The content on this page has been converted from PDF to HTML format using an artificial intelligence (AI) tool as part of our ongoing efforts to improve accessibility and usability of our publications. Note:

- No human verification has been conducted of the converted content.

- While we strive for accuracy errors or omissions may exist.

- This content is provided for informational purposes only and should not be relied upon as a definitive or authoritative source.

- For the official and verified version of the publication, refer to the original PDF document.

If you identify any inaccuracies or have concerns about the content, please contact us at [email protected].

Climate-related corporate reporting - Where to next?

- Quick read

- The Task Force on Climate-related Financial Disclosures

- Regulatory and market overview

- Tips for approaching climate considerations and disclosure

- Introduction

- Regulatory and market overview

- Section 1 - Investor expectations and company views

- Company view

- Business model and strategy

- Risk Management

- Scenario analysis

- Company view

- Scenario analysis

- Risk management

- Metrics and targets

- Company view

- Bringing disclosures together

- Section 2 Appendix A – questions and recommended disclosures

- 3 Appendix B – examples of developing practice

- Introduction to the examples

- HSBC Holdings plc: Sustainable Financing Data Dictionary 2019 (p1, 2)

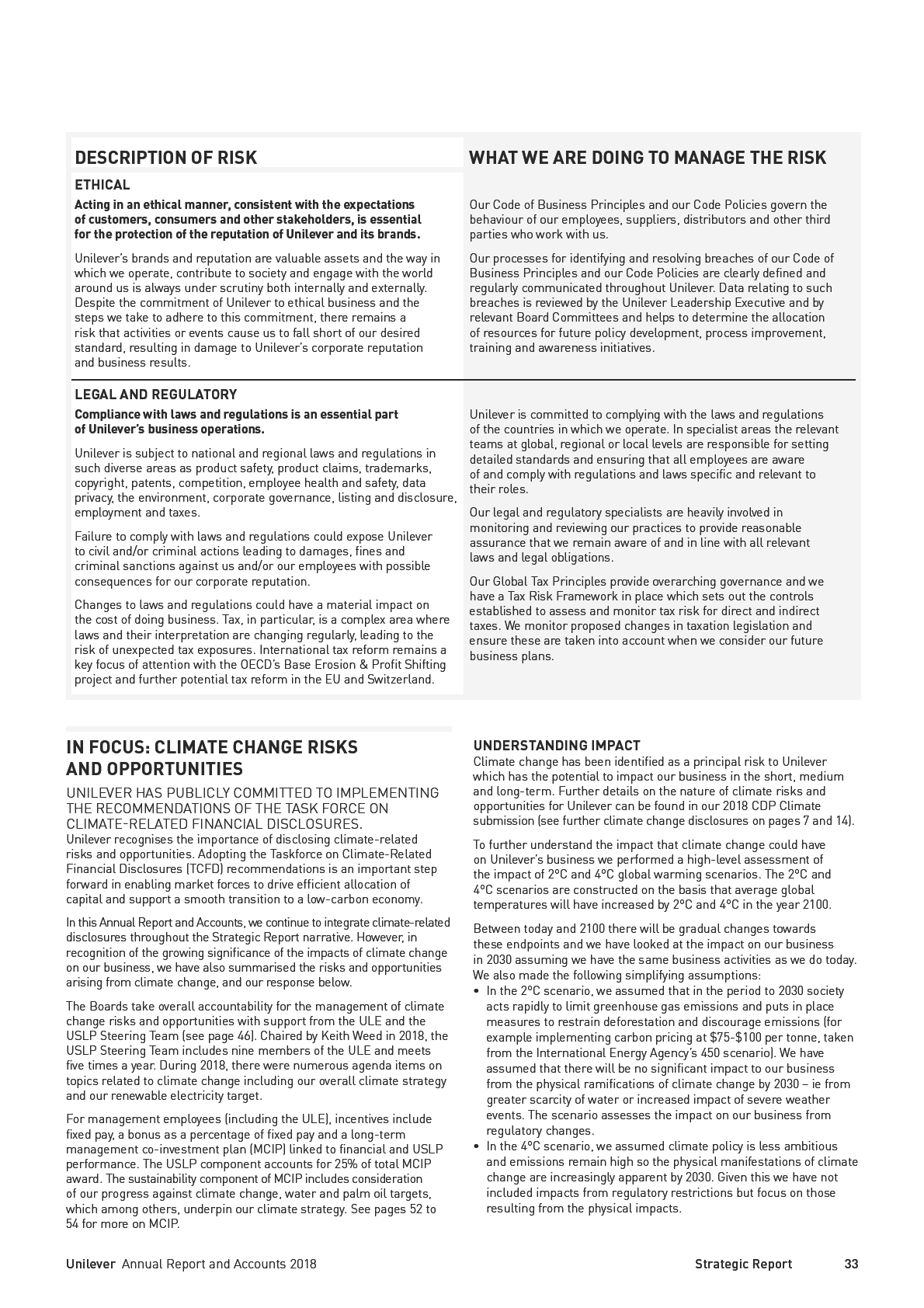

- Unilever PLC: Annual Report and Accounts 2018 (p34)

- DS Smith plc: Annual Report and Accounts 2019 (p35) and Sustainability Report 2019 (p22)

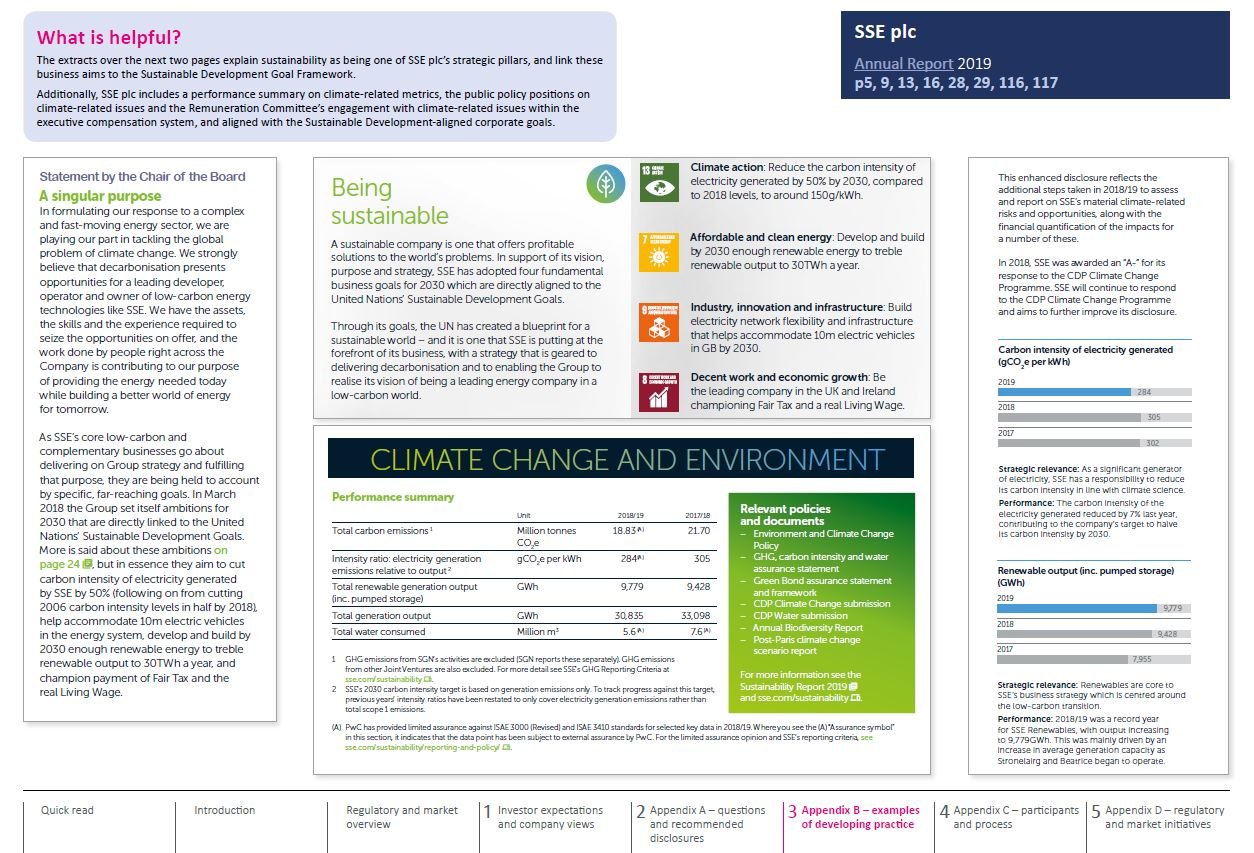

- SSE plc: Annual Report 2019 (p5, 9, 13, 16, 28, 29, 116, 117)

- Barclays plc

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Climate-related corporate reporting

- Section 4

- Section 5

Examples used

Our report highlights examples of current practice that were identified by the Financial Reporting Lab (Lab) team and investors. Not all of the examples are relevant for all companies, and all circumstances, but each provides an example of a company that demonstrates an approach to useful disclosures. Highlighting aspects of reporting by a particular entity should not be considered an evaluation of that entity's annual report as a whole. Investors have contributed to this project at a conceptual level.

The examples used are selected to illustrate the principles that investors have highlighted and, in many cases, have been tested with investors. However, they are not necessarily examples chosen by investors, and should not be taken as confirmation of acceptance of the company's reporting more generally.

Responding to feedback

In 2019 the Lab ran a stakeholder survey. As part of this survey we asked users of the reports for feedback. We received feedback that the example disclosures were of particular value to users.

Responding to this feedback, we have included more examples within this report than in previous Lab reports. Whilst it makes the report longer, we hope it adds to the overall value of this report.

If you have any feedback, or would like to get in touch with the Lab, please email us at: [email protected]

Quick read

Overview

Societal understanding of climate change and the need to take action has increased over recent years, leading to an increase in both public discourse and government initiatives. The 2015 Paris Agreement's central aim to restrict global temperature rise to 2 degrees above pre-industrial levels, and to pursue efforts to limit the increase to 1.5 degrees, set a new ambition for the world's response to climate change. The scope of this challenge is becoming more widely understood.

In this context, investors and the broader financial system are seeking better information to make more informed decisions about capital allocation and to price risk. While different companies will be affected by climate change in different ways, many will need to respond to potential increases in cost and/or decreases in revenue. The cost of water and energy, for example, may increase and assets (for example stock, investments, loans or infrastructure) may become stranded in specific locations. For some companies, climate-related issues are material now, with impacts already disrupting supply chains and changing consumer behaviour. For others, climate-related issues are key to longer-term strategic planning decisions. Climate-related risks are foreseeable, and as the implications become clearer, more are likely to adapt their behaviours and investments making the potential impacts a shorter-term issue for all companies.

The UK Government has set a target to bring all greenhouse gas emissions to net zero by 2050. Other governments are also realigning around such targets, with investors beginning to follow, for example as part of the UN-convened Net-Zero Asset Owner Alliance. This target provides a unique 30-year signal for the future for which both companies and investors can aim. Given this direction, there is an increasing demand for companies to respond, and report on what the business model looks like in the future and how it intends to get there.

“There is a not inconsiderable risk that the climate scientists are right, therefore it's irresponsible for boards not to be considering and looking at issues around climate change" - Investor

Investor views

Investors are increasingly calling for companies to report on challenges, targets and activities to support the action they are taking on this issue. This project has received an unprecedented amount of investor engagement, and this report focuses on disclosures by companies that better meet investors' needs.

The outcomes of climate change, including exact transitional and physical risks, and pathways we will take, are uncertain. As both companies and investors increasingly look to the future, there is a gap between the expectations of investors and reporting practice, both in the quality and granularity of information provided. Disclosure is developing, and as investor approaches become more sophisticated and increasingly affect capital allocation decisions, further development will be necessary. This report sets out how companies can fill this gap and move towards more effective and comprehensive reporting.

Investors outlined that they would like companies to articulate:

- how boards consider and assess the topic of climate change;

- whether, and how, the business model may be affected by climate change, whether it remains sustainable, and how the company may respond to the challenge posed by climate change;

- what the opportunities and risks are, including the prioritisation of risks and their likelihood and impact;

- what changes the company might need to make to strategy to capitalise on a changing climate and related opportunities;

- what scenarios might affect the company's sustainability and viability, and how; and

- how the impact is measured and how the company measures the climate-related challenges and the success of its strategy through strategically aligned, reliable, transparent metrics and financially-relevant information.

The Task Force on Climate-related Financial Disclosures

These areas reflect elements of a company's operating approach, and areas of assessment and consideration by investors. They are also consistent with the principles set out in the Lab's previous work on business models, risk and viability and performance metrics, and the recommendations of the Task Force on Climate-related Financial Disclosures (‘TCFD') framework.

Task Force on Climate-related Financial Disclosures

The discussions that we had with project participants soon coalesced around the TCFD framework. Many companies reported that the TCFD had helped them align their thinking and discussions, which provided a clearer route to reporting. Investors were also very supportive of TCFD reporting. As a consequence, rather than creating a separate framework, this Lab report is structured around the TCFD framework.

The TCFD, established by the Financial Stability Board (FSB), was tasked with reviewing how the financial sector could take account of climate-related issues. In 2017, the TCFD published a report which set out four core elements of recommended climate-related financial disclosures ('TCFD Core Elements'):

- Governance: The organisation's governance around climate-related risks and opportunities;

- Strategy: The actual and potential impacts of climate-related risks and opportunities on the organisation's businesses, strategy, and financial planning;

- Risk management: The processes used by the organisation to identify, assess, and manage climate-related risks; and

- Metrics and targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

These areas align closely with the questions about which investors seek information. On 2 July 2019 the UK Government announced, in its Green Finance Strategy, the expectation that listed companies and large asset owners should disclose in line with the TCFD recommendations by

- Given the investor support for the TCFD, and the Green Finance Strategy expectation, the Lab's report recommends that companies use the TCFD as a framework for thinking about and reporting on climate change. For those not familiar with the TCFD, a short summary and main disclosure recommendations can be found on page 9.

To help companies apply the principles of the TCFD framework, the Lab has also developed a series of questions they should ask, to address the areas that investors seek to understand. Consideration of these questions, by both companies and investors, will lead to more informative reporting and better discussions. Not surprisingly, some investors expressed a desire for more reporting by those companies where their business models were more at risk, or which were higher carbon emitters.

This report focuses on climate change, but many of the reporting recommendations in this report could equally apply to other sustainability-related topics, including the workforce (which will be the subject of a separate Lab report).

Role of Investors

While the focus of this project is on reporting by companies, it is clear that investors are seen as part of the solution to managing climate change. Investors themselves are also under pressure to report on climate issues under new regulations and client requests, where mandates from asset owners are increasingly referring to environmental, social and governance issues.

Indeed the TCFD framework and the UK Government's expectation relate as much to investor reporting as they do to company reporting. Information needs to flow through the ecosystem in order to meet the need not only for decision-useful information, but also to meet the needs of investors in carrying out their own reporting.

The TCFD also put together sector-specific reporting guidance for the financial industry (insurers, banks, asset managers and asset owners) and other non-financial sectors including energy; transportation; materials and buildings; and agricultural, food and forest products.

The recommended disclosures on the TCFD, across the four core elements of disclosure, are outlined below in Figure 1. In June 2019 the TCFD released its second status report on the uptake of its recommendations. The report noted that nearly 800 organizations have expressed their support for the TCFD recommendations. "The review of reports from over 1,100 large companies across multiple sectors in 142 countries found that the average number of recommended disclosures per company has increased by 29 per cent from 2.8 in 2016 to 3.6 in

- At the same time, the percentage of companies that disclosed information aligned with at least one of the Task Force's recommendations grew from 70 per cent in 2016 to 78 per cent in 2018". In a survey conducted with users and companies, 76 percent of users stated that they are already using climate-related financial disclosures in their decision making process. The report also highlights examples of how companies are reporting against the TCFD framework.

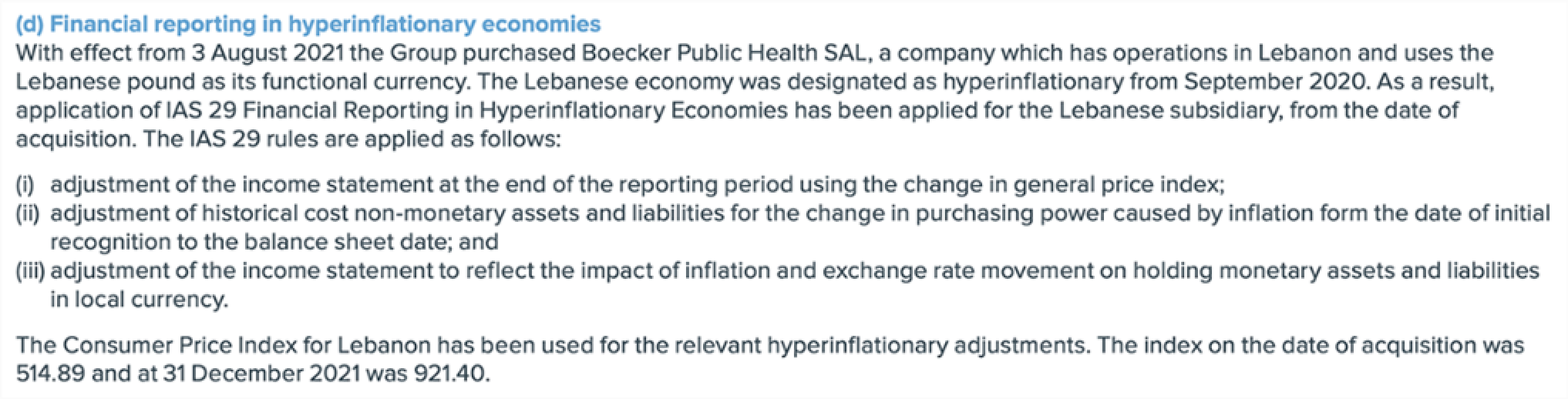

| Governance | Strategy | Risk Management | Metrics and Targets |

|---|---|---|---|

| Disclose the organization's governance around climate-related risks and opportunities. | Disclose the actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning where such information is material. | Disclose how the organization identifies, assesses, and manages climate-related risks. | Disclose the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material. |

| Recommended Disclosures | Recommended Disclosures | Recommended Disclosures | Recommended Disclosures |

| a) Describe the board's oversight of climate-related risks and opportunities. | a) Describe the climate-related risks and opportunities the organization has identified over the short, medium, and long term. | a) Describe the organization's processes for identifying and assessing climate-related risks. | a) Disclose the metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process. |

| b) Describe management's role in assessing and managing climate-related risks and opportunities. | b) Describe the impact of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning. | b) Describe the organization's processes for managing climate-related risks. | b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks. |

| c) Describe the resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. | c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organization's overall risk management. | c) Describe the targets used by the organization to manage climate-related risks and opportunities and performance against targets. |

Figure 1: TCFD recommended disclosures

Regulatory and market overview

Regulatory requirements

A company's activities may impact the environment, as well as the effects of climate change having an impact on the company. Companies should, therefore, consider the likely consequence of climate change on their business decisions, in addition to meeting their responsibility to consider the company's impact on the environment.

While in the UK there is no requirement to report on climate change specifically, there are many reporting requirements that may require companies to address climate-related issues. The Board has a role to consider the company's long-term success. The Companies Act 2006 ('the Companies Act') requires companies to provide information about how the directors have performed their duty to promote the success of the company, having regard to the matters set out in section 172, including environmental matters. The Strategic Report requires disclosure of principal risks and uncertainties and relevant non-financial information. The UK Corporate Governance Code 2018 (the Code) requires reporting on how opportunities and risks to the future success of the business have been considered and addressed, and there are specific requirements (including the Streamlined Energy and Carbon Reporting requirements) that require information on the impact of the company's business on the environment.

The FRC has also highlighted that a company's financial statements should, where material, 'reflect the current or future impacts of climate change on their financial position, for example in the valuation of their assets, assumptions used in impairment testing, depreciation rates, decommissioning, restoration and other similar liabilities and financial risk disclosures'.

Conclusion

Climate-related challenges will affect companies differently, however, investors consider the issues to be material to a wide range of businesses. There is inherent uncertainty in this area, but those companies and investors that are addressing and considering climate-related issues recognise the benefit that comes from a robust consideration of the future challenges facing the company, and a connected benefit to feeling more able to respond and reposition as necessary.

Reporting on climate-related matters requires companies to ask themselves challenging questions, make reasonable assumptions on the information available, and develop their strategic approach from there. Reporting then flows from this assessment.

"At the end of the day I want comfort that the company is preparing for many different outcomes, as no one knows" - Investor

How to read this report

This report is divided into five sections. Whilst those seeking a full understanding are encouraged to read the report sequentially, given its breadth, we have outlined below the contents of each section to enable readers to go directly to those of most relevance:

- Section 1 contains investor and company views on the four TCFD core elements - governance, business models and strategy, risk management and metrics and targets. Each includes a set of questions companies should ask themselves to help develop their reporting. The section also outlines areas of developing reporting practice and links to examples in Section 3. There is much interconnectivity between the four TCFD core elements. Some tips on how to bring this information together in a coordinated way are provided on the next page.

- Section 2 brings together the questions for companies and disclosure recommendations across the TCFD core elements to allow for easier consideration.

- Section 3 provides examples of developing reporting practice. These extracts illustrate how companies are trying to meet the reporting challenge. As changes in this area are dynamic, examples identified at this stage are likely to require further development in the future in order to respond to investors' needs. The examples are organised around the same four TCFD core elements, allowing readers to go directly to the examples most of interest to them.

- Section 4 provides a list of those companies and investors that participated in this project.

- Section 5 covers the main regulatory and market initiatives relevant to companies' disclosure on climate change, and some broader input on investor requirements and activity.

Tips for approaching climate considerations and disclosure

Many companies are considering how best to address climate-related issues. Throughout this project the Lab has seen companies take a range of approaches, many of which appear to be working successfully. However, some of the key elements that appear to be helping companies most effectively to address the issue are outlined below. A number of these are not climate-related, but may help companies to address challenges the company faces in a more coordinated way:

- A proper consideration of this topic starts with appropriate governance and oversight. Senior management and board engagement is necessary to ensure a coordinated approach, that a strategic view is taken, and that resources are appropriately allocated.

- Climate-related issues impact many areas of a business. It is important to be strategic to ensure that these areas all coordinate to make the best decisions and get the best outcomes. Different companies have taken different approaches to this, with some having a more decentralised structure, others using cross-firm working parties, and still others running a 'nominated' person approach with input from other areas. Any of these can work depending on the company, although most appear to need one point of contact/coordination, which can work most effectively by naming a responsible person.

- As so many operational areas of the business are coming together to discuss the topic it is important to ensure that they are discussing the same things. One approach to this is HSBC's 'Sustainable Financing Data Dictionary' (HSBC Holdings plc, page 33).

- Other organisations have highlighted that asking 'how do we respond to climate change?' can be an overwhelming and alienating question. They have worked hard to ask company-specific and operations-specific questions, which they have found a more helpful approach.

- Some companies have also reassessed their risks within this context – trying to draw out whether, at a cross-organisation level, there is a different risk level to that which they may identify in either a top-down or bottom-up risk format. Understanding management reporting tools in this context can be important.

- There is also a challenge, however, in not narrowing down the possible risks too early. Companies suggested thinking as broadly as possible, including considering whether the risk management process itself is capturing the interconnected elements of the risks and opportunities.

- Many reported that the main help had been a desire and/ or push to just get started. The topic is broad, but this approach allowed them to begin to understand what they knew and didn't know, what more information was required, and to begin to ask how that could be sourced. Some reported finding a roadmap of planned disclosure a helpful indication of where they aimed to be and what they were trying to achieve. (Roadmaps are disclosed by Unilever PLC, Barclays plc, SSE plc and DS Smith plc pages 34, 35 and 36).

Introduction

This project sought to test whether the principles of our previous reports on business models, risk and viability reporting and performance metrics could be applied in the context of climate-related reporting. Each of these reports has proven relevant, as they highlighted the importance of companies articulating how their business model remains sustainable, what the risks and opportunities are, what scenarios might affect their viability and how they measure the success of their strategy through reliable, transparent metrics.

However, as the project progressed it became apparent that there was a significant level of support for the TCFD framework. Therefore, this report has been developed to assist companies and provide practical guidance on how to meet investor expectations using the TCFD framework. It is structured around the four TCFD core elements; governance, strategy, risk management and metrics and targets.

Current reporting practice on climate change

Blacksun's latest corporate reporting trends research on the FTSE 100 (The Ecosystem of Authenticity) found that 61 per cent of companies make no mention of TCFD and only 16 per cent mention climate change in the Chair/CEO statements. The CDSB First Steps: Corporate climate & environmental disclosure under the EU Non-Financial Reporting Directive report found that of the top 80 companies by market capitalisation in Europe, 70 per cent made disclosures on environmental policies in comparison to 20 per cent on climate policies. These statistics do not mean that companies are not considering the issue of climate change internally, but it shows the scale of the challenge in ensuring investors get information on climate change that better meets their needs.

What this report seeks to achieve

At this stage, there are examples of developing reporting practice, but expectations are high, and further development of reporting to meet investor needs will be necessary. To assist, this report sets out how companies can make their reporting more effective and comprehensive by providing a set of questions that they should ask to help develop their reporting. These questions are framed around the four TCFD core elements.

During the project, both companies and investors stressed to us the inherent uncertainty in addressing and reporting on climate-related issues. Investors acknowledge the challenges, but also stress that they expect companies to be making reasonable assumptions on the information available and then developing the company's approach and reporting.

For companies that have not considered TCFD previously, the questions may be difficult to achieve in the short term, but they can be used as a starting point to support changes in reporting to address investor expectations and bridge the gap towards more effective reporting.

Investor reporting

Investors themselves are also under pressure to report on climate issues under new regulations and client requests, where the mandates they receive from asset owners are increasingly referring to environmental, social and governance issues. The TCFD framework relates as much to investor reporting as it does to company reporting.

Information needs to flow through the ecosystem in order to meet this information need. Investors, therefore, may also find this report helpful in their engagement with companies on climate change.

The challenge of climate change

The central aim of the Paris Agreement, signed in 2015, is to restrict global temperature rise to 2 degrees Celsius above pre-industrial levels and to pursue efforts to limit the rise to 1.5 degrees. The Agreement operationalises this by asking nations to disclose Nationally Determined Contributions (‘NDCs'), which outline how they aim to keep their emissions outlooks within the Agreement's thresholds. Where NDCs offer a granular view of the policy landscape, these documents can provide a potentially valuable input to strategic planning and analysis. The UK Government has set a target of being net zero by

- In this context, companies need to think about how their business models, strategy and financial planning will be affected by this, and other changes governments may wish to enact, and then report on the effects.

Whilst the risks of a changing climate may, in some circumstances, only crystallise fully over the longer-term, they are having an impact now, and many other risks are now foreseeable. The full consequences of a changing climate are uncertain, but have been broadly categorised into physical risks and transition risks. Physical risks, which require adaptation, include rising sea levels, global temperature rise and more frequent and intense weather events. Transitional risks, which may be mitigated, refer to risks relating to the movement towards a greener economy. Such transitions could relate to, for example, changes to product mixes, regulatory challenges, reputational issues or higher costs of doing business. Social and political upheaval related to these changes may also be widespread.

Regulatory and market overview

FRC statement on the Government's Green Finance Strategy

To coincide with the Government's release of the Green Finance Strategy on 2 July, the FRC published a statement saying that the effect of climate change on society and business is one of the defining issues of our time:

"The Boards of UK companies... should therefore address, and where relevant report on, the effects of climate change (both direct and indirect). Reporting should set out how the company has taken into account the resilience of the company's business model and its risks, uncertainties and viability in both the immediate and longer-term in light of climate change. Companies should also reflect the current or future impacts of climate change on their financial position, for example in the valuation of their assets, assumptions used in impairment testing, depreciation rates, decommissioning, restoration and other similar liabilities and financial risk disclosures."

Alongside the Green Finance Strategy, the FRC also joined the Pensions Regulator, the Prudential Regulation Authority and the Financial Conduct Authority to publish a joint-regulatory statement on this topic.

Companies Act 2006 Requirements

Section 414C of the Companies Act provides that:

"The strategic report must contain... (2)(b) a description of the principal risks and uncertainties facing the company... [and]... The review must, to the extent necessary for an understanding of the development, performance or position of the company's business, include... (b) where appropriate, analysis using other key performance indicators, including information relating to environmental matters and employee matters.

Sections 414C (7) requires disclosures, to the extent necessary for an understanding of the development, performance or position of the company's business, on the impact of the company's business on the environment.

Disclosures regarding principal risks and uncertainties may also be required under the Companies Act where climate-related issues are material, and will likely form part of the newer section 414CB requirement to consider the principal risks that the company poses to the outside world more generally.

In their Strategic Report, companies are now also required to make a Section 172(1) statement describing how directors have had regard to the matters set out in section 172(1)(a) to (f) of the Companies Act when performing their duties under section 172, which in subsection (1)(d) relates to the impact of the company's operations on the community and the environment.

UK Corporate Governance Code 2018

The Code also requires Boards to discuss how the matters (including impact on the environment) set out in section 172 of the Companies Act

- Provision 1 of the Code states that:

"The board should assess the basis on which the company generates and preserves value over the long-term. It should describe in the annual report how opportunities and risks to the future success of the business have been considered and addressed, the sustainability of the company's business model and how its governance contributes to the delivery of its strategy."

The Code also expects boards to be considering and responding to emerging risks.

IFRS requirements

Although the financial statements contain limited forward-looking information, climate-related risk could have a significant affect on the carrying value of the assets and liabilities reporting in the financial statements in certain industries. There is an expectation that, if material, information about how climate-related risks have been factored into impairment calculations, for example, should be disclosed.

The starting point is for companies to consider materiality. The definition as set out in IAS 1 is that "items are material if they could individually or collectively, influence the economic decisions that users make on the basis of the financial statements”. As investors increasingly factor in climate-change considerations into capital allocation decisions, this information in the financial statements is likely to become increasingly material.

Other market initiatives and reporting requirements

There are a number of other initiatives and reporting requirements relevant to climate-related issues, and these can be found in Section 5: Appendix D – regulatory and market initiatives.

Section 1 - Investor expectations and company views

Governance and management

One approach is to disclose what information the board sees (Royal Dutch Shell plc page 38), the governance arrangements in place (Unilever PLC page 39), who has responsibility, and a consideration of the necessary competence (National Grid plc page 40).

Investor participants are seeking a better understanding of:

- how boards consider and assess climate-related issues

Overview

Throughout this project, both companies and investors reinforced the importance of the board's role. Investors stressed the importance of understanding the way in which a board considers and assesses climate-related issues. This allows them to get comfort over procedures and the board's consideration of how the company's business model and strategy are affected. In the reporting, investors want more information about how boards consider and assess a range of sustainability-related topics, including climate-related issues and the workforce (which is subject to a separate Lab report) relevant to the company's business model and strategy.

Investor view

The role of the board

Investors seek more information on how boards consider and assess climate-related issues. Examples of such disclosure could include who has responsibility for climate-related matters and the frequency with which the item is discussed. However, process-specific disclosures should not substitute for insights into the quality of the discussion and the way in which relevant information has been incorporated into strategic planning and key decision-making.

This desire for an understanding of the board's involvement is not necessarily limited to climate change; investors are looking for more information on how boards consider and assess a range of sustainability-related issues. The views on governance that are set out in this section, the questions investors are asking and disclosures they are looking for, as outlined on page 12, could equally apply to other aspects of board consideration.

“It's not necessarily all about the numbers – I want to know they're thinking about the issue of climate change, as it is what I would be worried about if I was running the business" - Investor

Company view

Setting the strategy

The areas in which climate-related issues might be relevant are extremely interconnected, and therefore feedback between each of the areas, and incorporation into strategic planning, is essential. Board involvement in setting the company's strategy is considered key, as climate-related issues pose a challenge to strategy now and in the future.

A changing climate does not only pose risks, but also opportunities. The most relevant issues will differ by company, but the board is in a position to take a longer-term view and bring the challenges and opportunities together. In this context, the board's role in assessing and considering materiality is key. In measuring these aspects, where possible, the use of standardised metrics, or standardised or industry-based methodologies are welcomed by investors.

The importance of the board should not, however, downplay the importance of management. The achievement of targets are key to achievement of a wider strategy, and the TCFD also expects disclosures around the involvement and interaction of management in assessing and managing climate-related risks and opportunities.

The role of the board

Many companies agreed with investors that the role of the board should be central to considerations of climate-related issues and the connected challenges.

Some companies reported that they had to work quite actively to link activities at an operational level with the board's oversight. However, many felt that the focus of the TCFD on governance had allowed for more internal momentum regarding the topic. Some also reported that it had helped with wider integration of climate-related issues into strategic considerations.

Disclosures regarding the board's consideration of these issues, including relevant risks, are often qualitative. The company is in the best position to provide its own view of the challenges it faces, but also to support this with the data that is most relevant to the company, and that is being monitored and managed by the board.

In order to help investors understand how boards consider and assess climate-related issues, companies should ask themselves...

- What arrangements does the board have in place for assessing and considering climate-related issues? What is the board's view of the climate change challenge, and what assumptions is it making? +

- Who has responsibility for climate-related issues? How are the board and/or committees involved and how often are climate-related issues considered?+

- What insight does the information give the company and how is it being integrated into strategic planning?+

- What information helps the board understand the company's risk profile?

- What information and metrics do the board monitor in relation to climate-related issues? How does the board, establish, monitor and oversee, including modifying, climate-related goals and targets? +

- Is the board preparing for different outcomes where there is uncertainty?

- How does the board get comfort over the metrics being used to monitor and manage the relevant issues?

- What arrangements does the Executive Committee, or other divisional levels, have in place for assessing and considering climate-related issues, and who has responsibility for them? +

- Does the board consider the climate-related reporting to be fair, balanced and understandable?

- What competence and expertise does the board feel it needs, or needs access to, in order to consider and address the challenges climate-related issues pose?

- Has the board reviewed its public policy approach to climate-related issues for consistency?

- Is the organisation planning to report against the TCFD? If so, what can be shared about the progress made and what are the plans for disclosure?

TCFD expects companies to:

Disclose the organisation's governance around climate-related risks and opportunities

- Describe the board's oversight of climate-related risks and opportunities

- Describe management's role in assessing and managing climate-related risks and opportunities

"Every organisation has some kind of risk, we need them to sit down and look at what's relevant to them" - Investor

"It's fundamentally whether or not the company has envisioned a 20 year world that matches our view, whether their choices and strategy and competitive advantage are consistent with that 20 year view and how they will use their strengths to get there" - Investor

- notes where the questions align with expectations for reporting in the TCFD's 'Guidance for all sectors'

Business model and strategy

One approach is to disclose the resilience of the business model and opportunities, including a quantification of these risks and opportunities (SSE plc page 42-45) or where specific aspects of their business model may be affected and their capacity to respond (Stora Enso Oyj page 46).

Investor participants are seeking a better understanding of:

- how the business model may be affected by climate-related issues, whether it remains sustainable, and how the company may respond to the challenge posed by climate change, including what changes the company might need to make to strategy

Overview

The expectations outlined in our report and implementation study on business model reporting remain relevant in the context of reporting about climate-related challenges. Whilst business model disclosures generally focus on what is in place now, investors seek insight into the sustainability and resilience of the business model into the future. This includes information about which strategy gets a company from the current position to that future state.

Many investors are still developing their approaches to climate analysis. Others are more advanced, focusing on climate-related issues in their stewardship activities, developing models of weather patterns, building models of winners and losers in a world affected by climate change, or including management positioning and adaptability in discount factors.

Companies are also on a spectrum in responding to this issue. For many, consideration of this topic is in its infancy, and the questions it poses can be overwhelming. Taking action on this issue involves a consideration of the strategic issues facing the business in a low-carbon world. The opportunities offered by a changing climate and the issue of horizons were also raised.

Investor view

Materiality

Climate-related issues will impact different companies in different ways, but it is clear that investors seek a clear understanding of how companies have considered its materiality to business models, strategies and other areas that may be affected. The definition of materiality in IAS 1 (referenced on page 8) is helpful as it considers whether an item disclosed in the financial statements would influence the economic decisions that users make. As investors increasingly make capital allocation decisions that take into account climate-related factors, there is an increasing expectation that it is material to many businesses.

As a minimum, companies should make an assessment of whether climate-related issues are relevant to their business model by looking at the possible effects that it might have in the future. Investors want to see companies explain how they have assessed materiality, even if the outcome of that assessment is that it is considered not to be material.

Investors acknowledge that for some companies it can be difficult to see the short term impact, as it may not yet be having a financial impact. However, there are expectations that companies will be considering possible short, medium and longer-term impacts. Given the likely impact to the future business model, investors may consider it to be a material issue. For example if a business segment is only partly at risk from physical risks now, but is a growing part of the business, this can have a large impact and may, therefore, be considered material.

A number of companies use science-based targets, which involves adopting targets to reduce GHG emissions in line with what the climate science says is necessary to meet the goals of the Paris Agreement. Investors are particularly interested in what that means for the company and how they are intending to reach those targets. With action from governments, including the UK Government legislating for net zero emissions by 2050, investors want to understand how companies are going to react to those types of challenges over a longer-term horizon, what strategy will help the company get there and how this is being monitored.

Opportunities to the business model

Whilst many investors are considering climate-related issues predominantly through a risk lens, they also want to understand opportunities. This may include operating and capital expenditure in particular areas, a discussion of resilience of the organisational strategy, or a greater focus on green revenues. This all helps investors understand the sustainability of the business model, and what changes may need to be made in the future.

One approach is to disclose the opportunities a changing climate pose to the business (Halma plc page 47).

Data

An approach is to outline strategic plans for reaching net zero by 2050 (General Mills Inc page 48) , including reference to the IPCC recommended 1.5 degree pathway, and an indication of strategic decisions being made in light of this (Ørsted A/S page 49).

Whilst investors want to understand board oversight and functions, they are also increasingly calling for more data on an asset-by-asset basis. Companies will be affected differently by climate-related issues, so information on the key challenges the company faces, whether in relation to supply chains, manufacturing locations or other issues, will differ. Investors want to understand where and how the business is operating and what physical and regulatory change may be most relevant in those jurisdictions.

One approach is to explain the challenges a company faces at each asset location (Fresnillo plc page 50).

Investors acknowledge the challenges of gathering timely, robust and reliable data, as they are facing similar challenges when developing their own modelling and disclosure. Qualitative disclosures are useful, particularly in relation to governance and a view of the future, but in the absence of data, such disclosures may be less decision-useful. One example of a data point that is used by a number of investors to understand the company and its planning is whether or not a projected carbon price is being used for internal planning purposes, including project planning and assessment. The strategic planning purpose should align with the company's wider purpose as expected by the UK Corporate Governance Code, which allows for coherent consideration of this issue across the company.

One approach is to disclose an internal carbon price used for strategic planning purposes (Oil Search Ltd page 51).

"On scenarios, what are the drivers that change what is going on in the scenario - I really want to understand where it is impacting the business model. It's not about a number, not about the output, the journey is as important as the destination" - Investor

"Reporting has been an iterative process. It doesn't need to be perfect" - Company

Investors draw on a number of sources when considering climate-related issues, including using proxy information where specific disclosure is not provided. However, disclosure from the company allows investors to understand its position and make their own assessment of whether they agree.

Investors expect strategically important information to be included within an annual report alongside financial statements implications, where material. This aligns with the TCFD, which expects climate-related financial disclosures to be made in mainstream filings. This approach allows for more thorough stewardship and investment decision-making. Additional reporting may be provided elsewhere, for example in a sustainability report, to supplement this.

"We need to consider it asset-by-asset. We are currently in part assuming the whole company is one asset, even though we know it's wrong. One high and one low risk does not level out to a medium risk" - Investor

In understanding challenges, and required changes, to the business model, investors also welcome the work of a number of organisations, such as the CDP, Climate Disclosure Standards Board and Sustainability Accounting Standards Board, which provide guidance on reporting, and are increasingly displaying how their frameworks align with the TCFD. These frameworks and initiatives are covered in more detail in Appendix D. For investors it's not about companies providing TCFD reporting exclusively, but instead the integration of information from other frameworks where this assists in reporting, which makes the guidance on alignment to TCFD welcome.

“It's all about the context, so put together a three year reporting plan and update every year regarding the context. It's not just about the company's plans, it's also about resilience to how wider society is responding" - Company

“We understand the importance, but find it hard to reconcile to the here and now” - Company

Financial statement impact

If material to the business, investors also expect companies to consider and report on the impact on the financial statements, particularly on those aspects of financial statement reporting that involve estimates of the future. These might include, for example:

- pricing and demand assumptions used in impairment testing models that involve carbon products;

- depreciation rates of assets whose useful economic life may be affected by climate-related issues, and any decommissioning obligations that may follow;

- recognition of an onerous contract provision due to loss of revenues due to climate risk; and

- other information, not presented elsewhere in the financial statements, that would influence investors' decisions.

Some investors particularly emphasise the importance of companies considering the financial statement impacts of climate change as this information is subject to audit. It is also fundamental information that they need to value companies and make decisions on capital allocation.

In its July 2019 statement, the FRC stated that it would monitor how companies and their auditors fulfil their responsibilities, including in relation to the disclosures in the financial statements. It is clear that investor expectations in this area, on both companies and auditors, are increasing.

Better reporting includes outlining financially relevant information, but also explaining the impacts, the balance sheet effects and where there are assets and liabilities that, looking to the future, are already being impacted now. As outlined in the FRC's recent publication 'Thematic Review: Impairment of non-financial assets', companies for whom climate change and environmental impact are significant will explain how such factors, specific to the company's industry and value chain, have been taken into account in assessing medium and long term growth potential, costs and licence to operate.

"Is climate change a material risk? You can only tell that once you've looked at the materiality. Even low emitters may have exposure to vulnerable regions, so I expect companies to be thinking about it and at least doing a process of identification" - Investor

AASB/AAASB Guidance on financial statement impact of climate-related and other emerging risks

In April 2019, the Australian Accounting Standards Board and the Australian Auditing and Assurance Standards Board issued joint guidance on assessing when climate-related and other emerging risks are material in relation to the assumptions made in preparing the financial statements, and therefore require separate disclosure regardless of their numerical impact.

Climate-related and other emerging risks disclosures: assessing financial statement materiality using AASB/IASB Practice Statement 2 briefly outlines how climate-related risks may affect the financial statements and which accounting standards, such as impairment of assets, may be relevant. The guidance notes that while these issues are most commonly discussed outside the financial statements, “qualitative external factors such as the industry in which the entity operates, and investor expectations may make such risks 'material' and warrant disclosures when preparing financial statements, regardless of their numerical impact".

The guidance includes an overview flow chart of this process providing more detailed guidance on specific areas of the financial statements that may be affected by climate change.

Figure 2: Climate-related and other emerging risks disclosures: assessing financial statement materiality using AASB/IASB Practice Statement 2

"Is climate change a material risk? You can only tell that once you've looked at the materiality. Even low emitters may have exposure to vulnerable regions, so I expect companies to be thinking about it and at least doing a process of identification" - Investor

Company view

Horizons

For companies, reporting on climate-related issues can be challenging as it requires a view of an uncertain future, including the many different pathways that may be taken even where a target state is clear. With the level of assurance and governance over the annual report, it can make the inherent uncertainty difficult to report on. Companies also do not always know over which horizons they should be considering the issue. Some reported that they use their business planning cycle as a first step, but many are increasingly looking further, most often to

- A few are also looking beyond that, but recognise that this brings with it more uncertainty over the long term outlook, particularly in relation to the metrics used. Some of this uncertainty is highlighted in reporting, and it is important for companies to be clear on the horizon that they are assessing climate risk. Using the UK government's target of net zero emissions by 2050 can be helpful. However, the most important part of the challenge is reporting on how the insights gained from this horizon are changing, and will change, behaviour and plans in the future.

"It's about having a view of the future, then about considering the climate impacts on that view – ie the climate delta. Probably both are wrong, but it's insightful internally and then externally" - Company

Changes to the business model

Some companies are disclosing opportunities from climate-related issues, but some are also sensitive about disclosing information that might give away their competitive advantage. Scenario analysis can help, as it provides an indication of possible future impacts without committing a company to a long term direction. In this regard it is helpful for a company to identify key decisions points for future strategic direction.

"This topic has integrated company planning into more of a coordinated strategy assessment, offering additional value" - Company

Internal functions

Some companies are trying to consider not only short term risk, but also wider business resilience. This involves a fulsome assessment of the future and the company's key drivers in different contexts, including different climate scenarios. Such an analysis requires a great deal of coordination across many areas, including strategy, finance, risk, reporting, company secretarial, sustainability, investor relations, plus the management and board.

Coordinating these areas, and working across functions, is an important step in assessing the impacts of climate-related issues across the business. Not surprisingly, this level of coordination can be time-consuming and difficult to put in place. Companies taking part in this project have addressed this challenge in a number of ways. The Lab has developed some tips to help companies based on what the Lab has heard from companies involved in the project. These can be found on page 6.

An approach is to discuss the horizons over which different issues have been considered, and what those timeframes are (Land Securities Group PLC, Aviva plc, Bloomberg L.P pages 52, 58-59, 75-77)

Business model and strategy

In order to help investors understand how the business model may be affected by climate-related issues, whether it remains sustainable, and how the company may respond to the challenge posed by climate change, including what changes the company might need to make to strategy, companies should ask themselves...

- What does the company look like in the future and how will it continue to generate value? What strategy does the company have for responding to the challenges?

- How was the decision about the materiality of climate-related issues made? +

- What opportunities and risks concerning climate-related issues are most relevant to the company's business model and strategy? Which, if any, of these are financially material? What process has been followed in order to assess the impact of climate-related issues?+

- Where do the biggest risks and opportunities sit? +

- Has the company considered the impact of low-carbon transition as well as physical risk?

- What are the relevant short, medium and long-term horizons? How do these different horizons affect key divisions, markets, products and/or revenue/profit drivers? +

- How resilient is the business model to climate change? How does the company respond to a 1.5 degree, 2 degree or more world? +

- What strategy has been put in place to reach that aim, and what operational or capital expenditures are needed to address any necessary business model changes? How are long-term projects structured to ensure flexibility, including options for de-emphasising and emphasising if circumstances should dictate?+

- What are the possible effects on the company's revenues, expenditures, assets, liabilities, products, customers, suppliers etc of different climate scenarios?

- How does the information gathered factor into strategic planning? What triggers would require a change of direction?

- Are there opportunities better to explain exposure to particular product lines or 'green' revenues?

- How are the risks and opportunities reflected in the financial statements, for example the effect of assumptions used in impairment testing, depreciation rates, decommissioning, restoration and other similar liabilities and financial risk disclosures?

TCFD expects companies to:

Disclose the actual and potential impacts of climate-related risks and opportunities on the organisation's businesses, strategy, and financial planning where such information is material

- Describe the climate-related risks and opportunities the organisation has identified over the short, medium and long term

- Describe the impact of climate-related risks and opportunities on the organisation's businesses, strategy and financial planning

- Describe the resilience of the organisation's strategy, taking into consideration different climate-related scenarios, including a 2 degree or lower scenario

"We really need to be looking out 15 years" - Company

- notes where the questions align with expectations for reporting in the TCFD's 'Guidance for all sectors'

Risk Management

Investor participants are seeking a better understanding of:

- the risks and opportunities presented by climate change including the prioritisation, likelihood and impact, what scenarios might affect the company's sustainability and viability, and how the company is responding

Overview

The insights from the Lab's report and implementation study on risk and viability reporting continue to hold true. Investors seek company-specific disclosures that provide information about prioritisation of risk and their likelihood and impact. For companies, challenges could be numerous, including disrupted supply chains, regulatory changes, land use amendments, water scarcity, or weather-specific changes at main production sites, amongst a number of other challenges. The insight about what each may mean for the business is important, as this helps connect to strategic planning. This implies a level of asset-specific data. Investors would like to see more reference to climate-related issues across the risk and viability sections. A key aspect of this is gaining an understanding of the related governance and risk management process regardless of the assessment of materiality.

Whilst under the TCFD framework, scenario analysis sits more alongside strategy, we have instead included it in the risk management section. Many of the insights about what investors seek relate to the conclusions of the Lab's risk and viability report, which can therefore be helpful in identifying areas to focus on. Obviously, results of scenario analysis need to be incorporated into strategic planning, and potentially impairment testing in the financial statements and this illustrates one of the ways in which TCFD expects an interconnected picture to form.

Disclosure around the risk management process is necessarily qualitative. The question posed is, are systems or processes in place to protect the company and its assets? Much of the expectation around risk management assumes that companies will be including climate risk in current risk management considerations, rather than as a separate process or consideration.

An approach is to outline the risk management process in place (Swiss Reinsurance Company Limited page 54), or provide information on the oversight of the Audit Committee (National Grid plc page 55)

Materiality and principal risks

In general, investors believe that more companies should be assessing climate change as a risk, or at least as an uncertainty, in their reporting of principal risks and uncertainties. However, investors are also interested in which risks companies have themselves identified. There is an expectation that how a company assessed the materiality of climate risk should be reported even where it has not been considered a principal risk. If reported as a risk it should explain the impacts that raise that specific concern.

Granularity of information

Risks depend on the business, its business model, the location and vulnerability of assets and liabilities and the magnitude and rate of temperature increase. Investors are not only interested in the risks posed by climate change at a high level, they are also interested in asset-level data, for example where sites may be located, and what this means for specific transitional or physical risks faced.

An approach is to outline the risks in relation to key specific assets (Diageo plc page 56) or benchmarked results and changes made (Johnson Matthey plc page 57)

"The most difficult thing is the scenario – and the most interesting thing is obviously the scenario" - Company

“I want a company to do their own [scenario analysis], but if the analyst can't understand what they have done there is no point" - Investor

Investor view

Process and oversight Investors seek to understand the process that has been undertaken to identify risks, which risks have been identified, how important the risks are and what the company is going to do about them. They are using the risk disclosures to understand a company's resilience to risk, and how well-positioned the company is to respond.

"How do we get a meaningful outcome? A number of different scenarios and impacts need to be considered" - Investor

Scenario analysis

Given the uncertainty inherent to climate change, scenario analysis is considered important and is one of the key elements of the TCFD. Whilst implementation is developing, investors are supportive of companies evolving their approach. Investors acknowledge that it can be complicated to connect climate scenarios to financial and business operations, and they face similar challenges in their own modelling.

Investors seek information on which scenarios have been assessed, and what assumptions have been made. In addition, understanding the discussion around how these assumptions have been arrived at is helpful. These are key elements in understanding the credibility of the activity and as such, the question asked in the Lab's risk report applies – are the stress and scenario analyses disclosed in sufficient detail to provide investors with an understanding of the nature of those scenarios, and the extent and likelihood of mitigating activities?

Investors are interested in how a company will be affected under different scenarios, and what strategy they will then put in place to address the related challenges. Investors appreciate specific insight into the scenarios and key assumptions, although they don't expect 'one answer'. Although they would like an indication of possible effects on financial results under different scenarios, investors are more interested in the underlying information that allows them to make their own assessment.

Scenario analysis is about an openness to a range of possibilities and uncertainties and the development of an understanding of the important inflection points, signals and how decision-making may need to change in the future. Therefore, one of the crucial questions is how the results are specifically used in planning.

Many also wanted to see modelling against a higher, 'stressful' scenario, such as a 3 or 4 degree world, to understand company resilience. Companies are expected to use more than one scenario and/or pathway, and ensure that appropriate and credible assumptions around physical and transition risks are reported.

These scenarios should then tie not only into wider risk management considerations, but also strategic planning and viability assessments.

An approach is to outline asset-based outcomes referring to specific scenarios, including NPV-related results under which the scenarios may make certain investments less attractive, and modelling to a 1.5 degree scenario (Oil Search Ltd pages 60 and 61), or a description of the scenarios and impacts on key areas (in this circumstance related to commodity impacts) - (Rio Tinto plc pages 62 and 63)

“It's not about one scenario, but which range of scenarios and what did they tell you, how aggressive was it – it's all about assumptions and process – and what were the indicative effects?" - Investor

Viability statements

Most investors expect companies to assess their prospects over a longer time frame than is currently the practice, with many then expecting climate-related issues to be a factor included in viability statements.

The Lab's report on risk and viability suggested a two-stage process for a consideration of viability. This involves an assessment of prospects over a longer time horizon, taking into account current position, a robust assessment of principal risks and the business model. It was clear during this project that investors consider this assessment should be carried out over longer than a three year timeframe. For many companies this assessment should encompass risks and opportunities arising from climate change.

The second stage, which may be over a shorter period whilst taking into account insights from the first step, is an assessment of viability considering stress and sensitivity analysis, linkage to principal risks, qualifications and assumptions and the level of reasonable expectation.

An approach is to refer to signposts being monitored, with indicators and reference to future strategic decisions (Bloomberg L.P. pages 58 and 59)

Many investors want modelling against a 1.5 degree scenario, as envisaged by the Paris Agreement. The TCFD framework recommends a '2 degree, or lower' scenario, but investor expectation is also beginning to coalesce around an expectation of modelling towards a 1.5 degree world.

“It's about asking the people involved in the business to think about, and help ensure, the company is around in 10 years. About critical elements of the business' survival and encouraging and reporting on those" - Company

One approach is to refer to climate-related impacts in the viability statement disclosure (Royal Dutch Shell plc page 64)

Company view

Relevance

For many companies, climate change is not currently considered a principal, or even material, risk. For some this is reflective of horizons, whereas others do not see it having a material impact. Overall, it appears that some companies take a different view to investors on the issue of materiality.

Risk management processes

Companies reinforced the importance of the process of considering climate-related issues as a risk, and ensuring that multiple time horizons are considered. Some reported that time horizons can be difficult, as investors are often requesting disclosure over a time horizon which extends beyond a company's normal planning process. Some companies do not see climate-related issues affecting them in the shorter-term, and are concerned about setting a precedent on longer horizons. Companies can, at the very least, report over which horizons risks have been considered. Another approach may be more clearly to delineate between principal risks and uncertainties, rather than amalgamating the two.

Some companies are just starting to consider climate-related issues, and appropriate consideration can require a significant investment of time from people across an organisation. However, investors, and the TCFD itself, reinforce that much of the consideration of this challenge should build on existing considerations and processes. Many companies have also noted that they have gathered and utilised external expertise in order to assist their consideration of the relevant issues. We also include on page 6 some tips for how companies may be able to approach a consideration of climate-related issues.

One approach is to refer to what type of expertise has been gathered when specific external expertise has been sought (Royal Dutch Shell plc page 38)

Scenario analysis

“Scenario analysis has enabled us to say we know to the best of our capability what the physical risks are posed by climate change" - Company

There are real challenges in translating climate change scenarios into business and operational impacts. This has been a complex process for a number of companies. Such challenges include, for example, translating weather and other physical impact scenarios into the financial modelling and forward-looking planning process. However, where companies have done this they report having a much greater insight into the resilience of their business model, and where changes may need to be made to the business model or strategy.

Still, scenario analysis remains a complicated, and often expensive, exercise. As most companies are only at the beginning of this process reporting is expected to evolve over time.

Concerns remain that scenario analysis, and related financial disclosures, constitute a 'forecast' and are therefore not allowed within the regulatory framework. However, as companies have adopted scenario analysis and understand the use of a range of scenarios this concern appears to be decreasing.

Most companies using scenario analysis refer to the International Energy Agency (IEA) scenarios or the Intergovernmental Panel on Climate Change (IPCC). The IEA scenarios set out a long-term view of energy system trends and technologies. The IPCC scenarios detail a number of different scenarios and, in the 2018 Special Report on Global Warming of 1.5 degrees Celsius, the IPCC describes four pathways as illustrative examples of the different ways in which a below 2 degree outcome may be reached. A few companies are also using the Greenpeace Advanced Energy [R]evolution scenario (1.5 degree). Given different transition pathways, companies acknowledge that it is important to explain the assumptions used in the scenarios. The TCFD also provides a technical supplement on the use of scenario analysis.

One approach is to refer to assumptions made and the impact of different scenarios (Unilever PLC page 39)

Looking at the disclosure in this area, it is clear that not all companies are currently carrying out scenario analysis. There is much for both companies and investors to learn in this area. However, the strong investor view is that just because results cannot be quantified with a high degree of certainty, does not mean that disclosure is not warranted and helpful.

Risk management

In order to help investors understand the risks and opportunities presented by climate change including the prioritisation, likelihood and impact, what scenarios might affect the company's sustainability and viability, and how the company is responding, companies should ask themselves...

- What oversight does the board have of climate-related opportunities and risks? +

- What systems and processes are in place for identifying, assessing and managing climate-related risks? To what extent can current processes be developed to assist? +

- How will transitional and physical risks affect the company? +

- How is a consideration of climate-related issues integrated into the risk management process and connected to other related risks?

- Over what horizons have the risks been considered and risk assessments carried out?

- How are the risks from climate change being monitored, including decisions around mitigation, transfer, acceptance and control? +

- How is the assessment of the company's viability over the longer-term taking into account climate-related issues?

- Is the company's business and business model viable? What signals or leading indicators might encourage a reconsideration of this assessment and the related strategy, or an understanding of whether the risk mitigation activities are being achieved?

- If the company is undertaking scenario analysis, how did the company decide on which scenarios to use and what assumptions have been made? How do these relate to the outcomes advocated in the Paris Agreement?

- Are the scenarios sufficiently diverse and challenging?

- How did the company translate scenarios to operational/financial models?

- How is the scenario analysis used in strategic planning?

TCFD expects companies to:

Disclose how the organisation identifies, assesses, and manages climate-related risks

- Describe the organisation's processes for identifying and assessing climate-related risks

- Describe the organisation's processes for managing climate-related risks

- Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation's overall risk management

"Environmental risk... accounted for three of the top five risks by likelihood and four by impact. Extreme weather was the risk of greatest concern, but our survey respondents are increasingly worried about environmental policy failure: having fallen in the rankings after Paris, 'failure of climate-change mitigation and adaptation' jumped back to number two in terms of impact this year. The results of climate inaction are becoming increasingly clear" - World Economic Forum, The Global Risks Report 2019 - 14th edition, Insights Report

- notes where the questions align with expectations for reporting in the TCFD's ‘Guidance for all sectors'

Metrics and targets

Investor participants are seeking a better understanding of:

- how climate-related issues, and their impact, are measured, including metrics, data and financially-relevant information

Overview

One of the biggest challenges when reporting on climate-related issues is the need to be forward-looking in an uncertain world. Setting targets and measuring against these help to assess achievement and build management credibility, but some aspects of performance will be less relevant because they are backwards-looking.

Participants reiterated the importance of the five elements of disclosure identified in the Lab's performance metrics report. Metrics should be: aligned to strategy; transparent; in context; reliable; and consistent.

Investors are calling for quantitative information on how companies are affected at an asset-by-asset level where possible. In assessing possible impacts on future cash flows, financial data is important, and companies also need to consider the impact on their financial statements. Investors recognise the challenges of data, including quality and timeliness, but encourage companies to provide more relevant data.

One approach is to state that remuneration will be linked to climate-related metrics (Royal Dutch Shell plc and SSE plc pages 38 and 45)

"I'm interested in the information so I can take my own view. I'm not asking companies to value their business, but I need to understand the workings. It's about creating transparency" - Investor

Investor view

Investors are calling for metrics that are clearly aligned to strategy. This helps them understand which companies are leaders in their sectors – both for investment now, and assessing which companies are more likely to survive in, and adapt to, a low carbon future. To make a proper assessment, they seek to understand the performance, ambitions and targets of the company to give insight into the company's competitive advantage.

In building their understanding of what is relevant to the company, investors want information that gives insight into how the company sees its ambitions and plans. A clear link to the financial performance in the financial statements is also important.

Investors want the boundaries and scope of the metrics to be transparent, as well as being robust and reliable.

In understanding the scope and boundary of metrics, investors can make a better assessment of what the metric addresses. Investors feel that what is reported is often not sufficiently explained, and they cannot interrogate and interpret the disclosure as they would wish to. Understanding how the metrics had been overseen or assured, would also provide more confidence about their reliability.

An approach is to refer to competitive advantage with reference to the business model (Diageo plc page 66), or produce metrics seen as key to this with reference to climate change, such as 'Climate-Value-at-risk' (AXA page 67) or carbon footprints and how these are assessed and used (Aviva plc page 68)

Link to remuneration

Some investors feel that a quantitative link to remuneration can be difficult, although others would like a clear link between climate-related targets and remuneration in order to drive change. Generally, investors feel that remuneration can be an important signal to supplement other information, for example, capital allocation decisions, to enable them to understand whether the company is taking climate-related issues seriously. Typical remuneration structures have relatively short time horizons, although the UK Corporate Governance Code expects that remuneration policies and practices should be designed to support strategy and promote long-term sustainable success.

One approach is to refer to where a committee has been involved in the consideration of climate-related issues or the related disclosure (National Grid plc page 55)

"In terms of comfort about the reliability of information, views will evolve. We have a certain level now, but as reporting evolves expectation of comfort will evolve with it" - Investor

Many disclosures are also, by their nature, based on best estimates, in particular, Scope 3 emissions. The GHG Protocol Corporate Standard considers Scope 3 emissions to be all indirect emissions (not previously covered) that occur in the value chain of the reporting company, including both upstream and downstream emissions.

Investors are positive about more companies disclosing data on their Scope 3 emissions, but some noted that, where they had assessed this information across a market or geography, the current disclosures did not make sense in the aggregate. Reporting this metric is challenging, but both asset managers and asset owners are increasingly being asked to disclose portfolio carbon footprints and therefore need the information to enable them to do so.

One approach is to refer to scope 1, 2 and 3 emissions and related intensity (Fresnillo plc page 69)