The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC response to the European Commission’s consultation on the impact of IFRS in the European Union

Effects of using International Financial Reporting Standards (IFRS) in the EU: public consultation

Fields marked with * are mandatory.

Impact of International Financial Reporting Standards (IFRS) in the EU: public consultation

Purpose of the consultation

The European Commission is holding a public consultation to seek views from all interested parties on their experience of Regulation 1606/2002 ("the IAS Regulation"). The results of this public consultation will feed into the European Commission's evaluation of the IAS Regulation.

Background

Applying internationally accepted standards - the International Financial Reporting Standards (IFRS) – means standardising companies' financial reporting to make financial statements more transparent and comparable. The ultimate aim is for the EU capital market and the single market to operate efficiently.

Scope of the IAS Regulation

The IAS Regulation states that the IFRS must be applied to the consolidated financial statements of EU companies whose securities are traded on a regulated EU market. EU countries may extend the application of IFRS to annual financial statements and non-listed companies (view an update on the use of options in the EU). The Transparency Directive (2004/109/EC), as subsequently amended, also stipulates that all issuers (including non-EU ones) whose securities are listed on a regulated market located or operating in an EU country must use IFRS.

Impact of the IAS Regulation

The implementation of IFRS in the EU has had an impact on cross-border transactions, trade, the cost of capital, investor protection, confidence in financial markets and stewardship by management. However, it is difficult to differentiate their impact from that of other significant factors, including other regulatory changes in the EU and internationally.

Developments since adoption

Over 100 countries now use IFRS. These accounting standards have been increasingly discussed at international level (e.g. G20, Basel Committee) and with various interested parties in the EU, especially in the wake of the financial crisis.

Several initiatives concerning technical issues and governance are under way at both international and EU level. In the EU, the Maystadt report's recommendations are being implemented. These are designed to strengthen the EU's contribution to achieving global and high quality accounting standards by beefing up the role of the European Financial Reporting Advisory Group (EFRAG), which advises the Commission on IFRS matters.

Current Commission evaluation

The Commission is evaluating the IAS Regulation to assess:

- IFRS's actual effects

- how far they have met the IAS Regulation's initial objectives

- whether these goals are still relevant

- any areas for improvement.

This consultation is part of the evaluation process. The questionnaire was drafted with the help of an informal expert group which is to assist the Commission throughout the process.

Target group(s)

Any interested party - commercial, public, academic or non-governmental, including private individuals.

Especially: capital market participants and companies preparing financial statements or using them for investment or lending purposes (whether or not they use IFRS).

Consultation period

7 August – 31 October 2014 (12 weeks).

How to submit your contribution

If possible, to reduce translation and processing time, please reply in one of the Commission's working languages (preferably English, otherwise French or German).

Contributions will be published on this website with your name (unless – in your response – you ask us not to).

N.B.: Please read the specific privacy statement to see how your personal data and contribution will be dealt with.

Reference documents and other, related consultations

- IAS/IFRS standards & interpretations

- IFRS Foundation

- European Financial Reporting Advisory Group (EFRAG)

- Commission reports on the operation of IFRS

Results of public consultation & next steps

The results will be summarised in a technical report and will feed into the evaluation report to be presented by the Commission in line with Article 9.2 of Regulation 258/2014.

Questions

Please note that some questions do not apply to all groups of respondents.

Who are you?

1. In what capacity are you completing this questionnaire?

If it's not on behalf of an organisation, please indicate that you are a "private individual".*

- Company preparing financial statements [some specific questions for preparers marked with 'P']

- Company using financial statements for investment or lending purposes [some specific questions for users marked with 'U']

- A company that both prepares financial statements and uses them for investment or lending purposes [some specific questions for preparers and users marked with 'P' and 'U']

- Association

- Accounting / audit firm

- Trade union / employee organisation

- Civil society organisation / non-governmental organisation

- Research institution / academic organisation

- Private individual

- Public authority [one specific question for public authorities marked with ‘PA’]

- Other

1.10. Public authority - please specify

(you can tick more than 1 choice below if you are replying on behalf of more than 1 type of organisation)*

- International organisation

- EU institution

- EU agency

- National standard-setter

- National supervisory authority/regulator

- Other

2. Where is your organisation/company registered?

Where is your organisation/company registered, or where are you are located if you do not represent an organisation/company? Select a single option only.*

- EU-wide organisation

- Global organisation

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- The Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- United Kingdom

- Norway

- Iceland

- Liechtenstein

- Other European country

- Other

3. What is the name of the organisation or authority you represent?

What is the name of the organisation or authority you represent? If you are part of a group, give the name of the holding company as well.*

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS UK Contact: Melanie McLaren, Executive Director, Codes and Standards, DDI: 020 7492 2406, Email: [email protected]

5. How do you want your contribution to appear?

In the interests of transparency, your contribution will be published on the Commission's website. How do you want it to appear?*

- Under the name supplied? (/ consent to the publication of all the information in my contribution, and I declare that none of it is subject to copyright restrictions that would prevent publication.)

- Anonymously? (I consent to the publication of all the information in my contribution except my name/the name of my organisation, and I declare that none of it is subject to copyright restrictions that would prevent publication.)

Relevance of the IAS Regulation

Objective

6. Rationale for the IAS Regulation

The rationale for the IAS Regulation, imposing internationally accepted standards - the International Financial Reporting Standards (IFRS) - was to make companies use the same set of accounting standards, thus ensuring a high level of transparency and comparability of financial statements. The ultimate aim was to make the EU capital market and the single market operate efficiently.

In your view, are the Regulation's objectives still valid today?*

- Yes

- No

- No opinion

6.1. Comments.

We consider that this question is closely related to question 7 because the aims of the IAS Regulation include contributing to the efficient and cost effective functioning of the EU capital market (Recitals 2, 4 and 12) and to the aim of having a single set of high-quality global accounting standards that can be used for cross-border transactions and listing anywhere in the world (Recitals 2, 4 and 5). We welcome this review and consider that the objectives of the IAS Regulation have been broadly achieved. We strongly believe that the IAS Regulation's objectives are still valid today and will continue to be relevant in the future so that the gains made in comparability and transparency of financial statements are maintained and improved upon where necessary. We do not consider that the objectives of the IAS Regulation need to be amended. In his report to the European Commission on reinforcing the EU's contribution to international accounting standards, Mr Maystadt observed that the objective of adopting IFRS by the EU "does not seem to be challenged in Europe" based on his consultations with stakeholders (Philippe Maystadt (2013), Should IFRS Standards be More "European"?: Mission to reinforce the EU's contribution to the development of international accounting standards, paragraph 2.1). Mr Maystadt also observed that there was "a wide consensus on the commitment to global quality accounting standards". He highlighted that the global character of international accounting standards was the most significant factor, with all the stakeholders interviewed acknowledging that the IAS Regulation “has improved the quality, comparability and reliability of financial information". We strongly believe that the IAS Regulation has furthered the move towards establishing a set of globally accepted high-quality standards and consider that this can be demonstrated by the following actions: - The Financial Stability Board (FSB) has designated IFRS as one of the 12 key International Standards and Codes that are key for sound financial systems and deserving of priority implementation depending on country circumstances (http://www.financialstabilityboard.org/cos/key_standards.htm). This demonstrates that IFRS are a part of the global financial architecture. - The large number of jurisdictions that have mandated the use of IFRS for all or most public companies. This is evidenced by a major research project undertaken by the IFRS Foundation to obtain a full understanding of the use of IFRS around the world. The findings, which were verified by the relevant jurisdictional authority, show that 105 countries have mandated the use of IFRS for all or most public companies (http://www.ifrs.org/Use-around-the-world/Pages/Jurisdiction-profiles.aspx).

7. The IAS Regulation refers to IFRS

The IAS Regulation refers to IFRS as a set of global accounting standards. Over 100 countries use or permit the use of these standards. The US, for instance, allows EU companies listed in the US to report under IFRS. However, it continues to rely on its "generally accepted accounting principles" (GAAPs) for its domestic companies' financial statements, while the EU requires IFRS to be used for the consolidated accounts of EU listed companies.

Has the IAS Regulation furthered the move towards establishing a set of globally accepted high-quality standards?*

- Yes

- No

- No opinion

7.1. Please explain.

See our response to question 6.1. Whilst it is regrettable that even greater convergence with the US has not been achieved, the opportunity for EU companies listed in the US to report under IFRS without the need for reconciliation to US GAAP provides significant benefits and cost savings to such companies.

Scope

8. Scope of the IAS Regulation

The obligation to use IFRS as set out in the IAS Regulation applies to the consolidated financial statements of EU companies whose securities are traded on a regulated market in the EU. There are about 7,000 such firms.

In your view, is the current scope of the IAS Regulation right (i.e. consolidated accounts of EU companies listed on regulated markets)?*

- Yes

- No

- No opinion

8.2. Comments.

We agree with the current scope of the IAS Regulation (i.e. requiring consolidated accounts of EU companies listed on regulated markets to apply EU-adopted IFRS) is appropriate and do not propose any amendment to that scope. The options for Member States to permit or require the application of EU-adopted IFRS in companies' annual accounts and in the individual and consolidated accounts of non-publicly-traded companies enable Member States to tailor the use of IFRS as appropriate to their markets.

9. Extension of IFRS application

National governments can decide to extend the application of IFRS to:

- individual annual financial statements of companies listed on regulated markets

- consolidated financial statements of companies that are not listed on regulated markets

- individual annual financial statements of companies that are not listed on regulated markets.

In your view, are the options open to national governments:*

- Appropriate

- Too wide

- Too narrow

- No opinion

Cost-benefit analysis of the IAS Regulation

10. Pre-IFRS experience

Do you have pre-IFRS experience/ experience of the transition process to IFRS?*

- Yes

- No

11. Impact on transparency

In your experience, has applying IFRS in the EU made companies' financial statements more transparent (e.g. in terms of quantity, quality and the usefulness of accounts and disclosures) than they were before mandatory adoption?*

- Significantly more transparent

- Slightly more transparent

- No change

- Slightly less transparent

- Significantly less transparent

- No opinion

11.1. Please elaborate.

We consider that the consolidated financial statements of EU companies listed on regulated markets have become significantly more transparent by the application of EU-adopted IFRS. Evidence of the impact of IFRS (generally and specifically relating to questions 12-18) can be found: - In the large number of academic studies that have assessed the role of IFRS in capital markets and provided evidence that mandatory adoption of IFRS "has improved efficiency of capital market operations and promoted cross-border investment" (Ann Tarca (2012) The Case for Global Accounting Standards: Arguments and Evidence http://www.ifrs.org/Use-around-the-world/Documents/Case-for-Global-Accounting-Standards-Arguments-and-Evidence.pdf). The studies include topics such as market efficiency, investment decisions, the quality of financial information, foreign investment, capital market integration and other factors influencing the success of IFRS implementation. - In ESMA's 2013 report on the Activities of the IFRS Enforcers in Europe, where they observed that "improvement has been noted in many areas of application of IFRS" (ESMA (2013) Activities of the IFRS Enforcers in Europe, paragraph 61, http://www.esma.europa.eu/system/files/2014-551_activity_report_on_ifrs_enforcers_in_europe_in_2013.pdf) due to the experience issuers have developed over the last nine years in applying IFRS. ESMA also observes, however, that there is still room “for improvement in the quality of issuers' financial reporting in certain areas". - As highlighted in our response to question 6.1, Mr Maystadt noted that all the stakeholders interviewed acknowledged that the IAS Regulation "has improved the quality, comparability and reliability of financial information" (Philippe Maystadt (2013), Should IFRS Standards be More "European"?: Mission to reinforce the EU's contribution to the development of international accounting standards).

12. Impact on comparability

In your experience, has applying IFRS in the EU altered the comparability of companies' financial statements, compared with the situation before mandatory adoption?

| Significantly increased | Slightly increased | No change | Slightly reduced | Significantly reduced | No opinion | |

|---|---|---|---|---|---|---|

| In your country | ||||||

| EU-wide | ||||||

| Compared with non-EU countries |

12.1. Please elaborate.

See our response to question 11.1.

13. Ease of understanding financial statements

Have financial statements become easier to understand since the introduction of IFRS, compared with the situation before mandatory adoption?*

- Yes, in general

- Yes, but only in certain areas

- No, in general

- No, except in certain areas

- No opinion

13.2. Please elaborate.

See our response to question 11.1.

14. Level playing field

Has the application of IFRS in the EU helped create a level playing field for European companies using IFRS, compared with the situation before mandatory adoption? *

- Yes

- Yes, to some extent

- No

- No opinion

14.1. Please elaborate.

See our response to question 11.1.

15. Impact on access to capital

Based on your experience, to what extent has the application of IFRS in the EU affected access to capital (listed debt or equity) for issuers in domestic and non-domestic markets that are IFRS reporters?

| Made it a lot easier | Made it easier | No effect | Made it more difficult | Made it a lot more difficult | No opinion | |

|---|---|---|---|---|---|---|

| Domestic capital | ||||||

| EU capital other than domestic | ||||||

| Non-EU capital |

15.1. Provide data / examples

Please provide data / examples if available.

See our response to question 11.1.

16. Impact on cost of capital

In your experience, has the application of IFRS in the EU had a direct effect on the overall cost of capital for your company or the companies you are concerned with? (Please distinguish - as far as possible – the impact of IFRS from other influences, e.g. other regulatory changes in the EU and the international credit crunch and crisis.)*

- Cost has fallen significantly

- Cost has fallen slightly

- No effect

- Cost has risen slightly

- Cost has risen significantly

- No opinion

16.1. Provide data/ examples

Please provide data/ examples if available.

We note that an academic study using EU data has found evidence that, "on average, the IFRS mandate significantly reduces the cost of equity for mandatory adopters by 47 basis points" (Li, Siqi (2010), Does mandatory adoption of International Financial Reporting Standards in the European Union reduce the cost of equity capital? The Accounting Review, Vol. 85, No. 2 2010 pp. 607-636). We consider that this study provides evidence of a significant reduction in the cost of capital for EU companies.

17. Improved investor protection

In your view, has the application of IFRS in the EU improved protection for investors (compared with the situation before mandatory adoption), through better information and stewardship by management?*

- Yes, to a great extent

- Yes, to a small extent

- It had no impact

- No, protection for investors has worsened

- No opinion

17.1. Provide data/ examples

Please provide data/ examples if available.

See our response to question 11.1.

18. Confidence in financial markets

In your view, has the application of IFRS in the EU helped maintain confidence in financial markets, compared with the likely situation if it had not been introduced?

(N.B.: the “enforcement” section of this questionnaire deals with how IFRS are/ were applied.)*

- Yes, to a great extent

- Yes, to a small extent

- It had no impact

- No, confidence in financial markets has decreased

- No opinion

18.1. Provide data/ examples

Please provide data/ examples if available.

See our response to question 11.1.

19. Other benefits from applying IFRS

Do you see other benefits from applying IFRS as required under the IAS Regulation?*

- Yes

- No

- No opinion

19.1. Specify other benefits

Yes - please specify (you may select more than 1 option).*

- Improved ability to trade/expand internationally

- Improved group reporting in terms of process

- Robust accounting framework for preparing financial statements Administrative savings

- Group audit savings

- Other

19.2. Details and examples

If yes, please give details, with examples/ data if possible.

See our response to question 11.1.

20. Benefits vs. costs of IFRS application

In your experience, on balance and at global level, how do the benefits of applying IFRS compare to any additional costs incurred – compared with the situation before mandatory adoption, bearing in mind the increasing complexity of businesses that accounting needs to portray?*

- Benefits significantly exceed the costs

- Benefits slightly exceed the costs

- Benefits and costs are broadly equal

- Costs slightly exceed the benefits

- Costs significantly exceed the benefits

- No opinion

20.1. Additional comments

Please provide any additional comments you think might be helpful.

PA.1. Administrative and regulatory burden

How would you rate the administrative and regulatory burden for your authority (e.g. reporting, enforcement) arising from the ongoing application of IFRS (excluding costs relating to the initial transition to IFRS)?

If you are an EU agency, please give only a consolidated EU-level response on behalf of the authorities whose responses you are coordinating.*

- No significant impact

- Some impact

- Heavy burden

- No opinion

Endorsement mechanism & criteria

The EU's IFRS endorsement process

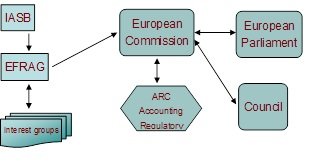

In the EU, IFRS are adopted on a standard-by-standard basis. The procedure is as follows:

- The International Accounting Standards Board (IASB) issues a standard.

- The European Financial Reporting Advisory Group (EFRAG) holds consultations, advises on endorsement and examines the potential impact.

- The Commission drafts an endorsement regulation.

- The Accounting Regulatory Committee (ARC) votes and gives an opinion.

- The European Parliament and Council examine the standard.

- The Commission adopts the standard and publishes it in the Official Journal.

This process typically takes 8 months.

Endorsement criteria

Under Article 3.2 of the IAS Regulation, any IFRS to be adopted in the EU must:

- be consistent with the "true and fair" view set out in the EU's Accounting Directive

- be favourable to the public good in Europe

- meet basic criteria on the quality of information required for financial statements to serve users (i.e. statements must be understandable, relevant, reliable and comparable, they must provide the financial information needed to make economic decisions and assess stewardship by management).

In his October 2013 report, Mr Maystadt discussed the possibility of clarifying the "public good" criterion or adding 2 other criteria as components of the public good, namely that:

- any accounting standards adopted should not jeopardise financial stability

- they must not hinder the EU's economic development.

He also suggested that more thorough analysis of compliance with the criteria of prudence and respect for the public good was needed.

21. IFRS Adoption Process in the EU

In the EU, IFRS are adopted on a standard-by-standard basis. The process, which typically takes 8 months, is as follows:

- The International Accounting Standards Board (IASB) issues a standard.

- The European Financial Reporting Advisory Group (EFRAG) holds consultations, advises on endorsement and examines the potential impact.

- The Commission drafts an endorsement regulation.

- The Accounting Regulatory Committee (ARC) votes and gives an opinion.

- The European Parliament and Council examine the standard.

- The Commission adopts the standard and publishes it in the Official Journal.

Do you have any comments on the way the endorsement process has been or is being conducted (e.g. in terms of the interaction of players, consistency, length, link with effective dates of standards, outcome, etc.)?*

We consider that the current endorsement process is appropriate. It is comprehensive in nature and a wide-ranging number of stakeholders are involved to ensure that the IFRS that are adopted are suitable for use in the EU. These aspects are illustrated by the length of time it takes for the endorsement process to take place. We note that the IAS Regulation envisages an endorsement mechanism that can be implemented expeditiously (Recital 11). We agree with this sentiment and do not consider that the endorsement process should be lengthened as it would severely restrict companies' ability to apply the same effective date as that specified in the IFRS. This ability is important for companies that are listed on other capital markets to be able to use the same financial statements as those used in the EU. We believe that the current IASB policy of setting effective dates approximately three years after the publication of the standard allows sufficient time for the endorsement process and for companies to take the necessary steps to implement the IFRS.

22. Endorsement Criteria for IFRS

Under Article 3.2 of the IAS Regulation, any IFRS to be adopted in the EU must:

- be consistent with the "true and fair" view set out in the EU's Accounting Directive

- be favourable to the public good in Europe

- meet basic criteria on the quality of information required for financial statements to serve users (i.e. statements must be understandable, relevant, reliable and comparable, they must provide the financial information needed to make economic decisions and assess stewardship by management).

Are the endorsement criteria appropriate (sufficient, relevant and robust)?*

- Yes

- Yes, to some extent

- No

- No opinion

23. Trade-off in IAS Regulation

There is a necessary trade-off between the aim of promoting a set of globally accepted accounting standards and the need to ensure these standards respond to EU needs. This is why the IAS regulation limits the Commission's freedom to modify the content of the standards adopted by the IASB.

Does the IAS Regulation reflect this trade-off appropriately, in your view? *

- Yes

- No

- No opinion

24. Problems due to IFRS differences

Have you experienced any significant problems due to differences between the IFRS as adopted by the EU and the IFRS as published by the IASB ("carve-out" for IAS 39 concerning macro-hedging allowing banks to reflect their risk-management practices in their financial statements)? *

- Yes

- No

- No opinion

Quality of IFRS financial statements

25. Overall opinion on IFRS financial statement quality

What is your overall opinion of the quality (transparency, understandability, relevance, reliability and comparability) of financial statements prepared by EU companies using IFRS?*

- Very good

- Good

- Moderate

- Low

- Very low

- No opinion

25.1. Additional comments on quality

Please provide any additional comments you think might be helpful.

We consider that the quality of financial statements prepared using EU-adopted IFRS by UK companies is good, though the quality is less so amongst smaller listed companies which may reflect the more limited resources at their disposal. We are not able to express an opinion on reporting across Europe. As highlighted in our responses to question 11.1, there is a growing body of academic literature that provides evidence that the mandatory adoption of IFRS is beneficial to capital markets. There are also the annual IFRS activities reports published by ESMA that chart the progress on improvements in the financial statements of EU companies using EU-adopted IFRS.

26. Complexity and understandability of IFRS financial statements

Given that firms have complex business models and transactions, how would you rate financial statements prepared in accordance with IFRS in terms of complexity and understandability?*

- Very complex & difficult to understand

- Fairly complex & difficult to understand

- Reasonable

- Not complex or difficult

- No opinion

26.1. Further comments on complexity

Please provide any further comments you think might be helpful, specifying any particular areas of accounting concerned, if appropriate.

Many companies have complex business models and transactions and this can lead to financial statements being fairly complex and difficult to understand. Some of this complexity is unavoidable due to the complexity of the underlying business and transactions. However, we acknowledge that IFRS are not perfect and may at times have contributed to that complexity; in other words the introduction of “avoidable" complexity. For example, disclosure requirements are not always drafted in a way that makes complex information readily understandable. We, together with EFRAG and the national standard setters of France, Germany and Italy have published a Bulletin (https://frc.org.uk/Our-Work/Publications/Accounting-and-Reporting-Policy/Getting-a-Better-Framework-Complexity-Bulletin.pdf) that discusses complexity and how it may be reduced to stimulate debate within Europe about this issue. In addition, we have launched a "Clear & Concise" initiative aimed at ensuring that annual reports are prepared so as to provide relevant information for investors. We believe that this initiative is a key step towards higher quality corporate reporting and is a part of our continuing efforts to address some of the common criticisms about the quality of communication in annual reports such as the use of boilerplate or disclosure of immaterial information (information about the FRC's Clear & Concise initiative can be found here: https://www.frc.org.uk/Our-Work/Headline-projects/Clear-Concise.aspx). The IASB is aware of concerns as to whether IFRS are contributing to complexity and has launched a Disclosure Initiative project (information about the IASB's Disclosure Initiative can be found here: http://www.ifrs.org/Current-Projects/IASB-Projects/Disclosure-Initiative/Pages/Disclosure-Initiative.aspx) to tackle these issues and in particular to address ongoing concerns about the quality of financial reporting disclosure.

27. IFRS vs. other standards: complexity and understandability

How would you rate financial statements prepared using IFRS in terms of complexity and understandability – compared with other sets of standards you use?

| IFRS information is easier to understand than... | IFRS information is neither easier nor more difficult to understand than ... | IFRS information is more difficult to understand than ... | No opinion | |

|---|---|---|---|---|

| Information under your local GAAPs | ||||

| Information under any other GAAPs |

27.1. Local GAAPs

What are your local GAAPs?

We have not expressed an opinion on question 27 as we consider that it is not comparing similar items so is not a sensible comparison to make (we also consider that question 28 is not a meaningful question). EU-adopted IFRS apply to the consolidated financial statements of companies listed on a regulated market whereas UK GAAP applies to individual accounts or to consolidated financial statements of companies that are not listed on a regulated market. The circumstances applying to these different companies may be quite different in terms of the complexity of their business model and the transactions they undertake. UK GAAP is specifically designed to set requirements proportionate to the size and complexity of the entities to which is applies. Description of UK GAAP: Smaller entities that meet the criteria of a small company, as defined by company law, may apply the Financial Reporting Standard for Smaller Entities (FRSSE) in full. Smaller entities that meet the criteria of a micro entity, as defined by company law, may apply those elements of the FRSSE written for micro entities. Entities that are not eligible to apply the FRSSE (or parts thereof), or entities that are eligible to apply the FRSSE but choose not to do so, must prepare financial statements in accordance with FRS 102 The Financial Reporting Standard applicable in the UK and Republic of Ireland, EU-adopted IFRS or, if the financial statements are the individual financial statements of a qualifying entity, FRS 101 Reduced Disclosure Framework. FRS 101 permits the application of IFRS measurement and recognition requirements (except where they conflict with company law) whilst providing exemptions from some of the IFRS disclosures. FRS 101 may be applied by ultimate parent companies and subsidiaries in preparing their individual financial statements and is intended to provide greater consistency with the group consolidated financial statements. FRS 102 is a single financial reporting standard that applies to the financial statements of entities that are not applying EU-adopted IFRS, FRS 101, the FRSSE or the FRSSE for micro entities.

27.2. Other GAAPs for comparison

Please identify other GAAPs you are using as a basis for comparison.

We have not considered any other GAAPs as they lie outside our remit and experience.

28. IFRS vs. other GAAPs: true and fair view

How do IFRS compare with other GAAPs in terms of providing a true and fair view of a company's (group's) performance and financial position?

| IFRS are better than... | IFRS are equivalent to... | IFRS are worse than... | No opinion | |

|---|---|---|---|---|

| Your local GAAPs (as identified under question 27) | ||||

| Any other GAAPs (as identified under question 27) |

29. Departures from IFRS

How often is it necessary to depart from IFRS under “extremely rare circumstances” (as allowed by IFRS), to reflect the reality of a company's financial performance and position in a fairer way?*

- Often

- Sometimes

- Hardly ever

- Never

- No opinion

29.1. Comments and examples of departures

Please provide additional comments and examples of departures from IFRS that you have seen.

The requirement in IFRS for financial statements to present fairly the financial position, financial performance and cash flows of an entity is an overarching principle which is also a requirement in the IAS Regulation (Article 3.2). It follows that there may be extremely rare circumstances where a requirement in IFRS must be overridden so that a fair presentation can be achieved. In practice, the monitoring activity of the FRC has challenged reports and accounts where companies have either explicitly, or implicitly, departed from a requirement of IFRS in order to provide a fair presentation to ensure that the departure is justified. Two examples of departures which have been upheld by the FRC's Conduct Committee or its predecessor body, the Financial Reporting Review Panel, is the 2005 report and accounts of National Express and the 2009 Interim report of HSBC Holdings plc. The other companies who were challenged accepted our regulatory findings and voluntarily corrected their accounts.

30. IFRS and business model reflection

How would you rate the extent to which IFRS allows you to reflect your company's business model in your financial statements?*

- This is not an issue

- IFRS are flexible enough

- IFRS should be more flexible, so different business models can be reflected

- No opinion

30.1. Explanation

Please explain.*

The "business model" notion is implicitly included in IFRS in such standards as IAS 2 Inventories under which the use of the assets defines whether or not they are considered as inventory. It is included explicitly in other standards such as IFRS 9 Financial instruments where it helps to determine the measurement basis for an entity's financial assets. To stimulate debate within Europe about the role of the business model in financial reporting we, together with EFRAG and the French national standard setter (ANC), published a Research Paper (http://www.efrag.org/files/PAAinE%20-%20Business%20Model/140415_Business_Model_Research_Paper.pdf) on this topic. We consider that, the IASB's Conceptual Framework should acknowledge that financial statements should provide information to assist in the assessment of the entity's business model (our views on the business model are set out in our comment letter to the IASB on its Discussion Paper (DP/2013/1) A review of the Conceptual Framework for Financial Reporting). The IASB is currently reviewing its Conceptual Framework and it has tentatively decided that the Conceptual Framework should describe how consideration of an entity's business activities would affect standard setting (http://www.ifrs.org/Current-Projects/IASB-Projects/Conceptual-Framework/Documents/Effect-of-Board-decisions-DP-July-2014.pdf).

Enforcement

Since 2011, the European Securities and Markets Authority (ESMA) has been coordinating national enforcers' operational activities concerning compliance with IFRS in the EU. ESMA has taken over where the Committee of European Securities Regulators (CESR) left off.

Enforcement activities regarding companies listed on regulated markets are defined in the Transparency Directive (2004/109/EC, as subsequently amended).

31. IFRS enforcement in your country

Are the IFRS adequately enforced in your country?*

- Yes

- Yes, to some extent

- No

- Not applicable

- No opinion

31.1. Additional comments on enforcement

Please provide any additional comments you think might be helpful.

The Conduct Committee of the FRC is the body responsible for the monitoring and enforcement of IFRS in the reports and accounts of UK public companies, both on the regulated and unregulated markets. (The London Stock Exchange Stock requires the accounts of AIM quoted companies to apply IFRS in their financial reporting). The Committee is required to have a set of operating procedures which, following consultation, it regularly updates to improve the quality, robustness or transparency of its approach. The procedures seek to comply with the requirements of the Standards of Enforcement issued under the authority of ESMA. The Committee is an active member of and contributor to the discussion and debates at EECS and participates in ad hoc Working Groups with a focus on financial reporting and enforcement.

32. ESMA coordination of enforcers

Does ESMA coordinate enforcers at EU level satisfactorily? *

- Yes

- Yes, to some extent

- No

- Not applicable

- No opinion

32.1. Additional comments on ESMA coordination

Please provide any additional comments you think might be helpful.

ESMA plays an important role in bringing together EU national enforcers and facilitating the sharing of enforcement issues, decisions and approaches with a view to determining a common understanding of the application and requirements of IFRS. We support and benefit from ESMA's co-ordinating activities but would be concerned if ESMA were to exceed its authority and commence issuing interpretations of accounting matters that national enforcers are expected to enforce.

33. Change in enforcement with IFRS

Has enforcement of accounting standards in your country changed with the introduction of IFRS?*

- Enforcement is now more difficult

- Enforcement has not changed

- Enforcement is now easier

- Not applicable

- No opinion

33.1. Examples of enforcement change

Please provide any specific relevant examples.

The FRC's Financial Reporting Review Panel (FRRP) the predecessor body to the FRC's Conduct Committee, was responsible for the monitoring and enforcement of UK GAAP, the reporting framework required of UK listed and AIM quoted companies, prior to the introduction of IFRS. The FRRP had been an active regulator since 1990. The operating procedures have been through a number of changes since the FRRP's inception but none that have impinged on the fundamental principles underlying the approach which rely on a peer review process. The basic approach is unchanged and the procedures remain constant to the principles of good regulation of transparency, accountability, proportionality, consistency and targeting. UK GAAP, like IFRS, is a principles-based financial reporting framework, which eased the challenge of monitoring the new reporting requirements when they were introduced in 2005.

34. Influence of national law on IFRS

In your experience, have national law requirements influenced the application of IFRS in the EU country or countries in which you are active? *

- Yes, significant influence

- Yes, slight influence

- No

- No opinion

- Not applicable

34.1. Impact of differences on transparency and comparability

If you have identified differences in the way IFRS are applied in different EU countries, to what extent does this limit the transparency and comparability of company financial statements? *

- Much less transparent & comparable

- Slightly less transparent & comparable

- No impact on transparency or comparability

- No opinion

35. Differences in enforcement and practice

If you are aware of any significant differences in enforcement between EU countries or with other jurisdictions, do they affect your practice in applying IFRS or analysing financial statements? *

- Yes, significantly

- Yes, but the impact is limited

- No

- No opinion

- Not applicable

35.1. Specific details on enforcement differences

Please provide specific details.

ESMA's Standards of Enforcement ensure an appropriate level of consistency and comparability at EU level while leaving each national enforcer as the best placed to determine its approach which suits the characteristics of its own market and behaviours of relevant market participants.

36. Clarification of IAS Regulation on penalties and enforcement

The recitals of the IAS Regulation stress that a system of rigorous enforcement is key to investor confidence in financial markets. However, the Regulation contains no specific rules on penalties or enforcement activities, or their coordination by the EU.

Should the IAS Regulation be clarified as regards penalties and enforcement activities?*

- Yes

- No

- No opinion

37. Guidance on IFRS application

Should more guidance be provided on how to apply the IFRS?*

- Yes

- No

- No opinion

Consistency of EU law

There are different types of reporting requirements in the EU (e.g. prudential requirements, company law, tax, etc.)

38. Interaction of reporting requirements

How would you assess the combined effects of, and interaction between, different reporting requirements, including prudential ones? *

Whilst there may, in principle, be a potential conflict between the objectives of reporting for the basis of prudential regulation and reporting to investors, we have no concerns in relation to the current prudential or company law interaction with the IAS Regulation.

39. Tensions between IAS Regulation and EU law

Do you see any tensions in interaction between the IAS Regulation and EU law, in particular:

| No | Yes | To some extent | No opinion | |

|---|---|---|---|---|

| Prudential regulations (banks, insurance companies) | ||||

| Company law | ||||

| Other |

User-friendliness of legislation

All standards are translated into the official EU languages before they are adopted. The Commission also regularly draws up a consolidated version of the current standards enacted by the EU (http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:02008R1126-20130331:EN:NOT). The consolidated version does not include any standards that are not yet in force, but can be applied before the date of entry into force.

40. Satisfaction with consolidated IFRS version

Are you satisfied with the consolidated version of IFRS standards adopted by the EU, which is not legally binding, or would you like to see improvements?

- Satisfied

- Need for improvements

- I wasn't aware of it

- I don't use it

- No opinion

41. Quality of IFRS translation

Are you satisfied with the quality of translation of IFRS into your language provided by the EU ?*

- Yes

- Yes, to some extent

- No

- No opinion

- Not applicable

General

42. Other comments on IAS Regulation

Do you have any other comments on or suggestions about the IAS Regulation?

We have included some additional comments relating to specific questions in this general comment box since we were not given a comment box option when responding to these questions. Our response to Question 22 indicated that we agreed with the question "Are the endorsement criteria appropriate (sufficient, relevant and robust)?" However we would like to comment on this question, as follows: We believe that the endorsement criteria as they are set out in the IAS Regulation are appropriate. We consider that, when assessed in light of the role they have played over the last ten years, they have served well. We note that the Maystadt report recommends that the criterion that IFRS adopted in the EU "are conducive to the European public good" could be clarified. We agree with this recommendation. However, in our view, it is not necessary to amend the Regulation to do this. Instead the Commission, in consultation with the new EFRAG Board, should explore and clarify how "public good" should be interpreted within the context of the IAS Regulation. We consider that the articulation of “public good" should encompass a range of factors that need to be balanced against one another when determining whether or not a standard meets the public good criterion. The factors could include the two aspects suggested by Mr Maystadt, namely that the accounting standards adopted should not endanger financial stability and they must not hinder the economic development of the EU. Moreover, these factors need to take into account broader aspects such as: - that capital markets are no longer jurisdictional rather they are global in nature and a real benefit is gained by EU companies having access to global capital markets; and - acknowledgement that the objective of prudential regulation can be contrary to the objective of capital market regulation. Our response to Question 23 indicated that we agreed with the question "Does the IAS Regulation reflect (the trade-off between the aim of promoting a set of globally accepted accounting standards and the need to ensure these standards respond to EU needs) appropriately?" However we would like to comment on this question, as follows: We strongly believe that the limitation in the IAS Regulation on the European Commission's freedom to modify the content of the IASB's standards is appropriate. We do not consider that the European Commission should be given more leeway to modify the content of the IASB's standards. In our view, this limitation (as it is currently worded) contributes directly to the success of the IAS Regulation in meeting its objectives, ensuring that EU-adopted IFRS are almost exactly identical to full IFRS as issued by the IASB. Other than the "carve-out" of IAS 39 relating to macro hedge accounting, the differences arise solely due to the necessary delay between the publication of an IFRS by the IASB and its endorsement for use in Europe. This enables EU companies to be on the same competitive footing as companies in non-EU jurisdictions applying full IFRS. We note that at the recent ACCA event in Brussels (Evaluating the impact of IFRS in the EU, an Association of Chartered Certified Accountants (ACCA) event hosted by Theodor Dumitru Stolojan (EPP, RO) of the European Parliament on 25 September 2014) participants expressed very positive support for the EU adopting full IFRS and not developing EU-IFRS, as it was felt that this would put EU companies at a disadvantage. Furthermore, allowing more leeway to the Commission to modify IFRS is likely to seriously undermine progress towards high-quality global accounting standards. For EU companies operating in international markets, this could lead to additional compliance costs e.g. to create reconciliations between EU-adopted IFRS financial statements and those based on other GAAP. Our response to Question 34.1 indicated that we had no opinion on the question "If you have identified differences in the way IFRS are applied in different EU countries, to what extent does this limit the transparency and comparability of company financial statements?" However we would like to comment on this question, as follows: Through EECS, we have at times discussed specific issues or decisions where we disagreed with the decision taken by the relevant national enforcer. These occasions, however, have been isolated cases and have not led to any view that the application of IFRS by a particular jurisdiction has led to widespread lack of comparability. Our response to Question 36 indicated that we did not agree with the question "Should the IAS Regulation be clarified as regards penalties and enforcement activities?" However we would like to comment on this question, as follows: As noted above, we believe that national enforcers are best placed to determine the monitoring approach which best suits the characteristics of its own market. Penalties are not necessarily an effective deterrent to inappropriate application of IFRS. As national enforcer of quality financial information our focus is on ensuring that corrected financial information is made available to the market in a timely manner rather than on apportioning or determining responsibility for the original financial information. Our response to Question 37 indicated that we did not agree with the question "Should more guidance be provided on how to apply the IFRS?" However we would like to comment on this question, as follows: We consider that the existing mechanisms of the IFRS Interpretations Committee and the IASB's annual improvements projects are satisfactory and note that the communication between ESMA'S EECS and the IFRS Interpretations Committee works well.

Thank you for your valuable contribution.