The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Annual Review of Audit Quality 2024

- Foreword from the Executive Director of Supervision

- 1. Introduction

- 2. Tier 1 inspection results: arising from our review of individual audits

- 3. The International Standard on Quality Management (UK) 1

- 4. Forward looking supervision

- Strengthening the UK audit market

- 5. Enhancing confidence in the UK audit market

- 6. A cross-system approach

- 7. The regulatory approach of the FRC

- 8. FRC actions

- 9. Market overview – barriers to growth

- 10. Market overview – the future of the audit profession

- 11. Market overview – opportunities and challenges in the UK audit market

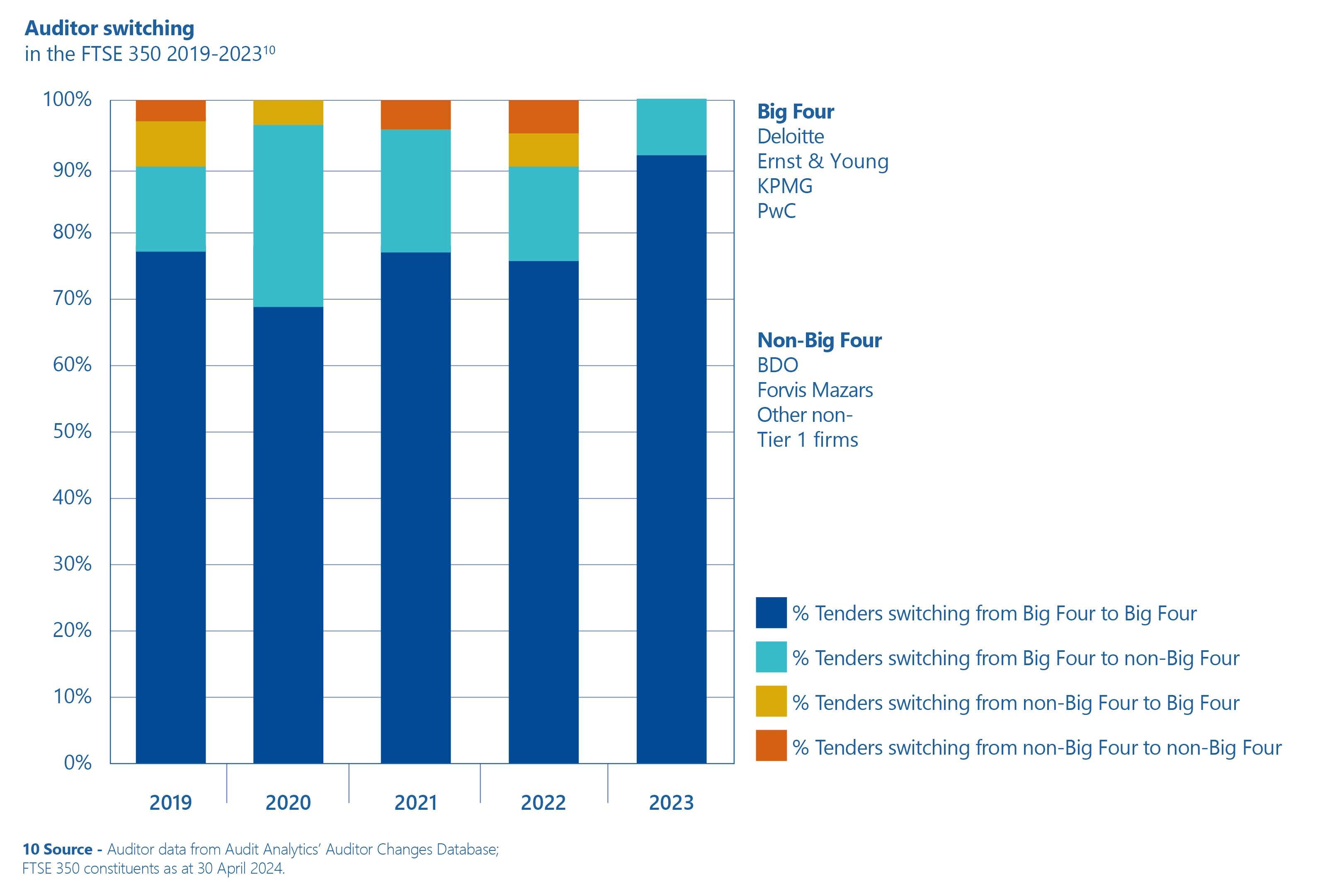

- Auditor switching in the FTSE 350 2019-2023

- 12. Market overview – new sources of capital and technological innovation

- Appendix A – Definitions

- Appendix B – Monitoring by the Quality Assurance Department of ICAEW

- Appendix C – Key findings and why it is important

- Appendix D – Tier 2 and 3 inspection results for 2022/23

Foreword from the Executive Director of Supervision

A robust and well-functioning audit market is vital for the UK economy as it ensures that investors, users of financial statements (such as pensioners, employees, and creditors), businesses and the public can trust financial statements. This environment of transparency and accountability is essential for promoting the attractiveness of the UK as an investment destination. We are pleased that audit quality in the UK compares favourably internationally but it remains a key priority for the FRC to enhance the resilience of the UK audit market.

I am delighted to present this year's overview of the Financial Reporting Council's assessment of quality among the Tier 11 firms. Tier 1 is defined by the FRC as those with the largest share of the UK Public Interest Entity (PIE) market. The continued good results in the FTSE 350 are commendable, and I welcome the work that the largest four firms (Deloitte, EY, KPMG and PwC) have undertaken over the past few years that has resulted in the improvement in their delivery of high-quality audits and want to see that sustained going forward.

All six Tier 1 firms have put considerable effort into refining and improving their delivery of high-quality audit. We expect firms to not only maintain, but continuously promote high standards. All Tier 1 firms must continue to embed a culture that promotes audit quality and high ethical standards, ensuring that these initiatives are refreshed periodically to remain effective. The widened quality gap in the risk-based samples between the largest four firms and the other firms in the PIE market, BDO and Forvis Mazars, shows the ongoing need for proactive efforts to minimise this disparity.

The second half of the report details that there are significant developments in the audit market that firms must consider in their delivery of high quality audit. These include: the future of the profession; barriers to entry for the smaller firms; de-risking by the larger firms; the growing prevalence of AI; and, the expansion of private equity in the sector. We will monitor the impact these areas have in the market and consider how they might drive further improvements without undermining resilience or the public interest.

Using our regulatory toolkit, we adopt a risk based, assertive and proportionate approach to selecting and inspecting audits. We focus on areas with significant potential impact on financial statements and investor reliance. We supervise audit firms rigorously, especially with the introduction of the International Standard on Quality Management (ISQM (UK) 1). All firms are required to take a more proactive and risk-based approach to managing audit quality. We set clear expectations and will continue to work with firms and professional bodies to ensure better behaviours, judgements and quality remain a focus.

Sarah Rapson Executive Director of Supervision

1. Introduction

The FRC is responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair and evidence-based approach, whether firms are enhancing audit quality and are resilient. To support this we:

- Set ethical, auditing and assurance standards and guidance, as well as influence the development of global standards.

- Promote improvement and innovation in the audit market.

- Promote a resilient audit market.

- Monitor the application of audit standards and hold to account those that fail to meet those standards.

Since our last report we have underlined our continued commitment to the public interest and underpinning trust in the audit profession through:

- Launching the Scalebox initiative in summer 2023 to help smaller audit firms develop and maintain audit quality as they start out in the PIE audit market and grow their business.

- Preparing to become shadow system leader for local audit which is now subject to a draft remit letter from the Department of Levelling Up Housing and Communities (DLUHC). Working in partnership with DLUHC and the National Audit Office to develop, consult and seek Ministerial approval on proposed policy measures to address local audit delays, focusing for now on two phases, reset and recovery.

- Implementing the updated Approach to Audit Supervision via our supervision teams.

- Sustaining the ecosystem by publishing a Minimum Standard for Audit Committees and the External Audit, and

- Introducing revisions to the UK Corporate Governance Code.

Using this publication

This report of the audit quality results of Tier 1 firms and our approach to the UK audit market is for general use by interested parties. However, we expect this report to be used in the following ways by:

- Audit firms to acknowledge and deliver on the areas for improvement outlined in their reports and their responsibilities to the market as a whole.

- Audit Committees to both assess the quality of the audit that they are getting from their current audit firm and also, if they are running a tender process in the near future, when thinking about which firms to invite to tender.

- Investors and users of financial reports to make assessments about the quality of audit, transparency and accountability in relevant markets.

Given our risk-based approach to selecting audits for inspection, it is important not to extrapolate our findings or assessment of quality to the whole population of audits performed by the firm. Given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance.

We also publish a separate inspection report on the quality of Major Local Audits, the latest version of which can be found here and was published in December 2023.

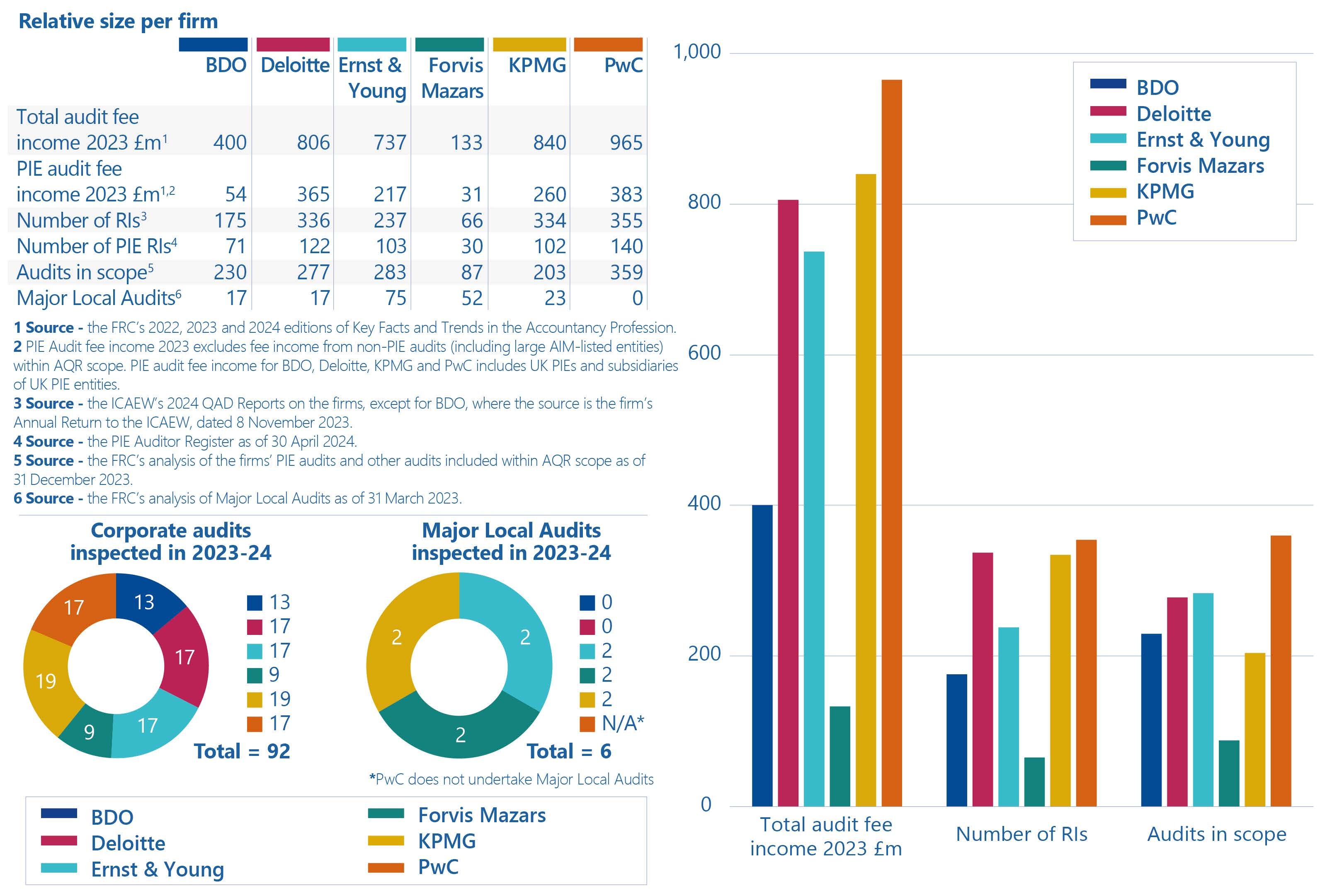

| BDO | Deloitte | Ernst & Young | Forvis Mazars | KPMG | PwC | |

|---|---|---|---|---|---|---|

| Total audit fee income 2023 £m2 | 400 | 806 | 737 | 133 | 840 | 965 |

| PIE audit fee income 2023 £m34 | 54 | 365 | 217 | 31 | 260 | 383 |

| Number of RIs5 | 175 | 336 | 237 | 66 | 334 | 355 |

| Number of PIE RIs6 | 71 | 122 | 103 | 30 | 102 | 140 |

| Audits in scope7 | 230 | 277 | 283 | 87 | 203 | 359 |

| Major Local Audits8 | 17 | 17 | 75 | 52 | 23 | 0 |

The visualization includes a bar chart on the right titled "Relative size per firm" with a y-axis from 0 to 1,000 and x-axis showing Total audit fee income 2023 £m, Number of RIs, and Audits in scope. Different colours represent BDO, Deloitte, Ernst & Young, Forvis Mazars, KPMG, and PwC.

There are also two donut charts on the left: Corporate audits inspected in 2023-24 Total = 92 Segments are coloured representing: BDO (17), Deloitte (13), Ernst & Young (19), Forvis Mazars (9), KPMG (17), PwC (17).

Major Local Audits inspected in 2023-24 Total = 6 Segments are coloured representing: BDO (2), Deloitte (0), Ernst & Young (2), Forvis Mazars (2), KPMG (0), PwC (N/A). PwC does not undertake Major Local Audits

2. Tier 1 inspection results: arising from our review of individual audits

While the overall quality of the audits of the leading four firms is good, the other Tier 1 firms have not yet delivered sufficient audit quality improvements.

We reviewed 92 individual audits (2022/23: 100) across the six Tier 1 firms this year. Of the audits inspected, 74% were categorised as good or limited improvements required (2022/23: 76%)9. These results form part of a trend of improvement over the last 5 years, although not a year-on-year increase.

Of our total inspections, we reviewed 39 audits of FTSE 350 entities (2022/23: 42). The percentage of these audits requiring no more than limited improvements this year was 87% (2022/23 81%) and is significantly higher than the 74% across all audits. This also reflects the trend of improvement we have seen over the past five years.

We continue to assess only a small number of audits as requiring significant improvements, with 4% of our reviews this year having this outcome (2022/23: 3%), none of which were audits of FTSE 350 entities.

The overall results from similar measures of audit quality, covering the broader population of audits, also show an improvement. The Institute of Chartered Accountants in England and Wales (ICAEW) reviewed 60 audits across the Tier 1 firms this year, weighted toward higher risk and complex audits of non-PIE entities within their scope. The results showed 88% of reviews carried out were graded good or generally acceptable. See Appendix B on page 24.

However, overall performance in audit quality for individual firms within Tier 1 continues to vary, with a widened gap between the top four leading audit firms, where results have either improved or are broadly stable, and BDO and Forvis Mazars, where results have declined.

Regulatory audit inspection results at Tier 1 firms.

% of audits inspected by the FRC requiring no more than limited improvements A horizontal bar chart showing percentages of audits requiring no more than limited improvements by the FRC over five years. * 2023/24: 74% * 2022/23: 76% * 2021/22: 74% * 2020/21: 70% * 2019/20: 68%

Alongside the chart, the text "4 audits inspected by the FRC required significant improvements" is displayed.

% of FTSE 350 audits inspected by the FRC requiring no more than limited improvements A horizontal bar chart showing percentages of FTSE 350 audits requiring no more than limited improvements by the FRC over five years. * 2023/24: 87% * 2022/23: 81% * 2021/22: 88% * 2020/21: 77% * 2019/20: 70%

Alongside the chart, the text "0 FTSE 350 audits inspected by the FRC required significant improvements" is displayed.

% of audits inspected by ICAEW classified as good / generally acceptable A horizontal bar chart showing percentages of audits inspected by ICAEW classified as good / generally acceptable over five years. * 2023: 88% * 2022: 95% * 2021: 90% * 2020: 88% * 2019: 92%

Alongside the chart, the text "1 audit inspected by the ICAEW required significant improvements" is displayed.

Percentage of audits assessed as good or limited improvements by Tier 1 firm

A line graph showing the percentage of audits assessed as good or limited improvements by Tier 1 firms over the periods 2019/21, 2020/21, 2021/22, 2022/23, and 2023/24. The y-axis ranges from 35% to 95%. * BDO (blue line) * Deloitte (red line) * EY (green line) * KPMG (purple line) * Forvis Mazars (orange line) * PwC (light blue line)

Over the last five years the largest firms have made substantial progress in improving audit quality. We welcome the sustained improvement from Deloitte, EY, KPMG and PwC to a level that is on average better than it has been since 2019. They must continue to ensure progress is maintained. We want them to consolidate their improvement, and ensure they are not either being complacent or de-risking their portfolios contrary to the public interest.

However, both BDO and Forvis Mazars must address why their inspection results have declined significantly and continue to commit to their investment in audit quality. The gap between the performance in audit quality for BDO and Forvis Mazars, and that of their peers in Tier 1 has widened significantly.

Both firms have taken actions in recent years to address inspection findings and to strengthen related firmwide systems and audit quality functions. However, these actions have not yet had the desired impact on the front-line audit teams to improve audit quality.

Both BDO and Forvis Mazars must urgently re-assess their recurring findings to understand why previous quality actions have not had the impact on audit quality expected. They must also rigorously assess all other areas where key findings have been identified this year.

BDO and Forvis Mazars are strategically important, and we want to work with them to succeed amongst their peers. That requires urgent and decisive action to increase their standards on delivering high quality audits. While we recognise that improving audit quality takes time, not least because of the timing differences between actions being taken and the audits being then performed and inspected, the progress that has been made has not met our expectations.

We will continue to apply more intensive supervision to BDO and Forvis Mazars. Our supervision will focus on areas that we and the firm have identified as priority areas. These areas have been identified through the development of quality plans that seek to transform their results and are specific to each firm. We may take stronger action, which could include using our PIE Auditor Registration powers, if we do not see improvements in 2025.

The most common inspection findings continue to be in areas of estimation and judgement and the audit of revenue.

We take a risk-based approach to determine the areas10 that we review on individual audits. These areas are those which would have a significant impact on an entity's financial statements should they not be fairly stated and on which investors and users of financial reports may rely. As shown in the graph of the most frequent audit execution areas reviewed, we paid particular attention to key areas of estimation and judgement (including impairment, valuation, going concern and provisions) as well as the audit of revenue and journals in our inspections. In addition to these areas, we also reviewed risk assessment (including fraud and climate risk), audit planning, and the communications to Audit Committees on all inspections.

Our analysis shows that the most common findings from our inspections continue to be in the audit of revenue and areas of estimation and judgement. Findings for revenue included issues with contract testing, data analytics and data input testing. For estimation and judgement, they were most often linked to weaknesses in the evaluation of key assumptions and judgements, and the challenge of management. We also identified common findings relating to journals testing, General IT Controls (GITCs) and inventory.

At a firm level, we identified key findings for impairment at all six firms and for revenue and provisions at three of the firms. All of the firms had recurring key findings in at least one of these areas, demonstrating that the actions that they have previously taken have not been sufficient. More must be done by firms to understand why previous actions have not sufficiently addressed inspection findings, and to improve the quality and consistency of audit work in these areas. Further details of these findings are set out in our individual reports.

Most frequent audit execution areas reviewed

A vertical bar chart showing the number of inspections (y-axis from 0 to 90) for various audit execution areas (x-axis). Percentages are displayed above the bars. * Revenue: 80% * Impairment of non-current assets: 52% * Journals testing: 49% * Valuation of investments, property and financial assets: 33% * Going concern: 21% * Provisions including ECL: 18%

Common inspection findings1112

A combined bar chart showing "Inspections with findings" (left y-axis from 0 to 25) and "Number of firms" (right y-axis from 0 to 6) for various audit areas (x-axis). The bars indicate: * Revenue: Inspections with findings (23), Key findings (15), Key findings at firm level (3) * Impairment of non-current assets: Inspections with findings (22), Key findings (15), Key findings at firm level (6) * Provisions including ECL: Inspections with findings (15), Key findings (10), Key findings at firm level (3) * Journals testing: Inspections with findings (12), Key findings (7), Key findings at firm level (1) * GITCs: Inspections with findings (8), Key findings (5), Key findings at firm level (0) * Inventory: Inspections with findings (7), Key findings (4), Key findings at firm level (0)

Good practice continues to be demonstrated but consistency in audit execution remains a key challenge for firms.

The most common areas in which we have identified good practice on inspections this year are largely consistent with those identified in previous inspection cycles. Encouragingly, while the frequency of good practice examples varied by firm, there were examples of the most common areas of good practice on inspections for at least five out of the firms, with all six having positive examples relating to the challenge of management and the effective use of specialists.

We identified a number of good practices in the same areas as the common inspection findings. Most notably, all firms had good practice relating to the challenge of management for the audit of accounting estimates and judgements, with several examples in the areas of impairment and provisions. This demonstrates that consistency in audit execution remains a key area of challenge, and one in which firms have more to do to ensure consistent audit quality across their audits.

Our inspections of individual audits paid particular attention to audit work in certain areas of focus due to their importance to audits. We identified examples of good practice across these areas, including the effective use of specialists, challenge of management for related judgements and thorough risk assessment for climate and fraud related risks. Whilst the standard of audit procedures was generally high in these areas, we identified key findings in relation to aspects of risk assessment or the assessment and response to fraud risks at two firms, and journals testing for one firm.

Further details of the good practice identified in our inspections are set out in our individual firm reports.

Common good practice on inspections

A vertical bar chart showing the number of inspections (y-axis from 0 to 30) for various good practice areas (x-axis). * Challenge of management: 27 * Use of specialists: 26 * Risk assessment: 20 * Group audit oversight: 16 * Revenue: 8

What do we mean by 'good practice'?

When we identify good practice, it typically reflects an innovative or effective way that an auditor or audit firm has found to address a requirement, or to respond to the specific circumstances robustly. We share these in order to promote effectiveness and to enable others to consider such approaches, if relevant in their circumstances.

3. The International Standard on Quality Management (UK) 1

The International Standard on Quality Management (UK) 1 (ISQM (UK) 1) replaced the quality control standard (ISQC (UK) 1), which firms have been applying for many years, and introduced a fundamental change for firms' quality management approaches. This evolution from quality control to a customised system of quality management means a transition from reactive quality checks to proactive, comprehensive, and risk-based quality management, which is more responsive to the complex and dynamic business landscape, and the diverse and nuanced challenges faced by different firms. ISQM (UK) 1 also emphasises the role of leadership and governance, the importance of a quality orientated culture, and the need for continuous improvement.

Key differences between ISQC (UK) 1 and ISQM (UK) 1 include:

Each firm is required, at least annually, to evaluate its own System of Quality Management (SoQM) to assess whether it provides the firm with reasonable assurance that its quality objectives are met. As part of this, firms must identify and assess the severity and pervasiveness of any deficiencies in their SoQMs and assess to what extent these have been remediated.

This year saw our firm-wide inspections enter a transitional cycle as ISQM (UK) 1 became effective on 15 December 2022, replacing ISQC (UK) 1. We adopted a new risk-based rotational inspection approach over the eight ISQM (UK) 1 components and the annual evaluation.

| ISQC (UK)1 requires: | ISQM (UK) 1 requires: |

|---|---|

| Specified quality control processes and policies | Identification of risks and responses to enable achievement of specified quality management objectives, with few specified responses. |

| Policies and processes over human resources. | Quality management of human, intellectual and technological resources, including those from networks and service providers. |

| Policies and processes over consultations. | Broader quality management of information and communication, including information being communicated throughout the firm, with personnel communicating with the firm and one another. |

| A culture recognising the importance of audit quality. | A culture that recognises the importance of serving the public interest, professional ethics and behaviours, and all personnel being responsible for quality. |

| Monitoring and remediation processes focused on completed audit engagements. | Proactive monitoring of the SoQM as a whole, with timely, effective remediation and an, at least annual, holistic evaluation, of the SoQM. |

| Quality focused remuneration policies for audit partners. | All leadership to be held responsible and accountable for quality, and those responsible for the SoQM to be evaluated with consideration of the evaluation of the SoQM. |

All firms have areas to improve in their new systems of quality management

This year, we reviewed the Tier 1 firms' training and methodology under ISQC (UK) 1, their compliance with the FRC's Revised Ethical Standard (2019), and their ISQM (UK) 1 implementation. This included assessing the design and implementation of their internal procedures for monitoring the effectiveness of their SoQMs and the processes and conclusions for their first annual evaluations. We did not independently perform, or reperform, the firms' overall annual evaluations.

The Tier 1 firms have invested considerable effort in implementing and operating the ISQM (UK) 1 requirements and have responded positively to our feedback. Our inspection identified areas for improvement for all firms. Key areas for improvement included where firms needed to strengthen their monitoring processes to ensure that responses to quality risks are designed and operating effectively and to assess other relevant sources of information relating to the extent of mitigation of quality risks.

Firms also needed to enhance the evidencing of their annual evaluation processes, including assessing if any findings indicate potential SoQM deficiencies, individually or in aggregate. One firm concluded that it did not have reasonable assurance over their SoQM. Given this is the first year of the new standard, we are supporting firms in their development of effective and proportionate SoQMs and will continue to challenge their conclusions in future inspections.

Although ISQM (UK) 1 is designed to be scalable, we noted that implementation has proved to be more challenging for firms outside of Tier 1, particularly regarding the monitoring & remediation processes. In response to that, we are increasing the frequency of our supervisory engagement with these firms to support continuous improvement through inspections, briefings, roundtables and publications.

Complementing our ISQM (UK) 1 monitoring, we conducted four audit thematic reviews to share good practice and findings identified from reviewing the Tier 1 firms.13

4. Forward looking supervision

We take a risk-based, assertive and proportionate approach to the supervision of firms, which is complementary to our programme of inspections. We balance holding firms to account to take prompt action to address quality findings, with acting as an improvement regulator and sharing good practice to facilitate improvements across the sector. A Supervisor dedicated to each firm draws together evidence and indicators of risks, identifying and prioritising what firms must do to improve audit quality and enhance resilience, alongside considering what could go wrong in the future. Our observations from the work we have conducted this year, and updates on what more the Tier 1 firms must do in respect of previous observations are set out below. Where we raise key findings, we require firms to include actions in their Single Quality Plan (SQP)14. All six Tier 1 firms have made significant progress in embedding a culture that promotes audit quality and the highest ethical standards. We encourage firms to refresh these initiatives periodically to ensure that they remain relevant to their teams.

Continuous engagement and holding the firm to account

A dedicated firm Supervisor works with a firm both as an improvement regulator in areas such as culture and conduct, but also holds the firm to account, for example, by using the SQP and through constructive engagement cases15 and the follow up of non-financial sanctions imposed from the conclusion of enforcement cases. Where appropriate, actions and themes related to open constructive engagement cases and non-financial sanctions will be included in the SQP to be monitored for progress and effectiveness.

Root cause analysis

Root cause analysis (RCA) is essential to ensuring that the actions included in the SQP have been developed from an understanding of the underlying root cause of internal and external inspection findings. In all Tier 1 firms there are detailed RCA processes, and all firms continually review and look to improve the process and the alignment of actions to addressing the root causes. Measuring the effectiveness of actions taken is key, and all firms can make improvements to how they go about this. Having a clear view of what an effective outcome looks like when actions are set, makes this process more straight forward.

Single Quality Plan and other quality initiatives

We require all Tier 1 firms to maintain an SQP to drive measurable improvements in audit quality and resilience, and to demonstrate the effectiveness of actions taken. In addition to this, BDO and Forvis Mazars have developed audit quality transformation plans to prioritise and focus on those actions needed to improve their audit quality inspection results. Collating and monitoring actions and their effectiveness is a necessary part of continuous improvement and all firms are committed to this.

Emerging risks and trends

Through our continuous engagement with the firms, we have identified firm specific emerging risk and trends. Our aim is to aid firms by identifying risks from emerging trends before quality issues arise. Examples are:

- The increased use of offshore delivery centres to perform higher risk, more complex audit work.

- Changes in firm structure that may increase the risk of conflicts or independence issues.

- Rapid growth and significant portfolio changes that directly impact audit quality because of insufficient resources.

- Changes to audit software that may not work as planned.

Strengthening the UK audit market

The challenges in relation to audit quality are market wide. The following sections of the report outline the significant market challenges and opportunities that have an impact on the strength of the UK audit market. All firms, and other stakeholders, must consider them in their delivery of high-quality audit and contribution to strengthening the audit market.

5. Enhancing confidence in the UK audit market

Audit market

The strength and integrity of the audit market is vital to the health of the UK economy, and is underpinned by quality, choice and access. A well-functioning audit market ensures that investors, businesses, users of financial reports, and the public can trust financial statements, fostering an environment of transparency and accountability. This provides more investment, driving growth and competitiveness in the UK economy. While there are high levels of trust in the largest audits, it is crucial that all firms contribute to improving the overall health and resilience of the audit market.

Audits

High-quality audits are crucial for enabling corporations to access the capital needed for growth, and promote confidence in the reliability of financial statements and other forms of corporate reporting. This is essential for the competitiveness of the UK economy. Reliable information enables investors, lenders, suppliers, customers, employees and other users to place their trust in well-managed companies, make informed decisions and have the confidence to place capital in UK markets.

Smaller and mid-market firms

Ensuring smaller and mid-market audit firms deliver high-quality audits instils market confidence in their ability to compete for larger, more complex audits. This is necessary to ensure access and choice of audit services across the market. In December 2023 we published inspection results for Tier 2 and Tier 3 firms. These results were from a small risk-based sample, but the number of audits requiring significant improvement was unacceptable. We have included a summary of these results in Appendix D of this report.

Audit quality

Inconsistent audit quality is a significant challenge in the market. Failing to ensure that audit firms deliver consistently high-quality audits can harm a broad range of societal and economic interests and impair growth by damaging investor and organisational trust in the UK as a favourable business environment.

Auditors

Encouraging all individuals involved in audit work to maintain high standards of professional ethics, skills, and competencies amidst the changing market landscape is vital for the continued development and resilience of the UK audit market.

What is high-quality audit?

The FRC defines high-quality audits as those that:

- Provide investors, businesses, and the public, with a high level of assurance that financial statements give a true and fair view.

- Comply both with the spirit and the letter of auditing and ethical standards and applicable legal and regulatory requirements.

- Are driven by a robust risk assessment, informed by a thorough understanding of the entity and its environment.

- Are supported by rigorous due process and audit evidence, avoid conflicts of interest, have strong audit quality processes, and involve the robust exercise of judgement and professional scepticism.

- Challenge management effectively and obtain sufficient audit evidence for the conclusions reached.

- Report unambiguously the auditor's conclusion on the financial statements.

6. A cross-system approach

The Spring Report

In response to an invitation from the Audit Committee Chairs' Independent Forum (ACCIF), a group of experienced audit committee chairs, auditors, and executives from the FRC (the Group) came together to see how they could further advance our common objective to enhance audit quality. The Group, acting in their own names but also supported by their relevant organisations, engaged in discussions and brought their collective experiences to address the question of audit quality.

We are pleased to have participated in this project and some key learnings from this are detailed in The Spring Report which can be found here.16

What can Audit Committees and other stakeholders in the ecosystem do to improve audit quality?

- Setting the tone for open and robust challenge that leads to healthy and productive culture and a challenging mindset to support the delivery of high-quality audits that serve the public interest.

- Audit Committees must challenge management and oversee the timely delivery of high-quality information to the auditors.

- Audit Committees must hold management to account for weaknesses highlighted by the auditors. Regular monitoring and challenge of actions must be performed.

- Active engagement with external auditors throughout the audit process to consider and challenge, where appropriate, risk-based assessments and key areas of judgement.

- The establishment of a constructive feedback loop and responding to concerns raised in clear, timely, and concise manner.

- Engagement with the FRC Audit Quality Reviews to improve audit quality where necessary.

- Ensure that advance notification and discussions with potential auditors are held prior to the announcement of a tender so as not to preclude firms from participating for independence reasons.

- Execute a robust and challenging tendering process, considering all aspects of the approach to ensure it is fit for purpose and has been tailored to the needs of the entity.

- Audit Committees should refer to the guidance in the FRC's Audit Committees and the External Audit: Minimum Standard.

7. The regulatory approach of the FRC

Enhancing the quality of audit and resilience of the UK audit market are key objectives of our work. Our approach to smarter regulation is underpinned by our four faces regulatory model, which is aligned with our core purpose: to serve the public interest by enhancing the quality of corporate governance, reporting, and audit, while supporting the UK's economic growth and its international competitiveness.

Our work is proportionate, fair and evidence-based, driving further improvements across the sector while holding audit firms accountable. By doing so, we foster an environment where good audit practices are shared and implemented, leading to an overall enhancement in the quality of audits.

In our role as an improvement regulator, we share good practice and support continuous improvement. However, where necessary we will also use all aspects of our regulatory toolkit including the use of constructive engagement, and, under PIE auditor registration, the imposition of conditions and undertakings to protect stakeholders.

Over the past year, significant steps have been taken to promote greater choice and quality across the audit market. We have focused on identifying and detecting emerging quality issues early, ensuring that proactive measures can be taken. We take targeted decisions, underpinned by the principle of high-quality audits, that support delivery of choice, growth, and resilience in the audit market.

Constructive dialogue between the FRC and audit firms is vital for the long-term success of the audit market. Our Approach to Audit Supervision17, sets out how we categorise the PIE audit firms into three tiers, based on their impact on the UK audit market. We review annually the tier status for each firm. However, we do not expect all firms to become Tier 1 firms. Equally, a firm being in a lower tier is not necessarily an indicator of poorer audit quality, rather it indicates a smaller PIE portfolio than firms in higher tiers. For further information on how we set out the tiers please see Appendix A.

As set out each year in our Annual Enforcement Review18, the FRC process for investigating any major corporate reporting or audit failure is aimed at identifying the cause of the failure. We work to prevent audit failures from happening in future through non-financial sanctions aimed at improving any weak processes or behaviours we identify, and deter others from creating similar issues in future through financial sanctions.

We provide support for firms to develop and maintain high standards of audit quality as they enter and grow in the PIE market. By addressing the current challenges in the UK audit market, we continue to promote the future of a resilient market driven by high quality audit, trust, and confidence that can unlock significant benefits for economic growth.

8. FRC actions

We are committed to taking targeted actions, underpinned by the pre-eminence of high-quality audits, that support delivery of choice, growth, and resilience in the audit market. We will continue to develop our understanding of the challenges experienced across the audit market, supporting our continued efforts to promote greater choice and market resilience. This has been actioned through programmes such as:

- A new audit market monitoring function;

- Operational Separation;

- The launch of a market study on sustainability assurance; and

- A revised Ethical Standard.

Audit Market Monitoring

We have created an Audit Market Monitoring function to develop our understanding for the whole audit market of emerging risks to audit quality, audit market resilience and capacity.

Operational Separation

We have worked with the largest four firms to implement voluntary operational separation between audit and non-audit to improve audit quality by ensuring people in the audit practice are focused above all on delivery of high-quality audits in the public interest.

Operational Separation also aims to improve audit market resilience by ensuring no material, structural, cross-subsidy persists between the audit practice and the rest of the firm. This work has been undertaken to ensure that audit practices are focused above all on delivery of high-quality audits in the public interest, and do not rely on persistent cross subsidy from the rest of the firm.

Sustainability Assurance Market Study

In the UK, some companies are required to provide climate-related financial disclosures and other sustainability-related information, but there are currently no statutory requirements for assurance over this information. Internationally, however, regulations are evolving to require companies to obtain assurance over specific categories of information, which could impact UK companies.

We aim to ensure that the UK's market for sustainability assurance operates effectively, providing high-quality assurance that supports useful and reliable reporting for investors and other stakeholders without imposing undue burdens and costs on businesses. We have launched a market study19 that will focus on how well the UK sustainability assurance market is functioning and whether it is delivering desirable outcomes with minimal burdens and costs on business.

Ethical Standard

High-quality ethical standards for auditors enhance trust in the quality of financial information that drives investment in the UK. This is balanced with ensuring that any requirements are targeted and proportionate. Following consultation, this year20 we simplified the ethical standard to ensure auditors are clear as to the high ethical standards expected, while the limited number of new requirements are proportionate and balanced to support trust and confidence in UK corporate reporting and audit.

Through this work, we aim to foster a competitive and resilient audit market that supports high-quality audits, effective sustainability assurance, and the growth of the UK economy.

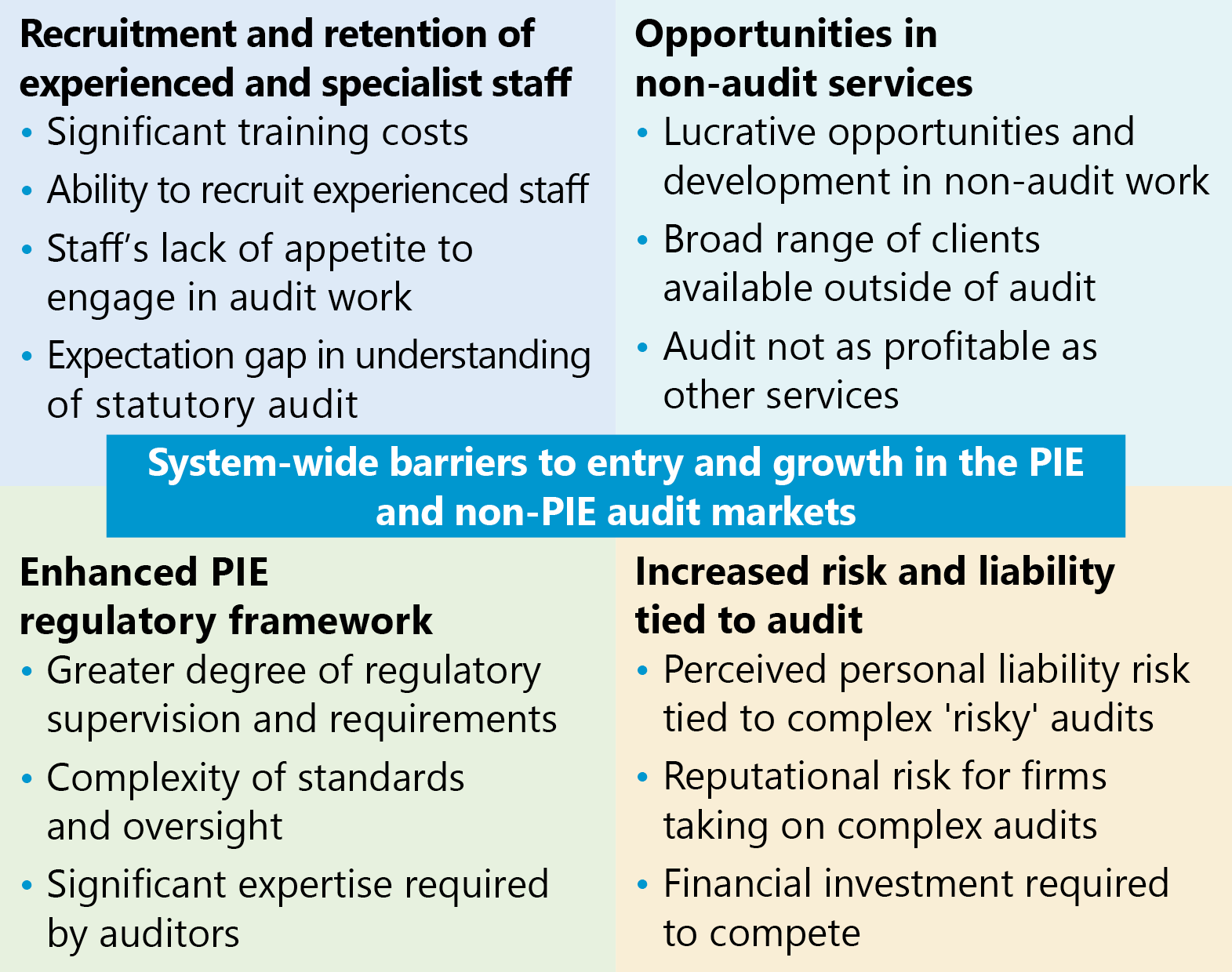

9. Market overview – barriers to growth

A resilient audit market requires smaller audit firms to engage proactively with the market. To this end, we commissioned research to examine the views of smaller audit firms regarding their opportunities and challenges in the market. The findings of this research informs our strategy to foster an environment that enables new market entrants and supports all audit firms to deliver high-quality audits. The research highlighted several barriers that smaller firms face in entering and expanding within the PIE and non-PIE audit markets. These barriers are set out below:

The diagram includes four interconnected areas: * Recruitment and retention of experienced and specialist staff * Significant training costs * Ability to recruit experienced staff * Staff's lack of appetite to engage in audit work * Expectation gap in understanding of statutory audit * Opportunities in non-audit services * Lucrative opportunities and development in non-audit work * Broad range of clients available outside of audit * Audit not as profitable as other services * Enhanced PIE regulatory framework * Greater degree of regulatory supervision and requirements * Complexity of standards and oversight * Significant expertise required by auditors * Increased risk and liability tied to audit * Perceived personal liability risk tied to complex 'risky' audits * Reputational risk for firms taking on complex audits * Financial investment required to compete

We recognise that there are barriers to entry and growth in the audit market. Reducing barriers to access, and supporting smaller and mid-market firms is crucial for enhancing choice, innovation, and resilience in the audit market. Our Audit Firm Scalebox aims to do just that.

Case Study: Audit Firm Scalebox

Our Audit Firm Scalebox initiative is a critical tool in helping overcome these barriers and supporting the growth of smaller and mid-market firms.

The Scalebox was launched in summer 2023 to help smaller audit firms develop and maintain audit quality as they start out in the PIE audit market and grow their business. The FRC is now working on a longer term plan for Scalebox including measures of success going forward.

It operates under a general principle that information gathered during Scalebox activities will not be shared with any other party21. There are currently 11 small audit firms participating in the Scalebox, nine of which have PIE clients. The first workstreams were:

- Audit area reviews: Reviewing an extract of a firm's audit file and providing feedback on good practice observed and areas where an external inspector might raise questions or identify potential areas for improvement. To date, areas reviewed include the audit of revenue, going concern, impairment and the approach to setting audit materiality.

- Discussions and roundtables: Topics, agreed with participants, include: what to expect from an AQR inspection; PIE Auditor Registration requirements and ongoing obligations; and IT audits and the use of data analytics and AI.

Feedback demonstrates that the firms have constructively engaged with these measures and are actively incorporating what they learnt into their root cause analysis process, training, audit methodology and template work programmes.

10. Market overview – the future of the audit profession

The UK audit profession provides vital services to companies and therefore to the economy. A healthy audit market attracts top talent and offers respected employment opportunities across the regions of the UK, further contributing to economic stability and growth.

Ensuring that the audit profession remains viable, both now and in the future, is essential for meeting the industry's resourcing challenges and is a key aspect of responsible audit firm leadership. Professional accountancy bodies, audit firms, audit committees, and investors must continue to be invested in ensuring that the profession is adequately resourced for the future, as we are. This objective can be supported by embedding quality training, development, and mentoring practices that enhance audit quality. The leadership of firms should continue to prioritise the importance of audit quality to reflect and support the strong commitment to quality demonstrated by individual auditors.

However, the accountancy and auditing profession worldwide faces ongoing capacity challenges. Recent years have seen declines in the number of audit firms registered with the Recognised Supervisory Bodies. The number of students joining UK accounting bodies has also plateaued in recent years, adding to the challenges of maintaining audit capacity.

The future of the profession also faces challenges from the varying expectations of a multi-generational workforce. We expect audit firms to prioritise strategies that better support their staff in maintaining a healthy work-life balance, while enabling a mindset of professional scepticism and challenge supported by high quality training and resources. Professional accounting bodies should continue efforts to attract new talent into the profession and maintain high auditing standards.

Addressing the impact of the international shortage of skilled auditors on the UK requires a collaborative, system-wide approach. Professional accountancy bodies play a key role in addressing the capacity challenges present at all levels of the audit market. These bodies should continue efforts to attract new accountants to the audit profession, highlighting the valuable role audit plays in supporting UK growth and competitiveness.

Findings from our various supervisory activities

Our firm supervisors collate data relating to resourcing levels and changes and assess future risks at each firm. We also collect information on culture and barriers to entry. Our findings include:

- UK resource is increasingly drawn from a global pool both in terms of recruitment and the use of offshore delivery centres. Firms must ensure that, where appropriate, processes and initiatives are adjusted to address the impact of this, for example, differences in experience.

- There are significant variations in the definition of “excessive overtime" between firms. This ranges from a few additional hours to almost doubling working hours per week.

- Many auditors feel under unreasonable pressure and do not have sufficient time to undertake quality audits.

- A work/life balance continues to be the principal reason why people leave the profession.

- Recruiting and retaining adequately skilled staff was cited by smaller firms as a significant market barrier.

We will continue to work as a system partner to increase capacity and capability and to promote auditing as a respected and valued profession, including changes to modernise the audit qualification by the professional bodies.

11. Market overview – opportunities and challenges in the UK audit market

A forward-looking, risk-based approach to ensuring the future of the audit market is essential so that it remains resilient, innovative, and capable of meeting future challenges. By supporting growth, fostering technological advancement, and maintaining a strong focus on public interest, we can ensure that the audit market continues to support economic stability.

We expect audit firms to cultivate a culture that promotes a strong commitment to quality and a focus on the public interest. De-risking audit portfolios is not acceptable, as the Audit Firm Governance Code directs firms to consider the public interest in their decision-making. The movement of challenging audits to smaller firms with a poorer quality track record undermines this objective.

Access to high-quality audit services should not be undermined by increase in cost. We recognise that there is risk that smaller companies are priced out of access to high quality audit services. We monitor and assess how developments in the UK's economic situation, and the delivery of different models of business services influence cost and its impact on choice and access in the market. We will also look into developing guidance and support for audit firms in the application of auditing standards when auditing small and medium enterprises.

However, we understand that, as the UK audit profession evolves, there are significant opportunities to drive improvements in audit approaches and cost. Managing the potential risks associated with emerging opportunities in the market is crucial. Access to new sources of capital can facilitate sustainable investment and technological innovation, but the entire ecosystem must work together to ensure these benefits are realised while mitigating risks.

We will closely monitor emerging issues in the audit market and assess any potential effects that will impact its resilience and ability to offer quality, choice, and access.

See graph on the next page for an analysis of the movement of audited entities between audit firms.

De-risking

Firms have a responsibility to consider the impact on the public interest before resigning, deciding not to re-tender and declining an invitation to tender for an audit. De-risking audit portfolios may result in audits being undertaken by firms less capable of performing a high-quality audit of that entity.

It is not in the public interest for firms to resign from audits without careful consideration of the implications on the public interest and the need for consistent, high-quality audit. All entities, regardless of risk, must be audited by audit firms with appropriate resources and robust quality control procedures to deliver a high-quality audit.

Firms must exhaust all available mechanisms to resolve concerns before resigning. However, resigning from a challenging company due to management weaknesses, governance concerns, relationship breakdowns, or refusal to pay a fair price for a high-quality audit is not classified as de-risking.

Through our inspections we have not found any conclusive evidence that improvements to audit quality by Tier 1 firms have been driven by de-risking. We will continue to be robust in our inspections in this area to ensure that this remains consistent year on year.

Auditor switching in the FTSE 350 2019-202322

The stacked bar chart shows auditor switching trends for the FTSE 350 from 2019 to 2023. The y-axis represents percentages from 0% to 100%, and the x-axis represents years from 2019 to 2023.

The legend indicates four categories of switching: * % Tenders switching from Big Four to Big Four (dark blue) * % Tenders switching from Big Four to non-Big Four (light blue) * % Tenders switching from non-Big Four to Big Four (yellow/orange) * % Tenders switching from non-Big Four to non-Big Four (red/dark orange)

12. Market overview – new sources of capital and technological innovation

Private Equity

Several PIE and non-PIE audit firms in the UK have entered into private equity (PE) deals, and larger firms have also been approached periodically for discussions. We are closely monitoring this situation through our PIE Auditor Registration team and our supervisory engagement discussions with firms.

Historically, audit firms have been funded by their equity partners, supplemented by traditional bank financing. Recently, there has been a notable trend in the UK and internationally of PE investors acquiring substantial equity stakes in smaller audit firms, which through consolidation have moved into the top 30 firms by turnover. PE investment might drive growth and innovation in the UK economy, but there is a risk that PE investors may lack a deep understanding of audit practice objectives, and the public interest incentive to deliver audit quality. A lack of clarity or long-term thinking regarding PE exit strategies also raises concerns about maintaining audit quality and public interest motives over future years.

PE investment could have the potential to offer opportunities in the audit market, but it is essential to avoid conflicts of interest that may impair auditor independence or undermine the resilience of the market.

The trend of PE investment in the UK audit market is expected to continue in the medium term, mirroring prominent PE deals in the US mid-tier audit firm space. The FRC continues to engage with UK audit firm leaders to understand potential impacts from overseas member network changes.

AI

Technological advancement is another critical area of focus for the future of the profession. Smart and proportionate use of technology underpins a strong and flexible audit and assurance market. While we recognise the opportunities that engaging with technological developments might bring into the workplace, we expect firms to adopt a measured approach to technology implementation. Before committing to a practice, firms should consider relevant regulations, guidance, and wider developing frameworks, including the UK Government's AI principles.

Companies, audit firms, and third-party providers have committed substantial financial and human resources to developing and deploying technology, leading to a significant increase in its usage. Where systemic risks or frictions are identified, we expect firms to bring these issues to our attention. We acknowledge that acquiring and implementing AI-related tools and requisite skills can be expensive, potentially limiting smaller firms' ability to use them. Therefore, we encourage firms and their representative bodies to consider these challenges and collaborate with us to find solutions.

Appendix A – Definitions

On slide six, we set out our regulatory audit inspection results for Tier 1 firms. Our assessment of the overall quality of the audit work inspected uses one of four audit quality categories:

Audit Quality Categories

| Category | Description |

|---|---|

| Good (1) | We identified no areas for improvement of sufficient significance to include in our report |

| Limited improvements required (2) | We identified one or more areas for improvement of limited significance. |

| Improvements required (3) | We identified one or more key findings requiring more substantive improvements. |

| Significant improvements required (4) | We identified significant concerns in one or more areas regarding the sufficiency or quality of audit evidence, the appropriateness of key audit judgements or another substantive matter such as auditor independence. |

We exercise judgement in assessing the significance of our findings on each inspection, both individually and collectively. One or more key findings will lead to an overall audit quality assessment of “Improvements required (3)” or “Significant improvements required (4)”, depending on their severity.

Tier Definitions (Further information can be found in Our Approach to Supervision)23

| Category | Description |

|---|---|

| Tier 1 | Firms with the largest share of the UK PIE and Major Local Audit markets, which together audit approximately 1,290 PIEs, including the majority of UK-incorporated FTSE 350 entities. |

| Tier 2 | The Tier 2 firms will ordinarily have a significant portfolio of PIE audits (usually at least ten) and we also take into account the nature of the firm's PIE audits and other risk factors that may apply, for example, the firm's growth plans or specific risks to audit quality. |

| Tier 3 | Firms which audit fewer than five PIEs. |

| Tier 4 | Firms that are looking to enter the PIE audit market. |

We consider the number and nature of the firm's audits, and other risk factors that may apply, for example the firm's growth plans or specific risks to audit quality, when assessing which tier is appropriate. The tiering decision impacts the level of supervisory activity each firm can expect, including the frequency of our audit inspection programme and assessment of the audit practice's system of quality management.

Appendix B – Monitoring by the Quality Assurance Department of ICAEW

ICAEW undertakes independent monitoring of non-PIE audits, under delegation from the FRC as the Competent Authority. ICAEW's work covers private companies, smaller AIM listed companies, charities and pension schemes. The FRC is responsible for monitoring the firms' firm-wide controls and ICAEW additionally reviews CPD records for a sample of the firms' staff involved in the audit work within ICAEW remit.

ICAEW has completed 2023 monitoring reviews on Deloitte LLP, Ernst & Young LLP, Forvis Mazars LLP, KPMG LLP, and PricewaterhouseCoopers LLP. Detailed reports summarising the audit file review findings and any follow-up action proposed by each firm will be considered by ICAEW's Audit Registration Committee.

Results of ICAEW's reviews for the last three years are set out below.

All inspections: Tier 2 and Tier 3

A stacked bar chart showing the breakdown of audit quality classifications (Significant improvement required, Improvement required, Good/generally acceptable) for ICAEW inspections in 2021, 2022, and 2023. The y-axis represents percentages from 0% to 100%.

- 2021:

- Good/generally acceptable: 46%

- Improvement required: 4%

- Significant improvement required: 1%

- 2022:

- Good/generally acceptable: 48%

- Improvement required: 2%

- Significant improvement required: 1%

- 2023:

- Good/generally acceptable: 44%

- Improvement required: 5%

- Significant improvement required: 1%

ICAEW did not inspect a sample of BDO's non-PIE audits in 2023, in accordance with its planned rotational inspection programme. All three years include inspection results of Deloitte, EY, KPMG and PwC. BDO is included in the 2022 results only. Forvis Mazars is included in the 2021 and 2023 results. File selection is focused towards higher risk and more complex audits. Given the sample size, changes from one year to the next cannot be relied upon to provide a complete picture of performance or overall change in audit quality.

ICAEW assesses audit quality as 'good', 'generally acceptable', 'improvement required', or 'significant improvement required'.

The quality of audit work reviewed across the five firms was of a generally good standard, with 88% of reviews graded either good or generally acceptable. Five audits required improvement and one audit required significant improvement. There was good practice identified across a range of audit areas. Where a weakness led to an audit requiring improvement, in some cases there was good practice in the same area identified in another audit reviewed at that firm.

Key findings

Key findings on the audits requiring improvement or significant improvement:

- Errors in primary financial statements (three audits).

- Weaknesses in audit of revenue (two audits).

- Reliance on work done by other network firms.

- Lack of challenge to management in relation to going concern.

- Flaws in substantive analytical procedures.

- Weaknesses in audit of inventory.

- Lack of consideration of the potential capitalisation of development costs.

Good practice

- Challenge of management evident across audit areas such as:

- accounting for prior period restatements, impairment and valuation

- assumptions underlying expected credit loss provisions and going concern.

- Robust approaches to the audit of revenue including

- well thought-out use of 'proof in total' testing, and

- inclusion of unpredictability in audit approach to inventory.

- Clear evidence of interaction with component auditors, with supervision and review of their work.

- Comprehensive audit documentation including:

- response to potential litigation

- internal consultation

- consideration of impairment risks

- journal selection and testing

- work on going concern.

Appendix C – Key findings and why it is important

On slide eight, we set out the most common inspection findings where, based on our inspections, we believe improvements in audit quality are required. Firms must take action to improve audit quality in these areas.

| Key findings | Why it is important |

|---|---|

| Revenue | Auditors should obtain sufficient and appropriate audit evidence to assess whether revenue is accurately recognised as it is a key driver of the entity's results. |

| Impairment of non-current assets | Auditors should adequately assess and challenge management's evaluation of impairment as this often involves significant judgement and can be subject to management bias or error. |

| Provisions including expected credit loss provisions | Auditors should adequately assess and challenge the reasonableness of management's estimates and assumptions to respond to the risk of management bias. |

| Journals testing | Journals testing is a key procedure to address the risk of management override of controls and fraud. Auditors should test the appropriateness of journals entries, including examining the supporting evidence for the items selected. |

| General IT controls | Where an audit approach relies on IT systems, data and associated automated controls, related General IT controls should be tested to a satisfactory level to support the reliance placed and ensure that sufficient, appropriate audit evidence is obtained overall. |

| Inventory | Auditors should perform appropriate procedures to assess the existence and valuation of inventory as it can be significant to an entity's balance sheet. |

Further details of these findings are set out in our individual firm reports.

Appendix D – Tier 2 and 3 inspection results for 2022/23

This appendix summarises our Tier 2 and Tier 3 Audit Quality Inspection and Supervision report24 which we published in December 2023.

Of the 13 inspections of audits conducted by Tier 2 and Tier 3 firms that we completed during 2022/23:

- Five (38%) were assessed as requiring no more than limited improvements, a minor improvement on the 36% average in this category over the period 2016/17 to 2021/22.

- A further five (38%) were assessed as requiring significant improvements, the highest in this category since 2019/20.

All inspections: Tier 2 and Tier 3

A stacked bar chart showing the breakdown of audit quality classifications (Significant Improvements required, Improvements required, Good or limited improvements required) for Tier 2 and Tier 3 firms from 2018/19 to 2022/23 and an Aggregate column. The y-axis represents percentages from 0% to 100%.

- 2018/19: Good/limited improvements (2%), Improvements required (2%), Significant Improvements required (4%)

- 2019/20: Good/limited improvements (2%), Improvements required (4%), Significant Improvements required (3%)

- 2020/21: Good/limited improvements (6%), Improvements required (6%), Significant Improvements required (4%)

- 2021/22: Good/limited improvements (2%), Improvements required (4%), Significant Improvements required (3%)

- 2022/23: Good/limited improvements (5%), Improvements required (3%), Significant Improvements required (5%)

- Aggregate: Good/limited improvements (17%), Improvements required (19%), Significant Improvements required (19%)

These percentages should be treated as indicative, given the small sample, that different firms and audits are inspected every year, and that the results of individual firms may vary. However, the overall results of our inspections for 2022/23 indicated an urgent need for improvements in audit quality in this sector of the market.

Our key inspection findings that year were common across the period and largely consistent with previous years, with the significant majority relating to the audit of:

- Judgements and estimates, reflecting that complex and judgemental audit areas require audit teams to exercise robust professional scepticism in their audit response.

- Going concern, with weaknesses in the rigour of the audit work and the challenge of the underlying evidence provided by management.

- Journal entry testing, including the lack of linkage to the presumed fraud risk of management override of controls.

Our 2022/23 reviews of Tier 2 and Tier 3 firms' quality control procedures also found similar themes to previous years with actions required by firms in:

- Developing competency frameworks for audit partners and staff, and improving links between audit quality and reward.

- Improving procedures for archiving audit files in line with the requirements of auditing standards.

- Establishing adequate procedures to monitor compliance with ethical standards, in particular regarding non-audit services and fees.

- Formalising acceptance and continuance procedures for audit engagements.

- Improving the depth and rigour of firms' internal quality monitoring procedures, including processes to follow up and remediate findings.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk Follow us on Linked in. or X @FRCnews

-

The six Tier 1 firms in 2023/24 were: BDO LLP, Deloitte LLP, Ernst & Young LLP, KPMG LLP, Mazars LLP and PricewaterhouseCoopers LLP. With effect from 1 June 2024, Mazars LLP changed its name to Forvis Mazars LLP. We have published a separate report for each of these firms which can be found here. More information on the Tiers and the definitions can be found in Appendix A on page 23. ↩

-

1 Source - the FRC's 2022, 2023 and 2024 editions of Key Facts and Trends in the Accountancy Profession. ↩

-

2 PIE Audit fee income 2023 excludes fee income from non-PIE audits (including large AIM-listed entities) within AQR scope. PIE audit fee income for BDO, Deloitte, KPMG and PwC includes UK PIEs and subsidiaries of UK PIE entities. ↩

-

3 Source - the ICAEW's 2024 QAD Reports on the firms, except for BDO, where the source is the firm's Annual Return to the ICAEW, dated 8 November 2023. ↩

-

4 Source - the PIE Auditor Register as of 30 April 2024. ↩

-

5 Source - the FRC's analysis of the firms' PIE audits and other audits included within AQR scope as of 31 December 2023. ↩

-

6 Source - the FRC's analysis of Major Local Audits as of 31 March 2023. ↩

-

2 Audit Quality Categories are defined in Appendix A on page 23. ↩

-

3 The published areas of focus for the 2023/24 inspection cycle are available here. ↩

-

4 Appendix C includes detail on why these areas are important to an audit. ↩

-

5 Further information on how the FRC assesses audit quality and classifies findings on individual inspections is available here. ↩

-

6 FRC's ISQM (UK) 1 audit thematic reviews can be found here: Audit Thematic reviews. ↩

-

7 Constructive engagement is carried out by the FRC's Supervision division and deals with cases where audit quality concerns can be appropriately and satisfactorily addressed, and the risk of repetition mitigated, without the time and expense of a full enforcement investigation. ↩

-

8 Further details on the SQP initiative and the principles we set can be found here. ↩

-

The Spring Report which can be found here. ↩

-

FRC's Audit Committees and the External Audit: Minimum Standard. ↩

-

Our Approach to Audit Supervision ↩

-

Annual Enforcement Review ↩

-

launched a market study ↩

-

this year ↩

-

9 Further information on the Audit Firm Scale box can be found on our website. ↩

-

10 Source - Auditor data from Audit Analytics' Auditor Changes Database; FTSE 350 constituents as at 30 April 2024. ↩

-

Tier Definitions (Further information can be found in Our Approach to Supervision) ↩

-

This appendix summarises our Tier 2 and Tier 3 Audit Quality Inspection and Supervision report which we published in December 2023. ↩