed to substantiate journals identified as meeting fraud risk criteria.

Revenue

We review the audit of revenue on most audits we inspect, given its significance to the financial performance being reported by the entity.

We had findings in this area on 57% of the audits we inspected (2022/23: 15%), more than half of which were assessed as being key findings.

Revenue – examples of key findings

- Insufficient procedures to test the effective interest rate calculations on banking audits, including assessment of management's accounting policy and key inputs and assumptions.

- For a revenue stream relating to activity performed jointly with third-parties, insufficient evidence of the audit team's understanding of contractual arrangements and the completeness and accuracy of revenue allocations.

- Weaknesses in the testing of revenue completeness and cut-off, where these areas had been identified as significant risks by audit teams.

Other common findings resulting in lower quality assessments

Key findings in the following areas were also common drivers of a lower quality assessment on individual audits:

- Risk assessment: We identified key findings on four audits. These mostly related to cases where there were shortcomings in the evidence retained by audit teams to support their risk assessment conclusions or to test the design and implementation of related controls. We also identified other findings on four additional audits relating to weaknesses in audit teams' procedures to meet the requirements of ISA (UK) 315 (Revised).

- Going concern: We identified key findings on three audits. These largely related to cases where audit teams had not sufficiently corroborated and challenged the cash flow forecasts used in management's forecast assumptions, or adequately assessed the impact of related sensitivities on the going concern model.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

3. Tier 2 and Tier 3 Inspection results: firms' SoQM

SoQM inspection scope

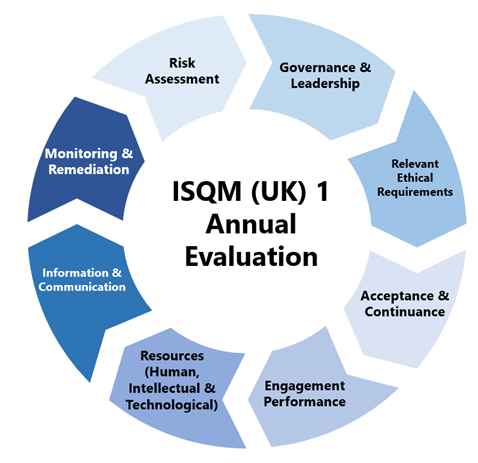

ISQM (UK) 1, which replaced the quality control standard International Standard on Quality Control (UK) 1 (ISQC (UK) 1), introduced a fundamental change for firms' quality management approaches from a quality control approach to a customised, risk-based system of management[^3].

ISQM (UK) 1 is underpinned by the principle that a firm's SoQM must be appropriate and proportionate to the nature and size of the firm. Each firm is required, at least annually, to evaluate its own SoQM to assess whether it provides the firm with reasonable assurance that its quality objectives are met. Firms must identify and assess the severity and pervasiveness of any deficiencies and the extent to which these have been remediated.

During 2023/24, we inspected the SoQM at two out of the 12 firms inspected.

Our inspection programme covered each area set out in ISQM (UK) 1 and we paid particular attention to firms' implementation of this new standard.

As part of reviewing each firm's SoQM, we evaluated samples of the operation of responses to the quality risks that have been identified. For 2023/24, we performed our inspection based on the systems firms had in place to support their annual evaluation falling into the 23/24 inspection year.

Given the small sample of Tier 2 and Tier 3 firms' SoQMs inspected in 2023/24, we are unable to draw conclusions about the implementation of ISQM (UK) 1 across these firms as a whole.

[^3] The FRC's 2024 Annual Review of Audit Quality contains details of the new standard and the key differences between ISQM (UK) 1 and ISQC (UK) 1 and is available on our website.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

3. Tier 2 and Tier 3 Inspection results: firms' SoQM (continued)

SoQM key inspection findings

We identified key inspection findings in the following areas in our inspections this year:

ISQM (UK) 1 annual evaluation process

ISQM (UK) 1 requires that the individual(s) assigned ultimate responsibility and accountability for the SoQM shall evaluate the SoQM every year. The latest date on which the first annual evaluation could be completed was 15 December 2023.

We identified the following inspection findings at the two firms inspected in relation to the annual evaluation completed:

- Insufficient monitoring performed to support the conclusions in the annual evaluation, including a lack of evidence of how certain monitoring that had been performed on individual responses was considered.

- Insufficient evidence that all relevant sources of information had been appropriately considered in the annual evaluation.

- Insufficient evidence of how the severity and pervasiveness of deficiencies had been assessed.

ISQM (UK) 1 monitoring

ISQM (UK) 1 requires firms to establish a monitoring and remediation process to provide relevant, reliable and timely information about the design, implementation and operation of the SoQM.

We identified the following inspection findings at the two firms inspected in relation to the monitoring performed:

- A lack of evidence to demonstrate that the firm had implemented and completed adequate monitoring processes for the year covered by the annual evaluation.

- An absence of monitoring activities for certain responses to quality risks.

- A lack of sufficient detail in planned monitoring activities to test the implementation and operation of responses to quality risks.

In addition, we identified inspection findings across both firms inspected in the design assessments of responses to quality risks. These included examples where assessments or parts of the assessments were not completed in a sufficiently timely manner, adequately documented, or did not clearly demonstrate how the responses addressed the quality risks identified.

Other key findings

We also identified other key inspection findings in the following areas, many of which are consistent with our reported findings at other Tier 2 and Tier 3 firms in previous inspection cycles:

- Acceptance and continuance procedures: Weaknesses in the timeliness or evidencing of considerations in acceptance and continuance assessments performed for audit engagements, or a lack of appropriate approvals.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

3. Tier 2 and Tier 3 Inspection results: firms' SoQM (continued)

- Ethics and independence: Weaknesses in the timeliness and monitoring of annual returns, the monitoring of prohibited investments and other areas, and root cause analysis for ethics breaches.

- Partner and staff appraisals: A lack of a clear linkage between audit quality and reward for partners and / or staff, and weaknesses in the consideration of audit quality in individual appraisals.

- Partner portfolio management: Insufficient monitoring of partner and / or staff portfolios to ensure that partners have manageable workloads, engagements are appropriately resourced and that portfolios are aligned to skills and experience and contain an appropriate balance of risk.

- Assessment of service providers: No evaluation performed (a requirement under ISQM (UK) 1) for certain key service providers.

- Archiving compliance and monitoring: Failure to archive certain audit files within the firms' policy or the period required by auditing standards, and weaknesses in the monitoring of archiving compliance.

- Audit methodology: A lack of a sufficiently developed audit methodology for certain sector-specific considerations.

- Internal quality monitoring: Weaknesses in the robustness of internal inspections, including examples where our inspections identified significant deficiencies not identified in the internal review.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

4. Forward looking supervision

We take a risk-based and proportionate approach to the supervision of PIE audit firms balancing holding firms to account to improve audit quality and sharing good practice to facilitate improvements across the sector. In 2023/24 we increased the extent and depth of our support for Tier 2 firms, many of which are growing their audit portfolios, and we expanded our programme of technical briefings and roundtables available to Tier 2 and Tier 3 firms to share more about what good looks like.

Our supervision work focuses on areas which are key to improving audit quality and enabling firms to grow safely and conduct more complex audits. Set out below are some of the key observations from our work in these areas in 2023/24.

Audit quality plans (AQP)

A comprehensive AQP enables a firm to capture and prioritise its audit quality initiatives, ensuring that they are well understood with clear accountabilities, timeframes and how the firm will measure the effectiveness of the actions it has taken.

Observations

We assessed the development of their AQPs as a key priority for most Tier 2 firms, particularly to ensure that they include:

- Forward looking improvement initiatives as well as the remediation of historical issues.

- Realistic time-frames for the implementation of initiatives as well as meaningful and timely measures to assess their effectiveness.

- Reporting tools and dashboards that facilitate oversight by the firm's leaders and independent non-executives.

We will continue to monitor this area in 2024/25.

Root cause analysis (RCA)

Monitoring and remediation of deficiencies is a vital component of a firm's SoQM. A robust RCA process is essential for identifying the causes of audit quality issues so that effective remedial actions may be developed.

Observations

Many Tier 2 and Tier 3 firms need to improve their RCA process and ensure that a wide range of potential causal factors, including cultural and behavioural factors, are considered.

In 2024/25, we will inspect all Tier 2 firms' monitoring and remediation procedures and convene roundtables for firms to share good practices.

We have recently published a thematic review on RCA at Tier 1 firms which all Tier 2 and Tier 3 firms should review carefully to identify any areas relevant to their circumstances.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

4. Forward looking supervision (continued)

Acceptance and continuance

Firms must develop a formalised and thorough acceptance and continuance process to ensure that the risks connected with an entity are understood and that the firm has sufficient suitably trained and competent individuals with sufficient time to perform the engagement, as well as comply with ethical requirements.

Observations

We reviewed and benchmarked most Tier 2 and Tier 3 firms' acceptance and continuance procedures in 2023/24. We found weaknesses in how several firms considered their resourcing capacity prior to accepting an audit and that many firms did not have formal continuance procedures, presenting a risk of inconsistent decision-making and a failure to consider issues arising during, and subsequent to, the previous engagement.

Examples of actions taken by firms to strengthen their procedures in this area include:

- Applying a risk classification to audit tenders based on the profile of the entity, enabling the acceptance process to be tailored proportionately to the risk.

- Developing a process for monitoring and responding to the risks posed by audited entities where the firm has developed concerns regarding management's behaviours and the quality of information provided to the audit team. Responses may include requesting improvements from management or considering resigning from the engagement.

Human resources

The ability to attract, develop and retain talent is key to delivering high-quality audits, particularly in a profession facing resourcing challenges. Portfolio and performance management processes also play an integral part in shaping and embedding an appropriate audit culture.

Observations

We reviewed and benchmarked elements of most Tier 2 and Tier 3 firms' human resources procedures in 2023/24. We found that some firms failed to monitor whether individuals had fulfilled CPD requirements, presenting a risk that staff do not maintain the appropriate level of knowledge, skills and behaviours. Others were not sufficiently taking audit quality into account in the appraisal process or explicitly linking audit quality to reward.

Examples of actions taken by firms to strengthen their procedures in this area include:

- Developing an automated tool used to monitor bespoke training requirements for individuals.

- Performing periodic portfolio reviews for both RIs and managers and setting specific thresholds or audit quality indicators that trigger portfolio reviews outside the normal cycle.

- The use of exit interviews and surveys to explore areas such as work intensity and wellbeing, time and resources, and training and development.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

4. Forward looking supervision (continued)

Culture

We expect firms to develop a culture that promotes a strong commitment to quality, with a focus on the public interest and the highest ethical standards.

Recurring inspection findings in the audit of estimates and judgements across Tier 2 and Tier 3 firms as a whole raise questions about whether some firms need to do more to develop and embed a culture of scepticism and challenge. Our culture work focuses on the behaviours and mindset that correlate to high quality audit and ethical conduct.

Observations

Tier 1 firms have invested heavily in audit culture over the last four years, and we are starting to see significant improvements as a result of the commitment to quality by the firms' leadership and greater awareness of the impact of values and behaviours.

Tier 2 and Tier 3 firms are at various stages of their culture journey. Those that have more advanced cultural programmes, where desired audit values and behaviours are promoted through their wider policies and procedures, including training and coaching, performance management and reward and recognition, typically have better or improving audit quality outcomes.

Governance

Our thematic work on governance is focused on Tier 1 and Tier 2 firms. As with Tier 1 firms, all Tier 2 firms apply the Audit Firm Governance Code (AFGC), some applying it for the first time in their financial year commencing in 2023.

During 2023/24 we focused on providing guidance and advice to Tier 2 firms on first steps when applying the AFGC, as well as, at some firms, monitoring changes made to address our previous observations.

Observations

Key to the successful implementation of the AFGC is the appointment of independent non-executives (INEs). Three is the general standard for firms applying the AFGC. If a firm considers that having two INEs is proportionate to its circumstances, this can be explained and remain compliant with the AFGC.

Considerable progress has been made by Tier 2 firms, all of which have now appointed at least two INEs. Our focus is now on each firm's broader governance structures and how the INEs are positioned within the governance framework.

We are in the process of assessing or updating our assessment of all Tier 2 firms against the 2022 AFGC, providing them with feedback on good practice we identify, areas for improvement and any gaps we find.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

5. PIE Auditor Registration

PIE Auditor Registration has now been operating for two years. All audit firms and RIs must register with the FRC before undertaking any PIE audit work.

As at 31 October 2024, Tier 2 and Tier 3 firms represent 24 of a total of 37 PIE registered firms. The number of Tier 2 and Tier 3 firms has remained relatively constant since the regime was launched on 5 December 2022 as illustrated below:

Tier 2 and Tier 3 PIE registered firms

The Registration team considers a wide range of information when making registration decisions. Where appropriate, we hold firms and RIs to account through measures on their registration. These include conditions, undertakings and suspending or involuntary removal of a firm's or an RI's registration.

On 5 December 2022, 25% of PIE registered firms had measures on their registration. This increased to 32% as at 31 October 2023 and has increased again to 38% as at 31 October 2024. The increase reflects our response to emerging audit quality concerns at certain firms.

The publication of measures on a firm's registration is considered on a case-by-case basis based on our assessment of the public interest. To date, no decisions to impose or agree measures have been published.

We monitor closely how firms are responding to measures on their registration and, in most cases, firms are required to report to us regularly on the actions they are taking.

Once we are satisfied that the matters giving rise to the measure have been adequately addressed by the firm, we will consider removing the measure, as illustrated in the case study below.

Further details of our PIE Auditor Registration regime may be found on our PIE Auditor Registration webpage.

Case study

Arising from issues raised in previous regulatory inspections, measures were attached to a firm's PIE Auditor Registration requiring it to demonstrate improvements in audit quality and to seek approval from the FRC before accepting any new PIE audit appointments.

The firm worked closely with the FRC over an 18-month period and was able to demonstrate the improvements it had made in areas including its:

- Methodology and working paper templates.

- Policies and procedures.

- Internal quality monitoring procedures.

- Root cause analysis process.

- Resources allocated to central audit quality functions.

As a result of the actions taken by the firm, and outcome of recent regulatory inspections, the FRC agreed to lift the measures on the firm's PIE Auditor Registration.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

6. Audit Firm Scalebox

The Audit Firm Scalebox (Scalebox) is an improvement initiative, launched in summer 2023, to help smaller audit firms develop and maintain the standards of audit quality expected in the PIE audit market.

Though it is still too early to assess the impact of Scalebox to date, we have been encouraged by the commitment to audit quality that firms joining the Scalebox have demonstrated. We are pleased that 13 firms (12 of which are registered PIE auditors and one firm looking to join the PIE market in the medium term) are currently participating and are engaging constructively with the Scalebox team.

The Scalebox operates under a general principle that information gathered during Scalebox activities will not be shared with any other party unless disclosure is deemed by the FRC to be necessary in the public interest. It is not intended as a standalone solution for challenges in the market but is aimed at providing firms with feedback on their audit work, as well as developing their understanding of actions to improve audit quality and other regulatory requirements. The quality assurance team at the ICAEW, which monitors firms' non-PIE audits, has also worked alongside the Scalebox team to provide co-ordinated feedback in certain areas.

Feedback to date from Scalebox participants has been extremely positive. Some firms have confirmed that Scalebox feedback is being incorporated into their audit working paper templates and internal training, and that the Scalebox has helped them develop a better understanding of what good looks like in a number of areas.

In 2024/25 we plan to further develop the range of activities offered by the Scalebox based on feedback from firms and emerging quality issues.

Recent Scalebox activities

Audit area reviews:

We reviewed extracts from audit files focusing on areas of common and recurring inspection findings. We gave firms bespoke feedback on their work and what good looks like, as well as identifying what they had done well. Firms also have the opportunity to have a whole non-PIE audit reviewed by the Scalebox team.

| Focus areas |

|---|

| Going concern |

| Revenue |

| Journal entries |

| Impairment |

| Use of experts |

| Group audits |

Aide memoires:

To promote consistent application, we provide written feedback on some audit areas to all Scalebox firms, covering the main high-level themes and good practice points.

Off the shelf methodology:

Most firms within Scalebox use off the shelf methodology as a starting point for their audit methodologies. We are conducting a review of certain aspects of the methodology packages, which will focus on helping firms understand where and how they need to tailor or enhance their methodology.

Developing understanding:

Many Scalebox firms are new to FRC regulation. In these monthly discussion and roundtable sessions we aim to share more about the FRC's approach to regulation so that they are prepared for our inspection, supervision and enforcement work. We also cover wider and emerging issues to help firms develop and adapt their audit practices and approaches.

| Example discussion topics |

|---|

| FRC inspection expectations |

| Enforcement at the FRC |

| Developing a firm's audit quality function |

| Common issues in corporate reporting |

| Climate change and audit |

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

Appendix A – Definitions

Tier definitions - further information may be found in Our Approach to Audit Supervision

| Category | Description |

|---|---|

| Tier 1 | Firms with the largest share of the UK PIE and Major Local Audit markets, which together audit approximately 1,290 PIEs, including the majority of UK-incorporated FTSE 350 entities. |

| Tier 2 | Tier 2 firms will ordinarily have a significant portfolio of PIE audits (usually at least ten). We also take into account the characteristics of a firm's audit practice as a whole. |

| Tier 3 | Firms that audit PIEs but do not meet the criteria for inclusion in Tier 1 or Tier 2. |

When assessing which Tier is appropriate for a firm, we consider the number and nature of its audits, and other risk factors that may apply, for example the firm's growth plans or specific risks to audit quality. The tiering decision impacts the base level of supervisory activity a firm can expect, including the frequency and nature of inspections of individual audits and the firm's SoQM. We may enhance our supervision and inspection activity at firms where we have particular audit quality concerns.

Audit inspections: how we categorise audit quality - further information may be found on our website

| Category | Description Soft Audit Quality Inspection and Supervision 2023/24

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Appendix B – Monitoring reviews by the Recognised Supervisory Bodies (RSBs)

Tier 2 and Tier 3 firms are subject to independent monitoring by their RSBs[^4], under delegation from the FRC as the Competent Authority. The RSBs monitor audits of private companies, smaller AIM listed companies, charities and pension schemes, and review the CPD records of a sample of the staff involved in those audits. The FRC is responsible for reviewing Tier 2 and Tier 3 firms' SoQM.

The frequency of an RSB review at a Tier 2 or Tier 3 firm will depend on the size and nature of a firm's audit practice and other risk factors, but is typically between every two and six years. The selection of audits for monitoring is focused towards higher risk, more complex entities. As a result, and as different firms receive visits each year, the outcomes for any year do not indicate overall audit quality for any individual firm, or for Tier 2 /3 firms as a whole. No conclusion on trends in audit quality should be drawn based on changes from one year to the next.

The outcomes of the RSBs' reviews for the last five years are set out below:

RSB review outcomes

Bar chart displaying RSB review outcomes from 2019/20 to 2023/24 and an aggregate, showing percentages of 'Significant improvements required', 'Improvements required', and 'Good/satisfactory or generally acceptable'. For example, 2023/24 shows 85% good/satisfactory, 3% improvements required, and 12% significant improvements required.

34 audit files were reviewed at six firms in the year ended 31 March 2024. 85% of audits were assessed as either good or generally acceptable (2022/23: 76%). Four audit files were assessed as requiring significant improvement (2022/23: nil). The findings in these audits largely related to deficiencies in the audit of complex areas, such as fraud and long-term contracts, where the audit teams had conducted insufficient audit work to support the conclusions reached.

Examples of findings

- Weaknesses in the audit of material provisions.

- Lack of challenge in relation to assumptions regarding investment property valuations and subcontractor retentions.

- Insufficient audit evidence in significant risk areas (fraud in revenue recognition and stock valuations).

- Weaknesses in identifying controls relevant to risk assertions and performing walkthrough testing of systems.

Examples of good practices identified

- Clear audit documentation in relation to: work conducted on going concern; consideration of independence and ethical matters; review of component auditor working papers.

- Robust challenge of management on key inputs and assumptions used in impairment models.

- Clear record of the quality control process, including evidence of challenge by the RI and the EQR.

[^4] The RSB for 23 of the 27 firms listed in Appendix C is the Institute of Chartered Accountants in England and Wales (ICAEW). The remaining firms are monitored by the Institute of Chartered Accountants of Scotland (ICAS) and Chartered Accountants Ireland (CAI).

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

Appendix C - Firms in Tier 2 and Tier 3 for 2023/24

The following tables set out the firms in Tier 2 and Tier 3 for 2023/24 together with, for comparison purposes, details of their audit portfolios.

| Tier 2 (6) | Audit fee income (£m) | PIE audit fee income (£m) | FRC scope audits |

|---|---|---|---|

| Crowe U.K. LLP | 61.0 | 1.5 | 37 |

| Grant Thornton UK LLP | 192.5 | 6.3 | 31 |

| Johnston Carmichael LLP | 17.6 | 0.9 | 45 |

| MacIntyre Hudson LLP | 52.0 | 5.0 | 47 |

| PKF Littlejohn LLP | 39.7 | 5.5 | 90 |

| RSM UK Audit LLP | 141.0 | 6.0 | 26 |

| 503.8 | 25.2 | 276 |

| Tier 3 (21) | Audit fee income (£m) | PIE audit fee income (£m) | FRC scope audits |

|---|---|---|---|

| Anstey Bond LLP | 0.4 | 0.02 | 1 |

| Beever and Struthers | 8.6 | 1.23 | 17 |

| Begbies | 0.9 | 1 | |

| Bright Grahame Murray | 1.8 | 0.06 | 2 |

| Deloitte (NI) Ltd | 5.5 | 4 | |

| Gerald Edelman LLP | 5.5 | 0.26 | 4 |

| Grant Thornton (NI) LLP | 4.8 | 0.27 | 4 |

| Gravita Audit II Limited | 4.2 | 0.70 | 2 |

| Hazlewoods LLP | 6.8 | 0.10 | 3 |

| HaysMac LLP (formerly Haysmacintyre LLP) | 29.3 | 0.15 | 5 |

| Johnsons Financial Management Ltd | 2.0 | 0.23 | 3 |

| Kreston Reeves LLP | 12.7 | 0.16 | 8 |

| LB Group Ltd | 2.0 | 0.03 | 2 |

| Macalvins Ltd | 0.4 | 0.01 | 2 |

| Moore Kingston Smith LLP | 28.5 | 0.60 | 12 |

| Pointon Young Limited | 0.1 | 0.03 | 2 |

| Price Bailey LLP | 9.4 | 0.02 | 2 |

| Royce Peeling Green Limited | 1.2 | 0.29 | 9 |

| RPG Crouch Chapman LLP | 3.8 | 0.70 | 9 |

| Shipleys LLP | 5.5 | 0.17 | 15 |

| Zenith Audit Ltd | 0.6 | 1 | |

| 134.0 | 5.03 | 108 |

Notes:

- Firms with names in orange were no longer PIE audit firms by 31 March 2024.

Sources:

- Submissions by firms to the FRC for the FRC Key Facts and Trends 2024 (KFAT) publication and other purposes, and other information held by the FRC, including firms' Transparency Reports, where available.

- The number of FRC scope audits is as per information held by the FRC as at 31 December 2023.

FRC | Tier 2 and Tier 3 Audit Firms | Audit Quality Inspection and Supervision 2023/24

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

www.frc.org.uk

Follow us on LinkedIn or X @FRCnews