The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Ernst & Young LLP Audit Quality Inspection and Supervision Report 2024

- Using this publication

- 1. Overview – overall assessment

- 1. Overview – Firm and FRC actions

- Ernst & Young LLP – at a glance

- 2. Review of individual audits

- 2. Review of individual audits

- 2. Review of individual audits

- 2. Review of individual audits

- Monitoring review results by the Quality Assurance Department of ICAEW

- 3. Review of the firm's system of quality management

- 3. Review of the firm's system of quality management

- 3. Review of the firm's system of quality management

- 4. Forward-looking supervision

- 4. Forward-looking supervision

- Appendix A – Firm's internal quality monitoring

- Appendix B – EY's responses and actions

- Appendix B – EY's responses and actions

- Appendix B – EY's responses and actions

- Appendix C – ISQM (UK) 1 Glossary

- Appendix C – ISQM (UK) 1 Glossary

Using this publication

The Financial Reporting Council (FRC) is responsible for the regulation of UK statutory auditors and audit firms. We assess, via a fair evidence-based approach, whether firms are consistently delivering high-quality audits and are resilient.

This report sets out the FRC's findings on key matters relevant to audit quality at Ernst & Young LLP (EY or the firm). It should be used alongside the FRC's Annual Review of Audit Quality, which contains combined results and themes for all Tier 1 firms 1 that are inspected annually.

Given our risk-based approach to selecting audits for inspection, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm. Given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance.

This report also considers other, wider measures of audit quality such as results of audit inspections completed by the Institute of Chartered Accountants in England and Wales (ICAEW) and results from the firm's own internal quality reviews. The firm's response to the findings and the actions it plans to take as a result are included on page 5 and Appendix B.

This report is for general use by interested parties. However, we expect the following:

- EY to use this report and its peers' reports to facilitate continuous improvement through actions in its Single Quality Plan (SQP).

- Other audit firms of all sizes to use this report for examples of good practice.

- Audit Committees to use this report to help them assess the quality of their audit/auditor and when appropriate as part of the process of appointing a new auditor.

- Investors to use this report in making assessments about the quality of audit, transparency and accountability in the relevant markets.

Throughout this report, the following symbols are used:

- Represents a key finding where the firm must take action to improve audit quality.

- Represents examples of good practice we identified in our supervision, and we encourage other firms to consider applying these if appropriate to their circumstances.

- Represents an observation relating to the firm's initiatives to improve audit quality.

Our Supervisory Approach

The audit supervisory teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our future supervision work.

Further details on our approach to Audit Supervision can be found here. We also publish a separate inspection report on the quality of major local audits, the latest version of which can be found here and was published in December 2023.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Overview – overall assessment

EY continues to focus on consistently delivering high audit quality. The firm has identified, and taken action in, a number of priority areas where it can make improvements to achieve such consistency. In our view, these priority areas are the right ones. The firm must ensure momentum is maintained and develop its use of effectiveness measures to determine whether the actions taken are working, or whether other actions are needed.

Regulatory audit inspection results at EY

% of audits inspected by the FRC requiring no more than limited improvements (Section 2)

| Year | % | Audits inspected by the FRC in 2023/24 required significant improvements |

|---|---|---|

| 2023/24 | 76% | 0 |

| 2022/23 | 80% | |

| 2021/22 | 65% | |

| 2020/21 | 79% | |

| 2019/20 | 71% |

Audit quality inspections

The percentage of audits inspected by the FRC requiring no more than limited improvements was 76%, which is similar to the prior year. None of the audits we inspected were found to require significant improvements. There continues to be recurring findings related to the audit of revenue, journals and deferred tax and the firm should review the effectiveness of its actions in these areas. As shown in Section 2 of this report, three audits of companies in the FTSE 350 were identified as requiring improvements compared to one in the prior year. The overall results profile for inspections by the ICAEW is 90% classified as good or generally acceptable (page 11) and the firm's internal quality monitoring results (Appendix A) show a year-on-year improvement.

% of audits inspected by the ICAEW classified as good / generally acceptable (Section 2)

| Year | % |

|---|---|

| 2023 | 90% |

| 2022 | 100% |

| 2021 | 100% |

| 2020 | 90% |

| 2019 | 100% |

Firm's system of quality management (SoQM)

EY has implemented ISQM (UK) 1, including monitoring and remediation processes, and completed its first annual evaluation of its SoQM. The firm has invested considerable effort into implementing its new system. The firm has already begun the iterative process of improving and refining it, including in response to our feedback. The firm must strengthen aspects of its SoQM, particularly where the firm had a number of responses to quality risks that it did not deem to be controls. The firm must include these within its design assessments and operating effectiveness monitoring.

FRC's firm-wide areas of focus (Section 3)

| Area | Good practice | Key finding |

|---|---|---|

| International Standard on Quality Management (UK) 1 (ISQM (UK) 1) 2 | ✅ | 🫱 |

| Compliance with the FRC's Revised Ethical Standard 2019 | ✅ | 🫱 |

| ISQC (UK) 1: Training and methodology | ✅ |

1. Overview – Firm and FRC actions

EY's response

Consistently delivering high-quality audits that serve the public interest is our purpose.

Our FRC results are consistent with those achieved last year and, for the fourth consecutive year, none of our audits have been assessed as requiring significant improvements. The many good practice examples identified by the FRC during their reviews are welcome, and in several cases overlap with the areas giving rise to findings. Therefore, our focus is on executing high-quality, consistently.

Our Audit Quality Strategy 3 which is underpinned by our Purpose-led Culture 4, is designed to achieve this consistency across our engagement portfolio. A key input into the strategy is the learnings from our root cause analysis (RCA) 5. The root causes of our findings are disparate, but include:

- Failure to understand and apply existing guidance, with some areas where additional guidance was required; and

- Failure to respond appropriately to late delivery by management of audit evidence, challenges in resourcing, and failure to prioritise appropriately.

Our culture is one of continuous improvement, and so we appreciate the feedback received in our regular interactions with both the FRC and ICAEW; identifying opportunities where we can improve and sharing best practice across the audit sector. We are learning from these insights and taking appropriate actions.

Each action is captured within our Single Quality Plan, for which we continue to develop and refine effectiveness measures.

EY's actions

Actions already taken include increasing headcount whilst reducing average total hours per FTE over the last year, to increase audit team capacity; issuing good practice examples and case studies to teams; and providing guidance, training, and targeted support to audits with identified impairment risk factors.

Ongoing actions include a focus on simplification and enhancing our existing suite of standardised work programmes and expanding our good practice examples repository. Our Audit Quality Strategy will also build core skills including project management.

We will iterate our SoQM to respond to the FRC's observations and assess the effectiveness of existing responses.

FRC's actions

In response to this year's findings, we will take the following action:

- Continue our inspection of completed audits and how the firm is developing its SoQM, including in response to our findings.

- Maintain our supervision of the firm's SQP and use it to monitor the actions taken to deliver high-quality audits more consistently and, in particular, how effectiveness measures are being used to determine whether the actions taken are working.

- Assess the FY25 audit quality strategy, including any changes to priority areas.

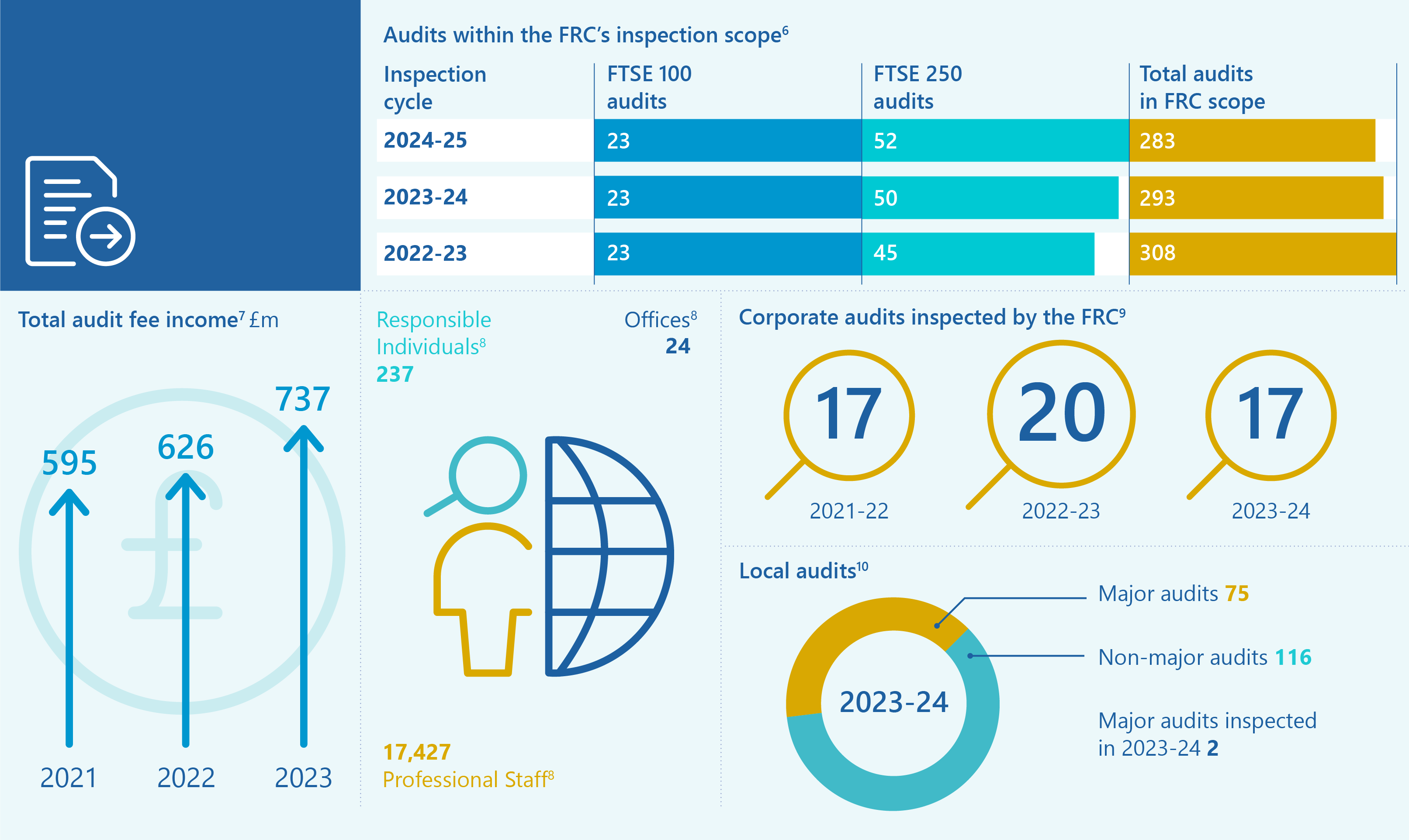

Ernst & Young LLP – at a glance

| Source |

|---|

| 6 Source – the FRC's analysis of the firm's PIE audits and other audits included within AQR scope as at 31 December 2023. |

| 7 Source – the FRC's 2022, 2023 and 2024 editions of Key Facts and Trends in the Accountancy Profession. Audit fee income relates to all audits performed by the firm, and not only those within the FRC's inspection scope. |

| 8 Source – the ICAEW's 2024 QAD Report on the firm. |

| 9 Excludes the inspection of local audits. |

| 10 Source – the FRC's analysis of Major Local Audits as of 31 March 2023. The FRC's inspections of Major Local Audits are published in a separate annual report. The December 2023 report can be found here. |

2. Review of individual audits

Our assessment of the quality of EY audits reviewed – All

We reviewed 17 individual audits this year and assessed 13 (76%) as requiring no more than limited improvements.

These results were similar to last year.

Chart showing "Our assessment of the quality of EY audits reviewed – All"

This chart displays the percentage of audits falling into three categories (Good or limited improvements required, Improvements required, Significant improvements required) over five years.

| Category | 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 |

|---|---|---|---|---|---|

| Good or limited improvements required | 10 | 15 | 11 | 16 | 13 |

| Improvements required | 3 | 4 | 6 | 4 | 4 |

| Significant improvements required | 0 | 1 | 0 | 0 | 0 |

FTSE 350

Of the six FTSE 350 audits we reviewed this year, we assessed three (50%) as achieving this standard.

These results were lower than last year.

Chart showing "FTSE 350" audit quality assessment

This chart displays the percentage of FTSE 350 audits falling into three categories (Good or limited improvements required, Improvements required, Significant improvements required) over five years.

| Category | 2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 |

|---|---|---|---|---|---|

| Good or limited improvements required | 7 | 9 | 7 | 8 | 3 |

| Improvements required | 1 | 3 | 2 | 1 | 3 |

| Significant improvements required | 0 | 0 | 0 | 0 | 0 |

The audits inspected in the 2023/24 cycle included above had year-ends ranging from June 2022 to April 2023. Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for inspection and the individual inspection scope. Our inspections are also informed by the priority sectors and areas of focus as announced annually. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm. Given our risk-based approach, it is important that care is taken when extrapolating our findings or assessment of quality to the whole population of audits performed by the firm.

Any inspection cycle with audits requiring more than limited improvements indicates the need for a firm to take action to achieve the necessary improvements.

2. Review of individual audits

We set out below the key findings in areas where, based on our inspections, we believe improvements in audit quality are required. These findings may also include those on individual audits assessed as requiring limited improvements, due to the extent of occurrence across the audits we inspected.

| Key findings | Why it is important |

|---|---|

| Continue to improve the testing of revenue and journals. | Auditors should obtain sufficient and appropriate evidence to assess whether revenue is accurately recognised as it is a key driver of an entity's results. Journals testing is a key procedure to address the risk of management override of controls and fraud. Auditors should test the appropriateness of journals entries, including examining the supporting evidence for the items selected. |

| Improve aspects of the audit of impairment and deferred tax assets, in particular relating to forecasts. | Auditors should adequately assess and challenge management's evaluation of impairment and deferred tax. The evaluation of impairment often involves significant judgement and can be subject to management bias or error. Changes in the assumptions of forecast profitability could materially impact the deferred tax assets recognised. |

| Improve the audit of the carrying value of investments in subsidiary undertakings (parent companies). | Auditors should adequately assess and challenge the carrying value of investments in subsidiaries as an impairment of these investments may have a material impact on distributable reserves. |

Further details of the above key findings are set out on the following pages, including the number of audits where we raised findings in these areas.

2. Review of individual audits

Continue to improve the testing of revenue and journals

We reviewed the audit of revenue on 16 audits and on journals for 11 of them. We raised findings in at least one of these areas on six audits, including one assessed as requiring improvements.

- Revenue testing: The audit team did not sufficiently validate the third-party revenue reports, which were provided by management and were used as a key source of audit evidence for a large proportion of group revenue. Another audit team performed insufficient procedures to test margins and obtain evidence over the revenue recognised for certain contracts.

- Revenue data analytics: On two audits, one being a component audit of the group, there was insufficient evidence obtained over aspects of the data analytics procedures used in the audit of revenue.

- Journals testing: On two audits, one being a component audit of the group, the audit team did not adequately demonstrate whether it had identified all the higher-risk journals and obtained sufficient supporting evidence for them. On two other audits the audit team did not sufficiently evidence how it had performed adequate procedures over related information produced by the entity when testing journals.

Improve aspects of the audit of impairment and deferred tax assets, in particular relating to forecasts

We reviewed the audit of impairment or deferred tax assets on ten audits and raised findings on six of them, including three assessed as requiring improvements.

- Impairment forecast assumptions: The audit team did not sufficiently evaluate and challenge the cash flow forecasts used in the value in use calculations, in particular for the revenue growth rate assumptions. On another audit there was insufficient evidence to corroborate the forecast sales assumptions. Another audit team did not challenge management about including actual cash flows, to compensate for a year-end discounting approach, in the impairment model used for management's impairment assessment.

- Other impairment assumptions: The audit team did not adequately assess, or evidence its challenge of, the discount rate assumptions, for one cash generating unit (CGU) in particular. Another audit team did not adequately assess the CGU groupings used in the impairment assessment.

- Deferred tax assets: The audit team obtained insufficient audit evidence to challenge the recoverability of the deferred tax asset against future profits and performed insufficient sensitivities on the related forecasts.

2. Review of individual audits

Improve the audit of the carrying value of investments in subsidiary undertakings (parent companies)

We reviewed the audit of the carrying value of investments in subsidiary undertakings on two audits and raised findings on both of them, with both assessed as requiring improvements.

Recoverability of parent company's investments: On two audits the audit team did not identify material misstatements in the carrying value of the parent company's investments in subsidiary undertakings. On one of these, the audit team did not consider the impact of the intercompany receivable due to the parent company on the impairment assessment. On the other audit, the audit team did not obtain an impairment model to support the impairment made, evidence any review of the impairment assumptions or challenge the appropriateness of not including any adjustments for external debt cash flows. Neither of these situations impacted dividends in the year.

We also identified good practice in the audits we reviewed, including:

Risk assessment and planning

- Comprehensive risk assessment procedures: Four audit teams carried out detailed analysis and review of various information with specialists to support the risk assessment over climate change, revenue, unauthorised trading and journals.

Execution

- Effective use of specialists in audit of provisions and climate: On two audits, specialists effectively assessed the appropriateness of tax and legal provisions and another audit had comprehensive evidence over the insurance liabilities. Another audit team involved the firm's specialists in climate workshops with management and in designing the audit procedures for climate related risks.

- Effective group oversight: On three audits, there were effective group oversight reviews of the work performed by the component audit teams, which were extensively evidenced.

- Challenge of management in impairment assessments: The audit team used an impairment analyser to perform sensitivities for all the CGUs. Another audit team challenged the consistency of the CGUs used for the segmental reporting disclosures and the goodwill assessment.

- Robust going concern procedures: The audit team performed extensive procedures over management's going concern assessment, including reviewing external publications to identify specific risks. Another audit team demonstrated heightened professional scepticism through the use of internal debt advisory specialists and various other procedures.

- Effective data analytics for revenue: On two audits, effective data analytic procedures were used in the audit of revenue.

Completion and reporting

- Effective review of climate disclosures: In assessing management's climate related disclosures, the audit team took into consideration its interactions with third parties and external feedback over the prior year climate disclosures.

Monitoring review results by the Quality Assurance Department of ICAEW

ICAEW undertakes independent monitoring of the firm's non-PIE audits, under delegation from the FRC as the Competent Authority. ICAEW's work covers private companies, smaller AIM listed companies, charities and pension schemes. The FRC is responsible for monitoring the firm's firm-wide controls and ICAEW additionally reviews Continuing Professional Development records for a sample of the firm's staff involved in the audit work within ICAEW remit.

Overall the quality of audit work continues to be acceptable in most files. Nine files were either good or generally acceptable and one file required improvement. On the file requiring improvement, there were weaknesses in reliance on work of other network firms and in testing inventory.

A detailed report summarising the audit file review findings and any follow-up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2024.

Chart showing "Monitoring review results by the Quality Assurance Department of ICAEW"

This chart displays the audit quality classifications over three years.

| Classification | 2021 | 2022 | 2023 |

|---|---|---|---|

| Significant improvement required | 0 | 0 | 1 |

| Improvement required | 7 | 11 | 9 |

| Good/generally acceptable | 10 | 10 | 9 |

Good practice

ICAEW identified good practice across the files reviewed. Examples included:

- Audit team discussions at the planning stage particularly in relation to estimates and going concern.

- Stocktake work incorporating unpredictability in selection of locations to attend.

- Response to potential litigation claim arising during the audit including internal consultation and clear documentation.

3. Review of the firm's system of quality management

In this section, we set out the key findings and good practice identified in our review of the firm's system of quality management (SoQM). ISQM (UK) 1 replaced the quality control standard (ISQC (UK) 1), which firms had been applying for many years, and introduced a fundamental change for firms' quality management approaches. EY has invested considerable effort in implementing and operating the ISQM (UK) 1 requirements and has responded positively to our feedback.

2023/24 was a transitional inspection cycle covering both standards (details of our new ISQM (UK) 1 & 2 rotational testing can be found here). A glossary of some key ISQM (UK) 1 terms can be found in Appendix C.

ISQM (UK) 1 - Risk Assessment, Governance and Leadership, Acceptance and Continuance, Monitoring and Remediation, and Annual Evaluation

We reviewed the firm's implementation of ISQM (UK) 1, focusing on its risk assessment processes and completeness of risks, the design and implementation of responses to mitigate quality risks in the Governance and Leadership and Acceptance and Continuance components, and the design of monitoring procedures over these responses and the attainment of the firm's quality objectives.

We also reviewed a small sample of the monitoring procedures performed to assess the operating effectiveness of responses. This sample focused on responses containing significant elements of judgement, such as management review controls.

We reviewed the process, evidence, and outcome for the firm's annual evaluation of its SoQM. This included how other sources of information on audit quality and the firm's SoQM were considered, and how matters were aggregated. We did not independently perform, or reperform, the firm's overall annual evaluation.

As ISQM (UK) 1 is focused on how firms achieve iterative improvement, we considered how the firm is developing its SoQM, including in response to the findings we shared during the inspection period. Our inspection findings in this area are reflective of our assertive and forward-looking approach as we seek to support firms in their development of effective, proportionate SoQMs.

Key findings

- Responses to quality risks – Identification and performance of testing: Some responses to quality risks were not deemed by the firm as controls. These responses included training events, review panels, and requirements for performance objectives and appraisals. The firm did not always perform sufficient design and implementation assessments and operating effectiveness monitoring for these responses.

- Responses to quality risks: In the context of the responses we reviewed:

- The description of some responses deemed controls were not sufficiently detailed to demonstrate clearly how these mitigated the quality risks and covered all specified responses per ISQM (UK) 1. The design assessments did not demonstrate consistently how each risk was sufficiently mitigated by responses, individually or in aggregate.

3. Review of the firm's system of quality management

-

Monitoring: In the small sample reviewed, the firm did not always demonstrate how each relevant element of the responses was operated and, for the monitoring of the elements of responses with high levels of judgement, the firm did not always demonstrate how it monitored that a robust review was performed.

We also understand the firm has commenced an enhancement programme to identify which responses, that were not deemed controls, were relied upon to mitigate risks and to improve the assessment and monitoring of these. We also understand the firm plans to improve the granularity, design assessments, and monitoring for control responses. - Assessment of root cause analysis (RCA) themes: The firm did not demonstrate sufficiently how it fully considered the impact of RCA themes, from audit inspection findings, on the effectiveness of its SoQM, including how it was satisfied that its existing responses sufficiently mitigated the risk of these causal factors recurring. We understand that the firm is enhancing this in its 2024 evaluation.

Good practice

- The design assessments for some responses identified clearly the evidence expected to conclude that the response was operating consistently.

- The firm has established a rebuttable threshold for what audit inspection and independence compliance testing results would give rise to a finding in the SoQM. This increased the consistency and clarity of the firm's assessment.

- The support for the firm's annual evaluation clearly demonstrated how numerous inputs were considered and senior leadership's review of each.

Relevant ethical requirements - Compliance with the FRC's Revised Ethical Standard 2019

In the current year, we evaluated the firm's compliance with the Ethical Standard. We focused our work on non-audit services. Our targeted sample testing included: checking for the provision of prohibited services; reviewing independence threats and safeguards assessments; and evaluating the completeness of independence reporting made by component auditors to the group auditors.

Key findings

- Threats and safeguards assessments: In the prior year, we reported that the firm did not perform sufficiently robust assessments of independence threats and safeguards for non-audit services. We identified a further instance for one of 32 non-audit services reviewed in our current year. In March 2023, the firm introduced new initiatives to enhance subsequent assessments, with a quarterly testing programme to test compliance. Our current year sample precedes these enhancements.

Good practice

- The firm undertook comprehensive checks to ensure completeness of non-audit services provided by component auditors. For one UK group, this included reconciling the audited UK group's fee approval request to the firm's approval and agreeing all the UK group's global charge codes to the Audit Committee pre-approvals every quarter.

3. Review of the firm's system of quality management

ISQC (UK) 1: Training and methodology

Given the transition to ISQM (UK) 1 we performed our final supervision of training and methodology under ISQC (UK) 1. We reviewed the firm's processes for identifying methodology updates and training needs. We also considered how the methodology updates and training were then designed, approved, and communicated to the audit practice. We paid specific attention to revisions following changes to ISA (UK) 240 and ISA (UK) 315. We also reviewed the firm's training processes, including monitoring attendance and evaluation of learning objectives.

No key findings were identified at the firm.

Good practice

- Prior to promotion to manager, all assistant managers are subject to a working paper review exercise to assess potential areas where the staff member may require additional training.

Our SoQM inspection work is undertaken on a risk-focused, cyclical basis. This is supported by targeted thematic work on particular aspects of firms' SoQMs. In this current year, we conducted four audit thematic reviews on the Tier 1 firms to complement our monitoring of ISQM (UK) 1. The areas covered in these thematic reviews were: Sampling; Hot Reviews; Network Resources and Service Providers; and Root Cause Analysis. Published reviews can be found here.

4. Forward-looking supervision

We take a risk-based, assertive and proportionate approach to the supervision of firms, which is complementary to our programme of inspections. We balance holding firms to account to take prompt action to address quality findings, with acting as an improvement regulator and sharing good practice to facilitate improvements across the sector. A Supervisor dedicated to each firm draws together evidence and indicators of risks, identifying and prioritising what firms must do to improve audit quality and enhance resilience, alongside identifying what could go wrong in the future.

Our observations from the work we have conducted this year, and updates on what more the firm must do in respect of previous observations are set out below. Where we raise key findings, we require the firm to include actions in their Single Quality Plan (SQP).

Single Quality Plan and other quality initiatives

We require all Tier 1 firms to maintain an SQP to drive measurable improvements in audit quality and resilience, and to demonstrate the effectiveness of actions taken. The SQP ensures that action in the most critical areas is prioritised and enables firms to be held to account by us and their non-executives.

Observations

The SQP is well integrated with the firm's strategic quality plan and sets out clear actions that are designed to improve audit quality. Since last year, the firm has made good progress developing and implementing a tool to monitor the completion of actions within the SQP and to enhance reporting of the SQP to support effective oversight by firm leadership and independent non-executives.

The firm must continue to develop how it measures the effectiveness of the actions taken and of the SQP as a whole. Where appropriate, these measures must include specific objectives where the firm has pre-determined what a good outcome will be.

Root cause analysis

Root cause analysis (RCA) is an important part of an effective continuous improvement cycle designed to identify the causes of quality issues so that action can be taken to address the risk of recurrence. Further, ISQM (UK) 1 has made RCA a requirement for all firms when deficiencies are identified in the system of quality management.

Observations

EY's approach to RCA for individual audit engagements is well developed. The reviews are performed under an established methodology and consider a wide range of information. Actions for the firm are tracked through the SQP and actions for individual audit team members are tracked with evidence retained to support their completion. The firm continues to run focus groups alongside the RCA process to get a real time perspective on factors impacting audit quality.

A separate team performs RCA on deficiencies identified in the SoQM. This team has had training on RCA techniques and tailors its methodology for specific firm-wide matters.

4. Forward-looking supervision

Continuous engagement and holding the firm to account

We hold firms to account to take prompt action to address quality findings and set an appropriate tone from the top.

Observations

- Tone at the top: The firm remains clear and consistent in its communications around the importance of audit quality. Audit leadership have shared detailed examples of good practice to bring to life their messages.

- Constructive engagement: We have engaged on one constructive engagement case during the period. The firm took prompt action aimed at preventing any recurrence of the findings.

- Non-financial sanctions (NFS): One NFS, which was opened in a previous period, has been completed. A further NFS has been opened in the period. The firm will report to the FRC on the effectiveness of its actions to improve audit quality in the related areas over the next 12 months.

- Progress against strategic quality priorities: The firm has continued with the same priority areas for the first half of 2024, being greater standardisation & simplification, more effective coaching & support, reducing & rebalancing work intensity, and audit culture. We agree that these are the right areas to prioritise. The firm has implemented a number of actions during the period and continuing with the same priority areas is a fair reflection of these being broad topics that require continued investment and focus. The firm must, however, maintain and in some cases increase momentum, including to reduce and rebalance work intensity where necessary. The firm is in the process of finalising its Audit Quality Strategy for FY25.

Emerging risks and trends

Our forward-looking supervision aims to aid firms by identifying risks from emerging trends before quality issues occur.

Observations

- Changing delivery models: The firm has been considering different ways to use onshore and offshore delivery centres. Any changes made to the nature and extent of work performed in such centres will require the firm to evaluate whether its quality control processes remain appropriate.

- Financial interest compliance rates: The firm's monitoring continues to identify too many instances where managers in non-audit service lines have not complied with the firm's personal independence policies. There is now a three-year trend of declining results. This creates an increased risk that the firm could breach independence rules. The firm is considering the root cause of this pattern of behaviour and is designing and undertaking remedial actions to address it.

Recruitment: There were concerns at a number of firms over the susceptibility of online recruitment tests to cheating. EY has taken strong action to mitigate such risks by reducing the online element of the process and holding in person assessment centres for candidates which include interviews, group and written exercises, and numerical reasoning tests.

Appendix A – Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements (Audit Quality Review, or internal AQR). We have not verified the accuracy or appropriateness of these results. The appendix should be read together with the firm's Transparency Report for 2023 and its 2024 report (when published) which provide further detail of the firm's internal quality monitoring approach, results, root cause analysis, remediation, and wider system of quality control. Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring are not directly comparable to those of other firms or external regulatory inspections.

Results of internal quality monitoring 11

The results of the firm's 2023 internal AQR and two previous years are set out below. The firm's 2023 internal AQR comprised inspections of 118 individual corporate audits (2022: 126) with financial year-ends between 31 December 2021 and 31 March 2023 inclusive.

Chart showing "Results of internal quality monitoring"

This chart displays the percentage of audits with different finding categories over three years.

| Category | 2021 | 2022 | 2023 |

|---|---|---|---|

| No or minor findings | 91% | 87% | 90% |

| Findings that were more than minor but less than material | 7% | 11% | 9% |

| Material findings | 2% | 2% | 1% |

Themes arising from internal quality monitoring

Whilst in 2023 90% of audits reviewed had no or only minor findings, one (1%) of the 118 engagements reviewed had a material finding. The material finding driving the rating on this engagement was insufficient procedures performed in relation to goodwill and intangible assets impairment.

Eleven engagements had grades that were driven by findings that, whilst not concluded as material, were not minor. These findings related to: specific aspects of substantive testing; insufficient or missing audit documentation; non-compliance with an EY policy; non-bank confirmation procedures, including alternative procedures; missing evidence of timely partner in charge review in isolated areas of the audit; IT general controls testing; and communications with those charged with governance. The latter four topics were newly identified as more than minor findings in 2023.

Appendix B – EY's responses and actions

A. Review of individual audits and the firm's system of quality management (SoQM)

We have again observed this cycle that the majority of the key areas identified as requiring improvements in audit quality overlap with examples of good practice. This is in line with the findings from our root cause analysis (see Section B) which show that our focus on consistency needs to be maintained.

We value the insights and independent perspective provided by our regulators as an important input into our refreshed Audit Quality Strategy (see Section C). We know that a key enabler to achieving consistency is our Purpose-led Culture (see Section D), which unites our people around the common purpose of serving the public interest.

Our accelerated RCA process and conscious targeting of timely interventions ensures that ongoing audits can benefit from the learnings of the review cycle as it progresses. Actions taken and planned include:

- Releasing bespoke coaching packs for journals, revenue and impairment.

- Delivering training on prospective financial information, journals, and the recoverability of investments in subsidiaries; including details of inspection findings and common issues.

- Enhancing our existing standardised work programme for impairment, which has led to good practice findings, to prompt further challenge of extended period forecasts and extrapolated growth rates, and to include reminders on parent company investment balances.

- Developing good practice examples of documentation, with further examples planned.

- Delivering ISA 220 training to educate audit teams on review and supervision responsibilities.

In certain areas, we have taken the decision to mandate additional involvement from specialists. This includes mandating technical consultation to support teams with assessing deferred tax asset recoverability, and mandating specialist involvement in assessing new or updated impairment models where certain criteria are met.

Each of these actions have been supplemented by communications to the audit practice via emails and webcasts.

At the same time, we are learning from the many occasions where we do good audits. This rebalanced focus is intended to encourage and demonstrate the benefits of working as a team and investing in our people; making the profession and our firm an attractive place to be.

We welcome the FRC's acknowledgement of the steps already taken in relation to firmwide findings identified. We expect the evidence of the success of these interventions and further actions, particularly relating to ethics and independence, to be apparent in subsequent years.

We have committed to a number of actions to iterate our SoQM. We have re-assessed the suite of structures, activities and processes in place prior to the implementation of ISQM (UK) 1 and determined which of these we will bring into our formally assessed SoQM. As part of this, we have more clearly articulated how each response addresses defined quality risks, individually or in aggregate.

Our automated Single Quality Plan (SQP) brings together each individual responsive action; facilitating ongoing review of their status by our Audit Quality Executive, and governance and oversight by our Audit Non-Executives. Effectiveness of the actions are assessed within the SQP, and themes arising from engagement inspections and root cause analysis, will be linked back to the system of quality management to determine if SoQM responses are effective or require enhancement.

Appendix B – EY's responses and actions

B. Root cause analysis (RCA)

We have maintained our investment in RCA, covering all FRC inspections, half our ICAEW inspections, all audits with more than minor findings from our own internal monitoring inspections, and other areas from firmwide reviews.

Our RCA process also focuses on positive quality outcomes. Understanding the behaviours and circumstances that drive strong results is as key to enabling consistent delivery of high-quality audits as understanding when our expected standards slip.

We continue to observe that senior members of each audit team have a critical role in fostering a team culture that is conducive to individuals having high levels of personal motivation and commitment to the audit team. Upfront involvement at senior levels correlates to high audit quality, whereas later involvement and less supervision can lead to less effective review, and poorer audit quality. In response, we have produced a Strong team culture guide which illustrates the factors that enabled teams to foster a strong team culture and thus achieve good audit quality.

Findings relating to the carrying value of subsidiaries were caused by a gap in knowledge, which has been addressed through targeted communications to potentially impacted audit teams, and additional guidance and training. This will be supplemented by case studies in face-to-face training being delivered over the summer.

The root causes relating to the remaining FRC findings are disparate in nature. They include failure to respond appropriately to late delivery by management of audit evidence, challenges in resourcing, and failure to prioritise appropriately.

Our findings are therefore:

- There is a clear link between a high degree of engagement by more senior members and a strong team culture.

- Adapting to the evolving circumstances of the engagement; adjusting priorities and increasing resources accordingly is critical to ensuring appropriate review and supervision.

- Audit teams need to consistently 'stand-back' and consider their findings and any contra-evidence before concluding.

- Where audit teams have taken advantage of existing standardised work programmes we see fewer findings in regulatory reviews. For example, we have seen that our investment in developing standardised programmes for group oversight has meant that we have received no key findings in this area over the past two years, and good practice examples identified by both the FRC and ICAEW in this area. Therefore, we will focus on increasing rates of implementation.

C. Audit Quality Strategy

Where we achieve positive grades in our FRC, ICAEW and internal reviews, we demonstrate our ability to achieve high-quality outcomes. We continue to challenge ourselves, reflecting on whether our Audit Quality Strategy remains appropriately targeted to achieving this consistently. We have revised our Audit Quality Strategy, for FY25 factoring in findings from our RCA, regulator insights, feedback from our people, and horizon scanning of emerging risks and opportunities.

Our Purpose-Led culture underpins our Strategy. The factors which led to the three key priority areas which were first introduced in FY23 and refreshed for FY24, continue to be important for FY25:

- Greater standardisation and simplification;

- More effective coaching and support; and

- Rebalancing work intensity.

Appendix B – EY's responses and actions

However, to accelerate consistency of execution we will refresh our strategy, challenging ourselves on whether there are new skills or changes in culture that are required.

Core to our strategy will be ensuring our people take pride in delivering high-quality audits, taking personal ownership for getting things right first time and enabling others to do likewise. We will:

- Refresh the breadth and depth of our standardisation and simplification programme to enable more people to achieve more consistent output.

- Enhance our coaching and teaming skills further to enable our people to continue to learn, develop and feel valued.

- Explore how we can address any softer skills gaps through enhanced training or development, including project management.

We remain committed to rebalancing work intensity as an organisation, and our strategy focuses on achieving this as a key outcome. We want to make sure our people feel supported in their roles. This support includes providing them with psychological safety to speak up and voice any concerns.

D. Our Purpose-Led Culture

Our purpose-led culture remains central to our Audit Quality Strategy.

It leads to teamwork and gives our people the support and confidence that they need to constructively challenge themselves, those around them and the companies that we audit.

Our Audit Quality Culture survey assesses the extent that the culture experienced by our people on a daily basis maps to one which they believe is necessary to deliver high-quality audits.

Our 2023 results show a high correlation between the two - 96%, a 10% increase from the previous year showing our people are describing our culture in increasingly positive terms. Areas for improvement or reinforcement are addressed via our Culture of Audit Quality Roadshows. For example, we recently used them to support teams in feeling more confident to challenge within the teams and business units within which they work. In recognition of the importance of the wider audit eco-system, we have expanded the workshops to our offshore delivery centre and specialists.

We continue to emphasise the importance of personal accountability, reinforcing this through setting clear role expectations. Finally, we are empowering our teams to hold others to account, both internally and the management of the companies we audit.

Our recently formed Culture Executive Committee consists of senior members across our business and meets monthly to discuss audit culture-related matters, develop our cultural initiatives and programmes and monitor the ongoing culture of our audit practice.

Each quarter, our root cause analysis lead and our Managing Partner for Talent & Ethics also attend and ensure that we are connected to the broader firm's culture initiatives.

E. Looking ahead

We are proud of the diligent, committed professionals in our teams, who seek to apply their training and to do the right thing in challenging circumstances. We encourage our people to take personal pride in audit, being very conscious of our public interest responsibility and the role that we play in making the audit profession attractive and fulfilling.

We are committed to the ongoing journey of delivering consistent, high audit quality.

Appendix C – ISQM (UK) 1 Glossary

The following definitions were extracted from ISQM (UK) 1 12.

| Term | Definition |

|---|---|

| System of quality management (SoQM) | A system designed, implemented and operated by a firm to provide the firm with reasonable assurance that:

|

| Quality objectives | The desired outcomes in relation to the components of the system of quality management to be achieved by the firm. |

| Quality risk | A risk that has a reasonable possibility of:

|

| Response | Policies or procedures designed and implemented by the firm to address one or more quality risk(s) in relation to its system of quality management:

|

| Findings | Information about the design, implementation and operation of the system of quality management that has been accumulated from the performance of monitoring activities, external inspections and other relevant sources, which indicates that one or more deficiencies may exist. |

Appendix C – ISQM (UK) 1 Glossary

| Term | Definition |

|---|---|

| Deficiency | A deficiency in a firm's system of quality management exists when:

|

| Ultimate responsibility | Individual(s) assigned ultimate responsibility and accountability for the firm's SoQM should evaluate the SoQM, on behalf of the firm, and shall conclude, on behalf of the firm, whether or not the SoQM provides the firm with reasonable assurance that the objectives of the SoQM are being achieved, required under ISQM (UK) 1 paragraph 54. |

Diagram showing ISQM (UK) 1 Annual Evaluation components

The diagram illustrates eight interconnected components around a central "ISQM (UK) 1 Annual Evaluation" hub:

- Risk Assessment

- Governance & Leadership

- Relevant Ethical Requirements

- Acceptance & Continuance

- Engagement Performance

- Resources (Human, Intellectual & Technological)

- Information & Communication

- Monitoring & Remediation

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

Visit our website at www.frc.org.uk

Follow us on Linked in or X @FRCnews

-

The six Tier 1 firms in 2023/24 were: BDO LLP, Deloitte LLP, Ernst & Young LLP, KPMG LLP, Mazars LLP, and PricewaterhouseCoopers LLP. With effect from 1 June 2024, Mazars LLP changed its name to Forvis Mazars LLP. We have published a separate report for each of these firms along with a cross-firm Annual Review of Audit Quality. ↩

-

The new standard is a significant change to ISQC (UK) 1, requiring firms to take a more proactive and risk-based approach to managing quality. The standard also required a step change in firms' monitoring, as well as the introduction of a self-evaluation of their SoQM. Page 10 of the Annual Review of Audit Quality sets out the key differences. ↩

-

Appendix B section C ↩

-

Appendix B Section D ↩

-

Appendix B Section B ↩

-

Source – the FRC's analysis of the firm's PIE audits and other audits included within AQR scope as at 31 December 2023. ↩

-

Source – the FRC's 2022, 2023 and 2024 editions of Key Facts and Trends in the Accountancy Profession. Audit fee income relates to all audits performed by the firm, and not only those within the FRC's inspection scope. ↩

-

Source – the ICAEW's 2024 QAD Report on the firm. ↩

-

Excludes the inspection of local audits. ↩

-

Source – the FRC's analysis of Major Local Audits as of 31 March 2023. The FRC's inspections of Major Local Audits are published in a separate annual report. The December 2023 report can be found here. ↩

-

The finding categories used by the firm (which drive the related gradings) are: Minor findings generally require additional explanation or limited additional documentation for clarity of the audit file; More than minor findings typically require more detailed documentation improvements or arise when a more significant piece of audit evidence was omitted from the audit file; Material findings either require additional audit procedures to be performed subsequent to the audit report or significant remediation of the audit file. ↩

-

https://media.frc.org.uk/documents/ISQM_UK_1_Issued_July_2021_Updated_March_2023.pdf ↩