The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 17 Insurance Contracts Disclosures in the First Year of Application

1. Executive summary – introduction

The Corporate Reporting Review (CRR) team of the Financial Reporting Council (FRC) carried out a review of disclosures in companies' first annual reports and accounts following their adoption of IFRS 17 'Insurance Contracts'. This report summarises the key findings of that review. It is a follow-up to our report published in November 2023 1 which considered the disclosures made in 2023 interim accounts relating to the implementation of IFRS 17.

In our previous review we noted that we were pleased with the quality of the interim IFRS 17 disclosures provided by the companies in our sample. However, we also identified areas for improvement and encouraged companies to carefully consider the recommendations in that report.

Overall, the quality of IFRS 17 disclosures provided by the companies in our sample of annual reports and accounts was good. We were also pleased with the way that the areas we identified in our interim report had been addressed in these first annual accounts.

While some further areas for improvement were identified in the annual reports and accounts in our sample, many of the issues identified related to areas we commonly raise with companies as part of our routine reviews, such as judgements and estimates, and alternative performance measures (APMs). The key observations from the reviews from this thematic report sample are presented on page 4 of this report.

We also recognise that this is a new accounting standard, with a significant impact on the insurance sector, and that practice will continue to develop and improve over time. In the early periods of implementation of a new standard we are particularly careful to take a proportionate approach, so that companies have the opportunity to innovate and consider fully how best to disclose the required information. This is particularly the case with IFRS 17 because of the significant amounts of disclosures that are required to be made.

We are aware of the significant effort and investment which has gone into the transition to IFRS 17 by both preparers and auditors. It is therefore pleasing that this effort has resulted in a high level of compliance with the standard for the companies in our sample. We believe the benchmarking reports produced by the audit and actuarial professions on the impact of the first year of reporting under IFRS 17 have also contributed to the overall quality of implementation of the standard.

Across both our interim and year-end samples, we have now covered a total of 17 separate insurance companies, which represent a significant share of the insurance companies within our scope.

We did not identify any further messages in relation to insurers' adoption of IFRS 9, 'Financial Instruments', beyond the messages given in our interim report 1. We also have not identified any further issues in relation to the adoption of IFRS 17 by non-insurers, beyond those areas mentioned in our interim report.

1. Executive summary – key observations

Disclosure quality was good

- We were pleased with the overall quality of disclosure of insurance contracts under IFRS 17 in our sample, including transition-specific disclosures.

- We were also pleased that the majority of companies within our sample provided high quality disclosures for the areas highlighted in our interim report.

Disaggregation and proportionality

- Annual reports and accounts should be clear, concise and understandable, which is aided by a logical layout of information and focus on the most significant and material areas. We were, therefore, pleased that most companies avoided disclosing insignificant information.

- We expect companies to consider the appropriate level of disaggregation for disclosures of insurance contracts and may challenge companies if it is not clear whether the basis chosen is appropriate.

Importance of carefully considering the disclosure requirements of IFRS 17

- We identified a number of areas, such as disclosures relating to insurance finance income or expense, and risks relating to insurance contracts, where disclosures were not always provided in a way that met the requirements of the standard.

- We also reiterate the message made in our interim thematic that disclosures of significant judgements and estimates, and accounting policies, are more useful when they are entity specific. Boilerplate language should also be avoided.

Alternative performance measures (APMs)

- While we were pleased that most of the insurance companies in our sample clearly explained the impact of IFRS 17 on their APMs, we identified a number of areas for improvement consistent with the findings from our previous thematic reviews of APMs.

2. Scope and how to use this publication

Scope

Our review consisted of a limited scope desktop review of the annual reports and accounts of a sample of companies. Our focus was on the adequacy of disclosures regarding the effect of the transition to IFRS 17 in the first year of adoption, following our 2023 interim review 2.

While the application of IFRS 17 to insurance contracts requires the use of actuarial models to determine the level of insurance liabilities our review did not consider the reasonableness of the assumptions used in those models; nor did we assess the appropriateness of the methodologies applied.

We reviewed the annual reports and accounts of a sample of ten entities, three of which had also been included in our interim thematic. The companies selected covered both life and general insurers, including larger listed companies, as well as smaller and private insurers.

Using this publication

The areas of good practice and opportunities for improvement are identified in the thematic report as follows:

- A characteristic of good quality application of reporting requirements.

- An opportunity for improvement by companies to move them towards good quality application of reporting requirements.

- An omission of required disclosure or other issue companies should avoid in their annual reports and accounts.

Examples of good practice disclosures, in grey boxes, represent good quality application of reporting requirements that companies should consider when preparing their annual reports and accounts. The examples will not be relevant for all companies or all circumstances.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The accuracy of the underlying information in these examples has not been verified by our review.

The word 'should' is used in this report to describe accounting applications or disclosures that are required if material and relevant.

The relevant requirements – how much is enough?

The financial reporting framework in the UK is principles-based and requires the application of judgement. Preparers must consider the following overarching requirements in determining which information requires disclosure in their annual report and accounts:

- The financial statements must present a true and fair view [s393 Companies Act 2006; IAS 1.15]

- The annual report and accounts, taken as a whole, should be fair, balanced and understandable [UK Corporate Governance Code Principle N, where applicable]

- The strategic report must be fair, balanced and comprehensive [s414C Companies Act 2006]

- Specific disclosures required by accounting standards need not be provided if the information resulting from that disclosure is not material [IAS 1.31]

- Companies are required to consider whether to provide additional disclosures if the specific requirements of IFRS accounting standards are insufficient to enable users to understand the impact of particular transactions, other events and conditions on the entity's financial position, financial performance and cash flows [IAS 1.17(c), 31 and 112(c)]

We do not expect companies to go beyond these requirements, or to provide information that is not material or relevant to users.

Our proportionate approach to corporate reporting review

Our formal powers relating to corporate reporting review are derived from the Companies Act 2006 and other relevant law.

This report sets out the areas where we may challenge companies on their reporting by asking the directors for further information or explanations about their annual reports and accounts. We only ask companies a substantive question when it appears that there is, or may be, a material breach of the relevant reporting requirements.

We principally engage with companies on a voluntary basis. We rarely resort to use of our formal powers. Further information about our approach, powers and remit is set out in our Operating Procedures for Corporate Reporting Review.

We carefully consider proportionality, and the materiality of the reporting matters concerned, at every stage of our review work. We are mindful of the need to balance high standards in corporate reporting, and our responsibility to protect stakeholders in the public interest, with supporting UK economic growth.

3. Areas of good practice

Update of areas considered in our interim thematic report

We have considered how the topics covered in our interim report have been dealt with in the annual report and accounts of the companies in this report's sample and found numerous examples of good quality disclosures, some of which have been included in this report.

While the quality of disclosures in these areas was generally good, we have also highlighted a small number of cases where further improvements are required.

Significant judgements and sources of estimation uncertainty

In our interim thematic report 3 we set out the requirements of IAS 1 and IFRS 17 in relation to the disclosure of significant judgements and estimates as well as referring to our 2022 thematic report on judgements and estimates 4.

All companies in our sample identified significant judgements and sources of estimation uncertainty related to IFRS 17, although the level of detail provided varied.

Overall, we were pleased with the quality of disclosure in this area as the majority of companies provided detailed information in order to meet the disclosure objective of the standard.

We were pleased that the majority of companies in our sample provided:

- Detailed descriptions of the specific judgements made in applying IFRS 17;

- Specific details of inputs, assumptions and methods used; and

- Meaningful sensitivities to changes in assumptions.

However, we did identify further opportunity for improvement in some cases where disclosures of significant judgements and estimates were boilerplate and provided little insight beyond repeating the requirements of the standard.

One company in our sample provided boilerplate wording in relation to significant judgements which did not explain the nature of the specific judgement made. It also did not provide an indication of the potential impact on the carrying value of insurance liabilities of the items identified as sources of estimation uncertainty, such as providing sensitivities to changes in those assumptions and estimates.

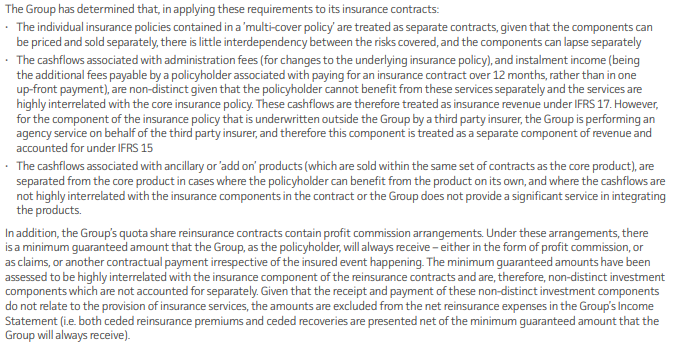

Unit of account: combination of insurance contracts and separation of distinct components (extract)

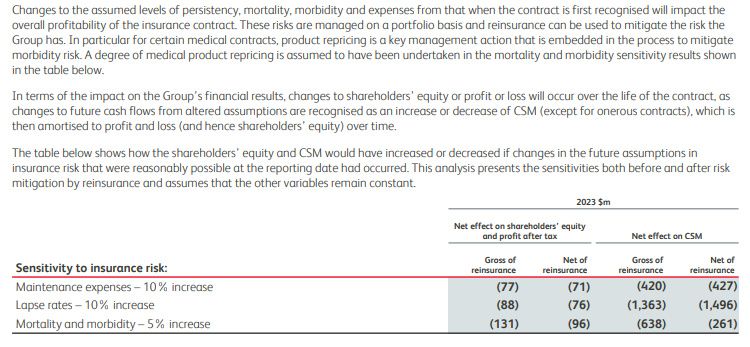

(b) Sensitivity to insurance risk (extract)

Changes to the assumed levels of persistency, mortality, morbidity and expenses from that when the contract is first recognised will impact the overall profitability of the insurance contract. These risks are managed on a portfolio basis and reinsurance can be used to mitigate the risk the Group has. In particular for certain medical contracts, product repricing is a key management action that is embedded in the process to mitigate morbidity risk. A degree of medical product repricing is assumed to have been undertaken in the mortality and morbidity sensitivity results shown in the table below.

In terms of the impact on the Group's financial results, changes to shareholders' equity or profit or loss will occur over the life of the contract, as changes to future cash flows from altered assumptions are recognised as an increase or decrease of CSM (except for onerous contracts), which is then amortised to profit and loss (and hence shareholders' equity) over time.

The table below shows how the shareholders' equity and CSM would have increased or decreased if changes in the future assumptions in insurance risk that were reasonably possible at the reporting date had occurred. This analysis presents the sensitivities both before and after risk mitigation by reinsurance and assumes that the other variables remain constant.

The company provides sensitivities showing the effect of changes in assumptions on equity and profit after tax, and the net effect on the contractual service margin (CSM). The sensitivities are given on both a gross and a net of reinsurance basis.

Transition disclosures

IFRS 17 must be applied retrospectively unless it is impracticable to do so for a group of insurance contracts, in which case an entity has a choice of applying either a modified retrospective approach or a fair value approach separately for each group of insurance contracts.

As noted in our interim thematic report 5, due to the range of transition approaches permitted under IFRS 17, as well as historical diversity in accounting practices under IFRS 4, ‘Insurance Contracts', there was significant diversity in how the companies in our sample disclosed the impact of IFRS 17. This creates challenges with comparability between companies.

However, we were pleased that the companies in our sample provided transition disclosures proportionate to the impact, and detailed disclosures for areas of significant judgements, such as where the fair value approach was used.

In addition to the examples noted in our interim thematic report, areas of good disclosure included:

- Narrative disclosure of the main presentational and measurement differences between IFRS 4 and IFRS 17 for the company;

- Detailed explanations of how impracticability was assessed for specific parts of the transition; and

- Explanation of how fair value was determined at the point of transition, including the level of aggregation used, the fair value approach applied, key inputs used, summary fair values, and sensitivity to changes in key inputs.

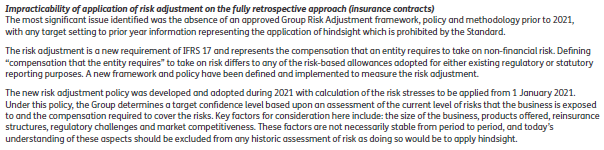

Impracticability of application of risk adjustment on the fully retrospective approach (insurance contracts)

The company provides a detailed explanation of the impracticability of applying the risk adjustment on a fully retrospective basis. The company also provides a similar assessment for reinsurance held.

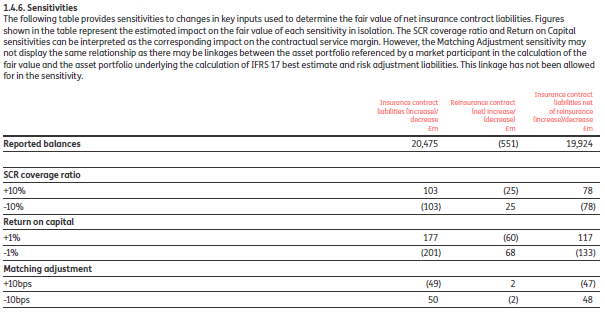

1.4.6. Sensitivities

The following table provides sensitivities to changes in key inputs used to determine the fair value of net insurance contract liabilities. Figures shown in the table represent the estimated impact on the fair value of each sensitivity in isolation. The SCR coverage ratio and Return on Capital sensitivities can be interpreted as the corresponding impact on the contractual service margin. However, the Matching Adjustment sensitivity may not display the same relationship as there may be linkages between the asset portfolio referenced by a market participant in the calculation of the fair value and the asset portfolio underlying the calculation of IFRS 17 best estimate and risk adjustment liabilities. This linkage has not been allowed for in the sensitivity.

The company provides sensitivities of the fair value of net insurance liabilities at transition.

Sensitivities are given on both a gross and net of reinsurance basis.

Recognition of the CSM in profit or loss

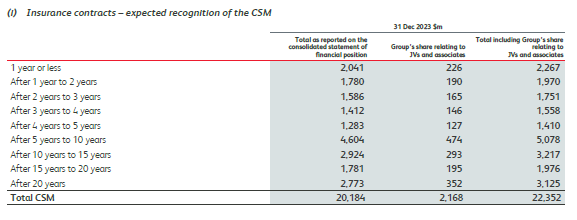

Paragraph 109 of IFRS 17 requires quantitative disclosure of the expected recognition of the CSM in profit or loss, in appropriate time bands, other than where the premium allocation approach is used.

All companies in our sample (other than those which only applied the premium allocation approach) provided quantitative information about the expected recognition of the CSM in profit or loss.

Most companies also provided quantitative information about how the balance of CSM had changed in the period, and additional narrative explanation for particular movements.

Examples of good disclosure included:

- Detailed explanations of how coverage units were determined, including whether time value of money was considered, and the approach taken for reinsurance contracts held;

- Explanation of the movement in the CSM for the period, including where changes in CSM are recognised; and

- Quantitative disclosure of the expected recognition of the CSM in appropriate time bands.

The company presents quantitative disclosures of the expected recognition of CSM, with annual time bands for the first five years, and wider ranges for later periods. A similar analysis is also presented for reinsurance contracts.

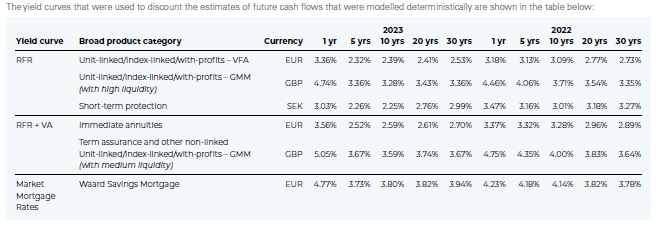

Discount rates

Paragraph 117(c)(iii) of IFRS 17 requires disclosure of the method used to determine the discount rates, and paragraph 120 requires disclosure of the yield curve (or range of yield curves) used.

All companies in our sample provided disclosures explaining the impact of discounting under IFRS 17, explaining how discount rates had been determined. The level of detail varied with the complexity of the business, and for one company in our sample the effects of discounting were not material, due to the specific nature of its portfolio.

Several companies in our sample also identified discount rates as an area of significant estimation uncertainty and provided sensitivities of CSM, profit and shareholders' equity to changes in discount rate assumptions.

Narrative disclosures were provided to explain the approach applied to determine the discount rates, either top-down or bottom-up, consistent with the messages provided in our interim thematic report 6. Where material, the companies in our sample disclosed the discount rates, or ranges of discount rates, used.

We were pleased that the majority of companies in our sample provided:

- Detailed explanations of how discount rates were determined;

- Quantitative information about the discount rates used, for example by product type, currency and time period; and

- Meaningful sensitivities to changes in assumptions.

The yield curves that were used to discount the estimates of future cash flows that were modelled deterministically are shown in the table below:

The company provides quantitative information about discount rates used by product category, currency and time period.

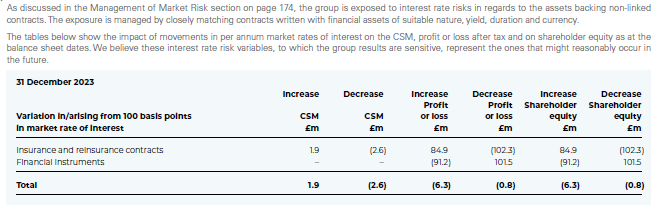

As discussed in the Management of Market Risk section on page 174, the group is exposed to interest rate risks in regards to the assets backing non-linked contracts. The exposure is managed by closely matching contracts written with financial assets of suitable nature, yield, duration and currency.

The tables below show the impact of movements in per annum market rates of interest on the CSM, profit or loss after tax and on shareholder equity as at the balance sheet dates. We believe these interest rate risk variables, to which the group results are sensitive, represent the ones that might reasonably occur in the future.

The company presents a sensitivity analysis of the CSM, profit and shareholder equity to changes in discount rates.

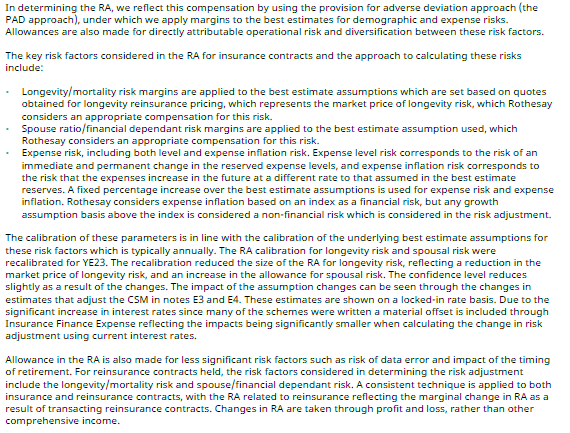

Risk adjustment

Paragraph 37 of IFRS 17 requires an adjustment to the estimate of the present value of the future cash flows to reflect the compensation required for bearing the uncertainty about the amount and timing of the cash flows that arises from non-financial risk.

Paragraph 119 of IFRS 17 requires disclosure of the confidence level used to determine the risk adjustment for non-financial risk, or the corresponding confidence level if another technique is used to determine the risk adjustment.

All companies in our sample provided disclosures explaining how the risk adjustment had been determined under IFRS 17, and the confidence level (or corresponding confidence level) used.

Examples of good disclosures included:

- Detailed explanations of the technique used, the risks considered, and where relevant, the link to regulatory measures;

- Insight into how key assumptions are determined and how often they are updated; and

- How the risk adjustment is allocated to groups of insurance contracts, including reinsurance contracts.

One company in our sample used a different technique, and different confidence levels, to calculate the risk adjustment for portfolios under the premium allocation approach and the general measurement model, but it did not explain why. Where this is the case, we would expect narrative disclosure to be provided to explain the rationale for this approach.

(e) Risk adjustment (RA) (extract)

The company explains the method used, as well as the key risk factors which are considered, and how they are determined.

A description is provided of how, and how often, parameters are calibrated, and the link between assumption changes and CSM is explained.

The company provides details of other risk factors considered and explains the impact on reinsurance contracts.

4. Disaggregation and proportionality

Clear, concise and understandable

Page 9 of our ‘What Makes a Good Annual Report and Accounts’ publication 7 states that companies should apply the concept of materiality to relevant information in order to determine what should be disclosed, ensuring that key information is not lost in distracting detail. Section 6.2 of that report also sets out factors to consider to ensure annual reports and accounts are clear, concise and understandable.

Logical presentation of information in the notes can significantly add to the clarity of reporting and help reduce clutter.

Companies should avoid discussing the same issue in too many separate places. One company in our sample provided similar disclosures in relation to discount rates in several different areas.

<blockquoteকথা> Examples of clear reporting included:

- Presenting accounting policies in an appropriate location, either in a single note or next to the relevant disclosures;

- Use of formatting, such as subheadings, lists and colour to focus on certain areas such as key judgements;

- Providing plain English explanations where appropriate, such as explanations of accounting policies and risks faced by the business; and

- Avoiding detailed disclosures for immaterial amounts.

Disaggregation of disclosures

Paragraph 95 of IFRS 17 requires entities to aggregate or disaggregate information so that useful information is not obscured either by the inclusion of a large amount of insignificant detail or by the aggregation of items that have different characteristics. Paragraph 96 gives examples of aggregation bases of product line, geographical area or reportable segment.

The appropriate level of disaggregation for disclosures will be a matter of judgement, which will depend on the nature of the business and types of insurance contracts held.

Examples of good disclosure included:

- Explanation of how management had determined the appropriate level of disaggregation for the purposes of disclosure, including the factors considered;

- Where all contracts are disclosed as a single portfolio, an explanation for the basis of this judgement; and

- Disaggregation of disclosures by separate portfolios where appropriate, e.g. by product line or segment.

In one instance disclosures were provided without any disaggregation despite there being a mix of product types and geographical segments. We may challenge companies where it is not apparent from the disclosures provided why the level of disaggregation is appropriate.

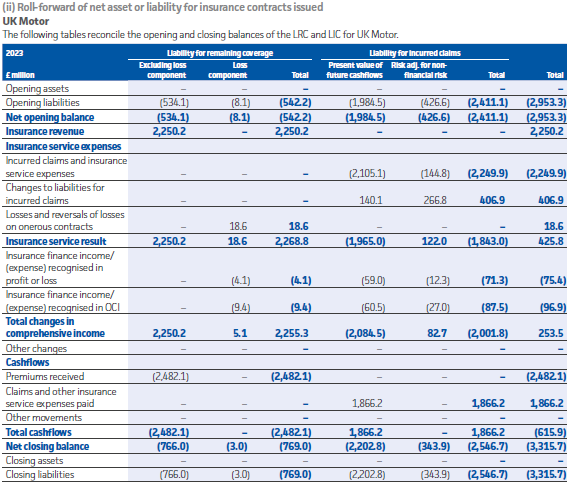

(ii) Roll-forward of net asset or liability for insurance contracts issued UK Motor

The following tables reconcile the opening and closing balances of the LRC and LIC for UK Motor.

The company provides the disclosure of the reconciliation between the opening and closing insurance liability balance by portfolio, which is based on product type, with similar tables also provided for UK non-motor and international insurance.

The company also provided disaggregation of insurance revenue, insurance service expenses, and claims development tables in the same note.

5. Areas for continued focus

While we found the quality of disclosures to be generally good, we did identify some areas for improvement, which are discussed in this section.

We expect companies to carefully consider the disclosure requirements of IFRS 17 to ensure full compliance with both the disclosure objective and specific requirements of the standard.

Nature and extent of risks that arise from contracts within the scope of IFRS 17

Paragraph 121 of IFRS 17 requires disclosure of information that enables users of financial statements to evaluate the nature, amount, timing and uncertainty of future cash flows that arise from contracts within the scope of IFRS 17, including both insurance and financial risks.

All companies within our sample provided detailed disclosures in relation to insurance and market risk, proportionate to the size and nature of their business.

Examples of good disclosures included:

- Plain English explanations of the nature of the risks and how they arise;

- Detailed explanation of the components of insurance risk, including how they are measured and managed; and

- Sensitivity of the carrying value of insurance contracts to changes in key inputs and assumptions.

Liquidity risk

Paragraph 132 of IFRS 17 requires disclosure of a description of how liquidity risk is managed for insurance contracts, as well as a maturity analysis of cash flows by estimated timings.

While most companies in our sample provided appropriate disclosure of liquidity risk, a number of companies provided disclosures which were not in the format required by the standard.

Some companies failed to provide:

- An explanation of how liquidity risk is managed for insurance contracts; and/or

- A maturity analysis of cash flows for each of the first five years after the reporting date.

Most companies in our sample integrated the disclosure of liquidity risk for financial instruments and insurance contracts into a single note.

One company provided a maturity analysis of cash flows for both insurance contracts and financial instruments only on a discounted basis, which is not consistent with the requirements of IFRS 7, 'Financial Instruments: Disclosures'.

Disclosure of insurance finance income or expenses

Paragraph 110 of IFRS 17 requires disclosure of the total amount of insurance finance income or expenses in the reporting period, and an explanation of the relationship between insurance finance income or expenses and the investment return on the company's assets.

While all companies within our sample disclosed the total amount of insurance finance income or expenses in the reporting period, not all explained the relationship between them and the investment return.

The majority of companies in our sample met the disclosure requirement for an explanation through presenting these amounts together in the same note. However, for several companies this was not done, and it was not clear to us how this disclosure requirement had been met.

We would expect additional narrative explanation of the relationship between insurance finance income or expenses and the investment return on the company's assets to be provided, where the relationship is not apparent from the way these amounts are presented in the notes.

Disaggregation of insurance finance income or expenses

Paragraph 118 of IFRS 17 requires an explanation of the methods used to determine the insurance finance income or expenses recognised in profit or loss, where insurance finance income or expenses are disaggregated between profit or loss and other comprehensive income.

We were pleased to find that the majority of companies in our sample provided clear disclosure of their accounting policies for the presentation of insurance finance income or expense.

However, of the companies which did disaggregate insurance finance income or expenses between profit or loss and other comprehensive income, not all provided a clear explanation of the methods used.

Where insurance finance income or expenses are disaggregated between profit or loss and other comprehensive income, we expect clear and specific disclosure of the method used to determine the split.

6. Alternative performance measures (APMs)

All the companies in our sample used APMs, most commonly premium measures, adjusted operating profit, and adjusted equity measures that include the CSM. Most general insurers also provided claims and/or combined ratios.

As explained in our 2021 APM thematic review report 8, sections 414C(2)(a) and (3) of the Companies Act 2006 require a strategic report to contain a fair, balanced and comprehensive analysis of a company's business. We consider that the European Securities and Markets Authority Guidelines on APMs ('the ESMA Guidelines') 9 provide helpful guidance on how to meet this requirement and reflect good practice in this area.

We were pleased that the majority of the companies in our sample appeared to have applied the ESMA Guidelines to their APMs.

As noted in our interim thematic report, in recent years we have not routinely challenged the use of APMs by insurance companies to the same extent as those in other sectors, due to the complexities of applying IFRS 4 and the fact that IFRS 17 adoption was underway. However, following the adoption of IFRS 17 we expect insurers to provide high quality disclosures for APMs, including those that are Key Performance Indicators (KPIs).

Many companies in our sample continued to use measures in their narrative reporting, such as gross or net premiums earned or written, that were formerly presented as line items in the income statement under IFRS 4. Where such measures are no longer IFRS line items under IFRS 17, these amounts now meet the definition of APMs, and fall within the scope of the ESMA Guidelines.

Definitions and labelling

We expect APMs to have clear definitions as well as labels that enable users to understand them and distinguish them from GAAP measures. APM labels should be used consistently throughout the report.

APMs should be defined even in the case of terms, such as 'claims ratio', that are commonly used in the insurance industry.

Companies should avoid using labels such as 'group revenue' that could be confused with IFRS measures.

Explanation and prominence

APMs should not be presented in ways that give them greater prominence than amounts stemming from the financial statements. Companies should provide specific, tailored explanations for the inclusion of individual APMs in their reports.

Companies should avoid comments that may imply APMs have more authority than amounts stemming from the financial statements, such as stating that APMs give a more representative view.

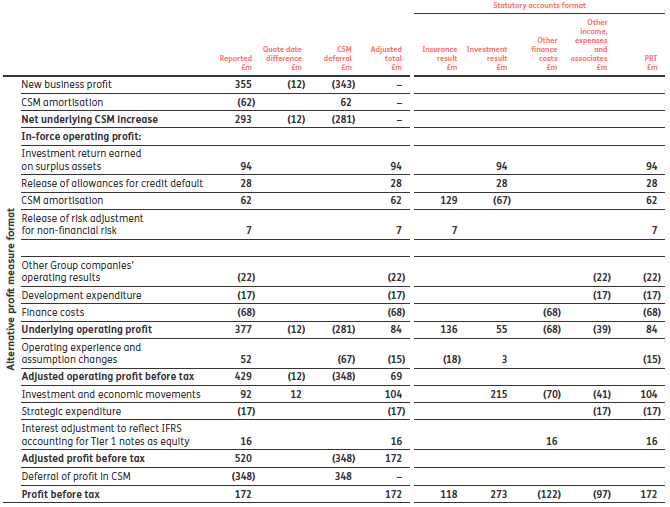

The company explains the reason for using the APM without implying greater authority than IFRS measures

Due to deferral of new business profits and sensitivity of profit to short-term volatility, the Group will continue to also analyse its results on an "adjusted operating profit" basis, which includes the full value generated from writing new business prior to the new business deferral and subsequent in-force release of profit via the CSM, and excludes investment related variances.

Reconciliations

We expect APMs to be reconciled to the most directly reconcilable line items, subtotals or totals presented in the financial statements.

Numerical reconciliations should generally be provided – narrative explanations alone may not be sufficient.

Calculations should be provided for any financial ratios presented, such as claims ratio or combined operating ratio. Calculations of financial ratios should state the numerator and denominator and, where necessary, reconcile them to amounts presented in the financial statements.

Individual adjustments are explained in the narrative below the table.

This table gives a clear depiction of how to get from APMs to amounts presented in financial statements.

It also shows how APM amounts are allocated between IFRS line items.

Text below the table explains that the rows and first numeric column of the table present the APM format.

The figures in the final row agree to the statement of comprehensive income.

Consistency

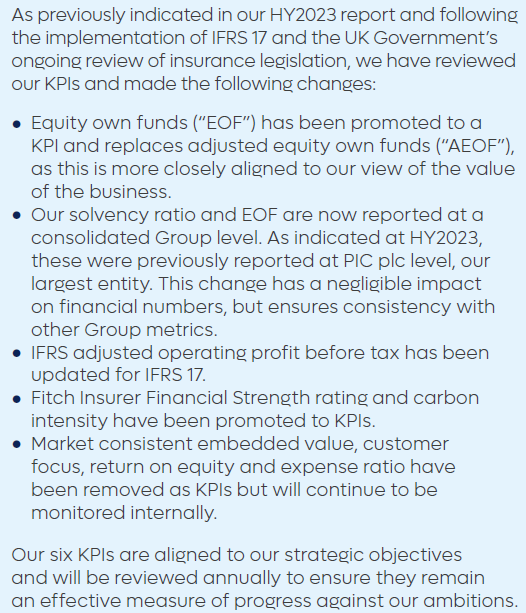

We expect APMs to be presented consistently over time to provide meaningful trend information. Any changes to definitions and/or calculations of APMs should be accompanied by relevant explanation 10, and where a company stops presenting an APM, it should explain why the measure no longer provides useful or relevant information.

Most of the companies in our sample provided clear explanations of the changes to their APMs as a result of the transition to IFRS 17.

Clear explanations of changes made to APMs (and other KPIs) and why they are made.

Details of KPIs no longer presented and the reasoning.

7. Key expectations

We expect companies to consider the examples provided of good disclosure and opportunities for improvement and to incorporate them in their future reporting, where relevant and material. In particular, companies should:

Continue to provide high quality disclosures, which meet the disclosure objective of IFRS 17 and enable users to understand how insurance contracts are measured and presented in the financial statements, while avoiding boilerplate language.

Ensure that accounting policies are sufficiently granular and provide clear, consistent explanations of accounting policy choices, key judgements and methodologies, particularly where IFRS 17 is not prescriptive.

Where sources of estimation uncertainty exist, provide information about the underlying methodology and assumptions made to determine the specific amount at risk of material adjustment and provide meaningful sensitivities and/or ranges of reasonably possible outcomes.

Provide quantitative and qualitative disclosures of the CSM, including how coverage units are determined, the movement in CSM during the period, and quantification of the expected recognition of CSM in appropriate time bands.

Provide appropriately disaggregated qualitative and quantitative information to allow users to understand the financial effects of material portfolios of insurance (and reinsurance) contracts.

Meet the expectations set out in our previous thematic reviews on the use of APMs, including commonly used measures such as premium metrics, and claims and expense ratios.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk

Follow us on Linked in or X @FRCnews

-

Thematic Review: IFRS 17 'Insurance Contracts' Interim Disclosures in the First Year of Application ↩↩

-

Thematic Review: IFRS 17 'Insurance Contracts' Interim Disclosures in the First Year of Application ↩

-

Thematic Review: IFRS 17 'Insurance Contracts' Interim Disclosures in the First Year of Application ↩

-

Thematic Review: Judgements and Estimates: Update ↩

-

Thematic Review: IFRS 17 'Insurance Contracts' Interim Disclosures in the First Year of Application ↩

-

Thematic Review: IFRS 17 'Insurance Contracts' Interim Disclosures in the First Year of Application ↩

-

What Makes a Good Annual Report and Accounts ↩

-

Thematic Review: Alternative Performance Measures (APMs) 2021 ↩

-

ESMA Guidelines on Alternative Performance Measures ↩

-

A description of each change, an explanation of why the change results in more reliable and relevant information, and restated comparatives (ESMA Guidelines paragraphs 41 and 42)</blockquoteকথা> ↩

The company explains how the relevant requirements have been applied to the specific types of contracts it issues, as well as the separation of components that fall within the scope of other IFRS accounting standards.

The company provides details of reinsurance contracts held and explains that these features were assessed in determining the appropriate accounting treatment under IFRS 17.