The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

NHS Audit Market Study Emerging Findings

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2024

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

- 1. Introduction

- 2. Summary of key emerging findings

- 3. Market background

- 4. Market characteristics and trends

- 5. Stakeholder views

- Views on the current functioning of the NHS audit market

- Overview of issues identified by stakeholders

- Market capacity constraints

- Timetable pressures

- Conflicts of interest

- Geographic limitations

- Recruitment of staff and access to talent pool

- Other potential constraints on market capacity

- Choice and competition

- Barriers to entry

- NHS audit procurement

- Audit quality and timeliness

- Engagement levels during audits

- Quality versus deadlines

- Value of audit

- Future effectiveness of the NHS audit market

- Potential changes to NHS audit procurement processes

- Potential changes to the delivery of financial statements and audits

- Potential changes to reporting, audit and regulatory frameworks

- 6. Invitation to comment

1. Introduction

1.1This document sets out the emerging findings from the Financial Reporting Council's (FRC's) NHS Audit Market Study, launched in July 2024. It includes a one-page summary; an overview of the market's characteristics and trends; and a summary of stakeholders' views on the market. In the final section, we set out areas where we would like to receive further written information to inform the remainder of the study.

Aims of the study

1.2One of the FRC's priorities is to lead work with system partners to improve the capacity and capability of the local audit market. As part of this activity, we have heard concerns from some stakeholders about the NHS external audit market.

1.3This study is focused on how the audit market for NHS providers (NHS Trusts and Foundation Trusts) and Integrated Care Boards (ICBs) in England is functioning, how it should function in the future, and whether there are any lessons on good practice for the wider local audit market.

1.4The market study has three broad themes – the supply of auditors, the demand for NHS audits, and the regulatory framework.

Information gathering and stakeholder engagement

1.5Following the launch of the market study, we have gathered the following information and data from several sources:

- Publicly available data on NHS audit engagements collated by NHS England (NHSE).

- Eighty-three responses to our survey of NHS bodies1 and two roundtables with NHS bodies.2

- Twenty-one bilateral meetings with audit firms, NHS bodies and other system stakeholders.

- Nine written submissions to our launch document. These have been published at: https://www.frc.org.uk/consultations/nhs-audit-market-study/

Next steps

1.6Alongside seeking written responses to these emerging findings, we intend to hold further meetings with stakeholders over the next few months. We are planning to conclude the market study and produce our final report with any proposals for action in Spring 2025.

2. Summary of key emerging findings

2.1Based on the data and stakeholder views gathered to date, it appears that the NHS audit market is functioning but there are issues in the market that may risk future resilience.

2.2These issues may be resulting in a limited choice of auditor for some NHS bodies, especially in certain parts of England. Only three of the nine firms active in the market have NHS audit clients across all of England's regions. A total of 87% of NHS bodies responding to our survey told us they had concerns about the choice of auditor for their next audit.

2.3The main issues we have identified to date are summarised below.

Potential constraints on market capacity (see paragraphs 5.5 – 5.16)

2.4Audit firms active in the market have told us they have sufficient capacity to supply audits to their current NHS audit clients but face barriers to expanding their capacity. The firms have reported the following as factors affecting their capacity: audit timetable pressures; conflicts of interest; geographic limitations and segmentation; hiring appropriately qualified staff; and local authority audit backlogs. Some NHS bodies' finance teams have also reported their capacity to produce high-quality financial information to support the delivery of high-quality audits may be limited.

Concerns about the procurement process (see paragraphs 5.17 – 5.21)

2.5Audit firms active in the market, and some audit firms not currently supplying NHS audits, have raised concerns about procurement frameworks used for external audit within the NHS. Audit firms have reported problems with the timing and complexity of audit tender processes, and a lack of pre-bidding engagement between NHS bodies and audit firms. These problems may be adding to the barriers to expansion mentioned above and creating barriers to entry for potential new suppliers.

Different views on the value of NHS audits (see paragraphs 5.22 – 5.29)

2.6Stakeholders have offered different views on the value and purpose of NHS audits. We have heard about good relationships between auditors and NHS bodies but potential differences in their priorities, with some audit firms telling us NHS bodies prioritise meeting audit deadlines and achieving financial targets over ensuring good quality accounts and audits. This may lead to different views on the value of NHS audits. Some NHS bodies have questioned the purpose of Value For Money (VFM) reporting that forms part of their audits, while other stakeholders have told us VFM is an important element of NHS audits.

3. Market background

3.1The scope of the market study is limited to external audit of NHS Trusts and Foundation Trusts (collectively known as NHS providers) and ICBs (also referred to as NHS commissioners). These different types of organisations are collectively referred to as NHS bodies in this document. The scope of the study does not include other types of NHS organisations.

3.2For the financial year 2023/24 there were 211 NHS providers and 42 ICBs. The 42 ICBs were established in 2022, replacing 106 Clinical Commissioning Groups (CCGs).3 NHS bodies sit within Integrated Care Systems (ICSs). Each ICS contains one ICB and several NHS providers, determined by geographic location.4

3.3Since the passing of the Local Audit and Accountability Act 2014 (the Act), NHS Trusts and ICBs (previously CCGs) have been required to procure and locally appoint their own auditors, with the process overseen by an auditor panel.5 NHS Trusts and commissioners have procured their own auditors since 2017/18. Public Sector Audit Appointments Limited (PSAA) managed the ongoing contracts during 2015/16 and 2016/17. Collectively, NHS Trust, ICB and local government audits are known as local audits.

3.4Foundation Trusts are responsible for appointing their auditors under the passing of NHS Act 2006.6 Appointments are made by Foundation Trusts' council of governors, with audit committees supporting the council of governors, including monitoring auditors' performance.7 Foundation Trust audits are not classified as local audits.

3.5Audits of NHS bodies are conducted in accordance with the Code of Audit Practice issued by the National Audit Office (NAO). The FRC's Audit Quality Review (AQR) team is responsible for monitoring the quality of major local audits (MLAs). An MLA is an audit of an NHS Trust, ICB or local government body with income or expenditure of at least £500 million, or which maintains a local authority pension scheme of certain characteristics.8 The ICAEW's Quality Assurance Department (QAD) is responsible for monitoring the quality of non-major local audits.

3.6NHSE is responsible for monitoring the quality of Foundation Trust audits. However, in recent years NHSE has contracted with AQR and QAD to perform quality inspections on its behalf, using the same income and expenditure thresholds as local audits to determine whether AQR or QAD performs the quality inspection.9

3.7In accordance with the Act and delegated legislation, to audit NHS Trusts and ICBs, audit firms must be a registered local audit firm,10 with key audit partners (KAPs) to sign off audits. While Foundation Trust audits are not subject to the same requirements, in practice it is local audit firms who conduct these audits.11

3.8There are currently 106 registered KAPs. Ninety KAPs have signed off NHS audits in the past year. We have been told that three of these will not be active in NHS audits for 2024/25. Two Responsible Individuals (RIs), who are not also KAPs, have also signed off Foundation Trust audits in the past year.

4. Market characteristics and trends

4.1This section provides details of NHS audit market characteristics and trends. It covers NHS audit fees, audit timeliness, audit firms' market shares, switching rates and regional differences in the supply of NHS audits across England.12

NHS audit fees

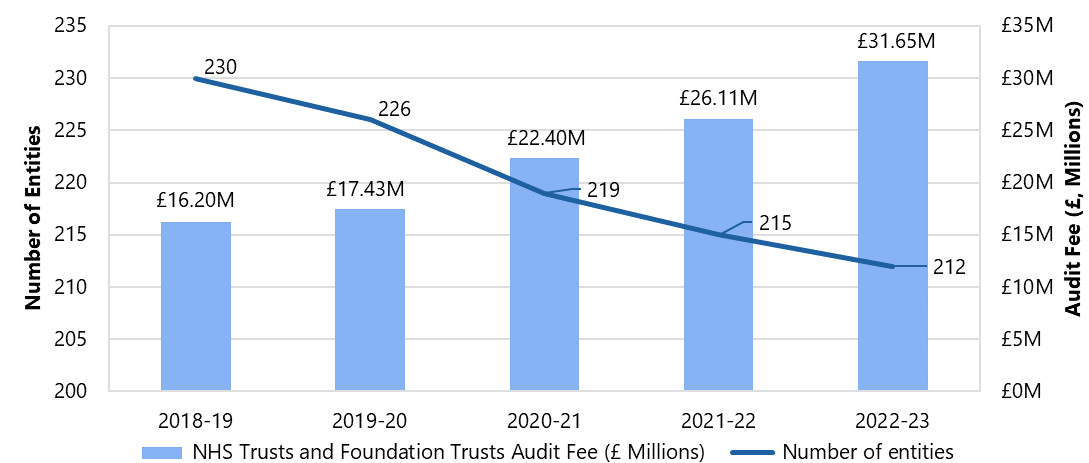

4.2In 2022/23, NHS providers paid a total of £31.65 million for their audits. Total audit fees increased by 95% from 2018/19 to 2022/23 (a period in which the number of NHS providers declined due to mergers). The trend in total audit fees is shown in Figure 1.

Figure 1. NHS providers' total audit fees and number of entities, 2018/19 to 2022/23

Source: Data from NHS providers' published consolidated accounts, collated by NHSE

4.3In 2020/21, there was a notable increase in audit fees, with NHS Trusts seeing a rise of 26% and Foundation Trusts experiencing a 20% increase. By 2022/23, however, the rate of increase had slowed, with NHS Trusts up by 19% and Foundation Trusts by 17%. This indicates that the trends in audit fee increases have been similar for both NHS Trusts and Foundation Trusts.

4.4The trends in audit fees for ICBs are difficult to conclude due to the transition from CCGs to ICBs in 2022/23. Currently, we have insufficient data (at least three years or more) to extract insights and establish a trend.

4.5In our recent survey of NHS bodies, we asked, "If your fees have increased, what do you believe the main reasons for this?"13 The most common factors cited for the rise in audit fees were additional requirements resulting from audit standards14 and regulations (62%) and the general increase in audit costs (52%).15

NHS audit timeliness

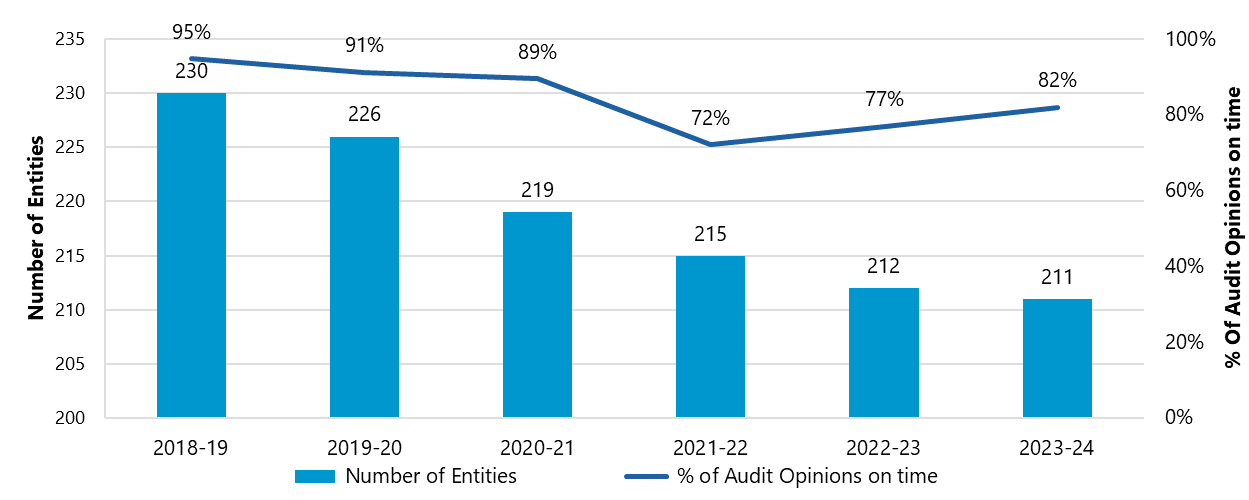

4.6In the past two years, there has been an improvement in the percentage of "on time” audit opinions for NHS providers following a decline between 2020/21 and 2021/22.16 The proportion of “on time” audit opinions rose from 72% in 2021/22 to 82% in 2023/24 as seen in Figure 2.

Figure 2. NHS providers percentage of opinions on time and total number of entities, 2018/19 to 2023/24

Source: Data from NHS providers' published consolidated accounts, collated by NHSE

4.7In our survey, most respondents (65%) indicated that receiving a delayed audit opinion did not apply to them. The reasons given for NHS audit delays included the capacity and capability of the auditor to complete the audit within the agreed timeline, which was selected by 21% of respondents. Additionally, 16% of respondents cited the auditor's capacity to handle unanticipated issues that arose during the audit. The survey results along with the market findings have reinforced that "on time" audit opinions are improving.

Audit firms' market shares

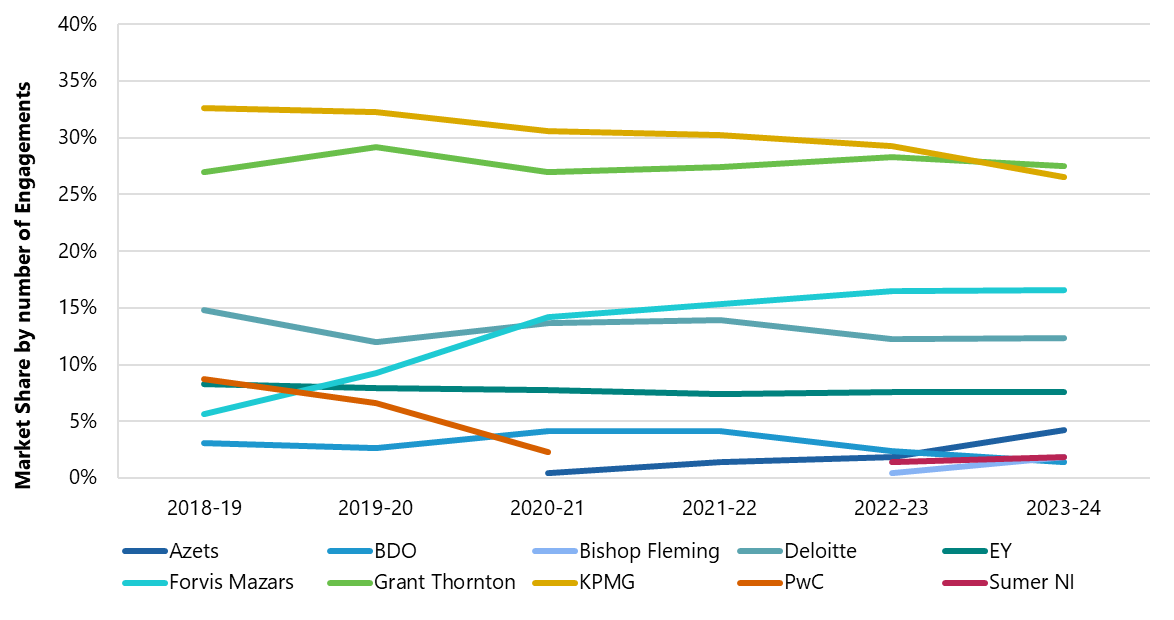

4.8Nine audit firms are currently active in the NHS audit market (Azets, BDO, Bishop Fleming, Deloitte, EY, Forvis Mazars, Grant Thornton, KPMG and Sumer NI).

4.9In terms of market shares by audit engagements, Grant Thornton and KPMG hold the largest shares with 27% and 26% respectively in 2023/24 for NHS providers. The three recent new entrants – Azets, Bishop Fleming and Sumer NI – have a relatively low combined market share of 8% as of 2023/24. In 2020/21, PwC exited the market. Forvis Mazars experienced the largest increase in its market share of NHS provider audit engagements with a rise of 11%, from 6% in 2018/19 to 17% in 2023/24. Figure 3 shows the market shares of audit firms by engagement for NHS providers.

Figure 3. Market share of audit firm engagements of NHS providers, 2018/19 to 2023/24

Source: NHSE collated data

Switching

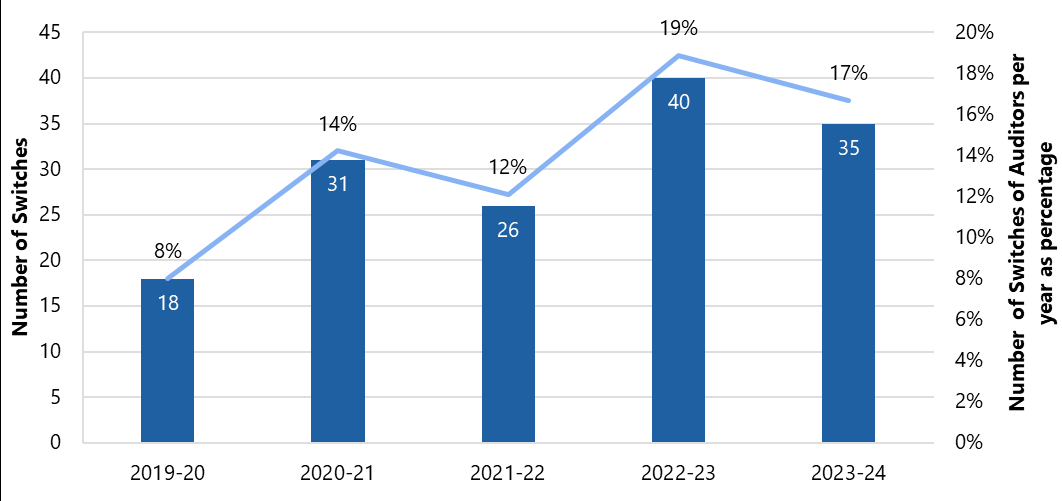

4.10As shown in Figure 4 below, the switching of audit firms by NHS providers has increased from 2019/20 to 2023/24. As we do not have data on the number of tenders per year, we do not know what percentage of tenders resulted in switches. Some of the switches may be due to mergers between some NHS bodies. In response to our survey, 41% of respondents said their last audit tender ended in a switch, though 47% said they only received one bid.

Figure 4. Number of audit firm switches per year for NHS providers 17, 2019/20 to 2023/24

Source: NHSE collated data

Regional analysis

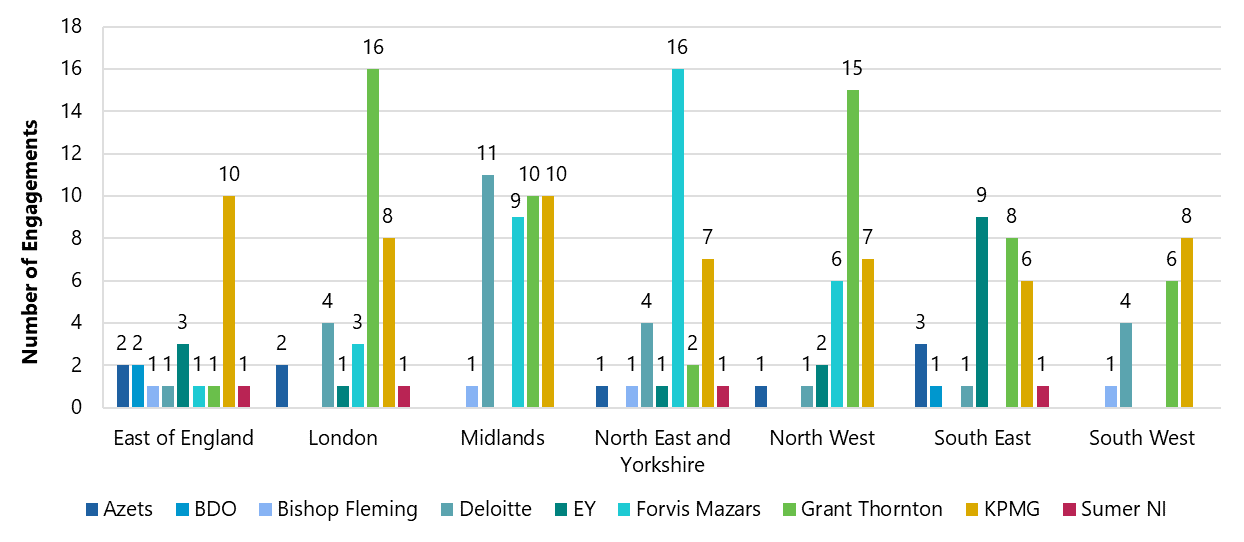

4.11The regional breakdown of audit engagements for NHS providers shows that the North-East and Yorkshire (8) together with the East of England (9) have the highest number of audits firms with NHS clients. Grant Thornton and KPMG have the largest number of engagements in most regions. The only region which has a substantial market leader, in terms of engagements, which is not Grant Thornton or KPMG is the North-East and Yorkshire, where Forvis Mazars are the market leader. The geographical spread of audit firms in these regions may be partly due to legacy contract allocation, pricing strategies and conflict of interest between audit and non-audit work. Figure 5 provides a breakdown of audit firms' NHS provider engagements by region.

Figure 5. Audit firm engagements by regions for NHS providers - 2023/24

Source: NHSE collated data

4.12The data suggests regional segmentation in the NHS audit market, which may impact the choice of audit firms available to some NHS bodies. Apart from KPMG, most audit firms appear to be more active in some geographic regions than others. For example, in 2023/4, 42% of Deloitte's NHS provider audits were in the Midlands and 45% of Forvis Mazars' NHS provider audits were in the North-East and Yorkshire.

5. Stakeholder views

5.1In this section, we set out emerging findings from our stakeholder engagement, in line with the themes and consultation questions set out in our market study launch document.

Views on the current functioning of the NHS audit market

5.2Most stakeholders (audit firms, NHS bodies and professional bodies) told us that the NHS audit market is functioning but there are issues affecting the market. Many stakeholders reported that the NHS audit market had functioned more effectively in the past and there was a downward trajectory in its effectiveness, particularly in terms of capacity and choice.

5.3While stakeholders mentioned concerns about the functioning of the NHS audit market, most firms active in the market told us it was working more effectively than the market for local government audits. Some audit firms mentioned positive demand-side features such as the high levels of engagement from NHS bodies and their professionalism.

Overview of issues identified by stakeholders

5.4In commenting on the downward trajectory in the NHS audit market's effectiveness, many stakeholders have mentioned similar issues about the market and many of these issues have been raised about the local government audit market too. The most important, varied by type of stakeholder, is summarised below:

- Many audit firms active in the market have reported capacity constraints and problems with the procurement process for NHS audits.

- Many NHS bodies mentioned limited auditor choice, increasing audit fees and regulatory pressures.

- Professional bodies reported barriers to entry and expansion, and capacity constraints.

Market capacity constraints

5.5Audit firms active in the market told us they had sufficient capacity to deliver their current NHS audits. However, there were barriers to expansion. Audit firms mentioned the following as specific barriers or constraints to increasing their capacity.

Timetable pressures

5.6Most audit firms mentioned that tight reporting timetables and short audit timeframes were causing resource strain and acting as barriers to growth by limiting the number of tenders they were willing to engage with and bid for. Audit firms indicated that from a risk perspective, they would prefer to focus on delivering a lower volume of audits to a high quality, within the designated timeframe, than risk compromising quality by taking on more work.

5.7Most audit firms told us that while well-organised NHS bodies could meet deadlines, capacity and capability among NHS bodies is variable, and the current deadlines could lead to capacity strain, which can compromise reporting and audit quality. Audit firms and NHS bodies both noted capacity constraints due to overlapping schedules for other essential activities, such as financial planning returns, which often coincide with the accounts and audit period, leading to coordination issues.

Conflicts of interest

5.8Five of the nine audit firms mentioned conflicts of interest considerations regarding the provision of non-audit services to NHS audit clients as a barrier to bidding for NHS audits. Some audit firms told us that they divide geographic regions based on where they offer audit and non-audit services, which constrains their ability to increase their NHS audit clients in certain areas.

5.9Some audit firms mentioned that the transition from CCGs to ICBs might reduce audit opportunities. Since ICBs cover larger areas, firms offering non-audit services to ICBs could be restricted from auditing more NHS providers within the same ICS than before (see paragraph 3.2). However, there appears to be inconsistent interpretations among audit firms as to what constitutes a conflict in this scenario. A system stakeholder told us this inconsistency may be attributable to individual audit firms' risk appetite rather than ambiguity in guidance.

Geographic limitations

5.10Most audit firms mentioned focusing on specific regions to manage their capacity. They told us that geographic location influences client selection and can impact market dynamics, particularly when it comes to auditor choice and price expectations.

5.11Some audit firms said geographic limitations are influenced by both physical presence in regions and strategic decisions regarding non-audit services. While hybrid audits have become more common, our roundtables with NHS bodies revealed a strong preference for auditors to be mainly on-site, which may limit auditor firms' ability to take on clients in certain regions.

Recruitment of staff and access to talent pool

5.12There was consensus among audit firms that recruitment and retention of good quality, experienced staff was a challenge. Audit firms reported that increasing capacity required substantial investment in training.

5.13The challenges in recruiting and retaining staff may be related to audit firms using the same resources for local government audits. All six audit firms which supply audits to local government bodies for the four-year period commencing 2023/24 are active in the NHS audit market. Firms which have been active in local government audits in recent years agreed that the local government audit backlog had impacted the resourcing of NHS audits and may continue to do so. We also note that there have been recent examples of delays in local government pension scheme audits directly delaying the delivery of NHS bodies' audits.

5.14Some audit firms told us that the regulatory environment, including the need for sector-specific knowledge and accreditation for NHS and local audits in general, added a particular challenge for the recruitment of staff to undertake NHS audits.

Other potential constraints on market capacity

5.15Alongside constraints affecting audit firms' capacity, we have heard of potential capacity issues for NHS bodies' finance teams that may adversely affect NHS financial reporting. Stakeholders cited several challenges for NHS finance teams including increasing workloads, the need for better national planning and for more continuous training and development to ensure high-quality financial reporting.

5.16However, we have received mixed views on the actual capacity and capability of NHS finance teams. While only 19% of NHS bodies responding to our survey said their capacity to deliver high quality audits on time was very good, 51% reported that they had very good capability. All audit firms told us that NHS bodies' finance teams face capacity challenges, with two audit firms highlighting this as a significant issue.

Choice and competition

5.17The majority of NHS bodies we engaged with told us that they have struggled to find auditors, had limited choice and had concerns about their next audit tender. Our survey results highlight the lack of choice some NHS bodies faced in their last audit tender exercise:

- A total of 47% of respondents only received one bid, with 7% receiving no bids at all.

- A total of 59% of respondents appointed their incumbent auditor, with nine appointments made without any formal bid.

- A total of 70% of respondents had concerns about their next audit tender, with a further 17% having serious concerns.

Barriers to entry

5.18We spoke to six audit firms that could potentially enter the NHS audit market. Four reported that they would consider entering the market, with two particularly interested and willing to audit MLAs, but all six audit firms reported barriers to entry:

- All six firms highlighted regulatory requirements as a major barrier, namely the experience requirement to be an accredited local audit firm with KAPs. Two of these firms, plus two firms currently active in NHS audits, told us that they see the concept of KAPs as an unnecessary barrier for NHS Trust and ICB audits.

- All six firms expressed concerns about having sufficient staff and resources to deliver high-quality audits if they were to enter a new market. Five firms said they would need to hire staff from current local audit firms, given the regulatory experience requirements.

- All six firms mentioned the need for attractive NHS audit fees and commercial returns. There was a perception that fees are still relatively low in comparison to other markets the firms operate in, though two firms commented on a recent increase in fees, which they find financially appealing.

- Five firms highlighted the complexity of public sector procurement frameworks. The process is seen as labour-intensive and slow, with limited opportunities for early engagement with clients. This mirrored concerns we heard from the audit firms currently active in NHS audits.

NHS audit procurement

5.19Most audit firms active in NHS audits told us there were substantial issues with the competitive process for winning NHS audit contracts, which could further limit choice for NHS bodies. While the firms recognised the effectiveness of the guidance that NHSE and HFMA have produced to improve the audit tendering process, they said more improvements could be made.

5.20The audit firms raised the following as concerns with the procurement process for NHS audits:

- Long and complicated tender processes, as well as NHS invitations to tender issued during busy audit periods like May, June or December.

- Tender exercises being procurement driven rather than led by NHS finance teams.

- Difficulties with procurement frameworks that hinder firms' ability to bid for audit work. Tender documentation and terms and conditions might be not relevant for external audits, which extended the bid process and made it difficult for audit firms to tailor their responses. One new entrant told us they had been waiting over a year to be put on an NHS procurement framework.

- A lack of engagement from NHS bodies before bids, which could lead to higher price points due to firms struggling to tailor their bids without any existing relationships or dialogue.

- A focus on price over quality. If the NHS bodies' selection criteria prioritised price, this could lead to audit firms deciding not to bid.

5.21Our survey results align with some of the issues raised by the audit firms. Through our survey, NHS bodies reported the most important factors for a successful audit procurement were: engagement of NHS finance teams with the tender process, audit fees, engagement with audit firms ahead of the tender, the time allowed for audit firms to bid and the tender timing.

Audit quality and timeliness

5.22We heard that generally the relationships between audit firms and NHS bodies were good but there can be differences in their priorities, which result in different perceptions of the quality and value of NHS audits.

Engagement levels during audits

5.23While it can vary by NHS body, audit firms told us that, generally, there was good engagement from NHS financial teams, audit committees and other senior staff during audits. NHS bodies also reported that relationships were good. In our survey, 45% of respondents described their relationship with their auditor as excellent, with a further 39% saying it was good.

5.24Some audit firms told us that some local government bodies could learn from their NHS counterparts, particularly in relation to having better resourced finance teams, stronger audit committees, more professionalism, better quality of accounts and better levels of collaboration and engagement.

Quality versus deadlines

5.25Eight audit firms told us that NHS bodies prioritised audit deadlines over audit quality, which can compromise quality. Most audit firms sympathised with NHS bodies, noting they had tight timetables, budget constraints and wider healthcare system pressure. These include the overlap of financial planning returns with the accounts and audit period, and the pressure to achieve financial targets while the funding picture remained uncertain. Should the audit timetable be condensed further, most audit firms had concerns about the potential impact on audit quality.

5.26In our survey, 73% of NHS bodies reported the deadline to produce draft accounts was about right and 59% felt the time to complete the audit was about right. Other system stakeholders have observed that delivering an audit on time is in itself a measurement of quality.

Value of audit

5.27Our survey results suggest a split in how NHS bodies value audits when assessed against the audit fee. A total of 46% of respondents said audits provided good value, while 38% said they did not. However, many (90%) valued auditors' financial statements opinions for decision making.

5.28During our roundtables with NHS bodies, many expressed views that the VFM reporting aspect of audits were unnecessary because they provided no new information to NHS bodies and did not actually measure value for money. In our survey, 28% of respondents did not value VFM reporting when it came to decision making, with only 23% indicating it was very valuable.

5.29However, other stakeholders told us VFM reporting was useful. One system stakeholder observed VFM reporting may not provide new information to some NHS bodies, but it may provide additional beneficial information for other users of NHS audits, such as members of the public. For example, for the financial year 2023/24, 65 NHS providers were found to have significant weaknesses in their VFM arrangements by their auditors. Audit firms told us they found VFM reporting valuable and interesting work.

Future effectiveness of the NHS audit market

5.30In our roundtables with NHS bodies, it was universally agreed that there was a need for more choice of auditors to improve the functioning of the NHS audit market.

5.31We have received various suggestions for how to address the issues in the market and improve the choice of audit firms.

5.32Stakeholders' proposals to date broadly fall into three categories relating to changes to: the procurement processes, the delivery of financial statements and audit and reporting, audit and regulatory frameworks.

Potential changes to NHS audit procurement processes

5.33We have received the following suggestions for changes to NHS audit procurement processes:

- Greater standardisation in NHS bodies' procurement processes and documentation.

- Implementation of national or block procurements as per the arrangements for local authority external audits.

- More effective planning in the logistics for the procurement process, for example:

- Enforcement of NHSE's procurement guidance to ensure sufficient time for invitations to tender (ITTs) to be completed and submitted.

- Mandating that procurement processes are concluded within appropriate timeframes to allow audit firms to incorporate tender opportunities into workforce planning.

- Requiring NHS bodies to disclose tendering plans to NHSE for publication to enable firms and stakeholders to evaluate the market.

- Facilitation of direct engagement between CFOs, Audit Committee Chairs and prospective external auditors during the tendering process.

- Prioritising quality in scoring of tender responses and clarifying elements of tender evaluation relating to social value.

- Permitting pricing flexibility in multi-year contracts to allow for changes in circumstances.

Potential changes to the delivery of financial statements and audits

5.34We have received the following suggestions for amending the delivery of financial statements and audits:

- Alignment of the timetable for financial statements closedown and audit with other activities, specifically:

- Designing the timeline for the following year's financial planning processes, so these are complete before the year-end.

- Finalising funding allocations from Government in sufficient time to enable these to be incorporated into the first draft of the financial statements.

- Considering staggered timeframes for the preparation of financial statements and delivery of audits for different categories of NHS body. For example, by body type or significance to group reporting.

- Introduction of a review process similar to the FRC's Corporate Reporting Review (CRR) to enhance accountability and quality in financial reporting.

- Re-introducing a public sector provider of external audit services for NHS bodies, or nationally-coordinating training for NHS auditors.

- Adequately considering the current situation in local government audit in any new developments given the same pool of auditors work across both sectors.

Potential changes to reporting, audit and regulatory frameworks

5.35We have received the following suggestions for changes to existing requirements and frameworks:

- Amendments to reporting frameworks, including:

- Rationalisation of Annual Report requirements for NHS bodies, including re-considering which elements are required to be subject to audit (e.g. remuneration and staff report disclosures).

- Simplifying financial reporting requirements relating to valuation of property.

- Amendments to audit and assurance frameworks, such as:

- Clarifying or relaxing the requirements of the NAO's Auditor Guidance Note 1 in relation to provision of non-audit services in ICB areas where firms provide external audit services to bodies within that ICB, and whether these represent conflicts of interest from an ethical perspective.

- Reconsidering whether the VFM arrangements work required under the NAO's Code of Audit Practice is adding value or providing new information to NHS bodies, in the context of wider scrutiny from regulators, and therefore whether requiring this work remains in the public interest.

- Removing of the requirement for external assurance over ICBs compliance with the Mental Health Investment Standard, with the potential to replace this with self-certification.

- Reconsideration of regulatory frameworks:

- Increasing the MLA threshold for NHS bodies to enable regulatory focus on the entities of highest risk or excluding ICBs from the definition of an MLA.

- Reconsidering whether KAPs should be required to sign the audit opinions for NHS bodies and/or enable a more straightforward pathway for corporate auditors to do so.

5.36In the next phase of the market study, we will be exploring these, and any other, suggestions for changes in more detail. We will be seeking to identify what, if any, actions should be taken in response to issues identified in the NHS audit market. Such actions may be informed by various factors including the unique features of NHS audits, how NHS and local government audits differ, and any similarities between NHS and corporate audits.

6. Invitation to comment

We welcome written submissions on any of the matters set out in this document by 6 February 2025. We particularly welcome responses to the questions/issues below.

- Do you agree with our emerging findings? Please explain.

- Do you have any views or suggestions on any actions that should be taken in light of our emerging findings, including any actions that could be implemented quickly?

- In the first part of the market study, we identified increases in NHS audit fees in recent years. We heard from some stakeholders that fee increases may be driven by changes to audit standards and regulations including in relation to whether the audit is an MLA. We intend to explore this issue further and welcome any further views and information including on the threshold for MLA status, and information that highlights any risks and unintended consequences of the current thresholds for designating MLAs?

- In the first part of the market study, we heard that a barrier to entry and expansion could be a lack of experience in NHS/local government audit. Do you think auditors with experience in auditing other sectors could deliver good quality NHS audits if there was no requirement for KAP accreditation? Should audit firms have more discretion on the staff responsible for NHS audits?

- In the first part of the market study, we did not explore in detail the role and effectiveness of NHS Audit Committees and Audit Committee Chairs in relation to the appointment and oversight of the external auditor. We welcome any views and information on this issue.

- In the first part of the market study, we received mixed comments on the usefulness of the VFM reporting element of NHS audits. We welcome any further information on this issue and any views on changes, if any, that should be made to the VFM reporting element.

- In the first part of the market study, we received some comments about different options for procurement arrangements for NHS audits. DHSC and NHSE have indicated an intention to explore this further following the final report of the market study. We welcome any views on options for procurement arrangements, which may help inform further exploration of this issue.

Please email any written responses to [email protected].

All responses will be acknowledged. We expect to make responses publicly available on the FRC website unless respondents specifically request otherwise. If you send an email response that includes an automatically generated notice stating that the content is to be treated as confidential, you should make it clear in the body of your message whether you wish your comments to be treated as confidential. We will process personal data in accordance with UK data protection legislation and the FRC's Stakeholder Engagement Privacy Notice.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in or @FRCnews

-

See paragraph 3.1 for NHS bodies definition. ↩

-

The FRC commissioned The Healthcare Financial Management Association (HFMA) to survey all NHS bodies and arrange two roundtable discussions with NHS finance professionals and NHS Audit Committee Chairs. ↩

-

CCGs were abolished by the Health and Care Act 2022, which inserted s14Z27 in the NHS Act 2006. ↩

-

ICSs also contain one Integrated Care Partnership, local authorities, companies and third sector organisations. ↩

-

s10(4) of the Local Audit and Accountability Act 2014. In accordance with paragraph 1(1)(c) of Schedule 4, the auditor panel can be an audit committee. In many cases, existing audit committees have been nominated to act as the auditor panel. ↩

-

Paragraph 23(2) of Schedule 7 to NHS Act 2006. ↩

-

Paragraph 23(6) of Schedule 7 to NHS Act 2006. ↩

-

A local authority pension scheme with at least 20,000 members or gross assets of £1,000 million or more (see Regulation 12(1) of the Local Audit (Professional Qualifications and Major Local Audit) Regulations 2014). ↩

-

Foundation Trust inspections do not feature in the FRC's annual MLA quality inspection report. ↩

-

See the Local Audit (Delegation of Functions) and Statutory Audit (Delegation of Functions) Order 2014 and the FRC's Local Auditors (Registration) Instrument 2015 (FRC 02/2015). Currently, ICAEW is the only Recognised Supervisory Body recognised to register local audit firms and KAPs in England. ↩

-

Although two audit firms reported that RIs, who are not KAPs, have signed off Foundation Trust audits. ↩

-

To note, most of this analysis focuses on NHS providers, as the recent transition for commissioner bodies from CCGs to ICBS makes trends more difficult to substantiate, given the available data. ↩

-

This survey question was completed by 82 of the 83 total respondents. 1 body skipped this question. ↩

-

As this is a survey, this represents the perception of respondents on the impact of changes to auditing standards and regulations on audit fees. In the next part of the market study, we intend to explore further the increases in NHS audit fees and the factors that have driven these changes ↩

-

23% selected other and provided qualitative responses such as lack of competition and inflation, only 9% said the fee has not increased, 7% it was due to delays in the previous year's audit and 2% said it was due to switching of audit firm. ↩

-

To note, these years were affected by the Covid 19 pandemic. ↩

-

Number of switches are based on changes in audit firms for NHS Trusts and Foundation Trusts from the previous year. ↩