The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting July 2024 Paper 4: Sources of guidance

AGENDA PAPER 4

Executive summary

| Date | 15 July 2024 |

| Paper reference | 2024-TAC-011 |

| Project | Technical assessment of IFRS S1 and IFRS S2 |

| Topic | Sources of guidance |

Objective of the paper

This paper considers the sources of guidance that are referenced in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and the Industry-based Guidance on Implementing IFRS S2 that accompanies IFRS S2 Climate-related Disclosures (IFRS S2). The TAC is asked to consider whether the sources of guidance are appropriate and whether the instruction 'shall refer to and consider' is clear.

This paper does not ask the TAC to make a decision on the content contained within the sources of guidance, particularly those that are published by third-party sources. The content in these sources of guidance is outside the scope of the TAC's technical assessment of IFRS S1 and IFRS S2.

Decisions for the TAC

The TAC is asked to tentatively decide to:

- amend the instruction ‘shall refer to and consider' to 'may refer to and consider' in IFRS S1 and IFRS S2 in relation to the SASB materials.

- maintain the references to other sources of guidance, including the GRI Standards and ESRS.

Appendices

There are no appendices to this paper.

This paper has been prepared by the Secretariat for the UK Sustainability Disclosure Technical Advisory Committee (TAC) to discuss in a public meeting. This paper does not represent the views of the TAC or any individual TAC member.

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including 'IAS®', 'IASB®', ISSB™, 'IFRIC®', 'IFRS®', the IFRS® logo, 'IFRS for SMEs®', IFRS for SMEsⓇ logo, ISSB™, the 'Hexagon Device', 'International Accounting Standards®', 'International Financial Reporting Standards®', and 'SIC®'. Further details of the Foundation's Trade Marks are available from the Licensor on request.

Context

1Both IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2) include sources of guidance for entities to use or refer to when identifying sustainability-related risks and opportunities, and when identifying applicable disclosure requirements. These sources of guidance refer to third-party documents that the International Sustainability Standards Board (ISSB) asserts in IFRS S1 Basis for Conclusions on General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1 Basis for Conclusions) are 'necessary to facilitate reporting on a range of sustainability-related risks and opportunities' (paragraph BC125). The relevant references to the requirements in IFRS S1 and IFRS S2 are as follows:

- IFRS S1 paragraphs 54–59

- IFRS S2 paragraphs 12, 23, 32, 37 and B65(d)

2The requirements in IFRS S1 and IFRS S2 refer to either the Sustainability Accounting Standards Board (SASB) Standards¹ or the Industry-based Guidance on Implementing IFRS S2. When this paper discusses both documents they will be referred to collectively in this paper as the SASB materials.

3This paper asks the TAC to discuss the instruction 'shall refer to and consider' in relation to the SASB materials in both IFRS S1 and IFRS S2. However, the TAC is not asked to make a decision on the content in the SASB materials or any other source of guidance. In its context letter dated 20 May 2024, the Department for Business and Trade (DBT) indicated that it would welcome the TAC's view on how entities are likely to interpret and act upon the instruction ‘shall refer to and consider'. DBT also noted in this letter that as the SASB materials were not embedded in the main body of the standards, the content could theoretically be changed by the ISSB without the UK Government being able to give these changes due consideration. DBT has invited the TAC to offer its views on whether permanent or temporary amendments to the standards are required.

Endorsement criteria

4The endorsement criteria applied in the analysis of this technical area include whether:

- use of the IFRS Sustainability Disclosure Standard is likely to result in an improvement in the international comparability of sustainability-related reporting in the UK.

- use of the IFRS Sustainability Disclosure Standard is likely to support companies in making disclosures that are understandable, relevant, reliable and comparable.

- use of the IFRS Sustainability Disclosure Standard is likely to improve the quality of corporate reporting within the UK in the long-term.

- companies are likely to be able to provide the disclosures required by the IFRS Sustainability Disclosure Standard within the timeframes that a company normally reports without undue cost or effort.

Analysis

5In relation to the sources of guidance, there are a number of matters for the TAC to discuss, including:

5.1references in both IFRS S1 and IFRS S2 to the SASB materials including the instruction ‘shall refer to and consider'. While most stakeholders agree that an industry-based approach is appropriate for sustainability-related disclosures, there is a mixed view on the use of the SASB materials. Additionally, some stakeholders have noted that although the ISSB has stated that there is no requirement for entities to use the SASB materials, the instruction ‘shall consider and refer to' is confusing. Paragraphs 12–33 provide a background on the SASB materials, outline stakeholder feedback, and discuss the instruction 'shall refer to and consider'. The TAC may decide to amend the instruction in IFRS S1 and IFRS S2 to 'may refer to and consider'.

5.2references to Global Reporting Initiative (GRI) Standards and European Sustainability Reporting Standards (ESRS) in IFRS S1. The ISSB agreed to permit entities to use the GRI Standards and ESRS to identify disclosure requirements only if these sources do not conflict with the objective of IFRS S1. While the GRI Standards and ESRS have some conceptual differences with the IFRS Sustainability Disclosure Standards—notably the definition of materiality—UK stakeholders have welcomed the inclusion of these sources of guidance. Paragraphs 34–37 discuss this further. The TAC may consider whether these references are appropriate.

5.3the UK's Environmental Reporting Guidelines, which contains guidance on environmental matters including greenhouse gas emissions, energy efficiency, water, waste, resource efficiency, emissions to air land and water, and biodiversity and ecosystem services. Paragraphs 42–45 provide an outline of the Environmental Reporting Guidelines. The TAC may consider whether it is appropriate to insert these UK specific guidelines as a source of guidance into IFRS S1.

General views on the sources of guidance

6The sources of guidance referenced in IFRS S1 have been the subject of significant debate in many different forums. Stakeholders generally welcomed the sources of guidance as a helpful starting point, especially in the absence of a full and comprehensive suite of IFRS Sustainability Disclosure Standards. Some stakeholders acknowledged that the approach taken by the ISSB balances the demand for prescriptive requirements and the need for flexibility in the application of IFRS S1 and IFRS S2.

7However, concerns have been raised by UK stakeholders about references to third-party materials within IFRS S1 and IFRS S2, especially when these materials were not developed using the same conceptual frameworks and are not subject to IFRS due process. UK stakeholders indicated that it is not common practice in accounting standards to require entities to use materials that are not part of the authoritative standard and that have not undergone IFRS due process procedures. For example, IFRS Accounting Standards do reference the IFRS Conceptual Framework, however this document has undergone the IFRS Foundation's full due process procedures and forms the conceptual foundation for IFRS Accounting Standards.

8Some stakeholders also expressed concerns about the instruction 'shall refer to and consider' being vague and confusing. This is discussed further in paragraphs 22-27.

Identifying risks and opportunities and identifying applicable disclosure requirements

9In relation to the sources of guidance, IFRS S1 distinguishes between sources of guidance to identify sustainability-related risks and opportunities and sources of guidance to identify applicable disclosure requirements.

10Regardless of whether a topic-specific IFRS Sustainability Disclosure Standard exists, the sources of guidance to identify sustainability-related risks and opportunities are permitted to be used. However, entities are only permitted to use the sources of guidance to identify applicable disclosure requirements when an IFRS Sustainability Disclosure Standard does not exist.

11This nuance may not impact the application of IFRS S1 but may impact the application of future standards. It is assumed that if the ISSB issues an IFRS Sustainability Disclosure Standard on a specific sustainability-related matter, then an entity need not use the sources of guidance to identify disclosure requirements. However, the entity would still be required to use the sources of guidance to identify sustainability-related risks and opportunities. IFRS S1 Basis for Conclusions paragraph BC128 provides a justification for this difference in wording, noting that the ISSB believes that ‘even though more IFRS Sustainability Disclosure Standards will be developed, the sources of guidance will still be useful to entities in identifying sustainability-related risks and opportunities and information to provide about those risks and opportunities.'

References to the SASB materials

12As described in IFRS S1, IFRS S2 and the accompanying materials, the ISSB asserts that an entity's exposure to sustainability-related risks and opportunities is likely to differ depending on the industry(s) in which the entity operates. Therefore, the ISSB concluded that both IFRS S1 and IFRS S2 would include requirements to disclose material industry-based information about sustainability-related risks and opportunities.

13Although neither IFRS S1 nor IFRS S2 specifically require entities to identify sustainability-related and climate-related risks and opportunities using an industry-based approach, the reference to the SASB materials is interwoven into IFRS S1 and IFRS S2 in a way that seemingly, and more subtly, requires entities to use an industry-based approach to identify sustainability-related risks and opportunities. IFRS S1 requires an entity to refer to and consider the SASB Standards, and IFRS S2 requires an entity to refer to and consider the Industry-based Guidance on Implementing IFRS S2 which was derived from the SASB Standards and includes a subset of disclosure topics and metrics relating to climate-related matters.

Background to the SASB materials

14The SASB materials identify sustainability-related topics that are most relevant to entities within a specific industry and provide specified metrics related to those sustainability-related topics. Information on these sustainability-related topics is useful for users when comparing the risk profiles and performance of entities across an industry. The SASB materials were developed over six years through extensive research, industry engagement and due process. They were based on the U.S. markets and include the SASB's Sustainable Industry Classification System® (SICS®) which classifies entities using sustainability profiles rather than sources of revenue. In particular, the SICS were developed using the characteristics of businesses in the U.S., and some jurisdictions have raised concerns about whether this classification system is internationally applicable. Both GRI Standards and ESRS have, or will have, sector standards and guidance but use different bases and classification for these sectors. Entities that are captured by multijurisdictional reporting requirements may encounter challenges when applying industry/sector standards that do not use the same classification system. In 2023, the ISSB published revised SASB Standards which included amendments to the metrics, which improved the applicability of the SASB materials but did not include a revision to the industry classifications. In its meeting in May 2024, the ISSB agreed to maintain the SICS categories for the ISSB's two-year work plan and to consider enhancing the industry categories when it further enhances the SASB Standards.

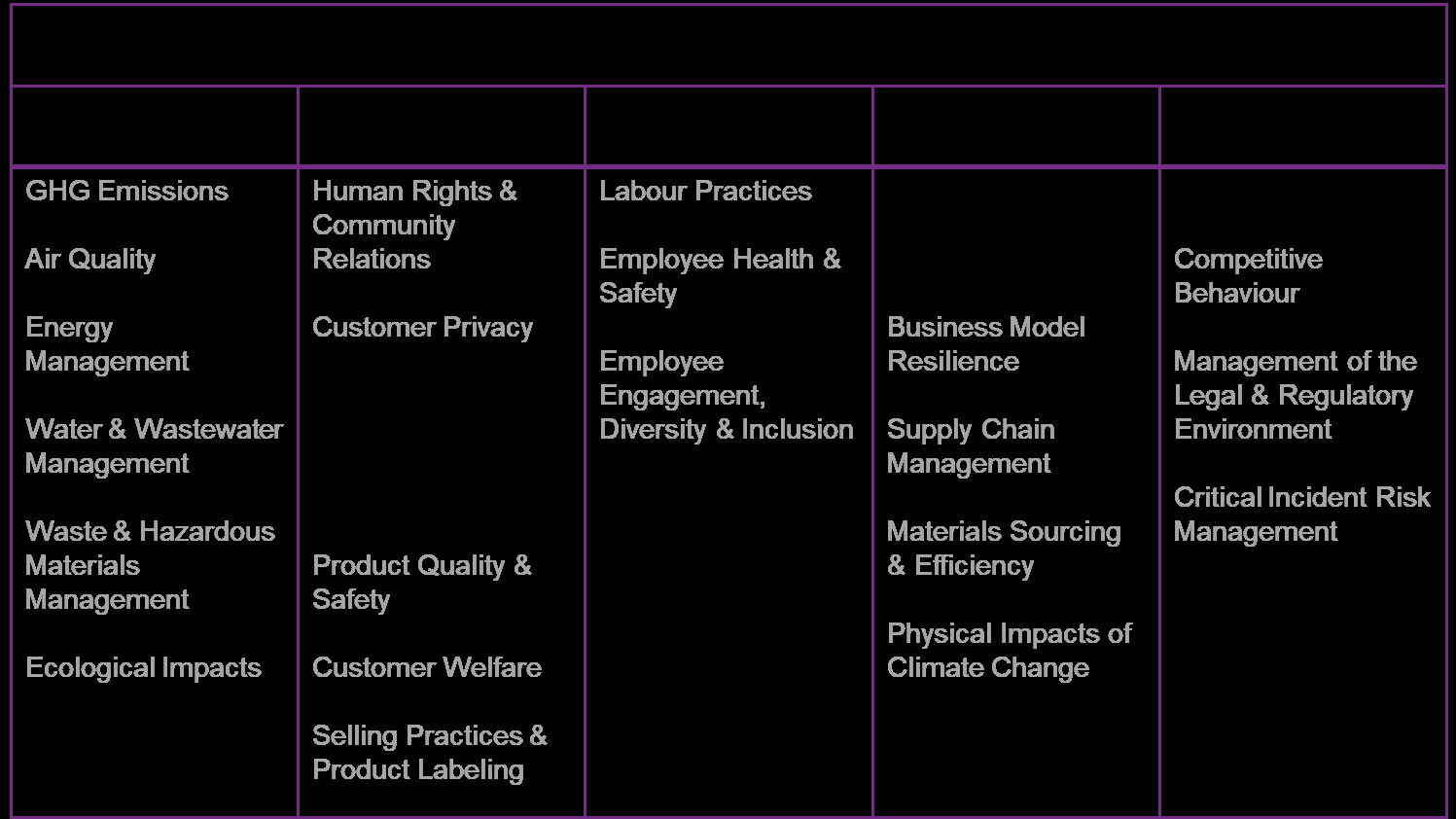

15For each of the 77 industries it identifies, the SASB materials describe which disclosure topics are most relevant alongside associated metrics. For example, according to the SASB materials an entity within the Commercial Banking industry is likely to identify the sustainability-related topics outlined in Figure 1 as most relevant.

16Importantly, the SASB materials explicitly state that these are a minimum set of disclosure topics that are typical to an entity in an industry and an individual entity may choose to disclose information about additional sustainability-related risks and opportunities based on their unique business model.

Figure 1 Relevant sustainability-related topics for Commercial Banking industry. Note the greyed text represents the issues that were not identified as the most likely to be useful to investors during the SASB standard setting process. Source: SASB

Stakeholder feedback

17Nearly all stakeholders supported an industry-based approach to sustainability-related reporting. In particular, stakeholders noted that an industry-based approach would improve transparency and comparability within sectors and would enable a better understanding of an entity's relative performance against peers. Stakeholders also suggested that an industry-based approach to measuring risks and opportunities encourages better understanding of these risks and opportunities for both the entity and users of reporting.

18However, stakeholders also noted challenges associated with industry-based requirements, including:

- concerns that an approach that is too prescriptive could lead to a 'tick-box' exercise approach and boilerplate disclosures that are not useful to investors;

- requests to balance an industry-based approach with entity-specific materiality assessments, especially when industry-specific elements are not necessarily material to individual entities; and

- challenges with capability and data constraints—including the availability and quality of data—that would increase cost and burden on entities.

19Although UK stakeholders recognise the SASB materials are helpful as a starting point, many of them have raised concerns that these materials are too prescriptive and, in some cases, not necessarily the most relevant sustainability-related risks and opportunities that could affect an entity's prospects. For example, an entity using the Casinos & Gaming standard may not identify smoke-free casinos—which is one of the disclosure topics—and information about the percentage of gaming floor where smoking is allowed (SV-CA-320a.1) as a sustainability-related risk and opportunity that might affect its prospects. There has been no comprehensive assessment to date from the ISSB across all 77 industry standards as to whether the disclosure topics and metrics are still relevant. Certain industries may have significant geographic differences, e.g., financials and health care. Feedback from UK stakeholders for the TAC's call for evidence suggest that some of the industry standards may not be entirely relevant in the UK, e.g., car rental and marine transportation. In its two-year workplan, the ISSB has committed to ensure the SASB materials continue to be relevant and fit for use by a global audience. Additionally, some responses to the TAC's call for evidence suggested that entities may apply the SASB materials using a "tick box” approach which could lead to boilerplate disclosure that are not decision useful. This could be further exacerbated for those industries where there are significant geographic differences.

20UK stakeholders also raised concerns that the use of the SASB materials should not replace an entity-specific materiality assessment which considers other factors that are specific to the entity's circumstances such as location of operations or organisational structure. IFRS S1 paragraph B19 states that 'materiality judgements are specific to an entity. Consequently, this Standard does not specify any thresholds for materiality or predetermine what would be material in a particular situation.' Although IFRS S1 is clear that an entity is required to use its own materiality judgements based on its own circumstances, there are some concerns from stakeholders that the SASB materials claim to have determined which disclosure topics and metrics are material to an industry, and therefore entities might solely use the SASB materials rather than conduct their own materiality assessment.

21To avoid an overly prescriptive approach, whilst taking advantage of the useful content in the SASB materials, many UK stakeholders support voluntary use of the SASB materials. IFRS S1 Basis for Conclusions paragraph BC132 states that the ISSB intended that entities are only required to consider the SASB materials, and they are not required to apply them. However, despite this clarification from ISSB, stakeholders have commented on this confusing instruction as it is not clear whether the use of the SASB materials are voluntary or required as part of the application of IFRS S1 and IFRS S2.

'Shall refer to and consider' instruction

22The instruction in IFRS S1 paragraphs 55(a) and 58(a) is that entities ‘shall refer to and consider' the SASB Standards and consider the applicability of the SASB metrics when identifying sustainability-related risks and opportunities, and, in the absence of an IFRS Sustainability Disclosure Standard, to identify disclosure requirements. The language ‘shall consider' is also used in IFRS Accounting Standards and UK accounting standards. for other situations. For example, in IAS 36 Impairment of assets paragraph 12, an entity 'shall consider' a list of factors to assist in assessing whether there is any indication that an asset may be impaired.

23The IFRS S1 Exposure Draft, proposed that entities be required to refer to and consider all listed sources of guidance. Responding to feedback that the sources of guidance were too burdensome, the ISSB decided to limit the sources of guidance that an entity would be required to consider. IFRS S1 Basis for Conclusions paragraph BC130 notes:

Due to feedback that industry-specific disclosures are important to users of general purpose financial reports, the ISSB decided to confirm that an entity is required to refer to and consider the applicability of the SASB Standards in identifying sustainability-related risks and opportunities and information to report about those risks and opportunities.

24Some stakeholders have noted, first in response to the Exposure Drafts and then in relation to IFRS S1 and IFRS S2 that the instruction 'shall refer to and consider' is confusing. Some stakeholders believe that this instruction is clear—that entities need only consider the content and there is no mandatory requirement to apply it. Therefore, an entity could still assert compliance with IFRS S1 and IFRS S2 without using the SASB materials. However, many other stakeholders commented on the confusing and contradictory language used in this instruction. Firstly, there is confusion about how an entity demonstrates to users that they have 'referred to' and 'considered' the materials. Secondly, despite the clarification from the ISSB, some stakeholders were still confused as to whether the use of 'shall'—which is a mandatory instruction—suggested that the application of the materials and subsequent disclosure is mandatory. Some stakeholders were also concerned about the significant cost and burden entities may face in having to consider all the SASB materials when preparing their disclosures.

25Additional to the requirements to refer to and consider the SASB Standards, IFRS S1 paragraph 59(b) requires an entity to identify 'the industry(s) specified in the IFRS Sustainability Disclosure Standards, the SASB Standards or other sources of guidance relating to a particular industry(s) that the entity has applied in preparing its sustainability-related financial disclosures, including in identifying applicable metrics.' IFRS S1 Basis for Conclusions paragraph BC140 notes that this requirement is considered helpful to users to understand how an entity has used industry-based requirements and whether the entity has omitted a metric that is applicable to that industry. This may imply that entities are required to use the SASB materials, especially if entities are required to disclose which industry classification(s) they have used.

26The ISSB noted in IFRS S1 Basis for Conclusions paragraph BC129 that a shorter list of required sources of guidance would reduce the complexities for assurance providers as they also would be required to consider fewer sources when providing an assurance opinion. However, given the volume of content and noting that assurance providers would need to ensure that an entity has fully referred to and considered all relevant 77 SASB Standards, this may still prove to be an extensive exercise for assurance providers, especially in the first years of reporting.

27To resolve the concerns about the prescriptive nature of the SASB materials (as described in paragraphs 18–21) and the confusion about the instruction to use the SASB materials, UK stakeholders have suggested that the instruction in IFRS S1 and IFRS S2 could be amended to ‘may refer to and consider' the SASB materials. This amendment may also reduce the reporting burden and allow market practice on industry-based disclosures to develop in the UK.

Industry-based Guidance on Implementing IFRS S2

28Similar to the requirement in IFRS S1, IFRS S2 paragraphs 23 and 32 require entities 'to refer to and consider' the applicability of the Industry-based Guidance on Implementing IFRS S2 which is part of the accompanying guidance to IFRS S2. In its October 2022 meeting, the ISSB agreed that the content in the Industry-based Guidance on Implementing IFRS S2 would be reclassified as guidance—it was previously Appendix B in IFRS S2 Exposure Draft—but the intention would be to make the content mandatory in the future, subject to public consultation.

29The UK’s proposed endorsement of IFRS S2 only includes the requirements and guidance that is set out within IFRS S2, including its appendices that are an integral part of the standard. It is important to note that the TAC's assessment does not include the non-authoritative accompanying material to IFRS S1 and IFRS S2—namely the Basis for conclusions and Accompanying guidance. This presents a challenge as the industry-based guidance is directly referenced within IFRS S2 and expected to be referred to by entities to comply with the standard. As noted by some respondents to the TAC's call for evidence, any content that is required by the standard should undergo the same endorsement process in the UK as used for the authoritative parts of the standard. However, the TAC has not been commissioned to assess the industry-based guidance and therefore will not provide advice about whether the Secretary of State should endorse it for use in the UK.

30Although this technical assessment does not assess the industry-based guidance, there were concerns raised by UK stakeholders about the content of the SASB materials. In addition to the general concerns about the SASB materials, concerns were raised that the requirements in the industry-based guidance of IFRS S2 are not necessarily climate-specific. Paragraph BC24 of the IFRS S2 Basis for Conclusions states ‘[t]he Industry-based Guidance is not intended to be comprehensive or interpreted as such.' Stakeholders agreed that the SASB materials could be a helpful starting point, but that the disclosure topics did not adequately reflect transition and physical climate-related risks that entities might be exposed to. Additionally, some stakeholders identified duplication between the requirements in IFRS S2 and the accompanying industry-based materials. For example, some, but not all, industries are required to disclose the gross global Scope 1 greenhouse gas emissions.

31Some respondents to the TAC’s call for evidence also suggested that there are some generally accepted climate-related metrics missing from the industry-based content. One stakeholder noted that industry-based metrics for financial institutions could also include portfolio alignment metrics (such as Implied Temperature Rise) and climate value-at-risk metrics which directly relate to the financial exposure of entities to physical and transition climate-related risks.

32Additionally, the requirement to use the non-authoritative guidance uses the instruction 'shall refer to and consider'. As described in paragraph 24, some respondents to the TAC's call for evidence believe that this instruction is clear, and an entity could assert compliance with IFRS S2 without using the prescribed industry-based guidance. However, many other respondents were confused about the use of ‘shall' which suggests that the accompanying guidance is mandatory.

33As noted in paragraph 27, to resolve the concerns about the content of the industry-based guidance and any potential confusion about the instruction to use the guidance, stakeholders have suggested that the reference to the Industry-based Guidance on Implementing IFRS S2 is maintained, but the instruction could be amended to ‘may refer to and consider'.

Reference to GRI Standards and ESRS

34IFRS S1 paragraphs 58(c) and C1-C3 permits entities to use the GRI Standards and ESRS to identify disclosure requirements only if these sources do not conflict with the objective of IFRS S1.

35The GRI Standards and ESRS have not been included as a source of guidance to identify sustainability-related risks and opportunities. IFRS S1 Basis for Conclusions paragraph BC137 explains that ‘[a]llowing these standards to be referred to in identifying information to provide but not to identify sustainability-related risks or opportunities, is intended to ensure that any information disclosed by entities relates to a topic that has been identified as of interest to users of general purpose financial reports.'

36Stakeholders that responded to the TAC's call for evidence welcomed the reference to GRI Standards and ESRS with the expectation that this will reduce the reporting burden. The GRI Standards are the most commonly used voluntary sustainability disclosure standards around the world, and therefore stakeholders have welcomed the reference in to IFRS S1. Additionally, many UK entities are, or will be, required to use ESRS to disclose sustainability-related information. Therefore, allowing entities to refer to these standards in the absence of IFRS Sustainability Disclosure Standards is expected to reduce the reporting burden and improve interoperability.

37However, the ISSB also noted that the GRI Standards and ESRS are intended to meet the information needs for a broader set of stakeholders and not just users of general purpose financial reports. This is reflected in the different definitions of materiality used in IFRS Sustainability Disclosure Standards, GRI Standards and ESRS. Given that the assessment of materiality required by each of these standards is different, an entity could conclude that different information about sustainability-related matters is required to be disclosed to satisfy each of the sets of standards. Therefore, entities are permitted to use the GRI Standards and ESRS as long as the information disclosed meets the objectives of IFRS S1. Importantly, to meet the requirements of IFRS Sustainability Disclosure Standards, any additional information disclosed to meet the requirements of the GRI Standards and ESRS must not obscure material information required by IFRS Sustainability Disclosure Standards.

Other sources

38In addition to the SASB Standards, GRI Standards and ESRS, IFRS S1 paragraphs 55(b) and 58(b) also permit entities to use the Climate Disclosure Standards Board (CDSB) Framework Application Guidance (on biodiversity and water-related disclosures), the most recent pronouncements of other standard-setting bodies, and information disclosed by entities in the same industry or geographical region.

39An entity ‘may refer to and consider’ these sources of guidance when identifying sustainability-related risks and opportunities and also when identifying disclosure requirements in the absence of topic-specific IFRS Sustainability Disclosure Standards. Using the instruction 'may' permits, but does not require, entities to use these sources. The ISSB decided to use this instruction for these sources to make it clear that entities are not required to consider these sources and to reduce the reporting burden. It was also noted by the ISSB that a shorter list of required sources of guidance would reduce the complexities for assurance providers as they also would be required to consider fewer sources when providing an assurance opinion.

Risk management requirements

40Both IFRS S1 and IFRS S2 include requirements in the risk management section that require entities to describe the process they use to identify risks and opportunities, including a requirement for entities to disclose which sources they have used. As IFRS S1 and IFRS S2 require or permit entities to use the sources of guidance outlined in the standards, it is assumed that entities will disclose which of these specific sources they have used in addition to any other sources.

41Although there is no proposed recommendation to remove the sources of guidance from IFRS S1 and IFRS S2, if the TAC did decide to remove them, entities would still be required to disclose what sources they have used in their risk management process to identify sustainability-related risks and opportunities.

UK Environmental Reporting Guidelines

42The UK government’s Environmental Reporting Guidelines (most recently updated in 2019) is a document that was published by the Department for Business, Energy & Industrial Strategy (BEIS) and Department for Environment, Food & Rural Affairs (Defra) to support both compliance with certain laws² and voluntary reporting on a variety of environmental matters.

43The Environmental Reporting Guidelines contain:

- principles for accounting and reporting environmental impacts;

- steps an entity might take to determine environmental impact and KPIs;

- guidance on Streamlined Energy and Carbon Reporting;

- voluntary greenhouse gas reporting;

- guidance on reporting on water;

- guidance on reporting on waste;

- guidance on reporting on resource efficiency;

- guidance on reporting on emissions to air, land and water;

- guidance on reporting on biodiversity and ecosystem services; and

- further support for the preparation and disclosure of environmental information.

44Some UK entities have indicated that they have used this guidance in the preparation of their Streamlined Energy and Carbon Reporting (SECR) disclosures. However, the usefulness of this guidance and the extent to which is it used is not clear.

45This UK specific guidance could be helpful in the context of the application of IFRS S1 and IFRS S2, especially as it goes beyond climate change. However, the guidance would need to be updated and amended so as not to conflict with IFRS S1 and IFRS S2 to avoid unnecessary complexity. In the 2023 Green Finance Strategy, the UK government committed to updating this guidance. As this guidance is co-authored by a number of government departments—including the Department for Energy and Net Zero (DESNZ)—and also includes impact reporting which goes beyond the scope of IFRS Sustainability Disclosure Standards, the timelines to amend the guidance and ensure it is consistent with IFRS S1 and IFRS S2 could be very long. Additionally, this guidance does not have to be explicitly referenced to in IFRS S1 or IFRS S2 for entities to be able to refer to it when preparing their disclosures. If the guidance is considered helpful and not contradictory to the objective and requirements in IFRS S1 and IFRS S2, entities would still be able to use it.

Other jurisdictional approaches

IOSCO's endorsement assessment of IFRS S1 and IFRS S2

46On page 11 of its endorsement assessment of IFRS S1 and IFRS S2, the International Organization of Securities Commissions (IOSCO) determined that the instruction 'shall refer to and consider' in reference to the SASB materials was clear in that an entity may conclude that the disclosure topics and metrics in the SASB materials are not applicable to the entity. However, IOSCO also noted that it is not clear how an entity might reach this conclusion, and therefore IOSCO concluded that this is an area that may warrant further monitoring.

European Sustainability Reporting Standards

47The ESRS do not have an equivalent list of sources of guidance. As ESRS already consists of a comprehensive set of topical standards, ESRS does not need to reference third-party standards. However, ESRS 1 General Requirements (ESRS 1) paragraph 11 requires an entity to provide additional entity-specific disclosures if the entity concludes that an impact, risk or opportunity is not covered—or sufficiently covered—by an ESRS.

48Additionally, Section 10.1 of ESRS 1 permits an entity to adopt transitional measures—only in the first three annual reporting periods—when preparing sustainability disclosures. This includes providing additional disclosures relevant to the entity's sector using available best practice, or available frameworks such as the IFRS industry-based guidance and the GRI Sector Standards.

Endorsement recommendations

Alternative options considered but not recommended

49In considering the TAC’s endorsement recommendations on the sources of guidance in IFRS S1 and IFRS S2, the Secretariat considered alternative options that have been disregarded, including:

49.1maintaining the instruction ‘shall refer to and consider’ regarding the SASB materials without amendment. Although some stakeholders believe that the instruction is clear and entities are only required to consider, and not use, the disclosure topics and metrics in the SASB materials, many other stakeholders commented on the potential confusion as to whether the instruction is mandatory. The ISSB has attempted to clarify their position that the use of the SASB materials is not mandatory in several documents, however, the confusion about the instruction remains. The TAC may consider maintaining the instruction and requesting that the ISSB provides further guidance about how to apply the SASB materials. However, it is unclear whether any additional guidance beyond what has already been published will resolve the confusion. Additionally, maintaining the requirement to 'refer to and consider' the SASB materials could support international comparability. However, the argument that the SASB materials promotes international comparability assumes that entities will use the SASB materials to identify sustainability-related risks and opportunities and related disclosure requirements. If the intention from the ISSB is that the SASB materials are not required to be used, then comparability is not necessarily going to be achieved.

49.2inserting transitional relief that phases in the use of the SASB materials. This option would not conflict with the ISSB's decision to include reference to the SASB materials in IFRS S1 and IFRS S2 but would instead emphasise its decision that entities are only required to consider the SASB materials, and they are not required to apply them. However, a transition relief would not resolve the confusion about the use of the SASB materials and may confirm that entities are expected to use these materials when identifying sustainability-related risks and opportunities and relevant disclosure requirements.

49.3inserting a reference to the UK Environmental Reporting Guidelines. Although the Environmental Reporting Guidelines could be a helpful location for UK specific guidance, they would require updating and significant amendment to ensure that the content does not contradict the requirements in IFRS S1 and IFRS S2. The TAC may consider encouraging the government departments involved in authoring this guidance to update it to reflect the content in IFRS S1 and IFRS S2.

49.4removing all sources of guidance. Although a helpful starting point, the sources of guidance may be viewed as a prescriptive list of sustainability-related matters which might be used by entities to take a ‘tick box' exercise approach. By removing all sources of guidance, entities will need to take a proactive approach to understanding which sustainability-related risks and opportunities could affect its prospects, and what information is material. However, without IFRS Sustainability Disclosure Standards on other sustainability-related matters it might be difficult for entities to know which parameters to use and therefore it is likely that with first time reporters, or for the disclosures of sustainability-related matters beyond climate change, entities will voluntarily use the sources of guidance.

Suggested endorsement recommendation

50On balance, and based on the analysis provided in this paper, the TAC is asked to tentatively recommend:

50.1to amend the instruction in IFRS S1 and IFRS S2 ‘shall refer to and consider' to ‘may refer to and consider' regarding the SASB materials. This amendment would be for all references to the SASB materials, including the Industry-based Guidance on Implementing IFRS S2. The intention of the ISSB is that entities are required to consider the disclosure topics and metrics in the SASB materials, but entities are not required to use the SASB materials. Amending the instruction is not expected to change this intention in practice. However, amending the instruction does reduce the confusion that has been identified by stakeholders. This amendment will also allay concerns that the application of the SASB materials will lead to undue cost or effort, and concerns that the use of the SASB materials could replace an entity-specific materiality assessment. The TAC may reconsider this recommendation when the ISSB has completed their project to enhance the SASB Standards.

50.2to maintain the references to the other sources of guidance, including the GRI Standards and ESRS without amendment. Stakeholders have agreed that the sources of guidance are helpful, especially the GRI Standards and ESRS. As intended by the ISSB, these sources of guidance could support international comparability and improve the quality of reporting if applied in accordance with the objectives of IFRS S1.

Questions for the TAC

- (i)Does the TAC agree with the analysis in this paper in relation to sources of guidance in IFRS S1 and IFRS S2?

- (ii)Does the TAC agree to tentatively recommend to amend the instruction ‘shall refer to and consider' to ‘may refer to and consider' in IFRS S1 and IFRS S2 in relation to the SASB materials?

- (iii)Does the TAC agree to tentatively recommend to maintain the references to the other sources of guidance, including the GRI Standards and ESRS?

-

Note that the IFRS Foundation has assumed responsibility for the SASB Standards, but still refers to them as the SASB Standards. ↩

-

Introduced by the Companies Act 2006 (Strategic Report and Directors' Report) Regulations 2013 (SI 2013/1970) and the Companies (Directors' Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018 (SI 2018/1155). ↩