The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRS 102 Factsheet 7 - Transition to FRS 102

This factsheet has been prepared by FRC staff to aid preparers in applying FRS 102 for the first time. It should not be relied upon as a definitive statement on the application of the standard nor is it a substitute for reading the detailed requirements of FRS 102.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

This document contains copyright material of the IFRS® Foundation (Foundation) in respect of which all rights are reserved.

No rights are granted to third parties other than as permitted by the Terms of Use (www.frc.org.uk/FRStermsofuse) without the prior written permission of the FRC and the Foundation.

Material issued in respect of the application of Financial Reporting Standards in the UK and the Republic of Ireland has not been prepared or endorsed by the International Accounting Standards Board.

© The Financial Reporting Council Limited 2024

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Transition to FRS 102

An entity may transition to FRS 102 from one of a number of other financial reporting frameworks including adopted IFRS, FRS 101 Reduced Disclosure Framework, FRS 105 The Financial Reporting Standard applicable to the Micro-entities Regime, or GAAP of another country.

Section 35 Transition to this FRS applies to the first-time adoption of FRS 102 and sets out how an entity prepares its first financial statements under FRS 102. Once an entity has applied Section 35, it need not apply it again (except as required by paragraph 35.2): therefore, any subsequent change to Section 35 is generally expected to have no impact on an entity that has already adopted FRS 102.

This factsheet outlines:

- the general procedures for transitioning to FRS 102;

- the mandatory transitional exceptions and optional transitional exemptions to retrospective restatement; and

- the disclosure requirements on transition.

What about entities that have previously applied FRS 102, but not in their most recent reporting period?

An entity may, either voluntarily or necessarily, move between regimes over time. For example, an entity that qualifies for the micro-entities regime may have voluntarily chosen to apply FRS 102 initially but subsequently decided to move to FRS 105 for cost or simplicity reasons. However, if the entity grows and it no longer qualifies for the micro-entities regime, it has to move back up to FRS 102. In this situation, paragraph 35.2 states that the entity must apply Section 35 on both transitions to FRS 102 (unless on the second occasion it chooses to apply FRS 102 as if it had never stopped applying it).

What about newly-incorporated entities?

There are no specific requirements or exceptions for newly-incorporated entities which apply FRS 102 in their first financial statements. However, such an entity has no preceding periods and hence has no comparative information to report, and would not be required to make the disclosures set out in paragraphs 35.12 to 35.15. The entity's date of transition to FRS 102 (see Section 2) is considered to be the date of its incorporation.

2. General procedure: Retrospective restatement

In general, transitioning entities are required to do full retrospective restatement. However, Section 35 includes both mandatory exceptions to this rule and optional transitional exemptions. (FRS 102 reference: 35.7)

Full retrospective restatement means that all assets and liabilities at the date of transition (see below) are recognised (or derecognised), classified (or reclassified) and measured in accordance with FRS 102.

When is the date of transition?

One of the key terms used in Section 35 is the 'date of transition'. The date of transition is the beginning of the earliest period for which an entity presents full comparative information. (FRS 102 reference: 35.6, Glossary)

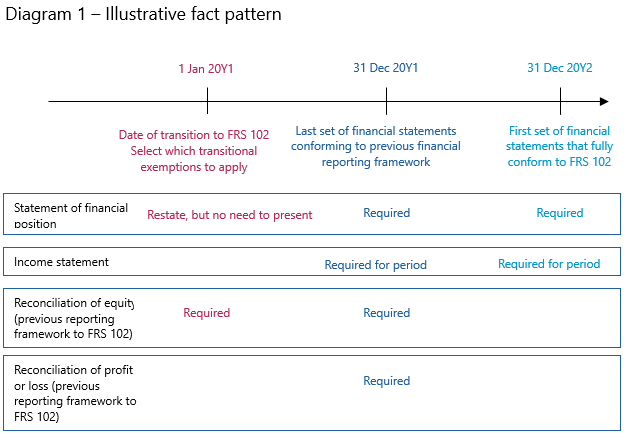

To illustrate this, for simplicity, this factsheet assumes the following fact pattern:

- An entity wishes to present financial statements for the first time under FRS 102 for the year ended 31 December 20Y2 with one year of full comparative information.

Section 35 acknowledges that some entities may choose to present more than one period of comparative information. However, in practice many entities present just one comparative period.

Based on the illustrative fact pattern above, the date of transition would be the beginning of the comparative period (i.e. 1 January 20Y1). It is not 1 January 20Y2, i.e. not the beginning of the current reporting period.

Diagram 1 summarises the key dates for the illustrative fact pattern, and the associated disclosures required.

| 1 Jan 20Y1 | 31 Dec 20Y1 | 31 Dec 20Y2 | FRS 102 Reference | |

|---|---|---|---|---|

| Date of transition to FRS 102 Select which transitional exemptions to apply | Last set of financial statements conforming to previous financial reporting framework | First set of financial statements that fully conform to FRS 102 | ||

| Statement of financial position | Restate, but no need to present | Required | Required | 35.7 |

| Income statement | Required for period | Required for period | ||

| Reconciliation of equity (previous reporting framework to FRS 102) | Required | Required | 35.13(b) | |

| Reconciliation of profit or loss (previous reporting framework to FRS 102) | Required | Required | 35.13(c) |

General requirements

In doing full retrospective restatement, the statements of financial position at both the date of transition (i.e. 1 January 20Y1) and the comparative reporting date (i.e. 31 December 20Y1) will need to be restated to conform with the requirements of FRS 102. (FRS 102 reference: 35.7)

The opening statement of financial position at the date of transition does not need to be presented. However, it still needs to be prepared so that the information needed for the transitional reconciliations can be determined.

The income statement for the prior year (i.e. the year ended 31 December 20Y1) shall also be restated and presented.

3. Disclosures

General requirements

FRS 102 contains an overarching requirement to explain how the transition to FRS 102 has affected an entity's reported financial position and performance. An entity also needs to provide a description of the nature of each change in accounting policy. (FRS 102 reference: 35.12)

To comply with the requirements of paragraph 35.12, an explanation must be provided of material changes that are not reflected in the reconciliation required by paragraph 35.13, including whether they arose as a result of error or a change in accounting policy. (FRS 102 reference: 35.12B)

Disclosure is required of which (if any) of the transitional exemptions in paragraph 35.10 (discussed in Section 4 of this factsheet) have been adopted. (FRS 102 reference: 35.12A)

FRS 102 also contains disclosure requirements for entities that have previously reported under FRS 102 but not in their most recent annual financial statements. (FRS 102 reference: 35.12C)

Specific requirements

The following disclosures are required for an entity following the illustrative fact pattern set out in Diagram 1.

Transitional reconciliations

The following transitional reconciliations are required:

- Equity determined in accordance with its previous financial reporting framework

to its equity determined in accordance with FRS 102 at: (FRS 102 reference: 35.13(b))

- the date of transition to FRS 102 (i.e. in the illustration, 1 January 20Y1); and

- the end of the latest period presented in the entity's most recent annual financial statements determined in accordance with its previous financial reporting framework (i.e. in the illustration, 31 December 20Y1).

- Profit or loss determined in accordance with its previous financial reporting framework for the latest period in the entity's most recent annual financial statements to its profit or loss determined in accordance with FRS 102 for the same period (i.e. in the illustration, the year ended 31 December 20Y1). (FRS 102 reference: 35.13(c))

FRS 102 does not prescribe the format of the transitional reconciliations. Two possible formats are illustrated below along with the associated notes. However, an entity may use any suitable format, taking into account the nature and amount of its own adjustments. For simplicity, these illustrations generally ignore any deferred tax impact.

If an entity becomes aware of errors made under its previous financial reporting framework, the reconciliations should distinguish the correction of these errors from changes in accounting policy. (FRS 102 reference: 35.14)

Example presentation of reconciliations

Option 1

Reconciliation of equity

| | | At 1 Jan 20Y1 | | At 31 Dec 20Y1 | | |:-----------------------------------------|:----|:----------|:----------|:----------|:----------|:----------| | | Note | As previously stated | Effect of transition¹ | FRS 102 | As previously stated | Effect of transition¹ | FRS 102 | | | | CU’000 | CU’000 | CU’000 | CU’000 | CU’000 | CU’000 | | Fixed assets | (i) | 5,868 | 2,800 | 8,668 | 5,416 | 3,450 | 8,866 | | Current assets | (ii) (iii) | 475 | 15 | 490 | 1,020 | 8² | 1,028 | | Creditors: amounts falling due within one year | (ii) | (355) | (11)³ | (366) | (324) | (14) | (338) | | Net current assets | | 120 | 4 | 124 | 696 | (6) | 690 | | Total assets less current liabilities | | 5,988 | 2,804 | 8,792 | 6,112 | 3,444 | 9,556 | | Creditors: amounts falling due after more than one year | (ii) | (2,900) | (6) | (2,906) | (2,840) | (3)⁴ | (2,843) | | Provisions for liabilities | | (410) | - | (410) | (465) | - | (465) | | Net assets | | 2,678 | 2,798 | 5,476 | 2,807 | 3,441 | 6,248 | | Capital and reserves | | 2,678 | 2,798 | 5,476 | 2,807 | 3,441 | 6,248 |

Reconciliation of profit or loss

| | | Year ended 31 Dec 20Y1 | | |:---------------------------------------------|:----|:----------|:----------|:----------| | | Note | As previously stated | Effect of transition⁵ | FRS 102 | | | | CU’000 | CU’000 | CU’000 | | Turnover | | 832 | - | 832 | | Cost of sales | (ii) (iii) | (520) | (12)⁶ | (532) | | Gross profit | | 312 | (12) | 300 | | Administrative expenses | (ii) (iii) | (65) | 45⁷ | (20) | | Other operating income | | 42 | - | 42 | | Fair value gain on investment property | (i) | - | 610⁸ | 610 | | Operating profit | | 289 | 643 | 932 | | Interest receivable and similar income | | 5 | - | 5 | | Interest payable and similar expenses | | (130) | - | (130) | | Taxation | | (35) | - | (35) | | Profit after taxation and for the financial year | | 129 | 643 | 772 |

Option 2

Reconciliation of equity

| At 1 Jan 20Y1 | At 31 Dec 20Y1 | ||

|---|---|---|---|

| Note | CU’000 | CU’000 | |

| Capital and reserves (as previously stated) | 2,678 | 2,807 | |

| Fair value gain on investment property | (i) | 2,800 | 3,450 |

| Recognition of derivative financial instruments | (ii) | (2) | 1 |

| Re-measurement of inventory using spot exchange rate | (iii) | - | (10) |

| Capital and reserves (FRS 102) | 5,476 | 6,248 |

Reconciliation of profit or loss

| Year ended 31 Dec 20Y1 | ||

|---|---|---|

| Note | CU’000 | |

| Profit for the year (as previously stated) | 129 | |

| Removal of depreciation charge on investment property | (i) | 40 |

| Fair value gain on investment property | (i) | 610 |

| Recognition of derivative financial instruments | (ii) | 3 |

| Re-measurement of inventory using spot exchange rate | (iii) | (10) |

| Profit for the year (FRS 102) | 772 |

Notes to the reconciliations

The following notes are applicable to both suggested formats set out above.

- Investment properties FRS 102 requires all investment properties that are not rented to another group entity to be measured at fair value, with gains and losses recognised in profit or loss. Under its previous financial reporting framework, the entity was not required to measure investment property at fair value on the balance sheet. Instead, investment property was measured at cost less accumulated depreciation and accumulated impairment losses. At 1 January 20Y1, the carrying amount of the investment property was CU1,000,000 and its fair value was measured at CU3,800,000 resulting in a fair value gain of CU2,800,000 on transition. At 31 December 20Y1, the carrying amount was CU960,000 and the fair value of the property had increased further to CU4,410,000. An adjustment of CU3,450,000 is required to the balance sheet along with an adjustment to remove depreciation of CU40,000 from administrative expenses and recognise a fair value gain of CU610,000 in profit or loss in the year9.

- Financial instruments Derivative financial instruments are classified as 'other financial instruments' in FRS 102 and are recognised as a financial asset or a financial liability, at fair value, when an entity becomes party to the contractual provisions of the instrument. Fair value gains and losses are recognised in profit or loss. Under its previous reporting framework, the entity was not required to recognise derivative financial instruments on the balance sheet; instead the effects of derivative financial instruments were recognised in profit or loss when the instruments were settled. At 1 January 20Y1, financial assets of CU15,000 and financial liabilities of CU17,000 have been recognised. At 31 December 20Y1, financial assets of CU18,000 and financial liabilities of CU17,000 have been recognised. Profit for the period has increased by CU3,000.

- The derivative financial instruments are foreign exchange forward contracts. Under its previous reporting framework, the entity translated purchases in foreign currencies at the rate of exchange specified in a matching forward contract. FRS 102 requires purchases to be translated using the spot exchange rate on the date of the transaction. Items purchased since the transition date have been re-measured based on spot exchange rate. At 31 December 20Y1 inventory has been reduced, and cost of sales for the year then ended has been increased, by CU10,000, and costs of CU2,000 have been reclassified as administrative expenses from cost of sales.

4. Transitional exceptions and exemptions

As noted in Section 2, transitioning entities are generally required to do full retrospective restatement.

Changes in accounting policies

Any adjustments made that relate to differences in accounting policies between FRS 102 and the previous financial reporting framework are recognised directly in retained earnings (or other component of equity) at the date of transition. (FRS 102 reference: 35.8)

If, under its previous financial reporting framework, an entity had adopted an accounting policy of capitalising borrowing or development costs, and on transition to FRS 102 it adopts an accounting policy of expensing such costs, it shall not include any capitalised borrowing or development costs (respectively) within the cost of an asset on transition. (FRS 102 reference: 35.8A, 35.8B)

As amended by the Periodic Review 2024 amendments, Sections 11 Basic Financial Instruments and 12 Other Financial Instruments Issues offer two accounting policy choices on transition to FRS 102:

- Apply the requirements of Sections 11 and 12; or (FRS 102 reference: 11.2(a) & 12.2(a))

- Apply the recognition and measurement requirements of IFRS 9 Financial Instruments and the presentation and disclosure requirements of Sections 11 and 1210. (FRS 102 reference: 11.2(c) & 12.2(c))

Exceptions and exemptions

Section 35 includes mandatory exceptions to full retrospective restatement, and optional transitional exemptions.

Mandatory exceptions to retrospective application

On transition, entities are not permitted to change the accounting for any of the following transactions: (FRS 102 reference: 35.9)

- Derecognition of financial assets and financial liabilities.

- Accounting estimates.

- Measurement of non-controlling interest.

Further details of the requirements can be found in paragraph 35.9.

Optional exemptions from retrospective application

On transition, entities are permitted to select from a range of optional exemptions. Entities are allowed to pick and choose which of these exemptions to take; it is not an 'all or nothing' choice. Not all the exemptions will be relevant to all entities; for example, a business combinations exemption is permitted, but not all entities will have made acquisitions prior to the date of transition. (FRS 102 reference: 35.10)

It should be remembered that, subject to the mandatory exceptions above, full retrospective restatement is required unless:

- a transitional exemption is allowed under Section 35;

- an entity chooses to apply that transitional exemption; and

- an entity discloses the fact that the exemption has been applied.

Paragraph 35.10 sets out the exact details of all the exemptions; they are summarised below:

Business combinations (including group reconstructions)

Entities can elect not to apply Section 19 Business Combinations and Goodwill to business combinations effected before the date of transition. (FRS 102 reference: 35.10(a))

Share-based payment transactions

Entities can elect not to apply Section 26 Share-based Payment to equity instruments (including the equity component of share-based payment transactions previously treated as compound instruments) that were granted before the date of transition to FRS 102, or to liabilities arising from share-based payment transactions that were settled before the date of transition, unless they had previously applied IFRS 2 Share-based Payment or FRS 101. (FRS 102 reference: 35.10(b))

Fair value as deemed cost

Entities can elect to use fair value on the date of transition as deemed cost for items of property, plant and equipment and intangible assets. (FRS 102 reference: 35.10(c))

Revaluation as deemed cost

Entities can elect to use a previous revaluation on or before the date of transition as deemed cost at the revaluation date for items of property, plant and equipment and intangible assets. (FRS 102 reference: 35.10(d))

Individual and separate financial statements

Entities can elect either to measure the cost of investments in subsidiaries, associates and jointly controlled entities at the date of transition or use their carrying amount at the date of transition as a deemed cost. (FRS 102 reference: 35.10(f))

Compound financial instruments

Entities can elect not to separate the liability and equity components of a compound financial instrument if the liability component is not outstanding at the date of transition. (FRS 102 reference: 35.10(g))

Extractive activities

Entities can elect to measure exploration and evaluation assets and assets in development or production phases at amounts determined under their previous financial reporting framework at the date of transition, subject to certain requirements including impairment testing. (FRS 102 reference: 35.10(j))

Decommissioning liabilities included in the cost of property, plant and equipment

Entities can elect to measure the decommissioning component of property, plant and equipment at the date of transition, rather than on the date the obligation initially arose. (FRS 102 reference: 35.10(l))

Decommissioning liabilities included in the cost of a right-of-use asset

Entities can elect to measure the decommissioning component of a right-of-use asset at the date of transition, rather than on the date the obligation initially arose. (FRS 102 reference: 35.10(IA))

Dormant companies and dormant LLPs

Dormant companies and dormant LLPs can elect to retain their accounting policies at the date of transition until there is any change in those balances, or the company or LLP undertakes any transactions, that would cause the company or LLP to cease to be dormant. (FRS 102 reference: 35.10(m))

Borrowing costs

Entities that will adopt a policy to capitalise borrowing costs going forward can elect to start capitalisation from the date of transition, rather than from when borrowing costs were incurred. (FRS 102 reference: 35.10(o))

Public benefit entity combinations

Entities can elect not to restate public benefit entity combinations effected before the date of transition. (FRS 102 reference: 35.10(q))

Assets and liabilities of subsidiaries, associates and joint ventures

If a subsidiary transitions to FRS 102 after its parent, the subsidiary can measure its assets and liabilities at either the carrying amounts included in the consolidated financial statements, based on the parent's date of transition to FRS 102, if no adjustments were made for consolidation procedures and for the effects of the subsidiary's acquisition, or in accordance with Section 35. (FRS 102 reference: 35.10(r))

If a parent transitions to FRS 102 after its subsidiary, the consolidated financial statements shall include the subsidiary's assets and liabilities at the same carrying amounts as those in the subsidiary's financial statements.

Similarly, the underlying amounts recognised in the separate and consolidated financial statements of a parent should be the same.

Designation of previously recognised financial instruments

Entities can designate any financial asset or financial liability at fair value through profit or loss at the date of transition, provided it meets certain criteria. (FRS 102 reference: 35.10(s))

Hedge accounting

Section 35 contains a number of exemptions in relation to hedge accounting depending on the particular facts and circumstances applicable. (FRS 102 reference: 35.10(t))

Development costs

Entities that will adopt a policy to capitalise development costs going forward can elect to start capitalisation from the date of transition, rather than from when development costs were incurred. (FRS 102 reference: 35.10(w))

Leases

An entity can choose to assess whether a contract contains a lease at the date of transition rather than at the commencement date of the lease. (FRS 102 reference: 35.10(x))

On transition, an entity shall calculate the lease liability by determining the present value (discounted using the lessee's incremental borrowing rate or the lessee's obtainable borrowing rate, for each lease) of the remaining lease payments at the date of transition, with the right-of-use asset equal to the lease liability, adjusted for prepaid or accrued lease payments.

An entity applying IFRS 16 Leases immediately prior to the date of transition has the option of measuring its lease liabilities and right-of-use assets on transition at the amount calculated under IFRS 16. If used, this election must be applied to all leases.

However, if a right-of-use asset meets the definition of investment property, it shall be measured at fair value on the date of transition (unless the election in paragraph 16.4A(b)(ii) is taken).

Revenue

An entity can apply one or more of the practical expedients set out in paragraph 1.65, which must be applied consistently to all contracts and disclosed: (FRS 102 reference: 35.10(y))

- An entity need not restate completed contracts that begin and end in the same reporting period or are completed before the earliest period presented (e.g. using the dates set out in Section 2 of this factsheet, are completed before 1 January 20Y1).

- To account for contracts with variable consideration which are completed by the reporting date (e.g. 31 December 20Y2), the entity may use the transaction price at the date the contract was completed, rather than estimating amounts of variable consideration in comparative periods.

- Contracts that were modified before the beginning of the reporting period (e.g. before 1 January 20Y2) need not be retrospectively restated. Instead, the aggregate effect of all of the modifications that occurred before the beginning of the earliest period presented (e.g. 1 January 20Y1), or before the beginning of the reporting period (e.g. 1 January 20Y2) (the choice between these dates depending on the transitional approach taken), may be reflected when identifying the satisfied and unsatisfied performance obligations, determining the transaction price, and allocating the transaction price to the satisfied and unsatisfied performance obligations.

In paragraph 1.65, a completed contract is one for which the entity has transferred all the identified goods and services whilst applying the previous financial reporting framework.

5. Illustrative examples

The following examples illustrate how the transitional exemptions may be applied to four common transactions. The examples assume the fact pattern illustrated earlier in this factsheet with an entity wishing to present financial statements for the first time under FRS 102 for the year ended 31 December 20Y2, with one year of full comparative information (i.e. for year ended 31 December 20Y1).

1. Accounting estimates

At 31 December 20Y0, Entity A had a debtor balance of CU500. At 31 December 20Y0, Entity A was concerned about the credit risk of the debtor and was in discussion with the debtor as to how the debt might be settled. As a consequence, Entity A had made a provision of CU250, i.e. for 50% of the balance as at that date. During 20Y1 the debtor collapsed and was liquidated. (FRS 102 reference: 35.9(c))

A timeline illustrating an accounting estimates fact pattern: * 1 January 20Y1: Date of transition. Instruction: "Do not restate 50% provision as retrospective adjustment to accounting estimates is prohibited." * 31 December 20Y1: Comparative year-end. Event: "Write off debtor." * 31 December 20Y2: Current year-end.

When Entity A prepares its opening balance sheet as at 1 January 20Y1 (the date of transition), it is clear that it will not be able to collect the outstanding debt. However, Entity A does not revise its estimate under its previous financial reporting framework because FRS 102 prohibits retrospective adjustments to accounting estimates on the date of transition.

2. Business combination before the date of transition

On 1 January 20X8, Entity B acquired a wholly-owned subsidiary. At the date of acquisition, Entity B recognised the following assets and liabilities at their fair values in its consolidated financial statements under its previous financial reporting framework. Entity B did not recognise deferred tax in respect of any of the fair value adjustments made on acquisition.

| CU | CU | |

|---|---|---|

| Property, plant and equipment | 30,000 | |

| Goodwill | 10,000 | 40,000 |

| Inventory | 1,000 | |

| Debtors | 1,500 | |

| Net current assets | 2,500 | |

| Creditors | (3,000) | |

| Net current liabilities | (500) | |

| Net assets acquired | 39,500 |

On transition:

Measurement of goodwill

FRS 102 states that goodwill shall be considered to have a finite useful life and in the exceptional case when an entity is unable to make a reliable estimate of the useful life, the life shall not exceed 10 years. (FRS 102 reference: 19.23(a))

On acquisition in 20X8, Entity B determined that the goodwill had an economic life of 15 years. At 31 December 20Y1 the carrying amount for the goodwill is therefore CU7,333 and has a remaining useful life of 11 years.

Entity B still considers the remaining useful economic life of that goodwill to be 11 years and can provide adequate evidence to support this. It is therefore not required to adjust the expected amortisation profile.

Measurement of other acquired assets and liabilities

In accordance with Section 35, Entity B decides not to apply the requirements of Section 19 Business Combinations and Goodwill retrospectively to the acquired assets and liabilities. Entity B is still required to recognise and measure those acquired assets and liabilities that remain within the group at the date of transition in accordance with the other first-time adoption accounting requirements set out in paragraphs 35.7 to 35.10. (FRS 102 reference: 35.10(a); 35.7 to 35.10)

Entity B determines that no adjustments to the acquired assets and liabilities are required in accordance with the first-time adoption accounting requirements of FRS 102, except for deferred tax. Paragraph 29.6 requires the recognition of deferred tax on all timing differences. Entity B still owns the acquired property, plant and equipment which were fair valued on the date of acquisition. Entity B measures the deferred tax liability on the fair value adjustments (to the extent that they have not been reduced by depreciation prior to the date of transition) based on tax rates enacted or substantively enacted at the date of transition and records the corresponding adjustment in equity. (FRS 102 reference: 29.6)

3. Revaluation as deemed cost

Entity C11 owns two properties, A and B. Neither Property A nor Property B is an investment property. Entity C has an existing accounting policy to revalue its properties and to fully depreciate them over a useful life of 50 years from the date of purchase.

Property A was acquired on 31 December 20U7 at a cost of CU1,000 and has been revalued on a regular basis; the last time was on 31 December 20X7 when its value was recorded in the financial statements at CU100,000 and its remaining useful life was 20 years. There has been no significant change in the value of Property A since that revaluation.

Property B was acquired on 31 December 20X7, at a cost of CU50,000. Property B has never been revalued as it was purchased in the same year that the most recent valuation was carried out and at that time its cost was the best available evidence of its valuation. There has been no impairment in its value.

On transition:

Entity C decides not to continue its policy of revaluation. (It is assumed that Entity C concludes that its estimates of the residual value and useful life of its properties remain appropriate under FRS 102.)

Paragraph 35.10(d) provides an optional exemption from restating the value of the property based on its original cost. Therefore Entity C has the following two choices in relation to Property A:

- it could elect to use the most recent revaluation from 20X7 (being CU100,000) as its deemed cost at that date and no further adjustment is required; or

- it could restate the cost of the property to its original cost of CU1,000, adjusting accumulated depreciation accordingly.

If the revalued amount of CU100,000 were used as its deemed cost, in order to comply with company law the difference from the relevant historical cost amount would need to be shown in a revaluation reserve and the excess depreciation, above that calculated on a historical cost basis, would continue to be offset against it. Also as Property A is not carried at historical cost any other company law disclosures relating to revalued property will be required. (FRS 102 reference: A3.40C)

If the property is restated to the original cost of CU1,000 the following adjustment would be required:

- Dr Revaluation reserve CU84,660

- Dr Accumulated depreciation CU14,34012

- Cr Property, plant and equipment CU99,000

No adjustment is required on transition for Property B13.

4. Borrowing costs

Entity D decided to construct a new building for its own use. Work on the construction commenced during 20Y0. Entity D capitalised tangible fixed assets on the basis of cost, in accordance with its previous financial reporting framework, but had not previously constructed any significant assets.

As at 31 December 20Y0, Entity D had capitalised construction costs of CU25,000 and estimated that it still had approximately nine months of construction work ahead. Entity D had adopted an accounting policy of not capitalising borrowing costs, but if it had, the amount capitalised would have been CU300.

During 20Y1, Entity D completed construction of the building. The total cost to be capitalised in accordance with FRS 102 (excluding borrowing costs) is CU90,000. Qualifying borrowing costs calculated in accordance with FRS 102 relating to the project as a whole are CU2,500, including the CU300 from 20Y0.

On transition to FRS 102, Entity D reviews its accounting policies and decides that it will now choose to capitalise borrowing costs in accordance with Section 25. In accordance with paragraph 35.10(o) it chooses to capitalise costs prospectively from 1 January 20Y1. As a result, no adjustment is made to the carrying value of the asset at the date of transition (i.e. 1 January 20Y1); the CU300 previously written off is not capitalised, but CU2,200 of borrowing costs are capitalised during the year ended 31 December 20Y1.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Linked in or X @FRCnews

-

In applying paragraph 35.14, if any errors are identified, the 'Effect of transition' column may need to be split into changes arising from errors and changes arising from changes in accounting policies. ↩

-

Adjustment for financial assets of CU18,000 less CU10,000 adjustment to inventory due to remeasurement using spot rate (see notes (ii) and (iii)). ↩

-

Adjustment for financial liabilities of CU17,000 which are split between those falling due within one year of CU11,000 and those falling due after more than one year of CU6,000 (see note (ii)). ↩

-

Adjustment for financial liabilities at 31 December 20Y1 of CU17,000 are split between those falling due within one year of CU14,000 and those falling due after more than one year of CU3,000 (see note (ii)). ↩

-

In applying paragraph 35.14, if any errors are identified, the 'Effect of transition' column may need to be split into changes arising from errors and changes arising from changes in accounting policies. ↩

-

Increase in cost of sales of CU10,000 due to remeasurement of inventory using spot rate plus CU2,000 reclassification of costs from administrative expenses (see note (iii)). ↩

-

CU2,000 reclassification of costs to cost of sales plus CU3,000 fair value gain on financial assets plus adjustment to remove CU40,000 depreciation on investment property (see notes (i), (ii) and (iii)). ↩

-

Fair value increase from CU3,80,000 to CU4,410,000 (see note (i)). ↩

-

This example ignores deferred tax, but a deferred tax liability would usually be recognised in relation to the fair value gain on the investment property. ↩

-

An entity may also apply the recognition and measurement requirements of IAS 39 and the presentation and disclosure requirements of Sections 11 and 12, but only if it is to align the entity's accounting policies with those adopted in the consolidated financial statements within which the entity is included. ↩

-

In this example, Entity C must have previously been applying either adopted IFRS or FRS 101, as FRS 105 does not permit revaluation of property, plant and equipment. ↩

-

This represents three years' depreciation (from 31 December 20X7 to 1 January 20Y1) on the revalued amount, being £15,000 in total (CU100,000 x 3 / 20 years remaining), less 33 years' depreciation (from 31 December 20U7 to 1 January 20X1) on the historical cost, being CU660 in total (CU1,000 x 33 / 50 years), which is not adjusted for. ↩

-

The exemption to permit revaluation as deemed cost is available at the level of individual items of property, plant and equipment. Entity C could choose to revalue Property B at the date of transition and use that new valuation as deemed cost. Similarly, as an alternative to using the 20X7 valuation for Property A, Entity C could revalue it at the transition date (irrespective of whether Property B is revalued at transition date). ↩