The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting September 2024 Paper 2: GHG emissions GHG Protocol and measurement methods

Executive summary

| Date | 03 September 2024 |

| Paper reference | 2024-TAC-013 |

| Project | Technical assessment of IFRS S1 and IFRS S2 |

| Topic | GHG Protocol and measurement methods |

Objective of the paper

This paper considers the requirements in IFRS S2 Climate-related Disclosures (IFRS S2) relating to the measurement methods used to calculate greenhouse gas emissions. This includes the reference to, and the requirements related to, the GHG Protocol Corporate Accounting and Reporting Standard. The TAC is asked to consider these requirements, including whether the instruction to use the GHG Protocol Corporate Accounting and Reporting Standard is appropriate.

Decisions for the TAC

The TAC is asked to tentatively decide to:

- maintain the reference to the GHG Protocol Corporate Standard, but change the instruction to ‘shall consider measuring’ temporarily until the ongoing review process by the GHG Protocol has been completed;

- maintain flexibility in the reporting boundaries but encourage entities to use a financial control approach, in addition to engaging with the ISSB and GHG Protocol;

- request further clarification and guidance from the ISSB on the requirement to disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees;

- suggest that the UK Government review the process for updating its greenhouse gas conversion factors, including providing clear rationale as to why the latest GWP values are not used;

- encourage UK entities to also provide market-based Scope 2 emissions data alongside the location-based data, and observe market practice to provide feedback to the ISSB during its post-implementation review of IFRS S2 as to whether the Scope 2 market-based approach should be included; and

- engage with both the GHG Protocol and ISSB to ensure that the requirements relating to Scope 2 emissions are consistent between the GHG Protocol materials and IFRS S2.

Appendices

There are no appendices to this paper.

This paper has been prepared by the Secretariat for the UK Sustainability Disclosure Technical Advisory Committee (TAC) to discuss in a public meeting. This paper does not represent the views of the TAC or any individual TAC member.

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including ‘IAS®’, ‘IASB®’, ISSB™, ‘IFRIC®’, ‘IFRS®’, the IFRS® logo, ‘IFRS for SMEs®’, IFRS for SMEs® logo, ISSB™, the ‘Hexagon Device’, ‘International Accounting Standards®’, ‘International Financial Reporting Standards®’, and ‘SIC®’. Further details of the Foundation’s Trade Marks are available from the Licensor on request.

Context

1IFRS S2 Climate-related Disclosures (IFRS S2) sets out requirements for the use of the GHG Protocol materials to measure an entity’s greenhouse gas emissions. IFRS S2 also includes requirements for the disclosure of the approach an entity uses to measure its greenhouse gas emissions, including the inputs and assumptions used in its calculations. The relevant references to the requirements in IFRS S2 are as follows:

- Paragraphs 29(a) Greenhouse gas emissions

- Appendix A Defined terms

- B19-B37 Application guidance

2The GHG Protocol is a partnership between World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD) and develops standards and guidance to measure and manage greenhouse gas emissions. The primary standard used by corporates is the GHG Protocol Corporate Accounting and Reporting Standard (GHG Protocol Corporate Standard), which is the only standard that is required to be used in IFRS S2. Additional and relevant GHG Protocol materials include the:

- GHG Protocol Corporate Value Chain (Scope 3) Standard;

- GHG Protocol Scope 3 Calculation Guidance; and

- GHG Protocol Scope 2 Guidance.

This body of material is sometimes referred to in shorthand as the GHG Protocol, which is incorrect as this is the name of the partnership. In this paper, each of the materials published by the GHG Protocol will be referred to individually using the titles above, or collectively as the GHG Protocol materials.

3In July 2024, the TAC discussed the sources of guidance in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) which included similar discussions to those presented in this paper. The outcome of the discussion in July has been reflected in this paper where appropriate. However, unlike the reference to the SASB materials, the GHG Protocol materials have not been acquired by—and therefore are not owned by—the IFRS Foundation and consequently sit outside of the IFRS Foundation’s governance and due process. Additionally, the instruction in IFRS S2 is that an entity ‘shall measure its greenhouse gas emissions in accordance with the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard (2004)’. This instruction is different from the one used for the reference to the SASB materials—which was for the SASB materials to be referred to and considered rather than mandating their use. For these reasons, the GHG Protocol materials are discussed separately from the other sources of guidance.

4This paper does not discuss in detail the Scope 3 emissions requirements or the financed emissions requirements, which will be presented in separate papers (2024-TAC-014 and 2024-TAC-015 respectively). Additionally, the issues associated with accounting for greenhouse gas emissions for leased assets will be discussed in paper 2024-TAC-014.

5In its context letter dated 20 May 2024, the Department for Business and Trade (DBT) indicated that it would welcome the TAC’s view on whether the supporting infrastructure for the disclosure of greenhouse gas emissions, including the availability of necessary data, is sufficient for UK companies to meet the disclosure requirements in IFRS S2—including a consideration of conversion factors and guidance. This matter has been considered in paragraphs 29–38, and a suggested recommendation is described in paragraph 52.5.

Endorsement criteria

6The endorsement criteria applied in the analysis of this technical area include whether:

- use of the IFRS Sustainability Disclosure Standard is likely to result in an improvement in the international comparability of sustainability-related reporting in the UK.

- use of the IFRS Sustainability Disclosure Standard is likely to support companies in making disclosures that are understandable, relevant, reliable and comparable.

- use of the IFRS Sustainability Disclosure Standard is likely to improve the quality of corporate reporting within the UK in the long term.

- companies are likely to be able to provide the disclosures required by the IFRS Sustainability Disclosure Standard within the timeframes that a company normally reports without undue cost or effort.

- use of the IFRS Sustainability Disclosure Standard is likely to be conducive to the UK’s economic growth and international competitiveness, taking into account the costs and benefits of compliance.

- the IFRS Sustainability Disclosure Standard is likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation.

Analysis

7In relation to the requirements relating to targets, there are a number of matters for the TAC to discuss, including:

7.1 general views and current reporting practice in the UK relating to the use of the GHG Protocol Corporate Standard. Most entities in the UK use the GHG Protocol Corporate Standard to calculate greenhouse gas emissions, but there are some concerns that the GHG Protocol Corporate Standard—which has not been updated for 20 years and is not subject to IFRS due process—would require a full endorsement assessment before it is mandated for use. Paragraphs 8–16 considers current reporting practice in the UK and general views from stakeholders relating to the use of the GHG Protocol Corporate Standard. The TAC is asked to consider whether to amend the instruction temporarily until the GHG Protocol has completed its

7.2 review and the updated GHG Protocol Corporate Standard has been through IFRS due process and incorporated into IFRS S2. the challenges associated with the organisational boundary approaches in the GHG Protocol Corporate Standard and the inconsistencies relating to the requirement to disaggregate Scope 1 and Scope 2 emissions by consolidated group and other investees. Paragraphs 17–21 discusses the organisational boundary approaches in the GHG Protocol Corporate Standard and the challenges with allowing a flexible approach. The TAC is asked to consider whether to prescribe the organisational boundary in IFRS S2. Paragraphs 22–28 discusses the requirement to disaggregate Scope 1 and Scope 2 emissions by consolidated group and other investees, and highlights some inconsistencies within IFRS S1 and IFRS S2 that may need to be clarified by the ISSB. The TAC is asked to consider whether these requirements are sufficiently clear and whether further guidance (e.g. illustrative examples) from the ISSB would be helpful.

7.3 the requirements to use the latest global warming potential (GWP) values and emissions factors. Paragraphs 29–38 highlight the challenges with the underlying data used to calculate greenhouse gas emissions, in that different sources are often used for emissions factors, which may not include the latest GWP values. The TAC is asked to consider whether it is appropriate to prescribe the use of specific emissions factors, including the UK Government’s conversion factors.

7.4 the slightly different requirements in IFRS S2 and GHG Protocol Scope 2 Guidance relating to the use of location-based and market-based Scope 2 emissions data. Paragraphs 39–46 discusses location-based and market-based Scope 2 emissions data, including the inconsistencies between IFRS S2 and GHG Protocol Scope 2 Guidance. The TAC is asked to consider whether to amend IFRS S2 to require a market-based approach to IFRS S2 emissions.

General views and current reporting practice in the UK

Current practice in the UK

8In its June 2024 meeting, the TAC was presented with paper 2024-TAC-004b which summarises current reporting practice in the UK based on a literature review. The TAC Secretariat also completed its own review of FTSE 100 companies in relation to greenhouse gas emissions reporting (as of August 2023). The TAC Secretariat’s review found that most FTSE 100 entities used the GHG Protocol Corporate Standard when calculating greenhouse gas emissions. The table below highlights which standards were found to be used by the FTSE 100 entities.

| Standard(s) used to calculate greenhouse gas emissions | No. of FTSE 100 companies |

|---|---|

| GHG Protocol Corporate Standard only | 70 |

| GHG Protocol Corporate Standard with supplemental guidance from other sources | 16 |

| Industry-specific guidance (e.g. IPIECA) | 1 |

| ISO 14064-1 only | 1 |

| UK Environmental Reporting Guidelines | 1 |

| No greenhouse gas emissions disclosure | 3 |

| Unclear | 8 |

9However, despite the majority of entities using the GHG Protocol Corporate Standard the review also found significant variation in the disclosures, especially in terms of the approaches and emissions factors used to calculate the greenhouse gas emissions. Although users may believe that the use of the GHG Protocol Corporate Standard creates consistency and comparability in the disclosure of greenhouse gas emissions data, the flexibility it offers in terms of approach has led to diverging practice which results in little comparability.

10In the UK, quoted companies have been required to disclose annual greenhouse gas emissions and an intensity ratio in their Directors’ Report since 2013. In 2018, The Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018 (SI 2018/1155) implemented the government’s policy on Streamlined Energy and Carbon Reporting (SECR) and introduced new requirements for quoted companies, unquoted companies and limited liability partnerships to disclose annual energy use and greenhouse gas emissions. Therefore, greenhouse gas emissions disclosures are not new to large UK entities. However, as noted by some stakeholders in their response to the TAC’s call for evidence, the SECR regulation does not prescribe a methodology and allows entities to select any major standard when calculating its greenhouse gas emissions. The GHG Protocol Corporate Standard is referenced in the UK Environmental Reporting Guidelines as a recommended methodology. Despite not mandating its use, practice in the UK has coalesced around the GHG Protocol Corporate Standard. Decisions about the consistency between the requirements in IFRS S2 and SECR should be discussed by the UK Sustainability Disclosure Policy and Implementation Committee (PIC).

General views on the GHG Protocol materials

11Most stakeholders that responded to the TAC’s call for evidence supported the reference to the GHG Protocol materials in IFRS S2. These stakeholders emphasised that the GHG Protocol materials are internationally recognised and

12used as standard practice in the market, which enables international consistency and comparability. However, some stakeholders raised concerns about mandating an external source in the standard, especially as the GHG Protocol materials do not use the same conceptual framework as the IFRS Sustainability Disclosure Standards. Unlike the SASB Standards, the GHG Protocol materials have not been incorporated into the IFRS Foundation, and therefore sit outside of the governance and due process of the IFRS Foundation. Recognising concerns that some stakeholders had on the proposals in the IFRS S2 Exposure Draft, the ISSB fixed the version of the GHG Protocol Corporate Standard to its most recent updated version in 2004—thus removing the ambulatory reference1.

13Although the GHG Protocol Corporate Standard has been supplemented over the years with additional standards and guidance, the last time it was revised was in 2004, making it 20 years old. In previous TAC discussions, some members commented on the GHG Protocol materials no longer being fit for purpose. The GHG Protocol Corporate Standard and its supplementary materials are currently being reviewed with draft standards and guidance planned to be published for public consultation in 2025 and the final standards and guidance to be issued in the latter half of 2026. To support the substantial review, in June 2024 the GHG Protocol announced the formation of a new Steering Committee and Independent Standards Board. A representative of the ISSB has been appointed as an observer on the GHG Protocol Independent Standards Board to ensure ongoing compatibility with IFRS S2. Additionally, the GHG Protocol and the ISSB have signed a Memorandum of Understanding so that the ISSB is actively engaged in the decisions made in relation to the GHG Protocol materials.

14In response to the TAC’s call for evidence, some stakeholders insisted that the GHG Protocol Corporate Standard needs to go through a full endorsement assessment for legal certainty in the UK. The TAC has not been commissioned to complete a full endorsement assessment of the GHG Protocol Corporate Standard, but only the reference to it in IFRS S2. However, given that the GHG Protocol Corporate Standard is currently going through a detailed review, it might be necessary for the TAC to consider whether the requirement to use it in IFRS S2 is appropriate at this time.

15Additionally, ESRS E1 Climate Change (ESRS E1) does not specify that entities are required to use the GHG Protocol materials. Instead, ESRS E1 requires entities to consider the principles, requirements and guidance provided by the GHG Protocol, but also allows an entity to consider other requirements (e.g. ISO 14064-1). The TAC Secretariat has not completed an assessment of the other available requirements as it goes beyond the scope of the technical assessment of IFRS S1 and IFRS S2.

16Despite concerns about the reference to a third-party standard that is out of date, most stakeholders supported the reference to the GHG Protocol materials and suggested that to remove it completely from IFRS S2 could undermine efforts towards consistency and comparability. The TAC may therefore consider whether the instruction that entities ‘shall measure’ greenhouse gas emissions using the GHG Protocol Corporate Standard should be amended to ‘shall consider measuring’. This amendment would retain the reference to the GHG Protocol Corporate Standard but provide flexibility by softening the instruction. Additionally, this wording would bring the instruction closure to the wording used in ESRS E1.

Reporting boundaries

Organisational boundaries according to the GHG Protocol Corporate Standard

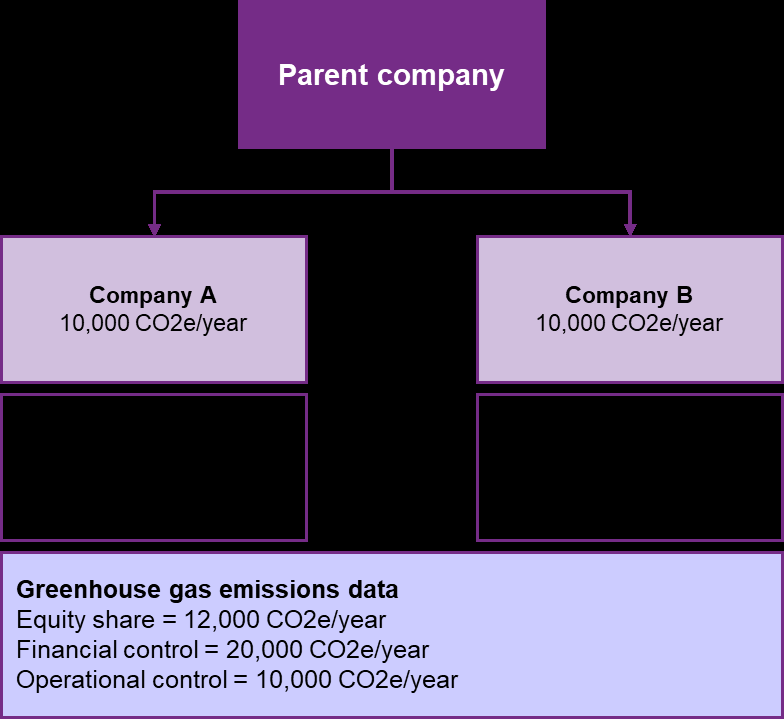

17An issue that is regularly cited as a significant challenge with the GHG Protocol materials is the different organisational boundaries that entities could use to collect and disclose greenhouse gas emissions. The GHG Protocol Corporate Standard specifies that an entity can use either the equity share approach or the control approaches (including operational control and financial control) to consolidate its greenhouse gas emissions. Depending on the approach taken on organisational boundary, the entity’s greenhouse gas emissions data may look very different. Figure 1 below is a simplified diagram that demonstrates how different approaches might result in different greenhouse gas data.

Figure 1 Simplified diagram of the different organisational boundaries used for greenhouse gas emissions

18The GHG Protocol Corporate Standard notes that consolidation of greenhouse gas data will only be consistent if all entities in the consolidated group use the same organisational boundaries. If the parent entity decides to use an

19operational control approach, then it is expected that all its consolidated entities will also use this approach. The TAC Secretariat’s review of FTSE 100 entities found that different approaches are taken by UK entities, which is demonstrated in the table below. This review found that over half (55 entities) used an operational control approach when calculating greenhouse gas emissions. Three entities used a mixed approach and applied different organisational boundaries. For example, one entity used an operational control approach for most of its greenhouse gas emissions but also used an equity share approach for its investments. Notably, the TAC Secretariat observed that disclosures about the approach taken were not always clear. The information about the approach was presented in different ways—in footnotes, in-text or in separate documents—and with different levels of detail, which sometimes made it difficult to understand exactly what approach the entity had taken.

| Organisational boundary approach | No. of FTSE 100 companies |

|---|---|

| Operational control approach only | 55 |

| Financial control approach only | 12 |

| Equity share approach only | 1 |

| Mixed approach | 3 |

| Unclear | 26 |

20An ongoing challenge with the organisational boundary approaches outlined in the GHG Protocol Corporate Standards is that these approaches do not necessarily align with reporting in the financial statements. There may be an expectation from stakeholders that an entity’s greenhouse gas emissions disclosure aligns with, and is connected to, the information in the financial statement, but this is unlikely to be the case due to the differences in the GHG Protocol Corporate Standard and accounting standards. Regardless of the organisational approach taken by the entity to measure its greenhouse gas emissions—equity share or either control approach—there are a number of significant complexities, that would need to be considered in detail to ensure alignment between greenhouse gas emissions disclosures and the information in the financial statements.

21In both the June and July 2024 TAC meetings, the TAC agreed that a financial control approach would be the preferred boundary as this would enable connectivity with the financial statements. However, some members also noted that many entities that currently report sustainability-related information collect data and disclose using an operational control approach—even for sustainability-related matters beyond greenhouse gas emissions. In these meetings, some TAC members suggested that transition relief may be necessary to support entities that will need to make significant changes to their internal processes to

22be able to disclose information using a financial control approach—especially if all entities within the consolidated group are expected to use the same approach as the parent entity. TAC members also recognised that the shift to a financial control approach could create significant cost and burden to the entity and the transition relief would help alleviate these costs and burden. However, IFRS S2 does not prescribe the organisational boundary approach an entity needs to apply when measuring greenhouse gas emissions and therefore the TAC would not be able to introduce transition relief unless the TAC agreed to introduce a new requirement that specifies that entities should use a financial control approach. As the GHG Protocol is currently reviewing its materials, the TAC may decide that it is appropriate to engage with the GHG Protocol and ISSB on its organisational boundary requirements and guidance rather than amending IFRS S2 at this time.

Disaggregation by consolidated accounting group and investees

23IFRS S2 paragraph 29(a)(iv) requires an entity to disaggregate its Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees (e.g. associates, joint ventures and unconsolidated subsidiaries). In IFRS S2 Basis for Conclusions on Climate-related Disclosures (IFRS S2 Basis for Conclusions) paragraph BC101, the ISSB confirmed that this requirement is intended to:

[F]acilitate comparability because the GHG Protocol Corporate Standard allows entities to take different measurement approaches to determine which emissions are included in the calculation of Scope 1, Scope 2 and Scope 3 greenhouse gas emissions. For example, an entity can include the emissions of unconsolidated investees using an equity share approach or control approach. These different approaches mean that the way information is provided in an entity’s financial statements about its investments in other entities might not align with how its greenhouse gas emissions are calculated. It also means that two entities with identical investments in other entities could report different greenhouse gas emissions in relation to those investments by virtue of choices made in applying the GHG Corporate Protocol Standard.

24However, the ISSB also confirmed in IFRS S2 Basis for Conclusions paragraph BC102 that an entity can still chose an organisational boundary approach from the GHG Protocol Corporate Standard, and therefore is only required to disaggregate the Scope 1 and Scope 2 emissions using its chosen approach. Therefore, it is not clear whether maintaining flexibility in the organisational boundary approach offered by the GHG Protocol Corporate Standard will meet the ISSB’s intention of bringing consistency and comparability to disclosures by requiring disaggregation by consolidated accounting group and investees. For example, if an entity does not have operational control of its joint ventures or associates, then the entity would disclose no disaggregated emissions for this requirement.

25In the IFRS S2 Basis for Conclusions paragraph BC103, the ISSB acknowledged that an entity would generally be expected to account for an investment in a joint venture using the equity method for the financial statements in accordance with IAS 28 Investments in Associates and Joint Ventures (IAS 28). However, as

26entities are able to choose the organisational boundary approach for greenhouse gas emissions, this information may still be misaligned with the approach used for financial reporting purposes. For example, if an entity uses an equity method for its financial statements in accordance with IAS 28, but uses an operational control approach for greenhouse gas emissions, the resulting disclosures will likely be misaligned. Additionally, IFRS S2 Basis for Conclusions notes that in accordance with IFRS 11 Joint Arrangements (IFRS 11) joint operations would be included in an entity’s financial statements on a pro-rata basis and therefore would be included as part of IFRS S2 paragraph 29(iv)(1) Scope 1 and Scope 2 consolidated group data, rather than as an investee. However, there may also be misalignment with the approach used for financial reporting if an entity applied the operational control approach to its greenhouse gas emissions.

27Additionally, IFRS S1 considers joint ventures, associates and investments as part of an entity’s value chain. In this regard, greenhouse gas emissions from joint ventures, associates and investments could be included as part of an entity’s Scope 3 emissions. In particular, investments are included in an entity’s Scope 3 Category 15 disclosure. If this assumption is correct, an entity may not consider its joint ventures, associates and investments as part of its Scope 1 and Scope 2 emissions, and therefore would be unable to provide disaggregated emissions in accordance with this requirement. Also, if this assumption—that joint ventures, associates and investments are part of the value chain—is correct, then an entity would be able to take advantage of the permission in IFRS S2 paragraph B19 that permits the use of data from the value chain for a different reporting period from the entity’s reporting period, in certain circumstances.

28ESRS includes a similar requirement in ESRS E1 that requires the disaggregation of Scope 1 and Scope 2 emissions by consolidated accounting group and investees. In accordance with ESRS E1—similar to IFRS S2—investees include associates, joint ventures, or unconsolidated subsidiaries that are not fully consolidated in the financial statements of the consolidated accounting group, in addition to any contractual arrangements that are joint arrangements not structured through an entity. Unlike IFRS S2, entities applying ESRS E1 need only disclose disaggregated Scope 1 and Scope 2 emissions for investees for which it has operational control. According to the ESRS-ISSB interoperability guidance published jointly by ISSB and EFRAG, if an entity has operations that result in ESRS E1 and IFRS S2 requiring different disaggregation of Scope 1 and Scope 2 emissions, then the entity will be required to disclose two different sets of disaggregation for consolidated accounting group and investees which could lead to confusing disclosures.

29The CDSB Climate Change Framework (2012)—which the IFRS S2 requirements are built on—introduced an approach to organisational boundary setting that sought to align with boundaries used for financial reporting purposes so that greenhouse gas emissions would be reported for the same entities as used for the financial statements. Similar to IFRS S2 and ESRS E1, the CDSB Climate Change Framework required entities to disaggregate Scope 1 and Scope 2 emissions by consolidated accounting group and joint ventures. However, the CDSB requirement specified that a financial control approach should be used to disclose consolidated accounting group, whereas an equity share approach should be used for joint ventures. The table below is adapted

| Entities | Greenhouse gas emissions (further disaggregated by Scope 1 and Scope 2) |

|

|---|---|---|

| Line 1 | Parent company and subsidiaries under financial control including leased assets treated as assets of the consolidated group for financial accounting purposes | 100% emissions |

| Line 2 | Joint ventures | % of emissions according to the % interest in the joint venture |

30from the CDSB Climate Change Framework and demonstrates the alternative approach to disaggregation of Scope 1 and Scope 2 emissions. The TAC may decide that further clarification and guidance on this requirement should be provided by the ISSB. In the IFRS S2 Accompanying Guidance on Climate-related Disclosures the ISSB provided an illustrative example of how an entity might disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees. However, in the fact pattern of the example, the entity applies the equity share approach. Given that entities are allowed to choose a control approach—either financial or operational—the TAC may consider engaging with the ISSB to provide further examples that demonstrate how an entity might disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees if it applies either an operational control or financial control approach.

Measurement methods

31IFRS S2 paragraph 29(a)(iii) requires an entity to disclose the measurement approach, inputs and assumptions it has used to measure its greenhouse gas emissions, which includes information about the emissions factors that have been applied in the calculations. IFRS S2 Basis for Conclusions paragraph BC91 notes that IFRS S2 does not specify what measurement approach, inputs and assumptions an entity is required to use, despite calls from stakeholders to standardise the approach that entities take. As noted in paragraph 9, despite many entities using the GHG Protocol Corporate Standard, the disclosure of greenhouse gas emissions has been inconsistent with concerns about the comparability of the data. Despite not standardising the approach entities take to measure greenhouse gas emissions, the requirements in IFRS S2 paragraph 29(a)(iii) in addition to the requirements in IFRS S1 that relate to the disclosure of judgements and uncertainties—may be expected to provide users with sufficient information to understand an entities greenhouse gas emissions, including which measurement approach, inputs and assumptions it has used.

32Two specific inputs that the ISSB considered were global warming potentials (GWP) values and emissions factors, as these two inputs could compromise the comparability of disclosures if entities use inputs that are starkly different.

33As defined in IFRS S2 Appendix A, GWP is a factor that describes the radiative forcing impact of one unit of a greenhouse gas relative to one unit of CO2. GWP values are multipliers applied to the seven constituent greenhouse gases² to convert them into carbon dioxide equivalent (CO2e), which is a standardised metric that enables data to be aggregated into absolute greenhouse gas emissions data. The GHG Protocol Corporate Standard recommends that entities use the GWP values that are defined by the Intergovernmental Panel on Climate Change (IPCC) and updated periodically to reflect improved scientific understanding of the greenhouse gases. The latest GWP values were published by the IPCC in June 2023 as part of the IPCC Sixth Assessment Report (AR6).

34IFRS S2 paragraph B21 requires an entity to use the latest GWP values as published by the IPCC if directly measuring its greenhouse gas emissions (i.e. not using estimates). However, if the entity uses emissions factors to calculate its greenhouse gas emissions, it is required to use the emissions factors that best represent the activity even if those emissions factors don’t use the latest GWP values. As a large proportion of entities prepare greenhouse gas emissions data using estimates and emissions factors—which convert activity data into CO2e—entities will be dependent on the GWP values that are already used in emissions factors, regardless of whether they are the latest GWP values.

35IFRS S2 paragraph B22 clarifies that if entities use emissions factors that best represent the entity’s activity, but do not use the latest GWP values, the entity is not required to recalculate the emissions factors using the latest GWP values. This means that entities could use multiple inputs to calculate their greenhouse gas emissions, each using different GWP values, making the data less consistent and comparable.

36An emissions factor is a number that enables an entity to convert activity data (e.g. transport of its goods by its delivery fleet) into greenhouse gas emissions data. There are several sources that an entity might use, including international emissions factors for specific activities or jurisdiction emissions factors that reflect the energy mix of that jurisdiction. The UK Government publishes its own annual greenhouse gas emissions factors—although the UK Government calls them conversion factors. The emissions factors an entity might use will depend on the facts and circumstances of that entity, including where its operations are and the types of equipment it uses. Therefore, it is not possible to prescribe or standardise emissions factors. IFRS S2 paragraph B29 clarifies that IFRS S2 does not specify which emissions factors an entity is required to use, but instead requires ‘an entity to use emission factors that best represent the entity’s activity as its basis for measuring its greenhouse gas emissions.’

37The UK Government’s conversion factors are one of the most widely used, even outside of the UK. Jurisdiction-specific emissions factors are appropriate to reflect the local energy mix—for example, an entity using the same machinery in

38both the UK and in another jurisdiction that relies on coal generated electricity will have different greenhouse gas emissions in the two jurisdictions even though the machinery is the same. The UK’s conversion factors are developed by a private sector organisation under contract with the Government. In the updated 2024 conversion factors, some of the factors have been updated to reflect the GWP values published in the IPCC Fifth Assessment Report (AR5) which was published in 2014. However, some of the conversion factors have been held consistently with the IPCC Fourth Assessment Report (AR4) which was published in 2007, thus making some of the emissions factors 17 years out of date. The methodology paper that accompanies the UK Government’s conversion factors notes that a risk-based approach has been used to focus on delivering accurate conversion factors. However, it is not clear why out of date GWP values have been used in some cases and why the latest GWP values from AR6 have not been used. The TAC may consider requesting that the UK Government review the process for updating the greenhouse gas conversion factors, including providing clear rationale as to why the latest GWP values are not used.

39The challenges in the underlying data used to calculate greenhouse gas emissions are widespread and not going to be resolved through IFRS S2. However, IFRS S2 paragraph 29(a)(iii) does require the disclosure of information that enables users to understand the measurement approach, inputs and assumptions that have been used to calculate greenhouse gas emissions. This should include the GWP values and the emissions factors that are used by entities to calculate greenhouse gas emissions data. However, given the number of inputs that an entity might use, this disclosure could become unwieldy. IFRS S2 Basis for Conclusions paragraph BC96 notes that in its deliberations:

[T]he ISSB observed that this disclosure requirement is subject to paragraphs B29–B30 of IFRS S1, which establishes requirements on the aggregation and disaggregation of information. Rather than disclosing information about every input, an entity is required to disclose information at a sufficient level of detail and aggregation to result in the disclosure of material information. For example, when an entity measures its Scope 3 greenhouse gas emissions, it might use different emission factors and activity data inputs to capture greenhouse gas emissions for different parts of its value chain. In this circumstance, the entity would be required to only disclose information about inputs that are helpful to users of general purpose financial reports to understand how the entity has measured its greenhouse gas emissions.

40The TAC Secretariat’s review of FTSE 100 entities greenhouse gas emissions reporting found that there were multiple emissions factors being used by entities. The TAC Secretariat observed the following:

- 59 entities used the UK Government’s conversion factors, either by themselves or alongside other conversion factors.

- Information about which emissions factors were used to calculate greenhouse gas emissions was generally not clear.

- Some entities that used multiple emissions factors did not specify which ones were used as they acknowledged that there were too many to list.

41Some emissions factors focused on specific activities, whereas others were from specific jurisdictions where the entities had significant operations.

- One entity also provided the publication year of the emissions factors—this entity used 2018 emissions factors for the reporting year 2021/2022.

- Entities did not provide specific insight into which GWP values were used beyond information about which emissions factors were used.

42The significant variation in, and inconsistent disclosure of which emissions factors were used mean that disclosures are not comparable. Although IFRS S2 requires the disclosure of the measurement approach, inputs and assumptions that have been used to calculate greenhouse gas emissions, the TAC may consider observing practice and providing feedback to the ISSB in its post-implementation review, especially if practice does not improve and disclosures remain incomparable.

Scope 2 requirements

43IFRS S2 paragraph 29(a)(v) requires an entity to disclose its location-based Scope 2 greenhouse gas emissions. Additionally, an entity is required to ‘provide information about any contractual instruments that is necessary to inform users’ understanding of the entity’s Scope 2 greenhouse gas emissions’. A location-based approach measures the average emissions intensity of the energy grids on which the energy consumption occurs using grid-average emission factor data. For example, the same energy use in operations in the UK and the USA will result in different greenhouse gas emissions due to the different energy mix on the grids. A market-based approach measures the greenhouse gas emissions from purchased electricity using source or supplier emissions factors. For example, the entity may collect information directly from the supplier about the energy mix of the electricity that it is supplying.

44The TAC Secretariat’s review of FTSE 100 entities found that entities used different approaches to disclose Scope 2 emissions, with 7 entities disclosing location-based only, 15 disclosing market-based only, 63 disclosing both, and 12 not providing clear information on which approach was used. The table below reflects anonymised Scope 2 emission data from a UK entity. This example demonstrates that depending on the approach taken, an entity’s Scope 2 emissions data could be significantly different.

| Emissions | 2023/24 | 2022/23 |

|---|---|---|

| Scope 2 (location-based) tCO2e | 17,000 | 16,000 |

| Scope 2 (market-based) tCO2e | 2,700 | 2,900 |

45The GHG Protocol Scope 2 Guidance encourages the disclosure of both approaches as they provide different insights into an entity’s energy consumption and greenhouse gas emissions. Additionally, the SECR does not specify an

46approach. In IFRS S2 Basis for Conclusions paragraph BC107, the ISSB acknowledged that both approaches could serve a useful purpose, noting that:

A location-based approach enables users of general purpose financial reports to understand the risks and opportunities associated with local grid resources and greenhouse gas emissions. A market-based approach enables users to understand the risks and opportunities created by contractual relationships and an entity’s procurement actions.

47Although the ISSB received feedback from stakeholders that both approaches should be required—as noted in IFRS S2 Basis for Conclusions paragraph BC105—the ISSB decided to require Scope 2 greenhouse gas emissions data using the location-based approach, and requiring information about contractual instruments (market-based approach) only if such instruments exist and information about them is useful to understand the Scope 2 emissions. It is not clear why the ISSB does not use the phrase ‘market-based’ in its requirements. IFRS S2 Basis for Conclusions paragraph BC109 clarifies that:

[T]he ISSB decided not to require a market-based approach to measuring Scope 2 greenhouse gas emissions due to the significant variation in mechanisms that an entity could use and depending on the maturity of the market in which it operates and is located. To reflect the challenges associated with a market-based approach, the ISSB decided that an entity is required to disclose information to help users understand any contractual instruments the entity has entered into for the sale and purchase of energy. In fulfilling this requirement, the ISSB noted that information about an entity’s market-based Scope 2 greenhouse gas emissions might be included as part of this disclosure.

48There are pros and cons to requiring market-based Scope 2 emissions data. This approach has been considered by some as controversial as there are many contractual arrangements—of varying quality—that entities currently use. Additionally, entities are able to misuse the data to present a skewed view of their Scope 2 emissions. For example, some entities have purchased renewable energy certificates in one jurisdiction to offset emissions in a different jurisdiction. This misuse of the requirements could lead to greenwashing. However, entities have indicated that they want to disclose market-based Scope 2 emissions data as it demonstrates the actions they are taking to mitigate and manage their emissions. As entities are unable to significantly influence the energy mix in a location, there may not be many actions—other than energy efficiency measures—an entity could take to reduce their location-based emissions. By providing market-based emissions data, the entity is able to demonstrate emissions reduction activities that it is pursuing.

49An additional consideration is that ESRS E1 requires entities to apply both location-based and market-based approach to calculate Scope 2 emissions in addition to information about the share and types of contractual instruments that the entity has used.

50As noted in paragraph 40, only 15 entities in the TAC Secretariat’s review disclose only market-based Scope 2 emissions, with the majority of entities disclosing both. Entities that only disclose a market-based approach will need to

51recalculate their Scope 2 emissions using a location-based approach when applying IFRS S2, which may present a significant cost. By requiring all entities applying IFRS S2 to use a standardised approach, the consistency and comparability of the disclosures will improve, which will ultimately improve the quality of reporting. However, to amend IFRS S2 at this stage may not be appropriate and it may be more helpful to observe market practice to see whether the requirements in IFRS S2 are sufficient. The TAC may consider encouraging UK entities to also provide market-based Scope 2 emissions data alongside the location-based approach. The TAC may consider recommending that market practice is observed and, in time, feedback is provided to the ISSB during its post-implementation review of IFRS S2 as to whether the Scope 2 market-based approach should be included in the standard.

52Between 2022 and 2023, the GHG Protocol collected stakeholder feedback in relation to the market-based approach. The final summary report was published in July 2024 which details the findings from this stakeholder feedback. Based on this feedback, the GHG Protocol has committed to publish new requirements and guidance on how entities can account for and report on mitigation actions and the use of market instruments in their greenhouse gas disclosures. The TAC may consider engaging with both the GHG Protocol and ISSB to ensure that the requirements relating to Scope 2 emissions are consistent between the GHG Protocol materials and IFRS S2.

Permission to not use the GHG Protocol Corporate Standard

53There are two reliefs—one permanent and one transition—that are available in IFRS S2 relating to the use of the GHG Protocol Corporate Standard. IFRS S2 paragraph B24 permits entities to use a different method if a jurisdictional authority requires the use of a specific method that is not the GHG Protocol Corporate Standard. For example, jurisdictions like Australia and Japan have their own national measurement schemes. Greenhouse gas reporting requirements in the UK—for example, in SECR—do not require any specific method to be used to calculate greenhouse gas emissions. Therefore, the relief in IFRS S2 paragraph B24 may not apply to UK entities. However, if a UK entity has a listing on a market where an alternative method to calculate greenhouse gas emissions is required, then this entity will be able to apply this permanent relief. The GHG Protocol Corporate Standard notes that consolidation of greenhouse gas data will only be consistent if all entities in the consolidated group use the same method and organisational boundaries. If an entity’s subsidiary in a different jurisdiction is required to use a different approach, then it is not clear whether the consolidated group would also be able to take advantage of this relief, or whether it would need to recalculate the greenhouse gas emissions for that subsidiary.

54IFRS S2 also includes transition relief regarding the use of the GHG Protocol Corporate Standard. IFRS S2 paragraph C4(a) permits an entity to continue to use a method other than the GHG Protocol Corporate Standard, if that entity uses the other method in the immediate preceding reporting period. For clarity, if an entity used a different method (e.g. ISO 14064) to calculate greenhouse gas emissions, then in the first year of applying IFRS S2 the entity is permitted to

55continue to use this different method. In the second year of applying IFRS S2, the entity is then required to use the GHG Protocol Corporate Standard.

56The TAC will discuss and make decisions on all transition reliefs available in IFRS S1 and IFRS S2 in a future paper. This will allow the TAC to consider all transition reliefs as a package.

57However, if the TAC decides to temporarily amend the instruction to use the GHG Protocol Corporate Standard from ‘shall use’ to ‘may use’, then the transition relief in IFRS S2 paragraph C4(a) is no longer necessary and can be removed from the standard. If the TAC decides to maintain the instruction as ‘shall use’, then the TAC will be asked to make a decision on the transition relief in this future discussion.

Endorsement recommendations

Alternative options considered but not recommended

58In considering the TAC’s endorsement recommendations on the requirements relating to the value chain, the Secretariat considered alternative options that have been disregarded. The alternative options that were considered but not recommended included:

58.1 removing the reference to GHG Protocol Corporate Standard. Some stakeholders have raised concerns about mandating an external source in the IFRS S2, especially as the GHG Protocol materials are not subject to the same due process as the IFRS Sustainability Disclosure Standards. Additionally, some stakeholders raised concerns about whether the GHG Protocol Corporate Standard was still fit for purpose, especially as it was last updated in 2004. However, although stakeholders raised these concerns, they also noted that to remove the reference to the GHG Protocol materials completely from IFRS S2 could undermine efforts towards consistency and comparability, in the absence of a commonly used alternative.

58.2 amending IFRS S2 to encourage entities to use a financial control approach. Although the TAC has previously agreed that a financial control approach would be preferable, it is not clear what mechanism the TAC should use to encourage entities to apply this approach. The TAC may decide to amend IFRS S2 to encourage the financial control approach or may consider using UK specific guidance. However, further consideration would need to be given to the interaction with the GHG Protocol materials and accounting standards before the TAC can fully conclude that amending the standard or creating UK specific guidance is necessary for the effective application of IFRS S2 within the UK. Instead, the TAC may consider engaging with the ISSB to develop further guidance materials and with the GHG Protocol in its review of the GHG Protocol Corporate Standard. Paragraph 52.3 discusses this recommendation further.

58.3 adding a transition relief that supports entities in switching to a financial control approach. The TAC has previously indicated that

58.4 financial control approach would be the preferred approach and entities should be encouraged to switch to this approach over time. However, a transition relief cannot be added to IFRS S2 if there is no specific requirement for entities to use a financial control approach. specifying that entities should use the UK Government’s conversion factors to calculate greenhouse gas emissions. Although there has been some suggestion that there should be standardisation as to the inputs used to calculate greenhouse gas emissions, an entity will use specific emissions factors that are relevant to its activities and the location of its operations. The UK Government’s annual conversion factors have been a popular source used by many UK entities. However, it may not be appropriate to specify that entities should use these factors as they may not reflect the entity’s facts and circumstances. Instead, the TAC may consider emphasising that entities should disclose which inputs they use to calculate greenhouse gas emissions, including which emissions factors they use.

Suggested endorsement recommendation

59On balance, and based on the analysis provided in this paper, the TAC is asked to tentatively recommend:

59.1 to maintain the reference to the GHG Protocol Corporate Standard but change the instruction to ‘shall consider measuring’ temporarily until the ongoing review process by the GHG Protocol has been completed. The opinions of stakeholders described in paragraphs 11–16 demonstrate that there is broad support for the use of the GHG Protocol Corporate Standard to encourage consistency and comparability, but there are some concerns about whether it is currently fit for purpose. Most notably, some stakeholders have called for a full endorsement assessment of the GHG Protocol Corporate Standard in the UK, which would be appropriate if its use became mandatory in the UK. However, the TAC has not been commissioned to complete this assessment. Even if the TAC were to be commissioned to assess the GHG Protocol Corporate Standard, it may not be appropriate to reach a conclusion at this stage given that the standard is currently being reviewed and updated by the GHG Protocol. Therefore, the TAC may decide to change the instruction for entities to be able to use the GHG Protocol Corporate Standard without mandating its use. This amendment could be temporary until the GHG Protocol has completed its review of its materials and the updated GHG Protocol Corporate Standard has been through an endorsement assessment in the UK. This amendment could also be temporary until the ISSB updates the reference in IFRS S2 to reflect the updated GHG Protocol Corporate Standard.

59.2 if the recommendation in paragraph 52.1 is approved, to remove the transition relief in IFRS S2 paragraph C4(a) permitting entities to use a different method in the first year the standard is applied. If the TAC agrees to amend the instruction from ‘shall use’ to ‘shall consider measuring’, then the transition relief in IFRS S2 paragraph C4(a) is no longer needed. However, if the TAC does not agree to amend the instruction from ‘shall use’ to ‘shall consider measuring’, the TAC will be

59.3 asked to make a decision about the transition relief in a separate discussion. to maintain flexibility in reporting boundaries but encourage entities to use a financial control approach, in addition to engaging with the ISSB and GHG Protocol. The TAC has previously agreed that a financial control approach would be preferable, but it may not be appropriate to amend IFRS S2 at this stage especially as it would require further analysis and could create undue cost and burden for entities that would be required to change their approach. In its final advice to the Secretary of State for Business and Trade, the TAC may consider providing a rationale as to why a financial control approach is the preferred approach. Additionally, the TAC may consider engaging with the ISSB and GHG Protocol to encourage greater alignment of the organisational boundary approaches, in addition to encouraging both organisations to emphasise a financial control approach. Encouraging the ISSB and the GHG Protocol to focus on a financial control approach will support international comparability.

59.4 to request further clarification and guidance from the ISSB on the requirement to disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees. For example, entities can still choose an organisational boundary approach from the GHG Protocol Corporate Standard, which may not align with the requirement to disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees. The TAC may consider engaging with the ISSB to provide further examples that demonstrate how an entity might disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees if it applies either an operational control or financial control approach. Additionally, IFRS S1 considers joint ventures, associates and investments as part of an entity’s value chain, and therefore further clarity may be provided by the ISSB as to how the requirement in IFRS S2 aligns with this view of joint ventures, associates and investments. For example, the ISSB could provide further clarity as to whether joint ventures, associates and investments should be included in an entity’s Scope 3 emissions disclosures, and if so, how this aligns with the requirement to disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees.

59.5 to suggest that the UK Government review the process for updating the greenhouse gas conversion factors, including providing clear rationale as to why the latest GWP values are not used. IFRS S2 requires entities to use the latest GWP values, however the UK Government’s conversion factors use outdated GWP values for different factors. The TAC may consider suggesting that the UK Government review the process for updating the greenhouse gas conversion factors to support entities in making disclosures that are reliable and comparable.

59.6 to encourage UK entities to also provide market-based Scope 2 emissions data alongside the location-based data. The TAC may also consider recommending that market practice is observed and, in time, feedback is provided to the ISSB during its post-implementation

59.7 review of IFRS S2 as to whether the Scope 2 market-based approach should be included in the standard. Many entities in the UK already disclose both location-based and market-based Scope 2 emissions data as suggested by the GHG Protocol guidance. There are benefits to providing both sets of data, especially when the total figure is starkly different between the two approaches. Although the ISSB decided to not use the phrase ‘market-based’, the requirements in IFRS S2 allow entities to provide information about contractual arrangements which would be useful information alongside location-based Scope 2 emissions data. Rather than amending IFRS S2 at this time, it may be more appropriate to observe market practice as it develops and provide feedback to the ISSB during its post-implementation review of IFRS S2. to engage with both the GHG Protocol and ISSB to ensure that the requirements relating to Scope 2 emissions are consistent between the GHG Protocol materials and IFRS S2. IFRS S2 and the GHG Protocol material differ slightly in their requirements related to Scope 2 emissions. The GHG Protocol materials encourage the disclosure of both location-based and market-based Scope 2 emissions, whereas IFRS S2 only requires the disclosure of location-based, and information about contractual arrangements that is necessary to inform users’ understanding of the entity’s Scope 2 emissions. Additionally, IFRS S2 does not use the term ‘market-based’ and it is unclear whether this subtle difference creates different reporting expectations. The TAC may consider engaging with both the GHG Protocol and ISSB to ensure that any updates to the GHG Protocol materials or IFRS S2 reflect the same objective, and any requirements relating to Scope 2 are consistent between the two documents.

Questions for the TAC

- Does the TAC agree with the analysis in this paper in relation to the requirements related to the GHG Protocol and measurement methods in IFRS S2?

- Does the TAC agree to tentatively recommend to maintain the reference to the GHG Protocol Corporate Standard but change the instruction to ‘shall consider measuring’ temporarily until the ongoing review process by the GHG Protocol has been completed? If the answer to this question is ‘yes’, does the TAC agree to tentatively recommend to remove the transition relief in IFRS S2 paragraph C4(a)?

- Does the TAC agree to tentatively recommend to maintain flexibility in the reporting boundaries but encourage entities to use a financial control approach, in addition to engaging with the ISSB and GHG Protocol?

- Does the TAC agree to tentatively recommend to request further clarification and guidance from the ISSB on the requirement to disaggregate Scope 1 and

- Scope 2 emissions between the consolidated accounting group and other investees?

- Does the TAC agree to tentatively recommend to suggest that the UK Government review the process for updating the greenhouse gas conversion factors, including providing clear rationale as to why the latest GWP values are not used?

- Does the TAC agree to tentatively recommend to encourage UK entities to also provide market-based Scope 2 emissions data alongside the location-based data? Does the TAC also tentatively recommend that market practice is observed and, in time, feedback is provided to the ISSB during its post-implementation review of IFRS S2 as to whether the Scope 2 market-based approach should be included in the standard?

- Does the TAC agree to tentatively recommend to engage with both the GHG Protocol and ISSB to ensure that the requirements relating to Scope 2 emissions are consistent between the GHG Protocol materials and IFRS S2?

Footnotes

-

An ambulatory reference is a reference in domestic legislation to an external (international) resource that could be modified from time to time, and therefore not the version of the resource that exists at the time the domestic legislation is made. ↩

-

The seven greenhouse gases identified in the United Nations Framework Convention on Climate Change (UNFCCC) and agreed upon as part of the Kyoto Protocol are: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). ↩