The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Audit Quality Inspection and Supervision Public Report 2022 - Tier 1 Firms Overview

- Our supervisory approach

- The supervisory staff producing our reports

- What is high audit quality?

- 1. Overview

- The results of the Quality Assurance Department of the ICAEW

- The firms' internal quality monitoring review results

- Inspection results: arising from our review of individual audits

- Inconsistency still hampers firms from eradicating poor-quality audits.

- Common good practices on inspections

- The inspection results at two firms (BDO and Mazars) remain unacceptable.

- Management of audited entities and their audit committees are also a critical element of a high quality audit and financial reporting ecosystem.

- Our forward-looking supervision work provides us with a holistic picture of each firm's approach to audit quality, resilience, and the future development of their audit quality improvement initiatives.

- On the Horizon - ARGA

- Appendix 1

- Appendix 2

- Appendix 3

- What Makes a Good Audit?

- Risk assessment and planning

- Execution – points arising from individual audit inspections

- Execution – points arising from review of firms' quality control procedures

- Completion and reporting

- Governance and leadership

- Performance monitoring and remediation

- Quality monitoring

- Resources – Methodology and technology

- Information and communication

- Appendix 4

- Appendix 5

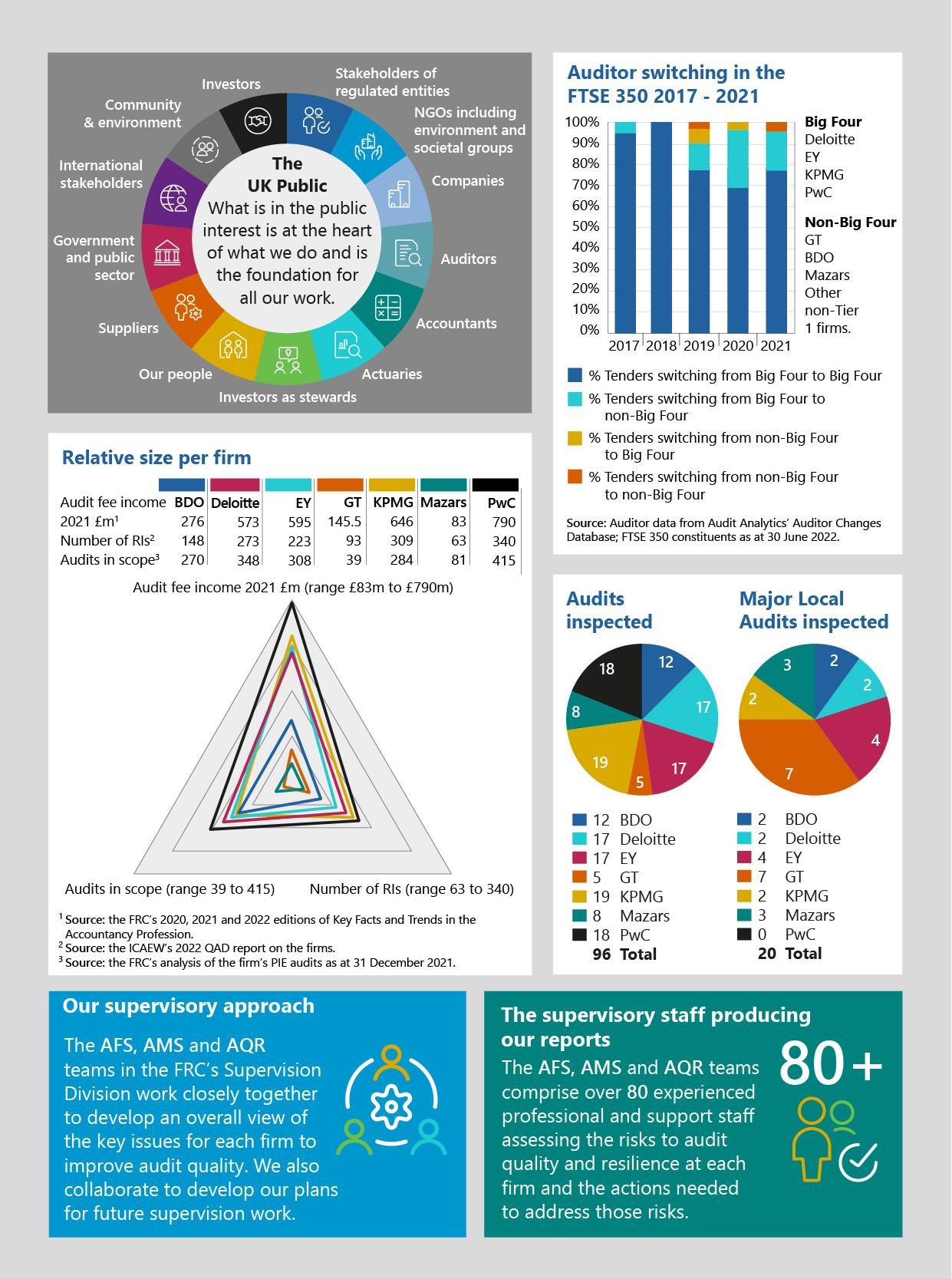

Our supervisory approach

The AFS, AMS and AQR teams in the FRC’s Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our plans for future supervision work.

The supervisory staff producing our reports

The AFS, AMS and AQR teams comprise over 80 experienced professional and support staff assessing the risks to audit quality and resilience at each firm and the actions needed to address those risks.

What is high audit quality?

The FRC defines high-quality audits as those that:

- provide investors and other stakeholders with a high-level of assurance that financial statements give a true and fair view;

- comply both with the spirit and the letter of auditing regulations and standards;

- are driven by a robust risk assessment, informed by a thorough understanding of the entity and its environment;

- are supported by rigorous due process and audit evidence, avoid conflicts of interest, have strong audit quality processes, and involve the robust exercise of judgement and professional scepticism;

- challenge management effectively and obtain sufficient audit evidence for the conclusions reached; and

- report unambiguously the auditor's conclusion on the financial statements.

1. Overview

Audit quality continues to improve at the largest audit firms and on the largest audits.

Based on the results of our individual audit quality inspections and other available quality data, audit quality continues to improve at the largest audit firms and on the largest audits, but still more improvement is required to deliver consistent audit quality.

Of the audits inspected, 75% were categorised as good or limited improvements required (71% in last year's public reports and 67% in 20/21).

We reviewed 96 individual audits across the seven Tier 11 firms this year. Five of the firms had no audits requiring significant improvements. Four of those firms showed an improvement in their overall inspection findings with over 80% of audits requiring no more than limited improvements.

Five firms had no audits requiring significant improvements.

The FTSE 100 audits are often the largest and most complex entities and of those audits inspected there was only one audit that required improvements and none that required significant improvements. Overall, this means that 93% (14 out of 15) were categorised as requiring no more than limited improvements, compared with 75% in 2020/21 and 64% in 2019/20. Of the 42 FTSE 350 audits we reviewed this year, we assessed 37 (88%) as achieving this standard, compared with 77% in 2020/21 and 71% in 2019/20, and for the FTSE 250 the figure is 85% (78% in 2020/21 and 74% in 2019/20).

Most of the audits we reviewed took place during the time that Covid-19 restrictions were in place and, given the challenges of remote auditing and hybrid working along with other factors such as insufficient resource, a steady improvement in audit quality is encouraging.

75%

Overall, an increasing number of audits inspected were categorised as good or limited improvement required.

The overall results from other measures of audit quality, covering a broader population of audits, are on the whole consistent with the FRC's findings, and they also show an improvement.

The results of the Quality Assurance Department of the ICAEW

The Quality Assurance Department of the ICAEW (QAD) reviewed 51 individual audits across the Tier 1 firms this year, weighted toward higher risk and complex audits of non-PIE entities within ICAEW scope. The results showed 90% of reviews carried out at five firms were graded good or generally acceptable. Further details are set out in Appendix 4.

The firms' internal quality monitoring review results

The firms also carry out their own internal quality monitoring reviews covering both PIE and non-PIE audits. This information can be seen for each Tier 1 firm in its individual report. Due to the firm's individual approaches and systems of grading, the results across the firms have not been consolidated in this report. Overall, these results are consistent with the FRC inspection results.

All Tier 1 firms are continuing to invest to improve audit quality.

All Tier 1 firms are continuing to invest to improve audit quality.

In our 2020/21 reports we said that the number of audits that we had assessed as requiring improvements remained unacceptably high and we detailed a number of actions that we required all the firms to take.

These actions included all firms continuing to develop their audit quality plans and root cause analysis (RCA) processes. We also said that a healthy culture within the audit practice that encourages challenge and professional scepticism was central to achieving consistent audit quality.

We are pleased that all firms have continued to invest in audit quality improvement, in particular by introducing or developing culture programmes and by developing their individual audit quality plans and RCA processes.

Examples of firms continued investment and improvement in audit quality include:

- Technology and the audit of the future – all firms are continuing to invest in technology such as new audit systems, data analytical tools and some are looking to the future of audit and developing AI tools.

- Methodology – in particular, there have been improvements made to banking methodology at a number of firms.

- Culture – all firms have started to develop culture programmes and, whilst they are at different stages within those programmes, the culture of challenge is central to the work the firms are doing.

- Resourcing – all firms are continuing to recruit and develop alternative solutions such as offshore delivery centres and virtual secondees (overseas secondments where the individual remains outside of the UK), to respond to a limited and competitive market.

Inspection results: arising from our review of individual audits

Bar chart: All inspections – Tier 1 (7 firms) (2017/18 - 2021/22)

This chart shows the percentage breakdown of audit inspection outcomes across all seven Tier 1 firms over five years.

- Good or limited improvements required (blue bars)

- Improvements required (light blue bars)

- Significant improvements required (dark blue bars)

The percentage of "Good or limited improvements required" audits were: 84% (2017/18), 91% (2018/19), 59% (2019/20), 73% (2020/21), 72% (2021/22).

Bar chart: All reviews – FTSE 100 (2017/18 - 2021/22)

This chart shows the percentage breakdown of audit review outcomes for FTSE 100 entities over five years.

- Good or limited improvements required (blue bars)

- Improvements required (light blue bars)

- Significant improvements required (dark blue bars)

The percentage of "Good or limited improvements required" audits were: 18% (2017/18), 18% (2018/19), 7% (2019/20), 15% (2020/21), 14% (2021/22).

Bar chart: All reviews – FTSE 250 (2017/18 - 2021/22)

This chart shows the percentage breakdown of audit review outcomes for FTSE 250 entities over five years.

- Good or limited improvements required (blue bars)

- Improvements required (light blue bars)

- Significant improvements required (dark blue bars)

The percentage of "Good or limited improvements required" audits were: 31% (2017/18), 30% (2018/19), 25% (2019/20), 21% (2020/21), 23% (2021/22).

The audits inspected in the 2021/22 cycle included above had year ends ranging from June 2020 to April 2021. We do not select audits for inspection on a statistical basis, so changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Line chart: All inspections – Tier 1 firms – Percentage assessed as good or limited improvements required (2017/18 - 2021/22)

This chart tracks the percentage of audits assessed as good or limited improvements required for individual Tier 1 firms over five years: BDO, Deloitte, EY, GT, KPMG, Mazars, and PwC. Lines vary showing fluctuations in performance for each firm.

Inconsistency still hampers firms from eradicating poor-quality audits.

Inconsistency still hampers firms from eradicating poor-quality audits.

Whilst a steady and sustained improvement is good, the improvement must speed up to meet the demands of the market.

Whilst a steady and sustained improvement is good (75% overall, up from 71% and prior to that 67%), the overall results must improve at a faster rate to meet the demands of the market.

During 2021-22 the most common inspection findings were often in areas where good practice was also identified. A number of them have also recurred from prior inspections.

Based on the number of firms where key findings were raised in those areas in the individual public reports, the most common findings were as follows:

Bar chart: Common inspection findings (Number of firms with these findings)

The chart shows the number of firms that had key findings in various areas:

- Estimates: 5 firms

- Impairment: 4 firms

- Revenue: 4 firms

- Ethics: 3 firms

- EQCR*: 3 firms

- Group audits: 2 firms

- Journals: 2 firms

*ECQR = Engagement Quality Control Review

Further details of these common findings, along with comments on areas of focus in the 2021-22 inspection cycle, are set out in Appendix 1.

During 2021-22 the most common good practices, based on the number of firms where these observations were raised, were as follows:

Common good practices on inspections

Bar chart: Common good practices on inspections (Number of firms with these good practices)

The chart shows the number of firms that demonstrated good practices in various areas:

- Group audits: 5 firms

- Fraud risk: 4 firms

- Climate risk: 3 firms

- Impairment: 3 firms

- Revenue: 3 firms

- Experts: 3 firms

- Contracts: 2 firms

- EQCR*: 2 firms

- Deferring audit report: 2 firms

- AC** reporting: 2 firms

ECQR = Engagement Quality Control Review *AC = Audit Committee

Further details of these good practices, examples of what good looks like, are set out in Appendix 3.

Findings and good practice examples arising from our review of the Tier 1 firms' quality control procedures are set out in Appendix 2 and Appendix 3 respectively.

Details of the prior year (2020/21) inspection findings and good practices were published on 27 May 2022, and are included in the following:

Key Findings Reported in 2020/21 Inspection Cycle

Good Practices Reported in 2020/21 Inspection Cycle

This was to provide enhanced transparency and facilitate a discussion with stakeholders on the nature and context of inspection reporting. Depending on stakeholder feedback, similar reports may be issued in future years.

The inspection results at two firms (BDO and Mazars) remain unacceptable.

Some firms have been growing too fast, picking up higher risk audits being dropped by their peers, without adequate controls to ensure high quality audits.

These firms have been growing too fast, picking up higher risk audits being dropped by their peers, without adequate controls to ensure high quality audits.

BDO and Mazars continue to grow and, given this and the results of their inspections in 2020/21, we again increased the sample of audits we selected for review at each firm. Four of the eight audits that we reviewed at Mazars and five of the 12 audits that we reviewed at BDO needed more than limited improvements. Three and four audits at Mazars and BDO respectively needed significant improvements. These results are worse than last year and suggest a downward trend which is unacceptable.

At both firms, the findings that drove our assessment that audits needed more than limited improvements were among the common key findings noted above. At Mazars, poor first year audits continue to lead to the lower grades in some cases, and initiatives to improve quality control on engagements need further consideration. At BDO the audit of revenue, the audit of financial services entities, and challenge in key judgement areas led to lower grades, with further findings on the need to improve quality control on engagements.

The Financial Reporting Council highlighted concerns at both of these firms in the 2021 reports and these firms must therefore take further actions to improve audit quality as a matter of urgency.

Specific supervisory plans have been developed, as outlined in their individual reports, to monitor closely BDO and Mazars' priority actions. This includes increasing the number of audits inspected at each firm and requiring the firms to take specific targeted actions related to their quality control processes. Each firm's Supervisor will then monitor the actions these firms are taking, challenging where the action is not effective.

The Financial Reporting Council plans for supervision require these firms to continue to take action. Specifically, each firm has performed RCA on inspection findings and created actions such as:

- Developing approaches to manage the growth and complexity of the firm's audit portfolio.

- Strengthening of the firm's processes for quality control including the appropriateness of risk-based selection of partners and Engagement Quality Control Review (EQCR) partners and role-specific training.

- Further considering audit client take on processes to ensure resourcing plans appropriately respond to higher risk audits.

- Embedding expanded central support teams.

Management of audited entities and their audit committees are also a critical element of a high quality audit and financial reporting ecosystem.

We acknowledge that, whilst the firms must continue to improve the quality of their audits, other participants in the financial reporting ecosystem have a role to play. For example, a well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. Management of audited entities and their audit committees must ensure information provided to the auditors is high quality and timely.

How can audit committees and other stakeholders in the ecosystem help to improve audit quality?

- Management of audited entities and their audit committees must ensure, or in some cases improve, the quality and timeliness of information provided to the auditors.

- Audit committees can and should challenge management and hold them to account on delivering high-quality information to the auditors.

- Where possible audit committee chairs should offer the opportunity to investors to discuss the approach to audit quality and potentially the appointment of auditors.

- Audit committee chairs should continue to engage with the FRC to further develop our inspection reports on individual audits to ensure they fully meet their needs.

- In tendering discussions or when discussing the audit plan with the auditor, audit committees should challenge firms to demonstrate to the committee that they are responding positively to the findings in the individual firm report and this Overview Report.

- When an audit firm presents their audit findings to the audit committee, the committee should seek assurance from the firm that a rigorous audit, focused on quality, has been performed.

The FRC believes that higher risk entities must be audited by audit firms with the resources and robust quality control procedures to deliver a high-quality audit.

The FRC believes that higher risk entities must be audited by audit firms with the resources and robust quality control procedures to deliver a high-quality audit. It is not in the public interest if the most challenging audits are undertaken by firms without the capacity and skills to deliver at the level of quality that an entity requires.

We saw examples of certain Tier 1 firms de-risking their audit portfolios, with the work transferring to smaller firms with a poorer track record of delivery in those types of audits.

We expect firms to achieve high-quality audits regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

It is not in the public interest for firms to resign from challenging audits without having sought to address weaknesses, such as in an entity's governance and internal controls, through all available mechanisms so they support the delivery of a high quality audit, including thorough engagement with those charged with governance and management and complete and transparent auditor's reports setting clear expectations on how to address those weaknesses.

When resigning from the audit is the only remaining option, firms can do more to clearly and transparently communicate the reasons for doing so, including their risks and concerns, to better inform the entity's shareholders and other stakeholders and any incoming auditors.

We are also concerned about the impact of portfolio de-risking on firms outside of Tier 1, and the potential consequence of companies in the public interest not having access to auditors. We are continuing to increase our supervision focus on Tier 2 and Tier 3 firms and will report publicly on this area of our work later in 2022.

As firms continue to improve, we will seek to reduce the number of inspections carried out at those firms in proportion to their share of audits in our scope.

We will continue our supervision of the remaining five Tier 1 firms during 2022/23, holding them to account on specific actions to be taken by each firm to improve audit quality. As firms continue to improve, we will seek to reduce the number of inspections carried out at those firms in proportion to their share of audits in our scope.

In our 2020/21 reports, three firms were highlighted as needing targeted or increased supervision, BDO and Mazars, plus KPMG.

The focus at KPMG remained on banking audits and close monitoring of actions taken to improve audit quality in time for 2021 year-end audits. This year, the results of our inspections of KPMG's individual audit inspections have significantly improved, which is encouraging, but is not yet a trend. We will continue to monitor the firm closely with a continuing focus on banking audits.

Additionally this year, EY's results show a year-on-year decline with more findings and audits requiring improvement in the non-FTSE 350 audits. It is too early to determine whether this is a trend. Our targeted supervision at EY will continue to focus on the inspection of non-FTSE 350 audits and the actions taken to address the root causes for related inspection findings

At Deloitte, GT and PwC the individual audit inspection results were all over 80%, showing an improvement on the prior year, and there is evidence that this is a positive trend. There is, however, more that can be done by these firms to achieve continuous improvement and risks for them to manage such as shortage of resources.

For all Tier 1 firms we will continue to monitor and analyse the firms' resources, along with their solutions to insufficient resource such as the use of offshore delivery centres and virtual secondees working from outside of the UK.

In all the supervisory responses detailed above, we recognise our role in the ecosystem and will continue to serve the public interest by holding to account those responsible for delivery of corporate reporting and auditing. We will continue to play our part in improving quality and resilience and thus seek to restore trust through our increasingly assertive supervisory approach. We have and will continue to promote improvements and innovation in the areas for which we are responsible, exploring good practice with a wide range of stakeholders as an improvement regulator.

All stakeholders should expect that no audits are assessed as requiring significant improvements.

We believe that all stakeholders should expect no audits undertaken by Tier 1 firms to be assessed as requiring significant improvements.

Firms should also aspire to a continuation of the improvement in the overall position, reducing the number of audits assessed as needing improvements.

Our forward-looking supervision work provides us with a holistic picture of each firm's approach to audit quality, resilience, and the future development of their audit quality improvement initiatives.

To improve audit quality, there are additional areas for the firms to focus on beyond those that directly impact individual audits.

We generally report privately to the firms or in thematic reports to share good practice, but the following areas are a significant focus of our forward-looking supervision and are areas on which we also expect the firms to continue to focus:

Single Quality Plan

Each firm monitors the implementation of a wide range of actions each year with the aim of improving audit quality. The source of these actions includes various teams within the FRC, QAD and the firm's internal quality monitoring process as referenced in the individual firm reports. There are numerous other sources of action plans, ranging from the outcome of RCA to actions needed in response to a firm's overall audit strategy and plan.

We will work with each Tier 1 firm to develop a Single Quality Plan (SQP) that pulls together the numerous strands of audit quality actions and monitors and prioritises those actions. As these SQPs are further developed, we will introduce formal reporting to the FRC of progress in respect of the SQP and will challenge the firm to ensure important milestones are met and to develop mechanisms to assess the effectiveness of audit quality initiatives in driving high quality audit. Over the next year, we will review these plans in their totality and draw conclusions on how and when the Tier 1 audit firms can be expected to have delivered the further audit quality improvements necessary to ensure high quality audit consistently.

International Standard on Quality Management

ISQM (UK) 1 (ISQM 1) is the new international standard on quality management that sets out the firm's responsibility to design, implement and operate a system of quality management for audits of financial statements, or other assurance or related services. ISQM 1 replaces the extant standard of quality control (ISQC 1) with an effective date of December 15, 2022. By the effective date, firms must have established their quality objectives, identified and assessed the risks to meeting those objectives, and designed and implemented their responses to address such risks.

During the first half of 2021, we performed a pre-implementation review to assess the preparedness of the Tier 1 firms to meet the effective date. Our main objective was to understand the firms' implementation plans and identify, at an early stage, if any firm appears to be less advanced in their preparations so we can encourage prompt action. This work also allowed us to ask 'pointed questions' of the firms to ensure that they have thought about key aspects of the standard in a timely manner.

We continue to monitor the firms' preparedness and will increasingly assess the appropriateness of the design of their system as we approach the implementation date, including in the following key areas: identification of quality objectives, assessment of and responses to quality risks, arrangements to evaluate network services and requirements and use of service providers.

Culture

An audit firm must have a culture focused on the public interest role of audit and promoting behaviours correlating to high quality audit (for example, exercising professional scepticism and the courage to challenge an audited entity's management).

During the first half of 2022 we performed a thematic review of how audit firms create an environment that promotes professional scepticism and challenge. We identified good practice in relation to training and communication from leadership and areas for improvement in relation to alignment of reward and recognition with desired behaviours. The biggest barrier to professional scepticism and challenge continues to be a lack of time and resources and we are challenging firms on how they are addressing this through their operating model and project management.

Some firms are at the start of their culture journey, still developing their awareness of culture, behaviours and the link to audit quality, whereas some firms have established culture programmes that have been in place for several years.

Our report will be published in the early autumn. Additionally, we have recently published professional judgement guidance for auditors2.

Audit Firm Governance Code

The governance structures of each of the Tier 1 firms are all very different and this variation is permitted by the Audit Firm Governance Code (AFGC). For example, the structures of some firms are heavily influenced by their global networks, whereas other firms belong to networks that have fewer implications for UK governance.

Some of the firms have created separate CEO and Chair of the Board roles, which we welcome. Separation of the roles of CEO and Chair of the Board is a fundamental of good governance, the rationale being that each postholder is a check and balance on the other.

Operational Separation

Operational Separation aims to ensure that the audit practices of the four largest firms are focused, above all, on the delivery of high-quality audits in the public interest. All four firms have started their transition to operating the audit practice separately from the rest of the firm and have taken a number of steps to implement the principles of Operational Separation including the restructuring of their governance framework, forming an audit governance body, appointment of Audit Non-Executives (ANEs), and their work on promoting a differentiated audit culture.

The requirements do not apply to the three remaining Tier 1 firms, but we have been pleased to see each taking steps to consider the principles and forming or being in the process of forming audit governance bodies and appointing ANEs.

Audit Quality Indicators

The Financial Reporting Council is consulting on public reporting of firm-level Audit Quality Indicators (AQIs)3, which are measured on a consistent and comparable basis; this will broaden the range of information regarding audit quality available to audit committees and other users of audit services. The publicly-reported AQIs can be used by Audit Committee Chairs to have richer conversations, especially when tendering for new auditors, including being able to compare the four largest firms with challengers on a range of metrics. The consultation will be running until mid- August.

PIE Auditor Registration

The Financial Reporting Council supervises all audit firms of Public Interest Entity (PIE4) audits with a view to ensuring that they deliver high quality audit consistently and that the audit firms are operationally and financially resilient. Separating PIE Auditor Registration from the activities of the RSBs augments the FRC's Supervisory toolkit and enables it to become increasingly assertive in holding audit firms and Responsible Individuals to account.

The FRC's consultation on the PIE Auditor Registration Regulations closed in May 2022 and responses are being considered, ahead of the registration process going live later in 2022.

On the Horizon - ARGA

On 12 July 2022 The Financial Reporting Council (FRC) published a Position Paper5 setting out the next steps to reform the UK's audit and corporate governance framework. The paper follows the Government Response to the consultation on strengthening the UK's Corporate Governance, Corporate Reporting and Audit systems, including the creation of the Audit, Reporting and Governance Authority (ARGA), to replace the FRC. The document builds on the areas of the Government Response that fall within the FRC's remit, providing advanced clarity for stakeholders on how the work of reform will be delivered ahead of government legislation.

Specifically in respect of audit, the Position Paper emphasises the following:

"Audit has been the subject of significant regulatory activity and intense political and public scrutiny in recent years. The fundamentals of what an audit is will remain unchanged, as the Government has chosen not to expand the scope of an audit. However, we will consult on changes to address some of the policy points in the Government Response through revisions to standards, including revisions to our Ethical Standard to reflect stakeholder feedback, evidence gathered through our inspection programme and our enforcement work. There are also significant changes to ethical requirements driven by changes to the International Code of Ethics, not least a revised global public interest entity definition, which includes market traded entities. We have already taken forward a project to develop a Professional Judgement Framework, which we published on 23 June. This will help with the application of professional judgement in the context of an audit, which was recommended in the Brydon Report. Our Supervision division will continue to build on its engagement and outreach with Audit Committees, seeking improvement in audit quality outcomes and we will continue to work on non-legislative developments in our Audit Quality Review team, with a view to providing a more effective and efficient AQR process. Supervision will also implement the new PIE auditor registration process and undertake a project on improving auditor education.”

Appendix 1

Inspection results: arising from our review of individual audits

During 2021-22 the most common inspection findings, based on the number of firms where key findings were raised in those areas in the individual public reports, were as follows:

Estimates (including provisions)

Audit teams should adequately assess and challenge management's judgements relating to estimates and perform appropriate procedures to respond to the relevant risks.

We identified examples where the audit teams had not adequately tested the basis of the estimates or had not challenged management sufficiently with regards to the robustness of the estimates (in particular provisions) including in relation to:

- Expected credit loss (ECL) provisions, in particular in relation to the testing of significant increases in credit risk (SICR), ECL models and post model adjustments.

- The completeness of onerous contract and uncertain tax provisions.

- Reliance on the internal experts work for net retirement obligations.

Impairment

Changes to key assumptions in impairment assessments could result in an impairment. Auditors should therefore sufficiently evaluate and challenge management's assumptions and cash flow forecasts for these assessments.

We identified examples where the audit teams did not adequately evaluate and challenge management's impairment assessments, including in relation to the:

- Short-term growth rates, in particular where there was significantly lower growth recorded in recent actual results.

- Discount rates - including consideration of the cost of debt on a pre or post-tax basis in the discount rate calculation.

- The inputs and calculations in the impairment models.

Revenue

Auditors should obtain sufficient and appropriate audit evidence to assess whether revenue is accurately recognised in the financial statements.

We identified examples where the audit teams did not obtain sufficient audit evidence over the revenue recognised, for example:

- Long-term contracts, including inadequate challenge of significant judgements and accounting treatment.

- Sample testing, including where some of the revenue had not been subject to sample testing.

- Substantive analytical procedures, including not corroborating material differences identified or not adequately setting the expectation for the level of revenue.

Ethics

The FRC Ethical Standard ("the Standard”) sets out principles and requirements in relation to independence and objectivity for audit firms and teams. The auditors should appropriately apply the FRC Ethical Standard, particularly in relation to the approval of non-audit services.

We identified examples where the audit teams did not adequately apply the Ethical Standard or did not adequately consider the objective, reasonable and informed third party test, including the following examples:

- Insufficient evidence that the audit team had adequately assessed the independence threats from the provision of non-audit services.

- Not consulting with the Ethics partner, as required by the Standard, where the ratio of non-audit to audit fees exceeded 1:1.

- Insufficient challenge and consideration of the independence threats in considering whether a former managing partner of the component auditor had been a covered person.

EQCR

An Engagement Quality Control Review (EQCR) should provide an objective assessment and challenge of significant audit judgements made by the audit team.

We identified examples where there was insufficient evidence of the EQCR partner's review and challenge of the audit team throughout the audit process. These included:

- Insufficient review procedures by the EQCR partner, including not identifying inadequate audit procedures for significant risk areas.

- Insufficient evidence of discussions between the EQCR partner and the key audit partners of significant components on group audits.

Group audits

The group audit partner and team is responsible for the oversight of the group audit, including audit work at a component level, and needs to demonstrate sufficient involvement throughout the audit.

We identified examples of insufficient evidence that the group audit team had adequately assessed the work of the component auditors, including the audit approach adopted. Also, audit teams did not always adequately communicate their involvement in, and level of oversight of, the component audit to the Audit Committee.

Journals

Auditors should perform appropriate testing of journals as one of the key audit procedures in response to the risk of management override.

We identified examples of weaknesses in the procedures performed over journal entries, including inadequate:

- Testing of the completeness of the journals.

- Evidence obtained to support certain high-risk journals.

- Justification as to the level of untested journals that met certain high risk fraud criteria.

Inspection areas of focus

As part of the 2021-22 inspections of individual audits, we paid particular attention to the audit work in the following areas, due to their continuing or heighted risk:

Covid-19 impact

We highlighted in our public reports last year how the firms had responded positively to the increased risk arising from Covid-19, especially in relation to the audit of going concern. In 2021-22 we considered, in particular, how the firms responded when auditing going concern, impairment of assets, inventory and group audits.

Our inspections have showed that the firms have continued to respond positively to Covid-19 and further refine their procedures around responding to Covid-19 risks, contributing to a number of good practices identified in the audits we inspected, including examples of:

- Going concern: effective challenge of management's assumptions, for example, use of external sources to evaluate projected growth rates;

- Impairment of assets: robust challenge of management assumption's supporting their impairment assessments; and

- Group audits: remote reviews of component audit files and interaction with component audit teams, and focused group instructions on how component audit teams should respond to Covid-19 risks.

At the same time, we raised key findings for impairment and group audits at certain firms. These issues continue to recur at certain firms and, while we have seen good practice in relation to the response to Covid-19, this has not been consistent for these areas across the audits we inspected.

Climate risks

- Following the publication of the FRC Climate thematic review in 2020, climate risk has been an area of focus. In 2021-22, on all audits inspected, as a minimum, we covered the audit team's assessment of climate related risks.

- In our inspections we observed an increased engagement by most audit teams with climate related risks, with a notably more visible footprint of consideration at the risk assessment stage. We identified some cases of good practice, for example, where audit teams performed detailed climate related risk analyses on each area of the financial statements. We also observed examples of good use of central resources, such as templates and industry guidance, as well as involvement of specialists at the risk assessment stage.

- We also noted that certain audit teams were not performing sufficiently thorough procedures at the risk assessment stage, not often considering the breadth of climate change implications for the entity. In other cases, we observed audit teams not following up sufficiently on how their climate change observations impacted the risk assessment and audit response. For example, not responding sufficiently to the potential impact of identified flood risks on expected credit losses of a material loan portfolio.

Fraud risks

During our 2021-22 inspections we observed that firms increased their guidance and training in relation to fraud risk assessment. We identified good practice relating to the extent and strength of the firms' training on fraud risk factors and awareness, increased access to external analysis, required use of financial ratio analysis in risk assessments, good examples of potential procedures to respond to fraud risks, and increased use of forensic specialists.

We identified examples of good practice on the audits we inspected, primarily at the planning and risk assessment stages, in respect of the use of forensic specialists in the risk assessment process and evidencing particularly comprehensive partner-led fraud discussions and fraud risk assessments.

We also raised findings in this area, including examples of audit teams not sufficiently demonstrating that they:

- Held robust partner-led fraud discussions inquiries with management and those charged with governance.

- Ensured that their audit risks took into consideration fraud risk factors identified at planning or arising during the audit.

- Ensured that their audit procedures were responsive to the fraud risks identified, particularly in respect of journal entry testing and cash testing.

Appendix 2

Inspection results: arising from our review of the Tier 1 firms' quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to fair value of financial instruments; and internal quality monitoring arrangements.

The table below provides an outline of the review procedures we performed on four areas of the firms' quality control arrangements and an overview of our findings. The work was primarily based on the policies and procedures the firms had in place at 31 March 2021:

| Review procedures performed on the firms' quality control arrangements | Overview of the key findings identified |

|---|---|

| Implementation of the FRC's Revised Ethical Standard (2019). | All firms need to improve the guidance for auditors and their Ethics Functions on how to more consistently consider the perspective of an Objective Reasonably Informed Third Party when taking decisions relating to ethics and independence. |

| We evaluated the firms' actions to implement the Revised Standard including: | |

| * changes to policies and procedures; and | We also identified some firm specific key findings. |

| * the support provided to audit teams to aid the transition (for example, communications, guidance and training events). | |

| EQCR, consultations and audit documentation | We identified four firms that need to improve their EQCR processes. For three of these firms our reviews of completed audits also identified quality control issues. |

| Our inspection included a review of the firms' policies and procedures in relation to: | Two firms had key findings relating to their arrangements to ensure that completed audit work is archived promptly. |

| * the appointment of EQCR reviewers and the training provided to them in order to perform their role; | We identified no key findings in relation to the firms' arrangements for auditors to consult with their central technical teams. |

| * auditors consulting with the firms' central quality teams on difficult or contentious matters; and | |

| * the firms' arrangements relating to the assembly and timely archiving of final audit files. | |

| Audit methodology | We found that four firms need to issue methodology and improve the quality and extent of IFRS 13 guidance in relation to auditing the fair value of financial instruments for banks and similar entities. |

| We evaluated the quality and extent of the firms' methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities. | |

| Monitoring - Internal quality monitoring | We found that several firms must improve the timeliness of their monitoring so that findings can be communicated to the audit practice in time for next year's audits. |

| We evaluated key aspects of the firms' annual processes to inspect the quality of completed audits. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring teams. | We also identified that all firms need to ensure that the professional judgements made by their reviewers are recorded to support the depth of their review and the conclusions reached. |

Appendix 3

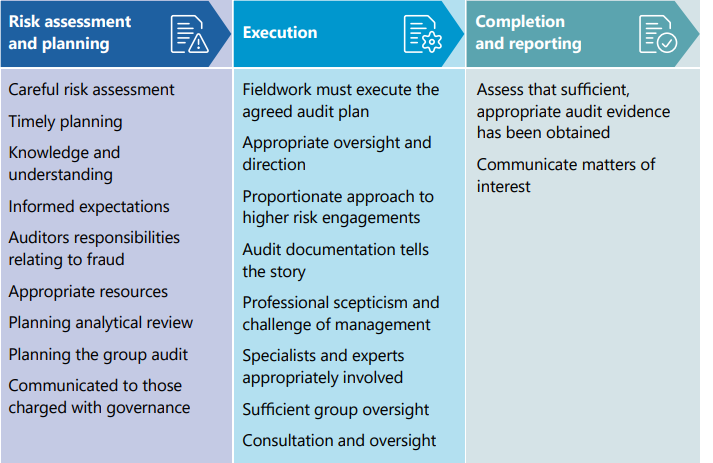

What Makes a Good Audit?

In 2021 we published a document called "What Makes a Good Audit?", setting out our experience of what a 'good audit' looks like based on our recent file inspections.

Good practices were identified across all firms during our inspection of both individual audits and of the firms quality control procedures.

Figure 1 - taken from What Makes a Good Audit? - highlights some of the key aspects which, when done well, contribute significantly to the delivery of a good audit.

Figure 1 - Key Aspects of the Audit Process

| Risk assessment and planning | Execution | Completion and reporting |

|---|---|---|

| Careful risk assessment | Fieldwork must execute the agreed audit plan | Assess that sufficient, appropriate audit evidence has been obtained |

| Timely planning | Appropriate oversight and direction | Communicate matters of interest |

| Knowledge and understanding | Proportionate approach to higher risk engagements | |

| Informed expectations | Audit documentation tells the story | |

| Auditors responsibilities relating to fraud | Professional scepticism and challenge of management | |

| Appropriate resources | Specialists and experts appropriately involved | |

| Planning analytical review | Sufficient group oversight | |

| Planning the group audit | Consultation and oversight | |

| Communicated to those charged with governance |

Examples of good practice identified in each part of the audit process, in the audits we reviewed, include the following:

Risk assessment and planning

Fraud risk assessment

- A comprehensive, partner led discussion on fraud risk involving the full audit team and fraud specialists

- Use of unpredictable audit procedures by the audit team

Climate risk assessment

- Detailed risk assessment of the impact of climate change on both the accounting and disclosures within the financial statements and involvement of specialists

Execution – points arising from individual audit inspections

Group audit oversight

- Clear evidence of oversight and interactions of the group audit team with the component audit teams, including a summary of the challenges raised and their resolution.

Impairment assessment

- Demonstration of a good level of professional scepticism, which included the use of look-back procedures to support the carrying value of goodwill and intangible assets.

Audit of revenue

- Thorough testing of the completeness of revenue and detailed understanding and assessment of complex agreements with third parties.

- Use of bespoke data analytic procedures, which provided strong assurance over high volume, complex revenue streams.

Use of experts

- Comprehensive evaluation of, and interaction with, internal property valuation experts, including the assessment of the reasonableness of yields and assumptions used.

- Good engagement with valuation experts to assess assumptions for investment valuations and pension scheme liabilities valuations.

- Effective involvement of business and restructuring specialists to assist in the assessment of going concern assumptions.

Long term contracts

- Robust challenge of management's accounting for project costs and loss provisioning.

- Engagement of infrastructure specialists to assist with the audit of certain construction contracts, contributing to a robust level of challenge over the contract forecasts and accounting.

Execution – points arising from review of firms' quality control procedures

Consultations

- Robust process for monitoring consultations by central specialists to identify topics where additional guidance or training would be beneficial for a wider audience.

- Monitoring of mandatory consultations through the internal quality monitoring process.

Ethics

- Oversight from the UK firm's Ethics Function on non-audit fee information from the network's global finance system for all approved services to UK PIEs and their international subsidiaries.

- Detailed guidance for group audit teams on conditions that could compromise independence of non-network and network firms.

Audit documentation

- Shortening of the archiving period for audit teams to assemble the audit file to a maximum of two days and spot checks from the central quality control team on a sample of files to ensure the correct archive date.

- Audit software that requires each audit working paper to be re-reviewed when it has been modified, including in the period after the audit report date.

Completion and reporting

Engagement Quality Control Review (EQCR)

- Good evidence of EQCR, including the challenge of the financial statements across a range of significant risks.

Deferring audit sign-off

- Delay in issuing the auditor's report until satisfied that sufficient and appropriate audit and quality control procedures were completed.

Audit Committee (AC) reporting

- Extensive quality and detail of information provided to the Audit Committee to understand the nature and complexity of the audit issues.

- Inclusion of a section on quality indicators, to inform the Audit Committee on where management should focus their attention and highlight where processes worked well.

- Inclusion in the Audit Committee report of graphical representations of the audit team's assessment of management's key assumptions.

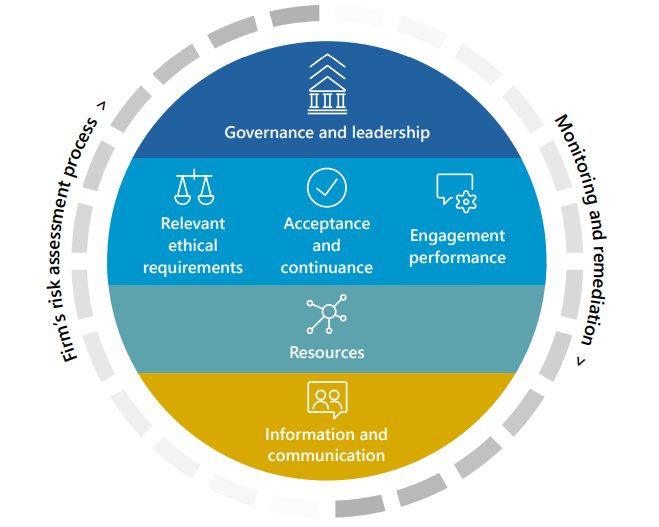

Figure 2 - again taken from What Makes a Good Audit? - shows the key components of a system of quality management

Figure 2 - Key Components of a System of Quality Management

We performed work on four areas of the firms' quality control arrangements within the following components of their systems of quality management, identifying the following examples of good practice in our review of the Tier 1 firms' quality control procedures:

Governance and leadership

- High quality, clear and consistent communications around the importance of audit quality, ensuring that the messages from the top are distributed through the firm.

- Regular provision of audit quality plans and other relevant material to the Audit Non-Executives (ANEs) and/or Independent Non-Executives (INEs). Well facilitated meetings with evidence of challenge from the ANEs and/or INEs and requests for 'deep dives' on specific areas.

Performance monitoring and remediation

- Comparing key findings in some audits to good practices in the same areas on other audits has led to more understanding of inconsistent audit quality and more specific, targeted actions.

- Additional focus on the characteristics of a good audit and related root causes being compared to poor graded audits with similar risks, to analyse what has worked better for one team compared with another. The results of this comparison suggest that team attributes such as a strong team dynamic and shared responsibility lead to better quality outcomes.

- Expanding the scope and coverage of reviews to capture firm-wide findings and good practices and to include other types of inspections (for example, audits with prior period adjustments).

- Increasing the role of audit quality indicators (AQIs) as predictive quality indicators, a key RCA input, and a tool for management at an engagement and firm-wide level.

Quality monitoring

Internal Quality Monitoring

- Full internal quality monitoring review of audit partners on a frequent basis (every two years, and for financial services audit partners every year).

- Monitoring, in the following year, of the effectiveness of the actions taken to remediate findings in audits with adverse quality assessments.

- Performing thematic reviews on selected key topics which have a wide scope and coverage

- Requiring a follow-up for all audits graded as improvements or significant improvements required (or equivalent grading) to ensure the remediation of findings.

- Requiring all grading decisions, including where no findings have been raised, to go through a moderation panel.

Resources – Methodology and technology

Methodology

- Having comprehensive and high-quality model risk management specialist guidance on how to assess valuation differences, independently assess valuation tools, perform a robust risk assessment and test model risk management controls.

- High standard guidance for auditing IFRS 13 disclosures, over and above baseline financial statement close process procedures.

- Developing clear guidance on auditing complex valuation adjustments which includes examples of the key audit procedures to perform over the different types of adjustment.

- Providing illustrative examples of good practice disclosures within the disclosure guidance.

Information and communication

- Making lengthy, difficult to read transparency reports more accessible (for example by publishing digitally with video content) and enabling more engagement with the key content of these and similar reports.

Appendix 4

Monitoring review by the Quality Assurance Department of ICAEW

The firms are subject to independent monitoring by the Institute of Chartered Accountants in England and Wales (ICAEW), undertaken under delegation from the FRC as the Competent Authority. The ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. The ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher-risk and potentially complex audits within the scope of ICAEW review.

ICAEW has undertaken monitoring reviews in 2021 on Deloitte LLP, Ernst & Young LLP, KPMG LLP, Mazars LLP and PricewaterhouseCoopers LLP and the reports summarising the audit file review findings and any follow up action proposed by each firm will be considered by ICAEW's Audit Registration Committee in July 2022.

Summary

90%

An increasing number of ICAEW reviews were assessed as either good or generally acceptable.

Overall, the quality of audit work we reviewed across all five firms was of a good standard, with 90.2% of reviews graded either good or generally acceptable.

Of the 51 files the ICAEW reviewed, four required improvement and one file required significant improvement. In several cases the issues related to areas of an audit with good practice identified elsewhere in that firm, demonstrating the challenge of ensuring audit work is always performed of consistent quality across a high number of audited entities by large and diverse teams of audit partners and staff.

In 2021, audits required improvement or significant improvement for the following broad reasons:

- Insufficient challenge by audit teams to potentially incorrect accounting treatment of significant balances or transactions in the financial statements.

- Weaknesses in the completion of certain audit procedures such as substantive analytical review or controls work leading to a lack of audit evidence.

It is also important to note that several of these audits also exhibited some good practice, showing that the challenge of consistency applies within a single audit as well as across a firm or even multiple firms.

Good practice seen in 2021 included:

- Depth in the understanding of the audited entity and audit risk assessment.

- Robust challenge of management on key judgements including in relation to going concern, stock provisions and impairment models.

- Comprehensive documentation of audit work in key risk areas such as revenue and valuations.

- High quality reporting to management and those charged with governance.

Results

Combined results of ICAEW's reviews at the largest audit firms6 for the last three years are set out below.

Bar chart: ICAEW Review Outcomes (2019-2021)

This chart shows the percentage breakdown of ICAEW review outcomes for the largest audit firms over three years.

- Significant improvement required (dark blue)

- Improvement required (light blue)

- Good / generally acceptable (blue)

In 2019: 3% Significant, 53% Improvement, 44% Good/Generally Acceptable. In 2020: 2% Significant, 5% Improvement, 53% Good/Generally Acceptable. In 2021: 1% Significant, 4% Improvement, 46% Good/Generally Acceptable.

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Appendix 5

FRC audit quality objective and approach to audit supervision

FRC's objective of enhancing audit quality

The Financial Reporting Council is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

This report

This report sets out the FRC's overview of findings on key matters relevant to audit quality at at the seven Tier 1 firms. As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firms' quality control systems.

In 2021/22 our inspections focused on the following priority sectors and audit areas7:

| Sectors | Audit Areas |

|---|---|

| * Travel, Hospitality and Leisure | * Covid-19 Impact (including going concern, impairment of assets, inventory and group audits) |

| * Retail | * Estimates |

| * Property | * Fraud Risk |

| * Financial Services | * Climate Risk |

Our firm-wide inspection work in 2021/22 focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to fair value of financial instruments; and internal quality monitoring arrangements.

In 2022/23 our inspections will focus on the following priority sectors and audit areas8:

| Sectors | Audit Areas |

|---|---|

| * Travel, Hospitality and Leisure | * Climate-related risks |

| * Retail | * Fraud risks |

| * Construction and Materials | * Cash and cash flow statements |

| * Gas, Water and Multi-utilities | * Provisions and contingent liabilities |

| * Impairment of assets | |

| * Revenue | |

| * Group audits |

Our firm-wide inspection work in 2022/23 will focus primarily on partner and staff matters, including performance appraisals and reward decisions, acceptance and continuance (A&C) procedures for audits, implementation and compliance testing of the FRC's Revised Ethical Standard (2019) and audit methodology (settlement and clearing accounts for banks and similar entities).

At the conclusion of all individual audit inspections that are assessed as requiring more than limited improvements, we will consider whether the audit should be referred for consideration under the Audit Enforcement Procedure (“AEP”)9. The Case Examiner then decides on the appropriate course of action, which may involve Constructive Engagement with the audit firm to resolve less serious potential breaches of auditing standards and other requirements or referral to the FRC's Conduct Committee to consider whether an investigation should be opened. An investigation may result in financial and non-financial sanctions being imposed on an individual statutory auditor and/or the statutory audit firm. The FRC publishes details of all sanctions imposed. From our 2021/22 inspections, 11 audits have so far been referred to the Case Examiner (compared to 15 from our 2020/21 inspection cycle). The FRC's Annual Enforcement Review, published annually in late July, will contain further details of audits considered under the AEP.

As well as planned supervision and inspection activities, we also respond quickly to emerging issues. For example, during 2021/22 we responded to Covid-19 by issuing guidance to audit firms (and companies) and carrying out a thematic review of the audit of going concern which included inspecting samples of audit work. Our findings were that firms had reacted well to the new challenges. In 2022/23 our areas of focus include climate related risks as noted above.

Financial Reporting Council

8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

Legal Disclaimer

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

The Financial Reporting Council Limited 2022

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Footnotes

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP (EY), Grant Thornton UK LLP (GT), KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP (PwC). We have published a separate report for each of these seven firms. ↩

-

https://frc.org.uk/news/june-2022-(1)/frc-publishes-first-of-its-kind-professional-judge/frc-publishes-first-of-its-kind-professional-judge) ↩

-

https://frc.org.uk/news/june-2022-(1)/frc-seeks-stakeholders'-views-on-publicly-available/frc-seeks-stakeholders'-views-on-publicly-available) ↩

-

Public Interest Entity - in the UK, PIEs are defined in the Companies Act 2006 (Section 494A of the Companies Act 2006.) as: - Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market". In the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.) - Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England) - Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩

-

https://www.frc.org.uk/getattachment/aafabbc3-81a3-4db3-9199-8aaebb070c7f/FRC-Position-Paper-July%202022.pdf ↩

-

Results of five firms in 2021 and 2019 (Tier 1 excluding BDO LLP and Grant Thornton UK LLP) and six firms in 2020 (Tier 1 excluding Mazars LLP). ↩

-

https://www.frc.org.uk/news/december-2020/frc-announces-its-thematic-reviews,-audit-areas-of ↩

-

https://www.frc.org.uk/news/december-2021-(1)/frc-announces-areas-of-supervisory-focus/frc-announces-areas-of-supervisory-focus) ↩

-

Other procedures apply to audits of non-UK entities (such as those incorporated in the Crown Dependencies). ↩