The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

FRC Deloitte LLP Public Report

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2022 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

Introduction: FRC's objective of enhancing audit quality

The FRC is the Competent Authority for statutory audit in the UK and is responsible for the regulation of UK statutory auditors and audit firms, and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

Auditors play a vital role in upholding trust and integrity in business by providing opinions on financial statements. The FRC's objective is to achieve consistently high audit quality so that users of financial statements can have confidence in company accounts and statements. To support this objective, we have powers to:

- Issue ethical, audit and assurance standards and guidance;

- Inspect the quality of audits performed;

- Set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and monitoring of non-public interest audits; and

- Bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

In March 2021 we published Our Approach to Audit Supervision which explains the work that our audit supervision teams do.

In May 2022 the Department for Business Energy & Industrial Strategy (BEIS) published the Government's response to its consultation 'Restoring Trust in Audit and Corporate Governance', which sets out the next steps to reform the UK's audit and corporate governance framework.

Legislation is required to ensure the new regulator - the Audit, Reporting and Governance Authority (ARGA) - has the powers it needs to hold to account those responsible for delivering improved standards of reporting and governance.

These reports, published in July 2022, provide an overview of the key messages from our supervision and inspection work during the year ended 31 March 2022 (2021/22) at the seven Tier 1 firms[^1], and how the firms have responded to our findings.

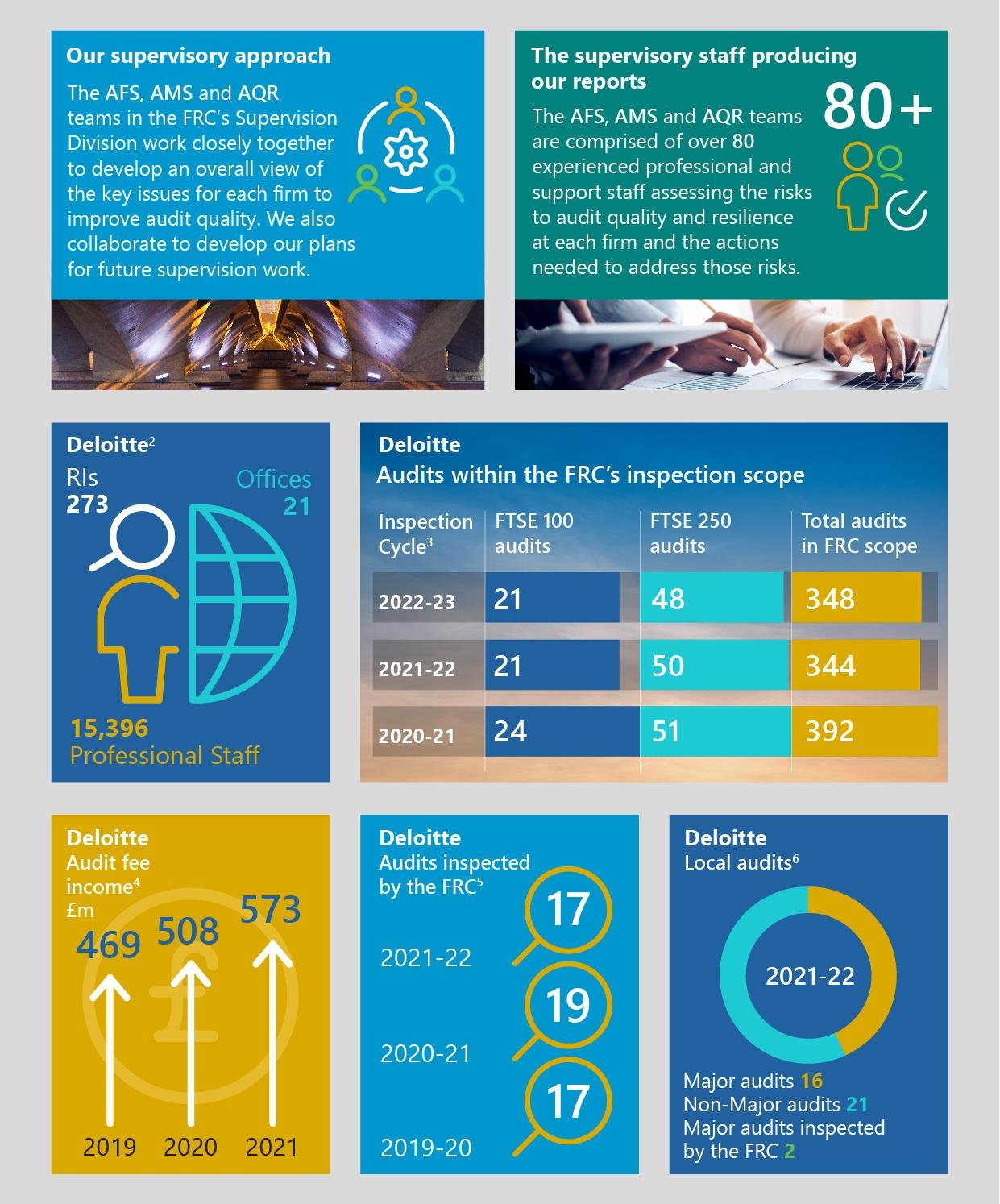

Our supervisory approach

The AFS, AMS and AQR teams in the FRC's Supervision Division work closely together to develop an overall view of the key issues for each firm to improve audit quality. We also collaborate to develop our plans for future supervision work.

The supervisory staff producing our reports

The AFS, AMS and AQR teams are comprised of over 80 experienced professional and support staff assessing the risks to audit quality and resilience at each firm and the actions needed to address those risks.

Deloitte Audits within the FRC's inspection scope

| Inspection Cycle | FTSE 100 audits | FTSE 250 audits | Total audits in FRC scope |

|---|---|---|---|

| 2022-23 | 21 | 48 | 348 |

| 2021-22 | 21 | 50 | 344 |

| 2020-21 | 24 | 51 | 392 |

[^2] Source - the ICAEW's 2022 QAD report on the firm. [^3] Source - the FRC's analysis of the firm's PIE audits as at 31 December 2021. [^4] Source - the FRC's 2020, 2021 and 2022 editions of Key Facts and Trends in the Accountancy Profession. [^5] Excludes the inspection of local audits. [^6] The FRC's inspections of Major Local Audits are published in a separate annual report to be issued later in 2022. The October 2021 report can be found here.

- Introduction: FRC's objective of enhancing audit quality

- Appendix

- 1. Overview

- 2. Review of individual audits

- Improve the audit of estimates in relation to certain provisions

- Further enhance the consistency of the evaluation by the group audit team of the component auditors' work

- Strengthen the evidence of review and challenge by the Engagement Quality Control Review partner

- Appropriately apply the FRC Ethical Standard, particularly in relation to the approval of non-audit services

- Review of individual audits:

- Monitoring review by the Quality Assurance Department of ICAEW

- 3. Review of the firm's quality control procedures

- Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

- Engagement Performance – EQCR, consultations and audit documentation

- Methodology

- Monitoring – Internal quality monitoring

- Approach to reviewing the firm's quality control procedures

- Firm-wide key findings and good practice in prior inspections

- 4. Forward-looking supervision

- Appendix

Appendix

Firm's internal quality monitoring

This report sets out the FRC's findings on key matters relevant to audit quality at Deloitte LLP (Deloitte or the firm). As part of our 2021/22 inspection and supervision work, we reviewed a sample of individual audits and assessed elements of the firm's quality control systems.

The FRC focuses on the audit of public interest entities (PIEs[^7]). Our risk-based selection of audits for inspection focuses, for example, on entities: in a high-risk sector; experiencing financial difficulties; or having material account balances with high estimation uncertainty. We also inspect a small number of non-PIE audits on a risk-based basis.

Entity management and those charged with governance can make an important contribution to a robust audit. A well-governed company, transparent reporting and effective internal controls all help underpin a high-quality audit. While there is some shared responsibility throughout the ecosystem for the quality of audits, we expect firms to achieve high-quality audits, regardless of any identified risk in relation to management, those charged with governance or the entity's financial reporting systems and controls.

Higher-risk audits are inherently more challenging, requiring audit teams to assess and conclude on complex and judgemental issues (for example, future cash flows underpinning impairment and going concern assessments). Professional scepticism and rigorous challenge of management are especially important in such audits. Our increasing focus on higher risk audits means that our findings may not be representative of audit quality across a firm's entire audit portfolio or on a year-by-year basis. Our forward-looking supervision work provides a holistic picture of the firm's approach to audit quality and the development of its audit quality initiatives.

The report also considers other, wider measures of audit quality. The Quality Assurance Department (QAD) of the Institute of Chartered Accountants in England and Wales ICAEW inspects a sample of the firm's non-PIE audits. The firm also conducts internal quality reviews. A summary of the firm's internal quality review results is included at Appendix 1.

[^7] Public Interest Entity – in the UK, PIEs are defined in the Companies Act 2006 (Section 494A) as: Entities with a full listing (debt or equity) on the London Stock Exchange (Formally "An issuer whose transferable securities are admitted to trading on a regulated market" where, in the UK, "issuer" and "regulated market" have the same meaning as in Part 6 of the Financial Services and Markets Act 2000.); Credit institutions (UK banks and building societies, and any other UK credit institutions authorised by the Bank of England); and Insurance undertakings authorised by the Bank of England and required to comply with the Solvency II Directive.

1. Overview

Overall assessment

In the 2020/21 public report, we concluded that the firm had made progress on actions to address our previous findings and made improvements in relation to its audit execution and firm-wide procedures.

The firm has continued to show improvement, with an increase in the number of audits we assessed as requiring no more than limited improvements to 82% compared with 79% in the previous year and 80% on average over the past five years. It is also encouraging that none of the audits we inspected were found to require significant improvements.

82% of audits inspected were found to require no more than limited improvements. No audits inspected in the current cycle required significant improvements.

The area which contributed most to the audits requiring improvement was the audit of estimates of certain provisions. There were also key findings in relation to group audits, the review and challenge by the Engagement Quality Control Review (EQCR) partner and the application of the FRC Ethical Standard. However, in contrast to the prior year, most of the audits requiring improvement arose in non-FTSE 350 audits, with stronger results for the FTSE 350 audits.

The results from other measures of audit quality, covering a broader population and a larger sample of audits, also show consistent improvements. The results from the Quality Assurance Department of the ICAEW (QAD) set out on pages 23 and 24, which is weighted towards higher risk and complex audits of non-PIE audits within ICAEW scope, assessed 80% of the audits it inspected as good or generally acceptable. Over a similar period, the firm's internal quality monitoring process (covering both PIE and non-PIE audits) assessed 83% of audits as meeting its highest quality standard (see page 38).

While there has been an improvement in inspection results, there continues to be certain similar themes across the FRC inspections and review of firm-wide procedures, the QAD and the firm's internal quality monitoring teams, in particular relating to the audit of estimates, independence matters, particularly in respect of the approval of non-audit services and the involvement of the Engagement Quality Control Review (EQCR) partner. In addition, findings identified last year continued to recur for group audits. The firm must assess why previous actions did not adequately address those findings. It is therefore imperative that the firm's Continuous Improvement Group (CIG), who will be responsible for assessing and challenging the appropriateness of the firm's responses, is fully implemented. The CIG must gain a holistic overview, working alongside other audit quality teams to ensure that there are consistent and clear priorities with effective and current responses.

In response to this year's findings, we will take the following actions:

- Reduce the number of audits inspected at Deloitte in proportion to the number of audits in scope, compared with other Tier 1 firms.

- Assess the scope of the CIG and monitor the progress made.

- Increase our focus on independence matters, including whether the firm has appropriately considered the FRC Ethical Standard, particularly in respect of the approval of non-audit services.

- Require all actions to be included in a Single Quality Plan (SQP), subject to formal reporting and regular review by the FRC.

Firms must include all actions within a Single Quality Plan, subject to formal reporting and regular review by the FRC.

Inspection results: arising from our review of individual audits

We reviewed 17 individual audits this year and assessed 14 (82%) as requiring no more than limited improvements. Of the 11 FTSE 350 audits we reviewed this year, we assessed ten (91%) as achieving this standard.

Our assessment of the quality of audits reviewed: Deloitte LLP

Bar chart showing the percentage of audits with different quality ratings from 2017/18 to 2021/22 for Deloitte LLP.

The bars represent: * Good or limited improvements required * Improvements required * Significant improvements required

Percentages for "Good or limited improvements required":

* 2017/18: 70% (19 audits total, 15 good/limited, 4 improvements, 0 significant)

* 2018/19: 80% (21 audits total, 12 good/limited, 6 improvements, 3 significant)

* 2019/20: 70% (13 audits total, 9 good/limited, 3 improvements, 1 significant)

* 2020/21: 65% (15 audits total, 8 good/limited, 4 improvements, 0 significant)

* 2021/22: ~80% (14 audits total, 10 good/limited, 3 improvements, 1 significant)

FTSE 350: Deloitte LLP

Bar chart showing the percentage of FTSE 350 audits with different quality ratings from 2017/18 to 2021/22 for Deloitte LLP.

The bars represent: * Good or limited improvements required * Improvements required * Significant improvements required

Percentages for "Good or limited improvements required":

* 2017/18: 80% (15 audits total, 12 good/limited, 3 improvements, 0 significant)

* 2018/19: 60% (9 audits total, 4 good/limited, 4 improvements, 1 significant)

* 2019/20: 80% (12 audits total, 9 good/limited, 3 improvements, 0 significant)

* 2020/21: 70% (8 audits total, 8 good/limited, 0 improvements, 0 significant)

* 2021/22: ~90% (10 audits total, 10 good/limited, 1 improvement, 0 significant)

The audits inspected in the 2021/22 cycle included above had year ends ranging from June 2020 to March 2021.

Changes to the proportion of audits falling within each category reflect a wide range of factors, including the size, complexity and risk of the audits selected for review and the scope of individual reviews. Our inspections are also informed by the priority sectors and areas of focus as set out in the Tier 1 Overview Report. For these reasons, and given the sample sizes involved, changes from one year to the next cannot, on their own, be relied upon to provide a complete picture of a firm's performance and are not necessarily indicative of any overall change in audit quality at the firm.

Any inspection cycle with audits requiring more than limited improvements is a cause for concern and indicates the need for a firm to take action to achieve the necessary improvements.

Our key findings on individual audits included the audit of estimates for certain provisions, group audits, the review and challenge by the EQCR.

Our key findings related to the audit of estimates for certain provisions, group audits, the review and challenge by the EQCR partner and the application of the FRC Ethical Standards, particularly the approval of non-audit services.

We identified a range of good practice related to risk assessment, the execution of the audit and completion and reporting.

Further details are set out in section 2.

Inspection results: arising from our review of the firm's quality control procedures

This year, our firm-wide work focused primarily on evaluating the firm's: actions to implement the FRC's revised Ethical Standard; policies and procedures for engagement quality control reviews, auditor consultations and audit documentation; audit methodology relating to the fair value of financial instruments; and internal quality monitoring arrangements.

With respect to quality control procedures, our key findings related to implementing the revised Ethical Standard, EQCR, methodology and internal quality monitoring.

Our key findings related to the firm's actions to implement the revised Ethical Standard, EQCR, methodology and internal quality monitoring reviews. In particular, we found that the firm needed to improve the effectiveness of its process relating to the appointment of EQCR partners.

We also identified good practice points in the areas of methodology and internal quality monitoring.

Further details are set out in section 3.

Forward-looking supervision

The firm has continued to communicate the importance of audit quality and continuous improvement and shares emerging issues and good practices on a real time basis. There has been increased communications involving audit teams sharing their experiences with the wider audit practice, often through webcasts. This reinforces audit quality messages and can make them more relatable.

Further enhancements have been made to the firm's Audit Quality Plan (AQP, or the plan) which now includes details of key initiatives that have been recently implemented. The plan must be further improved by providing clearer focus on the current priority areas, as well as continuing to strengthen the reassessment of the effectiveness of the AQP.

The firm has recognised that there is a need for a central team with clearly defined and dedicated responsibility for identifying and implementing an appropriate response to consistent and recurring findings (our 2020/21 public report, noted that more effective responses for findings that continued to recur was needed). The Continuous Improvement Group will have responsibility for this. It is important that there is increased focus on embedding the CIG team, who must have a clear and consistent focus on the priority areas, so that effective and comprehensive responses can be quickly implemented.

Deloitte's Root Cause Analysis (RCA) process and the RCA team is well established. There have been continued refinements in the year, including additional focus on the importance of behavioural factors. However, we found that the RCA taxonomy used global casual factor descriptors which must be improved to more accurately identify the underlying root cause. There also needs to be additional focus on common secondary factors.

Further details are set out in section 4.

Firm's overall response and actions

Introduction

We are proud of our people's commitment to delivering high quality audits and we continue to have an uncompromising focus on audit quality. We are pleased that both the overall and FTSE 350 inspection results for our audits selected by the FRC as part of the 2021/22 inspection cycle show an improvement. This reflects our ongoing focus on audit quality, and we will maintain our emphasis on continuous improvement as we seek to further enhance quality. We also welcome the balanced content of the report with the new forward-looking supervision approach taken by the FRC as well as the FRC's proposed response to this year's findings and seek to engage and respond proactively. Audit quality is and will remain our number one priority and is the foundation of our recruitment, learning and development, promotion and reward structures.

Audit strategy and culture

Audit quality continues to play a fundamental role in our evolution as a business by shaping our vision of the business we want to be, driving our priorities and defining our successes. Put simply, our strategy is about getting better at how we organise ourselves, how we develop and deploy our talent, how we shape our culture and how we strengthen our resilience to deliver high quality outcomes in the public interest.

Our strategy execution framework sets out the measurable steps – our 16 strategic objectives – that we are taking to deliver our strategy across our 4 areas of focus: quality, people, resilience and transformation. Achieving these strategic objectives means we will succeed in our aspirations; to be leaders in quality, to be the number one choice for talent, to continue to strengthen our financial and operational resilience in a ringfenced world, as well as to enhance our business' agility to fulfil our purpose of protecting the public interest and building trust and confidence in business.

These 16 strategic objectives reflect the breadth of activity demanded by our strategy and are underpinned by both day-to-day business operations (BAU) and an extensive programme of change activity to drive progress towards desired outcomes. As part of our annual strategy refresh and monitoring, we evaluate the strategic objectives to ensure they continue to reflect the needs of our business. We determine in-year strategic priorities to speed up seeing the results of our strategy; identifying three to four of our strategic objectives for increased focus and investment to create momentum and acceleration. For FY23, these are focussed on our strategic objectives related to building and upholding a purpose-led culture focused on delivering the highest audit quality, assessing emerging issues and risks, winning the race for talent and delivering a resilient audit portfolio. Similarly, we identify in-year operational priorities which, for FY23, are focussed on resourcing, pricing, reducing unnecessary time pressures, and spending time with our people.

The audit culture and the audit quality environment we create is critical to our resilience and reputation as a business. That is why on the 1 June 2021 the majority of our Audit & Assurance business was operationally separated from the rest of our practice and since then, we have been working within ring fenced boundaries and our new operating model came into effect. We are proud of being one of the first firms to successfully achieve this. As a fully transparent business, independently governed by the Audit Governance Board (AGB) we can better focus on delivering high-quality audits in the public interest. The first 12 months of our transition period to full operational separation has seen us become a stronger business; our structure is aligned to serve our purpose, we are clear on the work we can and cannot do, and our new operating model - so how we organise ourselves - sets us up for the future to ensure that all of our audits, no matter what the size or complexity, are delivered to the same standard of quality.

Getting better at how we organise ourselves to serve our purpose is helping us to build and nurture our purpose-led culture. Linked to our purpose are our values; we are focused on behaviours around our values and our collective responsibility to take action to support our ethics, integrity and professional responsibilities. Our tone and behaviours 'from the top' are driving this collective responsibility to challenge management, exercise professional scepticism and due care, and we want to ensure our people understand that if they do the right thing, they will be applauded for it. We have sought specialist input from our Risk Advisory practice to advise us on further actions we can take to define, embed, assess, measure and monitor the behaviours that we consider fundamental to our audit culture.

Continuous improvement and root cause analysis

We welcome the breadth and depth of good practice points identified by the FRC particularly those in respect of the effective challenge of management and group audit oversight, where the FRC also reports findings. The identification of good practice by the FRC assists us in our aim of promoting consistency in approach and execution across all our audit engagements. We are also pleased previous recurring findings relating to goodwill impairment and revenue were not identified as key findings in the current FRC inspection cycle, reflecting the positive impact of actions taken in previous years. We nevertheless remain committed to sustained focus and investment in these areas and more broadly to achieve consistently high-quality audits.

We acknowledge that there are several consistent themes arising across the FRC, ICAEW and our own internal quality monitoring reviews year-on-year, including recurring findings. In response and to drive the consistent delivery of high-quality audits, we are establishing a Continuous Improvement Group (CIG). The CIG will be led by a senior audit partner, independent of our central audit quality functions, with dedicated resource and one of its initial priorities will be to review and challenge the response to the identified root causes of the findings from the FRC 2021/22 inspection cycle. The CIG will enhance several existing activities for priority areas in respect of the assessment, challenge and monitoring of actions taken to respond to audit quality findings, including recurring issues. It will also review and challenge the Audit Quality Plan, including the monitoring and measuring plans in place and the effectiveness of actions taken. A further aim of the CIG is to challenge our executive management on emerging audit quality matters and any potential quality impact of operational change.

In response to the FRC's observations, we are also forming an Actions Development Group (ADG), comprising workstream leaders from across the business, which will formalise our existing processes and ensure consideration across functions around the development of actions which then flow into the Audit Quality Plan. These actions and the Audit Quality Plan will be reviewed and challenged by the CIG to ensure that actions are designed effectively and promote consistent audit execution. We have also enhanced our causal factor taxonomy which will be released over summer 2022 effective for the 2023 inspection cycle, in response to the FRC observations. Our robust root cause analysis (RCA) process together with the establishment of the CIG and ADG will enable us to address recurring findings in a more effective manner.

We continue to make further enhancements to our Audit Quality Plan, including providing greater clarity on the current priority areas and aligning to meet the new Single Quality Plan (SQP) requirements in response to the FRC observations. The establishment of the CIG will also support the ongoing assessment of the effectiveness of the AQP in determining whether there are recurring issues or remaining areas where further actions can be taken. Our Audit Governance Board (AGB) and Audit Non-Executives (ANEs) will continue to have responsibility for the oversight of the AQP and will also closely monitor the activities of the CIG going forward.

We have performed independent root cause analysis for findings across all FRC inspections and a wider collective analysis across all internal and external inspection findings and other quality events. Overall, our analysis of the root causes of audit quality findings indicates that there is not typically one primary cause, but several contributing factors that lead to individual findings.

The most significant root causes identified for the 2021/22 inspection cycle, further details of which are provided below, were as follows:

- supervision, direction and review, including reliance on knowledge gained from previous audits;

- the need for clearer and consistent guidance relating to the expected level of evidence of EQCR challenge and review;

- skills and knowledge gaps relating to IFRS 9 and the application of the FRC Ethical Standard;

- the quality of management information; and

- workload and capacity due to resource pressures and extended timetables due to COVID-19.

We were pleased to see that our enhanced audit procedures in response to COVID-19 related risks were identified as good practice by the FRC. However, we recognise the challenges that both audited entities and our audit teams have faced in navigating these unprecedented circumstances. The majority of audits inspected in this cycle were undertaken during the pandemic, during periods of lockdown and remote working. In the 2021/22 cycle, our root cause analysis identified that the impact of the COVID-19 pandemic has been a contributing factor to findings identified on several audits inspected.

Resourcing, learning and technology

Since the 2020/21 audit cycle the combined impact of the pandemic and an overall increase in demand for audit services across the sector as a whole means resourcing has become an operational priority for all audit firms. We are committed to improving the effectiveness and efficiency of our resourcing model. This will allow us to ensure we continue to deliver on our objective of protecting the public interest and building trust and confidence in audit. We are committed to driving improvements in the culture, governance and financial reporting of the entities we audit and actively review the portfolio of the entities we audit to make appropriate decisions about engagement continuance. We also successfully took action this year to move work out of our busiest periods, where that was possible and appropriate, including accelerating work in advance of year-end and adjusting reporting timetables where required to relieve resourcing pressures. This allowed us to create capacity in our business, protect wellbeing and maintain our focus on delivering consistent audit quality to the highest standards.

Investment in our learning and development ('L&D') programmes remains a priority within our business. We recognise the critical role that this investment in our people plays in supporting audit quality and the attractiveness of the profession. We have recently established a dedicated L&D transformation team to update our learning programme in line with hybrid working and lessons learnt during the COVID-19 pandemic. This has included a full review of the existing L&D curriculum in light of feedback received from the business, the expectations of our global talent standards for each grade and recurring issues identified during internal and external regulatory reviews. In response to the root cause analysis performed, we are also developing and deploying a targeted refresher audit training programme this summer to address skills gaps at Assistant Manager grade that may have arisen during the COVID-19 pandemic.

In addition, we are now entering initial pilot deployment of our two new cloud-based audit platforms. This will further support our people to consistently deliver high-quality audits over the coming years. These platforms bring together new technology, content and guidance, support greater collaboration between group and component auditors and drive greater consistency in group audits helping to address those findings and associated causal factors.

The following section sets the overall themes from our root cause analysis for each of the FRC key inspection findings, together with a summary of the actions already taken or planned:

Audit of estimates

Due to a combination of the Covid environment, as a result of either resource pressures, delays in the planned audit timetable or due to the complexity of the accounting estimates, there were timetable changes and challenges in the team structure impacting on the layers of review. Our root cause analysis identified that this impacted the quality, extent and timing of supervision, direction and review of audit work and this in turn impacted the ability to 'standback' and ensure the evidencing of the audit work in the audit files was sufficiently explained to support the final conclusions. Actions already taken to respond to resource pressures have been outlined above. We also continue to hold workshops with our partners and directors to brief them on areas of regulatory focus, including the root cause of issues identified and raise awareness of the importance of the review process.

Our root cause analysis also identified a skills and knowledge gap in respect of the application of IFRS 9 requirements by corporate audit teams and a broader lack of experience in applying existing guidance when auditing certain other accounting estimates. In response, our main annual technical training includes specific training relation to the audit of complex estimates and provisions. We also plan to develop a checklist, similar to that in place for our banking audits, for auditing ECL models for corporate audit teams to use where there are complex models being deployed by the companies we audit.

Group audits

Our root cause analysis identified that on a number of our audits, delays in component reporting due to Covid meant that senior members of the group audit team became directly involved in the review and challenge of component audit work. These team members relied on knowledge already obtained through their cumulative involvement and this introduced weaknesses in the depth of review affecting the level of evidence of oversight, challenge and review. Delays in transcribing contemporaneous notes of all interactions with component audit teams also resulted in insufficient detail of the challenge and oversight being visible on the audit file. We also identified that teams would benefit from further support on the practical application of existing guidance relating to the level of evidence that is required for group oversight and the sharing of good practice examples.

In response to the findings, we established a Group Audit coaching programme to support engagement teams in key areas relating to group audits, primarily through sharing of good practice and highlighting common pitfalls. This programme was launched after the completion of the audits subject to inspection in the 21/22 cycle and therefore we expect to see the positive impact of this programme in future years. We are also in the process of performing a refresh of our Group Audit practice aid in light of inspection findings to develop a reference point for good practice examples.

EQCR review and challenge

Specifically in respect of the EQCR process findings – both on individual audits and at a firmwide level, we acknowledge and agree with the findings raised. Our root cause analysis has identified that we need to formalise clearer and more consistent guidance regarding the level of evidence of EQCR challenge and resolution required. In response, during the second half of 2021 we commenced an EQCR transformation programme designed to build on our existing EQCR practices to further enhance the effectiveness of our EQCR process and improve the evidence retained to demonstrate the EQCR challenge.

The programme aimed to address the root causes of the findings identified and has focused on:

- culture, reinforcing the EQCR mindset and appropriate EQCR behaviours

- the scope, accountability and expectations of an EQCR

- the importance of resourcing and project management

- developing appropriate KPIs to monitor and measure the effectiveness of the EQCR process

Specific actions taken to date include enhancements to our process of allocation of EQCRs, updates to our evidence of EQCR review and challenge template, the delivery of additional guidance on expectations for the EQCR reviewers and the sharing of good practice examples. Due to the timing of the launch of this project, many of the audits subject to inspection in the 21/22 inspection cycle were finalised before the key actions of our transformation agenda were established and implementation had commenced.

Independence & Ethics

The firm takes the findings in relation to evidencing its application of the Ethical Standard very seriously and enhancing our System of Quality Management (SQM) on a continual basis remains a key priority. Whilst the independence related findings reflected in this report did not lead to any lower rated inspections, we have undertaken causal factor analysis to determine root causes. Actions have been taken to address these findings, including communications, updated templates, updated breach management processes as well as additional training and guidance on the application of the revised Ethical Standard. The actions taken directly address the primary identified root cause relating to a lack of experience and understanding in the application of the revised Ethical Standard, which was effective for audits commencing on or after 15 March 2020. We are committed to continuing to embed the revised Ethical Standard and continue to develop further guidance and to monitor these areas to manage the risk of recurrence.

The application of the objective reasonable and informed third-party test continues to remain a key area of focus and at the heart of discussions with practitioners. Our central independence team works collaboratively with our business quality and risk leaders to continuously reinforce this. Additionally, as needed, consultation discussions are also held with our Public Interest Review group (chaired by the UK Ethics Partner and comprising leaders from our Quality & Risk, Public Policy, Communications and People & Purpose teams, and a core of representative partners from across the business), as well as on occasion our Independent Non-Executives and in specific cases with third party stakeholders.

Our continuous improvement mindset, aided by the ongoing design and implementation of ISQM 1, has enhanced our SQM, and we continue to maintain our commitment to high quality as a key focus.

Conclusion

We are proud of how our teams have navigated the challenges of the past twelve months and are pleased that the investments we continue to make in audit quality are being recognised. We continue to operate in a volatile and uncertain business environment and are committed to the role that we play in protecting the public interest and building confidence and trust in business through delivering the highest quality audits. Our business structure is aligned to serve our purpose, with investment in our people a key priority. Looking ahead, our focus remains on continuing to cultivate an environment, underpinned by our purpose led culture, which supports continuous improvement, drives confidence and trust, serves the public interest and recognises the importance of our profession and high-quality audits.

2. Review of individual audits

We set out below the key areas where we believe improvements in audit quality are required. As well as findings on audits assessed as requiring improvements or significant improvements, where applicable, the key findings can include those on individual audits assessed as requiring limited improvements if they are considered key due to the extent of occurrence across the audits we inspected.

Improve the audit of estimates in relation to certain provisions

Provisions often involve estimation uncertainty and rely on the assumptions and judgement of management. Audit teams are expected to adequately assess and challenge management's judgements relating to estimates and perform appropriate procedures to respond to the relevant risks.

Key findings

We reviewed various different types of estimates and provisions on a number of audits and raised findings on five of them, including two assessed as requiring improvements.

- On two of the audits, one of which required improvements, the findings related to the estimation of Expected Credit Loss (ECL) provisions. In both audits, there were insufficient audit procedures performed, or evidence obtained, relating to aspects of the ECL provision. In particular, the findings were in relation to aspects of the assessment and testing of significant increases in credit risk (SICR) and ECL models.

- On the other audit assessed as requiring improvements, there was insufficient audit evidence to support the level of provision made for an onerous contract of an overseas component. The group audit team did not adequately evaluate or challenge the component audit team's procedures and conclusions in relation to the adequacy of the provision.

- In the other two reviews, the audit teams also did not sufficiently challenge management, in relation to the level of provisions recognised. On one of these audits there was insufficient evidence to support the conclusion that several uncertain tax positions did not require a provision or additional disclosure. On the other audit, there was insufficient challenge related to the completeness of the provision arising on contractual claims.

We reviewed estimates and provisions on several audits and raised findings on five of them, including related to the Expected Credit Loss allowance.

Further enhance the consistency of the evaluation by the group audit team of the component auditors' work

The group audit team is responsible for the oversight of the group audit, including audit work at a component level, and are expected to demonstrate sufficient involvement throughout the audit.

Most audits we reviewed were group audits, where we assessed the level of involvement of the group audit partner and team in the direction, supervision and review of component audit teams.

Key findings

Whilst we identified examples of good practice in relation to group audit team involvement throughout the audit process we continue to identify instances of inconsistency in relation to the degree of oversight and challenge of component audit teams. We raised findings on five audits, one of which was assessed as requiring improvements.

- On four of these audits, there were key areas of the audit where there was insufficient evidence that the group audit team had adequately assessed the work of the component auditors, including the approach adopted and whether additional procedures were required to obtain sufficient audit evidence. On one of the same audits, the group audit team did not adequately communicate its involvement in, and level of oversight of, the component audit to the Audit Committee, or justify why the audit team for the UK component was not treated as a component team in accordance with Auditing Standards.

- On the audit requiring improvements, following an internal quality monitoring review, quality control issues were identified in relation to the overseas Deloitte firm which audited one of the significant overseas components, and these included audits led by the previous component audit partner. While a new component audit partner was put in place, the previous component audit partner also remained involved in the audit, and it was therefore unclear who made the key judgements and decisions on the component audit.

We continue to identify instances of inconsistency in relation to the degree of oversight and challenge of component audit teams.

This was also identified as a key finding last year. As we continue to identify inconsistencies in this area, the firm must consider the effectiveness of its previous actions, and the results of its root cause analysis on the recurring findings, in determining what further actions are required.

Strengthen the evidence of review and challenge by the Engagement Quality Control Review partner

EQCR partners are required to be involved in PIE/listed audits and are also involved in those audits which the firm determines would benefit from additional quality control and direct oversight. An EQCR is expected to provide an objective assessment and challenge of significant audit judgements made by the audit team.

Key findings

We assessed the EQCR partners' involvement and the evidence of their review and challenge on the majority of audits inspected and raised findings on seven. The involvement and extent of challenge by the EQCR partner was highlighted as part of the findings relating to provisions (as detailed above) on two of the audits highlighted as requiring improvements.

- In all seven audits, there was insufficient evidence of the EQCR partner's review and challenge of the group audit team throughout the audit process.

- In four of these audits, the EQCR partner did not evidence their discussion with the key audit partner of at least one significant component on group audits, or clarify why this was not considered necessary, as required by Auditing Standards.

There was insufficient evidence of the EQCR partner's review and challenge of the group audit team throughout the audit process in seven audits.

Aspects of these findings were also noted as a key finding in last year's report, in particular in relation to group audits. The firm is in the process of making changes to better demonstrate the extent of the involvement of the EQCR partner and must ensure that the changes are implemented as a priority, to ensure there are improvements in this area.

Appropriately apply the FRC Ethical Standard, particularly in relation to the approval of non-audit services

The FRC Ethical Standard ("the Standard”) sets out principles and requirements in relation to independence and objectivity for audit firms and teams. It requires audit firms to establish appropriate policies and procedures to ensure partners and staff comply with the Standard. This includes the “objective, reasonable and informed third party test", which requires audit firms to consider whether a proposed action would affect their independence from the perspective of public interest stakeholders.

Key findings

We considered independence on all our reviews and raised the following findings on four audits.

- On all of these audits, we raised findings related to the provision of non-audit services, where there was insufficient evidence that the group audit team had adequately assessed the actual or perceived threats arising to independence from the provision of these services. In two of the findings the audit team's assessment did not adequately explain why the non-audit services were permissible, including, in one case, how the workshop provided by the management consulting practice on a nil fee basis was consistent with the firm's gift and hospitality policy. On another of these audits, the firm allowed rolling minor ad hoc tax advisory services below a certain value to be provided without any specific approval or consideration by the group audit team.

- In two of the above cases, the audit team had identified that there had been a breach of the Standard, which was not prevented by the firm's policies and procedures. In both cases, the non-audit fees exceeded the 1:1 non-audit: audit fee ratio and there had been no consultation with the Ethics Partner when the ratio was expected to be exceeded, as is required by the Standard. In one of these cases, the reporting of the breach was not performed on a sufficiently timely basis given the breach was not communicated to the Audit Committee until seven months after being identified, or to the FRC for a further nine months.

- In one of the audits, a finding was also raised with respect to the length of involvement of the component audit partners on a non-listed audit. For two overseas components of the group, the audit partners had acted continuously as component audit partner for periods greater than that recommended by the Standard. The group audit team consulted on this matter but did not adequately demonstrate why the incremental safeguards applied were adequate to address the self-interest/review or familiarity threats arising.

- On another audit, a member of the audit team obtained an offer of employment from the audited entity and accepted it. While the staff member was immediately removed from the audit, there was insufficient communication of the matter to the group Audit Committee and consideration of perceived independence threats by the audit team.

There was inadequate consideration of the objective reasonable and informed third party test, when assessing the related threats and safeguards, and the cumulative impact of ethical issues on four audits.

In the cases noted above the audit teams did not adequately consider the objective reasonable and informed third party test, when assessing the related threats and safeguards, or the cumulative impact of the ethical issues on the audits.

Review of individual audits:

Good practice

We identified examples of good practice in the audits we reviewed, including the following:

Risk assessment and planning

The risk assessment and planning phase of an audit is important to ensure a timely and appropriate risk assessment, enabling the audit team to tailor an effective audit approach which responds to those risks.

- Evaluation of Covid-19 related risks: In two cases, the audit teams produced a comprehensive risk and impact assessment regarding the impact of Covid-19. In one case this was appropriately used in determining a reduced audit materiality and in another additional audit procedures were performed to address the risks.

- Fraud risk assessment: The firm piloted an enhanced approach to fraud risk assessment and we saw this on two audits. In both cases, the audit teams demonstrated a strong awareness of the risk of fraud, and the audit partner led discussion on fraud was a comprehensive discussion involving the full audit team and specialists. This approach enhanced the audit procedures in a number of areas.

- Climate risk assessment: On one audit, the audit team performed a detailed risk assessment of the impact of climate change on both the accounting and disclosures within the financial statements. This included an analysis of each financial statement line item, the involvement of specialists and the firm's tools, including risk maps and industry guidance. This work resulted in the disclosure of a key audit matter relating to the impact of climate change on the useful economic life of certain assets.

- Evaluation of actuarial model risks: On one audit, a risk-based assessment of each actuarial model was used to determine the audit procedures needed. This enabled the audit team to mitigate the risks inherent in the models and improve the audit evidence that the models were working as intended.

Good practice examples included the evaluation of Covid-19 related risks, an enhanced approach to fraud risk assessment, evidence of challenge of management and effective group audit oversight.

Execution

The execution of an audit plan needs to be individually tailored to the facts and circumstances of the audit.

- Evidence of challenge of management: On four audits, evidence of challenge of management by the audit teams in key audit areas was heightened. In two of these, the audit team involved specialists to strengthen its challenge of management's judgements and underlying assumptions. On another, the audit team used external information to help challenge management's judgements. In the final case, the audit team consulted with an independent firm panel who assessed and challenged the audit team's work, which resulted in additional audit work and the use of forensic specialists to assess and challenge management's judgements.

- Effective group audit oversight: On four audits, the group audit teams clearly evidenced their oversight of and interactions with the component audit teams, including a summary of the challenges raised and their resolution. In one case, the challenge by the group audit team resulted in an audit adjustment.

- Bespoke revenue analytical procedures: We saw a good example of the use of bespoke data analytic procedures, which provided strong assurance over high volume, complex revenue streams. On another audit, the audit team used a standardised, bespoke testing template ensuring the revenue from all key customers was tested and included a complete recalculation of revenue based on inputs from contracts and other tested sources.

- Robust goodwill impairment assessment: On one audit, the audit team demonstrated a good level of professional scepticism, which included the use of look-back procedures to support the carrying value of goodwill and acquired intangible assets and sensitised management's cash flow models to reflect the assessment.

Completion and reporting

The completion and reporting phase of an audit is an opportunity to stand back and assess the level of work performed against the audit plan and ensure that the reporting of the outcome of the audit is appropriate and timely.

- Constructive Audit Committee Reporting: On one audit, the audit team designed a section on quality indicators, to inform the Audit Committee on where management should focus their attention and highlight where processes worked well. On another audit, the quality and detail of information provided was extensive, enabling the new Audit Committee and management team to understand the nature and complexity of the audit issues, the way in which these had been addressed and the thoroughness of the audit work undertaken.

- Detailed review of the front half of the annual report: On one audit, the audit team prepared a detailed working paper that linked all financial and non-financial disclosures in the front half of the annual report to other relevant work papers as well as to external audit evidence.

Monitoring review by the Quality Assurance Department of ICAEW

The firm is subject to independent monitoring by the ICAEW, which undertakes its reviews under delegation from the FRC as the Competent Authority. ICAEW reviews audits outside the FRC's population of retained audits, and accordingly its work covers private companies, smaller AIM listed companies, charities and pension schemes. ICAEW does not undertake work on the firm's firm-wide controls as it places reliance on the work performed by the FRC.

ICAEW reviews are designed to form an overall view of the quality of the audit. ICAEW assesses these audits as 'good', 'generally acceptable', 'improvement required' or 'significant improvement required'. Files are selected to cover a broad cross-section of entities audited by the firm and the selection is focused towards higher-risk and potentially complex audits within the scope of ICAEW review.

ICAEW has completed its 2021 monitoring review and the report summarising the audit file review findings and any follow up action proposed by the firm will be considered by ICAEW's Audit Registration Committee in July 2022.

Summary

Overall, the quality of audit work the ICAEW reviewed was of a good standard. Five files were good, three were generally acceptable and two required improvements. The overall profile is relatively consistent with the 2020 results.

80% of the ICAEW reviews were assessed as either good or generally acceptable.

Of the two files requiring improvement, the first file had insufficient evidence to support the accounting treatment of a key equity transaction and an impairment reversal; and on the second file the substantive analytical review of revenue was insufficient. Weaknesses in application of substantive analytical review to audit of revenue is a recurring matter, having featured as either a key or thematic issue in the ICAEW's last four visits to the firm.

Results

Results of the ICAEW's reviews for the last three years are set out below.

Bar chart showing the percentage of ICAEW audit reviews for Deloitte LLP from 2019 to 2021 by quality rating.

Ratings: * Significant improvement required * Improvement required * Good / generally acceptable

Percentages for "Good / generally acceptable": * 2019: 90% * 2020: 90% * 2021: 80%

Percentages for "Improvement required": * 2019: 9% * 2020: 9% * 2021: 8%

Percentages for "Significant improvement required": * 2019: 1% * 2020: 1% * 2021: 2%

Given the sample size, changes from one year to the next in the proportion of audits falling within each category cannot be relied upon to provide a complete picture of a firm's performance or overall change in audit quality.

Good practice

The ICAEW identified good practice across the files we reviewed. Broad themes were:

- Use of internal specialists in difficult audit areas.

- Clear and comprehensive documentation in working papers.

- Robust challenge of going concern.

- Good documentation of background understanding.

3. Review of the firm's quality control procedures

In this section, we set out the key findings and good practice we identified in our review of the following four areas of the firm's quality control procedures, which we have inspected this year. This table shows how these areas in International Standard on Quality Control (UK) 1 (ISQC 1) map to International Standard on Quality Management (UK) 1 (ISQM 1), which will come into effect at the end of 2022, and the FRC "What Makes a Good Audit?" publication.

| ISQC 1 area | ISQM 1 area | What Makes a Good Audit |

|---|---|---|

| • Relevant ethical requirements - Implementation of the FRC's Revised Ethical Standard (2019) | • Relevant ethical requirements | • Execution of the agreed audit plan |

| • Engagement performance - EQCR, consultations and audit documentation | • Engagement performance | • Execution – Consultation and oversight |

| • Audit methodology | • Resources – Intellectual Resources including methodology | • Resources – Methodology |

| • Monitoring - Internal quality monitoring | • Monitoring and remediation | • Monitoring and remediation |

We performed the majority of our review based on the policies and procedures the firm had in place on 31 March 2021. We also set out our approach to reviewing the firm's quality control procedures and a summary of our findings in the two previous years at the end of this section.

Relevant ethical requirements – Implementation of the FRC's Revised Ethical Standard

In 2019, the FRC revised certain requirements contained within the Ethical Standard for auditors (the “Revised Standard”). The revisions predominantly became effective for audits commencing on or after 15 March 2020. The focus of the revisions was to enhance the reality and perception of auditor independence, necessities both for auditors to form objective judgements about the entity being audited and for stakeholders to have confidence in the outcome of the audit. Certain prohibitions, on the type of non-audit services that could be provided to entities audited by the firm, were enhanced or extended. The Revised Standard also strengthened the role and authority of the Ethics Partner in firms and expanded the definition of the important “Objective Reasonable and Informed Third Party test”, against which auditors must apply judgements about matters of ethics and independence.

In the current year, we evaluated the firm's actions to implement the Revised Standard. We reviewed changes to policies and procedures and the support provided to audit teams to aid the transition (for example, communications, guidance and training events). We also conducted a benchmarking exercise to compare the implementation approaches across the firms and to share good practice.

Key findings

We identified the following key findings where the firm needs to:

- Improve the firm's guidance on how to more consistently consider the perspective of an Objective Reasonable and Informed Third Party when taking decisions relating to ethics and independence, and in particular, that of non-practitioners, such as informed investors, shareholders or other stakeholders.

- Improve the guidance provided to group audit teams to assess whether network firms/component auditors may have conditions and relationships that could compromise the independence of the audit engagement, including when they should consult with the UK Independence team.

Given the effective date of the Revised Standard, the majority of the audits inspected in the current year were performed under the previous Ethical Standard. Key findings related to the application of the Ethical Standard on individual audits are set out in section 2.

Our inspection work next year will assess whether audit teams have adhered to the firm's updated policies and procedures.

Engagement Performance – EQCR, consultations and audit documentation

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team. The reviews are completed on public interest and other heightened risk audits before the audit report is signed. Our inspection evaluated the firm's policies and procedures in relation to the appointment of EQCR reviewers. Key factors considered included the individuals' audit experience and level of seniority, availability and capacity, internal and external quality results and industry knowledge. We also considered how the challenges raised by the EQCR were made and resolved, as well the training provided to reviewers.

An EQCR is required to be an objective evaluation, by a suitably qualified audit practitioner, of the significant judgements made by the audit team.

Consultation with the firm's central functions, on difficult or contentious matters, enable auditors to be guided by the collective experience and technical expertise of the firm. We reviewed the firm's policies and procedures in relation to auditors consulting with the firm's central quality teams, including areas where mandatory consultations are required.

Audit documentation comprises the evidence obtained and conclusions drawn during an audit. Archiving ensures that the documentation is maintained should it be needed in the future. We reviewed the firm's arrangements relating to the assembly and timely archiving of final audit files, and the monitoring and approval of changes made to audit files after the signing of the audit report.

Key findings

We identified the following key finding where the firm needs to:

- Improve the effectiveness of the EQCR process. We identified a number of improvement points in relation to the firm's appointment of EQCR reviewers based on their experience, quality results, available time and other factors. Given these findings and the results of our inspections of individual audits the firm must take action to ensure the EQCRs are effective by improving the underlying processes and their application on individual audits.

Key findings related to the EQCR on individual audits are set out in section 2.

Methodology

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control, to help audit teams perform audits consistently and comply with auditing standards. In the current year, we evaluated the quality and extent of the firm's methodology and guidance relating to auditing the fair value of financial instruments, with a focus on the audits of banks and similar entities.

The firm's audit methodology, and the guidance provided to auditors on how to apply it, are important elements of the firm's overall system of quality control.

Key findings

We identified the following key finding where the firm needs to:

- Issue methodology and improve the extent of IFRS 13 guidance in relation to auditing the fair value of financial instruments for banks and similar entities. Within 2021, the firm created a practice aid for the fair value of financial instruments and unauthorised trading, which represents an improvement compared to the initial tools and templates provided to the FRC. The firm also has extensive arrangements requiring the use of specialists which, on past inspections, we have seen used to good effect. However, it is not a substitute for a complete and comprehensive IFRS 13 methodology.

We identified findings in all the firm-wide areas reviewed in the current year which the firm needs to address.

Good practice

We identified the following areas of good practice:

- Certain key aspects of the firm's model risk management specialist guidance are comprehensive and of a high quality. In particular, the guidance provides robust technical information on how to assess valuation differences, independently assess valuation tools and test model risk management controls.

- The guidance for auditing IFRS 13 disclosures is of a high standard, over and above the firm's baseline financial statement close process procedures.

Monitoring – Internal quality monitoring

It is a requirement for firms to monitor their own quality control procedures to evaluate whether they are adequate and operating effectively. This allows action to be taken should deficiencies be identified.

We evaluated key aspects of the firm's annual process to inspect the quality of completed audits. This included the criteria for selecting audit partners and completed audits for review, the composition and allocation of quality review teams, the scoping of areas to review, the evidencing of the review, the identification of findings and the overall assessment. We also compared the scope and outcome of a sample of audits reviewed by the FRC's AQR team with that undertaken by the firm's internal quality monitoring team.

Key findings

We identified the following key finding where the firm needs to:

- Ensure that the professional judgements made by the reviewer are recorded to support the depth of their review and the conclusions reached in key areas where no findings have been raised. This is particularly important for high-risk and complex areas where conclusions on the adequacy of the audit evidence obtained are inherently judgemental.

Good practice

We identified the following areas of good practice:

- The firm performs thematic reviews on selected key topics which have a wide scope and coverage.

- The firm requires a follow-up for all audits graded as improvements needed or non-compliant" to ensure the remediation of findings.

- The firm requires all grading decisions, including where no findings have been raised, to go through a moderation panel.

Approach to reviewing the firm's quality control procedures

We review firm-wide procedures based on those areas set out in ISQC 1, in some areas on an annual basis and others on a three-year rotational basis. The table below sets out the areas that we have covered this year and in the previous two years:

| Annual | Current year 2021/22 | Prior year 2020/21 | Two years ago 2019/20 |

|---|---|---|---|

| • Audit quality focus and tone of the firm's senior management | • Implementation of the FRC's Revised Ethical Standard (2019) | • Audit methodology (recent changes to auditing and accounting standards) | • Partner and staff matters, including performance appraisals and reward decisions |

| • Root cause analysis (RCA) process | • EQCR, consultations and audit documentation | • Training for auditors | • Acceptance and continuance (A&C) procedures for audits |

| • Audit quality initiatives, including plans to improve audit quality | • Audit methodology (fair value of financial instruments with a focus on banks) | ||

| • Complaints and allegations processes | • Internal quality monitoring |

Firm-wide key findings and good practice in prior inspections

In our previous two public reports we identified no key findings in relation to the following areas we reviewed on a rotational basis: Audit methodology and training (2020/21); Partner & staff matters (2019/20); and Acceptance and continuance procedures (2019/20).

Good practice

Good practice was identified in all three areas:

- On Audit methodology and training the firm had established a 'credit centre of excellence' team and had developed and provided guidance with illustrative audit procedures to teams performing banking audits.

- On Partner & staff matters we identified the effective use of a wide range of audit quality metrics to assess partners and staff performance, the incorporation of upward feedback into the partner appraisal and promotion process and robust processes for the centralised review and monitoring of partner portfolios.

- On Acceptance and continuance procedures we noted the effective interaction of the firm's finance and resourcing systems with A&C process, to monitor resourcing needs in real time.

4. Forward-looking supervision

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. For instance, we do this through assessing and challenging: the effectiveness of the firms' RCA processes; the development of firms' audit quality plans; the firms' progress against action plans; the effectiveness of firms' responses to prior year findings; and the spirit and effectiveness of the firms' response to non-financial sanctions. We are currently introducing a single quality plan (SQP) to be maintained by each Tier 1 firm as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve quality. A fuller explanation of our forward-looking supervision approach is set out in Our Approach to Audit Supervision.

In our role as an Improvement Regulator, we also seek to promote a continuous improvement of standards and quality across the firms by sharing good practice, carrying out benchmarking and thematic work, and holding roundtables on topical areas. In 2021/22 we held two roundtables, attended by the seven largest firms, sharing good practices and success stories on RCA. We have been undertaking benchmarking and thematic-based work on areas including Tone at the Top, ISQM 1, Overseas Delivery Centres, and on Culture and Challenge of Management.

We have also carried out pre-implementation work on the firms' preparedness for ISQM 1. Further details are set out in our Tier 1 Overview Report.

In the remainder of this section, we set out our observations from the work we have conducted this year, and updates from previously reported findings, as follows:

- Audit quality initiatives

- RCA

- Other activities focused on holding the firms to account

- Operational separation

Where our observation requires an action from the firm, we require its inclusion in the firm's SQP.

Audit quality initiatives

Background

Firms are expected to develop audit quality plans (AQPs) that drive measurable improvements in audit quality and include initiatives which respond to identified quality deficiencies as well as forward-looking measures which contribute directly or indirectly to audit quality.

Audit quality plans should include forward-looking measures which contribute directly or indirectly to audit quality.

Deloitte's AQP includes longer term and forward-looking audit quality initiatives with a clear linkage to ISQM 1. The firm's Audit Governance Board has responsibility for the oversight of the plan and, more widely, audit risk and quality.

When we reviewed the plan last year, we assessed it as relatively mature, and we identified good practices in relation to the clarity and breadth of the AQP and the clear linkage to ISQM 1. However, we found that the firm should improve the plan and/or quality initiatives by continuing to develop its procedures to monitor their overall effectiveness, continuing to strengthen the culture of challenge in the audit process and more fully embed audit culture into the plan.

Observations

We assessed the following:

- Oversight of the AQP: The Audit Governance Board is regularly provided with the latest version of the plan and other relevant material. The meetings are well facilitated and we have seen instances of challenge from the INEs and requests for 'deep dives' on specific areas.

- Key initiatives completed in the last year: The plan highlights the key initiatives that have recently been implemented alongside the firm's planned longer term initiatives. These include enhancing the impact, depth and reach of communications, for example, the regular partner and director catch ups for emerging issues (see 'tone at the top' below) and 'lessons learned' webcasts.

- Focus and prioritisation of the AQP: The AQP has continued to evolve in terms of breadth and detail. The resulting plan is comprehensive; however, it needs further clarity in respect of: The main areas of focus and priority for audit quality initiatives; and amalgamation of similar areas (and where initiatives are being led by different teams, the consideration of potential duplication and gaps). The firm must ensure that the plan has clear priorities that are consistent with that taken by the Continuous Improvement Group (CIG).

Deloitte's AQP is comprehensive, however it requires further clarity in respect of the main areas of focus and priority for audit quality initiatives.

- Continual reassessment of the effectiveness of the AQP and the quality and the appropriateness of the underlying initiatives: The firm must continue to strengthen the procedures to monitor the overall effectiveness of the AQP. In addition, while the firm monitors the progress of individual key initiatives (tracking against key milestones), there needs to be periodic reassessments of whether these initiatives remain the most effective response.

- Continue to strengthen the culture of challenge in the audit process and more fully embed audit culture into the plan: The firm has recently instigated a formal review of the audit culture and the plan includes references to audit culture. However, the plan must be further strengthened by incorporating the findings of the culture review alongside those of the Purpose & Values working group.

We will continue to assess the AQP and encourage all firms to develop or continue to develop their audit quality plans including the focus on continuous improvement and measuring the effectiveness of initiatives.

Root Cause Analysis

Background

The RCA process is an important part of a continuous improvement cycle designed to identify the causes of specific audit quality issues (whether identified from internal or external quality reviews or other sources) so that appropriate actions may be designed to address the risk of repetition.

Root cause analysis is an important part of a continuous improvement cycle.

ISQM 1, when implemented, introduces a new quality management process that is focused on proactively identifying and responding to risks to quality, and requires firms to use RCA as part of their quality remediation process.

ISQM 1 requires firms to use RCA as part of their quality remediation process.

When we reviewed the firm's RCA process last year, we assessed that its overall approach to RCA was well developed. We identified good practice in relation to an established and dedicated RCA review team with defined processes, the breadth of information used in the RCA analysis and (year round) continual RCA activities. However, we found that the firm needed to improve the effectiveness of addressing recurring findings. The firm has not made any significant changes to its RCA approach during the year but has continued to make refinements.

Observations

We assessed the following:

- The RCA team: There continues to be ongoing investment in the RCA team, all of whom have received RCA, psychology and behavioural training. The core RCA team is supported by a flexible team drawing on senior members of the audit practice (who have received RCA training). The head of the UK RCA team also takes a leading role in RCA for the global firm.

- Involvement of the engagement team: The RCA team interacts with all relevant members of the engagement team (where appropriate, this also includes members of overseas component teams) throughout the process. This ensures that the engagement team understand the RCA team's conclusions and feel fully involved. Where (positive and negative) learning points are identified, the engagement teams frequently share their experience with the wider audit practice (as part of the firm's audit quality communications). This has been positively received as it provides 'real-life' experience and context to audit quality messages.

- Behavioural causal factors: The firm recognises that behavioural factors form a significant part of overall causal factors. The RCA team have worked with external specialists to further explore ways in which the firm can learn from and respond to behavioural factors.

- Structured RCA taxonomy: Deloitte applies a global RCA taxonomy. While this results in a consistent and well understood approach, we have seen evidence that this has constrained the analysis, as the taxonomy requires the use of global causal factor descriptors. This has resulted in the assigned causal factor not necessarily being the most accurate or appropriately described root cause. The descriptors must be improved, or allow additional flexibility, so that they can better address the underlying root cause. In addition, the current approach does not allow a weighting of factors and therefore common secondary factors are not always followed up. The firm must look to widen the breadth of its analysis to incorporate common secondary causes.

- Responding to the causal factors: Deloitte has recognised that there should be more clearly defined and dedicated responsibility for identifying and implementing a response to the identified causal factors. Once established, CIG must drive a more focused response to causal factors and a reduction in the extent of recurring findings. It is imperative that the firm looks to quickly embed this process and ensures there is a joined-up approach between the RCA as well as the team responsible for developing the audit quality plan and initiatives.

Deloitte continues to invest in the RCA team.

We will continue to assess the firm's RCA process. We encourage all firms to develop their RCA techniques further as well as focus on measuring the effectiveness of the actions taken as a result.

Other activities focused on holding firms to account

Background

As part of our forward-looking supervisory approach we hold firms to account for making the changes needed. This firm was not subject to increased supervisory activities during the year.

Observations

We assessed the following:

- Tone at the top: The firm are clear and consistent in their communications around the importance of audit quality, highlighting the risks to quality and focus on continuous improvement. The firm has recently introduced regular catch ups for partners and directors in audit where emerging issues, good practices and themes can be discussed on a real time basis. There is also increasing use of actual experiences which has more impact and provides further context to matters.