The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting July 2024 Paper 3: Identifying sustainability related risks and opportunities

Executive summary

| Date | 15 July 2024 |

|---|---|

| Paper reference | 2024-TAC-010 |

| Project | Technical assessment of IFRS S1 and IFRS S2 |

| Topic | Identifying sustainability-related risks and opportunities |

Objective of the paper

This paper reviews the requirements in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) that relate to identifying sustainability-related risks and opportunities. This paper will consider the description of 'sustainability' used in IFRS S1 and will identify practical challenges which entities may face when identifying sustainability-related risks and opportunities.

This paper briefly discusses the overlapping areas of sources of guidance, value chain, application of materiality and the relief in IFRS S1 that permits entities to only disclose climate-related information in the first year. However, the TAC is not asked to make a decision on these technical areas in this paper.

Decisions for the TAC

The TAC is asked to tentatively decide to:

- insert a definition or detailed description for 'sustainability-related matters' which is taken from the definition used in UK law;

- encourage the ISSB to consider and address how an entity might assess whether a social-related matter could affect an entity's prospects in its upcoming research on risks and opportunities associated with human capital; and

- maintain the requirements in IFRS S1 that require an entity to explain what time horizons it has applied when identifying sustainability-related risks and opportunities. This will confirm that the UK Sustainability Reporting Standards should not specify the time horizons an entity is required to use.

Appendices

There are no appendices to this paper.

This paper has been prepared by the Secretariat for the UK Sustainability Disclosure Technical Advisory Committee (TAC) to discuss in a public meeting. This paper does not represent the views of the TAC or any individual TAC member.

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including 'IAS®', 'IASB®', ISSB™, 'IFRIC®', 'IFRS®', the IFRS® logo, 'IFRS for SMEs®', IFRS for SMEs® logo, ISSB™, the 'Hexagon Device', 'International Accounting Standards®', 'International Financial Reporting Standards®', and 'SIC®'. Further details of the Foundation's Trade Marks are available from the Licensor on request.

Context

1IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) requires an entity to provide a complete set of sustainability-related financial disclosures about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity's cash flows, its access to finance or cost of capital over the short, medium or long term. These disclosures should be made using all reasonable and supportable information that is available to the entity at the reporting date without undue cost or effort. The relevant references to the requirements in IFRS S1 are as follows:

- Paragraphs 2–3 Objective

- Paragraphs 11–13 Fair presentation

- Paragraphs 30–31 Sustainability-related risks and opportunities

- Paragraphs 43–44 Risk management

- Paragraphs B1–12 Sustainability-related risks and opportunities (paragraphs 11–12)

- Paragraph E5 Transition

2Paragraphs 10–12 of IFRS S2 Climate-related Disclosures (IFRS S2) also include requirements for the disclosure of climate-related risks and opportunities in addition to a definition for climate-related risks and opportunities in Appendix A of IFRS S2.

3The requirement to disclose information about sustainability-related risks and opportunities is fundamental to the IFRS Sustainability Disclosure Standards and is the primary objective of IFRS S1. This technical area overlaps with many other areas—including, but not limited to, materiality, sources of guidance, value chain, and judgements—which are briefly discussed in this paper. However, in this paper, the TAC is only asked to make a decision pertaining to the requirements to identify sustainability-related risks and opportunities (as included in paragraphs 1 and 2 above) and will be asked to make decisions about other related technical areas in separate discussions.

Endorsement criteria

4The endorsement criteria applied in the analysis of this technical area include whether:

- use of the IFRS Sustainability Disclosure Standard is likely to result in an improvement in the international comparability of sustainability-related reporting in the UK.

- use of the IFRS Sustainability Disclosure Standard is likely to support companies in making disclosures that are understandable, relevant, reliable and comparable.

- use of the IFRS Sustainability Disclosure Standard is likely to improve the quality of corporate reporting within the UK in the long-term.

- companies are likely to be able to provide the disclosures required by the IFRS Sustainability Disclosure Standard within the timeframes that a company normally reports without undue cost or effort.

- use of the IFRS Sustainability Disclosure Standard is likely to be conducive to the UK's economic growth and international competitiveness, taking into account the costs and benefits of compliance.

- the IFRS Sustainability Disclosure Standard is likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation.

Analysis

5In relation to the requirements for entities to disclose sustainability-related risks and opportunities, there are a number of matters for the TAC to discuss, including:

5.1the preparedness of UK entities to identify and disclose information about sustainability-related risks and opportunities other than climate change. Whilst many UK entities are already required to disclose certain information about sustainability-related matters, particularly climate change, concerns have been raised by stakeholders about the potential volume of sustainability-related matters that an entity may consider when applying IFRS S1. Paragraphs 6–9 provides analysis about the preparedness of entities in the UK in the context of identifying sustainability-related risks and opportunities. The TAC is asked to consider the challenges associated with identifying 'all' sustainability-related risks and opportunities. The TAC will be asked to discuss the relief in IFRS S1 that permits entities to only disclose climate-related information in the first year in a future paper.

5.2whether the description of 'sustainability-related risks and opportunities' is sufficient. IFRS S1 does not define 'sustainability-related risks and opportunities', nor does it specify a list of sustainability-related matters that might be included. However, other reporting requirements within the UK and in other jurisdictions define sustainability, which may impact the comparability of reporting if the definitions are substantially different. Paragraphs 10–24 outline the description of sustainability-related risks and opportunities in IFRS S1 and the different definitions that are used in existing sustainability-related reporting requirements in the UK and in other jurisdictions. The TAC is asked to consider whether to recommend an amendment to IFRS S1 to include a more comprehensive description of 'sustainability-related matters' to support the application of IFRS S1 in the UK.

5.3how the requirement to disclose information about sustainability-related risks and opportunities that could reasonably be expected to affect an entity's prospects¹ can be applied to sustainability-related matters other than climate change. In particular, stakeholders noted that this concept is difficult to apply to sustainability-related matters relating to social issues, for example, human rights or employee matters. Paragraphs 25–28 discuss this matter further. The TAC is asked to consider if this requirement is sufficiently clear, and whether to encourage the ISSB to consider and address how an entity might assess whether a social-related matter could affect an entity's prospects in its upcoming research on risks and opportunities associated with human capital.

5.4whether the difference between identifying sustainability-related risks and opportunities and assessing materiality is sufficiently clear. The ISSB has previously discussed a ‘two-step process' that distinguishes between identifying risks and opportunities and assessing the materiality of sustainability-related information. Paragraphs 29–31 discuss this matter further.

5.5whether the lack of specified time horizons over which an assessment should be made may affect the application of the standards and the comparability of disclosures. The ISSB decided to maintain flexibility in the standards and allow entities to define ‘short term', 'medium term' and 'long term' themselves. The EU has taken a different approach by defining these time horizons. Paragraphs 32–37 outlines the different approaches. The TAC is asked to consider whether the UK Sustainability Reporting Standards should include defined time horizons.

5.6whether an industry-based approach to identifying sustainability-related risks and opportunities is appropriate. Although most stakeholders agree that an industry-based approach is appropriate, it has also been suggested that other factors, including the location of operations and the structure of an entity, may affect the entity's exposure to sustainability-related risks and opportunities. Paragraphs 39–45 discuss this matter further. The TAC is not asked to discuss the sources of guidance, including the references to the SASB materials in this paper.

Preparedness of UK entities

6In the responses to the TAC's call for evidence and roundtables conducted in 2023, many stakeholders noted that existing UK legislation and regulations on sustainability-related reporting meant that UK entities should be well placed and prepared to disclose sustainability-related information (in comparison to those in other jurisdictions). In particular, stakeholders mentioned that entities are required to disclose sustainability-related information under the requirements in section 414C(7)(b) (for quoted companies), section 414CB(1) (for those subject to the Non-Financial and Sustainability Information Statement) and section 414CZA (section 172 statement) of the Companies Act 2006 which means that entities are already considering and disclosing broader sustainability-related matters. Paper 2024-TAC-004a—which was discussed in the TAC meeting on 18 June 2024—provided a summary of the sustainability-related reporting requirements that already exist in the UK, which included those pertaining to principal risks and the Task Force on Climate-related Financial Disclosures (TCFD) requirements.

7However, stakeholders also noted that the identification of sustainability-related risks and opportunities will be more challenging than asking entities to only consider climate-related risks and opportunities. Given that the UK has TCFD-related reporting requirements in both the Companies Act and FCA Listing Rules, many large UK entities will have already prepared and disclosed information about climate-related risks and opportunities. The literature review summarised in paper 2024-TAC-004b—which was discussed in the TAC meeting in June 2024—found that UK entities are already disclosing information about climate-related risks and opportunities, suggesting that the largest entities in the UK have a high level of preparedness for the implementation of the IFRS Sustainability Disclosure Standards, and in particular IFRS S2. However, the review also found that while the quantity of reporting had increased, there were still information gaps and a variability in the quality of reporting of climate-related information.

8Some stakeholders also raised concerns about the vague instruction to disclose information about 'all' sustainability-related risks and opportunities, noting that there are a large breadth of sustainability-related matters that could be incorporated into an assessment of risks and opportunities. Stakeholders noted that many of these matters are currently less mature than climate-related reporting in terms of systems, processes and available data. Stakeholders also suggested that entities that are not familiar with this type of reporting may struggle to establish the internal processes and prepare their disclosures on matters other than climate change.

9Given these significant challenges, the cost and effort required by an entity to report on 'all' possible sustainability-related risks and opportunities would likely be high, especially in the initial years of applying IFRS S1. In response to concerns about preparedness, the ISSB introduced a transition relief in IFRS S1 that permits an entity to only disclose information on climate-related risks and opportunities in the first year they apply IFRS S1 and IFRS S2. If an entity opted to apply this relief, then it would be required to disclose information about all sustainability-related risks and opportunities in the second annual reporting period. The TAC will be asked to make a decision about the reliefs at a future meeting when all reliefs that are available in IFRS S1 and IFRS S2 will be presented together.

Definition of 'sustainability-related risks and opportunities'

10Stakeholders noted that 'sustainability-related risks and opportunities' is not well defined and could include a large range of sustainability-related matters. The large breadth of matters that could be considered may make the process for identifying sustainability-related risks and opportunities challenging, especially throughout the value chain. It may also challenge the comparability and consistency of entity disclosures both within the UK and internationally. Some stakeholders suggested that without a clear definition and without specific IFRS Sustainability Disclosure Standards on other sustainability-related matters, there is likely to be inconsistency and disparity in reporting in the initial years of adoption, especially if entities are selecting from a different collection of sustainability-related matters.

11IFRS S1 does not include a definition for 'sustainability-related risks and opportunities' but there is a description in paragraph 2 which states:

Information about sustainability-related risks and opportunities is useful to primary users because an entity's ability to generate cash flows over the short, medium and long term is inextricably linked to the interactions between the entity and its stakeholders, society, the economy and the natural environment throughout the entity's value chain. Together, the entity and the resources and relationships throughout its value chain form an interdependent system in which the entity operates. The entity's dependencies on those resources and relationships and its impacts on those resources and relationships give rise to sustainability-related risks and opportunities for the entity.

12This description frames sustainability-related matters as the interactions between and entity and its stakeholders, society, the economy and the natural environment. Additionally, IFRS S1 paragraph B4 goes further and uses the Integrated Reporting (IR) Framework's capitals to frame the concept of resources and relationships:

Resources and relationships that an entity depends on and affects by its activities and outputs can take various forms, such as natural, manufactured, intellectual, human, social or financial. They can be internal—such as the entity's workforce, its know-how or its organisational processes—or they can be external—such as materials and services the entity needs to access or the relationships it has with suppliers, distributors and customers. Furthermore, resources and relationships include, but are not limited to, the resources and relationships recognised as assets in the entity's financial statements.

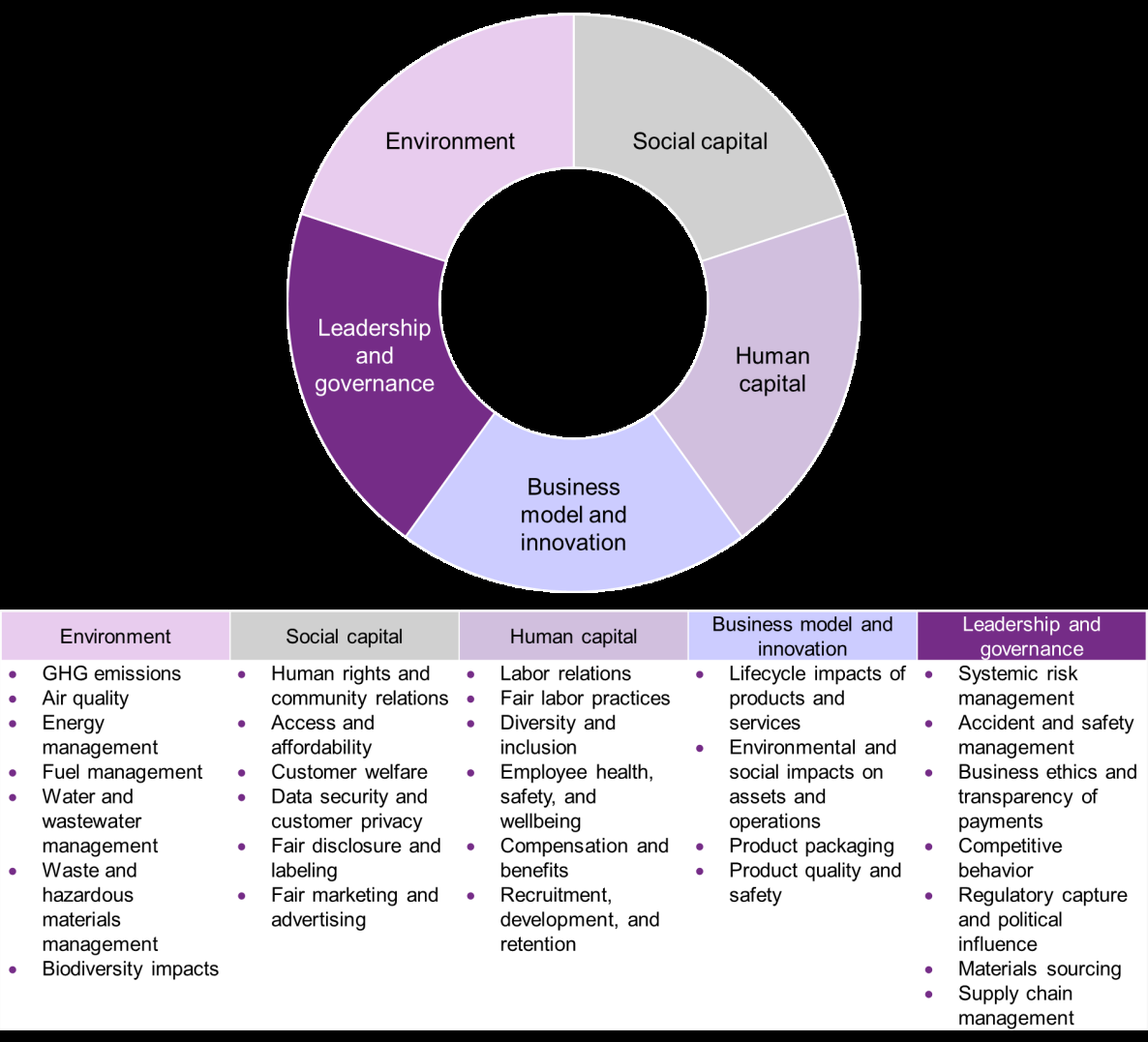

13Additionally, IFRS S1 paragraph 55 requires an entity to refer to and consider the disclosure topics in the industry-based Sustainability Accounting Standards Board (SASB) Standards when identifying sustainability-related risks and opportunities. The TAC will be asked to discuss and make a decision on the sources of guidance included in IFRS S1 in a separate paper (2024-TAC-011). However, for the purpose of discussing the definition of sustainability-related matters in IFRS S1 it is important to note that the SASB Standards use SASB's 'five dimensions of sustainability' and 'universe of sustainability issues' (Figure 1) concepts as described in the SASB Conceptual Framework to frame its standards and disclosure requirements. SASB's 'five dimensions of sustainability' refer to the grouping of sustainability-related matters into five categories. The 'universe of sustainability issues' sets out the list of issues reasonably likely to affect entities in an industry. Although SASB's 'five dimensions of sustainability' are not explicitly referenced in IFRS S1, the expectation that entities should use the disclosure topics as a starting point when identifying sustainability-related risks and opportunities means that this framing of sustainability is also expected to be used.

Figure 1 SASB's five dimensions of sustainability and universe of sustainability issues. Source: SASB Conceptual Framework

14Although there is no official definition for sustainability-related risks and opportunities in IFRS S1, there is a of 'climate-related risks and opportunities' in Appendix A of IFRS S2. This definition includes both physical risks and transition risks. The different approaches taken in the two standards may reflect the challenges of defining 'sustainability' more broadly and the acknowledgement that there is consensus as to what constitutes climate-related risks and opportunities. There is no similar consensus as to what constitutes sustainability-related risks and opportunities, especially as these risks may be less immediately apparent, could be more intangible than climate change, and could evolve in the future. It is also more difficult to draw a line between the different sustainability-related matters, for example, water-related matters could be inextricably linked to climate change or biodiversity-related matters.

15Without a clear definition for sustainability-related risks and opportunities, entities may find it difficult to understand which activities should be captured in their assessment of risks and opportunities. Additionally, no definition could lead to wide-ranging interpretations of what constitutes a sustainability-related risk and opportunity, which could compromise comparability.

16Additionally, other requirements within the UK and in other jurisdictions define sustainability-related matters, and UK entities could use these definitions in the absence of a definition in the IFRS Sustainability Disclosure Standards. The following paragraphs outline the existing definitions in both UK legislation and in other jurisdictional requirements.

Definitions used in the European Union

17In the European Union (EU), Regulation (EU) 2019/2088—which is also known as the Sustainable Finance Disclosure Regulation (SFDR)—defines 'sustainability factors' as environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters. The EU's Corporate Sustainability Reporting Directive (CSRD) builds on this and defines 'sustainability matters' as environmental, social and human rights, and governance factors, including sustainability factors defined in Regulation (EU) 2019/2088.

18The CSRD takes a topic-based approach and prescribes specific sustainability-related matters in the form of the ten topic-based European Sustainability Reporting Standards (ESRS) that all entities in scope must consider when assessing both sustainability-related impacts and sustainability-related risks and opportunities. As noted in the TAC call for evidence, many UK entities will be captured by the CSRD requirements—either because they are listed on a regulated EU market or because they have subsidiaries or branches operating in the EU that meet the reporting thresholds—which means that many of these entities will be required to consider the ten sustainability-related topics used for the ESRS.

19Using the definition in the CSRD, the ESRS frames sustainability using the categories 'environment, social and governance' and the ten topic-based standards are structured using these categories and includes the following sub-topics:

| Environmental | Social | Governance |

|---|---|---|

| Climate change | Own workforce | Business conduct |

| Pollution | Workers in the value chain | |

| Water and marine resources | Affected communities | |

| Biodiversity and ecosystems | Consumers and end-users |

| Environmental | Social | Governance |

|---|---|---|

| Resource use and circular economy |

20When applying ESRS, if an entity identifies information about sustainability-related matters that is material but is not covered in the topic-based standards, the entity is required to provide additional information that is entity-specific.

UK legislation and regulation

21The Financial Services and Markets Act 2023, section 416B(2) defines sustainability matters as the environment, including climate change; social, community and human rights issues; tackling corruption and bribery; and governance (so far as relevant to the environment; social, community and human rights issues; and tackling corruption and bribery). This is consistent with the definition used in EU law which in turn provides the basis for the structure of the ESRS standards. Additionally, section 414CB of the Companies Act 2006 requires entities to disclose information relating to environmental matters, employees, social matters, human rights, and anti-corruption and anti-bribery matters in the Non-Financial and Sustainability Information Statement. Although this is not a definition of sustainability, the inclusion of these sustainability-related matters in the requirements provides a framework for entities to use when preparing their sustainability-related disclosures in accordance with the Companies Act. Additionally, section 414CZA of the Companies Act 2006 requires entities within scope to report in the strategic report information about how directors have had regard to matters such as the interest of the company's employees, business relationships with suppliers and customers, and the impact on the community and the environment. The sustainability-related matters in section 172(1) of the Companies Act 2006 are broadly the same as in other UK legislation.

22Given that a description for sustainability-related matters exists in the UK framework—which also aligns with the EU's definition and ESRS requirements—the TAC could recommend an amendment to IFRS S1 that would include a definition or more detailed description to align with existing legislation and regulation in the UK. For example, borrowing from wording in UK law, the following detailed description could be inserted into IFRS S1:

Sustainability-related matters include those that relate to the environment (including climate change), society, community and human rights, and tackling corruption and bribery.

23In considering this approach the following points are to be noted.

23.1Recommending the addition of a detailed description for 'sustainability-related matters' in the UK Sustainability Reporting Standards would provide parameters for entities when identifying sustainability-related risks and opportunities. This may allay concerns about how extensive the exercise is for identifying sustainability-related risks and opportunities.

23.2Using a detailed description that already exists in UK law supports coherence with UK legislation and regulation. As this is a definition that is also used in EU law and as the basis for CSRD and ESRS, adding this definition would support interoperability and international comparability. However, this approach may only benefit entities registered in the UK that are in scope of the Companies Act requirements. Non-UK registered entities that may be captured by any FCA Listing Rules that requires the use of UK Sustainability Report Standards may not benefit from this approach, especially if other jurisdictions take a different approach.

23.3Providing a set of parameters for entities to follow when preparing sustainability-related information may improve understandability and comparability of disclosures for users.

23.4Recommending the addition of a detailed description for a concept that is so fundamental could have an impact on the application of the standard. The definition in UK law is not incompatible with the description in IFRS S1, but it does go further by referring to overarching sustainability-related matters that an entity should take into consideration. The application of IFRS S1 may not be directly impacted, but this could create a problem with future IFRS Sustainability Disclosure Standards if the ISSB decide to specify sustainability-related matters and create topic-specific standards that do not align with the UK's definition. However, the definition that already exists in UK law may be viewed as being sufficiently broad which would minimise the risk of impacting future IFRS Sustainability Disclosure Standards.

23.5There is a risk that providing this set of parameters could lead to a checklist approach. The current flexibility in IFRS S1 supports the development of market practice and allows entities to identify the sustainability-related risks and opportunities that are most relevant to their business. By inserting a definition that is too prescriptive, market practice could be stifled and it might discourage horizon scanning for new and emerging sustainability-related matters. This could lead to entities limiting their disclosure to the specific matters outlined in the UK detailed description, rather than considering a broader definition.

23.6The existence of these definitions in the UK framework may already support entities in understanding what sustainability-related matters to include in their reporting, especially if the entity is required to prepare the strategic report in accordance with the Companies Act. It may be unnecessary for these definitions to be inserted into the standard if they are already used by UK entities for the purpose of sustainability-related reporting. Rather than inserting the definition into the standard, it might be more appropriate to refer to the existing legislation or provide UK specific guidance on how the IFRS Sustainability Disclosure Standards interact with the existing relevant UK framework. However, this alternative approach would only benefit those that are required to comply with the Companies Act, and not non-UK registered entities that are captured by any FCA Listing Rules.

23.7The definition used in UK law framework does not list specific and detailed sustainability-related matters. For example, ‘environment' could include water, biodiversity, resource scarcity, pollution, or circular economy. Without a defined list of sustainability-related matters it would still be difficult for entities to understand what to include in their assessment of sustainability-related risks and opportunities. The SASB Standards have been welcomed as they provide a list of matters that the entity can use as a starting point rather than starting with 'all' sustainability-related matters. Although the definition in UK law would provide some parameters to the standard, it may not satisfy the needs of entities who may prefer a more detailed list of sustainability-related matters.

23.8Given the different approaches and different definitions used by standard setters, it may be more appropriate to maintain the flexibility in IFRS S1. By recommending the insertion of a more rigid definition, entities may encounter challenges when applying different definitions to meet requirements in multiple jurisdictions, which may create undue cost or burden.

24If the TAC decided to add this, or another, detailed description for 'sustainability-related matters' into IFRS S1, the TAC would also need to decide where in IFRS S1 the insertion should be placed, or if this description could be used in any government guidance, or within company law or listing rules. For example, the description could be added to the application guidance in IFRS S1 or in Appendix A. If the TAC decides to recommend inserting this detailed description, a paper on the location of this insertion will be presented to the TAC at a future meeting.

Risks and opportunities that affect an entity's prospects

25IFRS S1 paragraph 3 requires the disclosure of 'information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity's cash flows, its access to finance or cost of capital over the short, medium or long term. This requirement means that entities do not need to disclose information about all possible sustainability-related risks and opportunities, but rather just those that are considered to have, or potentially have, significant effect on the entity's prospects. Additionally, IFRS S1 paragraph 6 states that '[s]ustainability-related risks and opportunities that could not reasonably be expected to affect an entity's prospects are outside the scope of this Standard.'

26Although some concerns were raised in the TAC's call for evidence about the instruction to disclose 'all' sustainability-related risks and opportunities, other stakeholders believed that IFRS S1 has a clear and well-defined expectation that entities will only need to disclose material information about risks and opportunities that are likely to affect the entity's prospects. This additional filter should then, in the view of these stakeholders, reduce the burden by only requiring the disclosure of a subset of sustainability-related risks and opportunities.

27The IFRS S1 Exposure Draft, proposed that entities would be required to disclose information about all 'significant' sustainability-related risks and opportunities. The use of the term 'significant' was to indicate that disclosures were only required about those risks and opportunities that would have a sufficient impact on the entity's prospects and to confirm that entities would not be required to conduct an exhaustive assessment on all possible sustainability-related risks and opportunities. However, feedback to the Exposure Draft suggested that the term created more confusion, especially where stakeholders used the term 'significant' interchangeably with 'material'. The ISSB agreed to remove the term, expecting that the requirements on materiality, and clarification that entities are only required to disclose information on sustainability-related risks and opportunities that could reasonably be expected to affect its prospects, would be sufficient.

28Whilst disclosing information that could reasonably be expected to affect an entity's prospects is a narrower scope of risks and opportunities, additional concerns were raised in the TAC's call for evidence and roundtables about how this concept might apply to sustainability-related matters beyond the environment. In particular, a few stakeholders suggested that it might be challenging to identify risks and opportunities that may affect an entity's prospects specifically relating to social matters. One stakeholder specifically noted that further guidance might be required to help entities understand how to assess whether a social topic—for example, human rights or employee matters—could affect the entity's prospects, and whether this assessment needed to be qualitative or quantitative. In its two-year work plan, the ISSB has committed to conduct research on human capital which could lead to a future topic-specific standard on this matter. The TAC may encourage the ISSB to consider how an entity might assess whether a social-related matter could affect an entity's prospects as part of its upcoming research on risks and opportunities associated with human capital.

Identifying risks and opportunities and assessing materiality

29In the responses to the IFRS S1 Exposure Draft, some stakeholders commented on the different use of the term 'materiality' by different standard setters. In the context of IFRS Foundation, 'materiality' refers to the information that is useful to users when making decisions about capital allocation. The IFRS Foundation does not use the term 'material risks and opportunities', which has become common parlance to describe risks and opportunities that are relevant to the entity. The ISSB has previously discussed a ‘two-step process' that firstly requires entities to identify sustainability-related risks and opportunities, and secondly to determine the information that is material. This nuanced approach may not be clear to all stakeholders, and further guidance may be needed to explain how an entity may apply this two-step process and differentiate between identifying sustainability-related risks and opportunities, and assessing materiality.

30As noted in paragraph 25, IFRS S1 only requires the disclosure of information about sustainability-related risks and opportunities that might reasonably be expected to affect an entity's prospects. This suggests that an entity-specific approach is appropriate, and that the entity is only required to disclose information that it has assessed—in management's opinion—to be important to the entity. However, the definition of materiality focuses on the information needs of the user, which may not align with management's view of which sustainability-related risks and opportunities are relevant to the entity. One stakeholder noted that the assessment of whether a given sustainability-related risk and opportunity would influence users' decision-making will be highly subjective and require judgement as it may well depend on the investor, firm, fund and strategy. This is especially the case when investors have different objectives, risk appetites, and time horizons. Therefore, it might not be appropriate to rely solely on user information needs as a defining factor when identifying sustainability-related risks and opportunities, although entities are expected to assess the common information needs of primary users.

31IFRS S1 paragraph 75 notes that an entity will be required to apply judgement in identifying the sustainability-related risks and opportunities that could affect the entity's prospects. IFRS S1 paragraph 74 requires entities to disclose information 'to enable users of general purpose financial reports to understand the judgements...that the entity has made in the process of preparing its sustainability-related financial disclosures and that have the most significant effect on the information included in those disclosures.' Therefore, entities will be required to provide information about the judgements that they applied when identifying sustainability-related risks and opportunities, in addition to the judgements used to apply materiality. This requirement should provide the transparency required to understand why an entity has assessed information about certain sustainability-related risks and opportunities to be material.

Time horizons

32Some stakeholders commented on the lack of defined time horizons over which to identify sustainability-related risks and opportunities in both IFRS S1 and IFRS S2. Stakeholders also noted that the time horizons for financial reporting are not primarily geared towards long-term risks which could affect connectivity between sustainability-related information and information in the financial statements. A more detailed discussion on connectivity, including with the financial statements, will be provided to the TAC in a future meeting.

33Paragraph BC102 in IFRS S1 Basis for Conclusions on General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1 Basis for Conclusions) explains the ISSB's decision not to define the time horizons in IFRS S1 or IFRS S2. The ISSB recognises that the time horizons used by an entity will depend on several factors, including the industry in which it operates, its business planning and investment cycles, and also the nature of the risk and opportunity and how they might manifest in different locations. For example, a long-term perspective is likely to be significantly different between a bank and a property development entity. The flexibility provided for in IFRS S1 and IFRS S2 can therefore be viewed as appropriate to allow an entity to define its time horizons. This approach was also taken by the TCFD, which did not define time horizons for the same reason.

34Current reporting requirements in the UK have also taken this position and have not required entities to use prescribed time horizons.

35However, to support transparency, entities are required to 'explain how the entity defines 'short term', 'medium term' and 'long term' and how these definitions are linked to the planning horizons used by the entity for strategic decision-making' in both IFRS S1 paragraph 30(c) and IFRS S2 paragraph 10(d).

36The EU has taken a slightly different approach. Section 6.4 of ESRS 1 General Requirements (ESRS 1) specifies the definitions for short-, medium- and long-term time horizons as outlined in the table below.

| Time horizon | Definition |

|---|---|

| Short term | The period adopted by the undertaking as the reporting period in its financial statements |

| Medium term | From the end of the short-term reporting period up to 5 years |

| Long term | More than 5 years |

37Although the EU takes a different approach to ISSB in defining the time horizons, these approaches are not incompatible. If the UK were to introduce a definition for time horizons that was different from both approaches taken by the EU and ISSB, this could create unnecessary complexities for UK entities. Therefore, it may be appropriate to maintain the flexibility in IFRS S1 and IFRS S2 to prevent any additional complexities.

Value Chain

38Stakeholders highlighted the significant challenge entities will face in identifying sustainability-related risks and opportunities throughout the value chain. This technical area will be discussed further in paper 2024-TAC-012.

Industry-based sustainability-related risks and opportunities

39Both IFRS S1 and IFRS S2 include requirements for entities to disclose information that is relevant to particular business models, activities or other common features that characterise participation in an industry. These industry-based requirements relate to the identification of sustainability/climate-related risks and opportunities and the disclosure of industry-based metrics.

40As described in the IFRS S1, IFRS S2, and the accompanying materials, the ISSB asserts that an entity's exposure to sustainability-related risks and opportunities is likely to differ depending on the industry(s) in which the entity operates. Therefore, the ISSB concluded that both IFRS S1 and IFRS S2 would include requirements to disclose material industry-based information.

41Although IFRS S1 and IFRS S2 do not explicitly require entities to identify sustainability-related risks and opportunities using an industry-based approach, entities are required to 'refer to and consider' industry-based SASB materials when identifying sustainability-related and climate-related risks and opportunities. The TAC will consider the references to the SASB materials and the instruction 'shall refer to and consider' when discussing the sources of guidance in paper 2024-TAC-011.

42Broadly there is consensus from both UK stakeholders and international stakeholders that sustainability-related matters will affect different industries in different ways. Not only will the sustainability issues be different for each industry, but the nature and degree of exposure to the same sustainability issue will differ. For example, climate-related risks will affect an entity in the agriculture industry differently to an entity in the telecoms industry. Additionally, an entity's definition of 'short', 'medium’and ‘long' term will differ depending on its industry. For example, a real estate company will have a different definition of 'long term' in comparison to an asset manager, resulting in different assessments of long-term risks. Therefore, most stakeholders agree that an industry-based approach is important when identifying sustainability-related risks and opportunities. In particular, stakeholders noted that it was crucial for disclosures to include industry-based information to support comparability, but also to ensure the information about the risks and opportunities were relevant and material. Despite the support for an industry-based approach, some stakeholders have identified significant challenges for entities that are diversified conglomerates that operate across multiple industries.

43There is broad agreement that an industry-based approach is helpful for users, especially investors when they are considering sector allocation strategies in their portfolio construction. Industry-based disclosures help users to compare entities within specific industries which provides insight into that entity's performance and exposure to sustainability-related risks and opportunities. Users have signalled a strong preference for industry-based information that is prescribed and standardised to enable comparability between entities. However, in the TAC's call for evidence and roundtables, some stakeholders suggested a potential discrepancy between user expectations for comparable data and an entity's view of what is relevant to the business. Investors may want prescribed industry-based disclosures, but this information may not necessarily represent what the entity has identified as a risk or opportunity. These stakeholders concluded that it is important to balance user requests for standardised and prescribed industry-based information with management's view of what is material.

44An industry-based approach considers both industry relevance but also industry specificity (Figure 2). This distinction is important when considering what type of information is included in an industry-based approach, but also how industry-based requirements are incorporated into sustainability-related disclosure standards. For example, in the accompanying industry-based guidance in IFRS S2, the disclosure requirements include both climate-related matters that are specific to an industry, but also industry-agnostic information that has been determined as relevant to an industry. For example, Volume 10—Metals & Mining requires the disclosure of Gross global Scope 1 emissions (EM-MM-110a.1) whereas Volume 27—Drug Retailers does not have any greenhouse gas requirements. This approach allows for the identification of sustainability-related risks and opportunities that are specific to an industry, and also the identification of sustainability-related risks and opportunities that are likely to have a bigger impact on certain industries. For example, entities that manufacture household and personal products are more likely to be impacted by water-related risks than airline industries. At the same time, the incorporation of ESG factors in credit analysis is a disclosure topic that may only be relevant to the banking industry.

Figure 2 Industry-based approach

A diagram illustrating two concentric circles. The outer circle is labeled "Industry-relevant information". The inner circle is labeled "Industry-specific information". This shows that industry-specific information is a subset of industry-relevant information.

45Some stakeholders raised concerns about availability of data and the additional costs associated with providing industry-based disclosures. These respondents requested more flexibility in applying an industry-based approach which could include a phased adoption of industry-based requirements. However, as noted in paragraph 42, the identification of risks and opportunities—which is fundamental to the application of IFRS S1 and IFRS S2—is highly likely to depend on the industry in which an entity participates. Disregarding the references to the SASB materials, the industry-based requirements in IFRS S1 and IFRS S2 are suitably flexible to allow entities to disclose information that is entity-specific and material.

Reasonable and supportable information

46IFRS S1 paragraph B6(a) states that 'an entity shall use all reasonable and supportable information that is available to the entity at the reporting date without undue cost or effort to identify the sustainability-related risks and opportunities that could reasonably be expected to affect the entity's prospects'.

47Some stakeholders indicate that this concept and its application to identifying sustainability-related risks and opportunities is helpful and will support entities in preparing proportionate disclosures. Some stakeholders requested further guidance on the level of rigour that will be required when applying this concept, noting that inconsistent application could result in inconsistent practice. The TAC may consider observing market practice to understand whether any additional guidance or changes are necessary to the standards in the future.

Endorsement recommendations

Alternative options considered but not recommended

48In considering the TAC's endorsement recommendations on identifying sustainability-related risks and opportunities, the Secretariat considered alternative options that have been disregarded including:

48.1maintaining the requirements on identifying sustainability-related risks and opportunities without inserting a definition. The flexibility provided in IFRS S1 allows entities to determine the sustainability-related risks and opportunities that it is exposed to. However, there was concern from stakeholders that without a clear definition and without specific IFRS Sustainability Disclosure Standards on other sustainability-related matters, there is likely to be inconsistency and disparity in reporting in the initial years of adoption. Additionally, a description already exists in UK law which could be applied to IFRS S1.

48.2inserting definitions for ‘short term’, ‘medium term' and 'long term'. Although stakeholders commented on the lack of defined time horizons in IFRS S1 and IFRS S2, the flexibility in the requirements allows entities to apply the time horizons that are appropriate in their circumstance. Unlike the definition for 'sustainability-related matters', there is no existing definition in UK law that is applicable in these circumstances. Additionally, UK entities that are in scope of ESRS will be required to use the definitions in ESRS 1. Inserting definitions for the time horizons could create undue cost and burden to UK entities applying ESRS if these definitions do not align with those in ESRS 1.

48.3requesting additional guidance on the application of the concept ‘reasonable and supportable information that is available to the entity at the reporting date without undue cost or effort'. Although some stakeholders were concerned that inconsistent application of this concept could lead to inconsistent disclosure practice, it may not be appropriate to provide further guidance that is too prescriptive. Instead, the TAC may observe practice as it develops to understand whether any amendments are required in the future.

Suggested endorsement recommendation

49On balance, and based on the analysis provided in this paper, the TAC is asked to tentatively recommend:

49.1to insert a definition or detailed description for ‘sustainability-related matters' which is taken from the description used in UK law. The location of this insertion may be discussed at a future meeting. The criteria for amending the standards are that changes are considered necessary for the effective application within the UK. The TAC may decide that recommending the insertion of a definition for 'sustainability-related matters' would be conducive to the long-term public good by providing parameters for entities to use when identifying sustainability-related risks and opportunities. This would support improved comparability and understandability of disclosures. It would also support international comparability, especially with regard to interoperability with ESRS.

49.2to encourage the ISSB to consider and address how an entity might assess whether a social-related matter could affect an entity's prospects in its upcoming research on risks and opportunities associated with human capital. This might include examples from the ISSB as to how risks and opportunities associated with human capital could affect an entity's prospects.

49.3to maintain the requirements in IFRS S1 paragraph 30(c) and IFRS S2 paragraph 10(d) that require an entity to explain which time horizons it has applied when identifying sustainability-related risks and opportunities. This confirms that the UK Sustainability Reporting Standards should not specify the time horizons an entity is required to use. The TAC may decide that the flexibility in IFRS S1 and IFRS S2, coupled with the requirement to explain which time horizons have been applied, is appropriate. The TAC may also decide to encourage the ISSB to consider defining time horizons when it updates the SASB Standards. Although defined time horizons in IFRS S1 and IFRS S2 could improve comparability, it may also reduce the relevance of the disclosure if the time horizons used are not appropriate for all entities.

Questions for the TAC

- Does the TAC agree with the analysis in this paper in relation to identifying sustainability-related risks and opportunities in IFRS S1?

- Does the TAC agree to tentatively recommend to insert a definition or detailed description for 'sustainability-related matters' which is taken from the definition used in UK law?

- Does the TAC agree to encourage the ISSB to consider and address how an entity might assess whether a social-related matter could affect an entity's prospects in its upcoming research on risks and opportunities associated with human capital?

- Does the TAC agree to tentatively recommend to maintain the requirements in IFRS S1 paragraph 30(c) and IFRS S2 paragraph 10(d) that require an entity to explain which time horizons it has applied when identifying sustainability-related risks and opportunities?

- Does the TAC agree to tentatively confirm that the UK Sustainability Reporting Standards should not specify the time horizons an entity is required to use?

-

IFRS S1 uses the term 'prospects' as shorthand for 'cash flows, access to finance or cost of capital over the short, medium or long term'. ↩