The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

IFRS 16 'Leases' Interim Disclosures in the First Year of Application

Executive Summary

Introduction

The purpose of this report is to summarise the key findings of our thematic review of interim disclosures about the implementation of IFRS 16 ‘Leases', which:

- Became effective on 1 January 2019; and

- Replaces: IAS 17 ‘Leases' and: IFRIC 4, SIC 15 and SIC 27.

Key changes:

- Previously unrecognised 'operating leases' are now recognised on balance sheet as lease liabilities and right of use assets.

- Depreciation of right of use assets and interest expense on lease liabilities replace operating lease expenses in the income statement. While the profit before tax impact may be limited, this can have a significant affect upon levels of operating profit and finance expenses.

Companies in sectors that typically had a high number of operating leases will see a significant increase in assets and liabilities on applying IFRS 16. High-quality disclosures will be required in order to understand these changes.

Key findings

Our review identified a number of areas where disclosure could be improved. While we are mindful that the interim disclosure requirements are less extensive than those for full-year accounts, we felt that some companies did not sufficiently explain the impact of adopting IFRS 16. We have highlighted in this report where we expect companies to provide more comprehensive disclosure in their upcoming annual reports.

Our key findings were that the following disclosures could be improved:

- Information about key judgements made on adopting the new standard, explaining the specific judgements made and the effect on the accounts; common judgements relate to the lease term, and whether a contract contains a lease.

Modified retrospective adopters should provide:

- Clearer communication of the transition choices applied;

- Better explanations of the difference between the IAS 17 operating lease commitments and IFRS 16 lease liability; and

- For APMs – clarification that comparative amounts have not been restated, and, where new APMs are used to aid comparability, disclosure consistent with ESMA's guidelines.

Overall, the best disclosures were those that were specific to the company, and that provided additional details of the impact of IFRS 16.

We noted many good examples of disclosure, some of which are highlighted in this report. These excerpts of published interim accounts are intended to demonstrate the level of detail which we consider helpful when explaining various aspects of the impact of adopting IFRS 16 to users.

We encourage companies to carefully consider the findings of this review when determining the extent of disclosures included within their next annual reports. Companies should aim to ensure not only that mandatory disclosure requirements have been met, but that they have addressed the disclosure objective of the standard. Starting with this objective will go a long way to ensuring that readers understand the impact of IFRS 16 on the company. We hope companies find this thematic review useful.

Scope and sample

Background and scope of our review

Our review consisted of a limited scope desktop review of the interim financial statements of a sample of companies. We assessed the adequacy of disclosures regarding the effect of the transition to IFRS 16 in the first year of adoption. Our review focussed on lessees as the accounting requirements for lessors are substantially carried forward from IAS 17.

Interim disclosure requirements

What is a sufficient level of disclosure of the impact of IFRS 16 for one entity may be insufficient for another...

IAS 34 'Interim Reporting' does not specify how much detail entities must provide when explaining changes in accounting policy in interim accounts. The extent of disclosures is therefore largely left to management's judgement.

Where the adoption of IFRS 16 had a significant impact for a company, we expect management to consider the requirements of IAS 8 'Accounting Policies, Changes in Accounting Estimates and Errors', as well as the transition disclosure requirements of IFRS 16.

We also expect management to ensure that the disclosures are of a sufficient level of granularity as to allow users to understand fully the extent to which IFRS 16 has had an impact on the business.

Our thematic reviews of IFRS 9 and IFRS 15 adoption found that transition disclosures in year-end accounts were generally more comprehensive than the equivalent interim disclosures. We expect to see a similar pattern of improvement when we review year-end accounts containing disclosures relating to first time adoption of IFRS 16.

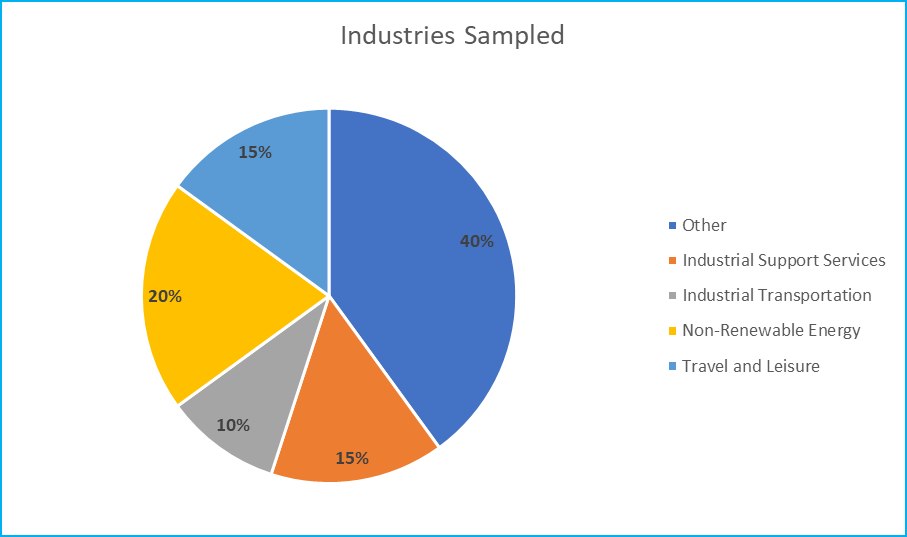

Our sample

We reviewed the interim financial statements of 20 entities. Our sample included companies from industries in which we would expect the implementation of IFRS 16 to have the most significant impact. As a result, our sample focused on the travel and leisure, support services, and non-renewable energy sectors. None of our sample early-adopted IFRS 16.

We intend to review the full-year accounts of those companies in our sample whose interim disclosures had greater scope for improvement, to determine whether such improvements have been implemented in their annual report and accounts.

Findings: Transition options

Transition method

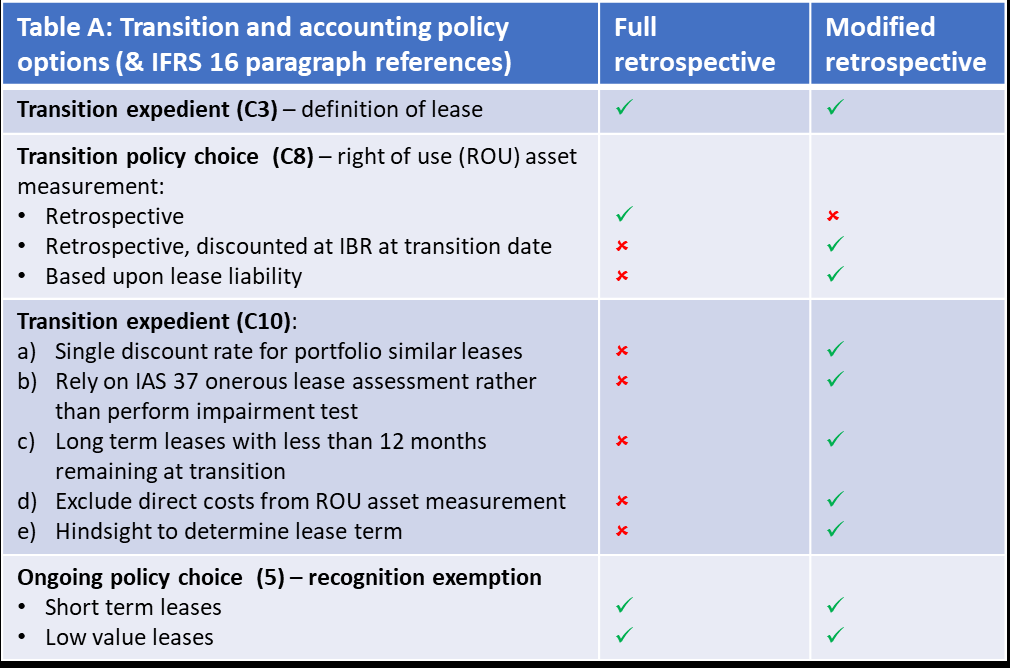

IFRS 16 may be adopted using either the full retrospective method or the modified retrospective method. The standard also permits early adoption. One practical expedient, on deciding whether a lease exists, applies to both methods. Table A sets out the other practical expedients and policy choices and the transition method they apply to.

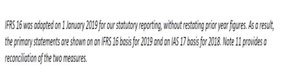

The full retrospective method involves first-time application of the standard on a retrospective basis, with full restatement of comparatives. The modified retrospective method also involves first-time application of the standard on a retrospective basis, subject to certain practical expedients, but with a cumulative catch-up posted through retained earnings on the date of transition. This means that comparative numbers are not restated.

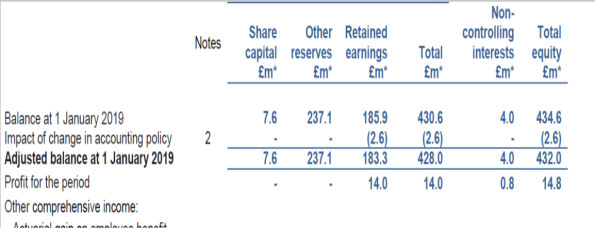

All but one company in our sample adopted the modified retrospective approach. While all companies made clear which transition approach had been adopted, some risked confusion by referring to their opening retained earnings figures as 'restated'.

Several companies in our sample included a helpful note that comparatives had not been restated on the face of primary statements.

Full retrospective adopters are reminded of the need to present a third balance sheet at the beginning of the restated comparative period (IAS 1.40A).

Examples of good disclosure...

Clarkson Plc's disclosure of the modified retrospective adjustment to opening retained earnings was clear and consistent with the wording of the standard.

Intertek Plc included a prominent explanation above its income statement that it had not restated prior year figures. It also labelled primary statement columns to make clear different standards had been applied in 2018 and 2019 (Intertek Plc, p24).

Practical expedient definition of lease

The standard provides certain practical expedients on transition. The majority of companies in our sample disclosed they had taken advantage of the practical expedient not to reassess whether contracts were, or contained, a lease. This effectively grandfathers conclusions under IAS 17 and IFRIC 4. Of those companies that did not disclose use of this practical expedient, several did not disclose any evidence of reassessing their lease population under IFRS 16 criteria, as we would have expected. We intend to revisit these disclosures in their annual reports.

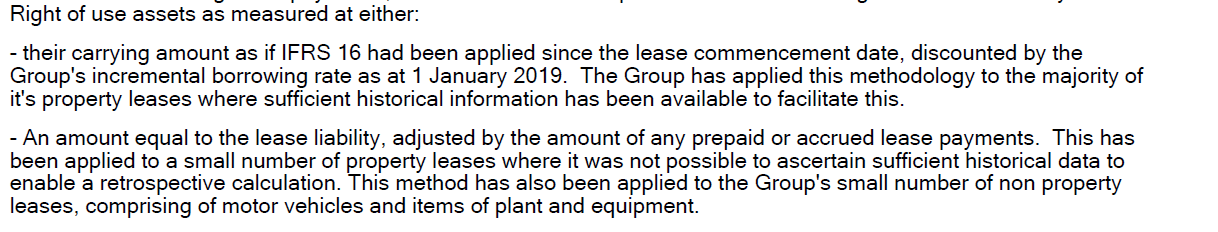

Pendragon Plc's transition explanation helpfully explained the circumstances where the different right of use measurement policies had been used.

Examples of good disclosure... Pendragon Plc, p24

Modified retrospective policy choice for right of use asset

On transition, companies can choose on a lease-by-lease basis whether to measure the right of use asset at: (i) The carrying amount as if the standard had been applied since commencement date, discounted at the incremental borrowing rate (IBR) at date of initial application, or (ii) An amount equal to the lease liability, adjusted for prepaid/accrued lease payments. 10 companies disclosed a combination of these approaches, while six disclosed option (ii), and three option (i). Of the 10, several referred to measuring the asset as though the standard had applied since commencement date, without any reference to the use of IBR at date of initial application – which is a requirement of the standard. We intend to revisit these disclosures in their year end accounts.

Of those companies that used both methods, the better examples explained the circumstances in which they applied the different options.

Points to remember on transition

The key disclosure requirements on transition to IFRS 16 are contained within IAS 8. For modified retrospective adopters, the requirements of IAS 8 paragraph 28 are modified by additional requirements in paragraph C12 to C13 of IFRS 16.

Companies must disclose whether they have applied the practical expedient not to reassess whether contracts contain a lease.

For modified retrospective adopters:

Companies must disclose the lessee's weighted average incremental borrowing rate (IBR) applied to lease liabilities at the date of initial application, and an explanation of the difference between operating lease commitments disclosed under IAS 17 and lease liabilities recognised on initial application of IFRS 16.

We encourage companies to communicate clearly that comparative figures have not been restated.

Companies should ensure their policy for right of use assets on transition is in accordance with the standard. Where using a mix of policies, it is helpful to explain the circumstances.

A number of practical expedients are available to those following the modified retrospective adoption.

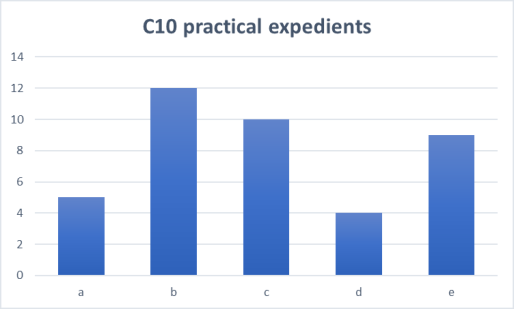

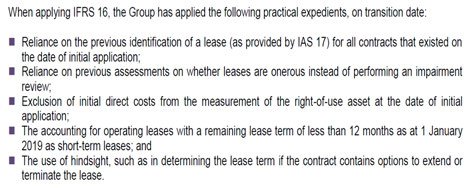

In some examples, companies were not as clear as they could be in identifying whether they had applied transition expedients (C10) or recognition exemptions (IFRS 16.5), summarised in Table A, on page 5. This clarity is important so users understand whether this has a one-off impact, or is an ongoing accounting policy choice.

For example, companies referred to the application of transition expedients including that for low value assets (a recognition exemption). We encourage companies to ensure clarity of communication of whether they have applied both the transition expedient (C10) for longer leases with a term ending within 12 months of the date of initial application of the standard, and the accounting policy recognition exemption (IFRS 16.5) for short term leases.

Examples of good disclosure...WPP Plc, p17

WPP clearly set out which of the transition practical expedients have been applied.

The disclosure of uptake of transition expedients in companies we reviewed ranged from none to all. The most common expedients disclosed by companies were the reliance on the IAS 37 assessment of whether a lease was onerous rather than performing an impairment test on transition (b), the expedient for leases with less than 12 months remaining (c), and using hindsight to determine the term of the lease (e).

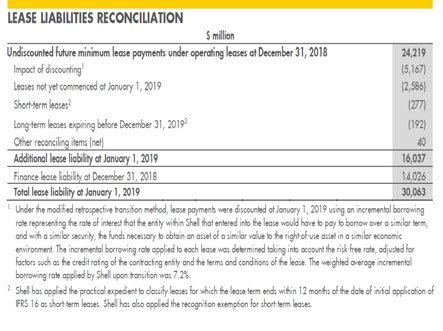

Shell's disclosure clearly distinguished the transition impact of long term leases with less than 12 months remaining, and the short term lease recognition exemption.

Findings: explaining changes in accounting policies

One of the key interim disclosure requirements in the first year of applying a new accounting standard is an adequate explanation of the nature and effect of any changes in relevant accounting policies or methodologies.

Companies within our sample generally did a good job of explaining the change in policies, albeit one company failed to include any explanation of the difference between their old and new accounting policies.

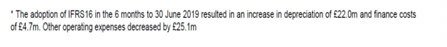

Generally, companies also clearly communicated the impact of adopting IFRS 16, with clear information about the size of new right of use assets, and lease liabilities. Better disclosures, such as Shell, on the following slide, showed the line by line impact on the balance sheet, highlighting and identifying other effects, such as the impact of derecognition of onerous lease provisions.

The explanation of the impact upon companies' profit or loss was more limited. In some cases it appeared that, although the balance sheet impact was very significant, the impact on the income statement was less so. In such circumstances, users may still find it helpful for the impact of the new standard to be explained.

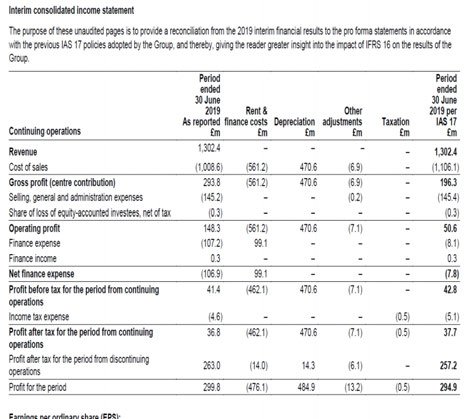

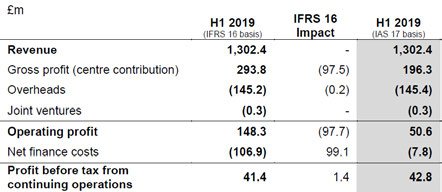

Two contrasting disclosures clearly communicated the profit and loss impact to users:

- IWG Plc presented a columnar, line by line, presentation to reconcile reported figures to pro-forma IAS 17 figures for the period;

- Savills Plc provided a clear explanation of the impact of the new standard as a footnote to the income statement.

Examples of good disclosure... IWG Plc, p27

Examples of good disclosure... Savills Plc, p12

Royal Dutch Shell Plc's transition note clearly identifies the impact of the new standard across a number of balance sheet lines (Royal Dutch Shell Plc, p17).

9 of the companies in our sample included right of use assets as part of PPE, rather than as a separate item on the face of the balance sheet. Separate presentation was most common where the impact was more significant.

14 of the companies in our sample presented lease liabilities on the face of the balance sheet. The other 6 included the balance within financial liabilities/debt.

Derecognition of onerous lease provisions is one common transition adjustment we have seen.

We found the use of footnotes a helpful addition in explaining those balance sheet movements on transition other than recognition of lease liabilities and right of use assets.

Findings: transition disclosures

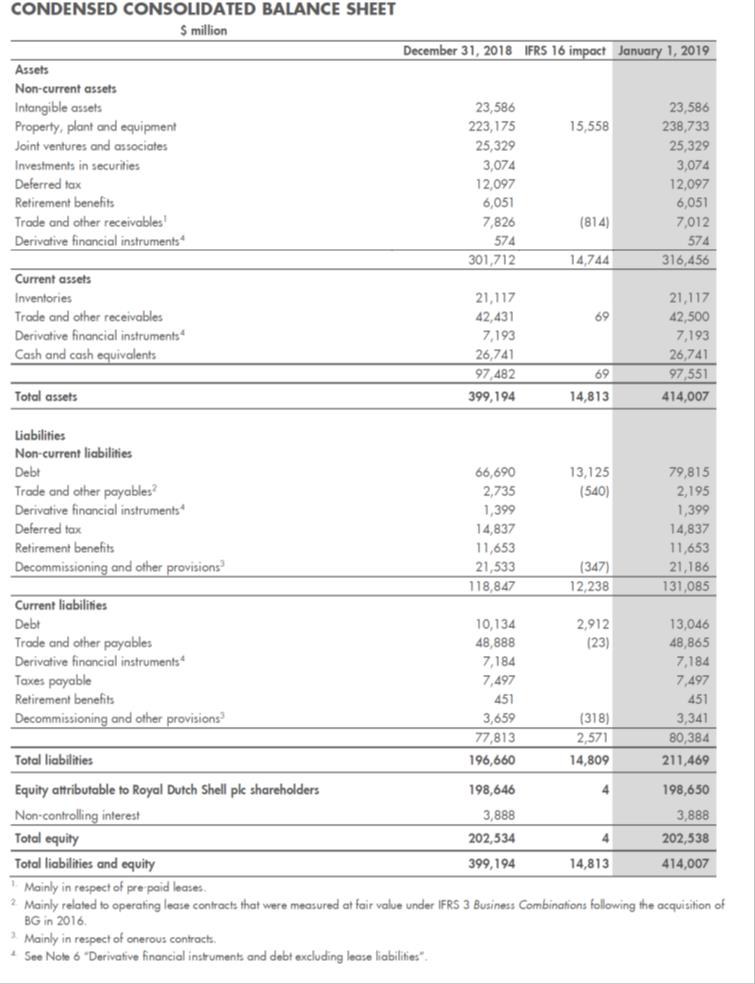

Modified retrospective adopters generally provided a clear disclosure of the weighted average incremental borrowing rate (IBR) applied to lease liabilities at the date of initial application. However, three of our sample failed to disclose this information.

In better examples, companies supplemented the IBR figure with an explanation of geographical variations, or range of rates underlying the weighted average. Where companies use a transition date IBR we expect it to be disclosed in their annual accounts.

Examples of good disclosure... Premier Oil Plc, p44

Premier Oil Plc's IBR disclosures provided a range of rates, in addition to the weighted average figure.

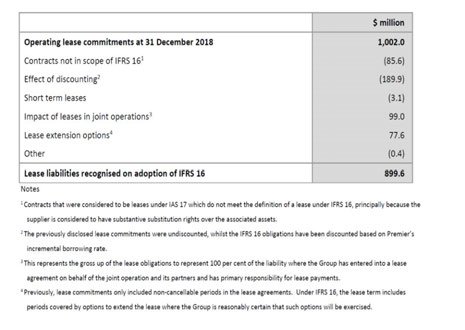

Disclosures explaining the difference between IAS 17 operating lease commitments disclosed at the previous year end, and the lease liabilities recognised on adoption of IFRS 16 were more mixed. Four of 19 companies within our review failed to provide a reconciliation. In some cases this absence from interim accounts was surprising, given the size of the difference.

While the remainder provided at least a reconciliation between the figures, we remind companies that the standard requires an explanation of any difference other than discounting.

We expect companies to explain significant or unusual reconciling items. We also encourage companies to consider the consistency of such disclosures with their identification of significant judgements, as discussed further on page 11.

Examples of good disclosure... Premier Oil Plc, p31

This footnote was further explained elsewhere in the accounts, with a link to recent IFRIC discussions regarding leases in joint operations.

Premier Oil Plc provided a clear reconciliation between IAS 17 operating lease commitments and IFRS 16 lease liabilities. The inclusion of footnotes to explain the significant reconciling items made this one of the clearer examples within our sample.

Findings: significant judgements

Disclosure of judgements provides important information about how a company has applied IFRS 16

A number of companies identified key judgements relating to IFRS 16, without adequately explaining the specific judgement. Most relied on boilerplate disclosures, or lifted wording from the standard.

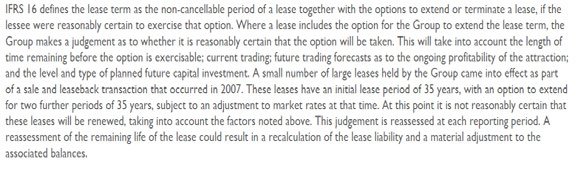

The most common judgement identified was in relation to lease extension or termination options. However, only one company identified any granular, entity specific, detail about the judgement. Most neither identified what judgement had been reached, nor indicated its impact.

Some companies identified calculation of the discount rate as a key judgement. As this is a judgement involving estimation, we expect companies identifying this as within the scope of paragraph 125 of IAS 1 to include the relevant disclosure, such as sensitivity to changes in assumptions.

A number of our sample disclosed no significant judgements on adoption of IFRS 16. Some of these companies disclosed significant reconciling items between IAS 17 lease commitments and IFRS 16 lease liabilities, such as lease extensions, or items which are not leases under IFRS 16, which suggested significant judgements may have been exercised. We expect companies to consider carefully whether these are judgements within the scope of paragraph 122 of IAS 1.

Merlin Entertainments Plc discloses what judgement has been taken in relation to lease extension options, and why. This was a rare good example from our review.

Disclosure of significant judgements and estimation uncertainty

IFRS 16 does not require additional disclosures on top of those contained in IAS 1. However the judgements or sources of estimation uncertainty in relation to leases may assume greater significance upon adoption of IFRS 16.

IAS 1 paragraph 122 requires disclosure of the judgements with the most significant effect upon amounts recognised in the financial statements. IAS 1 paragraph 125 requires additional disclosures in relation to judgements involving estimation uncertainty.

We expect companies to consider whether disclosure of existing judgements may now be required upon adoption of IFRS 16. Existing judgements such as whether a contract contains a lease under IAS 17/IFRIC 4, or the split between lease and service contract, may assume greater significance to the amounts recognised in the financial statements as a result of adoption of IFRS 16 compared to IAS 17, and so may now warrant disclosure for the first time.

This continues to be an area of focus for CRR. Our expectations in this area were set out in our thematic review on the subject.

Examples of good disclosure... Merlin Entertainments Plc, p20

Findings: disclosures

IFRS 16 paragraph 53 includes a number of specific disclosure requirements. The standard requires a tabular presentation of this information, unless another format is more appropriate. Only one company within our sample disclosed this in the suggested format. We consider that a tabular format can be a clear and concise way to provide these mandatory disclosures.

IFRS 16.59 requires disclosure of additional information, as necessary, to meet the disclosure objective of the standard. This includes exposure to future cash flows from lease extension options and variable lease payments, and covenant information.

A number of companies in our sample explained that loan covenants were linked to frozen GAAP. However we identified minimal discussion or disclosure of potential cash flow exposures not reflected in the measurement of lease liabilities. We expect companies whose leases include such exposures to explain this clearly to users.

We encourage companies to consider whether their additional disclosures adequately address the disclosure objective of IFRS 16 paragraph 51, namely to give users a basis for assessing the effect of leases on the lessee.

Half the companies in our sample disclosed an accounting policy of measuring lease liabilities at their incremental borrowing rate (IBR). The rest disclosed that both the IBR and rate implicit in the lease were used. In such cases, we encourage companies to be clear on the circumstances in which the different methods are used.

We also encourage clear disclosure of the accounting policy for where in the cash flow statement interest cash flows on leases are presented, as this varied between operating and financing cash flows.

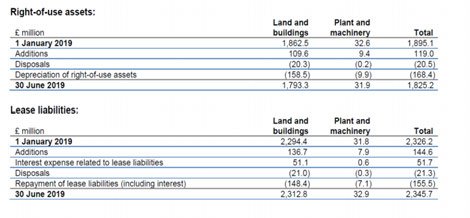

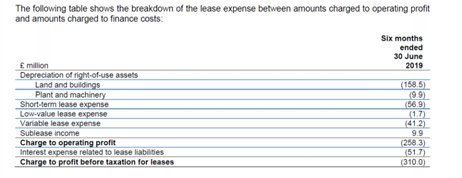

Examples of good disclosure, WPP Plc p29

WPP included tabular analysis of profit and loss amounts, in addition to reconciliations of opening and closing right of use assets and liabilities.

Merlin Entertainments plc (p20) explain the circumstances where the rate implicit in the lease is used to measure lease liabilities.

Findings: Comparability and use of APMs

Companies who choose the modified retrospective method are not permitted to restate comparative figures. They will, therefore, disclose current period results under IFRS 16 and prior period figures under IAS 17.

When disclosing profit and loss and net debt metrics in narrative reporting, whether IFRS measures or alternative performance measures ('APMs'), current and prior year figures will not be comparable. We noted that companies sought to address this through a variety of approaches in their narrative reporting.

We expect modified retrospective adopters to acknowledge this issue of comparability in their upcoming annual reports by, for example, clarifying for readers that the measures presented have been calculated under different measurement bases, thereby impacting comparability of current and prior year figures.

Some companies within our sample only made passing reference to IFRS 16 in the front half, and included no express statement that comparatives had not been restated. We expect companies to make clear that performance measures in the front half have not been restated where that is the case.

Modified retrospective adopters should consider carefully before disclosing proforma IFRS 16 figures for the prior period. It is difficult to see how such figures could be described as complying with IFRS 16 if relying upon transition date estimates. We encourage companies to ensure that any limitations in relation to the basis of calculation of published APMs are made clear.

NOTE ON IFRS 16:

As previously noted we have adopted the modified retrospective approach available within the new accounting standard and therefore we have not restated our comparative disclosures for the impact of IFRS 16, which came into effect from 1 January 2019. The statutory results have been split out to show the IFRS 16 impact to aid comparison period on period.

BBA Plc include a clear statement on their highlights page to make clear that comparatives have not been restated (BBA Plc, p3)

Examples of good disclosure...

IWG Pic's presentation of results within their financial review allowed easy comparison with prior periods prepared under IAS 17, as well as clearly showing the impact of the new standard upon reported profit. (IWG Plc, p6)

Bunzl Plc included a clear and unambiguous statement that comparatives have not been restated on the front page of their interims. They also make clear that IAS 17 figures are APMs, and cross refer to the required reconciliations (Bunzl Plc, p1).

Following the adoption of IFRS 16 'Leases' with effect from 1 January 2019, because the Group has adopted the accounting standard using the modified retrospective approach to transition and has accordingly not restated prior periods, the results for the six months ended 30 June 2019 are not directly comparable with those reported in the prior period under the previous applicable accounting standard, IAS 17 'Leases'. To provide meaningful comparatives, the results for the six months ended 30 June 2019 have therefore also been presented under IAS 17 with the growth rates shown on an IAS 17 basis. See Notes 2 and 3 for a reconciliation of the IAS 17 alternative performance measures to the equivalent IFRS measures.

ESMA Guidelines on APMs (the Guidelines)

Any IAS 17-based figures presented for periods after adoption of IFRS 16 are APMs, and should comply with ESMA's Guidelines on APMs. These guidelines apply to companies with securities listed on a regulated market, but are considered best practice for others.

In particular, we remind companies of the contents of the Guidelines in relation to

- labelling and defining APMs (Guidelines paragraph 21-25),

- explaining why APMs are used (Guidelines paragraph 33-34), and

- ensuring APMs are not displayed with more prominence or authority than IFRS measures (Guidelines paragraph 35-36).

A number of companies we reviewed reported first half performance on an IAS 17 basis, in addition to the statutory IFRS 16 results.

We encourage companies to review front half disclosures for compliance with the Guidelines. Issues we identified included:

- Front half discussion entirely, or largely, commenting on IAS 17 performance, with no or little discussion of IFRS 16 results. (prominence)

- Some companies had not updated APM glossaries to include new IAS 17 measures (defining)

- Some companies included a number of IAS 17 APMs for the interim performance where there did not appear to be a material difference from IFRS 16 figures. We would expect companies to consider the balance between including information to aid comparability, and obscuring clear reporting through excess clutter. (explaining)

- Referring to IAS 17-based figures as providing better representation of performance (authority)

- Using labels such as Earnings per share, net finance costs and net debt to refer to IAS 17-based figures for 2019, and referring to the statutory figures as "under IFRS 16”. (labelling)

Examples of good disclosure, Intertek Plc

Intertek Plc's operating segment disclosures explains a clear time limit upon how long IAS 17 figures will be presented for. Similar disclosures may be helpful for other APMs disclosed due to IFRS 16 transition (Intertek Plc, p31).

APMs continue to be an area of focus for CRR. Our expectations in this area were set out in our recent thematic review on the subject.

Next steps

Impact on our future reviews

We intend to review the full-year accounts of companies in our sample whose interim disclosures had greater scope for improvement, to determine whether such improvements have been implemented at the year-end. Our sample for this follow-up will also include a number of companies not considered as part of this thematic review. We will engage in correspondence with any companies whose disclosures are considered to require significant improvement.

Key points for companies to consider when preparing year-end disclosures

The year-end disclosure requirements of IFRS 16 are more extensive than those required for interim reporting purposes.

We encourage companies to invest the time during their year-end reporting cycle to ensure that:

- explanations of the impact of transition are comprehensive and are linked to other information disclosed in the annual report;

- changes made to accounting policies (in particular key judgements) are clearly articulated and convey company-specific information;

- disclosures of leasing activity meet the disclosure objective of the standard

- Any new APMs are consistent with the ESMA Guidelines

Quick checks: have you met the annual disclosure requirements about...?

This diagram illustrates key disclosure requirements. It shows six hexagonal elements connected, representing:

- IFRS 7 Lease liability maturity disclosures

- IAS 1 Judgement and estimates disclosures

- Tabular disclosures required by paragraph 54

- Use of transition expedients

- Unrecognised future cashflows (para 59(b))

- Clarity that comparatives not restated

Information about the Financial Reporting Council can be found at: https://www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in.

The FRC's mission is to promote transparency and integrity in business. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2019 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Financial Reporting Council