The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Review of Corporate Governance Reporting 2022

- 1. Foreword

- 2. Executive summary

- 3. Reporting expectations

- 4. Main findings

- The feedback cycle

- Board decision making

- Shareholder Engagement

- Board chair's engagement with shareholders

- Committee chair's engagement with shareholders

- Shareholder engagement following a significant vote against a board-recommended resolution

- Workforce Engagement

- Customer Engagement

- Supplier Engagement

- Modern Slavery

- Community Engagement

- Environment

- C. Division of Responsibilities and Board Composition

- D. Audit and Risk and Internal Controls

- 4. EMERGENCE OF ENVIRONMENTAL TAX INSTRUMENTS

- E. Remuneration

- 5. Conclusion

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

1. Foreword

Sir Jonathan Thompson CEO, Financial Reporting Council Last year, my introduction focussed on uncertainty and change

- caused by the pandemic – and the role of the UK Corporate Governance Code in helping business and investors respond to the challenges presented. Uncertainty remains the theme this year, but there are new causes in addition to the lasting effects of the pandemic. How companies govern themselves through these difficulties is more important than ever, and the UK Corporate Governance Code provides a clear and flexible basis to address governance policy and practice.

We continue to see improvements in the quality of reporting – risk management procedures and ESG disclosures and more generally, where there are departures from the Code. This is an area where improvement is needed for the Code to work effectively, so that companies report in a way which demonstrates that they are thinking critically about their governance. We will continue to work to improve the quality of explanations and provide clear information for shareholders about the activities undertaken and outcomes when companies depart from the Code's Provisions.

Despite the Code retaining widespread support from companies and investors, we have seen familiar criticism from a small section of practitioners and commentators. These criticisms are often due to a continuing misunderstanding and misrepresentation of the Code's purpose. The Code is not a set of hard rules and should not be treated as such; this is a guiding principle from the original Cadbury Report. The Code comprises principles which must be applied and provisions which allow companies to report on their governance on a "comply or explain" basis, which enables investors to engage more effectively on material governance issues relating to individual companies. It allows governance and stewardship to work hand-in-hand, improving market confidence and lowering the cost of capital. The vast majority of companies and investors prefer a Code-based approach to governance as it gives them a better opportunity to engage. Rules-based compulsory disclosures remove flexibility and risk creating friction between companies and shareholders, leading to conflict and litigation.

Next year the FRC will consult on a revision of the Code. This is chiefly a consequence of our transition to ARGA and the changes to governance and related reporting recommended in the government's response to its consultation “Restoring Trust in Audit and Corporate Governance”. We do not intend a wholesale revision of the Code. Our consultation will focus on those areas identified in the FRC's Position Paper, published in July this year. We will avoid and minimise duplication with other reporting requirements so that the Code continues to provide clear direction and reduces reporting burdens.

2. Executive summary

For the third year, the FRC has reviewed how companies have reported on their governance in line with the Principles and Provisions of the UK Corporate Governance Code (the Code). We assessed 100 FTSE 350 and Small Cap companies.

We now hold a body of evidence, on those areas where companies report well and where improvements could be made. This evidence is important, as our recently issued Position Paper explains that we will be consulting on changes to the Code where reporting is currently weaker.

Since we began assessing reporting, we have seen year-on-year improvements in reporting, but there are few companies whose disclosures meet the highest standards throughout their report.

We are pleased to see that more companies are now offering greater transparency when reporting departures from the Code, including those instances where the chair's tenure is extended beyond nine years. This demonstrates the Code's flexibility. Where a company has departed from a Provision a meaningful explanation should be provided. Some companies fail to provide an explanation, whereas many others give boilerplate or vague ones. We looked closely for the disclosure of actions and outcomes resulting from governance policies, procedures and activities. The better disclosures included specific examples and case studies

- but these were generally in the minority.

We were pleased to see that workforce engagement issues continue to be high on companies' agendas, although disclosures on outcomes of the engagement are almost exclusively in relation to flexible working matters. Where companies engaged their workers in reviewing corporate culture, purpose, values or desired behaviours, most reported on the positive impact of such an approach.

Reporting on wider stakeholder engagement is generally of a good standard. However, there is often insufficient narrative on the outcomes from the engagement, including feedback received, or commentary on whether the board acted on any of the issues raised and how decisions align with company strategy, or culture, purpose and values.

We found minimal disclosure of specific board members' engagement with major shareholders. Significant votes against resolutions are common, votes against remuneration matters remain high, and there is renewed interest in environmental, and social matters; therefore, we expected to see reporting on engagement by the chair and committee chairs increase in both quantity and quality. Regrettably, this is not the case. Indeed, where engagement is reported, it offers little insight.

We found that the majority of companies have met or are on track to meet external diversity targets. However, this progress has yet to translate into senior roles, for example, CEO and CFO roles where progress appears slow. Due to the lack of transparency in relation to diversity policies and targets, it is not clear how many companies strive to go beyond external targets.

Over half of the companies provided a statement to confirm that their risk management and internal control systems are effective or that no weaknesses or inefficiencies have been identified. However, many of those companies do not explain how they assessed the effectiveness of these systems to justify the results of their assessment.

Only through high-quality reporting, including outcomes and impacts, will readers be able to assess the effectiveness of governance activity.

3. Reporting expectations

Last year we said that good reporting is characterised by clear and consistent explanations, supported by real-life examples of application and cross-referencing between related initiatives and sections. Only the better reporters have taken this on board and also disclosed the outcomes and impacts of the governance policies that have been put in place.

Key Message:

Companies should disclose the effects of their policies and procedures by highlighting the outcomes and impacts of their initiatives/ actions and explaining how these relate to company purpose, strategy and values.

Additional disclosures of this nature should not increase the reporting burden on business. We found that many reports include instances of duplication and repetition, along with declaratory or boilerplate statements that offer little insight into company governance. While some reports repeat extracts of the Code and include paragraphs from previous years' reporting with minimal updating.

Key Message:

Companies should provide clear and specific reporting, avoiding repetition, ambiguity and lengthy boilerplate statements. The aim of reporting should not be to provide large amounts of detail. Indeed, the better reporters offered concise information that was clear and specific to the company.

To improve disclosures, the FRC reporting expectations include the following:

- Moving away from declaratory statements and providing specific disclosures.

- Providing clear and meaningful explanations when departing from the Code.

- Demonstrating how the company's culture, is aligned to its purpose, values and strategy.

- Reporting on engagement with shareholders and stakeholders, and how their views have been considered.

- Making clear linkages in the report to policies or disclosures that relate to stakeholder matters.

- Reporting on diversity, including at a senior leadership level beyond the recommended external targets including objectives and targets.

- Explaining how the board or a committee has reviewed the effectiveness of the risk management and internal control systems.

- Reporting on how the executive remuneration arrangements align with the company's purpose, values and strategy.

4. Main findings

A. Code Compliance

Application of the Principles

The Listing Rules require companies to provide a statement of how they have applied the Principles of the Code in a manner that would enable shareholders to evaluate how these Principles have been applied. This year our review looked closely at how companies have applied some of these Principles, analysing the quality of the disclosure supporting the application. Our review aimed to understand how companies have explained actions taken and the resulting outcomes as they apply the Code's Principles.

The Code states that: 'It is important to report meaningfully when discussing the application of the Principles and to avoid boilerplate reporting. The focus should be on how these have been applied, articulating what action has been taken and the resulting outcomes.'

We found some good examples of reporting against the requirements of different Principles, particularly on the application of Principle O (risk management procedures), with most companies providing a good level of helpful information about their risk management procedures.

However, our findings, overall, showed that disclosures on the application of other Principles could be improved, particularly those Principles that require actions by the board (for example, Principle D on shareholder engagement). We found that many companies may concentrate their reporting on compliance with the Provisions of the Code rather than articulating the application of the Principles.

While it is important to provide information on processes and procedures, a good statement of how Principles have been applied should also show the following:

- Actions – the work and decisions taken by the board during the year.

- Outcomes – the impact their work and decisions have had on the company's strategy and governance and how it affects shareholders and other stakeholders of the company.

Key Message:

High-quality reporting should show in a clear manner how the board has successfully applied the Principles of the Code to achieve effective outcomes for the company, shareholders and other stakeholders.

Compliance with Provisions

Seventy-three companies disclosed non-compliance with one or more Provisions of the Code

We were pleased to see that more companies are using the flexibility of the 'comply or explain' nature of the Code. While 58 companies claimed full compliance with the Code in 2020, only 27 companies did so this year.

Total number of companies claiming full compliance

This bar chart illustrates the total number of companies claiming full compliance with the Code over three years: - 2020: 58 companies - 2021: 36 companies - 2022: 27 companies

The chart shows a declining trend in full compliance.

Such an increase in non-compliance demonstrates the benefits of a code-based approach to governance, which allows companies to choose bespoke governance arrangements most suitable to their particular circumstances in both the short and long-term. We have seen instances where it is clear how non-compliance benefits the company and its strategy. As such, it is worth emphasising, as we have done in the past, that companies and shareholders should not favour strict compliance over effective governance and reporting.

We have seen no significant changes in the rate of non-compliance with Provisions compared to last year. However, there is a noticeable change compared to 2020, particularly an increase in non-compliance with Provision 38 (pension alignment), but also with provisions 24 and 32, (composition of audit and remuneration committees).

Interestingly there was a significant drop in the rate of non-compliance with Provision 9 (the chair not being independent on the appointment, or the roles of chair and CEO are combined). In 2020, 50% of those companies disclosing non-compliance with at least one provision disclosed non-compliance with Provision 9 (16 out of 32 companies). This year, that figure fell to 19%: only 12 out of 63 companies which disclosed non-compliance with at least one provision disclosed non-compliance with Provision 9.

Provisions with the highest rate of non-compliance this year, compared to the previous years:

| Provision Name | 2020 | 2021 | 2022 |

|---|---|---|---|

| Provision 38 Alignment of pension contributions |

11 | 27 | 30 |

| Provision 19 Chair tenure not exceeding nine years since their first appointment to the board |

9 | 16 | 15 |

| Provision 9 Chair independence on appointment and the combined roles of chair and CEO |

16 | 18 | 12 |

| Provision 41 Description of the work of the remuneration committee |

4 | 7 | 11 |

| Provision 24 Establishment and composition of the audit committee |

3 | 10 | 10 |

| Provision 32 Establishment and composition of the remuneration committee |

3 | 11 | 9 |

| Provision 36 Post-employment shareholding requirement |

6 | 11 | 8 |

| Provision 11 Board composition with a majority of independent NEDs |

4 | 4 | 7 |

Transparency and clarity

We are pleased to see that the increase in non-compliance is also directly linked to a higher level of transparency by companies. Our review in 2020 found that 58 companies disclosed full compliance; however, we also noted that most of these 58 companies failed to disclose non-compliance with one or more Provisions of the Code. The increased transparency is best demonstrated by the level of non-compliance with Provision 38 (executive pensions aligned to those of the workforce). Only 11 companies disclosed non-compliance with this Provision in 2020, despite a much larger number of companies not having their pensions aligned. We know that many more companies have had their pensions aligned since; however, the number of companies disclosing non-compliance with Provision 38 has nearly tripled since 2020.

Key Message:

In line with the Listing Rules, companies should be transparent about their non-compliance with the Code, by clearly acknowledging any departures from it.

Nevertheless, there remain a number of companies unwilling to provide full transparency, by not disclosing their non-compliance with one or more provisions. For example, we found that in at least four companies, the chair remained in their position for longer than nine years since their first appointment to the board; however, those companies did not disclose non-compliance with Provision 19.

In addition, similar to last year, some companies are still not offering clarity on their reporting of non-compliance by providing ambiguous statements such as 'the company has complied with all the Provisions of the Code except as specifically identified in this report.' In our last year's review and in our Improving the quality of 'comply or explain reporting' report, we emphasised that companies should be transparent in their reports about departures from the Code by naming the Provision(s) in the compliance statement, followed by an explanation or signposting to where the explanation could be found.

Financial Reporting Council

The FRC expects companies to make it easy for users of the annual reports to find whether the company has fully complied with all elements of the Provisions of the Code throughout the whole financial year; or in the case of departure from the Code, the Provision(s) it has not complied with and the explanation for non-compliance.

Explanations for non-compliance

Last year, we said that we expect companies to provide a clear and meaningful explanation for any departures from the Code. Unfortunately, this year, again, the quality of explanations provided by companies for non-compliance could be significantly improved. Of the many instances of non-compliance, our review found only four explanations which we considered good quality. Of all cases of disclosed non-compliance, some companies:

- did not provide an explanation or any other details other than disclosing non-compliance

- stated that they had either complied since or that they will comply at a specific date; however, they did not provide a reason for non-compliance

- provided brief and vague explanations, lacking clarity

- provided boilerplate explanations, which do not persuade a reader that non-compliance benefits the company

- provided slightly more detailed and meaningful explanations, which still lacked detail, particularly on risks associated with non-compliance and mitigating actions taken by the board

Similar to last year, we found many instances where companies simply state that they either complied with or will comply with a Provision without giving reasons for non-compliance. In line with the Listing Rules, companies should provide an explanation, even when non-compliance is temporary, which should include the reasons for non-compliance and the period they did not comply with the Provision(s). In our last year's review and in our Improving the quality of 'comply or explain reporting' report, we explain the elements of a clear and meaningful explanation, such as the one below:

Example: providing a meaningful explanation for non-compliance

Why it's useful:

The example shows why the company has not complied with Provision 19 of the Code. The explanation:

- Sets the context and background

- Gives a convincing rationale for the approach taken.

- Considers any risks and describes any mitigating actions

- Sets out when the company intends to comply (timescales)

It is overall an understandable and persuasive explanation Provision 19 of the Code states that 'The chair should not be in post beyond nine years from the date of their first appointment to the board.' Annette Court was appointed as Board Chair in April 2017, having spent five years as a Non-Executive Director of the Board. Annette reached her nine-year tenure as Non-Executive Director on the Board in March

As reported in the Annual Reports for the two prior periods, in 2019, the Board considered and agreed, having consulted shareholders, that she should remain in post as Board Chair for up to three years beyond March 2021, with the expectation that she would serve two years, subject to annual approval by the shareholders. This represents a departure from the Code for the 2021 financial year.

Provision 19 of the Code goes on to state that 'To facilitate effective succession planning and the development of a diverse board, this period can be extended for a limited time, particularly in those cases where the chair was an existing non-executive director on appointment.' Not only was Annette an existing Non-Executive Director upon her appointment as Board Chair, but we also believe that it continues to be necessary to extend her tenure until March 2024 at the latest, in order to facilitate Board continuity and succession following David Stevens, a founder of Admiral, stepping down from his role as CEO in December 2020 and Milena Mondini assuming the role of Group CEO in January 2021.

The Board takes comfort from the fact that Annette's re-election was supported by shareholders at the previous AGM on 30 April 2021 (99.93% votes in favour) and that her 2021 performance review, led by the SID, concluded that she continued to perform effectively as Board Chair, continued to exercise objective judgement and promoted constructive challenge amongst Board members.

Owen Clarke: 'The Board concluded that the risk of the Chair failing to operate with sufficient independence is low, but the Board, led by the Senior Independent Director, will continue to monitor the Chair's performance and objective judgement during 2022 in order to mitigate any risk of reduced challenge to decision-making and any compromise in the Chair's objectivity.'

The 2021 Board evaluation also concluded that the Board continued to function well, under the leadership of Annette. In addition, the Board's composition has continued to be refreshed during 2021, with the appointment of Evelyn Bourke and Bill Roberts, further strengthening the Board's mix of skills, experience and knowledge whilst further mitigating any potential reduction of challenge.

Source: Admiral Group PLC, Annual Report and Accounts 2021, p. 140

Financial Reporting Council

The FRC expects companies to provide clear and meaningful explanations for any departures from the Code, particularly where non-compliance is long-term or indefinite.

Reasons for non-compliance – non-UK registered companies

Some companies who are not registered in the UK, but listed in the UK, stated non-compliance with the Code for the following reasons:

- because the legislation in their country of incorporation does not require them to do something asked by a Provision; or

- because what the Provision asks for is not a common practice in their country of incorporation.

It is understandable that a requirement of the Code may be difficult to undertake by a company that is incorporated in an overseas jurisdiction, as it may be subject to different rules and legislation. The flexibility given by the Code provides companies with an alternative to compliance with the Provisions, considering the differences between companies, including taking into account different rules and legislation companies need to comply with.

However, every effort should be made to comply with the Code's provisions. Companies should choose alternative arrangements over the Code's requirements when this non-compliance benefits the company.

B. Leadership

Culture, purpose and values

Reporting in this area has generally improved, with more prominent disclosure – often via a dedicated section or together with other Environmental, Social and Governance (ESG) matters, and increased reference to the need of fostering a 'positive culture' within the organisation. This is in line with our report on Creating Positive Culture: Opportunities and Challenges (2021 Culture Report), which encourages companies to attain positive culture through honest conversations, psychological safety and by building trust to improve their performance and bolster sustainable growth. Additional resources to help companies address those areas can be found on the FRC's Culture Hub.

Although companies generally support the need for increased focus on culture, purpose and values, only one company reported on the benefits of increased investment and activity in those areas:

Example:

We increased investment in Group-wide leadership training and diversity and inclusion initiatives for our people, to help them develop more robust and ambitious strategies while leading change and creating a continuous improvement culture and capability. This is already having tangible benefits, with more robust strategies and execution plans, improved change management, factory and functional processes.

By bringing together different practices under culture reporting (for example, recruitment and training, diversity and inclusion, communication and engagement), supplemented by reporting on both the actions and outcomes (investment and benefits, for example), companies can demonstrate that their approach/strategy is comprehensive and has an impact.

Principle B states 'The Board should establish the company's purpose, values and strategy, and satisfy itself that these and its culture are aligned.'

We were pleased to see that almost all companies have disclosed their purpose statement. However, very few companies disclosed any supporting information explaining how this was derived in order to support strategy. We found seven companies which reported effectively on their purpose. Good disclosures in this area included examples of the effect on board decision-making and company stakeholders (mostly workers and consumers), and how purpose was established and is embedded across the organisation.

Better disclosures included case studies and reporting on actions and outcomes through the lens of the reported area – as opposed to reporting on a single issue in isolation:

Example:

That's why this year we introduced a new format for Board reporting which requires every matter that's brought to the Board for approval to clearly draw out the Purpose connection and in Board meetings the Chairman actively encourages Board members to constructively challenge management on why a recommendation is Purpose-driven.

Reporting on corporate values remains in line with our findings last year. Almost all companies refer to their values within their report; however, a quarter of companies did not disclose them. By not disclosing values it is difficult to assess how they translate into behaviours, are aligned with culture, contribute to success, and support the company's purpose and strategy.

Key Message:

Persistent reference to but non-disclosure of corporate values means that too many companies simply refer to principles of the Code without explaining how they applied them.

Better reporting in this area entailed disclosure of company values supported by an explanation of what they mean in practice, often including quotes from employees. Some companies described how their values translate into desired behaviours (see below), and how they were consulted on and periodically reviewed. Case studies were also used to support the narrative, which helped the reader better understand the role of values.

Example:

Integrity Always doing the right thing in a professional, respectful and honest way.

Desired behaviours:

- Be direct, honest and encourage constructive challenge

- Respect diversity and be inclusive in everything you do

- Create a safe environment in which everyone feels comfortable speaking up

Responsibility

For safety and the environment, for complying with our policies and procedures, for delivering against individual and team goals.

Desired behaviours:

- Demonstrate that you care for each other's safety every day

- Actively consider the environmental impact of every decision you take

- Take personal responsibility for delivery and results

Explaining in a meaningful way the alignment between corporate culture, purpose, values and strategy also continues to be a challenge for many companies. While 60 organisations mentioned alignment, half of them provided minimal supporting information and just two provided examples of application – the impact.

Key Message:

Disjointed reporting on corporate purpose, values, strategy and culture, or reporting that lacks examples of impact gives the impression that a company is not fully leveraging the benefits that the alignment can have on its performance and stakeholders.

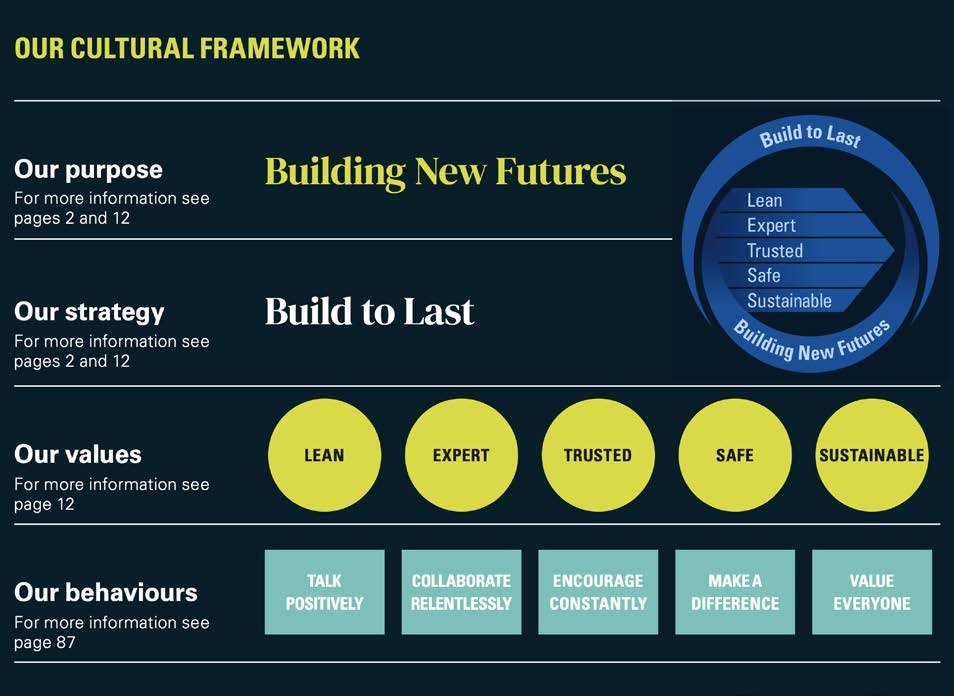

Some companies opted to present their alignment in a visual format (see below) and/or link it with corporate behaviours, risk, sustainability or ESG agendas. Those approaches are generally insightful, providing they are supplemented with a commentary or case studies to evidence the practice.

Example: Presenting the alignment in a visual form

Why it's useful: Balfour Beatty demonstrates how different elements fit together into their culture framework, with clear signposting.

Source: Balfour Beatty, Annual Report and Accounts 2021, p.128

Assessment and monitoring

Provision 2 states 'The board should assess and monitor culture. ...The annual report should explain the board's activities and any action taken.'

Although a majority of companies have given their reporting on culture assessment and/ or monitoring activities more prominence, 20 companies neither explicitly referred to this nor declared non-compliance with the Provision.

Out of those that did report in this area, only six companies provided meaningful disclosure beyond simply listing the review methods and briefly describing them, and just one organisation went a step further and discussed outcomes from the review process and referred to follow-up actions.

For example, they explained that their culture dashboards, which were presented to the board twice over the last year, were amended to include various trends and a section on workforce to capture staff demographics (for example, diversity, pay and reward). This helped to identify a potential red flag – exit interviews data exceeding the predefined tolerance level, which led to a salary benchmarking review and changes being implemented in some areas of the business.

We are concerned that no company reported on the impact of actions that were undertaken either in the year under review or following the previous year's culture review process.

Financial Reporting Council

FRC expects companies to report not only on the outcomes from their culture assessment and monitoring activities, but also on the impact of any remedy initiatives to assess their effectiveness in the following reporting year.

Some of the better disclosures described the remit of each board committee in this area – the approach we encourage, periodic review of assessment and monitoring methods, and how chosen measurement/observation methods correlate with the company's cultural priorities.

We were also pleased to see that the majority of companies went beyond workforce surveys both annual and pulse, and reported on some, or on rare occasions, on all of the methods set out below in the context of culture assessment and monitoring:

- culture/people dashboards

- HR, internal audit and executive reports

- whistleblowing and exit interviews

- designated NED, employee forum/ roundtables and other listening mechanisms

- direct engagement, including site visits and Q&A sessions

While it was encouraging to see that 30 companies listed a selection of their culture/ people metrics, we expect more companies to discuss the mix of their qualitative and quantitative measures. The most commonly referred to culture metrics include the following:

The most commonly referred to culture metrics include:

- Applications per vacancy

- Survey scores

- Covid-19 infection and quarantine data

- D&I statistics & targets

- Net Promoter Score

- Days of training

- Clients & suppliers metrics

- External ratings & benchmarks (e.g. Glassdoor)

- Sick days

- Anonymity rate of speak-up reports

- Pay gaps

- Sustainability & climate metrics/targets

- Leadership stability

- Lost Time Injury/Total Recordable Incident Rate

- Employee retention

- Employee assistance

- Annual certification of compliance

Implementation, embedding and assurance

We are pleased to see that almost half of companies have referred to the implementation and/or embedding of their corporate culture, purpose and values – the approach discussed and encouraged in the 2021 Culture Report.

Nonetheless, disclosures in those areas are largely limited to a statement. A handful of better reporters supplemented their reporting with examples of how implementation and/ or embedding were done in practice, and in a few instances, a case study or a flow chart was included to demonstrate the whole evaluation cycle.

Culture assurance, also addressed in the 2021 Culture Report, is still a relatively underdeveloped approach. Just one tenth of companies discussed it explicitly, and 20 referred to culture assurance only indirectly.

Evaluating, training and supporting our people to embed the 'Step-Up' culture framework.

| Evaluation | Training | Support |

|---|---|---|

| We use external benchmarks to evaluate our ethics and compliance practices, monitor our culture through the Culture and Perceptions Survey, and monitor our 'winning behaviours' with the ad hoc survey designed by the university. | We trained our executives and managers in masterclasses delivered by professors from the university, trained a group of internal trainers to deliver ethics workshops for the rest of our employees, and are deploying an e-learning course to reinforce areas of opportunity detected in the culture survey. All our training follows the 'Step-Up' culture framework. | We use the 'moral compass' tool and 'Step-Up' culture framework to enhance ethical decision-making. We are converting our trainers into ethical ambassadors, learning and sharing best practice by participating in external organisations, and raising awareness of key elements of our Code of Conduct through e-learning. |

While those numbers are low, it is encouraging to see that companies are increasingly reporting in this area. Out of those that disclosed details of their culture assurance process, four companies employed external consultants, and for others it was within a remit of responsibilities of the Internal Audit function. Most assurance appears to be proactive, at times linked to the acquisition/ merger, apart from one company, where the review and subsequent assurance were in response to the allegations of misconduct.

Key Message:

It is important to have a continuous focus on culture rather than wait for a crisis.

Example:

The Board asked [the auditing firm] to undertake a Culture Audit in 2021, the first time this has been completed at the Company. This provided the Board with further insights into how the Company's culture is developing and how effectively the link to our Values manifests itself across the business. This independent review also provides a triangulation point to complement the cultural insight gained from the Board site visits and the flow through the usual channels.

Other good practices

Increasingly, more companies are introducing non-financial/ESG performance targets in their executive pay. Good practice suggests clearly disclosing targets and demonstrating how they are stretching. Out of 35 organisations that included a culture-related underpin, most of them were related to H&S, employee engagement and undergoing a culture change. However, as most reports did not provide sufficient supporting information, it was difficult to determine how meeting the target and receiving the associated compensation correlated to improvements in culture. For example, a high return rate to a company questionnaire does not automatically denote a satisfied workforce. For more findings on executive pay reporting and ESG metrics, please see page 52. Consultation with workers on proposed culture change or the introduction of a new purpose, values or behaviours is good practice, but only 12 companies took this approach. A collaborative approach to workforce engagement is encouraged as it is more likely to lead to positive outcomes a position we took in the 2021 Culture Report. However, it is important that the reported feedback is balanced

- including both the opportunities and challenges. Please see page 21 for more insights on workforce engagement.

Nonetheless, we are pleased to see that some companies specifically referred to the constructive nature of their industrial relations – the approach that is encouraged.

Lastly, while we welcome increased reporting on corporate culture, purpose and values, this shouldn't lead to the overuse of those terms throughout the report. Companies ought to try to strike a balance between providing enough information for the reader to get a good picture of the strategies, policies and practices in place, and avoid disclosing too much operational detail, which can lead to confusing and lengthy reports.

Engagement with shareholders and stakeholders

Principle D of the Code asks that 'In order for the company to meet its responsibilities to shareholders and stakeholders, the board should ensure effective engagement with, and encourage participation from, these parties.'

'Effective engagement' and 'participation' for the Code's purposes should include different approaches to engagement which enable the board to consider views expressed and act on that information. There will normally be an element of dialogue, where all parties are able to express and discuss their views on strategy, governance and other matters as appropriate.

Importance of dialogue

The Guidance on Board Effectiveness: 'An effective board will appreciate the importance of dialogue with shareholders, the workforce and other key stakeholders, be proactive in ensuring that such dialogue takes place and that the feedback is taken into account in the board's decision-making.'

It is positive to see that boards continue to develop practices to engage with a wide range of stakeholders and shareholders. Companies reported on many different methods of engagement. These broadly fell into three categories:

- Giving – the company presents information, with little or no discussion; for example, the annual reports, the company's website, RNS announcements and Codes of Conduct.

- Receiving – the company receives information and generally is not able to respond to the views immediately; for example, surveys, questionnaires and feedback forms.

- Dialogue – an opportunity for all parties to air their views, discuss issues and receive information. The most common methods of dialogue that companies reported included Formal meetings, forums, townhalls, summits and roundtables. The most effective had a clear remit, were attended by senior management or the board and disclosed an outcome.

Example:

Since 2018, we have held annual roundtables with civil society organisations to listen, learn and understand how we can improve. The roundtables provide an opportunity for us to explore and discuss key social, environmental and economic issues facing society and our business. They also provide an important touch point to sense check the issues that matter most to society and help us to better understand evolving expectations. The roundtables are attended by senior leadership.

Feedback

Those companies that reported on a number of different approaches to engagement generally presented the most informative reporting describing outcomes and impacts.

Key Message:

Good reporting on how the board ensured effective engagement with shareholders and stakeholders should include details of:

- actions taken by the board: how the board engaged with the shareholders and stakeholders (methods of engagement, those involved, the frequency of engagement and topics discussed)

- outcomes from the engagement: what was the feedback from the shareholders and stakeholders, and the impact it had on board discussions and decision-making

We did see some reporting on engagement that went beyond the most common methods and, in some cases, explained that less complimentary feedback was welcomed.

Example:

This year we ran sessions for our senior management team where they listened directly to customers about their experience with the group – focussing as much on where we got things wrong as what we did well.

We also found some examples of companies sourcing feedback from a wide variety of partners, including international, and using engagement to understand if actions taken from previous feedback had improved relationships.

Example:

We completed our second annual Supplier Viewpoint survey, extending the participants to our top 30 product suppliers (previously top 20 product suppliers). This allows us to understand if actions we have taken following previous feedback has improved our supplier relationship management.

Although there was positive progress in some areas of stakeholder feedback, companies should reconsider the use of vague language such as 'feedback channels'. For transparency, companies should be as specific as possible in the exact methods that the board has used to obtain feedback. For example, some companies described in detail how they are using digital resources for engagement with a wider variety of stakeholders.

Effective engagement has the following characteristics:

- Clear purpose for the engagement

- Use the most appropriate method to achieve the purpose

- Feedback analysed with key issues drawn out and supported by any metrics

- Inform board discussions and decision-making

- Outcomes identified for either the company or stakeholder or not appropriate

- Dissemination of outcomes back to stakeholders

- Actions implemented, where appropriate

Engagement cannot be effective if shareholders and wider stakeholders do not get the opportunity to express their views or raise concerns.

The feedback cycle

Diagram illustrating the feedback cycle for stakeholder engagement. The cycle starts with "Inputs" (Who is responsible for engagement at company level? Why are we engaging?), moves to the central "Stakeholder Engagement" node, then to "Outputs" (What issues were raised during the engagement?), and finally to "Impacts and Outcomes" (Actions taken by the board as a direct result of stakeholder feedback and the impact of these actions).

Board decision making

Provision 5 of the Code asks that 'The board should understand the views of the company's other key stakeholders and describe in the annual report how their interests and the matters set out in section 172 of the Companies Act 2006 have been considered in board discussions and decision-making.'

We were pleased to see a few very good examples of reporting in this area. These included disclosure on the exact issue that has been discussed, the mechanisms by which they have taken feedback and from which stakeholder groups. The example below shows a high-quality explanation of how stakeholder feedback had been used by the board to help direct decision-making and outcomes:

Example:

During the year, we received feedback from cyclists that led to us to re-examine our training in this area. As a result, we engaged with partners to draw out key messages we needed to include in our revised training and created a short video to engage drivers. This was backed up with regular communications and a competition highlighting cycle awareness.

It is also encouraging to see that companies continue to consider how actions have led to long-term success for the company. Boards should continue to be as clear as possible on which areas of strategy or decision-making they have been impacted as boilerplate statements are still prevalent.

Better reporting linked feedback from stakeholders to outcomes. For example, reporting on customer feedback helping design net zero transition plans which included strategic decisions made by the board to improve and implement safety initiatives for stakeholders. Others focused on shorter-term issues where NEDs sat in on discussions with stakeholder focus groups to understand their insights.

When the stakeholder engagement section of a report signposts to other specific areas of the report, it can simplify the reading of the report and make it clearer to the reader how the board has incorporated a variety of discussions into their stakeholder engagement throughout the year, the outcomes achieved from the engagement and the impact of decisions taken on each stakeholder group. Some companies also used tables to demonstrate issues raised by different stakeholder groups – engagement is clearly linked to outcomes.

Shareholder Engagement

Key Message:

We are pleased to see that 92 companies reported engagement with shareholders during the year.

However, despite these encouraging figures, our review found that disclosures on shareholder engagement could be significantly improved. Some companies simply confirmed there had been meetings with shareholders without providing further detail on their engagement and its outcomes, whereas many others offered just brief statements; for example, "the CEO met with shareholders to update them on strategy."

Effective shareholder engagement

We have previously expressed concerns that engagement with shareholders can resemble an information campaign rather than a meaningful dialogue. This year, again, we found that disclosures were not always clear about the extent to which shareholders were able to ask questions and present their views and ideas rather than just hearing the company's presentation. We found instances where it was clear that engagement reported was only one-sided communication; for example, 'We engage through annual reports, the company's website and RNS announcements.'

Key Message:

Effective engagement with shareholders should allow them to express their views, ask questions and raise concerns.

Some companies only reported engagement by the investor relations unit. While we note the importance of the investor relations team in bringing shareholders up to date with company matters, beyond this, major shareholders should be offered meetings with members of the board – the chair, committees' chairs, the senior independent director and senior management, as appropriate.

Provision 3 states In addition to formal general meetings, the chair should seek regular engagement with major shareholders in order to understand their views on governance and performance against the strategy. Committee chairs should seek engagement with shareholders on significant matters related to their areas of responsibility. The chair should ensure that the board as a whole has a clear understanding of the views of shareholders.

Many companies did not report any engagement from the board chair and committee chairs but stated that they are 'available to meet with shareholders'. It is important to note that while the Stewardship Code stresses the importance of engagement by investors, Principle D and Provision 3 of the Code ask for active engagement from members of the board of the company. The engagement should therefore be sought by both the board and the investors.

Three companies reported engagement with shareholders at the AGM but no other engagement during the year. As stated above, to comply with Provision 3, the chair should seek regular engagement with major shareholders outside the general meetings. This would allow the board to be regularly informed about shareholders' views on governance and strategy.

In our recent Good Practice Guidance for Company Meetings, we emphasise that effective and transparent shareholder engagement should not be limited just to the AGM or in the lead-up to it. We highlight how meetings are an opportunity for the board to explain how they have considered matters raised through engagement with shareholders that may have a longer-term impact on the company's purpose, strategy, governance and future direction.

Key Message:

Regular engagement has a twofold purpose:

- It gives the board a clear understanding of the views of shareholders.

- It gives shareholders information on what impact their feedback has had on board decision-making, and as a result, on the company's strategy and governance, and social and environmental issues.

Board chair's engagement with shareholders

The Guidance on Board Effectiveness:

'The chair has an important role in fostering constructive relations with major shareholders and in conveying their views to the board as a whole.'

We were surprised that only 52 companies explicitly reported that the chair engaged with shareholders. It is important for the chair of the board to meet shareholders to obtain their views on and inform them about the important matters which impact the company. Some examples of issues where it may be useful for the chair to engage with shareholders include the following:

- Board effectiveness in directing the company

- Board structure, including board diversity and expertise

- Company compliance with legislative and other regulatory requirements, including compliance with the Code

- Performance of senior management

- Company strategy, culture and values

- Dividend payments

If the board chair has not engaged with shareholders during the reporting year outside formal general meetings, the company should disclose non-compliance with Provision 3, followed by an explanation.

Committee chair's engagement with shareholders

- 52 companies reported meetings with the board's chair

- 43 companies reported meetings with the remuneration committee's chair

- 2 companies reported meetings with the nomination committee's chair

- 0 companies reported meetings with the audit committee's chair

We were pleased to see that 43 companies in our sample explicitly stated that the chair of the remuneration committee met with shareholders during the year, which is in line with Provision 3 (in total, 70 companies reported engagement on remuneration matters; however, 27 companies did not specify if the committee chair was involved).

In contrast, we were surprised to see that only two companies stated that the chair of the nomination committee met with the shareholders, whereas none of the companies reported engagement from the chair of the audit committee.

Instances when the chair of the Nomination Committee may approach shareholders for engagement include the following:

- The company is appointing new directors, particularly when it is appointing a new chair, CEO or CFO.

- The board chair will continue to stay in their role even if they have been on the board of directors for over nine years.

- The company has not complied or has been unable to comply with the Code's requirements concerning the independence of the board or the chair, membership of the committees, or directors' re-election.

- The company has not reached its diversity targets, even in an instance where it is working towards achieving these targets.

- The board has not had an external evaluation in over three years.

- An internal or external board evaluation has identified significant weaknesses.

- A board-recommended resolution to appoint or reappoint a director has received significant votes against.

Instances when the chair of the Audit Committee may approach shareholders for engagement include the following:

- The company is in the process of appointing a new auditor.

- There is a significant increase in the likelihood or impact of the principal risks faced by the company.

- The going concern of the company is uncertain, or there are reasons to believe that the company will not be able to continue in operation and meet its liabilities as they fall due.

- Significant failings in the risk management procedures, the internal control systems or the internal audit function have been identified.

- A board-recommended resolution to appoint or reappoint the external auditor proposed by the board has received significant votes against.

Reporting engagement with shareholders

Three companies provided statements such as 'the chair and CEO regularly meet with shareholders'; however, it was unclear if they or anyone else actually met any shareholders during the year. In addition, some companies did not specify who carried out the engagement and/or the method used. Some companies listed the available engagement methods (for example, meetings and phone calls) without specifying which of these or any other methods were used during the year. Some also listed those who typically engage with shareholders (i.e. the chair, CEO, CFO and committee chairs) but without specifying who, if any, of those individuals met any shareholders during the year.

We were disappointed that only 39 companies provided insights on the subject of discussions with shareholders. Better reporters provided detailed and specific information. Examples of subjects discussed reported by companies included the following:

- Particular elements of the company's strategy and operations; for example, progress on specific projects, acquisition of new businesses, financial performance, product development and risks.

- Issues that affect shareholders more directly, such as dividend policy and distribution, share price and share buyback.

- Issues that affect other stakeholders, such as the environment, climate change, working conditions and relationships with suppliers.

- Governance issues, particularly on remuneration, but also succession planning, board diversity and expertise, and chair tenure and independence.

Good reporting should provide some level of specificity while not disclosing commercially sensitive information. General headings such as 'financial performance', 'investment in new products' or 'so succession planning for the new chair' provide context for users of the annual report. Better reporters discussed both the individual(s) who carried out the engagement and the topics discussed; for example: 'The CFO met with shareholders twice in the last quarter to discuss the financial results' or 'The chair had a meeting with two major shareholders to discuss board composition and succession planning.'

Key Message:

Disclosures are informative if they go beyond general statements stating that a meeting/event occurred.

Sixteen companies in our sample provided a timeline showing who engaged with shareholders, when and how. This made it more accessible and straightforward for the reader to understand how the board engaged with shareholders during the year.

Good reporting should include information on activities undertaken during the year and any outcomes, showing how the board engaged and considered shareholders' feedback. Feedback on shareholder engagement was reported by only 23 companies, with 17 of these companies only explaining the feedback received on remuneration matters.

Key Message:

Reporting on the feedback received from shareholders is an important indication of the effectiveness of the engagement.

Where appropriate, reporting on the outcomes from engagement should include how the shareholders' feedback affected board decisions, such as on strategy, governance, and approach to social and environmental issues. Examples of decisions taken by the company following shareholder feedback from the companies in our sample included:

- bringing forward the Net Zero targets

- changes to dividend policy

- separation of the roles of chair and CEO

- establishing a sustainability board committee

- recruitment of new NEDS

Good reporting on outcomes also includes instances where the board considered or discussed shareholders' feedback but decided not to take any action.

Shareholder engagement following a significant vote against a board-recommended resolution

Provision 4 states 'When 20 per cent or more of votes have been cast against the board recommendation for a resolution, the company should explain, when announcing voting results, what actions it intends to take to consult shareholders in order to understand the reasons behind the result. An update on the views received from shareholders and actions taken should be published no later than six months after the shareholder meeting. The board should then provide a final summary in the annual report and, if applicable, in the explanatory notes to resolutions at the next shareholder meeting, on what impact the feedback has had on the decisions the board has taken and any actions or resolutions now proposed.' The FRC is currently undertaking research into how companies report against the requirements of Provision 4 of the Code. The research will focus on those companies which have received a significant vote against a board-recommended resolution in the period between 2019 and

- It will evaluate the level of reporting on shareholder engagement on the statements provided by companies when announcing voting results, update statements published six months following the vote and the summary of these engagements in the annual reports.

Workforce Engagement

This year, companies explained their workforce engagement processes well. However, only 28 companies connected the views of the workforce and actions carried out by the board. Most companies listed boilerplate actions which appeared to be unrelated to their employee engagement feedback, or included a vague statement similar to the one below:

Example:

The issues that were identified in the engagement survey have been addressed by the board.

The majority of the outcomes reported centered around employee wellbeing and hybrid working. It is inevitable that the pandemic has had a disruptive effect on many employees, and it is encouraging to see companies focusing on initiatives to tackle this. However, we were unable to find many examples of outcomes which were linked to other matters; for example, delivering the company's strategy.

Beyond these specific pandemic-related outcomes, many companies have not reported in any detail outcomes and impacts of their workforce engagement. Good practice reporting would include examples of company-specific initiatives which were implemented as a result of employee feedback.

Those companies that did outline their outcomes in relation to wider issues discussed matters such as the following:

- Transformation and innovation

- Charity and volunteering

- Diversity and inclusion

- Discrimination at work

- Recycling policies

Better reporters gave specific examples of their initiatives, clearly linking them to employee feedback:

Example:

Employees raised that they wanted 'Better segmentation of audiences for communication purposes and greater visibility of the Senior Leadership Team. More structure around celebrating success and morale boosting activity.' As a result, 'The Group communications team has been strengthened with the recruitment of a new Head of Internal Communications. A 'Top 100' group has been created for planning and communication of new initiatives, and a programme of global townhalls introduced. Celebrating success has been amplified through more regular communications via multiple channels and a weekly written newsletter.

To enhance this, the company could have also outlined the expected impacts of implementing these new initiatives. This will help companies' explanations of their feedback cycles. If companies have not yet seen the results of their actions, it would be helpful for them to include the impacts of their initiatives implemented in the previous reporting year.

As mentioned earlier in the report, the most effective reporters used a table or a diagram to present their disclosures on workforce engagement. If used effectively, a table can help to ensure that the complete feedback loop is included in their report.

A few companies included a list of 'what is important to their employees', without explaining how they collected this information (for example, is the issue a direct result of information collected from employees or an assumption of the management). Companies should be specific and avoid including information that has no connection to their wider workforce.

Although some companies have given some detail of their actions and outcomes, their reporting could be improved if they included information on the regularity of their engagement and, importantly, link the outcomes to specific employee feedback. This can be found in the example below.

Agenda items at employee engagement meetings

It is recognised that having pre-agreed agenda items is an effective way of structuring a productive meeting. It is important that the employees are able to influence these meetings, and adding agenda items beyond those suggested by the board is one way to achieve this. However, it is important to avoid making the agenda so rigid that issues of the day can't be added to the agenda at short notice.

One company said that their designated NEDs will only attend workforce engagement meetings for pre-agreed topics.

Our report on Workforce Engagement and the UK Corporate Governance Code provides an understanding of the benefits of having a balance between topics of management interest and topics of workforce interest when setting an agenda. Good practice reporting would outline that they included topics that were agreed by the wider workforce as well as include items set by the board.

| Meeting | Presentations and topics discussed | Outcome/impact |

|---|---|---|

| The new ways of working Admiral's approach to ESG |

Please see the new way of working section under principal decisions on page 101. The importance of the internal communications strategy in respect of the work on ESG factors was emphasised, as was the need to help the community and other businesses. Please see the sustainability approach section under principal decisions on page 104 for further information. |

|

| February 2021 | Sale of the Penguin Portals businesses (as reported in the 2020 Annual Report) | Colleague views of the announcement of the sale of the Penguin Portals businesses were heard from the Confused.com ECG representative, noting that further clarity was needed in respect of how profits from the sale would be distributed. This was followed up by management after the meeting. This was raised as a specific topic for discussion at the Board during the year, at which it was reconfirmed that the majority of the sale proceeds would be returned to shareholders, with a proportion being retained by the Group to develop other areas of the business. |

Source: Admiral Group PLC, Annual Reports and Accounts 2021, p.92

Workforce engagement methods

Overall, companies have given good explanations of how views of the workforce are escalated to the board.

In line with last year's analysis, we found that a designated NED was the most common engagement mechanism. This continues to be an effective engagement mechanism, particularly when companies clearly define the role of the NED, outlining the board's expectations and how the NED's role will aid engagement with employees.

It was also encouraging to see that a few companies gave explanations of the reasons why a particular NED was appointed to engage with the workforce. A simple explanation of why the NED has been chosen ensures that companies are using this method appropriately and that the designated NED will genuinely facilitate two-way engagement between employees and the board.

It is especially helpful to see that some designated NEDs have experience in the relevant fields. Such as having a background in Human Resources and have knowledge of relevant ESG issues.

We were pleased that some companies explained how the membership of their formal workforce advisory panels were decided.

A few companies had elected members from the workforce to be on the panel; this is more likely to lead to a more effective engagement as they are more likely to accurately reflect the views of employees. For example:

Example:

There is a democratic member election process and members are provided with an induction to ensure that there is clarity about the role and remit of the employee forum, as well as their role as members.

More companies are combining the use of an advisory panel with the support or under the leadership of a designated NED to engage with the workforce. This approach allows for a form of structured engagement with employees that the NED is then able to feed back to the board. Although it is not often reported, we would expect that this approach allows the NED to directly feedback the views and outcomes from board discussions that the NED has raised.

We have not seen an increase in companies choosing to appoint a workforce director to the board. If more companies used this mechanism, we would be able to assess the effectiveness of it. One company that appointed a director from the workforce included an interview with them in their annual report. It was helpful to see how their workforce director viewed their role on using their own experiences as well as the opinions of their colleagues to inform the board on issues relevant to employees. One of the challenges they reported was the impact of Covid-19 and the effect that this had on company operations. The company's workforce director briefed the board, bringing any important feedback to the attention of the board.

Provision 5 of the Code states that 'If the board has not chosen one or more of these methods, it should explain what alternative arrangements are in place and why it considers they are effective.'

This year we have continued to see the use of alternative arrangements with some good explanations of why they are effective. Out of the 26 companies who opted to follow an alternative arrangement, 17 explained why their method was effective.

Example:

The Board reviewed [the company's] method of workforce engagement during 2021 and concluded that leveraging existing channels of colleague engagement had been an effective mechanism for providing a rich and varied insight into the views and experiences of colleagues across the workforce with feedback from both Directors and colleagues participating in the programme being extremely positive. The innovative use of digital channels continued to be a key enabler to the success of the programme ensuring that Board members, management and colleagues remained connected despite the restrictions on face-to-face meetings which were in place throughout the year. The Board has therefore decided to continue with this approach for workforce engagement rather than adopting one of the methods prescribed in the Code and will continue to both evolve and enhance the approach and keep its effectiveness under review.

In our previous report, we mentioned that we would be paying closer attention to how companies assess their engagement mechanisms to ensure that they are continually effective. Our analysis this year shows that very few companies disclosed that they reviewed the effectiveness of one of the three engagement mechanisms.

Key Message:

Good practice reporting would include an explanation of why the company has chosen their engagement mechanism and how they will monitor this to ensure that it is effective.

Customer Engagement

This year we found that 47 companies reported explicitly in this area. Many organisations have created specific programmes and channels through which to hear feedback from customers, with surveys and customer satisfaction scores among the most prevalent modes of direct engagement.

Many of this year's disclosures referred to the use of data to illustrate how they had reported against the Principles and Provisions of the Code. This allowed for more effective measurement and metrics to quantify the effectiveness of engagement. Despite many positive examples of targets for customer engagement from a range of companies, only one company provided any examples of targets concerning customer-focused engagement not being met. When boards had discussed poor scores, more general narratives were given. There is an opportunity when reporting for companies to explain how they had dealt with poor scores and what positive actions were proposed.

Customer engagement was the area where some good-quality feedback-based stakeholder engagement was seen and where outcomes were clear. During discussions concerning feedback, the better reporting companies were specific on what was sought from these groups. For example:

Example:

Non-executive directors were able to observe customer-facing colleagues in action and to hear customer feedback as part of a focus group or customer listening surgery. Feedback videos were shown to the Board as part of the annual Board strategy session and provided useful insights to help inform Board discussions.

Two companies this year had discussed the work of the Chief Customer Officer (CCO). The role of the CCO is to feed customer-related issues directly to the board for discussion and necessary decisions. For example, one company had effectively linked customer satisfaction data to the formulation of its 2022 strategy and how this approach had led to the hiring of a CCO:

Example: We gather feedback throughout the customer journey, including onsite product reviews, public review sites and internal customer satisfaction measures. At each Board meeting, the Chief Executive Officer reports the latest customer satisfaction indicators and provides updates on key actions taken in relation to ongoing improvements to the customer proposition at each Board meeting. Customer feedback and satisfaction data has been a key driver for the Board's formulation of the 2022 strategy

- Experience, Reach, Choice and Sustainability. The Board demonstrated its commitment to improving customer experience by approving the hire of a dedicated Chief Customer Officer to the Executive Leadership Team who will join in 2022.

This year, 12 companies discussed the use of Net Promoter Score (NPS), this is an increase of 11 companies compared to last year. Net Promoter Score is a measurement tool for customer loyalty and satisfaction, and has allowed directors to have a clear measure on the views of its customers. In reporting, Net Promoter Scores have been used to illustrate clear targets and improvements in service.

Aggregated scores are used by companies to help businesses improve in areas such as delivery and customer service. These were typically used as positive examples demonstrating how companies had actively engaged with their stakeholders throughout the year. The use of metrics does, however, need to be balanced across all stakeholders, not just customers, to have maximum impact:

Example: Goal 8 - Reach and maintain a top-quartile Customer NPS score of at least

- The Group's mission is to help people connect, and it is important that the Group's customers believe it is doing this. The Group's weighted average Customer NPS score across its brands was 71 in FY22 (FY21: 67), which places it in the top quartile for technology companies. We have improved order and delivery information, introduced a customer service chatbot, worked with our partners to improve delivery performance and worked with our supply chain to improve flower quality.

Supplier Engagement

Climate-related and sustainability issues were a major theme in this area. Companies took time to discuss how they had worked as a partner alongside suppliers to embed climate-related issues. This also included examples of considerations in Requests for Proposal and how stakeholder integration was used as a pillar for the board's climate change policy. Presentations to the board and executive management were again a popular form of supplier engagement. This has been used as a strong form of two-way engagement. These presentations discussed a variety of long-term business interests and different issues across geographies.

As well as the most common methods of engagement mentioned earlier in this section, those specific to suppliers included the following:

- Use of relationship managers

- Supplier reviews

- Audits and inspections

- Awareness training, including modern slavery

- Ethical audits

- Due diligence questionnaires

- Clauses in supplier contracts

- Whistleblowing channels

- On-site visits

Better reporters talked about the frequency of their engagement and shared information on the exact issues considered in regular engagement with suppliers.

Impact reporting on suppliers and communities

It was positive to see companies this year engaging on how their operations and activities impacted their suppliers and communities. We found that 76 companies reported on outcomes of engagements compared to 69 last year. Most notably, climate

- and sustainability-related issues. Reporting on impacts was most effective when companies were able to quantify results or timeframes for actions. Examples of sustainability related impacts on companies included working with materials suppliers on one-on-one ESG practice assessments and upskilling suppliers on sustainability issues to better understand the barriers and issues within the sector.

A good example might include training suppliers on ESG concepts. Companies have also consulted with suppliers on the formation of their climate-change strategies as well as working with specific manufacturers on the development of low-emissions infrastructure and equipment.

Impacts on communities were more varied. Many companies still gave boilerplate examples of very general discussions concerning the impact of a company's activities, such as improvements to career opportunities or more common disclosures were those surrounding climate risks.

Despite this continued use of boilerplate reporting, when companies actively engaged with these issues, reporting was strong. This was most effective when it was linked to wider business concerns and strategy. One company designed a 'Responsible Business framework' alongside community stakeholders, which is used by the internal CSR Committee to review progress against targets. Other better reporting examples include linking commitments on net zero targets to the opportunity to create a fairer society and supporting livelihoods inside communities in which they operate:

Example:

"We developed the Driving What Matters plan (the Plan) during 2021. Two of its pillars, Places and Planet, will assess the impact of the Group's operations on the community and the environment. The Responsible Business framework was designed collaboratively and is owned and delivered by our colleagues around the Group. Their input has shaped the way we approach responsibility and set out what responsible business means for Inchcape. The CSR Committee, and the Board, will regularly review progress against targets as the Plan matures alongside monitoring the Group's corporate responsibility, sustainability and stakeholder engagement activities”

Modern Slavery

Provision 1 states that companies 'should describe in the annual report how opportunities and risks to the future success of the business have been considered and addressed.'

Earlier this year, in collaboration with Lancaster University and the UK Independent Modern Slavery Commissioner, we published a report on Modern Slavery Reporting Practices in the UK. A number of the Code's Principles and Provisions cover matters relating to supplier issues, including the board's responsibility to assess and manage the company's risks, to embed appropriate internal controls and for effective engagement with wider stakeholders. This year, we therefore continue our research to determine reporting quality in annual reports as it relates to areas of the Code. Our assessment this year focused on (i) Risk and Governance (ii) Policies and Effectiveness and (iii) Stakeholder Engagement.

Overall, while nearly half of companies report on their policies and procedures as they relate to modern slavery, reporting fails to address the effectiveness of these measures.

While almost all companies mention modern slavery in their annual report, these were mostly brief and in relation to legal and compliance issues. Others reported on modern slavery within sustainability strategies, s.172 and risk statements. Concerningly, just 24 companies provided a direct working link (URL) to their modern slavery statement from their annual report.

Key Message:

Companies should provide appropriate cross-referencing to modern slavery statements in annual reports.

Risk and governance

We found that 53 companies identified modern slavery as a risk in their annual report, with 13 identifying it as a principal risk and the majority only briefly mentioning the term in the context of risk. As a principal risk, modern slavery was categorised as third-party and supplier risk, legal and compliance risk, reputational risk, supplier management and breach of contract. Those who did report on modern slavery as a principal risk were from a wide range of sectors.

We saw some good practice on how companies identify and manage risks relating to modern slavery.