The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

TAC Public Meeting June 2024 Paper 4: Commercially sensitive information

This paper has been prepared by the Secretariat for the UK Sustainability Disclosure Technical Advisory Committee (TAC) to discuss in a public meeting. This paper does not represent the views of the TAC or any individual TAC member.

This publication contains copyright material of the IFRS Foundation®. All rights reserved. Reproduced and distributed by the FRC in its role as the secretariat for the UK Sustainability Disclosure Technical Advisory Committee with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the International Sustainability Standards Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Information contained in this publication does not constitute advice and should not be substituted for the services of an appropriately qualified professional.

The Foundation has trade marks registered around the world (Trade Marks) including 'IAS®', 'IASB®', ISSB™, 'IFRIC®', 'IFRS®', the IFRS® logo, 'IFRS for SMEs®', IFRS for SMEs® logo, ISSB™, the 'Hexagon Device', 'International Accounting Standards®', ‘International Financial Reporting Standards®', and 'SIC®'. Further details of the Foundation's Trade Marks are available from the Licensor on request.

Executive summary

| Date | 18 June 2024 |

| Paper reference | 2024-TAC-006 |

| Project | Technical assessment of IFRS S1 and IFRS S2 |

| Topic | Commercially sensitive information |

| Objective of the paper | This paper presents an analysis of the exemption and requirements in IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) that entities can use to omit commercially sensitive information from their disclosures in specific and limited circumstances. |

The TAC is asked to consider whether this exemption and requirements are appropriate and whether there are any issues with their compatibility with existing UK legislation and regulation.

Decisions for the TAC

The TAC is asked to tentatively decide:

- to maintain the exemption and requirements in IFRS S1 relating to commercially sensitive information; and

- to flag to the Department of Business and Trade that there are inconsistencies in UK legislation, but this should not impact the application of the standard.

Appendices

There are no appendices to this paper.

Context

1 In response to strong feedback from stakeholders on the Exposure Drafts of IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2), the International Sustainability Standards Board (ISSB) introduced a narrow-scope exemption that entities can use to omit commercially sensitive information in specific and limited circumstances. As noted in IFRS S1 Basis for Conclusions on General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1 Basis for Conclusions), respondents to the Exposure Drafts (in particular reporting entities) stated that they would be reluctant to disclose information about certain opportunities if this information is considered commercially sensitive—that is, that this information might reduce their competitiveness or be commercially harmful.

2 IFRS S1 paragraphs 73 and B34–B37 sets out the disclosure exemption that allows entities, in limited circumstances, to omit information about sustainability-related opportunities that are determined as commercially sensitive. Entities only qualify for the exemption if the information about the opportunity is not already publicly available, and its disclosure could reasonably be expected to prejudice seriously the economic benefits the entity would otherwise be able to realise. If the entity uses this exemption it is required to disclose that it has used the exemption and reassess whether the information still qualifies for the exemption at each reporting date. Specifically, the entity is not permitted to use the exemption for information about sustainability-related risks nor for broad non-disclosure.

3 Exemptions for the disclosure of commercially sensitive information already exist in UK legislation and accounting standards (both UK-adopted international accounting standards and UK Accounting Standards). In addition to considering the overall appropriateness of the commercial sensitivity exemption, the TAC needs to consider compatibility of the exemption in IFRS S1 with exemptions in current UK legislation and accounting standards, and whether any incompatibilities that exist would make them unsuitable for inclusion in UK domestic legislation and regulation.

4 The assumption in this paper is that IFRS S1 and IFRS S2 reporting could be mandated through the Companies Act in the future and that entities that are in scope could be required to disclose sustainability-related financial information in the strategic report. Therefore, the challenges outlined in this paper assume that the exemption in IFRS S1 could sit below the overarching exemption for commercially sensitive information in the Companies Act 2006 Section 414C. The challenges outlined in this paper may not apply if entities are not required to disclose IFRS S1 and IFRS S2 information in the strategic report. For example, the FCA Listing Rule on Task Force on Climate-related Reporting (TCFD) reporting allows entities to disclose information outside of the strategic report. If a similar approach is taken for the implementation of IFRS S1 and IFRS S2, the differences between the Companies Act exemption and the IFRS S1 exemption are likely to be irrelevant. This is a matter for the UK Sustainability Disclosure Policy and Implementation Committee (PIC) to discuss. However, the TAC may consider whether there are any technical challenges that may need to be included in the TAC's final endorsement recommendations to the Secretary of State (SoS).

Endorsement criteria

5 The endorsement criteria applied in the analysis of this technical area include whether:

- use of the IFRS Sustainability Disclosure Standard is likely to result in an improvement in the international comparability of sustainability-related reporting in the UK.

- use of the IFRS Sustainability Disclosure Standard is likely to support companies in making disclosures that are understandable, relevant, reliable and comparable.

- use of the IFRS Sustainability Disclosure Standard is likely to improve the quality of corporate reporting within the UK in the long-term.

- use of the IFRS Sustainability Disclosure Standard is likely to be conducive to the UK's economic growth and international competitiveness, taking into account the costs and benefits of compliance.

- the IFRS Sustainability Disclosure Standard is likely to be coherent with, and suitable for inclusion in, UK domestic legislation and regulation.

Analysis

6 In relation to commercially sensitive information, there are two matters for the TAC to discuss, including:

6.1 whether the exemption and requirements in IFRS S1 are appropriately applied to only sustainability-related opportunities. Paragraphs 7–13 outline the views from UK stakeholders that suggest that commercially sensitive information could apply to information other than opportunities. The TAC may consider whether to extend the exemption and requirements in IFRS S1 to allow entities to omit any information that is considered commercially sensitive, whilst continuing to apply the criteria in IFRS S1.

6.2 whether the exemption and requirements in IFRS S1 are compatible with UK legislation and regulation. Paragraphs 14–28 outline the differences between similar exemptions and requirements in IFRS S1, the Companies Act, IFRS Accounting Standards and UK Accounting Standards. The TAC should consider whether any inconsistencies could present challenges in the application of IFRS S1 and whether any observed inconsistencies could make the exemption and requirements in IFRS S1 incompatible with UK legislation and regulation. The TAC should consider whether amendments are necessary in IFRS S1 to address any inconsistencies.

General views on the disclosure of commercially sensitive information

7 In response to the Exposure Drafts of IFRS S1 and IFRS S2, many UK stakeholders raised concerns about potential commercial sensitivity of certain information including:

- forward-looking information relating to scenario analysis and transition plans;

- effects of the sustainability-related risks and opportunities on the entity's strategy and business models (e.g., M&A transactions, contracts in negotiation, or products in development);

- opportunities that have not been realised;

- internal carbon price; and

- certain industry-based disclosure requirements in the SASB Standards.

8 Some concerns were raised by UK respondents to the Exposure Drafts about the commercial sensitivity of information about unrealised opportunities, but this was not a common theme amongst UK responses. In response to the Exposure Drafts of IFRS S1 and IFRS S2, one stakeholder noted that entities are likely to disclose information about opportunities without being prompted to disclose this information, and if an entity does not include such information in the annual report, then it is likely due to commercial sensitivities. Other stakeholders noted that information about speculative opportunities could be commercially sensitive, whereas opportunities that an entity is pursuing should be disclosed as part of the entity's overall strategy. The exemption in IFRS S1 does not differentiate between speculative opportunities or opportunities the entity is pursuing. Instead, it allows for entities to omit commercially sensitive information about opportunities if that information is not already publicly available or it could prejudice seriously the economic benefits the entity would otherwise be able to realise in pursuing the opportunity.

9 Commercial sensitivity was not a common theme in the responses to the TAC's call for evidence and in the roundtable discussions. Only two stakeholders commented on the commercial sensitivity of information relating to internal carbon pricing and certain requirements in the SASB Standards.

10 Although concerns were raised by UK stakeholders about the commercial sensitivity of other information listed in paragraph 7, the ISSB introduced the targeted and narrow-scope exemption only for information about sustainability-related opportunities. This is consistent with the exemptions in accounting standards (both international and UK) which only permit the use of the exemption in relation to information that is considered prejudicial in a dispute with other parties about provisions, contingent liabilities or contingent assets.

11 However, commercially sensitive information may not be limited to information about opportunities, and therefore the TAC may consider expanding the exemption for all information that could be commercially sensitive. This would mean that entities could take advantage of the exemption in situations when information about certain risks or forward-looking financial information could be commercially sensitive. For example, an entity may have information about a particular risk in its supply chain that, if disclosed, could provide insight into proprietorial or patented processes that is not already publicly available and could be prejudicial. However, by increasing the availability of the exemption to cover any information that could be considered commercially sensitive, this could lead to some entities exploiting the exemption and could impact the completeness of their disclosure and its decision usefulness.

12 Additionally, only permitting the use of the exemption for sustainability-related opportunities could create a disconnect and imbalance between information on sustainability-related risks and any related opportunities. As noted in IFRS S2 Basis for Conclusions paragraph BC23, climate-related—and sustainability-related-risks and opportunities are not always mutually exclusive. For example, a risk might also present an opportunity to an entity depending on the mitigating actions taken by an entity. This means that entities will have to carefully consider how to structure their disclosures when a sustainability-related risk and opportunity are connected.

13 Although the use of the exemption is expected to be rare, the application of it could compromise the quality of reporting—especially if its use creates a disconnect and imbalance in the disclosure as described in paragraph 12. However, if the exemption were to be removed, this could impact the competitiveness of UK entities if they were not permitted to omit commercially sensitive information. On balance, the exemption in IFRS S1 could be viewed as sufficiently narrow in scope which could satisfy concerns about the quality of reporting and the competitiveness of UK entities.

Compatibility with UK legislation and regulation

14 The TAC is asked to consider whether the exemption and requirements set out in IFRS S1 on commercially sensitive information are compatible with existing UK legislation and regulation.

15 As noted in paragraph 4, this paper assumes that IFRS S1 and IFRS S2 could be mandated through the Companies Act in the future and that entities that are in scope could be required to disclose sustainability-related financial information in the strategic report. If a different approach is taken for the implementation of IFRS S1 and IFRS S2, the differences between the Companies Act exemption and the IFRS S1 exemption are likely to be irrelevant.

16 In particular, the TAC should consider whether the following differences between IFRS S1 and UK legislation and regulation could be incompatible, including:

- the definition of 'commercially sensitive';

- the conditions for determining whether information is commercially sensitive;

- the disclosure requirements for the use of the exemption; and

- the statement of compliance.

An analysis of these differences is set out in the following sections. The table below summarises the differences between IFRS S1, the Companies Act and the accounting standards. If all disclosures are required in the annual report and accounts, then any incompatibility could be challenging in practice.

| IFRS Sustainability Disclosure Standards¹ | Section 414C(14) and Section 414CB of the Companies Act | IFRS Accounting Standards | UK Accounting Standards | |

|---|---|---|---|---|

| Permits use of exemption for specific information. | ✓ | ✓ | ✓ | ✓ |

| Defined as information that could 'prejudice seriously' the interests of the company. | ✓ | ✓ | ✓ | ✓ |

| Permits use of exemption if information is not already publicly available. | ✓ | |||

| Information is determined as commercially sensitive if it is 'expected to' prejudice seriously the interests of the company. | ✓ | ✓ | ✓ | |

| Information is determined as commercially sensitive 'in the opinion of directors' prejudice seriously the interests of the company. | ✓ | |||

| Requires disclosure of use of exemption. | ✓ | ✓ | ✓ | |

| Requires disclosure of contextual information if the exemption is used. | ✓ | ✓ |

17 In particular, the TAC may consider whether any inconsistencies could lead to significant variations in disclosure practice and whether entities could exploit these inconsistencies.

18 Whilst there may be differences between IFRS S1 and current UK legislation and regulation, this does not necessarily mean that the exemptions and requirements are incompatible. The presence of some inconsistencies may still make the commercial sensitivity provisions suitable for inclusion in UK legislation and regulation and/or adaptions could be recommended to accommodate the standards. Additional guidance could also be considered to support entities in understanding when they are able to use the exemption and omit information that is considered commercially sensitive.

Definition of ‘commercially sensitive'

19 IFRS S1 does not provide a definition for what is meant by 'commercially sensitive' information. However, it does provide certain criteria that determine when information qualifies for this exemption. Consistent with the terminology used in the Companies Act 2006 and accounting standards (both international and UK), IFRS S1 exempts the disclosure of information if 'that information could reasonably be expected to prejudice seriously the economic benefits the entity would otherwise be able to realise in pursuing the opportunity'.

20 However, IFRS S1 also permits use of the exemption if ‘information about the sustainability-related opportunity is not already publicly available'. This additional criterion is not consistent with existing requirements in the UK. Although IFRS S1 seems to set a higher bar for non-disclosure, the exemption in IFRS S1 can only be used for sustainability-related opportunities and cannot be used for broad non-disclosure, nor can it be applied to information about risks. Additionally, the criteria listed in IFRS S1 paragraph B35 is inclusive—that is, the information only qualifies for the exemption if all three criteria are met. This would likely make use of the exemption less common.

Determining whether information is ‘commercially sensitive'

21 A key difference between IFRS S1 and existing UK legislation and regulation is how commercial sensitivity is determined. IFRS S1 is consistent with accounting standards (both international and UK) in that commercially sensitive information is information that is 'expected to' prejudice the economic benefits the entity would otherwise be able to realise. These standards do not provide any criteria to support an entity in determining how to do this and who is to make such a determination and would require the entity to apply judgement. However, IFRS S1 goes further than IAS 37 and FRS 102 in that it requires entities to determine if the information 'could reasonably' be expected to be commercially sensitive. However, it does not stipulate who would be expecting the information to be prejudicial.

22 The Companies Act requirements are different in that information is determined as commercially sensitive 'in the opinion of the directors' which could mean a different process is used to determine whether information is commercially sensitive. This means that a different level of judgement may be required to be applied by the entity when complying with IFRS S1 and the Companies Act. However, an entity would need to establish its own process to determine whether the information meets the exemptions criteria in both the Companies Act and IFRS S1.

Stipulations for non-disclosure

23 Section 414CB of the Companies Act 2006 states that an entity can use the exemption to omit commercially sensitive information 'provided that the non-disclosure does not prevent a fair and balanced understanding of the company's development, performance or position or the impact of the company's activity.' This stipulation goes further than the exemption in IFRS S1 and requires greater judgement from entities when deciding what information to disclose.

Disclosure of the use of the exemption

24 IFRS S1 paragraph B36(a) requires an entity to disclose that they have used the exemption if they use it, which is helpful for users and from a supervisory perspective. However, as described in paragraph BC81 of the IFRS S1 Basis for Conclusions, entities are not required to disclose why they have used the exemption as this might reveal the commercially sensitive information. This is different to accounting standards (both international and UK) which require entities to disclose that they have used the exemption and some information setting out why the exemption has been used.

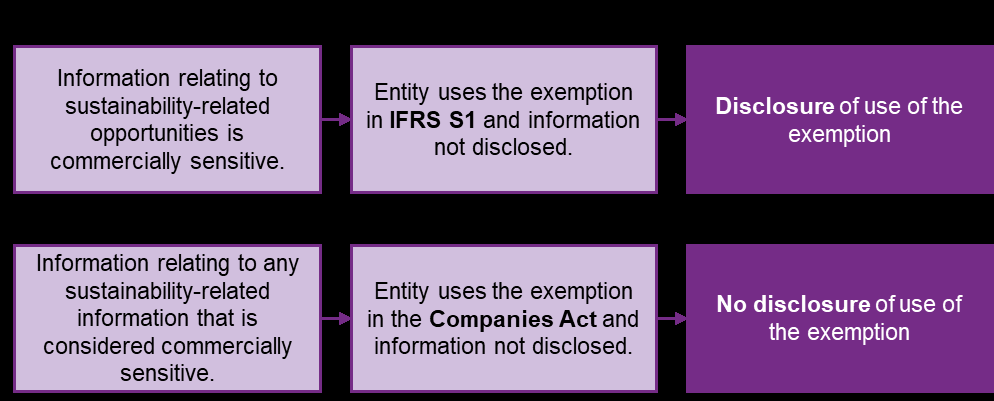

25 The requirement in IFRS S1 to disclose information about whether the exemption has been used goes beyond the requirements in the Companies Act which do not require an entity to disclose whether they have used the exemption. This inconsistency could create an imbalance in disclosures if entities omit information that is considered commercially sensitive but not relating to opportunities. For example, if an entity uses the exemptions in the Companies Act and does not disclose certain metrics that could be commercially sensitive, the entity is not required by the Companies Act to disclose that they have used the exemption. Figure 1 demonstrates this imbalance with two scenarios.

Figure 1 Disclosure of the use of exemptions for commercially sensitive information

Figure 1 Disclosure of the use of exemptions for commercially sensitive information

26 The TAC is unable to suggest amendments to the Companies Act as this is beyond its remit. However, as noted in IFRS S1 Basis for Conclusions paragraph BC81(a), the disclosure of when the exemption is used would be a helpful signal to users that the information has been omitted because of commercial sensitivity. For this reason, the TAC may recommend that the disclosure requirements are maintained without amendment.

Statement of compliance

27 One stakeholder raised a question as to whether the use of the exemption would prevent an entity from being able to state compliance with the standard. Whilst the exclusion of information could reduce the completeness of the disclosure, IFRS S1 requires an entity to disclose that they have used the exemption which provides users with insight that commercially sensitive information has been omitted. Additionally, IFRS S1 paragraph 73 states that an entity using the exemption is not prevented from asserting compliance. For this reason, the TAC may recommend that no amendments to IFRS S1 are necessary.

28 However, if an entity uses the exemptions in Section 414C(14) and Section 414CB of the Companies Act—especially if they are used for information other than sustainability-related opportunities and does not disclose the use of the exemption—then the entity will be unable to assert compliance with IFRS S1. Conversely, if an entity only uses the exemption in IFRS S1, then it is still able to assert compliance with the Companies Act requirements.

Endorsement recommendations

Alternative options considered but not recommended

29 In considering the TAC's endorsement recommendations on the exemption and requirements on commercially sensitive information, the Secretariat considered alternative options that have been disregarded. The criteria for amending the standards—notably that changes are considered necessary for the effective application within the UK and failure to amend the standard would be of detriment to the long-term public good—have not been met in this instance.

30 The alternative options that were considered but not recommended including to:

30.1 remove the exemption in IFRS S1. Entities that report in accordance with the requirements in the Companies Act would still be able to take advantage of the exemption which covers all commercially sensitive information—not just those that relate to sustainability-related opportunities. However, removing the exemption from IFRS S1 would likely reduce international comparability of sustainability-related reporting in the UK.

30.2 extend the exemption in IFRS S1 to cover all commercially sensitive information, not just that which relates to sustainability-related opportunities. Although UK stakeholders have identified that information other than sustainability-related opportunities could be commercially sensitive, entities that report in accordance with the requirements in the Companies Act would also be able to take advantage of the broader exemption, assuming that IFRS S1 and IFRS S2 could be mandated through the Companies Act. Additionally, this alternative option would likely not improve the quality of corporate reporting within the UK as it could impact the completeness of information. For example, if an entity chose to omit significant amounts of information on the basis of that information being commercially sensitive, this could result in incomplete disclosure.

30.3 add additional wording to IFRS S1 that resolves some of the inconsistencies with the Companies Act. For example, the wording used in the Companies Act, including 'in the opinion of the directors' and 'provided that the non-disclosure does not prevent a fair and balanced understanding of the company's development, performance or position or the impact of the company's activity', could be added to IFRS S1 paragraph B35. This option would align the wording in the exemption and requirements in IFRS S1 and the Companies Act and, therefore, would remove some of the inconsistencies. However, these amendments could reduce the international comparability of the sustainability-related reporting in the UK.

Suggested endorsement recommendation

31 On balance, and based on the analysis provided in this paper, the TAC is asked to tentatively recommend that the exemption and requirements in IFRS S1 relating to commercially sensitive information are maintained without amendment but note in its advice to the Department of Business and Trade (DBT) that there are some inconsistencies with IFRS S1 and the UK's legal framework.

32 As noted by the ISSB, the use of the exemption on commercially sensitive information is expected to be rare. However, if applied by an entity it could compromise the quality of reporting—especially if its use creates a disconnect and imbalance in the disclosure as described in paragraph 12. On the other hand, if the exemption were to be removed, UK entities would not be permitted to omit commercially sensitive information from their sustainability-related disclosure which could impact the competitiveness of UK entities. On balance, it could be concluded that the exemption in IFRS S1 is sufficiently narrow in scope which could satisfy concerns about the quality of reporting and the competitiveness of UK entities.

33 Although inconsistencies have been identified, the adoption of these requirements would still likely be coherent with, and suitable for inclusion in, UK domestic legislation and regulation. Entities that report in accordance with the requirements in the Companies Act, and therefore able to use the exemptions in Section 414C(14) and Section 414CB, would still be able to apply the broader exemption that could apply to information other than sustainability-related opportunities. However, the TAC should provide DBT with information about where the inconsistencies are in the Companies Act.

Questions for the TAC

- Does the TAC agree with the analysis in this paper in relation to the exemption in IFRS S1 on commercially sensitive information?

- Does the TAC tentatively recommend that the exemption and requirements in IFRS S1 paragraph B34–B37 relating to commercially sensitive information are maintained without amendment?

- Does the TAC tentatively recommend to flag to DBT that there are inconsistencies in UK legislation, which could prevent entities from asserting compliance with IFRS S1?

-

To use the exemptions in IFRS Sustainability Disclosure Standards all criteria outlined and marked in the table must be met. ↩