The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

COVID 19 Going concern, risk, and viability - a look forward

- Introduction

- Going concern, risk and viability - background

- How to read this report

- Going concern and viability

- Looking back

- Scenarios and forecasts

- Recent developments

- Looking forward

- Land Securities Group plc Annual Report 2020 page 57

- SCENARIO PLANNING TO STRESS TEST FINANCING

- Ascential plc Interim results 2020 presentation slide 43

- Auto Trader Group plc Annual Report 2020 page 59

- Nedbank Ltd Integrated Report 2019 page 36

- National Grid plc Annual Report 2019/2020 page 26

- Next plc Half Year Results July 2020 pages 40 and 41

- Risk reporting

Introduction

In response to the COVID-19 pandemic, and based on discussions with investors, the Lab issued an infographic in March and two reports (and related summaries): Going concern, risk and viability and Resources, action the future in June 2020 relating to Reporting in times of uncertainty.

The June reports reflected the practice at the time, which was limited. Practice has evolved and, therefore this report aims to provide examples that reflect more recent reporting practice. Further examples of good practice and guidance can be found in the FRC Corporate Reporting Review's Covid-19 Thematic Review.

Company reporting is continuing to develop to meet the challenges of the extended COVID-19 pandemic and the uncertainties that it brings. Against this backdrop, investors' needs are evolving with the aim of understanding how companies are meeting the challenges of the pandemic.

This report looks back at key elements highlighted in the Lab's previous work, considers current practice and takes a look forward at how reporting is developing.

The report focuses on the areas and themes addressed previously in the COVID-19 – Going concern, risk and viability report. Where relevant it includes examples of current disclosure practices and provides some ideas of how we expect disclosure to evolve. In addition, an update to the report focused on Resources, action, the future can be found on the FRC website.

COVID-19 – Resources, action, the future

Reporting in times of uncertainty - June 2020

COVID-19 – Resources, action, the future

Reporting in times of uncertainty - June 2020

COVID-19 – Going concern, risk and viability

Reporting in times of uncertainty - June 2020

COVID-19 – Going concern, risk and viability

Reporting in times of uncertainty - June 2020

Using QR codes

For those reading the report in a printed form, the QR codes provide a direct way to view linked publications using a mobile phone. To use the QR codes point your camera at the QR code (special QR reader apps may be required for older phones). The phone should then take you automatically to the publication.

Going concern, risk and viability - background

The level of uncertainty that still remains in the business environment reinforces the need for companies to disclose how they are managing the current situation.

Investors expect disclosures detailing a range of possible outcomes given the level of uncertainty – companies may, however, be concerned about providing such disclosures.

Disclosures should provide clarity about the key factors and events that impact the level of uncertainty and prospects over the short, medium and longer term.

Many parts of the annual report may be impacted by the current situation, but in this report, we consider the impact on three key areas of disclosure and whether and how such disclosures have changed over time: - going concern; - risk reporting; and - viability statement.

Lab view

Different aspects and elements of disclosure can help investors and other stakeholders understand different elements of the future. However, no single element of reporting can or does answer all investor questions. Understanding is gained through good quality, connected and holistic disclosure across the annual and interim reports.

How to read this report

This report is structured to provide a reminder of the views and practice that existed in June along with updates to reflect more recent disclosure practices. In addition, we provide some suggestions about how disclosure could evolve further to provide more information to investors. These suggestions are based on our observations of recent reporting practices in the context of the input received from investors prior to the release of the original reports.

The different sections of this report have been broken into four areas: - Looking back: key messages from the Lab's earlier reports; - Recent developments: an update on recent developments in corporate reporting; - Looking forward: some thoughts regarding how corporate reporting can develop; and - practical examples from reports and presentations released by companies since June.

This report follows the themes identified in June, namely: going concern, risk and viability.

Going concern and viability

Looking back

Disclosure around going concern helps to provide context in uncertain times. Given the level of uncertainty in the market in the early part of the crisis, a significant number of companies needed to highlight material uncertainties. This did not mean necessarily that the companies were in trouble, but was a natural reflection of the lack of certainty around many aspects of companies' business models, liquidity and strategy. In this context helpful disclosures: - clarified the going concern position and detailed the factors that supported that decision; - provided detail of the actions management planned to or were taking and their status; - provided detail of the elements of uncertainty (specific to the business) and consideration of the impacts on the company where the position was subject to or impacted by uncertainty; and - connected to broader reporting within the report, such as risk and viability disclosures.

Disclosure around viability should consider a period beyond the going concern period and provide insight into a company's longer-term prospects and viability. The uncertainty caused by the COVID-19 crisis provides an opportunity for the viability statement to act as a vehicle for companies to communicate a more stable long-term vision post crisis. However, while many statements do not do this effectively, the better statements: - covered company-specific detail and context on both prospects and viability; - provided details on actions and expectations; and - provided details of realistic scenarios considered and key assumptions used.

Further disclosures that provide useful insight into the impact of COVID-19 on viability include: - specific short and medium-term COVID-19-related factors that had been considered; - details on business model resilience and actions with reference to the situations highlighted by COVID-19; and - details of how the board was monitoring and controlling the situation; - details of how COVID-19 had been reflected in scenarios and stress-testing of both prospects and viability.

Scenarios and forecasts

Scenarios and forecasts are, necessarily, related to many of the themes discussed in this report.

Many different scenarios and underlying forecasts are considered and prepared by management when reporting on a company's going concern and viability. In the original report, it was noted that useful aspects of disclosure included: - Management's base case for recovery over the short term and into a longer transition period. - The key assumptions and the basis for each assumption. - The sensitivity of the base case to movements in the key assumptions. - Plausible upside and downside cases. - The assurance and controls that management has around the forecasts. - The process for updating scenarios.

Useful disclosures previously identified in the June reports, highlighting scenarios and related planning, include Informa (in their 2020 COVID-19 Action plan released in April 2020) and Norwegian Air Shuttle (in their presentation to Bondholders on 27 April 2020).

CRR thematic

In their Covid-19 Thematic Review released in July 2020, the FRC's Corporate Reporting Review (CRR) team identified the following areas that represent an opportunity for enhancing disclosures in the context of going concern:

“Given the current uncertain environment, we expect company specific going concern disclosures to explain clearly the key assumptions and judgements that the board has made in determining whether or not the company is a going concern and whether or not there are material uncertainties."

“We expect going concern discussion in the strategic report to reflect the going concern information presented in the notes to the accounts."

In addition, the report encouraged interim financial statements to provide going concern disclosures which followed the same characteristics of good reporting that are applied in annual financial statements. Furthermore, companies should ensure that they disclose the significant judgements in respect of going concern in annual and interim reports.

Recent developments

Companies are providing more information to support management's assessment that reporting on a going concern basis is appropriate. The majority of companies are providing information about the scenarios they have considered when assessing going concern and viability (refer to Land Securities and Ascential). However, some reported scenarios can be limited to generic information being provided regarding the underlying assumptions. The most commonly referred to scenarios are ‘best case' and 'realistic worst case'.

Information regarding going concern and viability incorporates assessments on various scenarios determined by management (refer to Auto Trader, Nedbank and National Grid). Some companies provide insight into the expected impact of different scenarios on different aspects of performance and other metrics (refer to Next).

It is noticeable that information presented in interim and quarterly information is far less detailed than that provided in annual reports. Given the level of uncertainty, it would be useful for companies to provide a detailed update at any time they report to the market.

Looking forward

Useful disclosure would discuss the process for identifying scenarios, determining the related inputs and adjusting these for changes in circumstances and how these are monitored and evaluated over time. The actions management has taken to mitigate against such changes should be explained. As time passes, there is an expectation that companies would provide an update about the status of the scenarios outlined and their progress against these.

In their Covid-19 Thematic Review released in July 2020, the FRC's CRR team stated the following about scenarios and stress testing in the context of going concern:

“We also expect disclosure of the possible scenarios that could lead to failure, and details of any mitigating actions available to the board. The disclosures presented should be sufficiently granular to enable a user to understand clearly the way in which the company intends to meet its liabilities as they fall due.”

“Going concern disclosures could be further improved by including information which explains any reverse stress testing that has been conducted."

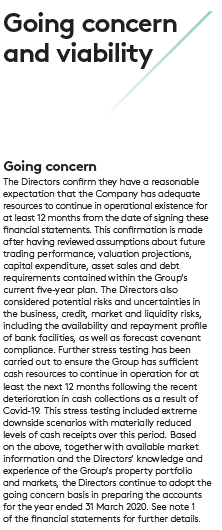

Land Securities Group plc Annual Report 2020 page 57

What is useful?

Land Securities clearly explains the process applied to make the going concern and viability assessments. The impact of the viability scenario on key metrics includes the available financial headroom.

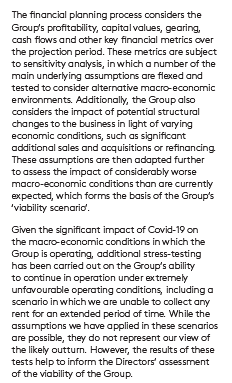

Going concern

Viability statement

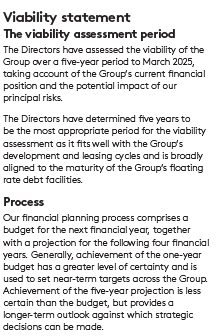

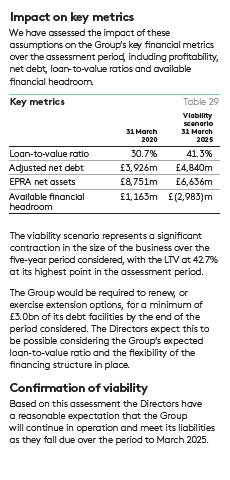

Process

Impact on key metrics

We have assessed the impact of these assumptions on the Group's key financial metrics over the assessment period, including profitability, net debt, loan-to-value ratios and available financial headroom.

Key metrics

The viability scenario represents a significant contraction in the size of the business over the five-year period considered, with the LTV at 42.7% at its highest point in the assessment period.

The Group would be required to renew, or exercise extension options, for a minimum of £3.0bn of its debt facilities by the end of the period considered. The Directors expect this to be possible considering the Group's expected loan-to-value ratio and the flexibility of the financing structure in place.

Confirmation of viability

Based on this assessment the Directors have a reasonable expectation that the Group will continue in operation and meet its liabilities as they fall due over the period to March 2025.

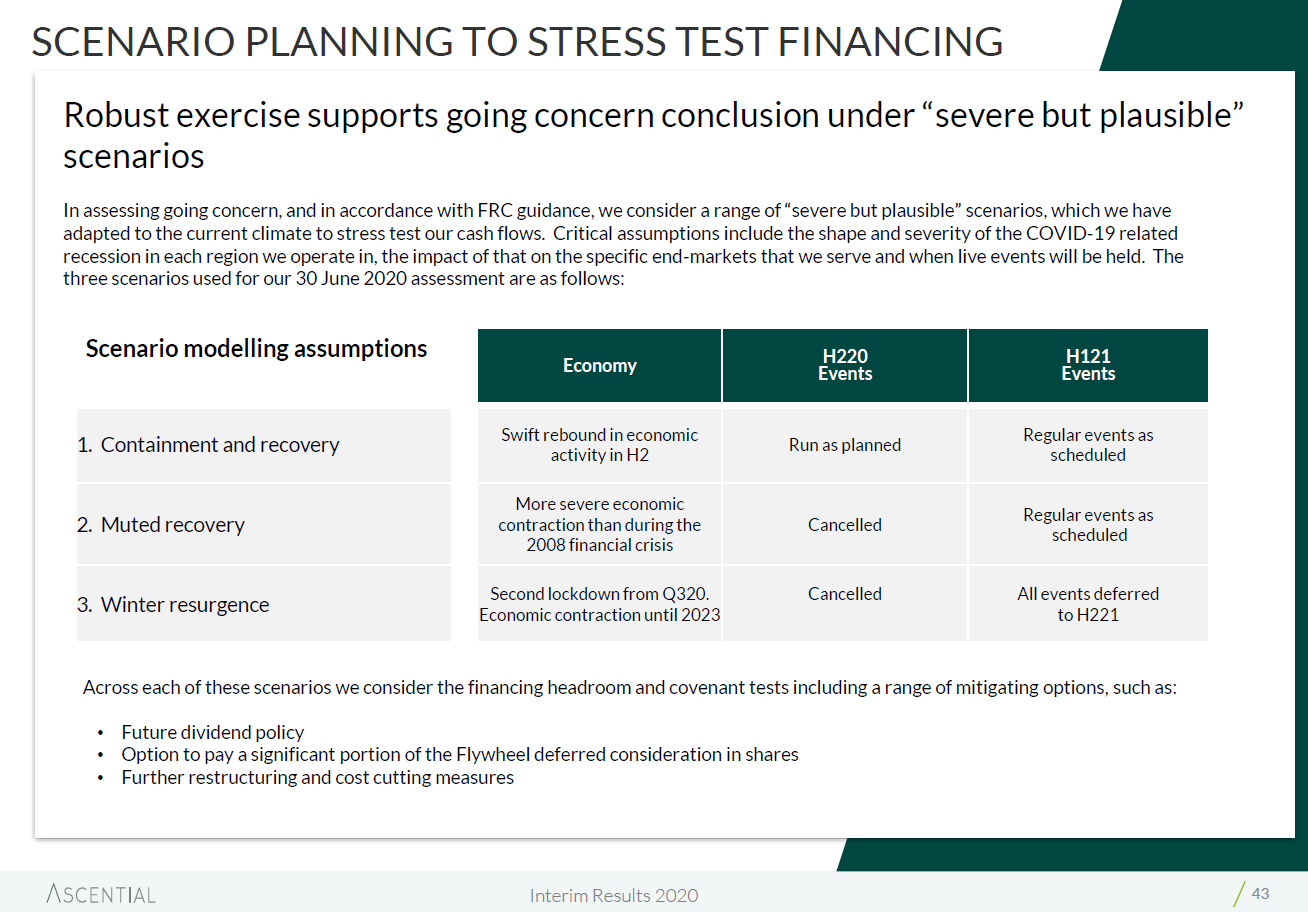

SCENARIO PLANNING TO STRESS TEST FINANCING

Robust exercise supports going concern conclusion under “severe but plausible" scenarios

In assessing going concern, and in accordance with FRC guidance, we consider a range of "severe but plausible" scenarios, which we have adapted to the current climate to stress test our cash flows. Critical assumptions include the shape and severity of the COVID-19 related recession in each region we operate in, the impact of that on the specific end-markets that we serve and when live events will be held. The three scenarios used for our 30 June 2020 assessment are as follows:

Ascential plc Interim results 2020 presentation slide 43

What is useful?

Ascential provides good detail about the scenarios utilised when assessing going concern in addition to potential actions that may be taken in response.

Across each of these scenarios we consider the financing headroom and covenant tests including a range of mitigating options, such as: - Future dividend policy - Option to pay a significant portion of the Flywheel deferred consideration in shares - Further restructuring and cost cutting measures

Auto Trader Group plc Annual Report 2020 page 59

What is useful?

Auto Trader clearly explains the scenarios utilised to determine viability. These scenarios have been linked to and discussed in the context of the company's principal risks.

Commentary is provided regarding the potential impact on the scenarios should stricter lockdown restrictions be reintroduced. In addition, the company specifies some of the actions that could be taken in response to such a situation, too.

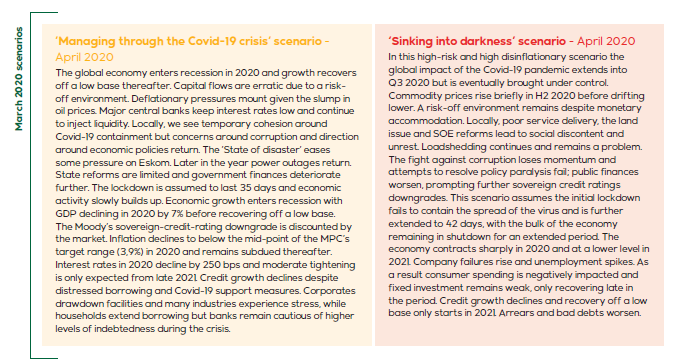

Nedbank Ltd Integrated Report 2019 page 36

What is useful?

Nedbank illustrates the impact of the COVID-19 pandemic on its short to medium-term scenario planning. This is achieved by providing the scenarios used just post-year-end (in January), and, included on the following page, those to be applied in March (prior to the Integrated Report being issued in April 2020) based on local and international developments.

The company has considered the potential impact of these scenarios on its business model and ability to create sustainable value for its stakeholders.

Scenarios for the short to medium term

In the context of challenging macroeconomic dynamics we have created scenarios that represent the underlying assumptions for our three-year planning (2020 to 2022), stress testing and communication to the investment community.

These scenarios were set in January 2020 and formed the base case of our 2020 financial guidance, which is no longer valid.

Given the developments in March 2020 around lower oil prices and the emerging and unknown impact of the Covid-19 pandemic on both global and local economic growth, we have updated our January 2020 base case scenario titled: 'More of the same with a new base case scenario titled: 'Managing through the Covid-19 crisis' based on our revised April 2020 economic forecasts. We additionally introduced a severe stress scenario (should the crisis not be contained in a reasonable period, both globally and locally in SA and the rest of Africa).

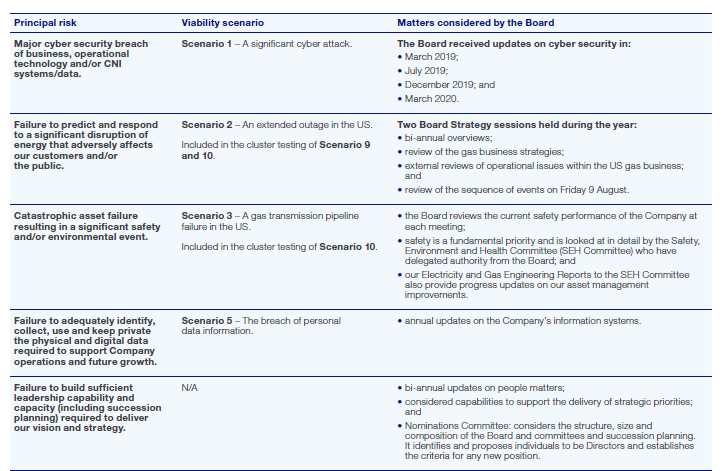

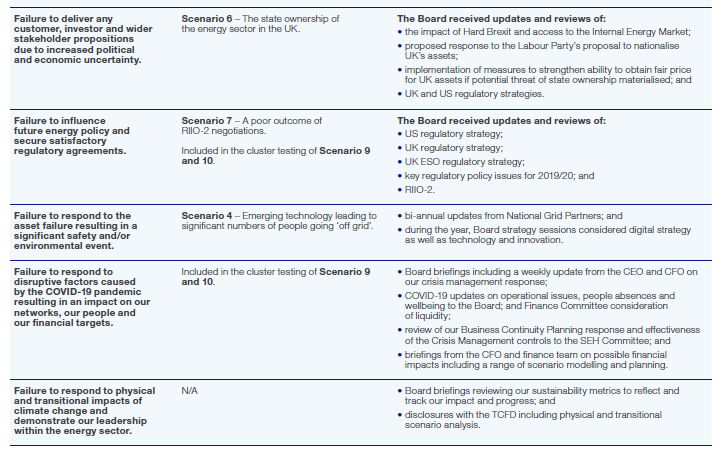

National Grid plc Annual Report 2019/2020 page 26

What is useful?

National Grid provides an explanation of the approach it has taken to determine longer-term viability.

The assessment incorporates identified principal risks and considers these in scenarios, either individually or as part of a cluster.

The company also discusses how the expected impacts of COVID-19 on its business plan and viability over the assessed period have been considered.

What is useful?

National Grid provides further information about how each identified principal risk was considered as part of a viability scenario (or where principal risks were included in a scenario as part of a cluster). In addition, the company indicates how the risk and related scenario has been considered by the Board throughout the period.

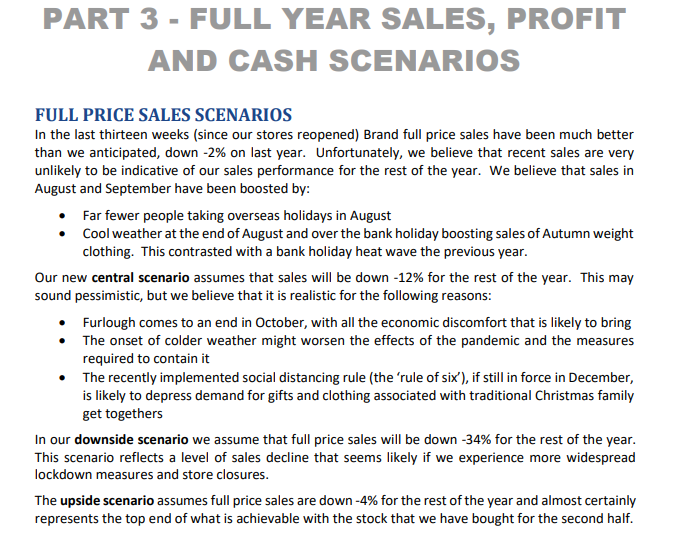

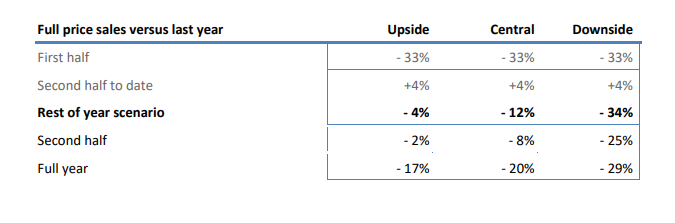

Next plc Half Year Results July 2020 pages 40 and 41

What is useful?

Next outlines the scenarios considered and the expected impact on sales and performance, and other measures.

PART 3 - FULL YEAR SALES, PROFIT AND CASH SCENARIOS

FULL PRICE SALES SCENARIOS

PROFIT BEFORE TAX, CASH AND NET DEBT

Based on these three scenarios for full price sales, the expected profit, surplus cash and net debt at the end of the year are set out below.

Risk reporting

Looking back

It is important to remember that a different approach to reporting short-term risks is needed than that for longer-term risks. As the time horizon becomes shorter, the level of information a user needs increases. Based on previous investor discussions, useful disclosure is: - consistent and provides the context for changes; - relevant by focusing on the most relevant issues such as liquidity, solvency and operational matters; - reflective of timescales by clarifying timing of triggers to the risks and their run-off; - focused on impacts by providing information on impacts, changes to risks and their mitigation, and changes to risk appetite; and - detailed by contextualising risks by geographies, operations or segments.

Two examples of interesting disclosure in this area, included in the June reports, were prepared by Informa and G4S in their 2019 Annual Reports.

Recent developments

'COVID-19', or 'pandemic' has been included by almost all companies as a new primary or emerging risk (refer to Dixons Carphone). For most entities, this risk is considered to be pervasive and significant at least in the short term. However, whilst this approach draws attention to the risk, it can reduce visibility around how individual components of the risk unwind – which will become increasingly important as we begin to move to a post-COVID-19 situation.

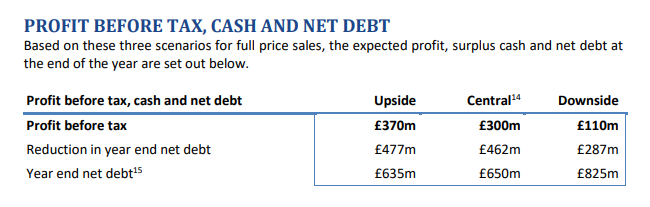

Some companies have adopted an alternative approach. Instead of disclosing COVID-19 itself as a primary or emerging risk, some companies have disclosed the effects the pandemic has had on their other risks and how the ‘rating' of these risks has changed since their previous reporting (refer to Land Securities and U + I).

A 'blended' approach in which a new COVID-19 risk has also been identified with other risks tailored to take the effect of COVID-19 into account could also be useful.

Looking forward

Disclosing the effects of the components of COVID-19 on other risks, rather than as a separate risk, may provide more useful information to users. COVID-19 was an event that triggered a cascade of other risks. As we move into the longer term, the longevity and nature of impact on the individual components of risk will be different. Therefore, what becomes important is understanding the impacts, the actions and the mitigations at this component level rather than ‘pandemic risk' as an individual risk. The component risks associated with it (government regulation, lockdowns, effect on employees, securing funding and financing and the general economic impact, for instance) may extend to the medium and longer term. Hence, instead of an entity removing a principal (or emerging) risk, the explanation of the risk can be tailored instead.

Reporting on risks, uncertainties and scenarios

Investors and other stakeholders are increasingly looking for information from companies about how they will evolve, adapt and respond to changes in the external business environment. The risks and uncertainties that could impact a company's business model, strategy and viability will vary over the short, medium and longer term. Given the significant reassessment many companies are making to their longer-term business model and strategy, risk, uncertainty and scenario reporting is likely to become even more important.

If you would be interested in finding out more about the Lab's current project on the reporting of risks, uncertainties and scenarios (and possibly take part) you can find details on the Lab's section of the FRC's website.

Dixons Carphone plc Annual Report 2019/2020 page 20

What is useful?

Dixons Carphone has chosen to identify COVID-19 (or pandemic) as a risk on its own, but has discussed its impact, management and change since the last report (in this instance, it is a 'new' risk).

U and I Group plc COVID 19 Risk assessment report pages 1 -3

What is useful?

U + I released a separate document, on the date of the preliminary results release, providing an update to its principal risks due to COVID-19 and the related mitigations and changes.

Land Securities Group plc Annual Report 2020 page 52

What is useful?

Land Securities has chosen to discuss the impacts of COVID-19 in the context of the previously identified principal risks.

The change in the significance of the risk is considered, and the responsible executive, as well as Key Risk Identifiers (KRIs), are identified.

Our principal risks and uncertainties

continued

1. Customers

Structural changes in customer and consumer expectations leading to a change in demand for space and the consequent impact on income.

Executive responsible: Colette O'Shea

Example KRIs - UK net retail openings and shopping centre vacancy rates (external metric) - Amount of people visiting our assets - Percentage of lease expiries over our five-year plan - Void rates across our portfolio - Customer credit risk profile and tenant counterparty risk - Customer retention - Like for like rental income metrics - Customer and space churn

Mitigation - Our Customer Relationship Management processes actively monitor our customer base and performance - We have a robust credit policy and process which defines what level of credit risk we will accept - Our Property Committee reviews customers at risk and agrees the best plan of action, as well as monitoring online sales trends - The monthly management accounts review lease expiries, breaks, re-gears and compare new lettings against estimated rental value - We measure footfall and retail sales at our shopping centres to provide insight into consumer trends - We regularly measure customer satisfaction across our retail and office customer base

Change in year prior to Covid-19

We were already operating in a tough retail environment, with a number of company voluntary arrangements (CVAs) throughout the year, and like-for-like footfall and retail sales declining. We were monitoring our retailers at risk of CVA and looking at more flexible leasing options in retail. The office market had remained resilient through 2019. We elevated this risk last year to reflect the deterioration in the retail market.

Covid-19 impact: change since Dec-19

The Covid-19 outbreak is a very challenging time for many businesses and, in particular, some of our retail and leisure customers. We are regularly communicating with our customers and are engaged in conversations about how we can support them through this difficult time. We continue to closely monitor the cash collections of rents across the whole portfolio and we have seen a material reduction in cash collections in late March 2020. This indicates a likely increase in business failures and we are closely monitoring any customers in financial distress. We expect to see greater non-payment of rent as we move through 2020.

We have established a support fund to provide up to £80m of rent relief for customers – around £15m of this fund will support our F&B customers and the remaining £65m will be allocated on a case-by-case basis to small- and medium-sized businesses.

Opportunity

Enhance and maintain our position as the partner of choice for our customers by better understanding their needs.

We are assessing plans for significant mixed use developments on our suburban London retail sites where we see opportunities to create value.

The Lab has published reports covering a wide range of reporting topics.

Reports include:

-  - Blockchain and the future of corporate reporting

How does it measure up?

June 2018

- Blockchain and the future of corporate reporting

How does it measure up?

June 2018

Reports and information about the Lab can be found at: https://www.frc.org.uk/Lab

The FRC's mission is to promote transparency and integrity in business. The FRC sets the UK Corporate Governance and Stewardship Codes and UK standards for accounting and actuarial work; monitors and takes action to promote the quality of corporate reporting; and operates independent enforcement arrangements for accountants and actuaries. As the Competent Authority for audit in the UK the FRC sets auditing and ethical standards and monitors and enforces audit quality.

The FRC does not accept any liability to any party for any loss, damage or costs howsoever arising, whether directly or indirectly, whether in contract, tort or otherwise from any action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2020

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 8th Floor, 125 London Wall, London EC2Y 5AS

Follow us on Twitter @FRCnews or Linked in