The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 17 ‘Insurance Contracts’ Interim Disclosures in the First Year of Application

- 1. Executive summary

- 2. Scope and how to use this publication

- 3. Transition disclosures

- 4. Accounting policies, judgements and estimates

- 5. Estimates of future cash flows and contractual service margin (CSM)

- 6. Discount rates

- 7. Risk adjustment

- 8. Measurement models

- 9. Alternative Performance Measures (APMs)

- 10. IFRS 9

- 11. Other considerations

- 12. Non-insurance companies

- 13. Key expectations

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2023 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Executive summary

Introduction

This report summarises the key findings of our thematic review of disclosures in 2023 interim accounts relating to the implementation of IFRS 17 'Insurance Contracts', which became effective on 1 January 2023. IFRS 17 represents a fundamental change in accounting for insurance contracts, introducing a comprehensive principles-based approach to replace the fragmented approach previously required under IFRS 4.

As the insurance sector is by far the most significantly affected by IFRS 17, we have predominantly written this report for preparers and auditors of insurance companies. It aims to provide examples of better practice for these companies when considering the completeness of their upcoming, and more extensive, year-end disclosures.

Overall, we were pleased with the quality of IFRS 17 disclosures in the interim accounts of the companies in our sample. However, we did identify areas for improvement, and believe almost all companies within our sample could make improvements to their reporting by carefully considering our recommendations, in particular the key findings on page 4 of this report.

Where the adoption of IFRS 17 has had a significant impact on a company, we expect management to consider the requirements of IAS 8 'Accounting Policies, Changes in Accounting Estimates and Errors' in order to explain adequately the adjustments made to financial statement line items for the comparative period(s).

Management should review their interim disclosures in the light of our findings and where appropriate enhance these for the full year accounts. The disclosures must be of a sufficient level of granularity as to allow users to understand fully the extent to which IFRS 17 has had an impact on the financial statements.

Judgement is required as to the level of detail required to meet the disclosure objective of the standard. Overall, the best disclosures were those that provided decision-useful information that was specific to the company, and that disclosed sufficient detail to give a relevant and robust explanation of the impact of IFRS 17.

We acknowledge that insurance companies have been working on the implementation of IFRS 17 for a considerable length of time, and that large amounts of technical guidance on how to apply the standard already exist, including guidance on key judgements and accounting policy choices by the Global Public Policy Committee1. This report does not seek to add to this detailed technical guidance, but rather aims to improve the overall quality and readability of financial reporting, from the perspective of a desk-top review of the financial statements. This is also the lens through which the Corporate Reporting Review (CRR) team will primarily monitor the ongoing financial reporting of the insurance sector.

We intend to follow up this thematic report with a similar thematic review of the first annual financial statements under IFRS 17. We recognise that it may not be possible to implement all of our recommendations in the 2023 annual reports; however, we do expect insurance companies to continue to develop and improve their financial reporting under IFRS 17 as better practice emerges.

Summary of key observations

Companies should provide high quality disclosures in respect of complex or subjective areas

- While IFRS 17 introduces more consistency and comparability in accounting for insurance contracts, we found that the quality of disclosure varied, particularly in areas such as the choice of transition method, the determination of risk adjustment and discount rates, where the standard is not prescriptive. Companies should consider providing both quantitative and qualitative disclosures, which are sufficiently disaggregated to enable users to understand how insurance contracts are measured and presented in the financial statements.

- When determining an appropriate level of aggregation or disaggregation2, companies should consider which provides the most useful disclosure.

Accounting policies should be company-specific

- While we were pleased to note that companies disclosed accounting policies for the key elements (such as the CSM, risk adjustment, reinsurance, etc.) for each of the measurement models under IFRS 17, we found that most companies used boilerplate language.

- We expect accounting policies to be specific to the company and its business. Policies should be sufficiently granular to enable users to understand the approach taken by the company for each material line of business and give clear, and consistent, explanations of accounting policy choices.

Disclosure of significant judgements and estimates should be sufficiently detailed

- Companies should clearly distinguish between key judgements and major sources of estimation uncertainty as identified under IAS 1 'Presentation of Financial Statements'3 and other judgements and estimates made in the application of IFRS 17.

- Disclosure should be entity-specific and provide details of the particular judgements made by management.

- Where significant sources of estimation uncertainty exist, we expect companies to quantify the assumptions underlying significant estimates and to provide meaningful sensitivities and/or ranges of reasonably possible outcomes.

Companies should explain the transition approach adopted

- Given the choice of transition approach will affect the quantum of the CSM at transition date, we expect companies to clearly explain the impact of transition to IFRS 17. Where material to the business, disclosures should include details of the methods and assumptions used to measure insurance contracts at the transition date and provide quantitative information, including the reconciliation of the CSM and revenue by transition method.

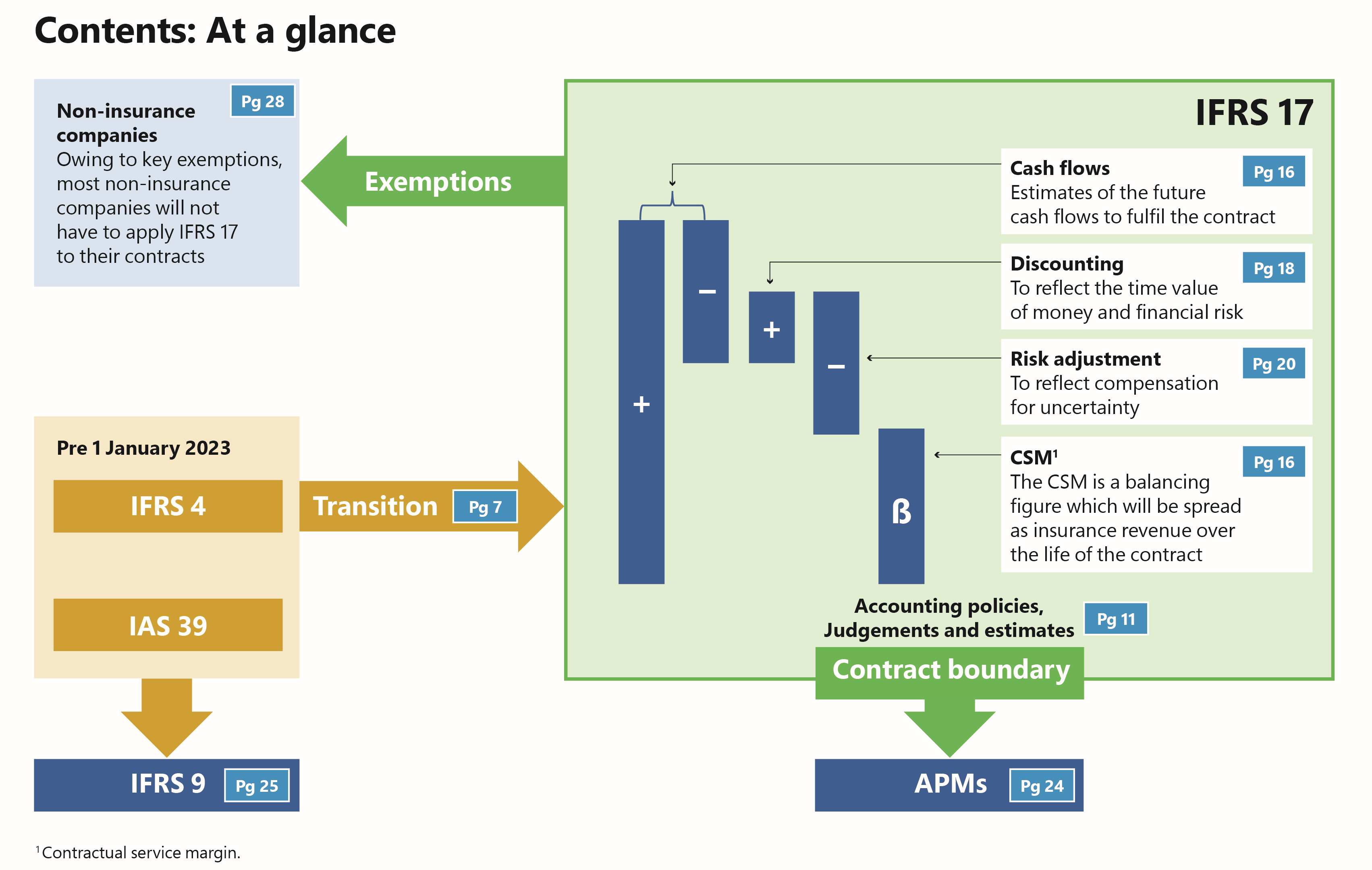

Non-insurance companies Owing to key exemptions, most non-insurance companies will not have to apply IFRS 17 to their contracts. Pg 28 Exemptions

Pre 1 January 2023 IFRS 4 IAS 39 IFRS 9 Pg 25 Transition Pg 7 IFRS 17

Cash flows Pg 16 Estimates of the future cash flows to fulfil the contract

Discounting Pg 18 To reflect the time value of money and financial risk

Risk adjustment Pg 20 To reflect compensation for uncertainty

CSM4 Pg 16 The CSM is a balancing figure which will be spread as insurance revenue over the life of the contract

Accounting policies, Judgements and estimates Pg 11

Contract boundary APMs Pg 24

2. Scope and how to use this publication

Scope

Our review consisted of a limited scope desktop review of the interim financial statements of a sample of companies. Our focus was on the adequacy of disclosures regarding the effect of the transition to IFRS 17 in the first year of adoption. We have only considered IFRS 17 transition documents published by the insurers in our sample to the extent necessary to support the interim disclosures.

The FRC's Actuarial Policy team supported us with specialist knowledge and expertise as the application of IFRS 17 requires the use of actuarial models to determine the level of insurance liabilities. Our review did not consider the reasonableness of the assumptions used in those models nor did we assess the appropriateness of the methodologies applied.

We reviewed the interim financial statements of a sample of 10 entities. The companies selected were predominantly listed life and general insurers, but also included specialty, re-insurance and bancassurance. While not included within our sample, the thematic review also considered disclosures made by non-insurance groups where a material impact of IFRS 17 had been disclosed. These were identified through our routine monitoring work and by working with other FRC departments.

requirements. We encourage preparers to carefully consider the findings of this report as they prepare their upcoming annual reports.

The examples presented in this report will not be relevant for all companies or circumstances, but each demonstrates a particular characteristic of better disclosure. Inclusion of an extract from a company's interim report and accounts should not be seen as an evaluation of that company's overall compliance with the reporting requirements of IFRS 17 or its reporting as a whole and should not be relied upon as such.

As explained on page 9 of our ‘What makes a good annual report and accounts', companies should apply the concept of materiality to relevant information in order to determine what should be disclosed, ensuring that key information is not lost in distracting detail.

We use symbols in this report to denote:

- A good quality application that we want other companies to consider when preparing their annual reports.

- Opportunities for improvement by companies to move them towards better practice.

- An omission of required disclosure or other issue. We want companies to avoid such issues in their annual reports.

How to use this publication

This thematic report summarises briefly some of the key financial reporting issues to consider in the first year of application of IFRS 17. It is not intended to cover all aspects of the relevant requirements and should not be relied upon as a comprehensive guide to the detailed

3. Transition disclosures

IFRS 17 must be applied retrospectively unless it is impracticable to do so for a group of insurance contracts5, in which case an entity has a choice of applying either a modified retrospective approach or a fair value approach separately for each group of insurance contracts.

Within the modified retrospective and fair value approaches there are also measurement choices available depending on the level of prior year information. As a consequence, there is likely to be considerable diversity of practice across entities in calculating the CSM at transition date. This results in potentially different releases of the CSM for similar contracts.

Generally, companies provided sufficient information to enable users to understand the impact of transition on the company although the quality of the disclosure varied across the sample. Only those companies providing longer-term life business applied two or more of the transition approaches permitted by IFRS 17.

- While it was clear which transitional approach had been used and why, quantitative information was not always provided to fully explain the impact of each approach.

- Only one company provided the reconciliation of the CSM and insurance revenue by transition approach6.

The better disclosures:

- Provided qualitative and quantitative information about the impact of both measurement and presentational changes on the statement of financial position7.

- Explained the circumstances which supported the use of the modified retrospective approach or the fair value approach.

- Detailed the groups of contracts to which each transition method had been applied.

- Explained the methodology underlying each transition method.

The company explains how each transition approach applies to material insurance contract portfolios.

Transition to IFRS 17 (extract)

Legal & General Group PLC, Half year report 2023, p50

Prudential plc, Half year report 2023, p11

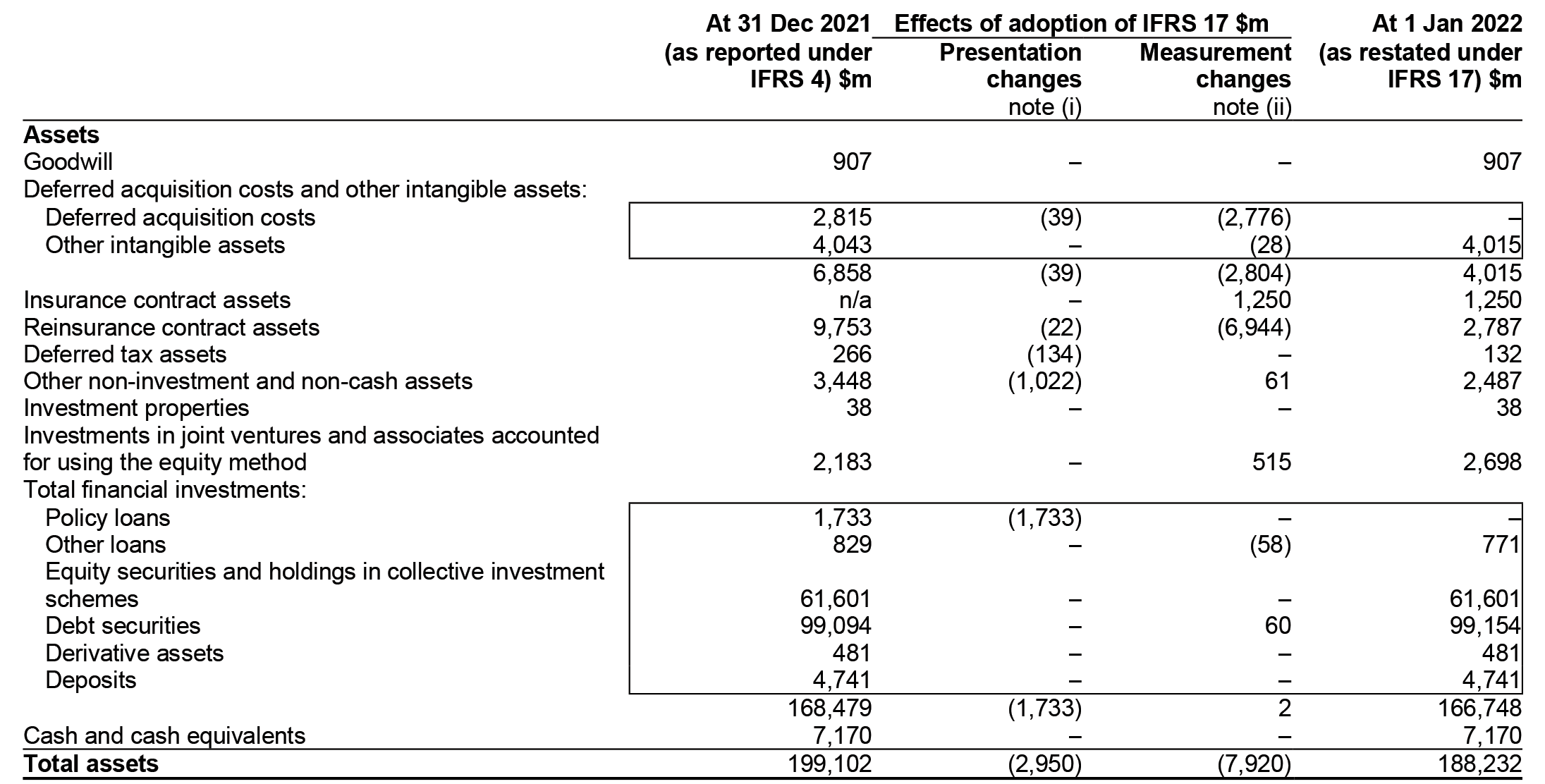

Although not required by IFRS 17, the company clearly shows the transitional effect of the presentation and measurement requirements of IFRS 17 on individual line items. While not presented here, this disclosure was supported by qualitative explanation of the significant changes.

Full retrospective approach

All the companies in our sample applied the full retrospective approach, where possible, on transition to IFRS 17.

- The more helpful disclosures provided both qualitative and quantitative disclosures which explained some of the key differences compared with IFRS 4 (for example, no separate acquired value of in force, inherited estate, or claims outstanding provisions).

Modified retrospective approach

Where it is impracticable to apply the full retrospective approach, companies may choose to apply the modified retrospective approach to the extent that reasonable and supportable information exists. Under this approach certain modifications can be applied to achieve the closest possible outcome to retrospective application.

Of those companies in our sample which did adopt this approach, all explained which modifications had been applied to contracts measured under both the general measurement model and the variable fee approach.

Fair value approach

All companies in our sample that applied the fair value approach on transition explained how the CSM was determined under the fair value approach and linked the determination of fair value to the requirements of IFRS 13 (including exclusion of the demand deposit floor8).

Where relevant, all listed the modifications which had been applied, such as the aggregation of contracts issued more than one year apart. Only one company elected to disaggregate finance income or expenses between amounts included in profit or loss and other comprehensive income. In this instance, the company adequately explained that the cumulative amount recognised in other comprehensive income had been reset to nil.

- Nearly all the companies that applied the fair value approach on transition did not explain the key judgements, assumptions and valuation inputs used to determine fair value.

Application of the FVA (extract)

The valuation models determine the fair value using a cost of capital approach. Expected cash flows and the required capital to run the business are projected forward, applying an appropriate weighted average cost of capital (WACC). Inputs have been calibrated to those Aviva would expect market participants to use had they priced the insurance contracts for transfer to them at the transition date.

This is based on a number of actuarial assumptions, including discount rates, and involves consideration of:

- The most appropriate assumptions for use by a third party in the principal market.

- The specifics of the group of insurance contracts being valued, such as the insurance cover and policyholder benefits provided and any legal requirements for its administration.

- Benchmarking against market transactions, where these exist.

Valuation inputs reference market information where available, with unobservable inputs otherwise used to estimate those that a third party would have applied as at the transition date of 1 January 2022. The most significant judgements for each portfolio were as follows:

- Identification of the principal market;

- The return on assets backing the insurance contracts and the consequential impact on the discount rate, particularly for UK annuities where the Solvency II capital regime was assumed to apply to market participants;

- The level of regulatory capital required to support the group of insurance contracts, which reflected Aviva's total Group working range for the Solvency II cover ratio of 160%-180%, adjusted to reflect differences in market participants for specific types of insurance contracts. It was assumed that a third party would require a higher level of regulatory capital for certain UK with-profits business aligned to the legal commitments made following the reattribution of the inherited estate in 2009; and

- The required rate of return on capital deployed, which reflected the characteristics of the group of contracts being measured.

All other material assumptions were aligned to the Aviva Solvency II valuation basis.

The FVA CSM on UK annuities is included within the life risk product group, whilst the FVA CSM on UK with-profits business measured in accordance with the VFA is included in the life participating product group.

For business transitioning under the FVA, the Group has taken advantage of the simplification permitting contracts in different annual cohorts to be placed into a single group of contracts.

Aviva plc, Half year report 2023, p60

The company provides an overview of the significant judgements used to determine fair value, including linkage to the Solvency II valuation basis.

4. Accounting policies, judgements and estimates

Accounting policies

Following adoption of IFRS 17 insurance companies need to fully revise their accounting policies for the impact of the new standard, as well as the impact of adopting IFRS 9.

We were pleased that all companies in our sample provided detailed updated accounting policies, proportionate to the nature of their business. However, while all companies presented the new accounting policies under IFRS 17, we found that most had duplicated text directly from the standard.

- IFRS 17 permits a number of accounting policy choices, and there are areas, such as the determination of the risk margin and discount rates, where IFRS 17 does not prescribe the methodology to be used. Where relevant, company-specific disclosures should explain the policy choices made and methodology applied.

Better disclosures of accounting policies included:

- Entity specific information about how policies applied to the business, for example, the contract boundary or the treatment of reinsurance contracts held.

- Clear disclosure (for example tabular) of options and accounting policy choices made.

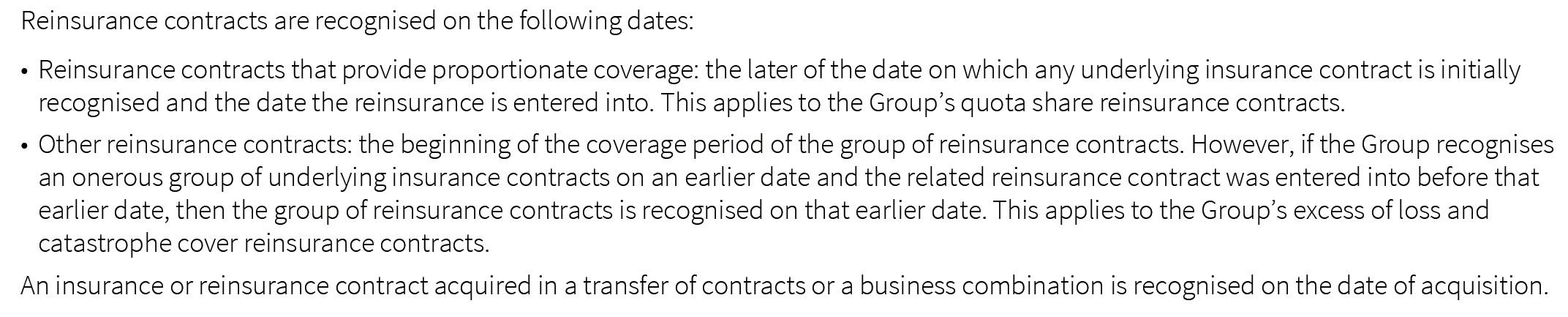

Recognition and derecognition (extract)

Aviva plc, Half year report 2023, p54

Specific accounting policies are provided explaining how the recognition requirements apply to reinsurance contracts.

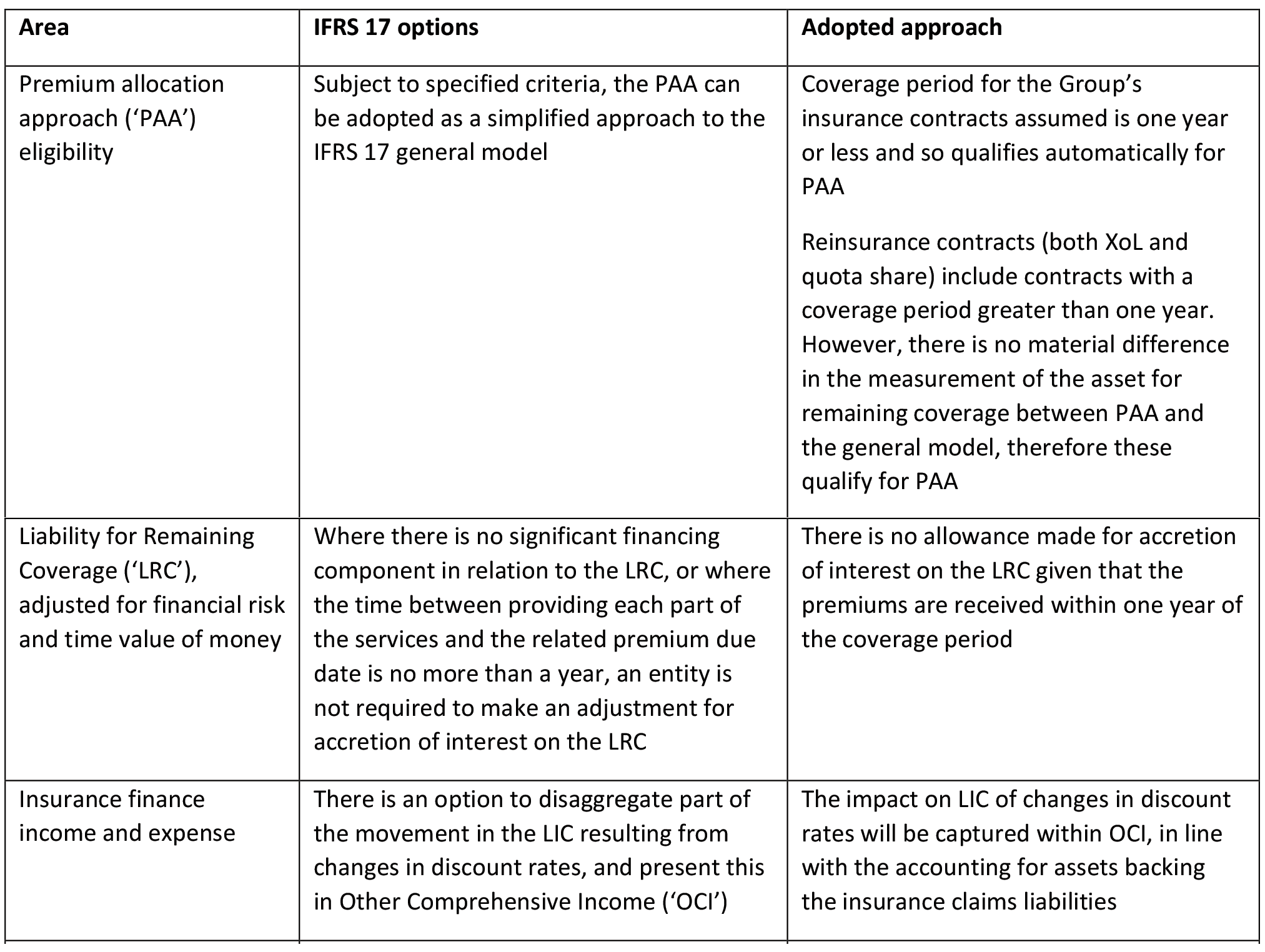

Accounting policy choices (extract)

Admiral Group plc, Half year report 2023, p33-34

Clear tabular disclosure is provided of the accounting policy choices and options available on adoption of IFRS 17, as well as an explanation of the approach the company has adopted.

Determination of contract boundaries (extract)

The assessment of the contract boundary defines which future cash flows are included in the measurement of a contract. This requires judgement and consideration of the Group's substantive rights and obligations under the contract. The Group exercises significant judgement to determining the appropriate contract boundaries, taking into consideration a number of factors, including: features and terms and conditions of products; any implied substantive obligations and rights arising from the features of the product or policyholder needs it is meeting; pricing practices; and administrative practices.

Cash flows are within the boundaries of investment contracts with DPF if they result from a substantive obligation of the Group to deliver cash at a present or future date.

Separating distinct investment components from insurance and reinsurance contracts

When assessing whether an investment component is distinct, the Group considers the following, which may indicate that the insurance and investment component are highly interrelated:

- the value of one component varies with the other component;

- existence of an option to switch between the different components;

- discounts that span both elements e.g. reduced asset management charges based on total size of contract; and

- other interacting features, e.g. insurance risk from premium waivers, return of premium covering both elements of the policy.

Where the investment component is non-distinct, the whole contract is measured under IFRS 17. Distinct investment components are measured under IFRS 9.

Phoenix Group Holdings plc, Half year report 2023, p49

Explanation of the factors considered to identify distinct investment components is provided.

Further details are provided for contracts with discretionary participation features.

The company explains the nature of the judgement made, including the factors which are taken into consideration.

Significant judgements in applying IFRS 17

Paragraphs 117 to 120 of IFRS 17 require companies to disclose details of the significant judgements made in applying the standard, including the inputs, assumptions and estimation techniques used.

Paragraph 94 of IFRS 17 requires consideration of the level of detail needed to meet the disclosure objective of the standard, and disclosure of additional information if necessary.

Most of the companies in our sample provided disclosure of the significant judgements in applying IFRS 17; however, some disclosures were boilerplate with little specific information being provided about the nature of these judgements.

Examples of better disclosure provided:

- Specific details of assumptions used, such as quantitative disclosure of the illiquidity premiums used for discount rates, by product and currency.

- Meaningful sensitivities to changes in assumptions, such as changes in expected claims inflation, or the confidence level used to determine the risk adjustment.

In addition to the disclosures required by IFRS 17, IAS 1 also requires disclosures relating to significant judgements and areas of estimation uncertainty. Judgements and estimates have consistently featured in the CRR team's Top Ten matters of challenge, and guidance on meeting the requirements of IAS 1 is set out in our recent report 'Judgements and Estimates: Update' (July 2022)9.

For significant judgements we expect companies to:

- Give detailed descriptions of the specific, material judgements made by the directors in applying their accounting policies.

For significant estimates we expect companies to:

- Provide sufficient granularity in the descriptions of assumptions and/or uncertainties to enable users to understand management's most difficult, subjective or complex judgements.

- Provide meaningful sensitivities and/or ranges of reasonably possible outcomes for significant estimates not necessarily limited to those required by other standards.

- Quantify the assumptions underlying significant estimates when investors need this information to fully understand their effect.

In many cases it will not be possible for a user of the financial statements to understand the degree of estimation uncertainty and hence, assess the effect of insurance contracts on the company's financial statements without quantified sensitivity analysis. This is due to the complexity of the models required to produce figures under IFRS 17.

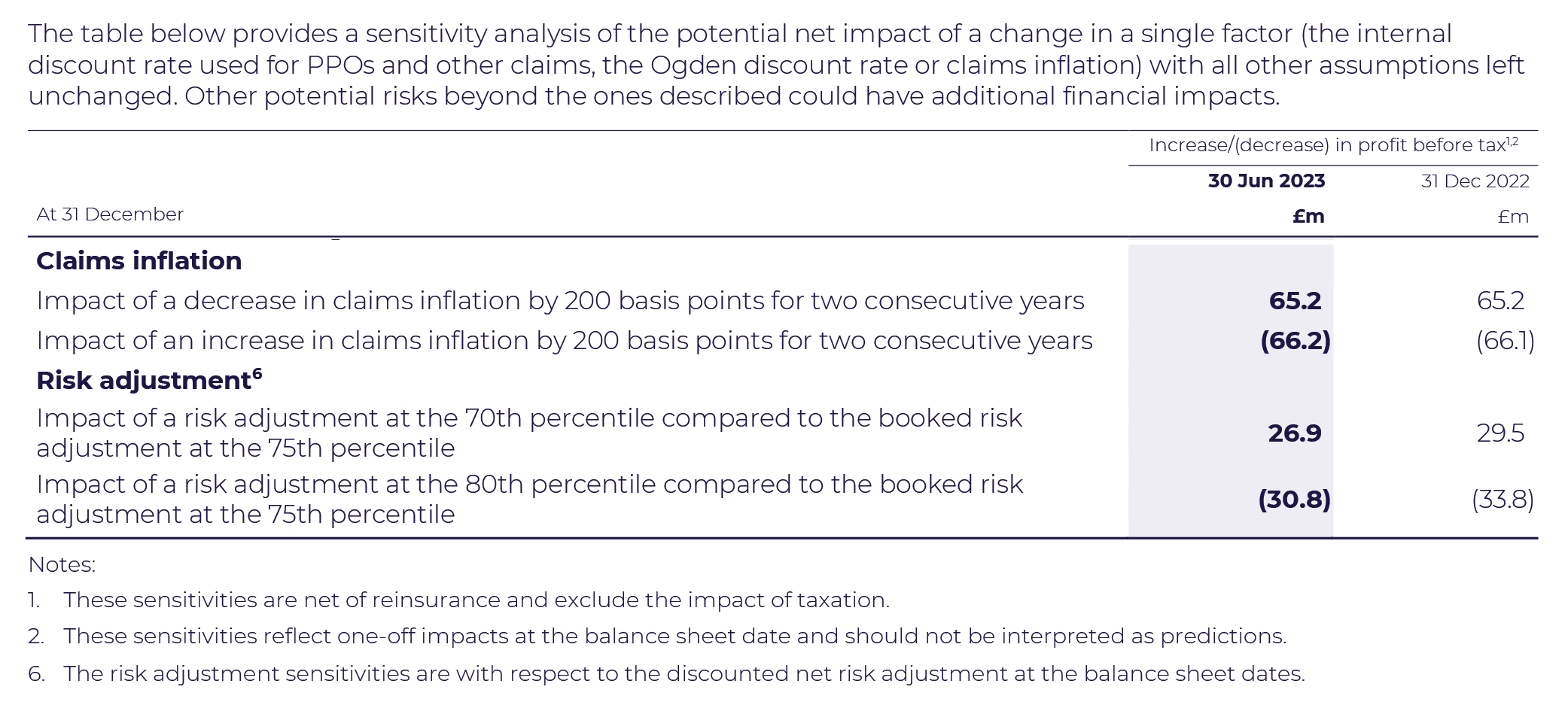

Sensitivity analysis (extract)

The table below provides a sensitivity analysis of the potential net impact of a change in a single factor (the internal discount rate used for PPOs and other claims, the Ogden discount rate or claims inflation) with all other assumptions left unchanged. Other potential risks beyond the ones described could have additional financial impacts.

Notes: 1. These sensitivities are net of reinsurance and exclude the impact of taxation10. 2. These sensitivities reflect one-off impacts at the balance sheet date and should not be interpreted as predictions11. 3. The risk adjustment sensitivities are with respect to the discounted net risk adjustment at the balance sheet dates12.

Direct Line Insurance Group plc, Half year report 2023, p22

The company provides a sensitivity to reasonably possible changes in future claims inflation. The disclosures also provide sensitivities to changes in the confidence level (percentile) used for the risk adjustment. The notes explain that the sensitivity to the risk adjustment reflects a one-off impact at the balance sheet date, and that it is net of reinsurance.

5. Estimates of future cash flows and contractual service margin (CSM)

Estimates of future cash flows

Paragraph 33 of IFRS 17 requires companies to include in the measurement of each group of insurance contracts all expected future cash flows within the boundary of each contact, adjusted to reflect the timing and uncertainty of those amounts.

Paragraph 34 identifies that cash flows are within the boundary of an insurance contract if they arise from the rights and obligations that exist during the period in which the policyholder is obligated to pay premiums or the company has a substantive obligation to provide the policyholder with insurance contract services.

Most insurers in our sample presented the description of cash flows included within the contract boundary as a list which was reflective of paragraph B65 of IFRS 17.

- The more helpful disclosures provided further information where judgement was applied to determine the future cash flows, including:

- cash flows where the company has discretion over the amount or timing of payments to policyholders;

- expense assumptions;

- projections of policyholder benefits; and

- the impact of riders and options within insurance contracts.

Recognition of the CSM in profit or loss

Paragraph B119 requires the CSM to be recognised in profit or loss as insurance and investment related services are provided to the customer. The amount of CSM recognised in each period is determined by identifying the coverage units in a group of insurance contracts, the number of which are determined by the quantity of insurance benefits provided under a contract and its expected coverage period.

All insurers in our sample identified the CSM as a key measure when reporting their results as it represents the stock of future profit.

- All insurers in our sample applying the general measurement model or the VFA explained how coverage units had been determined. However, we were pleased to note that nearly all also provided information about the coverage units used for major product lines and disclosed how weightings had been applied where a contract provides a combination of services, such as an annuity.

- The better disclosures provided an analysis of the expected release of the CSM.

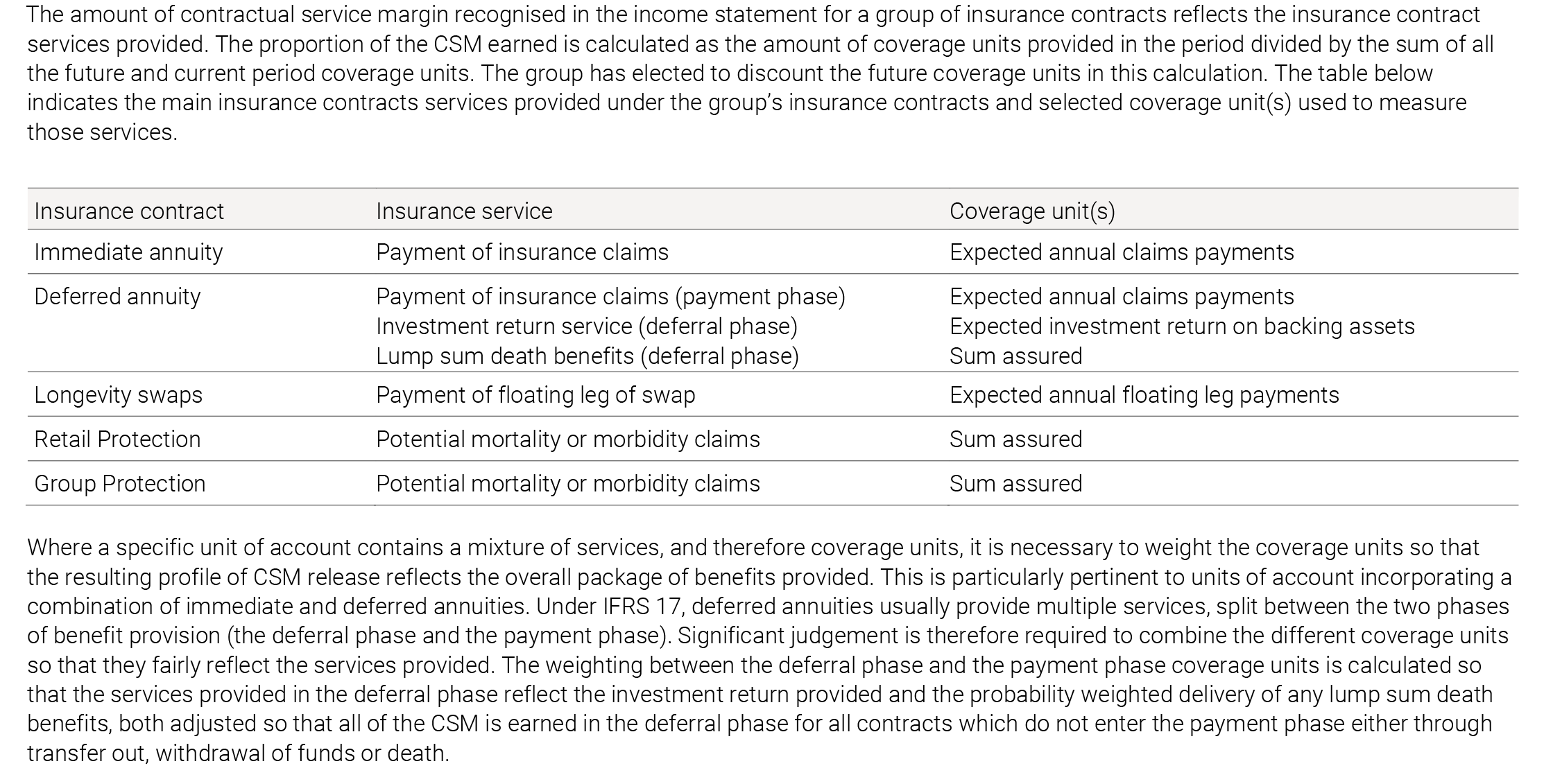

Contractual service margin – recognition (extract)

The amount of contractual service margin recognised in the income statement for a group of insurance contracts reflects the insurance contract services provided. The proportion of the CSM earned is calculated as the amount of coverage units provided in the period divided by the sum of all the future and current period coverage units. The group has elected to discount the future coverage units in this calculation. The table below indicates the main insurance contracts services provided under the group's insurance contracts and selected coverage unit(s) used to measure those services.

Where a specific unit of account contains a mixture of services, and therefore coverage units, it is necessary to weight the coverage units so that the resulting profile of CSM release reflects the overall package of benefits provided. This is particularly pertinent to units of account incorporating a combination of immediate and deferred annuities. Under IFRS 17, deferred annuities usually provide multiple services, split between the two phases of benefit provision (the deferral phase and the payment phase). Significant judgement is therefore required to combine the different coverage units so that they fairly reflect the services provided. The weighting between the deferral phase and the payment phase coverage units is calculated so that the services provided in the deferral phase reflect the investment return provided and the probability weighted delivery of any lump sum death benefits, both adjusted so that all of the CSM is earned in the deferral phase for all contracts which do not enter the payment phase either through transfer out, withdrawal of funds or death.

Legal & General Group PLC, Half year report 2023, p49

The company links coverage units to each phase of the insurance services provided for each product group and discusses how weightings are applied to coverage units to reflect the service provided.

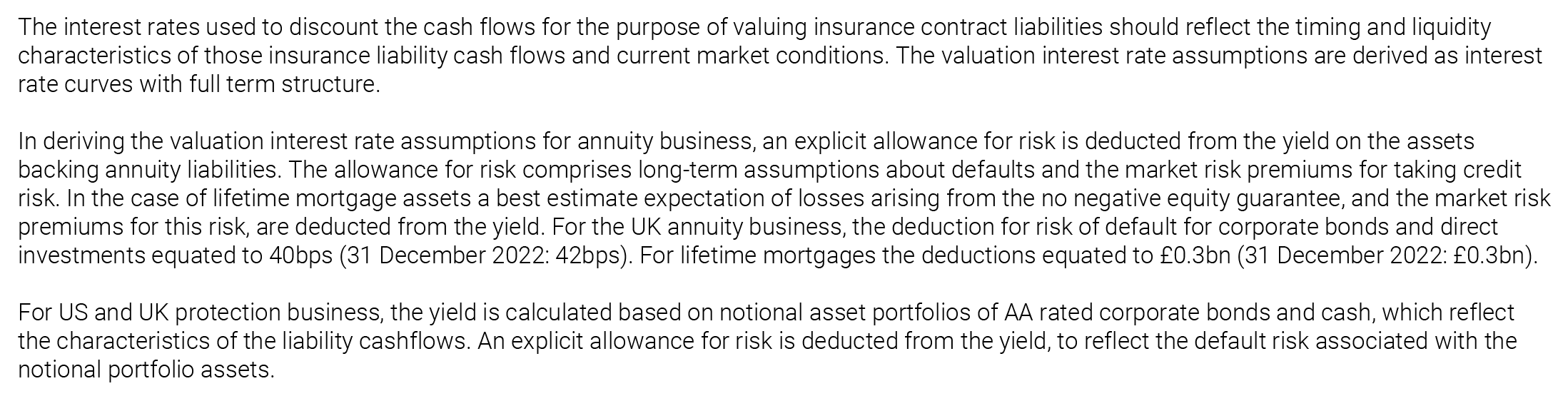

6. Discount rates

Paragraphs 36 and B72 to B85 of IFRS 17 provide guidance on how to determine an appropriate discount rate under IFRS 17, in particular, that a 'top-down' or 'bottom-up' approach may be used.

Paragraph 117(c)(iii) of IFRS 17 requires disclosure of the method used to determine the discount rates, and paragraph 120 requires disclosure of the yield curve (or range of yield curves) used.

While all entities in our sample explained the use of the 'top-down' or 'bottom-up' approaches, further details of how the discount rates had been calculated were sometimes limited.

Examples of better disclosure included:

- Tabular quantitative information of discount rates by currency and maturity.

- Graphical representation of discount rate curves.

- Explanation of the specific methods used to determine the discount rate (such as how the illiquidity premium was calculated).

- Sensitivity analysis of insurance balances to changes in discount rates.

Diagram illustrating Top-down and Bottom-up approaches for discount rates

Top-down approach Yield on reference portfolio of assets → Risk of default, downgrade, etc. → IFRS 17 discount rate

Bottom-up approach "Risk free" yield → Illiquidity premium → IFRS 17 discount rate

While IFRS 17 was outside the scope of our recent thematic review on discount rates13, that report did set out our general expectations regarding the disclosure of discount rates, which are consistent with the specific disclosure requirements of IFRS 17. In particular:

- We believe it is particularly important to provide high quality disclosures in relation to discount rates when judgement has been exercised and / or discount rates are a source of significant estimation uncertainty.

- High quality disclosure will include disclosure of the discount rate used, an explanation of how it was determined and, where material, sensitivity of insurance balances to changes in the discount rates.

Bottom-up approach

Where the bottom-up approach is used, we would expect disclosures to include:

- How the risk-free rates (or curves) were determined.

- Specific details of how the illiquidity premium was determined.

- An explanation of why particular data sources are appropriate, where external sources of data are referred to, for example, EIOPA discount rates.

Top-down approach

Examples of better disclosure where the top-down approach was used included:

- Explanation of the assets in the reference portfolio.

- Explanation of how credit risk from the reference portfolio was calculated and reflected in the discount rate.

The company explains, by type of business, how the reference portfolio of assets was determined. An explanation is provided for how credit risk of the reference portfolio is quantified and reflected in the discount rate, including quantification of the impact.

Valuation rates of interest and discount rates (extract)

Legal & General Group PLC, Half year report 2023, p71

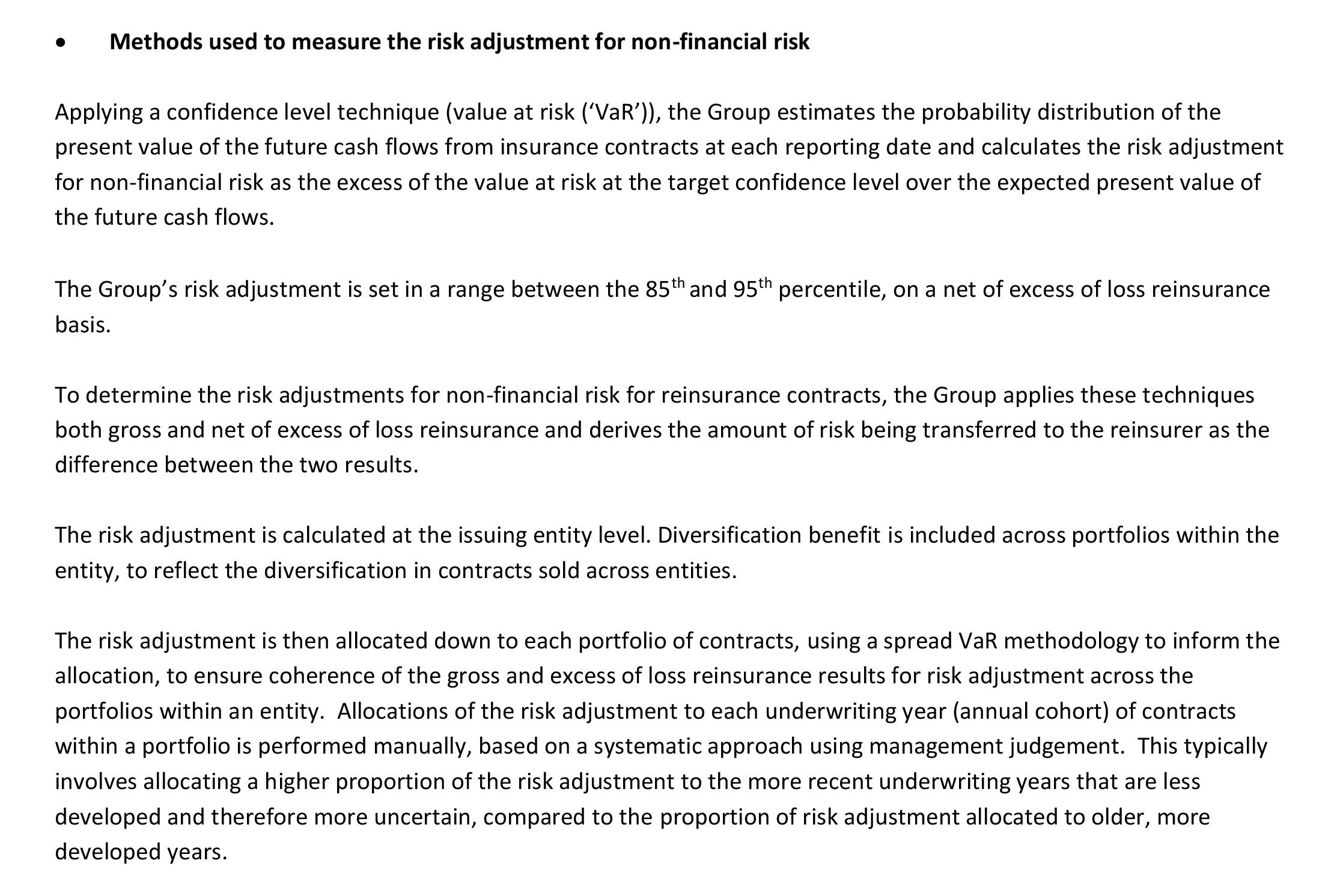

7. Risk adjustment

Paragraph 37 of IFRS 17 requires an adjustment to the estimate of the present value of the future cash flows to reflect the compensation required for bearing the uncertainty about the amount and timing of the cash flows that arises from non-financial risk.

Paragraph 119 of IFRS 17 requires disclosure of the confidence level used to determine the risk adjustment for non-financial risk, or the corresponding confidence level if another technique is used to determine the risk adjustment.

Calculation of the risk adjustment

As the standard does not prescribe a particular method to calculate the risk adjustment, it is important to provide a clear description of the method used, including any links to regulatory calculations, such as those used under Solvency II.

While most companies in our sample described the method used to calculate the risk adjustment, the level of detail varied. In particular, we identified several areas for improvement:

- How the risks considered compared to those used for Solvency II calculations.

- Adequately describing how the risk adjustment differed between portfolios, where different methods were used.

- How diversification benefits were considered.

- How the risk adjustment was calculated for reinsurance contracts held.

- The method used to allocate the risk adjustment to groups of insurance contracts.

Disclosure of the risk adjustment

In addition to disclosure, required by the standard, of the confidence level used to determine the risk adjustment for non-financial risk, examples of better disclosures included:

- Explanation of the level of risk appetite for non-financial risk, including any targeted range of confidence intervals in which the risk adjustment is set.

- Sensitivity of the carrying value of insurance liabilities to changes in the confidence level.

Methods used to measure the risk adjustment for non-financial risk (extract)

Admiral Group plc, Half year report 2023, p37

The company explains the method used to determine the risk adjustment as well as the percentile range used.

Further details are provided of how the risk adjustment is calculated for the company's reinsurance contracts.

Explanation is provided of how the risk adjustment is allocated to portfolios and annual cohorts, including the judgement required and typical patterns between cohorts.

8. Measurement models

In addition to the General Measurement Model (GMM), IFRS 17 contains the simplified Premium Allocation Approach (PAA) for qualifying contracts, the Variable Fee Approach (VFA) for investment contracts with discretionary participation features, and modifications to the GMM for reinsurance contracts held.

We were pleased to find that all companies in our sample clearly explained which measurement models applied to which groups of insurance, and reinsurance contracts.

Premium allocation approach (PAA) eligibility

Where the PAA was used, better disclosures explained:

- The groups of contracts to which the PAA was applied, including any associated reinsurance contracts.

- How management assessed eligibility for contracts with a coverage period of over one year.

The company explains, for both insurance and reinsurance contracts, the basis for applying the PAA, including where materiality judgements have been made.

Measurement – Premium Allocation Approach ("PAA") (extract)

Direct Line Insurance Group plc, Half year report 2023, p36

VFA eligibility

Where the VFA was used, better disclosures explained:

- The groups of contracts to which the VFA was applied.

- How management assessed eligibility.

VFA eligibility (extract)

Aviva plc Half Year Report 2023, p53

The company explains how the VFA eligibility requirements have been applied.

9. Alternative Performance Measures (APMs)

The diversity of reporting by insurance companies under IFRS 4 resulted in the widespread use of Alternative Performance Measures (APMs). Despite APMs being one of our main areas of focus in our routine reviews of corporate reporting, in recent years we have not routinely challenged the use of APMs by insurance companies to the same extent, due to the complexities of applying IFRS 4, and the fact that IFRS 17 adoption was underway. However, following the adoption of IFRS 17 we expect insurers to provide high quality disclosures for APMs, including those that are KPIs.

Our thematic review 'Alternative Performance Measures (APMs)'14 set out our expectations and guidance on the reporting of APMs, building on several earlier thematics. We expect companies to:

- ensure that APMs are not presented in ways that give them greater prominence than amounts stemming from the financial statements;

- avoid comments that imply APMs have more authority than amounts stemming from the financial statements;

- provide specific, tailored explanations for the inclusion of individual APMs in their reports, as well as the basis for classifying amounts as adjusting items;

- explain terms such as 'underlying profit' or 'core operations' and the basis for identifying adjustments as 'non-underlying' or non-core'; and

- ensure that APMs are reconciled to the most directly reconcilable line items, subtotals or totals presented in the financial statements, and not to other APMs.

Most of the companies in our sample used APMs. We noted changes to the value of particular APMs due to adopting the IFRS 17 measurement basis. In addition, many companies changed calculation methodologies, added additional APMs or withdrew APMs.

- Several companies in our sample did not explain how the use of APMs had changed following the adoption of IFRS 17 or disclose the impact on the value of APMs, or on trends, as a result of the transition in their interim financial statements. However, we note that some companies did provide this information in separate transition documents.

Examples of better disclosure included:

- Explanation of how management use APMs as well as a rationale for why particular APMs are presented.

- Description of each APM, identification of closest IFRS measurement, and link to a reconciliation or calculation.

- Reconciliation, for key APMs, between the previously reported IFRS 4 comparative figure and the revised value following adoption to IFRS 17.

10. IFRS 9

The majority of companies in our sample had previously taken the temporary exemptions from applying IFRS 9, and so applied IFRS 9 for the first time alongside IFRS 17.

Most of the companies in our sample recognised only an immaterial, or nil, adjustment to equity at the date of transition. The most notable impact on transition to IFRS 9 we identified related to changes to the classification and measurement of portfolios of financial assets; for example, moving from amortised cost measurement under IAS 39 to fair value through profit or loss under IFRS 9, or vice versa. The IFRS 9 impairment requirements did not have a material impact on the companies within our sample, due to the credit quality of financial asset investments held.

Many of the messages contained in our thematic reviews of the transition to IFRS 915 concerning classification and measurement will be relevant to insurers applying IFRS 9 for the first time. We were pleased that the companies in our sample explained the impact of adopting IFRS 9 and provided proportionate transitional disclosures and accounting policies.

Better disclosure:

- Explained any choices made on transition, such as whether the classification overlay16 was applied for comparative periods.

- Provided tabular information about changes to the classification of financial asset portfolios, with additional narrative explanations of any elections made, or accounting mismatches which the company is seeking to manage.

The company explains that the comparatives have not been restated for IFRS 9, however, the classification overlay has been applied.

Effect of adoption of IFRS 17 and IFRS 9 (extract)

Prudential plc, Half year report, p10

The change to classification is explained and quantification of measurement changes is provided.

Remeasurement from FVTPL to amortised cost (extract)

Legal & General Group PLC, Half year report 2023, p56

The company explains a change in classification for a sub-portfolio under IFRS 9 with reference to the use of locked-in discount rates for the measurement of CSM under IFRS 17.

The company explains how a previous accounting mismatch no longer exists as finance income and expense on certain insurance liabilities is presented in OCI.

11. Other considerations

Aggregation and disaggregation

Paragraph 95 of IFRS 17 requires entities to aggregate or disaggregate information so that useful information is not obscured either by the inclusion of a large amount of insignificant detail or by the aggregation of items that have different characteristics.

The level of detail provided in disclosures varied across our sample, some insurers provided entity-level disclosures whereas others provided disclosures by line of business or geography.

- While we recognise that the disclosure requirements for interim financial statements are not as detailed or prescriptive as those for annual reports and accounts, the lack of disaggregation meant that the full extent of the impact of IFRS 17 was not always clear.

Implementation costs

Some companies disclosed significant IFRS 17 implementation project costs, which were presented as adjusting items in the determination of adjusted profit APMs.

- In the future, as insurers fully embed IFRS 17 into their reporting framework, we will expect to see the ongoing costs of compliance included as part of the normal cost of operations.

Tax implications

The implementation of IFRS 17 also has implications for the calculation of current and deferred taxes. Taxes may have an effect on the measurement of the insurance liabilities under the standard. Additionally, multinational groups may find that there are different impacts on tax accounting in different territories.

- Most companies in our sample did not explain the tax impact of the adoption of IFRS 17. Companies will need to carefully assess the tax implications as a result of the adoption of the standard. Where the effect is material, we expect companies to adequately explain the key drivers impacting the current and deferred tax balances.

12. Non-insurance companies

As IFRS 17 is a contract-based standard, it applies to all entities which have contracts that meet the definition of an insurance contract, unless a scope exclusion, or specific accounting policy choice applies.

We did not include non-insurance companies within our sample for this thematic review. Instead we identified, through our routine work and by working with other FRC departments, a small number of examples of non-insurers disclosing the impact of IFRS 17, one of which has been included in this report.

The most common reference to IFRS 17 for non-insurers was for financial guarantee contracts. We also identified companies which mentioned the impact of performance guarantees within the scope of IFRS 15, fixed-fee service contracts, investment contracts within the scope of IFRS 9, and subsidiaries which underwrite insurance business.

Other potential impacts of IFRS 17

In addition, we identified several areas where careful analysis may be required to determine whether IFRS 17 has an impact:

- Annuity arrangements with members of Limited Liability Partnerships (LLPs) which are outside the scope of IAS 19, as IFRS 17 scopes out employee benefits plans, but not arrangements with members of the entity.

- In some cases where captive insurance arrangements existed it was not apparent that all transactions of the captive would fully eliminate on consolidation as the captive had contracts which transferred insurance risk from an external party.

Scope exemptions in IFRS 17

Some contracts may meet the definition of an insurance contract but are accounted for under another standard. Paragraph 7 of IFRS 17 excludes certain insurance contracts from the scope of the standard including, but not limited to:

- certain warranties provided by a manufacturer;

- certain financial guarantee contracts; and

- insurance policies held by the entity (apart from reinsurance contracts).

Paragraph 8 of IFRS 17 allows a policy choice between IFRS 17 and IFRS 15 for fixed fee service contracts, where certain conditions are met.

Paragraph 8A of IFRS 17 allows a policy choice between IFRS 17 and IFRS 9 for certain insurance contracts, where compensation is limited to the amount required to settle the policyholder's obligation under the contract (such as equity release mortgages).

Better disclosures:

- Identified specific types of contracts held by the company which may meet the definition of an insurance contract.

- Explained with reference to the standard whether these contracts were within the scope of IFRS 17.

- Explained any policy choices made with reference to the criteria in the standard.

IFRS 17 Insurance Contracts (extract)

Rolls-Royce Holdings PLC, Half year report, p16

The company explains judgement applied in assessing whether a specific contract type transfers insurance risk and concludes the contracts should continue to be measured under other accounting standards.

The company identifies a captive insurance company and explains why there is no impact of IFRS 17 on the consolidated financial statements.

The company has identified that parent company guarantee arrangements meet the definition of an insurance contract. A potential impact on the individual financial statements is noted.

13. Key expectations

We expect companies to consider the examples provided of better disclosure and opportunities for improvement. These should be incorporated in future reporting where relevant and material. In particular, we expect companies to:

- Provide quantitative and qualitative disclosures, that are both decision-useful and company-specific, which meet the disclosure objective of IFRS 17 and enable users to understand how insurance contracts are measured and presented in the financial statements.

- Ensure that accounting policies are sufficiently granular and provide clear, consistent explanations of accounting policy choices, key judgements and methodologies, particularly where IFRS 17 is not prescriptive.

- Where sources of estimation uncertainty exist, provide information about the underlying methodology and assumptions made to determine the specific amount at risk of material adjustment and provide meaningful sensitivities and/or ranges of reasonably possible outcomes.

- Provide sufficiently disaggregated qualitative and quantitative information to allow users to understand the financial effects of material portfolios of insurance (and reinsurance) contracts.

- Clearly explain the impact of transition to IFRS 17, including details of underlying methodology to measure insurance contracts at the measurement date and disclosure of reconciliations of the CSM and revenue by transition method.

- Ensure alternative performance measures, and any changes to such measures, are adequately explained, not given undue prominence and reconciled to the most directly reconcilable line item in the financial statements.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 230 www.frc.org.uk

Follow us on Twitter @FRCnews or LinkedIn

-

https://www.iasplus.com/en-gb/publications/global/other/implementation-ifrs-17-key-judgements ↩

-

Paragraph 95 of IFRS 17. ↩

-

Paragraphs 122 and 125 of IAS 1. ↩

-

Contractual service margin. ↩

-

Subject to certain conditions, paragraph C5A of IFRS 17 also permits an entity to choose to apply the fair value approach for a group of insurance contracts with direct participation features when risk mitigation has been applied prospectively to the group from the transition date. None of the companies in our sample chose this option to a material extent. ↩

-

Paragraph 114 of IFRS 17. ↩

-

Paragraph C3(a) of IFRS 17 provides an exemption from the requirements of paragraph 28(f) of IAS 8 to disclose the impact of transition on individual line items. We noted that some companies chose to provide this disclosure to explain the impact of adoption of IFRS 17 on the statement of financial position. ↩

-

IFRS 13 includes a requirement on demand deposits such that the fair value of a financial liability with a demand feature can never be less than the present value of the amount payable on demand. Under IFRS 17, an entity should not increase the fair value to the amount that would be payable on demand. ↩

-

https://media.frc.org.uk/documents/Judgements_and_Estimates_IAS_1_2022.pdf ↩

-

These sensitivities are net of reinsurance and exclude the impact of taxation. ↩

-

These sensitivities reflect one-off impacts at the balance sheet date and should not be interpreted as predictions. ↩

-

The risk adjustment sensitivities are with respect to the discounted net risk adjustment at the balance sheet dates. ↩

-

https://media.frc.org.uk/documents/Discount_Rates.pdf ↩

-

https://media.frc.org.uk/documents/Alternative_Performance_Measures_APMs_2021.pdf ↩

-

https://www.frc.org.uk/accountants/corporate-reporting-review/corporate-reporting-thematic-reviews ↩

-

Paragraphs C28A to C28E of IFRS 17. ↩