The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Annual Report and Accounts 2015/16

The Financial Reporting Council Limited - including the Report of the Independent Supervisor Year to 31 March 2016

The Report of The Financial Reporting Council Limited ('FRC' or 'Company') as the body designated by a delegation order under section 1252 of the Companies Act 2006 and the Report of the Independent Supervisor is presented to Parliament pursuant to sections 1231(3) and 1252(10) of, and paragraph 10(3) of Schedule 13 to, the Companies Act 2006.

The Report of the Independent Supervisor is also presented, pursuant to section 1231(2), to:

- The First Minister in Scotland;

- The First Minister and Deputy First Minister in Northern Ireland; and,

- The First Minister for Wales and is laid before the National Assembly for Wales pursuant to section 1231(3A) of the Companies Act 2006.

The Financial Reporting Council Limited 2016 The text of this document (excluding logos) may be reproduced free of charge in any format or medium providing that it is reproduced accurately and not in a misleading context. The material must be acknowledged as FRC copyright and the document title specified. Where third party material has been identified, permission from the respective copyright holder must be sought.

Any enquiries regarding this publication should be sent to us at

The Financial Reporting Council Limited 8th Floor 125 London Wall London EC2Y 5AS

This document is also available at our website at www.frc.org.uk

Registered number: 02486368 HC534

- 1. Strategic Report

- Our business model

- Our role

- Our strategy for 2016-19

- Scope of the FRC's work

- Chairman's statement

- Chief Executive's report

- Corporate governance and investor stewardship

- Technical Actuarial Standards and actuarial oversight

- Corporate reporting

- Enforcement

- Our international role

- Our strategy for 2016-19

- Our regulatory approach

- Footnotes

- Our regulatory approach

- 1. Strategic Report

- 2. ACTIVITY REPORT 2015/16

- 3. GOVERNANCE

- 3 Governance

- Role and composition

- Board and Committee member attendance for the period from 1 April 2015 to 31 March 2016.

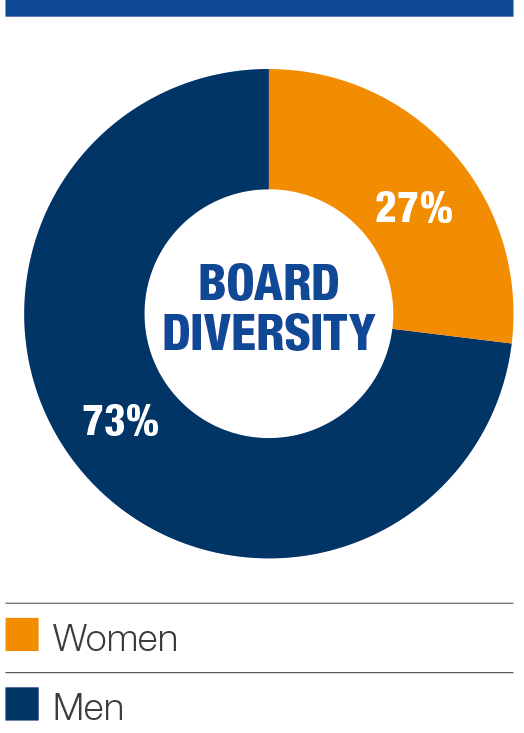

- Board diversity and succession

- Activities of the Board

- Internal controls and risk management

- Board effectiveness review

- BOARD COMMITTEES

- AUDIT COMMITTEE REPORT

- NOMINATIONS COMMITTEE REPORT

- REMUNERATION COMMITTEE REPORT

- CODES & STANDARDS COMMITTEE REPORT

- CONDUCT COMMITTEE REPORT

- Whistleblowing to the FRC as a prescribed person – public interest disclosures

- Complaints about the FRC

- DIRECTORS’ REMUNERATION REPORT

- 4. FINANCIAL STATEMENTS

- Independent auditor's report to the members of the Financial Reporting Council Limited

- Opinion

- An overview of the scope of our audit

- Our application of materiality

- Our assessment of risks of material misstatement

- Opinion on other matter prescribed by the Companies Act 2006

- Matters on which we are required to report by exception

- Respective responsibilities of directors and auditors

- Scope of the audit of the financial statements

- PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 MARCH 2016

- BALANCE SHEET AT 31 MARCH 2016

- STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 MARCH 2016

- CASH FLOW STATEMENT FOR THE YEAR ENDED 31 MARCH 2016

- 1. Principal accounting policies

- c) Financial instruments

- d) Case costs and fines

- e) Costs funds

- f) Deferred lease incentive

- 2. Operating expenses

- 3. Staff and related people costs (including directors)

- 4. Financial risk management

- 5. Intangible assets

- 6. Tangible assets

- 7. Debtors

- 8. Cash and investments held

- 9. Creditors – Amounts falling due within one year

- 10. Creditors – Amounts falling due after more than one year

- 11. Significant transactions with other standard setters

- 12. Provisions for liabilities

- 13. Commitments

- 14. Related party transactions

- 15. Liability of members

- 5. Directors' Report

- Directors' Report

- 6. Appendices

- FRC'S OVERSIGHT RESPONSIBILITIES

- INTRODUCTION: MONITORING OF RECOGNISED SUPERVISORY BODIES AND RECOGNISED QUALIFYING BODIES

- 2015/16 OVERSIGHT AND MONITORING

- RESULTS OF 2015/16 RSB MONITORING – MAIN POINTS

- ACCA

- ICAS

- CAI

- Other Issues

- Audit quality

- International Education Standard (IES) 8 (revised)

- Complaints

- MAIN ISSUES IDENTIFIED AT THE RECOGNISED QUALIFYING BODIES (RQBS)

- (ii) Report on the FRC's statutory oversight of local audit

- (iii) Report of the Independent Supervisor of Auditors General

- (iv) Report on regulation of third country auditors

- (v) Other oversight responsibilities

- ABBREVIATIONS

1. Strategic Report

Our business model

Our activities are designed to encourage trustworthy behaviour and trustworthy information in pursuit of our mission.

A circular diagram illustrating the FRC's business model. At the center is "Our mission is to promote high quality corporate governance and reporting to foster investment." This mission is supported by "Strong values" at the bottom. The mission is surrounded by three interconnected areas: "Corporate governance and reporting", "Audit", and "Enforcement". These three areas are within a larger circle labeled "Powers and responsibilities" on one side and "People and resources" on the other.

The diagram also has a side panel describing the functions of each area:

Corporate governance and reporting * Set the UK corporate governance and stewardship codes * Set accounting and actuarial standards * Publish narrative reporting guidance * Monitor corporate reporting compliance

Audit * Set auditing standards * Monitor the quality of audit * Oversee the auditing, actuarial and accountancy professions

Enforcement * Case examination and enquiry * Take enforcement action where necessary

Underpinning our work

- High quality people

- Adequate resources

- Our integrated structure enables us to take a joined up approach to the delivery of our regulatory responsibilities and strategic objectives

- We seek evidence to enable us to be decisive

- We reach out to our stakeholders and show respect

- Our approach is to be proportionate

- We publish thought leadership material and promote good practice and reporting

- Our principles-based approach guides the development of codes, standards and guidance

- We are influential internationally

- We are independent from those we regulate and act in the public interest

- Funded by market participants, we consult annually on the amounts we raise

Our role

- The FRC maintains codes and standards for corporate governance, investor engagement, corporate reporting, audit and other forms of assurance, and actuarial information. We also monitor compliance with corporate reporting standards.

- The Government has designated the FRC the Competent Authority for audit in the UK with responsibility for the regulation of statutory audit (The Competent Authority), including setting auditing and ethical standards, monitoring and reporting on audit quality, and enforcement.

- We oversee the accountancy and actuarial professional bodies in their regulatory roles and operate independent disciplinary schemes for accountants and actuaries.

- Our Financial Reporting Lab helps companies and investors collaborate in improvements to reporting.

- We represent UK interests internationally across a range of issues.

Our mission is to promote high quality corporate governance and reporting to foster investment

Our strategy for 2016-19

Fostering investment and the importance of effective but proportionate regulation will continue to guide our priorities over the next three years. We will concentrate on promoting a step change in audit quality and on driving up standards of governance, stewardship and reporting.

Scope of the FRC's work

The FRC's work contributes to the effective function of UK Capital markets and is important to both the accountancy and actuarial profession. The following statistics indicate the size of the community that benefits from FRC's work.

£2.9tr UK listed companies (Main and AIM market) total market cap (as at 31 May 2016)

5,200 Current number of registered statutory audit firms in UK (as at 30 June 2016)

£5.5tr including £2.1Tr UK pension assets UK asset management industry total (as at December 2014)

21,400 Current number of registered statutory auditors (as at 30 June 2016)

Chairman's statement

2016 sees a step change in the FRC's responsibilities and the start of our next three year strategy.

Sir Winfried Bischoff Chairman

The most important event of 2016, although after the close of our financial year, was the referendum on the UK's membership of the European Union (EU). While this has not changed our regulatory framework, and we will therefore continue to apply it, it does raise questions about whether it should change in the future. We will consequentially play close attention to the decisions now taken by the Government and Parliament, and continue to work in collaboration with our key stakeholders, particularly investors, business and the professionals we regulate, in order to ensure our work continues to support economic growth and the effective functioning of the capital markets. At the same time we will continue to play an effective role in representing the interests of the UK internationally.

Since I joined the FRC in 2014 I have heard the views of the organisations and individuals we regulate, and to the investors who benefit from our activities. I am grateful for their insight, candour and willingness to engage with us to help us achieve our mission.

Our Strategic Report explains the actions we have taken to strengthen the regulatory framework in response to the financial crisis. We wish to give boards, the professions and investors the opportunity to absorb and respond to those initiatives before we make any further significant changes to our codes and standards. Under our new three year strategy, for 2016-19, we expect to drive up standards, not only through our regulatory powers, but also through the work of our Financial Reporting Lab and other non-regulatory initiatives.

I have taken a personal interest in our 'culture coalition' project. Embedding a healthy corporate culture, with a focus on good behaviour, is vital to the success of any business and creates an environment on which investors can depend. We have brought together a number of organisations to gather insights into corporate culture and the role of boards, to understand how boards can shape and assess culture, and to identify and promote good practice.

Under our new three year strategy we expect to drive up standards, not only through our regulatory powers but also through other non-regulatory initiatives

2016 sees a step change in the FRC's responsibilities and the start of our next three year strategy. New rules on audit regulation across the EU took effect on 17 June 2016, and the FRC has been designated as the Competent Authority for audit regulation. Our clear aim is that by the end of the strategy period at least 90 per cent of FTSE 350 audits will require no more than limited improvements as assessed by our monitoring programme.

We are not only looking outwards. We have reformed to create a new executive structure aligned with our audit role with separate Audit, Corporate Governance and Reporting, and Enforcement divisions. Our Committees and Councils will be aligned with our new role.

The FRC's own culture is also important. Our values of reaching out, seeking evidence, being decisive, joining up and showing respect have been part of the FRC's DNA for some time. The Board is bench-marking the FRC against the best by drawing on our Directors' expertise and experience in other leading organisations.

During the year John Stewart stepped down from the Board and the Codes & Standards Committee. I thank John for his advice and commitment to the work of the FRC. We are fortunate in the talented individuals on our Board, Committees and Councils. They are vital to the effective functioning of the FRC and I am grateful for their support, advice and good judgement.

Most importantly the Board of the FRC and I value the commitment, team work and often extraordinary effort in meeting the challenges faced by the FRC, Stephen Haddrill and his executive team. This ethos of commitment and professionalism I can happily say permeates right throughout the organisation.

Over the coming year we will seek further independent evidence of our effectiveness in fulfilling our various roles in the public interest. We are grateful for any feedback on this Annual Report.

Sir Winfried Bischoff Chairman 13 July 2016

2016 sees a step change in the FRC's responsibilities and the start of our next strategy period. Our clear aim is that by the end of the strategy period at least 90% of FTSE 350 audits will require no more than limited improvements

Chief Executive's report

The Financial Reporting Council's (FRC) mission is to promote high quality corporate governance and reporting to foster investment.

Stephen Haddrill Chief Executive Officer

We promote high quality audit, we encourage companies to produce trustworthy information necessary for informed investment decisions, and we encourage trustworthy behaviour by directors and professionals and engagement with them by investors. In addition, we seek to build justified confidence internationally in the UK regulatory framework for corporate governance and reporting.

This report covers the final year of our 2013-16 three year strategy and our strategy for 2016-19, including our new regulatory approach.1 Section 2 gives an overview of our activities in 2015/16.

In addition to this report, the FRC will issue more detailed assessments of the quality of corporate governance and investor stewardship, corporate reporting, auditing and actuarial practice – drawing on developments in standards and policy, monitoring, professional oversight, and enforcement. These reports will give stakeholders further opportunity to consider changes in the environment in which we are operating and our effectiveness in influencing that environment.

Our strategy for 2013-16

We developed our three year strategy, for 2013-16 in the wake of the financial crisis. We concluded that we still needed to make some significant changes to the regulatory framework – building on the provisions we included in the revised UK Corporate Governance Code in 2012 on audit tendering, audit committee reporting and 'fair, balanced and understandable' reporting.

It was an ambitious strategy. Taken as a whole, we believe that the changes we have made to the regulatory framework, supported by effective monitoring – and, where necessary, enforcement

It was an ambitious strategy. Taken as a whole, we believe that the changes we have made to the regulatory framework, supported by effective monitoring – and, where necessary, enforcement

- will contribute to the overall quality of corporate governance and reporting in the UK in line with our mission. But we also recognise the continuing challenges. More detail on how we performed against the key effectiveness indicators on which we are reporting can be found in our Activity Report on pages 28 to 40.

Audit quality

We have put in place a challenging set of measures designed to enhance audit quality and strengthen investor confidence in audit. During 2016-19 we will evaluate the effectiveness of these measures; and consider how we make best use of our new role as the Competent Authority to drive further improvements in audit quality.

The FRC recently issued its annual report on Developments in Audit.2 This report encompasses developments in the audit market, standards and policy, professional oversight, audit quality review and enforcement.

As a starting point for our audit strategy in 2013-16, we made clear our expectation that audit committees as well as auditors should play a much stronger role in driving audit quality. Audit committees should now be reporting on all significant matters they have discussed, including their assessment of the audit. This was an essential underpinning for the requirements for auditor re-tendering.

For auditors, we introduced extended auditor reporting. This requires auditors to give an overview of their approach to the audit, the audit risks they identified, how they addressed them, and the level of materiality they applied.

We have put in place a challenging set of measures designed to enhance audit quality and strengthen investor confidence

Corporate governance and investor stewardship

Survey evidence suggests that investors have welcomed extended auditor reporting and the additional information it provides about the companies being audited. Audit committees have been encouraged to focus even harder on securing audit quality, and have encouraged auditors to innovate in their reporting. We must build on that promising start and will continue our dialogue with audit committee chairmen and audit firms.

Our reports on our reviews of individual audit firms during 2015/16 reflects the FRC's focus on promoting continuous improvement in audit quality. For the first time, we asked the firms to carry out a root cause analysis into each of our key findings before developing proposed actions and discussing these with us. The firms responded positively to this request and engaged in a constructive dialogue with us on the outcome of their work and how this had informed the actions they intend to take.

However, during 2015/16 we concluded that we could not promote improvement in audit quality much further, or at least not do so quickly, without adopting new approaches to our audit monitoring and changing the way we engage with firms and companies. We decided to be more transparent and to report our views on the quality of individual audit firm's work to the market to encourage better auditing.

We have undertaken and reported annually on our independent oversight of the regulation of statutory auditors by the UK Recognised Supervisory Bodies (RSBs). This work involves monitoring visits to these bodies in order to evaluate the effectiveness of specific aspects of their regulatory systems and procedures and whether they continue to meet the requirements to be a Recognised Supervisory Body (RSB) or a Recognised Qualifying Body. Details of our work during 2015/16 can be found at Appendix 1.

In preparation for our new role as Competent Authority, we reviewed our standards for auditors, our enforcement regime and established new delegation agreements to cover the objectives and operation of the tasks we will delegate to the RSBs. We believe it is most important that they have a strong relationship with the FRC in promoting high quality audit.

In updating the UK Corporate Governance Code in 2014 we sought to strengthen the focus of companies on the longer term and on sustainable value creation. Our aim was to improve the quality of information that companies were giving investors on the long-term health, strategy and risk management of listed companies.

The updated Code clarified that boards should look at least a year ahead in making their going concern judgement for accounting purposes. More fundamentally we introduced a requirement for a viability statement through which boards should state that they have a reasonable expectation that the company can continue in operation and meet its liabilities over a longer period. These were substantial and complex changes which followed on from the significant changes we made to the Code in

- While it is too early to draw firm conclusions about their effect we strongly believe that over time they will deliver real benefits for companies and investors and we will monitor their impact.

The purpose of corporate governance is to facilitate effective, entrepreneurial and prudent management that can deliver the long-term success of the company

Technical Actuarial Standards and actuarial oversight

We have led a major project, in coalition with stakeholders, on company culture and how to promote good practice and will report on this imminently. The updated guidance on risk management we published alongside the new UK Corporate Governance Code highlighted the need for boards to think hard about how they can better assess whether the culture practiced within the company is the same as that which they espouse, particularly under pressure.

We believe that effective dialogue between investors and the companies in which they allocate funds supports good corporate governance and is essential to achieve sustainable long term growth in the UK economy.

The UK Stewardship Code was introduced in order to encourage fund managers and owners to engage with companies on all matters of concern. It complements the UK Corporate Governance Code. The UK Stewardship Code has led to improvements in the quality and quantity of engagement between investors and companies. However, this is not universal and we wish to maintain momentum by ensuring that signing up to the Code is a genuine marker of commitment. We will focus on promoting effective investor engagement, including by 'tiering' signatories on the basis of their commitments to the Code. We will do this in late 2016.

Actuarial work is central to many financial decisions in insurance and pensions and is an important element in other areas requiring the evaluation of risk and financial returns. High quality actuarial work promotes well-informed decision-making and mitigates risks to users and the public; poor quality actuarial work can result in decisions being made which are detrimental to the public interest.

In recognition of the public interest, by agreement, we provide oversight of the regulation of its members by the UK professional body for actuaries, the Institute and Faculty of Actuaries (IFoA). We also set technical standards for actuaries carrying out work in the UK. Early in the 2013/16 strategy period we reviewed the oversight and standards regime with the IFoA and identified that there should be better coordination of the identification of and response to public interest risks to which actuarial work is relevant. The Joint Forum on Actuarial Regulation (JFAR) was set up in 2013; it is chaired by the FRC and includes the IFoA, the Financial Conduct Authority (FCA), the Prudential Regulatory Authority (PRA) and the Pensions Regulator.

The FRC issued a JFAR discussion document on public interest risks in 2014 and issued a feedback statement in 2015/16. JFAR and the FRC are using the feedback to guide future work.

High quality actuarial work promotes well-informed decision-making and mitigates risk to users and the public

Corporate reporting

Corporate reports should be fair, balanced and understandable – but we believe that they should also be clear and concise. Our Guidance on the Strategic Report was designed to help companies give investors an insight into the way a business is run and its strategic direction. During 2015/16 we reviewed and reported on its effectiveness. There has been extensive reporting on the issues arising from the work of our Financial Reporting Lab and the findings of corporate reporting reviews to help companies enhance the usefulness of their reports for investors.

On the evidence of our latest reviews of corporate reports, we are reassured that the quality of corporate reporting remains high among listed companies. We are generally pleased with the efforts made by boards to embed the strategic report requirements in their reports but have identified there is still room for improvement. Whilst we have made progress on our project to help smaller listed and AIM companies with the quality of their reporting, we have continuing concerns about the quality of reporting by some smaller listed and AIM companies.

Enforcement

During 2015/16 the FRC consulted on a new framework for Technical Actuarial Standards, seeking to develop a framework better aligned to public interest risks. We are currently consulting on specific standards for aspects of technical actuarial work which are of heightened public interest and on the risk assessment process that supports it.

Our oversight work has focused on the IFoA's development of practices and standards to underpin the quality of actuarial work, including its ethical code.

In 2017 we plan to consult publicly on the appropriateness of the framework of actuarial regulation and standard setting recognising the changing nature of the public interest risks.

During 2013-16 the FRC's independent disciplinary arrangements contributed to the achievement of the FRC's overall mission by taking enforcement action where it was in the public interest to do so. Undertaking investigations in-house has resulted in the production of investigation reports within a shorter time frame and in a more cost effective way. It has also enabled us to manage case progress more proactively.

All investigations that commenced before FRC reform in 2012 have now been concluded. More recent cases are running to our new faster timetable.

In addition, cooperation between the FRC and other regulators on areas of monitoring and enforcement, including the lawful sharing of information, is expected to continue to aid in the conduct of the investigation of cases.

Considerable improvement in the pace of progression of cases from the investigation stage of the disciplinary process to the prosecution stage has been made

Our international role

We also extended our international influence, including through enhancing our reputation for thought leadership. This has included:

- Contributing to the work of the International Accounting Standards Board (IASB)/ IFRS Foundation; direct involvement in the European Financial Reporting Advisory Group and the European Securities Markets Authority; influencing developments in IOSCO; and contributing to the development of integrated reporting.

- Continuing to take a leading role in EU and international audit regulatory networks, including the International Forum of Independent Audit Regulation (IFIAR) – reflecting the international dimension to many audits – including the International Federation of Independent Audit Regulators. We will also continue to contribute significantly to the International Audit and Assurance Standards Board (IAASB), on which one of our staff is a member.

We also saw codes on corporate governance and investor stewardship adopted in Japan and on stewardship in South Korea.

Our strategy for 2016-19

In October 2015, we published our strategy for 2016/19. Fostering investment and the importance of effective, but proportionate, regulation will continue to guide our priorities over the next three years. We will concentrate on promoting a step change in audit quality and on driving up standards of governance, stewardship and reporting. Our goal is to ensure that reporting and audit in the UK are world-leading in order to give the greatest possible confidence to investors globally, and by doing so help drive growth.

After completing the changes already in hand, we will, as far as possible, seek to avoid changes to the codes and standards for which we are responsible for at least the remainder of the strategy period, and longer if possible. In particular, we intend to avoid making further changes to the UK Corporate Governance Code in the next three years. We will, however, continue to monitor application of the codes and standards to assess their impact and to identify whether any change is needed. We will also need to take account of both the need for and opportunity from change presented by the UK leaving the EU.

We will also seek to remove regulatory burdens wherever possible. We will remain influential internationally and will continue to invest in our own skills and capabilities. We will continue to recognise the essential role of the professional bodies in promoting high standards.

Our priorities for 2016/17, the first year of the new three year strategy, are:

- On audit, our major task is to establish and make the most effective use of the new role we have been given by government as the Competent Authority for audit. We will seek to ensure that the new framework established under ARD serves the interests of investors in the reliability of financial statements; and supports the UK audit profession in delivering statutory audit to the necessary high standards and with close regard to the public interest. Our aim is that by the end of the strategy period at least 90 per cent of FTSE 350 audits will require no more than limited improvements as assessed by our monitoring programme.

- On corporate governance, we will focus on good practice, including through our work on corporate culture and promoting effective engagement between boards and investors. We are also keeping a close eye on how companies are responding to the major changes we introduced in 2014 on the monitoring of internal controls and the reporting of viability. We believe very strongly that risk management and internal control should be incorporated within the company's normal management and governance processes, not treated as a separate compliance exercise.

- On corporate reporting, we will focus on embedding recent changes, influencing the development of IFRS, and helping smaller listed and AIM companies with the quality of reporting.

- We will complete our update of the framework for actuarial standards by implementing a standard to cover a broader range of actuarial work and refocusing our specific Technical Actuarial Standards. In 2017, we will consult publicly on the future of actuarial regulation.

We will concentrate on promoting a step change in audit quality and on driving up standards of governance, stewardship and reporting

Our regulatory approach

Our approach to our corporate reporting and audit quality review functions will be developed in the light of the independent review of their effectiveness we commissioned in

Our approach to our corporate reporting and audit quality review functions will be developed in the light of the independent review of their effectiveness we commissioned in

- We are taking a number of related actions to:

- Enhance the degree of investor involvement in our work. We will seek to achieve this through consultation on our procedures and priorities promoting effective reporting by audit committees and by communicating more clearly the outcome of our review activity in terms that investors find helpful.

- Establish a regulatory stance that promotes continuous improvement in standards of reporting and auditing. This will be based on a careful analysis of what constitutes good practice, and on identifying and addressing the root cause of problems. We believe that our approach will be effective in driving up standards without compromising our ability to take tough action when necessary.

- Invest in the skills and capabilities of our Audit Quality and Corporate Reporting Review teams to benefit from their combined expertise.

- Simplify and standardise our processes to promote greater transparency in the way we operate.

- Name in advance a small proportion of those reports and audits we intend to review; we will inform companies when their reports have been reviewed and we do not intend to take any further action; and we have made clear our expectation that audit committees should when appropriate report on the outcomes of the FRC's audit quality and corporate reporting reviews.

- Implement a new strategic stakeholder communications programme, looking at new ways to communicate the outcomes of our work, including through our annual assessments of the quality of reporting and auditing.

FTSE 350 AUDITS AT A GOOD STANDARD

A bar chart illustrating the percentage of FTSE 350 audits meeting a good standard. * Current: 70% * Target: 90%

Footnotes

Our regulatory approach

Our approach to our corporate reporting and audit quality review functions will be developed in the light of the independent review of their effectiveness we commissioned in

- We are taking a number of related actions to:

- Enhance the degree of investor involvement in our work. We will seek to achieve this through consultation on our procedures and priorities promoting effective reporting by audit committees and by communicating more clearly the outcome of our review activity in terms that investors find helpful.

- Establish a regulatory stance that promotes continuous improvement in standards of reporting and auditing. This will be based on a careful analysis of what constitutes good practice, and on identifying and addressing the root cause of problems. We believe that our approach will be effective in driving up standards without compromising our ability to take tough action when necessary.

- Invest in the skills and capabilities of our Audit Quality and Corporate Reporting Review teams to benefit from their combined expertise.

- Simplify and standardise our processes to promote greater transparency in the way we operate.

- Name in advance a small proportion of those reports and audits we intend to review; we will inform companies when their reports have been reviewed and we do not intend to take any further action; and we have made clear our expectation that audit committees should when appropriate report on the outcomes of the FRC's audit quality and corporate reporting reviews.

- Implement a new strategic stakeholder communications programme, looking at new ways to communicate the outcomes of our work, including through our annual assessments of the quality of reporting and auditing.

1. Strategic Report

In pursuing this approach we will be alert to opportunities to enhance the effectiveness of the current regulatory framework. For example, one priority will be to find ways to secure the full benefits intended from the Stewardship Code. Another will be to develop reporting frameworks which will enable companies to balance the competing demands of an increasingly broad range of stakeholders for greater transparency and encourage clear and concise reporting. Fresh thinking will be required.

Pursuing our mission effectively requires us to recognise and manage risk. As well as operational risks which we can reasonably address, the principal risks identified in this report for audit include risks arising from corporate failures or scandals over which we have no control, but which affect confidence in the regulatory framework. We need to respond to legitimate public concern about failures in corporate governance and reporting; but at the same time we need to make clear the boundaries and limits of our role.

We need to tread a careful line between our emphasis on non-regulatory initiatives based on collaboration with market participants and the need to deploy our enforcement powers decisively and effectively when we judge it to be in the public interest. We are also conscious that the markets themselves evolve and we need to keep up with changes to investor needs.

Our organisation

The 2013-16 strategy built on the reforms to our powers and structure instituted in

- We have since operated as a unified regulator, enabling us to deliver our objectives and priorities in a coherent and joined-up way and to develop a more cost-effective approach. We are now considering how to deliver our new responsibilities as the Competent Authority to best effect.

We have created a new structure. A Corporate Governance and Reporting Division brings together the standards team for accounting and reporting policy with the team responsible for monitoring corporate reports so each can more readily benefit from the other's knowledge. We have adopted a similar approach in relation to audit and have created a new Audit Division which will bring together our standards, monitoring and professional oversight work. An Enforcement Division will facilitate an independent focus as we assess whether those we regulate have met relevant requirements.

The FRC has a wide, and increasing, range of responsibilities. It is important that we prioritise clearly and continue to focus on principles and outcomes. To do so effectively our people need the extensive skills needed to identify the big, underlying issues and the confidence to tackle them. An effective approach to driving up quality by working constructively with market participants means continuing to invest in our Financial Reporting Lab, developing similar approaches in other areas and ensuring good, early communication with companies, investors and the professions on difficult issues.

The FRC needs to continue to evolve if we are to remain effective and efficient

As we explain in the 'our people' section, over the period of our next three year strategy we will continue to invest in the development of our people – including through programmes focusing on leadership, management capability and communication skills. We will continue to recruit, develop and value colleagues with the necessary strong technical skills. Further recruitment will be necessary as we take on additional responsibilities. We will also focus on diversity, both as an employer and in our governance arrangements. The FRC will seek to understand and respect the perspective of colleagues from different backgrounds.

Our staff survey shows that the FRC remains a great place to work with high levels of job satisfaction. The recent executive restructuring however generated some uncertainty and the leadership team recognises that it needs to engage colleagues earlier in management issues and communicate better.

Funding

We have expanded since the 2012 reforms as a result of the new responsibilities we have been required to undertake and the need to tackle complex regulatory issues. We will expand further as we assume our new responsibilities in relation to audit, and for this we will need to be adequately resourced. It is also important that we have adequate reserves to give us the means to tackle unplanned emerging issues of significant concern to our stakeholders and to underpin our non-statutory funding. We are planning to increase our general reserves during the strategy period to a level equivalent to six months' operating expenditure.

Since 2009 the government has progressively withdrawn its contribution to the FRC's funding and will from 2016 no longer provide any direct contribution. Our audit work has required increased resources to carry out the role we have been given as the Competent Authority and in response to the recommendations of the Competition and Markets Authority (CMA). We will continue to discuss our funding arrangements with the audit profession in particular, given that their contribution will increase over the period of our 2016-19 Strategy. The FRC Board has noted their concerns and has taken steps to give the audit profession more time to adjust to the new funding arrangements.

We will continue to consult annually on our priorities and budget, and to take every opportunity to deliver our responsibilities as efficiently and effectively as possible.

We will continue to consult annually on our priorities and budget, and to take every opportunity to deliver our responsibilities as efficiently and effectively as possible

OUR PEOPLE

As an organisation committed to continuous improvement we invest in our people to make sure they have the skills needed to identify underlying issues and the confidence to tackle them.

At 31 March 2016 we employed 161 people. As at 30 June 2016, we employed 165, of whom, 56 are in our Audit Division, 43 in our Corporate Governance and Reporting Division, 42 in our Corporate Division and 24 in our Enforcement Division.

Culture

At all levels we need our people to be committed to the culture and behaviours that we expect within the organisation. Our citizenship values are: show respect, be decisive, create outreach, join up and seek evidence. The evidence of our staff surveys suggests that the values are well-understood and embedded across the organisation and they form part of our performance management process.

People strategy

Our people strategy is designed to attract, inspire and develop high calibre people with the right skill sets. We recruit in a fair, open and efficient manner to develop and build a core team with the necessary skills and competencies.

As we have a relatively flat structure, with promotions representing big jumps in responsibility, we have increased our commitment to training and development with particular focus on preparing people to take on leadership responsibilities. Our leadership and management development framework includes management capability, communication skills, as well as expert technical skills. The 'Future Leaders' programme is an opportunity to develop individuals on a trajectory to senior roles.

We are keen to offer new development opportunities for all our people, to update their knowledge and skills in areas such as exercising judgement, giving and receiving feedback, influencing, communications and programme management. As well as coaching and mentoring we are looking at other opportunities for development, including through placements and secondments.

Chart showing 'OUR PEOPLE' division percentages:

- Audit division: 34%

- Corporate Governance and Reporting division: 26%

- Corporate division: 25%

- Enforcement division: 15%

Recruitment

During 2015/16, we recruited 31 new people into the organisation. We continue to support internal and external secondments, and a number of our staff hold positions in international regulatory networks. In 2015/16 we supported 13 intern placements. Next year we will be looking to expand our apprenticeship programme.

Employee engagement

Our annual employee survey provides us with valuable insight and allows us to focus our efforts in areas that matter most to our people. We also carry out regular surveys on topics of particular organisational interest.

In our 2016 survey, 84.5 per cent of our employees responded, 98 per cent of whom told us how proud they are to work for the FRC. In some areas, such as perceptions of senior leadership, the results fell and we will be conducting a short survey to look in to the causes.

We engage our people in all our activities, we consult with them on strategy and organisational changes and provide regular Board feedback sessions. We offer lunchtime learning sessions on internal and external topics. The CEO holds Celebrating Success events and 'Come and talk to me' sessions.

We hold an annual all Staff away day through which we encourage colleagues, from across the organisation to share their ideas with other teams.

Equality and diversity

We aim to be an organisation where diversity is valued and respected and we recruit and retain a diverse workforce. As we develop our talent pipeline we continue to focus on diversity and ensuring broad representation of views and backgrounds, both as an employer and in our governance structure.

All our employees are encouraged to reach their full potential in a supportive working environment that exemplifies our value of mutual respect.

Next steps

In 2016/17, we will:

- Continue our work to retain and develop our people, including a second round of the Future Leaders' programme and the Leadership and Management Development programme.

- Continue to promote our citizenship values.

- Review our learning and development framework, and ensure effective succession planning.

- Invest in new HR systems and processes.

- Establish a 'People Forum' to encourage and capture the views of all our people.

- Manage performance through good objective setting, feedback and development.

- Introduce greater interchange and secondments between teams and externally.

Gender diversity within the FRC (*)

Chart showing Gender diversity for Senior managers: * 56% (9 Female) * 44% (7 Male)

Chart showing Gender diversity for All other staff: * 61% (89 Female) * 39% (56 Male)

(*) Figures for senior managers include executive directors, as at 31 March 2016.

RISK MANAGEMENT AND INTERNAL CONTROL

Effective risk management is key to sustainable success

The FRC Board has overall responsibility for the FRC's risk management and internal control systems in line with the UK Corporate Governance Code and the associated 'Guidance on Risk Management, Internal Control and Related Financial and Business Reporting'.

The Audit Committee, advised by the Executive Committee, supports the Board by monitoring risk and by keeping the FRC's risk management and internal controls under review.

Principal risks

The Board has carried out a robust assessment of the principal risks facing the Company, including those that would threaten its business model, future performance, solvency or liquidity.

The FRC's Risk Register sets out the FRC's strategic risks. The Board reviews the Register as a whole at least twice a year. The strategic risks include risks to the quality of corporate governance and reporting in the UK and to the FRC's ability to pursue its mission. The Board has set a risk appetite and categorises risks by impact and likelihood and the necessary level of management or mitigation.

Table 1 identifies the principal risks identified and reviewed by the Board in 2015/16 based on the processes described above. It indicates how, in the Board's view, the risks have changed since last year.

During 2016/17 the Board will oversee further work by the executive on the identification and management of risk, reflecting the outcome of the EU referendum, the FRC's new role in regulating audit, international issues and developments in the market.

Table 1 - Principal risks

| FRC principal risks | Mitigation and movement in the year |

|---|---|

| Major failures or scandals undermine confidence in the UK governance and reporting model | Static risk (➔) Increased risk (↑) Decreased risk (↓) |

| In accordance with its mission, and recognising that it cannot eliminate the risks inherent in the capital markets, the FRC aims to reduce the likelihood and impact of corporate failures by: • Promoting high standards of corporate governance through the UK Corporate Governance Code; and effective investor engagement through the UK Stewardship Code. • Driving improvements in standards of corporate reporting and auditing through its framework of codes and standards, and through its monitoring, oversight and enforcement work. • Reporting on the outcome of monitoring, oversight and enforcement activities as appropriate. • Promoting the quality of actuarial information through our role in setting technical actuarial standards and oversight of the actuarial profession. • Research and increased focus on horizon scanning and consultation with stakeholders on emerging issues. |

|

| Failure to hold individuals or individual organisations that fall within the scope of the FRC's activities to account, resulting in a loss of trust in the UK governance and reporting model. | The FRC takes enforcement action where it has the power to do so and when it is necessary in the public interest. The FRC maintains constructive working relationships with the accountancy and actuarial professional bodies. The FRC sets out what it expects from market participants through UK Corporate Governance Code, the Stewardship Code, and the FRC's work to secure improvements in standards of corporate reporting and auditing, and its framework of reporting, auditing and actuarial standards. |

| Failure to identify and prevent loss of capacity in the UK audit market. | In its role in setting and monitoring auditing standards and promoting audit quality, the FRC has regard to the importance of a competitive UK audit market. The FRC works with other regulatory authorities and the major audit firms to develop contingency plans to minimise the impact on the quality of reporting and audit in the UK in the event of a major audit failure or a major firm exiting the UK market. The FRC has contributed to the development of the new UK framework for audit regulation under the EU Audit Regulation and Directive, including through its work on ethical standards. |

| The FRC takes actions that are ineffective or misguided, with damaging consequences for UK markets and the FRC's reputation. | The FRC works with market participants to ensure that its actions will genuinely contribute to trustworthy information and behaviour – including extensive consultation on all aspects of its activities. It seeks evidence from its own and others' activities, and promotes an improvement culture, working with companies and auditors to identify and highlight good practice and to drive up standards. The FRC's procedures are designed to be thorough, fair and consistent and minimise the risk of legal challenge. The FRC works with other regulators to identify the risks to the public interest where actuarial work is relevant. The FRC strategy for 2016-19 strategy focuses on embedding recent regulatory changes and improving compliance, without adding additional regulatory burdens. The FRC works closely with the government, and applies the Principles of Good Regulation and the Regulators' Code. |

| Failure to achieve our strategic objectives in both UK and internationally as a result of the complexity of the regulatory framework in the UK and Internationally and a dependency on other regulators. | The FRC maintains a close dialogue with the government and other regulators to ensure that the FRC's work supports and is supported by others' regulatory activities; and will contribute as appropriate to any changes following the EU referendum. The FRC will focus on the effective implementation of its role as the Competent Authority. The FRC engages extensively with regulators in other jurisdictions and in international fora. |

| Failure to raise sufficient financial resources to fund its budgeted expenditure and fulfil our responsibilities. | The FRC has developed a revenue strategy to ensure secure and sufficient funding for the next strategy period, including increasing the level of reserves. The FRC is further developing its funding arrangements to support its role as Competent Authority. Until those arrangements are fully in place, the FRC faces heightened risks in relation to its funding. |

| Failure to retain and/or recruit good quality leaders and staff undermines our effectiveness. | The FRC has implemented a comprehensive people strategy designed to attract, retain and develop talent across the organisation. There has been detailed preparation, including consideration of staffing needs, in response to the FRC's new role as the Competent Authority. |

| Failure to maintain a safe information security system. | Guidance issued to all FRC staff and non-executive Directors on IT information security; and updated guidance to be issued in 2016/17 on other aspects of data security and new legislation. Reminder and awareness sessions held for all staff to improve their awareness of IT security – including cyber-security threats. The FRC has overseen the management of IT systems to ensure contractors operate to its specifications. IT system security is tested regularly. |

Internal controls

The FRC maintains internal controls that support the management of risk and contribute to its organisational effectiveness and efficiency. It is currently reviewing its internal controls and will enhance them if necessary during 2016/17.

Going concern basis of accounting and long term viability

The Directors have carried out a critical review of the company's budget for 2016/17 and its strategic objectives for that year; and have a reasonable expectation that the company has adequate resources to continue to operate for the foreseeable future. Accordingly, the Directors continue to adopt the going concern basis in preparing the Annual Report and Accounts.

As part of its assessment of principal risks, the FRC has also considered its viability and prepared the following statement in accordance with provision C.2.2 of the UK Corporate Governance Code.

Viability statement

This Statement covers the period to March 2019, which will mark the end of the FRC's current three-year strategy. For the reasons stated below, the Directors have a reasonable expectation that the Company will be able to continue in operation and meet its liabilities as they fall due over this period.

In making this assessment, the Directors have considered the principal risks identified on pages 19 to 21 and the FRC's ability to mitigate those risks. They have considered the FRC's continuing ability to secure the necessary resources. This includes the potential impact of any damage to the FRC's reputation that could make stakeholders less willing to fund us.

We acknowledge the authority of the government and Parliament in determining the FRC's future; and recognise that regulatory arrangements will inevitably evolve over time in response to changing circumstances, including the outcome of the EU referendum. In June 2016, the government significantly extended our regulatory responsibilities by designating the FRC as the Competent Authority. On that basis it is reasonable to expect that we will continue to operate as a regulatory authority for the period of our current strategy.

The FRC currently raises most of its income from companies and the RSBs.

The levies on companies are collected on a voluntary basis. They are set annually following public consultation, and take account of the FRC's past experience in securing payment from the different funding groups. Having this element of our funding on a voluntary basis enhances our accountability as an authority operating in the public interest, but is inherently uncertain. There are reserve powers in company law that would enable the government to put some or all of our funding on a statutory basis. If we considered there was a risk that we could not raise sufficient funding to carry out our core functions, we could request that the government exercise these powers.

The contributions from the RSBs to fund the work of the FRC as the Competent Authority are a condition of their recognition for the purposes of audit regulation.

We recover enforcement case costs from the professional bodies. They are the most uncertain and variable element of our costs. If a tribunal considered that no reasonable person would have pursued a particular case, the enforcement procedures would enable a tribunal to make a costs order against the FRC. We have checks in place to ensure that formal complaints are pursued appropriately. But in the event that the tribunal made such an order, the FRC would not be able to recover the relevant costs directly from the professional bodies. We would have to meet them from other sources or from reserves.

Looking ahead, our new role as the Competent Authority may expose us to further calls on our resources. The FRC has undertaken stress-tests based on our assessment of the potential impact of severe but plausible risks related to both our new and existing responsibilities. We have stated our intention to significantly increase the FRC's general reserves over the period of the FRC's 2016-19 strategy. We will keep the actual and target level of reserves under review.

The FRC will continue to consult stakeholders on its priorities, regulatory approach, expenditure and funding. The Board will take account of stakeholders' views on the FRC's effectiveness and efficiency, including through independent survey evidence. The Board recognise that new risks may emerge and that they will need to keep the FRC's arrangements for managing risk under regular review.

FINANCIAL REVIEW

The FRC will continue to consult stakeholders on its priorities, regulatory approach, expenditure and funding

Our annual budget sets out the resources we need to carry out our regulatory responsibilities for the year. The budget for 2016/17 will enable us to make a strong start to our new responsibilities for audit regulation and embed our new regulatory approach as we begin our new three year strategy.

Our revenue and expenditure were managed under four main headings reflecting the organisational structure that was in place during the financial year.

- Core operating activities

- Audit quality review

- Accountancy and actuarial disciplinary cases

- XBRL taxonomy development

Core operating activities include our responsibilities for corporate governance, corporate reporting, and audit. They are funded through voluntary levies on publicly traded, large private and public sector organisations plus contributions from the accountancy profession and from government. Our actuarial activities are funded by levies on pension funds and insurance companies plus a contribution from the Institute and Faculty of Actuaries (IFOA). Ad-hoc income streams, such as from publications, registration fees and inspection fees are included as part of total revenue.

Audit quality review costs are recovered from the accountancy professional bodies and other authorities.

Disciplinary case costs are recovered from the accountancy professional bodies for accountancy and audit cases and from the actuarial funding groups for actuarial cases.

XBRL taxonomy development direct costs are funded by Companies House, HMRC and the Charities Commission, with people resources being provided by the FRC and Charities Commission.

The expenditure necessary to carry out the FRC's activities and meet key objectives is set out each year in the published Plan & Budget. Stakeholders are invited to comment on the priorities identified in the plan and the associated levels of expenditure required. The grant from government and the total amounts to be collected from the professional bodies were agreed at the start of the year as part of the consultation process.

During the year revenue increased by £1.3m and expenditure by £1.1m. Our general reserve increased by £0.1m, a better result than budgeted which was a deficit of £0.2m.

Expenditure

Total expenditure is set out in detail in note 2 to the financial statements. Expenditure across the main areas of our operations is analysed below.

Bar chart showing AUDIT QUALITY REVIEW EXPENDITURE: * 2014/15: £4.3m * 2015/16: £4.9m

| Total expenditure by activity | Actual 2015/16 £m | Actual 2014/15 £m | Budget 2015/16* £m |

|---|---|---|---|

| Core operating costs | 20.9 | 20.1 | 20.9 |

| Audit quality review costs | 4.9 | 4.3 | 5.4 |

| Accountancy disciplinary case costs | 4.1 | 4.2 | 7.0 |

| Actuarial disciplinary case costs | 0.1 | 0.2 | 0.4 |

| XBRL Development | 0.2 | 0.3 | 0.3 |

| Total | 30.2 | 29.1 | 34.0 |

Note: *The budget expenditure shown here includes expenditure of £0.3m relating to the cost of producing publications which, in the plan and budget as previously published, was netted from revenue. The previously published budget was £33.7m

Comparison to prior year

The increase in core costs was mainly in staffing (£1.2m) as we have recruited additional staff to deliver the priorities set out in our annual plan. During the year, headcount in the core business increased by nine.

Expenditure on legal and professional fees has increased by £0.5m. Much of this is due to the cost of the external review of the effectiveness of our CRR and AQR activities, including the additional cost of implementing its recommendations. We have incurred higher legal fees associated with the work to define our role as the Competent Authority.

We relocated our office during 2014 and this led to higher than usual expenditure on rent and rates in that year. Expenditure here has fallen back during 2015/16 and we have reduced costs by £0.5m.

During the year we have sought to make savings in the discretionary areas of our expenditure such as business travel and conferences. Expenditure in these areas was £0.2m lower than in the prior year.

Other savings have been realised in IT of £0.1m following the move to a new supplier and in research of £0.1m.

Audit quality review expenditure grew by £0.6m to reach £4.9m. This reflects the increased team size and number of reviews carried out in order to implement the CMA recommendations following their review of the audit market and to prepare for the additional reviews that will be required as we become the Competent Authority on 17 June 2016.

The net expenditure on disciplinary case costs (accountancy and actuarial taken together) was broadly unchanged at £4.2m.

XBRL development costs reduced further as this project has moved into a maintenance only phase.

Comparison to budget

Total expenditure was £3.8m lower than budget, the notable variance being in accountancy disciplinary case costs which accounted for £2.9m of the reduction. The number and complexity of the cases progressed and settled during the year was broadly as expected; although the number reaching tribunal was lower. We have continued to carry out work in-house rather than externally, wherever possible, in order to reduce costs.

In addition there were successful outcomes to a number of accountancy cases, leading to awards of costs being made against other parties. These totalled £0.5m compared to a nil budget. There was one major active actuarial case during the year with delays in receiving the response to our proposed formal complaint from the respondent. We did not therefore incur the expected level of expenditure in taking this case forward. The reduction here was £0.3m, but we expect this case to progress further in 2016.

Expenditure on our AQR activity was £0.5m lower than budget as headcount ran at a level below budget. Despite that we were able to complete the required number of reviews.

Expenditure on XBRL was also below budget as the development work was completed without the need for any external chargeable people resource. The cost actually incurred of £0.2m was associated to the hosting and maintenance of the development platform being used.

Bar chart showing TOTAL BUDGET VS TOTAL EXPENDITURE: * Total budget: £34m * Total expenditure: £30m

Income

Our income for the year was £30.2m:

| For Core Operating Costs | Actual 2015/16 £m | Actual 2014/15 £m | Budget* 2015/16 £m |

|---|---|---|---|

| Preparers levy | 12.2 | 11.3 | 12.1 |

| Insurance and pension levies | 2.2 | 2.2 | 2.1 |

| Accountancy professional bodies | 5.2 | 5.0 | 5.2 |

| Actuarial profession | 0.2 | 0.2 | 0.2 |

| Government | 0.25 | 0.5 | 0.25 |

| Publications | 0.6 | 0.5 | 0.7 |

| Other | 0.3 | 0.4 | 0.2 |

| Sub Total | 20.9 | 20.1 | 20.8 |

| For Audit Quality Review | Actual 2015/16 £m | Actual 2014/15 £m | Budget* 2015/16 £m |

|---|---|---|---|

| Accountancy professional bodies | 3.9 | 3.4 | 4.4 |

| Other Income | 1.0 | 0.7 | 1.0 |

| Sub Total | 4.9 | 4.1 | 5.4 |

| For Accountancy Disciplinary Case Costs | Actual 2015/16 £m | Actual 2014/15 £m | Budget* 2015/16 £m |

|---|---|---|---|

| Accountancy professional bodies | 4.6 | 5.2 | 7.0 |

| Less cost awards recovered | -0.5 | -1.1 | 0.0 |

| Sub Total | 4.1 | 4.1 | 7.0 |

| For Actuarial Disciplinary Case Costs | Actual 2015/16 £m | Actual 2014/15 £m | Budget* 2015/16 £m |

|---|---|---|---|

| Insurance and pension levies | 0.1 | 0.2 | 0.3 |

| Sub Total | 0.1 | 0.2 | 0.3 |

| For XBRL Development | Actual 2015/16 £m | Actual 2014/15 £m | Budget* 2015/16 £m |

|---|---|---|---|

| Companies House | 0.2 | 0.3 | 0.3 |

| Sub Total | 0.2 | 0.3 | 0.3 |

| Total | 30.2 | 28.8 | 33.8 |

|---|---|---|---|

Note: * The budget income shown here includes £0.3m relating to the cost of producing publications which, in the plan and budget as previously published, was netted from revenue. The previously published budget for income was £33.5m

Comparison to prior year

Total income grew by £1.3m in 2015/16, compared to prior year, the majority being for core operating costs. The levy on publicly traded companies provided most of the additional amount of £0.9m. Levy rates were increased by 3.2 per cent for small companies and by 9 per cent for the very largest. We also benefited by £0.2m from new market entrants. (As an illustration, the levy for a listed company with a market capitalisation of £1.3bn was £10k.)

The contribution received from the accountancy professional bodies and the Actuarial Profession increased by 2 per cent.

Funding sought to cover AQR and accountancy disciplinary costs moved in line with expenditure in those areas.

Comparison to budget

Total income in 2015/16 was £3.6m less than budget. Income for AQR, XBRL and cases is set to match expenditure. During the year expenditure in these three areas was collectively £3.7m lower.

Income for core operating costs exceeded budget by £0.1m, with gains from levy payers being slightly offset by lower publications income.

Balance Sheet

The balance sheet at 31 March 2016 is included in the financial statements.

Net assets and our general reserves have increased by £0.1m reflecting the overall surplus result generated in the year.

Within that we have improved our total cash and investments position by £0.8m, primarily by reducing total debtors by £0.4m and generating £0.4m of additional cash from our operations.

By order of the Board

Stephen Haddrill Chief Executive Officer 13 July 2016

2. ACTIVITY REPORT 2015/16

This section describes our work in 2015/16 for each of our strategic priorities in pursuing our three year strategy. For each priority we have set out the high level objective and key effectiveness indicators against which we are reporting.

- Audit - 29

- Corporate Reporting - 31

- Corporate Governance - 34

- Investor Stewardship - 35

- Actuarial - 37

- Enforcement - 39

AUDIT

It is essential that within audit firms there is a culture of commitment to delivering consistent and rigorous audit quality

Audit underpins public confidence in corporate governance and reporting by UK companies.

Since the financial crisis, the FRC has introduced measures to enhance confidence in the quality of audit and increase the value of auditor reporting to investors. The measures include retendering, enhanced and extended auditor and audit committee reporting, and increased transparency of the results of the FRC's audit quality reviews. It is essential that within audit firms there is a culture of commitment to delivering consistent and rigorous audit quality.

During 2015/16 we have:

- Monitored and reported on the quality of individual engagements and made appropriate use of our new regulatory powers designed to impose sanctions where poor quality audit work was identified. In determining which engagements were subject to monitoring we took account of the priority sectors and relevant areas of focus outlined under the high quality corporate reporting objective. We also paid particular attention to the quality of first year audits.

- Undertaken thematic studies on audit quality processes covering quality control monitoring procedures and the Engagement Quality Control Review (EQCR) together with audit sampling.

- Continued to discharge our responsibilities for statutory oversight of the regulation of auditors by the recognised professional accountancy bodies.

- Continued to work with BIS to ensure that the ARD was implemented to ensure an effective, appropriate and proportionate regulatory regime for audit. This included considering the impact of any changes on the structure of audit regulation and related FRC powers and on the FRC's ethical and auditing standards.

- Consulted on and finalised proposed revisions to the ethical standards to address issues identified in our review of the ethical framework.

- Contributed to the work of the International Auditing and Assurance Standards Board (IAASB), the International Forum of Independent Audit Regulators (IFIAR) and other EU and international groups.

- Worked on the development of an updated Audit Firm Governance Code which we expect to issue later in 2016.

Objective: To promote high quality audit and confidence in the value of audit

| Key effectiveness indicator | Outcome |

|---|---|

| Evidence from our audit quality reviews | We inspected 137 individual audit engagements in 2015/16 (compared with 126 engagements in 2014/15), including 66 FTSE 350 (54 in the previous year). |

| The findings from the 2015/16 Audit Quality Inspection Annual Report published in May 2016 found that 23 per cent were assessed as requiring improvements or significant improvements compared with 33 per cent in 2014/15. | |

| 77 per cent of audits inspected were assessed as either good or requiring only limited improvement compared with 67 per cent in 2014/15. | |

| Progress in the implementation of the extended audit committee and auditor reporting changes and investor feedback | Auditors continued to demonstrate innovation in developing high quality, accessible reports in the second year of extended auditor reporting according to a FRC survey. |

| Investors have welcomed extended auditor reporting and the additional information it provides about the companies being audited. The findings from the survey can be found on our website.4 | |

| Findings from a survey of audit committee chairmen on audit quality show a positive picture and the results were an improvement on the previous years. |

CORPORATE REPORTING

Our aim is to encourage all those involved in the financial reporting process to focus on communication and the clear presentation of information that is material and relevant

Investing time and resources in producing high quality corporate reporting can result in significant benefits for companies. Corporate reports should be clear and concise as well as fair, balanced and understandable.

Our aim is to encourage all those involved in the financial reporting process to focus on communication and the clear presentation of information that is material and relevant, including in relation to the longer-term viability of the company. We have published guidance on the Strategic Report, and reported on our reviews of corporate reports and accounts, and on the work of the Financial Reporting Lab (The Lab).

During 2015/16, we:

- Undertook our annual programme of reviews of corporate reports, completing 192 reviews during the year. The reviews were directed at companies of economic significance where a material misstatement could have implications not just for the individual company but for confidence in the market as a whole. Our priority sectors were insurance, food, drink and consumer goods manufacturers and retailers, companies servicing the extractive industries and business services. We have paid particular attention in our reviews to revenue recognition, the reporting of complex supplier arrangements, business combinations and the implementation of new accounting standards.

- Undertook an evaluation of the impact of the Guidance on the Strategic Report, worked with BIS on the UK implementation of the EU Directive on Non-financial Reporting and continued to influence other regulators to support clearer and more concise reporting that is relevant to investors.

- Continued our project aimed at achieving over a three year period a step change in the quality of reporting of smaller listed and AIM companies.

- Issued new reporting requirements for small and micro companies in response to the implementation of the EU Accounting Directive; and considered consequential amendments to FRS 102.

- Continued to influence the International Accounting Standard Board (IASB) agenda, particularly its Conceptual Framework and its work on disclosures, including specific research to influence developments in cash flow reporting.

- Published the latest findings from the Lab project on Corporate Reporting in a Digital World and published the outcomes of the Lab's work on disclosure of dividend policy and capacity.

Objective: High quality corporate reporting that is fair, balanced and understandable

| Key effectiveness indicators | Outcomes |

|---|---|

| Quality of reporting evidenced by the corporate reporting reviews | The overall quality of the 192 corporate reports reviewed in the year was generally good although the most common areas of challenge remain broadly the same as in previous years. |

| Some improvement in respect of principal risk reporting, presentation of cash flows statements and capital management disclosures. | |

| Appropriate effort was made to implement new reporting standards and the Strategic Report. | |

| Assessment of the contribution of the Lab project and Strategic Report guidance to clearer and more concise reporting | We undertook a study on the impact of the Strategic Report and related FRC Guidance. |

| The study found that companies are taking on board the objectives of the FRC's 'Clear & Concise' initiative, including the work of the Lab; and that the overall quality of corporate reporting has improved since the introduction of the Strategic Report. However, it also highlighted areas where further improvements could be achieved. | |

| Evidence on the root causes of problems in reporting by smaller listed and AIM companies | We identified that many smaller quoted companies incorrectly believe that investors place little value on their annual reports, and that these companies see the preparation of the annual report as a necessary compliance exercise rather than an opportunity to provide relevant information to stakeholders. |

| We identified proposals to help improve the quality of their reporting, including facilitating greater dialogue between preparers and investors and encouraging investors to give more feedback to Boards on the quality of the financial information. | |

| Evidence of the extent of voluntary adoption of FRS101 and the impact of FRS102 | Many companies did not adopt the new standards before the effective date of 2015, and therefore, given the small number of early adopters of FRS 101 and FRS 102, there was insufficient data for an effective review of the impact of the standards this year. |

The FRC's Guidance on the Strategic Report has had a positive effect on the quality of corporate reporting. Many companies have embraced this as an opportunity to rethink how they communicate with investors

| Key effectiveness indicators | Outcomes |

|---|---|

| The impact of our work to secure user views on IFRS and how effectively we have represented them in our responses to and work with the IASB | We have continued to influence IFRS including through representation on the IFRS Advisory Council and responding to all major consultations to feedback the views of UK stakeholders through our outreach and Council activities. |

| We have contributed significantly to EFRAG through representation on its Board and Technical Expert Group in support of its work to reinforce the EU's contribution to the development of IFRS. | |

| The extent of direct company and investment community participation in Lab projects and influence of the Lab's reports on corporate reporting practice | The Lab continues to build its base of project participants. While FTSE 350 participation continues to be strong, small companies now represent nearly a quarter of participating companies, and over 300 retail investors participated individually or through associations. |

| The Lab's work on debt and cash flows helped to influence changes made by the IASB that will require better information on cash and non-cash changes in reported debt. We are already seeing examples of improved disclosures of dividend policy and practice following the Lab's report in November. |

The Financial Reporting Lab provides an environment where investors and companies can come together to develop pragmatic solutions to today's reporting needs

CORPORATE GOVERNANCE

The UK has some of the highest standards of corporate governance in the world, which makes the UK market attractive to new investment

High quality corporate governance and investor stewardship foster trust in the way companies are run.

The FRC sets the UK Corporate Governance Code that is based on the underlying principles of good governance including the exercise of judgement, accountability, transparency, probity and a focus on the sustainable success of an entity over the long-term. It includes a clear principle that boards should provide annual reports and accounts that present a fair, balanced and understandable assessment of the company's position and prospects.

During 2015/16, we:

- Continued an assessment of the quality of board succession planning and considered how to develop best practice.

- Considered further how best to assess company culture and practices and how effective companies are at embedding good corporate behaviours, and considered how to promote good practice.