The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC KPMG LLP Public Report

Introduction: FRC's objective of enhancing audit quality

Financial Reporting Council

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms¹, and how the firms have responded to our findings.

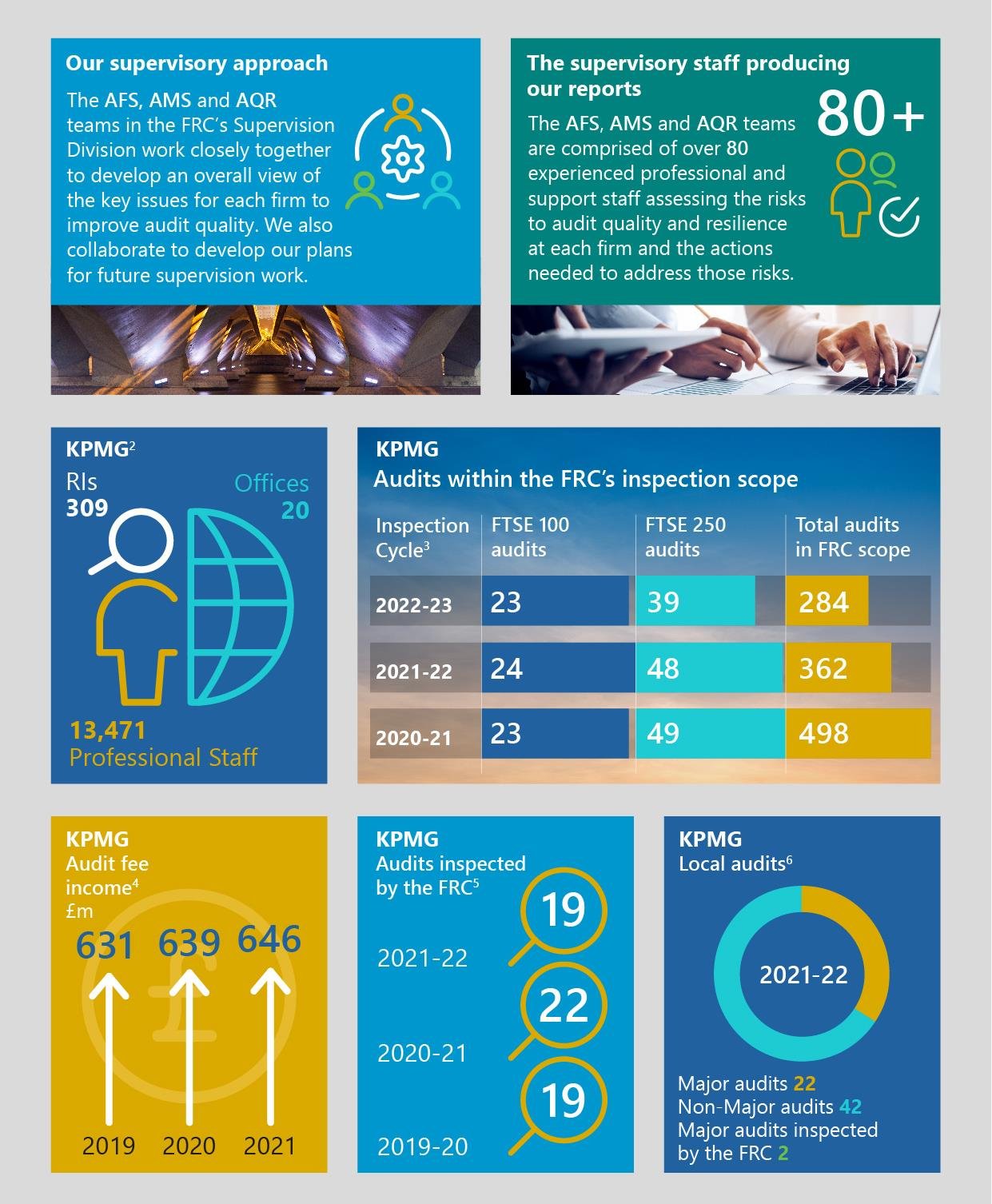

Our supervisory approach

The AFS, AMS and AQR teams in the FRC’s Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our plans for future supervision work.

The supervisory staff producing our reports

The AFS, AMS and AQR teams are comprised of over 80 experienced professional and support staff assessing the risks to audit quality and resilience at each firm and the actions needed to address those risks.

| KPMG² RIs | Offices |

|---|---|

| 309 | 20 |

| KPMG Audits within the FRC's inspection scope |

|---|

| Inspection Cycle³ | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope |

|---|---|---|---|

| 2022-23 | 23 | 39 | 284 |

| 2021-22 | 24 | 48 | 362 |

| 2020-21 | 23 | 49 | 498 |

13,471 Professional Staff

| KPMG Audit fee income⁴ £m |

|---|

| 631 | 639 | 646 |

|---|---|---|

| 2019 | 2020 | 2021 |

| KPMG Audits inspected by the FRC⁵ |

|---|

| 19 |

|---|

| 2021-22 |

| 22 |

| 2020-21 |

| 19 |

| 2019-20 |

| KPMG Local audits⁶ |

|---|

| 2021-22 |

| Major audits 22 |

| Non-Major audits 42 |

| Major audits inspected by the FRC 2 |

² Source - the ICAEW's 2022 QAD report on the firm. ³ Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. ⁴ Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. ⁵ Excludes the inspection of local audits. ⁶ The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- Inspection results: arising from our review of individual audits

- Inspection results: arising from our review of the firm's quality control procedures

- Firm's overall response and actions

- 2. Review of individual audits

- Further improve the quality of audit work on banks and similar entities, in particular in the area of expected credit losses

- Continue to strengthen the audit procedures performed over impairment assessments for tangible and intangible non-current assets

- Implement measures to improve audit quality in response to other issues driving lower audit quality assessments

- Monitoring review by the Quality Assurance Department of ICAEW

- 3. Review of the firm's quality control procedures

- 4. Forward-looking supervision

- Appendix

This report sets out the FRC's findings on key matters relevant to audit quality at KPMG LLP (KPMG or the firm). As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of public interest entities (PIEs⁷). Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based basis.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. Whilst there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high-quality audits, regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher-risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

The report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales ICAEW inspects a sample of the firm's non-PIE audits. The firm also conducts internal quality reviews. A summary of the firm's internal quality review results is included at Appendix 1.

1. Overview

Overall assessment

In 2020/21 we reported that 59% of the audits we inspected required no more than limited improvements and that it was unacceptable that we had reported key findings on the quality of the firm's audit work on banks and similar entities for three years. We also found that the firm needed to improve the quality and extent of its IFRS 9 procedures and guidance, and noted that the firm's senior leadership had committed to make the necessary improvements in this area in time for 2021 year-end audits.

This year, we found that 84% of audits inspected required no more than limited improvements. This is encouraging and provides some evidence that the firm's investment in initiatives to improve audit quality, including a Culture Change Programme, is having an impact. It is also encouraging that none of the audits we inspected were found to require significant improvements.

We continued to have findings in relation to our inspection of 2020 year-end audits of banks and similar entities although these were of less severity and in a narrower range of areas than last year. Our engagement with the firm during 2021/22 in this area has been intensive, including detailed oversight of its banking audit quality improvement plan which was refreshed and extended during the year. However, the firm made slower progress during the year than we expected on rectifying deficiencies in its IFRS 9 procedures and guidance, and this year we also found that the firm must improve the quality and extent of its IFRS 13 procedures and guidance.

The firm must demonstrate that further improvements have been made in its 2021 year-end audits of banks and similar entities, which we will inspect in 2022/23. During 2022 the firm must also deliver the remaining improvements to its IFRS 9 and IFRS 13 procedures and guidance and ensure that these are embedded for 2022 year-end audits. We remain satisfied that the firm's current leadership is committed to making the necessary improvements, which must be sustained across all aspects of the firm's portfolio of banking audits.

The firm's leadership must also ensure that momentum is maintained in its continuous improvement programme to address recurring issues or inconsistencies in the execution of individual audits in impairment and other areas identified in by the FRC and by other quality reviews. The firm's internal quality monitoring process (covering both PIE and non-PIE audits) found that 64% of audits met its highest quality standard but had recurring findings in several areas (see page 32). The inspections by the ICAEW's QAD in this period found 75% of audits inspected to be good or generally acceptable compared to 100% last year as set out on pages 17 and 18. QAD's findings were in areas which did not overlap with our quality findings.

The firm must take adequate steps to identify the root causes and remediate the recurring issues and inconsistencies, including implementing the findings of an external review of its Root Cause Analysis process (RCA). The firm must also focus on ensuring that barriers to embedding the desired culture, including the potential impact of adverse reputational events, are identified and addressed.

In response to this year's findings, we will take the following principal actions:

- Continue our focused engagement with the firm on the oversight of its banking audit quality plan, including progress against the key deliverables and milestones. We will also closely monitor and assess the further improvements being made to the firm's procedures and guidance (including in relation to IFRS 9 and IFRS 13), and we will continue our focus on banking audits in our 2022/23 inspections.

- Assess and challenge the firm's response to the external RCA review and other proposed changes to the firm's system of quality control, as it prepares for the introduction of International Standard on Quality Management (UK) 1 (ISQM 1).

- Review and assess the progress of the firm's Culture Change Programme and how the firm is responding to barriers to embedding the desired culture.

- Closely monitor the development of the firm's audit quality and other metrics and assess whether the firm is taking appropriate action to address issues identified by the metrics.

- Require all actions to be included within a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

These actions are designed to hold the firm's leadership to account for delivering improvement and change in the areas that we regard as most important to the continuous improvement in audit quality that is required.

Inspection results: arising from our review of individual audits

We reviewed 19 individual audits this year and assessed 16 (84%) as requiring no more than limited improvements. Three inspections were of banks and similar entities and the remaining audits covered a range of industry sectors. Of the audits inspected, 11 were of entities in the FTSE 350. We assessed ten (91%) of these as achieving this standard.

Our assessment of the quality of audits reviewed: KPMG LLP

Chart showing the quality of audits reviewed for KPMG LLP.

The chart shows percentages of audits falling into three categories (Good or limited improvements required, Improvements required, Significant improvements required) for each inspection cycle from 2017/18 to 2021/22.

- 2017/18: Good or limited improvements required: 14 (74%); Improvements required: 8 (42%); Significant improvements required: 1 (5%)

- 2018/19: Good or limited improvements required: 22 (76%); Improvements required: 7 (24%); Significant improvements required: 0 (0%)

- 2019/20: Good or limited improvements required: 11 (69%); Improvements required: 7 (44%); Significant improvements required: 0 (0%)

- 2020/21: Good or limited improvements required: 13 (68%); Improvements required: 8 (42%); Significant improvements required: 1 (5%)

- 2021/22: Good or limited improvements required: 16 (84%); Improvements required: 3 (16%); Significant improvements required: 0 (0%)

- Good or limited improvements required

- Improvements required

- Significant improvements required

FTSE 350: KPMG LLP

Chart showing the quality of FTSE 350 audits reviewed for KPMG LLP.

The chart shows percentages of FTSE 350 audits falling into three categories (Good or limited improvements required, Improvements required, Significant improvements required) for each inspection cycle from 2017/18 to 2021/22.

- 2017/18: Good or limited improvements required: 8 (100%); Improvements required: 7 (88%); Significant improvements required: 1 (13%)

- 2018/19: Good or limited improvements required: 16 (100%); Improvements required: 4 (25%); Significant improvements required: 0 (0%)

- 2019/20: Good or limited improvements required: 7 (100%); Improvements required: 5 (71%); Significant improvements required: 0 (0%)

- 2020/21: Good or limited improvements required: 9 (100%); Improvements required: 3 (33%); Significant improvements required: 0 (0%)

- 2021/22: Good or limited improvements required: 10 (91%); Improvements required: 1 (9%); Significant improvements required: 0 (0%)

- Good or limited improvements required

- Improvements required

- Significant improvements required

The audits inspected in the 2021/22 cycle included above had year ends ranging from September 2020 to March 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings related to the quality of audit work on banks and similar entities, particularly in the area of expected credit losses, and on impairment assessments for tangible and intangible non-current assets.

We identified a range of good practice related to risk assessment, execution of the audit and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews (EQCR), auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

Our key findings related to: the firm's actions to implement the revised Ethical Standard; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements. We also raised good practice points in relation to implementation of the revised Ethical Standard and EQCR.

Further details are set out in section 3.

Forward-looking supervision

Improving audit quality is a key element of the firm's audit strategy and the firm's leadership communicates this clearly to the audit practice.

In light of our findings last year, a main focus of our supervision activities this year has been on the firm's banking audit quality improvement plan. The firm responded to our findings by refreshing the plan. The planned improvements to its procedures and guidance were not all delivered in time for 2021 year-end audits. The firm introduced additional quality control procedures over these audits to address the risks arising from this time-lag and the effectiveness of these remains to be assessed. A significant amount of further improvement work is planned for delivery during 2022 which our supervision work will focus on.

The firm also responded to our findings last year by setting up a new second line of defence team, to test and challenge the procedures and controls in place in the audit practice, and commissioning an external review of its RCA. These initiatives are encouraging but there remains work for the firm to do to deliver the full benefits they may bring.

The firm has responded well to operational separation and we are satisfied with the design of the firm's governance structure. The firm's leadership and its Audit Non-Executives (ANEs), who were mostly new to their role in 2021/22, must demonstrate that they can work effectively together to develop and oversee the delivery of the improvements required and a forward-looking programme of continuous improvement.

Further details are set out in section 4.

Firm's overall response and actions

Introduction

We have welcomed the constructive input from the FRC throughout the review and broader supervisory activity covered by this report and are pleased that our continued drive and investment in audit quality has resulted in improvements to our audit quality inspection results at both the overall and FTSE350 level. We are also pleased to note the areas of good practice identified by the FRC and have actions in place to address the inspection and supervision findings identified within this report.

The FRC has inspected audits with year ends from September 2020 to March 2021 and performed firm wide supervisory work throughout 2021 and into 2022. This year's results, with 84% (vs 59% last year) of all inspections and 91% (vs 75% last year) of FTSE350 inspections requiring no more than limited improvements, in addition to a number of examples of good practice in the audits, demonstrate that our strategy and continued focus on audit quality is making a difference. The results are particularly pleasing given these audits were undertaken during the Covid-19 pandemic, when our teams and audited entities had to adapt to significant changes to how our audits were delivered.

In response to the FRC's findings from last year, specifically on Banking audit quality, we have undertaken an intensive programme of activity and made significant investment in our Banking Audit Quality Improvement Plan. We are pleased to see an improvement in our banking inspection results this year, although we recognise there is more to do and our plans are set out further below.

Our Audit Quality Plan

Audit quality is at the heart of our strategy and our focus now is on embedding further, sustainable improvements across our business. Our Audit Quality Plan brings together our key priority areas to drive continuous improvements in audit quality.

This year's plan includes a focus on: our Banking Audit Quality Improvement Plan; the continued rollout of KPMG Clara our modern global audit system; continued investment in our “high challenge, high support" culture; and embedding changes to our Root Cause Analysis (RCA) process which drives audit quality through our aligned behaviours. We have also continued to embed changes to our governance, to help build trust in our firm and the wider profession and in readiness for ISQM1.

Our Governance

We are committed to working with the FRC to help shape the future for a profession that produces high-quality audits and acts in the public interest. An important part of this is embedding strong and separate governance of our UK Audit practice, in preparation for operational separation, to help strengthen trust in our firm and the profession.

We are making good progress in preparing for operational separation and were the first firm to create a separate Audit Board to oversee and monitor our Audit practice, its delivery of audit quality and the interaction of the Audit practice with the rest of the firm. In 2021, we were delighted to welcome Claire Ighodaro CBE as the new Chair of that board. She joined us as an independent Audit Non-Executive along with Melanie Hind and Kathleen O'Donovan (who has also served as a firm-wide independent Non-Executive since July 2019).

Our Banking Audit Quality Improvement Programme

Last year, we outlined the significant investment we had made in our banking audits in advance of 2020 year end audits, and the establishment of our Banking Audit Quality Improvement Programme (“BAQIP”). We are pleased to see the improvements in our banking inspection results, but we recognise that there is more to do – we have a clear plan and a way forward that we have shared with the FRC. We are confident that our plan and oversight will enhance our audits of banks.

Our Phase 1 investment resulted in enhanced workpapers and guidance and progress on capacity management and laid strong foundations. The banking audits which were inspected by the FRC in the cycle covered by this report, had implemented these enhancements and demonstrated improvements.

During 2021/22, Phase 2 saw further progress on areas such as methodology, where we have engaged constructively with the FRC particularly on both IFRS 9 and IFRS 13. We committed to enhancing our methodology in these complex areas and issued a substantial element of the associated deliverables by December 2021, with the remainder issued in Q1 2022. Throughout this period of investment, we have undertaken a significant number of targeted measures to ensure consistent execution and will continue to build on these going forward. Over the next twelve months our focus is on embedding and refining in order to sustain the progress we have made.

Evolving how we work

Since 2018 we have invested by bringing over 2,000 additional people into our Audit practice, while at the same time reducing the number of audit engagements we perform to ensure that we focus on delivering high quality audits. We continue to look carefully at the shape and size of our portfolio, as well as our pricing, to ensure that we deliver a high-quality audit for all stakeholders.

Technology is at the heart of our efforts to further improve audit quality, create greater consistency in the performance of our audits and strengthen the monitoring of engagement milestones. We believe that high audit quality is best achieved when the power of smart technology is matched with inquiring minds and professional scepticism, and our tools are designed for exactly that.

Our new cloud-based audit platform – KPMG Clara – is a step change in how we are innovating, digitising and transforming the audit experience, not just in the UK but across our global firm. Nearly half of our audit hours in the UK have transitioned onto the platform, with all audits moving onto it in the year ahead. Our data analytics procedures, an example of which was noted as good practice by the FRC in section 2 of this report, are already used widely across our audits, processing over 900 billion rows of data in the last year providing broader insights and greater evidence to our audit teams.

We have also developed our Delivery Solutions Group to deliver subject matter expertise and specialisation on specific aspects of audit engagements. This includes four specialist solutions teams: Pensions; Real Estate Valuation, Project Management in Audit; and Audit of Tax which are supporting our audit teams and driving higher standards of quality.

Embedding changes to our Root Cause Analysis

An effective RCA process is a critical step in achieving sustainable audit quality and has played an important role in the improved inspection results covered by this report. Our RCA considers each individual finding linked to the themes identified by the FRC in section 2 of this report. In many ways, it is the first step in the audit quality journey and an area where we continue to make further investment and improvement. During the past twelve months, we have utilised external advice regarding our approach to RCA, to ensure that we continue to deliver best practice. Moving forward, both our RCA process and our associated remedial actions increasingly reflect the importance of behavioural science and ensuring that our efforts our targeted in the most effective way.

Building a stronger culture

Our commitment to culture starts at the very top of our firm, with our leadership demonstrating and communicating a commitment to quality, ethics and culture. In April 2022, our Chief Executive Jon Holt and Chair Bina Mehta publicly set out a new culture ambition for the firm –

"We want to build a culture that is guided by our values and doing great work that matters. A culture that is open, safe and inclusive, and that operates to the highest ethical and quality standards. A culture that is continually listening, learning and evolving."

Having the right culture in place is fundamental if we are to deliver high audit quality, every time. We continue to drive our comprehensive culture change programme, which began in 2020, to strengthen our 'high challenge, high support' culture one where all our people feel they are in an open and inclusive environment, where they are confident to give and receive constructive challenge, and where they have the support they need to do high quality work. The FRC has noted that significant progress has been made against this plan and we will continue to listen, learn and evolve to help us achieve our cultural ambition.

Our focus has been to continue to share, drive and embed our culture ambition - one where we deliver high-quality work, fulfil our public interest role, and ensure the role of auditors is highly valued. We have developed significant resources that we use for this purpose, demonstrating good practices and expected behaviours, and making it relevant and real for all colleagues.

Conclusion

Audit quality is our number one priority, and we are committed to consistently delivering high quality audits. We value the constructive input and challenge from the FRC throughout this year's audit quality inspection and supervision process. We continue to work closely with the FRC and thanks to their input, we are clear on areas of good practice, and importantly where we need to continue to focus to ensure that we build trust and confidence in our profession and the markets.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Further improve the quality of audit work on banks and similar entities, in particular in the area of expected credit losses

Determining the provision for expected credit losses involves significant management assumptions and estimation uncertainty. Audit teams are therefore expected to consider the complexity and subjectivity of management's judgements and obtain appropriate audit evidence to assess their reasonableness.

Last year we reported that the firm needed to take urgent and comprehensive action to address continuing deficiencies in the quality of audit work on banks and similar entities, in particular in the areas of: expected credit losses; valuation of financial instruments; settlement and clearing accounts; and IT specialist testing. This followed key findings raised in relation to audits of banks and similar entities in each of the previous two quality inspection cycles.

We have seen improvements in the overall quality of the audit work inspected for banks and similar entities in 2021/22, including some examples of good practice. These improvements need to be sustained.

However, we have continued to identify findings in relation to the audit of expected credit losses and certain other areas, as set out below.

Key findings

- Expected credit losses: On one audit, assessed as requiring more than limited improvements, we identified issues with the audit work performed over certain key aspects of the expected credit loss allowance, primarily the audit team's model testing and monitoring, assessment and challenge of non-Covid post-model adjustments and data input testing. We also identified findings in relation to the assessment and challenge of post-model adjustments relating to Covid or other uncertainties in the economic environment on this and two other audits reviewed.

- Journals testing: For two of the three audits we reviewed, we identified weaknesses in the procedures performed over journal entries. In the first case, insufficient procedures were performed to assess and test variances linked to reallocation journals between the banking subledger and general ledger. In the second case, there were weaknesses in the testing of the completeness of the journals listing and the evidence obtained to support certain high-risk journals.

- Other audit procedure weaknesses: We also identified, on one or more audits, weaknesses in the audit procedures performed over settlement and clearing accounts and the assessment of conduct-related provisions.

Further details of our supervision and inspection work on KPMG's banking audit methodology and banking audit quality improvement plan are set out in sections 3 and 4 of this report.

Continue to strengthen the audit procedures performed over impairment assessments for tangible and intangible non-current assets

The assessment of impairment often involves significant judgement. Changes to the methodology adopted or the key assumptions and inputs made by management could result in a material impairment. Auditors are expected to obtain sufficient and appropriate evidence to assess the reasonableness of the methodology, cash flows and other judgements made by management to support their conclusions over the extent of impairment.

Key findings

We reviewed the audit of impairment of tangible and intangible non-current assets on 13 of the audits inspected this year. We identified issues relating to the evaluation and challenge of management's impairment assessments on six of these, including the following:

- On one audit assessed as requiring more than limited improvements, the audit team did not sufficiently consider and challenge the appropriateness of revenue and EBITDA multiples or perform sufficient procedures to assess the reasonableness of revenue and EBITDA forecasts used in the impairment assessment for a key division.

- On five other audits, insufficient procedures were performed in relation to impairment assessments at a disaggregated level. These included weaknesses in relation to the assessment and challenge of cash flow forecasts and other key assumptions, testing of model methodology and inputs and the evaluation of sensitivities.

This was also identified as a key finding last year. As we continue to identify inconsistencies in this area, the firm must consider the effectiveness of its previous actions, and the results of its root cause analysis on the recurring findings, in determining appropriate further actions to continue to strengthen its audit procedures over impairment assessments.

Implement measures to improve audit quality in response to other issues driving lower audit quality assessments

Key findings

On one audit assessed as requiring more than limited improvements, we identified deficiencies in the audit testing performed in the following areas:

- Accrued revenue: The audit team obtained insufficient appropriate evidence for accrued revenue items sampled at an interim date and ageing reports used to roll forward interim testing.

- Journal entries: The audit team did not adequately justify why journal entries for the first ten months of the year did not require any further audit procedures, or how its approach to journal entry testing was responsive to identified internal control deficiencies.

Review of individual audits: Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach responding to those risks.

- Climate change risk assessment: On one audit, the group audit team included supplemental risk assessment procedures in its instructions to component auditors to support its assessment of the impact of climate change on the overall audit approach.

- Fraud risk assessment: On two audits, there was a high standard of work over fraud risk assessments, updated throughout the audit process. On one of these audits, the audit team also engaged a fraud specialist to assist in the risk assessment and develop a robust audit response.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Challenge of management: We observed several examples of well-evidenced and robust challenge of management across the audits inspected. These included, on one or more audits, procedures in the area of impairment, going concern, provisions and deferred tax assets.

- Group audits: On two audits, the group team's oversight of, and involvement with, component auditors was of a high standard with well-evidenced interactions and review of component audit procedures.

- Data analytics: We observed the effective use of data analytics as part of the audit approach for a number of the audits that we inspected. These included a bespoke, robust audit approach to test general IT controls for a bank, and the recalculation of 100% of fee income for another audit.

- Expected Credit Losses data testing: On one banking audit, an analysis was performed to establish a complete list of data elements used in the calculation of expected credit losses and assess how these data elements were used.

- Contract accounting: On one audit, KPMG infrastructure specialists were engaged to assist with the audit of certain construction contracts, contributing to a robust level of challenge over the status of the associated contract forecasts and accounting.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Engagement Quality Control Review: On one audit, there was strong evidence of the EQCR across all areas that we reviewed, with particularly robust evidence and challenge in the area of goodwill impairment.

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by ICAEW, which undertakes its reviews under delegation from the FRC as the Competent Authority. ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher-risk and potentially complex audits within the scope of ICAEW review.

ICAEW has completed its 2021 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2022.

Summary

The quality of audit work the ICAEW reviews continues to be of a good standard in many areas. However, the overall picture of audit quality from the grading profile is more variable than in 2020. Nine of the twelve standard file reviews were good or generally acceptable, two files required improvement, and one file required significant improvement. In 2020, all ten of the standard file reviews were graded good or generally acceptable.

There were two specific and quite unusual issues contributing to the file requiring significant improvement. The financial statements were prepared using financial information as at an incorrect date, and there was an error in equity accounting for a material associated undertaking. Both issues had existed for several years.

On the audit of a pension scheme requiring improvement we had broader concerns over testing of contributions and discrepancies between descriptions of controls, planned procedures and work performed. On the other file requiring improvement, we identified a single specific issue that resulted in an overstatement of the amortisation charge greater than materiality. The work reviewed on this second file was good in all other respects.

Results

Results of ICAEW's reviews for the last three years are set out below.

Chart showing results of ICAEW's reviews for the last three years (2019-2021).

The chart indicates the percentage breakdown of audits graded as 'Significant improvement required', 'Improvement required', and 'Good / generally acceptable'.

- 2019: Significant improvement required: 0%; Improvement required: 9%; Good / generally acceptable: 91%

- 2020: Significant improvement required: 0%; Improvement required: 10%; Good / generally acceptable: 90%

- 2021: Significant improvement required: 1%; Improvement required: 9%; Good / generally acceptable: 89%

- Significant improvement required

- Improvement required

- Good / generally acceptable

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

The ICAEW identified good practice across all but one the files reviewed. Broad themes were:

- Comprehensive and thoroughly documented work, including on revenue, leases, service concession arrangements, property valuation and defined benefit pension liabilities.

- Clear challenge to management, including going concern work, a customer compensation agreement and provisions for stock and contract support.

- Effective use of the firm's templates.

3. Review of the firm's quality control procedures

In this section, we set out the key findings and good practice we identified in our review of the following four areas of the firm's quality control procedures, which we have inspected this year. This table shows how these areas in International Standard on Quality Control (UK) 1 (ISQC 1) map to International Standard on Quality Management (UK) 1 (ISQM 1), which will come into effect at the end of 2022, and the FRC "What Makes a Good Audit?" publication.

| ISQC 1 area | ISQM 1 area | What Makes a Good Audit |

|---|---|---|

| Relevant ethical requirements - Implementation of the FRC's Revised Ethical Standard (2019) | Relevant ethical requirements | Execution of the agreed audit plan |

| Engagement performance - EQCR, consultations and audit documentation | Engagement performance | Execution – Consultation and oversight |

| Audit methodology | Resources – Intellectual Resources including methodology | Resources – Methodology |

| Monitoring - Internal quality monitoring | Monitoring and remediation | Monitoring and remediation |

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our findings in the two previous years at the end of this section.

Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important Objective Reasonable and Informed Third Party test, against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified the following key findings where the firm needs to:

- Improve the firm's guidance on how to more consistently consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, that of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Embed the new Gifts and Entertainment system, which went live on 1 December 2021, to ensure pre-approvals are sought from the firm's Ethics Function in advance of gifts/hospitality being accepted/offered.

Good practice

We identified the following areas of good practice:

- The UK firm's Ethics Function can access non-audit fee information from KPMG's global finance system for approved services to UK PIEs and their international subsidiaries. This information is used to inform group audit teams' assessment of whether the amount of non-audit fees meets the requirements of the Revised Standard. The UK Ethics Function maintains oversight of this assessment.

- The firm requires group audit teams to discuss with component audit teams how their systems and processes support them in complying with the Revised Standard requirements. The firm also has detailed guidance for group audit teams which includes examples of the conditions/relationships that could compromise the independence of network or non-network firms that assist in the conduct of an audit engagement.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard.

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

Engagement Performance – EQCR, consultations and audit documentation

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors considered included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well as the training provided to reviewers.

Consultations with the firm's central functions, on difficult or contentious matters, enable auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified no key findings.

Good practice

We identified the following areas of good practice:

- The firm has designed and implemented a thorough audit accreditation framework to identify which individuals are suitable to work on entities in different sectors, including being appointed as EQCR.

- The firm's archiving period is the 14 days after the audit report is signed and includes two phases. The firm has shortened phase one of the archiving period for audit teams to assemble the audit file to a maximum of two days after the audit report is signed. The firm also uses a central quality control team as part of phase two of the archiving period, to perform spot checks (of approximately 10% of audit files) on the accuracy of audit report dates recorded in the electronic audit files to ensure the correct archive date.

Good practice relating to the EQCR on an individual audit is set out in section 2.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

Key findings

We identified the following key findings where the firm needs to:

- Issue methodology and improve the quality and extent of IFRS 13 guidance in relation to auditing the fair value of financial instruments for banks and similar entities. Action is required to sufficiently guide audit teams in planning and executing independent audit procedures in this complex area. Since our original inspection work in early 2021, the firm has developed initial methodology and has adjusted its approach to auditing certain key areas. Further improvements are needed, particularly given the size and complexity of the entities being audited.

Monitoring - Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring team.

Key findings

We identified the following key findings where the firm needs to:

- Ensure that the professional judgements made by the reviewer are recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised. This is particularly important for high risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental.

- Increase the number of focus areas scoped into each review for large and complex audits with more significant risks or key audit matters. Currently the firm's guidance requires only two focus areas.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| Audit quality focus and tone of the firm's senior management | Implementation of the FRC's Revised Ethical Standard (2019) | Audit methodology (recent changes to auditing and accounting standards) | Partner and staff matters, including performance appraisals and reward decisions |

| Root cause analysis (RCA) process | EQCR, consultations and audit documentation | Training for auditors | Acceptance and continuance (A&C) procedures for audits |

| Audit quality initiatives, including plans to improve audit quality | Audit methodology (fair value of financial instruments with a focus on banks) | ||

| Complaints and allegations processes | Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas:

- For Audit methodology and training (2020/21) the firm needed to improve the quality and extent of its IFRS 9 methodology and guidance relating to the audit of banks and similar entities.

- For Partner & staff matters (2019/20) improvements were needed on how adverse quality findings were considered in partner appraisals.

We provided an update on the firm's actions in our 2020/21 report.

Good practice

Good practice was also identified in our review of Audit methodology and training (2020/21) and Acceptance and continuance procedures (2019/20):

- On Audit methodology and training the firm provides extensive training to experienced hires including detailed scenarios and case studies to prepare the individual for their new role.

- On Acceptance and continuance procedures the firm introduced a new acceptance and continuance form, which provided a robust control to help audit teams address the risks facing the firm. The firm went further than its peers to reiterate to teams the importance of potential damage to values, reputation and brand during the process, including asking teams to consider explicitly how their decision would be perceived by third parties.

4. Forward-looking supervision

We supervise by holding the firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through assessing and challenging: the effectiveness of the firm's RCA processes; the development of firms' audit quality plans; the firm's progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of the firm's response to non-financial sanctions. We are currently introducing a single quality plan (SQP) maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including on Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in our Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Banking audit quality

- Other audit quality initiatives

- RCA

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Banking audit quality

Background

Last year we reported that it was unacceptable that, for the third year running, improvements were required to KPMG's audits of banks and similar entities. We also reported that further improvements were required to the firm's IFRS 9 procedures and guidance to provide a stronger basis for KPMG's banking audit teams to deliver high quality audits in this area. The firm had set up a banking audit quality improvement plan during 2020 and its senior leadership responded well to our findings last year by committing to make the further changes necessary to improve audit quality in time for 2021 year-end audits. We said that we would monitor these changes closely to assess on a timely basis the extent to which they address our findings.

Observations

This year, we have closely monitored the progress of the banking audit quality improvement plan which includes development of the firm's IFRS 9 procedures and guidance.

We assessed the following:

- The firm's current leadership has demonstrated that it is committed to improving the quality of audits in this area and has continued to respond well to our findings.

- During mid-2021, as a result of the FRC's concerns, the firm conducted an internal review, by a team from outside the audit practice, of the banking audit quality improvement plan. The review resulted in changes to the governance over the plan and the extension of the plan in terms of the nature and range of activities being conducted and their timeframe. We held, and continue to hold, frequent meetings with the firm to assess and challenge how the plan is being delivered.

- As a result of the specific concerns we reported last year in relation to the firm's IFRS 9 procedures and guidance, our work included a detailed review of improvements being made in this area (in accordance with an action plan agreed with the firm). While the firm had originally planned to complete these improvements in time for 2021 year-end audits, our review found that insufficient progress had been made in producing procedures and guidance of the required quality. We communicated to the firm our expectation that progress must continue at a rapid pace but not at the expense of quality. The firm then focused on a prioritised set of improvements for delivery in time for 2021 year-end audits. While we note that the firm has devoted considerable resource to development of its procedures and guidance in this area, which is continuing through 2022, the firm must ensure that its methodology development achieves an appropriate balance between speed of development and quality.

- As part of the refreshed banking audit quality improvement plan, and in response to the continuing gaps in its procedures and guidance, the firm introduced additional quality control procedures over 2021 year-end banking audits. These included introducing new consultation and feedback processes designed to ensure that audit teams were aware of and able to act on developments in the firm's methodology and findings arising from the FRC's 2021/22 inspection work. The firm must formally assess the effectiveness of these procedures and apply any lessons learned to the 2022 year-end audits.

- The internal review of the banking audit quality programme reported positively on the culture within banking audit teams and their acceptance of the need to improve the quality of audits. The refreshed banking audit quality plan included a culture workstream which piloted new initiatives on a sample of audits, some of which are now being rolled out more widely.

In 2022/23 we will continue to monitor closely the firm's progress in delivering the banking audit quality plan in conjunction with specific and detailed follow-up work on the firm's IFRS 9 and IFRS 13 methodologies, as well as inspecting a sample of banking audits. While, as noted in section 2, our inspection in 2021/22 of 2020 year-end banking audits found some improvement, it is essential that further improvements are made and sustained. We are satisfied that the firm's leadership and its audit teams are fully committed to making the necessary improvements. These improvements must be made and sustained across all aspects of the firm's banking audit portfolio.

Other audit quality initiatives

Background

Firms are expected to develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

Last year we reported that the firm had a comprehensive quality plan in place, which included a multi-year Culture Change Programme, over which there was good governance. The firm had introduced new management information, including audit quality indicators, and a new process to assess the effectiveness of actions taken but needed to do more to prioritise actions and put in place appropriate effectiveness measures.

Observations

We assessed the following:

- There is a clear emphasis on audit quality in the firm's audit strategy and in communications from the firm's leadership. The firm responded well to the main quality messages we reported last year and introduced a more focused audit quality plan for 2022.

- The firm is further investing in its audit quality functions. A new Audit Regulatory Compliance (ARC) team was set up in Autumn 2021 to provide independent challenge to the audit function and assurance on the effectiveness of the audit control environment. The ARC team has developed a programme of work focusing on ten priority areas. The workstreams are designed to develop a greater understanding of processes, to assess their design or to assess their effectiveness, or a combination. Some of the ARC team's planned activities are behind schedule, including work on how the firm assesses the effectiveness of remedial actions and its internal hot-review process, and the firm must ensure that the ARC has access to the resources it requires from the wider audit function. The firm must also ensure that success factors for the ARC team's work are developed and monitored.

- Significant progress has been made in delivering the Culture Change Programme, we consider to be well-designed, with the focus now on embedding the cultural collateral in individual practice groups. Activities are under way to assess and monitor culture including surveys and metrics. The firm must ensure that it addresses the potential impact on its staff of adverse reputational events. It must also continue to focus on encouraging wider staff participation in surveys, assessing the validity of metrics and ensuring that reward programmes are adequately aligned to the desired behaviours.

- In addition to culture metrics, the audit quality and other indicators measured by the firm and reported to its Audit Executive and Audit Board have also evolved (for example, in relation to audit quality and resourcing). The firm has also updated its risk taxonomy which now more clearly focuses on risks relating to the framework of audit quality and the quality of audit execution. The firm should keep all metrics under regular review and focus on developing the real-time indicators available from its new audit platform (KPMG Clara) and how they are used. The firm must also ensure that appropriate audit quality metrics are devised and reported to the firm's main Board and its Public Interest Committee.

- The newly constituted Audit Board, including three independent Audit Non-Executives (ANEs) one of whom acts as Chair, has been in operation since October 2021. We have observed a recent Audit Board meeting and noted that the ANEs are focused on areas that we would regard as priorities and are challenging the firm to demonstrate the effectiveness of its actions.

We will continue to assess the firm's AQP and other quality initiatives. Developing the SQP referred to above will assist in ensuring that quality initiatives are appropriately prioritised with expectations for when they will be effective and mechanisms in place to measure this.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risk to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we found that the firm should review the depth of its RCA process in light of recurring quality findings in certain areas which raised questions about the efficacy of the execution of the RCA process in prior years and whether it has identified the full extent of underlying root causes which then result in appropriately prioritised and targeted actions being taken and embedded effectively.

Observations

We assessed the following:

- The firm commissioned an external, independent review focusing on: whether the firm was performing RCA in accordance with its methodology; whether the RCA process is fit for purpose and linked to the firm's Culture Change Programme; and whether remediation steps undertaken to address root causes are implemented and monitored effectively.

- The review reported in March 2022 and its conclusions, which supported our findings, were that the firm was performing RCA in accordance with its methodology; that the RCA process is fit for purpose and linked to the Culture Change Programme in certain situations, but some areas could be enhanced; and the firm's process to monitor the effectiveness of the remedial actions could be enhanced.

- The review made six principal recommendations, including in relation to the prioritisation of root causes and actions, ensuring cultural aspects are integrated into all steps of the process and strengthening resources in the RCA team.

- The firm has agreed to take action on all of the findings of the review and has commenced prioritisation of root causes in this year's RCA reports.

- The RCA conducted by the firm on this cycle of audits identified that that the root causes of findings on FRC scope audits were predominantly behavioural. This indicates that the procedural improvements put in place by the firm are having an impact and underlines the importance of cultural factors in audit teams' performance. RCA conducted on good practice examples also emphasised the importance of the tone set by a team's leadership, the team's dynamics and good communication between team members.

- Closely related to RCA are the firm's processes to identify emerging issues, develop remedial actions and assess their effectiveness. The firm must ensure that all of these processes are aligned, and we note that this will be an area of focus for the firm's ARC team during the year.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

Operational separation of audit practices

Operational Separation aims to ensure that audit practices are focused, above all, on the delivery of high-quality audits in the public interest. In October 2021, KPMG started its transition to operating the audit practice separately from the rest of the firm and has taken a number of steps to implement the principles of Operational Separation including the restructuring of its governance framework, forming an Audit Board, appointment of Audit Non-Executives (ANEs), and its work on promoting a differentiated audit culture.

Prior to this, in early 2021, the firm separated the roles of Chair and CEO. Both positions have clearly defined roles and responsibilities. Separation strengthens oversight of the activities of the management team by the firm's board and it complements the introduction of independent ANEs.

KPMG has six independent non-executives in total and they perform the following roles: three are independent non-executives (INEs) who sit on the firm's Public Interest Committee; two are ANEs who sit on the firm's Audit Board; and one is both an INE and an ANE (dual function). The chair of Public Interest Committee is an INE, and the chair of the Audit Board is an ANE.

Appendix

Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements. We consider that publication of these results provides a fuller understanding of quality monitoring in addition to our regulatory inspections, but we have not verified the accuracy or appropriateness of these results.

The appendix should be read in conjunction with the firm's Transparency Report for 2021 which provides further detail of the firm's internal quality monitoring approach and results, and the firm's wider system of quality control.

Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring may differ from those of external regulatory inspections and should not be treated as being directly comparable to the results of other firms.

Results of internal quality monitoring

The results of the firm's most recent Quality Performance Review (QPR), which comprised internal inspections of 92 audit engagements (for periods ending up to 31 March 2021), are set out below along with the results for the previous two years, where 122 and 108 audits were inspected in the 2020 and 2019 review cycles respectively⁸:

Bar chart showing Results of internal quality monitoring from 2019 to 2021.

The chart displays the percentage of audits falling into 'Satisfactory', 'Performance Improvement Necessary', and 'Unsatisfactory' categories.

- 2019: Satisfactory: 56%, Performance Improvement Necessary: 27%, Unsatisfactory: 17%

- 2020: Satisfactory: 59%, Performance Improvement Necessary: 25%, Unsatisfactory: 16%

- 2021: Satisfactory: 64%, Performance Improvement Necessary: 20%, Unsatisfactory: 16%

- Satisfactory

- Performance Improvement Necessary

- Unsatisfactory

Inspections are graded as performance improvement necessary where the auditor's report is supported by evidence, but the independent reviewer required additional information to reach the same conclusion as the auditor; or where supplementary evidence obtained as part of the audit was not sufficiently documented; or specific requirements of the firm's audit methodology were not followed. Inspections are graded as being unsatisfactory where the audit was not performed in line with KPMG's professional standards and policies in a more significant area, or where there are deficiencies in the related financial statements.

Firm's approach to internal quality monitoring

Our internal review cycle is aligned with our annual performance review cycle and completes in the Autumn each year. The 2021 internal QPR programme described above covered audits with year-ends of 31 March 2021 and earlier, which is contemporaneous with those reviewed by the FRC in this report.

The firm's QPR programme considers the full population of audits performed. All engagement leaders are subject to selection for review at least once in a three-year cycle. Engagements for review are selected by the QPR inspection team after review of individual engagement leader portfolios to ensure an appropriate mix of engagements is selected taking account of size, risk and profile. In particular, audit engagements of each FTSE350 audited entity will be reviewed at least once every five years. Each QPR inspection is overseen by an Independent Lead Reviewer from outside KPMG UK and the programme is monitored by the firm's Global Audit Quality Monitoring Group. The Independent Lead Reviewer participates in a moderation process at both national and regional level, designed to achieve consistency of results both between engagement findings in the UK and other KPMG member firms. Where significant deficiencies are identified through internal inspections, a remedial action plan is prepared, applicable at both an engagement level and at a firm level where findings are considered pervasive.

The firm undertakes Root Cause Analysis ('RCA') on Unsatisfactory-rated engagements and other pervasive findings, including some arising on engagements assessed as Satisfactory and PIN, which informs further remedial actions at a firm level incremental to the team level actions described above. A pervasive matter is one that occurs on 10% or more relevant engagements generally without regard to the severity of the finding. The identification of such matters happens progressively throughout the review cycle which means we take some remedial actions identified on individual inspections as soon as their need is identified accelerating their impact on audit delivery across the audit practice. Findings from a range of inspections are considered to ensure that robust remedial actions are developed and implemented. The effectiveness of such actions is monitored. Engagement teams also undertake specific incremental or remedial training based on the deficiencies identified for Unsatisfactory-rated engagements.

Internal quality monitoring themes arising

The most frequently occurring issues identified through the 2021 QPR programme included sampling, evidencing risk assessment, auditing journals, testing controls, estimates, group audits and substantive analytical procedures. Our programme of standardised workpapers continues to drive consistency and higher quality but issues have arisen when teams have not used the workpapers effectively. Estimates and Group audits were new pervasive issues as teams used the new Estimates standardised workpaper for the first time and there were some instances of component teams not having appropriately followed templates in drafting opinions submitted to group auditors.

All RCA projects in respect of the prior year have been completed and actions have either been implemented or implementation is ongoing. We have seen tangible progress in a number of areas but some remain to be fully addressed.

Areas that contributed most significantly to unsatisfactory ratings were insufficient clarity or evidence on the audit file to allow an independent reviewer to understand the basis for individual conclusions, weaknesses in the preparation of KPMG-mandated workpapers, and weaknesses in the performance or documented explanation of specific substantive audit procedures. As in the prior year, we did not identify any engagements where we concluded the underlying financial statements were inappropriate or that the audit opinion was not appropriately delivered.

Financial Reporting Council

8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP. We have published a separate report for each of these seven firms along with a Tier 1 Overview Report. ↩

-

Public Interest Entity – in the UK, PIEs are defined in the Companies Act 2006 (Section 494A) as: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market" where, in the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); and Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩

-

The data previously reported for 2019 and 2020 covered the QPR results for all audit and assurance engagements ↩