The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Approach to Audit Supervision

The FRC does not accept any liability to any party for any loss, damage or costs however arising, whether directly or indirectly, whether in contract, tort or otherwise from action or decision taken (or not taken) as a result of any person relying on or otherwise using this document or arising from any omission from it.

© The Financial Reporting Council Limited 2023 The Financial Reporting Council Limited is a company limited by guarantee. Registered in England number 2486368.

We are responsible for the regulation of UK statutory auditors and audit firms and for monitoring developments, including risk and resilience, in the market. We aim, through our supervision and oversight, to develop a fair, evidence-based and comprehensive view of these firms, to judge whether they are being run in a manner that enhances audit quality and supports the resilience of individual firms and the wider audit market. We adopt a forward-looking supervisory approach to audit firms, and we hold firms to account for making the changes needed to safeguard and improve audit quality.

This publication is an update of the first (March 2021) Our Approach to Audit Supervision report, and it serves three purposes. First, to aid accountability and transparency by describing what we seek to achieve by audit supervision and how we achieve it. Second, to communicate to the firms performing statutory audits of Public Interest Entities what we expect of them, in both requirements and practices, and what they can expect from us in the course of supervision. Third, by setting out examples and case studies, to demonstrate the value of our approach to supervision. This publication includes updates since March 2021 – including the major milestone of the FRC assuming responsibility for Public Interest Entities audit firms and auditor registration from 5 December 2022. We will update it again when the FRC transitions to the Audit, Reporting and Governance Authority (ARGA), in which we will set out our new supervisory responsibilities and powers.

Foreword by Deputy Chief Executive and Executive Director of Supervision

Sarah Rapson Deputy Chief Executive and Executive Director of Supervision, FRC

Auditors play a vital role in upholding trust and integrity in business and public services, including through providing opinions on financial statements. The FRC's objective is consistent high audit quality so that users of financial statements can have confidence in the information provided in reports and accounts.

This publication sets out the approach that the FRC takes in supervising audit firms, with the goal of promoting good practice in order to strengthen capability, and addressing concerns in a timely and effective manner.

At the heart of our approach are three teams within the FRC's Supervision Division – Audit Firm Supervision, Audit Market Supervision and Audit Quality Review. These teams are dedicated to promoting audit quality and fostering resilience among firms.

Over the past two years, we have made significant strides, including the introduction of Public Interest Entities Auditor Registration, Supervisor letters, and Single Quality Plans. The FRC has also taken on the role of shadow system leader for local audit, highlighting our commitment to ensuring high-quality audits in the public sector as well as the corporate sector.

The FRC's supervisory activity is not only in the best interest of audit firms but also in the public interest, and we believe that fair, proportionate and assertive engagement with firms is critical to protecting that interest.

We are confident that the approach outlined in this publication will continue to support the highest standards of audit quality in the United Kingdom, and we look forward to working with the audit community to achieve this goal.

- Foreword by Deputy Chief Executive and Executive Director of Supervision

- Introduction

- 1. Our approach to supervision and what we expect from firms

- 2. Focusing on those firms that have the greatest impact

- 3. Supervisory activities

- Engagement framework of regular meetings

- Audit inspections

- Audit practices' system of quality management (ISQM 1)

- Review of root cause analysis, action planning and audit quality plans

- Cross-firm review of key supervisory pillars

- Developments since March 2021

- Audit thematic reviews; Thematic briefings; Dear Head of Audit letters

- 4. Holding firms to account

- 5. Measuring success

- 6. Future priorities

- Appendices

Introduction

The FRC's purpose is to serve the public interest by setting high standards of corporate governance, reporting and audit, and by holding to account those responsible for delivering them. We are the UK's statutory audit regulator. This means we:

- set ethical, auditing and assurance standards and guidance, as well as influence the development of these standards globally

- are responsible for the registration of auditors who carry out PIE audit work

- inspect the quality of audits performed at Public Interest Entities (PIEs1) and the implementation of PIE audit firms' systems of quality management

- set eligibility criteria for auditors and oversee delegated regulatory tasks carried out by professional bodies such as qualification, training, registration and the monitoring of non-public interest audits, and

- bring enforcement action against auditors, if appropriate, in cases of a breach of the relevant requirements.

Overall, we seek to promote high audit quality and a resilient UK audit market

Overall, we seek to promote high audit quality and a resilient UK audit market.

The Government Paper, Restoring Trust in Audit and Corporate Governance was published in March 2021. By the time the consultation closed in July 2021, BEIS received over 600 responses covering all areas of the Paper. The Government Response to the consultation was then published in May 2022 and includes details on which proposals, including new supervisory responsibilities and powers, the government intends to take forward, which have been amended or dropped from the reform package, and how these changes will be implemented. We published our Position Paper in July 2022, providing clarity on how the FRC will address issues in the Government Response which fall within our remit. It allows our stakeholders to understand how that work will be delivered by building on the 'what' in the Government Response, and explaining the 'how' and 'when'.

This publication focuses on our current audit supervisory activities under existing powers in relation to UK firms that audit PIEs (PIE audit firms) and Major Local Audits (MLAs).

It does not cover, except at the highest level, our new responsibilities as system leader for local audit, which is subject to legislation. Our inspections of MLAs aims to hold audit firms to account for making the changes needed to safeguard and improve audit quality. As the firms that undertake MLAs all audit PIEs, our work on MLAs informs our supervisory work for those firms.

The Recognised Supervisory Bodies (RSBs) play an important role in the regulation of non-PIE audit firms (and local audits) and contribute to the regulation of the PIE audit firms. Appendix 1 summarises the delegation of certain statutory responsibilities from the FRC to the RSBs.

1. Our approach to supervision and what we expect from firms

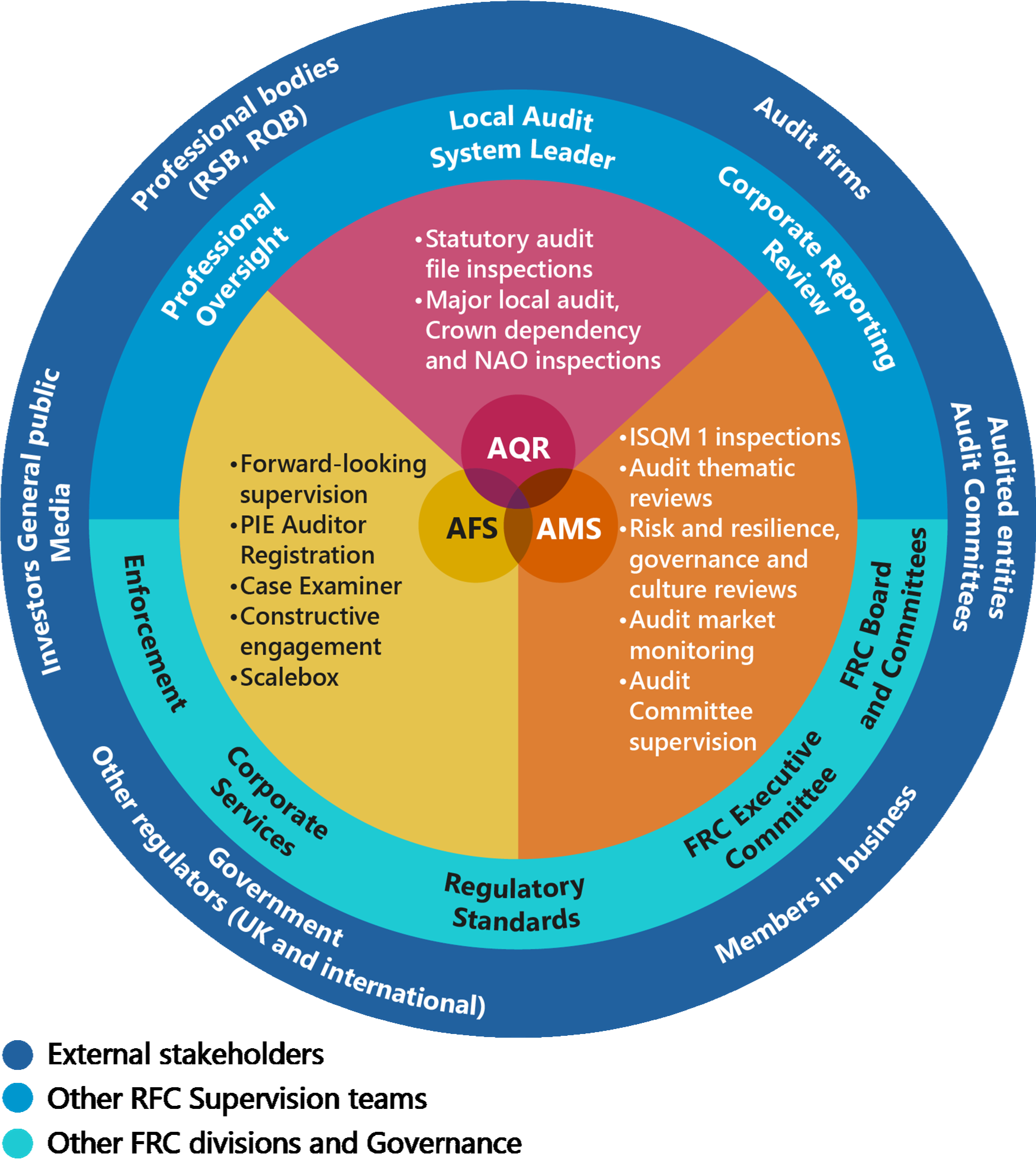

Our supervisory approach is forward-looking – identifying and prioritising what firms must do to improve audit quality and enhance resilience. Our three teams (Audit Firm Supervision (AFS), Audit Market Supervision (AMS) and Audit Quality Review (AQR)) balance an assertive approach, holding audit firms accountable, while also acting as an improvement regulator, identifying and sharing good audit practice to drive further improvements across the sector.

We focus our risk-based supervision on those firms that have the largest share of the UK PIE and MLA audit market, and thus where weaknesses in the firm would have the greatest impact on overall audit quality. Our approach is therefore proportionate and includes a tier-based approach (further detailed in Section 2), with each Tier 1, 2 and 3 firm having a dedicated Supervisor.

We have continued to build on the breadth and depth of our work with firms, including a new Overview Report,2 first issued with the Tier 1 public reports in July 2022, that included the challenges and key matters arising, increased interaction with smaller firms and the nature and extent of the thematic work undertaken. The depth of the Supervisors' knowledge and understanding of the firms has resulted in more focused engagement and facilitated a broader understanding across the FRC.

We balance an assertive approach, holding audit firms accountable, while also acting as an improvement regulator

In the last two years we have also continued to develop our forward-looking approach with initiatives including the introduction of PIE Auditor Registration, Supervisor letters and Single Quality Plans; an increased focus on Tier 2 and Tier 3 firms; and the development of the Audit Firm Scalebox initiative. Also, as part of our engagement and outreach with stakeholders (which is an expectation under the Regulators Code), we have been participating in Project Spring,3 a collaborative project with audit committee chairs exploring high-quality auditing and reporting. We have also become the shadow system leader for local audit while we await legislation to create ARGA. These key developments are detailed in Section 3.

In the last two years we have continued to develop our forward-looking approach with initiatives including the introduction of PIE Auditor Registration

As we transition to ARGA, our future priorities, as detailed in Section 6, include the implementation of the Audit Firm Scalebox, reporting to the firms on the implementation of operational separation, increasing the supervision of audit firm culture and, through the Developing AQR project, improving the transparency and effectiveness of our AQR inspection process.

The supervisory teams continue to engage with the senior leadership, independent non-executives (INEs) and audit non-executives (ANEs) of the firms. They are also communicating clearly what actions a firm must prioritise to promote audit quality and a resilient audit market. Firms have an obligation under their professional bodies' membership rules to cooperate with the competent authority. There is therefore an expectation that firms will be open and honest in their dealings with us, taking the initiative to raise issues of possible concern at an early stage (this is a requirement under the PIE Auditor Registration Regulations, which state that firms and Responsible Individuals (RIs) at those firms must deal with the FRC in an open, cooperative and timely manner). We do not expect firms to approach their relationship with us as a negotiation, but, in coming to our judgements, we will review the evidence presented by firms and listen to their views.

We seek to be transparent in the clear articulation of our expectations and concerns in both our private communications with the audit firms and other stakeholders, and our public reporting.

Our three supervisory teams

Our supervision of PIE and MLA audit firms, under our statutory responsibilities, is carried out by three teams (AQR, AFS and AMS), working closely together and in cooperation with colleagues in our Professional Oversight Team, responsible for oversight of the regulatory activities of the RSBs, and our Regulatory Standards and Enforcement Divisions.

The three teams build an overall view of the key issues for each firm. They also work together to develop plans for future supervision work. For example, issues identified as occurring regularly in audit inspections are considered as topics for thematic reviews; assessment of the effectiveness of a firm's implementation within its methodology to meet new auditing standards informs the scope of audit inspections; and concerns identified by a Supervisor of a particular firm can be assessed for wider impacts by a piece of cross-market work.

Our overall supervision of the firms draws together the results of work undertaken by all three teams as well as other areas of the FRC

Firm feedback

'Direct point of contact While it may be fairly simple, the firm Supervisor has created a direct point of contact with whom our appointed partner can have open conversations, providing a simple escalation route, so that as a firm we can ensure that any issues are raised and resolved swiftly.

The appointed Supervisor also means that, as a firm, we can probe and fully understand any feedback we are receiving to ensure that the correct actions are being taken that will have the greatest impact to improve audit quality.'

Audit Firm Supervision

Audit Firm Supervision is responsible for our overall supervision of the firms, drawing together the results of work undertaken by the other two teams, as well as other areas of the FRC. The dedicated Supervisors for the Tier 1, 2 and 3 firms have a deep and broad understanding of the various audit-quality initiatives being undertaken by the PIE audit firms. They act as a central point of contact both for the firm and within the FRC (for that firm). This role is undertaken on a proportionate basis.

The dedicated Supervisors for the Tier 1, 2 and 3 firms have a deep and broad understanding of the various audit-quality initiatives being undertaken by the PIE audit firms

Firm feedback

'We appreciate the confidential insight that the Supervisor can provide to the firm, and the periodic aggregation of these views into a formal report will assist both us, and the FRC, to focus on the key priority areas going forward.'

We also lead on holding firms to account through enforcement (in respect of completed investigations where we monitor non-financial sanctions) and constructive engagement. We agree actions with the firm to improve audit quality or prevent recurrence of an identified issue and monitor their implementation.

Since December 2022, AFS has led our work on the registration of PIE auditors and audit firms (including, where applicable, non-UK firms and the National Audit Office – the NAO).

Audit Market Supervision

Audit Market Supervision takes a cross-market approach to areas of importance to audit quality and firm resilience, including firmwide inspection work to ensure compliance with the International Standard on Quality Management (ISQM 1). Staff have a range of backgrounds (governance, risk management, internal audit, culture, regulation, and audit) representing the broad subject matter within the team's remit.

Firm feedback

'Benchmarking of good practice and areas for improvement The insights we obtain from the FRC through its reporting of good practice across the Tier 1 firms and the areas of improvement specific to our firm, provided in both firmwide and thematic reviews, are incredibly powerful.

We are able to understand where, as a firm, we can: – make adjustments to policies and procedures to enhance audit quality; – learn from our peers; and

– understand which changes will have the biggest impact, so we can prioritise.

A specific example of positive engagement is the recent publication What makes a good environment for auditor scepticism and challenge, which was then followed by a tailored private report for each firm. This confirmed areas for us to continue as well areas to consider implementing which we are building into our refreshed culture plan. This is a very practical example of good engagement both ways.'

Audit Quality Review

Audit Quality Review undertakes inspections of PIE audits, and also (under separate arrangements) Crown Dependency and MLAs undertaken by the PIE audit firms. AQR also performs full-scope inspections of NAO audits, audits by third country audit firms and certain Crown Dependency audit firms.4 It comprises suitably qualified and skilled staff with extensive previous audit experience, including sector and IT specialists.

Governance

Our supervisory work is overseen by the FRC Board, supported by the Supervision Committee5 (a subcommittee of the Board), to which it delegates some of its responsibilities. The Board is made up of non-executives, Deputy Chief Executive and the Chief Executive. All Board members are appointed by the Secretary of State for Business and Trade.

The Board's role is to provide strategic leadership of the FRC within a framework of prudent and effective controls that enable risk to be assessed and managed. The Board sets the FRC's strategic aims, ensures that the necessary financial and human resources are in place for the FRC to meet its objectives, and reviews management performance. The Board also sets the FRC's values and culture, and ensures that its obligations to its stakeholders and others are understood and met.

Working with other parts of the FRC

Our supervisory activities, including audit selection, identification of areas of focus and potential thematic reviews, are informed by regular dialogue with the Audit and Assurance Policy team (responsible for setting auditing and ethical standards) and the Economics, Strategy and Analytics team (which provides market intelligence that informs our selection of audits to inspect and priority sectors).

There is a rich feedback loop between standard setting, supervision and enforcement

As well as gaining technical auditing and ethical standards advice from the Audit and Assurance Policy team, our staff are supported on accounting and corporate reporting issues by dialogue with the Corporate Reporting Review (CRR) team, which reviews the Directors' and strategic reports and accounts of public and large private companies (subject to, where necessary to protect confidentiality, suitable safeguards).

In turn, the findings from our inspection work provide feedback and evidence for the Audit and Assurance Policy team in their considerations regarding future developments in both UK auditing and ethical standards, and their work to influence the development of international standards.

The Audit and Assurance Policy team also has regular engagement with the ethics partners of the largest firms and hosts technical advisory groups to provide a forum for discussion of topical issues for the wider audit market. In December 2022 the Audit and Assurance Policy Team launched the Audit & Assurance Sandbox,6 which is intended to deal with specific technical auditing and ethical standards issues, as well as support innovation in the market.

Our work can also lead to formal investigations into individual audits or the quality control arrangements in place at a firm. This is usually undertaken by the FRC's Enforcement Division (see Section 4 for more information).

The Professional Oversight Team is responsible for overseeing the work that it delegates to the RSBs in respect of the audit of non-PIEs.

All these interactions form part of a rich feedback loop between standard setting, supervision and enforcement across the profession. Appendix 2 summarises the Audit Firm Supervision structure at the FRC.

Communication with other regulators is important for our work

Working with other regulators

Communication with other regulators, in both the UK and internationally, is important for our work, as explained below. Where appropriate, our relationship is covered by a Memorandum of Understanding (MoU).

Recognised Supervisory Bodies (RSBs)

As well as being chartered accountancy membership organisations, the RSBs (ICAEW, ICAS, CAI, ACCA) – recognised under statute are delegated certain tasks by the FRC and perform an important role in the regulation of audit, including inspecting audits of entities that are non-PIEs at both the PIE and non-PIE audit firms.

Prudential Regulatory Authority (PRA)

We share information with the PRA,7 primarily to inform the PRA of audit issues which may be relevant to its supervision of banks and insurers. Reciprocally, our risk assessment and audit file selection process is informed by information received through regular dialogue with the PRA. The FRC and the PRA meet regularly to discuss risks in the sector and share experiences in respect of financial services accounting and auditing.

Financial Conduct Authority (FCA)

We collaborate with the FCA8 (and the PRA) on matters related to individual entities and the wider financial markets. Periodically, the FRC convenes a Joint Forum on Audit Firm Contingency Planning, attended by the FCA and other peer regulatory bodies, where we share insights and discuss risks relating to the resilience of the largest audit firms and the functioning of the wider UK audit market generally.

International Forum of Independent Audit Regulators (IFIAR)

The largest UK audit firms are part of global networks with member firms in many other jurisdictions. Audit is regulated at a national level and IFIAR brings together independent audit regulators from around the world. The FRC is a member and actively contributes to its activities. IFIAR regularly engages with the global network firms to influence their continual improvements to audit quality. It enhances the capabilities of its members through consultation, training, and a collaborative knowledge-sharing network. The ultimate goal for this collective activity is to improve audit oversight worldwide and advance sustainable high-quality audits.

The FRC also has regular bilateral conversations with other international audit regulators in key financial markets so that we can share good practice, discuss emerging and evolving concerns, and develop ways to support audit quality and promote audit market resilience. We also undertake joint inspections of the audits of entities of mutual interest.

2. Focusing on those firms that have the greatest impact

We group the PIE audit firms into three tiers, based on their impact on the UK audit market, and we review annually each firm's tier status and inform the firm of the tier to which they have been assigned. This provides firms with a broad indication of the level of supervisory activity to expect. We also aim to issue firms, at least annually, with a forward look of specific supervision activities to assist their forward planning.

We review annually each firm's tier status, which provides firms with a broad indication of the level of supervisory activity to expect

Our audit inspection programme continues to be risk-based and focused primarily on those firms carrying out audits in which the public interest is greatest. We annually review the firms with the largest share of the UK PIE and MLA markets (Tier 1), which together audit approximately 1,290 PIEs, including the majority of UK-incorporated FTSE 350 entities. Around 31 firms audit the remaining (circa 230) PIE audits, based on the current definition of a PIE. Of these firms, only a few audit a significant number of PIEs and these firms are inspected at least every three years (Tier 2). The remainder, most of which audit fewer than five PIEs, are inspected at least once every six years (Tier 3).

Taking a similar, proportionate approach, we vary the intensity of our forward-looking supervisory work across the three tiers of PIE audit firms. For Tier 1 firms, in addition to the annual AQR inspection cycle, we also assess the audit practice's system of quality management (ISQM 1) annually and carry out other cross-firm thematic reviews. The Tier 2 firms will ordinarily have a significant portfolio of PIE audits (usually at least ten) and we also take into account the nature of the firm's PIE audits and other risk factors that may apply, for example, the firm's growth plans or specific risks to audit quality.

By using a tier-based, proportionate approach, we vary the intensity of our forward-looking supervisory work

There are also a number of other PIE audit firms which are not included in the tiering. These are the NAO and Crown Dependency audit firms (which are subject to separate arrangements) and non-UK firms (which are part of the Third Country Audit regime).

The FRC is increasing its support to other firms that are looking to enter the PIE audit market (referred to as ‘Tier 4'). A key element of this additional support is the Audit Firm Scalebox (see below), which is being launched in Spring/Summer 2023.

The following table summarises our approach across the three Tiers. More details on the various activities noted in the table are provided in Section 3.

| Category | Measure | Target (FY) | 2021/22 (FY) | 2022/23 (HY) |

|---|---|---|---|---|

| Current allocation of firms (subject to change as the market evolves) | Largest seven firms9 | |||

| A further five to seven firms, based on our current risk assessment. Firms with more than ten PIE audits are likely to be in this tier10 | ||||

| Remaining PIE audit firms (other than NAO and non-UK firms) | ||||

| Engagement Framework of regular meetings | Full | |||

| Independent non-executives (INEs), senior partner and Head of Audit meetings only | ||||

| No | ||||

| Audit inspections | Annual (at least five audits inspected each year) | |||

| Typically a three-year cycle (two or three audits). Annual risk-based sample of firms | ||||

| A maximum of a six-year cycle plus ad hoc inspections to address risks (one or two audits) | ||||

| Audit practice system of quality management (ISQM1) | Annual (currently topics addressed in rotation over a three-year cycle) | |||

| Smaller firms programme (may be extended at our discretion) | ||||

| Smaller firms programme | ||||

| Review of audit strategy and audit quality plans | Yes | |||

| Yes, in the year of AQR audit inspection, plus annual updates for significant changes | ||||

| Firms on six-year cycle – no (may undertake a review at our discretion, particularly if inspection on an accelerated timeframe) | ||||

| Action plan follow up | Yes | |||

| Yes | ||||

| Yes | ||||

| Supervisory pillars and thematic reviews | Full scope | |||

| At our discretion | ||||

| No | ||||

| Pre-appointment meetings | Yes | |||

| Head of Audit and INEs | ||||

| No | ||||

| Risk reporting protocol | Yes | |||

| Yes | ||||

| No |

| Conveying supervisory messages | Tier 1 firms | Tier 2 firms | Tier 3 firms |

|---|---|---|---|

| Annual supervisor letter to the firm's leadership | Tailored, annual | Tailored, annual | Generic, annual. Risk-based tailored elements where appropriate |

| Firm-level reporting | Annual public report for each firm (and an Overview Report summarising key messages for our work across the Tier 1 firms) | Included in consolidated public report on the smaller firms | Included in consolidated public report on the smaller firms |

| Individual audit inspection reports | Private to firm and audit committee | Private to firm and audit committee | Private to firm and audit committee |

| Published audit thematic reviews | Yes | No | No |

| Constructive engagement | Private | Private | Private |

PIE auditor registration

| PIE auditor registration | Tier 1 firms | Tier 2 firms | Tier 3 firms |

|---|---|---|---|

| PIE audit firm and auditor registration (5 December 2022) | Yes | Yes | Yes |

Firm feedback

'During our work with the FRC as part of our commitment to audit quality, we've found our Supervisor to have a good balance between supportive and challenging. They have been happy to have open discussions about initiatives we are considering, giving views on documents and messages we are sharing with the practice and encouraging us to bring the best in from what they see from other firms. Whilst very time consuming, the relationship we have developed with our FRC contacts has assisted us significantly in our direction of travel and helped to prioritise on the activities which make the most difference to audit quality.'

Audit Firm Scalebox

The 'Scalebox' is an initiative being launched in 2023/24 to provide bespoke input outside the FRC's formal supervision and inspection processes to Tier 2 and Tier 3 firms, as well as firms that are considering entering the PIE audit market (Tier 4). This is with the aim of improving audit quality and promoting resilience and competition in the audit market.

The Audit Firm Scalebox, will provide Tier 2, 3 and 4 audit firms, bespoke input outside the FRC's formal supervision and inspection processes

Through closer, direct access to the FRC, the Scalebox will help Tier 2, Tier 3 and Tier 4 audit firms:

- better understand the FRC's regulatory regime

- meet the high-quality standards expected by the FRC, and

- develop robust quality management systems to improve and maintain quality as they grow.

The types of activities that the Scalebox will conduct with firms include inspection of individual non-PIE audits (not currently within the FRC's scope) and reviewing and providing feedback on a firm's system of quality management and governance arrangements.

3. Supervisory activities

This section describes how, in practice, we supervise firms in Tier 1. The Tier 2 and Tier 3 firms are subject to some of the below elements, as set out in the table in Section 2.

Our supervisory work comprises the following types of activity

Engagement framework of regular meetings

Our supervision involves engagement with firms at all levels of seniority. At a senior level, key role holders should expect regular dialogue with us, either in groups or on an individual basis.

Key role holders at the firms should expect regular dialogue with us

Firm feedback

'Engagement framework meetings We have found the Engagement framework meetings to be an important element in developing and maintaining a productive two-way relationship with the FRC. Through these meetings we have been able to develop an open relationship at senior levels, which provides an avenue to discuss and identify resolution to issues as they arise.'

To inform our overall supervisory activity, develop and maintain productive dialogue with the firms and hold senior individuals at the firms to account, we have a programme of regular meetings, known as the 'engagement framework'. For each Tier 1 firm we hold twice-yearly meetings as follows:

- INEs (without the attendance of partners or staff from the firm)

- ANEs (for firms that have operationally separate audit practices, without the attendance of partners or staff from the firm)

- Firm leadership (the individual in the senior partner/chief executive role, or equivalent)

- Audit leadership

- Ethics partner

- Culture leadership (the individuals responsible for developing and promulgating the firm's culture)

- Risk leadership (the individual in the chief risk officer role, or equivalent)

- Finance leadership (the individual in the chief finance officer role (or equivalent) for the firm) annually to discuss the firm's financial results and budget.

To maintain our proportionate approach, the programme is reduced for Tier 2 firms, at which we meet with INEs, firm leadership and audit leadership only. We do not meet routinely with senior management of Tier 3 firms, except in the course of audit inspections.

Audit inspections

We select individual audits for inspection from a firm's audit portfolio, balancing several factors, including the size of the entity, the risk associated with the audit, how recently we inspected audits of that entity previously and the grading of those inspections, and random selections. We aim to inspect audits of all FTSE 350 companies at least every five years.

Our audit inspection activity includes a focus on the audits where we might be more likely to find significant audit quality issues and where the lack of high-quality corporate reporting will have the most adverse impact. In December the FRC publishes its priority sectors and areas of focus for the year ahead. Factors that may indicate high audit risk include where the group or entity:

- is in a high-risk sector or geography

- is experiencing financial difficulties and/or has a volatile share price and high short-selling interest

- has balances with high estimation uncertainty, or

- where the auditor has identified governance or internal control weaknesses in previous years.

Firm feedback

'A constructive regulatory relationship is, in our view, a critical feature in the overall ecosystem. The clarity provided by the identification of the FRC of priority areas is constructive, facilitating focused discussions on key matters. Of particular note is the time taken by both the Supervisor and AQR inspection teams to provide more balanced feedback to the engagement teams and firm functions that are subject to inspection activities. This feedback is constructive, supports auditor confidence, enables us to undertake root cause analysis on positive contributory factors, and directly contributes to the culture within our audit practice.'

The risk to audit quality also increases where audit teams are required to assess and conclude on complex issues of judgement, for example:

- headroom on impairment assessments may be lower and the entity's balance sheet may be more sensitive to changes in key assumptions, and

- going concern assessments are less clear cut.

We maintain the flexibility and discretion to alter the specific audits inspected and overall number of inspections in response to the changing market environment, and where the nature of the company and its audit pose new or difficult challenges.

Firm feedback

'We value the FRC approach to audit firm supervision and are supportive of the principles and the overall objectives that the FRC have in this area. In particular we welcome the greater transparency and the focus on identifying and sharing good practice within the industry to support overall improvements in audit quality.'

Our inspectors do not review an entire audit but rather focus on areas of higher risk. Our reviews of individual audits place emphasis on the appropriateness of key audit judgements made in reaching the audit opinion and the sufficiency and appropriateness of the audit evidence obtained.

Our reviews of individual audits place emphasis on the appropriateness of key audit judgements

Following each inspection, we form a view on the quality of the audit work we have examined and provide an overall assessment for each audit. The categories are:

- Good (1)

- Limited improvements required (2)

- Improvements required (3), and

- Significant improvements required (4).

The outcome of each review is reported to the audit firm and to the audit committee chair of the audited entity.

Audit committee chair feedback

'We have received feedback from audit committee chairs that the opening meetings helped clarify the inspection process, and it was good providing the time to discuss the report in the final meeting, where this was needed. The reports were also seen as being clear and in plain English so they were understandable by all the Board. Also that the reports were balanced, and it was appreciated that the good practice had been put up front.'

The quality and consistency of individual audit inspection work is supported by our two-stage quality control (QC) process (including a panel of senior AQR staff and then executive review by a director). At both stages there is an independent review of the evidence used to support the assessment rationale and challenge of the inspection team on their findings and conclusions.

Final decisions on our overall assessment of individual reviews rest with the Director of AQR. They can seek advice from the FRC's Senior Advisors11 and members of the FRC Advisory Panel12 (for example, on reviews where the decision is complex and/or finely balanced). By exception, firms can request that the overall assessment is reconsidered independently of the FRC staff who were involved in the inspection and original decision. Such reconsideration is undertaken by a panel of advisors/senior advisors, who make a recommendation to the Executive Director of Supervision, whose decision is final.

Audit practices' system of quality management (ISQM 1)

ISQM 1, which came into effect on 15 December 2022, sets out the quality management requirements for firms that perform audits, reviews of financial statements and other assurance and related engagements. It requires firms to establish and maintain a system of quality management, centring on establishing quality objectives, identifying and assessing quality risks, and designing and implementing responses to them. It also requires firms to design and implement monitoring and remediation activities, including root cause analysis (RCA), to ensure the effectiveness of these responses and address deficiencies arising. This system of quality management needs to cover:

- governance and leadership within the firm

- relevant ethical requirements

- acceptance and continuance of relationships with audited entities and specific engagements

- resources (including human, technology and intellectual)

- network resources and services providers relied upon in the firm's system of quality management

- engagement performance (including implementation of ISQM 2, which relates to the appointment, eligibility and responsibilities of an Engagement Quality Reviewer), and

- information and communication.

ISQM 1 came into effect on 15 December 2022

In the first year of ISQM 1 application we will focus on the firms' risk assessment processes and completeness of risks identified

In the first year of ISQM 1 application we will focus on the firms' risk assessment processes and completeness of risks identified. In addition, we will review areas of the system of quality management that are new or we feel are higher risk. In these areas we will look at the design and implementation of responses. On an ongoing basis, our inspection will be undertaken on a risk-focused and cyclical basis, supported by targeted thematic work where we will perform in-depth reviews of particular aspects of firms' systems of quality management.

Our work will assess how firms have tailored their system of quality management to their specific circumstances and use benchmarking against their peer group to identify good practice and areas for improvement. We will review how firms monitor their system of quality management, how they identify and assess findings, and how they design and implement remediating actions. We will also perform testing of the operational effectiveness of the responses and monitoring procedures in place.

Under ISQM 1, firms are required to perform an annual evaluation of their system of quality management. We will review the processes in place to perform this evaluation as well as the outcomes.

ISQM 1 requires a holistic approach to design and implement a system of quality management, which necessitates a commensurately broad approach to supervising the firms. Therefore, our supervision of ISQM 1 will draw on, and integrate with, the work of the other AMS supervisory pillars being Governance and Leadership; Culture and Conduct and Risk Management and Resilience.

Our supervision of ISQM 1 will draw on, and integrate with, the work of the other AMS supervisory pillars

The quality and consistency of our ISQM 1 and 2 inspection work is supported by a similar quality control and peer-review process to that employed for inspections of individual audits, together with oversight from the Executive Director of Supervision, and the FRC's Board Committees.

Significant findings from this inspection activity are reported annually in the public reports on each Tier 1 firm and, since December 2022, for the Tier 2 and 3 firms on an anonymised basis.

Review of root cause analysis, action planning and audit quality plans

We supervise by holding firms to account through assessment, challenge, setting actions and monitoring progress. This review includes the firms' detailed root cause analysis, the proposed remedial actions being undertaken to address findings and the integration of those actions into the firms' audit quality plan (AQP). It is important that the firms respond to identified deficiencies and focus on measurable audit quality improvements.

We now require all Tier 1 firms to maintain a single quality plan (SQP) to monitor the progress and effectiveness of actions to improve audit quality and, where necessary, resilience, and facilitate our holding firms to account.

Cross-firm review of key supervisory pillars

It is the responsibility of each firm's leadership to manage the firm effectively to ensure audit quality and firm resilience. However, as part of our wider role, we undertake cross-firm projects to assess the effectiveness of the firms' arrangements in the areas listed below. These projects are reported privately to the firms included in the work, with anonymised, peer-benchmarking data (usually Tier 1 and Tier 2 firms separately) to promote improvements that support audit quality and audit market resilience.

Governance and leadership

All firms in Tier 1, the majority in Tier 2, and (currently) one Tier 3 firm, fall within the scope of the Audit Firm Governance Code (revised 2022). The scope of the Audit Firm Governance Code is based on a threshold of a firm auditing 20 PIEs, whereas our tiering decision also includes a risk based assessment of the audit firm and their PIE audit portfolio. We review the effectiveness of the firms' governance arrangements and consider any risks that these arrangements may pose to audit quality or resilience.

Culture and Conduct

Audit firms need the right culture to drive the right behaviours, which in turn are necessary for high-quality audits. We undertake work to assess and monitor various aspects of the culture at the firms, with a specific focus on the behaviours and mindset that correlate to high-quality audit. We also expect firms to have an ethical culture, and we monitor ethical conduct matters, including non-financial misconduct.

Audit firms need the right culture to drive the right behaviours, which in turn are necessary for high-quality audits

Firm case study

During 2021 the firm started a programme to redefine their audit quality culture. Their desired audit quality culture was based on the FRC's vision for an audit quality culture, as outlined in the June 2021 culture conference. The firm appointed a dedicated audit culture lead and have launched numerous culture initiatives to embed their desired audit quality culture.

The firm have further enhanced their culture survey to assess the behaviours that drive high-quality audits. The latest culture survey indicates that they have seen an improvement in the behaviours of scepticism and challenge, and an evolution of their culture to one that prioritises stakeholder confidence and the public interest over 'client service'. The firm believes that improving audit quality culture is an ever-evolving process, embedded within the wider firm culture and values. They continue to monitor progress and implement specifically focused initiatives designed to continually enhance the culture of audit quality.

Risk management and resilience

The firms should manage their business environment to ensure that high-quality audit services can be provided without interruption. Firms should have robust frameworks in place for risk management – including financial, operational, regulatory and network risks that could all have consequential impacts. Controls should be proportionate to the nature, scale and complexity of the firms' businesses (not just audit) and should be overseen by competent and sufficiently independent second and third 'lines of defence' risk management and internal audit functions. We undertake work to assess the effectiveness of these supporting control functions at the firms, the robustness of firms' crisis and contingency planning (including recovery and resolution planning for extreme events) and the adequacy of firms' professional indemnity insurance coverage.

Firm feedback

'Our firm's risk management and internal audit arrangements were assessed by the FRC against recognised external benchmarks. The feedback we have received from the FRC has been instrumental in driving the formalisation and maturity of our approach to 2nd and 3rd lines of defence.'

Financial information and Key Performance Indicators

The firms should manage their cash flows, borrowings and investments in a way that provides sufficient liquidity headroom to withstand both planned periods of high cash utilisation (for example, annual staff bonuses and partner drawings) and unexpected events that place a material stress upon their future earning capacity or their cash collection. They should develop and monitor appropriate management information to do this. We expect regular reporting from Tier 1 firms on certain management information and will monitor this for evidence of risks to a firm or across the market. We also engage with the chief finance officer of each Tier 1 firm annually to discuss their budgets and financing arrangements (as mentioned above in the section on the Engagement framework).

Operational separation

The four largest audit firms (Deloitte LLP, Ernst & Young LLP, KPMG LLP and Pricewaterhouse Coopers LLP) are transitioning to operational separation of their audit practices, with a final deadline in 2024. The FRC published Principles for Operational Separation of Audit Practices in July 2020 (updated in February 2021), which these firms have agreed to meet. The objectives of operational separation are (a) to improve audit quality by ensuring that people in the audit practice are focused above all on delivery of high-quality audits in the public interest, and (b) to improve audit market resilience by ensuring that no material, structural, cross-subsidy persists between the audit practice and the rest of the firm. Each firm has developed a transition plan and many elements of operational separation will be in place well in advance of this deadline. All the firms have established an Audit Board, with a majority of independent ANEs, and are reporting benefits from the increased governance focus that this brings.

The four largest audit firms are transitioning to operational separation of their audit practices, with a final deadline in 2024

Our supervision of operational separation is evolving. In each transition year we assess the effectiveness of the arrangements in place and the progress of the firms' transition plans, and report our findings privately to the firms.

The other Tier 1 firms of BDO, Grant Thornton and Mazars are implementing certain elements of operational separation, such as setting up of Audit Boards, and we will provide feedback to these firms in a similar fashion.

After the end of the transitional period in 2024 we intend to publish an assessment of the effectiveness of the four largest firms' arrangements for operational separation.

Pre-appointment meetings for key roles

We expect the individuals stepping into certain key roles at the Tier 1 and Tier 2 firms to attend a meeting with the FRC before appointment is confirmed, to ensure that they have the right characteristics and experience for the role and to communicate our regulatory expectations. Some of these meetings include one of the FRC's Senior Advisors or Advisory Panel members to enhance the rigour of our conversation. The roles in scope for this are:

- Senior partner/managing partner (CEO role) – Tier 1

- INEs - Tier 1 and 2

- ANEs – Tier 1 firms that have implemented operational separation

- Head of Audit – Tier 1 and 2

- Ethics partner – Tier 1

- Chief Risk Officer (or equivalent) – Tier 1

- Chair of the Governance/Oversight Board – Tier 1

Risk reporting protocol

We have an agreed protocol with the Tier 1 and Tier 2 firms, which are required to notify the FRC without undue delay of incidents which occur either in the UK or across the firm's global network which could reasonably be considered to pose a significant financial, operational or reputational threat to the UK firm.

Developments since March 2021

Introduction of PIE Auditor Registration

The FRC is now responsible for the registration of all firms which carry out statutory audit work on PIEs, in addition to the ongoing requirement for firms and Responsible Individuals (RIs) to register with their RSB. The FRC's registration remit includes firms and relevant Rls which audit one or more PIEs, which includes UK-incorporated entities listed on the London Stock Exchange (or other UK-regulated market); a UK registered bank, building society or other credit institution (but not credit unions or friendly societies); or a UK insurance entity which is required to comply with the Solvency II regulations.

All firms and RIs carrying out statutory audit work on PIES were required to register with the FRC by 5 December 2022 under a set of transitional provisions

All firms and RIs carrying out statutory audit work on PIEs were required to register with the FRC by 5 December 2022 under a set of transitional provisions.

Thereafter, any firm that plans to take on a PIE audit, or remain auditor to an entity that is to become a PIE (for example, if it obtains a listing on the London Stock Exchange, together with relevant RIs), must register with the FRC before undertaking any PIE audit work.

Further information is available on the PIE Auditor registration process and requirements, including the regulations, guidance and other supporting documents,13 as well as a link to the PIE Auditor Register, which contains the names of all of the firms and RIs registered with us.

Annual Supervisor Letters

The Annual Supervisor Letters (ASLs) were introduced at the end of 2021. The ASL is a private letter that takes stock of the work conducted by the FRC in relation to each Tier 1 firm. The letter prioritises those matters assessed by the firm's Supervisor to be the most important in respect of safeguarding and improving audit quality and firm resilience. An assessment was made against eight categories that have been identified as those that are key to delivering a high-quality audit practice. Each firm responded to the ASL outlining proposed actions, with regular updates provided over the year.

The ASL prioritises those matters assessed by the firm's Supervisor to be the most important in respect of safeguarding and improving audit quality and firm resilience

The second ASL for Tier 1 firms was issued in early February 2023 and we are currently assessing the adequacy of the firms' responses and proposed actions.

Firm feedback

'Based on our experience, we see the ASL as a helpful and carefully considered summary of the FRC's assessment and observations relating to our ongoing objective of delivering high-quality audits. In particular, it has assisted our executive management teams and governance bodies to ensure we invest in and focus on those parts of our audit practice that will enhance quality.

The ASL process has also, in conjunction with the FRC's wider engagement, assisted the firm in designing a Single Quality Plan (SQP), which we believe will help both the firm and the FRC ensure we direct our future resources and investment to agreed priority areas.'

Increased focus on Tier 2 and Tier 3 firms

In December 2022 we issued our first public report on the key messages from our supervision and inspection work at Tier 2 and Tier 3 firms. In this report, we identified that Tier 2 and Tier 3 firms had a 13% share of the PIE audit market in 2022/23 and this had grown from 9% in 2021/22.

In December 2022 we issued our first public report on the key messages from our supervision and inspection work at Tier 2 and Tier 3 firms

There is an unacceptable shortfall in the average quality of PIE audits undertaken by Tier 2 and 3 firms compared to those conducted by Tier 1 firms.

To address these challenges, we have increased our support for Tier 2 and Tier 3 firms through increasing our supervisory resources dedicated to these firms and sharing more good practice and forward-looking insights. Tier 2 and Tier 3 firms will also now have access to the Audit Firm Scalebox.

Single Quality Plans – Tier 1

The SQP, required for each Tier 1 firm, will demonstrate the firm's commitment and underlying approach to the continuous improvement of audit quality over time. The SQP should prioritise key actions and outcomes, and acts as a mechanism to facilitate our holding firms to account and monitor the progress and effectiveness of actions to improve audit quality and resilience.

Each Tier 1 firm is now required to maintain an SQP

Firm feedback

'Our Audit Firm Supervisor has been constructive and supportive in working with us to address the complexities and challenges associated with the transition to the SQP model and, importantly, acknowledging that the functionality of the SQP and nature of reporting needs to work for the firm first as well as the FRC. Having a direct point of contact, in the form of the Audit Firm Supervisor is considered to be vital by the firm, particularly given the increasing size and complexity of the FRC itself.'

Project Spring

As part of our engagement and outreach with stakeholders (which is an expectation under the Regulators Code) we have been participating in Project Spring. This initiative, led by the Audit Committee Chairs Independent Forum (ACCIF), brings together members of ACCIF, the FRC and the six largest audit firms in the UK to explore what might constitute common objectives and outcomes in a high-quality external statutory audit. Over a series of roundtable meetings, we have sought to find agreement, amongst participants, on a core set of essential and proportionate audit quality objectives and outcomes which every audit engagement and audit inspection should (at least) include. Whilst there has not yet been unanimous agreement across all participants, the sharing of information and the greater understanding of our various roles and responsibilities will support enhancements to the ecosystem for delivering higher audit quality.

Local audit system leader

We are responsible for monitoring the quality of MLAs. Our review of MLAs aims to hold audit firms to account for making the changes needed to safeguard and improve audit quality. Subject to legislation, ARGA will become the system leader for local audit.

Ahead of ARGA being implemented, an MoU14 has now been published which transfers the shadow system leader role for local audit from the Department for Levelling Up, Housing and Communities to the FRC. The FRC will have five areas of responsibility as shadow system leader ahead of ARGA. These include audit supervision activities such as reporting on the local audit system in England and leading work to bolster capacity and market supply.

Other ad hoc initiatives

We also conduct a variety of other ad hoc exercises (for example, exam cheating review) and various roundtables with the firms (for example, to share best practice on specific topics).

Conveying supervisory messages

We publish annual Audit Quality Inspection and Supervision Reports on Tier 1 firms, usually in July each year. These bring together the key findings from the three audit supervision teams. The breadth of these reports has been widened to include key findings from thematic reviews and observations relating to forward-looking supervision. In addition in 2022, for the first time, we issued an Overview Report which brought together all the key messages and reiterated why these reports are important and highlighted market-relevant challenges, such as the impact of audit firms 'de-risking' their audit portfolios by resigning or not re-tendering for certain audits considered by the incumbent auditor to be higher risk or outside the firm's risk appetite. We raised concerns that a number of these complex, challenging audits were picked up by Tier 2 and Tier 3 firms, who, in some cases, may not have sufficient resources or expertise to perform a high-quality audit of that entity. Our first public report on our aggregated key findings at Tier 2 and Tier 3 firms was issued in December 2022, and we intend to produce a similar report annually.

We expect firms to learn lessons from these inspections and take actions to improve audit quality across the firm

The outcomes of all individual audit inspections are privately reported to the audit firm and to the audit committee chair of the audited entity. Each report sets out our overall assessment of the quality of the audit, the specific key findings we identified and, where appropriate, examples of good practice observed. We expect firms to develop an appropriate action plan to ensure that our key findings are addressed in subsequent audits of the specific entity and also to apply the lessons learned from these inspections across the firm to improve audit quality and to promote good practice.

Concerns, observations and good practice arising from our inspection of a firm's system of quality management, including from our cross-firm benchmarking, are also privately reported to each firm in detail. Firms are expected to develop action plans to address our concerns, including how they will assess whether the actions they have taken have been effective.

We send a private ASL to each Tier 1 firm. These outline our view of the key audit quality and resilience risks. These letters are tailored to each firm. We ask firms to reply setting out the actions they will take in response to our letter.

Firm feedback

'Annual Supervisory Letter We have found that the Annual Supervisor Letter gives us great clarity of the FRC's views of our risks. We feel that by receiving this external challenge in a more structured and cohesive approach, we have been able to develop our Audit Quality Plan (and going forward our Single Quality Plan) and direct our efforts accordingly.'

Similarly, we send a private ASL to each Tier 2 firm, by the end of each calendar year, focused on the work we have done in respect of that firm in the year and any areas of particular concern where we want leadership at the firm to focus in the future.

Our private ASL to Tier 3 firms, also sent by the end of each calendar year, will be generic to all Tier 3 firms unless the firm has been subject to an inspection in that year. In all cases, we assess the actions a firm has taken in response to our letters at the time of our next inspection or sooner if considered necessary.

Audit thematic reviews; Thematic briefings; Dear Head of Audit letters

In addition to our direct supervisory activity, we publish other types of information and findings arising from our supervision and inspection work. Although much of the evidence for these publications derives from our work at the Tier 1 firms, the audience for them is wider and the findings and recommendations should be considered by all audit firms, particularly PIE audit firms.

In an audit thematic review, we look at firms' policies and procedures in respect of a specific area or aspect of the audit or system of quality management to make comparisons between firms, with a view to identifying both good practice and areas of common weakness. These reviews are chosen to focus on an aspect of audit or quality management arrangements in greater depth with extended benchmarking and analysis. One objective of our thematic reviews is to encourage the spread of good practices leading to wider improvement in audit quality.

Thematic briefings are similar to audit thematic reviews but are produced over a shorter period, enabling more agile reporting and influencing of audit quality.

Firmwide case study – climate-related firmwide work

In early 2022, the FRC performed a follow-up review of the climate-related firmwide work performed in the 2020 thematic, where we had reported that the quality of support, training and resources provided to the audit practice varied considerably across the seven largest audit firms, with some firms, at the time, only just starting to identify the impact of climate change risks on audits and only having limited oversight of how audit teams were responding to this risk in practice.

Our follow-up review in 2022 highlighted that all firms had shown progress in responding to the issues raised in the 2020 thematic, with most firms showing significant enhancements since 2020. All firms had, at a minimum, updated methodology to reflect climate change issues, provided climate-related training, and issued specific climate change-related communications to staff.

We also write to the Heads of Audit of the Tier 1 firms when we wish to highlight matters of emerging risks to audit quality. These letters are published on our website to enable all audit firms to access the information.

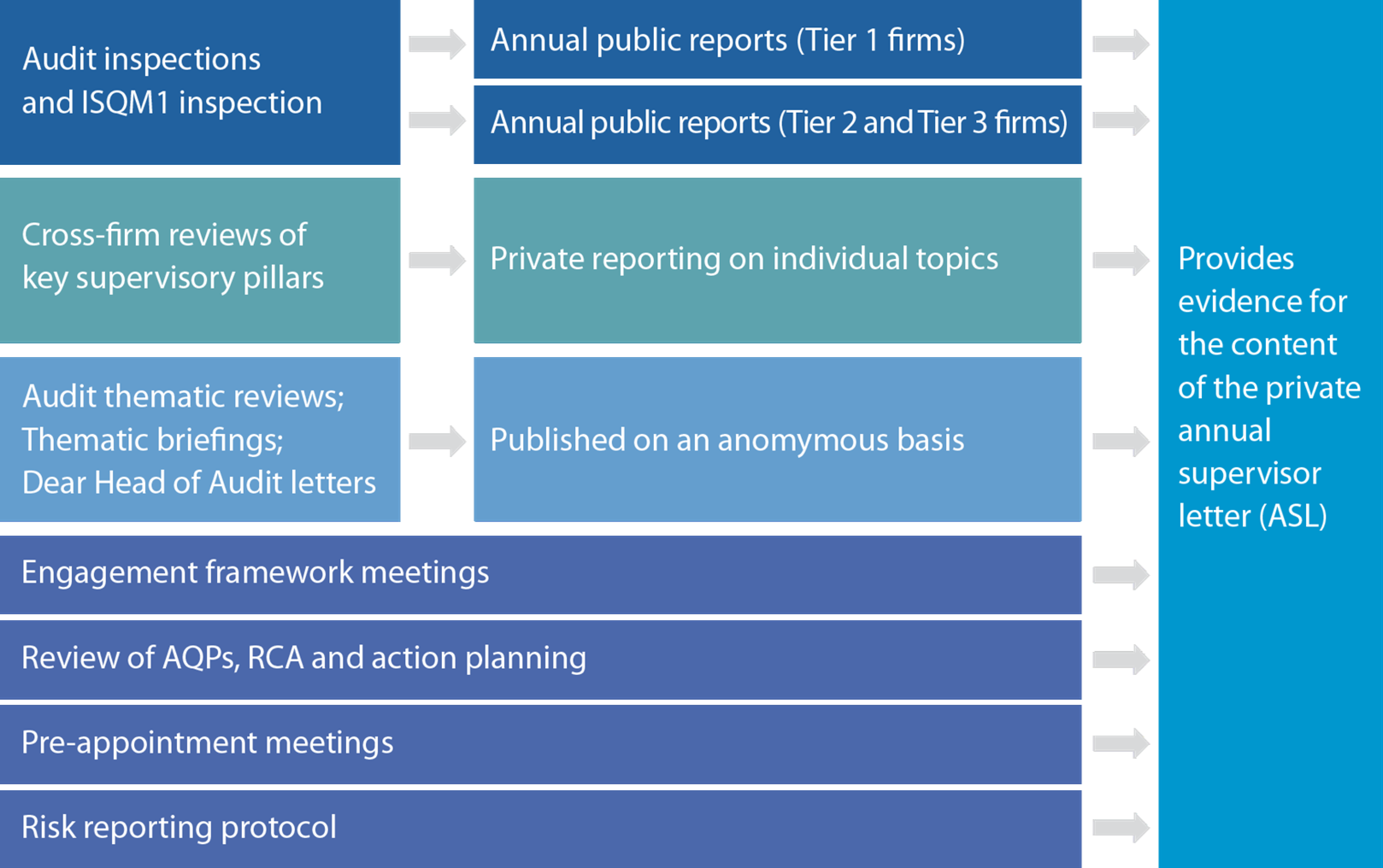

A number of the above areas highlighted in this section contribute to the private ASL as follows:

Firmwide case study – exam cheating

In July 2022, the FRC wrote to the Tier 1 audit firms and Recognised Qualifying Bodies (RQBs) requesting information on the controls and assurance measures in place to prevent and detect cheating in internal assessments and professional exams. Our request was prompted by recent regulatory sanctions imposed on audit firms around the world regarding exam cheating.

In response, Tier 1 audit firms and RQBs made clear that they take these matters seriously and gave assurances as to the robustness of their measures. The information that has been provided to us to date has not revealed systemic issues related to exam cheating in the UK. However, it has revealed issues that require improvement and instances of cheating at Tier 1 Audit Firms. These include the matters relating to the PCAOB's recent sanctioning of a Tier 1 firm. Affected firms and RQBs have committed to review and/or update relevant policies and procedures.

The issues surrounding exam cheating remain live and the FRC's consideration of any further regulatory action needed in response is ongoing.

4. Holding firms to account

Much of the broader audit supervision activity undertaken by AFS and AMS builds on our statutory role to oversee and monitor statutory audit, undertaken by AQR. We expect firms to work with us to respond to our concerns, however raised, and remedy any deficiencies.

The FRC's audit investigation and enforcement powers, including issues arising from AQR's inspections of PIE audits and AMS's ISQM 1 inspection work, are now exercised under the Audit Enforcement Procedure (AEP).15 This procedure was established by the FRC in 2016 following the introduction of the EU Audit Regulation and Directive. Some audit-related investigations have been delegated to the RSBs, but the FRC can reclaim an investigation from an RSB in certain circumstances. Under the AEP the FRC can, amongst other things, investigate any statutory auditor or statutory audit firm in relation to a statutory audit.

The latest report on the FRC's investigation and enforcement work can be found in the Annual Enforcement Review.16

In addition to the AEP the FRC continues to operate the Accountancy and Actuarial Schemes, which can be used for cases of misconduct by individuals who are members of the accountancy profession, such as those who undertake audits, but are not Senior Statutory Auditors or individuals involved in the preparation of financial statements (The Accountancy Scheme17) and individuals who are members of the Actuarial profession (The Actuarial Scheme18).

Referral to the Case Examiner

If we identify an issue which, in our opinion, warrants further consideration, this will be referred to the FRC's Case Examiner. The Case Examiner considers whether a relevant ethical, audit, accounting or actuarial requirement may have been breached. If so, the Case Examiner determines whether further action is required, for example – in the case of audit matters, under the Audit Enforcement Procedure. Decisions on whether a case should be investigated by the FRC's Enforcement Division are made by the FRC's Conduct Committee19 (a subcommittee of the FRC Board).

The Case Examiner also considers potential breaches in relevant requirements or potential misconduct, not arising from a referral from AQR or AMS (for example, from horizon scanning activities or referral from another regulator). In these cases, the Case Examiner will consider what is the most appropriate course of action. Options include taking no further action, undertaking Constructive Engagement (audit matters only), or referral to the Conduct Committee to decide whether to open an investigation.

For MLA and the audit of Crown Dependencies, enforcement action is undertaken by AQR in accordance with the Auditor Regulatory Sanctions Procedure (ARSP)20 and the Crown Dependency Recognised Auditor Sanctions Procedure (CDRASP)21 respectively.

Constructive engagement

Constructive engagement deals with cases where audit quality concerns can be appropriately and satisfactorily addressed, and the risk of repetition mitigated, without the time and expense of a full enforcement investigation.

In cases where the Case Examiner or Conduct Committee are of the view that constructive engagement is appropriate, the case may be referred back to the Supervisor to undertake constructive engagement with the audit firm to ensure appropriate actions are taken to address our concerns. The process was introduced by the AEP to allow a more proportionate regulatory approach. Constructive engagement may result in enhanced monitoring and scrutiny over the relevant firm until we believe that the risks relating to the firm's poor conduct have been addressed. We may ask for specific action to be taken by the firm to address the issues raised, or we agree that existing remedial actions are sufficient or should be amended.

If, after discussing the actions taken by the firm, the Supervisor is not satisfied that sufficient progress has been made, the case may be referred back to the Case Examiner to determine whether further enforcement action may be needed.

5. Measuring success

The Key Performance Indicators (KPIs) below are those for Supervision and Monitoring which we have chosen to publish in our three-year plan. These represent quantitative metrics against which we assess our operational performance. They are supported by more detailed management information and additional internal metrics. The table shows our full-year target for each KPI, the previous full year's performance, and our half-year performance for the current financial year.

These KPIs represent quantitative metrics which we assess against our operational performance

| Category | Measure | Target (FY) | 2021/22 (FY) | 2022/23 (HY) |

|---|---|---|---|---|

| Supervision and Monitoring | Number of Audit Quality Review (AQR) reports completed | 154 | 152 | 84 |

| Constructive engagement cases concluded within 12 months | 100% | 100% | 100% |

The feedback we have received from Tier 1 audit firms has been very supportive of our threefold approach to supervision to drive improvements to audit quality, which includes the inspection regime at engagement level, the allocated supervisor at firm level, and thematic projects promoting continuous improvements across all firms. This document includes examples of feedback and case studies of where firms have benefited from the positive impact of our supervisory approach on audit quality and resilience.

6. Future priorities

We will continue to develop our role as an Improvement Regulator, by bringing the four faces of regulation, as explained in our FRC plan and budget, to life.

We set out our key priorities in our three-year plan published in March 2023. The priorities for Supervision included both continuing the work we complete annually as well as implementing initiatives, and include, but are not limited to:

- delivering a full programme of high-quality AQR inspections and publishing associated reporting, including thematic reviews

- increasing activities focused on improvements and innovation to support improved audit quality and resilience in the market, including the implementation of the Audit Firm Scalebox

- approval and registration of audit firms and RIs who undertake PIE audit work

- assessing effectiveness of firms' implementation of new auditing and quality management standards (ISQM 1), and their culture

- developing the supervisory approach for audit committees

- developing the local audit system leader role and team in shadow form ahead of ARGA implementation

- reporting on implementation of operational separation, and

- developing our audit market monitoring function.

The priorities for Supervision included both continuing the work we complete annually as well as implementing initiatives

Appendices

Appendix 1 – Respective responsibilities of the FRC and the Recognised Supervisory Bodies (RSBs)

The legislation

The framework for statutory audit oversight and regulation is set out in the following legislation, which has been amended to reflect the UK's departure from the European Union:

- Retained EU Regulation 537/2014 on specific requirements regarding statutory audit of public-interest entities

- Part 42 of, and Schedules 10 to 13 of, the Companies Act 2006 (the Act). Schedule 10 of the Act sets out the detailed requirements for RSBs and Schedule 11 sets out the corresponding requirements for RQBs.

- The Statutory Auditors and Third Country Auditors Regulations 2013 (SI 2013/1672)

- The Statutory Auditors and Third Country Auditors Regulations 2016 (SI 2016/649)

- The Statutory Auditors and Third Country Auditors (Amendment) (EU Exit) Regulations 2019 (SI 2019/177)

- The Statutory Auditors and Third Country Auditors (Amendment) (EU Exit) Regulations 2020 (SI 2020/108)

Under this framework the FRC is the competent authority with responsibility for the oversight and monitoring of statutory audit.

The FRC

For statutory audit, as well as monitoring PIE and certain other audits, the FRC is responsible for the oversight of the regulation of auditors by the RSBs, delegated by the FRC. In particular, we recognise, and can derecognise, those professional accountancy bodies as statutory audit supervisory bodies.

Since December 2022, AFS has led our work on the registration of PIE auditors and audit firms (including, where applicable, non-UK firms and the NAO).

The RSBs

The FRC is named in the Statutory Auditors and Third Country Auditors Regulations 2016 as the Competent Authority responsible for the public oversight of statutory auditors. As permitted by those regulations, the FRC has delegated responsibility for the following tasks in respect of UK non-PIE audit to the RSBs:

- Registration of firms and Rls as Statutory Auditors (non-PIE)

- Audit Monitoring (non-PIE)

- Continuing Professional Development (CPD)

- Enforcement (non-PIE)

In our role as Competent Authority we undertake an annual programme of oversight work at each of the RSBs to ensure that the delegated tasks performed by the RSB are performed to a sufficiently high standard to promote and enforce audit quality across the entire audit market. The oversight work also forms the basis on which we conclude whether the recognition of each RSB should be continued. This oversight work is the subject of a separate annual FRC publication.

Third country auditors

We do not consider in this document the audit work of non-UK auditors of non-UK PIEs listed in the UK, which are subject to the requirements of the Third Country Audit regime.

Under SATCAR 2013, the FRC is also responsible for the registration and regulation of auditors from third countries that audit the accounts of companies from third countries that issue securities on regulated markets in the UK ('third country auditors' or 'TCAs').

These TCAs are subject to certain regulatory requirements in the UK regardless of where the company, or auditor, is located. The regulatory regime aims to establish a level of oversight equivalent to that required of the audits of listed companies incorporated in the UK. This is intended to enhance and safeguard public confidence in the annual and consolidated financial statements of companies listed on regulated markets in the UK that are audited by TCAs. Where TCAs are based in countries which have been deemed to provide an 'equivalent' standard of audit oversight to that in the UK, certain monitoring and inspection requirements are disapplied.

Further information on the TCA registration process and requirements, including the regulations, guidance and other supporting documents, may be found via this link.22 This page includes a link to the UK Register of Third Country Auditors, which contains the names of all of the firms which are registered with us.

Appendix 2 – Audit Firm Supervision structure at the FRC

- External stakeholders

- Other FRC Supervision teams

- Other FRC divisions and Governance

Financial Reporting Council 8th Floor 125 London Wall London EC2Y 5AS +44 (0)20 7492 2300

www.frc.org.uk

Follow us on Twitter @FRCnews or Linked in

Footnotes

-

Public Interest Entity – in the UK, PIEs are defined in Section 494A of the Companies Act 2006 ↩

-

FRC Audit Quality Inspection and Supervision Public Report 2022: Tier 1 Firms – Overview, July 2022 ↩

-

Project Spring (see page 27) ↩

-

The focus of this document is on the PIE audit work undertaken by UK PIE audit firms ↩

-

FRC Supervision Committee web page ↩

-

FRC Audit & Assurance Sandbox web page ↩

-

MoU between FRC and BoE ↩

-

MoU between FRC and FCA ↩

-

BDO LLP, Deloitte LLP, Ernst & Young LLP, Grant Thornton UK LLP, KPMG LLP, Mazars LLP and PricewaterhouseCoopers LLP ↩

-

Tier 2 and Tier 3 Audit Firms report ↩

-

Details of the FRC's Senior Advisors ↩

-

Details of the FRC's Advisory Panel ↩

-

Public Interest Entity (PIE) Auditor Registration | Financial Reporting Council (frc.org.uk) ↩

-

MoU between FRC and the Department for Levelling Up, Housing and Communities ↩

-

FRC Audit Enforcement Procedure ↩

-

FRC Annual Enforcement Review 2022 ↩

-

Accountancy Scheme ↩

-

Actuarial Scheme ↩

-

FRC Conduct Committee web page ↩

-

FRC Auditor Regulatory Sanctions Procedure ↩

-

FRC Crown Dependencies Recognised Auditor Sanctions Procedure ↩

-

FRC Third Country Auditors web page ↩