The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting December 2024 Paper 2: TAC draft endorsement recommendations

Executive summary

| Date | 05 December 2024 |

|---|---|

| Paper reference | 2024-TAC-029 |

| Project | Technical assessment of IFRS S1 and IFRS S2 |

| Topic | Technical assessment and endorsement recommendations |

Objective of the paper

This paper presents the technical assessment and endorsement recommendations in relation to IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2).

Decisions for the TAC

The TAC is asked whether the technical assessment in relation to IFRS S1 and IFRS S2 reflects its decisions and key views. The TAC is also asked to vote on the proposed amendments and on the endorsement recommendations in relation to IFRS S1 and IFRS S2.

Appendices

Technical assessment and endorsement recommendations

This paper has been prepared by the Secretariat for the UK Sustainability Disclosure Technical Advisory Committee (TAC) to discuss in a public meeting. This paper does not represent the views of the TAC or any individual TAC member.

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including 'IAS®', 'IASB®', ISSB™, 'IFRIC®', 'IFRS®', the IFRS® logo, 'IFRS for SMEs®', IFRS for SMEs® logo, ISSB™, the 'Hexagon Device', 'International Accounting Standards®', 'International Financial Reporting Standards®', and 'SIC®'. Further details of the Foundation's Trade Marks are available from the Licensor on request.

Context

1The commission received from the Secretary of State for Business and Trade (Secretary of State) requires the TAC to provide advice as to whether the endorsement of IFRS S1 and IFRS S2 would be conducive to the long-term public good in the UK. The TAC is expected to provide its advice based upon a rigorous technical analysis of the standards with a target date of the end of 2024.

Technical assessment and endorsement recommendations

2The TAC Secretariat are tabling, for approval in this meeting, a final draft of the technical assessment and endorsement recommendations in relation to IFRS S1 and IFRS S2. Appended to this paper is a copy of the technical assessment and endorsement recommendations.

3The TAC is asked to vote on the proposed amendments and on the endorsement recommendations in relation to IFRS S1 and IFRS S2. The threshold for the vote is a simple majority of members present.

Questions for the TAC

- Does the TAC agree that the technical assessment in Appendices 4 and 6 reflects its decisions and key views, including the recording of those that differ?

- Does the TAC vote to approve the proposed amendments in Appendix 5?

- Does the TAC vote to approve the following statements:

- Overall, the TAC's technical assessment concludes that the endorsement of both IFRS S1 and IFRS S2 for the creation of UK Sustainability Reporting Standards meet the endorsement criteria.

- The TAC is of the opinion that the endorsement of IFRS S1, including the proposed amendments, would be conducive to the long-term public good in the UK.

- The TAC is of the opinion that the endorsement of IFRS S2, including the proposed amendments, would be conducive to the long-term public good in the UK.

Next steps

4If the report on the technical assessment and endorsement recommendations is approved subject to final comments, then the Chair can agree the resolution of those comments.

5If any members do not vote to approve the endorsement recommendations, and therefore dissent, then the members must provide written explanations for why they dissent which will be appended to the report.

6Further proofreading and formatting work will be completed to finalise the report on the technical assessment and endorsement recommendations.

7Finally, the report on the technical assessment and endorsement recommendations will be submitted to the Department for Business and Trade (DBT).

Technical assessment and endorsement recommendations

Executive Summary

1After receiving a commission in May 2024 from Kevin Hollinrake MP, then Minister of State for Enterprise, Markets and Small Business, the UK Sustainability Disclosure Technical Advisory Committee (TAC) initiated its technical assessment of the two inaugural IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB), namely IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2). No decisions have been taken as to the scope of entities to which these standards will apply and therefore the TAC was commissioned to provide its assessment by considering UK Public Interest Entities (PIEs) as the expected scope of applicable entities. The completed assessment has been used to provide recommendations to the Secretary of State for Business and Trade (Secretary of State) on whether the endorsement of IFRS S1 and IFRS S2 would be conducive to the long-term public good in the UK. This report provides the TAC's technical assessment and endorsement recommendations.

2Overall, the TAC's technical assessment concludes that the endorsement of both IFRS S1 and IFRS S2 for the creation of UK Sustainability Reporting Standards meet the endorsement criteria. The TAC is of the opinion that:

- the endorsement of IFRS S1, including the proposed amendments, would be conducive to the long-term public good in the UK; and

- the endorsement of IFRS S2, including the proposed amendments, would be conducive to the long-term public good in the UK.

For clarity, the TAC has conducted its technical assessment of both IFRS S1 and IFRS S2 at the same time and has therefore collated its recommendations for both standards within a single report.

3The endorsement criteria for the TAC's technical assessment, including the criteria for amendments, is set out in paragraphs 14–17 and detailed in the TAC's Terms of Reference (ToR). The TAC's application of the endorsement criteria, including the criteria for amendments, is set out in paragraphs 18–20 and Appendix 2.

4To ensure that the technical assessment and endorsement recommendations were delivered to the Secretary of State in a timely manner, the TAC prioritised its work to focus on technical areas in IFRS S1 and IFRS S2 that were considered to be the most important based on views provided by UK stakeholders. The TAC's assessment approach, including the scope and process for assessment and the prioritisation of the technical areas, is set out in Appendix 3.

5The TAC discussed the specific priority technical areas of IFRS S1 and IFRS S2 during its public meetings from May to December 2024. A summary of the TAC's technical assessment and endorsement recommendations is provided in the table below. Further and more detailed information about the TAC's technical assessment, including the reasons for any proposed amendments, is set out in Appendix 4.

| Technical area | Endorsement recommendation |

|---|---|

| International interoperability | N/A as this is an implementation matter. |

| Materiality of sustainability-related financial information | Maintain the requirements without amendment, but note there are differing views on the expected application of materiality. |

| Identifying sustainability-related risks and opportunities | Maintain the requirements without amendment. |

| Sources of guidance | Maintain the requirements without amendment, but note there are differing views. |

| Location and timing of sustainability-related disclosures | Maintain the requirements without amendment. |

| Connectivity and integration | Maintain the requirements without amendment. |

| Commercially sensitive information | Maintain the requirements without amendment. |

| Judgements, uncertainties and errors, including revising comparatives | Maintain the requirements without amendment. |

| Reporting entity boundary and consolidated reporting | Maintain the requirements without amendment. |

| Value chain | Maintain the requirements without amendment. |

| Current and anticipated financial effects | Maintain the requirements without amendment. |

| Greenhouse gas emissions: GHG Protocol and measurement methods | Maintain the requirements without amendment, but note there are differing views. |

| Greenhouse gas emissions: Scope 3 emissions | Maintain the requirements without amendment. |

| Greenhouse gas emissions: financed emissions | Amend the requirement in IFRS S2 relating to the use of Global Industry Classification Standard (GICS) when disaggregating gross financed emissions. Amend both IFRS S1 and IFRS S2 to clarify that the reporting date of investment/gross exposure used to calculate financed emissions might not be the same as the current reporting period for the financial statements, and to introduce an additional disclosure requirement when it is impractical to disclose financed emissions generated during the current reporting period. Note there are differing views. |

| Cross-industry metrics (other than greenhouse gas emissions) | Maintain the requirements without amendment. |

| Resilience and scenario analysis | Maintain the requirements without amendment. |

| Targets | Maintain the requirements without amendment. |

| Transition plans | Maintain the requirements without amendment, but note there are differing views. |

| Proportionality mechanisms and permanent reliefs | Maintain the requirements without amendment. |

| Transition reliefs | Remove the transition relief in IFRS S1 that permits delayed reporting in the first year (IFRS S1 paragraph E4). Extend the 'climate-first' reporting relief in IFRS S1 to two years. Note that there are differing views. |

| Effective date | The TAC defers the decision to the PIC but suggests amended wording for voluntary application of the standards. |

6The TAC has also provided the suggested wording for the proposed amendments to IFRS S1 and IFRS S2, which is presented in track changes in Appendix 5.

7In a letter sent by the Department for Business and Trade (DBT), the TAC was also asked to provide its views and supporting analysis on several issues. The TAC's responses to these requests are provided in Appendix 6.

Introduction

8On 31 May 2024, the UK Sustainability Disclosure Technical Advisory Committee (TAC) initiated its technical analysis of two IFRS Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB): IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2). This analysis has been used to provide recommendations to the Secretary of State for Business and Trade (Secretary of State) on whether the endorsement of IFRS S1 and IFRS S2 would be conducive to the long-term public good in the UK. This report provides the TAC's technical analysis and endorsement recommendations.

Context

9The Department for Business and Trade (DBT) published the Framework and Terms of Reference for the Development of UK Sustainability Reporting Standards (Framework)1 on 16 May 2024. The Framework explains that:

- The Secretary of State is responsible for endorsing IFRS Sustainability Disclosure Standards to create UK Sustainability Reporting Standards.

- Endorsement refers to the creation of a set of UK Sustainability Reporting Standards that will become available for use by UK companies and will form the basis of any future requirements in, or amendments to, UK legislation and regulation. The term endorsement does not refer to the creation of legal obligations for companies to use UK Sustainability Reporting Standards.

- When making endorsement decisions, the Secretary of State will be supported by recommendations and advice from the TAC and by DBT.

- The Financial Conduct Authority (FCA) holds responsibility for implementation decisions that would apply to UK listed companies, while the UK government holds responsibility for implementation decisions that would apply to UK registered companies.

- Implementation refers to future decisions that might be taken to reference UK Sustainability Reporting Standards in legislation or regulation. This includes future decisions that might be taken to require reporting in accordance with UK Sustainability Reporting Standards or to exempt companies from existing requirements should they choose to use UK Sustainability Reporting Standards voluntarily.

- The UK government has established a UK Sustainability Disclosure Policy and Implementation Committee (PIC), which is responsible for co-ordinating implementation decisions taken by the FCA and DBT.

10The TAC's Terms of Reference (ToR), which are included within the Framework, explain the TAC's function and remit, including the requirements for its technical endorsement recommendations on an IFRS Sustainability Disclosure Standard.

11The TAC's ToR also explain that DBT will submit the TAC's endorsement recommendations to the Secretary of State alongside advice from DBT. After consideration of the recommendations and advice provided by the TAC and DBT, the Secretary of State will decide on a draft UK Sustainability Reporting Standard which will be published for public consultation. DBT will be responsible for the drafting of UK Sustainability Reporting Standards. This consultation will be accompanied by an analysis of the costs and benefits, performed by DBT. A response to this consultation will be published on GOV.UK. Following the public consultation, the Secretary of State will decide whether to create a UK Sustainability Reporting Standard. Before the Secretary of State finalises this decision, the TAC can, if necessary, amend its endorsement recommendations based on new information received during the public consultation on the draft UK Sustainability Reporting Standards. If the TAC decides it is necessary to amend its original endorsement recommendations, a letter will be sent to the Secretary of State.

Commission

12Kevin Hollinrake MP, then Minister of State for Enterprise, Markets and Small Business, DBT, sent a letter, dated 17 May 2024, to Sally Duckworth, Chair of the TAC, to commission the TAC to initiate work to develop endorsement recommendations on IFRS S1 and IFRS S2.

13The ministerial letter states that the TAC is to advise the Secretary of State whether the endorsement of IFRS S1 and IFRS S2 would be conducive to the long-term public good in the UK. The TAC is expected to provide its advice based upon a rigorous technical analysis of the standards with a target date of the end of 2024.

Criteria for the TAC's analysis

Endorsement criteria

14The TAC's ToR state that the TAC's analysis of an IFRS Sustainability Disclosure Standard should be used to provide recommendations to the Secretary of State on whether:

- use of the IFRS Sustainability Disclosure Standard is likely to result in an improvement in the international comparability of sustainability-related reporting in the UK;

- use of the IFRS Sustainability Disclosure Standard is likely to support companies in making disclosures that are understandable, relevant, reliable and comparable;

- use of the IFRS Sustainability Disclosure Standard is likely to improve the quality of corporate reporting within the UK in the long-term; and

- companies are likely to be able to provide the disclosures required by the IFRS Sustainability Disclosure Standard within the timeframes that a company normally reports without undue cost or effort.

15The TAC may also provide recommendations on whether:

- the use of the IFRS Sustainability Disclosure Standard is likely to be conducive to the UK's economic growth and international competitiveness, taking into account the costs and benefits of compliance; and

- the IFRS Sustainability Disclosure Standard is likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation.

Criteria for amendments

16The TAC's ToR also state that the TAC may recommend whether, in light of its assessment, amendments are necessary before the IFRS Sustainability Disclosure Standard can be endorsed, or whether amendments to other legislative or regulatory provisions in the UK might be required. The TAC may propose amendments if:

- changes are considered necessary for the effective application of the IFRS Sustainability Disclosure Standard within a UK context; or

- a failure to amend an IFRS Sustainability Disclosure Standard would be of detriment to the long-term public good in the UK, taking into consideration the matters in paragraph 14.

17The TAC may also propose amendments to build upon the material provided within the global baseline provided by an IFRS Sustainability Disclosure Standard upon request from DBT or where UK stakeholders raise a strong need.

Application of criteria

18The objective of the ISSB is to develop sustainability standards that will result in a high-quality, comprehensive global baseline of disclosures that focuses on the needs of primary users and the financial markets. Primary users are existing and potential investors, lenders and other creditors. The ISSB's standard-setting work is subject to due process and oversight procedures that aim to ensure it takes into consideration the views from the full range of stakeholders across multiple jurisdictions. Whilst the ISSB has issued international standards to serve as the 'global baseline', the TAC's technical assessment considered the requirements in the context of the UK and views obtained from UK stakeholders. The TAC considered issues that have been raised by UK stakeholders that are also relevant to the international application of the requirements as they pertain to the UK.

19When applying the criteria in its technical assessment, the TAC was cognisant that satisfying one criterion might compromise another, and there was a balance to be struck. The criteria were assessed individually and in combination to ensure a full assessment was completed. Additionally, where the TAC has recommended amendments to the standards for use in the UK, including insertions and deletions, the TAC determined that those amendments satisfied the endorsement criteria.

20Additional information about the application of the criteria is included in Appendix 2 and further information about the TAC's assessment approach is included in Appendix 3.

Endorsement recommendations

Vote on the endorsement recommendations

21In a public meeting held on 5 December 2024, the TAC voted on the endorsement recommendations, including the proposed amendments to IFRS S1 and IFRS S2 for the creation of the UK Sustainability Reporting Standards. All 15 members of the TAC were present and approved the endorsement recommendations.

Endorsement opinion and technical analysis

22Overall, the TAC's technical assessment concludes that the endorsement of both IFRS S1 and IFRS S2 for the creation of UK Sustainability Reporting Standards meet the endorsement criteria. The TAC is of the opinion that:

- the endorsement of IFRS S1, including the proposed amendments, would be conducive to the long-term public good in the UK; and

- the endorsement of IFRS S2, including the proposed amendments, would be conducive to the long-term public good in the UK.

23The TAC discussed the technical areas of IFRS S1 and IFRS S2 during the public meetings outlined in paragraphs 80–81. A summary of the TAC's technical assessment and endorsement recommendations, including the reasons for the proposed amendments, is provided in Appendix 4. Appendix 5 contains the marked-up versions of the proposed amendments.

24Although overall the TAC is of the opinion that endorsement of IFRS S1 and IFRS S2, including proposed amendments, meet the endorsement criteria and would be conducive to the long-term public good in the UK, there are a number of technical areas where there was significant debate and differing views within the TAC. These include the requirements relating to sources of guidance, references to the GHG Protocol Corporate Standard, the application of materiality, and the requirements relating to transition plans. Additionally, there was significant debate and differing views on the TAC's suggested amendments for financed emissions and transition reliefs. These differing views are described in more detail in Appendix 4.

25In relation to a number of technical areas, the TAC recommends that actions are taken without specifying who will complete these actions. For example, the TAC recommends engagement with the ISSB on specific matters but does not specify in these recommendations who will or should be engaging with the ISSB. Additionally, the TAC recommends continued monitoring of market practice in relation to certain technical areas, but does not specify in these recommendations who will or should be doing that monitoring. Not specifying who will complete these actions is deliberate as it is recognised that it is the responsibility of the UK Government to make these decisions or delegate to an appropriate body. It is anticipated that the Government will consider this as an implementation matter.

26As a general point, the TAC highlights that the application of IFRS Sustainability Disclosure Standards will be an evolutionary process. The TAC recommends that, across the corporate reporting ecosystem, regulators consider ways of supporting stakeholders with the achievement of transparency and with the learning this process will entail. The TAC also recognises the importance of a post-implementation review to monitor practice as it develops and to understand whether any amendments to the standards are required in the future.

Contextual information, implementation issues and other matters to raise with the PIC

27Andrew Death (Chair of the PIC and Deputy Director for Audit and Corporate Reporting, Company Law and Governance Directorate, DBT) sent a letter dated 20 May 2024 to Sally Duckworth (Chair of the TAC) to provide the TAC with contextual information. The TAC has completed its technical assessment of IFRS S1 and IFRS S2 with regard to this contextual information and has also suggested other matters that DBT and the PIC could consider when deliberating on implementation matters.

28The DBT letter states that DBT would appreciate the TAC's view and supporting analysis on the following issues:

- whether definitions in IFRS S1 and IFRS S2 are sufficiently clear and whether any significant incompatibilities are identified with those currently used in UK legislation and regulation.

- whether the existing transition reliefs in IFRS S1 and IFRS S2 should be maintained or extended upon a UK endorsement, including consideration of the level of preparedness of UK companies.

- the timescales involved for Public Interest Entities (PIEs) to have the capacity, skills, and systems to be able to produce reliable Scope 3 emissions disclosures, if they do not do so already, and whether further guidance and data infrastructure would be needed to facilitate Scope 3 emissions reporting.

- companies to meet the disclosure requirements in IFRS S2, including a consideration of conversion factors and guidance.

- how, in practice, companies are likely to interpret and act upon elements within IFRS S1 and IFRS S2 that state that companies 'shall refer to and consider' the SASB materials2, and whether permanent or temporary amendments might be required.

- whether there is need for additional ISSB-issued or UK-specific guidance to be issued to assist with specific disclosure requirements in IFRS S1 or IFRS S2.

- the degree to which disclosures against the proposed UK-endorsed IFRS S1 and IFRS S2 are capable of being assured to a reasonable assurance level.

29As part of this contextual information, the TAC was asked to provide its analysis of IFRS S1 and IFRS S2 using PIEs as the scope in absence of decisions regarding implementation.

30Appendix 6 provides the TAC's view and supporting analysis on these issues, including cross referencing to the section of the technical analysis where the issue has been assessed.

31During its technical assessment, the TAC also noted a number of matters to raise with the PIC. As noted in paragraph 9, the PIC is responsible for co-ordinating implementation decisions taken by the FCA and DBT. These matters relating to implementation of the standards are also listed in Appendix 6.

Appendix 1: Glossary

| Term | Definition |

|---|---|

| CDSB | Climate Disclosure Standards Board |

| DBT | Department for Business and Trade |

| EFRAG | European Financial Reporting Advisory Group, which provides technical advice to the European Commission in the form of draft ESRS |

| ESRS | European Sustainability Reporting Standards |

| ESRS 1 | ESRS 1 General requirements |

| ESRS E1 | ESRS E1 Climate change |

| Framework | Framework and Terms of Reference for the Development of UK Sustainability Reporting Standards |

| FCA | Financial Conduct Authority |

| FRC | Financial Reporting Council |

| GHG | Greenhouse gas |

| GICS | Global Industry Classification Standard |

| GRI | Global Reporting Initiative |

| GWP | Global Warming Potential |

| IFRS S1 | IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information |

| IFRS S2 | IFRS S2 Climate-related Disclosures |

| ISSB | International Sustainability Standards Board |

| PCAF | Partnership for Carbon Accounting Financials |

| PIC | UK Sustainability Disclosure Policy and Implementation Committee |

| PIEs | Public Interest Entities, which are one of the following: a) entities whose transferable securities are admitted to trading on a UK-regulated market, b) credit institutions, or c) insurance undertakings |

| Term | Definition |

|---|---|

| CDSB | Climate Disclosure Standards Board |

| DBT | Department for Business and Trade |

| EFRAG | European Financial Reporting Advisory Group, which provides technical advice to the European Commission in the form of draft ESRS |

| ESRS | European Sustainability Reporting Standards |

| ESRS 1 | ESRS 1 General requirements |

| ESRS E1 | ESRS E1 Climate change |

| Framework | Framework and Terms of Reference for the Development of UK Sustainability Reporting Standards |

| FCA | Financial Conduct Authority |

| FRC | Financial Reporting Council |

| GHG | Greenhouse gas |

| GICS | Global Industry Classification Standard |

| GRI | Global Reporting Initiative |

| GWP | Global Warming Potential |

| IFRS S1 | IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information |

| IFRS S2 | IFRS S2 Climate-related Disclosures |

| ISSB | International Sustainability Standards Board |

| PCAF | Partnership for Carbon Accounting Financials |

| PIC | UK Sustainability Disclosure Policy and Implementation Committee |

| PIEs | Public Interest Entities, which are one of the following: a) entities whose transferable securities are admitted to trading on a UK-regulated market, b) credit institutions, or c) insurance undertakings |

| SASB | Sustainability Accounting Standards Board, noting that, in August 2022, the ISSB assumed responsibility for the SASB Standards |

| SECR | Streamlined Energy and Carbon Reporting |

| Secretary of State | Secretary of State for Business and Trade |

| TAC | UK Sustainability Disclosure Technical Advisory Committee |

| TAC's ToR | TAC’s Terms of Reference |

| TCFD | Task Force on Climate-related Financial Disclosures |

| TIG | Transition Implementation Group on IFRS S1 and IFRS S2 (hosted by the IFRS Foundation) |

| TPT | Transition Plan Taskforce |

| UKEB | UK Endorsement Board |

Appendix 2: Application of criteria

Endorsement criteria

32 In its inaugural public meeting on 31 May 2024, the TAC approved the following paragraphs, which provide definitions and further explanations about how the endorsement criteria should be applied in its technical assessment of the IFRS Sustainability Disclosure Standards. These definitions and explanations align with definitions used by the IFRS Foundation, the FRC and the UKEB.

International comparability

33 The TAC is required to assess whether the requirements in the IFRS Sustainability Disclosure Standards are likely to result in an improvement in the international comparability of sustainability-related reporting in the UK.

34 International comparability relates to how disclosures provided by UK entities compare to, and relate to, disclosures provided by entities in other jurisdictions. International comparability can be considered from the entity perspective (i.e. in the preparation of the required information) but also from the primary user perspective (i.e. in using the reported information to assess the performance of different entities).

35 IFRS Sustainability Disclosure Standards are intended to be a 'global baseline' that serve as a foundation for disclosure requirements that are designed to meet the needs of primary users. International comparability can be achieved if all jurisdictions apply the IFRS Sustainability Disclosure Standards without, or with minimal, amendment. Therefore, it is assumed that adoption of the IFRS Sustainability Disclosure Standards in the UK without, or with minimal, amendment is likely to improve international comparability. However, in the technical assessments of the standards the TAC should identify any instances, should they exist, where the requirements are not likely to improve international comparability.

36 Additionally, the TAC should consider whether any suggested amendments to the IFRS Sustainability Disclosure Standards for use in the UK, including insertions and deletions, could negatively affect the international comparability of disclosures.

37 An assessment of international comparability will require an understanding of how jurisdictions will be applying sustainability disclosure requirements in different local contexts. Existing, and upcoming, requirements that are set by individual jurisdictions can make international comparability difficult if these requirements are not predicated on the same conceptual foundations or if the requirements are substantially different. However, the TAC is not expected to conduct a detailed comparative analysis of the use of IFRS Sustainability Disclosure Standards in other jurisdictions, or of any other jurisdictional sustainability reporting requirements. Instead, the TAC should be aware of other jurisdictional developments and may observe specific matters outside the UK that might impact international comparability. The TAC is also not expected to review every possible jurisdictional requirement and will prioritise certain jurisdictions to monitor. These matters should be considered by the TAC when they might have a significant effect on international comparability.

38 In some cases, the discussions that pertain to international comparability focus on the interoperability of different requirements. 'Interoperability' is not when disclosure requirements are the same but is achieved when these disclosure requirements can be applied together in a coherent way to alleviate the burden on entities and to improve the usability of the disclosure for primary users. The TAC is not expected to map all jurisdictional requirements against the IFRS Sustainability Disclosure Standards to assess interoperability.

Understandable, relevant, reliable and comparable

39 The TAC is required to assess whether the requirements in the IFRS Sustainability Disclosure Standards are likely to support entities in making disclosures that are understandable, relevant, reliable and comparable. The criteria 'understandable', 'relevant', 'reliable' and 'comparable' are commonly used when assessing reporting standards, such that the resulting information can be used by primary users in making decisions relating to providing resources to an entity.

40 Sustainability-related information can be ‘understandable’ if it is clear and concise. This includes avoiding generic and boilerplate information, avoiding duplication, and using clear language that is well structured. Information is understandable if it is accessible, easy to navigate and is capable of being comprehended by users. Understandability will depend on the nature of the information and can be achieved through appropriate presentation and communication of information. Some sustainability-related information will be inherently complex and difficult to present in a clear and concise manner. However, the complexity of the information is not a reason to exclude requirements from the standards as it might impact the completeness of disclosure.

41 Sustainability-related information can be ‘relevant’ if it is capable of making a difference in the decision-making of primary users. Information might be relevant and therefore capable of making a difference in a decision, even if some users choose not to take advantage of it. Relevance can be distinguished from materiality, which is entity-specific and based on the nature or magnitude of the information to which it relates.

42 Information can be 'reliable' if it can be depended on by users to faithfully represent what it purports to represent, or could reasonably be expected to represent, and is, unless otherwise stipulated by the reporting entity, complete, neutral and free from material error. Reliable information should be verifiable. That is, information that is supportable, and would support knowledgeable and independent observers to reach consensus that the information is a faithful representation. Ideally, reliable information would also be assurable, but the TAC recognises that the assurance of sustainability-related information is an evolving practice.

43 Information can be 'comparable' if it enables users to identify and understand similarities in, and differences between, two sets of information. Comparability can relate to information from the same entity but across different reporting periods, or comparability between entities in the same reporting period. Information does not have to be prepared in identical ways to be comparable. The use of estimates for example might mean different sources of data for the same disclosures. However, the preparation of the data should be similar enough to allow users to make meaningful comparisons. Comparability is not uniformity. That is, information that is alike should look alike, and different information should look different.

44 The assessment of the characteristics 'understandable', 'relevant', 'reliable' and 'comparable' will be applied to the requirements in the IFRS Sustainability Disclosure Standards, recognising that it is also incumbent on entities to ensure their disclosures meet these characteristics.

Quality of corporate reporting

45 The TAC is required to assess whether the requirements in the IFRS Sustainability Disclosure Standards are likely to improve the quality of corporate reporting within the UK in the long-term.

46 An assessment of the quality of reporting is highly subjective and requires a review of current practice to understand whether the implementation of the IFRS Sustainability Disclosure Standards would be likely to improve reporting. The TAC is not expected to complete a detailed assessment of current reporting practice in the UK but should be cognisant of how entities are currently reporting on sustainability-related risks and opportunities. The TAC may utilise reviews of reporting published by suitable third parties and any research that is readily available.

47 The quality of reporting will be influenced by a number of factors. For example, the enforceability of the requirements will reduce the risk of error or divergent practice, which will increase the quality of reporting. Additionally, improved transparency, better connectivity and improved faithful representation will contribute to an improvement in the quality of reporting over time. The TAC also recognises that an increased quantity of information might not necessarily improve the quality of reporting.

48 The technical assessment will consider whether the application of the IFRS Sustainability Disclosure Standards is likely to enhance the quality of corporate reporting. It is not possible to assess whether the application of the IFRS Sustainability Disclosure Standards will absolutely improve the quality of reporting. However, the TAC should be able to assess whether the application of the standards has the potential to do so.

Undue cost or effort

49 The TAC is required to assess whether entities are likely to be able to provide the disclosures required by the IFRS Sustainability Disclosure Standards within the timeframes that an entity normally reports without undue cost or effort. This includes assessing whether the application of the requirements is technically and practically feasible in the required timeframes.

50 Information is timely if it is available to primary users in time to be capable of influencing their decisions. The TAC should consider whether the cost and effort required by entities to obtain and report information in the timeframes they normally report (i.e. when publishing their annual reports and accounts) is reasonable and proportionate.

51 The introduction of new reporting requirements will undoubtedly include increased efforts and implementation costs. The TAC should focus on whether these costs or efforts can be considered ‘undue’, which will require the TAC to make a judgement as to whether the costs or efforts are greater than believed to be reasonable or proportionate in line with the intended benefits of timely reporting.

52 The assessment of undue cost or effort does not include a detailed analysis of the costs and benefits of application of the IFRS Sustainability Disclosure Standards. However, the TAC should have regard to the cost and benefits of compliance (refer to paragraph 57) when assessing whether the required cost or effort is reasonable and proportionate.

53 The TAC should also have regard to the entities that are likely to be in scope. The TAC has been requested to focus its assessment of IFRS Sustainability Disclosure Standards on the application of the requirements by PIEs. For example, the assessment of whether cost or effort is undue for PIEs will be significantly different from the assessment of whether cost or effort is undue for small or medium-sized entities. The TAC should be cognisant of the size and complexity of entities in scope, and also the public interest and users’ information needs.

Economic growth and international competitiveness

54 The TAC is not required to complete an assessment of, but may provide advice on, whether the application of the IFRS Sustainability Disclosure Standards is likely to be conducive to the UK’s economic growth and international competitiveness. This would require an assessment of the potential impact of introducing the IFRS Sustainability Disclosure Standards on economic growth and competitiveness in the UK.

55 Having regard to economic growth and competitiveness does not necessarily mean requiring less disclosure. Instead, having regard to economic growth and competitiveness will include an assessment of whether the requirements are proportionate and conducive to sustainable growth in the UK’s economy.

56 This criterion overlaps with the other criteria and therefore the TAC may observe matters that might contribute to, or have a negative impact on, economic growth and international competitiveness. For example, when assessing whether the application of the standards is likely to improve the quality of reporting, the TAC may observe that improved quality of reporting will improve primary users’ confidence in that information and enable them to better assess the financial position, financial performance and financial prospects of an entity, which could support economic growth and international competitiveness through increased availability of capital and a reduction in the cost of capital.

Costs and benefits of compliance

57 The TAC is not required to complete a cost-benefit analysis. However, the TAC may provide advice on the costs and benefits of disclosing the information required by the IFRS Sustainability Disclosure Standards. In considering costs and benefits, the TAC should reflect on the balance between the needs of users and the efforts required of entities. The TAC should also have regard to the entities that are likely to be in scope (refer to paragraph 53).

Coherent with, and suitable for inclusion in, UK domestic legislation and regulation

58 The TAC is not required to complete an assessment of whether the IFRS Sustainability Disclosure Standards are likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation. However, the TAC may provide advice on how the application of the standards is likely to interact with current UK legislation and regulation, especially when there is an overlap in the requirements and when there might be incompatibilities that impact the other criteria. For example, if the TAC observes incompatibilities between the IFRS Sustainability Disclosure Standards and UK legislation and regulation, this could reduce the quality of corporate reporting or create undue cost or effort.

59 The TAC is not expected to complete a full mapping of the requirements in the IFRS Sustainability Disclosure Standards with the detailed requirements within current UK legislation and regulation.

Criteria for amendments

60 The following paragraphs provide definitions and further explanations about how the criteria for amendments are applied in the technical assessment of the IFRS Sustainability Disclosure Standards.

61 As per the TAC’s ToR, the TAC may, in light of its technical assessment, recommend whether amendments (including insertions and deletions) are necessary before the IFRS Sustainability Disclosure Standards can be endorsed, or whether amendments to other legislative or regulatory provisions in the UK might be required. The TAC may propose amendments if:

changes are considered necessary for the effective application of the IFRS Sustainability Disclosure Standards within a UK context; or

a failure to amend the IFRS Sustainability Disclosure Standards would be of detriment to the long-term public good in the UK, taking into consideration the matters in paragraph 14.

62 The TAC’s technical assessment may also consider whether the IFRS Sustainability Disclosure Standards can be endorsed without amendments to other legislative or regulatory provisions in the UK. The TAC is not, however, required to complete an assessment of whether the standards are likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation (refer to paragraph 58).

63 The technical assessment considers the matters in paragraph 14, namely, the endorsement criteria considered under the headings ‘International comparability’, ‘Understandable, relevant, reliable and comparable’, ‘Quality of corporate reporting’ and ‘Undue cost or effort’. If a failure to amend the IFRS Sustainability Disclosure Standards would mean that these criteria are not met, then this would be of detriment to the long-term public good in the UK.

64 The TAC may also propose amendments to build upon the material provided within the global baseline provided by the IFRS Sustainability Disclosure Standards, upon request from DBT or where UK stakeholders raise a strong need. The TAC should consider such requests and whether such a need is evident in its outreach with UK stakeholders.

65 The TAC should also consider the interaction of any suggested amendments to the IFRS Sustainability Disclosure Standards for use in the UK with the endorsement criteria. For example, such amendments could negatively affect the international comparability of disclosures (refer to paragraph 36).

Appendix 3: Assessment approach

Summary scope and process of assessment

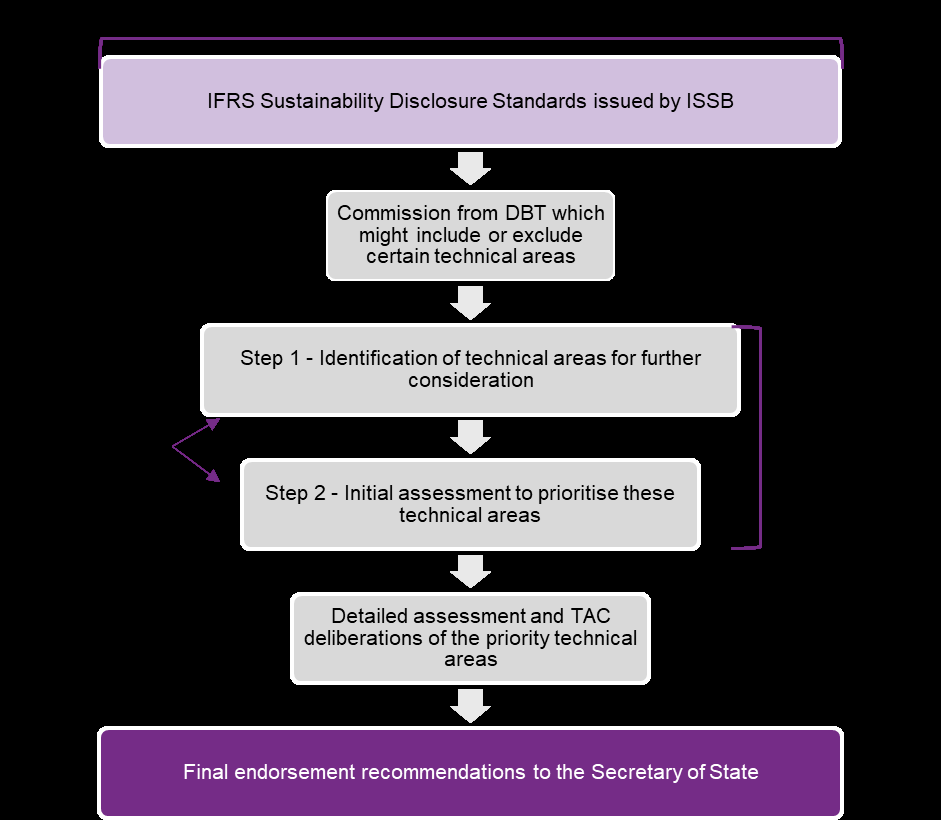

66 Figure 1 summarises the scope of content included in the technical assessment and the process used to assess the IFRS Sustainability Disclosure Standards.

Figure 1 Scope of content and process for the technical assessment of IFRS Sustainability Disclosure Standards.

67 The following paragraphs provide further explanations about how IFRS S1 and IFRS S2 were assessed, including the prioritisation of technical areas and detailed assessment of those areas.

68 The TAC assessed IFRS S1 and IFRS S2 concurrently. Although IFRS S1 and IFRS S2 are separate standards, the ISSB intended that the two standards be applied together. As described in paragraphs BC5–BC6 of IFRS S2 Basis for Conclusions on Climate-related Disclosures, IFRS S2 sets out supplementary requirements to IFRS S1 that relate specifically to climate-related risks and opportunities. When applying IFRS S2, an entity is required to apply the conceptual foundations, general requirements and requirements relating to judgements, uncertainties and errors that are described in IFRS S1. Therefore, the TAC could not assess IFRS S2 in isolation but in the context of the requirements in IFRS S1. However, IFRS S1 goes beyond climate-related risks and opportunities and therefore the TAC also considered IFRS S1 in the context of other sustainability-related topics.

69 IFRS S1 has sometimes been referred to as an overarching standard that establishes the conceptual framework for all other IFRS Sustainability Disclosure Standards, including current and future standards. Whilst IFRS S1 includes conceptual principles, it also includes core content requirements for the disclosure of all sustainability-related information, with or without a particular IFRS Sustainability Disclosure Standard to provide the detailed and more specific topic requirements. The expectation is that the ISSB will, in the future, issue further topic-specific IFRS Sustainability Disclosure Standards like IFRS S2. The TAC’s technical assessment was only on IFRS S1 as issued in June 2023 and did not give detailed consideration to any future IFRS Sustainability Disclosure Standards and how it might be applied to those. However, in its deliberations, the TAC did note some considerations for future IFRS Sustainability Disclosure Standards. If the ISSB amends IFRS S1 and IFRS S2 in the future, it is likely that further assessment of those standards for use in the UK will be required.

70 There are currently no plans in the UK to endorse the materials that accompany the IFRS Sustainability Disclosure Standards. This means that the TAC’s technical assessment only considered the content in the IFRS Sustainability Disclosure Standards, including the appendices that are an integral part of the standards, but not the accompanying documentation. Consequently, the bases for conclusions and accompanying guidance for IFRS S1 and IFRS S2, including the Industry-based Guidance on Implementing IFRS S2, were excluded from this assessment. In performing its technical assessment, the TAC referred to the content in the accompanying documentation to provide context, but was not required to and did not assess this content.

71 Additionally, the IFRS Sustainability Disclosure Standards might refer to content that is published in other standards and frameworks. For example, IFRS S1 refers to other IFRS Sustainability Disclosure Standards, including those issued and those that will be issued in the future, in addition to standards that were published by third-party standard setters such as the Greenhouse Gas (GHG) Protocol, the Sustainability Accounting Standards Board (SASB) and the Climate Disclosure Standards Board (CDSB). The TAC assessed the requirements in IFRS S1 and IFRS S2 that referred to the use of the GHG Protocol Corporate Standard and SASB Standards, but did not assess the content of these standards. The TAC makes some references in its technical assessment to European Sustainability Reporting Standards (ESRS) and the Global Reporting Initiative (GRI) Standards, but did not assess the content of these standards. The TAC could not assess the content of IFRS Sustainability Disclosure Standards that will be issued in the future and was not required to and did not assess the content of any third-party standards or frameworks.

72 As requested by DBT, the TAC conducted its technical assessment considering PIEs as the relevant scope for application of the standards.

Prioritisation of technical areas

73 A two-step prioritisation process was used to establish which technical areas the TAC focused on in its assessment of IFRS S1 and IFRS S2. The prioritisation process involved stakeholder outreach and research activities, including a call for evidence, and involved the identification of technical areas that merited further consideration and an initial assessment of those areas against the endorsement criteria. The work undertaken in the prioritisation process is outlined further in paper 2024-TAC-002.

74 On completion of the prioritisation process, a number of priority technical areas were agreed by the TAC in its meeting on 31 May 2024.

Detailed assessment of priority technical areas

75 Once the priority technical areas were agreed, the TAC commenced a detailed assessment of those areas.

76 In its meetings, the TAC reviewed and deliberated on technical papers, which included: * an outline of the priority technical area, including the requirements and any insight into the ISSB’s decisions; * a summary of UK stakeholder views; * where appropriate, a summary of other jurisdictional approaches; * an analysis of the requirements compared to the endorsement criteria; * suggested endorsement recommendations (including options that were considered but disregarded).

77 The assessment considered whether the views raised by stakeholders were unique to the UK and, if so, whether the standards could be introduced in the UK without amendment, or if this was not possible whether insertions and deletions should be made or whether they required further clarification or guidance. Matters that were not necessarily UK-specific were noted to be fed back to the ISSB by requesting clarification or further guidance or could inform the ISSB’s post-implementation reviews of the standards.

78 The TAC then concluded whether it agreed with the assessment and whether it approved, rejected or amended the suggested endorsement recommendations.

79 The TAC’s decisions in its meetings formed the basis for the endorsement recommendations included in this report.

TAC meetings

80 TAC meetings were held in public and meeting agendas, technical papers and meeting summaries are available on the FRC website3.

81 Certain priority technical areas are pervasive and were covered in a number of technical papers, including the relationship with existing UK requirements and aggregation and disaggregation of information. Specific priority technical areas were assessed in the following meetings:

| Technical area | Meetings(s) and summary minutes | Paper reference(s) |

|---|---|---|

| International interoperability | 05 November 2024 | 2024-TAC-024 |

| Identifying sustainability-related risks and opportunities | 15 July 2024 | 2024-TAC-010 |

| Materiality of sustainability-related financial information | 15 July 2024 | 2024-TAC-009 |

| Sources of guidance | 15 July 2024 | 2024-TAC-011 |

| Location and timing of sustainability-related disclosures | 18 June 2024 | 2024-TAC-005 |

| Connectivity and integration | 05 November 2024 | 2024-TAC-023 |

| Commercially sensitive information | 18 June 2024 | 2024-TAC-006 |

| Judgements, uncertainties and errors, including revising comparatives | 18 June 2024 | 2024-TAC-007 |

| Reporting entity boundary and consolidated reporting | 18 June 2024 | 2024-TAC-008 |

| Value chain | 15 July 2024 | 2024-TAC-012 |

| Current and anticipated financial effects | 08 October 2024 | 2024-TAC-017 |

| Greenhouse gas emissions: GHG Protocol and measurement methods | 03 September 2024 | 2024-TAC-013 |

| Greenhouse gas emissions: Scope 3 emissions | 03 September 2024 | 2024-TAC-014 |

| Greenhouse gas emissions: financed emissions | 03 September 2024 08 October 2024 05 November 2024 15 November 2024 |

2024-TAC-015 2024-TAC-022 2024-TAC-025 |

| Cross-industry metrics (other than greenhouse gas emissions) | 03 September 2024 | 2024-TAC-016 |

| Resilience and scenario analysis | 08 October 2024 | 2024-TAC-018 |

| Targets | 08 October 2024 | 2024-TAC-020 |

| Transition plans | 08 October 2024 | 2024-TAC-019 |

| Proportionality mechanisms and permanent reliefs | 08 October 2024 | 2024-TAC-021 |

| Transition reliefs | 08 October 2024 05 November 2024 |

2024-TAC-021 2024-TAC-026 |

| Effective date | 08 October 2024 05 November 2024 |

2024-TAC-021 2024-TAC-026 |

Appendix 4: Technical assessment and endorsement recommendations

Interoperability

Endorsement recommendation

There are no specific endorsement recommendations in respect of the requirements in IFRS S1 and IFRS S2 and their interoperability with other frameworks and standards as this is an implementation matter.

Additional recommendations and observations

82 Recognising UK stakeholder concerns and the challenges identified relating to interoperability, the TAC recommends that, as an implementation issue, the UK government engages specifically with the ISSB and EFRAG on interoperability challenges and the potential for equivalence.

Technical assessment and deliberations

83 The TAC supports continued efforts towards greater global alignment and interoperability of the IFRS Sustainability Disclosure Standards with other sustainability reporting frameworks and standards, notably with the EU’s Corporate Sustainability Reporting Directive (CSRD) and ESRS. With the range of requirements required by other jurisdictions (some ISSB based, but others using different reporting frameworks or standards), there is a risk that international comparability is compromised and the quality of decision-useful information decreases. Both reporting entities and users of general purpose financial reports will benefit from increased interoperability, and therefore the TAC supports the global baseline and greater alignment between IFRS Sustainability Disclosure Standards and jurisdictional reporting requirements around the world.

84 The TAC has observed specific matters relating to interoperability which are included as part of the technical assessment of other technical areas, including identifying sustainability-related risks and opportunities, materiality, location of disclosures, sources of guidance, reporting entity boundaries, and greenhouse gas emissions.

85 The TAC recognises that one of the key challenges with interoperability is the different approaches to materiality and identifying sustainability-related matters that are taken by different reporting frameworks and standards, notably with ESRS. The TAC recommends that the UK Government engages with the ISSB and EFRAG on the key challenges for UK entities that will be disclosing information in accordance with multiple frameworks with the objective of supporting UK entities in meeting their disclosure obligations.

Identifying sustainability-related risks and opportunities

Endorsement recommendation

The TAC recommends that the requirements in IFRS S1 and IFRS S2 relating to identifying sustainability-related risks and opportunities are maintained without amendment.

Additional recommendations and observations

86 The TAC recommends that the PIC considers, as an implementation matter, developing jurisdictional guidance on how IFRS S1 would be applied in conjunction with the sustainability-related information entities are required to disclose in line with the current UK legal framework.

Technical assessment and deliberations

87 IFRS S1 paragraphs 2–3, 11–13, 30–31, 43–44, B1–12 and E5 set out requirements for a complete set of sustainability-related financial disclosures about all sustainability-related risks and opportunities that could reasonably be expected to affect an entity’s cash flows, its access to finance or cost of capital over the short, medium or long-term. IFRS S2 paragraphs 10–12 set out the requirements for the disclosure of climate-related risks and opportunities in addition to a definition for climate-related risks and opportunities in Appendix A.

88 In response to the TAC’s call for evidence, some UK stakeholders were concerned that the lack of a clear definition for ‘sustainability-related matters’ and specific IFRS Sustainability Disclosure Standards on other sustainability-related information could compromise the quality of reporting. A definition for ‘sustainability-related matters’ already exists in UK law (namely, section 416B(2) of the Financial Services and Markets Act 2000) which could be applied to IFRS S1 as UK entities are already disclosing sustainability-related matters using this definition. However, the TAC is in agreement that this definition should not be inserted into IFRS S1 as it is unnecessary and could compromise the international comparability of disclosures. The TAC recommends that the requirements on identifying sustainability-related risks and opportunities should be maintained without amendment, but cautions that it will be challenging to align reporting under the IFRS Sustainability Disclosure Standards with reporting under existing UK reporting requirements, especially in relation to section 172 of the Companies Act 2006. The TAC recommends that the PIC should consider, as an implementation matter, developing jurisdictional guidance on how IFRS S1 would be applied in conjunction with the sustainability-related information entities are required to disclose in line with the current UK legal framework.

89 The TAC notes that it is more challenging in practice for entities to identify risks and opportunities for non-climate sustainability-related matters that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term, especially those for social-related matters. This is because the necessary data and processes for identifying such sustainability-related risks and opportunities that could be expected to affect an entity’s prospects are less well established.

90 The TAC recommends that the requirements in IFRS S1 paragraph 30(c) and IFRS S2 paragraph 10(d) that require an entity to explain which time horizons it has applied when identifying sustainability-related risks and opportunities should be maintained without amendment and that the UK Sustainability Reporting Standards should not specify what time horizons an entity is required to use. Although UK stakeholders commented on the lack of defined time horizons in IFRS S1 and IFRS S2 while noting that defined time horizons could improve the comparability of disclosures, the flexibility in the requirements allows entities to apply the time horizons that are appropriate in their circumstances. Prescribed time horizons might reduce the relevance of the disclosures if the time horizons used are not appropriate for all entities. Additionally, UK entities that are in scope of ESRS will be required to use the definitions of time horizons in ESRS 1 General requirements (ESRS 1) except in some limited situations4. Therefore, inserting definitions for time horizons in IFRS S1 and IFRS S2 could create undue cost and effort to UK entities applying ESRS and compromise the international comparability of disclosures, if these definitions do not align with those in ESRS 1.

Materiality of sustainability-related financial information

Endorsement recommendation

The TAC recommends that the requirements in IFRS S1 relating to materiality are maintained without amendment. However, there are differing views on the expected application of materiality.

89The TAC notes that it is more challenging in practice for entities to identify risks and opportunities for non-climate sustainability-related matters that could reasonably be expected to affect the entity's cash flows, its access to finance or cost of capital over the short, medium or long term, especially those for social-related matters. This is because the necessary data and processes for identifying such sustainability-related risks and opportunities that could be expected to affect an entity's prospects are less well established.

90The TAC recommends that the requirements in IFRS S1 paragraph 30(c) and IFRS S2 paragraph 10(d) that require an entity to explain which time horizons it has applied when identifying sustainability-related risks and opportunities should be maintained without amendment and that the UK Sustainability Reporting Standards should not specify what time horizons an entity is required to use. Although UK stakeholders commented on the lack of defined time horizons in IFRS S1 and IFRS S2 while noting that defined time horizons could improve the comparability of disclosures, the flexibility in the requirements allows entities to apply the time horizons that are appropriate in their circumstances. Prescribed time horizons might reduce the relevance of the disclosures if the time horizons used are not appropriate for all entities. Additionally, UK entities that are in scope of ESRS will be required to use the definitions of time horizons in ESRS 1 General requirements (ESRS 1) except in some limited situations4. Therefore, inserting definitions for time horizons in IFRS S1 and IFRS S2 could create undue cost and effort to UK entities applying ESRS and compromise the international comparability of disclosures, if these definitions do not align with those in ESRS 1.

Materiality of sustainability-related financial information

Endorsement recommendation

The TAC recommends that the requirements in IFRS S1 relating to materiality are maintained without amendment. However, there are differing views on the expected application of materiality.

Additional recommendations and observations

91The TAC recommends that the development of educational material by the ISSB on materiality is monitored and, if a need for any further educational material is identified, the ISSB is engaged with and encouraged to develop this additional material.

92The TAC recommends that the PIC considers, as an implementation matter, the difference between the approaches to materiality in IFRS S1 and the requirement for climate-related financial disclosures set out in section 414CB of the Companies Act 2006 with regard to disclosures about governance and risk management processes. The PIC might consider how to transition from the current climate-related financial disclosures rules to IFRS Sustainability Disclosure Standards without reducing the quality of disclosure in the UK.

Technical assessment and deliberations

93IFRS S1 paragraphs 17–19, B13–B18 and B19–B28 set out requirements for the disclosure of ‘material information’.

94The TAC recommends that the materiality definitions in IFRS S1 should be maintained without amendment. Overall, UK stakeholders indicated support for the ISSB's decision to align the definition of materiality with that used in financial reporting, focusing on the information needs of users. The TAC notes that aligning the definition of materiality in IFRS S1 with that used in IFRS Accounting Standards might assist practitioners who are already familiar with applicable accounting standards (including the IFRS Foundation's materiality concept) and UK reporting requirements.

95The TAC supports consistency in the definition of materiality across IFRS Standards but cautions that different definitions between the IFRS Sustainability Disclosure Standards and ESRS are likely to cause challenges for entities reporting under both. The ESRS financial materiality definition is aligned with the ISSB's materiality definition, so the two are not incompatible, but UK stakeholders have cited challenges with applying the ESRS's requirement to consider impact materiality.

96The TAC does not agree that a broader definition of materiality should be inserted into IFRS S1. Some UK stakeholders questioned the appropriateness of maintaining the same materiality definition for sustainability-related information as that used for financial information. However, changing the materiality definition in IFRS S1 would diverge both from the current UK legal framework, which is focused on the needs of primary users, and from the global baseline that IFRS Sustainability Disclosure Standards are seeking to establish. This could therefore compromise the international comparability of disclosures. Additionally, IFRS S1 and IFRS S2 have been developed and drafted based on the concept of materiality in IFRS Accounting Standards, and amending the standards to widen this concept would require significant amendments to the standards as a whole. The TAC supports the ISSB's work on interoperability, and agrees that the UK government engages with the ISSB and EFRAG on the key challenges for UK entities that will be disclosing information in accordance with multiple frameworks.

97The TAC stresses the importance of not overly prescribing or defining what information is considered material as there is value in entities assessing and deciding what is material for their primary users. The TAC considered the benefit of requesting additional guidance from the ISSB to support entities in applying the concept of materiality to sustainability-related information and acknowledges the recently published guidance on sustainability-related risks and opportunities and materiality from the ISSB. The TAC has not assessed this guidance. The TAC believes that if a need is identified for further educational material or standard setting on the application of materiality, the ISSB should be encouraged to develop this material.

98The TAC notes that the approach to materiality in IFRS S1 is different from that in the UK's approach to climate-related financial disclosures, which are currently required by the Companies Act 2006 and FCA Listing Rules, both of which are based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). In contrast to the requirement in IFRS S1, the UK's climate disclosure requirements require the disclosure of information regarding climate-related governance and risk management processes regardless of an entity's assessment of its climate-related risks and opportunities. This is because it is assumed that the governance and risk management information is useful to users in understanding the processes used by an entity for identifying and assessing climate-related risks and opportunities, even if the entity has determined that it does not have any significant climate-related risks and opportunities. In contrast, if an entity has not identified any climate-related risks and opportunities, the entity is permitted by IFRS S1 to not disclose any information about climate change, including information about the governance and risk management processes used to determine that climate-related risks and opportunities are not significant. A minority of TAC members believe that this difference could negatively affect the long-term public good in the UK as it might reduce the quality of corporate reporting in the UK. This difference between IFRS S1 and the UK's climate disclosure requirements could be resolved with a general requirement for entities to disclose how they have determined which sustainability-related risks and opportunities are relevant. The TAC recommends that the PIC considers the difference between IFRS S1 and the UK's climate disclosure requirements as an implementation issue. In particular, the PIC might consider how to transition from the current climate-related financial disclosures rules to IFRS Sustainability Disclosure Standards without reducing usefulness of the disclosures for users.

99The TAC is in agreement that UK-specific guidance on materiality is not necessary or appropriate, even though it has been requested by some UK stakeholders. This option is not considered appropriate at this stage as it could compromise the international comparability of disclosures.

Sources of guidance

Endorsement recommendation

The TAC recommends that the requirements in IFRS S1 and IFRS S2 relating to sources of guidance are maintained without amendment. However, there are differing views on this recommendation.

Additional recommendations and observations

100The TAC recommends that UK stakeholders' attention is drawn to the ISSB's assertion that entities are not required to use the SASB materials, but only refer to and consider them.

101The TAC recommends that the FRC considers developing further guidance regarding assurance expectations relating to the extent to which an entity has 'referred to and considered' the SASB materials.

102The TAC recommends that the ISSB is engaged with on the enhancement of the SASB materials.

Technical assessment and deliberations

103IFRS S1 paragraphs 54–59 and IFRS S2 paragraphs 12, 23, 32, 37 and B65(d) include sources of guidance for entities to use or refer to when identifying sustainability-related risks and opportunities, and when identifying applicable disclosures.

104The sources of guidance referenced in IFRS S1 have been the subject of significant debate. UK stakeholders generally welcomed the sources of guidance as a helpful starting point, especially in the absence of a full and comprehensive suite of IFRS Sustainability Disclosure Standards. Some stakeholders considered that the approach taken by the ISSB balances the demand for prescriptive requirements and the need for flexibility in the application of IFRS S1 and IFRS S2. However, other stakeholders raised concerns about references to third-party materials within IFRS S1 and IFRS S2, especially when these materials were not developed using the same conceptual basis and have not been or are not subject to IFRS due process.

105Although there are differing views, the TAC recommends that the instruction in IFRS S1 and IFRS S2 that entities 'shall refer to and consider' the SASB materials should be maintained without amendment. The ISSB has communicated in several materials that entities are required to consider the disclosure topics and metrics in the SASB materials, but entities are not required to use the SASB materials. Feedback from UK stakeholders was mixed, with some believing that the instruction is clear and others commenting on the potential confusion as to whether the instruction leads to mandatory disclosures. Additionally, some stakeholders were concerned that the application of the SASB materials would lead to undue cost or effort, and that the use of the SASB materials could replace an entity-specific materiality assessment.

106A minority of TAC members disagree with the decision to maintain the requirements and are in favour of amending the instruction in IFRS S1 and / or IFRS S2 from ‘shall refer to and consider’ to ‘may refer to and consider’. Some favour amending the instruction in IFRS S1 but not in IFRS S2 due to the greater level of understanding and consensus around climate-related reporting metrics. Amending the instruction for both IFRS S1 and IFRS S2 might reduce the confusion that has been identified by stakeholders, and also allay stakeholder concerns about undue cost or effort and concerns about entity-specific materiality assessment being replaced.

107Overall, the TAC concludes that the criteria for amending the standards have not been met in this instance. The word 'consider' already suggests that entities are not required to use the SASB materials and as such the amendment from "shall' to "may' would not meaningfully change the requirement and so does not meet the threshold for amendment. Additionally, maintaining the instruction could support the international comparability of disclosures. However, the argument that the SASB materials promote international comparability assumes that entities will use the SASB materials to identify sustainability-related risks and opportunities and related disclosure requirements. Given that the intention from the ISSB is that the SASB materials are not required to be used, then international comparability is not necessarily going to be achieved.

108The ISSB has attempted to clarify its position that the use of the SASB materials is not mandatory in several documents. However, confusion about the instruction remains. The TAC recommends that UK stakeholders' attention should be drawn to the ISSB's assertion that entities are not required to use the SASB materials, but only refer to and consider them. The TAC also notes that the instruction 'shall' will have implications for assurance and recommends that the FRC considers developing further guidance regarding assurance expectations. TAC members have mixed views on the SASB materials. Some consider them to provide a useful common starting point in the achievement of a global baseline, whereas others consider them to be overly focused on the US context. The assessment of the content within the SASB materials is outside the scope of this technical assessment, and therefore the TAC does not present concluding views on the usefulness of the SASB materials. However, the TAC suggests that entities approach the SASB materials as guidance rather than as a prescriptive list of material disclosure topics. The TAC also recommends that the ISSB should be engaged with on the enhancement of the SASB materials.

109The TAC recommends that the references to the other sources of guidance, including the GRI Standards and ESRS, should be maintained without amendment. Stakeholders have agreed that these sources of guidance are helpful. As intended by the ISSB, these sources of guidance could support interoperability and international comparability, which will likely improve the quality of reporting if applied in accordance with the objectives of IFRS S1.

Location of sustainability-related disclosures

Endorsement recommendation

The TAC recommends that the requirements in IFRS S1 for the location of sustainability-related financial disclosures are maintained without amendment.

Additional recommendations and observations

110The TAC recommends that the PIC considers how to simplify and streamline the existing rules in the UK relating to the location of sustainability-related disclosures. This includes consideration of the requirements in the Companies Act 2006 and FCA Listing Rules, and the possible implications for future assurance requirements.

111In considering the location of disclosures, the PIC should also consider the interoperability challenges with other jurisdictional requirements, and the availability of safe harbour provisions for information in the strategic report that are currently in the Companies Act 2006.

112Noting that the ultimate decision about the location of disclosures is an implementation issue to be addressed by the PIC, the TAC recommends that the PIC considers whether to also require the disclosure of an index to enable users to navigate and locate the necessary disclosures.

Technical assessment and deliberations

113IFRS S1 paragraphs 60–63, B27 and B45–B47 sets out requirements for the appropriate location of sustainability-related financial disclosures.

114The TAC believes that providing disclosures in a consistent location is very helpful, especially for users of general purpose financial reports. However, the TAC acknowledges that the location of disclosures is also dependent on whether information is determined as material, which might result in different approaches being taken by different entities. It is noted that users would find it helpful if information that is material for primary user decision-making purposes was in the general purpose financial report, whereas information that is not material for primary users should be in a different report.

115The TAC notes that entities that are required to disclose information in accordance with the EU's CSRD, and are required to do so in the management report, might face interoperability challenges in meeting UK requirements. The PIC might wish to consider this as an implementation matter.