The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Lab Report: Improving ESG Data Production - Summary

Summary of findings

As explained in the FRC's ESG statement of intent, the systems to produce, distribute and consume ESG data are significantly less mature than those for financial information. In this context, the FRC Lab (Lab) launched a project about the production, distribution and consumption of ESG data, with the first phase focusing on the production of ESG data.

The Lab's report focuses on the company's perspective on ESG data production (covering what is produced for both internal use and external reporting) and is based on interviews and roundtables with a diverse range of organisations across sectors and sizes (including large listed companies, private companies and housing associations).

This summary covers the current landscape and challenges faced by these organisations. It also includes a step-by-step approach to ESG data production based on what we heard from participants and a set of questions for boards to consider in optimising how ESG data is collected and used.

What do we mean by ESG data?

ESG data stands for environmental, social and governance data. However, the focus of conversations with participants tended to be predominantly on environmental and social matters, with particular emphasis on climate issues due to both regulatory and investor pressure in the last few years.

ESG data is also sometimes referred to as non-financial information – although related issues can have a financial effect and this term may also include other topics. Some consider ESG to be synonymous with sustainability information and a company's impact, whereas others consider ESG to be focused on what affects the company, or both. For the purposes of this project, we sought to understand what companies consider to be ESG data and how they approach its production.

Ultimately, this project aims to understand how companies are collecting data which enables them to respond to the risks and opportunities associated with environmental and social issues. How data is distributed and consumed externally will be explored in the next stage of the Lab's ESG data project.

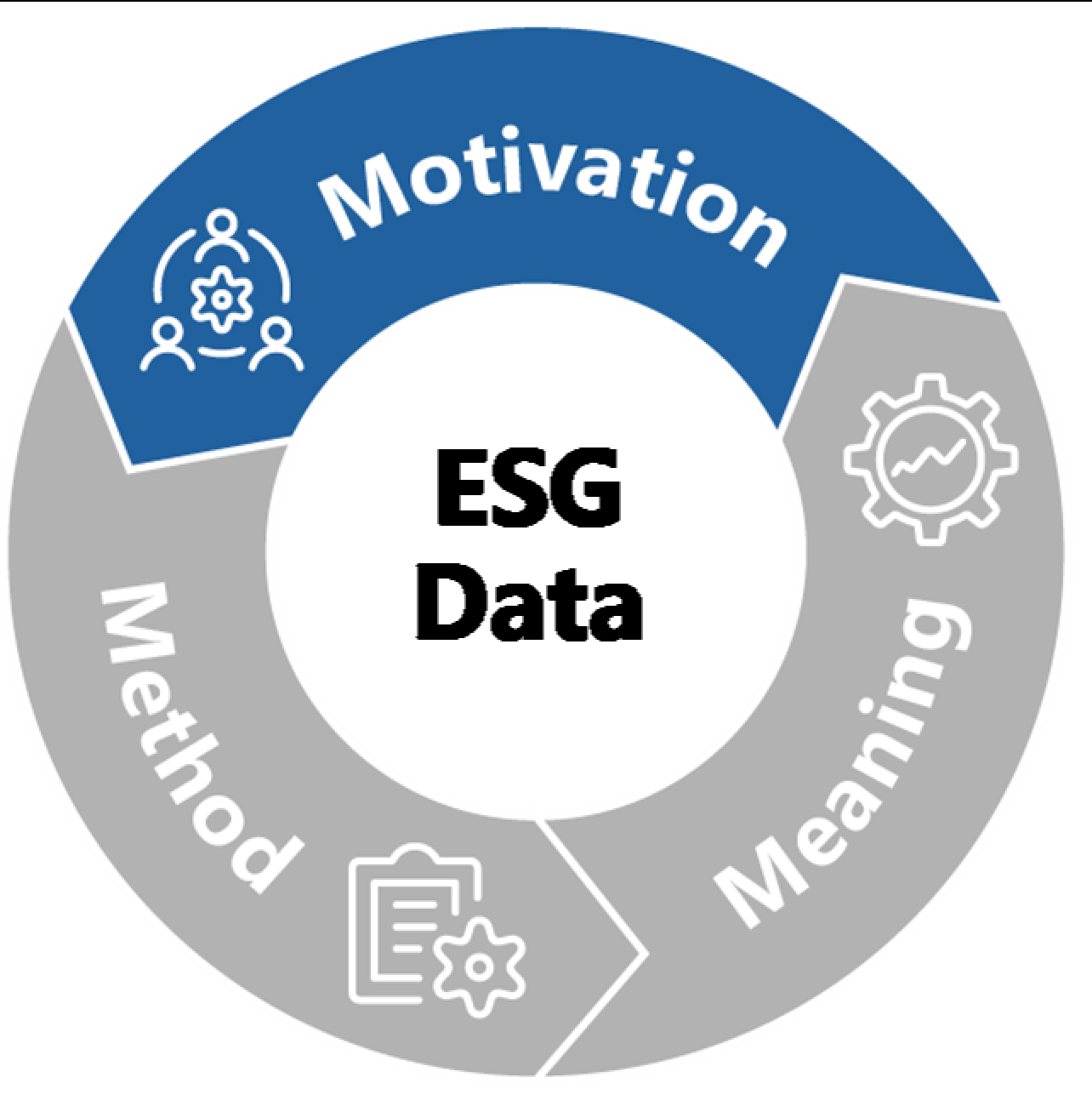

In our work we identified three elements of ESG data production – we use these to explore the current landscape, challenges and positive actions to address them. The three elements are:

- Motivation – What motivates the company to collect ESG data and how does it identify what is needed?

- Method - How is ESG data collected?

- Meaning – How is the data used within the company and how does it impact decision-making?

Motivation

This element is about the drivers for data collection and how companies identify what data they need for internal and external purposes. The key drivers are:

- Business and strategy needs – These can be further categorised as driven by:

- Operations – to monitor costs or performance in relation to their licence to operate (e.g. health and safety);

- Purpose – to monitor alignment with strategic objectives, which may be linked to sustainability;

- Commitments – to track progress against goals (e.g. net zero); and

- Internal stakeholders – to address employee interests.

- Investor and stakeholder requests – These include requests by:

- Investors – to fill in questionnaires and report against frameworks;

- Debt providers – to assess use of proceeds of green and sustainable bonds or loans;

- Existing and prospective customers – to meet supply chain information requests and for certifications and labels; and

- Industry bodies, authorities and initiatives – to meet membership criteria or industry targets.

- Regulatory and framework requirements – These will be driven by legal requirements (e.g. Companies Act) across different jurisdictions, stock exchange rules and the data points required by standards and frameworks voluntarily adopted.

These drivers feed into materiality assessments to help companies decide what data points need to be collected. Challenges include:

- Volume of requests;

- Pace of change in legislation; and

- Nuances between different but similar requests for data.

Method

business intelligence visualisation tools to specialised ESG platforms, financial reporting and enterprise resource planning systems.

The frequency of data collection and processing is dependent on whether it is used operationally or for reporting purposes, internal expectations and the maturity of the systems available.

Once data is collected, it is assessed for accuracy and validity through:

- Variance analysis – comparison with prior periods, forecasts and targets;

- Lines of defence approach – application of controls, internal reviews, checklists and sign-offs;

- Internal audit – review of methodologies, specific data sets and key performance indicators (KPIs); and

- External assurance – typically, limited assurance and mostly focused on environmental data.

This element sets out how data is collected by identifying:

- Roles – Who is involved in collecting the data can be split between:

- Producers and owners – directly involved in the collection and are typically subject matter experts; and

- Coordinators and reporters – responsible for collating, bringing other teams together and consolidating, typically from a reporting or sustainability function.

- Sources – Companies gather:

- Internal data – directly measured through automated systems or manual input, or derived from documents; and

- External data – obtained from third parties, including suppliers, through contracts, questionnaires and invoices.

- Processing tools – Companies export the gathered data into different types of platforms ranging from spreadsheets and

Challenges associated with this stage of data production include:

- Difficulties obtaining data from suppliers, particularly where many small ones are involved;

- Risks of error associated with manual input; and

- Differences in jurisdictional requirements or what is culturally acceptable and in data systems when requesting data across multiple geographies and subsidiaries.

Meaning

How data is used will to an extent depend on the level of board and executive oversight. The board itself or delegated committees responsible for ESG topics typically receive ESG information between once and four times a year, through reports, including balanced scorecards. The frequency and approach will influence how it is used, which often includes:

- Scenario analysis, forecasting and risk management – This has been in part driven by the Task Force on Climate-Related Financial Disclosures (TCFD) requirements, but is being applied to other areas to assess risks and model future possibilities.

-

Analysis of performance and progress against targets – Data on performance may be reviewed from both an operational basis and a sustainability perspective. Ultimately, it can be used to assess performance against strategy and to identify where action is needed.

-

Capital allocation and procurement choices – ESG factors are influencing capital expenditure decisions, particularly where needed to fulfil commitments, but also operational expenditure choices, both on type and on selection of suppliers.

- Remuneration decisions – Some companies are using ESG metrics for performance bonuses or long-term incentive plans to increase accountability and incentivise action.

How companies use ESG data is still evolving and will depend on the level of maturity and quality of data, processes and systems. There is also a challenge in getting leading/forward-looking indicators and whether the data is timely enough for decision-making. The more awareness there is on how ESG data can be used strategically, the more there is a business case for investing in the human resources and systems needed to improve the quality of the data. This in turn leads to more effective use of the data both internally and by external stakeholders.

A recommended step-by-step approach to ESG data production

Motivation

Identifying what data is needed to meet business strategy, stakeholder and regulatory needs

- Perform a materiality assessment to understand what ESG topics and data points are relevant to the company:

- Identify both current and future drivers for ESG data

- Engage internal stakeholders across all levels to understand what is needed operationally and strategically, and identify what is already collected and what is missing

- Engage with key investors and other stakeholders to understand what data is important to them

- Review regulation and framework requirements

Method

Collecting and processing data effectively

- Identify who are the data producers and owners across the company for different data sets, and the coordinators, reporters and validators for a joined-up approach

- Identify the internal and external sources for the data and set out the methodology and frequency for gathering the data

- Whether a manual or automated system, engage with finance and internal audit teams to apply controls over the data, including evidence trails, reviews and sign-offs

- Assess which data should be subject to internal and external assurance

- Document responsibilities and processes for knowledge retention

- Share lessons learnt with teams and subsidiaries where approaches may be historically different

Meaning

Using the data strategically

- Consider training and education for the board and across the company on why ESG data is needed and how it can be used for effective strategic decision-making

- Do not treat ESG data just as part of an annual reporting cycle; integrate it in regular processes and embed in the company's culture to understand:

- company performance and impact

- risks and opportunities

- progress against commitments

- what action (including strategic change, capital allocation and incentivisation) is necessary

Questions for boards: Motivation

The board establishes an organisation's purpose, values and strategy and should satisfy itself that these are aligned with its culture. ESG data needs are not separate from these goals; they are an enabler of them. Effective organisations set their ESG data collection and information objectives based on what will be useful for managing the business and monitoring its overall performance, not just to meet external disclosure requirements.

Ask:

- Does the organisation and the board have an understanding of the benefits derived from ESG data?

- What ESG data do we need to support our goals, measure our impacts and monitor our culture?

- What ESG data do we need to monitor and assess risks?

- What ESG data is required by regulation and how can we use that information for business decision-making?

- What information do we already have, and is it suitable and robust?

- Does current ESG information meet our needs?

Organisations also need to consider stakeholder needs. Dialogue with stakeholders will allow boards to understand future trends and to realign strategy. Boards could consider engaging with a wide range of stakeholders on ESG data including the communities in which they operate and those within their supply chain, in line with directors' Section 172 duty. The chair has an important role in fostering these relationships and ensuring that the views of all stakeholders, both large and small, are considered when discussing ESG issues.

Ask:

- How do we engage with stakeholders on ESG both at group and local level?

- What frameworks are our stakeholders using to assess and compare companies?

- How do we communicate to employees, communities, customers, suppliers and governments?

- How do we assess the views of our stakeholders and integrate them into necessary data collection and decision-making?

Questions for boards: Method

The board's objective is to ensure that the necessary resources (both in terms of people and systems) are in place for the organisation to meet its goals and measure performance against them. It is important, therefore, to establish a framework of prudent and effective controls, which enable risk to be assessed and managed, as well as identify where improvements are needed. ESG data and information should be collected, collated and reported in a way that ensures appropriate quality and integrity with supporting policies and procedures. Boards may also wish to consider whether external or internal assurance of any this data would enhance the credibility of the data and subsequent reporting. Having reporting of the highest quality and accuracy ensures that boards and stakeholders can make effective decisions and are better prepared for additional reporting demands in the future.

Ask:

- Where does expertise on ESG issues sit within the organisation and how does the board access this?

- Who collects the information and is that the appropriate team? Is the information collected top-down or bottom-up?

- Are the collectors of information joined up to avoid duplication of data and to maximise effective collaboration?

- What processes and controls should we have in place to collect and manage ESG data?

- How does our approach compare to that used for financial information?

- Are processes and controls consistently robust across the group?

- Do we have the right systems and tools?

- Do we need to improve training on ESG data issues and methodologies to allow better collection, control and decision-making?

- What is the process in place to periodically review the quality and accuracy of data?

- What is the process for identifying how systems and controls need to be strengthened?

- Do we have a consistent level of maturity of data and systems across the group?

- Where can assurance of the information (internal or external) add value?

Questions for boards: Meaning

The saying "What gets measured, gets managed" is highly relevant to ESG data. For data to be used effectively and not be considered solely an external reporting exercise, boards need to set the tone at the top and recognise its importance which then cascades through the organisation. Boards will want to develop a continuous improvement approach to data, which also addresses that the right data is collected.

Ask:

- How do we build a data-centric decision culture?

- How is ESG data being embedded into the organisation?

- Do we have a balance of lagging and leading data sets that help monitor performance on both operational and strategic needs?

- Do we have the right committees in place to optimise the use of ESG data?

- How do we build a continual improvement culture within the organisation on ESG?

- Who owns the improvement discussion?

The alignment of financial and non-financial reporting is essential to achieve a holistic view of the company through its reporting. This will allow investors and wider stakeholders to better analyse the risks and opportunities for a business. The board also has a role to play in ensuring that the company remains agile in responding to changes in the external environment and reporting landscape.

Ask:

- Is our reporting across financial and non-financial information connected?

- How can we ensure that our ESG disclosures are reliable?

- How do we monitor developments, changes and practice across the market?

- How do we contribute to the debate on ESG standards and disclosures?

Having a strong foundation for producing ESG data means that the company's external reporting is also more useful to investors and other stakeholders.

Further Information and Contact

Reports and information about the Lab can be found at www.frc.org.uk/Lab

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in