The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC BDO LLP Public Report 2022

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms[^1], and how the firms have responded to our findings.

[^1] The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP. We have published a separate report for each of these seven firms along with a Tier 1 Overview Report.

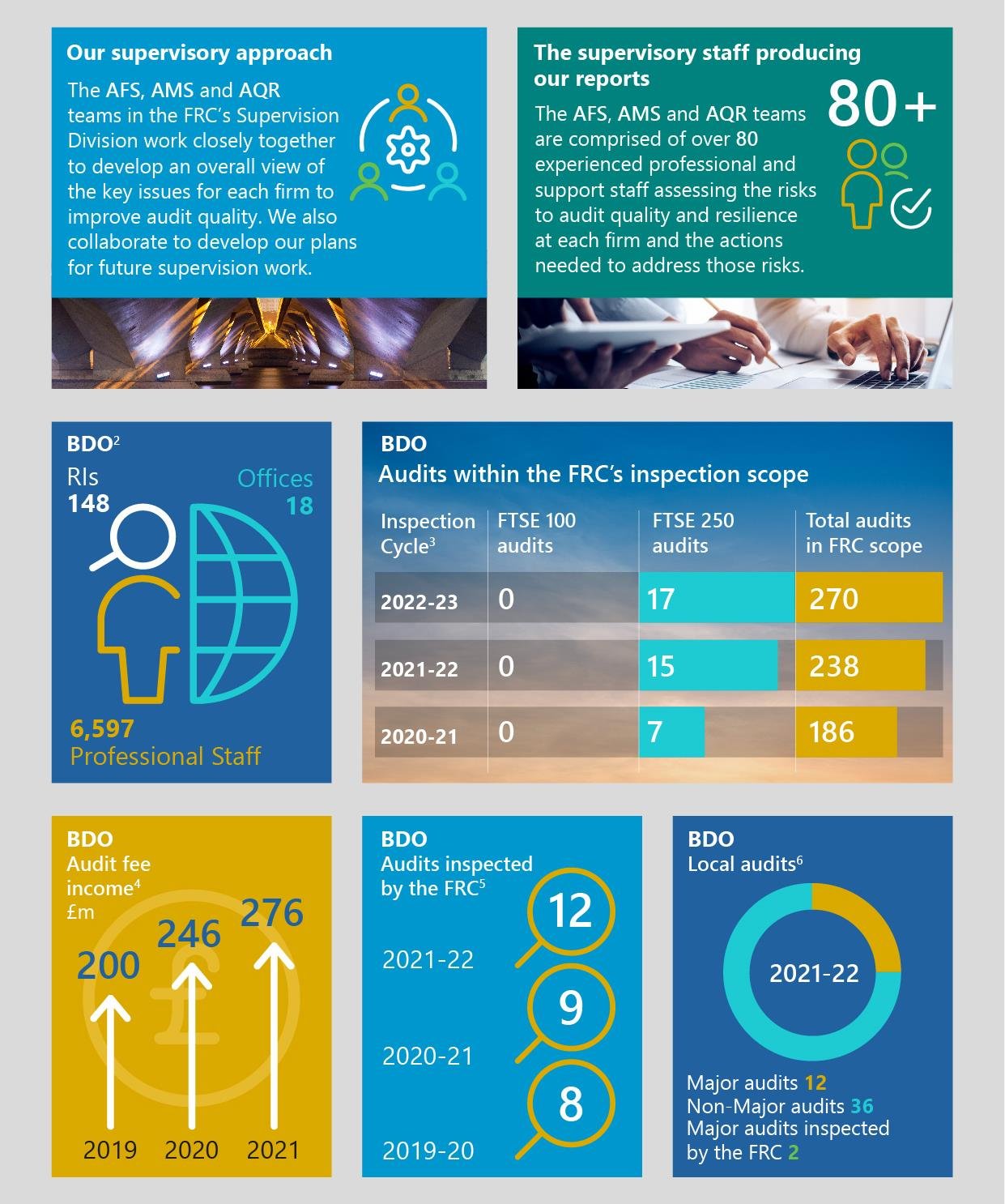

[^2] Source - the ICAEW's 2022 QAD report on the firm. [^3] Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. [^4] Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. [^5] Excludes the inspection of local audits. [^6] The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- Overall assessment

- Inspection results: arising from our review of individual audits

- Inspection results: arising from our review of the firm's quality control procedures

- Forward-looking supervision

- Firm's overall response and actions

- Focus on 4 key areas of the Audit Quality Plan

- Good practice

- Root Cause Analysis (RCA)

- Firm-wide actions

- 2. Review of individual audits

- Prioritise resources to address the continuing deficiencies in the quality of the firm's audit of revenue

- Key findings

- Address deficiencies in the quality of audit work on financial services entities

- Urgently improve scepticism and challenge surrounding assumptions in management's forecasts in key areas of judgement, in particular for going concern and viability assessments

- Enhance certain aspects of the firm's procedures over independence assessments

- Improve the audit testing over journals in response to the risk of management override of controls

- Quality control and Engagement Quality Control Review procedures

- Review of individual audits: Good practice

- 3. Review of the firm's quality control procedures

- Relevant ethical requirements – Implementation of the FRC’s Revised Ethical Standard

- Engagement Performance – EQCR, consultations and audit documentation

- Methodology

- Monitoring – Internal quality monitoring

- Good practice

- Approach to reviewing the firm's quality control procedures

- Firm-wide key findings and good practice in prior inspections

- Good practice

- 4. Forward-looking supervision

- Appendix

1. Overview

Overall assessment

In the 2020/21 public report, we concluded that the continuing decline in the number of audits requiring no more than limited improvements in the year was unacceptable and set out how the firm and the FRC would respond. We assessed that the firm needed to strengthen its audit quality infrastructure to support its recent growth and its strategic growth ambition. The firm is continuing to grow and in the last year the number of audits within the FRC's inspection scope has increased from 186 to 238. In 2022/23 the number of audits within the FRC's inspection scope is expected to be 270 with 17 FTSE 250 entities.

This year, the results from our audit inspections have again been unacceptable. We assessed 33% of the audits we reviewed as requiring significant improvements. Overall, the proportion of audits assessed as requiring significant improvements or improvements was 42%. The areas which contributed most to this were the audit of revenue, audit work on financial services entities, scepticism and challenge in key areas of judgement, and quality control and review.

33% of audits inspected were assessed as requiring significant improvement. This is unacceptable.

We have, in the last three years, both given strong messages to the firm and increased the depth of our supervision. Nonetheless, so far, the firm's efforts have not produced the desired or intended results and there have been recurrent key findings which the firm's actions have not adequately addressed. These include, in particular, the audit of revenue, the audit of long-term contracts, and challenge in areas of judgement.

As set out in the Appendix, the results from the firm's internal quality monitoring process (IQM), covering both PIE and non-PIE audits, assessed 72% of audits as meeting its highest quality standard (top two levels combined). However, despite the differences in scope, these results are more markedly different from our own findings than we would expect. Accordingly, we are requiring the firm to assess and reinforce the effectiveness of its IQM. The firm was not assessed by the Quality Assurance Department of the ICAEW in this period.

Recently, the firm has made a step-change in its investment in resources and other audit quality initiatives. Notwithstanding this level of investment and focus there are timing delays between our review cycle and seeing the impact of quality related actions the firm has commenced or taken. Additionally, we acknowledge that the population of audits undertaken by BDO includes a greater proportion of companies with less developed management functions and systems and controls. This may mean that they have been disproportionately impacted by weaknesses in the market ecosystem.

The firm has adopted a set of approaches to manage the growth and complexity in its audit portfolio. These must be maintained until all the necessary foundations to support growth, while achieving consistently high quality audits, are in place.

In response to this year's findings, we will take the following action:

- Further increase the number of audits inspected from 12 to at least 13 in our 2022/23 inspection.

- Require that the breadth of the firm's hot reviews include all the most frequent and significant recurring issues identified in internal and external reviews.

- Require the firm to assess and reinforce the effectiveness of its internal quality monitoring reviews (scoping, depth, and culture of challenge) to support audit quality.

- Require the firm's internal quality monitoring function to review the following year's audit for all external inspections assessed as improvements required, or significant improvements required, in the previous year.

- Require strengthening of the firm's processes for quality control including the appropriateness of risk-based selection of partners and Engagement Quality Control Review (EQCR) partners and role-specific training.

- Require all actions to be included in a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

Firms must require all actions within a Single Quality Plan, subject to formal reporting and regular review by the FRC.

Inspection results: arising from our review of individual audits

We reviewed 12 individual audits this year and assessed seven (58%) as requiring no more than limited improvements. Within financial services we looked at the audits of an insurer and a financial services provider. We also reviewed audits within the retail, construction, and technology sectors.

Our assessment of the quality of audits reviewed: BDO LLP

Our assessment of the quality of audits reviewed: BDO LLP

Bar chart illustrating the quality assessment of audits from 2017/18 to 2021/22.

| Category | 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

|---|---|---|---|---|---|

| Good or limited improvements required | 7 | 7 | 5 | 4 | 4 |

| Improvements required | 1 | 1 | 2 | 1 | 1 |

| Significant improvements required | 0 | 0 | 1 | 4 | 7 |

The audits inspected in the 2021/22 cycle included above had year ends ranging from June 2020 to March 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings related to the audit of revenue, audit work on financial services entities, scepticism and challenge in key areas of judgement, the firm's procedures over independence assessments, the audit testing of journals and quality control and review.

We identified a range of good practice related to risk assessment and planning, execution of the audit, and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for the EQCR partners, auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

Our key findings related to the firm's actions to implement the revised Ethical Standard; the firm's policies and procedures in relation to EQCR; the firm's audit methodology in relation to the auditing of fair value instruments; and internal quality monitoring arrangements. We also identified good practice in the area of internal quality monitoring.

Further details are set out in section 3.

Forward-looking supervision

In response to feedback from the FRC (including the findings identified in our 2020/21 public report), the firm's internal quality monitoring, and the firm's strategic ambitions, the firm reset the focus of its Audit Quality Plan (AQP or the plan) in March 2022. The firm set out a medium-term plan which is forward-looking, takes account of the challenges of implementing International Standard on Quality Management (UK) 1 (ISQM 1), and has clear prioritisation. The plan identified four priority audit focus areas for the next year: the audit of revenue; strengthening effective challenge of management; improving procedures to detect material fraud; and improving the consistency of assessment of going concern and viability. Further, in parallel, the plan recognised the need to control growth, invest in central audit quality infrastructure, strengthen audit methodologies, and embed a culture of challenge.

Ahead of resetting the AQP, the firm had reviewed its audit portfolio and implemented steps to manage the growth and complexity within it. In addition, the firm had committed to ensure that audit resources and audit quality infrastructure were in place ahead of future growth.

Our key findings on individual audits included the audit of revenue, audit work on financial services entities, and scepticism and challenge in key areas of judgement.

With respect to quality control procedures, our key findings related to implementing the revised Ethical Standard, EQCR, methodology and internal quality monitoring.

The firm also took steps to improve the coverage of Root Cause Analysis (RCA), recruit a new RCA Partner, and to produce more consistent analysis of causal factors which will help them to evaluate the root causes on more complex audits. However, there is still more to do, and the RCA function needs to be built up and the framework further developed to support comprehensive and consistent analysis.

Additionally, during the period we interacted with the firm on improving its methodologies in certain areas.

Since our 2021 public report there has been a step-change in the firm's commitment to improving its audit quality and the firm now has a comprehensive plan. However, given the unacceptable inspection results this year, it is vital that the firm's leadership now implements all these initiatives and makes the investment necessary to support them.

Further details are set out in section 4.

Firm's overall response and actions

We acknowledge that this is the third year that the firm's results have fallen short of the high audit quality expected by both the firm's leadership and the regulator. In our response to the report last year, we made an unequivocal commitment to improve audit quality in order to support our growing audit practice. Our strategic plans are focused on adding quality resource to the audit stream, managing the size and shape of our audit portfolio, strengthening central infrastructure and tools and providing high quality development for our people through a quality transformation program to deliver on our commitment to serve the public interest by consistently delivering high quality audits.

The actions taken over the past year are holistic, far reaching and we know that they will take time to bed in and start to show in our inspection results. We did not therefore expect to see these changes reflected in the sample of audit files reviewed and reported in this cycle. We have performed an in depth consideration of the findings in this report to ensure that the actions we are taking are still in direct response to the issues arising and will contribute towards the improvements needed to our audit quality.

As noted by the FRC in section 4 of their report we have made substantial enhancements to a number of areas at both firm-wide and audit stream level. Key actions implemented include a revision of the firm's governance structure including establishment of an Audit Board, strengthening of central audit quality infrastructure as part of a £8m investment program and enhancements to specific methodologies supported by targeted training. We have also recently further enhanced the Audit Quality Plan to take in to account actions already undertaken and highlight the areas of focus going forward noting that the underlying themes and commitments are unchanged.

Our strategic priorities reflected within the Audit Quality Plan are as follows:

- Controlled growth: We are focused on careful control of the size and shape of our 'book of work', active management of the audit portfolio for effective governance of growth together with continued investment in capacity and skills of our people.

- Investment in central audit quality infrastructure: We will continue investment in central audit quality infrastructure, including embedding the newly established Audit Quality Improvement Team to strengthen audit quality monitoring (Audit Quality Indicators), support for engagement teams (Inflight Quality Reviews and Centres of Excellence), monitoring (Internal Quality Monitoring) and improvement (Root Cause Analysis).

- Strengthening methodologies to support consistent high quality: We are undertaking a comprehensive review of our audit methodologies and technical support materials and implementing enhancements to drive more consistent application across engagement teams supported by continued investment in the central technical team.

- Fostering a culture of challenge: Consistent audit quality is underpinned by a strong culture of challenge. We are focused on clearly articulating, fostering and developing our unique audit culture and enabling, promoting and recognising behaviours focused on challenge and scepticism that support audit quality.

A key part of our continuous improvement cycle is our root cause analysis ("RCA") process. We have made a number of enhancements to this during the period including ensuring we perform a stand-back consideration to identify any broader issues arising including behavioural factors. This has allowed us to gain a better understanding of causal factors and themes driving audit quality. We will continue to develop this framework under the auspices of the new RCA partner. Over the next year we will continue investment in this team, perform a full-scale analysis of the current process and implement changes required to ensure that actions undertaken by the firm have appropriate focus on issues emerging relating to behaviours and mindset of staff at all levels to drive quality improvement.

Audit quality is of critical importance to BDO as a firm. The Leadership Team, Audit Board, INEs and the firm's governance bodies are focused on ensuring audit quality is our priority, growth is controlled, so enabling the transformation programs and change that will support quality and provide appropriate governance and challenge. To support the firm's commitment to improved audit quality changes to the firm's organisational structures and governance have been made.

The firm acknowledges the need to ensure its central infrastructure is further strengthened to supportits priorities in relation to audit quality, which requires investment in capacity and capabilities within the audit stream. To respond to this, in the last year the firm has:

- Invested heavily in resource including recruitment of three additional partners within the Audit Quality Directorate, (including a partner to lead the newly established AQIT and a partner focused on root cause analysis) and an expansion in excess of 30% in that team.

- Demonstrated our commitment to digital audit with recruitment of four additional partners and a 25% expansion in the Technology Risk Assurance Team (“TRA”), as the initial phase of a significant investment project.

- Investment in 20 new partners within the audit stream, including sector specialists, and around 300 additional professional roles within the audit stream.

- Emphasised our commitment to highly controlled growth with 5 Year National Audit Stream Revenue and Resourcing Plans, with central monitoring. To support this, we have implemented a critical analysis of the firm's existing portfolio and established a new tender approval platform to control the volume and shape of our portfolio growth.

- Implemented enhanced portfolio review procedures, including review of all public interest audits with targeted allocation of central audit quality support.

- Initiated a comprehensive review of audit methodologies, policies and procedures.

- Continued to reform the performance review process for our people to strengthen the linkage between audit quality behaviours, recognition and reward.

Focus on 4 key areas of the Audit Quality Plan

During the period we have continued our focus on the four principal areas of the Audit Quality Plan. Our annual Summer School program for 2022 will concentrate on these our four major areas of focus, namely; the audit of revenue, challenge of management, responses to fraud and going concern.

1. Audit of Revenue

In our response last year we acknowledged the need for further action in relation to the audit of revenue, representing one of the key areas of the firm's Audit Quality Plan and that we intended to take immediate and impactful actions in this area. In response:

- We established a new approach to the audit of revenue based on the revised ISA (UK) 315, detailed end-to-end understanding of revenue streams and the use of 'What Could Go Wrong' analysis for all December 2021 year ends onwards. This was supplemented with sector-based case studies for engagement teams focused on application guidance and best practice examples.

- We ran a full day dedicated mandatory revenue training session for the Audit Stream in Q3 2021 on the new approach. This will be further embedded through training in the 2022 Summer School.

- We have established our revenue centre of excellence.

- We have reviewed and enhanced audit methodologies and support materials in key areas including the audit of long-term contracts and are continuing to enhance those in the financial services sector.

The actions taken to date form part of a wider program to ensure engagement teams have comprehensive audit of revenue methodology. This includes guidance and materials for each sector to drive detailed understanding of revenue systems and tailored audit strategies, together with, a 'controls and digital first' mindset. This will all be supported by continued investment in central quality support providing for large and complex audits.

2. Culture of challenge

Driving consistent and effective challenge of management is a priority of the Audit Quality Plan, ensuring engagement teams have the skills and confidence to challenge management and demonstrate scepticism on a consistent basis supported by the integration of our Professional Judgment Framework into the audit tool, practice aids materials and behavioural based coaching. During the period we initiated our BDO People and Culture Program and challenge of management was a core theme of the 2021 Summer School and wider communications, supported by enhanced materials to support effective challenge by engagement teams.

As part of our Audit Quality Plan:

- We are undertaking a wider review of the audit tool, methodology, guidance and practice aids to embed the Professional Judgment Framework throughout the audit.

- We are developing guidance and practice aids to support the audit of forecasts and uncertainty which includes impairment, deferred tax assets, going concern and provisions.

- We have engaged external data providers to provide ready access to data and information to support challenge of management forecast assumptions.

We understand from our root cause analysis that many of the barriers to scepticism and challenge are behavioural and so over the next 12 months there will be continued focus in this area:

- We will launch and evolve our BDO People and Culture Program to support challenge, scepticism and positive behaviour, involving external consultants to assist in identifying and addressing barriers to challenge.

- In addition to being a core theme for the 2022 Summer School, the Audit Summit 2022 will focus on promoting positive behaviours that support BDO audit culture.

3. Going concern

We note the comments from the FRC in relation to going concern which highlight both key issues and areas of good practice. Going concern and viability assessments continue to be a focus area for the firm particularly in relation to consistency of approach across the audit stream and we have implemented a number of actions including additional training, enhancements to working practices and capturing evidence of assessments fully - this includes the use of Business Restructuring experts where considered necessary. Actions to drive increased consistency include the roll out of a 'Going concern non-negotiables' framework and tools to support engagement teams in obtaining consistent high quality management information and embedding of a challenging mindset whereby teams identify areas of uncertainty, challenge and evidence that challenge consistently.

4. Response to the risk of management override

We note with disappointment the comments in relation to the audit of journals. Again, we note that good practice in this area has been identified and have key actions in place to address this inconsistency and support all engagement teams in their work in this area.

Good practice

We are pleased to note that we have received a number of good practice points in the report, particularly in relation to two areas:

- Going concern – going concern has been a continued focus area throughout the last year including enhancements to working practices and file documentation – this includes the use of Business Restructuring where considered necessary. As we note above ensuring we improve consistency across all audit engagements in this area is an important focus.

- First year audits we received a number of good practice points on audits which were first year engagements, including in relation to the work done on the first year audit procedures on one of the audits inspected. These points have been shared with our Audit Transition Support team in order to ensure we consistently reflect these in future first year audits. This team comprises of specialist members of the central support function to aid audit teams in establishing the audit strategy in the first year of audit on larger, complex engagements.

Given that in a number of areas we have both findings and good practice points we are acutely aware of the importance of driving consistency across the firm and ensuring that teams are clear on "what good looks like”.

We were pleased to note that there were no issues arising in this review period on either working with specialists or audit of defined benefit pension schemes which were both focus areas for training, workshops and central consultations in the last year. We continue to focus on the importance of integrated working practices within the audit team and the Leadership Team has approved a TRA Strategic Framework placing Technology Risk Assurance 'at the heart of audit'.

Root Cause Analysis (RCA)

We have performed extensive RCA on all audit reviews included in this report.

A number of overall key themes were evident in the individual findings on the RCA investigations performed which link to a number of the actions taken above:

- Lack of appropriate skilled resource on certain engagements.

- Inappropriate setting of audit strategy including testing of controls.

- Inappropriate application of firm's standardised policies and procedures.

- A lack of challenging mindset in relation to audit evidence.

- Insufficient planned supervision and review of the audit team

Firm-wide actions

A number of firm-wide areas were also reviewed during the period - below is a summary of the actions we have undertaken to implement responses to the findings.

1. Implementation of the FRC's Revised Ethical Standard (2019)

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard. Since the FRC undertook its review, the firm has taken a number of steps to ensure the action points identified are addressed.

- The firm has enhanced its procedures such that teams are required to more explicitly document how the Objective Reasonable and Informed Third Party (ORITP) test has been applied in relation to each and every non-audit service engagement. Complementing this, the firm's annual ethics training released in 2021 had a dedicated module addressing the application of the ORITP test and tested the learners understanding on who they think would be a suitable third party over some practical based examples.

- The firm has enhanced its guidance for network firms, and non-network firms involved as component auditors providing minimum expected procedures. The firm has also delivered a series of training sessions to the audit practice. These training sessions were responsive to the requirements of the particular offices/sectors but all included 'Overseas firm monitoring' and reminders of minimum expected procedures as standing agenda items.

2. Engagement Performance – EQCR, consultations and audit documentation

The firm recognises the importance of the EQCR Program. As part of the Audit Quality Plan a review of the EQCR function has been undertaken considering the allocation, training and performance thereof and key proposals have been approved by the Audit Executive which are to be implemented in FY23.

We note the FRC's findings relating to file archiving on Value for Money arrangements on a Major Local Audit. The Firm will implement controls to ensure that report release dates are recorded accurately and that there are no completed engagements without a report release date being entered in the audit tool.

3. Methodology

The firm developed new audit guidance in relation to IFRS 13 in 2021. A project is underway to enhance and expand this guidance further in 2022 as well as IFRS 9 and the payments process, particularly in their application to audits in the financial services sector.

4. Monitoring – Internal quality monitoring

The firm has recognised that the time taken to complete the AQAR reviews is too lengthy and have conducted a review of the whole AQAR process. A proposal document has been taken to and approved by the Audit Executive with the aim of improving the quality, effectiveness and timeliness of completing our AQAR reviews.

We have updated our guidance for reviews of high risk and complex areas to ensure that there is adequate evidence of review and the basis for the reviewer's conclusion.

The firm has commenced a review of AQAR inspection findings and resultant gradings in respect of PIE audits to evaluate whether the difference in results between the external inspection population and wider internal inspection population indicates further revisions to enhance the effectiveness of the AQAR process are required. This review is being overseen by the Audit Executive and additional root cause analysis will be undertaken as necessary following conclusion of the initial review.

During 2022 we will formally document our review of the firm's internal quality control system for audits of financial statements in line with the requirements of ISQC (UK) 1.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Prioritise resources to address the continuing deficiencies in the quality of the firm's audit of revenue

Revenue is a key driver of operating results for many entities and is often identified as a key performance indicator for investors and other users of the financial statements around the growth and future prospects of companies. Accounting for revenue recognition, including long-term contracts, may be susceptible to management bias or error. Auditors are expected to evaluate and address the related risks and obtain sufficient appropriate audit evidence over revenue recognised.

Last year we reported that the firm needed to take urgent action to address continuing deficiencies in the audit work on revenue in particular in the areas of:

- Long-term contracts, including inadequate challenge of significant judgements and accounting treatments arising on contracts;

- Challenging the revenue process and whether there were alternative methods to record revenue and whether the scope and extent of controls testing relied upon were adequate;

- Challenge of management over adjustments to revenue for agency arrangements, including the completeness risk; and

- Substantive procedures performed not adequately addressing the risks identified in relation to accuracy and occurrence and whether revenue was recorded in the correct accounting period.

This followed key findings raised in relation to the audit of revenue in each of the previous two quality inspection cycles.

Key findings

We have seen no improvement in the overall quality of the audit work inspected over revenue. The lack of improvement is unacceptable and calls into question the firm's efficacy and timeliness of actions to achieve improvements in this area. Our continued findings in relation to the audit of revenue from the current year inspection cycle are set out below.

We reviewed the audit of revenue on the majority of audits inspected and identified weaknesses relating to revenue on eight audits, of which three were assessed as requiring improvement or significant improvement:

- On one audit, the audit team did not adequately challenge the significant judgements arising on long-term contracts to support the revenue and profit recognised. Insufficient audit procedures were performed to assess, corroborate and challenge the accuracy and completeness of costs to complete for contract arrangements that were not substantially complete.

- On another audit, the audit team failed to perform adequate procedures over the occurrence and accuracy of sales recognised in the year. Specifically, the decision not to test controls should have resulted in a significant increase in detailed substantive testing. The overall audit approach to revenue was inappropriate and the resultant level of testing performed insufficient and not justifiable.

- On a financial services audit, the substantive audit procedures were not sufficient to conclude on the occurrence, accuracy and completeness of revenue.

On five further audits, we identified a broad range of weaknesses associated with aspects of the work over revenue:

- On one of these audits, the audit team did not adequately evidence its risk assessment for revenue which had changed from a preliminary assessment.

- On two audits, the audit team placed unwarranted reliance on controls and thus performed insufficient substantive testing.

- On one audit, we identified instances where there was insufficient evaluation of a control report (a report on operating effectiveness of controls as a service organisation) to assess the testing performed over data used in calculating revenue, as well as inadequate evidence of evaluation of IT control deficiencies and assessment of the resulting impact on the audit approach.

- On one further audit and three of the above audits, the substantive procedures performed did not adequately address the risks identified in relation to completeness, accuracy and occurrence of revenue and/or whether revenue was recorded in the correct accounting period. On one of these audits, the audit team obtained insufficient evidence to confirm the accuracy of break clauses. The audit team performed insufficient substantive testing on certain adjustments to revenue, on one audit and on another, the audit team did not sufficiently evidence its assessment of the homogeneity of revenue populations from which revenue sample items were selected for testing.

We have seen no improvement in the overall quality of the audit work inspected over revenue.

During the year, we engaged with the firm in its effort to improve the quality of long-term contract audits. We reviewed and provided feedback on the firm's new methodology for these audits, which is effective for audits of 31 December 2021 year-end entities.

The firm must now take prompt action to understand the root causes of the deficiencies identified above and ensure the firm's audit quality plan is evaluated to ensure that planned actions are responsive to these findings. The firm should also consider why the firm's review processes are not consistently improving audit quality in this area. Resulting actions must be given the highest priority.

Address deficiencies in the quality of audit work on financial services entities

Financial services audits, including financial services providers and insurance entities, have specialist areas involving high volumes of transactions, significant management judgement and estimation uncertainty in complex areas. These all require a highlevel of sector audit expertise.

Settlement, clearing and payments processes and the resultant reconciliations represent a core area for financial services entities. Audit teams are expected to understand the overall process, including the IT and manual control environment, and perform sufficient and appropriate substantive testing. Audit teams are expected to design and perform procedures, tailored to the audited entity's risks and business, to obtain sufficient, appropriate audit evidence to ensure that there is no material misstatement in the recording of transactions, particularly over revenue.

The valuation of technical insurance provisions is complex and represents a core risk in the audit of an insurance entity. FRC actuarial experts are typically used on insurance audits to review the firm's actuarial expert work in supporting the audit team's overall conclusion on the appropriateness of provisions. Audit teams are expected to perform sufficient procedures to assess the reasonableness of technical provisions, including considering performing independent re-projection of the recorded reserves; and adequately evaluate the use of, and conclusions from, actuarial expert reports.

Key findings

Key findings – Financial services provider

We identified deficiencies on one audit, including:

- The audit team's overall approach to revenue recognition was inadequate and, as a result, the risk of an undetected material misstatement was unacceptably high. The audit team's substantive testing for the majority of the revenue streams was inadequate as it was limited to agreeing transactions between the entity's internal systems. In addition, given the highly automated nature of the entity's processes, it was not appropriate to rely on substantive audit procedures alone.

- Deficiencies were identified in the audit testing of the entity's payments process. There was insufficient evidence to demonstrate the audit team's and IT specialist's understanding of this area, as well as inadequate procedures being performed. The audit team's testing over the end-to-end payments process was inadequate, and the risk of an undetected material misstatement remained unacceptably high.

- The audit team's quality control review procedures failed to identify our significant concerns and therefore whether the issues that we raised may have led to any material misstatements.

Key findings – Non-life insurance entity

On a non-life insurance entity audit inspected:

- Insufficient procedures were performed over liability provisions as certain material liability populations were not tested.

- The audit team did not adequately evaluate whether the firm's actuarial expert report provided sufficient and appropriate audit evidence over the material accuracy of certain insurance provisions or the appropriateness of management's methodology, assumptions and provision models.

The firm's guidance and methodology has been updated in this inspection cycle, albeit not in time to make any impact on the audits we inspected in the year. Notwithstanding this, urgent and comprehensive action is required from the firm on specialised audits to address our concerns. This should include an update to the firm's overall financial services guidance and methodology, as detailed in Section 3, covering how the firm engages and works with firm's own actuaries and responds to any recommendations made by the actuaries.

Urgently improve scepticism and challenge surrounding assumptions in management's forecasts in key areas of judgement, in particular for going concern and viability assessments

The risk of bias in key management judgements means that auditors are expected to provide an appropriate level of challenge when assessing the reasonableness of management's estimates and assumptions, particularly when used in going concern and viability statement assessment and the valuation of assets and impairment testing.

Last year, for the second year in succession, we reported that the firm should take action on a range of issues arising on the challenge and testing of estimates and assumptions.

Key findings

We continue to identify weaknesses on audits in the firm's testing of key estimates and judgements, including this year in audit procedures over going concern and viability and valuation of intangible assets.

Key findings – Going concern and viability assessments

We identified significant deficiencies in the audit procedures performed over forecasts and other assumptions supporting the going concern and viability assessment on two audits. We also identified good practice in this area, indicating an element of inconsistency across the audits we reviewed.

- On both audits, the audit team did not sufficiently challenge certain assumptions in management's cash flow forecasts and models to evaluate and support the going concern assessment and there was inadequate sensitivity analysis performed on the liquidity and capital forecasts.

- On one of these audits, the audit team failed to perform sufficient, appropriate procedures on the directors' viability assessment to conclude whether there were any matters to be reported.

We continue to identify weaknesses on audits in the firm's testing of key estimates and judgements.

Urgent improvement of scepticism and challenge is required.

Key findings – Other estimates and assumptions in key areas of judgement

We reviewed the challenge and testing of estimates and assumptions in key areas of judgement on all of the audits inspected and we identified findings on three audits, of which one was assessed as requiring significant improvement.

We identified issues relating to the sufficiency of the evidence obtained and challenge of management's valuation estimates and cash flow assumptions for acquired assets on two audits. On a further audit, there was insufficient evidence of challenging management's determination of cash generating units over impairment.

Challenge of assumptions and inputs in management's going concern forecast is a recurring issue and whilst the firm has taken certain actions in response to our findings raised over the last two years, it must urgently develop further actions to address continuing deficiencies. This could include actions to promote greater consistency over the use of scepticism, assistance from the firm's internal experts and updating its methodology and guidance.

Enhance certain aspects of the firm's procedures over independence assessments

Auditor independence is key to ensuring confidence in the auditor's opinion on the financial statements. Auditors are expected to consider actual and perceived independence threats from the perspective of an objective, reasonably informed third party and implement appropriate safeguards to demonstrate the firm's commitment to independence.

Key findings

We raised the following findings in relation to independence on four audits:

- On one financial services audit, an assessment of independence for the firm's actuarial expert was not performed. The audit team also did not assess perceived conflicts of interest for the firm's actuarial expert and failed to communicate to the Audit Committee potential threats and safeguards to address these threats. On a further audit, the audit team did not obtain written confirmation from the overseas tax specialists that they were independent.

- On two audits, the audit team did not assess or sufficiently evidence the nature and scope of the non-audit services provided and an evaluation of potential threats to independence.

- On one of these audits, the audit team did not evidence sufficiently an assessment of the period when the services were provided, the permissibility of services provided or whether the same conclusions would likely be reached by another party.

Action is needed from the firm to promote improvements in how audit teams assess independence matters.

We identified findings in relation to independence on four audits.

Improve the audit testing over journals in response to the risk of management override of controls

Auditors are expected to perform appropriate testing of journals as one of the key audit procedures to respond to the risk of management override.

Last year we reported that the firm should improve its auditing of journals.

Key findings

This year we reviewed the audit team's testing of journals in response to the risk of management override on most of the audits inspected and we continued to identify findings on five audits:

- On four audits, the audit team obtained insufficient evidence or performed insufficient procedures to corroborate management's explanations to assess the appropriateness of journals selected for testing. We identified findings in relation to the appropriateness and range of risk criteria used by the audit team for selecting journals for testing on three of these audits.

- On two of these audits and one further audit, the audit team did not adequately evidence how it assessed the completeness of journal populations.

We reviewed the testing of journals in response to the risk of management override on most of the audits inspected and we continued to identify findings on five audits.

Quality control and Engagement Quality Control Review procedures

Last year on one audit, several key findings were identified, indicating that the audit partner and EQCR's quality control and review procedures were not effective in ensuring that the audit work was sufficient or fully supported the conclusions reached. We continue to identify key findings driving a lower audit quality assessment on individual audits and the firm must take robust action to ensure that its quality control and engagement quality control procedures are effective.

Review of individual audits: Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach which responds to those risks.

- First year audit procedures: On one audit, there was comprehensive evidence of review of the predecessor auditor's work papers and audit of opening balances, including a robust consideration of how prior control deficiencies could impact the current year's audit.

- Fraud risk assessment: The audit team involved its forensic specialists as part of its fraud risk assessment on one audit. The specialists performed a review of the work of the predecessor auditor and management's expert which enhanced the audit approach adopted for areas impacted by fraud risks.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Effective involvement of experts and specialists: Audit teams often use specialists to provide audit evidence in support of key assumptions, particularly valuations. We found good examples of engagement with valuation experts both at component and group level to assess assumptions for investment valuations on one audit and pension scheme liabilities valuations on another audit. On two audits, we found examples of good practice involving the use of, and coordination with, specialists to assess key assumptions for property valuation. On one audit, the audit team involved business and restructuring specialists effectively to assist in the assessment of going concern assumptions.

- Going concern and viability assessment: We observed examples of good practice over the assessment of going concern on five audits, including use of technical panels and involving the Head of Audit, considering the reasons for a competitor's financial difficulties to inform judgements, performing extensive audit procedures over the management's scenarios, challenging management's assumptions and corroborating management's forecast assumptions robustly.

- Investment property valuation assessment: Various sources of third party market data were used by the audit team to set independent expectations in corroborating and challenging yield rates for investment property valuations on one audit.

- Use of consultations: On one audit, the audit team consulted internally in several key areas, including the accounting for a significant disposal. Such consultations in the audit process assist in enhancing audit quality.

- Group audit team oversight and interaction with component auditors: On one audit, the group audit team demonstrated an effective integration of the component audit team in the audit process.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Other information – disclosures: On one audit, there was a comprehensive reconciliation of all financial and non-financial disclosures in the front half of the annual report to relevant audit working papers and, where considered necessary, independent external supporting evidence.

Good practice examples included the effective involvement of experts and specialists and the assessment of going concern.

3. Review of the firm's quality control procedures

In this section, we set out the key findings and good practice we identified in our review of the following four areas of the firm's quality control procedures, which we have inspected this year. This table shows how these areas in International Standard on Quality Control (UK) 1 (ISQC 1) map to International Standard on Quality Management (UK) 1 (ISQM 1), which will come into effect at the end of 2022, and the FRC "What Makes a Good Audit?" publication.

| ISQC 1 area | ISQM 1 area | What Makes a Good Audit |

|---|---|---|

| - Relevant ethical requirements - Implementation of the FRC's Revised Ethical Standard (2019) | - Relevant ethical requirements | - Execution of the agreed audit plan |

| - Engagement performance - EQCR, consultations and audit documentation | - Engagement performance | - Execution - Consultation and oversight |

| - Audit methodology | - Resources - Intellectual Resources including methodology | - Resources - Methodology |

| - Monitoring - Internal quality monitoring | - Monitoring and remediation | - Monitoring and remediation |

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our findings in the two previous years at the end of this section.

Relevant ethical requirements – Implementation of the FRC’s Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important “Objective Reasonable and Informed Third Party test”, against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified the following key findings where the firm needs to:

- Improve the firm's guidance on how to consider more consistently the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, how to include the perspective of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Improve the guidance provided to group audit teams to assess whether network firms/component auditors may have conditions and relationships that could compromise the independence of the audit engagement, including when they should consult with the UK Independence team.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard. Key findings related to the application of the Ethical Standard on individual audits are set out in section 2.

Engagement Performance – EQCR, consultations and audit documentation

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well as the training provided to reviewers.

Consultation with the firm's central functions, on difficult or contentious matters, enables auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained, should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified the following key findings where the firm needs to:

- Strengthen and formalise its EQCR policies and procedures. We identified a number of improvement points in relation to the firm's appointment of EQCRs based on their experience, quality results, available time and other factors. Given these findings and the recurring quality control issues identified from our inspection of audits in the current and prior years (see Section 1), the firm must take urgent action to strengthen its processes and the effectiveness of its EQCR process.

- During our inspection visit, we identified working papers and evidence supporting the auditor's conclusion on Value for Money arrangements for a major local audit which had not been archived on a timely basis. The archiving deadline was not met as no date was entered in the documentation; this meant that the firm's archiving controls failed to identify that these work papers were not archived. The firm must ensure that appropriate controls operate to prevent instance of late archiving.

Key findings related to the EQCR on individual audits are set out in section 2.

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

Key findings

We identified the following key findings where the firm needs to:

- Issue methodology and improve the quality and extent of IFRS 13 guidance in relation to auditing the fair value of financial instruments for banks and similar entities. Comprehensive and precise action is required to guide audit teams in planning and executing audit procedures in this complex area. Since our original inspection work in early 2021, the firm has developed an initial methodology framework and has adjusted its approach to auditing certain key areas. Further improvements are needed, particularly given that the size and complexity of the banking audits the firm undertakes is increasing.

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control.

Monitoring – Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring team.

We identified findings in all the firm-wide areas reviewed in the current year which the firm needs to address.

Key findings

We identified the following key findings where the firm needs to:

- Improve the timeliness of monitoring the quality of completed audits so that all findings and insights can be communicated to the audit practice in time for the planning and performance of next year's audits. The firm did not meet its completion target with a significant number of reviews still in progress after the targeted completion date.

- Ensure that the professional judgements made by the reviewer are recorded to support the depth of their review and the conclusions reached in key areas that have been reviewed where no findings have been raised. This is particularly important for high risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental.

- Perform an annual evaluation of its internal quality control system. The firm monitors the adequacy and effectiveness of its quality control system through a combination of arrangements including monthly Audit Quality Reports to the firm's leadership team, an annual compliance review, monitoring of completion of mandatory training and internal audit reviews. The firm should use the output from this monitoring activity to inform an annual evaluation of its system of quality control.

Good practice

We identified the following areas of good practice:

- Each audit partner is subject to a full internal quality monitoring review every two years. Furthermore, all financial services audit partners are subject to a full review every year.

- Where an audit receives an adverse quality assessment, the firm requires a review in the following year to monitor the effectiveness of the actions taken to remediate the findings. This includes all audits with significant improvements, all public interest entities' audits with improvements required, and a sample of other audits with improvements required.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| - Audit quality focus and tone of the firm's senior management | - Implementation of the FRC's Revised Ethical Standard (2019) | - Audit methodology (recent changes to auditing and accounting standards) | - Partner and staff matters, including performance appraisals and reward decisions |

| - Root cause analysis (RCA) process | - EQCR, consultations and audit documentation | - Training for auditors | - Acceptance and continuance (A&C) procedures for audits |

| - Audit quality initiatives, including plans to improve audit quality | - Audit methodology (fair value of financial instruments with a focus on banks) | ||

| - Complaints and allegations processes | - Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:.

For Audit methodology and training (2020/21) the firm needed to ensure audit practitioners complete their mandatory training on a timely basis, improve the guidance issued to audit teams in relation to auditing lease accounting in accordance with IFRS 16 and improve the quality and extent of IFRS 9 methodology and guidance relating to banking audits.

For Partner and staff Matters (2019/20) the firm needed to enhance staff's compliance with the firm's requirements for objective setting and appraisal completion, improve the consideration and assessment of audit quality within the appraisal process and introduce a formal and standardised assessment process for senior audit manager promotions.

- For Acceptance and continuance procedures (2019/20) the firm needed to strengthen the acceptance and continuance approval process, in particular the evidence to record and conclusions reached. We provided an update on the firm's actions in our 2020/21 report.

Good practice

Good practice was identified in our review of audit methodology and training (2020/21) in relation to the firm mandating the use of experts when auditing multiple economic scenarios on banking audits.

4. Forward-looking supervision

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through assessing and challenging: the effectiveness of the firms' RCA processes; the development of the firms' audit quality plans; the firms' progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of firms' response to non-financial sanctions. We are currently introducing a single quality plan (SQP) to be maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in our Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Audit quality initiatives

- RCA

- Other activities focused on holding the firms to account

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Audit quality initiatives

Background

Firms are expected to develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

Last year we reported that we had reviewed key aspects of the firm's audit quality plan which continues to evolve as part of its wider system of Audit Quality Management.

When we reviewed the plan last year, we identified good practice in relation to the audit governance restructure. We also found that the firm should improve the plan and/or quality initiatives by continuing to develop the embedding and oversight of the AQP; aligning incentives, recognition and promotion to audit quality; and should provide clarity on the AQP's medium term priorities and key milestones.

Observations

We assessed the following:

- Embedding & oversight of the AQP: since our last assessment the AQP is better embedded and is now at the core of the firm's ambition to improve audit quality alongside controlled growth. Messages from senior management, training, and the annual Summer School all reinforce the importance of the plan. Responsibility for areas within the plan have been assigned to partners, as sponsors. Management and leadership give challenge to the plan, its progress, and its evolution at periodic intervals.

- Progress on focus areas: BDO has undertaken a number of targeted actions across the four focus areas identified as posing the most significant threat to audit quality and corporate failure: Audit of revenue; Detecting material fraud; Going concern and viability, and Challenge of management. Notably on Audit of revenue, the firm has launched a revised approach to revenue, improved data analytics and provided tailored training. With respect to Detecting material fraud, the firm has sought to leverage its forensics specialists to drive strategy and audit discussion groups. The actions taken by the firm should start to impact the quality of audits in the next period.

- Incentives, recognition and promotion: the firm has made progress with aligning incentives, recognition, and promotion to quality at the Partner level through the Partner review process and risk and quality dashboards. Enhancements to the performance review system for staff, including audit quality dashboards and an Audit Quality Stars programme, are yet to be fully implemented. The firm must ensure that all its reward and recognition structures remain positively aligned with maintaining high audit quality.

- Evolution of the AQP: In April 2022, BDO refreshed its AQP. As part of that process, BDO reaffirmed the four focus areas identified as posing the most significant threat to audit quality and corporate failure plus, in parallel, the firm also introduced a strategic framework based on the building blocks necessary to sustain audit quality on a consistent basis. The firm sought to give more prominence to challenge of management, recognising the importance of behavioural change and that the Professional Judgement Framework it had developed still needed to be rolled out, embedded, and effectively used in practice. The AQP is prioritised and includes short and medium-term actions that support the vision. The firm must now ensure that the plan is comprehensively implemented.

We will continue to assess the AQP and encourage all firms to develop or continue to develop their audit quality plans including the focus on continuous improvement and measuring the effectiveness of initiatives.

Audit quality plans should include forward-looking measures which contribute directly or indirectly to audit quality.

BDO has reaffirmed the four focus areas of its AQP and introduced a strategic framework to sustain audit quality on a consistent basis.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we found that the firm should improve or develop its RCA process in the following areas: Analysis of root causes; Coverage; Challenge of management and scepticism; and Accountability and oversight. We also identified good practice in relation to sector-wide and thematic reviews. The firm has made some changes to its RCA process during the year.

Observations

We assessed the following:

- Analysis of root causes: BDO have now introduced a more consistent framework for the analysis of causal factors which should assist with deeper probing of root causes, consistency of assessment, and comparison of findings and their development. The firm must develop further this framework in areas that it has identified to enable it to capture the root cause risks for complex audits.

- Audit Quality Indicators: the firm has started to use audit quality indicators as a core part of the RCA process, providing insights on input factors to drive investigation and to support interviews, and to corroborate and challenge findings. BDO must continue to ensure that it has a broad set of input factors to support effective RCA enquiries and its judgements on causal factors.

- Coverage and resourcing: the firm now undertakes RCA on all FRC in-scope reviews and is increasing its RCA on the non-PIE population at all grades. Coverage must be further expanded as the resourcing in the RCA function is built up. The firm is giving more attention to capturing and leveraging the drivers behind positive quality occurrences.

- Emerging themes: BDO's RCA process shows an improved understanding of causal factors driving quality occurrences and has led to the identification of a range of key themes including: inappropriate application of the firm's policies and procedures; inappropriate setting of audit strategy; insufficient planned supervision and reviews of audit teams; and a lack of a challenging mindset in relation to audit evidence. BDO must ensure its actions responding to these findings address, as necessary, both elements of the firm's quality control framework and the mindset and behaviours staff at all levels should demonstrate to deliver high quality audits. BDO's analysis of emerging themes must be fully integrated into its AQP initiatives.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

Root cause analysis is an important part of a continuous improvement cycle.

ISQM 1 requires firms to use RCA as part of their quality remediation process.

BDO needs to further develop its framework for the analysis of causal factors and expand coverage as resourcing in the RCA function is built up.

Other activities focused on holding firms to account

Background

As part of our forward-looking supervisory approach we hold firms to account for making the changes needed. During the year we undertook increased supervisory activities at this firm including increased inspections and monitoring the implementation of the firm's audit transformation plan.

Over the last year, BDO has responded constructively to our findings and has developed a comprehensive multi-year plan which aspires to meet ISQM 1 requirements, address our audit quality concerns and reinforce the importance of a positive audit culture. Our findings in this report on individual audits and on firm-wide procedures pre-date a number of changes and this comprehensive plan.

Observations

We assessed the following:

- Investment: the firm is strengthening its investment in, and commitment to, the resourcing of the infrastructure functions and Technical Standards Group which support audit quality. It is also strengthening its Technology Risk Assurance function recognising the need to move to more controls-based audits and to have additional analytics capability. We continue to challenge the firm on the adequacy of these functions for the complexity of the firm's business and its growth aspirations.

- Non-Financial Sanctions: we have reviewed and challenged the actions BDO has taken against set criteria on a number of selected audits. We were satisfied that the firm had acted on the non-financial sanction.

- Financial Services methodology: based on our reviews and given BDO's planned growth in banking, and financial services more generally, we expect the firm to develop overarching financial services guidance that includes but is not limited to: engaging and challenging specialists; shifting the focus on IT reliance; shifting the focus on controls and guidance, and materiality considerations.

- Improve the quality and extent of IFRS 9 methodology and guidance for banks and similar entities: based on the 2021 updates by the firm, overall, the updates present an improvement compared to the guidance seen in the prior year inspection cycle. The firm has prepared an overall guidance document and an updated audit programme alongside more comprehensive methodology and guidance for key chapters. Notwithstanding the improvements identified, certain aspects of our prior year findings have not been sufficiently addressed, and in some cases, the improvements required are significant.

- Action plans: BDO has made progress in remediating action plan items. A range of identified actions have been taken that link to the firm's AQP. However, a number of key actions, including the revised revenue methodology and the Professional Judgment Framework, are still embedding and known time lags mean that we are yet to see a positive impact on audit quality. Over the coming year BDO must focus on ensuring the changes it has put in process are implemented and effective.

- Internal Quality Monitoring: BDO has applied a rigorous risk-based approach to selecting those audits to be subject to IQM review in response to last year's public report. As part of the selection process, the firm has given detailed consideration to: priority sectors; portfolio composition; poor review results; and audits outside of the responsible individuals' normal portfolio. The results of the reviews of this selection will be seen in the coming year.

Nonetheless, based on current inspection results, we are concerned that the firm's IQM reviews may provide insufficient depth or challenge.

We will continue to hold the firms to account through our ongoing supervisory activities.

BDO has responded constructively to our findings and has developed a comprehensive multi-year plan.

Operational separation of audit practices