The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Reporting by the UK’s largest private companies

Thematic Review: Reporting by the UK's Largest Private Companies

- 1. Executive summary – introduction

- 1. Executive summary – key observations

- 2. Scope and background to the thematic report

- 3. Users and materiality

- 4. Strategic report

- 5. Primary statements and accounting policies

- 6. Revenue

- 7. Judgements and estimates

- 8. Provisions and contingent liabilities

- 9. Financial instruments

- 10. Climate reporting

- 11. Key expectations

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2024 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Executive summary – introduction

The UK's largest private companies are economically significant entities, often providing jobs for large numbers of people, sustaining extensive supply chains and utilising substantial debt financing. They are often important drivers for growth in the economy. Transparent and relevant communication of key matters in their annual report and accounts is needed to provide users with decision-useful information.

This thematic seeks to further develop our understanding of the quality of corporate reporting by the UK's largest private companies. We have considered the areas of the annual report and accounts that are of most importance to users and where we expect the highest risk of poor compliance.

All the companies included in our review are substantial entities in terms of revenue and employees. Many have complex structures, business models and operations. Several also have significant pension obligations.

1. Executive summary – key observations

Summary of key observations

The quality of reporting was mixed, particularly in terms of how clearly companies explained material matters that were complex or judgemental. Our main findings were as follows:

- The best strategic report disclosures focused on the elements of development, performance and position that are key for an understanding of the company, explaining them in a clear, concise and understandable way that was consistent with the disclosures in the financial statements. Good quality reporting does not necessarily require greater volume.

- To enable users to fully understand a business, disclosures should explain the nature of its operations and how it fits into a wider group structure.

- Accounting policies for complex transactions and balances were often untailored, providing boilerplate wording. Entity-specific policies are particularly critical for revenue, where the better examples explained the nature of each significant revenue stream, the timing of recognition and how the value of revenue was determined.

- Better examples of judgement and estimates disclosures included detail of the specific judgement involved and clearly explained the rationale for the conclusion. The significance of estimation uncertainty was much more apparent when sensitivities were quantified.

- For some material provisions the level of detail provided on the nature of the obligation and the associated uncertainty was below the level we expected. Users benefit from clear disclosure of this information to allow them to fully understand the risks affecting the company.

- The disclosure of financial instrument risks such as liquidity risk was generally boilerplate and generic, describing the nature of risks without fully explaining why they are relevant. Better examples explained the specific nature of the risk and quantified the exposure and sensitivity to potential future changes.

Many of the issues we identified could have been avoided if a sufficiently critical review of the annual report and accounts had been conducted prior to finalisation. This includes taking a step back to consider whether the report as a whole is clear, concise and understandable, omits immaterial information and whether additional information is necessary to understand particular transactions, events or circumstances. It also includes a review for internal consistency and more detailed presentation and disclosure matters.

2. Scope and background to the thematic report

Scope

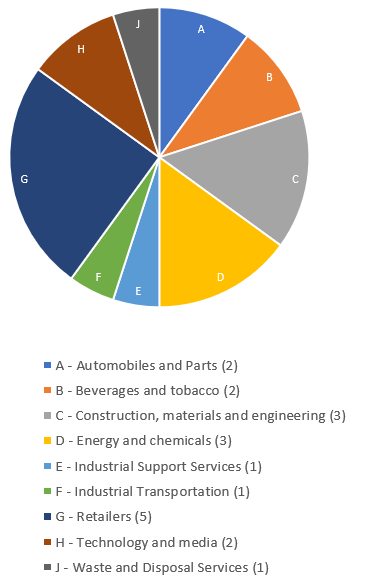

Our review looked at the annual report and accounts of 20 UK companies with revenues ranging from £1.5 billion up to £24 billion, employing between 1,000 and 145,000 people.

Our selection covered year-ends falling between September 2022 and December 2022. Companies were chosen from a variety of industries, which are set out in the chart opposite.

Our sample included financial statements prepared using the accounting frameworks applicable to companies of their size, being IFRS Accounting Standards (IFRSs) and UK GAAP (including FRS 1011 and FRS 1022).

We also considered the findings of our routine reviews of large private companies performed over the last few years.

The companies can be split into three broad categories:

- Parent companies of privately owned groups. These entities all prepared consolidated accounts.

- Subsidiary companies of overseas entities. These entities are a mix of those that prepare an intermediate level consolidation and those that present only individual accounts.

- Subsidiaries of UK-listed companies. All these entities prepared individual accounts under FRS 101.

Industries sampled (number of reports)

- A - Automobiles and Parts (2)

- B - Beverages and tobacco (2)

- C - Construction, materials and engineering (3)

- D - Energy and chemicals (3)

- E - Industrial Support Services (1)

- F - Industrial Transportation (1)

- G - Retailers (5)

- H - Technology and media (2)

- J - Waste and Disposal Services (1)

What does this review cover?

We considered the following areas of the annual report and accounts all of which have featured in the top ten topics on which we have corresponded with companies, as set out in our Annual Review of Corporate Reporting:

- Strategic report

- Presentation of primary statements including cash flow statement and supporting notes

- Revenue

- Judgements and estimates

- Provisions and contingencies

- Financial instruments

How to use this thematic review

The areas of better practice and opportunities for improvement are identified in the report as follows:

Represents good quality application that we encourage other companies to consider when preparing their annual reports.

Represents opportunities for improvement by companies to move them towards good practice.

Represents an omission of required disclosure or other issue. We want companies to avoid such issues in their annual reports.

We have provided examples of better practice in our report, highlighted in grey boxes. The examples will not be relevant for all companies or all circumstances, but each demonstrates a characteristic of useful disclosure.

Highlighting aspects of reporting by a particular company should not be considered an evaluation of that company's reporting as a whole. The examples included should not be taken as an indication of the accuracy of the underlying information, which has not been verified by our review.

In this report we refer to other thematic reports written by the FRC. Their key messages will often be relevant to large private companies.

3. Users and materiality

Users of private company annual reports and accounts

The nature of private companies means that, compared to their listed peers, there will often be fewer users of the annual report and accounts. In particular there may be fewer users who are external to the group that are not in a position to demand reports tailored to meet their particular information needs.

For example, private companies often have fewer shareholders, and they are more likely to be involved in the business to some degree and have greater access to internal information. The emphasis those shareholders place on the annual report and accounts may be lessened due to that involvement.

There are, however, external users of the annual report and accounts beyond shareholders. Those users are likely to be providers of credit to the business. Their interest will generally be focused on information about the liquidity and solvency of the company. This is because that information might be relevant to the ability of the company to pay (or repay) any credit advanced.

In addition, other users of the accounts, for example, employees (and former employees with pension interests) and customers may also have common information needs to providers of credit.

It is the purpose of the annual report and accounts to provide financial information that satisfies these common information needs.

Materiality

Materiality is not just a fundamental concept embedded in accounting frameworks, it is also a practical tool that companies can use to focus reporting on what matters. Companies use materiality to decide what to include and exclude in corporate reporting. It provides a lens through which to consider the amount and depth of information needed. The assessment of materiality should consider the needs of the main users of the annual report and accounts to ensure disclosures are relevant and provide decision-useful information. While a balance may need to be struck across the annual report and accounts as a whole, it will often be the case that better reporting does not equate to more disclosures.

In 2022 we published 'What Makes a Good Annual Report and Accounts'. Section 4 of that publication identifies the characteristics that should be considered in determining whether information is material, including in the context of the strategic report.

The FRC Lab has also recently completed a project looking at the application of materiality in practice by companies which large private companies may find useful.

4. Strategic report

All large companies incorporated in the UK must prepare a strategic report under section 414A of the Companies Act 2006 (the Act).

The contents are specified in sections 414C and 414CZA. The contents are specified in sections 414C and 414CZA.3 Where a company prepares consolidated accounts, the strategic report should also be prepared on a group basis.

The disclosure requirements that apply to large private companies are not as prescriptive as those that apply to some others, such as quoted companies. However, they still require a fair, balanced and comprehensive review of the development, performance and position of the business, consistent with its size and complexity.

In preparing their strategic report, we encourage companies to consider the relevant sections of the FRC's 'Guidance on the Strategic Report' (June 2022), which provides principles-based guidance to help achieve best practice.

Group structures

The companies in our sample had a variety of ownership and group structures. Some were the top company in their group and prepared consolidated accounts. Others were intermediate parents or subsidiaries preparing a lower-level consolidation or only individual accounts.

A clear description of how the company and its operations fit into the wider group structure is often necessary for a user to understand the information in the annual report and accounts in its full context.

All the companies in our sample are required to disclose the nature of the entity's operations and its principal activities.4 It might be beneficial to incorporate an explanation of a company's role and function within a group.

Better examples clearly explained the nature of the group that was included in the consolidation, the scope of its strategic report disclosures and defined any relevant key terms.

The company operates as a production site within the BMW Group production network manufacturing MINI brand vehicles. The company currently has three MINI derivatives in production – MINI 3 Door Hatch including a full Battery Electric Derivate (BEV), MINI 5 Door Hatch & MINI Clubman.

Company strategic objectives The main corporate objectives are: * to manufacture MINI brand vehicles to BMW Group quality standards; * to continuously implement operational efficiencies to reduce the cost of production; and * to achieve targeted production volumes in support of BMW Group sales objectives.

BMW (UK) Manufacturing Limited, Annual report and financial statements to 31 December 2022, p1

Describes the company's position and function within the wider group, including how this is incorporated in its strategic objectives.

The disclosures should allow a user to understand the performance and risks of the individual company or subgroup headed by that company. This may include principal risks that arise at a company level but are not a significant risk for the wider group.

Sometimes the details disclosed related to the wider group, rather than the specific company or subgroup. We found examples of this in the disclosure of principal risks and uncertainties and key performance indicators (KPIs).

In one instance, while the operations of the wider group could be well understood it was unclear how the specific subsidiary generated revenue.

The Directors present their strategic report for Bellis Finco plc ("the Company”), and Bellis Finco plc and its subsidiaries, (together "Asda”, “the Group"), for the year ended 31 December 2022. Bellis Finco plc is the holding company of the Asda group of businesses and all references throughout this Annual Report to Asda refer to the group of companies consolidated within Bellis Finco plc.

Bellis Finco PLC, Annual Report and Consolidated Financial Statements for the year ended 31 December 2022, p4

Clearly explains which companies are included within the group strategic report and defines key terms.

Fair, balanced and comprehensive analysis

The strategic report must contain a review that provides a fair, balanced and comprehensive analysis of the development and performance of a company's business during the financial year and its position at year end.5

This review should be consistent with the size and complexity of the business. The report must also, where appropriate, include references to, and additional explanations of, amounts included in the company's annual accounts.6

Determining what needs to be disclosed requires judgement. The quality of discussion varied significantly across the sample with room for improvement overall.

The Act requires 'an analysis', indicating that the reason for movements should be explained where it is necessary for an understanding of the development, performance or position of the company.

Some companies did not go beyond repeating the figures quoted in the financial statements, commenting only whether the figure had increased or decreased and providing no further discussion.

Better practice examples provided a clear analysis of the underlying reasons for significant movements in key metrics or balances.

Several companies focused purely on the income statement with no discussion of material balance sheet and cash flow items or changes.

The FRC's 'What Makes a Good Annual Report and Accounts' publication provides some useful considerations on how to ensure that the business review is of a good quality.

A number of strategic reports in our sample demonstrated the corporate reporting principles and the 4Cs of effective communication that we set out in that publication. They focused on the elements of development, performance and position that were key for an understanding of the company, explaining them in a clear, concise and understandable way that was consistent with disclosures in the financial statements.

Some of the best examples were far from the longest business reviews, emphasising that quality reporting does not necessarily require a greater volume of words.

Capital Expenditure

Capital expenditure of £276m in the year was £143m lower than the prior year on an annualised basis. Historically Asda's capital expenditure strategy involved significant investment each year in a small number of stores. Its policy has been revised in FY22 to take a more customer-focused approach to investment decisions, focusing spend on projects which enable more frequent investment in a higher number of stores which deliver better returns on investment.

Around 53% of the Group's investment in FY22 was on essential asset replacement and maintenance, including replacement of store refrigeration units and property maintenance costs, and 32% was focused on discretionary spend to drive growth, including upgrades to store environment and investment in systems to improve efficiency of operations. The remaining 15% (£49m) was invested in Project Future, comprising investment in the detailed design and initial build phase of Asda's standalone IT environment as we separates from previous owner Walmart's IT systems.

Please refer to the Reconciliation of Non-IFRS to IFRS Measures section below for detail on the calculation of management's Capital Expenditure KPI.

Bellis Finco PLC, Annual Report and Consolidated Financial Statements for the year ended 31 December 2022, p15

Companies should take a step back and consider whether, when taken as a whole, the review and analysis is balanced.

In one instance, a company provided detailed analysis of some profitable divisions within its business, without providing similar analysis for those divisions that gave rise to a net loss in the group.

We challenge companies where the financial review does not appear to be fair, balanced and comprehensive.

In our regular review work we successfully challenged whether a large private company's strategic report contained sufficient information to meet the requirements of the Act when it omitted a discussion of the company's performance compared to pre-pandemic levels, did not include key performance indicators, and did not describe how its principal risks affected the company or were mitigated.

Clearly highlights where the alternative performance measures (APMs) used are reconciled to the financial statements.

Provides an analysis of movements on material balance sheet and cash flow items and explains the reason for changes.

Key performance indicators (KPIs)

The Act requires that the fair review of a company's business must, to the extent necessary for an understanding of the development, performance or position of the company's business, include:

- analysis using financial key performance indicators; and

- where appropriate, analysis using other key performance indicators, including information relating to environmental matters and employee matters.

When done well, an analysis using KPIs can be a very concise way of producing a good quality review of the business. The level of analysis provided for KPIs varied across the companies reviewed.

Better examples: * Clearly defined which measures are KPIs. * Explained the reason why they were important. * Disclosed the performance in the period. * Provided analysis of the reasons for the performance compared to targets and/or prior years.

Explains that these measures are the key financial and other performance indicators.

Discloses the current and prior year performance as well as the percentage change, including actual performance for non-financial KPIs.

The Group's principal activities during the year were the hiring, selling and servicing of motor vehicles. The Group's key financial and other performance indicators during the year were as follows:

2022 2021 Change Group revenue £4,922m £4,741m 3.8% Used car sales (units) 192,904 224,071 (13.9%) New car sales (units) 55,820 56,780 (1.7%) Group operating profit £191m £278m (31.3%) Profit before tax £173m £263m (34.2%) Inventories £651m £682m (4.5%) Net funds available £325m £393m (17.3%) Shareholders' funds £1,441m £1,370m 5.2% The Group has performed well during 2022 with the restricted new vehicle supply and the related shortage of used cars helping the Group maintain vehicle margins throughout the year. Following on from the exceptional performance reported last year, this was our second most profitable year. Our new vehicle units sold remained in line with prior year, reaching 55,820, but remains below 2019, however, new car unit prices increased which accounts for the majority of our increased revenue in the year. Used car retail units decreased by 13.9% to 192,904, reflecting the shortage of quality used cars and slowing customer demand due to the 'cost of living' crisis. Careful stock selection and robust pricing disciplines helped maintain average used car margins. Demand for aftersales services remained strong with revenues of £201m (2021-£204m).

Arnold Clark Automobiles Limited, Annual Report and Accounts 2022, p10

Provides analysis to explain the reasons for the performance and change from prior years, including how the non-financial KPIs link into this.

We identified some instances where the KPIs appeared to relate to the wider group, rather than the company or subgroup for which the annual report and accounts was prepared.

Seven of the companies reviewed presented some information regarding the non-financial KPIs monitored by management.

Good examples explained how the performance of these non-financial measures linked to the financial and wider performance of the company.

Not all companies that identified non-financial KPIs provided the actual performance during the year or an analysis.

Alternative performance measures (APMs)

Financial measures that are not derived directly from accounting standards are referred to as APMs or non-GAAP measures. Common examples include measures such as EBITDA or adjusted profit.

Several of the companies reviewed used APMs, either as KPIs or in other analysis of the company's performance.

APMs are incorporated into the strategic report if management considers them to be necessary for an understanding of the development, performance or position of the business in addition to GAAP measures.

Users should be able to appreciate the importance of APMs and understand how they have been calculated.

Better examples provided disclosures in line with the ESMA Guidelines on APMs. This included: * clearly defining the APMs; * explaining why the APMs provide useful information about financial performance; and * reconciling the APMs to the nearest GAAP measure.

For further information on the use of APMs, please see our October 2021 thematic review on Alternative Performance Measures.

APMs should not be given undue prominence over GAAP measures.

We challenge companies where the presentation of APMs is unclear or misleading.

Principal risks and uncertainties

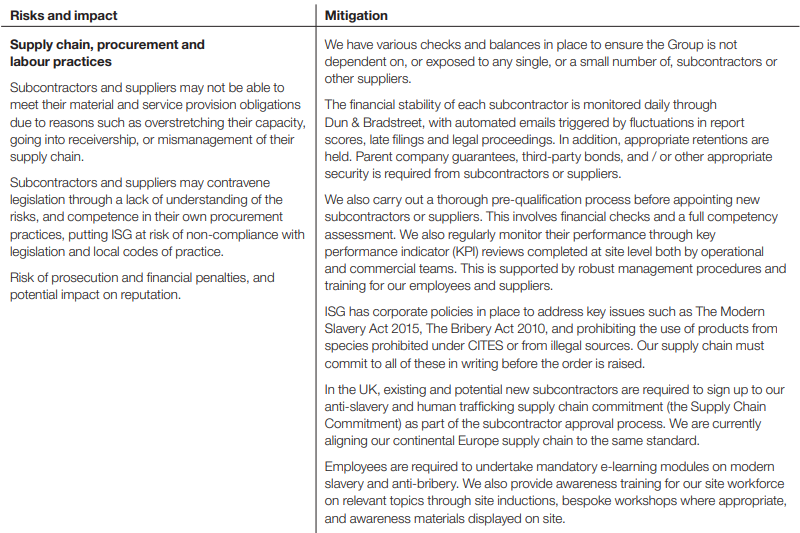

All strategic reports are required to include a description of the principal risks and uncertainties facing the company. The quality of these disclosures was mixed.

Better examples explained which risks were considered 'principal' and why. They disclosed the nature of the risks, the potential effect on the business, as well as any mitigation adopted by the company.

Companies that adopted a tabular format to present this information were often able to express this more clearly and use fewer words.

Section 172 statement

All large companies must include a statement explaining how directors have considered stakeholder needs and other matters when performing their duty under section 172 of the Act.8 All companies in our sample met this requirement.

We have written to several companies in our routine casework which did not provide a section 172 statement when required.

Provides qualitative analysis explaining how the company manages liquidity risk and the target minimum level of cash it maintains.

Explains that the values disclosed are undiscounted, providing a comparison of the carrying amount to the total contractual amount.

Distinguishes between derivative and non-derivative liabilities.

Includes the potential amount from financial guarantee contracts.

ISG Limited, Annual Report 2022, p31

Describes the nature of the risk and its potential impact.

Explains the mitigating actions taken by the company to control or manage the risk.

5. Primary statements and accounting policies

Primary statements and accounting policies are fundamental for an understanding of a business. The issues we raise with companies are generally more serious in nature when the presentation of a primary statement is affected.

Profit and loss account and balance sheet

IFRSs – companies must apply IAS 1.

FRS 101 and FRS 102 – companies can choose to present their profit and loss account and balance sheet either using a format prescribed by the accounting regulations9 (prescribed format) or one that is generally aligned with IAS 1 (adapted format).

All companies applying FRS 101 chose to present an adapted balance sheet format. Those that presented a profit and loss account also mostly used the adapted format. This indicates a preference for consistency within groups.

All FRS 102 reporters in our sample presented their balance sheet using a prescribed format and largely took the same approach for the profit and loss account.

A main difference between the formats relates to the presentation of current and non-current assets and liabilities on the balance sheet:

- Prescribed formats – amounts due in one year and after more than one year are determined based on when the entity can contractually require repayment.10

- Adapted format and IAS 1 – classification between current and non-current assets also takes account of the entity's expectation of when the repayment will be sought.11

One company, applying IFRSs, classified an intercompany receivable as current, although the accounting policy stated that there was no expectation of imminent repayment. Part of the balance was subsequently converted into equity, further suggesting the longer-term nature of the balance.

One company, applying FRS 101 using the adapted format, presented an intercompany payable as non-current. However, it indicated that the balance is repayable on demand without explaining why it was not current.

Observations relating to the line items presented

A company is required to:

- present additional line items, headings and sub-totals when relevant and appropriate; and

- where material, disclose their nature and amount separately, either on the face of the primary statements or in the notes.12

Better examples disclosed additional line items for more complex and significant transactions.

A company with extensive hedging arrangements disclosed a detailed breakdown of movements in its cash flow hedges in other comprehensive income. These could be reconciled to the statement of changes in equity and the notes.

The nature of certain items particularly those labelled as 'other' (e.g. 'other income', 'other receivables/payables') was less clear. This is also a common finding in our routine reviews.

Operating profit was the most commonly disclosed subtotal in our sample. It is not directly defined in IFRSs13 but FRS 102 provides some guidance which is based on the basis for conclusions for IAS 1.14

Most of the items excluded from operating profit appeared to be appropriate. More questionable items included non-financial asset impairments and losses on disposal of fixed assets.

We also noted the following item in relation to foreign exchange differences:

One company had significant foreign exchange gains and losses in both operating income and expenses. Coupled with other information in the annual report, this raised a question on the appropriateness of its functional currency.

Statement of cash flows

The cash flow statement is an area where we frequently find instances of misclassification or issues around the amounts presented. Our previous thematic report of cash flow and liquidity disclosures outlines many of the common issues and our expectations in this area. It also includes a list of consistency checks performed by our reviewers.

The relevant requirements stem from IAS 715 and Section 7 of FRS 102 which are broadly aligned.

Certain preparers using FRS 102 and all using FRS 101 can take an exemption from the requirement to present a cash flow statement.16

Most issues identified on cash flow statements were company specific and related to more unusual transactions.

Definition of cash and cash equivalents

Under IAS 7 cash equivalents are held for meeting short-term cash commitments rather than for the purpose of investment; this detail is not included in FRS 102.17

One IFRS reporter had a significant surplus in cash equivalents that was invested in short-term deposits and money market funds. It was unclear why this was not recognised as an investment.

Three companies disclosed restricted cash balances.

One company excluded restricted amounts from cash and cash equivalents but the notes stated that the restrictions applied only to its transfer from certain countries. This did not explain why the balance did not meet the definition of cash and cash equivalents.

Cash flows included in operating, investing and financing activities

For more complex and unusual transactions we encourage companies to explain how these transactions are reflected in the cash flow statement and any associated judgements.

Examples of potential cash flow issues identified included:

- The classification of derivatives associated with borrowings as investing rather than financing.

- A non-cash charge on a non-recourse invoice factoring facility recognised within financing cash flows.

In one company it was not clear why amounts related to a group cash pooling arrangement were disclosed as a single financing figure rather than being split between investing for loans made to, and financing for borrowings from, fellow group companies.18

Supporting notes

The most common finding related to incomplete or highly aggregated net debt reconciliations or the disclosure of changes in liabilities arising from financing activities.19

In two cases this disclosure was missing altogether. In conjunction with good liquidity risk disclosures this information is important for understanding companies' sources of finance and how these have been used over time.

Companies disclosing just one number for multiple non-cash movements should consider further disaggregation or better labelling to provide meaningful information. Examples include the effects of changes in foreign exchange rates, changes due to capitalised interest or business combinations.

Parent companies preparing their accounts under IFRSs are required to provide the disclosure of changes in liabilities. We often see instances of it being missed in the individual financial statements.

(c) Analysis of changes in net funds

Group

| 1 January 2022 £000 | Cash flow £000 | Exchange movement £000 | 31 December 2022 £000 | |

|---|---|---|---|---|

| Cash at bank and in hand | 273,183 | 80,352 | 11,196 | 364,731 |

| Debt due after more than one year (note 17) | (9,229) | – | (1,163) | (10,392) |

| Finance leases (notes 16, 17) | (1,095) | 1,095 | – | – |

| Shares classed as financial liabilities (note 16) | (18) | 4 | – | (14) |

| Total net funds | 262,841 | 81,451 | 10,033 | 354,325 |

Separate column for exchange movements.

Detailed breakdown of net funds with cross-references to the relevant notes.

Mott MacDonald Group Limited, Report and financial statements for the year ended 31 December 2022, p63

Accounting policies

We identified a high number of generic accounting policies that did not go beyond repeating the wording from the standard. While this may be adequate in areas where limited judgement is required in their application, in other cases this led to the omission of important information.

Companies should focus on tailoring accounting policies and providing more in-depth explanations for their most material and complex transactions.

Diagram illustrating the relationship between qualitative/quantitative significance and complexity/judgement, with a 'Focus area' identified in the high significance, high complexity quadrant.

Example of a tailored accounting policy which explains a material transaction relevant for an understanding of parent company accounts and, in particular, the treatment of the unrealised profit under FRS 102.

Dividend income On 30 April 2021, Westcoast (Holdings) Limited transferred the shares of XMA limited to Westcoast Group Holdings Limited by way of a dividend in specie. The dividend income is recorded at fair value of the investment received in the financial statements of Westcoast Group Holdings Limited since the transfer of XMA Limited was achieved by means of a dividend between companies under common control. The dividend income is recognised in other comprehensive income since XMA Limited is unquoted and the shares are not readily convertible to cash.

Westcoast Group Holdings Limited, Annual report and financial statements for the year ended 31 December 2022, p24

In a number of instances redundant, irrelevant or duplicative accounting policies were disclosed. In other cases we noted missing accounting policies for material transactions or balances. In some companies incorrect or out of date accounting policies were disclosed.

Companies should keep policies under review to ensure that they remain complete, relevant and accurate.

Consolidated accounts must still disclose a full set of accounting policies for the parent company. Cross-referencing can often be used to support clear and concise reporting, provided that it is clear how a specific group policy is applied at the parent company level.

Rounding

Within our sample several companies for which we estimated materiality to be in multiple millions presented their financial statements to the nearest thousand.

A higher level of rounding may have reduced the disclosure of unnecessary detail or clutter. It would also avoid a reader inappropriately inferring a greater level of accuracy.

6. Revenue

Revenue is a key metric for most companies. Clarity around revenue streams and revenue recognition policies is important not only for understanding historical performance but also for assessing the future prospects of a business.

The recognition, measurement and disclosure requirements vary between the different accounting standards.

IFRSs – the requirements of IFRS 1520 apply.

FRS 101 as IFRSs except they have several disclosure exemptions.

FRS 102 – apply Section 23 of that standard.

Our two thematic reports on IFRS 15, the 2019 IFRS 15 ‘Revenue from Contracts with Customers' and the 2020 follow up report, will be relevant for entities reporting under IFRSs.

There was a wide range in the quality of revenue disclosures for the companies reviewed. While we noted some good examples, for other companies, greater attention could have been paid to the clarity and granularity of reporting.

Accounting policies

A clear articulation of a company's accounting policy is important to allow users of the financial statements to understand the various ways in which it generates revenue. It also complements information included in the strategic report.

A good policy: * Describes the nature of revenue covering all material revenue streams and separately identifiable components/performance obligations. * Is specific to the company explaining how the requirements of the standard have been applied and any related judgements. * Identifies when revenue is recognised and the methods adopted to measure revenue recognised over time. * Provides details of how the transaction price for revenue is determined.

Makes clear the transaction price recognised by the company and that they are acting as an agent for the manufacturer.

The Group offers servicing products on behalf of the manufacturer and retains a proportion of the sales price of the product. The Group recognises the revenue at the contract inception date as the obligation to satisfy the servicing obligations lie with the manufacturer. If a customer redeems a valid servicing element identified within the contract with a Group branch, the branch performs the service and invoices the manufacturer for pre-determined contractual amounts on completion. Revenue is recognised on completion of the service.

Arnold Clark Automobiles Limited, Annual Report and Accounts 2022, p43

Identifies when revenue is recognised and why.

Separately clarifies how revenue for subsequent servicing is recognised if undertaken by the company.

Sets out the timing of recognition and how the transaction price is determined.

Revenue mainly comprises direct sales to end-customers and the sale of goods to authorised third parties for resale. The Group recognises revenue when it transfers control over a product to a customer, excluding taxes, net of discounts and after elimination of intercompany sales.

Clearly explains the nature of the revenue stream and the types of good sold.

Direct sales to end-customers are mainly made through retail stores for fashion goods, certain fragrance and beauty products, and certain watches and fine jewellery items. These sales are recognised at the time of purchase by the retail end-customers. Sales made in stores owned by third parties are treated as retail transactions if control of the inventories is retained by the Group.

Explains how sales made through third party stores are recognised.

Chanel Limited, Annual Report and Financial Statements for the year ended 31 December 2022, p63

Contracts are typically accounted for as a single performance obligation; even when a contract (or multiple combined contracts) includes both design and build elements, they are considered to form a single performance obligation as the two elements are not distinct in the context of the contract given that each is highly interdependent on the other.

ISG Limited, Annual Report 2022, p74

Explains how the performance obligations have been determined and why they have been combined.

In some instances there was a disconnect between the revenue streams disclosed in the disaggregation of revenue disclosure and the accounting policy. It was not clear if the same policy applied to all revenue streams.

Some companies provided a policy covering the main revenue stream but it was unclear whether additional revenue streams apparent from the other information disclosed were also material.

IFRS 15 contains prescriptive detail about how its disclosure objective should be met, including information which will often be included in an accounting policy. In contrast, Section 23 of FRS 102 has a broader, less detailed disclosure requirement. In both cases the policy disclosure should be sufficient to provide an understanding of the amounts recognised in the financial statements. Under FRS 102 this may require greater professional judgement.

Disaggregation of revenue

Entities that report under IFRS 15 are required to disclose a disaggregation of revenue into categories.21 Examples include:

- Type of good or service

- Geographical region

- Market or type of customer22

FRS 101 and FRS 102 reporters are required by law to disclose turnover attributable to each class of business and each market.23 There is also a requirement for disclosure by category in FRS 102, based on specified minimum categories in the standard.24

Disaggregation of the total revenue figure can provide useful information on how the company generates revenue from different streams or markets and their relative importance. Along with a tailored accounting policy it can also be used to gauge the amount of revenue that might be subject to more judgemental recognition policies or estimation uncertainty.

The requirements leave an element of judgement. The most common disaggregation presented was either based on the type of good/service or by geographical market.

Some companies provided more than one disaggregation such as the split between goods and services and between major revenue streams. This is particularly useful in groups with diversified operations.

One company also provided details of revenue recognised at a point in time and revenue recognised over time. This reflected the cyclical or recurring nature of some revenue streams.

Three companies reporting under FRS 102 took the statutory exemption from disclosing the breakdown of turnover on the basis that it was considered seriously prejudicial to the interests of the company.25 This test is a high hurdle, as non-disclosure of the analysis is a loss of useful information for users.

We will challenge companies when we believe that there may not be an appropriate reason for taking the seriously prejudicial exemption.

Irrespective of the statutory exemption, companies must still apply the disclosure requirements in FRS 102 itself.

7. Judgements and estimates

Where accounting policies are subject to significant judgements or estimation uncertainty, users of the accounts must have a sufficient understanding of them in order to obtain a true and fair view of the assets, liabilities, financial position and performance of the business. Without that, they will be unable to make informed decisions.

Companies are required to provide information about:

- Significant judgements made by management in applying an entity's significant accounting policies, other than those relating to estimation uncertainty.

- Key sources of estimation uncertainty that have a significant risk of causing a material adjustment to assets and liabilities within the next financial year. Disclosure is also required of the nature and the carrying amount of those assets and liabilities.26

Further details can be seen in our thematic review of Judgements and Estimates: Update.

Most companies disclosed significant judgements separately from key sources of estimation uncertainty.

Judgements

The most frequently disclosed judgements were around revenue recognition, followed by matters relating to control and provisions.

Better judgement disclosures were: * Tailored to companies' specific circumstances. * Clear in terms of the precise judgements made and the rationale for the conclusion.

In several instances it was unclear why a certain conclusion was reached given the detail disclosed in the judgement and elsewhere in the annual report and accounts. Examples included:

- The non-consolidation of an entity even though the company had the ability to appoint its board.

- Fair value accounting for an equity investment with an interest exceeding 20%, rather than using the equity method.

- The revenue streams that were affected by a principal or agent judgement.

Defined benefit pension schemes

Section 28 of FRS 102 permits an entity to recognise a plan surplus as a defined benefit plan asset only to the extent that it is able to recover the surplus either through reduced contributions in the future or through refunds from the plan. In the opinion of the directors, the Group does not have an unconditional right to the surplus and therefore no surplus has been recognised.

Mott MacDonald Group Limited, Report and financial statements for the year ended 31 December 2022, p35

Clearly explains the conclusion reached and the rationale.

Explains the nature of the judgement and the circumstances in which it arises.

Identifies factors considered in reaching the conclusion.

Supply Chain Finance

Judgement is made in determining whether balances under supply chain financing arrangements should be classified as trade payables or as another line item on the Balance Sheet. In determining the classification, the Group reviews each arrangement against a number of characteristics to assess whether the substance of liabilities owed by the Group to the participating banks under the contractual terms of the arrangement is consistent with other trade payables. These include: * Whether participation in the schemes is voluntary for suppliers; * Whether the Group is involved in the negotiations and agreements between the banks and suppliers or tri-partite agreements exist; * Whether payment terms have been extended outside industry norms for trade payables; * Whether interest is accrued on outstanding balances or fees are receivable by the Group; * Whether the banks require parent guarantees in respect of the Group's obligations; * Whether the Group retains its rights to offset credits or withhold payment. The nature of the Group's liabilities under supply chain financing arrangements when considering these characteristics supports classification of amounts owed by the Group under its supply chain financing arrangements as trade payables.

Bellis Finco PLC, Annual Report and Consolidated Financial Statements for the year ended 31 December 2022, p83

Estimates

The most frequent estimates disclosed related to defined benefit pension schemes, followed by impairment reviews and taxation. Overall, the number of estimates was significantly higher than the number of judgements.

Key estimate disclosures should include: * Only those estimates that have a significant risk of material adjustment to assets and liabilities within the next 12 months. * The carrying amounts of assets and liabilities at risk. * IFRS and FRS 101 reporters should provide additional forward-looking information, e.g. quantified sensitivity analysis or information on ranges of possible outcomes. We encourage FRS 102 reporters to also make this disclosure.

Assessment of whether an estimate is significant

The diagram below shows the differentiation between critical estimates and other less significant or longer-term estimates.

Flowchart illustrating the assessment process for determining whether an estimate is significant, considering the level of estimation uncertainty and likelihood of crystallisation within 12 months, leading to disclosures as key sources of estimation uncertainty or as relevant/material information.

Most companies disclosed the nature of estimates and quantified the carrying amount of assets and liabilities at risk.

Where the estimation uncertainty relates only to a component of an asset or liability the value of the balance at risk should be disclosed.

For half of the companies the carrying amount of assets and liabilities subject to estimation uncertainty was not always material or sensitivities appeared to show that there was not a significant risk of material adjustment in the next year.

There is an opportunity for companies to revisit their estimation uncertainty disclosures as not all of them appeared to meet the threshold for disclosure.

We do not discourage companies from disclosing less significant estimates or estimates that are likely to crystallise over a period longer than 12 months. However, these should be clearly distinguished from significant estimates and the reason for their disclosure should be explained.

Critical judgements and key sources of estimation uncertainty

The application of the Company's accounting policies may require the use of estimation or judgement in a manner which may affect the Company's financial position or results.

There are not considered to be any critical judgements applied in the preparation of the financial statements.

Critical areas of estimation, determined as being areas for which there are major sources of estimation uncertainty at the reporting year end that have a significant risk of causing a material adjustment to be made to the carrying value amounts of assets or liabilities within the next financial year, are disclosed below.

Additional areas where estimation or judgement is applied have been discussed in the related accounting policies sections above.

SKY UK Limited, Annual report and financial statements for the year ended 31 December 2022, p28

Explicit mention that there are no critical judgements.

Introductory narrative defining key estimates.

Other, non-critical estimates or judgements are disclosed elsewhere.

Additional information on estimates

Judgements and estimates disclosures should be sufficient to provide an understanding of the amounts recognised in the financial statements.

For IFRS and FRS 101 reporters, IAS 1 paragraph 129 provides examples of information that may be required to help users understand the sources of estimation uncertainty identified, such as sensitivity analysis or information about the range of possible outcomes.

In our routine casework we often see these disclosures omitted by FRS 101 reporters despite there being no exemption.

FRS 102 does not include these examples. As such management will need to apply greater professional judgement to determine what information may be necessary to provide an indication of the significance of the estimation uncertainty. The disclosure of only the nature and carrying amount of the asset or liability may not be sufficient in all cases.

We encourage FRS 102 reporters to consider disclosing key assumptions, sensitivities to changes in those assumptions or ranges of potential outcomes.

[...]The financial forecasts used to determine the recoverable amount remain highly sensitive to changes in external conditions. There is significant uncertainty over the shape and timing of the recovery in demand for aircraft maintenance services, which could give rise to possible impairments in future periods. A 100 basis-points increase in discount rate would decrease the estimated recoverable amount by £123 million. A 50 basis-points decrease in gross profit margin would decrease the estimated recoverable amount by £29 million. A one-year delay in business recovery to pre-COVID-19 levels would decrease the estimated recoverable amount by £72 million[...]

John Swire & Sons Limited, Annual Report & Consolidated Financial Statements 31 December 2022, p58

Includes quantified sensitivities in relation to each key assumption.

It was not always clear why certain sensitivity ranges were chosen or whether sensitivities expressed management's view of the extent of reasonably possible changes. This information can be particularly important where the change in assumptions has a non-linear effect on the carrying value of an asset or a liability.

8. Provisions and contingent liabilities

Provisions and contingent liabilities are often subject to a high degree of estimation uncertainty. Clear disclosure of these is of key importance to users as it allows them to understand the nature of emerging or potential liabilities, including those that may not yet have met the threshold for recognition on a company's balance sheet.

Our 2021 thematic review of provisions, contingent liabilities and contingent assets may be useful for companies if they have significant provisions or contingencies.

Provisions

The requirements are generally aligned across the frameworks. There must be a reconciliation for each class of provision showing the movement in the balances during the year. Details are also required to explain the nature of the obligation giving rise to the provisions, the expected amount and timing of outflows, an indication of the uncertainties relating to the amount or timing and any expected reimbursement.29

In some instances, we found that the level of detail provided to explain the nature of the obligation giving rise to a provision, and the associated uncertainty, was below the level we would expect given the nature and size of the exposure.

The best examples provided company specific details, which were proportionate to the size of the balance and explained the obligations giving rise to material provisions, the expected timing of outflows and included an indication of the uncertainties in the amount and/or timing.

Clearly explains the obligation giving rise to the provision.

Details the expected timing of the outflows and the key assumptions for determining the provision.

In 2007 the Company signed a 20-year lease contract on a new distribution centre. The contract requires the Company to remove any building alterations at the end of the lease, including sprinkler systems and other refrigeration plant. This obligation in year 2027 has been calculated at current prices, as the full cost of decommissioning such assets. This has been capitalised as a directly attributable cost of the relevant asset and is to be charged to the profit and loss account over the term of the lease.

Martin-Brower UK Ltd, Annual Report and Financial Statements for the year ended 31 December 2022, p46

Describes how the cost has been capitalised as part of the associated leasehold improvement asset and recognised as an expense over the lease term through the depreciation charge.

Three companies included individually material classes of provision labelled as 'other'.

Companies should use meaningful labels or provide other explanation of what the balance comprises. They should also consider carefully the level of disaggregation they provide for classes of provisions.

We also identified some potential recognition issues.

One company did not present any provisions in its financial statements. However, the nature of its business and other disclosures in the annual report and accounts indicated that there may be obligations that gave rise to provisions.

Companies should focus accounting policies on the classes of provision that are most significant or less common in nature.

We noted that a number of accounting policies included specific detail on restructuring even though the companies had only limited or no restructuring provisions.

Contingent liabilities

A contingent liability does not currently meet the recognition criteria to be included as a liability on the balance sheet. However, there are important disclosure requirements to:

- Explain the nature of the contingent liability.

- Provide an estimate of its financial effect.

- Provide an indication of the uncertainties relating to the amount or timing together with any possibility of reimbursement.30

For some companies the potential financial effect was very significant.

The best examples of contingent liability disclosures were tailored to the companies' circumstances and clearly explained each of the elements required by the accounting standards.

In some instances, companies stated that it was not practicable to calculate an estimate of the financial effect of a contingent liability. The better examples provided an explanation of why that was the case.

In December 2022, the Group was subject to a cyber-attack, by an unauthorised third party. This resulted in certain personal data which was stored on our network being compromised.

We remain in dialogue with the Information Commission Officer (ICO) regarding the cyber-attack. All requests for further information have been responded to although we anticipate there will be additional requests for information as the ICO further investigates this matter which we self-reported. At the date of this report, no formal action has been taken by the ICO as regards the incident and there have been no preliminary findings communicated by the ICO as regards any fault on behalf of the Group. If the ICO were to identify any breach of data protection law, this could result in a potential fine being levied from the ICO.

The group has received notification of complaints and claims for damages by or on behalf of a number of individuals whose data has or may been compromised in the cyber-attack. Court action is threatened but the claims remain at the pre-litigation stage at the date of this report. Whether any claims will, ultimately, be filed remains uncertain but the Group will vigorously defend any such claims. At the date of this report, the amount of any such obligations cannot be measured with sufficient reliability for the financial effect to be disclosed.

Arnold Clark Automobiles Limited, Annual Report and Accounts 2022, p67

Provides clear detail of the nature of the contingent liability and how it arose.

Explains the uncertainty surrounding a possible cash outflow and its timing.

States that the level of uncertainty means that the financial effect cannot currently be measured with sufficient reliability.

Linkage between balances

Two companies had both provisions and contingent liabilities arising from the same set of circumstances. They provided clear disclosure, cross-referring between the relevant notes, explaining the link between the two and how additional exposure may arise from the contingent liability. Linkage between provisions and other balances was sometimes less clear.

It is helpful to highlight provisions and associated payables and explain why they are treated differently.

9. Financial instruments

Understanding the nature and extent of risks arising from financial instruments, and the timing of future cash flows is important information in the assessment of a company's financial health and viability.

The requirements for financial instruments vary between the different accounting standards:31

- IFRSs – the recognition and measurement requirements in IFRS 9,32 IFRS 1333 and IAS 3234 and the disclosure requirements of IFRS 735 and IFRS 13 apply.

- FRS 101 as IFRSs except there is an exemption from the disclosure requirements of IFRS 7 and IFRS 13. Some disclosures are still required by the accounting regulations.

- FRS 102 – reporters may apply Sections 11 and 12 of that standard or the requirements of either IFRS 9 or IAS 39.36

All the FRS 102 reporters in our sample appeared to apply the recognition and measurement requirements of Sections 11 and 12 of that standard.

While there was a variation across the sample of companies, based on our desktop review most had relatively simple financial instruments.

Quantitative financial instrument disclosures

To a greater or lesser extent, all the applicable accounting standards require some detailed quantitative disclosures. We identified a large number of potential disclosure errors or omissions during our review, as well as some potential measurement or recognition errors.

One company held an investment at fair value but it was not clear that the valuation approach disclosed complied with the measurement requirements of IFRS 13.

Where relevant companies that hold assets or liabilities at fair value should consider our 2023 thematic review of IFRS 13 for further guidance.

Some companies:

- Excluded assets or liabilities from their disclosures that were financial instruments, or included some that were not.

- Did not provide the hedge accounting disclosures despite them appearing to be material.

Nature and extent of risks arising from financial instruments

All large companies are required to provide disclosures explaining their financial risk management objectives and policies, as well as their exposure to price risk, credit risk, liquidity risk and cash flow risk as part of the directors' report requirements.37 These are in addition to disclosures required by accounting standards.

IFRS reporters often met these disclosure requirements by cross-referring to the IFRS 7 disclosures38 in the financial statements.

FRS 102 has an overarching requirement for companies to disclose information that enables users to evaluate the significance of financial instruments on a company's position and performance.39 Unlike IFRS 7 it does not provide a detailed list of mandatory disclosures.

Where financial instrument risks are particularly significant, FRS 102 suggests that additional disclosure may be necessary to meet the overarching requirement.40 No companies in our sample provided this additional disclosure.

For significant financial instrument risks companies should: * Disclose company specific information on the nature of each risk. * Quantify the exposure to the risk. * Provide required specific disclosures (if applicable) including quantitative sensitivity. * Explain clearly the methods and assumptions used and the rationale for them.

We generally found the disclosure of financial instrument risks to be relatively boilerplate and generic, describing the general nature of risks but without always fully explaining how they are relevant to the company. We also identified a number of IFRS 7 disclosures that had not been provided for material items or risks.

Liquidity was the most pervasive and significant risk in our sample. Understanding this risk is important to users, especially in a challenging economic environment.

IFRS 741 (and FRS 10242 where liquidity risk is particularly significant) requires disclosure of a maturity analysis for financial liabilities based on contractual maturities and undiscounted cash flows as well as details of how the company manages the risks arising.

A company with significant liabilities falling within one time band should carefully consider the level of granularity to apply.

Three companies disclosed an analysis of financial liabilities based on discounted, rather than undiscounted, values. In some instances, this was a significant quantitative difference given the amounts of interest that would be due on borrowings.

For companies with external borrowing, users will benefit from understanding the covenants that apply. We expect companies to provide information about their banking covenants unless the likelihood of any breach is considered remote.43

Some companies disclosed helpful additional information to further clarify their liquidity risk exposure.

At 31 December 2022, the Group held cash of £662.5m (2021: £505.5m) to secure short-term flexibility. The amount of financing facilities available at the year/period end are disclosed below:

| Utilised at 31 December 2022 £m | Remaining at 31 December 2022 £m | Utilised at 31 December 2021 £m | Remaining at 31 December 2021 £m | |

|---|---|---|---|---|

| Committed overdraft facilities | – | – | – | 5.0 |

| Revolving credit facilities | – | 5.0 | – | 500.0 |

| Standby credit facilities - bonds | – | 500.0 | – | 53.2 |

| Other short-term facilities | 64.4 | 43.2 | 16.2 | 98.8 |

| Supply chain financing facilities | 39.1 | 114.3 | 323.7 | 75.3 |

Clearly discloses the total amounts remaining and utilised for each type of borrowing facility.

Bellis Finco PLC, Annual Report and Consolidated Financial Statements for the year ended 31 December 2022, p133

iii. Liquidity risk

Liquidity risk is the risk that the Group will encounter difficulty in meeting the obligations associated with its financial liabilities that are settled by delivering cash or another financial asset. The Group's approach to managing liquidity is to ensure, as far as possible, that it will have sufficient liquidity to meet its liabilities when they are due, under both normal and stressed conditions, without incurring unacceptable losses or risking damage to the Group's reputation.

The Group uses activity-based costing to cost its products and services, which assists it in monitoring cash flow requirements and optimising its cash return on investments.

The Group aims to maintain the level of its cash and cash equivalents and other highly marketable debt investments at an amount in excess of expected cash outflows on financial liabilities (other than trade payables) over the next 60 days. The Group monitors the level of expected cash inflows on trade and other receivables together with expected cash outflows on trade and other payables.

Provides qualitative analysis explaining how the company manages liquidity risk and the target minimum level of cash it maintains.

Explains that the values disclosed are undiscounted, providing a comparison of the carrying amount to the total contractual amount.

Distinguishes between derivative and non-derivative liabilities.

Includes the potential amount from financial guarantee contracts.

Exposure to liquidity The following are the remaining contractual maturities of financial liabilities at the reporting date. The amounts are gross and undiscounted, and include estimated interest payments and exclude the effect of netting agreements.

| Carrying amount £'m | Total £'m | Less than 1 year £'m | 1-2 years £'m | 2-5 years £'m | More than 5 years £'m | |

|---|---|---|---|---|---|---|

| 31 December 2022 | ||||||

| Trade and other payables | 3,798 | 3,798 | 3,109 | 84 | 193 | 412 |

| Borrowings (including interest obligations) | 7,832 | 8,365 | 1,801 | 744 | 4,257 | 1,563 |

| Lease liabilities | 798 | 878 | 203 | 172 | 174 | 329 |

| Derivative financial instruments | 24 | 24 | 14 | – | 8 | 2 |

| Financial guarantee contracts | – | 923 | 923 | – | – | – |

| 12,452 | 13,988 | 6,050 | 1,000 | 4,632 | 2,306 |

John Swire & Sons Limited, Annual Report & Consolidated Financial Statements 31 December 2022, p77

10. Climate reporting

Upcoming Companies Act requirements

The UK government introduced mandatory climate-related financial disclosure (CFD) requirements for private companies with turnover of more than £500 million and more than 500 employees for accounting periods beginning on or after 6 April 2022.44 These will be included in a new Non-Financial and Sustainability Information Statement as part of the strategic report.

As companies approach the new reporting requirements they should consider the extent to which climate-related targets and transition plans could affect the financial statements and ensure that the disclosures are consistent with reporting elsewhere in the annual report and accounts. This may include new judgements or uncertainties which arise related to the disclosures.

For further information please refer to our recent thematic review of Climate-Related Metrics and Targets (pages 9, 18, 75 and 77), as well as the FRCs Guidance on the Strategic Report. We will also be publishing a thematic review specifically focused on CFD requirements later this year.

Observations on climate-related disclosures

Climate-related disclosures were not in the scope of this thematic as they have been covered by previous publications.45 However, we noted some observations below as part of our review of the strategic report:

- Nearly half of the companies provided additional information to that required by the Streamlined Energy and Carbon Reporting (SECR), for example including their progress towards achieving net zero.

- Two companies stated that they are in the process of implementing the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and provided more extensive disclosures on climate-related risks and opportunities, time horizons, governance arrangements and emissions' metrics and targets.

Greenwashing continues to be an area of concern for users.46

In one instance excessive prominence was given to 'green claims' and to more minor 'greener' revenue streams despite the majority of the company's operations involving fossil fuels. It was, therefore, unclear whether the strategic report met the 'fair, balanced and comprehensive' requirement.

11. Key expectations

The quality of reporting by large private companies is mixed. To achieve consistently high-quality reporting we encourage companies to consider the findings and expectations in this report when drafting their upcoming annual reports and accounts. Companies should focus their efforts on the disclosure of the most significant, complex or judgemental matters. Better reporting does not necessarily require greater volume.

We expect companies to:

Provide a strategic report that contains a balanced analysis focused on the elements of development, performance and position that are key for an understanding of the company.

Explain how the company or subgroup fits into a wider group structure to allow a user to understand fully the context in which it operates.

Tailor accounting policies for transactions and balances that are complex or judgemental and keep policies under review to ensure that they remain complete, relevant and accurate.

Disclose revenue policies explaining the nature of each significant revenue stream, when it is recognised and how its value is determined.

Provide specific details of judgements taken and clearly explain the rationale for the conclusion reached.

Clearly distinguish which estimates have a significant risk of material adjustment to the carrying amount of assets and liabilities in the next financial year. Provide additional quantitative detail where it is necessary for an understanding of the significance of the estimate.

Disclose clearly the nature of the obligation giving rise to a provision and the associated uncertainty in timing or amount for significant provisions.

-

FRS 101, 'Reduced Disclosure Framework' ↩

-

FRS 102, 'The Financial Reporting Standard applicable in the UK and Republic of Ireland' ↩

-

For periods beginning on or after 6 April 2022 section 414CB will also apply to these companies ↩

-

FRS 102, paragraph 3.24(b) and IAS 1, 'Presentation of Financial Statements', paragraph 138(b) ↩

-

Sections 414C (2)(a) and (3) of the Companies Act 2006 ↩

-

Section 414C (12) of the Companies Act 2006 ↩

-

Section 414C (4) of the Companies Act 2006 ↩

-

Section 172 requires that directors must act in the way they consider, in good faith, would be most likely to promote the success of the company for the benefit of its members as a whole ↩

-

The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008 (SI 2008/410), Schedule 1 ↩

-

SI 2008/410, Schedule 1, Part 1, Section B note (5) and paragraph 4.4A of FRS 102 ↩

-

IAS 1 paragraph 66 and FRS 102 Appendix I Glossary definitions of non-current assets ↩

-

IAS 1 paragraphs 29, 55, 85, 97 and FRS 102 paragraphs 3.15, 4.3, 5.9, 5.9A ↩

-

Upcoming IFRS 18 'Presentation and Disclosure in Financial Statements' is expected to include a definition of operating profit ↩

-

FRS 102 paragraph 5.9B and IAS 1 paragraph BC56 ↩

-

IAS 7, 'Statement of Cash Flows' ↩

-

FRS 101 paragraph 8(h), FRS 102 paragraph 1.12(b) ↩

-

IAS 7 paragraph 7, FRS 102 paragraph 7.2 ↩

-

IAS 7 paragraphs 16(e) and (f) 17(c) and (d), FRS 102 paragraph 7.5(e) and (f), 7.6(c) and (d) ↩

-

IAS 7 paragraphs 44A – E, FRS 102 paragraph 7.22 ↩

-

IFRS 15, 'Revenue from Contacts with Customers' ↩

-

IFRS 15, paragraph 114 ↩

-

IFRS 15, paragraph B87 to B89 ↩

-

The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, Schedule 1, paragraph 68 ↩

-

FRS 102, paragraph 23.30(b) ↩

-

The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, Schedule 1, paragraph 68(5) ↩

-

IAS 1, paragraphs 122 and 125; FRS 102 paragraphs 8.6 and 8.7 ↩

-

IAS 1 paragraph 125 and FRS 102 paragraph 8.7 ↩

-

IAS 1 paragraph 129, we encourage FRS 102 reporters to also provide this information ↩

-

FRS 102, paragraph 21.14 and IAS 37, 'Provisions, Contingent Liabilities and Contingent Assets', paragraphs 84 and 85 ↩

-

FRS 102, paragraph 21.15 and IAS 37, paragraph 86 ↩

-

Under FRS 101 and FRS 102 there are additional requirements for financial institutions, these are outside the scope of our thematic ↩

-

IFRS 9, 'Financial Instruments' ↩

-

IFRS 13, 'Fair Value Measurement' ↩

-

IAS 32, 'Financial Instruments: Presentation' ↩

-

IFRS 7, 'Financial Instruments: Disclosures' ↩

-

IAS 39, 'Financial Instruments: Recognition and Measurement' ↩

-

The Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations 2008, Schedule 7, paragraph 6 ↩

-

IFRS 7, paragraphs 31 to 42 ↩

-

FRS 102, paragraph 11.42 ↩

-

FRS 102, paragraphs 11.42 and 34.19-34.30 ↩

-

IFRS 7, paragraph 39 ↩

-

FRS 102, paragraph 11.42 and 34.28 ↩

-

Annual Review of Corporate Reporting 2022/23, p31 ↩

-

Statutory instrument 2022/31 also applies to certain other UK-registered companies that meet the relevant thresholds, as explained in UK Government's guidance document ↩

-

Thematic review of Streamlined Energy and Carbon Reporting, 2021 ↩

-

Climate-Related Metrics and Targets, page 9 ↩