The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Public Report on the 2011/12 inspection of Mazars LLP

This report is issued by the FRC's Audit Inspection Unit. It has been approved for publication on behalf of the Professional Oversight Board.

1. Background information and key messages

1.1 Introduction

This report sets out the principal findings arising from the inspection of Mazars LLP ("Mazars" or "the firm") carried out by the Audit Inspection Unit ("the AIU") of the Financial Reporting Council (“the FRC"), in respect of the year to 31 March 2012 (“the 2011/12 inspection"). Our inspection was conducted in the period from April 2011 to November 2011 (referred to as “the time of our inspection"). The objectives of our work are set out in Appendix A.

This was the first full scope inspection of the firm undertaken by the AIU. The findings of our review of the firm's policies and procedures should be read in this context.

Our inspection comprised reviews of individual audit engagements and a review of the firm's policies and procedures supporting audit quality.

We reviewed four audit engagements undertaken by the firm in our 2011/12 inspection. These related to AIM listed and other major public interest entities, with financial year ends between 31 August 2010 and 31 March 2011. Our reviews were selected on a risk basis, utilising a risk model; each review covered only selected aspects of the relevant audit.

Each year we select a number of areas of particular focus. For 2011/12, these were: group audit considerations; the valuation of assets held at fair value; the impairment of assets (including goodwill and other intangibles); the assessment of going concern; revenue recognition; related parties and the quality of reporting to Audit Committees.

Our review of the firm's policies and procedures supporting audit quality covered the following areas:

- Tone at the top and internal communications

- Transparency report

- Independence and ethics

- Performance evaluation and other human resource matters

- Audit methodology, training and guidance

- Client risk assessment and acceptance/continuance

- Consultation and review

- Audit quality monitoring

- Other firm-wide matters

The AIU exercises judgment in determining those findings which it is appropriate to include in its public report on each inspection, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to areas of particular focus in the AIU's overall inspection programme for the relevant year. In relation to reviews of individual audits, we have generally reported our findings by reference to important matters arising. Where appropriate, we have commented on themes arising or issues of a similar nature identified across a number of audits.

Further information on the scope of our work and the basis on which we report is set out in Appendix A.

All findings requiring action set out in this report, together with the firm's proposed action plan to address them, have been discussed with the firm. Appropriate action may have already been taken by the date of this report. The adequacy of the actions taken and planned will be reviewed during our next inspection.

The firm was invited to provide a response to this report for publication. The firm's response is set out in Appendix B.

The AIU acknowledges the co-operation and assistance received from the partners and staff of Mazars in the conduct of the 2011/12 inspection.

1.2 Background information on the firm

The firm is a UK Limited Liability Partnership. It is part of the Mazars international organisation, which is described as an integrated partnership. The firm had 15 offices in the UK at 31 August 2011.

The firm operates under two business units, Public Interest Entities and Owner Managed Businesses. Audit work is undertaken in both business units.

For the year ended 31 August 2011, the firm's turnover was £109.1 million, of which £44.3 million related to audit work and other assurance services. There was a total of 108 partners, of whom 53 were authorised to sign audit reports, and four employees (audit directors) who were authorised to sign audit reports.1.

The AIU estimates that the firm audited eleven entities within the scope of independent inspection by the AIU, under UK company law, as at the 2011/12 reference date of 28 February 2011. Of these entities, AIU records show that two had securities listed on the main market of the London Stock Exchange.

Audits of entities incorporated in Jersey, Guernsey or the Isle of Man whose securities are traded on a regulated market in the European Economic Area are subject to inspection by the AIU under separate arrangements agreed with the relevant regulatory bodies. The firm currently has no such audits within our scope.

1.3 Overview

We focus in this report on matters where we believe improvements are required to safeguard and enhance audit quality. We set out our key messages to the firm in this regard in section 1.4. While this report is not intended to provide a balanced scorecard, we highlight certain matters which we believe contribute to audit quality.

The firm places considerable emphasis on its overall systems of quality control. In many areas the firm has appropriate policies and procedures in place for its size and the nature of its client base. However, we have identified certain areas where improvements are required to the firm's procedures, which we set out in this report.

Our file review findings, as set out in section 2, largely relate to the application of the firm's procedures by audit personnel, whose work and judgments ultimately determine the quality of individual audits.

1.4 Key messages

The firm should pay particular attention to the following areas in order to enhance audit quality and safeguard auditor independence:

- Give increased focus and attention to compliance with Ethical Standards, including properly identifying threats and safeguards arising from non-audit services and assessing the cumulative threat to independence arising from high levels of non- audit services.

- Ensure that staff and partner remuneration and evaluation decisions do not reflect success in selling non-audit services to audit clients. The firm should also ensure that there is greater focus on audit quality indicators in appraisals for audit partners and staff.

- Extend the firm's central approval process for audit acceptance and continuance decisions to cover normal risk entities as well as those assessed as high risk.

- Provide further guidance on identifying those charged with governance and on the matters which are required to be communicated to them.

- Give increased focus and attention to the audit of going concern, including the need to ensure that a going concern assessment is undertaken by the audited entity; and the need to perform appropriate audit procedures to evaluate this assessment and the adequacy of related disclosures.

2. Principal findings

The comments below are based on our reviews of individual audits and the firm's policies and procedures supporting audit quality.

2.1 Review of audit engagements

Overview of audits reviewed

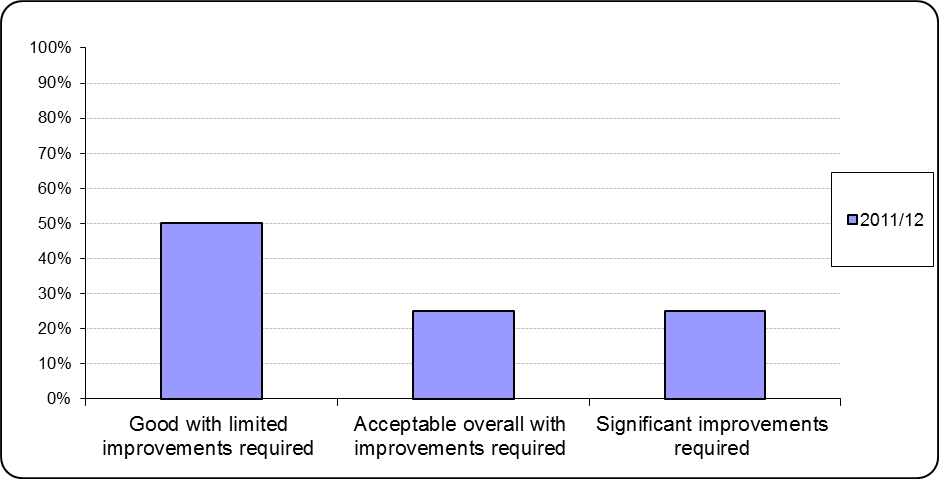

We reviewed and assessed the quality of selected aspects of four audits. Two of the audits were performed to a good standard with limited improvements required; one audit was performed to an acceptable overall standard with improvements required; and one audit required significant improvement in a number of areas.

The bar chart below shows the number and percentage of the audits we reviewed in 2011/12 by AIU grade.

An audit is assessed as requiring significant improvement if the AIU had significant concerns in relation to the sufficiency or quality of audit evidence or the appropriateness of audit judgments in one or more key audit areas, or the implications of concerns relating to other areas are considered to be individually or collectively significant. This assessment does not necessarily imply that an inappropriate audit opinion was issued.

Findings in relation to audit evidence and judgments

The focus of our reviews has been on the audit evidence and related judgments for material areas of the financial statements and areas of significant risk.

We draw attention to the following findings which the firm should ensure are adequately addressed in future audits:

- Audit evidence We identified issues in relation to the sufficiency of audit evidence in a number of areas on three of the four audits reviewed. These issues included key areas of judgment, such as the adequacy of a loan provision and the sufficiency of audit evidence for certain financial assets and liabilities.

- Going concern assessment There were weaknesses in the evidence obtained to support the going concern assessment in three of the four audits reviewed. In two cases, a formal going concern assessment was not obtained from the audited entity and there was no evaluation by the audit team of the assumptions underlying the forecasts used to assess going concern.

- Assessment of experts' independence and competence There was insufficient consideration of the appropriateness of using the work of experts in three of the four audits reviewed. In one case, the audit team did not undertake any procedures to assess the independence or competence of the valuer of freehold land and buildings, despite there being directors in common between the audited entity and the valuer. The valuer was also engaged to provide other services to the audited entity.

- Substantive analytical procedures On three audits, there were weaknesses in the performance of substantive analytical procedures for certain account balances. The setting of expectations was insufficiently precise in two cases, and there was also no consideration of the reliability of the source data or setting of thresholds for investigation of variances in these cases. There was a lack of adequate corroboration of variances identified in all three cases.

- Procedures in response to the risk of fraud In two audits, insufficient work was performed in relation to the risk of management override and journal testing. In both cases there was a lack of consideration of the potential for management override of controls and insufficient or no testing of year end journals. In one case, the audit team did not plan or perform specific audit tests in response to fraud risks, including the risk of management override and other risks specific to the sector.

Recurring findings from one year to the next

This is the first year that the firm has been subject to a full scope inspection by the AIU. In 2009 we reviewed two of the firm's audits within our scope and the firm took a number of steps to address our findings on these audits. However, a number of our current year findings relate to the same areas and further action at a firm-wide level is, therefore, required.

Other findings in the current year

Identifying threats and safeguards relating to non-audit services

In two audits there was insufficient consideration of the independence threats arising from the non-audit services provided and of any related safeguards required to be put in place.

Communicating with Audit Committees

In all four of the audits reviewed we found weaknesses or omissions in the communications with Audit Committees. Our review identified certain information required to be communicated to Audit Committees that was either communicated to the Finance Director only, or was not communicated in sufficient detail.

In one audit, planning information and significant findings from the audit were communicated to the Chairman and executive directors only, rather than to the Audit Committee, and certain identified disclosure errors were not communicated to either management or the Audit Committee. In another audit, the communications regarding the recoverability of a deferred tax asset did not demonstrate that an appropriate level of professional scepticism had been exercised.

In two audits we identified weaknesses in the communication of threats and safeguards regarding non-audit services provided. In one case, there was no communication regarding non-audit services provided to those charged with governance. In the other case, threats and safeguards relating to various non-audit services provided were communicated only to the Chair of the Audit Committee.

Role of the engagement partner

In relation to the audit that required significant improvements the engagement partner did not consult with the firm's risk management team, as was necessary in view of the unusual circumstances that had arisen and the specialist nature of this engagement, before deciding to accept reappointment for the 2010 audit. Despite the 2010 audit being the engagement partner's eighth year of involvement in the audit in a senior role, no independent partner review was undertaken, as required under the firm's policies for an audit of this nature. Furthermore, there was insufficient evidence of adequate involvement of the engagement partner in the planning and review of the audit.

2.2 Review of the firm's policies and procedures

The firm's policies and procedures are developed on a national basis. The firm's positive response to our findings and actions already taken or in progress demonstrates its commitment to continuous improvement in audit quality. This is further demonstrated by the firm's decision to apply the Audit Firm Governance Code on a voluntary basis.

The firm requires individuals to obtain an internal licence before they are permitted to act as the audit engagement partner for audits of listed or AIM companies or entities in certain specialist sectors. All partners who act as engagement quality control reviewers are also required to be licensed and receive training in the role. These new licensing processes should contribute to improving audit quality.

All potential new audit partners are required to undergo a technical interview. In addition, a review is undertaken of the quality of a sample of the audit files of internal candidates. The firm has rejected candidates for partnership as a result of these processes.

We identified certain areas for improvement, as outlined below, which need to be addressed.

- Approval of and consultation on non-audit services The partner responsible for a proposed non-audit service is required to inform the audit engagement partner before accepting the engagement. However, the results of our file reviews indicated that the firm lacked a standard method of documenting the approval of non-audit services by the audit engagement partner. The firm introduced a new client and engagement acceptance system in September 2011, which we will review the next time we visit.

- The firm requires both the audit engagement partner and the Ethics Partner to be notified in advance if any non-audit services are proposed to be provided on a contingent fee basis. The firm's new client and engagement acceptance system, however, does not include processes to ensure that such notifications are made.

- For one listed company audit where non-audit fees were more than four times the audit fee, no discussion with the Ethics Partner had taken place as required by Ethical Standards. For one non-listed company audit for which non-audit fees were more than twice the audit fee, it was not clear whether the engagement partner had taken any action to mitigate the threats to independence arising. The firm needs to issue further guidance and training in this area.

- Business relationships The firm does not maintain a central register to monitor business relationships with audited entities. The lack of such a register gives rise to a risk that any inappropriate business relationships with current or prospective audited entities are not identified and resolved in a timely manner.

- Appraisals and partner promotions Ethical Standards require that the criteria for evaluating the performance or promotion of audit partners or staff should not include success in selling non-audit services to an entity they audit.

- We noted three cases of audit partners seeking credit in appraisal forms for sales of non-audit services to an entity they audit and a further two cases where objectives were set for sales of non-audit services. There was only very limited consideration of audit quality indicators and audit quality objectives in the partner appraisal forms. Our review of staff appraisals also identified a number of cases where staff appeared to be seeking credit for their involvement in selling non-audit services to audited entities.

- Both internal and external candidates for partnership were assessed by an external consultancy on the "Mazars Capability Matrix", which mapped Mazars' competencies to the consultancy's personality traits. The personality traits included the ability to sell to existing clients and cross-selling ability. Our review of partner promotion material identified that a number of audit partner candidates included reference to cross-selling skills and the ability to generate new fees from existing audit relationships.

- Risk assessment and acceptance/continuance decisions The firm's central approval process for audit acceptance and continuance decisions only covers those entities deemed to be high risk. The firm assesses all audits within the AIU's scope as being high risk. Prior to the introduction of a new client acceptance system, the firm did not identify audits which might be higher risk for other reasons, for example going concern issues. As a result, there was no central oversight of the appropriate audit response to such risks.

- Identification of public interest entities The firm seeks to apply many of the additional ethical requirements for audits of listed entities to other audits within the AIU's scope and also applies some of these requirements to "other public interest entity" audits. However, the firm does not have a monitoring process to ensure that all other public interest entities, as defined by it, are correctly identified.

- Annual Quality Review (“AQR") There is no formal process in place to consider any necessary action in relation to the firm's audit report where the outcome of an AQR review indicates that the appropriateness of the audit report is, or may be, in doubt.

Further, the "general office procedures" review part of the AQR appeared, in a number of areas, to form part of the firm's quality control processes, rather than being an independent review of the effectiveness of the relevant processes.

Andrew Jones Director of Audit Quality Audit Inspection Unit FRC Conduct Division 10 May 2012

Appendix A – Objectives, scope and basis of reporting

Scope and objectives

The overall objective of our work is to monitor and promote improvements in the quality of auditing. As part of our work, we monitor compliance with the regulatory framework for auditing, including the Auditing Standards, Ethical Standards and Quality Control Standards for auditors issued by the FRC's Auditing Practices Board and other requirements under the Audit Regulations issued by the relevant professional bodies. The standards referred to in this report are those effective at the time of our inspection or, in relation to our reviews of individual audits, those effective at the time the relevant audit was undertaken.

Our reviews of individual audit engagements and the firm's policies and procedures cover, but are not restricted to, the firm's compliance with the requirements of relevant standards and other aspects of the regulatory framework. Our reviews of individual audit engagements place emphasis on the appropriateness of key audit judgments made in reaching the audit opinion together with the sufficiency and appropriateness of the audit evidence obtained.

We seek to identify areas where improvements are, in our view, needed in order to safeguard audit quality and/or comply with regulatory requirements and to agree an action plan with the firm designed to achieve these improvements. Accordingly, our reports place greater emphasis on weaknesses identified which require action by the firm than areas of strength and are not intended to be a balanced scorecard or rating tool. We also assess the extent to which the firm has addressed the findings arising from its previous AIU inspection.

Our inspection was not designed to identify all weaknesses which may exist in the design and/or implementation of the firm's policies and procedures supporting audit quality or in relation to the performance of the individual audit engagements selected by us for review and cannot be relied upon for this purpose.

The monitoring units of the professional accountancy bodies in the UK which register firms to conduct audit work are responsible for monitoring the quality of audit engagements falling outside the scope of independent inspection but within the scope of audit regulation in the UK. Their work, which is overseen by the FRC, covers audits of UK incorporated companies and certain other entities which do not have any securities listed on the main market of the London Stock Exchange and whose financial condition is not otherwise considered to be of major public interest. All matters raised in this report are based solely on work carried out by the AIU.

Basis of reporting

This report is based on the AIU's more detailed private report on its inspection of the firm to the Audit Registration Committee (“the ARC") of the Institute of Chartered Accountants in England and Wales (“the ICAEW") with which the firm is registered for audit purposes. This is the first year that Mazars has been subject to a full scope inspection by the AIU. The AIU currently inspects firms such as Mazars over a two year cycle and thus we would expect to report on our next inspection in two years' time. The ARC considers whether audit registration should be continued for the firm following each inspection undertaken. The AIU's report to the ARC, which was finalised in March 2012, recommended that the firm's registration to conduct audit work should be continued.

The AIU exercises judgment in determining those findings which it is appropriate to include in its public report on each inspection, taking into account their relative significance in relation to audit quality, both in the context of the individual inspection and in relation to areas of particular focus in the AIU's overall inspection programme for the relevant year. In relation to reviews of individual audits, we have generally reported our findings by reference to important matters arising on one or more audits. Where appropriate, we have commented on themes arising or issues of a similar nature identified across a number of audits.

While the AIU's public reports seek to provide useful information for interested parties, they do not provide a comprehensive basis for assessing the comparative merits of individual firms. The findings reported for each firm in any one year reflect a wide range of factors, including the number, size and complexity of the individual audits selected for review by the AIU which, in turn, reflects the firm's client base. An issue reported in relation to a particular firm may therefore apply equally to other firms without having arisen in the course of the AIU's inspection fieldwork at those other firms in the relevant year. Also, only a small sample of audits are selected for review at each firm and the findings may therefore not be representative of the overall quality of each firm's audit work.

The fieldwork at each firm is completed at different times during the year and comprehensive quality control procedures are applied before the AIU's private and public reports are finalised. As a result, there may be a significant period of elapsed time between completion of the AIU's inspection fieldwork at a firm and the publication of a report on the inspection findings.

The AIU also issues confidential reports on individual audits reviewed during an inspection which are addressed to the relevant audit engagement partner or director.

Firms are expected to provide copies of these reports to the directors or equivalent of the relevant audited entities.

Purpose of this report

This report has been prepared for general information only. The information in this report does not constitute professional advice and should not be acted upon without obtaining specific professional advice.

To the full extent permitted by law, the FRC and its employees and agents accept no liability and disclaim all responsibility for the consequences of anyone acting or refraining from acting in reliance on the information contained in this report or for any decision based on it.

Appendix B – Firm's response

2 May 2012

Dear Sirs

Public Report on the 2011/12 Inspection of Mazars LLP

Mazars is pleased to submit its response to the Audit Inspection Unit (“AIU") Public Report on the 2011/12 inspection of this firm. We recognise that independent audit inspection by the AIU plays a key role in assuring audit quality in the UK and welcomed this inspection, our first full scope review from the AIU. As you have acknowledged, we are committed to continuous improvement in audit quality and that commitment is demonstrated by the actions already taken or in progress. We will continue to work constructively with the AIU to meet our shared audit quality objectives.

Yours faithfully

Mazars LLP

Mazars LLP - Tower Bridge House - St Katharine's Way - London E1W 1DD Tel: +44 (0)20 7063 4000 Fax: +44 (0)20 7063 4001 www.mazars.co.uk

Mazars LLP is the UK firm of Mazars, an integrated international advisory and accountancy organisation. Mazars LLP is a limited liability partnership registered in England and Wales with registered number OC308299 and with its registered office at Tower Bridge House, St Katharine's Way, London E1W 1DD.

Registered by the Institute of Chartered Accountants in England and Wales to carry out audit work.

Financial Reporting Council 5TH FLOOR ALDWYCH HOUSE 71-91 ALDWYCH LONDON WC2B 4HN TEL: +44 (0)20 7492 2300 FAX: +44 (0)20 7492 2301 WEBSITE: www.frc.org.uk

© The Financial Reporting Council Limited 2012

The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368. Registered Office: 5th Floor, Aldwych House, 71-91 Aldwych, London WC2B 4HN.

-

As disclosed in the annual return to the ICAEW as at March 2011. ↩