The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

What Makes a Good Annual Report and Accounts

1. Foreword

Sarah Rapson Executive Director of Supervision

The annual report and accounts (ARA) is the cornerstone of corporate reporting. It should provide investors with clear and relevant information on the company's performance and prospects to help them make informed investment decisions and promote effective stewardship. ARAs are also used by other stakeholders to inform their decisions. It is vital, and in the public interest, that ARAs are high quality.

Some companies rise to the challenge and produce high quality ARAs in which the narrative reports and the financial statements, supporting each other, provide reliable decision-useful information for stakeholders. Unfortunately, some companies publish ARAs that are long and full of boilerplate text, with the key messages lost in excessive detail.

Preparing a good ARA is a demanding exercise given the complexity of most businesses and the growing – and often challenging– reporting requirements. This task is further complicated by the different information needs of stakeholders.

Nevertheless, producing a high quality ARA is worth the effort. Research shows that companies with higher quality ARAs tend to have lower costs of debt and equity capital, more accurate analyst earnings forecasts and more constructive, insightful and well informed dialogue with investors. 12

Furthermore, high quality corporate reporting is less likely to be subject to regulatory intervention by the FRC or another body.

This document sets out the FRC's view on the attributes of a good ARA from our perspective as an Improvement Regulator. It draws heavily on previous FRC publications and is informed by our day-to-day work.

In setting out these attributes, we use a principles based framework that identifies corporate reporting principles and effective communication characteristics. Where possible, we provide published examples to bring the underlying principles to life.

An assumption that underpins this publication is that a good ARA must comply with the relevant legal, regulatory, financial reporting and code requirements. However, preparing a high quality ARA is more than just a compliance exercise.

Every business is different and, as a result, what a good ARA looks like will vary between individual entities. This makes it difficult to provide an answer to what good looks like that can be applied to every company. We have, however, identified the characteristics generally associated with a high quality ARA, which we hope that preparers, committee chairs and company secretaries will find helpful when preparing their next ARA.

2. Using this publication

The examples presented in this publication will not be relevant for all companies or all circumstances, but each demonstrates a particular characteristic of a high quality ARA. Inclusion of an extract from a company's ARA should not be seen as an evaluation of that company's reporting as a whole; nor does it provide any assurance or confirmation of the viability or going concern of that company, and should not be relied upon as such.

The principles identified in this document can be applied to the entirety of the ARA. These principles apply irrespective of the company's listing status, size or GAAP.

The opportunities for improvement and illustrations of better practice are identified as follows:

- Represents good quality application that we encourage other companies to consider when preparing their ARA.

- Represents issues identified in ARAs in our role as regulator.

- Represents the ways in which a company may improve the quality of its reporting.

3. Attributes of a good annual report and accounts

A high quality ARA:

- complies with relevant accounting standards, laws and regulations, and codes;

- is responsive to the needs of stakeholders in an accessible way; and

- demonstrates the corporate reporting principles and effective communication characteristics outlined in this publication.

Compliance is an essential element of a good ARA and is a focus of the FRC's work, supplemented by insights into better practice highlighted within our publications on how best to apply relevant GAAP, codes and regulations.

This publication does not provide specific details on how to meet the requirements of accounting standards, laws and regulations, and codes. There is, however, overlap between matters of compliance and other attributes of good corporate reporting. The good reporting principles in this publication are relevant to informing an approach to compliance.

Appendix 2 contains links to several FRC resources which provide suggestions on how to approach compliance with accounting standards, laws and regulations, and codes. Appendix 3 provides details of the process a company could follow to help deliver a high quality ARA.

The remainder of this publication assumes that the ARA complies with accounting standards, laws and regulations, and codes.

Attributes of a high quality ARA

We have distinguished the attributes of high quality corporate reporting from effective communication principles but acknowledge there may be overlap. Materiality must be considered in applying both sets of principles as should the size and complexity of the business to ensure that the breadth and depth of the ARA is commensurate with the business.

Diagram: The Hierarchy of a Good Annual Report and Accounts

This pyramid diagram illustrates the foundational elements and progressive attributes of a high quality Annual Report and Accounts (ARA).

- Apex: Good annual report and accounts

- Second Layer: Effective communication principles

- Third Layer: Corporate reporting principles

- Base: GAAP, law and code requirements met

A central vertical arrow labeled "Materiality" spans from the base to the second layer, indicating its pervasive importance across all levels.

Corporate reporting principles

Corporate reporting principles are the overarching qualitative characteristics of a good ARA.

Effective communication principles

Communication principles focus on how information can be delivered to users.

Diagram: Materiality, Corporate Reporting Principles, and Effective Communication Principles

This diagram shows "Materiality" as a central horizontal bar, with two main blocks beneath it, both indicating they are crucial for "Good ARAs take ACCOUNT of corporate reporting principles and the 4Cs of effective communication".

Left Block: Corporate reporting principles * Accurate * Connected and consistent * Complete * On-time * Unbiased * Navigable * Transparent

Right Block: 4Cs of effective communication * Company specific * Clear, concise and understandable * Clutter free and relevant * Comparable

4. Materiality

4.1 Materiality

Materiality is the bedrock of corporate reporting. It is a fundamental concept embedded in accounting frameworks and the primary tool that helps companies to focus on key matters for them and their stakeholders. Materiality informs the breadth and depth of what needs to be included in the full ARA.

Information is material if omitting it or misstating it could influence the decisions and assessments of ARA users.

Materiality applies to all transactions, balances and disclosures – both numerical and textual – in the ARA, not just those transactions affecting the accounts.

What is material in any part of the ARA will be determined by quantitative 3 and qualitative 4 factors but also by their nature or context.

When considering the information to present to meet the needs of the users, it is important that materiality is determined in the context of both the entity's business and any additional relevant and authoritative guidance in respect of specific elements of the ARA. For example, the strategic report (4.6), TCFD related disclosures (4.7) and the UK Corporate Governance Code (4.8). As a result, whether a particular piece of information is material will vary between entities.

In this publication we discuss materiality and its interaction with relevance in the context of IAS 1 'Presentation of Financial Statements', the Conceptual Framework for Financial Reporting, and the IFRS Practice Statement ‘Making Materiality Judgements, Practice Statement 2'. However, the contents of this section are relevant to UK GAAP preparers and are applicable to the ARA as a whole.

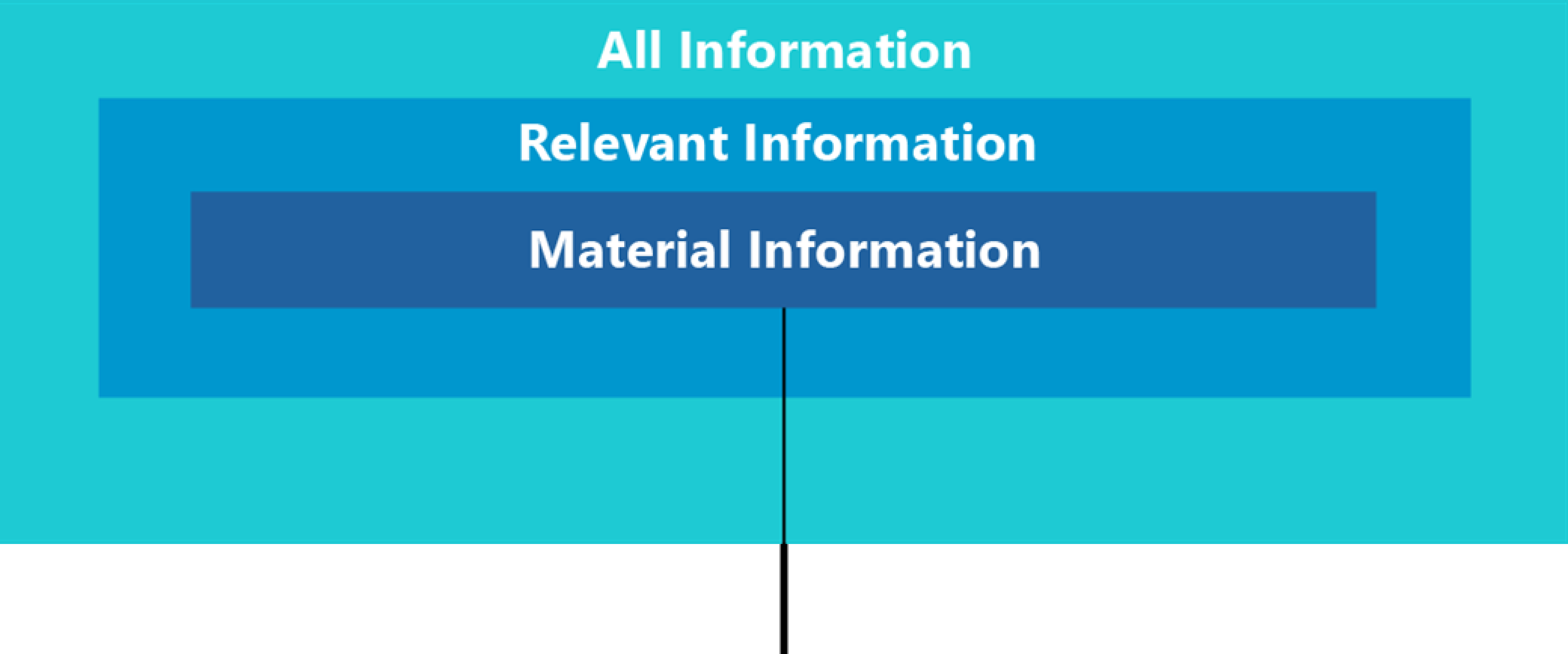

4.2 Materiality and Relevance

Information in the ARA needs to be useful. To be useful, it must be relevant and represent faithfully what it purports to represent. Information is faithfully represented when it is complete, neutral and free from error. We cover these concepts within Complete, Unbiased and Accurate, respectively.

Relevant financial information is capable of making a difference in the decisions made by users. Information may be capable of making a difference in a decision even if some users choose not to take advantage of it or are already aware of it from other sources.

Information is likely to be relevant to users if it: * has predictive value; * has confirmatory value; or * provides information in respect of the organisation's ability to create (or lose) value.

The relevance of a specific piece of information will vary between entities. This is because the information has to be considered in the context of the entity's business. For example, disclosure of research and development activities and expenditure will be more important in a pharmaceutical company than for companies in many other sectors.

If an ARA were to include all relevant information, it would become overly long, too detailed and lose its usefulness. To avoid this, materiality is applied to relevant information to determine what should be disclosed, ensuring that key information is not lost in distracting detail.

Information can be material, either on the basis of quantitative factors, qualitative factors or both. Materiality should be determined in the context of the entity's business. Whether a particular piece of information is material will vary between entities.

4.3 Quantitative factors

To assess whether information is quantitatively material, companies should consider the size of the impact of: * the transaction, other event or condition compared against measures of the entity's financial position, financial performance and cash flows; and * any unrecognised items that could affect the users' overall perception of the company's financial position, performance and cash flows.

The transaction, other event, condition or unrecognised item would be considered quantitatively material if the size of its impact is likely to influence users' decisions about providing resources to the entity or their perception of its performance or future prospects.

Determining whether something is quantitatively material is a matter of judgement, not a mechanical exercise. Common benchmark examples include revenue, profitability, balance sheet ratios and cashflow measures, but the benchmark used should be that which is most appropriate in the context of the business and of greatest value and interest to the users.

For example, a property investment company is likely to use a balance sheet ratio as a benchmark because investors assess its performance on a net asset basis; whereas a manufacturer is likely to use a profitability benchmark as investors are more likely to assess performance on an earnings basis.

Auditors of financial statements must also assess their materiality. This is a matter of professional judgement, and is influenced by the auditor's perception of the financial information needs of users of the financial statements. 5

Where auditor materiality is disclosed in the auditor's report, 6 users are likely to assume that the company has used a similar quantitative materiality in their approach to the preparation of the accounts. When this is not the case, the company may wish to disclose details of their assessment.

4.4 Qualitative factors

Qualitative factors are those factors other than size. Determining whether something is material as a result of a qualitative factor is also a matter of judgement.

Examples of qualitative factors are: * involvement of a related party of the entity; * uncommon or non-standard features of a transaction or other event or condition; * unexpected variation or unexpected changes in trends. For example, a quantitatively immaterial amount might be considered material if it reverses a long-standing trend or is unexpected; or * those that affect risk or may affect future rather than historical results, for example, the loss of a major customer.

Each of these indicators should be considered in the context of the business when determining whether something is material. For example, the entity's location, its sector or the state of the economy may make certain information of higher priority to users. A company with immaterial operations in a previously politically stable country may need to disclose additional information in the event of significant political unrest.

4.5 Interaction between qualitative and quantitative factors

Qualitative factors may reduce the materiality threshold derived from quantitative factors. For example: * some matters are likely to be so significant to users that they will be material regardless of quantum. Examples may include regulatory fines, and transactions with related parties and directors; * some disclosures must be made to comply with legal requirements, irrespective of their perceived materiality, for example, SECR disclosures; and * some items cannot be assessed quantitively.

Evidence of qualitative factors being used to increase quantitative materiality for certain transactions, events or conditions is likely to prompt regulatory challenge.

Flowchart: Materiality Disclosure Assessment

This flowchart illustrates the decision process for assessing whether an item should be disclosed based on materiality.

- Start: "Is the disclosure required by law or regulation irrespective of materiality?"

- If Yes → Disclose

- If No → "Is the item quantitatively material?"

- If Yes → Disclose

- If No → "Does the item have characteristics which may suggest it is qualitatively material?"

- If Yes → "Does the significance of the item's qualitative characteristics mean it is likely to influence ARA users?"

- If Yes → Disclose

- If No → Omit

- If No → Omit

- If Yes → "Does the significance of the item's qualitative characteristics mean it is likely to influence ARA users?"

4.6 Materiality and the strategic report

The concept of materiality is implicitly recognised in the strategic report requirements, which include filters such as 'principal' risks and uncertainties and 'key' performance indicators.

It may be harder to assess items in the strategic report on a quantitative basis. As a result, qualitative factors will often have a greater influence in determining materiality. When making an assessment of materiality for the strategic report, the board should consider: * the significance of the matter relative to the entity's business model and strategy; and * the potential magnitude of future effects of a matter on the entity's development, performance, position or future prospects.

For example, the directors should consider the implications for the company's long-term value generation arising from stakeholder, legal or regulatory responses when determining whether the impact of the entity's activities on the environment is material.

The approach taken to assess the materiality in the strategic report can be applied to the whole ARA including other narrative reporting unless there are requirements that: * are more specific; or * mandate the disclosure of information irrespective of materiality.

See Interaction between qualitative and quantitative factors.

We encourage preparers to consult section 5 of 'Guidance on the Strategic Report (June 2022)’ 7 which provides direction on how to determine materiality in the context of the strategic report.

4.7 Materiality and TCFD related disclosures

Under the TCFD framework organisations should determine materiality for climate-related issues consistent with how they determine the materiality of other information included in their ARAs.

The TCFD cautions organisations against prematurely concluding that longer-term climate related risks and opportunities are immaterial.

Listing Rule 9.8.6R provides further criteria for companies to consider when preparing listing rule compliant TCFD disclosures.

We encourage companies to disclose the basis on which they have assessed the materiality of climate-related disclosures. This helps readers to understand whether materiality considerations have driven omissions of recommended disclosures, or whether disclosures have been omitted for other reasons such as the non-availability of information.

See '[CRR Thematic review of TCFD disclosures and climate in the financial statements.'] 8

4.8 Materiality and the UK Corporate Governance Code

Materiality is not explicitly referred to within the Code. Effective communication should ensure that shareholders are able to evaluate the application of the Principles and reporting against the Provisions. Companies can demonstrate the effectiveness of their policies and procedures by explaining the impact on decision making or company strategy.

5. Corporate reporting principles

In producing a good quality ARA, preparers should take ACCOUNT of the following corporate reporting principles: * Accurate, Connected and consistent, Complete, On-time, Unbiased, Navigable; and Transparent.

5.1 Accurate

When aiming to produce a good quality ARA that meets user needs, preparers should ensure the ARA is accurate. An accurate ARA is free from material misstatement and error. Determining whether an ARA is free from material misstatement and error is judgemental as misstatements and errors must be considered in the context of both materiality (see Materiality) and the entity's specific circumstances.

The accuracy of the ARA depends, to a large extent, upon the quality of the company's underlying data supporting both financial and non-financial information. Companies need to: * develop effective information systems to collect relevant and complete data; * introduce robust internal controls to maintain data and protect its integrity; and * apply an accounting system that enables data to be retrieved and reported fully and faithfully. 9

This is of increasing importance as the range and nature of required data, particularly in respect of ESG reporting, continues to develop and expand into new areas of activity.

When information presented in narrative reporting is not derived from the accounting system, it should be evidence based.

We encourage companies to disclose the sources of significant facts and claims made in the narrative reporting, where they are important for a user's understanding.

Language used in narrative reporting needs to be specific and not open to misinterpretation by users, it should also be balanced. See Unbiased.

Some directors may be concerned about their personal liability for providing forward-looking narrative information. The 'safe harbour' provisions (s463 CA06), which apply to information contained within the strategic report, the directors report, and the directors' remuneration report, limit the directors' liability to misleading statements or omissions knowingly or recklessly made. This should allay concerns about including forward-looking analysis.

A premium listed company's ARA must state clearly whether or not it has complied throughout the accounting period with all relevant provisions of the UK Corporate Governance Code. Any areas of non-compliance must be disclosed and supported by a meaningful explanation. See 'Improving the quality of 'comply or explain' reporting'. 10

Data capture controls and systems may require updating for changes in accounting standards, regulations or codes and, in some cases, entirely new systems will need to be created. Companies should plan ahead for these changes, which can take some time to implement and involve considerable investment.

Companies may use approximations or shortcuts to determine figures in the ARA. For example, a simple interest rate rather than the effective interest rate method may be acceptable when the resulting information is materially correct.

Information presented in narrative sections (such as sustainability information) often comes from management systems not subject to financial reporting disciplines or audit. 11

Consideration should be given to both the effectiveness of the controls and the level of assurance required over such information in order to ensure its accuracy.

Certain disclosures prepared solely for the ARA (for example tax disclosures and cash flow statements) are often derived from management information systems but are prepared using non-routine processes subject to fewer controls and reviews. Such disclosures are more susceptible to error, estimation uncertainty and manipulation.

To be confident of its accuracy, management should consider both the sufficiency and effectiveness of the controls over information prepared solely for the ARA as perceived material errors may attract regulatory enquiry.

Clear accountability, not just for the individual sections of the ARA but for its overall quality, and a comprehensive and coordinated review process will help resolve these issues. Appendix 2 provides further information but such a process would involve: * identifying and correcting factual inaccuracies and material errors; * ensuring that judgements taken and significant estimates made are appropriately disclosed; * considering whether or not the ARA reflects the requirements of current GAAP and legislation; and * ensuring that financial information presented is consistent throughout the report and consistent with the non-financial information. See Consistency.

Some information in the ARA, often forward-looking information, is subject to significant estimation uncertainty. Appropriate disclosure is vital to explain the uncertainty in the figures.

For areas of significant estimation uncertainty, we expect: * the assumptions used to be reasonable in the context of the business; and * appropriate disclosures to be presented which usually requires quantification of the key assumptions and a sensitivity analysis to explain how changing the assumptions would affect the figures recognised in the financial statements.

5.2 Connected and Consistent

A good ARA tells the story of the business using a package of reports. For this story to make sense, the reports should be connected and consistent.

5.2.1 Connected

An ARA is connected when information on the same or related subject matter, either within the same section or in different parts of the ARA, is linked together so that users can understand how the elements interact.

Linkages 12 are relationships or interdependencies between, or the causes and effects of, facts and circumstances disclosed in the ARA. Effective linkages can provide greater insight into the entity's business and enhance the ARA; for example by highlighting and explaining the linkages between: * culture, purpose, values, and strategy; * principal risks and uncertainties and key performance indicators; * the drivers of directors' remuneration and the entity's KPIs, purpose, value and strategy; * climate-related risks and transition plans disclosed in the narrative reporting and amounts in the financial statements; 13 * the business model and the financial performance, position and the future prospects of the company; and * clearly defined APMs and IFRS numbers. See Comparable.

In discussing relationships and interdependencies, a company should focus on those that are most relevant to an assessment of its development, performance, position and future prospects.

Reporting requirements often mandate that certain disclosures are made in particular reports. This can result in information on the same or a related subject matter being included in more than one report.

Many users have access to various versions and formats of the ARA including the official Structured Digital Report, (see On-time) unofficial PDF and web versions, and a printed version. Companies may wish to consider the best way of achieving effective linkage across these different formats, such as sign-posting, cross-referencing, and potentially hyperlinks (or a combination where allowed).

Where hyperlinks to other documents are used, consideration should be given to the implication for assurance and usability. See Completeness.

Icons can be useful if they are distinct, clearly defined in a glossary and relate to easily identifiable information.

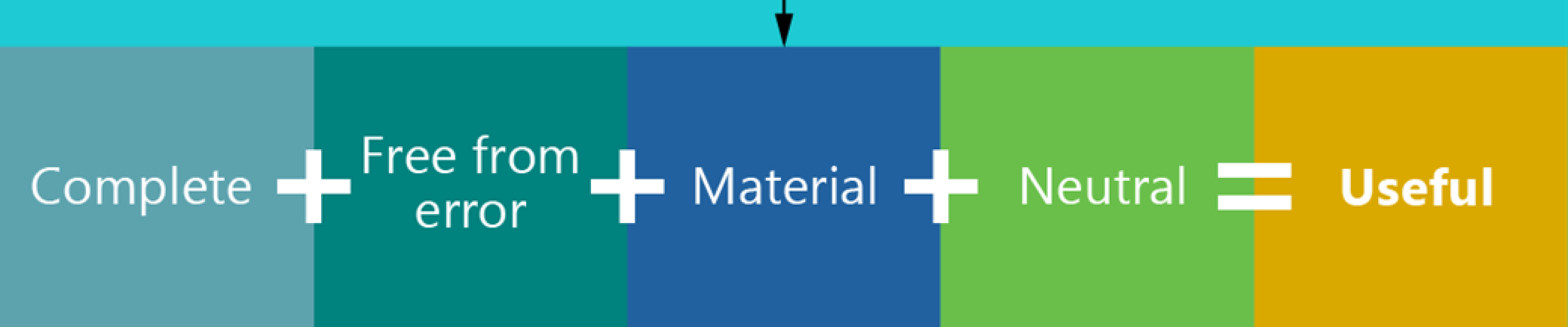

Our purpose-driven approach

This schematic highlights how the company's purpose, culture, sustainability and governance link to the company's business model and strategy. Cross references are provided to where further relevant details can be found.

Howden Joinery Group plc, Annual Report & Accounts 2021, pp8-9

Further examples of connectivity in respect of the corporate governance report can be found in the 'Review of Corporate Governance Reporting'. 14

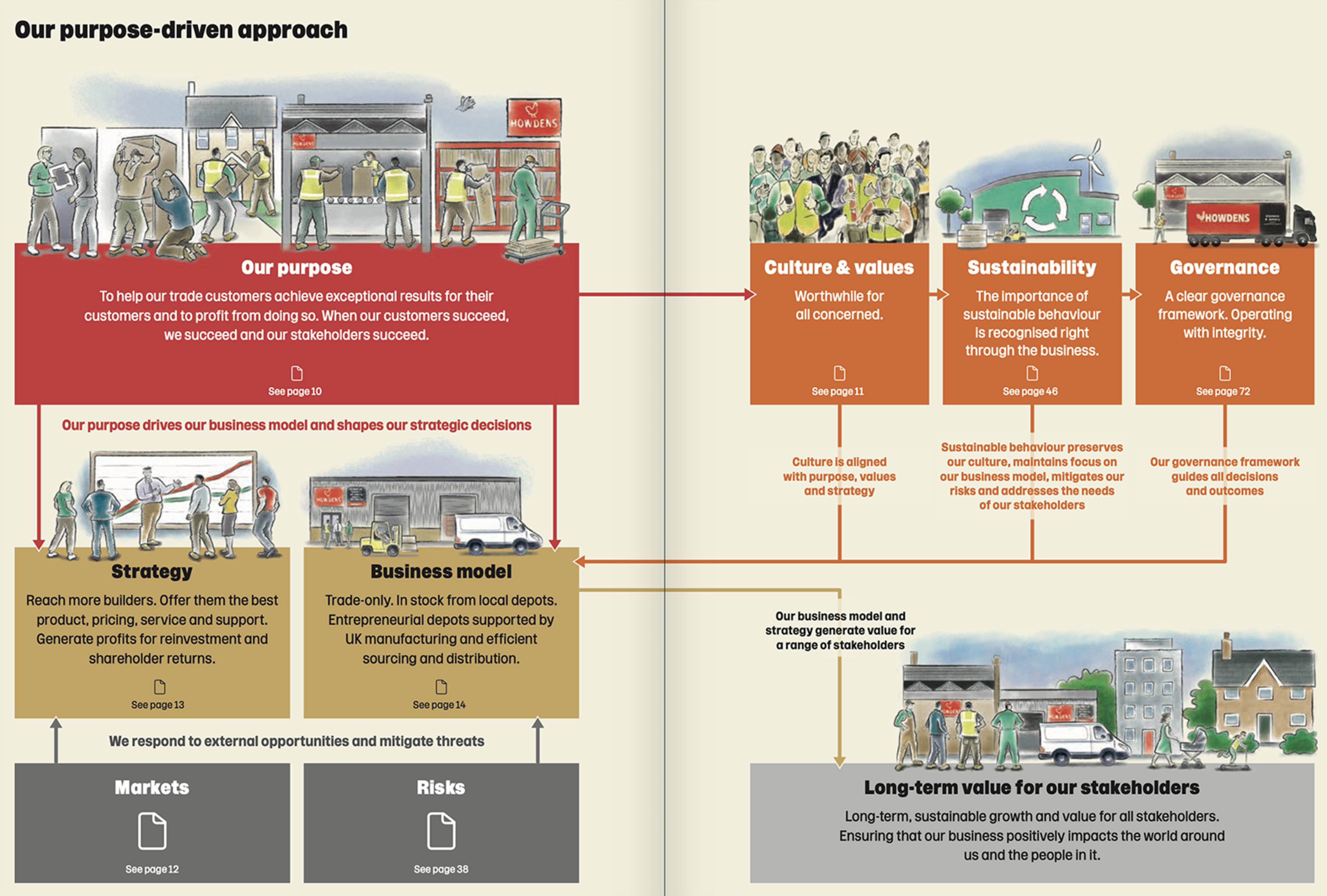

OUR BUSINESS MODEL

Explains what the company does and how it generates value for shareholders.

Derwent London plc, Report & Accounts 2021, pp28-29

5.2.2 Consistent

Inconsistency undermines the coherence and credibility of the ARA.

ARAs should be internally consistent and consistent with other public information produced by the company.

Using the same terms throughout the ARA supports consistency; for instance: * the same term should mean the same thing if it is used in more than one section; and * a metric - for example, adjusted profit – should be the same figure if referred to in multiple sections.

Discussing a company's performance using different measurement bases, for example, using APMs and GAAP measures without providing reconciling information introduces unreliability. Inconsistency is also introduced when the way in which metrics are calculated or defined is changed over time without appropriate explanation. See Comparable.

Narrative reports should discuss the material transactions and balances reported elsewhere in the ARA. Information in narrative reports should be internally consistent and consistent with the information presented in the primary statements, accounting policies and notes, and other narrative reports in the ARA. Differences between any assumptions used in different parts of the ARA should be explained.

For instance, the description of the entity's business model should explain how it generates and preserves value over the longer term. The business model should be consistent with the entity's purpose.

As a further example, risks and uncertainties incorporated within viability scenarios and sustainability reporting should reflect the company's principal risks and uncertainties, to the extent that this is possible given the likely differing timescales that apply.

The assumptions used in viability statements and sustainability reporting should be consistent with: * each other; and * the assumptions used in other forward-looking parts of the financial statements such as the cash flow forecasts prepared for impairment testing, going concern and deferred tax asset recognition purposes.

See 'Thematic review: Viability and Going Concern' for details of our expectations in this area. 15

Companies should identify interdependencies between different parts of the ARA at the planning stage. Teams preparing different sections of the ARA should communicate regularly during the report preparation process to reduce inconsistencies.

ARAs should also be read as a single document before publication to identify, and then correct or explain any residual inconsistency.

See Appendix 3.

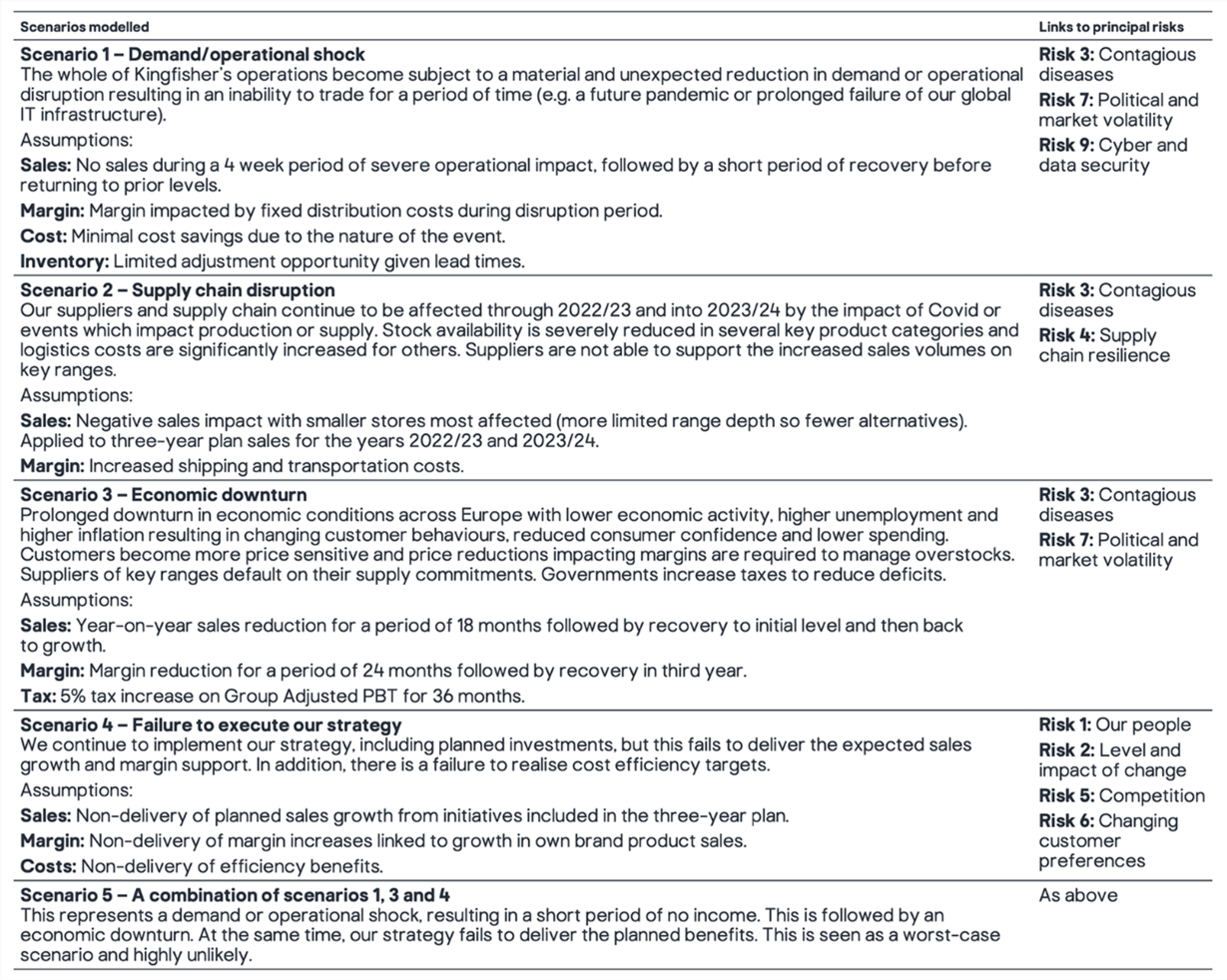

Scenarios modelled

Scenario 1-Demand/operational shock The whole of Kingfisher's operations become subject to a material and unexpected reduction in demand or operational disruption resulting in an inability to trade for a period of time (e.g. a future pandemic or prolonged failure of our global IT infrastructure). Assumptions: Sales: No sales during a 4 week period of severe operational impact, followed by a short period of recovery before returning to prior levels. Margin: Margin impacted by fixed distribution costs during disruption period. Cost: Minimal cost savings due to the nature of the event. Inventory: Limited adjustment opportunity given lead times.

Scenario 2 - Supply chain disruption Our suppliers and supply chain continue to be affected through 2022/23 and into 2023/24 by the impact of Covid or events which impact production or supply. Stock availability is severely reduced in several key product categories and logistics costs are significantly increased for others. Suppliers are not able to support the increased sales volumes on key ranges. Assumptions: Sales: Negative sales impact with smaller stores most affected (more limited range depth so fewer alternatives). Applied to three-year plan sales for the years 2022/23 and 2023/24. Margin: Increased shipping and transportation costs.

Scenario 3-Economic downturn Prolonged downturn in economic conditions across Europe with lower economic activity, higher unemployment and higher inflation resulting in changing customer behaviours, reduced consumer confidence and lower spending. Customers become more price sensitive and price reductions impacting margins are required to manage overstocks. Suppliers of key ranges default on their supply commitments. Governments increase taxes to reduce deficits. Assumptions: Sales: Year-on-year sales reduction for a period of 18 months followed by recovery to initial level and then back to growth. Margin: Margin reduction for a period of 24 months followed by recovery in third year. Tax: 5% tax increase on Group Adjusted PBT for 36 months.

Scenario 4 - Failure to execute our strategy We continue to implement our strategy. including planned investments. but this fails to deliver the expected sales growth and margin support. In addition, there is a failure to realise cost efficiency targets. Assumptions: Sales: Non-delivery of planned sales growth from initiatives included in the three-year plan. Margin: Non-delivery of margin increases linked to growth in own brand product sales. Costs: Non-delivery of efficiency benefits.

Scenario 5 - A combination of scenarios 1, 3 and 4 This represents a demand or operational shock, resulting in a short period of no income. This is followed by an economic downturn. At the same time, our strategy fails to deliver the planned benefits. This is seen as a worst-case scenario and highly unlikely.

Links to principal risks Risk 3: Contagious diseases Risk 7: Political and market volatility Risk 9: Cyber and data security

Risk 3: Contagious diseases Risk 4: Supply chain resilience

Risk 3: Contagious diseases Risk 7: Political and market volatility

Risk 1: Our people Risk 2: Level and impact of change Risk 5: Competition Risk 6: Changing customer preferences As above

Impairment

There is a wide range of potential outcomes regarding the possible future performance of each of ITV Group's cash generating units, Media & Entertainment, ITV Studios and SDN. In the impairment review the Directors used the scenarios utilised for the viability statement.

ITV plc, Annual Report and Accounts for the year ended 31 December 2021, p204

Highlights that the same assumptions have been used in different parts of the ARA.

This viability statement extract links the assumptions used in the viability assessment scenarios to the group's principal risks and uncertainties.

Kingfisher plc 2021/22, Annual Report and Accounts, p50

5.3 Complete

A good quality ARA should be complete. Completeness reflects the breadth, rather than depth, of information included in the ARA. Achieving completeness is not a tick box exercise and materiality (see Materiality) should be applied to determine what must be disclosed.

A complete ARA includes all the positive and negative 16 material 17 information needed by a user to understand the transactions the company has entered into and the company's financial performance and position, development, liquidity status, and future prospects. For instance: * the narrative reports should refer to the transactions and events which had a material impact on the entity's financial performance or position; * details of events, transactions or other conditions which could have a material impact on the future prospects of the entity should be disclosed in the narrative reports; * relevant accounting policies and disclosures for material transactions and events discussed in the narrative reports should be provided; and * details of the significant decisions made by the board during the year and the reasoning behind those decisions should be disclosed. See 'Reporting on stakeholders, decisions and Section 172'. 18

Inadequate descriptions of the nature of certain events and transactions or poor explanation of the accounting applied are likely to prompt regulatory challenge.

The content requirements of some elements of the ARA are largely prescribed by legislation and accounting standards. In these cases, completeness is easier to achieve. For example, the content of the directors' remuneration report is governed by detailed statutory requirements and completeness is achieved by providing this mandatory content. Similarly, accounting standards include detailed requirements that, if followed, are usually sufficient to achieve completeness. However, accounting standards cannot anticipate or cater for every commercial transaction and, in some more complex or unusual cases, additional disclosures may be required. (See Transparent.)

Other parts of the ARA require more judgement to be applied in determining the range of content. For example, the content requirements of the strategic report and corporate governance statement are necessarily less prescriptive and pitched at a higher level, with a greater emphasis on policy and outcomes, and strategic issues.

The strategic report must incorporate information which has a forward-looking orientation to be complete. Forward-looking information is also used in several areas throughout the financial statements such as going concern, viability, asset impairment, and deferred tax asset recognition assessments and within significant estimates and judgements, fair value measurement and financial instrument risk disclosures. Assumptions used in forward-looking areas should be consistent throughout the ARA. (See Consistent.)

In assessing whether an ARA is complete, it may be useful to consider the reporting of peer group companies as this might highlight gaps.

UK Corporate Governance Code reporting is complete only if the disclosure: * reflects how the company has applied the Principles; and * reports against the Provisions or gives a meaningful explanation of non-compliance.

Disclosure of the way in which the company has applied the Principles should cover impacts and outcomes. It should not solely consist of declaratory statements, process information or policy explanations. See 'Review of Corporate Governance Reporting'. 19

The ARA should be a standalone document. We acknowledge that it may be helpful to refer to reports or websites which include additional information that exceeds relevant reporting requirements (for example, sustainability disclosures). In these circumstances we encourage companies to use specific cross references to make additional information easy to locate.

Financial review

... On 2 July 2021, the Group's balance sheet and liquidity was further strengthened by an equity placing. The Gym Group plc issued 11,350,000 new ordinary shares and raised gross proceeds of £31.2m. The costs directly related to the transaction amounted to £0.9m. At the same time as the equity placing, certain restrictions in the Group's banking facilities around capital expenditure and finance lease debt were relaxed. Following the share issue, the total number of shares in issue was 177,560,022. The proceeds of the share issue are being used to accelerate the Group's site rollout programme.

The Gym Group plc, Annual reports and accounts 2021, p61

Narrative reporting clearly explains the nature of the transaction, and the impact it has had on the company's position, performance and future prospects.

Provisions

The actuarial model in 2020 provided a range of potential liability based on levels of probability from 10% to 90%, which, on an undiscounted basis, equates to £53m-£133m. The mean actuarial estimate of £91m represents the expected undiscounted value over the range of reasonably possible outcomes. The provision in the financial statements is based on the mean actuarial estimate which is then adjusted each year to reflect expected settlements in the model, discounting and restricting our estimate to ten years of future claims.

The Weir Group PLC, Annual Report and Financial Statements 2021, p202

This disclosure goes beyond the requirements of IAS 37 'Provisions, contingent liabilities and contingent assets' paragraph 85 (b) as it: * puts the point estimate in the context of a range, with clear boundaries representing 'reasonably possible' outcomes; and * explains how the mean value relates to the best estimate.

This help users to understand more clearly the basis for the provision recognised in the ARA.

5.4 On-time

Publishing ARAs

The Companies Act and the Disclosure Guidance and Transparency Rules (DTR) require UK registered and UK listed companies to file their accounts by certain specific dates.

Many companies publish their ARAs in advance of these dates and it is common practice for listed companies to publish their accounts well in advance of the four month DTR deadline. We understand the particular pressure on listed companies to report results to the market as soon as possible. However, we encourage preparers to ensure adequate time is available to prepare high quality ARAs and that these are then subject to a high quality audit.

As part of the UK implementation of the European Single Electronic Format (ESEF) initiative, many companies are now required to file an ARA with the FCA in a structured digital format. A range of tools and approaches for preparing such reports are available, with different effects on companies' annual report preparation timetable. Where possible, companies should consider reducing the time lag between results being announced and the structured report being published as this is likely to enhance the usefulness of the structured report to users.

See 'Structured digital reporting – Improving quality and usability'. 20

Timely information

The older the information, the less valuable it is likely to be to users. Although we encourage preparers not to compromise ARA quality by compressing reporting timetables, long lead times between the balance sheet date and the date of ARA publication reduce the usefulness of the ARA.

Many companies are required to update the market with information in respect of significant transactions or events affecting the entity's future performance, position and prospects. As these updates must be made on a timely basis, they are usually disclosed before ARA publication. The ARA, when published, enhances information previously announced as it typically provides further details of the impact of the significant transactions or events on the company's performance, position and future prospects.

5.5 Unbiased

Information is unbiased if it is balanced. This attribute is a feature of the 'true and fair' requirement and the UK Corporate Governance Code, which requires the annual report to be 'fair, balanced and understandable'. See Accurate.

A balanced ARA should make reference to both positive and negative aspects of the company's performance, position and future prospects as well as the risks and opportunities the company faces. The ARA as a whole should present an open and honest account of the company's activities and performance and future prospects.

ARAs are balanced if they avoid using presentation formats, language and case studies that give a slanted view. For example, formats which give undue prominence to APMs over GAAP measures should be avoided, as should language which offers an inflated view of the company's performance, position or future prospects.

The ARA may attract regulatory attention if its use as a marketing tool undermines the need for the ARA to be fair and balanced.

Performance

Overall our results for the year were in line with our guidance. Reported revenue was £20,850m, down 2% and adjusted♭ revenue was £20,845m, down 2%. Revenue has grown in Openreach, was flat in Consumer, but declined in Enterprise and Global as a result of challenging market conditions. Adjustedª EBITDA of £7,577m was up 2%, with revenue decline more than offset by lower costs from our modernisation programmes, tight cost management, and lower indirect commissions. Reported profit before tax was £1,963m, up 9% with higher adjustedª EBITDA offsetting higher finance expenses. Capital expenditure of £4,807m was up 14% primarily due to continued higher spend on our fibre infrastructure and mobile networks. Normalised free cash flowᵈ was £1,392m, down 5% primarily due to higher cash capital expenditure, partially offset by higher adjustedª EBITDA and lower tax payments.

BT Group plc, Annual Report 2022, p46

The description provided identifies the positive and negative aspects of performance in the year. The use of alternative performance measures is balanced with the use of statutory measures.*

* The example demonstrates a balanced narrative from a short section of the ARA. We expect the ARA as a whole rather than each individual paragraph to be balanced.

5.6 Navigable

A good ARA must be accessible and easy to navigate.

Companies that publish a copy of the ARA on their website should do so in a place where the document can be easily found.

The ARA on the company's website should be available for download in its entirety. It is less helpful when the components of an ARA can only be downloaded separately.

ARAs included on the company's website are navigable when they include detailed contents pages, navigation panes, clear titles and descriptions, specific cross references and hyperlinked cross references. They are also searchable to enable users to perform text searches for specific words and phrases.

We have recently seen many companies adding a useful page to their annual report that explains the purpose, nature, and location of different reports that comprise the ARA.

Regulators may raise unnecessary questions if it is difficult to locate information in relation to a material transaction, event or other condition.

The introduction of tagged digital reports (see On-time) improves searchability but adds additional complexity to reporting. For companies that are subject to the DTR, the digital format (XHTML) version of the ARA is the official version of the annual report (under these rules) and is the only version that meets the requirements of the DTR. Given the importance of this version, the digital version should be made available on the company's website. Further detail about these requirements can be found on the FCA website. 21

TOTAL ACCOUNTING RETURN

Our aim is to achieve above-market total business returns, together with significant social and economic value for all of our stakeholders.

How we manage risk see pages 58-69

How we monitor performance see page 19

How we reward success see pages 110-113

How to navigate this report

| Contents | Page |

|---|---|

| Strategic report | |

| Our year in review | 02 |

| Chairman's statement | 04 |

| Chief Executive's statement | 06 |

| Market context | 10 |

| Our top 10 assets | 12 |

| Our stakeholders | 13 |

| Our business model | 14 |

| Our strategy | 16 |

| Key performance indicators | 19 |

| Our strategic focus | 20 |

| Operating and portfolio review | 26 |

| Financial review | 32 |

| Our people and culture | 38 |

| Our approach to sustainability | 44 |

| Build well - our commitment to the environment | 49 |

| Live well - our commitment to our communities | 53 |

| Act well - our commitment to being a responsible business | 56 |

| Managing risk | 58 |

| Principal risks and uncertainties | 60 |

| Going concern and viability | 70 |

| Non-financial information statement | 72 |

| Governance | |

| Introduction from the Chairman | 74 |

| Board of Directors | 75 |

| Executive Leadership Team | 80 |

| Our governance structure | 82 |

| The Board in action | 84 |

| The Board and our stakeholders | 87 |

| The Board and our culture | 92 |

| Introduction from the Chairman of the Nomination Committee | 94 |

| Report of the Nomination Committee | 95 |

| Board evaluation | 96 |

| Board induction | 99 |

| Introduction from the Chairman of the Audit Committee | 100 |

| Report of the Audit Committee | 102 |

| Directors' Remuneration Report - Chairman's Annual Statement | 108 |

| Remuneration at a glance | 110 |

| Annual Report on Remuneration | 114 |

| Directors' Remuneration Policy Summary | 125 |

| Directors' Report | 128 |

| Financial statements | |

| Statement of Directors' Responsibilities | 131 |

| Independent Auditor's Report | 132 |

| Income statement | 141 |

| Statement of comprehensive income | 141 |

| Balance sheets | 142 |

This report includes interactive elements that allow you to go to specific pages and open weblinks.

Go to contents

Go to previous page

Back one page

Forward one page

Hyperlinks

Land Securities Group plc, Annual Report 2022, pp 0,1,15

This ARA includes hyperlinks to enable easy navigation. It also includes a detailed hyperlinked contents page, and specific hyperlinked cross references.

5.7 Transparent

The ARA should faithfully represent the economic substance of the transactions that the company has entered into. This means that: * any significant judgements taken should be disclosed (see Accurate); * additional disclosures over and above stated requirements may be necessary for users to fully understand transactions (see Completeness); and * audited and unaudited information should be clearly labelled.

We encourage preparers to critically assess whether the ARA, when taken as a whole, provides sufficiently transparent information to meet the likely needs of users.

Accounting policies that lack clarity, are not company or transaction specific, or are inconsistent with other information in the ARA, are likely to attract regulatory enquiry.

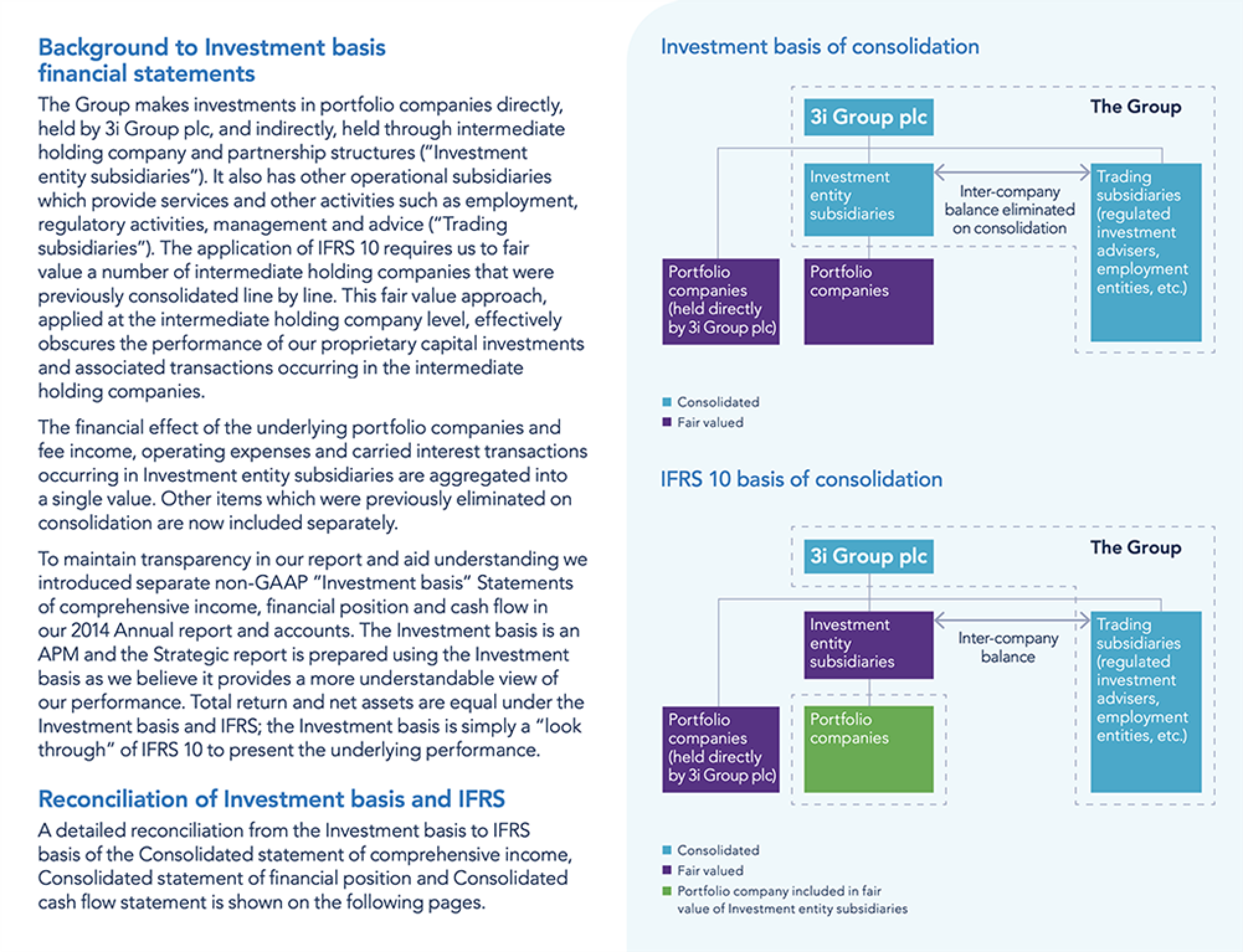

Background to Investment basis financial statements

The Group makes investments in portfolio companies directly, held by 3i Group plc, and indirectly, held through intermediate holding company and partnership structures ("Investment entity subsidiaries"). It also has other operational subsidiaries which provide services and other activities such as employment, regulatory activities, management and advice ("Trading subsidiaries"). The application of IFRS 10 requires us to fair value a number of intermediate holding companies that were previously consolidated line by line. This fair value approach, applied at the intermediate holding company level, effectively obscures the performance of our proprietary capital investments and associated transactions occurring in the intermediate holding companies.

The financial effect of the underlying portfolio companies and fee income, operating expenses and carried interest transactions occurring in Investment entity subsidiaries are aggregated into a single value. Other items which were previously eliminated on consolidation are now included separately.

To maintain transparency in our report and aid understanding we introduced separate non-GAAP "Investment basis" Statements of comprehensive income, financial position and cash flow in our 2014 Annual report and accounts. The Investment basis is an APM and the Strategic report is prepared using the Investment basis as we believe it provides a more understandable view of our performance. Total return and net assets are equal under the Investment basis and IFRS; the Investment basis is simply a "look through" of IFRS 10 to present the underlying performance.

Reconciliation of Investment basis and IFRS

A detailed reconciliation from the Investment basis to IFRS basis of the Consolidated statement of comprehensive income, Consolidated statement of financial position and Consolidated cash flow statement is shown on the following pages.

3i Group plc, Annual report and accounts 2022, p53

This ARA includes additional disclosures over and above those required by accounting standards. These additional disclosures were specifically designed by the company to allow users to better understand the underlying performance of the company. Although extracts are not reproduced here, in subsequent pages of the ARA primary statements prepared on the Investment basis are provided and reconciled to the IFRS financial statements.

6. Effective communication principles

Effective communication helps investors identify relevant information and understand the linkages between the different parts of the ARA. When the information in an ARA is conveyed effectively, users are able to make better informed decisions.

We have organised the effective communication principles into the 4Cs: * Company specific; * Clear, concise and understandable; * Clutter free and relevant; and * Comparable.

6.1 Company specific

Boilerplate disclosures and generic statements are unlikely to hold the interest of users or help them understand the company's business.

A company's ARA should: * provide insights into the board's decision making, for example, the ARA should explain why key decisions were taken and how stakeholder feedback influenced the board's thinking (see Reporting on stakeholders, decisions and Section 172 22); * explain the company's business model in jargon free language (see FRC Lab project report: Business model reporting 23); * explain the key judgements and estimates in the accounts and provide details of how the figures would change if the judgements and estimates were altered (see Thematic Review Judgements and Estimates: Update 24 and Corporate Reporting Thematic Review Judgements and Estimates 25); and * include accounting policies tailored to the company's transactions (see p31).

Preparers should replace boilerplate disclosure with information that is tailored to the company's specific circumstances. This provides better quality, more decision useful information.

PROVISIONS

The Group provides product warranties on all new vehicle sales. Warranty provisions are recognised when vehicles are sold or when new warranty programmes are initiated. Based on historical warranty claim experience, assumptions are made on the type and extent of future warranty claims including non-contractual warranty claims as well as on possible recall campaigns. These assessments are based on the frequency and extent of vehicle faults and defects in the past. In addition, the estimates include assumptions on the potential repair costs per vehicle and the effects of possible time or mileage limits. The provisions are regularly adjusted to reflect new information.

Aston Martin Lagonda Global Holdings plc, Annual Report 2021, p166

This accounting policy describes how the company has applied the principles to its specific facts and circumstances. It identifies the specific transaction or event that triggers the recognition of the provision and provides a greater insight into the factors that affect its measurement.

Provisions are recognised when there is a present legal or constructive obligation as a result of a past event, it is probable that an outflow of economic resources will be required and amounts can be estimated reliably. The timing or amount of the outflow may still be uncertain.

Provisions are measured at the estimated expenditure required to settle the present obligation, based on the most reliable evidence available at the reporting date, including the risks and uncertainties associated with the present obligation. Where there are a number of similar obligations, the likelihood that an outflow will be required in settlement is determined by considering the whole class of obligations. Provisions are discounted to their present values, if the impact of discounting is expected to be material.

This is a typical example of an uninformative policy as it repeats the principles of the relevant accounting standard. It fails to communicate how they have been applied by the company. As a result, it does not provide useful information to readers.

6.2 Clear, concise and understandable

The ARA should be clear, concise and understandable.

All material information is communicated efficiently in a concise ARA.

A clear, concise and understandable ARA: * uses straightforward language and short sentences; * uses specialist terms only where necessary and makes sure they are used consistently; * focuses on content that is important to investors (see Materiality and Clutter free and relevant); * excludes irrelevant information (see Materiality and Clutter free and relevant); * does not repeat information clearly shown in diagrams, tables or other narrative; * defines specialist terms and acronyms, for example, in a glossary; and * uses diagrams, images and tables only if it makes the information easier to understand.

Information should be organised within the ARA logically. This may take one of many forms.

For example, the accounting policies could be presented together after the primary statements or spread throughout the notes, placed next to relevant disclosures.

It may also be helpful to pull together disclosures on a particular issue in one place; for example, liquidity disclosures are often spread across the accounts. Presenting such disclosures together may make it easier to assess how sound a company's liquidity position is.

Presenting the Directors' report at the back of the ARA so that it does not detract from the effective communication of the information that the directors consider to be most relevant to shareholders, may be useful.

Formatting can make an ARA easier to follow. Preparers may wish to use extra line spaces, subheadings, lists, bullets points and different font effects to draw attention to certain areas.

Please see IFRS Foundation Disclosure Initiative - Case Studies: 'Better Communication in Financial Reporting; Making disclosures more meaningful' 26 which includes examples of ways in which companies have improved their ARAs to make them clearer, more concise or more understandable.

See our clear and concise publication landing page 27 and our 'Louder than Words' 28 publication.

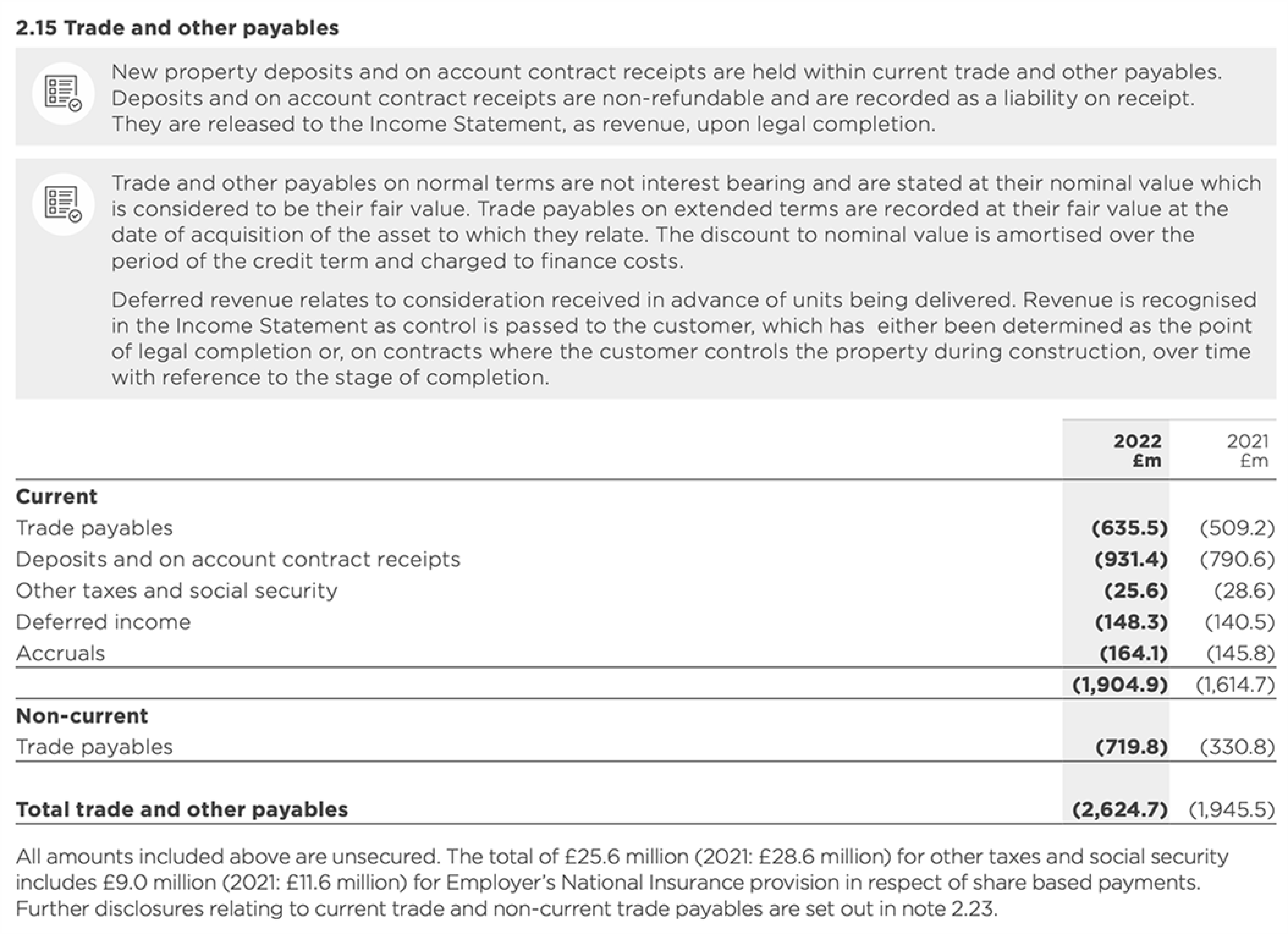

2.15 Trade and other payables

New property deposits and on account contract receipts are held within current trade and other payables. Deposits and on account contract receipts are non-refundable and are recorded as a liability on receipt. They are released to the Income Statement, as revenue, upon legal completion.

Trade and other payables on normal terms are not interest bearing and are stated at their nominal value which is considered to be their fair value. Trade payables on extended terms are recorded at their fair value at the date of acquisition of the asset to which they relate. The discount to nominal value is amortised over the period of the credit term and charged to finance costs.

Deferred revenue relates to consideration received in advance of units being delivered. Revenue is recognised in the Income Statement as control is passed to the customer, which has either been determined as the point of legal completion or, on contracts where the customer controls the property during construction, over time with reference to the stage of completion.

In this disclosure note: * accounting policies are presented together with the relevant disclosure; * short, simple sentences are used; and * icons, shading and different font effects are used.

These characteristics help make the information in the note easy to understand.

Berkeley Group plc, Annual Report, 2022, p191

6.3 Clutter free and relevant

See Materiality for determining what is relevant in the context of materiality.

A clutter free ARA avoids duplication. If information contained within one part of the ARA is relevant to another part, a cross reference should be used. See Connected.

Excessive duplication of material across the ARA that obscures other decision relevant information may attract regulatory comment.

Only relevant information is included in a good quality ARA. Irrelevant material obscures the important information that users need to make informed decisions and judgements.

We encourage preparers to remove irrelevant information. This is particularly important given the drift of increasing reporting requirements.

When preparing the ARA, it is common practice to roll forward last year's publication. In doing so preparers should: * review the skeleton carefully and remove information that is no longer relevant; and * amend the skeleton to include relevant disclosures required by amended requirements or new circumstances.

ITV plc, Annual Report and Accounts for the year ended 31 December 2021, p180

Disclosure highlights that the comment is only applicable to the comparative data. This makes the information provided more relevant.

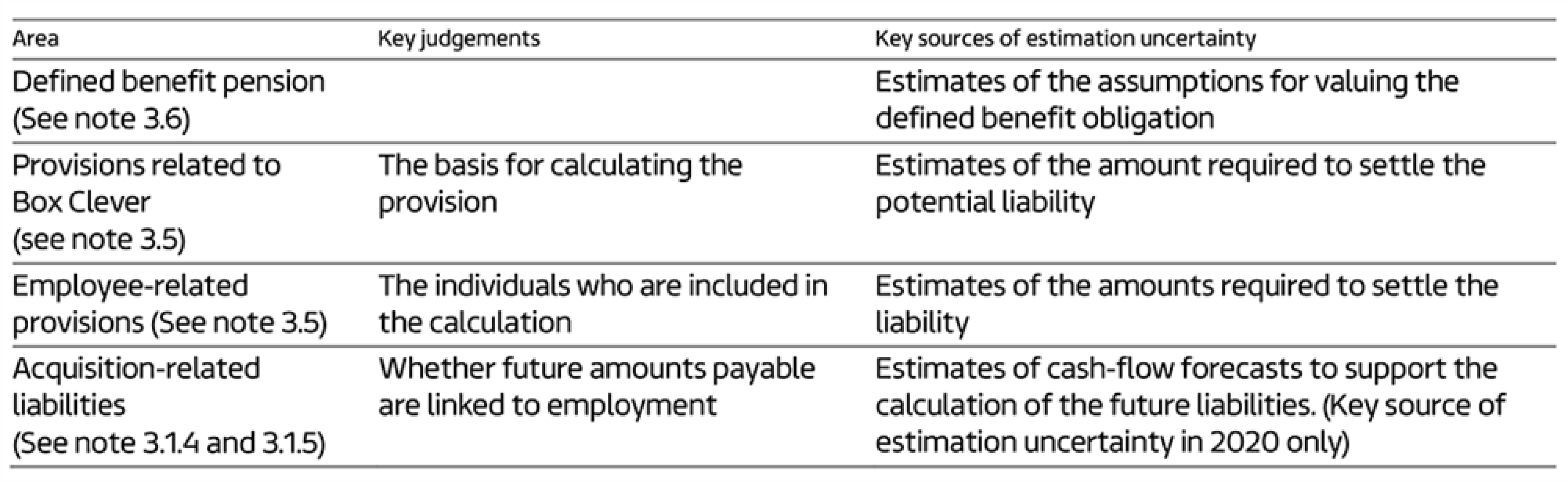

Key areas of judgement and sources of estimation uncertainty

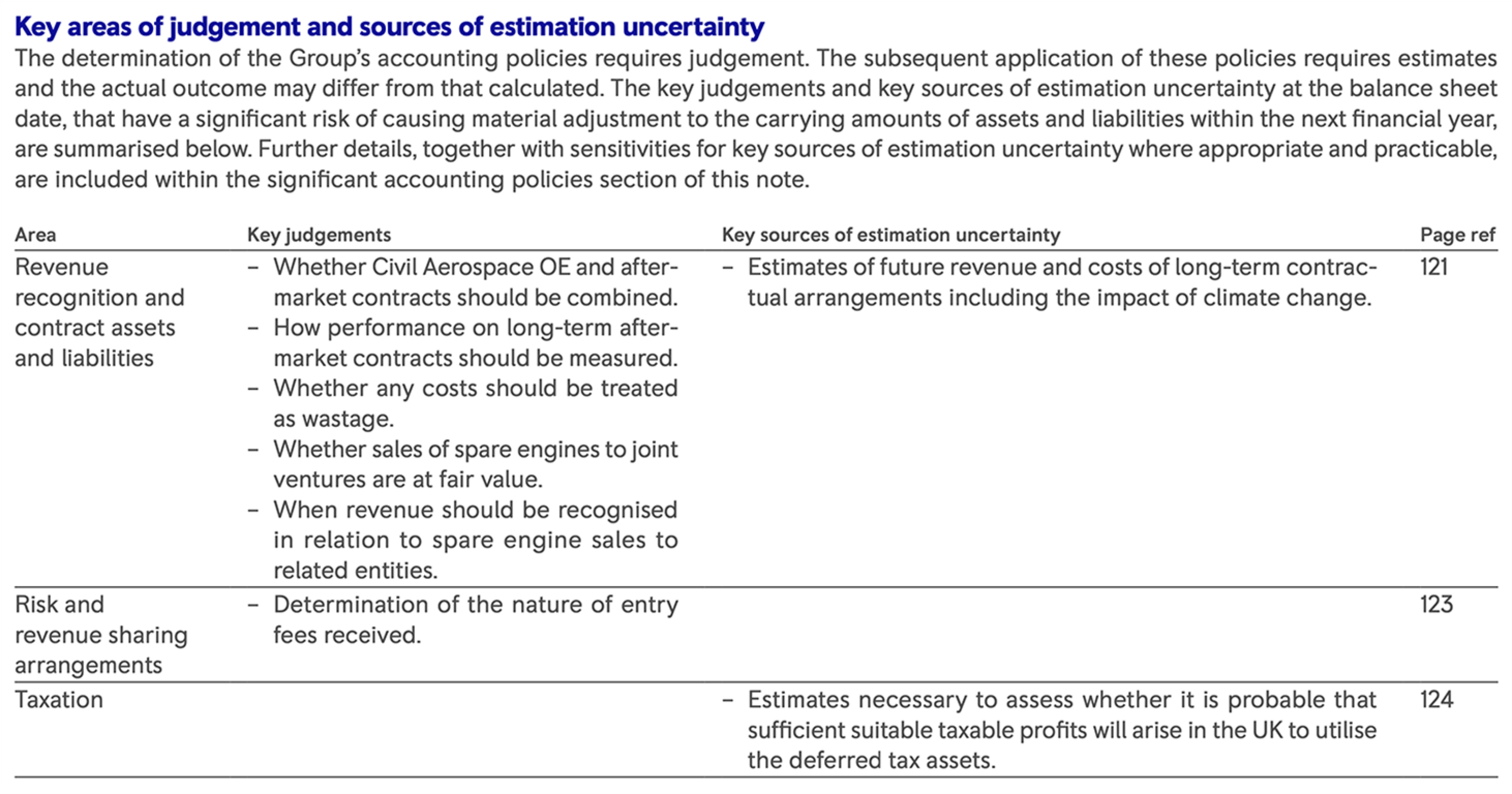

The determination of the Group's accounting policies requires judgement. The subsequent application of these policies requires estimates and the actual outcome may differ from that calculated. The key judgements and key sources of estimation uncertainty at the balance sheet date, that have a significant risk of causing material adjustment to the carrying amounts of assets and liabilities within the next financial year, are summarised below. Further details, together with sensitivities for key sources of estimation uncertainty where appropriate and practicable, are included within the significant accounting policies section of this note.

Rolls-Royce Holdings plc, Annual Report 2021, p119

The key areas of judgement and sources of estimation uncertainty are summarised in one place so users can easily identify them.

Rather than repeating the disclosures required by IAS 1, a clear cross-reference is provided to the disclosure note containing relevant disclosures.

6.4 Comparable

The ARA should present updated information on matters that are relevant to user decisions year on year.

This applies to metrics such as key performance indicators (KPIs), alternative performance measures (APMs), other financial ratios and certain narrative information.

It is helpful for investors when an ARA is comparable to that of its peers. As a result, consideration should be given to sector practices and policies as well as information disclosed by peer group companies.

For example, real estate companies prepare metrics in accordance with European Public Real Estate Association (EPRA) guidelines. Inclusion of such metrics can provide additional decision useful information to readers of the accounts.

The way in which metrics are described and calculated can facilitate comparability. This is particularly important if the calculation of a particular metric is inconsistent with the method used by another similar company.

A comparable ARA contains metrics that are calculated consistently year on year, defined and reconciled to GAAP measures.

If a significant change to the calculation of a metric has been made, the company should: * describe the change; * explain why it results in more reliable and relevant information; and * restate the comparatives.

Metrics and narrative information must be presented consistently each year. This means that information should be presented in a similar location, using a similar format. However, the benefits of continuity should not override innovation where this will improve the relevance and understandability of the information presented.

ARAs that fail to explain how APMs have been calculated or how they reconcile to GAAP measures are likely to prompt regulatory enquiry.

We encourage preparers to consider the information and best practice examples contained within the Alternative Performance Measures thematic reviews, 2930 when presenting financial ratios within their accounts.

Appendices

Appendix 1: Summary infographic

Diagram: Summary of Good Annual Report and Accounts Framework

This diagram is a summary of the framework for a good annual report and accounts. It's structured as a pyramid with "Materiality" as a central vertical element.

Pyramid Layers (from top to bottom): * Good annual report and accounts * Effective communication principles * Corporate reporting principles * GAAP, law and code requirements met

Callout Box 1: 4Cs of effective communication * Company specific * Clear, concise and understandable * Clutter free and relevant * Comparable

Callout Box 2: Corporate reporting principles * Accurate * Connected and consistent * Complete * On-time * Unbiased * Navigable * Transparent

Appendix 2: Sources of further information

The links refer to FRC developed publications and landing pages which detail further relevant publications. These documents can be used to support the preparation of an ARA which meets the requirements of relevant GAAP, legislation and codes.

Strategic report (including sustainability reporting) * Guidance on the strategic report * FRC Lab publications on the strategic report * FRC sustainability and climate related reporting guidance landing page

Remuneration report * FRC Lab publications on remuneration reporting

Corporate governance report * Guidance on risk management, internal control and related financial and business reporting * FRC Lab publications on governance reporting * Corporate governance and stewardship landing page

Financial statements, accounting policies and notes * Thematic reviews landing page * Annual reviews of corporate reporting landing page * FRC Lab publications on financial statements

Appendix 3: Process map for accounts preparation

This section of the report highlights some areas preparers may wish to consider in regards to their reporting process. Our discussions with companies show that a good process, focused on continual improvement, is most likely to generate a quality annual report.

Stages in the corporate reporting process

This diagram shows four interconnected stages in a corporate reporting process: Plan, Manage, Fulfil, and Improve. The stages are arranged in a circular flow.

Plan the project

- Identify a project sponsor. This is usually a senior board member or an executive. Set timelines and targets.

- Identify the team. Consider who are the sources of data, who are the disclosure coordinators, who are the authors and who are the reviewers. Being clear on roles will help ensure the project runs smoothly. Depending on the company's size consider whether a central project management team would be useful.

- Assign accountability. Accountability for individual sections and the overall quality and consistency of the ARA should be assigned to team members.

- Identify your audience. Be clear about the intended audience for the ARA. This helps identify relevant content.

- Speak to advisors. Advisors can provide insight into what is current best practice. Looking at peers' reports can also be helpful.

- Understand the time needed by those undertaking tagging. Build this and appropriate review time into your timetable.

- Engage with auditors. Consider changes to logistics, control points and disclosure issues raised in the prior period.

- Rethink paper. The annual report is no longer a paper document. Consider how to make the most of the digital opportunity.

- Consider regulations. New and evolving regulation such as digital and sustainability reporting requirements may impact timelines. Build education into your plan.

- Speak to investors and other users. Use comments received by investor relations teams or from retail shareholders via the company website to help understand what investors want.

- Use the data. Look at your website's analytical data to understand what information is popular.

Manage the process

- Understand the governance process. Ensure there is agreement and understanding of the governance process to be followed including who needs to sign off on each step.

- Set the overall aim. For example, the ARA produced should be high quality and include only material information.

- Obtain board agreement. Get early agreement from the board on key elements of the ARA such as the business model and strategy. This should help focus the document.

- Create a wireframe. Each team needs to know how much space they are allocated. It is important at this stage to stress the importance of the document working as a whole.

- Obtain another perspective. Get input from someone outside the core team using the prior year ARA. Ask them to identify areas they think could be improved.

Fulfil the plan

- Ask whether the ARA reflects the company's developments. Early on, challenge the emphasis of narrative in the ARA to ensure it clearly reflects the significant developments of the company in the period and is consistent with other material the company has released.

- Ask whether it is material. Develop a common understanding of what is likely to be material, this helps to decide what should be reported and what is no longer needed. See Materiality.

- Build time for review. Plan reviews for the right time (when changes can actually be made). Proper review is key to the process. This includes review over the digital and tagged elements of the report.

- Read the ARA all the way through. Ensure that when read as a whole the ARA reflects the corporate reporting principles and the 4Cs of effective communication. It is useful if one individual is assigned to complete this task.

- Use each other. Ask teams to review each others' disclosures to ensure they reflect the corporate reporting principles, the 4Cs of effective communication, that the ARA reflects the requirements of relevant codes, regulations and GAAP, and that the ARA makes sense as a single document.

Improve the process

- Debrief early. Debrief the process while the experience is fresh to capture good quality feedback.

- Ask investors. Ask the investor relations team to track the types of questions they receive from analysts. Analyst questions often give an indication of where information is not clear or where further information could be useful.

- Consider what others have done. Look across UK and international peers, what really adds value to disclosures?

- Consider digital. Each year tools and expectations around digital reporting develop. Move forward with, or ahead of the market.

- Start the cycle again. Lessons learnt in one period can be taken forward to the next as a basis for further improvement. What has been learnt could be relevant for half year and other reporting.

The FRC Lab continually looks at how to improve reporting. The Lab's reports provide insights into emerging and developing practice and process. The Lab's recent report on Structured Digital Reporting highlights some key aspects of the tagging process that listed companies should consider. All the Lab's reports are available on the FRC website.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

www.frc.org.uk

Follow us on Twitter @FRCnews or LinkedIn

-

Understanding research findings and evidence on corporate reporting: An independent literature review, pp 6,7: https://www.frc.org.uk/getattachment/ba1c51d0-e933-4235-9c67-0bd2aa592edb/Literature-Review-Final.pdf ↩

-

IFRS Foundation Disclosure Initiative, Case Studies: Better Communication in Financial Reporting: Making disclosures more meaningful, p 27: https://www.ifrs.org/content/dam/ifrs/project/disclosure-initative/better-communication-making-disclosures-more-meaningful.pdf ↩

-

International Standard on Auditing (UK) 320 (Revised June 2016), Materiality in Planning and Performing an Audit ↩

-

International Standard on Auditing (UK) 701 (Revised November 2019), Communicating Key Audit Matters in the Independent Auditor's Report] – paragraph 16-1(a)(i) ↩

-

https://www.frc.org.uk/getattachment/343656e8-d9f5-4dc3-aa8e-97507bb4f2ee/Strategic-Report-Guidance_2022.pdf ↩

-

https://www.frc.org.uk/getattachment/65fa8b6f-2bed-4a67-8471-ab91c9cd2e85/FRC-TCFD-disclosures-and-climate-in-the-financial-statements_July-2022.pdf ↩

-

See Tech 01/11 'Guidance for directors on accounting records under the Companies Act 2006: https://www.icaew.com/-/media/corporate/files/technical/technical-releases/legal-and-regulatory/tech-01-11-guidance-for-directors-on-accounting-records-under-the-companies-act-2006.ashx ↩

-

https://www.frc.org.uk/getattachment/6a4c93cf-cf93-4b33-89e9-4c42ae36b594/Improving-the-Quality-of-Comply-or-Explain-Reporting.pdf ↩

-

FRC Staff Guidance Auditor responsibilities under ISA (UK) 720 in respect of climate-related reporting by companies required by the Financial Conduct Authority: https://www.frc.org.uk/getattachment/b6e1b51c-4dc8-413f-8a83-ae051e4d000e/FRC-Staff-Guidance-Auditor-responsibilities-under-ISA-(UK)-720-in-respect-of-climate-related-reporting.pdf-720-in-respect-of-climate-related-reporting.pdf) ↩

-

https://www.frc.org.uk/getattachment/343656e8-d9f5-4dc3-aa8e-97507bb4f2ee/Strategic-Report-Guidance_2022.pdf ↩

-

For further details on climate related risks and TCFD, please refer to our thematic review in this area: https://www.frc.org.uk/getattachment/65fa8b6f-2bed-4a67-8471-ab91c9cd2e85/FRC-TCFD-disclosures-and-climate-in-the-financial-statements_July-2022.pdf ↩

-

https://www.frc.org.uk/getattachment/6a896f6b-8f4a-4a19-8662-f87a269ffce3/Review-of-Corporate-Governance-Reporting_-2022.pdf ↩

-

https://www.frc.org.uk/getattachment/2b213ba8-b950-49e4-838d-d919cbcbd6e6/Going-Concern-and-Viability-Review.pdf ↩

-

See Materiality ↩

-

https://www.frc.org.uk/getattachment/d0470ab4-f134-4584-9f54-a48a8bfdc62d/FRC-LAB-Stakeholders-Report-s172.pdf ↩

-

https://www.frc.org.uk/getattachment/6a896f6b-8f4a-4a19-8662-f87a269ffce3/Review-of-Corporate-Governance-Reporting_-2022.pdf ↩

-

https://www.frc.org.uk/getattachment/5a50cd03-e209-4ac5-b95b-d91c39520acf/FRC-Structured-Digital-Reporting_September-2022.pdf ↩

-

https://www.fca.org.uk/markets/company-annual-financial-reporting-electronic-format ↩

-

https://www.frc.org.uk/getattachment/d0470ab4-f134-4584-9f54-a48a8bfdc62d/FRC-LAB-Stakeholders-Report-s172.pdf ↩

-

https://www.frc.org.uk/getattachment/4b73803d-1604-42cc-ab37-968d29f9814c/FRC-Lab-Business-model-reporting-v2.pdf ↩

-

https://www.frc.org.uk/getattachment/0243cb06-9f44-4427-af07-879488df7877/FRC-Judgements-Estimates-Thematic-Review_-July-2022.pdf ↩

-

https://www.frc.org.uk/getattachment/42301e27-68d8-4676-be4c-0f5605d1b467/CRTR_Judgements-and-Estimates-v5.pdf ↩

-

https://www.ifrs.org/content/dam/ifrs/project/disclosure-initative/better-communication-making-disclosures-more-meaningful.pdf ↩

-

https://www.frc.org.uk/accountants/accounting-and-reporting-policy/clear-and-concise-and-wider-corporate-reporting/clear-and-concise ↩

-

https://www.frc.org.uk/getattachment/f6c99341-6fb6-46f1-966c-97fdbe8e9325/-;.aspx ↩

-

https://www.frc.org.uk/getattachment/74ed739d-2237-4d3e-a543-af8ada9b0e42/FRC-Thematic-Review-on-APMs-October-2021.pdf ↩

-

https://www.frc.org.uk/getattachment/ff987c01-416f-4635-8dba-fdda5530f4b5/CRTR_APMs_v6.pdf ↩