The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Assurance of Sustainability Reporting Market Study Emerging Findings

- 1. Introduction

- 2. Summary – key emerging findings

- 3. Market trends – demand for sustainability assurance

- Market trends – market composition

- Market trends – audit vs non-audit firm sustainability assurance providers

- Market trends – using an auditor for sustainability assurance

- Market trends – switching of assurance providers among FTSE 350 companies

- Market trends – assurance standards

- Market trends – level of assurance

- 4. Stakeholder engagement and views

- Functioning of the market

- Benefits and costs of assurance

- Stakeholder views – choice and competition

- Stakeholder views – interplay with audit

- Stakeholder views – opportunities and barriers

- Stakeholder views – market capacity

- Stakeholder views – changes in the UK sustainability assurance market

- Stakeholder views – international regulatory developments

- Stakeholder views – different approaches from around the world

- 5. Invitation to comment

- 6. Appendices

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from an action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Introduction

-

This document highlights the emerging findings from our market study on the assurance of sustainability reporting by UK companies, which we launched in March 2024.

-

We provide a one-page summary of these followed by a section detailing data we have gathered on the provision of sustainability assurance to FTSE 350 companies. There is also a section summarising stakeholder views.

-

Page 20 sets out some areas where we would find it helpful to receive further information in writing to inform the remainder of the market study.

Aim of the market study

-

The Financial Reporting Council (FRC) wants to ensure the UK's market for sustainability assurance is working effectively, with a wide range of providers producing high quality assurance.

-

The market study is focused on how well the UK sustainability assurance market is functioning, whether it is delivering desirable results including high-quality assurance without creating undue burdens and costs for business; and how it could develop in the future.

-

It has three broad themes:

- Choice of sustainability assurance provider and competition

- Market capacity, opportunities and barriers to entry/expansion

- The regulatory framework including how changing international requirements could affect the UK market.

Information gathering and stakeholder engagement

-

Following the launch of the market study, we have gathered information and data from several sources.

- A third-party provider Minerva Analytics Ltd collated publicly available data on the assurance of sustainability information reported by the FTSE 350 companies since 2019.

- Through 32 one-to-one meetings and 10 roundtables, we engaged with over 100 stakeholders. These included FTSE 350 companies, private UK companies, audit and non-audit firm providers of sustainability assurance, sustainability consultancies, investors, professional and industry trade bodies, academics and other institutions with an interest in sustainability.

- We received 31 written submissions to our launch document. Many of these have been published at: www.frc.org.uk/consultations/assurance-of-sustainability-reporting-market-study/

-

We would like to take this opportunity to thank all stakeholders who have engaged with us to date.

Next steps

-

Alongside obtaining written submissions on our emerging findings, we intend to hold further meetings with stakeholders.

-

We are planning to conclude the market study and produce our final report with any proposals for action by early 2025.

2. Summary – key emerging findings

Based on the data and stakeholder views gathered to date, we have identified four key findings.

1. There appears to be a wide variety and choice of sustainability assurance providers in the UK but there are concerns over the consistency in quality of the assurance.

- In 2022, there were 64 providers of assurance to FTSE 350 companies although 44 carried out only one or two assurance engagements.

- Large companies reported a choice of three to four providers, but smaller companies claimed to have fewer options.

- Many companies reported difficulties in determining the suitability of sustainability assurance providers and assessing their likely quality, especially when appointing a new provider.

2. We have heard from some stakeholders that the UK sustainability assurance market could become dominated by the Big Four audit firms, which could limit choice and effective competition.

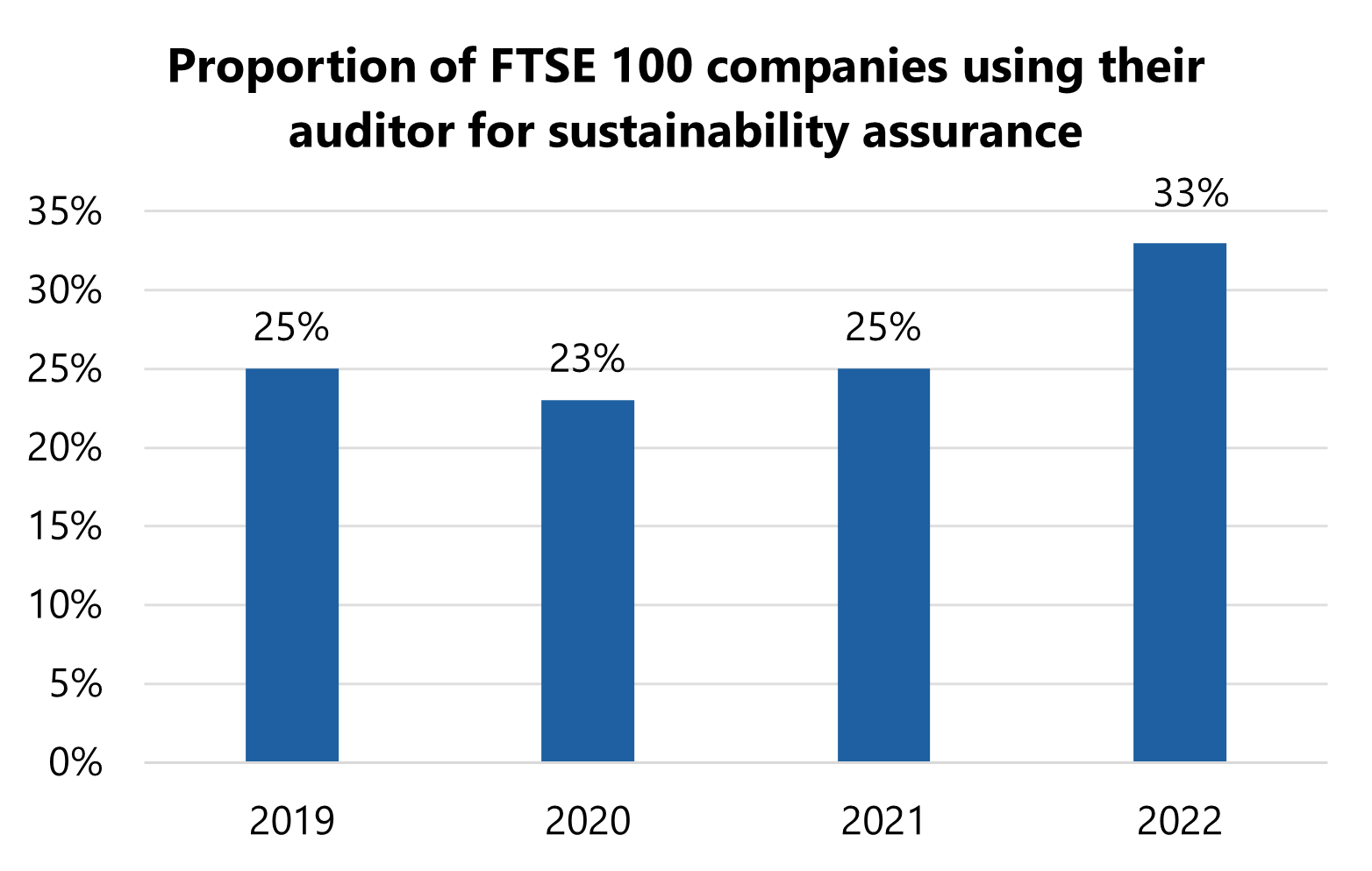

- Among FTSE 100 companies, there has been an increase in the proportion of auditors providing sustainability assurance to their clients, from 25% in 2019 to 33% in 2022.

- Many stakeholders reported growing preference for companies to use their auditor for sustainability assurance.

- This may be driven by international changes affecting some UK companies, for example the EU's Corporate Sustainability Reporting Directive (CSRD) requirements.

3. There are concerns about the immaturity of the UK sustainability assurance market and that a lack of clarity on the UK's regulatory position could hinder investment, planning and capacity development.

- All stakeholders anticipate the demand for sustainability assurance to grow and many expect opportunities for the UK market as a result.

- Stakeholders collectively agreed that there was a clear need for transparency and clarity on likely future regulatory requirements, or at least the direction of travel, to enable adequate planning, investment and future compliance.

- Many stakeholders would like any UK regulatory requirements to be fully interoperable with other international regulations.

4. There could be a risk that without an established regulatory framework, the UK sustainability assurance market may not produce consistent, high-quality sustainability information for decision-making.

- Given the market is still immature, many stakeholders suggested that a regulatory framework could play an important role in helping to ensure high-quality sustainability information.

- Some stakeholders had concerns the lack of an established framework for the quality of assurance created inconsistencies in the market.

3. Market trends – demand for sustainability assurance

In this section we set out key emerging findings from the data gathered by Minerva Analytics Ltd on the sustainability assurance obtained by FTSE 350 companies between 2019 and 2022.

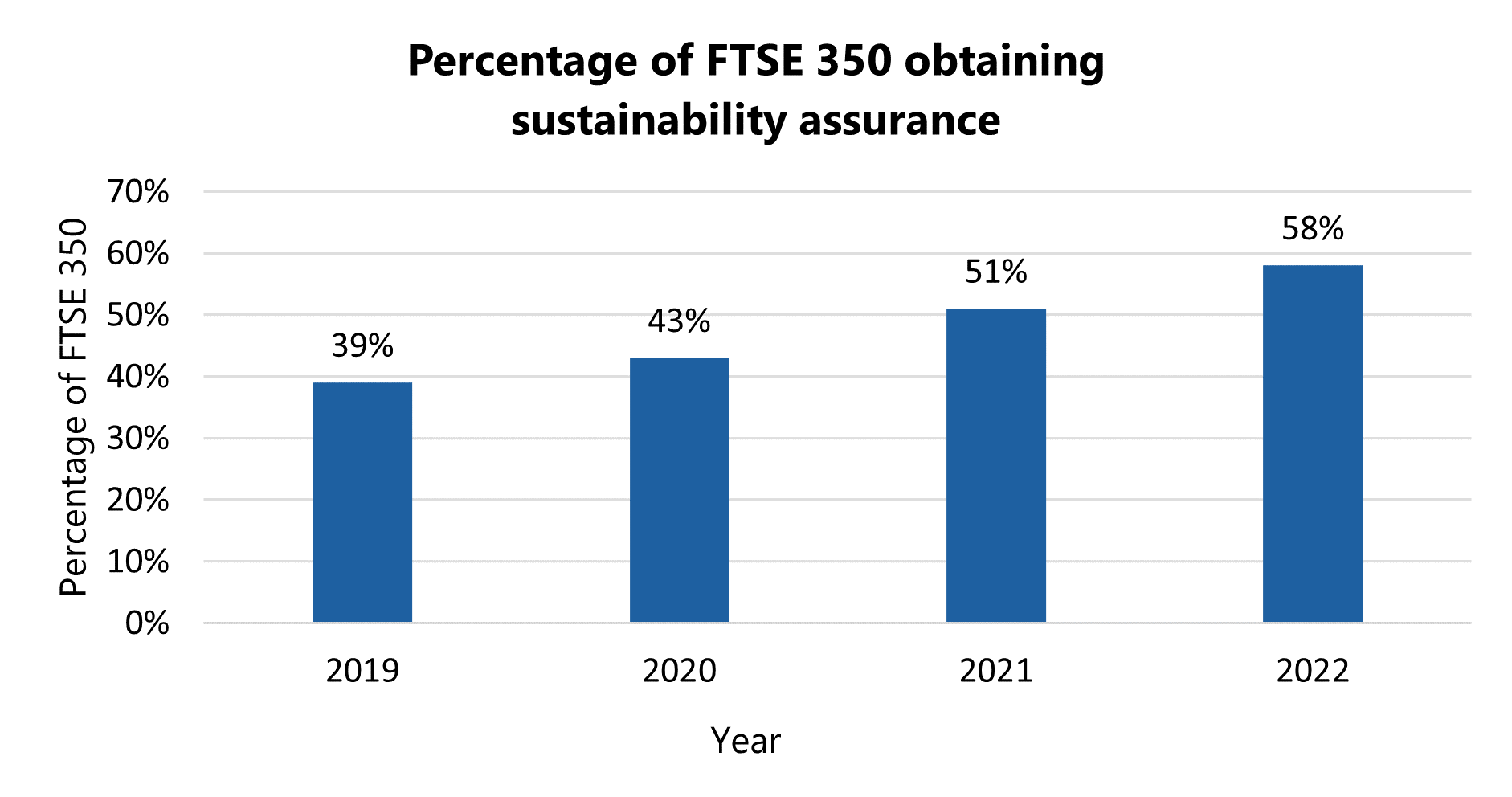

Demand for sustainability assurance is growing amongst FTSE 350 companies

- The proportion of FTSE 350 companies that obtained sustainability assurance grew by 19 percentage points between 2019 and 2022.

- Larger companies are more likely to obtain sustainability assurance. In 2022, 83% of the FTSE 100 did, compared to 47% of FTSE 250 companies.

Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

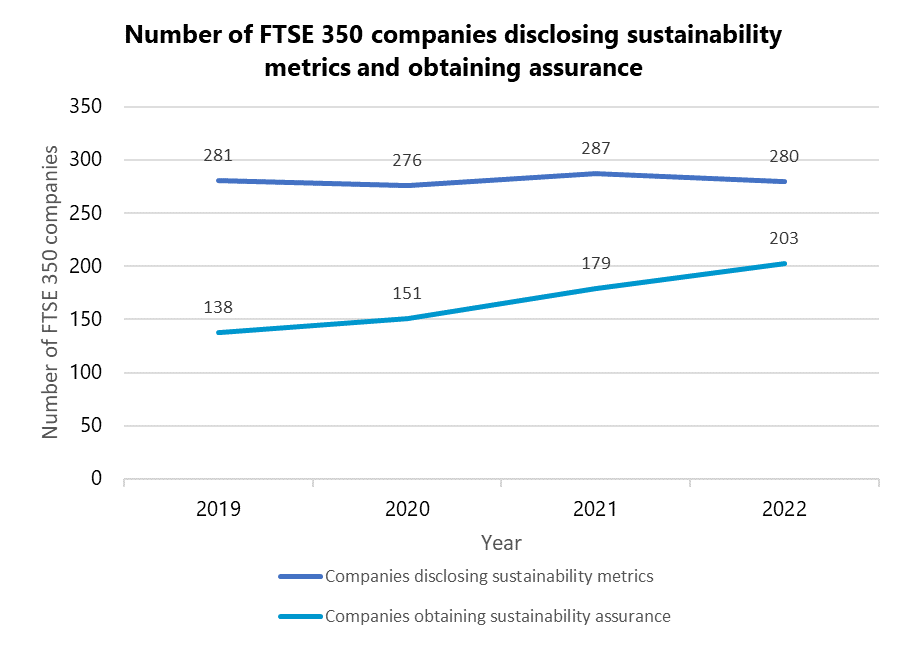

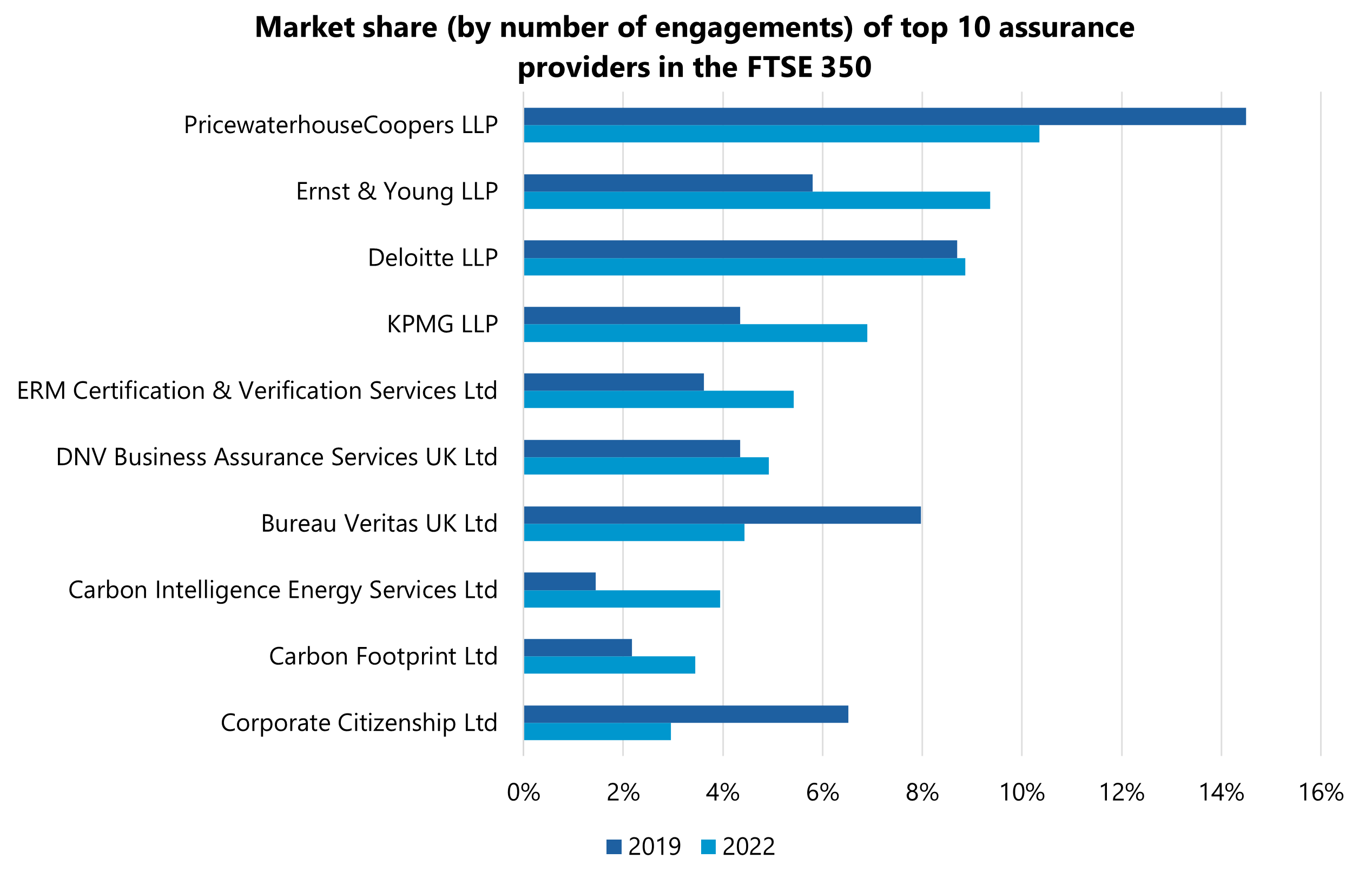

Market trends – market composition

There is a wide variety of providers of sustainability assurance to FTSE 350 companies

- There were 64 providers of sustainability assurance to FTSE 350 companies in 2022 although, 44 only carried out only one or two assurance engagements.

- The 64 providers were a mix of audit firms and non-audit firms.

- The Big Four audit firms supplied 35% of FTSE 350 sustainability assurance engagements in 2022.

Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

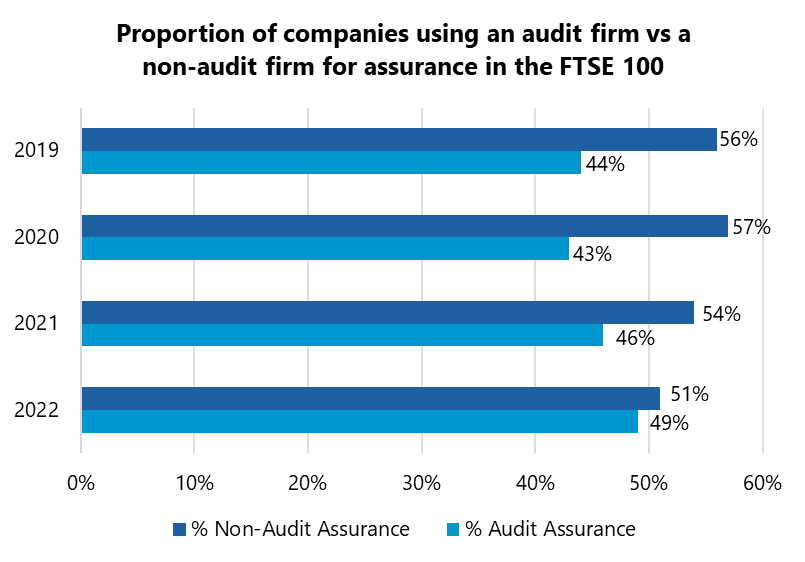

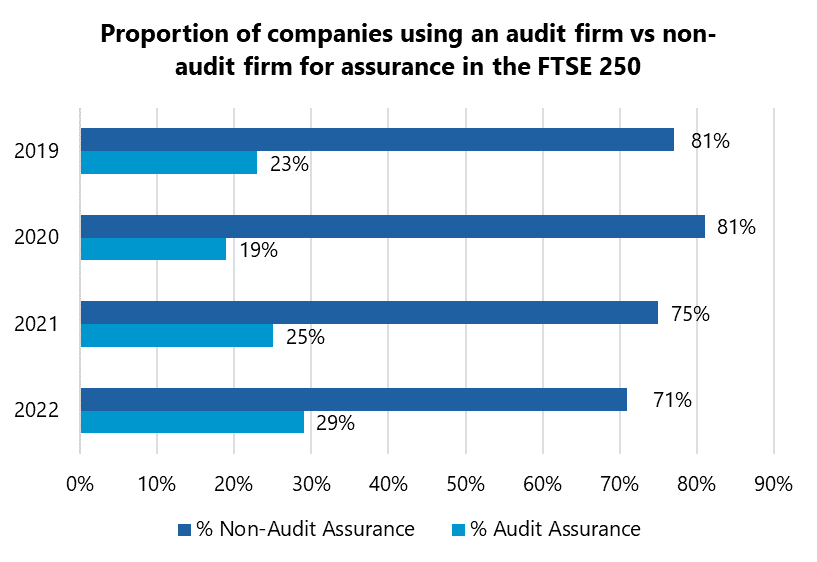

Market trends – audit vs non-audit firm sustainability assurance providers

The use of an audit firm to provide sustainability assurance is growing among FTSE 350 companies

- Approximately 38% of FTSE 350 companies used an audit firm for sustainability assurance in 2022.

- Audit firms have a larger share of the market among the FTSE 100, with approximately 49% of companies using an audit firm compared to 29% of the FTSE 250.

Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

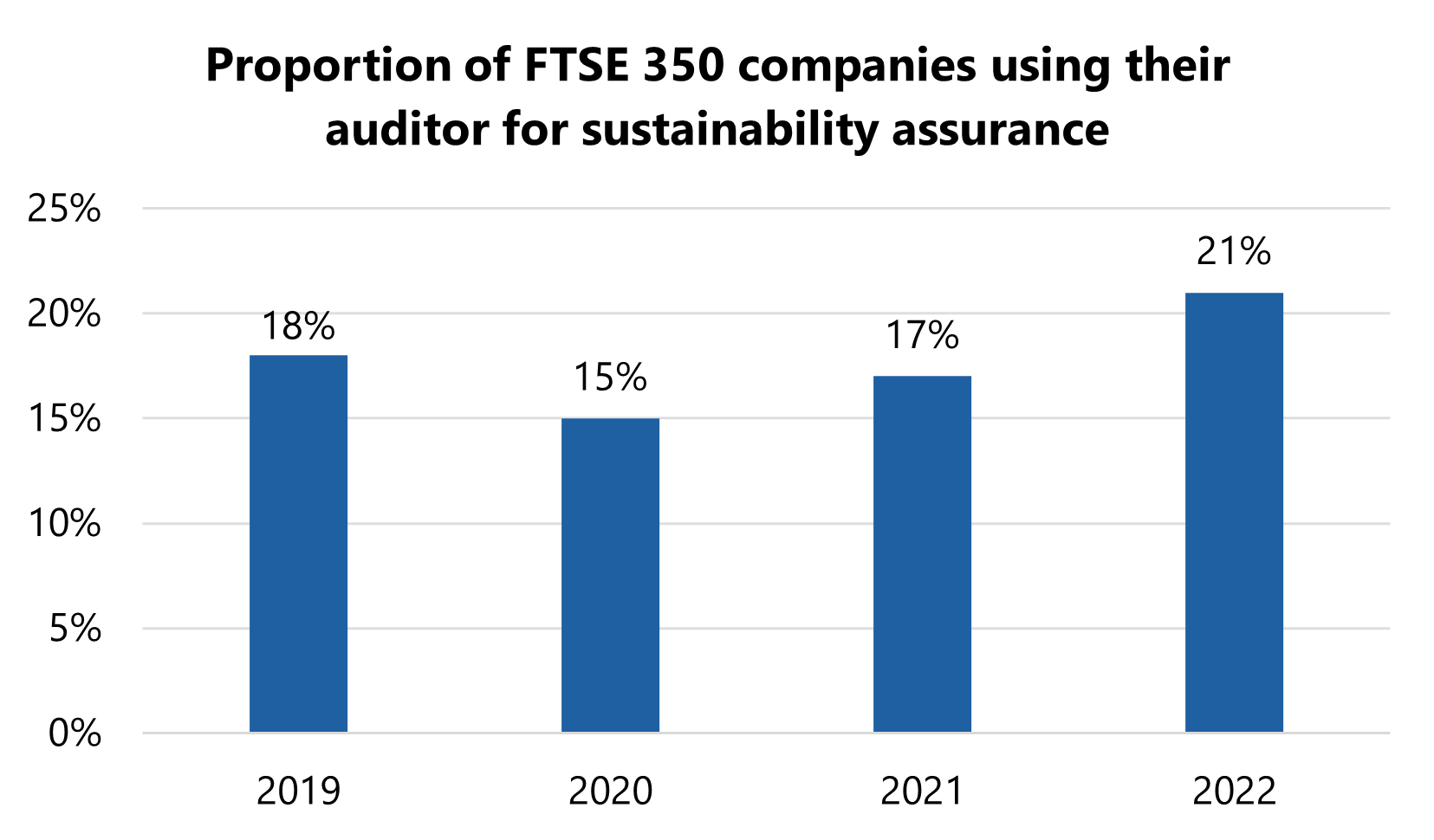

Market trends – using an auditor for sustainability assurance

There has been an increase in the proportion of FTSE 350 companies using their auditor for sustainability assurance since 2019

- FTSE 100 companies are more likely to use their auditor for sustainability assurance.

- In 2022, 33% of FTSE 100 sustainability assurance engagements were carried out by the auditor compared to 12% of FTSE 250 companies that used their auditor for assurance.

Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

Market trends – switching of assurance providers among FTSE 350 companies

FTSE 350 companies are switching between assurance providers, with 92 instances between 2019 and 2022

- A total of 53 FTSE 100 and 39 FTSE 250 companies changed assurance providers at some point between 2019 and 2022.

- We observed more FTSE 100 companies moving from non-audit firms to audit firms over the same period.

Number of switches of sustainability assurance provider by FTSE 100 and FTSE 250 companies between 2019 and 2022

The chart shows the number of switches between audit firms and non-audit firms for sustainability assurance for FTSE 100 and FTSE 250 companies from 2019-2022, broken down by type of switch (Non-audit firm to non-audit firm, Non-audit firm to audit firm, Audit firm to non-audit firm, Audit firm to audit firm). The categories for switches are from 2019-2020, 2020-2021, and 2021-2022.

Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

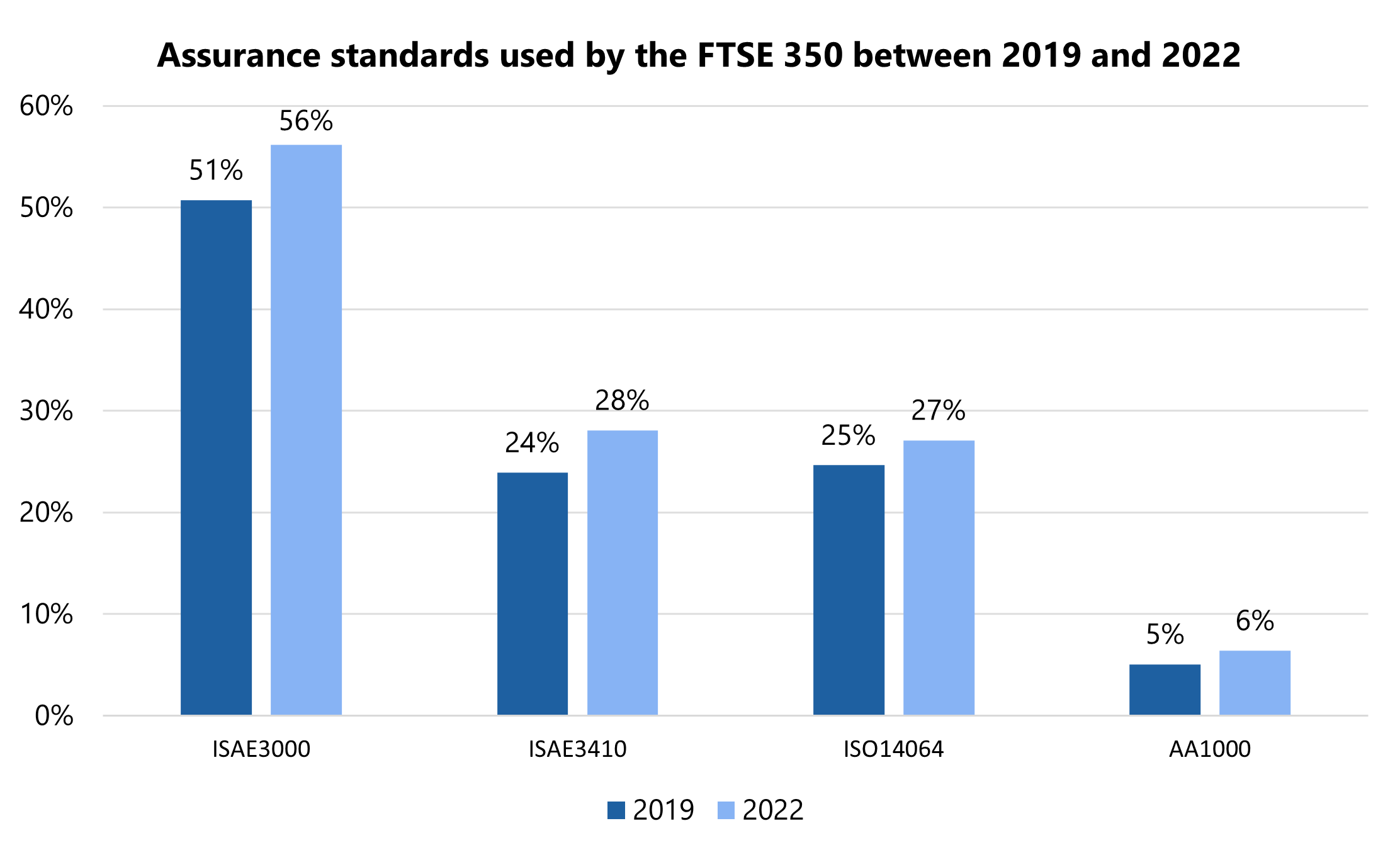

Market trends – assurance standards

ISAE 3000 is the most commonly used assurance standard for FTSE 350 sustainability assurance engagements

- In 2022, 56% of FTSE 350 assurance engagements used the ISAE 3000 standard compared to 71% in the FTSE 100.

- Use of ISAE 3000 rose by 5 percentage points among FTSE 350 companies between 2019 and 2022, but a larger increase of 9 percentage points was seen in the FTSE 100.

- The use of ISO 14064 and AA 1000 remained relatively consistent between 2019 and 2022 among both FTSE 100 and FTSE 250 companies.

Note: For each assurance opinion, more than one assurance standard can be applied, so the total may exceed 100% in any year. Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd - may be subject to future revisions

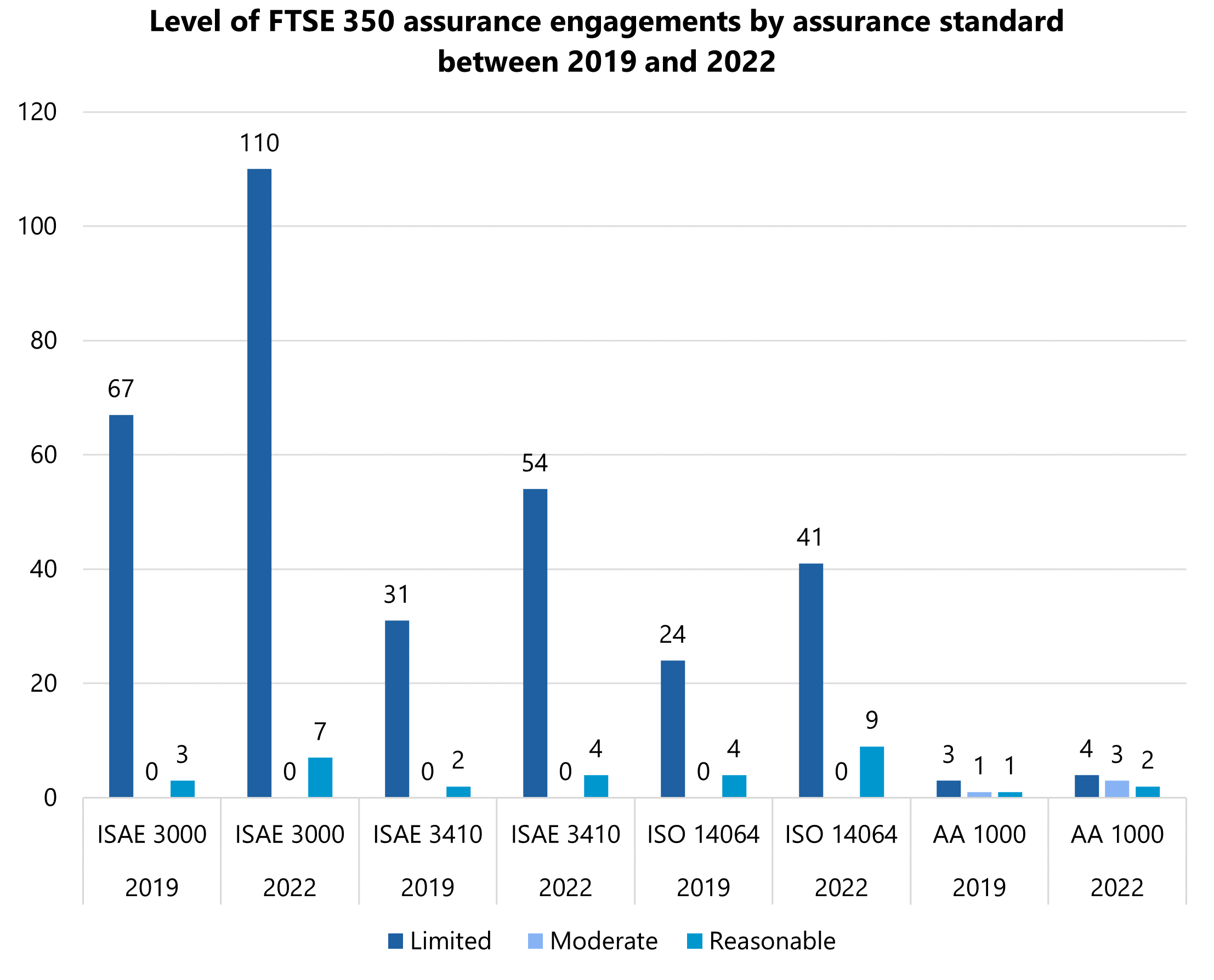

Market trends – level of assurance

Limited assurance is the most common level obtained by FTSE 350 companies

- In 2022, 75% (152) of FTSE 350 assurance engagements included limited assurance over some, or all, of the metrics being assured.

- Higher levels of assurance (either moderate* or reasonable) appear to be more common, as a proportion of engagements using that standard, when non-ISAE assurance standards are used.

*Moderate assurance is only applicable under AA 1000. Under other assurance standards, such as ISAE 3000, this would constitute limited assurance. Note: More than one assurance standard may be applied in an assurance engagement; for example, ISAE 3000 and ISAE 3410 are often applied together. Source: Preliminary analysis based on publicly available data collated by Minerva Analytics Ltd – may be subject to future revisions

4. Stakeholder engagement and views

In this section, we share emerging findings from our stakeholder engagement, in line with the three themes and specific consultation questions set out in our market study launch document.

Functioning of the market

Many stakeholders commented that the market is immature and not delivering consistent high-quality assurance of sustainability reporting.

- All audit firms commented on the lack of a mandatory framework for sustainability assurance which could set a baseline for quality. They also said it was not always clear to companies how different assurance services vary.

- Many providers mentioned an 'uneven playing field'. Some said the market was partially regulated, with audit firms subject to some regulation. Others felt existing regulation, as well as other factors, made it more likely audit firms would be preferred.

- Some companies reported difficulties in selecting a credible provider due to variations in quality.

Benefits and costs of assurance

Most stakeholders said that sustainability assurance is valuable.

Assurance gives stakeholders confidence on the data being reported by companies which supports additional benefits, such as:

- Greater competitiveness for investor funding; including via improved Environmental, Social and Governance (ESG) ratings from ESG ratings agencies.

- Better access to improved financing arrangements through green financing initiatives.

- More confidence in data for internal management, leading to more informed strategic decision-making.

Many stakeholders, including the majority of companies, told us there are significant costs associated with obtaining assurance.

- This includes both the direct fees payable to the assurance provider and the costs associated with developing the company systems, processes and controls underpinning disclosures.

- There may be greater burdens for small/mid-cap companies that have fewer resources available to dedicate to obtaining assurance.

- Anecdotally, we have been told the price of assurance can vary significantly, from 5% to 30% of the statutory audit fee.

Stakeholder views – choice and competition

All stakeholders said there was a variety of providers but many felt that, in practice, choice is limited.

- Most audit firms and some companies suggested wide variability in quality and capability of providers meaning that, in reality, the choice was limited to a few providers.

- All non-audit assurance providers felt that choice was being limited by a perception that the Big Four audit firms (or audit firms more generally) were best placed to provide assurance.

- Some stakeholders noted that there are smaller non-audit firms that are unable to provide assurance over a growing range of sustainability metrics, so may be unable to compete for some larger engagements.

Many stakeholders told us that companies are increasingly using a formal tender process to select an assurance provider.

- Most providers of assurance noted this increase; some told us that they often compete with three to four providers in a tender.

- Some non-audit firm providers noted difficulties in winning tenders when competing with audit firms; they win most of their assurance engagements through direct appointments, often by cross-selling to existing clients.

Most companies told us that the primary factors they considered when selecting a sustainability assurance provider related to their perceived quality, such as subject matter expertise, reputation and experience.

- Many stakeholders reported that price is also a factor, particularly among companies with less experience of sustainability assurance services.

- Some stakeholders told us that a provider's global presence can influence selection, particularly if they are multinational companies with operations across the world.

Stakeholder views – interplay with audit

Most audit firms, and many companies, noted that there are synergies in appointing the same provider for statutory audit and sustainability assurance.

- Audit firms commented on the requirement for an auditor to check for consistency between non-financial and financial reporting.

- Some stakeholders suggested future sustainability reporting standards will drive greater connectivity between financial and sustainability data.

- Audit firms said they had expertise in assessing and understanding companies' control environments, governance structures and reporting processes, so had deeper knowledge of the businesses they audit.

Many non-audit firms note an increasing bias towards the use of an auditor (or an audit firm more generally) for assurance provision.

However, some assurance providers and companies commented on the importance of providers having subject matter expertise which some said was more likely among non-audit firms.

All audit firms said they retrain auditors to provide sustainability assurance and consider auditors' skills to be directly transferrable to the provision of sustainability assurance.

- Most audit firms told us that they see sustainability assurance as a key tool in increasing the attractiveness of the audit profession because many potential auditors have an interest in sustainability.

Stakeholder views – opportunities and barriers

Opportunities for growth

Stakeholders agreed that there was growing demand for assurance and this would result in significant new opportunities for providers.

- A considerable proportion of this demand will be driven by international regulatory changes that will mandate assurance over a variety of sustainability metrics. This includes the EU's Corporate Sustainability Reporting Directive (CSRD) which will create mandatory requirements for UK companies carrying out activities in the EU (above a designated threshold).

- Demand may also increase amongst smaller companies not subject to international regulatory changes; particularly those within the supply chain of a larger company caught by the regulation.

Stakeholders suggested a number of opportunities within the market related to the process and delivery of assurance, including:

- Improving or challenging the robustness of data and working with data solutions and companies to improve data collection, quality and outcomes.

- Enhancing and developing methodologies so data and standards can be used for financial decisions with a degree of confidence.

- Developing skills and training and sharing the capacity to upskill industries to move towards a greener economy supported by data.

Barriers to market entry and expansion

Providers expressed differing views on potential barriers to entry and expansion in the market.

- Many said the lack of clarity on the UK's future position and policy direction prevents the necessary investment in their assurance capabilities. Non-audit firms in particular would like greater clarity on the UK's position on non-audit firms operating in this market.

- Many non-audit firms and those outside of the Big Four suggested the growing preference for using the same provider for both statutory audit and assurance services would result in greater use of the Big Four to provide assurance.

- Many audit firms said the non-audit service fee cap will be a key barrier for them, particularly as assurance engagements become broader in scope and reasonable assurance becomes more prominent.

- Many stakeholders commented that difficulties in attracting skilled staff created barriers for some firms, especially given the perception that there is a shortage of technical experts in the market.

Some providers said there were no barriers to entry in this market because there are no regulatory requirements for sustainability assurance.

Stakeholder views – market capacity

Many stakeholders raised concerns about whether there is sufficient supply to meet future demand for sustainability assurance in the UK.

- Some providers reported a shortage of skills and technical expertise in the market, both in the supply of assurance and within companies preparing sustainability reporting. There was concern that this tight labour market could become more constrained as demand increases.

- To meet growing demand, some stakeholders said significant investment will be required, both within providers and within companies that need to improve their systems and controls environments and recruit specialist people.

- Non-audit firms said capacity would be severely limited if the UK regulatory position prevented non-audit providers from operating in this market.

Many audit firm providers reported making investments to grow their capabilities, both through increasing recruitment and training their people.

However, some providers told us that the uncertainty around the UK's future regulatory position inhibited these necessary investments.

Stakeholder views – changes in the UK sustainability assurance market

Most stakeholders expressed a desire for regulation in the UK sustainability assurance market but they had different views on the form it should take.

- Audit firms in particular voiced support for a mandatory assurance regime, and some said the FRC should be a key part of it.

- Many investors and companies wanted businesses to be able to decide what metrics they should have assured and what level of assurance they should obtain.

- Many companies called for greater alignment between international standards and expectations (including sustainability reporting).

- Many companies wanted to see a range of assurance providers operating in the market, including non-audit firms, and did not want any regulation that might limit choice.

- Many stakeholders requested a level playing field for qualifications and supervision of providers of sustainability assurance.

- Some said they would be keen for the Government to revisit the proposal for companies to have an Audit & Assurance Policy and incorporate sustainability assurance within this.

Stakeholder views – international regulatory developments

Impact of regulatory developments

Stakeholders commented that CSRD will have a considerable impact on UK entities with significant operations in the EU.

- Developments in other jurisdictions, such as Japan, Bangladesh, Brazil, Australia, New Zealand and California, might also have an impact. The multitude of requirements was adding complexity and putting strain on providers and preparers (multinationals, in particular).

- Many stakeholders said the UK needs to 'catch up' with these other jurisdictions and agree a regulatory regime for sustainability assurance.

Stakeholders told us of significant variance between assurance requirements in different jurisdictions.

- Some jurisdictions were proposing to limit the ability of non-audit firms to provide sustainability assurance.

- Different jurisdictions have suggested different sustainability metrics will require assurance. Some are focusing on assurance only for metrics relating to greenhouse gas (GHG) emissions.

- Some jurisdictions have proposed an eventual move towards mandatory reasonable assurance.

Stakeholders reported concerns over the use of different assurance standards, such as ISAE 3000, AA 1000 and incoming standards like ISSA 5000.

- Many noted that not all standards are clearly understood by companies and investors and there were concerns over the perceived inconsistency in how standards are applied (if at all).

Stakeholder views – different approaches from around the world

Stakeholders highlighted approaches to sustainability assurance being taken in other jurisdictions, as summarised below.

France

- One of three EU member states to require mandatory assurance of some non-financial reporting under the Non-Financial Reporting Directive 2015. A broader scope of assurance will become mandatory under CSRD.

- Both audit firms and non-audit firms will be permitted to provide assurance following the implementation of CSRD.

- Non-audit assurance providers are accredited by the national accreditation body (COFRAC). However, they will be required to register with the audit regulator (H2C) in due course.

- In 2022, 100% of the top 50 companies engaged an audit firm for assurance.* We have heard anecdotally that over 90% of companies in France use an auditor, and that this pattern continues as companies ready themselves for CSRD.

Spain

- One of three EU member states to require mandatory assurance of non-financial reporting under the Non-Financial Reporting Directive 2015. A broader scope of assurance will become mandatory under CSRD.

- Both audit firms and non-audit firms will be permitted to provide assurance following the implementation of CSRD.

- Non-audit assurance providers are accredited by the national accreditation body (ENAC).

- In 2022, 85% of the top 50 companies engaged an audit firm for assurance.* However, we have heard anecdotally that CSRD could make it more likely that companies will select their auditor for this work.

Singapore

- Reporting under the ISSB standards, and assurance over GHG emissions, will become mandatory for listed companies in 2025, and all companies from 2027.

- Audit firms and non-audit providers are permitted to carry out sustainability assurance, reporting against ISSA 5000 and ISO 14064, respectively. It is hoped that a unified set of standards will be adopted in time.

- Regulator ACRA will have oversight of all providers. However, non-audit providers will need to be accredited by the national accreditation body (SAC).

- The government and private sector are working together to build capacity.

- In 2022, 59% of the top 50 companies engaged an audit firm for assurance.*

Japan

- There are no current plans for mandatory sustainability assurance.

- Both audit firms and non-audit providers are able to provide assurance. There are no restrictions on who can enter the market.

- All assurance providers are overseen and supervised by the regulator (FSA).

- We have heard anecdotally that capacity is becoming a concern, particularly among audit firms.

- In 2022, 43% of the top 100 companies engaged an audit firm for assurance.*

*Source: IFAC data published in "State of Play: Sustainability Disclosure and Assurance 2019-2022 Trends & Analysis", February 2024.

5. Invitation to comment

We welcome written submissions on any of the matters set out in this document by 29 November 2024.

We particularly welcome responses to the questions below.

1Do you agree with our emerging findings? Please explain. 2Do you have any views or suggestions on any actions that should be taken in light of our emerging findings? 3How might future developments such as mandatory application of the International Sustainability Standards Board's (ISSB) sustainability disclosure standards impact the UK sustainability assurance market, including choice of provider and capacity? 4What should be the future regulatory and policy approach to sustainability assurance in the UK to ensure a well-functioning market that delivers high-quality assurance? Please provide any specific suggestions for changes you would like to see including in relation to the introduction of any regulatory regime.

Please email any written responses to [email protected]

All responses will be acknowledged. We expect to make responses publicly available on the FRC website unless respondents specifically request otherwise. If you send an email response that includes an automatically generated notice stating that the content is to be treated as confidential, you should make it clear in the body of your message whether you wish your comments to be treated as confidential. We will process personal data in accordance with UK data protection legislation and the FRC's Stakeholder Engagement Privacy Notice.

6. Appendices

Appendix 1: Glossary/further background information on sustainability assurance

Sustainability assurance

- Sustainability assurance is the provision of an independent third-party opinion on whether an organisation's sustainability disclosures are aligned with the reporting criteria.

- In this context, sustainability information includes ESG metrics that are published by a company.

-

Assurance opinions are often published in companies' annual reports or standalone annual sustainability reports.

-

Sustainability assurance is not a homogenous product and is not yet subject to any mandatory requirements in the UK. However, in the EU, reporting and assurance of sustainability information are required as a result of CSRD. UK companies with material EU subsidiaries or levels of business may be caught by these requirements.

Market participants

- Providers: Sustainability assurance is carried out by a variety of audit and non-audit firms including sustainability consultancies, engineering firms and industry certification and inspection firms.

- Buyers and users of sustainability assurance: Typically, FTSE 100 and FTSE 250 companies and investors. However, sustainability assurance is also obtained by smaller and non-listed companies.

Regulatory requirements

- Mandatory requirements over sustainability reporting have yet to be determined in the UK, other than reporting under the Taskforce on Climate Related Financial Disclosures framework.

- The UK is currently considering whether to adopt the ISSB sustainability disclosure standards, IFRS S1 and S2.

Assurance standards

- While there are no mandatory standards in the UK, there are some internationally recognised standards in the market. These include ISAE 3000 and AA 1000 for broad-scope assurance and ISO 14064-3 and ISAE 3410 for GHG metrics.

Level of assurance

- Assurance can be provided to different levels, indicating how robust the provider has been when reviewing the metrics and the underlying data and systems.

- The lowest level, is limited. This is followed by moderate (in the case of assurance under the AA1000 standard) and reasonable (the highest level).

- UK companies affected by CSRD will need to obtain limited assurance, likely moving to reasonable assurance by the end of the implementation period.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

www.frc.org.uk

Follow us on Linked in. or X @FRCnews