The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

PricewaterhouseCoopers LLP Audit Quality Inspection and Supervision Report 2024

Using this publication

The Financial Reporting Council (FRC) is responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are consistently delivering high-quality audits and are resilient.

This report sets out the FRC's findings on key matters relevant to audit quality at PricewaterhouseCoopers LLP (PwC or the firm). It should be used alongside the FRC's Annual Review of Audit Quality, which contains combined results and themes for all Tier 1 firms8 that are inspected annually.

Given our risk-based approach to selecting audits for inspection, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm. Given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm’s performance.

This report also considers other wider measures of audit quality, such as results of audit inspections completed by the Institute of Chartered Accountants in England and Wales (ICAEW) and results from the firm’s own internal quality reviews. The firm’s response to the findings and the actions it plans to take as a result are included on page five and Appendix B.

This report is for general use by interested parties. However, we expect the following:

- PwC to use this report and its peers’ reports to facilitate continuous improvement through actions in its Single Quality Plan (SQP).

- Other audit firms of all sizes to use this report for examples of good practice.

- Audit Committees to use this report to help them assess the quality of their audit/auditor and when appropriate as part of the process of appointing a new auditor.

- Investors to use this report in making assessments about the quality of audit, transparency and accountability in the relevant markets.

Throughout this report, the following symbols are used:

- Represents a key finding where the firm must take action to improve audit quality.

- Represents examples of good practice we identified in our supervision, and we encourage other firms to consider applying these if appropriate to their circumstances.

- Represents an observation relating to the firm's initiatives to improve audit quality.

Our Supervisory Approach

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our future supervision work.

Further details on our approach to Audit Supervision can be found here. We also publish a separate inspection report on the quality of major local audits, the latest version of which can be found here and was published in December 2023.

- Using this publication

- 1. Overview – overall assessment

- 2. Review of individual audits

- Improve the audit of inventory

- Improve aspects of the audit of impairment and valuation of non-current assets, in particular relating to forecasts

- Improve the audit of the carrying value of investments in subsidiary undertakings (parent company)

- Monitoring review results by the Quality Assurance Department of ICAEW

- 3. Review of the firm's system of quality management

- 4. Forward-looking supervision

- Appendix A – Firm's internal quality monitoring

- Appendix B – PwC's responses and actions

- Appendix C - ISQM (UK) 1 Glossary

- Contact Information

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Overview – overall assessment

PwC continues to prioritise achieving high audit quality. The results taken as a whole, across internal and external inspections, have remained largely constant over the last four years. The effectiveness of actions taken, including their timing, remains key in continuous and further improvement. The firm has continued to launch new culture initiatives and to further embed its well-developed audit culture. It must also ensure that as the audit cultural programme evolves further it incorporates firmwide actions in relation to ethical conduct.

Regulatory audit inspection results at PwC

% of audits inspected by the FRC requiring no more than limited improvements (Section 2)

| 2023/24 | 2022/23 | 2021/22 | 2020/21 | 2019/20 | |

|---|---|---|---|---|---|

| % requiring no more than limited improvements | 76% | 82% | 83% | 80% | 65% |

| Audits inspected by the FRC in 2023/24 required significant improvements | 0 |

Audit quality inspections

The percentage of audits inspected by the FRC requiring no more than limited improvements was 76%. This was 100% for audits of FTSE 350 entities. Across all the audits we inspected none were found to require significant improvements. All audits inspected by the ICAEW were in the good / generally acceptable category (page 11). Internal quality monitoring results (Appendix A) are also similar to prior years.

There were findings in relation to the consistency of audit work in complicated, non-high risk areas, which has also been seen previously. Whilst the firm has responded quickly to the specific findings, it needs to be more proactive to improve consistency going forward. The firm must also consider the effectiveness of actions responding to recurring elements of the impairment and forecasting findings.

% of audits inspected by the ICAEW classified as good / generally acceptable (Section 2)

| 2023 | 2022 | 2021 | 2020 | 2019 | |

|---|---|---|---|---|---|

| % classified as good / generally acceptable | 100% | 90% | 100% | 90% | 70% |

Firm's system of quality management (SoQM)

PwC has implemented ISQM (UK) 1, including monitoring and remediation processes, and completed its annual evaluation of its SoQM. The firm has invested considerable effort into implementing the new standard, including early adoption of most elements. The firm has already begun the iterative process of improving and refining it, including in response to our feedback.

FRC's firm-wide areas of focus (Section 3)

| Area | Good practice | Key finding |

|---|---|---|

| International Standard on Quality Management (UK) 1 (ISQM (UK) 1)1 | Yes | |

| Compliance with the FRC's Revised Ethical Standard 2019 | Yes | |

| ISQC (UK) 1: Training and methodology | Yes |

1. Overview – Firm and FRC actions

PwC's response

We appreciate the insights shared by the FRC during its inspection process. We particularly value the number and breadth of good practice examples identified in audit reviews, the observations from the firm Supervisor, and recommendations arising from the review conducted following our implementation of ISQM (UK) 1.

Whilst our FRC audit inspection outcomes are consistent with the last few years, we recognise some inconsistency remains and more can be done to address specific matters driving lower inspection outcomes and in the audit areas reported as key themes. We continue to understand and learn from FRC audit inspection findings and other reviews through our established root cause analysis (RCA) process. The principal factors identified in respect of the key themes from FRC audit inspections include:

- Auditor Mindset: Oversight of the design and execution of audit procedures to address some of the more complicated aspects of non-high risk areas were not always a primary focus for senior team members;

- Inherent knowledge: Over-reliance on knowledge of the entity or prior year audit when designing the approach and reviewing procedures; and

- Application of guidance/methodology: Relevant guidance was sometimes misinterpreted by the audit team.

Further details of our quality initiatives, broader RCA activities, and responsive actions are included in Appendix B.

PwC's actions

Our responsive actions include audit-wide communications sharing examples of auditor mindset behaviours, and the delivery of mandatory training programmes in areas of key findings. These will incorporate examples of good practice alongside key findings. We will also make revisions to specific aspects of our existing guidance.

In addition, our firm-wide actions include piloting a new non-audit service authorisation monitoring control and enhancements to certain monitoring test procedures and annual assessment activities in relation to specific ISQM (UK) 1 activities.

FRC's actions

In response to this year's findings, we will take the following action:

- Continue our inspection of completed audits and how the firm is developing its SoQM, including in response to our findings.

- Maintain our review of the SQP using it to monitor the actions taken to improve audit quality, their effectiveness (over the short and long term) and its use in complying with ISQM (UK) 1.

- Continue to monitor and assess the firm's initiatives in relation to audit quality, in particular those in relation to resourcing, culture, conduct and ethics. This will be with a particular focus on the impact of those that the firm plans to refresh or reinvigorate.

PwC – at a glance

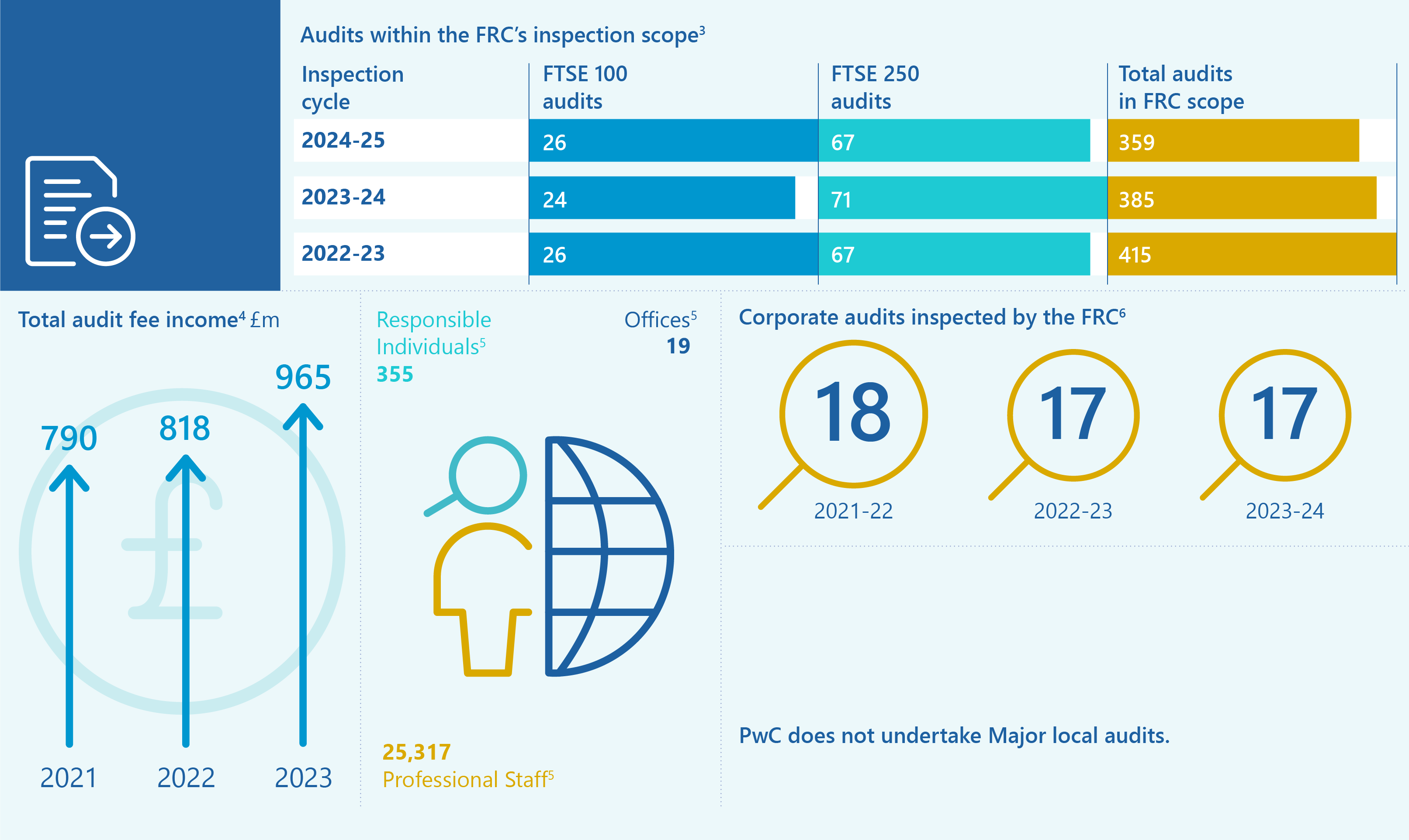

Audits within the FRC's inspection scope2

| Inspection cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope |

|---|---|---|---|

| 2024-25 | 26 | 67 | 359 |

| 2023-24 | 24 | 71 | 385 |

| 2022-23 | 26 | 67 | 415 |

Total audit fee income3 £m

Chart showing total audit fee income in £m for 2021, 2022, and 2023.

- 2021: 790

- 2022: 818

- 2023: 965

Responsible Individuals4 355

Offices4 19

Professional Staff4 25,317

Corporate audits inspected by the FRC5

PwC does not undertake Major local audits.

The FRC's inspections of Major Local Audits are published in a separate annual report. The December 2023 report can be found here.

2. Review of individual audits

Our assessment of the quality of PricewaterhouseCoopers LLP audits reviewed – All

We reviewed 17 individual audits this year and assessed 13 (76%) as requiring no more than limited improvements. These results are largely consistent with prior years.

FTSE 350

Of the 11 FTSE 350 audits we reviewed this year, we assessed 11 (100%) as achieving this standard. The results are an improvement on the prior year.

Bar chart showing audit quality assessment for "All" audits (left) and "FTSE 350" audits (right) from 2019/20 to 2023/24.

All Audits: * 2019/20: Good or limited improvements required: 11; Improvements required: 5; Significant improvements required: 1 * 2020/21: Good or limited improvements required: 16; Improvements required: 4; Significant improvements required: 0 * 2021/22: Good or limited improvements required: 15; Improvements required: 3; Significant improvements required: 0 * 2022/23: Good or limited improvements required: 14; Improvements required: 3; Significant improvements required: 0 * 2023/24: Good or limited improvements required: 13; Improvements required: 4; Significant improvements required: 0

FTSE 350 Audits: * 2019/20: Good or limited improvements required: 8; Improvements required: 3; Significant improvements required: 1 * 2020/21: Good or limited improvements required: 9; Improvements required: 1; Significant improvements required: 0 * 2021/22: Good or limited improvements required: 8; Improvements required: 1; Significant improvements required: 0 * 2022/23: Good or limited improvements required: 10; Improvements required: 1; Significant improvements required: 0 * 2023/24: Good or limited improvements required: 11; Improvements required: 0; Significant improvements required: 0

The audits inspected in the 2023/24 cycle included above had year-ends ranging from June 2022 to April 2023. Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus as announced annually. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm’s performance and are not necessarily indicative of any overall change in audit quality at the firm. Given our risk-based approach, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm.

Any inspection cycle with audits requiring more than limited improvements indicates the need for a firm to take action to achieve the necessary improvements.

We set out below the key findings in areas where, based on our inspections, we believe improvements in audit quality are required. These findings may also include those on individual audits assessed as requiring limited improvements, due to the extent of occurrence across the audits we inspected.

| Key findings | Why it is important |

|---|---|

| Improve the audit of inventory. | Auditors should perform appropriate procedures to assess the existence and valuation of inventory as it can be significant to an entity's balance sheet. |

| Improve aspects of the audit of impairment and valuation of non-current assets, in particular relating to forecasts. | Auditors should adequately assess and challenge management's evaluation of the impairment and valuation of non-current assets, as it often involves significant judgement and can be subject to management bias or error. |

| Improve the audit of the carrying value of investments in subsidiary undertakings (parent company). | Auditors should adequately assess and challenge the carrying value of investments in subsidiaries as an impairment of these investments may have a material impact on distributable reserves. |

Further details of the above key findings are set out on the following pages, including the number of audits where we raised findings in these areas.

Improve the audit of inventory

We reviewed the audit of inventory on four audits and raised findings on all of them, including two assessed as requiring improvements.

- Inventory cost: There were insufficient procedures over the cost of inventory on two audits.

- Inventory provision: There was insufficient testing performed of the inputs to the mechanical inventory provision calculation by one audit team. Another audit team did not obtain sufficient evidence to assess the completeness of the inventory provision. On another audit, the audit team did not sufficiently consider the nature of charges to cost of sales in the year and how they impacted the inventory provision.

- Impact of post balance sheet events on valuation of inventory: There was insufficient evidence of one audit team’s challenge as to why the change in the entity’s operating model was treated as a non-adjusting post-balance sheet event, resulting in no impact on the year-end inventory provisions.

- Perpetual inventory counts: There was insufficient evidence to support one audit team’s conclusion that the perpetual inventory count programme at the entity’s warehouses operated effectively.

Improve aspects of the audit of impairment and valuation of non-current assets, in particular relating to forecasts

Since last year, the firm has implemented a number of actions to address the root cause of findings in this area, and we have seen examples of good practice. However, we are still raising findings in this area. We reviewed the audit of impairment or valuation of non-current assets on 13 audits and raised findings on four of them, including one assessed as requiring improvements.

- Impairment forecast assumptions: One audit team did not perform, or adequately evidence, sufficient procedures to assess the reasonableness of revenue forecast growth. Another audit team did not sufficiently evidence why store forecasts were appropriate and why different assumptions were used for the impairment and the going concern assessments.

- Impairment cash generating units (CGU): Insufficient audit procedures were performed by one audit team to determine the accuracy of the allocation of certain financial information (in the management accounts in respect of the opening position) to individual CGUs as part of the goodwill impairment assessment.

- Fair value of acquisition: The audit team did not obtain sufficient audit evidence to support the fair value of certain intangible assets on acquisition. In particular, it did not identify discrepancies that led to a balance sheet reclassification above materiality in the subsequent period.

Improve the audit of the carrying value of investments in subsidiary undertakings (parent company)

We reviewed the audit of the carrying value of investments in subsidiary undertakings on four audits and raised a finding on one of them, assessed as requiring improvements.

- Recoverability of parent company investment: The audit team performed insufficient audit procedures over the recoverability of the parent company’s investment in subsidiary undertakings. In particular, it did not challenge management to deduct debt held by the company’s subsidiaries from the value-in-use calculation. As a result, the audit team did not identify a material misstatement in the parent company’s carrying value of the investment.

We also identified good practice in the audits we reviewed, including:

Risk assessment and planning

- Comprehensive risk assessment procedures: Five audit teams carried out a detailed analysis or benchmarking of various information to support their risk assessment.

- Effective group audit planning: Two group audit teams held detailed planning workshops for component auditors, involving the Audit Committee Chairs.

Execution

- Robust impairment assessments: On four audits, the audit team robustly challenged management’s key impairment assumptions, including the effective use of third-party data and industry experts to corroborate management’s assumptions.

- Challenge of management through independent modelling and benchmarking: The audit team assessed and challenged management’s ECL models through independent recalculations of the group’s models. On two other audits there was independent development of a model or baselining to corroborate management’s estimates for claims or the valuation of financial investments. On another audit, the firm’s pension experts performed detailed benchmarking in assessing the valuation of the defined benefit obligations, which was used to challenge management in this area.

- Effective group audit oversight: The level of reporting from the component audit teams was comprehensive and the group audit team’s assessment of this work was thorough. Another audit team performed enhanced oversight of non-network component auditors.

- Robust going concern procedures: The audit team challenged management regarding their loan covenant arrangements, convened two technical panels and delayed signing the auditor’s report.

Completion and reporting

- Reporting to the Audit Committee: The audit team’s reports to the Audit Committee included challenges encountered in the audit, alternative procedures undertaken and how it addressed key findings in the FRC’s public reports.

Monitoring review results by the Quality Assurance Department of ICAEW

ICAEW undertakes independent monitoring of the firm’s non-PIE audits, under delegation from the FRC as the Competent Authority. ICAEW’s work covers private companies, smaller AIM listed companies, charities and pension schemes. The FRC is responsible for monitoring the firm’s firm-wide controls and ICAEW additionally reviews Continuing Professional Development records for a sample of the firm’s staff involved in the audit work within ICAEW remit.

Overall the audit work reviewed was of a good standard. All ten files were either good or generally acceptable with no significant issues arising.

A detailed report summarising the audit file review findings and any follow-up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2024.

Bar chart showing percentage of audits inspected by ICAEW from 2021 to 2023, classified by quality.

- 2021: Compliant with Improvements Required: 15%; Improvement required: 2%; Good/generally acceptable: 83%

- 2022: Compliant with Improvements Required: 6%; Improvement required: 7%; Good/generally acceptable: 87%

- 2023: Compliant with Improvements Required: 9%; Improvement required: 6%; Good/generally acceptable: 85%

Good practice

ICAEW identified good practice in each of the files reviewed. Examples included:

- Comprehensive documentation including internal consultations, interactions with component auditors and consideration of impairment risks.

- Challenge of management on accounting matters including in relation to prior period restatements and valuation.

- High-quality risk assessments informing the audit work undertaken.

3. Review of the firm's system of quality management

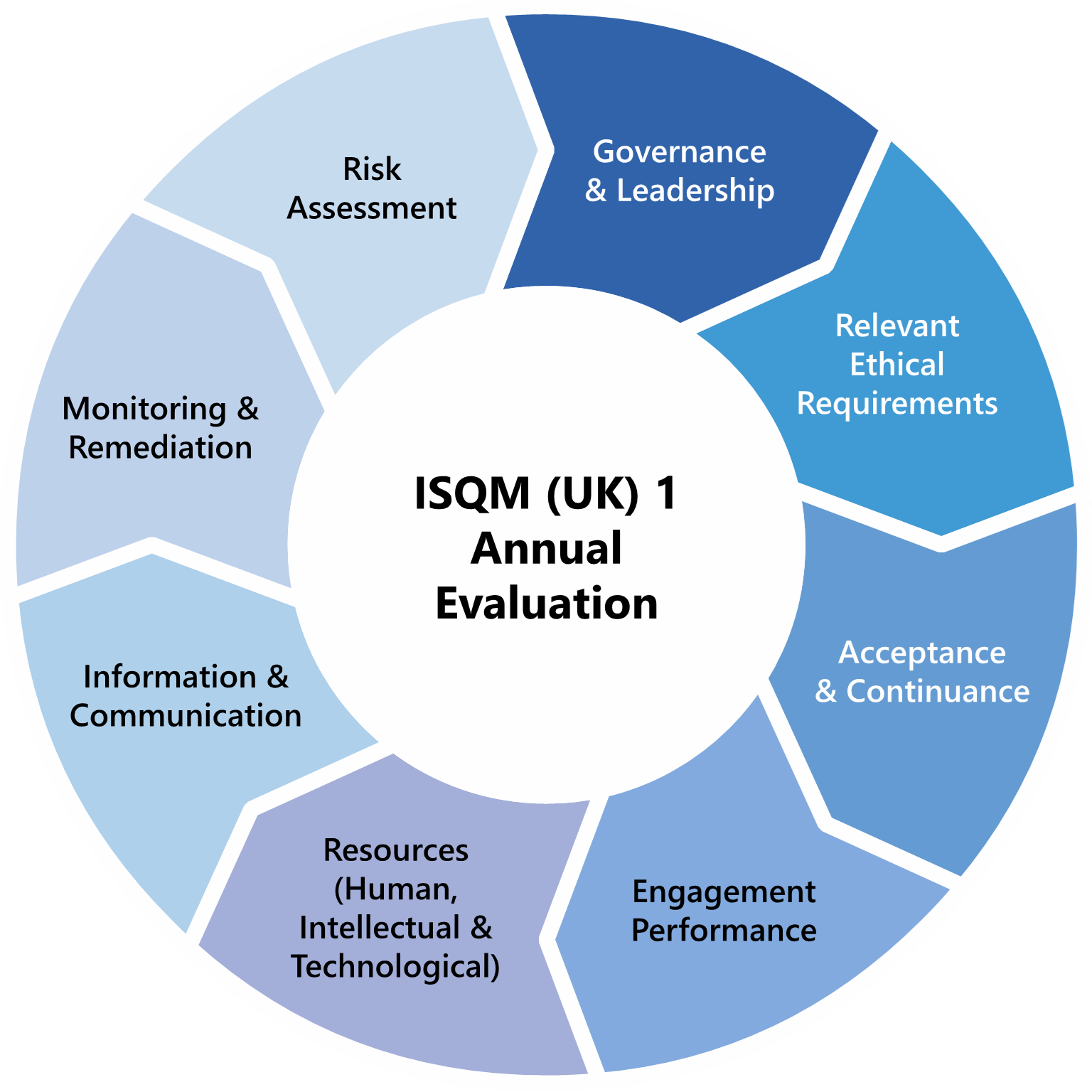

In this section, we set out the key findings and good practice identified in our review of the firm’s system of quality management (SoQM). ISQM (UK) 1 replaced the quality control standard (ISQC (UK) 1), which firms had been applying for many years, and introduced a fundamental change for firms’ quality management approaches. PwC has invested considerable effort in implementing and operating the ISQM (UK) 1 requirements and has responded positively to our feedback.

2023/24 was a transitional inspection cycle covering both standards (details of our new ISQM (UK) 1 & 2 rotational testing can be found here). A glossary of some key ISQM (UK) 1 terms can be found in Appendix C.

ISQM (UK) 1 - Risk Assessment, Governance and Leadership, Acceptance and Continuance, Monitoring and Remediation and Annual Evaluation

We reviewed the firm’s implementation of ISQM (UK) 1, focusing on its risk assessment processes and completeness of risks, the design and implementation of responses to mitigate quality risks in the Governance and Leadership and Acceptance and Continuance components, and the design of monitoring procedures over these responses and the attainment of the firm’s quality objectives. We also reviewed a small sample of the monitoring procedures performed to assess the operating effectiveness of responses. This sample focused on responses containing significant elements of judgement, such as management review controls.

We reviewed the process, evidence, and outcome for the firm’s annual evaluation of its SoQM. This included how other sources of information on audit quality and the firm’s SoQM were considered, and how matters were aggregated. We did not independently perform, or reperform, the firm’s overall annual evaluation. As ISQM (UK) 1 is focused on how firms achieve iterative improvement, we considered how the firm is developing its SoQM, including in response to the findings we shared during the inspection period. Our inspection findings in this area are reflective of our assertive and forward-looking approach as we seek to support firms in their development of effective, proportionate SoQMs.

Key findings

- Monitoring: In the small sample reviewed, for the monitoring of the elements of responses with high levels of judgement, the firm did not adequately demonstrate how a robust review was performed. We have seen this being enhanced in more recent monitoring procedures.

- Assessment of other sources of findings: The firm considered other sources of findings including those relating to ethics and independence matters and root causes from audit file inspections on an individual basis. The firm did not sufficiently justify its conclusion that these individual inputs did not aggregate to a level requiring the identification of additional quality deficiencies or require amendments to risk responses. We understand that the firm will further aggregate these inputs in its 20QM4 annual evaluation process.

Good practice

- The firm evidenced robust design assessments, which included mapping responses to specific elements within each risk and clear analysis of relevant design factors.

- The firm’s descriptions of its responses were granular and identified the specific response elements that must operate. This contributed to a structured monitoring approach.

Relevant ethical requirements – Compliance with the FRC's Revised Ethical Standard 2019

In the current year, we evaluated the firm’s compliance with the Ethical Standard. We focused our work on non-audit services. Our targeted sample testing included: checking for the provision of prohibited services; reviewing independence threats and safeguards assessments; and evaluating the completeness of independence reporting made by component auditors to the group auditors.

Key findings

- Prohibited non-audit services: For one of 36 proposed services we reviewed, the firm’s controls did not prevent or detect the provision of a prohibited tax service to an Other Entity of Public Interest (OEPI). We welcome the firm’s commitment to trial exception reporting of non-audit service approvals to FRC PIEs/OEPIs to identify where the service is not on the permitted services list.

- Component auditors’ compliance: For one of the six group reporting acknowledgements reviewed, the firm did not obtain confirmation of compliance with the Ethical Standard from a component audit team.

ISQC (UK) 1: Training and methodology

Given the transition to ISQM (UK) 1 we performed our final supervision of training and methodology under ISQC (UK) 1. We reviewed the firm’s processes for identifying methodology updates and training needs. We also considered how the methodology updates and training were then designed, approved, and communicated to the audit practice. We paid specific attention to revisions following changes to ISA (UK) 240 and ISA (UK) 315. We also reviewed the firm’s training processes, including monitoring attendance and evaluation of learning objectives. No key findings were identified at the firm.

Good practice

- The firm reviews a detailed analysis of training pass rates for all course assessments. The analysis includes the: average pass mark; number of attempts; average percentage score on first attempt; percentage of participants who passed on the first attempt; and average pass mark by question. This is then used to assess the effectiveness of each course and shape future courses.

- The firm’s audit file platform includes a tool which flags any changes to standard procedures since the file was created. This prompts the team to consider updates during the audit.

Our SoQM inspection work is undertaken on a risk-focused, cyclical basis. This is supported by targeted thematic work on particular aspects of firms’ SoQMs. In this current year, we conducted four audit thematic reviews on the Tier 1 firms to complement our monitoring of ISQM (UK) 1. The areas covered in these thematic reviews were: Sampling; Hot Reviews; Network Resources and Service Providers; and Root Cause Analysis. Published reviews can be found here.

4. Forward-looking supervision

We take a risk-based, assertive and proportionate approach to the supervision of firms, which is complementary to our programme of inspections. We balance holding firms to account to take prompt action to address quality findings, with acting as an improvement regulator and sharing good practice to facilitate improvements across the sector. A Supervisor dedicated to each firm draws together evidence and indicators of risks, identifying and prioritising what firms must do to improve audit quality and enhance resilience, alongside identifying what could go wrong in the future.

Our observations from the work we have conducted this year, and updates on what more the firm must do in respect of previous observations are set out below. Where we raise key findings, we require the firm to include actions in their Single Quality Plan (SQP).

Single Quality Plan and other quality initiatives

We require all Tier 1 firms to maintain an SQP to drive measurable improvements in audit quality and resilience, and to demonstrate the effectiveness of actions taken. The SQP ensures action in the most critical areas is prioritised and enables firms to be held to account by us and their non-executives.

Observations

The firm’s SQP integrates and prioritises the firm’s audit strategy. Actions within the SQP are monitored and their effectiveness assessed at the overall priority level. As the firm continues to develop its SQP it should focus on improving the effectiveness measures by pre-defining what effective looks like.

- ISQM (UK) 1 and the SQP: All SQP actions are mapped to relevant ISQM (UK) 1 components and a ‘stand back’ check is performed to assess whether any information in the SQP indicates an ISQM (UK) 1 deficiency. Additionally, all actions to remediate ISQM (UK) 1 deficiencies are in the SQP.

- Independent monitoring of closed actions is performed as part of the firm’s ISQM (UK) 1 monitoring procedures.

Root cause analysis

RCA is an important part of an effective continuous improvement cycle designed to identify the causes of quality issues so that action can be taken to address the risk of recurrence. Further, ISQM (UK) 1 has made RCA a requirement for all firms when deficiencies are identified in the system of quality management.

Observations

PwC’s overall approach to RCA is well developed with an established methodology that is embedded in its processes to remediate findings and drive continuous improvement.

The firm’s taxonomy of risk factors has been updated for the use of onshore and offshore delivery centres in advance of the increased use of alternative delivery models in audits. The RCA interviews also include remote teams, where relevant.

The firm is continuing to consider the root causes of inconsistent audit quality and recurring findings with a focus on team behaviours. Also assessing the effectiveness of actions taken remains key in continuous and further improvement.

Continuous engagement and holding the firm to account

We hold firms to account to take prompt action to address quality findings and to set an appropriate tone from the top.

Observations

- Tone at the top: The firm remains clear and consistent in its communications around the importance of audit quality.

- Constructive engagement: We have engaged on four constructive engagement cases throughout the period, none of which remain open. The firm has taken prompt actions including strengthening procedures, guidance and training aimed at preventing future recurrence of findings.

- Non-financial sanctions: One non-financial sanction has been agreed and imposed since the last public report with reporting and monitoring of three further sanctions which were opened in a previous cycle. Two of these have also now been closed following reports from the firm on actions taken, their effectiveness and further actions to be taken where necessary. Two non-financial sanctions remain open.

- Culture and conduct: The firm has launched innovative initiatives covering areas such as psychological safety and team ways of working to further embed a culture focused on achieving high-quality audits (a priority in the SQP). The firm recognises that it remains important that it pays attention to individual behaviour that is not consistent with the firm’s values and expected behaviours. As the firm evolves its audit culture programme it must incorporate firmwide actions in relation to ethical conduct.

Emerging risks and trends

Our forward-looking supervision aims to aid firms by identifying risks from emerging trends before quality issues occur.

Observations

- Lessons learnt from Australia: Following the sharing of confidential information being uncovered in the Australian network firm, the focus on both culture and ethics are of increasing priority for the PwC network. The UK firm has assessed the lessons it can learn from the cultural, conduct and governance-related findings, and has put in place a responsive action plan. We will continue to closely monitor the firm’s response and progress against these actions.

- Use of onshore and offshore delivery centres: To mitigate the risk of increased use of alternative delivery models involving remote teams to deliver audits, the firm must continue to evaluate and evolve its quality control processes locally and centrally.

- Financial interest compliance rates: The completeness and accuracy of staff’s portfolio recording of financial investment requires further improvement. The firm has identified a number of actions to improve compliance rates. We will monitor the ongoing programme of activities through the SQP.

Recruitment:

The firm has mitigated the market risk of cheating in audit firms’ recruitment processes by changing the nature of the online element of their process and changing the style of questions. In person meetings form a significant part of PwC’s approach.

Appendix A – Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements (Engagement Compliance Review, or ECR). We have not verified the accuracy or appropriateness of these results. The appendix should be read together with the firm’s Transparency Report for 2023 and its 2024 report (when published) which provide further detail of the firm’s internal quality monitoring approach, results, RCA, remediation, and wider system of quality control. Due to differences in how inspections are performed and rated, the results of the firm’s internal quality monitoring are not directly comparable to those of other firms or external regulatory inspections.

Results of internal quality monitoring6

The results of the firm’s 2023 ECR are set out below along with the results for the previous two years. The firm’s 2023 ECR comprised internal inspections of 163 individual audits (2022: 156), the majority of which had 31 December 2022 year-ends.

Stacked bar chart showing results of internal quality monitoring from 2021 to 2023.

- 2021: Compliant: 83%; Compliant with Improvements Required: 15%; Non-Compliant: 2%

- 2022: Compliant: 87%; Compliant with Improvements Required: 6%; Non-Compliant: 7%

- 2023: Compliant: 85%; Compliant with Improvements Required: 9%; Non-Compliant: 6%

Themes arising from internal quality monitoring

Three of the Non-Compliant outcomes were driven by specific opinion related findings, including omitted narrative and inaccuracies in language. With the exception of these opinion related findings, there were no common grade driving technical themes within the Non-Compliant outcomes, and the remaining findings were not isolated to any particular area of the audit work performed.

In Compliant with Improvements Required outcomes, there was a recurring theme in the journals testing in respect of the design of the tests in response to specific fraud risks and the sufficiency of evidence obtained.

Proactive team contracting with entity management and responding quickly to unforeseen challenges by adapting the audit plan and approach were the key differentiators between good quality and adverse quality outcomes. The teams that failed to prioritise how they would work as a team failed to prioritise coaching, which resulted in insufficient and/or poor quality review and an over-reliance on prior year approaches.

Appendix B – PwC's responses and actions

At PwC, our purpose is to build trust in society and solve important problems. The audit profession is critical to building confidence in business, with wider society looking for organisations to provide transparent financial and non-financial reporting that they rely on.

Quality remains our top priority and we are focused on delivering consistently high-quality audits that meet the needs of investors, the organisations we audit and wider stakeholders. We are grateful for the continued efforts of our audit teams in seeking to achieve our quality objectives.

System of Quality Management (SoQM)

The PwC UK Transparency Report for 2023 sets out the firm’s commitment to audit quality and its SoQM. Our SoQM is made up of policies, processes and controls that support the delivery of quality assurance engagements. This ongoing process includes monitoring, evaluating, assessing, reporting and being responsive to changes in quality risks, driven by the firm’s internal and external environment. Our Continuous Improvement (CI) activities, including RCA, our Audit Quality Plan (AQP) and Single Quality Plan (SQP) all form part of our SoQM.

Our CI Team operates independently from engagement teams and is responsible for our SQP process including action effectiveness assessments and conducting ongoing RCA and action planning. We are pleased that this report identifies good practice in respect of our SQP.

Firm-wide findings from FRC inspection activities are incorporated into our SoQM processes and actions taken as appropriate. This has included enhancements to certain monitoring procedures and annual evaluation activities in relation to specific ISQM (UK) 1 activities.

Annually, the firm conducts a review of SoQM effectiveness to enable an assessment of the design of our quality control system for the audit practice to take place, and a reasonable assurance statement to be made.

Audit Quality Plan

Our Audit Executive’s detailed AQP ensures our continued priority is on performing high-quality audits. The AQP is reviewed by our Audit Oversight Body (AOB). The AQP is aligned with the Audit Strategy and includes five strategic pillars to support the delivery of high-quality audits, underpinned by our audit culture. The AQP details the core activities relating to audit quality under each pillar.

Single Quality Plan

The SQP is a prioritised action plan which includes all of the actions we are taking to continually improve audit quality, and underpins the AQP. The SQP is used to monitor all of our activities that are fundamental to delivering high-quality work. Each action has an individual sponsor at the Audit Executive level, and a clear timeline for completion. Regular status meetings take place to monitor outstanding actions and individuals are held to account.

The CI team uses a framework to assess the effectiveness of a package of actions under each SQP priority area, rather than at an individual action level. The CI team continues to develop how action effectiveness is measured, including both immediate and long term impact, and in less tangible priority areas, such as audit culture and behaviours.

Single Quality Plan

Our current SQP key priorities include:

- embedding and reinforcing ethical and audit behaviours and a culture focused on achieving high-quality audits;

- maintaining a balance between the demand for audit services and the supply of auditors available to deliver these services;

- continued focus on how we project manage and phase our audits including agreement of timely deliverables with entity management;

- supporting audit teams through the transition period for new standards; and

- a continued focus on the future talent development model, including coaching initiatives and development programmes.

Our SQP also includes activities to support the delivery of a technology powered high-quality audit and an ongoing focus on compliance with the FRCs operational separation principles.

Root cause analysis and action planning

Our RCA process is well established and is performed by the CI team on a continuous basis across the quality spectrum. This includes external regulatory cycles, internal quality monitoring, prior year adjustments, and on other specific matters identified for RCA activities. The RCA process for engagement findings follows a consistent methodology, updated periodically to ensure that risk and causal factors impacting audit quality, are identified and analysed appropriately.

The CI team evaluates the results of RCA on both individual cycles and in aggregate to identify and develop appropriate actions, whether at the engagement level or across the practice, which are then incorporated as actions into the SQP.

The insights gained from RCA are shared with the practice through training, in all-audit communications, and via the Chief Auditor Network. These channels facilitate the dissemination of lessons learned from RCA, promoting a culture of continuous improvement and enhancing audit quality.

a) Regulatory inspection - Root cause analysis and related actions

As summarised in the overview section, the CI team has undertaken RCA for the FRC 2023/24 audit inspection cycle, incorporating both good practice and inspection findings within the analysis. Audit teams across all inspections were subject to interview or other RCA activities.

The CI team continues to focus on identifying the activities and behaviours which drive good practice examples and higher quality inspection outcomes, alongside the factors leading to the reported findings. Audit teams achieving the highest quality outcomes set clear team contracting expectations and invested time in developing positive team behaviours. These teams also performed stand-back considerations across all elements of the audit, including when undertaking review.

i) Audit of inventory

The root cause of the findings was identified as auditor mindset, where the oversight of the design and execution of audit procedures to address normal risk assertions were not a primary focus for senior team members.

i) Audit of inventory

This mindset factor was identified in specific instances including: when planning the audit approach and assigning responsibilities; in coaching team members; and when performing review of specific audit procedures. Other factors identified included audit teams not correctly applying relevant guidance and methodology.

Actions identified in response to these findings include updates to the years 1 - 4 inventory training and the development and delivery of our External Auditor Training (EAT) for qualified partners and staff on inventory in Autumn 2024. Messaging on setting the standard for consistent quality across the audit file will be shared through audit wide communications and ongoing development programmes, including Be Your Best and Connected Development.

ii) Audit of impairment and valuation of non-current assets, in particular relating to forecasts

The root cause driving the range of findings related to inherent knowledge or understanding within the audit team being over-utilised during planning, execution or review stages of the audit. Within the issues identified, industry or entity specific knowledge and/or background rationale had not been captured alongside the audit procedures to explain the designed audit approach, the consideration of testing results, or overall conclusions.

One audit team did not appropriately adjust the project management plan to align to the provision of deliverables in a number of stages, relating to the valuation of acquisitions. In addition, they did not sufficiently focus on, or challenge, the detail included in the final output deliverable provided by the auditors’ expert, with evidence of discussions held and conclusions drawn not evidenced appropriately.

To identify actions, the RCA considered perspectives from our Real Time Review (RTR) team on the behaviours adopted when undertaking stand back and broader review activities. These actions include sharing practical good practice examples that are applicable to a broad range of entities and sharing the RTR team’s perspectives on approach and mindset, as part of a mandatory EAT programme module this summer.

iii) Audit of carrying value of investments in subsidiary undertakings (parent company)

The root cause was a misinterpretation of existing accounting guidance relating to the accounting treatment of debt in management’s VIU calculation by the audit team. This was due to the team dealing with challenges elsewhere on the audit.

The CI team considered other sources of information as to whether this indicated a more systemic challenge and concluded that it was not. In conjunction with our accounting specialists, the CI team has reviewed the guidance and proposed certain amendments to address further potential misinterpretations. Furthermore, our independent financial statement review policy has been revised to facilitate specialist review of financial statements using a risk-based approach.

b) Root cause analysis and action planning - aggregated themes

The RCA factors from the FRC 2023/24 inspection cycle have been combined with those identified through our Internal Quality Monitoring and other RCA cycles and activities. The key themes from these factors relate to Auditor Mindset and the sufficiency of Coaching, Supervision and Review. The firm’s Connected Development and Be Your Best programmes, which are included as high priority areas within the SQP, include sessions on coaching behaviours and skills.

Appendix C - ISQM (UK) 1 Glossary

The following definitions were extracted from ISQM (UK) 17.

| Term | Definition |

|---|---|

| System of quality management (SoQM) | A system designed, implemented and operated by a firm to provide the firm with reasonable assurance that:

|

| Quality objectives | The desired outcomes in relation to the components of the system of quality management to be achieved by the firm. |

| Quality risk | A risk that has a reasonable possibility of:

|

| Response | Policies or procedures designed and implemented by the firm to address one or more quality risk(s) in relation to its system of quality management:

|

| Findings | Information about the design, implementation and operation of the system of quality management that has been accumulated from the performance of monitoring activities, external inspections and other relevant sources, which indicates that one or more deficiencies may exist. |

| Deficiency | A deficiency in a firm’s system of quality management exists when:

|

| Ultimate responsibility | Individual(s) assigned ultimate responsibility and accountability for the firm’s SoQM should evaluate the SoQM, on behalf of the firm, and shall conclude, on behalf of the firm, whether or not the SoQM provides the firm with reasonable assurance that the objectives of the SoQM are being achieved, required under ISQM (UK) 1 paragraph 54. |

Contact Information

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

www.frc.org.uk

Follow us on Linked in or X @FRCnews

Footnotes:

-

The new standard is a significant change to ISQC (UK) 1, requiring firms to take a more proactive and risk-based approach to managing quality. The standard also required a step change in firms’ monitoring, as well as the introduction of a self-evaluation of their SoQM. Page 10 of the Annual Review of Audit Quality sets out the key differences. ↩

-

Source - the FRC's analysis of the firm's PIE audits and other audits included within AQR scope as at 31 December 2023. ↩

-

Source - the FRC's 2022, 2023 and 2024 editions of Key Facts and Trends in the Accountancy Profession. Audit fee income relates to all audits performed by the firm, and not only those within the FRC's inspection scope. ↩

-

Excludes the inspection of local audits. ↩

-

The grading categories used by the firm are: Compliant – audits which comply with relevant standards in all material respects; Compliant with Improvements Required - when the issues identified for improvement are mitigated by other procedures which had been performed in the audit, are not considered to be a significant departure from relevant standards, or where there are audit report (opinion) issues that are more than grammatical/punctuation errors, but which do not mislead the user; Non-Compliant – audits which do not comply with relevant standards in respect of a material matter. ↩

-

https://media.frc.org.uk/documents/ISQM_UK_1_Issued_July_2021_Updated_March_2023.pdf ↩

-

The six Tier 1 firms in 2023/24 were: BDO LLP, Deloitte LLP, Ernst & Young LLP, KPMG LLP, Mazars LLP, and PricewaterhouseCoopers LLP. With effect from 1 June 2024, Mazars LLP changed its name to Forvis Mazars LLP. We have published a separate report for each of these firms along with a cross-firm Annual Review of Audit Quality. ↩