The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Ernst & Young LLP Public Report

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms1, and how the firms have responded to our findings.

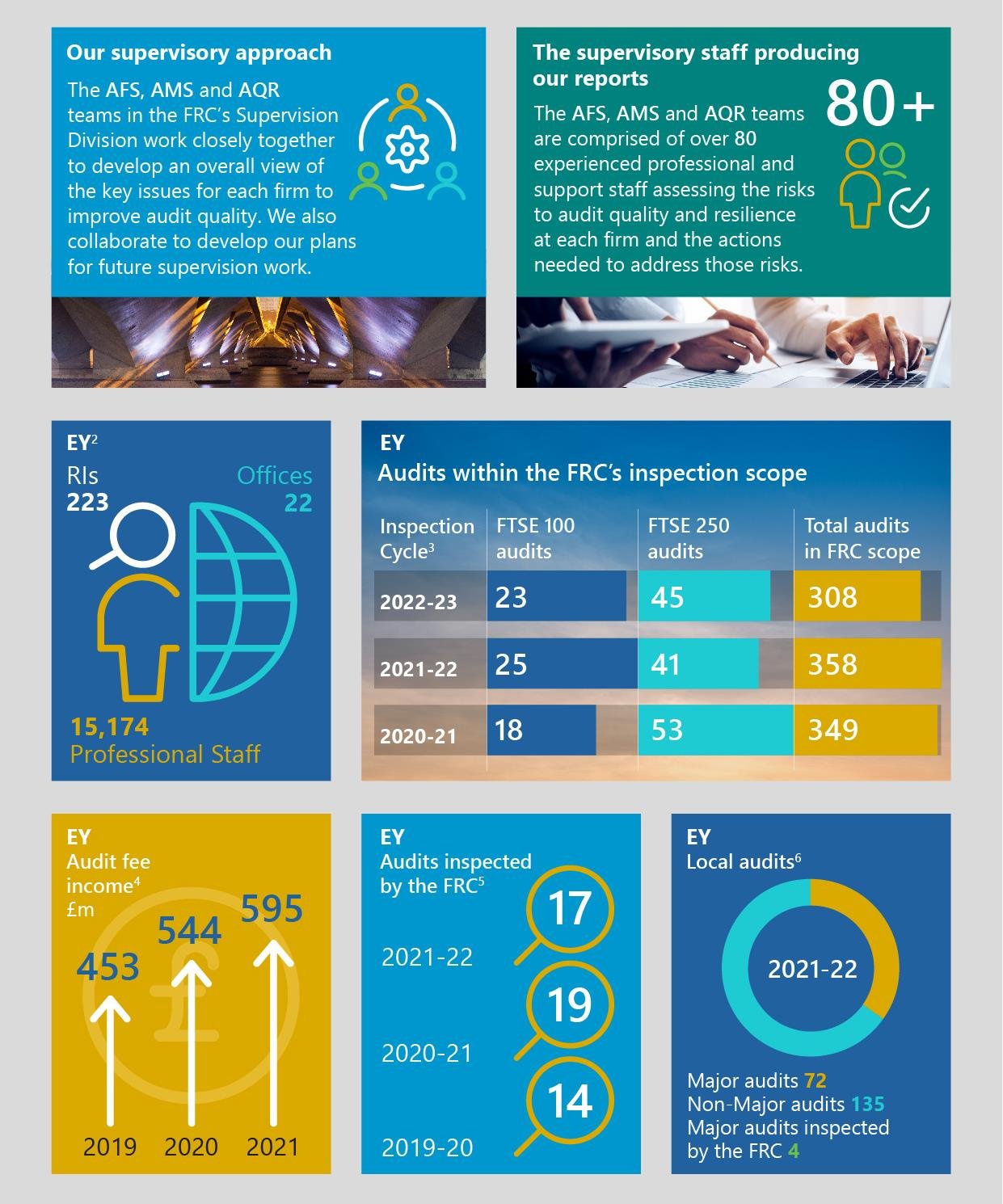

[^2] Source - the ICAEW's 2022 QAD report on the firm. [^3] Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. [^4] Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. [^5] Excludes the inspection of local audits. [^6] The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- 1. Overview

- Firm's overall response and actions

- 2. Review of individual audits

- Improve the effectiveness of the testing of revenue

- Strengthen the evaluation by the group audit team of aspects of component auditors testing

- Improve the evidence of procedures performed over cash and bank balances

- Further enhance the evaluation and challenge of aspects of impairment assessments

- Improve the identification of covered persons for independence purposes and the reporting of non-audit services

- Monitoring review by the Quality Assurance Department of ICAEW

- Results

- 3. Review of the firm's quality control procedures

- Relevant ethical requirements – Implementation of the FRC’s Revised Ethical Standard

- Engagement Performance – EQCR, consultations and audit documentation

- Methodology

- Monitoring – Internal quality monitoring

- Approach to reviewing the firm's quality control procedures

- Firm-wide key findings and good practice in prior inspections

- 4. Forward-looking supervision

- Appendix

This report sets out the FRC's findings on key matters relevant to audit quality at Ernst & Young LLP (EY or the firm). As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of public interest entities (PIEs2). Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based basis.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. While there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high-quality audits, regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher-risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

The report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales ICAEW inspects a sample of the firm's non-PIE audits. The firm also conducts internal quality reviews. A summary of the firm's internal quality review results is included at Appendix 1.

1. Overview

Overall assessment

In the 2020/21 public report, we concluded that the firm had made progress on actions to address our previous findings and had sought to make improvements in relation to its audit execution and firm-wide procedures. This year, however, we assessed 35% of the audits we inspected as requiring improvements, an increase from 21% the previous year. The areas of the audit which contributed most to this were revenue, group audits, and cash, none of which were areas where we had key findings last year. Most of these findings arose in non-FTSE 350 audits, with 22% of the FTSE 350 audits we reviewed requiring improvements.

At the same time, we identified a range of good practice in these and other areas. It is also encouraging that none of the audits we inspected were found to require significant improvements. While we have not identified any systemic reasons for our inspection results, we note in particular that the firm's Root Cause Analysis (RCA) identifies the need for more effective coaching from senior levels which has been an operationally challenging aspect of remote working.

The results from other measures of audit quality, covering a broader population and a larger sample of audits, showed an improvement. The results from the Quality Assurance Department of the ICAEW (QAD) set out on pages 22 and 23, which is weighted toward higher risk and complex audits of non-PIE audits (within ICAEW scope), assessed 100% of the audits it inspected as good or generally acceptable. QAD identified several good practices, including examples of good professional scepticism, which was previously one of the firm's Audit Quality Plan priorities. In addition, issues raised by QAD in previous years did not reoccur. Over a similar period, the firm's internal quality monitoring process (covering both PIE and non-PIE audits) assessed 91% of audits as meeting its highest quality standard (see page 35). The firm has continued to make systems and technology investments aligned with its Sustainable Audit Quality Programme priorities.

While our inspection results this year only provide a single point in time view on audit quality, the firm must critically evaluate all its audit quality results in relation to its current Audit Quality Plan and related initiatives and its growth intentions. In particular, the firm should consider how the learnings from this year's reviews can be implemented to support audit quality in focus areas for strategic growth.

In response to this year's findings, we will take the following action:

- To continue to focus on the inspection of non-FTSE 350 audits in the next cycle.

- Require the firm to reconsider its previous RCA findings and actions to improve audit quality.

- Require all actions to be included in a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

Inspection results: arising from our review of individual audits

We reviewed 17 individual audits this year and assessed 11 (65%) as requiring no more than limited improvements. Of the nine FTSE 350 audits we reviewed this year, we assessed seven (78%) as achieving this standard.

Our assessment of the quality of audits reviewed: Ernst & Young LLP

Bar chart showing the percentage of audits with Good or limited improvements required, Improvements required, and Significant improvements required from 2017/18 to 2021/22.

| Category | 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

|---|---|---|---|---|---|

| Good or limited improvements | 12 | 14 | 10 | 15 | 11 |

| Improvements required | 5 | 3 | 3 | 4 | 6 |

| Significant improvements | 0 | 1 | 1 | 0 | 0 |

FTSE 350: Ernst & Young LLP

Bar chart showing the percentage of FTSE 350 audits with Good or limited improvements required, Improvements required, and Significant improvements required from 2017/18 to 2021/22.

| Category | 2017/18 | 2018/19 | 2019/20 | 2020/21 | 2021/22 |

|---|---|---|---|---|---|

| Good or limited improvements | 9 | 8 | 7 | 9 | 7 |

| Improvements required | 1 | 1 | 1 | 3 | 2 |

| Significant improvements | 0 | 0 | 0 | 0 | 0 |

The audits inspected in the 2021/22 cycle included above had year ends ranging from June 2020 to April 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

The areas of audit where we had key findings related to revenue, group audits, cash, impairment assessments and the consideration of certain independence related matters.

We identified a range of good practice related to risk assessment, execution of the audit, and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

Our key findings related to the firm's actions to implement the revised Ethical Standard and internal quality monitoring arrangements. We also identified good practice in the areas of consultations, methodology and internal quality monitoring.

We identified two instances where reviews performed by the firm's internal quality monitoring team did not identify key areas of an audit that required improvement. The firm must assess the reasons and take appropriate action to ensure that key areas of an audit that require improvement are consistently identified.

Further details are set out in section 3.

Forward-looking supervision

In response to our audit inspection results identified in our 2020/21 public report, and the firm's internal quality monitoring, the firm refreshed the focus of its Audit Quality Plan (AQP or the plan) which is the UK's implementation of the Global Sustainable Audit Quality Programme, for its 2022 financial year. The firm has identified three priority focus areas for the next year, which are to promote and strengthen audit culture, embed the firm's digital audit and digital tools, and to leverage better standardisation to achieve more consistency across audits. Throughout the plan there is a recognition that a cultural shift in mindset and scepticism is needed to support high quality audits. The firm strengthened its measurement of progress of audit quality initiatives through a portfolio of measures including audit quality indicators and focus groups.

The firm also sought to refine parts of its Root Cause Analysis (RCA) approach to increase the independence of those setting the actions in the process and to systematically capture the context to support sound analysis of causal factors.

The firm responded promptly to feedback from the FRC and has developed a robust core fair value methodology.

Although we recognise there are timing delays between our review cycle and seeing the impact of quality related actions the firm has taken, we are concerned about this year's results. In light of these results the firm must take stock and reconsider whether its RCA analysis is adequately identifying the root causes of the inspection findings, whether the actions taken to date have been sufficiently effective and whether, in hindsight, these were the right actions. The firm should also ensure that its action plans on emerging themes are effectively integrated into its audit quality initiatives. We note the firm has recently undertaken a reassessment process.

Further details are set out in section 4.

Firm's overall response and actions

A. Executive Summary

EY is committed to serving the public interest through achieving the highest standard of audit quality across all our engagements. We plan to achieve that through ensuring that we have the best culture, enabling learning and development of our people whilst adhering to the highest ethical standards in the profession. Our UK audit strategy has been updated annually to reflect our commitment to continuous improvement to live up to the expectations of our stakeholders. We are committed to continue working with our regulators to make our profession more attractive, and to serve the public interest in the years to come.

We are disappointed that this year's FRC inspection results are out of line with the improved results seen in other inspections during the year including our own internal inspections.

The period covered by this review included the most difficult backdrop from the uncertainty brought about by COVID-19 and its impact on businesses, as people navigated lockdown, remote working, and the transition to hybrid working. The good practice identified by the FRC and QAD across a number of areas, including those made more challenging by this context, is therefore welcome and a testament to the talent and hard work of our teams under difficult circumstances.

As noted by the FRC, changes in results from one year to the next are not necessarily indicative of an overall reduction in audit quality at the firm. Notwithstanding this, our culture promotes self-improvement and we want to learn from the FRC's feedback and findings. We are seeing the benefits from a constructive supervisory relationship with the FRC and are keen to address the recommendations offered.

The FRC have not identified any systemic reasons for the inspection results. Having carried out in-depth root cause analysis on the inspections that have fallen below our desired standards, there are no systemic weaknesses in strategy, approach, or systems that we have identified.

However, we must achieve greater consistency to deliver high audit quality across our portfolio. While it is encouraging that progress has been made in certain judgemental and complex areas of the audit which have previously been identified as key areas needing improvement (e.g., going concern, expected credit loss allowances and deferred tax), actions are needed in relation to areas that have driven lower grades on some inspections this year.

In April 2022, informed by the outcomes from our root cause analysis and feedback from our teams, this year's refresh of our multi-year Audit Quality Strategy, discussed in more detail in section D, identified three key priority areas for the next 12 months. The steps we will take in these areas will enable our people to concentrate their efforts in the right places to drive consistent high quality, whilst maintaining an emphasis on wellbeing:

- Greater standardisation and simplification

- More effective coaching; and

- Rebalancing and reducing workloads.

Underpinning these areas of focus is our audit culture, which is the cement that binds together the building blocks and foundation of our audit strategy. We know that audit quality starts with having the right culture embedded in the business, and the steps that we are taking continue to implement this. We describe our cultural evolution in section E.

EY is committed to consistently delivering high quality audits that serve the public interest. Our Audit Quality Strategy brings together all of the strands of our coordinated response to deliver against this commitment. The effectiveness of its implementation continues to be regularly monitored and assessed by UK Audit leadership and the Audit Board including Audit Non-Executives.

Critical to the success of delivering high audit quality is creating both a profession and firm in which it is attractive to work. Across the audit profession, there has been higher levels of staff attrition in the aftermath of the pandemic, which has led us to reflect on our own working practices. This has renewed our focus on capacity planning and the effective deployment of our people to engagements.

B. Review of individual audits and the firm's quality control procedures

Although good practice was identified across many areas, we are disappointed that there were also areas identified that require improvement. Of the audits rated as requiring improvement, all were planned and some were completed before the launch of our 2020 Audit Strategy. Whilst we challenged the significance of the FRC's findings on two engagements, we accept the findings and have taken action to address them. We performed extensive root cause analysis on all findings from internal and external inspections, as well as those with positive outcomes, executing many of these learnings as part of strategy refreshes or tailored responsive actions. As a result, several of those actions have already been embedded in the business today. We have also taken these learnings into our latest strategy update (noted above and set out in section D) and introduced some industry-specific guidance where findings appeared to be limited to particular sectors.

We welcome the good practice identified by the FRC, noting that examples have been identified against two of the three key improvement areas identified in last year's report. We also note that three areas of good practice also appear in the list of key areas of findings in the current year. This supports our assessment that the building blocks of our strategy are robust and effective, and that our focus now needs to be on ensuring its consistent application across the practice.

Each year we critically assess the Internal Quality Monitoring process and make enhancements to improve its effectiveness. FRC findings and recommendations form one of the inputs into this assessment. For example, in 2022, a more detailed scoping template has been introduced to enable reviewers to document more fully the rationale behind scoping decisions. We have extended our pilot of a more in depth independence review into compliance with Independence standards to all FTSE 350 listed engagements reviewed during the 2022 AQR cycle. We will assess the outcome of this pilot and enhance it further before extending the reviews in 2023. Our reviews continue to be undertaken by independent reviewers selected based on their audit and industry experience and quality track record.

C. Root cause analysis (RCA)

We continue to invest heavily in RCA, recognising its importance in enabling continuous improvement by identifying the causes of quality issues and successes, and identifying appropriate actions. Whilst the actions taken in response to our root cause analysis make a difference, as evidenced by the non-recurrence of findings in subsequent years, given our current results the effectiveness of the root causes and responsive actions identified has been re-assessed this year.

This year we have once again enhanced the RCA process, and increased the extent of reviews performed to 107 reviews in the 2021/22 cycle (from 84 in the 2020/21 cycle and 51 in the 2019/20 cycle). Our RCA covered all 17 FRC inspections, all engagements subject to PCAOB inspections in the year, a sample of the inspections undertaken by the ICAEW's QAD, all 2 or 3 rated engagements from our own internal monitoring inspections, and other areas from firmwide reviews. Our in-person training events for the audit practice over the summer will communicate all of the RCA findings and include reminders of the key learnings from the inspections.

There is a spread of root causes from this year's inspection cycle, with no structural or common cause. This is reflective of the disparate nature of the findings across each engagement. They can be broadly grouped into the following themes:

- Ability to apply existing guidance, or to fully comprehend, and subsequently address, the risk. There were occasions where audit teams had not made effective use of our existing guidance and enablement, including templates. In some instances, it was also apparent that the audit risk was not as well defined as it could be due to lack of experience or due to over-reliance on an understanding obtained in previous years. At the same time, we saw evidence of the experience of more senior team members knowing 'what good looks like', and good coaching being embedded in the team, contributing to good overall audit quality.

- Adequacy of review procedures and ability to get things right first time There were instances where audit procedures were not executed correctly initially, and where review procedures had not subsequently addressed this. Factors identified as leading to this were insufficient standardisation and, on occasions, lack of sufficient time to summarise findings and overconfidence in the underlying capabilities of the reviewers allocated. We also found positive quality outcomes where executive team members had timely input and where our standardised forms were used.

- Resource allocation There were a number of examples of audits performing well in inspections that had a high concentration of high performing staff. This has led to reflection on whether staff deployment is sufficiently focused on allocating high performers more broadly across engagements, to spread knowledge and experience and to help coach and train new team members.

Each of these themes are reflected in and addressed by our refreshed Audit Quality Strategy.

D. Audit Quality Strategy

Following a major redesign in 2020, and a refresh in 2021, our multi-year Audit Quality Strategy has remained adaptable and responsive to emerging issues. In recent times, the strategy reacted to the additional audit challenges arising from Brexit, COVID-19 and the impact of the war in Ukraine. We expect to see the impact of these changes being evidenced in the outcomes of future inspection cycles.

Last year's audit quality strategy update created a direct link between the adoption of the quality management standard ISQM1, effective from 15 December 2022, and our audit quality strategy. We also embedded the audit response to the impact of climate change on businesses and the broader environmental, social and governance agenda as one of the elements of our audit quality strategy; rolling out an enhanced methodology and guidance for our teams. Our FY22 priorities were:

- Further embedding our audit culture with a focus on professional scepticism.

- Successfully adopting the digital audit; and

- Improving standardisation on our audits.

We responded to these priorities by introducing new tools such as our Audit Purpose Barometer and an Active Scepticism Framework. These tools are used by teams to avoid biases in our decision making and support the exercise of professional scepticism in a structured format. Our teams now also have access to detailed industry data analysis from an external provider, for use as a source of alternative data to support with challenge and scepticism. The data-driven EY Digital Audit has now been implemented. This transformation of the audit approach is focused on scanning entire data sets to better pinpoint risks or errors. Finally, we launched a pilot project to leverage our Forensic & Integrity Services (FIS) practice expertise to support our teams in assessing fraud risk and other indications of management bias. The resulting risk assessment on an inspected engagement was recognised as good practice by the FRC. In the current year, this collaboration with FIS has been expanded.

Most recently, the audit quality strategy has been refreshed for 2022/23, with the identification of three key focus areas shown below. The impact of changes made now will benefit engagements performed over the next year and captured by the FRC's reporting in 2024 and onwards. Nevertheless, we have validated the initiatives that underpin these focus areas to ensure that they are responsive to the root causes of the FRC and other inspection findings, both internal and external in today's context. The initiatives identified serve both to address quality failings that led to key findings and to reinforce the positive behaviours that have given rise to good practice and positive inspection outcomes:

Greater standardisation and simplification

We have seen success by showing teams what 'good' looks like and driving consistency through our introduction of standardised work programmes in areas such as cashflow, IFRS 9, Expected Credit Loss and impairment. We will build on this success, helping teams to execute our methodology and rebalance their audit effort through:

- Creation of further standard work programmes and workpapers, and

- Expansion of Centres of Excellence.

As part of the development of new work programmes and workpapers, a focus on simplification will help audit teams more easily navigate the various and often complex auditing requirements.

More effective coaching

We intend to significantly extend our quality control capacity to be able to provide additional support to audit teams. This will include enhancing our existing quality enablement network through senior manager representatives leading in every office. Technology is central to our strategy, and we plan to further invest in technology-enabled self-service support solutions through online coaching and expanding our task specific digital training offerings.

Rebalancing and reducing workloads

We recognise the pressure that our teams have felt, particularly over the last few years. Prolonged remote working during the pandemic led to an erosion of boundaries, with people struggling to switch off. In our transition to hybrid working, we have started to address this by empowering our people to work in the location and way that suits them and the people they collaborate with, best. Our ambition is to restore balance by meaningfully reducing workloads. We will achieve this by bolstering our levels of resource and at the same time, reducing the administrative burden that our audit teams currently deal with through additional project management support. We also want to improve resource deployment by rebalancing our teams and better aligning appropriate skills and experience with engagement risk.

The natural benefit of more effective coaching and increased standardisation and simplification will also contribute to enhanced efficiency and reduced work intensity.

E. Audit Culture Framework

Audit Quality starts with having the right culture embedded in the business. A fundamental element of our audit quality strategy is having a relentless focus on strengthening our culture. We must nurture the values, attitudes and behaviours that guide our teams to do the right thing, regardless of how difficult.

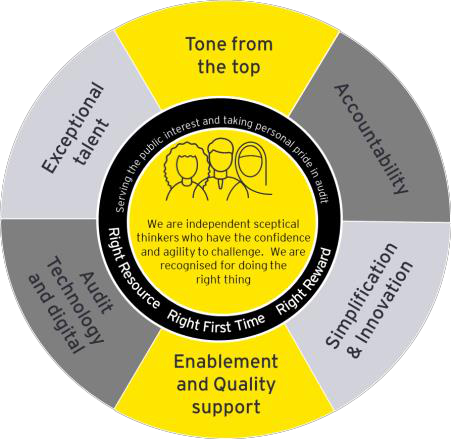

In 2021, as part of implementing operational separation, we introduced the EY Audit Culture Framework. This articulates our desired audit culture, identifying those elements which we consider to be important to foster the behaviours that drive the delivery of high quality audits.

Each year we complete an audit quality culture assessment to obtain feedback from our people on the values and behaviours they experience, and those they consider to be fundamental to our audit quality culture of the future. By gathering and responding to this feedback, we ensure our culture continues to evolve accordingly. Our Cultural Icon brings together the purpose of our people, the components of Sustainable Audit Quality, and our three cultural attributes of Right Resources, Right Reward, and Right First Time:

We have reinforced the importance of delivering against our purpose through our establishment of a link between audit quality and partner remuneration. This year we have also introduced the 'Audit Trust Awards' to recognise our people for the role they play in building a quality-led culture. Our audit leadership team and Audit Non-Executives have also taken part in our Culture of Quality Roadshows, touring the country to hear first-hand from our people and showing them how seriously we take our culture - emphasising the importance of audit quality and the role our whole team plays in achieving this.

While we have made progress in implementing this culture, we must do more.

F. Planning for the future

We are proud of the way that our people have responded to the unprecedented challenges experienced in recent years. We need to continue to look forward and to equip them to deal with emerging geopolitical issues, global supply chain disruption, and the cost of living crisis whilst combatting the need to attract, develop and retain talent. We remain convinced of the importance of the audit profession, and are committed to working with the FRC and other stakeholders to demonstrate the attractiveness of audit as a profession for the long-term, and to serve the public interest.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Improve the effectiveness of the testing of revenue

Revenue is a key driver of operating results and a key performance indicator on which investors and other users of the financial statements focus. Auditors should obtain sufficient and appropriate audit evidence to assess whether revenue is accurately recognised in the financial statements.

Key findings

We reviewed the audit of revenue on the majority of audits inspected. While good practice was highlighted in some audits, we raised the following findings relating to the testing of revenue on five audits, including two assessed as requiring improvements:

- On two of the audits, there was insufficient evidence in relation to the testing of inputs for revenue procedures. On one of these audits, which was assessed as requiring improvements, there was insufficient evidence of the audit work performed to assess the differences between revenue recognised and cash received that related to VAT.

- On another two audits, there were insufficient substantive procedures performed. On one of these audits, which was assessed as requiring improvements, the audit team did not perform any specific substantive audit procedures that covered the reasonableness of the estimated premium income that was outstanding at the year-end.

- On the other audit, the audit team did not sufficiently evidence their consideration of, and justification for, the level of audit procedures over revenue recognition for long term contracts, in particular relating to the selection of the sample of contracts tested and the consideration of the residual untested population.

Strengthen the evaluation by the group audit team of aspects of component auditors testing

The group audit team should ensure that there is sufficient oversight, evaluation and challenge of the work of the component auditors, especially for areas of significant risk.

Key findings

Most audits we reviewed were group audits and we identified examples of good practice in relation to group auditor involvement. We also raised findings on three audits, including two assessed as requiring improvements:

- On one of the audits assessed as requiring improvements, there was insufficient oversight by the group audit team of certain component auditors' procedures in relation to revenue, in particular relating to the testing of revenue to cash receipts and the risk assessment for incorrect pricing and billing.

- On the other audit assessed as requiring improvements, the group audit team did not sufficiently evidence its oversight and challenge of the audit of key assumptions in the impairment assessment by the component audit team, in particular the revenue growth assumptions and the risk adjustment to the discount rate. In addition, on this audit, the group audit team did not adequately evidence its review or consideration over the component audit testing of provisions and contingencies; and the consolidation procedures.

- On another audit, there was insufficient evidence of the group audit team's oversight and evaluation of aspects of the component auditors' procedures, particularly in relation to revenue.

Improve the evidence of procedures performed over cash and bank balances

External bank confirmations provide audit evidence that the relevant balances and related disclosures are independently verified. Auditing Standards state that, where external bank confirmations are not received, alternative audit procedures should be performed to obtain relevant and reliable audit evidence.

Key findings

We reviewed the audit of cash and cash equivalents on five audits. We identified findings on three audits, including two assessed as requiring improvements:

- On one of the audits assessed as requiring improvements, the audit team did not evidence the performance of sufficient alternative audit procedures to respond to the low level of external bank confirmations received. There was also insufficient consideration of whether there was an increased risk of fraud, inadequate control over the bank confirmation requests and responses, and insufficient communication with the Audit Committee on the matter.

- On another audit assessed as requiring improvements, the group audit team did not adequately consider whether sufficient evidence was obtained for the cash balances across those components, which were not full or specific scope, and there was insufficient audit evidence over a material year-end cash balance at one of the overseas components. On a further audit, the group audit team did not adequately justify how sufficient evidence was obtained from the external confirmations as they were received one month before the year-end.

Further enhance the evaluation and challenge of aspects of impairment assessments

The evaluation of management's impairment assessment often involves significant judgement, including the estimation of future cash flows. Changes to key assumptions in the assessments could result in an impairment. Auditors should therefore sufficiently evaluate and challenge management's assumptions and cash flow forecasts for these assessments.

Key findings

We reviewed the audit of impairment assessments on all audits that we inspected where this was identified as an area of significant risk. We raised the following findings on four audits, including one assessed as requiring improvements:

- On the audit assessed as requiring improvements, there was insufficient evaluation and challenge of management's goodwill impairment assessment relating to the achievability of the revenue forecasts for two of the Cash Generating Units (CGUs). On another audit, the audit team also performed insufficient procedures to test the cash flow forecasts at an individual CGU level.

- On another audit, insufficient audit procedures were performed to verify the formulae and calculations used in the impairment model. On a further audit, the audit team did not adequately evidence their evaluation and challenge of certain key assumptions.

Improve the identification of covered persons for independence purposes and the reporting of non-audit services

The FRC Ethical Standard states that, where a partner who was a covered person in the previous two years is appointed as a director, the firm shall resign from the audit where possible. A covered person is someone in a position to influence the conduct or outcome of the audit. All breaches of the FRC Ethical Standard must be reported to the FRC.

Key findings

We considered independence on all our reviews, and raised the following findings on three audits, including one assessed as requiring improvements:

- On the audit assessed as requiring improvements, the audit team did not adequately consider whether the former office managing partner of the component auditor had been a covered person and whether there was a breach of the FRC Ethical Standard. Although the audit team concluded there was no breach of the Standard, there was insufficient scepticism and challenge about the managing partner's role and a lack of consideration of the perceived threats. In addition, there was no formal consultation on this matter with the Ethics Partner, including considering the view of an objective, reasonable and informed third party.

- On another audit, a minor independence breach, which impacted two financial years, was not reported to the FRC. In addition, the auditor's report did not state that prohibited non-audit services were provided for the second of the two years affected. On a further audit the audit team should have obtained independence clearance in a more timely manner.

Review of individual audits: Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach which responds to those risks.

- Fraud and climate risk assessments: On one audit, the audit team involved relevant specialists to enhance its risk assessment over fraud and the impact of climate change.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Use of specialists: On four audits, we observed good practice in relation to use of specialists. On one of these audits, the quality of evidence demonstrated that the specialists were part of a well-integrated audit team. On another audit, the audit team's work demonstrated clear oversight and interaction with the internal actuarial specialists and valuation experts on key procedures. On another audit, there were instances of good practice in using actuarial and valuation experts. On the other audit, the audit team undertook an extensive consultation with its accounting technical team, including the firm's global IFRS committee.

- Going concern, impairment and impact of Covid-19: These instances of good practice related to three audits. On one audit, the audit team performed a clear evaluation of management's going concern assessment, in particular the impact of the principal and strategic risks on the forecast liquidity and covenant headroom. On another audit, when assessing impairment, the audit team performed extensive procedures over cash flow forecasts. On the other audit, there was an in-depth analysis of cash flows to support the recoverability of debtors which had been impacted by Covid-19.

- Group oversight: On two audits, we observed good practice in relation to group oversight. On one of these audits, the group audit team's oversight was of a high standard and included adapting the planned approach due to Covid-19, as well as an extensive review of the working papers for the overseas component. On the other audit, the group audit team clearly evidenced its oversight of and interactions with the component audit teams, including a summary of the challenges raised by them and their resolution.

- Revenue: On two audits, we observed good practice in relation to the audit of revenue. On one of these audits, the audit team obtained data covering the post year-end period as well as the period being audited and created data analyses that also targeted cut-off testing. On the other audit, the audit team engaged forensics specialists which enhanced the substantive audit procedures performed.

- Expected Credit Loss (ECL)/Financial instruments: On one audit, we found good practice relating to the audit under IFRS 9 of the expected credit loss (ECL) provision and financial instruments. For the audit of the ECL provision, comprehensive audit procedures were performed and there was a strong level of independent challenge and evidence to support the audit team's conclusions, including the testing of Significant Increase in Credit Risk. For the audit of financial instruments, there were thorough independent revaluation procedures performed by the firm's financial instrument experts.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Financial statement review/Engagement Quality Control Review: There were two audits with good practice. Both audits had good evidence of Engagement Quality Control Review, including the challenge of the financial statements on one audit and across a range of significant areas of the other audit.

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by ICAEW, which undertakes its reviews under delegation from the FRC as the Competent Authority. ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. ICAEW does not undertake work on the EY's firm-wide controls as it places reliance on the work performed by the FRC.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher-risk and potentially complex audits within the scope of ICAEW review.

ICAEW has completed its 2021 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2022.

Summary

Audit work continues to be of a good standard overall. All ten files were either good or generally acceptable, which is an improvement in the grading profile compared to the previous visit.

Results

Results of the ICAEW's reviews for the last three years

Bar chart showing the percentage of reviews for Significant improvement required, Improvement required, and Good / generally acceptable from 2019 to 2021.

| Category | 2019 | 2020 | 2021 |

|---|---|---|---|

| Significant improvement required | 0% | 1% | 0% |

| Improvement required | 10% | 9% | 7% |

| Good / generally acceptable | 85% | 77% | 91% |

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

The ICAEW identified good practice across the files we reviewed. Broad themes were:

- Teams demonstrated a detailed knowledge of the implementation of IFRS 16, particularly incorporating the impact of the pandemic.

- Files showed evidence of good engagement and interaction with component auditors.

- Examples of good professional scepticism, including one particularly robust risk assessment incorporating findings from a variety of external sources relating to a comparable business. In another case, the team demonstrated a risk focused and sceptical approach to challenging management in the testing of key judgements.

3. Review of the firm's quality control procedures

In this section, we set out the key findings and good practice we identified in our review of the following four areas of the firm's quality control procedures, which we have inspected this year. This table shows how these areas in International Standard on Quality Control (UK) 1 (ISQC 1) map to International Standard on Quality Management (UK) 1 (ISQM 1), which will come into effect at the end of 2022, and the FRC "What Makes a Good Audit?" publication.

| ISQC 1 area | ISQM 1 area | What Makes a Good Audit |

|---|---|---|

| • Relevant ethical requirements - Implementation of the FRC's Revised Ethical Standard (2019) | • Relevant ethical requirements | • Execution of the agreed audit plan |

| • Engagement performance - EQCR, consultations and audit documentation | • Engagement performance | • Execution – Consultation and oversight |

| • Audit methodology | • Resources – Intellectual Resources including methodology | • Resources – Methodology |

| • Monitoring - Internal quality monitoring | • Monitoring and remediation | • Monitoring and remediation |

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our findings in the two previous years at the end of this section.

Relevant ethical requirements – Implementation of the FRC’s Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important “Objective Reasonable and Informed Third Party test”, against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified key findings where the firm needs to:

- Improve the guidance on how to more consistently consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, that of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Ensure cumulative fees for non-audit services are monitored on a timely basis to inform independence decisions taken by audit teams.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard. Key findings related to the application of the Ethical Standard on individual audits are set out in section 2.

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

Engagement Performance – EQCR, consultations and audit documentation

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors considered included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well the training provided to reviewers.

Consultation with the firm's central functions, on difficult or contentious matters, enable auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified no key findings.

Good practice

We identified the following areas of good practice:

- The firm has a robust process for monitoring consultations by audit teams with the firm's central specialists to identify topics where additional guidance or training would be beneficial for a wider audience.

Good practices related to the EQCR on individual audits are set out in section 2.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

Key findings

We identified no key findings.

Good practice

We identified the following areas of good practice:

- The firm has developed clear guidance on auditing complex valuation adjustments which includes examples of the key audit procedures to perform over the different types of adjustment.

- The disclosure guidance is of a high standard and provides illustrative examples of good practice disclosures.

Monitoring – Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring team.

Key findings

We identified key findings where the firm needs to:

- Take action to strengthen the reviews of completed audits to consistently identify key areas that require improvement. In the current year, for two audits reviewed by both the FRC's Audit Quality Review team and the firm's internal quality monitoring team, there were differences in the key findings raised. In both cases, AQR identified key findings in areas of the audit that had also been inspected by firm's internal quality monitoring team without similar findings being identified. The firm must assess the reasons for the differences and identify what changes need to be made to the scope of the review, or to the review process.

- Ensure that the professional judgements made by the reviewer are recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised. This is particularly important for high-risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental.

Good practice

We identified the following areas of good practice:

- The firm requires a follow-up review for all audits rated as having more than minor findings or material findings, to ensure the findings have been remediated appropriately.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| • Audit quality focus and tone of the firm's senior management | • Implementation of the FRC's Revised Ethical Standard (2019) | • Audit methodology (recent changes to auditing and accounting standards) | • Partner and staff matters, including performance appraisals and reward decisions |

| • Root cause analysis (RCA) process | • EQCR, consultations and audit documentation | • Training for auditors | • Acceptance and continuance (A&C) procedures for audits |

| • Audit quality initiatives, including plans to improve audit quality | • Audit methodology (fair value of financial instruments with a focus on banks) | ||

| • Complaints and allegations processes | • Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified key findings in relation to the following areas we reviewed on a rotational basis:.

- For Partner & staff Matters (2019/20), improvements were required relating to the global performance management system (LEAD).

We provided an update on the firm's actions in our 2020/21 report.

Good practice

Good practice was identified in three areas:

- On Audit methodology and training we noted the amount of mandatory training provided to managers, the good illustrative audit procedures for the allowance for expected credit losses, and the disclosure guidance on performing banking audits.

- On Partner & staff matters we identified a strong link between audit quality and partner remuneration, and a robust manager promotion and partner portfolio review processes.

- On Acceptance and continuance procedures we recognised the clear evidence of direct Board involvement in monitoring, oversight and challenge of high-risk audits.

4. Forward-looking supervision

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through: assessing and challenging the effectiveness of the firms' RCA processes; the development of the firms' audit quality plans; the firms' progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of the firms' response to non-financial sanctions. We are currently introducing a single quality plan (SQP) to be maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in our Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Audit quality initiatives

- RCA

- Other activities focused on holding the firms to account

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Audit quality initiatives

Background

Firms must develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

Last year we reported that we had reviewed key aspects of the firm's audit quality plan which continues to evolve informed by the firm's Global Sustainable Audit Quality Programme which is structured under six core pillars.

When we reviewed the plan last year, we assessed it as relatively mature, and we identified good practice in relation to Audit Quality communications, the use of predictive audit quality indicators, and the role of sponsors in driving quality initiatives. However, we found that the firm must continue to develop its procedures to monitor the overall effectiveness of the plan to ensure its effective implementation.

Observations

We assessed the following:

- Continual evolution of the AQP: For its financial year 2022, EY refreshed its AQP. As part of that process EY reset its priorities for the year, refocussed existing initiatives, and identified two initiatives that were fully embedded and could continue to take effect in business as usual. Preparing for ISQM1 and Audit response to climate change were added to the plan. The firm adapted its existing initiative on embedding culture and scepticism to have additional focus on audit culture, in particular the specific behaviours and mindset shift it sought within the audit practice. This responded to the firm's RCA analysis that behaviours and values were core to continually achieving high quality audits and, going forward, the current findings on challenging management's assumptions.

- Making technology central to the AQP: Technology is pivotal to EY's plans for achieving high quality audit and meeting ISQM1 technology requirements through better connecting teams, replacing manual tasks with quality automation, and enhancing the analysis of audit evidence. Adopting a data driven approach, where data is used throughout the audit cycle, building out from the general ledger analyser to sector and custom analysers, should improve audit efficiency and allow audit teams to refine their focus. The ability of the firm to implement and embed its technology initiatives is fundamental to achieving the standardisation and consistency that supports high quality audits. This is an important initiative for the firm given this year's inspection results.

- Extending the role of audit quality indicators: The role of audit quality indicators (AQIs) as predictive quality indicators, a key RCA input, and a tool for management at an engagement and firm-wide level has increased. The firm devotes time and resource to considering tolerance ranges from AQI measurement, developing new AQI metrics and challenging existing AQI metrics. Grouping of metrics within the AQI Dashboard provides visibility to UK Audit Leadership on current risks to audit quality and supports effective decision making and timely interventions.

- Assessing the effectiveness of the AQP's implementation: The firm has put in place a number of approaches to assess the effective implementation of the plan: focus groups; interviewing audit teams; milestones and AQIs; and data and reporting collected on adoption of initiatives. The periodic assessment of the plan formally considers overall progress, completion of initiatives and future priorities. A review of the implementation of the Audit Quality Strategy by Internal Audit made several positive observations including on implementation oversight, ongoing monitoring and reviewing strategic priorities while noting the composition of focus groups could be extended to include more new joiners.

We will continue to assess the AQP and encourage all firms to develop or continue to develop their audit quality plans including the focus on continuous improvement and measuring the effectiveness of initiatives.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we assessed that the firm's overall approach to RCA was well developed and identified good practice in relation to targeted thematic analysis, extent of challenge from audit leadership, breadth of information used in RCA analysis and reporting, and analysis of good practices. We had no key findings. The firm has not made any significant changes to its RCA approach during the year but has continued to make refinements.

Observations

We assessed the following:

- Separation of responsibilities: EY has implemented a clearer separation of responsibilities between those performing the RCA analysis and those remediating the actions. This increases the independence of those setting the actions and allows a clearer focus on causal factors.

- Prompt assessment of causal factors: The firm, globally, has shortened the time period in which RCAs should be performed. This increases its ability to share lessons and implement actions more quickly.

- Structured assessment of input factors: EY has enhanced its RCA template to capture consistently a range of key input factors relevant to audit quality including: AQIs, milestones, use of its Purpose Led Outcome Thinking approach, resourcing, and risk assessment. This more structured approach has formed the basis of more effective interviews and analysis and has supported the identification of the causal factors.

- Current inspection results: Nonetheless, despite the firm acting on specific RCA findings, overall RCA themes, and evidence that RCA has prompted progress on prior year issues, this year our inspection results have been weaker than previous years. EY must take stock and reconsider the depth and breadth of its RCA analysis and whether the actions it has taken to date have been effective. We note that EY has recently performed this process.

- Emerging themes: EY has identified that strong team culture and coaching within teams are key contributors to positive audit quality. In comparison, where coaching from senior levels was limited, by time or physical location, there were instances of poorer outcomes. Executive team experience and knowing what good looks like were important aspects in providing adequate review and determining coaching needs. EY must ensure that its analysis of emerging themes is integrated into its AQP initiatives.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

Other activities focused on holding firms to account

Background

As part of our forward-looking supervisory approach we hold firms to account for making the changes needed. This firm was not subject to increased supervisory activities during the year.

Observations

We assessed the following:

- Current inspection results: Despite the actions taken by the firm, this year's inspection results have been weaker than previous years. EY must take stock and reconsider whether the actions it has taken have been effective and whether, in hindsight, these were all the right actions. We note the firm has recently performed this process.

- Action plans: EY has made sound progress in remediating the majority of its action plan items. The identified actions are thorough and there is clear linkage to the firm's AQP. However, some key actions, such as developing a centre of excellence for impairment reviews, are still in the pilot stage. Others, including to further support scepticism and challenge, need to be more widely adopted.

- Acting on FRC feedback: The firm has listened to and acted promptly on previous feedback in relation to Fair Value (IFRS 13) and has put in place a robust core fair value methodology and other guidance with plans for future improvement.

- Tone at the Top: The firm are clear and consistent in their communications about the importance of audit quality, highlight the risks to quality, and focus on continuous improvement. Leadership messages from the Audit Quality Summit are complemented by internal programmes that celebrate quality and multi-layered communication.

We will continue to hold the firms to account with our ongoing supervisory activities.

Operational separation of audit practices

Operational Separation aims to ensure that audit practices are focused, above all, on the delivery of high-quality audits in the public interest. In July 2021, EY started its transition to operating the audit practice separately from the rest of the firm and has taken a number of steps to implement the principles of Operational Separation including the restructuring of its governance framework, forming an Audit Board, appointment of Audit Non-Executives (ANEs), and its work on promoting a differentiated audit culture.

EY has five independent non-executives in total and they perform the following roles: one executive is an independent non-executive (INE) at the firm level; one executive is solely an ANE; and three executives are both ANEs and INEs (dual function). The chairs of the Public Interest Board and Audit Board are both dual function.

Appendix

Firm's internal quality monitoring

This appendix sets out information prepared by the firm relating to its internal quality monitoring for individual audit engagements. We consider that publication of these results provides a fuller understanding of quality monitoring in addition to our regulatory inspections, but we have not verified the accuracy or appropriateness of these results.

The appendix should be read in conjunction with the firm's Transparency Report for 2021 and the firm's report to be published in 2022 which provide further detail of the firm's internal quality monitoring approach and results, and the firm's wider system of quality control.

Due to differences in how inspections are performed and rated, the results of the firm's internal quality monitoring may differ from those of external regulatory inspections and should not be treated as being directly comparable to the results of other firms.

Results of internal quality monitoring

The results of the firm's most recent Audit Quality Review (internal AQR), which comprised internal inspections of 113 individual corporate audits are shown below along with the results for the previous two years. The majority of the audits reviewed had year ends between March 2020 and April 2021 but also included thirteen December 2019 and one December 2018 year-ends, where the signing of the accounts was delayed.

Bar chart showing the percentage of internal AQR results for No or minor findings, Finding(s) that were more than minor but less than material, and Material findings from 2019 to 2021.

| Category | 2019 | 2020 | 2021 |

|---|---|---|---|

| No or minor findings | 85% | 77% | 91% |

| Finding(s) that were more than minor but less than material | 12% | 23% | 7% |

| Material findings | 3% | 0% | 2% |

Firm's approach to internal quality monitoring

The firm's internal inspection program considers the full population of audits performed. The internal AQR is designed to cover each individual responsible for signing audit opinions (“RI”) at least once every three years, however RIs are often reviewed more frequently due to additional risk-based sampling. Risk based criteria are applied to both Rls and to audit engagements and FTSE350 engagements must be reviewed at least every 6 years.

Inspections are conducted by experienced EY professionals from offices other than those in which the audit was undertaken, with a significant proportion of reviewers drawn from EY member firms outside the UK. In 2021 these reviews were undertaken remotely due to the ongoing travel restrictions from COVID 19. The reviews are subject to oversight from senior partners of other EY member firms in order to ensure rigour and integrity of each file review. The internal AQRs are supervised, moderated and graded by the EMEIA regional and global AQR teams.

The firm undertakes RCA of the findings from all audits reviewed in the internal AQR with more than minor findings (2 rated) or material findings (3 rated), as well as a sample of audits where good practice was identified. The results of the RCA, along with the key findings identified through the internal AQR process, are fed back into auditors' training and the firm's audit quality strategy.

Audit files are remediated as necessary after the internal AQR is finalised. For audits with material findings, additional audit procedures may be required as part of the remediation and action plans are drawn up seeking to avoid the same issues recurring the following year. The subsequent audit files are reviewed to ensure the planned actions were taken and the issues have not recurred. Where RIs receive a 3 grading they are also subject to further quality checks that include an additional internal AQR in the current and following years on different files.

Internal quality monitoring themes arising

Whilst in 2021 91% of audits reviewed had no or only minor findings, two of the 113 engagements reviewed had material findings.

| Drivers of 3 rating: |

|---|

| Inadequacies in the audit work performed over the potential reversal of a historic impairment of an investment in associate |

| After the internal AQR was finalised it was concluded that a reversal of the impairment was required |

| Non-compliance with elements of PCAOB rules when seeking preapproval of tax services |

| No actual breach of independence had occurred, this was a weakness in written communications to an Audit Committee |

The eight engagements rated ‘2' were driven by findings that, whilst not concluded as material, were not minor. These findings related to: testing of controls; revenue testing; errors within the audit report (also identified in 2020); misstatement in the cashflow statement; missed consultation mandated by EY policy; and key work papers omitted from the archive. The first two topics were identified on more than one engagement, the other topics were isolated to specific engagements where the finding led to a '2' grading. Across the relatively low number of engagements rated '2' or '3' (ten out of 113 engagements reviewed) there were no significant themes. All engagements rated '2' and '3' have been incorporated into the RCA process and all 'more than minor' findings have been incorporated into post-internal AQR training and guidance.

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300 www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

Footnotes:

-

The seven Tier 1 firms are: BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP, PricewaterhouseCoopers LLP. We have published a separate report for each of these seven firms along with a Tier 1 Overview Report. ↩

-

Public Interest Entity – in the UK, PIEs are defined in the Companies Act 2006 (Section 494A) as: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market" where, in the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); and Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive. ↩