The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

MoU between FRC and SFO

Introduction

1The Serious Fraud Office (SFO) and the Financial Reporting Council (FRC) ("the parties") are committed to working together in the public interest to achieve the appropriate outcomes in the investigation and prosecution of fraud and bribery and corruption offences and the regulation and the enforcement of standards within corporate reporting and audit as applicable. In support of that aim, this Memorandum of Understanding ("MoU") sets out the framework for effective liaison and communications between the SFO and the FRC.

2The aims of this MoU include:

- To assist co-operation and co-ordination between the parties in the performance of their respective statutory functions in the public interest so far as such assistance is lawful;

- To provide arrangements for co-operation and the exchange of useful information.

Legal status and effect

3Nothing in this MoU shall, or is intended to:

- create any legal or procedural right or obligation which is enforceable by either of the parties against the other; or

- create any legal or procedural right or obligation which is enforceable by any third party against either of the parties, or against any other third party; or

- prevent either of the parties from complying with any law which applies to them; or

- fetter or restrict in any way whatsoever the exercise of any discretion which the law requires or allows the parties to exercise; or

- create any legitimate expectation on the part of any person that either of the parties will do any act (either at all, or in any particular way, or at any particular time), or will refrain from doing any act.

Nevertheless, the parties are genuinely committed to pursuing the aims and purposes of this MoU in good faith, and intend to act in accordance with its terms on a voluntary basis to enhance mutual co-operation.

Roles and responsibilities

4The SFO was set up in April 1988 following the report of the Fraud Trials Committee under the late Lord Roskill.

5The SFO's status and powers derive from the Criminal Justice Act 1987 (CJA 1987). The principal power is contained in section 2 of the CJA 1987, which gives the Director or a designated member of staff the power to require a person or entity to provide information to the SFO for the purpose of an investigation.

6In considering whether to take on an investigation, the Director of the SFO considers:

- whether the matter undermines UK commercial / financial plc in general and in the City of London in particular;

- whether the actual or potential loss involved is high;

- whether actual or potential harm is significant;

- whether there is a very significant public interest element and

- whether there is a new species of fraud.

7The FRC is a company limited by guarantee and is the United Kingdom's independent regulator responsible for promoting high quality corporate governance and reporting to foster investment. The FRC (and where applicable its Conduct Committee, referred to collectively as the FRC), sets the framework of codes and standards for the accounting, auditing, actuarial and investor communities and also oversees the conduct of professionals involved. Its powers derive from a number of sources including statute and contractual arrangements which in some cases are underpinned by statutory provisions, as follows:

- setting codes and standards for governance, accounting, auditing, assurance and actuarial work through being the prescribed accounting standard issuing body under s464 of the Companies Act 2006 (Companies Act) and through independent arrangements required by Schedule 10 of the Companies Act for audit and as otherwise agreed with the accounting and actuarial professional bodies;

- monitoring whether the accounts, directors' or strategic reports produced by public and large private companies comply with the requirements of the Companies Act through being an 'authorised body' under s 457 of the Companies Act (for the purposes of section 456 of the Companies Act), which gives the FRC the power to apply to court for a declaration that the accounts, directors or strategic report does not comply with the Companies Act and an order requiring the directors of the company to prepare revised accounts or a revised report as applicable;

- monitoring compliance with accounting requirements of listing rules by issuers of listed securities through being a 'prescribed body' under s14 Companies (Audit Investigations and Community Enterprise) Act 2004, which gives the FRC the power to compel information under section 15B from an issuer, officer, employee or auditor and report their findings if they think fit, to the Financial Conduct Authority;

- monitoring and reporting publicly on the quality of the audit of listed and other major public interest entities through independent arrangements with the professional bodies as required by Schedule 10 of the Companies Act;

- investigating misconduct by accountants, auditors and actuaries through independent arrangements required by Schedule 10 of the Companies Act for audit and as otherwise agreed with the accounting and actuarial professional bodies pursuant to the Accountancy and Actuarial Schemes and Regulations in force from time to time1, under which the FRC's Executive Counsel can exercise his powers to compel every Member and Member Firm (including Former Member, Former Member Firm and Successor Member Firm), to the extent that is lawful to do so, to provide information and explanation relevant to any matter under investigation or preliminary enquiry and to permit the inspection and, when requested, the provision of such documents (in whatever form it may be held) in the possession or under the control of the Member or Member Firm; and

- overseeing the regulation of accountants auditors and actuaries by their professional bodies and of auditors based outside the EU through delegated powers in accordance with s1252 of the Companies Act for audit and as otherwise agreed with the accounting and actuarial professional bodies.

Information sharing

8Where it is lawful and in the public interest to do so, the parties agree to timely disclosure of information to the other:

- so that suspected criminality, misconduct, breach of applicable requirements, oversight powers or other failures are properly investigated and decided upon;

- for the purposes of regulatory, disciplinary or other legal proceedings.

9The SFO may provide information to the FRC pursuant to the gateways at sections 3(5) (b) and (d) of the CJA 1987.

10The FRC may share information with the SFO through a number of different means which include:

- Schedule 11A (permitted disclosure for the purposes of s1224A) Companies Act;

- The Conduct Committee's Operating Procedures;

- Paragraph 19(i) of the Accountancy Scheme and 48(c) of the Accountancy Regulations;

- Paragraph 18(i) of the Actuarial Scheme and 46(c) of the and Actuarial Regulations;

- Paragraph 21(1) of the Auditor Regulatory Sanctions Procedure.

Depending on (i) how such information was obtained and (ii) the use to which the information will be put by the receiving party, the disclosing party may be under a legal requirement to provide the person from whom the information was obtained with an opportunity to object to disclosure before reaching a decision on whether the information may lawfully be disclosed through these gateways. Where there is no such legal requirement, the disclosing party may, at its sole discretion, voluntarily provide such advance notification, but is not required to do so as a pre-condition to co-operation or exchange of information pursuant to this MoU.

11Exchange of information under this MoU and in accordance with the laws applicable to the disclosing party may take place voluntarily as well as in response to a request.

12The disclosing party also agrees to notify the recipient of:

- any restrictions on the use to which the information can be put, and

- any restrictions which apply to the onward disclosure of the information, and

in the absence of such notification, the receiving party may assume that there are no such restrictions (in addition to any restrictions that apply as a matter of law).

13Neither party will disclose data supplied by the other to any outside organisation unless:

- permitted by law (in which case the receiving party will always first seek and obtain the consent of the supplying party before providing disclosure); or

- required by law (in which case the receiving party will, so far as is practicable, first notify the supplying party before providing disclosure).

14The recipient of information from the other party will:

- comply at all times with the Data Protection Act 1998, the Human Rights Act 1998 and any related or analogous legislation;

- keep the information secure;

- only use the data for the purposes for which they have received it;

- ensure that only people who have a genuine business need to see that data will have access to it;

- use the information only for proper purposes, such as regulatory, disciplinary or other legal investigations or proceedings;

- liaise or co-operate where appropriate to avoid action that prejudices or may prejudice an investigation by another party or person;

- report data losses or wrongful disclosure to the SPOCs;

- follow retention and destruction guidelines.

Proper purposes may also include further lawful disclosure of the information such as to persons under investigation, witnesses, legal advisers, other regulators, professional bodies, prosecuting bodies, and law enforcement agencies including the police and HM Revenue and Customs (or any body that in future carries out the functions of such bodies).

Practical exchange of information

15All information exchanged between the parties should be passed via the following individuals:

| SFO | ||

|---|---|---|

| All enquiries | Head of Intelligence | 020 7239 7428 |

| FRC | ||

| Corporate Reporting Review | ||

| Carol Page | Director, CRR | 020 7492 2460/ [email protected] |

| Investigations | ||

| Phil FitzGerald | Head of Supervisory Inquiries | 020 7492 2358/ [email protected] |

| Gareth Rees QC (or his nominated delegate on a case by case basis) | Executive Counsel (Professional Discipline investigations) | 020 7492 2450/ [email protected] |

| All other enquiries | ||

| Anne McArthur/Kate Cobill | General Counsel/Assistant General Counsel | 020 7492 2380/ [email protected] |

| 020 7492 2470/ [email protected] |

Additional assistance

16Either of the parties may request additional co-operation in the following areas, and such requests shall be given due consideration:

- sharing subject-matter expertise;

- supplying witness statements, expert advice or oral evidence for use or potential use in court or tribunal proceedings

Freedom of Information (FoI) Act 2000

17If a FoI request is received in relation to the other party's information then the receiving party will inform the other party, and invite representations on the potential impact of disclosure.

Costs/charges

18No charges will be made in relation to the supply of information by either party.

Resolving problems

19Problems that arise between the parties will be resolved through discussion by the SPOCs, with escalation to more senior managers where necessary.

Reporting and review arrangements

20This MoU will remain in force until terminated by either party. The parties will use their best endeavours to review its operation every two years.

21Any changes to this MoU may be agreed in writing.

Transparency

22This MoU is a public document and the parties may publish it as they separately see fit.

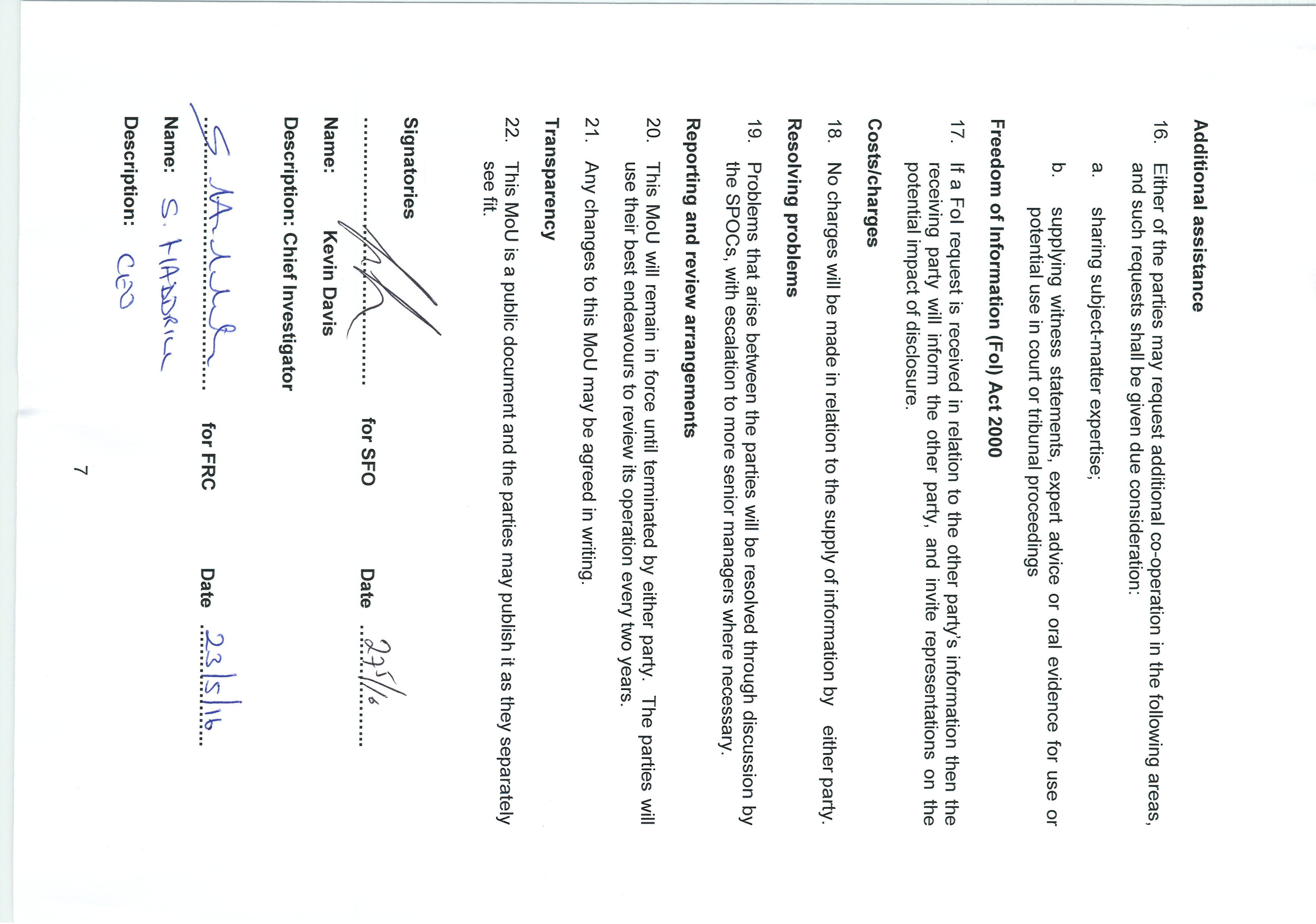

Signatories

for SFO Name: Kevin Davis Date 23/5/16 Description: Chief Investigator

for FRC Name: S. HADDRILL Date 23/5/16 Description: CEO

Footnotes

-

Pursuant to paragraphs 7 and 14 of the Accountancy and Actuarial Schemes and paragraph 10 of the Accountancy Regulations and Paragraph 9 of the Actuarial Regulations, dated 8 December 2014 and currently in force ↩