The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Offsetting in the financial statements

1. Executive summary

Introduction

Offsetting (also known as 'netting') classifies dissimilar items as a single net amount.1 IFRS Accounting Standards (IFRSs) require or permit offsetting only in specific situations. Determining when to offset can be challenging, because the requirements are complex and not all located in one place in IFRS. Certain IFRSs contain explicit guidance on offsetting while others rely on the offsetting principles in IAS 1, 'Presentation of Financial Statements'. Applying these requirements may require management to make significant judgements, especially when accounting for complex arrangements.

Although the requirements for offsetting are reasonably well established, the Corporate Reporting Review (CRR) team of the Financial Reporting Council (FRC) regularly identifies material errors in this area through its routine monitoring work, even in fairly straightforward scenarios. Offsetting issues often result in substantive questions to companies, and contribute to a number of the top ten topics set out in our Annual Review of Corporate Reporting.

Inappropriate application of the offsetting requirements can mask the full extent of the risks relating to a company's income and expense, assets and liabilities, or cash flows. For example, exposure to credit and/or liquidity risk may be underestimated when a financial asset and financial liability are inappropriately offset. Offsetting can affect important measures like covenant ratios and operating efficiency ratios, which can have a significant effect on the economic decisions of users. Therefore, to enhance comparability, complete and clear presentation of income and expenses, assets and liabilities and cash inflows and outflows is important as well as high quality disclosures on offsetting.

This report reflects CRR's experience in relation to offsetting in annual reports and accounts over recent years. It focusses on the requirements for offsetting in areas where we find more frequent application issues. These issues are not restricted to companies of a particular size or sector, although we rarely see offsetting issues in the banking and insurance sectors. The report highlights examples of good practice and disclosures on offsetting, and areas where we believe reporting could be improved. It does not cover unit of account as this is a separate concept from offsetting under IFRSs.

This report is not intended to cover all aspects of the requirements for offsetting and should not be relied upon as a guide to the detailed requirements. We encourage companies to familiarise themselves with the detailed requirements and seek professional advice, if needed.

Offsetting issues observed by CRR in the last four years by topic

A - Cash flow statement B - Financial instruments C - Provisions D - Income taxes E - Presentation of financial statements F - Other

Key observations

High quality disclosures are important (see sections 3 to 6)

- Companies should disclose material accounting policy information relating to offsetting, ensuring all relevant aspects of any offsetting conditions are included. Any significant judgements made by management in applying these policies should also be disclosed.

- High quality disclosures are important where financial instruments have been offset or are subject to a master netting arrangement or similar agreement.

Cash flows should be presented gross, unless otherwise permitted (see section 4)

- IAS 72 requires cash inflows and outflows within investing or financing activities to be presented on a gross basis in the cash flow statement, except in limited cases where netting is either required or permitted.

- Companies should consider whether to exclude overdrafts from cash and cash equivalents in the cash flow statement when the overdrafts remain overdrawn over several reporting periods.

- The accounting requirements for including overdrafts within cash and cash equivalents in the cash flow statement differ significantly from those relating to the offset of overdrafts and cash and cash equivalents in the statement of financial position.

The terms of a cash pooling arrangement and an intention to settle on a net basis are key (see section 5)

- Notional cash pooling arrangements (CPAs) do not generally satisfy the criteria to offset positive bank balances and overdrafts in the statement of financial position as they do not usually involve the physical transfers of individual bank balances to one bank account.

- Zero balancing CPAs usually require or permit individual bank balances to be physically transferred to a central clearing account. The regularity of these cash sweeps and their timing in relation to period-end balances differs between arrangements. This can increase the complexity of determining whether to offset positive bank balances and overdrafts in the statement of financial position.

- A company must demonstrate an intention to physically transfer period-end balances to one account to satisfy criterion b) of the offsetting criteria in paragraph 42(b) of IAS 32.3

The accounting treatment applied to reimbursement rights should be clearly explained (see section 6)

- IAS 374 requires a reimbursement asset to be separately presented from the associated provision.

- Any reimbursement rights that satisfy the contingent asset requirements of IAS 37 should be appropriately disclosed.

2. Scope and how to use this publication

Scope

This thematic report covers the requirements for offsetting in IFRSs, including the related disclosure requirements for financial instruments in IFRS 7.5 It focusses on the areas where we most frequently challenge companies.

We did not select a sample of annual reports and accounts to review for this thematic report. Instead, we identified, through our routine work and by working with other FRC departments, areas of good practice and opportunities for improvement.

Areas not covered in this thematic report

We have not considered the application of offsetting requirements by banks and insurers. We believe the offsetting requirements are well understood by these sectors and the quality of their reporting in this area is usually high.

While requirements for offsetting are found in a number of IFRSs, we rarely see application issues in the areas of derivatives, hedge accounting and government grants. These topics have, therefore, been excluded from the scope of this thematic report.

Offsetting assets and liabilities differs from treating a set of rights and obligations as a single unit of account.6 The concept of unit of account is, therefore, not covered in this thematic report.

Using this publication

The areas of good practice and opportunities for improvement are identified in the thematic report as follows:

A characteristic of good quality application of reporting requirements.

An opportunity for improvement by companies to move them towards good quality application of reporting requirements.

An omission of required disclosure or other issue companies should avoid in their annual reports and accounts.

A case study which illustrates improvements to reporting and disclosures as a result of engagement with companies as part of our routine reviews.

Examples of good practice disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

The word 'should' is used in this report to describe accounting applications or disclosures that are required if material and relevant.

The relevant requirements – how much is enough?

The financial reporting framework in the UK is principles-based and requires the application of judgement. Preparers must consider the following overarching requirements in determining which information requires disclosure in their annual report and accounts:

- the financial statements must present a true and fair view [s393 Companies Act 2006; IAS 1.15]

- the annual report and accounts, taken as a whole, should be fair, balanced and understandable [UK Corporate Governance Code Principle N, where applicable]

- the strategic report must be fair, balanced and comprehensive [s414C Companies Act 2006]

- specific disclosures required by accounting standards need not be provided if the information resulting from that disclosure is not material [IAS 1.31]

- companies are required to consider whether to provide additional disclosures if the specific requirements of IFRS accounting standards are insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity's financial position, financial performance and cash flows [IAS 1.17(c), 31 and 112(c)]

We do not expect companies to go beyond these requirements, or to provide information that is not material or relevant to users.

Our proportionate approach to corporate reporting review

Our formal powers relating to corporate reporting review are derived from the Companies Act 2006 and other relevant law. This report sets out the areas where we may challenge companies on their reporting by asking the directors for further information or explanations about their annual reports and accounts.

We only ask companies a substantive question, when it appears that there is, or may be, a material breach of the relevant reporting requirements.

We principally engage with companies on a voluntary basis. We rarely resort to use of our formal powers. Further information about our approach, powers and remit is set out in our Operating Procedures for Corporate Reporting Review.

We carefully consider proportionality, and the materiality of the reporting matters concerned, at every stage of our review work. We are mindful of the need to balance high standards in corporate reporting, and our responsibility to protect stakeholders in the public interest, with supporting UK economic growth.

3. Presentation of financial statements

General prohibition on offsetting

IAS 1 prohibits entities from offsetting assets and liabilities or income and expenses, unless required or permitted by an IFRS.7

We may challenge companies when labels used for line items in the primary financial statements indicate a possible offset of items of income and expense or assets and liabilities (for example ‘other net income’) and the reason for using that label is not explained.

The general prohibition on offsetting does not, however, preclude the presentation of a subtotal of separate line items in the income statement when this is relevant to an understanding of the company’s financial performance.8 For example, net finance costs presented as a subtotal of finance income and finance costs.

Exceptions to the general prohibition on offsetting

The exceptions to the general prohibition on offsetting, and some examples, are set out in the table below:

| Exception | Examples |

|---|---|

| Exception: Offsetting is required or permitted by an IFRS. | Page 23 provides a summary of a number of IFRS requirements that either require or permit offsetting. |

| Exception: Offsetting reflects the substance of the transaction or other event.9 | Deducting from the amount of consideration received on disposal of a non-current asset the carrying amount of that asset and any related selling expenses to present a net gain or loss on disposal. |

| Netting an expense related to a provision liability against related reimbursement income under a contract with a third party, for example, a supplier’s warranty agreement. See section 6 of this thematic report for further information. | |

| Exception: Gains and losses arising from a group of similar transactions. However, these gains or losses are presented separately, if material.10 | Foreign exchange gains and losses. |

| Gains and losses arising on financial instruments held for trading. |

Forthcoming changes

Good practice disclosures explain the nature of the items offset, clearly describe which exceptions to the general prohibition on offsetting apply, and the basis for using those exceptions, when relevant. Please refer to page 15 for an example disclosure.

Case study: inappropriate offset in the income statement11

Background A property company disclosed in the notes to the accounts that service charge income was included in property expenses. It also disclosed, within administration expenses, one-off gains arising from a sale and leaseback transaction and a bargain purchase.

FRC's approach and company's response We asked the company to explain the basis for offsetting the income and expense items. The company acknowledged that it had acted as principal in all relevant transactions and that none of the exceptions to the general prohibition on offsetting applied. It agreed to restate the comparative income statement to present the income and gains on a gross basis in its next accounts.

IFRS 18, 'Presentation and Disclosure in Financial Statements'

IFRS 18 was issued in April 2024. It affects all IFRS reporters and will give investors more transparent and comparable information about companies’ financial performance. Despite the significant changes introduced by the new standard, the general prohibition on offsetting remains substantially unchanged.

IFRS 18 replaces IAS 1 and is effective for years beginning on or after 1 January 2027, subject to UK endorsement.

4. Cash flow statement

Investing and financing activities

An entity shall report separately major classes of gross cash receipts and gross cash payments arising from investing and financing activities, except to the extent that certain cash flows described in the standard are reported on a net basis.12

Cash flows arising from the following operating, investing or financing activities may be reported on a net basis:

- cash receipts and payments on behalf of customers when the cash flows reflect the activities of the customer rather than those of the entity; and

- cash receipts and payments for items in which the turnover is quick, the amounts are large, and the maturities are short.13

Circumstances in which cash flows may be presented net

Cash receipts and payments referred to in paragraph (a) generally include those where the company is acting as an agent. In our experience, the reporting of cash flows referred to in paragraph (a) on a net basis will usually arise in banking activities. An example of paragraph (a) for a non-banking activity is rents collected on behalf of, and paid over to, the owners of a property.

Examples of cash receipts and payments referred to in paragraph (b) include certain transactions that may typically arise in a group treasury function such as the purchase and sale of investments, and receipts and repayments of other short-term borrowings which have a maturity of three months or less.14

We may challenge companies that present net cash flows in relation to short-term borrowings within financing activities where the liquidity risk disclosures show maturity periods of greater than three months.

The significant judgements that management has made under paragraph 122 of IAS 1 in determining whether to present certain material cash flows on a net basis should be disclosed.

Page 11 of our 2020 thematic report on cash flow and liquidity disclosures, explains our detailed expectations in respect of the disclosure of significant judgements made in relation to cash flow statements.

Acquisitions and disposals of subsidiaries or other businesses

Case study: presentation of cash receipts and repayments on notes payable on a gross rather than net basis

Background An investment company presented a net cash inflow in relation to notes payable within financing activities in its statement of cash flows.

FRC's approach and company's response We asked the company to explain how the net presentation of cash receipts and repayments relating to notes payable complied with the requirement of paragraph 21 of IAS 7.

The company explained that net cash flows had been presented on the basis that, during the year, the drawdowns on notes payable were frequent and generally made with the intention that they would be repaid within the short-term. However, after further consideration, the company noted that the maturity periods were greater than three months and, therefore, agreed to amend the presentation to report gross cash receipts and gross cash payments relating to notes payable separately in future accounts.

Aggregate cash flows arising from obtaining or losing control of subsidiaries or other businesses shall be presented separately and classified as investing activities.15

The aggregate amount of the cash paid or received as consideration for obtaining or losing control of subsidiaries or other businesses is reported in the statement of cash flows net of cash and cash equivalents acquired or disposed of as part of such transactions, events or changes in circumstances.16

Page 31 of our 2022 thematic report on business combinations provides further information on the classification of cash flows on acquisitions and disposals of subsidiaries or other businesses in the cash flow statement.

Page 32 of that thematic report, as well as pages 9 to 10 of our 2020 thematic report on cash flow and liquidity disclosures, also explain our detailed expectations about those cash flows which may be presented within investing activities on acquisitions and disposals of subsidiaries. For example, the reports consider the classification of cash flows relating to repayments of borrowings of the acquiree, deferred consideration and contingent consideration.

Good practice disclosures enable users to reconcile the investing cash outflows in relation to the acquisition of subsidiaries included in the cash flow statement to the corresponding business combination disclosures.

Definition of cash and cash equivalents

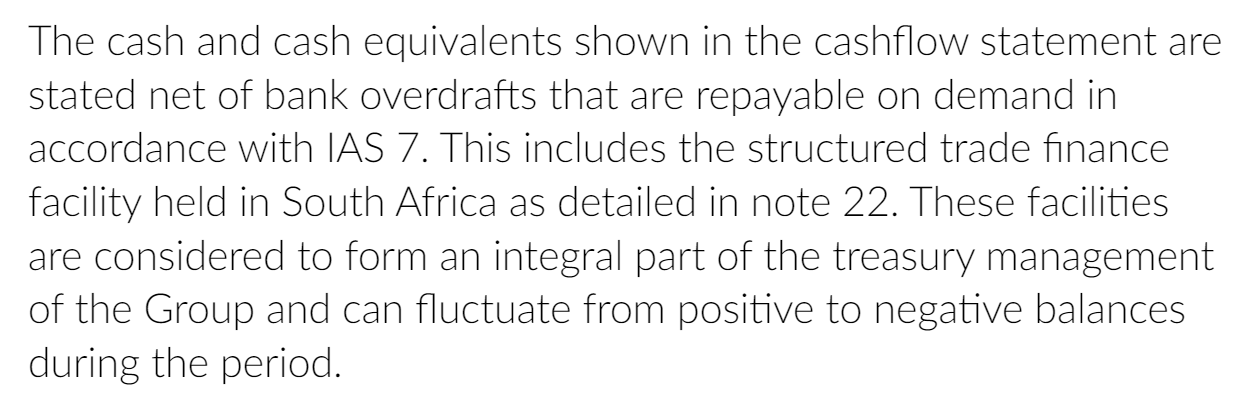

Bank borrowings are generally considered to be financing activities but, in some countries (for example, in the UK), bank overdrafts which are repayable on demand form an integral part of an entity’s cash management. In these circumstances, bank overdrafts are included as a component of cash and cash equivalents in the cash flow statement. A characteristic of such banking arrangements is that the bank balance often fluctuates from being positive to being overdrawn.17

The types of borrowings that can be included as a component of cash and cash equivalents in the cash flow statement were considered by the IFRS Interpretations Committee (the Committee) in their June 2018 agenda decision. The Committee observed that, if the balance of a banking arrangement does not often fluctuate from being negative to positive, then this indicates that the arrangement does not form an integral part of the company’s cash management and, instead, represents a form of financing.

Where a company’s bank overdraft has remained as a liability over several previous reporting dates and is included in cash and cash equivalents, we may ask the company to explain how such an overdraft meets the definition of cash and cash equivalents.

The company explains the basis on which bank overdrafts are included in cash and cash equivalents in the cash flow statement.

Case study: presentation of an invoice discounting facility

Background In our routine casework, we identified a liability for an invoice discounting facility included within cash and cash equivalents.

FRC's approach and company's response We asked the company to explain the basis on which the liability met the definition of cash and cash equivalents since it did not appear to fluctuate from being positive to being overdrawn. It was also not clear whether the facility was repayable on demand.

The company acknowledged that the facility was neither repayable on demand nor would ever have a positive balance and, hence, should not be included within cash and cash equivalents. The company agreed to restate the comparative information in its next accounts to present the cash flows from the facility within financing activities.

Cash and cash equivalents in the statement of financial position

Bank overdrafts that meet the definition of cash and cash equivalents for the purposes of the cash flow statement can only be offset in the statement of financial position if the criteria for offsetting in IAS 3218 are met. Section 5 provides further information on the circumstances in which financial instruments can be offset.

The requirements in IAS 32 for offsetting bank overdrafts or other short-term borrowings against cash and cash equivalents in the statement of financial position are stricter than those in IAS 7 for including them within cash and cash equivalents in the statement of cash flows.

Good practice disclosures describe whether or not bank overdrafts or other short-term borrowings are:

- included within cash and cash equivalents in the statement of cash flows, and

- offset against cash and cash equivalents in the statement of financial position,

and provide a clear explanation of the reasons for the accounting treatments applied.

Interest and dividends

Cash flows from interest and dividends received and paid shall each be disclosed separately.19

Leases

Case study: inappropriate netting of financing cash flows relating to leases and other financing activities20

Background The company’s statement of cash flows disclosed a cash outflow within financing activities described as 'net payment of lease obligations'.

FRC's approach and company's response We asked the company to explain what it meant by 'net payment' in this context. The company acknowledged that it had incorrectly presented payments of the capital element of leases net of inflows arising from other financing activities and agreed to restate its statement of cash flows to present the payments and receipts separately.

5. Financial instruments

Offsetting criteria

The criteria for offsetting in paragraph 42 of IAS 32 (Offsetting Criteria) require financial assets and financial liabilities to be offset in the statement of financial position when, and only when, an entity:

- currently has a legally enforceable right to set off the recognised amounts; and

- intends either to settle on a net basis, or to realise the asset and settle the liability simultaneously.

Companies should disclose material accounting policy information for offsetting financial instrument balances that includes both the above criteria.

The Offsetting Criteria do not apply to income and expenses (or gains and losses) from financial instruments. These elements of the income statement are subject to the general prohibition on offsetting in IAS 1 covered in section 3 of this report.

Legal right

The right of set off is a legal right, by contract or otherwise, to settle on a net basis that is currently enforceable. The diagram opposite summarises the guidance on the meaning of currently enforceable in IAS 32.21

Flowchart: Currently Enforceable Legal Right

-

Is enforceability of the legal right contingent on future events?

- No -> Proceed to 2.

- Yes -> Not currently enforceable

-

Is the legal right enforceable in the normal course of business*?

- Yes -> Proceed to 3.

- No -> Not currently enforceable

-

Is the legal right enforceable in the event of default*?

- Yes -> Proceed to 4.

- No -> Not currently enforceable

-

Is the legal right enforceable in the event of insolvency or bankruptcy*?

- Yes -> Currently enforceable

- No -> Not currently enforceable

*of the company and all of the other counterparties

Intention

Offsetting financial assets and financial liabilities reflects a company's expected future cash flows from settling two or more separate financial instruments.22 This requires an intention to settle a financial asset and liability on a net basis or simultaneously.

That intention may be influenced by normal business practices, requirements of financial markets or other circumstances that limit the company's ability to settle on a net basis or simultaneously.23

Cash pooling arrangements

Cash pooling arrangements (CPAs) are used by companies to manage their cash, liquidity and exposure to interest costs. Although various types of CPAs exist, they usually provide a right to set off positive bank balances and overdrafts of subsidiaries in a group, and have one (or both) of the following characteristics:

| Characteristic | Description |

|---|---|

| Notional interest calculation | Interest is calculated on a notional basis using the net balance across all bank accounts. |

| Cash sweeping / Zero balancing | Individual bank balances are physically transferred to a central clearing account. |

Notional CPAs often do not involve cash sweeps and, therefore, offsetting is generally not appropriate in those circumstances.

We may challenge companies that offset positive bank balances and overdrafts that form part of a notional CPA when no explanation of the arrangement is given.

Judgement may be required in determining whether a zero balancing CPA satisfies the Offsetting Criteria when period-end balances are not settled soon after the reporting date.

Companies should disclose the significant judgements made by management under paragraph 122 of IAS 1 in determining whether to offset positive bank balances and overdrafts.

Zero balancing cash pooling arrangements

Hypothetical example

Each subsidiary in a group has its own bank account, which form part of a zero balancing CPA. The CPA provides a legal right to set off positive bank balances and overdrafts. Interest is calculated on a notional basis and a cash sweep to a central clearing account takes place every Friday. The group’s reporting date falls on a Monday.

Discussion

The group expects the entire individual period-end account balances to be used for business purposes before the next cash sweep. It would, therefore, not be appropriate for the group to assert that it has the intention to settle those balances on a net basis at the reporting date. This is in line with the conclusion reached in the March 2016 IFRIC agenda decision (March 2016 AD). As a result, despite having a legal right to set off positive bank balances and overdrafts, it would not be permissible for the group to offset these bank balances.

The March 2016 AD is specific about the link between an intention to settle, on a net basis, period-end bank balances that form part of a CPA and a cash sweep of those balances. It also explains that, to the extent that these period-end balances are not expected to be settled net, it would not be appropriate to assert that there is an intention to settle the entire period-end balances on a net basis at the reporting date.

Where a cash sweep occurs on the reporting date, individual bank account balances would be transferred into a central clearing account on that date. As a result, only one bank account would have a balance at the reporting date and there would be nothing to offset.

Offsetting receivables and payables

Case study: inappropriate offset of positive bank balances and overdrafts24

Background An overdraft liability was included in the parent company statement of financial position, but not in the consolidated accounts.

FRC's approach and company's response We asked the company why the parent company’s overdraft balance was not included in the consolidated statement of financial position.

The company explained that it had offset positive bank balances and overdrafts in the consolidated statement of financial position on the basis that its CPA provided a legal right of offset. However, following a review of this arrangement, the company concluded that the Offsetting Criteria were not satisfied as the company had conducted further transactions before the next net settlement date and could not demonstrate an intention to settle the period-end balances on a net basis.

The company agreed to restate the comparative information in its next accounts to present the balances on a gross basis.

We may challenge companies when an overdraft in the parent company accounts exceeds the overdraft in the consolidated accounts and no explanation is provided.

Good practice disclosures explain how a company intends to settle positive cash balances and overdrafts on a net basis.

The Group’s bank arrangements and facilities with both HSBC Bank plc and Barclays Bank plc provide the legally enforceable right to offset and the Group demonstrated its intention to offset by formally sweeping the balances within each bank. Consequently, the balances have been offset in the financial statements.

Galliford Try Holdings plc, Annual Report and Financial Statements, 2023, p157

The company explains the basis for offsetting cash and cash equivalents and overdrafts under its CPA.

To help companies manage counterparty credit risk and liquidity risk, some contracts include terms that allow set off of amounts owed to and from the same counterparty.

Even when those agreements are in place, the receivables and payables are only offset when both Offsetting Criteria are satisfied.

Good practice disclosures include a description of what the offset of receivables and payables relates to, for example, customer/supplier rebates.

Offsetting disclosures

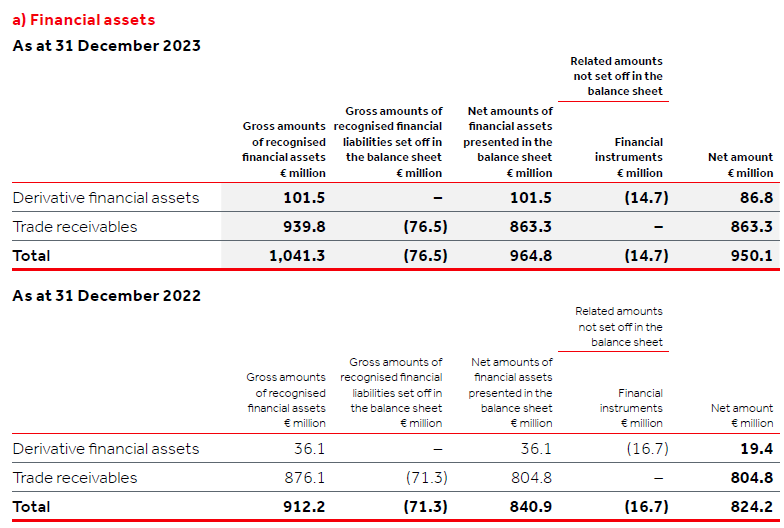

Paragraph 13B of IFRS 7 explains that the objective of the offsetting disclosure requirements in IFRS 7 (Offsetting Disclosures) is to provide information to enable users of the accounts to evaluate the effect or potential effect of netting arrangements on the balance sheet.

Offsetting Disclosures may be required even if the offset of financial instrument balances is not permitted. The scope of the Offsetting Disclosures25 is summarised below under four possible scenarios:

| Financial instruments offset under IAS 32 | Master netting arrangement or similar agreement26 in place | Offsetting Disclosures required? |

|---|---|---|

| Scenario 1: Yes | No | Yes |

| Scenario 2: Yes | Yes | Yes |

| Scenario 3: No | Yes | Yes |

| Scenario 4: No | No | No |

IFRS 7 requires companies to disclose quantitative information separately for financial assets and financial liabilities that are within the scope of the Offsetting Disclosures, as summarised below.

| Quantitative disclosure requirements in paragraph 13C of IFRS 7 | Item | Disclosure required?* | Disclosure required?* |

|---|---|---|---|

| Offsetting Criteria in IAS 32 satisfied (Scenarios 1 and 2) | Offsetting Criteria in IAS 32 not satisfied (Scenario 3) | ||

| a) Gross amount of the financial asset/(liability) | A | Yes | Yes |

| b) Amount offset against the financial asset/(liability) | B | Yes limited to amounts offset | n/a |

| c) Net amount in the statement of financial position | C | Yes A – B | Yes A |

| d)(i) Related amount not offset against the financial asset/(liability) | D | n/a | Yes |

| d)(ii) Fair value of financial collateral received/(pledged) | E | Yes27 limited to C | Yes27 limited to C – D |

| e) Net exposure under IFRS 7 | F | Yes C – E | Yes C – D – E |

* Includes explanations of how amounts disclosed are calculated.

We may challenge companies that do not provide Offsetting Disclosures when financial instruments have been offset, or are subject to a master netting arrangement or similar agreement such as a derivative clearing agreement.

Companies should disclose a description of the rights of set off associated with financial instruments subject to enforceable master netting and similar arrangements, including the nature of those rights.28

The company presents information separately for financial assets using a layout that is consistent with the illustrative disclosures in IFRS 729 (its financial liabilities are disclosed similarly).30

The company provides quantitative information about financial instruments offset in the statement of financial position.

The company provides quantitative information about financial instruments not offset in the balance sheet and subject to master netting arrangements.

Coca-Cola HBC AG, Integrated Annual Report, 2023, p236

6. Provisions

Reimbursement assets

Where some or all of the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement shall be recognised when, and only when, it is virtually certain that the reimbursement will be received if the entity settles the obligation. The reimbursement shall be treated as a separate asset. The amount recognised for the reimbursement shall not exceed the amount of the provision.

In the statement of comprehensive income, the expense relating to a provision may be presented net of reimbursement income.31

Companies may be able to seek reimbursement for some or all of the expenditure for a present obligation through arrangements such as insurance contracts, indemnity clauses in contracts or warranties.

For a reimbursement to meet the 'virtually certain' criterion, a company must demonstrate that recovery is virtually certain in the event that the company is required to settle the obligation. The amount of the recovery may be uncertain but, provided it can be reliably estimated, it may still qualify for asset recognition.

Companies should disclose an accounting policy to present reimbursement income gross or net of the related provision expense in the income statement and apply it consistently. Net presentation in the income statement may better reflect the substance of the transaction.32

Case study: inappropriate netting of insurance reimbursement against provisions for contractual claims

Background The company disclosed that contracts with third-party insurers were in place to cover contractual claims against the group. However, the company did not disclose a reimbursement asset or contingent asset in respect of insurance claims.

FRC's approach and company's response We sought further explanation of the accounting treatment applied to these insurance arrangements. The company acknowledged that it had presented the provision net of insurance reimbursement assets. It agreed to restate the comparative balance sheet to present the reimbursement asset separately.

We may challenge companies that have recognised a provision and disclose that all or part of the related expenditure may be reimbursed by another party, but the accounting treatment applied to this reimbursement is not clear from the accounts.

In situations where an inflow of economic benefits is not virtually certain if the entity settles the obligation, but is still probable, paragraph 89 of IAS 37 explains that an entity shall disclose a brief description of the nature of the contingent assets at the end of the reporting period and, where practicable, an estimate of their financial effect.

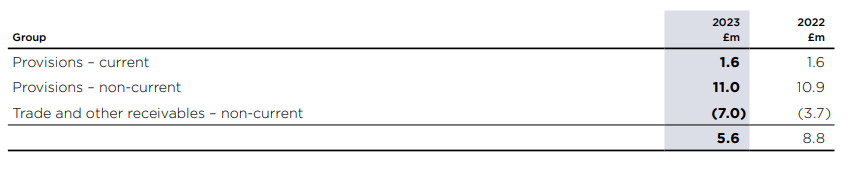

Reimbursement assets

The Group recognises a reimbursement asset in respect of third party claims made against the Group, but which under the terms of its insurance policy, the Group is indemnified. All of the expenditure required to settle such claims will be reimbursed by the insurer under the terms of the policy, and therefore it is virtually certain that reimbursement will be received.

NWF Group plc, Annual Report and Accounts 2023, p87

The company explains the basis on which the reimbursement is virtually certain and recognised as an asset.

Savills plc, Annual Report and Accounts 2023, p238

The company presents an insurance asset separately from the associated liability. In addition to providing the required IAS 37 disclosures, the company discloses in the notes the overall net exposure to professional indemnity claim liabilities after factoring in an insurance asset included in non-current trade and other receivables.

7. Income taxes

Deferred tax

Deferred tax assets and liabilities are required to be offset in the statement of financial position if, and only if:

- the entity has a legally enforceable right to set off current tax assets against current tax liabilities; and

- the deferred tax assets and liabilities relate to income taxes levied by the same taxation authority on either:

- the same taxable entity; or

- different taxable entities which intend to settle current tax liabilities and assets on a net basis or simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.33

The offset conditions are summarised in the diagram opposite. The first part of these conditions requires a legal right to set off current tax balances. For example, when a company has no currently enforceable legal right to set off capital tax losses against trading tax profits, associated deferred tax assets and liabilities cannot be offset.

Another key aspect of these conditions is whether the deferred tax assets and liabilities relate to the same or separate tax jurisdictions and taxable entities.

Flowchart: Offsetting Deferred Tax

-

Is there a legally enforceable right to offset current tax assets and liabilities?

- Yes -> Proceed to 2.

- No -> Present separately

-

Do deferred tax balances relate to the same tax authority?

- Yes -> Proceed to 3.

- No -> Present separately

-

Do deferred tax balances relate to the same taxable entity?

- Yes -> Offset

- No -> Proceed to 4.

-

Do the entities intend to settle the current tax balances on a net basis or simultaneously in each future period in which significant amounts of deferred tax balances are expected to be settled?

- Yes -> Offset

- No -> Present separately

As noted on page 20 of our 2022 thematic report on deferred tax assets, when balances are not offset, good practice disclosures provide a geographical analysis of the gross deferred tax asset and liability balances to help explain why the offset conditions in IAS 12 are not satisfied.

Disclosures

The gross deferred tax balances required to be disclosed by IAS 12 for each type of temporary difference and unused tax losses or tax credits34 are unaffected by any offset of recognised deferred tax balances in the statement of financial position.

Case study: net presentation of deferred tax assets and liabilities

Background A company operating exclusively in the UK presented its deferred tax assets and liabilities separately.

FRC's approach and company's response We asked the company to explain the reason for presenting these balances on a gross basis. The company acknowledged that certain deferred tax asset and liability balances had arisen in the same tax jurisdiction and met the offset conditions under IAS 12. The company agreed to restate comparative information in its next accounts to present these balances on a net basis.

We may challenge companies that fail to explain why:

- deferred tax asset and liability balances have not been offset when the companies operate in a single tax jurisdiction; or

- all deferred tax asset and liability balances have been offset when the companies operate in multiple tax jurisdictions.

8. Other areas

IFRS 15, 'Revenue from Contracts with Customers'

When (or as) a performance obligation is satisfied, an entity is required to recognise as revenue the amount of consideration to which the entity expects to be entitled in exchange for transferring promised goods or services.35 For example, the amount of revenue recognised reflects any volume rebates the entity allows.

Case study: revenue described as net of certain charges

Background A company in the mining industry described its revenue as being presented net of treatment and refining charges.

FRC's approach and company's response We asked the company to explain its rationale for deducting these charges from revenue. The company explained that this deduction formed part of a contractual method for determining the transaction price and agreed to clarify this in its future accounts.

Refund liability and right of return asset

Companies should present an obligation to refund customers separately from the corresponding asset recognised for the company’s right to recover products from a customer on settling a refund liability.36

IAS 19, 'Employee Benefits'

Paragraph 131 of IAS 19 explains that an entity offsets defined benefit assets and liabilities relating to different plans only when:

- the entity has a legally enforceable right to use a surplus in one plan to settle obligations under the other plan; and

- the entity intends to settle the obligations on a net basis, or to realise the surplus in one plan and settle its obligation under the other plan simultaneously.

IFRS 5, 'Non-current Assets Held for Sale and Discontinued Operations'

An entity presents assets (liabilities) of a disposal group classified as held for sale separately from other assets (liabilities) in the statement of financial position. Those assets and liabilities are not offset.37

IAS 34, 'Interim Financial Reporting'

IAS 34 does not contain explicit requirements for disclosures on offsetting. However, it does require an entity to include in its interim report an explanation of events and transactions that are significant to an understanding of the changes in financial position and performance since the end of the last annual reporting period.38 This may include disclosures on offsetting when it was not applied previously.

9. Summary of offsetting accounting requirements

Offsetting assets and liabilities, income and expenses or cash inflows and outflows is prohibited under IFRSs, except in a few circumstances when it is required or permitted. A summary of a number of these requirements is provided below:

General prohibition on offsetting, except when it is required or permitted.39

Certain IFRSs specifically require gross presentation in some cases. For example, reimbursement assets and provisions40, cash flows on acquisitions and disposals of subsidiaries41, interest income and finance costs42, and refund liabilities and right of return assets43.

Offsetting required

In all instances: * Cash flow on a business acquisition/disposal net of cash acquired/disposed44 * Consideration received on disposal of a non-current asset net of the carrying amount and selling expenses45

If conditions satisfied: * Financial instrument balances46* * Income tax balances47 * Defined benefit deficits and surpluses48 * Reflects substance or arises from a group of similar transactions49

Offsetting permitted

Policy choice: * Provision expense and reimbursement income50 * Government grants51 * Income and expenses from a group of reinsurance contracts52

If conditions satisfied: * Cash flows from operating (direct method), investing and financing activities53 * Net interest of a segment54

* IFRS 7 specifically requires disclosures in relation to offsetting for financial instruments (see section 5).

IFRS references

- IAS 1.32

- IAS 37.53

- IAS 7.41

- IAS 1.82

- IFRS 15.B25

- IAS 7.42

- IAS 16.68 and IAS 38.113

- IAS 32.42

- IAS 12.71 and .74

- IAS 19.131

- IAS 1.33 to .35

- IAS 37.54

- IAS 20.24 and .29

- IFRS 17.86

- IAS 7.22

- IFRS 8.23

10. Key expectations

We expect companies to consider the areas of good practice and opportunities for improvement and to incorporate them in their future reporting, where relevant and material. In particular, companies should:

- Disclose material accounting policy information relating to offsetting, ensuring all relevant aspects of any offsetting conditions are included.

- Disclose significant judgements made in relation to offsetting income and expenses, assets and liabilities or cash inflows and outflows.

- Present cash inflows and outflows within investing and financing activities on a gross basis in the cash flow statement, except in limited cases where netting is either required or permitted.

- Consider whether to exclude overdrafts from cash and cash equivalents in the cash flow statement when the overdrafts remain overdrawn over several reporting periods.

- Consider the terms and conditions of cash pooling arrangements when determining whether to offset positive bank balances and overdrafts that form part of such an arrangement in the statement of financial position. For example, whether they provide a legal right of set off that is currently enforceable, are notional or zero balancing arrangements and how the timing of any cash sweeps relates to the reporting date.

- Demonstrate an intention at the reporting date to physically transfer the period-end balances of positive bank balances and overdrafts that form part of a cash pooling arrangement to one account to satisfy the intention criterion of the Offsetting Criteria in IAS 32.

- Provide high quality offsetting disclosures where financial instruments:

- have been offset, or

- form part of a master netting arrangement or similar agreement.

- Present a reimbursement asset separately from the associated provision. Any reimbursement rights that satisfy the contingent asset requirements of IAS 37 should be appropriately disclosed.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk Follow us on Linked in. or X @FRCnews

Legal Disclaimer and Copyright Notice (from PDF page 2):

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Footnotes:

-

Conceptual Framework, paragraph 7.10 ↩

-

IAS 7, 'Statement of Cash Flows' ↩

-

IAS 32, 'Financial Instruments: Presentation' ↩

-

IAS 37, 'Provisions, Contingent Liabilities and Contingent Assets' ↩

-

IFRS 7, 'Financial Instruments: Disclosures' ↩

-

Conceptual Framework, paragraph 7.11 ↩

-

IAS 1, paragraph 32 ↩

-

IAS 1, paragraph 85 ↩

-

IAS 1, paragraphs 33 and 34 ↩

-

IAS 1, paragraph 35 ↩

-

Hypothetical case study based on correspondence with more than one company. ↩

-

IAS 7, paragraph 21 ↩

-

IAS 7, paragraph 22 ↩

-

IAS 7, paragraph 23A(b) and (c) ↩

-

IAS 7, paragraph 39 ↩

-

IAS 7, paragraph 42 ↩

-

IAS 7, paragraph 8 ↩

-

IAS 32, paragraph 42 ↩

-

IAS 7, paragraph 31 ↩

-

Hypothetical case study based on correspondence with more than one company. ↩

-

IAS 32, paragraph AG38B ↩

-

IAS 32, paragraph 43 ↩

-

IAS 32, paragraph 47 ↩

-

Hypothetical case study based on correspondence with more than one company. ↩

-

IFRS 7, paragraph 13A ↩

-

An arrangement that commonly creates a right of set off that is only enforceable in the event of default or other circumstance not expected in the normal course of business. ↩

-

IFRS 7, paragraph 13E ↩

-

IFRS 7, paragraph IG40D ↩

-

Qualitative information about the amounts offset and the rights of set off for amounts not offset is given on page 235 of the integrated annual report and has not been reproduced here. ↩

-

IAS 37, paragraphs 53 and 54 ↩

-

IAS 1, paragraph 34(b) ↩

-

IAS 12, 'Income Taxes', paragraph 74 ↩

-

IAS 12, paragraph 81(g)(i) ↩

-

IFRS 15, paragraphs 46 and 47 ↩

-

IFRS 15, paragraph B25 ↩

-

IFRS 5, paragraph 38 ↩

-

IAS 34, paragraph 15 ↩

-

IAS 1.32 ↩

-

IAS 37.53 ↩

-

IAS 7.41 ↩

-

IAS 1.82 ↩

-

IFRS 15.B25 ↩

-

IAS 7.42 ↩

-

IAS 16.68 and IAS 38.113 ↩

-

IAS 32.42 ↩

-

IAS 12.71 and .74 ↩

-

IAS 19.131 ↩

-

IAS 1.33 to .35 ↩

-

IAS 37.54 ↩

-

IAS 20.24 and .29 ↩

-

IFRS 17.86 ↩

-

IAS 7.22 ↩

-

IFRS 8.23 ↩