The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Annual Review of Corporate Reporting 2022/2023

- Highlights

- 1. Introduction

- Quality of corporate reporting

- 2. Our monitoring activities and outcomes: at a glance

- 3. Our findings: at a glance

- 4. Key matters for 2023/24 annual reports and accounts

- Our findings in greater depth

- 5. Top ten issues

- 5.1 Impairment of assets

- 5.1 Impairment of assets (continued)

- 5.1 Impairment of assets (continued)

- 5.2 Judgements and estimates

- 5.2 Judgements and estimates (continued)

- 5.3 Cash flow statements

- 5.3 Cash flow statements (continued)

- 5.4 Strategic report and other Companies Act 2006 matters

- 5.4 Strategic report and other Companies Act 2006 matters (continued)

- 5.4 Strategic report and other Companies Act 2006 matters (continued)

- 5.5 Financial instruments

- 5.5 Financial instruments (continued)

- 5.6 Income taxes

- 5.6 Income taxes (continued)

- 5.7 Revenue

- 5.7 Revenue (continued)

- 5.8 Provisions and contingencies

- 5.8 Provisions and contingencies (continued)

- 5.9 Presentation of financial statements and related disclosures

- 5.10 Fair value measurement

- 6.1 Thematic review: fair value measurement

- 6.2 Thematic review: TCFD metrics and targets disclosures

- Has companies’ climate-related metrics and targets reporting improved since last year?

- Are companies adequately disclosing their plans for transition to a lower carbon economy, including interim milestones and progress?

- Are companies using consistent and comparable metrics?

- Are companies explaining how their targets have affected the financial statements?

- 6.3 Thematic review: IFRS 17, ‘Insurance Contracts’ Interim Disclosures in the First Year of Application

- 6.4 Thematic review: reporting by the largest private companies

- Focus of review

- The companies to be reviewed

- Publication

- 6.4 Thematic review: reporting by the largest private companies

- 6.5 Other reviews: TCFD and climate in the financial statements

- 6.5 Other reviews: TCFD and climate in the financial statements (continued)

- 6.5 Other reviews: TCFD and climate in the financial statements (continued)

- 6.6 Other reviews: Directors' Remuneration Reports (DRR)

- 7. Other key reporting issues

- 7.1 Inflation and rising interest rates

- 7.1 Inflation and rising interest rates (continued)

- 7.2 Corporate Governance reporting

- 7.3 FRC Lab

- 7.4 What Makes a Good Annual Report and Accounts

- 7.4 What Makes a Good Annual Report and Accounts (continued)

- 7.4 What Makes a Good Annual Report and Accounts (continued)

- Appendices

- Appendix 1: CRR monitoring activities (Review activities for the year) (continued)

- Appendix 1: CRR monitoring activities (Publication of CRR interaction) (continued)

- Case summaries

- Revision of defective accounts

- Required references

- Cash flow statements

- Cash flow statements (continued)

- Presentation of financial statements

- Financial instruments

- Non-current assets held for sale

- Foreign currency

- Research & Development Expenditure Credits (RDECs)

- Earnings per share (EPS)

- Separate financial statements

- Dividends

- Income taxes

- Business combinations

- Appendix 1: CRR monitoring activity (Post-review survey)

- Appendix 2: Developments in corporate reporting

- Appendix 2: Developments in corporate reporting: amendments to various IFRSs (continued)

- ① Annual Improvements to IFRS Standards 2018-2020 Cycle

- ② Proceeds before Intended Use (Amendments to IAS 16)

- ③ Onerous Contracts – Cost of Fulfilling a Contract (Amendments to IAS 37)

- ④ Reference to the Conceptual Framework (Amendments to IFRS 3)

- ⑤ Deferred Tax related to Assets and Liabilities arising from a Single Transaction (Amendments to IAS 12)

- ⑥ Definition of Accounting Estimates (Amendments to IAS 8 'Accounting Policies, Changes in Accounting Estimates and Errors')

- ⑦ Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice Statement 2)

- ⑧ International Tax Reform — Pillar Two Model Rules (Amendments to IAS 12)

- ⑨ Non-current Liabilities with Covenants (Amendments to IAS 1)

- ⑩ Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

- ⑪ Lease Liability in a Sale and Leaseback (Amendments to IFRS 16)

- ⑫ Supplier Finance Arrangements (Amendments to IAS 7 and IFRS 7)

- Appendix 2: Developments in corporate reporting: IFRS 17

- Appendix 2: Developments in corporate reporting: narrative reporting

- Appendix 2: Developments in corporate reporting: narrative reporting

- Sustainability-related disclosures

- Sustainability-related disclosures (continued)

- 16 Disclosure of diversity and inclusion on company boards and executive committees on a comply-or-explain basis for listed companies

- 17 The Companies (Strategic Report and Directors' Report) (Amendment) Regulations 2023

- Appendix 2: Developments in corporate reporting: UK GAAP

- Appendix 3: Scope of CRR's work

- Appendix 4: How to deal with a CRR query

- Appendix 5: How we perform our reviews

Highlights

1. Introduction

Companies have faced several years of economic and geopolitical turbulence following the pandemic and Russia's invasion of Ukraine. Interest rate rises in response to persistent inflation, the related impact on consumer behaviour, and limited growth remain immediate concerns in many economies. There are also considerable uncertainties surrounding companies' exposures to climate change and their plans for the transition to a low carbon economy.

This presents a challenging environment for financial reporting as companies need to consider, and communicate to investors, how these issues affect their business, as well as the assumptions underpinning the values of assets and liabilities in their financial statements.

The development and consolidation of the sustainability reporting ecosystem continues at pace, with the phased introduction of climate-related disclosures in the UK and a major milestone, the publication of the first International Sustainability Standards Board (ISSB) standards,1 this year, reflecting the demand for investor-focused information in this area.

The Corporate Reporting Review (CRR) team of the Financial Reporting Council (FRC) works to ensure that company annual reports and accounts comply with the relevant financial and narrative reporting requirements and deliver high quality, decision-useful information for investors and other stakeholders.2 This report sets out the findings from our review work in our 2022/23 monitoring cycle3 and our expectations for the coming reporting season, with a particular focus on those areas where we have challenged companies most frequently, or where the requirements are complex or changing.

How to use this report

This report provides information which is relevant to preparers and auditors of financial statements, investors and other users of corporate reports and accounts, and wider FRC stakeholders. It has been structured to help readers focus on the content best suited to their needs.

The Highlights section provides an overview of our activities, findings, expectations for 2023/24 reports and reporting developments which we consider to be relevant to all stakeholders. It outlines the key corporate reporting issues with links to more detailed material elsewhere in the report.

Our findings in greater depth contains further technical detail illustrating and explaining the reporting issues. We consider this content to be most relevant to those directly involved in the preparation, audit or analysis of annual reports and accounts.

The Appendices include detailed data providing transparency on our monitoring activities and outcomes, as well as further reference material about upcoming changes to reporting requirements and the scope of our reviews.

Quality of corporate reporting

Financial reporting

We are pleased to note that the general quality of corporate reporting across the population of FTSE 350 companies we reviewed has been maintained. Our reviews resulted in a similar number of substantive questions to previous years and we were able to resolve these enquiries through open and constructive engagement with companies. This is a positive outcome in the context of a challenging trading and reporting environment.

We saw improvements in a number of areas, with Alternative Performance Measures (APMs) falling out of our 'top ten' issues for the first time in several years. We are pleased that many companies have responded to our interventions and to the investor need for better quality reporting of non-GAAP performance measures, although we note that room for improvement remains and we will continue to challenge where necessary. We continue to see a gradual fall in issues related to the revenue, leasing and financial instruments standards, which initially presented some difficulties for many companies.

Our most frequently raised issues this year were impairment, and judgements and estimates. This may reflect the heightened economic uncertainties companies need to factor into their financial reporting. Reduced headroom in impairment tests may trigger additional disclosure requirements for assumptions and sensitivities; and estimates, such as discount rates, may need to reflect a wider range of possible outcomes than in previous reporting periods. Companies have not always provided adequate disclosures on these points for users to understand the positions taken. We expect these to remain areas of risk, and close CRR focus, for the coming reporting season.

We also continue to find, through our desktop reviews, a significant number of issues with cash flow statements. This has again resulted in a number of companies restating their results.

Climate-related reporting

Our current review cycle (2023/24) is the second in which premium listed companies have been required to provide Taskforce for Climate-related Financial Disclosures (TCFD) disclosures, on a comply or explain basis, and the first for those with a standard listing. We have embedded the review of these disclosures into our routine reviews and carried out further thematic work, focused on disclosures of metrics and targets, this year. We also continue to monitor the extent to which climate change is incorporated into companies' financial statements through our routine review work.

Our reviews suggest companies are still at very different stages of maturity in their reporting. Our initial regulatory approach to mandatory TCFD disclosure focused on driving improvements in quality as companies tackled the new requirements. We raised a substantial number of points in our letters for companies to consider in future reports. As practice becomes more established, it is more likely we will enter into substantive correspondence with companies where their disclosures do not meet our expectations.

2. Our monitoring activities and outcomes: at a glance

Our activities during the 2022/23 review cycle are summarised below:

| Category | 2022/23 | 2021/22 | 2020/21 | Description |

|---|---|---|---|---|

| Reviews performed | 263 | 252 | 246 | As in prior years, our monitoring work was weighted towards the FTSE 350. This proportion has fallen slightly since 2020/21. Our thematic review selections and targeted work on the FRC's priority sectors, such as retail, have included a higher proportion of AIM-quoted and large private companies and we have reviewed the reports of several professional services firms this year, which are outside the FTSE 350. |

| FTSE 350 (% of reviews above) |

59% | 57% | 72% | |

| Substantive letters | 112 | 103 | 97 | We write to companies where we need additional information or further explanations to help us better understand their reporting. |

| Required references to the FRC's review | 25 | 27 | 15 | We ask companies to refer to our enquiries in their next annual report and accounts where more significant changes are made as a result of our enquiry, typically because the company restated comparative information in primary financial statements. |

Detailed information about our activities and outcomes, including how we collaborate with other public bodies across the FRC, is included in Appendix 1: CRR monitoring activity.

Transparency

Since March 2021, in response to a need for greater transparency and in advance of expected legislation to implement one of the Kingman recommendations, the FRC has published summaries of its findings of closed cases that resulted in substantive enquiries. Currently, legal restrictions mean that we can only publish case summaries with the consent of the relevant companies. Only nine companies (3%) so far have not consented to the publication of a case summary.

Use of the FRC's powers

The vast majority of companies voluntarily provide information in response to our enquiries and we rarely need to invoke our statutory powers to obtain information. We have used these powers once in the last three years.

Priority sectors

The focus of our work during this cycle has been on companies in the following sectors, assessed by the FRC to be of higher risk:

2022/23

- travel, hospitality and leisure

- retail

- construction and materials

- gas, water and multi-utilities

2023/24

We announced in December that we would focus on the following risk sectors in the coming review cycle:

- travel, hospitality and leisure

- retail and personal goods

- construction and materials

- industrial transportation

3. Our findings: at a glance

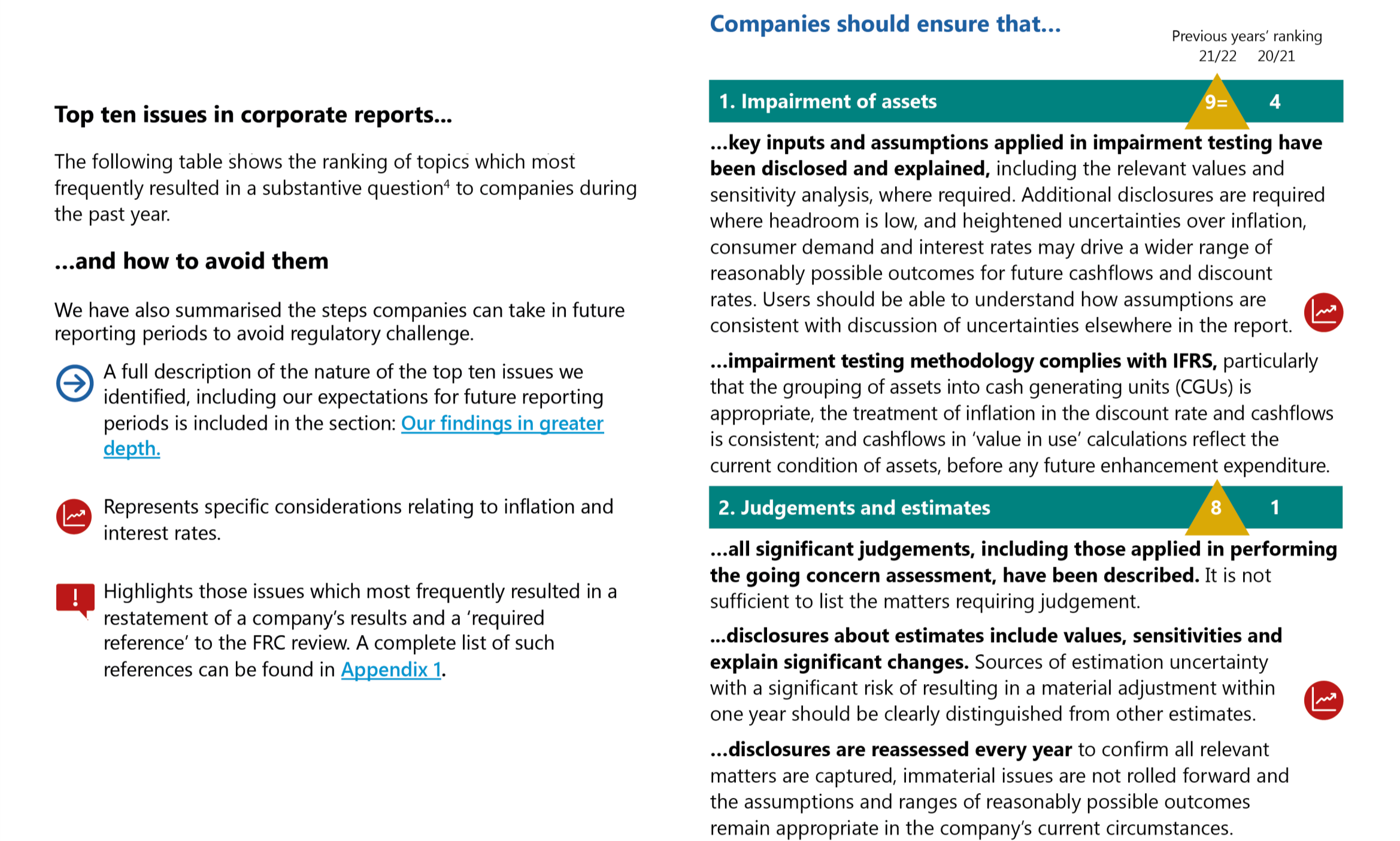

Top ten issues in corporate reports...

...and how to avoid them

We have also summarised the steps companies can take in future reporting periods to avoid regulatory challenge.

A red arrow with a line indicates a full description of the nature of the top ten issues we identified, including our expectations for future reporting periods is included in the section: Our findings in greater depth.

A megaphone icon indicates specific considerations relating to inflation and interest rates.

An exclamation mark highlights those issues which most frequently resulted in a restatement of a company's results and a 'required reference' to the FRC review. A complete list of such references can be found in Appendix 1.

Companies should ensure that...

1. Impairment of assets

(Previous years' ranking: 21/22: 9=, 20/21: 4)

...key inputs and assumptions applied in impairment testing have been disclosed and explained, including the relevant values and sensitivity analysis, where required. Additional disclosures are required where headroom is low, and heightened uncertainties over inflation, consumer demand and interest rates may drive a wider range of reasonably possible outcomes for future cashflows and discount rates. Users should be able to understand how assumptions are consistent with discussion of uncertainties elsewhere in the report.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

...impairment testing methodology complies with IFRS, particularly that the grouping of assets into cash generating units (CGUs) is appropriate, the treatment of inflation in the discount rate and cashflows is consistent; and cashflows in 'value in use' calculations reflect the current condition of assets, before any future enhancement expenditure.

2. Judgements and estimates

(Previous years' ranking: 21/22: 8, 20/21: 1)

...all significant judgements, including those applied in performing the going concern assessment, have been described. It is not sufficient to list the matters requiring judgement.

...disclosures about estimates include values, sensitivities and explain significant changes. Sources of estimation uncertainty with a significant risk of resulting in a material adjustment within one year should be clearly distinguished from other estimates.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

...disclosures are reassessed every year to confirm all relevant matters are captured, immaterial issues are not rolled forward and the assumptions and ranges of reasonably possible outcomes remain appropriate in the company's current circumstances.

Please see Appendix 5 for information about the FRC's approach to reviews.

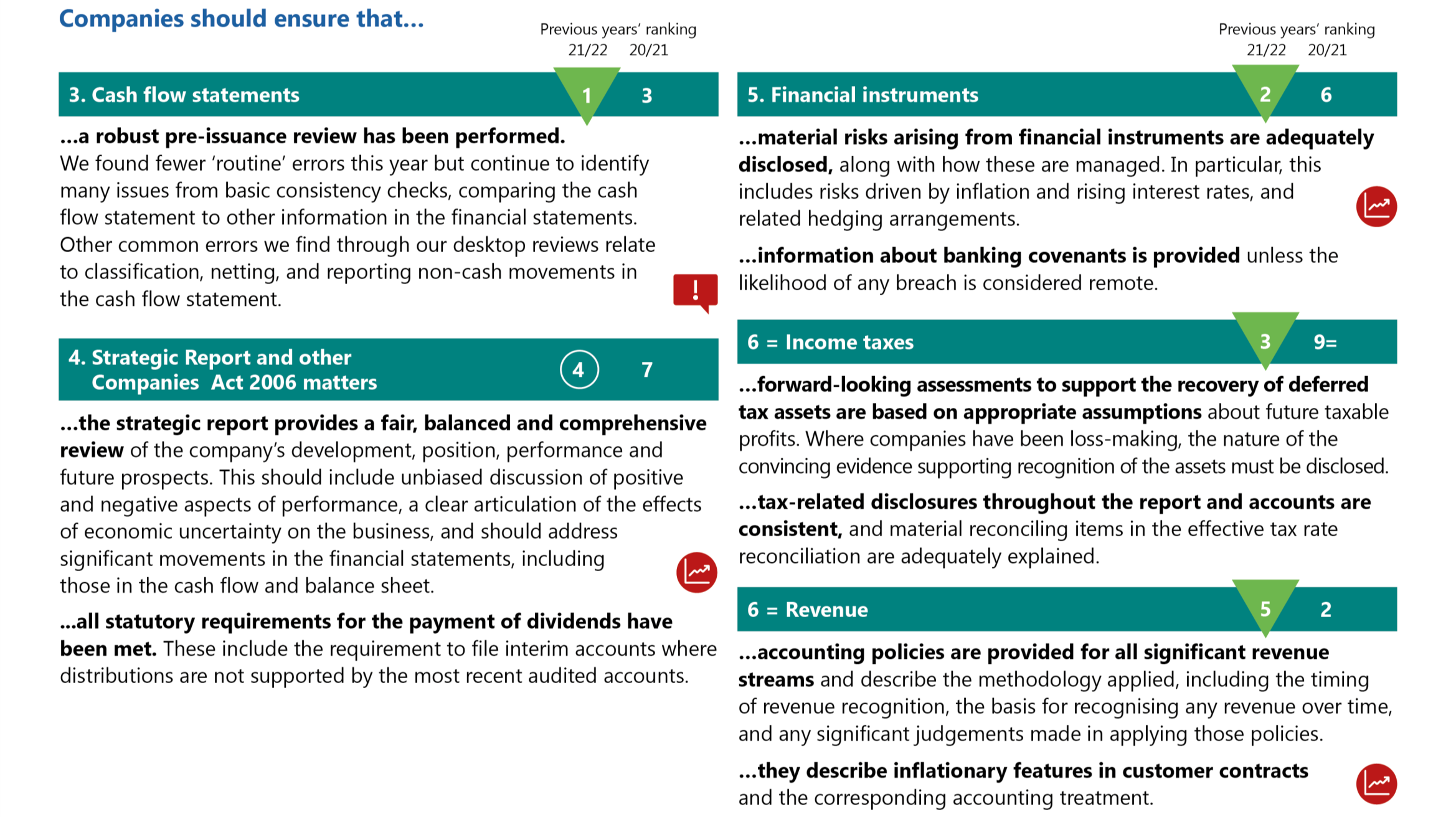

3. Cash flow statements

(Previous years' ranking: 21/22: 1, 20/21: 3)

...a robust pre-issuance review has been performed.

We found fewer 'routine' errors this year but continue to identify many issues from basic consistency checks, comparing the cash flow statement to other information in the financial statements. Other common errors we find through our desktop reviews relate to classification, netting, and reporting non-cash movements in the cash flow statement.

An exclamation mark highlights this issue resulted in a restatement of results or required reference to the FRC review.

4. Strategic Report and other Companies Act 2006 matters

(Previous years' ranking: 21/22: 4, 20/21: 7)

...the strategic report provides a fair, balanced and comprehensive review of the company's development, position, performance and future prospects. This should include unbiased discussion of positive and negative aspects of performance, a clear articulation of the effects of economic uncertainty on the business, and should address significant movements in the financial statements, including those in the cash flow and balance sheet.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

...all statutory requirements for the payment of dividends have been met. These include the requirement to file interim accounts where distributions are not supported by the most recent audited accounts.

5. Financial instruments

(Previous years' ranking: 21/22: 2, 20/21: 6)

...material risks arising from financial instruments are adequately disclosed, along with how these are managed. In particular, this includes risks driven by inflation and rising interest rates, and related hedging arrangements.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

...information about banking covenants is provided unless the likelihood of any breach is considered remote.

6. Income taxes

(Previous years' ranking: 21/22: 3, 20/21: 9=)

...forward-looking assessments to support the recovery of deferred tax assets are based on appropriate assumptions about future taxable profits. Where companies have been loss-making, the nature of the convincing evidence supporting recognition of the assets must be disclosed.

...tax-related disclosures throughout the report and accounts are consistent, and material reconciling items in the effective tax rate reconciliation are adequately explained.

6. Revenue

(Previous years' ranking: 21/22: 5, 20/21: 2)

...accounting policies are provided for all significant revenue streams and describe the methodology applied, including the timing of revenue recognition, the basis for recognising any revenue over time, and any significant judgements made in applying those policies.

...they describe inflationary features in customer contracts and the corresponding accounting treatment.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

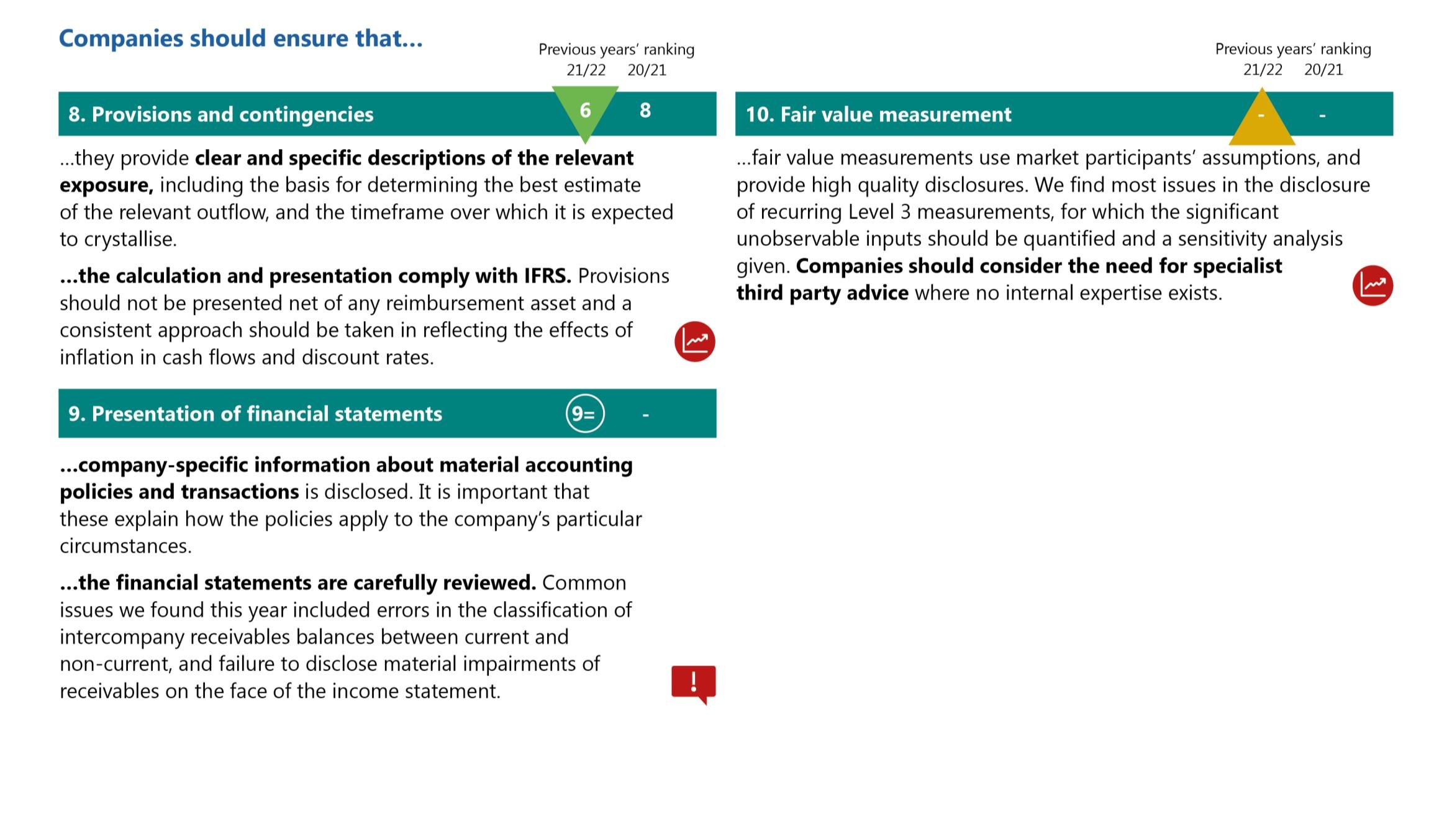

8. Provisions and contingencies

(Previous years' ranking: 21/22: 6, 20/21: 8)

...they provide clear and specific descriptions of the relevant exposure, including the basis for determining the best estimate of the relevant outflow, and the timeframe over which it is expected to crystallise.

...the calculation and presentation comply with IFRS. Provisions should not be presented net of any reimbursement asset and a consistent approach should be taken in reflecting the effects of inflation in cash flows and discount rates.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

9. Presentation of financial statements

(Previous years' ranking: 21/22: 9=)

...company-specific information about material accounting policies and transactions is disclosed. It is important that these explain how the policies apply to the company's particular circumstances.

...the financial statements are carefully reviewed. Common issues we found this year included errors in the classification of intercompany receivables balances between current and non-current, and failure to disclose material impairments of receivables on the face of the income statement.

An exclamation mark highlights this issue resulted in a restatement of results or required reference to the FRC review.

10. Fair value measurement

(Previous years' ranking: 21/22: -, 20/21: -)

...fair value measurements use market participants' assumptions, and provide high quality disclosures. We find most issues in the disclosure of recurring Level 3 measurements, for which the significant unobservable inputs should be quantified and a sensitivity analysis given. Companies should consider the need for specialist third party advice where no internal expertise exists.

A megaphone icon indicates this refers to specific considerations relating to inflation and interest rates.

Thematic reviews

2022/23

Performing focused thematic work allows us to assess the quality of reporting on emerging or complex reporting areas, set out clear expectations, and provide companies with guidance and better practice examples. Reports reviewed as part of a thematic review represented over a third of our casework this year. We reported on these reviews in section 4.1 of last year's annual review. Links to the full reports can be found below:

- Discount rates

- TCFD disclosures and climate in the financial statements

- Deferred tax assets

- Business combinations

- Earnings per share

- Judgements and estimates

The findings of substantive enquiries that arose from these reviews have been incorporated into the 'top ten' findings on the previous pages.

Fair value measurement (IFRS 13)

Many IFRSs require or permit fair value measurements. The challenging economic environment and the risks posed by climate change may increase the degree of estimation uncertainty and management judgement in this area. Consequently, clear and transparent disclosures of fair value measurements are likely to become increasingly important. Although the review focuses on disclosure matters, it also highlights those areas where CRR commonly finds errors in its routine monitoring of corporate reporting and to which companies may want to pay particular attention.

Section 6.1 Full report

TCFD – metrics and targets

We also carried out a focused thematic review to assess the quality of companies' disclosures of metrics and targets, and the extent to which they had been reflected in the financial statements. We saw an incremental improvement in reporting since our 2022 thematic review, although some companies are struggling to clearly articulate their plans to adapt to a lower carbon economy. Most companies have set net zero or other climate-related targets and interim emissions targets, but these were not always well explained. We assessed the extent of comparability between companies in the same sector and found some commonality, but methodological differences made direct comparisons challenging. It was often difficult to determine the extent to which the impact of climate-related targets on the financial statements had been considered, due to lack of company-specific disclosures.

Section 6.2 Full report

2023/24

We are performing the following four thematic reviews in our 2023/24 review cycle:

- Fair value measurement

- TCFD – metrics and targets

- Large private companies (review in progress)

- Insurance contracts (review in progress)

Our findings or planned work for each of these projects are summarised below, with further detail in Section 6 of this report.

Thematic reviews

Insurance contracts (IFRS 17)

Section 6.3

We are carrying out a thematic review on the disclosures of the impact of this new standard included within the June 2023 interim reports of a sample of companies, which we expect to publish in November. The purpose of the review is to observe the initial application of the standard and to identify good examples, and any weaknesses, within interim disclosures, to help us provide relevant and timely guidance for companies to consider when preparing their year-end accounts. The thematic review will also inform our selection of annual reports for review during the next year. The companies selected are predominantly listed life and general insurers, but the sample will also cover specialty, re-insurance and bancassurance.

Reporting by the largest private companies

Section 6.4

The proposed introduction of new reporting requirements for the largest private companies will bring an enhanced regulatory focus on entities in that part of the market. While it is still subject to finalisation, at the time of writing, the Government's intended threshold for these new requirements is entities that exceed £750 million annual revenue and 750 employees. The Reporting by the largest private companies thematic review, due to be published in early 2024, will consider a selection of the annual reports and accounts of private companies that meet this definition to identify any areas of poorer compliance with reporting requirements, with a view to informing our future monitoring activities.

Other reviews

Outcomes of 2022/23 TCFD case reviews and our regulatory approach for 2023/24

Section 6.5

The review of TCFD-aligned disclosures was embedded into CRR's routine reviews of premium listed company annual reports in the 2022/23 cycle. We also continued to monitor the extent to which climate change was incorporated into companies' financial statements.

Our initial supervisory approach for mandatory TCFD reporting, developed in collaboration with the FCA, was focused on raising awareness of the new rules and guidance and improving the quality of disclosure in this fast-evolving area. This meant that the majority of the FRC's correspondence with companies in respect of TCFD disclosures was in the form of points for the company to consider when preparing its next annual report and accounts, referencing the expectations set out in our 2022 TCFD thematic report.

In the second year of listed companies' reporting against the TCFD framework, we are more likely to enter into substantive correspondence with companies that do not meet the expectations set in both our 2022 and 2023 thematic reports, especially when climate change is significant for the company, and it does not provide the TCFD recommended disclosures that are 'particularly expected' by the Listing Rules. We will continue to work closely with the FCA in this respect. We will also develop our regulatory approach in respect of new Companies Act climate-related financial disclosures (see Appendix 2).

Other reviews

Review of Directors' Remuneration Reports (DRR)

Section 6.6 In preparation for our transition to ARGA, we have extended our review work to include directors' remuneration reporting for a selection of ten companies. We have reviewed the disclosures against the requirements of Schedule 8 to the Large and Medium-sized Companies and Groups (Accounts and Reports) Regulations

- We wrote to nine companies with most of the points being raised relating to the clarity of targets and achieved performance. This will continue to be our key area of focus going forward. We also highlighted instances of non-compliance as well as lack of consistency between DRR and the information presented elsewhere in the report and accounts, such as alternative performance measures, TCFD disclosures and the key management personnel note. We are repeating this exercise in 2023/24 cycle with a slightly larger sample size.

Review of Corporate Governance disclosures

Appendix 1

CRR continued to work with the FRC's Corporate Governance team, coordinating a number of our reviews with their annual review of governance disclosures (see next page). We wrote to companies where we identified opportunities to improve reporting. As in previous years, we focused on potential non-compliance with the Code's provisions not declared, inadequate explanations for non-compliance and instances where it was unclear how the company had applied the Code's principles, particularly when disclosures lacked detail about actions and outcomes.

Update on the FRC's transition to ARGA

In May 2022, the government issued its response to the consultation 'Restoring Trust in Audit and Corporate Governance', which included proposals to transform the FRC into a new regulator, the Audit, Reporting and Governance Authority (ARGA). Several of these proposals increase the scope and powers of the FRC's CRR function and are based primarily on the recommendations of Sir John Kingman's 'Independent Review of the Financing Reporting Council' in

- A number of the changes proposed5 require primary legislation to grant the relevant powers. We are disappointed that it remains unclear when the ARGA Bill will receive parliamentary time. In the absence of a firm legislative timetable, we continue to focus on changes we can implement using our existing powers and remit, such as the publication of case summaries, with companies' consent. Other corporate reporting developments rooted in the Kingman recommendations are progressing through draft secondary legislation as described in Appendix 2.

CRR continues to raise matters on areas within ARGA's proposed remit, but outside the FRC's current statutory enforcement powers, as part of its routine reviews. Where appropriate, we are drawing companies' attention to potential opportunities for improvement. Such work includes our trial reviews of remuneration reports and ongoing work on corporate governance disclosures (left). Our findings from this work will help inform our regulatory approach once we have statutory powers over the whole report and accounts.

Messages from other FRC publications

Corporate Governance reporting

Section 7.2 Full report

The FRC's Corporate Governance team performs annual reviews of companies' reporting on their governance in line with the Principles and Provisions of the UK Corporate Governance Code (the Code). A majority of companies disclose non-compliance with at least one Code provision, which is permitted under the comply-or-explain framework. However, explanations for departures continue to lack detail specific to companies' circumstances. Improvements could also be made to disclosures of the effects of companies' policies and procedures, which should highlight outcomes and impacts and explain how these relate to the company's purpose, strategy and values.

FRC Lab

Section 7.3

The FRC Lab continues to focus on encouraging better practice reporting to meet the needs of investors. Its current work is focused on two themes: environmental, social and governance (ESG) and technology. This year, the Lab's projects include 'Materiality in practice', which provides tips for companies on how to apply a materiality mindset; and 'ESG data: distribution and consumption', reporting on how investors are accessing and collecting ESG data, the related role of third party providers and how investors are using this data in their investment processes.

What Makes a Good Annual Report and Accounts

During the year we published 'What Makes a Good Annual Report and Accounts'. This publication, which complements our thematic reviews, is designed to support preparers, audit committee chairs and company secretaries in preparing high quality annual reports and accounts.

In the report we set out our view, as an improvement regulator, of the high-level characteristics a good quality ARA possesses. It does not provide information on how to meet GAAP, legislation or code requirements.

Set against a backdrop of materiality, the publication identifies these characteristics using a framework of corporate reporting principles and the 4Cs of effective communication:

- Company specific

- Clear, concise and understandable

- Clutter free and relevant

- Comparable

Where possible, the report uses published examples to demonstrate these attributes.

Section 7.4 Full report

4. Key matters for 2023/24 annual reports and accounts

The FRC seeks to support companies in complying with the relevant reporting requirements and providing decision-useful information for users of their annual reports and accounts. Our headline expectations for the coming reporting season, set out in this section, are driven by our findings throughout this report, as well as matters in the current trading or reporting environment which we consider likely to present reporting challenges for companies.

'Top ten' and other key reporting issues

We have highlighted how our headline expectations align to those reporting issues which we most frequently raise with companies, or have highlighted elsewhere in the report. We also expect companies to carefully consider how current economic conditions may impact on financial and narrative reporting in 2023/24. In particular:

- High inflation and rising interest rates may drive significant changes to discount rates and expected future cash flows which can have effects ranging from additional impairments to a reduction in pension scheme liabilities and the potential recognition of a surplus.

- The range of uncertainty over a number of economic factors, including inflation, has increased. This may increase the degree of judgement required by management in determining inputs to the financial statements, and require disclosure of sensitivities to a wider range of reasonably possible outcomes.

An arrow pointing right indicates the potential implications of reporting in an uncertain and inflationary environment are summarised on the following page.

An arrow pointing right indicates further detail on the reporting implications of high inflation and rising interest rates can be found in Section 7.1.

Developments in corporate reporting

Changes to IFRS accounting standards for the coming reporting season are relatively minor, with the exception of the implementation of IFRS 17. This will have a greater impact on reporting in the insurance sector, but companies outside the sector will need to assess whether they have any contracts within its scope, which could include certain warranties, breakdown or product replacement cover, and guarantees.

Sustainability-related disclosure requirements continue to develop at pace. This year, in addition to those subject to the FCA's comply or explain TCFD listing rules, a larger range of companies and LLPs will be required to provide mandatory, TCFD-based, climate-related financial disclosures in their annual reports.

An arrow pointing right indicates for full detail and a timeline of effective dates see: Appendix 2: Developments in corporate reporting.

4.1 Reporting on the effects of inflation and other uncertainties

Businesses continue to report in a context of significant economic and geopolitical uncertainty and in an inflationary trading environment. The extent of companies' exposures will vary depending on the profile, including the pace of any reduction, of inflation in the territories in which they operate. The annual report and accounts, taken as a whole, should tell a coherent story about the anticipated impacts on the business, and the assumptions the company has made about those uncertainties in preparing the financial statements.

The central diagram illustrates key economic factors and uncertainties: Rising interest rates6, High inflation6, Climate change, Labour market constraints, Supply chain stresses, and Changes in consumer demand. These are all encompassed by 'Uncertainties'.

Companies should...

| Category | Narrative Reporting | Financial Statements 1See Appendix 2 for details on proposals for the endorsement of ISSB standards for use in the UK 2Please see Appendix 3 for details on the scope of our work 3Case reviews opened between 1 April 2022 and 31 March 2023, generally companies with December 2021 or later year-ends 4Please see Appendix 5 for information about the FRC's approach to reviews 5A description of the Government's proposals most relevant to CRR's monitoring work can be found in Section 6.4 of last year's annual review 6See Section 7.1 for further information about reporting considerations relating to high inflation and rising interest rates

| Companies should... | |

|---|---|

| ...explain the risks and changes in the business environment and their impact on the company's position, performance and prospects | ...consider the effect of uncertainty and high inflation on the recognition and measurement of assets and liabilities, and related disclosures. This should include review of whether assumptions and 'reasonably possible' ranges for sensitivity disclosures remain appropriate |

| NARRATIVE REPORTING | FINANCIAL STATEMENTS |

| Going concern and viability reporting | |

| TCFD and climate-related disclosures | |

| Updates to investing, financing and hedging strategies and financial instruments disclosures | |

| Principal risks and uncertainties | Impairment testing |

| Changes in business environment | Judgements and estimates |

| Impacts on the business model | Recoverability of assets including deferred tax, inventory and expected credit loss provisions |

| Financial position and performance | Recognition and measurement of pensions, including assets in respect of surpluses6 |

| Provisions, contingencies and onerous contracts | |

| ...ensure assumptions are consistent, to the extent required by the standards, and explain any differences in approach to users |

Diagram showing key areas of uncertainty and their relation to reporting

The diagram illustrates several types of uncertainties and highlights their connection to "Rising interest rates" and "High inflation".

Uncertainties highlighted: * Climate change * Rising interest rates * High inflation * Labour market constraints * Supply chain stresses * Changes in consumer demand

4.2 Our key disclosure expectations for 2023/24

How these align to the top ten areas we challenge, and other key matters in this report

Our overall expectations, bringing together the major themes identified previously in this report, are set out below. We expect companies to...

- ...ensure disclosures about uncertainty are sufficient to meet the relevant requirements and for users to understand the positions taken in the financial statements. In particular:

- The values of key assumptions and sensitivities or a range of reasonably possible outcomes, must be provided, where required for impairment tests and major sources of estimation uncertainty.

- Significant accounting judgements must be described.

- Disclosures should be re-assessed each year to ensure they remain relevant and assumptions, and the range of outcomes used for sensitivity disclosures, remain appropriate.

- Better disclosure helps users understand the linkage between narrative reporting on uncertainties such as inflation and climate change, and the assumptions made in the financial statements.

- ...give a clear description in the strategic report of risks facing the business, their impact on strategy, business model, going concern and viability, cross-referenced to relevant detail in the reports and accounts.

- ...provide transparent disclosure of the nature and extent of material risks arising from financial instruments, including changes in investing, financing and hedging arrangements; the use of factoring and reverse factoring in working capital financing; the approach to and significant assumptions made in the measurement of expected credit losses; concentrations of risks and information about covenants (where material).

- ...provide a clear statement of consistency with TCFD7 which explains, unambiguously, whether management considers they have given sufficient information to comply with the framework in the current year. We may challenge companies which have not disclosed information the FCA 'particularly expects' to be provided.8 Companies must, in any case, comply with the new mandatory requirements for disclosure of certain TCFD-aligned information.9

- ...perform sufficient critical review of the annual report and accounts, including...

- ...taking a step back to consider whether the report as a whole is clear, concise and understandable, omits immaterial information and whether additional information, beyond the requirements of specific standards, is required to understand particular transactions, events or circumstances; and

- ...a robust pre-issuance review to consider issues we commonly challenge including: internal consistency; whether accounting policies address all significant transactions; and presentational matters, such as cash flow and current/non-current classification.

| 1. Impairment |

| 2. Judgements and estimates |

| 6= Income taxes |

| 8. Provisions and contingencies |

| 10. Fair value measurement |

| Other: TCFD/Climate change |

| 4. Strategic Report/Companies Act |

| 5. Financial instruments |

| Other: TCFD/Climate change |

| 3. Cash flow statements |

| 6= Revenue |

| 9. Presentation of financial statements |

| Other: What Makes a Good Annual Report and Accounts |

Our findings in greater depth

5. Top ten issues

This section explores the most common topics on which we raised substantive questions with companies in our 2022/23 monitoring cycle,10 ranked in order of the number of companies involved. For each topic, we outline the more significant or common issues that arose as a result of our reviews.

These summaries are not a substitute for knowing the relevant reporting requirements, but they do provide insights into common areas for improvement. We encourage preparers to read the summaries and consider whether the matters raised are relevant to their own reports and accounts.

This year we have continued to publish case summaries for reviews that resulted in a substantive question to a company. This process is explained further in Appendix 1.

- Represents relevant requirements of a standard or guidance

- Represents key points to consider when preparing annual reports and accounts

- Represents specific considerations relating to inflation and interest rates

5.1 Impairment of assets

Impairment of assets has consistently been in our top ten topics. Although we raised queries with more companies than last year, the issues involved are generally the same. The effect of inflation and higher interest rates on cash flow projections and discount rates may have resulted in more instances of impairment, or reduced headroom in recoverable amounts, prompting more detailed disclosures under IAS 36, ‘Impairment of Assets’. Many of our queries would have been avoided by clearer, more complete disclosures.

For further guidance, including examples of better disclosure practice, we encourage companies to refer to our previous reports on impairment of non-financial assets, the financial reporting effects of Covid-19, and discount rates.

| Key inputs and assumptions | Impairment method |

|---|---|

| • Disclosures about the key inputs and assumptions used to determine recoverable amounts, including discount rates and growth rates, were not always provided. | • When descriptions of forecasts used in VIU calculations included restructuring programmes or meeting carbon reduction targets, we asked whether cash flows related to improving or enhancing an asset, rather than reflecting the asset's current condition. |

| • We queried the discount rates used in value in use (VIU) calculations if they appeared inconsistent with other information in the annual report and the general economic environment. | • We asked a retailer that allocated online sales to cash generating units (CGUs) based on physical stores how the sales related to the stores, and whether the assets of the online business had also been allocated to the CGUs. |

| • We asked a company that had calculated VIU using a post-tax discount rate to confirm whether its estimated future cash flow forecasts reflected the specific amount and timing of future tax cash flows, and to explain how it had concluded that using a post-tax discount rate produced a result that was not materially different to using pre-tax cash flows and a pre-tax discount rate, as required by IAS 36.11 | • A company with significant exposure to climate risks was asked to clarify how its VIU calculations took account of those risks. |

| • We asked for further information when companies’ VIU calculations used financial budgets/forecasts for a period longer than five years without explaining why.12 | • Some companies did not explain clearly how they had determined their CGUs, or their CGUs seemed inconsistent with descriptions of operations elsewhere in the report. |

| • We questioned assumptions used for impairment that appeared inconsistent with those in going concern and viability assessments. | • In one case, it was unclear if goodwill acquired in a business combination during the year had been tested for impairment. |

| • We asked for an explanation when a company’s interim report stated that no impairment review had been performed because it was impractical to do so. |

5.1 Impairment of assets (continued)

| Indicators of impairment | Investments in subsidiaries |

|---|---|

| • We raised queries with companies when their net assets, or the carrying amount of subsidiaries in their parent company accounts, exceeded their market capitalisation at the reporting date, but there was no evidence that an impairment assessment had been performed. | • We asked companies for further explanation when it was not clear whether a parent’s investments in subsidiaries had been assessed for impairment. |

| • We asked for clarification where a company’s TCFD disclosures identified significant climate related risks to parts of its business, and it was unclear whether they had been considered as indicators of impairment. | • We asked for more information about the impairment loss recognised on an investment in a subsidiary where the company’s disclosures did not clearly explain the basis on which the impairment had been recognised. |

| Sensitivity to key assumptions | Other disclosure and presentation considerations |

|---|---|

| • Several companies did not disclose whether reasonably possible changes in assumptions would result in a recoverable amount below the carrying amount. | • The disclosures required when a material impairment loss or reversal has been recognised were not always provided. |

| • Some companies that disclosed that such a change would result in impairment did not provide the required quantitative disclosures about the amount of headroom in the recoverable amount over the carrying amount, the key assumptions, or the sensitivity of the headroom to changes in the key assumptions.13 | • We questioned a company whose accounting policy referred to using VIU for impairment testing, but the explanation of the impairment test said that fair value less costs to sell had been used. |

| • We questioned why a company had accounted for an impairment reversal as a prior year adjustment, rather than recognising it in the current year.14 |

5.1 Impairment of assets (continued)

Companies should ensure that ...

- they provide adequate disclosures about the key inputs and assumptions used in their impairment testing, including justifying the use of financial budgets/forecasts for periods longer than five years.

- the discount rates used in VIU calculations are consistent with the assumptions in the cash flow projections, particularly in respect of risk and the effect of inflation (that is, nominal cash flows, which include the effect of inflation, should be discounted at a nominal rate and real cash flows, which exclude the effect of inflation, should be discounted at a real rate).15

- the forecasts used for VIU calculations reflect the asset in its current condition. When VIU disclosures cross-refer to forecasts used in going concern and viability assessments, it should be made clear how any costs and benefits in those forecasts that relate to future improvements to assets or restructuring activities have been addressed for the VIU calculation.

- impairment reviews and/or disclosures appropriately reflect information elsewhere in the report and accounts, including events or circumstances that are indicators of potential impairment.

- they explain the sensitivity of recoverable amounts to reasonably possible changes in assumptions, particularly where increased economic uncertainty has widened the range of possible outcomes.16

- descriptions of CGUs, and explanations of how they have been determined, are consistent with information about the company’s operations elsewhere in the report and accounts.

5.2 Judgements and estimates

This year, significant judgements and estimates has returned to being one of the highest ranked topics in our top ten. Most of the queries related to estimation uncertainty, and often involved disclosures that either did not contain sufficient information to be useful, or which appeared inconsistent with information elsewhere in the report and accounts. This highlights the importance of providing disclosures that are tailored to a company’s circumstances and explain the specific judgements and assumptions made.

Providing quality disclosures in this area remains particularly important in the light of ongoing economic and political uncertainty. We refer companies to last year’s judgements and estimates thematic review report for guidance on this topic, including examples of better disclosures.

| Key sources of estimation uncertainty | |

|---|---|

| • Disclosures of estimation uncertainty did not always include sufficient information about the key assumptions, or the sensitivities to changes in those assumptions or ranges of potential outcomes. | • One company had disclosed estimation uncertainty relating to cash flows for its value in use calculations, but it was unclear whether this applied to all cash generating units for which an impairment review was performed. |

| • We questioned a company that had not disclosed an estimation uncertainty when other information in the report suggested there were estimates with a significant risk of material adjustment in the following year.17 | • A query we raised on a company’s disclosures on the impairment of investments in subsidiaries identified that there were estimation uncertainties involved that should have been disclosed. |

| • We asked for explanations if an estimation uncertainty disclosed in the prior year was no longer disclosed, but information in the report and accounts suggested it was still relevant. | • We commented that a company’s accounts did not include a full explanation of changes made to past assumptions for an uncertainty that remained unresolved,18 but noted that more helpful explanations had been included in the audit committee report. |

| • We asked for more information where a company had disclosed estimation uncertainty relating to the use of a discount rate, but had not explained how the discount rate had been derived. As noted in our report on discount rates, we expect this disclosure where the effect of discounting is material. |

5.2 Judgements and estimates (continued)

| Significant accounting judgements | Material uncertainties in relation to going concern |

|---|---|

| • We raised a query where disclosures did not make clear whether a judgement was considered a key judgement under IAS 1. | • When a company concludes that a material going concern uncertainty does not exist but the conclusion required significant judgement, we expect the judgement to be disclosed.19 |

| • In some cases, responses from companies to our queries on particular accounting treatments indicated that significant judgements had been made that should have been disclosed. | • We questioned companies where information in the report and accounts indicated that such a judgement might have been required, but no such judgement was disclosed. |

| • We asked why a significant judgement disclosed in the prior year was no longer disclosed, when information in the report and accounts suggested it was still relevant. | |

| • We queried where disclosures in the group accounts referred to judgements made in the impairment testing of operating subsidiaries, but no similar disclosures were made in the parent company’s accounts in relation to investments in subsidiaries. |

Companies should ensure that ...

- disclosures explain the significant judgements involved in applying accounting policies (a list is not sufficient), and provide quantified sensitivities where such judgements involve a significant source of estimation uncertainty. This should include judgements and estimates relating to the going concern assessment and accounting for inflationary features, including the use of discount rates.

- sources of estimation uncertainty and the related disclosures are reassessed to ensure they remain relevant at the reporting date.

- changes to assumptions are explained, particularly if the range of possible outcomes has widened due to increased uncertainty.

- judgements and estimates disclosures are consistent with information elsewhere in the report and accounts.

We also remind companies that sources of estimation uncertainty with a significant risk of resulting in a material adjustment within one year should be clearly distinguished from any other estimates disclosed.

5.3 Cash flow statements

Cash flow statements are again high in our top ten, with the frequency of questions raised only slightly lower than last year. It also remains one of the most frequent reasons for companies making a prior year restatement as a result of our enquiries, although the number of companies restating their cash flow statement fell to seven compared to 15 last year. The type of questions we raised remains similar to previous years, but there were fewer ‘routine’ errors, with a number of our queries relating to relatively unusual or more complex transactions. In some cases, our question would have been avoided if the transaction, and the rationale for the treatment of its cash flows, had been more clearly explained.

The findings below summarise the issues identified from our routine reviews. Further detail of the restatements relating to cash flow statements are provided in Appendix 1.

We expect companies to consider the guidance and better disclosure examples in our cash flow and liquidity disclosures thematic review. The report provides more detail of the issues we have raised on the cash flow statement in recent years, and outlines the consistency checks we perform in this area.

Cash advances and loans made to other parties and repayments thereof are examples of investing cash flows.20 Cash proceeds from, or repayments of, borrowings are examples of financing activities.21

| Classification of cash flows |

|---|

| • We questioned companies when cash flows that appeared to relate to funding from or to subsidiaries were classified as operating activities in parent company cash flow statements. We also queried when it was unclear whether such cash flows had been appropriately classified as investing or financing activities. |

| • We have challenged companies that did not classify the repayment of debt acquired in a business combination as financing activities, when the repayment was material. We generally expect this cash flow to be financing, although there may be certain scenarios where investing is appropriate. Where that is the case, companies should explain the reasons for classification as investing. |

| • Two companies had classified the acquisition-related costs of a business combination as investing activities rather than operating activities. |

IASB Priorities 2022 to 2026 The IASB has added the cash flow statement to its work plan as one of its priorities for 2022 to

- This is in response to stakeholders identifying deficiencies in the reporting of cash flows. As part of its initial work, the IASB will consider whether the aim should be to review IAS 7 comprehensively, or make targeted improvements.

5.3 Cash flow statements (continued)

| Reported cash flows | Disclosures |

|---|---|

| • We asked for further explanation when there appeared to be inconsistencies between amounts or descriptions in the cash flow statement compared to other information in the report and accounts, or transactions referred to elsewhere did not appear be identified in the cash flow statement. For example, amounts described in the cash flow statement as relating to current balances included non-current items; and payment of contingent consideration referred to in the narrative report was not identifiable in the cash flow statement. | • We asked for more information where we could not link items in the reconciliation of changes in liabilities from financing activities to the cash flow statement. |

| • We queried the net presentation of cash flows, such as a single net amount for notes payable rather than separate cash advances and repayments. | • We also queried companies that did not present sufficiently disaggregated information in the reconciliation of liabilities from financing activities, including cash movements relating to business combinations and non-cash changes. |

| • In some cases, non-cash investing or financing transactions were included in the cash flow statement, for example where bondholders had exchanged one issue of bonds for another. | • We questioned a company that had not disclosed any restrictions over cash and cash equivalents, but other disclosures indicated that cash equivalents had been pledged as security for borrowings. |

Companies should ensure that ...

- amounts and descriptions of cash flows are consistent with those reported elsewhere in the report and accounts.

- the parent company cash flow statement (where provided22) complies with the requirements of the standard.

- non-cash investing and financing transactions are excluded from the statement and disclosed elsewhere if material (non-cash operating transactions will normally be disclosed as adjustments in deriving cash flows from operating activities).

- classification of cash flows, cash and cash equivalents comply with relevant definitions and criteria in the standard.

- cash flows are not inappropriately netted.

5.4 Strategic report and other Companies Act 2006 matters

This year, the most common aspects of the Companies Act 2006 (CA 2006) on which we asked questions of companies were the requirement for the strategic report to be ‘fair, balanced and comprehensive’, and compliance with distributable profits requirements when paying dividends and repurchasing shares.

Last year we raised a number of questions on SECR disclosures as part of our 2020/21 SECR thematic review, but this year we have not raised any substantive questions specifically on non-financial reporting requirements, including SECR. This may indicate that companies are becoming more familiar with these newer areas of reporting. However, we have made observations on climate-related reporting requirements in appendix points to our letters with companies, which do not contribute to our top ten issues, but which are summarised in Section 6.5.

| Fair, balanced and comprehensive | Section 172 statement and stakeholder engagement |

|---|---|

| • We questioned companies that did not discuss material balance sheet and cash flow items, and significant changes in balances from the prior year, in the strategic report. | • Several companies, including large private companies, did not provide a section 172 statement. |

| • One company’s strategic report did not include sufficient discussion of a very large impairment loss. | |

| • In one instance, we questioned whether the prominence given to a company’s alternative performance measures (APMs) over its IFRS measures, and deficiencies in its explanations of APMs, resulted in the strategic report failing to give a fair review of the business. | |

| • We successfully challenged whether a large private company’s strategic report contained sufficient information to meet the requirements of CA 2006, when it omitted a discussion of the company’s performance compared to pre-pandemic levels, did not include key performance indicators, and did not describe how its principal risks affected the company or were mitigated. |

5.4 Strategic report and other Companies Act 2006 matters (continued)

Where we identify company law-related matters, such as lawfulness of distributions, we raise these with companies even when, strictly, they are outside of our statutory powers. We are pleased to note that companies generally respond constructively to these enquiries.

| Distributable profits | Other Companies Act 2006 matters |

|---|---|

| • We queried the lawfulness of dividends and share repurchases that were not supported by the company’s last audited accounts, and where the required interim accounts had not been filed at Companies House.23 | We asked questions where: |

| • We asked for clarification when the process to be followed to rectify dividends that had been paid in breach of CA 2006, as set out in the company’s report and accounts, did not appear to have been implemented. | • large private companies had not disclosed information about directors’ emoluments. |

| • We asked companies for further information where it was unclear whether certain transactions had been treated as realised or unrealised profits when assessing distributable profits to support dividend payments, including: | • the nominal value of a company’s allotted share capital had fallen below the authorised minimum for a public company. |

| – cumulative equity-settled share-based payment amounts not expensed by the company. | • it was unclear whether the accounting treatment for a company’s additional investment in a subsidiary complied with CA 2006 requirements and relevant IFRSs. |

| – dividends receivable from subsidiary undertakings. | • a company disclosed an investment in a subsidiary but had not prepared consolidated accounts and had not explained why. |

| • a company had filed revised accounts but made no statement giving the reasons for doing so, which CA 2006 requires. | |

| • it was not clear which of the balance sheet presentations permitted by CA 2006 was being used in the parent company’s accounts, and whether the classification of loans from subsidiaries complied with the relevant requirements. | |

| • a company had not recognised share premium or merger relief on shares issued in connection with a business combination. |

5.4 Strategic report and other Companies Act 2006 matters (continued)

Companies should ensure that ...

- the strategic report does not focus only on financial performance, but also explains significant movements in the statements of financial position and cash flows.

- they comply with the legal requirements for making distributions and share repurchases, including the requirement to file interim accounts that show sufficient distributable profits to support the transaction, if the distribution or repurchase exceeds distributable profits reported in the most recent annual accounts.

As well as complying with legal requirements, companies should refer to the FRC’s 'Guidance on the Strategic Report' (June 2022)), which provides principles-based guidance to help prepare a high-quality strategic report. The guidance is mindful of recent developments in narrative reporting best practice and is aligned with the requirements in the UK Corporate Governance Code. Application of its principles will help to ensure that the strategic report:

- articulates the effect of the risks and uncertainties facing the business, which should include economic and other risks such as inflation, rising interest rates, supply chain issues and labour relations in the inflationary environment.

- explains the company’s risk mitigation strategies.

- where relevant, links the risks and uncertainties to the discussion of the entity’s strategy and business model, and information disclosed in the financial statements.

- highlights and explains linkages between information presented within the strategic report and the accounts.

We also encourage companies to consider the principles set out in our publication 'What Makes a Good Annual Report and Accounts' when preparing their strategic report (see Section 7.4).

5.5 Financial instruments

The number of substantive questions raised this year in relation to financial instruments is similar to last year, but the topic’s ranking has fallen as more queries have been raised in other top ten areas. In 2022/23, five companies (2021/22: two) restated their primary statements as a result of our enquiries on this topic. Further details of those restatements are included in Appendix 1.

We have again raised questions about companies’ expected credit loss (ECL) provisions, although this year most of these related to smaller financial institutions rather than non-financial companies. A lack of clear disclosures to explain the basis on which cash and overdraft balances have been offset has led us to question several companies this year.

An entity shall disclose information that enables users of its financial statements to evaluate the nature and extent of risks arising from financial instruments to which the entity is exposed at the end of the reporting period.24

| Scope, recognition and measurement |

|---|

| • When companies had announced arrangements to repurchase their own shares but had not recognised a liability for the apparent obligation, we asked for further information if it was unclear whether the obligation could be avoided. |

| • We asked companies to clarify how certain significant items had been accounted for, where this was not clear from their accounting policies, including: |

| – cash flow hedge accounting movements. |

| – non-controlling interests classified as financial liabilities measured at fair value through profit and loss. |

| – deferred equity consideration, relating to a business combination, presented within equity. |

| – a debt restructuring involving an exchange of instruments. |

| – a net own credit adjustment that significantly reduced the fair value of financial liabilities (for a company reporting under FRS 102, and applying IAS 39 to its financial instruments). |

| • For one company reporting under FRS 102, it was unclear which of the permitted accounting policy choices for financial instruments it had applied.25 |

5.5 Financial instruments (continued)

| ECL provisions and credit risk | Offsetting |

|---|---|

| • We questioned a financial institution when it was unclear how the scenarios used in its ECL model reflected an unbiased and probability-weighted amount that is determined by evaluating a range of possible outcomes, as required by IFRS 9. | • We asked for further information where a company had offset cash and overdraft balances but it was unclear whether the qualifying criteria for offset had been met.26 |

| • We also asked a financial institution to explain why it had not recognised a loss allowance and determined that a significant increase in credit risk had not occurred, in the light of the severity of the downside scenario described in the accounts. | • We also questioned why overdrafts in the parent company accounts were greater than those in the consolidated accounts, when no disclosures were provided about offsetting financial assets and financial liabilities. |

| • We asked a financial institution to explain the factors considered in determining whether there had been a significant increase in credit risk for a financial instrument, and its definition of default, where these were not disclosed. | Other disclosures |

| • We asked financial institutions for explanations of how forecasts of future economic conditions had been incorporated into the determination of ECLs, details of key assumptions used, and any overlay adjustments made to ECL models, where such information had not been disclosed. | • We asked companies to explain apparent inconsistencies in information disclosed about their borrowings or committed facilities. |

| • We queried apparent inconsistencies in disclosures of ECL provisions for trade receivables where the analysis of movement in the provision did not align with the closing balance of the provision disclosed elsewhere in the accounts. | • We asked for further information where companies had not provided disclosures about the collateral held as security for financial instruments. |

| • We questioned a company when disclosures indicated that financial assets had been pledged as security, but no details of the amount or nature of the security were provided. | |

| • A company did not provide information about liquidity risk associated with contingent consideration. |

ECL provisions and credit risk

- We questioned a financial institution when it was unclear how the scenarios used in its ECL model reflected an unbiased and probability-weighted amount that is determined by evaluating a range of possible outcomes, as required by IFRS 9.

- We also asked a financial institution to explain why it had not recognised a loss allowance and determined that a significant increase in credit risk had not occurred, in the light of the severity of the downside scenario described in the accounts.

- We asked a financial institution to explain the factors considered in determining whether there had been a significant increase in credit risk for a financial instrument, and its definition of default, where these were not disclosed.

- We asked financial institutions for explanations of how forecasts of future economic conditions had been incorporated into the determination of ECLs, details of key assumptions used, and any overlay adjustments made to ECL models, where such information had not been disclosed.

- We queried apparent inconsistencies in disclosures of ECL provisions for trade receivables where the analysis of movement in the provision did not align with the closing balance of the provision disclosed elsewhere in the accounts.

Offsetting

- We asked for further information where a company had offset cash and overdraft balances but it was unclear whether the qualifying criteria for offset had been met. 26

- We also questioned why overdrafts in the parent company accounts were greater than those in the consolidated accounts, when no disclosures were provided about offsetting financial assets and financial liabilities.

Other disclosures

- We asked companies to explain apparent inconsistencies in information disclosed about their borrowings or committed facilities.

- We asked for further information where companies had not provided disclosures about the collateral held as security for financial instruments.

- We questioned a company when disclosures indicated that financial assets had been pledged as security, but no details of the amount or nature of the security were provided.

- A company did not provide information about liquidity risk associated with contingent consideration.

Companies should ensure that...

- the nature and extent of material risks arising from financial instruments (including inflation and rising interest rates) and related risk management are adequately disclosed, including:

- the methods used to measure exposure to risks and any changes from the previous period.

- any hedging arrangements put in place to fix interest rates or hedge against the effects of inflation. 27

- the approach and significant assumptions applied in the measurement of ECL, and concentrations of risks, where material, are disclosed.

- in making ECL assessments, historical default rates are reviewed and adjusted for forecast future economic conditions.

- accounting policies are provided for all material financing (including factoring and reverse factoring) and hedging arrangements, and any changes in the arrangements.

- the effect of refinancing and changes to covenant arrangements is explained.

- cash and overdraft balances have been offset only when the qualifying criteria have been met. Balances that are part of a cash-pooling arrangement that includes a legal right of offset may only be offset in the balance sheet when there is also an intention either to settle on a net basis, or to realise the asset and settle the liability simultaneously.

We also remind companies that information about banking covenants should be provided unless the likelihood of any breach is considered remote.

5.6 Income taxes

This year, we raised fewer queries in relation to income taxes, but the topic remains firmly in our top ten. Clarification of reconciling items in effective tax rate reconciliations, and support for the recoverability of deferred tax assets, are the most common aspects on which we asked questions of companies. In 2022/23, two companies restated their primary statements as a result of our questions on income taxes (2021/22: one). Details of these restatements are included in Appendix 1.

Almost all the questions we raise on income taxes relate to companies reporting under IFRSs and the requirements of IAS 12, ‘Income Taxes’. However, the same principles apply to UK GAAP reporters using FRS 102, 28 although the specific disclosure requirements differ in some respects. This year we raised a query with one company on a disclosure that is specific to FRS 102, which is shown separately in our summary below.

Further guidance on accounting for income taxes, and examples of better disclosures, can be found in our thematic report from last year, which considered the basis of recognition of deferred tax assets and related disclosure requirements in the light of the effect of the Covid-19 pandemic on companies’ profitability. We also expect companies to consider our previous tax thematic report which addresses other aspects of disclosure including the effective tax rate reconciliation.

Recoverability of deferred tax assets (DTAs)

- Where companies with a recent history of losses had recognised material DTAs, we asked for details of the convincing evidence supporting their recognition, as required by IAS 12. 29 In such instances, the companies were encouraged, or agreed, to improve the related disclosures in future annual report and accounts.

Effective tax rate reconciliation

- We asked for explanations when it was unclear what significant items in the effective tax rate reconciliation related to, or why they were reconciling items.

- We questioned the basis on which a company had used the standard UK tax rate for its reconciliation when its business operated outside the UK.

In such cases, where a group operates in several jurisdictions, it may be more meaningful to aggregate reconciliations prepared using the domestic rate in each individual jurisdiction 30 and to disclose a weighted average tax rate applied to accounting profit.

5.6 Income taxes (continued)

Recognition of deferred tax assets and liabilities

- We asked a company that had presented deferred tax asset and liability balances on a gross basis for more information as the extent to which it had assessed the balances against the qualifying criteria for offsetting deferred tax assets and liabilities was not clear.

- We queried the apparent non-recognition of deferred tax assets where disclosures indicated that there were taxable temporary differences relating to the same tax authority and taxable entity.

- We asked a company for more information where the description of deferred tax liabilities recognised in a business combination appeared inconsistent with the nature of the assets acquired.

Other issues

- Companies were asked to explain the accounting for current and deferred tax recognised on share-based payments when the basis for recognising the tax was unclear.

- We asked for more information when we were unable to reconcile movements in the current tax balances with the current tax expense and cash outflow disclosed.

- Meaningful descriptions were not always provided for the types of temporary difference to which deferred tax balances related.

- We asked a company to provide further explanation of its uncertain tax provision when it was unclear from the disclosures provided what the provision related to.

- We questioned a company when it was unclear why a movement in deferred tax assets had been recognised directly in equity.